Washington, D.C. 20549

The Leuthold Funds

Dear Fellow Shareholders:

At the outset, we’d like to thank all of you for your support over the last twelve months. Our family of mutual funds continues to grow, and 2006 saw the launch of two new mutual funds.These latest Funds offer new and current shareholders viable alternatives to our Leuthold Core Investment Fund and Leuthold Select Industries Fund, both of which are now closed to additional investment (although capital gains and dividends may continue to be reinvested).Thus far, we have been very encouraged by the interest in the new “successor”Funds.Your continued confidence in our investment management is most appreciated.

We are also encouraged that our longstanding investment strategies and disciplines continue to gain recognition and acceptance by individual and professional investors. Much of our investment process is the result of decades of exhaustive research focusing on the capital markets.As a research-intensive firm, we expend much effort to determine how asset prices respond under different conditions, in order to make rational and informed investment decisions. These endeavors have helped us to achieve a successful long term track record and we are confident that our ongoing research, our conviction in the philosophies,and adherence to the disciplines will allow us to carry on this success going forward.

A year ago, we expected that the next twelve months would become a period of transition for the stock market. Although this did not come to fruition,our defensive orientation did not cost us much in terms of performance.Over the 12-months ended September 30, 2006, our Leuthold Core Investment Fund appreciated 6.64%, and the Leuthold Select Industries Fund gained 8.67%, both falling short of the 10.80% gain in the S&P 500 (total returns).The final stretch of the Funds’fiscal year (ending September 30) was characterized by a strong rally led by large cap stocks.This put indexes like the Dow Jones Industrial Average and S&P 500 well ahead of the rest of the market in terms of YTD performance. In terms of the last twelve months, other measures such as the S&P 400 Mid Cap Index (+6.55% total return) and the S&P 600 Small Cap Index (+7.18% total return) fell much closer to the performance of our own Funds. Our ‘bear market’ Grizzly Short Fund (always 100% short) lost 10.23% total return, which was close to the same percentage that the S&P 500 gained (+10.80% total return).

| Ø | As we have often warned Grizzly Fund shareholders, it is very difficult (some would say impossible) to profit with an all-short stock portfolio during a rising market. Per the Prospectus, the Grizzly Short Fund (typically employed for hedging or speculative purposes) is always 100% short, regardless of our own market opinion. |

THE INVESTMENT OUTLOOK

In late September 2006, our composite analysis of over 180 market indicators led us to conclude that overall conditions within the U.S. stock market warranted a more aggressive structure within our flexible asset allocation portfolio. This move has served us well so far. Since the end of the Funds’fiscal year (September 30), the stock market has continued to rise,and has been regularly achieving new cyclical bull market highs.

The Leuthold Funds

However, we are viewing the current strength in the stock market with an eye of caution, and our bullishness toward the U.S.stock market might be considered somewhat “tactical”in nature. Although an assessment of our quantitative model suggests that there is additional upside in the stock market, there are also signs that the bull market is quite mature. Beyond the intermediate term, forward visibility for corporate earnings growth, the economy,inflation and interest rates have become more nebulous than a year ago.While we currently cannot predict how long we will stay positive on the stock market,we can say with certainty that the quantitative disciplines,based on our “weight of the evidence”approach to assessing the health of the market, will continue to guide our future asset allocation decisions.

As of the stock market’s closing level on November 6, 2006, the S&P 500 stood at about 1380, which brings the cumulative bull market gains in this cycle to about 78% (price only;measured from early October 2002).This compares to a 61% average gain when looking at previous bull market cycles in the twentieth century. This is not to say that the gains in the current cycle are excessive or overextended, but our long term cycle studies do suggest that we are somewhat beyond what could be considered an “average”stock market recovery.

| Ø | The current economic expansion is now five years old, compared to the median length of 3-1/2 years since WWII. (However,the two expansions prior to the current expansion averaged nine years in duration.) |

| Ø | Post WWII economic history also indicates that new bear markets in stocks get underway before an economic expansion ends - typically 6-12 months sooner.This is why the stock market is considered a “leading indicator”for the economy. |

Of course, models based purely on the stock market and economic history are far from precise and thus can only be considered as proxies for what might be considered “typical”or “normal.”Nevertheless,as students of market history, we continue to be aware that current stock market and economic cycles could be considered “later-stage”when compared to past cycles.

While various economic indicators continue to point to a growing economy,we are firmly aware of the growing list of risks that could eventually forestall further economic growth. Some of these risks include a weakening housing market,costly energy prices,higher interest rates,a contraction of the global monetary base,and an increasingly hostile geo-political climate.

History also warns us that this economic expansion is now beyond what would be considered “normal”in terms of duration,thus it would not be unusual for a recession to occur sometime in 2007 by historical standards.Certainly,past experience demonstrates that market and economic cycles can extend beyond their long term averages,but we believe a heightened sense of skepticism is clearly appropriate when the current market cycle extends beyond historical norms.

On a total return,cumulative basis,the S&P 500 is now up 91.1% from its October 9,2002,low through November 6, 2006, while the Leuthold Select Industries Fund is up 170.6%, and even the relatively lower risk Leuthold Core Investment Fund is up 118.7% over the same timeframe.

| Ø | In summary,we are currently bullish in our outlook for the stock market,and the evidence before us suggests that equities may finish 2006 on a strong note. However, our current outlook should be considered tactical at this point. How long we remain bullish on the U.S. stock market will hinge on future“weight of the evidence”assessments of our quantitative market analysis. |

The Leuthold Funds

Investors in the Leuthold Select Industries Fund should keep in mind that this Fund, per its Prospectus, remains fully invested in stocks. If a bear market develops in the coming year, our Select Industries Fund may go down as much or more than the market averages. (On the other hand, the Grizzly Short Fund may do very well.)

| Ø | All things considered,for those interested in a flexible,diversified holding,we believe our flagship asset allocation strategy is the most appropriate for long-term investors and retirement account assets.Investments can be made in this strategy through our Leuthold Asset Allocation Fund (the successor to the now-closed Leuthold Core Investment Fund). |

Leuthold Core Investment Fund: This Fund’s strategy is flexible, value-oriented, and risk-averse. The Leuthold Core Investment Fund adjusts asset class exposure, based on underlying market dynamics and trends, in order to avoid undue risk,and attempts to take advantage of areas that appear poised to outperform.Assets are actively allocated between stocks, bonds, money market instruments, and foreign securities.When appropriate, the Fund may also hedge by selling short certain securities when our disciplines indicate potential underlying market weakness.While at times individual allocations may appear unorthodox, they are intended to come together as complementing positions in an effort to carry out the Fund’s guiding principles:make and keep positive returns.

| Ø | Through September 30,2006,Morningstar rated this Fund “Five-Stars Overall”within the “Moderate Allocation”category containing 808 funds. |

| Ø | The Morningstar rating is based on historical risk-adjusted performance calculated from the Fund’s 3- 5- and 10-year (if applicable) average annual returns, with a Five-Star rating being the highest, and awarded to the top 10% of funds in a category. The Fund is also rated “Five-Stars”for both the 3-year,5-year and 10-year periods ended September 30,2006,out of 808,627,and 319 funds, respectively, within the Moderate Allocation category. |

Ratings subject to change each month.The ‘star’rating is based on historical risk-adjusted performance, calculated from the Fund’s 3- 5- and 10-year (if applicable) average annual returns.(The top 10% of funds in a category receive 5 stars,the next 22.5% receive 4 stars,middle 35% receive 3 stars,next 22.5% receive 2 stars,and the bottom 10% receive 1 star.)

