- B Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Barnes (B) DEF 14ADefinitive proxy

Filed: 25 Mar 22, 8:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| þ Filed by the Registrant | ¨ Filed by a Party other than the Registrant |

| Check the appropriate box: | |

¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) þ Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material under § 240.14a-12 | |

BARNES GROUP INC.

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check the appropriate box): |

þ No fee required. ¨ Fee paid previously with preliminary materials. ¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

March 25, 2022

Dear Stockholders:

You are invited to attend the 2022 Annual Meeting of Stockholders of Barnes Group Inc. (“Barnes” or the “Company”) to be held on May 6, 2022 at 11:00 A.M. Eastern Time (E.T.) at the DoubleTree by Hilton, 42 Century Drive, Bristol, CT 06010. For your convenience, the 2022 Annual Meeting will be a hybrid meeting*. This means that you may attend the 2022 Annual Meeting either in person, or virtually via a live audio webcast by visiting www.virtualshareholdermeeting.com/B2022. Instructions on how to attend and participate virtually in the live audio webcast of the 2022 Annual Meeting and how to vote your shares virtually while attending this live audio webcast are detailed on the following page and posted on www.virtualshareholdermeeting.com/B2022.

The Board of Directors of the Company (the “Board of Directors” or the “Board”) is soliciting proxies, in the accompanying form, to be used at the 2022 Annual Meeting and any adjournments thereof. This proxy statement, along with the accompanying Notice of 2022 Annual Meeting of Stockholders, summarizes the purpose of the 2022 Annual Meeting and the information you need to know to vote at the 2022 Annual Meeting. The enclosed materials were first mailed or provided on or about March 25, 2022 to our stockholders of record as of March 11, 2022. A list of stockholders entitled to vote at the 2022 Annual Meeting will be available to stockholders of record during the entire time of the 2022 Annual Meeting both at the in person meeting and on the virtual meeting website. This list will also be available during the 10 days prior to the 2022 Annual Meeting at the Company’s principal executive offices located at 123 Main Street, Bristol, CT 06010.

Following a report on business operations, stockholders will vote on the following proposals:

| Proposals | Board Vote Recommendation | |

| 1. | Election of 11 directors (page 13) | FOR each of the nominees |

| 2. | Advisory vote for the resolution to approve the Company’s executive compensation (page 28) | FOR |

| 3. | Ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditor for 2022 (page 68) | FOR |

| ● | To transact such other business that may properly come before the meeting | |

Your vote is important. Whether or not you plan to attend the 2022 Annual Meeting, we encourage you to vote as promptly as possible. You are eligible to vote if you were a stockholder of record at the close of business on March 11, 2022 (the “Record Date”) or hold a legal proxy for the meeting provided by your broker, bank or nominee as of the Record Date. Each share of our common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. As of the Record Date, there were 50,694,661 shares of common stock outstanding and entitled to vote at the 2022 Annual Meeting.

*As part of our COVID-19 precautions and related public health measures, we will monitor the need to potentially alter the location of the in person 2022 Annual Meeting of Stockholders or to switch to solely a virtual meeting format. If we take this step, we will announce the decision to do so in advance via a press release and the filing of necessary proxy materials with the Securities and Exchange Commission. Please monitor our website at www.barnesgroupinc.com for updated information. If you are planning to attend our meeting in person, please check the website one week prior to the meeting date.

1

Stockholders of record as of the Record Date are entitled to vote at the 2022 Annual Meeting, either in person or virtually by live audio webcast. Stockholders of record as of the Record Date may also vote before the 2022 Annual Meeting in the following ways:

| Vote by Phone: 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. E.T. the day prior to the 2022 Annual Meeting date. Have your proxy card in hand when you call and then follow the instructions. |

| Vote by Mail: Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| Vote by Internet: Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. E.T. the day prior to the 2022 Annual Meeting date. Go to www.proxyvote.com or scan the QR Barcode in the proxy card you received. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

If you vote by Internet or telephone, you should not return your proxy card. If you hold your shares through a broker, bank or other nominee, you will receive separate instructions from the nominee describing how to vote your shares. Proxies will be solicited on behalf of the Board by mail and other electronic means or in person, and we will pay the solicitation costs.

How to Attend and Vote Virtually During the Live Audio Webcast of the 2022 Annual Meeting

Go to www.virtualshareholdermeeting.com/B2022 and follow the instructions below:

| ● | To be admitted to the live audio webcast of the 2022 Annual Meeting, use the following link: www.virtualshareholdermeeting.com/B2022. | |

| ● | Enter the control number found on your proxy card, voting instruction form or notice you received with the proxy materials. If you are a beneficial shareholder, you may contact the bank, broker or other institution where you hold your account if you have questions about obtaining your control number. | |

| ● | Once admitted to the live audio webcast of the 2022 Annual Meeting, you may vote and/or submit questions by following the instructions available on the 2022 Annual Meeting website, www.virtualshareholdermeeting.com/B2022. | |

| ● | If you do not have your control number, you may attend the 2022 Annual Meeting as a guest (non-stockholder). As a guest, you will not have the option to vote your shares at the 2022 Annual Meeting. |

Whether or not you plan to attend the 2022 Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the 2022 Annual Meeting. You may revoke your proxy at any time prior to the meeting. If you attend and vote during the 2022 Annual Meeting, your proxy will be revoked automatically and your vote at the 2022 Annual Meeting will be counted.

Cordially,

|  |

Thomas O. Barnes

Chairman of the Board

2

Proxy Statement for 2022

Annual Meeting of Stockholders

May 6, 2022

We are sending this proxy statement and a proxy or voting instruction form in connection with Barnes Group Inc.’s solicitation of proxies on behalf of its Board of Directors for our 2022 Annual Meeting of Stockholders. Availability of this proxy statement and accompanying materials is scheduled to begin on or about March 25, 2022. “Voting Information” may be found on page 69.

3

| Proposals | Board Vote Recommendation | |

| 1. | Election of 11 directors (page 13) | FOR each of the nominees |

| 2. | Advisory vote for the resolution to approve the Company’s executive compensation (page 28) | FOR |

| 3. | Ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditor for 2022 (page 68) | FOR |

| ● | To transact such other business that may properly come before the meeting |

2022 Director Nominees

|  |  |  |  |  |  |  |  |  |  |  |

| Thomas O. Barnes | Mylle H. Mangum | Patrick J. Dempsey | JoAnna L. Sohovich | Elijah K. Barnes | Hans-Peter Männer | Thomas J. Hook | Richard J. Hipple | Anthony V. Nicolosi | Daphne E. Jones | Jakki L. Haussler | |

| INDEPENDENCE | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| DIRECTOR TENURE1 | 43 yrs. | 19 yrs. | 8 yrs. | 7 yrs. | 5 yrs. | 5 yrs. | 5 yrs. | 4 yrs. | 4 yrs. | 2 yrs. | 0 yrs. |

| Director Since | 1978 | 2002 | 2013 | 2014 | 2016 | 2016 | 2016 | 2017 | 2017 | 2019 | 2021 |

| Age | 73 | 73 | 57 | 50 | 41 | 59 | 59 | 69 | 68 | 65 | 64 |

| Term Expires | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 | 2022 |

| BGI BOARD COMMITTEES1 | 1 | 3 | 0 | 1 | 1 | 1 | 2 | 2 | 1 | 1 | 1 |

| Audit | ● | ● | C | ● | |||||||

| Corporate Governance | C | ● | ● | ● | |||||||

| Compensation | ● | C | ● | ● | |||||||

| Executive | C | ● | |||||||||

| OTHER PUBLIC COMPANY BOARDS | 0 | 2 | 1 | 0 | 0 | 0 | 0 | 2 | 0 | 2 | 2 |

| QUALIFICATIONS/ ATTRIBUTES/ EXPERIENCE | |||||||||||

| Global Business | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Manufacturing/Operational | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Government/Regulatory | ● | ● | ● | ● | ● | ● | |||||

