Director Nominee Qualifications and Selection Process

Our Board, led by the Corporate Governance Committee, maintains a rigorous selection and evaluation process for potential Board members. The Corporate Governance Committee strives to maintain an engaged and independent Board with broad and diverse qualifications that serve the long-term interests of our stockholders. Our Corporate Governance Guidelines establish minimum qualifications for director nominees, including:

| • | Character, wisdom, judgment and integrity; |

| • | Experience in positions with a high degree of responsibility; |

| • | Prominence and accomplishments in areas relevant to the Company’s business activities; |

| • | Understanding of the Company’s business environment; |

| • | Strategy development, experience in technology-laden industrial businesses, and/or other relevant firms; |

| • | Capacity and desire to represent the interests of the Company’s stockholders as a whole; |

| • | Commitment to maximize stockholder value; |

| • | The extent to which the interplay of the nominee’s skills, knowledge, expertise, experience and diversity of background (considering, without limitation, gender, race, ethnicity and national origin) with that of the other Board members will help build a Board that is effective in collectively meeting the Company’s strategic needs and serving the long-term interests of the Company and its stockholders; and |

| • | Ability to devote sufficient time to the affairs of the Company. |

The Corporate Governance Committee evaluates stockholder-recommended candidates in the same manner as all other candidates. Information for stockholders wishing to submit a recommendation can be found under the section entitled “Stockholder Proposals” in this proxy statement.

Arrangements or Understandings Regarding Service as a Director

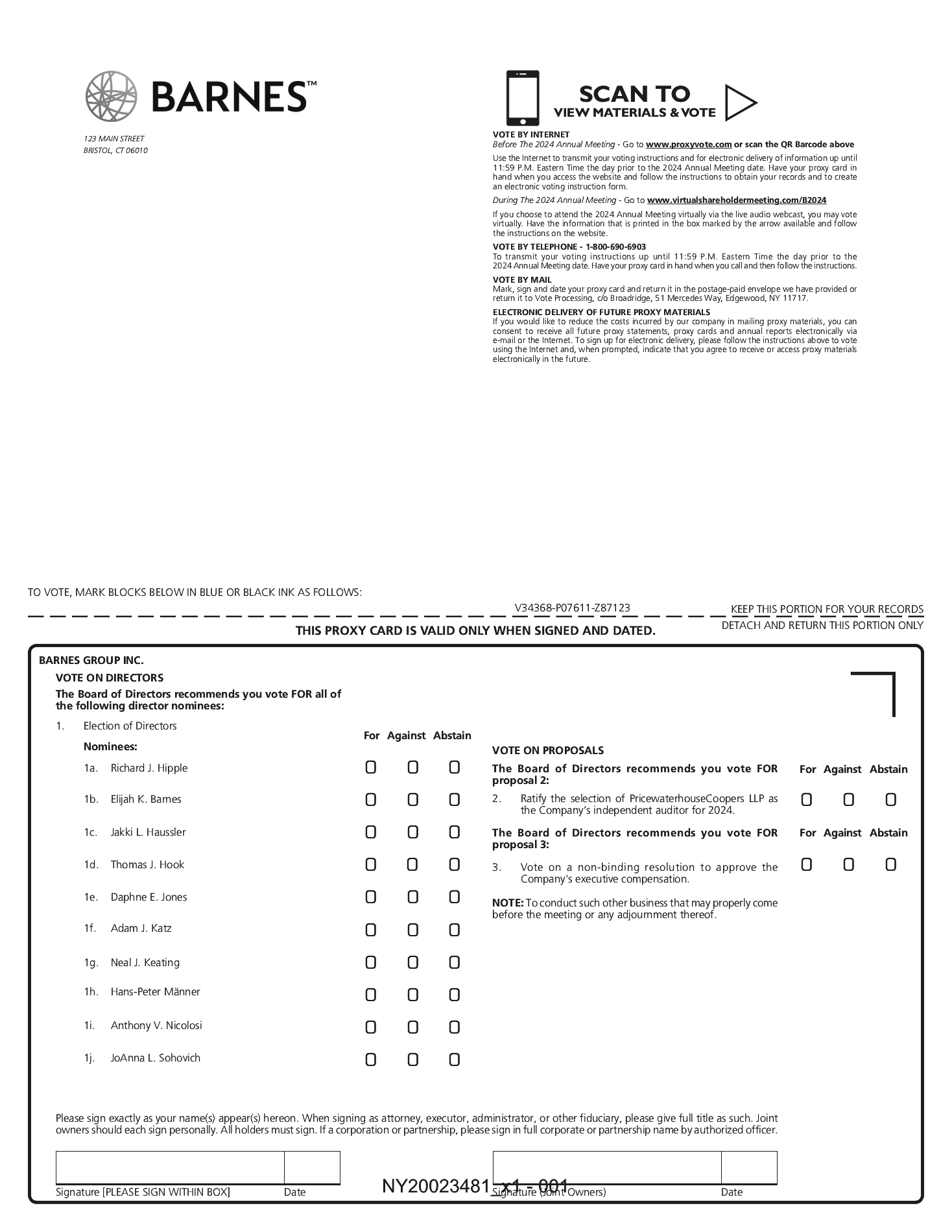

On March 5, 2024, Barnes entered into a cooperation agreement (the “Cooperation Agreement”) with Irenic Capital Management LP and certain of its affiliates (collectively, “Irenic”), pursuant to which we agreed to appoint Mr. Adam J. Katz, the co-founder and current Chief Investment Officer of Irenic, as a new director to the Board and nominate him for election at the 2024 Annual Meeting. Pursuant to the Cooperation Agreement, Mr. Katz was appointed to the Board and to the Corporate Governance Committee of the Board, effective as of March 5, 2024. In addition, pursuant to the Cooperation Agreement, Barnes has entered into a consulting agreement, effective as of March 5, 2024, to engage Larry Lawson, former Chief Executive Officer of Spirit AeroSystems Holdings, Inc., to serve as a special advisor to the Board and Barnes’ senior management team.

Additionally, Barnes and Irenic have agreed to cooperate to identify an additional independent director candidate, who will be mutually agreed upon, for appointment to the Board.

Pursuant to the Cooperation Agreement, Irenic irrevocably withdrew its nomination notice regarding its slate of proposed director nominees for election at the 2024 Annual Meeting. The Cooperation Agreement also provides for certain procedures for determining replacements for the newly appointed directors, as well as customary standstill restrictions, voting commitments, and other provisions restricting certain conduct and activities during the periods specified in the Cooperation Agreement, among other items.

A summary of the Cooperation Agreement is included in the Company’s Current Report on Form 8-K filed with the SEC on March 5, 2024 (the “Form 8-K”), with the full Cooperation Agreement filed as an exhibit to the Form 8-K.

Codes of Ethics and Conduct

We have adopted a Code of Business Ethics and Conduct applicable to the conduct of our business by our employees, officers (including to our chief executive officer, our chief financial officer, our controller