Leuthold Asset Allocation Fund: This is the successor Fund to the now-closed Leuthold Core Investment Fund, which began trading on May 24, 2006.The strategy and objective of this Fund are identical to those of the Leuthold Core Investment Fund in terms of flexibility, asset class exposure, disciplines and risk aversion. The only difference between the two portfolios is in the construction of the domestic equity allocation.

| Ø | The Leuthold Asset Allocation Fund uses a multi-strategy approach for domestic equity selection.The balance of the strategies employed allows us to construct an equity portfolio that has risk-reward characteristics that we believe are suitable for an asset allocation portfolio. |

| Ø | The Select Equities strategy is a bottom-up, stock-based quantitative model that ranks stocks on a bi-weekly basis.This strategy is also available as a stand-alone all-equity mutual fund. |

| Ø | The Undervalued and Unloved equity strategy is a “value”stock screening methodology that has been in existence for over 25 years.This stock screen has previously been employed (and may continue to be employed going forward) in the Core Investment Fund when value-type stock exposure is targeted. |

The Leuthold Funds

Leuthold Select Industries Fund: Unlike the Leuthold Core Investment Fund and Leuthold Asset Allocation Fund,we cannot apply our asset allocation dexterity in this Fund.The Leuthold Select Industries Fund is mandated to remain 100% invested in stocks at all times. This attribute results in the potential for considerable volatility, undoubtedly higher risk,and the probability investors will lose money when the stock market declines.

| Ø | Through September 30, 2006, Morningstar rated this Fund “Four-Stars Overall”within the “Mid-Cap Growth”category containing 821 funds. |

| Ø | The Fund is rated “Five-Stars”by Morningstar for the 3-year period ended September 30,2006, out of 821 funds in the Mid-Cap Growth category.Also, the Fund is rated “Four-Stars”by Morningstar for the 5-year period ended September 30, 2006, out of 637 funds within the Mid-Cap Growth category. |

Ratings subject to change each month.The ‘star’rating is based on historical risk-adjusted performance, calculated from the Fund’s 3- 5- and 10-year (if applicable) average annual returns.(The top 10% of funds in a category receive 5 stars,the next 22.5% receive 4 stars,middle 35% receive 3 stars,next 22.5% receive 2 stars,and the bottom 10% receive 1 star.)

The Select Industries Fund strategy is based on industry stock selection, industry group rotation, and sector concentrations. It is driven by a quantitative evaluation of stocks spanning almost 140 equity-industry groups, attempting to detect where there may be collective strength and emerging leadership potential, while exposing areas that appear vulnerable.

| Ø | The element of sector/industry group concentrations results in this Fund’s higher volatility profile, being potentially more risky while offering potentially more reward. |

Leuthold Select Equities Fund: This is the successor Fund to the now-closed Leuthold Select Industries Fund,which began trading on May 24,2006.The Leuthold Select Equities Fund is mandated to remain 100% invested in stocks at all times.This attribute results in the potential for considerable volatility, undoubtedly higher risk, and the probability investors will lose money when the stock market declines significantly.

Where the Fund differs from the Leuthold Select Industries Fund is in its approach to equity selection.Whereas the Select Industries employs a top-down industry group approach as the primary driver to portfolio construction, the Leuthold Select Equities Fund uses a quantitative bottom-up, stock picking strategy.While the Select Equities Fund can, at times, result in similar sector and/or industry group over-weights, the overlap of specific equity securities between the two strategies is minimal.

| Ø | The Select Equities Fund typically maintains approximately equally-weighted positions in about 50 individual stocks, selected per a multi-factor quantitative discipline.This model is run on a bi-weekly basis.The strategy is based on a stock rating system that was originally developed by The Leuthold Group in the late-1980s. |

Grizzly Short Fund: This is an actively managed Fund that is 100% short a group of individual stocks. Short-selling strategies are aimed at profiting when stock prices decline. Even when our firm is bullish toward the stock market, the Grizzly Short Fund’s policy mandates the portfolio to target 100% short exposure, regardless of the trend of the market.Because of this,shareholders should anticipate they will most likely lose money investing in this Fund when stock prices,in general,are in a rising trend.

The Leuthold Funds

The Grizzly Short Fund is a tool for sophisticated investors.This Fund is often used by traders and other speculators anticipating the market may decline, in order to tactically regulate stock market risk, or used in varying degrees with other complex portfolio strategies.This is not a Fund for buy and hold investors!

| Ø | The Grizzly Short Fund typically maintains approximately equally-weighted short positions in about 50 individual stocks, initially selected per a multi-factor quantitative discipline. Each position is monitored daily and subject to a set of short covering disciplines. |

A LOOK IN THE REAR VIEW MIRROR

| Ø | In this section we provide an overview of the performance (good and bad) of the Leuthold Funds that traded for the entire fiscal year ended September 30, 2006. |

Leuthold Core Investment Fund

This is our flagship Fund,with current assets (November 6,2006) of about $1.6 billion.As previously noted,for the fiscal year ended September 30, the Fund posted a total return of +6.64% compared to +10.80% for the S&P 500. Despite a lower than normal equity exposure for a good portion of the year,a fair amount of the positive return for the Core Fund came from our common stock commitments,both in “Emerging Market”equities,and the “Select Industries” portion of the portfolio. For the year, an average of 5.5% of assets was invested in emerging market equities, with 45% on average in the Select Industries equity allocation. For the 12-months ended September 30 our equity commitment in emerging market equities resulted in a 21% gain, while the Select Industries portion of the equity exposure added almost 10%.

In late-September, as a result of improvement in the readings of our disciplined “weight of the evidence”market analysis,our equity exposure was increased back up to near our normal guideline minimum of 70%.As it stands,equity exposure remains near these 70% target maximums.

Our Core Fund’s normal minimum guideline for fixed income is 30% of assets. For the majority of the year, our comparative analysis had suggested that attractive fixed income opportunities on a risk-reward basis were in relatively short supply, leading us to have a lower than minimum exposure to fixed income securities. For the year, we had an average 16% of portfolio assets allocated to fixed income,which was about half our normal minimum percentage.

One area of the bond market that continued to offer an attractive risk-reward profile was in corporate automotive bonds (now limited to GMAC issues).We originally established a position in these bonds back in May 2005, as the auto industry was hit with a steady stream of bad news and debt downgrades.This investment paid off quickly and we sold the GMAC position at about a 20% gain.However,another tactical opportunity presented itself and we re-established a position in GMAC bonds (currently a 12% portfolio position).This position was up about 12% from purchase,as of the end of September.

The balance of our fixed income position is comprised of 5 year T-notes, which from a risk/reward perspective, appeared to be much more attractive than anything of longer duration, such as 10 year Treasuries. During the fiscal year, we had added exposure to this position, which currently stands at about 9% of portfolio assets. For the year, this position was moderately additive to portfolio performance as of the end of September 2006, gaining about 1.8% on a total return basis.We had been looking to add to this position in recent months, however yields moved away from us and we have put the purchase on hold until a more favorable opportunity presents itself.

The Leuthold Funds

For much of the year, we had employed a tactical hedge to adjust our equity exposure, as a means for moderating stock market risk. At certain times during the year, our assessment of market risk resulted in us moving toward our normal minimum in terms of equity exposure.But as of late-September 2006,the equity hedge had been eliminated as our outlook for the stock market had improved.Today,we have no equity hedges in place,and have taken steps to move toward an aggressive level of equity exposure. In retrospect, our caution during the year was premature, although it did not cost us very much in terms of performance.

We continue to see a favorable secular story unfolding for Industrial Metals.We introduced this investment to the Core Fund in mid-2002 (through industrial metals stocks) and originally viewed it as an outstanding long-term opportunity - perhaps a four to five-year play. The basis behind this investment continues to be a global supply/demand imbalance.We believe global demand for these metals will continue to be strong, with growth in the Pacific-Rim being a significant driver. On the supply side, we had experienced a decade of under-investment as depressed metals prices caused companies to reduce production and shutter mines during the 1990s. It could be a number of years before production can be increased enough to satisfy the growing global demand.