| Talent Management/Development | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology/Innovation | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Marketing/Branding | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Risk Management/Oversight | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Current/Past Board Committee Chair | ● | ● | ● | ● | ● | ● | ● | ||||

| Prof. License/ MBA/Econ. or Engineering Degree | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| 1 | Director tenure is listed in full years. |

| 2 | “C” indicates Committee Chair. |

4

Governance Highlights1

Barnes Group Inc. (“Barnes” or the “Company”) is committed to good corporate governance, which promotes the long-term interests of the Company’s stockholders. Key features of the Company’s corporate governance practices include:

| Board Independence | Lead Independent Director | |||

● Independent Chairman of the Board ● 11 of our 12 directors are independent (and 10 of 11 directors standing for election are independent) ● CEO is the only management director ● All board committees are composed exclusively of independent directors | ● Clearly established authority and responsibility over board governance and operations ● Selected by independent directors ● Serves as a liaison between the Chairman of the Board and the independent directors ● Presides at executive sessions of the independent directors | |||

| Board Practices | Other Best Practices | |||

● Committee Charters reflect the Committees’ respective oversight of the Company’s environmental, social and governance efforts ● Consideration of gender, race, ethnicity and national origin among the qualifications reviewed when selecting director nominees ● Annual board and committee evaluations ● Regular review of committee chair and member rotation ● Director retirement age of 75, extendable in special circumstances ● Corporate Governance Guidelines require directors to attend education programs and briefing sessions ● Prohibition on directors simultaneously serving on more than 4 public company boards and 3 public company audit committees, including the Company’s ● Annual election of directors and declassified board ● Regular executive sessions of board and committees without management present | ● Separate CEO and Chairman of the Board roles ● Prohibition on the CEO, or directors who serve as CEO for another public company, simultaneously serving on more than 2 public company boards, including the Company’s ● Corporate Governance Committee approval required before an executive officer accepts outside board membership with a for-profit entity ● Stockholder engagement and outreach to allow for management and the board to understand and consider issues that matter most to stockholders and enable the Company to effectively address them ● Restrictions on hedging and pledging Company stock by directors and executive officers ● Annual say-on-pay vote ● Policy prohibiting corporate contributions to political candidates, election campaigns or political parties | |||

| Stockholder Rights and Accountability | Stock Ownership Requirement | |||

● Directors must receive more “for” than “withhold” votes in uncontested elections ● Stockholders have right to hold special meetings ● Stockholder right to proxy access ● No stockholder rights (poison pill) or similar plan | ||||

| Directors | 5X | Annual Cash Retainer | ||

| CEO | 5X | Annual Salary | ||

| Other NEOs | 3X | Annual Salary | ||

| 1 | The metrics in these Governance Highlights include current directors as of the date of this proxy statement, including Director William J. Morgan. Director Morgan will retire from the Board effective as of the 2022 Annual Meeting in accordance with the mandatory retirement provisions of our Corporate Governance Guidelines. |

5

Director Highlights1

Women in Board Leadership Roles Mylle H. Mangum - Lead Independent Director and Chair, Corporate Governance Committee |

| 1 | The metrics in these Director Highlights include current directors as of the date of this proxy statement, including Director William J. Morgan. Director Morgan will retire from the Board effective as of the 2022 Annual Meeting in accordance with the mandatory retirement provisions of our Corporate Governance Guidelines. Metrics above are based on the number of full years of service that each director has served as of the date of this proxy statement. Metrics are based on director self-reporting. |

6

|  |  |  |  | ||||

| Governance | Health, Safety & Environmental Affairs | Employee Development & Engagement | Community | Products & Processes |

Environmental, Social and Governance Highlights

Striving for Next with Respect for Now

Barnes is committed to corporate responsibility and furthering environmental, social and governance (ESG) principles. We believe this allows us to create value for our stakeholders and is key to our success as a responsible and environmentally friendly organization. Since the launch of our company-wide ESG initiative in 2014, we continue to identify and implement ways in which we can benefit our customers, the environment, and society while executing our vision and strategy.

Where We Plan to Go – Setting Ambitious Goals Setting ambitious goals is an integral aspect of our Barnes Enterprise System (BES). As part of our strong commitment to furthering ESG principles, the Company has established environmental targets for 2025. We will work to reduce the energy we use in our factories1 – as measured in carbon dioxide equivalents - by 15%, the amount of water we use by 20%, and the amount of industrial process waste we generate by 15%. | Energy Water Waste

| |

Pillars of our ESG Program | How We Will Get There – Understanding Our Risks, Aligning with Standards and Planning a Path to Success In 2021, we conducted our first climate scenario analysis. We are focused on further aligning our ESG activities with the United Nations Global Compact (UNGC). We have selected disclosures from the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board’s (SASB) 2018 Industrial Machinery & Goods standard. We published indices detailing our disclosure against select items from the GRI and SASB standards and began to report results against the Task Force for Climate-related Financial Disclosures (TCFD) standard. In January 2022, we launched a project to develop an energy roadmap and identify opportunities to decarbonize and reduce emissions through renewable energy use. | |

Who Will Guide Us – Our Company Leaders Our Board of Directors exercises governance over ESG through its three key standing committees - Corporate Governance, Audit, and Compensation and Management Development. In addition, ESG is driven by a Steering Committee consisting of members of the Senior Leadership Team. In 2022, our Corporate Governance, Audit, and Compensation and Management Development Committees amended their Charters to reflect their respective ESG governance and oversight responsibilities. These Committee Charters and our ESG Steering Committee Charter are published on our Company’s website, www.barnesgroupinc.com. More detail on the Board’s oversight of ESG efforts and risk can be found in the “Board Role in Risk Oversight” section on page 23. | ||

| 1 | On a normalized basis versus 2019 baseline year. |

7

ESG Recognition

We were honored to be recognized in 2021 for our ESG efforts.

EcoVadis, the worldwide Sustainability Ratings Provider, re-evaluated our Automation Gimatic business, increasing its rating of Gimatic and awarding it a Silver EcoVadis medal, placing Gimatic among the top 25% of companies assessed. The EcoVadis rating is a common tool used globally for supplier evaluation.

Newsweek has recognized the Company as one of “America’s Most Responsible Companies 2021”.

Our Barnes Values

Our Barnes Values are the cornerstone of our Company and the bedrock upon which Barnes has been built and sustained for 165 years. Consistent with these values, we strive to conduct business with the highest ethical standards, always mindful that our Values define who we are and what we stand for, both as employees and as a company. We maintain a Code of Business Ethics and Conduct (the “Code”) and compliance program. We offer the Code in nine languages and train our employees to ensure they are familiar with the Code. In 2022, we published a new, modernized Code, with enhanced emphasis on respect for human rights and the importance of diversity and inclusion.

| Integrity. Respect. Collaboration. Empowerment. Determination. |

At Barnes, we believe in:

Integrity

We uphold the highest ethical standards - rooted in openness, transparency, and honesty.

Respect

We treat each other with respect and dignity - and don’t tolerate any other way. As a global business that spans across cultures, promoting fairness, equality, safety, and diversity is fundamental to how we work together to do business.

Collaboration

We solve complex challenges by bringing together the best minds with diverse backgrounds to build inclusive teams that collaborate and inspire one another. Together, we challenge the status quo and reimagine what’s possible.

Empowerment

We empower each other to make positive impacts on our communities, customers, and shareholders by being accountable to one another.

Determination

We embrace change and break down barriers through the relentless pursuit of next. We continuously challenge ourselves, learn from one another, and deepen our expertise as we seek the next generation of solutions from our stakeholders.