As you are most likely aware, Refco Inc., one of the largest global commodities firms, filed for bankruptcy shortly after the previous fiscal year ended September 30, 2005. Refco had held a small percentage of our Core Fund’s assets (Physical Industrial Metals positions).We are continuing to diligently pursue the return of these assets using all legal avenues available,to seek a favorable outcome on behalf of our shareholders.As expected, the bankruptcy proceedings have been prolonged. Nevertheless, we believe that we are making some progress. The Refco, Inc. debtors have prepared a plan which contemplates the disposition of their assets and the resolution of outstanding claims. The Refco, Inc. debtors are currently soliciting acceptances of the plan from creditors with the goal of having the plan approved by the end of the year.We do not know if the plan will be approved. In the meantime,the Core Fund values the affected assets pursuant to its fair value pricing policy. In order to continue to attempt to benefit from our bullish long-term outlook for Industrial Metals, we established an Industrial Metals proxy within the portfolio, using a group of Industrial Metals stocks.This Industrial Metals proxy held steady at about 5% of assets during the year, and returned 64% for the 12-months ended September 30, 2006.

Our positions in Emerging Market equities also continued to benefit performance during the fiscal year. For the year, we had an average of 5.5% of assets deployed here, which is slightly above our normal minimum core position (5%).At the end of September, we increased our exposure in Emerging Market equities to 8%, encouraged not only by improved performance, but by the fact that much of the previous speculative froth in this asset class had cleared . For the 12-month period ended September 30,2006,our Emerging Market positions had gained 21%.

In January 2006,we enhanced our global equity exposure by initiating a small position in Japanese equities,using a package of open-end mutual funds and exchange traded funds (ETFs).Our investment here was built on the premise that Japan will continue to benefit from a secular recovery and restructuring within its own financial system.Although we expect that the Japanese economy will be subject to cyclical fits and starts, we suspect that the longer term prospects for Japan continue to be bullish.

The Leuthold Funds

Over the last 12-months ended September 30, 2006, the Leuthold Core Investment Fund’s +6.64% total return lagged the S&P 500 by about 400 basis points. However, keep in mind our primary objective is not to beat some market index. It is not difficult to achieve positive results investing in stocks during a strong rising market,but our normal maximum limit of 70% in equity exposure can make it difficult for the Core Fund to match or exceed a stock market index that is 100% invested in stocks.Our primary objective is to make and keep positive returns for our investors. This means attempting to reduce risk when market conditions are looking less favorable or downright dire,as they were in 2000-2002.

The last five years shows how productive our approach can be. But it is no assurance we will do as well in future unfavorable stock market periods.

| Ø | Over the last five years (ended September 30, 2006), the Leuthold Core Investment Fund has a very wide performance advantage compared to the stock market. The Core Fund’s cumulative total return gain of +84.13% (+12.99% annualized), compares to the S&P 500’s cumulative total return gain of 40.08% (+6.97% annualized), and the Lipper Flexible Fund Index cumulative total return gain of +40.06% (+6.97% annualized). |

Leuthold Asset Allocation Fund

This is the successor Fund to our flagship Leuthold Core Investment Fund,with current assets (November 6,2006) of about $106.9 million.This “new”Leuthold Asset Allocation Fund uses a different U.S. stock selection strategy, but otherwise will follow the very same asset allocation directives and use the same asset class investment vehicles as the Leuthold Core Investment Fund.As previously noted,this Fund was launched on May 24,2006 and thus does not have a full year of investment performance to discuss in this annual review.

Leuthold Select Industries Fund

As previously noted, this all-equity Fund was up 8.67% total return for the year ended September 30, 2006, compared to a 10.80% total return gain for the S&P 500.This latest 12-month gain for the Select Industries Fund compares with its 31.08% total return gain for the previous 12-month period (September 30, 2004 - September 30, 2005).

| Ø | Since inception (June 19, 2000) through September 30, 2006, the Leuthold Select Industries Fund has produced a cumulative total return gain of +74.63% (+9.39% annualized) compared to a cumulative total return loss of -0.31% for the S&P 500 (-1.98% annualized). |

A year ago, as of September 30, 2005, the Leuthold Select Industries Fund was heavily weighted in Health Care, Basic Materials and Transportation stocks.The combined weight of these three sectors made up 60% of portfolio assets, including group positions in Industrial Metals, Health Care Cost Containment, Big Pharmaceuticals, Biotechnology,Generic Pharmaceuticals,Railroads,and Airlines.

Over the past year, the Leuthold Select Industries Fund has reduced exposure to the Health Care sector somewhat, although we continue to hold “Big Pharmaceuticals”stocks as a 15% position, currently, and another 6% invested in Life Sciences Tools & Services.While our exposure to Transportation stocks remains as it did a year ago (12%), our exposure here is now fully concentrated in Airlines stocks, since Railroads were eliminated in early September. Our exposure in Materials is now concentrated in two groups. Our Industrial Metals group, at 15% of portfolio assets, represents our largest single group holding. Additionally, we have another 6% of assets in Industrial Gases,bringing our total Materials exposure to about 21%.

The Leuthold Funds

More recently, the portfolio has increased exposure to “value”stocks.Value, as an investment theme, has become a more significant presence within our portfolio. In recent months, we have added two groups that employ quantitative screening methodologies that seek to identify stocks with “value”attributes. During this time, we have also increased exposure to the Big Pharmaceuticals stocks, which are also considered to have “value”characteristics. Combined, these three group positions represent about 41% of portfolio assets as of September 30,2006.

It is worth noting that, four of the ten group positions held in the Select Industries portfolio on September 30, 2005, remained in the portfolio one year later, including Industrial Metals, Big Pharma, Airlines, and Life/Health Insurance. Each of these long-term group positions were among the portfolio’s top performance contributors during the twelve months ended September 30, 2006. Not only does this demonstrate that sector rotation strategies do not necessarily result in a high rate of turnover, but also shows how our quantitative approach to industry group selection can be successful in helping us to identify areas of longer-term leadership potential in the stock market.

| Ø | About 52% of the current portfolio mix as of September 30, 2006, was composed of industry groups that had been activated in the portfolio for more than one year. |

The best equity industry group gains for this Fund (and the Core Fund’s “Select Industries”equity exposure), for the 12-months ended September 30, were Airlines stocks (+66%), Industrial Metals (+35%), Life & Health Insurance (+18%), Big Pharma (+19%), Railroads (+14%), and Computer Storage & Peripherals (+10%). Five of these top six group performers remain in the equity portfolio as of fiscal year end.

Our biggest disappointment was a 15% realized loss from our investment in Home Entertainment Software stocks.This group position had,by far,the biggest negative impact on portfolio performance.Other group positions that were adverse to performance included Biotechnology (-7%), Fertilizers & Agricultural Products (-6%), and Independent Power Producers (-3%). None of these group positions remain in the portfolio as of the fiscal year end on September 30, 2006.

Leuthold Select Equities Fund

This is the alternative Fund to the Leuthold Select Industries Fund, which was closed to further investment.The Leuthold Select Equities Fund has current assets (November 6, 2006) of about $5.0 million.As previously noted, this Fund was launched on May 24, 2006 and thus does not have a full year of investment performance to discuss in this annual review.

Grizzly Short Fund

As noted earlier, one year ago we estimated that the coming 12-month period would become increasingly difficult for traditional 100% long-stock investment strategies and for the market indexes in general.After all, the bull market had passed its 3-year anniversary in early October 2005,and measured up to the duration of past bull market cycles,we considered the 3-year mark as being relatively mature.From that point,we expected the market was more likely poised to transition to the next phase of the rotation - a cyclical bear market for stocks - which would have been more conducive to finding opportunities with the short-selling strategy of our Grizzly Short Fund.

The Leuthold Funds

In retrospect, we were premature in our expectation for the stock market to become increasingly vulnerable, and the bull market maintained a strong upper hand for the majority of the 12-months ended September 30, 2006.Needless to say,for a strategy designed to profit in down market conditions,this was not a constructive period for profiting with the Grizzly Short Fund.

| | • | For the 2006 fiscal year,the actively managed Grizzly Short Fund turned in a total return loss of -10.23% for the 12-months ended September 30, 2006. |

| | • | On a relative basis1,the Grizzly Fund loss compares favorably to the +13.13% total return gain in the DJIA and the +10.80% total return gain of the S&P 500 for the same 12-month period ended September 30, 2006. The Grizzly Fund loss is comparable to the inverse of the +9.98% total return gain of the Russell 2000 for the same 12-month period ended September 30, 2006. However, it notably underperformed over that period when measured up to the S&P Mid Cap index (+6.55% total return), and we believe the Mid Cap index is a more realistic yardstick in view of the stock characteristics of the Grizzly Short Fund. |

| | 1 | For a practical relative assessment of Grizzly Short Fund performance,one should compare the Fund’s performance to the inverse of traditional long-stock index results. For example, if the S&P 500 gains 5%,investors employing an S&P 500 index short would expect to lose about 5%.If the Grizzly Short Fund loses 3% over the same time frame, this would be considered relatively value-added for a short-selling strategy, since it is a smaller loss than the loss incurred by the index short. If the Grizzly Short Fund loses more than an index gains,it is not value-added over an index short. |

Please keep in mind that the Grizzly Short Fund has extremely high turnover, and sector concentrations and industry group exposure can fluctuate day to day. The individual stock positions are similarly weighted across the portfolio,and there are limitations as to how much of the portfolio can be concentrated within a particular sector or sub-industry group therein.

| Ø | Those features combined with the Fund’s quantitative methodology make it unrealistic to attribute specific performance dynamics to isolated short positions. Sector concentrations and stock market themes are more practical portfolio characteristics to use when reviewing Grizzly Short Fund performance drivers. |

Additional Comments Related to the Grizzly Short Fund

As this is written, one month into the new fiscal year, we have a relatively positive outlook for stocks in coming months.If our assessment is correct,the Grizzly Short Fund may continue to suffer losses as a consequence of its 100% short-stock mandate.At the same time, there are a number of conditions that could trigger a damaging, rapid stock market retreat.In terms of the economy,we have become increasingly concerned that the consumer driven expansion is going to come under pressure from the cumulative consequences of higher debt servicing, higher energy costs, and a softer housing market.These may eventually begin to have a notable effect on the consumer’s ability to spend.A slowing economy could become increasingly apparent as the year winds down, and a contraction could develop sometime in 2007.These,among other considerations,lead us to view the stock market as possibly having upside potential only on a tactical basis.

The Leuthold Funds

| Ø | Longer-term, we have doubts about the sustainability of an extended bull market run-up in stocks. The Grizzly Short Fund is a vehicle that endeavors to offer portfolio defense, however, not just in negative market conditions,but also in uncertain and transitioning market environments. |

Investors who are not experienced in short-selling and adjusting market risk should consider the Leuthold Asset Allocation Fund.The Leuthold Asset Allocation Fund is the successor to the now-closed Leuthold Core Investment Fund. It has the flexibility to overlay the short-selling strategy of the Grizzly Fund as a hedge against stock market declines when the Advisor views the stock market as overvalued and vulnerable to a downside correction.

The year-by-year results are volatile with the Grizzly Short Fund,and while the advantage for employing a short-selling strategy during down-market years is evident, we cannot stress the importance of being aware of the extreme down-side risk of short-selling in rising market conditions. As the past 12-months’ Grizzly Short Fund performance demonstrates,you should expect to lose money during rising market conditions.

IN CLOSING

Looking ahead to the next twelve months,it should be evident from this letter that while our outlook for the stock market over the near term (3-6 months) has improved, we continue to have lingering concerns about the sustainability of the bull market in the longer term. Nevertheless, it is our disciplines, not our gut feelings, which will determine the course of our investment strategies over the coming twelve months.While no market cycle will exactly mimic the progression of a prior cycle, it is important to recognize that financial history is a vast early-warning system. In addition, our quantitative disciplines are the guiding principles for our investment strategies, designed to remove emotions, severely restrict judgments, and diminish the potential for personal bias to come into play with portfolio decisions.We believe that adherence to these disciplines allow us to identify opportunities and attempt to protect assets in both up and down market cycles.

The Leuthold Funds

Our firm is majority employee-owned and operated.And, as we mentioned last year, although Steve Leuthold is the portfolio team leader, we would like you to keep in mind that all our strategies are team-managed; typically involving all of the same professionals since each Fund’s inception,and in most cases the same investment professionals have been involved for many years prior,responsible for the research behind the development of the Fund concepts.The Portfolio Managers and other Chartered Financial Analysts make up the investment strategy committee.This structure allows for an improved flow of insight and opinion from a mixture of backgrounds and experience.While our team approach eliminates the risks associated with a ‘one man show’, it also serves as a function of checks-and-balances for ensuring adherence to the investment disciplines.Portfolio decisions must always align with the methodologies.

Sincerely,

| |  | |  |

Steve Leuthold Portfolio Team Leader | | Andy Engel,CFA Co-Portfolio Manager | | Eric Bjorgen,CFA Co-Portfolio Manager |

| | | | | |

| | | | | |

| |  | | |

Chuck Zender Co-Portfolio Manager | | Matt Paschke,CFA Co-Portfolio Manager | | |

The Leuthold Funds

Expense Example - September 30,2006 (Unaudited)

As a shareholder of the funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (April 1,2006 - September 30,2006).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Funds charge no sales load (the Core Investment Fund and the Asset Allocation Fund charge a 2% redemption fee for redemptions made within five business days after a purchase), you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that the Funds invest in shares of other investment companies as part of its investment strategy,you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary by fund. These expenses are not included in the example below. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by the Funds and extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6),then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period”to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition,if these transactional costs were included,your costs would have been higher.

The Leuthold Funds

Expense Example Tables (Unaudited)

Leuthold Core Investment Fund - Retail Class

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | April 1,2006 | September 30,2006 | April 1,2006 - September 30,2006 |

| Actual** | | $1,000.00 | $ 994.00 | $7.11 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses)*** | 1,000.00 | 1,017.93 | 7.20 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.42%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.47 and the Fund’s annualized expense ratio would be 1.10%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.54 and the Fund’s annualized expense ratio would be 1.10%. |

| | | | | |

Leuthold Core Investment Fund - Institutional Class | | | |

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | April 1,2006 | September 30,2006 | April 1,2006 - September 30,2006 |

| Actual** | | $1,000.00 | $ 993.40 | $6.61 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses)*** | 1,000.00 | 1,018.44 | 6.69 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.32%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $4.97 and the Fund’s annualized expense ratio would be 1.00. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.04 and the Fund’s annualized expense ratio would be 1.00. |

| | | | | |

Leuthold Select Industries Fund | | | |

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | April 1,2006 | September 30,2006 | April 1,2006 - September 30,2006 |

| Actual | | $1,000.00 | $ 959.00 | $6.56 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.37 | 6.76 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.34%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

The Leuthold Funds

Expense Example Tables (Unaudited) (Continued)