In 2022, Newsweek recognized the Company as one of “America’s Most Trusted Companies 2022”.

8

Our Commitments

| Human Rights |  | Our Human Capital | |

We respect the value and dignity of every individual. We do not tolerate any human rights abuses in any part of our business, anywhere we do business, and we expect the same of our partners. We pulse our global leadership to help identify any facts or circumstances which may indicate a potential human rights concern in our businesses. In early 2022, we published a Human Rights Policy formalizing our belief of respecting the value and dignity of every individual and clearly stating our intolerance for human rights abuses in any part of our business, anywhere we do business. | Grounded in our Values and an integral part of our Barnes Enterprise System (BES), we manage human capital through our Talent Management System (TMS). TMS integrates our key human resource processes and tools to facilitate talent management decisions. The TMS framework focuses on five key areas – Attract, Perform, Develop, Engage and Recognize. TMS enhances our ability to attract and hire talented employees and supports their growth, development and engagement. | |||

| Safety of Our Employees |  | Our Products | |

| We have a strong health, safety and environmental affairs (HSE) program led by our Vice President, HSE and ESG. We maintain a “safety first” mindset and strive to integrate safe practices in everything we do. We continue to implement preventive measures and controls to protect our employees. Our strong focus on safety resulted in zero serious injuries and zero work-related fatalities with over 9.3 million hours worked in 2021. | Our products and product roadmaps are focused on delivering or accelerating automation capabilities, lighter-weight products for our end markets, and technology and equipment to ultimately enable our customers to manufacture products using recycled and biofriendly polymers. | |||

| Our Communities |  | Our Environment | |

| Being a good corporate citizen begins with being a great community leader, which is why we encourage philanthropy, compassion, and change through our Barnes Group Foundation. Founded in 1945 and funded by the Company, the Barnes Group Foundation is committed to the support of education, the arts, civic and youth activities, and health- related charities in the communities in which the Company operates. | We have established environmental targets, maintain HSE standards that require internal reporting of metrics and internally audit select data. In 2021, we established additional controls to further validate our data and upgraded our centralized HSE information system. | |||

Diversity & Inclusion We are committed to diversity and inclusion (D&I). This commitment is anchored by our D&I Mission Statement: At Barnes, we promote and embrace a diverse and inclusive workplace, where everyone is treated with dignity and respect; where all employees are supported, encouraged and empowered to engage, contribute and achieve their fullest potential in a safe and rewarding environment. In 2021, we updated our Corporate Governance Guidelines to reflect our Board’s practice of considering gender, race, ethnicity and national origin when recruiting for director nominees. Our Board is 33% women, and 25% self-identify as racially and/or ethnically diverse. | ||||

Responsible Sourcing We maintain a Supplier Code of Business Ethics and Conduct and a Conflicts Mineral Policy to support ethical sourcing practices. | ||||

Additional Information For additional information, please see the Company’s 2021 Environmental, Social and Governance Report, Code of Business Ethics and Conduct, and our Human Rights Policy on www.barnesgroupinc.com. Additionally, please see the forward-looking statement at the end of this proxy statement. | ||||

9

Compensation Highlights

2021 Executive Compensation - Key Elements

The following summarizes key features of the compensation program for our named executive officers (NEOs).

Executive Compensation - Key Elements

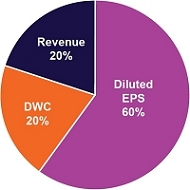

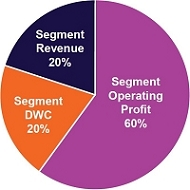

| Short-Term | Long-Term Equity Incentive Award | |||||||

| Base Cash Salary | Annual Cash Incentive Award | PSAs | Stock Options | RSUs | ||||

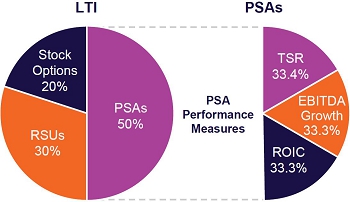

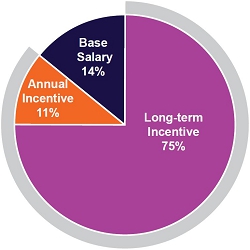

| Base salaries are reviewed annually and are typically increased at periodic intervals, often at the time of a change in position or assumption of new responsibilities. | Stockholder-approved program with payouts based on achieving targeted financial performance measures. Annual incentive targets for our NEOs range from 45% to 75% of base salary at target level performance1. Actual payouts may range from zero to three times target based on performance compared to our three performance measures. | Performance-based vesting at the end of a 3-year period; based on three equally weighted measures in 2021: (1) EBITDA growth relative to the performance of the Russell 2000 Index companies; (2) Total Shareholder Return (TSR) relative to the performance of the Russell 2000 Index companies; and (3) Return On Invested Capital (ROIC) performance against an absolute internal goal as determined by the Compensation and Management Development Committee. | Time-based vesting; 18, 30 and 42 months from the grant date in equal installments. | Time-based vesting; 18, 30 and 42 months from the grant date in equal installments. | ||||

| 1. | With the exception of Marian Acker, Vice President, Controller of the Company, and the Company’s Principal Accounting Officer. Ms. Acker served as the Company’s Interim Chief Financial Officer and Principal Financial Officer from January 1, 2021 – May 2, 2021. Ms. Acker resumed her role as Vice President, Controller of the Company, and the Company’s Principal Accounting Officer, as of May 3, 2021. Ms. Acker’s annual incentive target is 35% of base salary at target level performance. |

Other Compensation and Benefits

Retirement: NEOs participate in qualified retirement programs generally available to the Company’s U.S. employees. NEOs also participate in a nonqualified retirement program that provides benefits on base salary earnings in excess of Internal Revenue Service (IRS) limits on qualified plans. In 2021, Mr. Dempsey and Ms. Acker participated in grandfathered nonqualified executive retirement programs that are closed to new entrants.

Change in Control and Severance: NEOs participate in severance programs where severance is payable and benefits continue upon termination of employment in certain specified circumstances or upon a change in control. Severance ranges from a multiple of one times base salary plus pro rata bonus for certain non-change in control events, to two times base salary plus pro rata bonus and additional benefits for other change in control events.

Limited Perquisites: NEOs are provided financial planning and tax preparation services, annual physicals (for amounts not otherwise covered by health insurance) and executive life insurance (with a tax gross-up benefit for grandfathered participants only).

10

2021 NEO Compensation Summary

| Name & Principal Position | Salary | Bonus | Stock Awards | Option Awards | Non-Equity Incentive Plan Comp. | Change in Pension Value & Nonqualified Deferred Comp. Earnings | All Other Comp. | Total | ||||||||

| Patrick J. Dempsey President and Chief Executive Officer, Barnes Group Inc. | $900,000 | $0 | $4,240,076 | $1,322,973 | $1,861,758 | $1,981,776 | $189,885 | $10,496,468 | ||||||||

| Julie K. Streich1 Senior Vice President, Finance and Chief Financial Officer, Barnes Group Inc. | 316,667 | 100,000 | 573,670 | 174,536 | 439,218 | 0 | 55,382 | 1,659,472 | ||||||||

| Marian Acker1 Vice President, Controller, Barnes Group Inc. | 305,000 | 60,000 | 352,874 | 110,970 | 294,434 | 0 | 82,831 | 1,206,109 | ||||||||

| Michael A. Beck2 Senior Vice President, Barnes Group Inc. and President, Barnes Aerospace | 460,000 | 0 | 628,127 | 201,134 | 603,589 | 0 | 48,898 | 1,941,748 | ||||||||

| Stephen G. Moule Senior Vice President, Barnes Group Inc. and President, Barnes Industrial | 500,000 | 170,000 | 628,127 | 201,134 | 493,616 | 0 | 47,474 | 2,040,351 | ||||||||

| Patrick T. Hurley, Ph.D. Senior Vice President and Chief Technology Officer, Barnes Group Inc. | 387,000 | 0 | 496,350 | 157,786 | 480,334 | 0 | 32,562 | 1,554,032 |

| 1. | Julie K. Streich joined the Company as Senior Vice President, Finance and Chief Financial Officer effective May 3, 2021. Marian Acker, Vice President, Controller of the Company, and the Company’s Principal Accounting Officer, served as the Company’s Interim Chief Financial Officer and Principal Financial Officer from January 1, 2021 – May 2, 2021. Ms. Acker resumed her role as Vice President, Controller of the Company, and the Company’s Principal Accounting Officer, as of May 3, 2021. |

| 2. | Michael A. Beck advised in November, 2021 that he will retire from the Company, effective April 30, 2022. In connection with his retirement, on March 11, 2022, Mr. Beck entered into a Covenant Agreement and Release of Claims with the Company as further detailed in the “Additional Information” section on page 46, and in the Form 8-K filed by the Company on March 15, 2022. |