Grizzly Short Fund

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | April 1,2006 | September 30,2006 | April 1,2006 - September 30,2006 |

| Actual** | | $1,000.00 | $ 976.80 | $14.42 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses)*** | 1,000.00 | 1,010.48 | 14.66 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.91%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $7.85 and the Fund’s annualized expense ratio would be 1.59%. |

| | | | | |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $8.01 and the Fund’s annualized expense ratio would be 1.59% |

| | | | | |

LeutholdAssetAllocation Fund | | | |

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | May 24,2006(1) | September 30,2006 | May 24,2006(1) - September 30,2006 |

| Actual** | | $1,000.00 | $ 973.00 | $5.97 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses)*** | 1,000.00 | 1,011.48 | 6.09 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.73%, multiplied by the average account value over the period, multiplied by 130/365 to reflect the number of days in the period. |

| ** | Excluding dividends and interest on short positions, your actual cost of investment in the Fund would be $5.19 and the Fund’s annualized expense ratio would be 1.50%. |

| *** | Excluding dividends and interest on short positions, your hypothetical cost of investment in the Fund would be $5.29 and the Fund’s annualized expense ratio would be 1.50%. |

| | | | | |

| (1) | Commencement of Operations | | | |

| | | | | |

Leuthold Select Equities Fund | | | |

| | | Beginning | Ending | Expenses Paid |

| | | AccountValue | AccountValue | During Period* |

| | | May 24,2006(1) | September 30,2006 | May 24,2006(1) - September 30,2006 |

| Actual | | $1,000.00 | $ 915.00 | $6.21 |

| | | | | |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,011.05 | 6.52 |

| | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.85%, multiplied by the average account value over the period, multiplied by130/365 to reflect the number of days in the period. | | | |

| (1) | Commencement of Operations | | | |

The Leuthold Funds

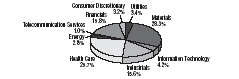

Leuthold Core Investment Fund

Allocation of Portfolio Holdings

September 30, 2006*

Leuthold Select Industries Fund

Allocation of Portfolio Holdings

September 30, 2006*

Grizzly Short Fund

Allocation of Portfolio Holdings

September 30, 2006*

| | * | Excludes short term investments. |

The Leuthold Funds

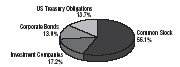

LeutholdAssetAllocation Fund

Allocation of Portfolio Holdings

September 30, 2006*

Leuthold Select Equities Fund

Allocation of Portfolio Holdings

September 30, 2006*

| | * | Excludes short term investments. |

The Leuthold Funds

Leuthold Core Investment Fund | | |

| | | |

Components of Portfolio Holdings* | | |

| Common Stock | | $767,587,932 |

| Investment Companies | | 199,081,269 |

| Physical Industrial Metals | | 290,460 |

| Corporate Bonds | | 191,390,887 |

| US Treasury Obligations | | 156,467,538 |

| Investments Subject to Bankruptcy Proceedings | | 47,398,738 |

| | Total: | $1,362,216,824 |

| | | |

| | | |

Leuthold Select Industries Fund | | |

| | | |

Components of Portfolio Holdings* | | |

| Common Stock | | $75,030,489 |

| | Total: | $75,030,489 |

| | | |

| | | |

Grizzly Short Fund | | |

| | | |

Components of Portfolio Holdings* | | |

| Short Securities: | | |

| Common Stock | | $47,765,412 |

| | Total | $47,765,412 |

| | | |

| | | |

LeutholdAssetAllocation Fund | | |

| | | |

Components of Portfolio Holdings* | | |

| Common Stock | | $33,513,750 |

| Investment Companies | | 10,297,072 |

| Corporate Bonds | | 7,767,264 |

| US Treasury Obligations | | 8,153,485 |

| | Total: | $59,731,571 |

| | | |

| | | |

Leuthold Select Equities Fund | | |

| | | |

Components of Portfolio Holdings* | | |

| Common Stock | | $3,147,886 |

| | Total: | $3,147,886 |

| | | |

| * Excludes short term investments. | | |

The Leuthold Funds

Leuthold Core Investment Fund - Retail Class

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | | | | |

| | 1Year | 3Year | 5Year | 10Year |

| Leuthold Core Investment Fund - | | | | |

| Retail Class | 6.64% | 13.53% | 12.99% | 11.64% |

| Lipper Flexible Fund Index | 8.47% | 10.60% | 6.97% | 6.72% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.58% |

A $10,000 Investment in the Leuthold Core Investment Fund - Retail Class

The Lipper Flexible Fund Index is an equally weighted index of the largest 30 mutual funds within the Flexible Portfolio investment objective, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 9/30/96. Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

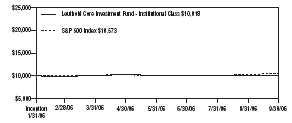

Leuthold Core Investment Fund - Institutional Class

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | 1Year | 3Year | 5Year | Since Inception |

| Leuthold Core Investment Fund - | | | | |

| Institutional Class | n/a | n/a | n/a | 0.17% |

| Lipper Flexible Fund Index | 8.47% | 10.60% | 6.97% | 7.22% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.25% |

A $10,000 Investment in the Leuthold Core Investment Fund - Institutional Class

The Lipper Flexible Fund Index is an equally weighted index of the largest 30 mutual funds within the Flexible Portfolio investment objective, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 1/31/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

Leuthold Select Industries Fund

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | 1Year | 3Year | 5Year | Since Inception |

| Leuthold Select Industries Fund | 8.67% | 18.86% | 11.88% | 9.28% |

| Russell 2000 Index | 9.92% | 15.48% | 13.78% | 8.70% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.25% |

A $10,000 Investment in the Leuthold Select Industries Fund

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index,representing approximately 11% of the Russell 3000 total market capitalization.

This chart assumes an initial gross investment of $10,000 made on 6/19/00 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

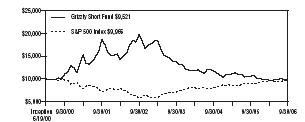

Grizzly Short Fund

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | | | | |

| | 1Year | 3Year | 5Year | Since Inception |

| Grizzly Short Fund | (10.23%) | (11.89%) | (12.62%) | (0.78%) |

| Russell 2000 Index | 9.92% | 15.48% | 13.78% | 8.70% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.25% |

A $10,000 Investment in the Grizzly Short Fund

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index,representing approximately 11% of the Russell 3000 total market capitalization.

This chart assumes an initial gross investment of $10,000 made on 6/19/00 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

LeutholdAssetAllocation Fund

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | | | | |

| | 1Year | 3Year | 5Year | Since Inception |

| Leuthold Asset Allocation Fund | n/a | n/a | n/a | (2.70%) |

| Lipper Flexible Fund Index | 8.47% | 10.60% | 6.97% | 8.66% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.25% |

A $10,000 Investment in the Leuthold Asset Allocation Fund

The Lipper Flexible Fund Index is an equally weighted index of the largest 30 mutual funds within the Flexible Portfolio investment objective, as defined by Lipper.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

This chart assumes an initial gross investment of $10,000 made on 5/24/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

Leuthold Select Equities Fund

Average Annual Rate of Return For Periods Ended September 30,2006 |

| | | | | |

| | 1Year | 3Year | 5Year | Since Inception |

| Leuthold Select Equities Fund | n/a | n/a | n/a | (8.50%) |

| Russell 2000 Index | 9.92% | 15.48% | 13.78% | 8.70% |

| S&P 500 Index | 10.80% | 12.30% | 6.97% | 8.25% |

A $10,000 Investment in the Leuthold Select Equities Fund

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index,representing approximately 11% of the Russell 3000 total market capitalization.

This chart assumes an initial gross investment of $10,000 made on 5/24/06 (commencement of operations). Returns shown include the reinvestment of all dividends. The Fund’s past performance is not necessarily an indication of its future performance. It may perform better or worse in the future. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

The Leuthold Funds

Statements of Assets and Liabilities | | | | | | | | | | | |

September 30, 2006 | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Leuthold Core | | Leuthold Select | | Grizzly | | Leuthold Asset | | Leuthold Select | |

| | | Investment Fund | | Industries Fund | | Short Fund | | Allocation Fund | | Equities Fund | |

| ASSETS: | | | | | | | | | | | |

| Investments,at value (cost $1,449,616,916, | | | | | | | | | | | | | | | | |

| $79,201,532,$20,900,610,$73,070,403 | | | | | | | | | | | | | | | | |

| and $3,252,280,respectively) | | $ | 1,627,372,502 | | $ | 89,978,649 | | $ | 20,900,610 | | $ | 74,067,108 | | $ | 3,241,488 | |

| Repurchase agreements | | | | | | | | | | | | | | | | |

| (cost $266,166,344, $15,833,656, | | | | | | | | | | | | | | | | |

| $0, $0 and $0, respectively) | | | 266,166,344 | | | 15,833,656 | | | — | | | — | | | — | |

| Cash | | | 342,773,014 | | | 3,722 | | | 27,814,886 | | | 8,379,994 | | | — | |

| Receivable for fund shares sold | | | 337,340 | | | 2,216 | | | 247,014 | | | 2,306,103 | | | 20,000 | |

| Receivable for investments sold | | | 34,590,082 | | | 3,720,719 | | | 479,029 | | | — | | | — | |

| Deposit for short sales | | | — | | | — | | | 45,093,786 | | | — | | | — | |

| Receivable from broker for proceeds | | | | | | | | | | | | | | | | |

| on securities sold short | | | — | | | — | | | 47,332,211 | | | — | | | — | |

| Interest receivable | | | 6,096,460 | | | 159 | | | 2,682 | | | 268,483 | | | 244 | |

| Dividends receivable | | | 488,539 | | | 56,560 | | | — | | | 26,868 | | | 516 | |

| Receivable from Adviser | | | — | | | — | | | — | | | — | | | 20,594 | |

| Other assets | | | 172,381 | | | 34,934 | | | 65,024 | | | 27,821 | | | 17,616 | |

| Total Assets | | | 2,277,996,662 | | | 109,630,615 | | | 141,935,242 | | | 85,076,377 | | | 3,300,578 | |

| LIABILITIES: | | | | | | | | | | | | | | | | |

| Collateral on securities loaned | | | 494,957,377 | | | 29,443,937 | | | — | | | — | | | — | |

| Securities sold short,at market value | | | | | | | | | | | | | | | | |

| (proceeds $0,$0,$47,332,211,$0 | | | | | | | | | | | | | | | | |

| and $0,respectively) | | | — | | | — | | | 47,765,412 | | | — | | | — | |

| Payable for investments purchased | | | 134,911,191 | | | 3,545,455 | | | 27,814,859 | | | 7,412,673 | | | — | |

| Payable for fund shares purchased | | | 2,188,907 | | | 164,766 | | | 17,346,281 | | | 38 | | | — | |

| Advisory fees payable | | | 1,229,638 | | | 64,268 | | | 105,282 | | | 44,061 | | | — | |

| Payable to Custodian (See Note 5) | | | 13,508,289 | | | — | | | — | | | — | | | — | |

| Dividends payable | | | 127,567 | | | — | | | 39,212 | | | 3,567 | | | — | |

| Accrued expenses and | | | | | | | | | | | | | | | | |

| other liabilities | | | 1,562,830 | | | 142,064 | | | 141,203 | | | 43,008 | | | 18,863 | |

| Total Liabilities | | | 648,485,799 | | | 33,360,490 | | | 93,212,249 | | | 7,503,347 | | | 18,863 | |

| NET ASSETS | | $ | 1,629,510,863 | | $ | 76,270,125 | | $ | 48,722,993 | | | 77,573,030 | | $ | 3,281,715 | |

See notes to the financial statements.

The Leuthold Funds

Statements of Assets and Liabilities (Continued) | | | | | | | | | | | |

September 30, 2006 | | | | | | | | | | | |

| | | Leuthold Core | | Leuthold Select | | Grizzly | | Leuthold Asset | | Leuthold Select | |

| | | Investment Fund | | Industries Fund | | Short Fund | | Allocation Fund | | Equities Fund | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | |

| Capital stock | | $ | 1,452,436,460 | | $ | 64,956,767 | | $ | 74,289,427 | | $ | 77,436,446 | | $ | 3,396,961 | |

| Accumulated net investment income | | | 2,990,325 | | | 334,218 | | | 77,613 | | | 262,386 | | | — | |

| Accumulated net realized | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (3,671,508 | ) | | 202,023 | | | (25,210,846 | ) | | (1,122,507 | ) | | (104,454 | ) |

| Net unrealized appreciation (depreciation) | | | | | | | | | | | | | | | | |

| on investments and short positions | | | 177,755,586 | | | 10,777,117 | | | (433,201 | ) | | 996,705 | | | (10,792 | ) |

| Total Net Assets | | $ | 1,629,510,863 | | $ | 76,270,125 | | $ | 48,722,993 | | $ | 77,573,030 | | $ | 3,281,715 | |

| Retail Class Shares | | | | | | | | | | | | | | | | |

| Net assets | | $ | 1,490,923,347 | | $ | 76,270,125 | | $ | 48,722,993 | | $ | 77,573,030 | | $ | 3,281,715 | |

| Shares outstanding (1,000,000,000 | | | | | | | | | | | | | | | | |

| shares of $.0001 par value authorized) | | | 85,457,840 | | | 4,421,376 | | | 8,567,871 | | | 7,973,228 | | | 358,577 | |

| Net Asset Value,Redemption Price | | | | | | | | | | | | | | | | |

and Offering Price Per Share(1) | | $ | 17.45 | | $ | 17.25 | | $ | 5.69 | | $ | 9.73 | | $ | 9.15 | |

| | | | | | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | | | | | |

| Net assets | | $ | 138,587,516 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Shares outstanding (1,000,000,000 | | | | | | | | | | | | | | | | |

| shares of $.0001 par value authorized) | | | 7,950,096 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Net Asset Value,Redemption Price | | | | | | | | | | | | | | | | |

and Offering Price Per Share(1) | | $ | 17.43 | | | n/a | | | n/a | | | n/a | | | n/a | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) Redemption price may differ from NAV if redemption fee is applied. | | | | | | | | | | | | | | | | |

See notes to the financial statements.

The Leuthold Funds

Statements of Operations For the Period Ended September 30,2006 | | | | | | | | | | | |

| | | Leuthold Core | | Leuthold Select | | Grizzly | | Leuthold Asset | | Leuthold Select | |

| | | Investment Fund | | Industries Fund | | Short Fund | | Allocation Fund | | Equities Fund | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| INVESTMENT INCOME: | | | | | | | | | | | |

| Dividend income (net of foreign taxes | | | | | | | | | | | |

| withheld of $206,569,$21,605, | | | | | | | | | | | |

| $0,$467 and $55,respectively) | | $ | 14,848,064 | | $ | 1,221,622 | | $ | — | | $ | 80,579 | | $ | 7,732 | |

| Interest income | | | 45,544,588 | | | 64,133 | | | 7,218,625 | | | 346,076 | | | 2,389 | |

| Total investment income | | | 60,392,652 | | | 1,285,755 | | | 7,218,625 | | | 426,655 | | | 10,121 | |

| EXPENSES: | | | | | | | | | | | | | | | | |

| Investment advisory fee (Note 3) | | | 13,901,806 | | | 820,908 | | | 1,061,508 | | | 85,664 | | | 6,934 | |

| Administration fee | | | 826,250 | | | 60,874 | | | 44,727 | | | 4,008 | | | 1,628 | |

| Transfer agent fees and expenses | | | 285,706 | | | 15,469 | | | 11,461 | | | 688 | | | 512 | |

| Legal fees | | | 122,463 | | | 7,569 | | | 7,758 | | | 8,812 | | | 10,280 | |

| Audit fees | | | 94,671 | | | 18,996 | | | 28,385 | | | 19,360 | | | 19,128 | |

| Fund accounting fees and expenses | | | 228,981 | | | 16,249 | | | 13,384 | | | 1,216 | | | 128 | |

| Custody fees | | | 137,182 | | | 13,317 | | | 3,254 | | | 216 | | | 128 | |

| Shareholder servicing fees | | | | | | | | | | | | | | | | |

| and expenses - Retail Class | | | 1,476,338 | | | 82,091 | | | 84,921 | | | — | | | — | |

| Federal and state registration | | | 137,580 | | | 37,343 | | | 33,992 | | | 2,136 | | | 2,048 | |

| Reports to shareholders | | | 401,994 | | | 32,704 | | | 37,391 | | | 216 | | | 128 | |

| Directors’fees and expenses | | | 55,165 | | | 3,134 | | | 4,194 | | | 304 | | | 128 | |