11

Our Board and senior management devote considerable time and attention to corporate governance matters, and we maintain a comprehensive set of policies and procedures to enable effective corporate governance. We regularly review best practices in corporate governance and modify our policies and procedures as warranted. We solicit feedback from stockholders on governance and executive compensation practices. The following governance materials are available on our website at www.barnesgroupinc.com; click on “Investors” and then “Governance.” These materials will also be provided without charge to any stockholder upon written request to Legal Services, Barnes Group Inc., 123 Main Street, Bristol, Connecticut 06010.

Governance Materials

| ● | Bylaws |

| ● | California Transparency in Supply Chains Act Disclosure |

| ● | Certificate of Incorporation |

| ● | Charters for Board Committees |

| ● | Charter of the ESG Steering Committee |

| ● | Code of Business Ethics and Conduct |

| ● | Code of Business Ethics and Conduct for Suppliers |

| ● | Policy Regarding Reporting of Complaints and Concerns |

| ● | Human Rights Policy |

| ● | Conflict Minerals Policy |

| ● | Corporate Governance Guidelines |

| ● | Political Expenditures and Public Policy Matters Policy |

| ● | UK Tax Disclosure |

Code of Business Ethics and Conduct

Integrity, and the way we treat our employees, stockholders, customers, suppliers, competitors and communities, are key to our Company’s longevity and success. Our Barnes Values, as well as BES, form the foundation of our business culture and serve as a roadmap for navigating the complex and dynamic marketplaces in which we do business. Our Code reinforces the Barnes Values and establishes the behaviors that we expect from all of our employees, officers and directors. Our Code applies to everyone at our Company and unites us as “One Team, One Company.”

Key Governance Changes

Board Oversight of ESG: The Company’s ESG efforts are managed by the ESG Steering Committee which consists of members of the Company’s Senior Leadership Team. Our Board of Directors exercises governance over ESG through its three key standing committees: Audit, Corporate Governance, and Compensation and Management Development. In February 2022, the Board amended the Charters of each of these three committees to reflect each committee’s specific role in overseeing ESG. Also in 2022, the Company published a revised Charter of its ESG Steering Committee.

Diversity and Inclusion: We believe that a board that is diverse and inclusive is more effective in meeting the Company’s strategic needs and serving the long-term interests of the Company and its stockholders. In February 2021, the Company amended its Corporate Governance Guidelines to formalize our practice of considering gender, race, ethnicity and national origin, among other qualifications, when evaluating director candidates for nomination to the Company’s Board. The Board assesses the effectiveness of this practice when reviewing the composition of the Board. Additionally, the Company recently published a Diversity and Inclusion Mission Statement reflecting the Company’s practice of promoting and embracing a diverse and inclusive workplace, where everyone is treated with dignity and respect; where all employees are supported, encouraged, and empowered to engage, contribute and achieve their fullest potential in a safe and rewarding environment.

12

Human Rights Policy: In 2022, the Company published a Human Rights Policy, formalizing the Company’s current practice of respecting the value and dignity of every individual and intolerance of human rights abuses in any part of our business, anywhere we do business.

Proposal 1 – Election Of Directors1

Upon the recommendation of the Corporate Governance Committee, the Board has nominated Thomas O. Barnes, Elijah K. Barnes, Patrick J. Dempsey, Jakki L. Haussler, Richard J. Hipple, Thomas J. Hook, Daphne E. Jones, Mylle H. Mangum, Hans-Peter Männer, Anthony V. Nicolosi and JoAnna L. Sohovich to be elected at the 2022 Annual Meeting for continuing membership to the Board.

William J. Morgan, a current member of the Company’s Board of Directors, will retire from the Board, effective as of the 2022 Annual Meeting in accordance with the mandatory retirement provisions of the Company’s Corporate Governance Guidelines and is therefore not standing for re-election.

The Board has determined that except for Mr. Dempsey, each nominee is an independent director. If elected, each nominee will hold office until the 2023 Annual Meeting unless the nominee earlier dies, resigns, retires or is removed, as provided in the Bylaws. The eleven nominees are listed herein with brief biographies. None of the organizations listed as business affiliates of the nominees is a subsidiary or other affiliate of the Company unless otherwise noted. If a nominee for director should become unavailable for any reason, it is intended that votes will be cast for a substitute nominee designated by the Board. The Board has no reason to believe the persons nominated will be unable to serve if elected.

| The Board recommends a vote FOR all Director nominees. |

Nominees for Board of Directors

| THOMAS O. BARNES | Age: 73 | Director since: 1978 (43 yrs.) | Committees: E | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Talent Management/Development ● Board Committee Chair ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Mr. Barnes is Chairman of the Board and was a non-management employee of the Company through December 31, 2014. From 2007 until 2012, he served as a director of New England Bank Shares, Inc. He served as a director of Valley Bank from 2005 to 2007, when it was merged into New England Bank Shares, Inc. Mr. Barnes’ qualifications to be a member of our Board include his experience in the fields of manufacturing, finance and governance with numerous organizations throughout his career, including the Company’s former distribution business. In addition, Mr. Barnes has owned and managed several businesses and has experience in the commercial lending field. He has served on the Board for over 40 years, has served as Chairman of our Board since 1995, and has served as chairman, trustee or director for over 20 non-profit organizations. | |||

| 1 | As previously disclosed, effective March 8, 2022, Mr. Dempsey began a temporary leave of absence from his role as President and Chief Executive Officer to address health matters affecting a family member and Ms. Streich will serve as Interim Chief Executive Officer (principal executive officer) until Mr. Dempsey’s return. Ms. Streich will also continue to serve as the Company’s Senior Vice President, Finance and Chief Financial Officer during this interim period. |

13

| ELIJAH K. BARNES | Age: 41 | Director since: 2016 (5 yrs.) | Committees: CG | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Talent Management/Development ● Marketing/Branding ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Mr. Barnes serves on the Corporate Governance Committee of the Board of Directors. Mr. Barnes has over 18 years of experience in the areas of commercial real estate, lease negotiation, marketing and finance. He has been a Principal at Avison Young, where he is the co-head of the Agency Leasing Practice Group for the Washington, D.C. office, since September 2014. From 2008 to 2014, he was Managing Director and Principal at Cassidy Turley. Prior to Cassidy Turley, he was a Vice President for the Leasing Management Group at Jones Lang LaSalle. He received his bachelor’s degree in Economics from the University of Virginia and his Master of Business Administration from Johns Hopkins University. Mr. Barnes is a former National Association of Corporate Directors (NACD) Governance Fellow, having demonstrated his commitment to the highest standards of boardroom excellence by earning NACD Fellowship - The Gold Standard Director Credential. NACD Fellowship is a comprehensive and continuous program of study that empowered directors with the latest insights, intelligence, and leading boardroom practices. Mr. Barnes’ qualifications to serve on our Board include his significant commercial real estate experience that contributes to the Company’s management of its extensive owned and leased real estate portfolio. In addition to his business and financial qualifications, Mr. Barnes is the sixth generation of the Barnes family to serve on the Board, continuing a legacy of family oversight that is uniquely devoted to the Company’s long-term success and returning value to Company stockholders. | |||

| PATRICK J. DEMPSEY | Age: 57 | Director since: 2013 (8 yrs.) | Committees: None | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Government/Regulatory ● Talent Management/Development ● Marketing/Branding ● Technology/Innovation ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: 1 ● Nucor Corporation | Mr. Dempsey was appointed the President and Chief Executive Officer of the Company in March 2013. Prior to this appointment, since February 2012, he served as the Company’s Senior Vice President and Chief Operating Officer, and was responsible for oversight and direction of the Company’s global business segments, as well as working closely on the development and execution of the Company’s strategic plan. Mr. Dempsey joined the Company in October 2000 and has held a series of roles of increasing responsibility. He was appointed Vice President, Barnes Group Inc. and President, Barnes Aerospace in 2004, Vice President, Barnes Group Inc. and President, Barnes Distribution in October 2007, and Vice President, Barnes Group Inc. and President, Logistics and Manufacturing Services in October 2008. He is currently a director of Nucor Corporation having been appointed in 2016. He also serves as the Chair, Executive Committee and Board of Trustees of the Manufacturers Alliance for Productivity and Innovation (MAPI) and on the Board of Trustees for Connecticut Science Center. Mr. Dempsey’s qualifications to be a member of our Board include his extensive knowledge of the Company’s business operations and his depth of experience in the fields of business management, enterprise management systems, business development and international operations. | |||

14

| JAKKI L. HAUSSLER | Age: 64 | Director since: 2021 (0 yrs.) | Committees: CMDC | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Government/Regulatory ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree ● Board Committee Chair Other Current Public Directorships: 2 ● Service Corporation International ● Various Morgan Stanley Funds | Ms. Haussler was appointed to the Board of Directors in July 2021 and will stand for election at the 2022 Annual Meeting of Stockholders. Ms. Haussler serves on the Compensation and Management Development Committee of the Board of Directors. From 1996 until 2019, Ms. Haussler was Co-founder, Chairman, and CEO of Opus Capital Management, Inc., a registered investment advisory firm, where she currently remains non-executive Chairman. Ms. Haussler previously served on the Board of Cincinnati Bell Inc. where she was Chair of the Audit and Finance Committee, as well as the Governance and Nominating Committee, and served on the Executive Committee and Compensation Committee. Ms. Haussler is currently on the Board of Directors/Trustees of various Morgan Stanley Funds where she serves on the Audit Committee and Equity Committee, and is also on the Board of Directors of Service Corporation International where she serves on the Investment Committee and the Audit Committee. Ms. Haussler’s qualifications to be a member of our Board of Directors include her extensive experience in public accounting, investment banking, venture capital and asset management. | |||

| RICHARD J. HIPPLE | Age: 69 | Director since: 2017 (4 yrs.) | Committees: CMDC, CG | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Government/Regulatory ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Board Committee Chair ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: 2 ● Luxfer Holdings ● KeyCorp. | Mr. Hipple serves on the Board of Director’s Corporate Governance and Compensation and Management Development Committees. Mr. Hipple is the retired Executive Chairman of the board of directors of Materion Corporation, a title he held until December 2017. Materion supplies highly engineered advanced enabling materials and coatings used in a range of electrical, electronic, thermal, optical, and structural applications. Previously, he was the Chairman, President and Chief Executive Officer of Materion from 2006 to 2017 and its President and Chief Operating Officer from 2005 to 2006. He initially joined Materion in 2001. Prior to joining Materion, Mr. Hipple served 26 years in roles of increasing responsibility at LTV Corporation, a large U.S. metals conglomerate, culminating in the position of President. Mr. Hipple has previously served on the board of directors of Ferro Corporation and is currently a director of KeyCorp (serving as Chair of the Audit Committee and a member of the Nominating and Governance Committee and Director of Key Bank) and Luxfer Holdings (serving as Chair of the Remuneration Committee and a member of the Audit Committee). He also is a Chair Emeritus and current member of the Board of Trustees for the Cleveland Institute of Music. Mr. Hipple is a graduate of Drexel University with a Bachelor of Science degree in engineering. Mr. Hipple’s qualifications to be a member of our Board include his extensive executive management and leadership experience and an accomplished record of leading transformational global growth and product diversification, including through acquisitions. Additionally, Mr. Hipple brings a wealth of additional public company board experience to our Board. | |||

15

| THOMAS J. HOOK | Age: 59 | Director since: 2016 (5 yrs.) | Committees: Audit, CG | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Government/Regulatory ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Board Committee Chair ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Mr. Hook has been the Chief Executive Officer of SaniSure, Inc. since February 2021 and a director of SaniSure, Inc. since December 2019. He has been a director of Q Holding Company since September 2017, where he served as Chief Executive Officer from September 2017 to January 2021. Mr. Hook also serves as a director of NeuroNexus Inc. Mr. Hook was the President and Chief Executive Officer of Integer (formerly Greatbatch) from August 2006 to May 2017. Prior to this, he was Chief Operating Officer of Integer (formerly Greatbatch), a position he held from September 2004 to August 2006. From August 2002 until September 2004, Mr. Hook was employed by CTI Molecular Imaging where he served as President, CTI Solutions Group. From March 2000 to July 2002, he was General Manager, Functional and Molecular Imaging for General Electric Medical Systems. From 1997 to 2000, Mr. Hook worked for the Van Owen Group Acquisition Company and prior to that, Duracell, Inc. Until March 1, 2021, Mr. Hook served as Chairman of the Board and member of the Executive Committee of HealthNow New York, Inc., a leading health care company in Western New York, and he is also former director of Tactiva Therapeutics, Inc. Mr. Hook’s qualifications to be a member of our Board include his leadership experience, particularly in the high-tech manufacturing industry, together with his substantial knowledge of finance and accounting by virtue of his educational background and multiple executive management positions. | |||

| DAPHNE E. JONES | Age: 65 | Director since: 2019 (2 yrs.) | Committees: Audit | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Talent Management/Development ● Technology/Innovation ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: 2 ● Masonite International Corporation ● AMN Healthcare | Ms. Jones has been a director of Masonite International Corporation since February 2018, where she currently is a member of the Sustainability and Governance Committee. Ms. Jones has served as a director of AMN Healthcare since September 2018, where she is a member of the Audit Committee and Compensation Committee. Previously, Ms. Jones served as the Senior Vice President - Digital/Future of Work for GE Healthcare, the healthcare business of GE, from May 2017 to October 2017 and prior to that, she served as the Senior Vice President - Chief Information Officer for GE Healthcare Diagnostic Imaging and Services since August 2014. Prior to joining GE Healthcare, Ms. Jones was the Senior Vice President, Chief Information Officer for Hospira, Inc., a provider of pharmaceuticals and infusion technologies, from October 2009 through June 2014. Ms. Jones also served as Chief Information Officer at Johnson & Johnson from 2006 to 2009 and served in various information technology roles with Johnson & Johnson from 1997 through 2006. Ms. Jones began her career in sales and systems engineering at IBM. She previously served on the board of the Thurgood Marshall College Fund, a not-for-profit organization and the nation’s largest organization representing historically black colleges and universities, medical schools, and law schools. Ms. Jones’ qualifications to be a member of our Board include her extensive executive and leadership experience, and experience driving innovation using digital technology. | |||

16

| MYLLE H. MANGUM | Age: 73 | Director since: 2002 (19 yrs.) | Committees: CG (Chair), CMDC, E | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Board Committee Chair Other Current Public Directorships: 2 ● Express, Inc. ● Haverty Furniture Companies, Inc. | Ms. Mangum has served as Chief Executive Officer of IBT Enterprises, LLC, a leading provider of branch banking solutions, since October 2003. Prior to this, she served as the Chief Executive Officer of True Marketing Services, LLC since July 2002, focusing on consolidating marketing services companies. From 1999 to 2002, she was the Chief Executive Officer of MMS Incentives, Inc., a private equity company involved in developing and implementing marketing and loyalty programs in high-tech environments. She is currently a director of Haverty Furniture Companies, Inc. (serving on the Executive Committee and Chair of the Nominating, Compensation and Governance Committee) and Express, Inc. (serving as Chairman of the Board and member of the Audit Committee and Compensation and Governance Committee). Additionally, Ms. Mangum is an advisory board member of Piedmont College and The Shopping Center Group. She also served as a director of PRGX Global Inc. from 2013 until March, 2021, Collective Brands Inc., and its predecessor PaylessShoeSource, Inc., from 1997 to 2012, Scientific-Atlanta, Inc. from 1993 to 2006, Respironics, Inc. from 2004 to 2008, Matria Healthcare, Inc. from 2006 to 2008, and Emageon Inc. from 2004 to 2009, and as an advisory board member of Emory University/Goizueta Business School. Ms. Mangum’s qualifications to be a member of our Board include her current service as a chief executive officer, and extensive business and management experience including, in addition to that mentioned above, serving as an executive with General Electric, BellSouth and Holiday Inn Worldwide. She has extensive knowledge of marketing, accounting and finance, as well as compliance and internal controls. | |||

| HANS-PETER MÄNNER | Age: 59 | Director since: 2016 (5 yrs.) | Committees: Audit | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Mr. Männer is the former Chief Executive Officer of Otto Männer GmbH, a leader in the development and manufacture of high precision molds, valve gate hot runner systems, and micro-injection molding systems, which the Company acquired in 2013. Prior to joining Männer in 1990, Mr. Männer studied product engineering at the University of Applied Sciences, graduating as a civil engineer completing three years of vocational training as a toolmaker. He has over 18 years of experience as a board member for Volksbank Freiburg and over 10 years of experience as a board member for WVIB Wirtschaftsverband, a trade association. Mr. Männer is currently the Managing Director of HPM Invest GmbH, a limited partnership managing properties and capital assets, and an Advisory Board member of EMERAM Capital Partners. He holds an Executive MBA from Steinbeis University, Berlin. The Board appointed Mr. Männer to the Board as a director in 2016. Mr. Männer’s qualifications to be a member of our Board include his extensive experience in the plastic injection molding industry and industrial manufacturing, together with a background in finance and asset management. As such, Mr. Männer is well-qualified to help lead the strategic direction and investment decisions for the Company’s evolving portfolio of differentiated technologies. | |||

17

| ANTHONY V. NICOLOSI | Age: 68 | Director since: 2017 (4 yrs.) | Committees: Audit (Chair) | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Government/Regulatory ● Talent Management/Development ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Mr. Nicolosi is a retired partner of the accounting firm KPMG, where he had an approximately 39 year career. Most recently, Mr. Nicolosi served in the firm’s National Office from 2008 to 2013 as the Regional Risk Management Partner for the Americas (one of three KPMG Global Regions), the National Partner in charge of risk management for the US Audit Practice and the Coordinator of the firm-wide Enterprise Risk Management Process. He also served as a member of the Global Quality and Risk Management Steering Group; U.S. Legal, Risk and Regulatory Committee; Audit Operations Leadership and others. From 1987 to 2008, Mr. Nicolosi held positions as Engagement Partner or SEC Reviewing Partner for U.S. and multinational clients in many industries, including diversified industrials and power generation. For certain years in this period, Mr. Nicolosi served in the National Office’s Department of Professional Practice and held various leadership positions. Mr. Nicolosi also served for over 10 years as a panel member on KPMG’s Audit Committee Institute roundtables and other related initiatives. Mr. Nicolosi’s qualifications to be a member of our Board include his extensive practice as a certified public accountant and experience relative to accounting, auditing, internal controls, risk management, compliance and corporate governance acquired through serving notable multinational companies, leadership positions, audit committee contributions and more. He is the Audit Committee financial expert of our Board. | |||

| JOANNA L. SOHOVICH | Age: 50 | Director since: 2014 (7 yrs.) | Committees: CMDC (Chair) | |

QUALIFICATIONS/ATTRIBUTES/EXPERIENCE ● Global Business ● Manufacturing/Operational ● Aerospace, Industrial, Medical/Pharma, Automation, Robotics or Plastics End-Markets ● Government/Regulatory ● Talent Management/Development ● Technology/Innovation ● Marketing/Branding ● Risk Management/Oversight ● Prof. License/MBA/Econ. or Engineering Degree Other Current Public Directorships: None | Ms. Sohovich is the Chair of the Board of Directors for Chamberlain Group, a role she assumed on January 1, 2022 after serving as the Chief Executive Officer of Chamberlain Group from February 2016 until December 31, 2021. Prior to that, from January 2015 to February 2016, she was the Global President, STANLEY Engineered Fastening at Stanley Black & Decker, Inc. where she led a global technology and manufactured goods business. Before being appointed to this position in 2015, she served as Global President, Industrial & Automotive Repair since 2012 and, prior to that, Industrial & Automotive Repair President - North America, Asia and Emerging Regions since 2011, both at Stanley Black & Decker, Inc. From 2001 to 2011, Ms. Sohovich served in several roles of increasing responsibility at Honeywell International, including President, Security & Communications from 2010 to 2011 emphasizing new product development and innovation, Vice President & General Manager, Commercial Building Controls from 2008 to 2010 leading growth initiatives across a broad commercial building controls portfolio, and Integration Leader from 2007 to 2008 resulting in Honeywell’s successful acquisition and integration of Maxon Corporation. Ms. Sohovich served as General Manager, Building Controls Field Devices from 2005 to 2007 and Vice President, Six Sigma for Honeywell from 2004 to 2005. Her earlier experience includes plant management, repair and overhaul shop management, quality management and service as an officer in the United States Navy. Ms. Sohovich’s qualifications to be a member of our Board include her extensive executive management and leadership experience, broad knowledge of industrial manufacturers, global mindset and direct experience in driving innovation and strategic growth initiatives. | |||

18

Family Relationships

Other than Chairman Thomas O. Barnes as the father of Director Elijah K. Barnes, there are no family relationships among the officers and directors, nor are there any arrangements or understandings between any of the directors or officers of our Company or any other person pursuant to which any officer or director was or is to be selected as an officer or director.

Director Independence Assessment

The Board has adopted categorical standards to guide it in determining director independence. Under these standards, which are part of our Corporate Governance Guidelines, an “independent” director must meet the independence requirements in the New York Stock Exchange (NYSE) listing standards, including the requirement that the Board must have affirmatively determined that the director has no material relationships with the Company, either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company.

| a. | A director will not be independent if (i) the director is, or was within the preceding three years, employed by the Company; (ii) an immediate family member of the director is, or was within the preceding three years, employed by the Company as an “executive officer” (as such term is defined by the NYSE) other than on an interim basis; (iii) the director or any immediate family member has received from the Company, during any 12 consecutive months within the preceding three years, more than $120,000 in direct compensation from the Company, other than compensation received by an immediate family member of a director for service as a non-executive employee of the Company and director and committee fees and deferred compensation for prior service, provided that such deferred compensation is not contingent on continued service; (iv) the director is employed by the Company’s independent auditor; (v) an immediate family member of the director is employed by the Company’s independent auditor (I) as a partner or (II) otherwise as an employee who personally works on the Company’s audit; (vi) the director or an immediate family member was within the last three years a partner or employee of the Company’s independent auditor and personally worked on the Company’s audit within that time; or (vii) a Company executive officer is, or was within the preceding three years, on the board of directors of a company which, at the same time, employed the Company director or an immediate family member of the director as an executive officer. |

| b. | The following commercial and charitable relationships will not be considered material relationships that would impair a director’s independence: (i) if a Company director is an employee, or an immediate family member is an executive officer, of another company that does business with the Company and, within any of the last three fiscal years, the annual sales to, or purchases from, the Company are less than 1% of the annual revenues of the other company; (ii) if a Company director is an employee, or an immediate family member is an executive officer, of another company that is indebted to the Company, or to which the Company is indebted, and the total amount of either company’s indebtedness to the other is less than 1% of the total consolidated assets of the other company; or (iii) if a Company director serves as an officer, director or trustee of a charitable organization, and the Company’s discretionary charitable contributions to the organization are less than 1% of such organization’s total annual charitable receipts, provided that the amount of the Company’s contributions shall not include the matching of charitable contributions by Barnes Group Foundation, Inc. pursuant to the Matching Gifts Program. |

| c. | For relationships not covered by b. above, the directors who are independent under the Corporate Governance Guidelines in a. and b. above will determine whether the relationship is material or not and, therefore, whether the director is “independent.” The Company will explain in the next proxy statement the basis of any Board determination that a relationship was immaterial despite the fact that it did not meet the categorical standards of immateriality in b. above. |

The Board has determined that, other than Mr. Dempsey, all of our director nominees are independent under the listing standards of the NYSE and the above categorical standards.

19

Process For Selecting Director Nominees,

Stockholder Recommended Director Candidates

Nominee Qualifications

The Corporate Governance Committee strives to maintain an engaged and independent Board with broad and diverse qualifications that serve the long-term interests of our stockholders. Candidates for director shall be selected on the basis of their qualifications, such as:

| ● | Character, wisdom, judgment and integrity; |

| ● | Experience in positions with a high degree of responsibility; |

| ● | Prominence and accomplishments in areas relevant to the Company’s business activities; |

| ● | Understanding of the Company’s business environment; |

| ● | Strategy development, experience in technology-laden industrial businesses, and/or other relevant firms; |

| ● | Capacity and desire to represent the interests of the Company’s stockholders as a whole; |

| ● | Commitment to maximize stockholder value; |

| ● | The extent to which the interplay of the nominee’s skills, knowledge, expertise, experience and diversity of background (considering, without limitation, gender, race, ethnicity and national origin) with that of the other Board members will help build a Board that is effective in collectively meeting the Company’s strategic needs and serving the long-term interests of the Company and its stockholders; and |

| ● | Ability to devote sufficient time to the affairs of the Company. |

Director Nominee Selection Process

The Corporate Governance Committee will consider director candidates recommended by stockholders of the Company, directors, officers and third-party search firms. When utilizing a third-party search firm, the search firm is instructed to identify candidates based on criteria specified by the Corporate Governance Committee, perform initial screenings of the candidates’ resumes and conduct initial interviews. The Corporate Governance Committee evaluates stockholder-recommended candidates in the same manner as all other candidates. Information for stockholders wishing to submit a recommendation is located on page 73.

Board Size

Our Corporate Governance Guidelines provide that the Board should generally have no fewer than six and no more than twelve directors. The Board currently has twelve directors. Each director is required to resign from the Board no later than the annual meeting of stockholders following his or her 75th birthday. Director William J. Morgan will retire from the Board effective as of the 2022 Annual Meeting in accordance with these mandatory retirement provisions. Each director is also required to advise the Chairman of the Board of any change in his or her status, including a change in employment or service on other boards of directors, or retirement from his or her principal occupation or another board of directors. Director Thomas O. Barnes, Chairman of the Board, is designated to preside at executive sessions of non-management directors. Mylle H. Mangum, the Lead Independent Director, is designated to preside at executive sessions of the independent directors.

20

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management and a highly engaged and high-functioning Board. The Company’s Corporate Governance Guidelines provide the Board with flexibility to select the appropriate leadership structure for the Company. In making leadership structure determinations, the Board considers many factors including the specific needs of the business and what is in the best interests of the Company’s stockholders.

Our Board has chosen to separate the roles of Chief Executive Officer and Chairperson of the Board. Mr. Dempsey is our Chief Executive Officer and Director Thomas O. Barnes is our Chairman. As Chief Executive Officer, Mr. Dempsey is responsible for day-to-day management of the Company and the overall execution of our strategy. As Chairman, Thomas O. Barnes presides at meetings of the Company’s stockholders and Board of Directors, and is responsible for director orientation and continuing education and review of Board committee assignments and consideration of Chair rotation in conjunction with the Corporate Governance Committee, among other responsibilities as set forth in our Corporate Governance Guidelines and Bylaws.

While our Chairman has been independent under relevant NYSE listing standards as of January 1, 2018, the Board has maintained a Lead Independent Director elected by our independent directors. Director Mangum currently serves as Lead Independent Director.

The responsibilities of the Lead Independent Director are to:

| ● | Preside at all meetings of the Board at which the Chairman of the Board is not present; |

| ● | Preside at executive sessions of the independent directors; |

| ● | Serve as a liaison between the Chairman of the Board and the independent directors; |

| ● | Together with the Chairman of the Board, determine the nature and scope of the information sent to the Board; |

| ● | Approve the final meeting agendas for the Board following review by the Chairman of the Board; and |

| ● | Approve meeting schedules to ensure that there is sufficient time for discussion of all agenda items. |

The Board believes that the current structure is appropriate for the Company and provides for effective independent Board leadership and engagement. This structure is enhanced by the fact that the Board’s Audit Committee, Compensation and Management Development Committee (Compensation Committee), Corporate Governance Committee and Executive Committee are comprised entirely of independent directors. Further, the Company’s independent directors periodically meet in executive sessions.

Board Committees

We have a standing Audit Committee, Compensation Committee and Corporate Governance Committee. The primary responsibilities for each of these committees are summarized below. Charters for the committees are available on the Company’s website, www.barnesgroupinc.com, under the Governance tab of Investors (https://ir.barnesgroupinc.com/governance/highlights/default.aspx). All members of the Audit Committee, Compensation Committee and Corporate Governance Committee are independent within the meaning of the NYSE listing standards and the Board’s categorical standards, and all members of both the Audit Committee and the Compensation Committee meet the additional independence requirements of the NYSE listing standards that are applicable to members of such committees. The Executive Committee meets only (i) when action between Board meetings is necessary or desirable, and the convening of a special Board meeting is not practical, or (ii) at the request of a majority of the independent directors. The Executive Committee did not meet in 2021.

21

Audit Committee By its charter, the Audit Committee’s primary responsibility is to assist the Board of Directors in fulfilling its oversight of the integrity of the Company’s financial statements; the effectiveness of the Company’s internal control over financial reporting; the Company’s compliance with legal and regulatory requirements; the performance of the Company’s internal audit function; and the review of the qualifications, independence, and performance of the independent registered public accounting firm. The Audit Committee has responsibility for overseeing the guidelines and policies that govern the processes by which the Company assesses and manages its exposure to risk. The Audit Committee also reviews and discusses with management the ESG reporting process, climate related metrics and management’s evaluation of the adequacy and effectiveness of controls for related disclosures. For additional information about the Audit Committee’s oversight of the risks faced by the Company and the Audit Committee’s role with respect to ESG oversight, see “Board Role in Risk Oversight” on page 23 and the “Audit Committee Report” on page 67. The Board has determined that Mr. Nicolosi, who qualifies as an independent director under the NYSE listing standards and the Company’s Corporate Governance Guidelines, is an “audit committee financial expert” as defined by the Securities and Exchange Commission (SEC). | Meetings in 2021: 8

Current Members: ● Chair: Anthony V. Nicolosi ● Thomas J. Hook ● Daphne E. Jones ● Hans-Peter Männer ● William J. Morgan | |

Compensation and Management Development Committee The Compensation Committee acts on behalf of the Board to establish the compensation of executive officers and other senior management and provides oversight of the Company’s compensation philosophy and of compensation policies and practices as they relate to risk management. The Compensation Committee also acts as the oversight committee with respect to the Performance-Linked Bonus Plan (annual cash incentive program), the 2014 Barnes Group Inc. Stock and Incentive Award Plan (the “Stock and Incentive Award Plan”), and other arrangements covering executive officers and other senior management. The Compensation Committee’s processes for establishing and overseeing executive compensation can be found in the Compensation Discussion and Analysis section. In overseeing those plans and programs, the Compensation Committee may delegate authority for day-to-day administration and interpretation of the plans, including selection of participants, determination of award levels within plan parameters, and approval of award documents, to officers of the Company or the Company’s Benefits Committee. However, the Compensation Committee may not delegate any authority under those plans for matters affecting the compensation and benefits of the executive officers. With respect to ESG, the Compensation Committee oversees the Company’s effort to ensure the Company is seeking, developing and retaining human capital appropriate to support the ongoing transformation of the Company, to drive business performance, to foster diversity and inclusion across the organization and support the successful execution of the Company’s growth strategy. The Compensation Committee also oversees succession planning programs, including plans for the Chief Executive Officer and key officers, and reports to the Board at least annually regarding the strengths and weaknesses of the Company’s processes for management development and succession planning. Compensation Committee agendas are established in consultation with the Compensation Committee Chair and its independent compensation consultant. The Compensation Committee has sole authority to retain outside advisors to assist in evaluating executive officer compensation and approve the terms of engagement including the fees of such advisors. The Compensation Committee typically meets in executive session without management present during each meeting. | Meetings in 2021: 4

Current Members: ● Chair: JoAnna ● Jakki L. Haussler ● Richard J. Hipple ● Mylle H. Mangum |

22

Corporate Governance Committee The Corporate Governance Committee makes recommendations concerning Board membership, functions and director compensation and the Company’s overall corporate governance policies and practices. The Corporate Governance Committee serves as the nominating committee for the Board. Additional responsibilities include board succession matters, the annual performance review of the Chairman of the Board, reviewing matters relating to potential director conflicts of interest and director independence, overseeing the Company’s practices related to political activities and the engagement with the Company’s stockholders on topics of environmental, social and governance matters, and administering the Company’s related person transactions policy. | Meetings in 2021: 4

Current Members: ● Chair: Mylle H. Mangum ● Elijah K. Barnes ● Richard J. Hipple ● Thomas J. Hook ● William J. Morgan |

Board and Committee Meeting Attendance 2021

Directors are strongly encouraged to attend our annual meeting of stockholders, all Board meetings and meetings of the committees on which they serve. Our Board held 8 regular (in person or videoconference/telephonic) meetings during 2021. Overall attendance at Board and committee meetings during 2021 was 99% for directors. All twelve directors serving at the time of the 2021 Annual Meeting attended the 2021 Annual Meeting.

While risk management is the responsibility of the Company’s management team, the Board is responsible for oversight of the Company’s risk management activities generally. The Audit Committee has been designated by the Board to take the lead in overseeing risk management at the Board level and each of the committees of the Board are tasked with assisting the Board with the oversight of certain categories of risk management within their respective areas of responsibility.

Board of Directors

Consistent with its oversight role, the full Board regularly receives information about the Company’s risk management activities and the most significant risks faced by the Company. This is accomplished through attendance at committee meetings by the other Board members when warranted, periodic reports on these matters from each of the committees, and by addressing significant risks with the full Board at Board meetings or in executive sessions as appropriate.

23

Audit Committee

The Audit Committee has primary responsibility for reviewing and discussing the guidelines and policies that govern the processes by which the Company assesses and manages its exposure to risk, including the Company’s enterprise risk management program.

The Audit Committee periodically meets with management and the Board of Directors to discuss these guidelines and policies, and reviews and assesses management’s identification and assessment of major risk exposure and the manner in which risk is being monitored and controlled in areas such as: external financial reporting and controls, litigation and compliance, safety, data protection and cybersecurity. The Audit Committee also reviews and discusses with management the ESG reporting process, climate related metrics and management’s evaluation of the adequacy and effectiveness of controls for related disclosures. In conducting the above, the Audit Committee considers the nature of the material risks the Company faces and the adequacy of the Company’s guidelines and policies to respond to and manage these risks. The Audit Committee receives updates from management and others, including the Company’s internal and external auditors and, in many instances, the discussion of these risk factors is integrated within the topics on the Board and committee agendas.

Compensation and Management Development Committee

The Compensation and Management Development Committee oversees compensation programs so that they are designed with the appropriate balance of risk and reward in relation to the Company’s overall business strategy and performance, and are not reasonably likely to have a material adverse effect on the Company. The Compensation Committee also:

| ● | Evaluates and reviews our incentive compensation arrangements annually based on an inventory of all relevant compensation programs prepared by the Human Resources department which includes details of the principal features of the programs, including key risk mitigation factors to ensure that our employees, including our NEOs, are not encouraged to take unnecessary risks in managing our business; |

| ● | Reviews and provides input to management regarding compensation risk management, including whether compensation arrangements incentivize unnecessary and excessive risk taking; and |

| ● | Oversees the Company’s effort to ensure the Company is seeking, developing and retaining human capital appropriate to support the ongoing transformation of the Company, to drive business performance, to foster diversity, equity and inclusion across the organization and support the successful execution of the Company’s growth strategy. |

Corporate Governance Committee

The Corporate Governance Committee makes recommendations concerning the Company’s overall corporate governance policies and practices, including:

| ● | Reviewing potential director conflicts of interest and director independence; |

| ● | Overseeing engagement with the Company’s stockholders on topics of environmental, social and governance matters; |

| ● | Overseeing practices related to political activities; |

| ● | Reviewing feedback from shareholder outreach; and |

| ● | Administering the related person transactions policy. |

24

We have posted our Policy Regarding Reporting of Complaints and Concerns on our website. The policy provides that stockholders and other interested parties may communicate with the Board, a committee of the Board, the independent directors or with an individual director, by any of the following methods:

By Phone - 1-800-300-1560

(alternatively, access the Reporting Tool Phone List at https://www.barnesgroupinc.com/wp-content/uploads/2022/02/2022-EthicsPoint-Dialing-Instructions.pdf to find telephone numbers outside of the United States)

By Mail

Barnes Group Corporate Compliance Hotline

P.O. Box PMB 3667

13950 Ballantine Corporate Place, Ste. 300

Charlotte, NC 28277-2712

By Internet

https://barnesgroupinc.ethicspoint.com

All complaints and concerns reported by the above methods will be received by a third-party provider, who will forward each complaint or concern to the Office of the General Counsel which is responsible for relaying communications to the Board. The Chair of the Audit Committee receives regular summary reports of all reported complaints and concerns.

We believe it is critical to maintain a connection with our stockholders. We reach out to our largest institutional stockholders twice per year and invite them to speak with us regarding governance matters, including ESG, and compensation practices, to ensure we know what our stockholders’ top priorities are in those areas. In 2021, we continued this outreach. During those outreach conversations, we highlighted our ESG program enhancements, human capital management, key governance practices including the Company’s focus on director refreshment and diversity, limitations on simultaneous public board service, and aspects of our current executive compensation program.

| DIRECTOR COMPENSATION IN 2021 |