| Distribution (Rule 12b-1) fees | | | — | | | — | | | — | | | 23,796 | | | 1,733 | |

| Other | | | 149,868 | | | 6,265 | | | 4,247 | | | 128 | | | 128 | |

| Total expenses before dividends | | | | | | | | | | | | | | | | |

| and interest on short positions | | | 17,818,004 | | | 1,114,919 | | | 1,335,222 | | | 146,544 | | | 42,903 | |

| Dividends and interest on short positions | | | 4,703,924 | | | — | | | 1,151,738 | | | 21,495 | | | — | |

| Securities lending credit (See Note 9) | | | (1,156,366 | ) | | (45,220 | ) | | — | | | — | | | — | |

| Reimbursement from Adviser | | | — | | | — | | | — | | | (3,770 | ) | | (30,075 | ) |

| Recoupment by Adviser | | | — | | | 15,762 | | | — | | | — | | | — | |

| Total expenses | | | 21,365,562 | | | 1,085,461 | | | 2,486,960 | | | 164,269 | | | 12,828 | |

| NET INVESTMENT INCOME (LOSS) | | | 39,027,090 | | | 200,294 | | | 4,731,665 | | | 262,386 | | | (2,707 | ) |

See notes to the financial statements.

The Leuthold Funds

Statements of Operations (Continued) For the Period Ended September 30,2006 | | | | | | | | | | | |

| | | Leuthold Core | | Leuthold Select | | Grizzly | | Leuthold Asset | | Leuthold Select | |

| | | Investment Fund | | Industries Fund | | Short Fund | | Allocation Fund | | Equities Fund | |

| | | | | | | | | | | | |

| REALIZED AND UNREALIZED | | | | | | | | | | | |

| GAINS (LOSSES) ON INVESTMENTS | | | | | | | | | | | |

| AND SHORT POSITIONS: | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | |

| Investments | | $ | 73,182,713 | | $ | 770,223 | | $ | — | | $ | (293,313 | ) | $ | (103,110 | ) |

| Investment companies | | | (226,718 | ) | | (1,271 | ) | | — | | | 23,682 | | | (1,344 | ) |

| Short positions | | | (56,590,635 | ) | | — | | | (13,935,068 | ) | | (852,876 | ) | | — | |

| Net unrealized appreciation (depreciation) | | | | | | | | | | | | | | | | |

| during the year on: | | | | | | | | | | | | | | | | |

| Investments | | | 22,114,064 | | | 3,759,420 | | | — | | | 953,519 | | | (10,792 | ) |

| Investment companies | | | 9,153,296 | | | — | | | — | | | 43,186 | | | | |

| Short positions | | | 2,269,247 | | | — | | | (1,241,976 | ) | | — | | | — | |

| Net realized and unrealized gain (loss) | | | | | | | | | | | | | | | | |

| on investments and short positions | | | 49,901,967 | | | 4,528,372 | | | (15,177,044 | ) | | (125,802 | ) | | (115,246 | ) |

| NET INCREASE (DECREASE) | | | | | | | | | | | | | | | | |

| IN NET ASSETS RESULTING | | | | | | | | | | | | | | | | |

| FROM OPERATIONS | | $ | 88,929,057 | | $ | 4,728,666 | | $ | (10,445,379 | ) | $ | 136,584 | | $ | (117,953 | ) |

See notes to the financial statements.

The Leuthold Funds

Leuthold Core Investment Fund | | | | | |

Statements of Changes in Net Assets | | | | | |

| | | Year Ended | | Year Ended | |

| | | September 30,2006 | | September 30,2005 | |

| OPERATIONS: | | | | | |

| Net investment income | | $ | 39,027,090 | | $ | 4,979,428 | |

| Net realized gain on investments and short positions | | | 16,365,360 | | | 35,979,042 | |

| Net unrealized appreciation on investments and short positions | | | 33,536,607 | | | 88,394,244 | |

| Net increase in net assets from operations | | | 88,929,057 | | | 129,352,714 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

| From net investment income - Retail Class | | | (36,214,922 | ) | | (4,971,989 | ) |

| From net investment income - Institutional Class | | | (2,287,242 | ) | | — | |

| From net realized gains - Retail Class | | | (52,860,537 | ) | | (22,205,065 | ) |

| From net realized gains - Institutional Class | | | — | | | — | |

| Total distributions | | | (91,362,701 | ) | | (27,177,054 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | |

| Proceeds from shares sold - Retail Class | | | 720,319,818 | | | 625,650,100 | |

| Proceeds from shares sold - Institutional Class | | | 141,259,594 | | | — | |

| Proceeds from shares issued to holders in | | | | | | | |

| reinvestment of dividends - Retail Class | | | 83,593,622 | | | 25,864,690 | |

| Proceeds from shares issued to holders in | | | | | | | |

| reinvestment of dividends - Institutional Class | | | 1,940,121 | | | — | |

| Cost of shares redeemed - Retail Class * | | | (426,785,031 | ) | | (152,198,762 | ) |

| Cost of shares redeemed - Institutional Class ** | | | (1,330,668 | ) | | — | |

| Net increase in net assets from capital share transactions | | | 518,997,456 | | | 499,316,028 | |

| TOTAL INCREASE IN NET ASSETS | | | 516,563,812 | | | 601,491,688 | |

| NET ASSETS | | | | | | | |

| Beginning of year | | | 1,112,947,051 | | | 511,455,363 | |

| End of year (including accumulated net investment | | | | | | | |

| income (loss) of $2,990,325 and $(1,986),respectively) | | $ | 1,629,510,863 | | $ | 1,112,947,051 | |

| | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | |

| Shares sold -Retail Class | | | 41,144,127 | | | 38,393,557 | |

| Shares sold - Institutional Class | | | 7,914,236 | | | — | |

| Shares issued to holders in reinvestment | | | | | | | |

| of dividends - Retail Class | | | 4,897,534 | | | 1,634,749 | |

| Shares issued to holders in reinvestment | | | | | | | |

| of dividends -Institutional Class | | | 110,999 | | | — | |

| Shares redeemed - Retail Class | | | (24,179,738 | ) | | (9,441,172 | ) |

| Shares redeemed - Institutional Class | | | (75,139 | ) | | — | |

| Net increase in shares outstanding | | | 29,812,019 | | | 30,587,134 | |

| | | | | | | | |

| * Net of redemption fees of (Retail Class): | | $ | 10,163 | | $ | 596 | |

| ** Net of redemption fees of (Institutional Class): | | $ | 360 | | $ | — | |

See notes to the financial statements.

The Leuthold Funds

Leuthold Select Industries Fund | | | | | |

Statements of Changes in Net Assets | | | | | |

| | | Year Ended | | Year Ended | |

| | | September 30,2006 | | September 30,2005 | |

| OPERATIONS: | | | | | |

| Net investment income (loss) | | $ | 200,294 | | $ | (48,040 | ) |

| Net realized gain on investments | | | 768,952 | | | 1,874,242 | |

| Net unrealized appreciation | | | | | | | |

| on investments during the year | | | 3,759,420 | | | 4,416,258 | |

| Net increase in net assets from operations | | | 4,728,666 | | | 6,242,460 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

| From net investment income | | | (186,217 | ) | | — | |

| From net realized gains | | | (525,301 | ) | | — | |

| Total distributions | | | (711,518 | ) | | — | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | |

| Proceeds from shares sold | | | 102,719,187 | | | 23,393,521 | |

| Proceeds from shares issued to holders | | | | | | | |

| in reinvestment of dividends | | | 656,576 | | | — | |

| Cost of shares redeemed | | | (62,320,268 | ) | | (19,214,680 | ) |

| Net increase in net assets | | | | | | | |

| from capital share transactions | | | 41,055,495 | | | 4,178,841 | |

| TOTAL INCREASE IN NET ASSETS | | | 45,072,643 | | | 10,421,301 | |

| NET ASSETS | | | | | | | |

| Beginning of year | | | 31,197,482 | | | 20,776,181 | |

| End of year (including accumulated net investment | | | | | | | |

| income (loss) of $334,218 and $(167),respectively) | | $ | 76,270,125 | | $ | 31,197,482 | |

| | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | |

| Shares sold | | | 6,048,563 | | | 1,645,141 | |

| Shares issued to holders in reinvestment of dividends | | | 39,412 | | | — | |

| Shares redeemed | | | (3,608,089 | ) | | (1,397,786 | ) |

| Net increase in shares outstanding | | | 2,479,886 | | | 247,355 | |

See notes to the financial statements.

The Leuthold Funds

Grizzly Short Fund | | | | | |

Statements of Changes in Net Assets | | | | | |

| | | Year Ended | | Year Ended | |

| | | September 30,2006 | | September 30,2005 | |

| OPERATIONS: | | | | | |

| Net investment income (loss) | | $ | 4,731,665 | | $ | 489,851 | |

| Net realized loss on short positions | | | (13,935,068 | ) | | (4,025,257 | ) |

| Net unrealized appreciation (depreciation) | | | | | | | |

| on short positions during the year | | | (1,241,976 | ) | | 42,205 | |

| Net decrease in net assets from operations | | | (10,445,379 | ) | | (3,493,201 | ) |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

| From net investment income | | | (4,654,052 | ) | | (489,851 | ) |

| From return of capital | | | - | | | (19,224 | ) |

| Total distributions | | | (4,654,052 | ) | | (509,075 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | |

| Proceeds from shares sold | | | 145,206,015 | | | 100,788,121 | |

| Proceeds from shares issued to holders | | | | | | | |

| in reinvestment of dividends | | | 3,524,411 | | | 379,718 | |

| Cost of shares redeemed | | | (139,592,870 | ) | | (64,235,556 | ) |

| Net increase in net assets | | | | | | | |

| from capital share transactions | | | 9,137,556 | | | 36,932,283 | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (5,961,875 | ) | | 32,930,007 | |

| NET ASSETS | | | | | | | |

| Beginning of year | | | 54,684,868 | | | 21,754,861 | |

| End of year (including accumulated net investment | | | | | | | |

| income (loss) of $77,613 and $0,respectively) | | $ | 48,722,993 | | $ | 54,684,868 | |

| | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | |

| Shares sold | | | 22,951,853 | | | 14,381,712 | |

| Shares issued to holders in reinvestment of dividends | | | 589,588 | | | 54,895 | |

| Shares redeemed | | | (23,115,132 | ) | | (9,174,033 | ) |

| Net increase in shares outstanding | | | 426,309 | | | 5,262,574 | |

See notes to the financial statements.

The Leuthold Funds

LeutholdAssetAllocation Fund | | | |

Statement of Changes in Net Assets | | | |

| | | | |

| | | Period from May 24,2006(1) | |

| | | through | |

| | | September 30,2006 | |

| OPERATIONS: | | | |

| Net investment income | | $ | 262,386 | |

| Net realized loss on short positions | | | (1,122,507 | ) |

| Net unrealized appreciation | | | | |

| on investments and short positions during the period | | | 996,705 | |

| Net increase in net assets from operations | | | 136,584 | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold | | | 78,545,320 | |

| Proceeds from shares issued to holders | | | | |

| in reinvestment of dividends | | | — | |

| Cost of shares redeemed | | | (1,108,874 | ) |

| Net increase in net assets | | | | |

| from capital share transactions | | | 77,436,446 | |

| TOTAL INCREASE IN NET ASSETS | | | 77,573,030 | |

| NET ASSETS | | | | |

| Beginning of period | | | — | |

| End of period (including accumulated net investment | | | | |

| income of $262,386) | | $ | 77,573,030 | |

| | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | |

| Shares sold | | | 8,087,502 | |

| Shares issued to holders in reinvestment of dividends | | | — | |

| Shares redeemed | | | (114,274 | ) |

| Net increase in shares outstanding | | | 7,973,228 | |

| | | | | |

| | | | | |

| (1) Commencement of operations. | | | | |

See notes to the financial statements.

The Leuthold Funds

Leuthold Select Equities Fund | | | |

Statement of Changes in Net Assets | | | |

| | | | |

| | | Period from May 24,2006(1) through September 30,2006 | |

| | | | |

| OPERATIONS: | | | |

| Net investment loss | | $ | (2,707 | ) |

| Net realized loss on short positions | | | (104,454 | ) |

| Net unrealized depreciation | | | | |

| on investments during the period | | | (10,792 | ) |

| Net decrease in net assets from operations | | | (117,953 | ) |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold | | | 3,704,493 | |

| Proceeds from shares issued to holders | | | | |

| in reinvestment of dividends | | | — | |

| Cost of shares redeemed | | | (304,825 | ) |

| Net increase in net assets | | | | |

| from capital share transactions | | | 3,399,668 | |

| TOTAL INCREASE IN NET ASSETS | | | 3,281,715 | |

| NET ASSETS | | | | |

| Beginning of period | | | — | |

| End of period | | $ | 3,281,715 | |

| | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | |

| Shares sold | | | 391,304 | |

| Shares issued to holders in reinvestment of dividends | | | — | |

| Shares redeemed | | | (32,727 | ) |

| Net increase in shares outstanding | | | 358,577 | |

| | | | | |

| | | | | |

| (1) Commencement of operations. | | | | |

See notes to the financial statements.

The Leuthold Funds

Leuthold Core Investment Fund - Retail | | | | | | | | | | | |

Financial Highlights | | | | | | | | | | | |

| | | Years ended September 30, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

Per Share Data: | | | | | | | | | | | |

| Net asset value,beginning of year | | $ | 17.50 | | $ | 15.49 | | $ | 13.39 | | $ | 9.95 | | $ | 10.92 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.43 | | | 0.09 | | | — | | | 0.09 | | | 0.20 | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | |

| on investments and short positions | | | 0.68 | | | 2.65 | | | 2.15 | | | 3.44 | | | (0.97 | ) |

| Total from investment operations | | | 1.11 | | | 2.74 | | | 2.15 | | | 3.53 | | | (0.77 | ) |

| Less distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.42 | ) | | (0.09 | ) | | — | | | (0.09 | ) | | (0.20 | ) |

| In excess of net investment income | | | — | | | — | | | (0.05 | ) | | — | | | — | |

| From net realized gains | | | (0.74 | ) | | (0.64 | ) | | — | | | — | | | — | |

| Total distributions | | | (1.16 | ) | | (0.73 | ) | | (0.05 | ) | | (0.09 | ) | | (0.20 | ) |

| Net asset value,end of year | | $ | 17.45 | | $ | 17.50 | | $ | 15.49 | | $ | 13.39 | | $ | 9.95 | |

| | | | | | | | | | | | | | | | | |

| Total return | | | 6.64 | % | | 18.26 | % | | 16.03 | % | | 35.60 | % | | (7.21 | %) |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | |

| Net assets,end of year | | $ | 1,490,923,347 | | $ | 1,112,947,051 | | $ | 511,455,363 | | $ | 317,603,196 | | $ | 116,363,247 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

Before expense reimbursement(2) | | | 1.39 | % | | 1.74 | % | | 1.37 | % | | 1.31 | % | | 1.25 | % |

After expense reimbursement(2) | | | 1.39 | % | | 1.74 | % | | 1.37 | % | | 1.31 | % | | 1.25 | % |

| Ratio of net investment income (loss) | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | |

Before expense reimbursement(3) | | | 2.51 | % | | 0.67 | % | | (0.03 | %) | | 0.71 | % | | 1.85 | % |

After expense reimbursement(3) | | | 2.51 | % | | 0.67 | % | | (0.03 | %) | | 0.71 | % | | 1.85 | % |

Portfolio turnover rate(4) | | | 86.40 | % | | 163.88 | % | | 132.96 | % | | 89.59 | % | | 132.77 | % |

| (1) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |