QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Millennium Pharmaceuticals, Inc.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

March 13, 2002

To our stockholders:

I invite you to the 2002 annual meeting of Millennium stockholders. The meeting this year is on Thursday, April 25, 2002 at 10:00 a.m., local time, at the Boston Marriott Cambridge, 2 Cambridge Center, Cambridge, Massachusetts 02142. The annual meeting is a terrific opportunity to learn more about Millennium's business and operations, and I hope you will be able to join us.

On the pages following this letter you will find the notice of 2002 Annual Meeting of Stockholders, which lists the matters to be considered at the meeting, and the proxy statement, which describes the matters listed in the notice. We have also enclosed your proxy card and our Annual Report for the year ended December 31, 2001.

Your vote is important. Whether or not you plan to attend the meeting, I hope you will vote as soon as possible. If you are a stockholder of record, you may vote over the Internet, by telephone, or by mailing the enclosed proxy card in the envelope provided. You will find voting instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name" (that is, held for your account by a broker or other nominee), you will receive instructions from the holder of record that you must follow for your shares to be voted.

Thank you for your ongoing support and continued interest in Millennium.

Sincerely,

MARK J. LEVIN

Chairperson and Chief Executive Officer

MILLENNIUM PHARMACEUTICALS, INC.

75 Sidney Street

Cambridge, Massachusetts 02139

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

The 2002 Annual Meeting of Stockholders of Millennium Pharmaceuticals, Inc. will be held at the Boston Marriott Cambridge, 2 Cambridge Center, Cambridge, Massachusetts 02142, on Thursday, April 25, 2002 at 10:00 a.m., local time. At the meeting, stockholders will act on the following matters:

- 1.

- Election of four Class III directors, each for a term of three years; and

- 2.

- Any other business as may properly come before the meeting or any postponement or adjournment of the meeting.

Stockholders of record at the close of business on February 26, 2002 are entitled to vote.

|

By Order of the Board of Directors, |

|

|

|

JOHN B. DOUGLAS III

Secretary |

March 13, 2002 |

|

TABLE OF CONTENTS

| Proxy Statement | | 1 |

| Voting Procedures | | 1 |

| | Who can vote? | | 1 |

| | How do I vote? | | 1 |

| | How can I change my vote? | | 2 |

| | Will my shares be voted if I do not return my proxy? | | 2 |

| | How many shares must be present to hold the meeting? | | 2 |

| | What vote is required to approve the election of directors and how are votes counted? | | 3 |

| | Are there any other matters to be voted on at the meeting? | | 3 |

| | Where do I find the voting results of the meeting? | | 3 |

| | How can I receive future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail? | | 3 |

| Proposal One—Election of Directors | | 4 |

| | Nominees for Class III Directors—Terms to Expire in 2005 | | 4 |

| | Class I Directors—Terms to Expire in 2003 | | 5 |

| | Class II Directors—Terms to Expire in 2004 | | 6 |

| Ownership of Millennium's Common Stock | | 7 |

| | Ownership by Management | | 7 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 8 |

| | Ownership By Principal Stockholders | | 8 |

| Corporate Governance | | 9 |

| | The Board of Directors | | 9 |

| | Committees of the Board | | 9 |

| | Compensation Committee Interlocks and Insider Participation | | 10 |

| | Indemnification of Officers and Directors | | 10 |

| Director Compensation | | 10 |

| | Cash compensation | | 10 |

| | Stock compensation | | 10 |

| Compensation of Executive Officers | | 12 |

| | Summary Compensation | | 12 |

| | Option Grants in 2001 | | 14 |

| | Aggregated Option Exercises and Fiscal Year-End Option Values | | 15 |

| | Employment Agreements | | 15 |

| Certain Relationships and Related Transactions | | 16 |

| Stock Performance Graph | | 17 |

| Compensation Committee Report on Executive Compensation | | 18 |

| Audit Committee Report | | 21 |

| Independent Auditors | | 23 |

| | Aggregate Fees for 2001 | | 23 |

| Additional Information | | 23 |

| | Stockholder Proposals for 2003 Annual Meeting | | 23 |

| Appendix A—Audit Committee Charter | | 25 |

i

MILLENNIUM PHARMACEUTICALS, INC.

75 Sidney Street

Cambridge, Massachusetts 02139

PROXY STATEMENT—2002 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement contains information about the 2002 Annual Meeting of Stockholders of Millennium Pharmaceuticals, Inc., including any postponements or adjournments of the meeting. The meeting will be held at the Boston Marriott Cambridge, 2 Cambridge Center, Cambridge, Massachusetts 02142, on Thursday, April 25, 2002 at 10:00 a.m., local time.

In this proxy statement, we refer to Millennium Pharmaceuticals, Inc. as "Millennium," the "Company," "we" or "us."

We are sending you this proxy statement in connection with the solicitation of proxies by Millennium's Board of Directors.

Our Annual Report for the year ended December 31, 2001 was first mailed to stockholders, along with these proxy materials, on or about March 13, 2002.

You may request a copy of Millennium's Annual Report on Form 10-K for the year ended December 31, 2001, which we will provide to you without charge, by writing to Investor Relations, Millennium Pharmaceuticals, Inc., 75 Sidney Street, Cambridge, Massachusetts 02139, or by e-mailing Investor Relations at "info@mlnm.com." You can also find a copy on the Internet through the SEC's electronic data system called EDGAR at www.sec.gov or through Millennium's website at www.millennium.com.

VOTING PROCEDURES

Your Vote is Important Whether or not you plan to attend the meeting, please take the time to vote as soon as possible (1) over the Internet, (2) by telephone or (3) by completing and mailing the enclosed proxy card in the enclosed envelope.

Who can vote?

Each share of Millennium's common stock you own as of the close of business on February 26, 2002, the record date, entitles you to one vote on each matter to be voted upon at the meeting.

As of the record date, there were 279,896,054 shares of Millennium common stock issued, outstanding and entitled to vote.

How do I vote?

If your shares are registered directly in your name, you may vote:

- •

- By Internet. Access the website of our tabulator, EquiServe, at www.eproxyvote.com/mlnm, using the voter control number that we have printed on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message.

- •

- By Telephone. Call 1-877 PRX-VOTE (1-877-779-8683) toll-free from the U.S. and Canada and follow the instructions on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your telephone vote cannot be completed.

- •

- By Mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope to EquiServe. Your proxy will be voted in accordance with your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors.

- •

- In Person at the Meeting. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting.

If your shares are held in "street name" (held for your account by a broker or other nominee):

- •

- By Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote by Internet or telephone.

- •

- By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares.

- •

- In Person at the Meeting. Contact the broker or other nominee who holds your shares to obtain a broker's proxy card and bring it with you to the meeting. You will not be able to vote at the meeting unless you have a proxy card from your broker.

How can I change my vote?

You may revoke your proxy and change your vote at any time before the meeting. You may do this by:

- •

- signing a new proxy card and submitting it as instructed above;

- •

- voting by Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted; or

- •

- attending the meeting in person and voting in person. Attending the meeting in person will not revoke your proxy unless you specifically request it.

Will my shares be voted if I do not return my proxy?

If your shares are held directly in your name, they will not be voted if you do not return your proxy or vote in one of the manners described in the previous question.

If your shares are held in "street name," your brokerage firm, under certain circumstances, may vote your shares. Brokerage firms have authority under Nasdaq rules to vote customers' unvoted shares on some routine matters. The election of directors at this meeting is considered a routine matter.

If you do not give a proxy to vote your shares, your brokerage firm may either:

- •

- vote your shares on routine matters, or

- •

- leave your shares unvoted.

We encourage you to provide voting instructions to your brokerage firm by giving your proxy. This ensures your shares will be voted at the meeting according to your instructions. You should receive directions from your brokerage firm about how to submit your proxy to them at the time you receive this proxy statement.

How many shares must be present to hold the meeting?

A majority of Millennium's outstanding shares as of the record date must be present at the meeting to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if the stockholder is present in person at the meeting or is present by submitting

2

a proxy (including voting by telephone or over the Internet). Shares that abstain or do not vote on one or more of the matters to be voted upon are counted as present for establishing a quorum.

If a quorum is not present, we expect that the meeting will be adjourned until we obtain a quorum.

What vote is required to approve the election of directors and how are votes counted?

The four nominees for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Abstentions are not counted for purposes of electing directors. Brokerage firms have authority under Nasdaq rules to vote customers' unvoted shares held by the firms in street name on the election of directors.

You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors and will have no effect on the results of the vote.

Are there other matters to be voted on at the meeting?

We do not know of any other matters that may come before the meeting other than the election of directors. If any other matters are properly presented to the meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment.

Where do I find the voting results of the meeting?

We will announce preliminary voting results at the meeting. We will publish final results in our quarterly report on Form 10-Q for the second quarter of 2002, which we will file with the Securities and Exchange Commission by August 14, 2002. You may request a copy of the Form 10-Q by writing to Investor Relations, Millennium Pharmaceuticals, Inc., 75 Sidney Street, Cambridge, Massachusetts 02139, or by e-mailing Investor Relations at info@mlnm.com. You will also be able to find a copy on the Internet through the SEC's electronic data system called EDGAR at www.sec.gov or through Millennium's website at www.millennium.com.

How can I receive future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail?

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2001 are available on our Internet site at www.millennium.com. Most shareholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. If you are a shareholder of record, you can choose this option and save us the cost of producing and mailing these documents by checking the appropriate box on your proxy card. If you are a shareholder of record and choose to view future proxy statements and annual reports over the Internet, you will receive a proxy card in the mail next year with instructions containing the Internet address to access those documents. If your shares are held through a broker or other holder of record, you should check the information provided by them for instructions on how to elect to view future proxy statements and annual reports over the Internet.

3

PROPOSAL ONE—ELECTION OF DIRECTORS

The Board has nominated four people for election as Class III Directors. Each nominee is currently serving as a Class III Director. The Board of Directors recommends a vote "FOR" the nominees named below.

Our Board of Directors is divided into three classes. One class is elected each year and members of each class hold office for three-year terms. The Board of Directors currently consists of twelve directors. Four are Class I Directors (with terms expiring at the 2003 Annual Meeting), four are Class II Directors (with terms expiring at the 2004 Annual Meeting) and four are Class III Directors (with terms expiring at the 2002 Annual Meeting).

The persons named in the enclosed proxy will vote to elect as Class III directors Mark J. Levin, Shaun R. Coughlin, A. Grant Heidrich, III and Kenneth E. Weg, the four nominees listed below, unless you indicate on the proxy that your vote should be withheld from any or all of these nominees. If they are elected, Mr. Levin, Dr. Coughlin, Mr. Heidrich and Mr. Weg will hold office until the 2005 Annual Meeting of Stockholders and until their successors are duly elected and qualified. All of the nominees have indicated their willingness to serve, if elected, but if any of them should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors, unless the Board chooses to reduce the number of directors serving on the Board.

There are no family relationships between or among any of our executive officers or directors.

Below are the names and certain information about each member of the Board of Directors, including the nominees for election as Class III directors.

NOMINEES FOR CLASS III DIRECTORS—TERMS TO EXPIRE IN 2005

| Mark J. Levin | Director since January 1993 |

Mr. Levin, age 51, has served as Millennium's Chairperson of the Board of Directors since March 1996, as Millennium's Chief Executive Officer since November 1994 and as a director of Millennium since its inception. From 1987 to 1994, Mr. Levin was a partner at Mayfield, a venture capital firm, and co-director of its Life Science Group. While employed with Mayfield, Mr. Levin was the founding Chief Executive Officer of several biotechnology and biomedical companies, including Cell Genesys Inc., Stem Cells, Inc. (formerly CytoTherapeutics Inc.), Tularik Inc., Focal, Inc. and Millennium. Mr. Levin holds an M.S. in Chemical and Biomedical Engineering from Washington University. Mr. Levin also serves on the Board of Directors of StemCells, Inc. a biotechnology company.

Shaun R. Coughlin, M.D., Ph.D. |

Director since February 2002 |

Dr. Coughlin, age 47, has been Professor of Medicine since 1996 and Professor of Molecular and Cellular Pharmacology since 1997 at the University of California, San Francisco and Director of the Cardiovascular Research Institute at UCSF since 1997. Dr. Coughlin is also a member of the editorial boards of Trends in Cardiovascular Medicine, Molecular Medicine and Journal of Clinical Investigation. Dr. Coughlin joined our Board of Directors after the merger of COR Therapeutics, Inc., a biotechnology company, into Millennium on February 12, 2002 after serving on the COR Board of Directors since 1994.

4

A. Grant Heidrich, III |

Director since January 1993 |

Mr. Heidrich, age 49, has served as a general partner of Mayfield, a venture capital firm, since 1983. Mr. Heidrich received his M.B.A. from Columbia University Graduate School of Business. Mr. Heidrich also serves as Chairman of the Board of Tularik, Inc., a biotechnology company.

Kenneth E. Weg |

Director since March 2001 |

Mr. Weg, age 63, has served as founder and Chairman of Clearview Projects Inc., a company engaged in partnering and deal transaction services to biopharmaceutical companies and academic institutions, since February 2001. Prior to his retirement in February 2001 from Bristol-Myers Squibb Company, a pharmaceutical company, he served as Vice Chairman since 1999 and a member of the Office of Chairman since 1998, having been elected to the Board in 1995. Mr. Weg was elected Executive Vice President of Bristol-Myers in 1995 and was President of the Worldwide Medicines Group from 1997 to 1998, President of the Pharmaceutical Group from 1993 to 1996 and President of Pharmaceutical Operations from 1991 to 1993.

CLASS I DIRECTORS—TERMS TO EXPIRE IN 2003

| Vaughn M. Kailian | Director since February 2002 |

Mr. Kailian, age 57, joined Millennium as Vice Chairperson upon the COR merger in February 2002. From March 1990 to February 2002, he served as President, Chief Executive Officer and a director of COR. From 1967 to 1990, Mr. Kailian was employed by Marion Merrell Dow, Inc., a pharmaceutical company, and its predecessor companies in various U. S. and international general management, product development, marketing and sales positions. Mr. Kailian is also a director of Amylin Pharmaceuticals, Inc., a biotechnology company, and NicOx S.A, a biotechnology company.

Ginger L. Graham |

Director since February 2002 |

Ms. Graham, age 46, has been Group Chairman, Office of the President, for Guidant Corporation, a medical device company, since 2000. She served as President of the Vascular Intervention Group of Guidant Corporation from 1995 to 2000 and as President and Chief Executive Officer of Advanced Cardiovascular Systems at Guidant from 1993 to 1995. Ms. Graham joined our Board of Directors upon the COR merger in February 2002 after serving on the COR Board of Directors since February 2001. Ms. Graham is also a director of Amylin Pharmaceuticals, Inc., a biotechnology company.

Norman C. Selby |

Director since May 2000 |

Mr. Selby, age 49, has served as President and Chief Executive Officer of TransForm Pharmaceuticals, Inc., a drug development company since June 2001. He served as head of Consumer Internet Business at Citigroup, a financial services company, from June 1999 to July 2000. He also served as Executive Vice President at Citicorp from September 1997 to July 2000. Prior to joining Citicorp, he was a director and senior partner at McKinsey & Company, an international management consulting firm, and head of the firm's global pharmaceutical practice.

Edward D. Miller, Jr., M.D. |

Director since October 2000 |

Dr. Miller, age 59, has served as Chief Executive Officer of Johns Hopkins Medicine, Dean of The Johns Hopkins University School of Medicine and Vice President for Medicine of The Johns Hopkins University since 1997. He was Professor and Chairman of the Department of Anesthesiology and Critical Care at The Johns Hopkins University from 1994 to 1999.

5

CLASS II DIRECTORS—TERMS TO EXPIRE IN 2004

| Eugene Cordes, Ph.D. | Director since July 1995 |

Dr. Cordes, age 65, has been a Professor of Pharmacy and Adjunct Professor of Chemistry, University of Michigan in Ann Arbor since September 1995. From 1988 to October 1994, Dr. Cordes served as a Vice President of Sterling Winthrop, Inc., a pharmaceutical company, and as President of that company's Pharmaceuticals Research Division.

Raju S. Kucherlapati, Ph.D. |

Director since January 1993 |

Dr. Kucherlapati, age 59, is a founder of Millennium. Since September 2001, Dr. Kucherlapati has served as the Paul C. Cabot Professor of Genetics, Harvard Medical School and as the first Scientific Director, Harvard-Partners Center for Genetics and Genomics. From 1989 to September 2001, Dr. Kucherlapati served as the Lola and Saul Kramer Professor and Chairman of the Department of Molecular Genetics at the Albert Einstein College of Medicine. He received his M.S. in Biology from Andhra University (India) and his Ph.D. in Genetics from the University of Illinois, Urbana. Dr. Kucherlapati also serves on the Board of Directors of Abgenix, Inc. and Valentis, Inc., both of which are biotechnology companies.

Eric S. Lander, Ph.D. |

Director since January 1993 |

Dr. Lander, age 45, is a founder of Millennium. From 1993 to the present, Dr. Lander has served as Director of the Whitehead/MIT Center for Genome Research and has been a member of the Whitehead Institute for Biomedical Research since 1989. From 1989 to the present, Dr. Lander has also held the positions of Associate Professor and Professor in the Department of Biology at the Massachusetts Institute of Technology. Dr. Lander received his Ph.D. in Mathematics from Oxford University, which he attended as a Rhodes Scholar. Dr. Lander also serves on the board of directors of Aclara Biosciences Inc. a biotechnology company.

Ernest Mario, Ph.D. |

Director since February 2002 |

Dr. Mario, age 63, is Chairman and Chief Executive Officer of Apothogen, Inc., a pharmaceutical development company he founded in 2002. He served as Chairman and Chief Executive Officer of ALZA Corporation, a pharmaceutical company, from December 1997 through December 2001 and as Co-Chairman and Chief Executive Officer of ALZA from July 1993 to November 1997. From 1989 to 1993, he was Deputy Chairman and Chief Executive Officer of Glaxo Holdings plc, a pharmaceutical company, in London. Prior to 1989, Dr. Mario served as Chief Executive Officer of Glaxo, Inc., a pharmaceutical company, in the United States. Dr. Mario joined our Board of Directors upon the COR merger in February 2002 after serving on the COR Board of Directors since 1995. Dr. Mario is also a director of Catalytica Energy Systems, Inc., a biotechnology company, Orchid Biosciences, Inc., a biotechnology company, Pharmaceutical Product Development, Inc., a pharmaceutical development company, Boston Scientific Corp., a medical devices company, Maxygen, Inc., a biotechnology company, and SonoSite, Inc., an ultrasound products and services company.

6

OWNERSHIP OF MILLENNIUM'S COMMON STOCK

Ownership By Management

On February 26, 2002 Millennium had 279,896,054 shares of common stock issued and outstanding. This table shows certain information about the beneficial ownership of Millennium common stock, as of that date, by:

- •

- each of our current directors;

- •

- each nominee for director;

- •

- our Chief Executive Officer;

- •

- each of our four other most highly compensated executive officers; and

- •

- all of our directors and executive officers as a group.

According to SEC rules, we have included in the "number of issued shares" all shares over which the person has sole or shared voting or investment power, and we have included in the "number of shares issuable" all shares that the person has the right to acquire within 60 days after February 26, 2002 through the exercise of any stock option or other right.

Unless otherwise indicated, each person has sole investment and voting power (or shares such power with his spouse) for the shares listed opposite his name. Where applicable, ownership is subject to community property laws. The inclusion in this table of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

Name(1)

| | Number

of Issued

Shares(1)

| | Number

of Shares

Issuable

| | Total

| | Percent

| |

|---|

| Mark J. Levin | | 3,341,764 | | 1,303,946 | | 4,645,710 | | 1.7 | % |

| Vaughn M. Kailian | | 342,176 | | 996,180 | | 1,338,356 | | * | |

| Eugene Cordes, Ph.D | | 57,580 | | 58,646 | | 116,226 | | * | |

| Shaun R. Coughlin, M.D., Ph.D. | | 32,752 | | 59,238 | | 91,990 | | * | |

| Ginger L. Graham | | 0 | | 11,517 | | 11,517 | | * | |

| A. Grant Heidrich, III | | 224,564 | | 112,528 | | 337,092 | | * | |

| Raju S. Kucherlapati, Ph.D | | 687,858 | | 437,251 | | 1,125,109 | | * | |

| Eric S. Lander, Ph.D.(2) | | 10,000 | | 129,049 | | 139,049 | | * | |

| Ernest Mario, Ph.D. | | 0 | | 29,619 | | 29,619 | | * | |

| Edward D. Miller, Jr., M.D | | 2,000 | | 12,540 | | 14,540 | | * | |

| Norman C. Selby | | 3,800 | | 30,583 | | 34,383 | | * | |

| Kenneth E. Weg | | 10,000 | | 8,553 | | 18,553 | | * | |

| John B. Douglas III(3) | | 14,944 | | 200,328 | | 215,272 | | * | |

| John Maraganore | | 79,901 | | 153,827 | | 233,728 | | * | |

| Kevin P. Starr | | 28,064 | | 291,778 | | 319,842 | | * | |

| Robert I. Tepper(4) | | 43,755 | | 485,005 | | 528,760 | | * | |

| All directors and executive officers as a group (18 persons) | | 5,335,228 | | 4,810,986 | | 10,146,214 | | 3.6 | % |

- *

- Less than one percent.

- (1)

- Includes shares contributed by Millennium to the 401(k) plan for the benefit of the named executive officer as of December 31, 2001 as follows: Mr. Levin, 2,540 shares; Mr. Douglas, 353 shares; Mr. Maraganore, 746 shares; Mr. Starr, 876 shares; Dr. Tepper, 2,151 shares and all directors and executive officers as a group, 9,114 shares.

7

- (2)

- Shares of Millennium common stock beneficially owned include 10,000 shares beneficially owned by the Lander Family Charitable Trust for which Dr. Lander disclaims beneficial ownership.

- (3)

- Includes 800 shares held by a custodian under the Uniform Transfer to Minors Act for each of Mr. Douglas' three children. Mr. Douglas disclaims beneficial ownership of these shares.

- (4)

- Includes 333 shares held by a custodian under the Uniform Gifts to Minors Act for each of Dr. Tepper's two sons. Dr. Tepper disclaims beneficial ownership of these shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of our records, we believe that in 2001 our directors and executive officers filed on a timely basis all reports of holdings and transactions in Millennium common stock required to be filed with the SEC pursuant to Section 16(a) of the Securities Exchange Act of 1934, except that Dr. Tepper did not report the sale on January 7, 2000 of an aggregate of 1,560 shares held by a custodian for his two sons under the Uniform Gifts to Minors Act, which has now been reported on a Form 5 for the year ended December 31, 2001.

Ownership By Principal Stockholders

This table shows certain information, to the best of our knowledge, about the beneficial ownership of Millennium common stock as of the dates indicated below by each person owning beneficially more than 5% of Millennium common stock.

Name and Address

| | Number of

Shares

| | Percent

| |

|---|

FMR Corp.

82 Devonshire Street

Boston, Massachusetts 02109 | | 33,192,512 | (1) | 11.9 | % |

Bayer AG and Agfa Holding GmbH

D51368 Leverkusen

Federal Republic of Germany |

|

19,830,640 |

(2) |

7.1 |

% |

- (1)

- Shares held by FMR Corp. as reported in an amendment to Schedule 13G filed with the Securities and Exchange Commission on February 14, 2002. FMR reported having sole voting power for 840,214 shares and sole dispositive power for all 33,192,512 shares.

- (2)

- Shares held by Bayer AG and Agfa Holding GmbH, a wholly owned subsidiary of Bayer AG, as reported in an amendment to Schedule 13D filed with the Securities and Exchange Commission on July 6, 2000. Bayer reported having sole voting power and sole dispositive power for 1,038,960 shares and shared voting power and shared dispositive power for 18,791,680 shares. Agfa Holding reported having shared voting power and shared dispositive power for 18,791,680 shares.

8

CORPORATE GOVERNANCE

The Board of Directors

Millennium is governed by a Board of Directors that currently consists of twelve members. In 2001, the Board of Directors met eleven times. During 2001, each director attended at least 75% of the total number of meetings of the Board of Directors and all committees of the Board on which the director served, except Dr. Lander who attended 69%. Members of the Board are kept informed of Millennium's business through discussions with the Chairperson and officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

The Board has designated a Lead Outside Director who oversees an annual process of Board and director evaluation, including providing appropriate feedback to the Board. He provides assistance to the Chairperson and Corporate Secretary in planning Board agendas, acts as the leader of the outside directors on appropriate matters, acts as Chairperson of the outside directors in meetings of the outside directors, and acts as Chairperson of the Board in the absence of the Chairperson or Vice Chairperson or a vacancy in the position of Chairperson or Vice Chairperson. Mr. Heidrich is currently serving as our Lead Outside Director.

Committees of the Board

The Board has four ongoing committees: an Audit Committee, a Compensation Committee, a Nominating and Board Governance Committee and an Executive Committee. The Board also appoints from time to time ad hoc committees to address specific matters.

Audit Committee. The Audit Committee has responsibility for recommending the appointment of independent auditors, reviewing the scope and results of audits and reviewing Millennium's internal accounting control policies and procedures. In 2001, the Audit Committee met two times. In addition there were three meetings with representatives of management and the independent auditor to review financial statements prior to release of earnings, at which the Chairman of the Committee represented the Audit Committee. The current members of the Audit Committee are Mr. Selby (Chairman), Dr. Cordes and Dr. Miller. A more detailed description of the functions of the Audit Committee may be found in the Audit Committee Charter, included as Appendix A to this proxy statement. Please see also the Audit Committee Report at page 21 below.

Compensation Committee. The Compensation Committee's primary responsibility is to oversee compensation and benefit matters. In 2001, the Compensation Committee met five times. The current members of the Compensation Committee are Mr. Heidrich (Chairman), Mr. Selby and Mr. Weg. Dr. Cordes served on the Compensation Committee through June 21, 2001 and Mr. Weg joined the Committee on that date. Please see also the Compensation Committee Report on Executive Compensation at page 18 below.

Nominating and Board Governance Committee. The Nominating and Board Governance Committee is responsible for considering Board governance issues. The Committee also recommends individuals to serve as directors and will consider nominees recommended by security holders. Recommendations by stockholders should be submitted in writing to the Nominating and Board Governance Committee, in care of the Secretary of Millennium. In 2001, the Committee met three times. The current members of the Nominating and Board Governance Committee are Dr. Kucherlapati (Chairman), Mr. Heidrich and Dr. Lander.

Executive Committee. The Executive Committee may exercise, when the Board of Directors is not in session, all powers of the Board of Directors in the management of the business and affairs of Millennium to the extent permitted by law, our By-laws and as specifically granted by the Board of

9

Directors. The Executive Committee did not meet in 2001. The current members of the Executive Committee are Mr. Levin (Chairman) and Mr. Heidrich.

Compensation Committee Interlocks and Insider Participation.

The current members of the Compensation Committee are Mr. Heidrich, Mr. Selby and Mr. Weg. Dr. Cordes served on the Compensation Committee through June 21, 2001 and Mr. Weg joined the Committee on that date. No member of the Compensation Committee was at any time during 2001, or formerly, an officer or employee of Millennium or any subsidiary of Millennium. No executive officer of Millennium has served as a director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity, while an executive officer of that other entity served as a director of or member of the Compensation Committee of Millennium.

Indemnification of Officers and Directors

We indemnify our directors and officers to the fullest extent permitted by law for their acts and omissions in their capacity as a director or officer of Millennium, so that they will serve free from undue concerns for liability for actions taken on behalf of Millennium. This indemnification is required under our charter.

DIRECTOR COMPENSATION

Cash compensation

Each director who is not an employee of Millennium receives:

Annual retainer: |

|

$ |

15,000 |

|

|

Attendance Fees: |

|

$ |

1,500 |

|

for each Board meeting; |

| | | $ | 750 | | for each conference telephone Board meeting; and |

| | | $ | 750 | | for each Board committee meeting attended in person and not held in conjunction with a Board meeting. |

Millennium also reimburses non-employee directors for reasonable travel and out-of-pocket expenses in connection with their service as directors.

Stock compensation

Directors also participate in Millennium's 2000 Stock Incentive Plan. Under the option program for directors adopted by the Board, our non-employee directors receive stock option grants as follows:

Initial Option Grant: |

|

30,000 |

|

shares, granted in three equal installments on the date the director is first elected, one month later and two months later. |

Annual Option Grant: |

|

7,500 |

|

shares granted in three equal installments on May 1st, June 1st and July 1st of each year, prorated for service on the Board of less than one year. |

Committee Chair: |

|

500 |

|

shares added to Annual Option Grant. |

Lead Outside Director: |

|

1,500 |

|

shares added to Annual Option Grant. |

10

The initial option grants vest on a monthly basis beginning one month from the date of election and become fully vested on the fourth anniversary of the date of election. The annual grants vest monthly beginning as of June 1st in the year granted and become fully vested on May 1st of the fourth year after the grant date. Each option terminates on the earlier of (i) ten years after the date of grant or (ii) the date 90 days after the optionee ceases to serve as a director (or one year in the case of disability and three years in the event of death). Under the 2000 Plan, an option becomes fully vested upon the death of the director. The exercise price of options granted under the 2000 Plan is equal to the closing price of Millennium common stock on the Nasdaq National Market on the date of grant.

Under the Millennium 2000 Stock Incentive Plan, Kenneth E. Weg, upon his election to the Millennium Board of Directors in 2001, was granted an option to purchase 10,000 shares on March 12, 2001 at an exercise price of $25.18 per share, an option to purchase 10,000 shares on April 12, 2001 at an exercise price of $34.95 per share, and an option to purchase 10,000 shares on May 11, 2001 for an exercise price of $34.38 per share. The exercise prices for all of these options are equal to the fair market value on the dates of grant.

On May 1, 2001, under the Millennium 2000 Stock Incentive Plan, Eugene Cordes and Eric S. Lander were each granted an option to purchase 2,500 shares, A. Grant Heidrich III was granted an option to purchase 3,167 shares, Raju Kucherlapati and Norman C. Selby were each granted an option to purchase 2,667 shares, Edward D. Miller, Jr. was granted an option to purchase 1,875 shares, and Mr. Weg was granted an option to purchase 625 shares. Dr. Miller's and Mr. Weg's annual grants were prorated for service of less than one year on the Board. The exercise price for all of these options is $36.46 per share, the fair market value on the date of grant.

On June 1, 2001, under the Millennium 2000 Stock Incentive Plan, Dr. Cordes and Dr. Lander were each granted an option to purchase 2,500 shares, Mr. Heidrich was granted an option to purchase 3,167 shares, Dr. Kucherlapati and Mr. Selby were each granted an option to purchase 2,667 shares, Dr. Miller was granted an option to purchase 1,875 shares, and Mr. Weg was granted an option to purchase 625 shares. The exercise price for all of these options is $39.92 per share, the fair market value on the date of grant.

On July 1, 2001, under the Millennium 2000 Stock Incentive Plan, Dr. Cordes and Dr. Lander were each granted an option to purchase 2,500 shares, Mr. Heidrich was granted an option to purchase 3,166 shares, Dr. Kucherlapati and Mr. Selby were each granted an option to purchase 2,666 shares, Dr. Miller was granted an option to purchase 1,875 shares, and Mr. Weg was granted an option to purchase 625 shares. The exercise price for all of these options is $35.58 per share, the fair market value on the date of grant.

Dr. Coughlin, Ms. Graham and Dr. Mario joined our Board of Directors after the merger of COR into Millennium in February 2002 after serving on the COR Board of Directors and are treated as continuing directors for purposes of the director option grant program. They will receive annual option grants in accordance with the annual grant program at the same time as our other non-employee directors.

11

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation

This table shows certain information about the compensation paid to our Company's Chief Executive Officer and each of our four other most highly compensated executive officers.

Summary Compensation Table

| |

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

|---|

| |

| | Shares

Underlying

Options

Granted(#)

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation($)

| | All Other

Compensation($)

| |

|---|

Mark J. Levin

Chairperson, Chief Executive Officer

and President | | 2001

2000

1999 | | 405,997

400,575

400,400 | | 365,765

—

32,032 | | —

—

76,632 |

(1) | 375,000

400,000

336,000 | | 9,368

7,281

6,985 | (2)

(2)

(2) |

Kevin P. Starr

Chief Operating Officer

and Chief Financial Officer |

|

2001

2000

1999 |

|

328,557

285,577

224,154 |

|

275,626

—

26,828 |

|

—

—

— |

|

207,200

228,000

117,176 |

|

7,642

5,021

4,095 |

(3)

(3)

(3) |

Robert I. Tepper

Executive Vice President, Discovery

and Chief Scientific Officer |

|

2001

2000

1999 |

|

327,813

300,490

298,105 |

|

229,688

—

16,456 |

|

—

—

— |

|

210,000

96,000

158,892 |

|

8,060

4,161

3,923 |

(4)

(4)

(4) |

John B. Douglas III(6)

Senior Vice President, General Counsel

and Secretary |

|

2001

2000

1999 |

|

307,339

300,000

193,269 |

|

139,050

25,000

— |

|

—

—

— |

|

90,000

81,000

502,740 |

|

8,028

6,090

1,452 |

(5)

(5)

(5) |

John Maraganore

Senior Vice President,

Strategic Product Development |

|

2001

2000

1999 |

|

265,942

238,247

238,247 |

|

120,510

—

11,912 |

|

—

—

— |

|

103,333

93,067

126,296 |

|

7,528

3,695

1,764 |

(7)

(7)

(7) |

- (1)

- Represents amounts attributable to the forgiveness of a loan.

- (2)

- Includes for 2001, $1,656; 2000, $1,656; and 1999, $1,982 representing term life insurance premiums paid by Millennium on Mr. Levin's behalf. Includes for 2001, $7,012; 2000, $5,100; and 1999, $5,003 representing the dollar value of shares of Millennium's common stock contributed by Millennium on behalf of Mr. Levin pursuant to Millennium's 401(k) Plan. Includes for 2001, $700; and 2000, $525 paid to Mr. Levin for choosing no benefit under Millennium's transportation policy.

- (3)

- Includes for 2001, $630; 2000, $574; and 1999, $480 representing term life insurance premiums paid by Millennium on Mr. Starr's behalf. Includes for 2001, $7,012; 2000, $4,447; and 1999, $3,615 representing the dollar value of shares of Millennium's common stock contributed by Millennium on behalf of Mr. Starr pursuant to Millennium's 401(k) Plan.

12

- (4)

- Includes for 2001, $1,048; 2000, $991; and 1999, $893 representing term life insurance premiums paid by Millennium on Dr. Tepper's behalf. Includes for 2001, $7,012; 2000, $3,170; and 1999, $3,030 representing the dollar value of shares of Millennium's common stock contributed by Millennium on behalf of Dr. Tepper pursuant to Millennium's 401(k) Plan.

- (5)

- Includes for 2001, $1,016; 2000, $990; and 1999, $1,452 representing term life insurance premiums paid by Millennium on Mr. Douglas' behalf. Includes for 2001, $7,012; and 2000, $5,100 representing the dollar value of shares of Millennium's common stock contributed by Millennium on behalf of Mr. Douglas pursuant to Millennium's 401(k) Plan.

- (6)

- Mr. Douglas joined Millennium in April 1999.

- (7)

- Includes for 2001, $516; 2000, $461; and 1999, $512 representing term life insurance premiums paid by Millennium on Mr. Maraganore's behalf. Includes for 2001, $7,012; 2000, $3,234; and 1999, $1,252 representing the dollar value of shares of Millennium's common stock contributed by Millennium on behalf of Mr. Maraganore pursuant to Millennium's 401(k) Plan.

13

Option Grants in 2001

This table shows all options to purchase our common stock granted in 2001 by us to our Chief Executive Officer and each of our four other most highly compensated executive officers.

Option Grants in 2001

| |

| |

| |

| |

| | Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

|

|---|

| | Number of Shares Underlying Options Granted(#)

| | Percent of Total Options Granted to Employees in 2001

| |

| |

|

|---|

| | Exercise or Base Price ($/Sh)

| |

|

|---|

Name

| | Expiration Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Mark J. Levin | | 100,000

100,000

100,000

75,000 | (2)

(3)

(4)

(5) | 1.0

1.0

1.0

* | %

%

%

| 33.25

26.55

37.78

16.13 | | 3/6/2011

4/6/2011

5/4/2011

9/26/2011 | | 2,091,074

1,669,715

2,375,964

760,805 | | 5,299,194

4,231,386

6,021,159

1,928,030 |

Kevin P. Starr |

|

27,400

27,400

27,400

25,000

25,000

25,000

50,000 |

(2)

(3)

(4)

(2)

(3)

(4)

(5) |

*

*

*

*

*

*

* |

|

33.25

26.55

37.78

35.78

32.09

23.41

16.13 |

|

3/6/2011

4/6/2011

5/4/2011

6/21/2011

7/20/2011

8/21/2011

9/26/2011 |

|

572,954

457,502

651,014

562,546

504,531

368,061

507,204 |

|

1,451,979

1,159,400

1,649,798

1,425,603

1,278,580

932,738

1,285,353 |

Robert I. Tepper |

|

28,334

28,333

28,333

25,000

25,000

25,000

50,000 |

(2)

(3)

(4)

(2)

(3)

(4)

(5) |

*

*

*

*

*

*

* |

|

33.25

26.55

37.78

35.78

32.09

23.41

16.13 |

|

3/6/2011

4/6/2011

5/4/2011

6/21/2011

7/20/2011

8/21/2011

9/26/2011 |

|

592,485

473,080

673,182

562,546

504,531

368,061

507,203 |

|

1,501,474

1,198,879

1,705,975

1,425,603

1,278,580

932,738

1,285,353 |

John B. Douglas III |

|

20,000

20,000

20,000

30,000 |

(2)

(3)

(4)

(5) |

*

*

*

* |

|

33.25

26.55

37.78

16.13 |

|

3/6/2011

4/6/2011

5/4/2011

9/26/2011 |

|

418,215

333,943

475,193

304,322 |

|

1,059,839

846,277

1,204,232

771,212 |

John Maraganore |

|

6,667

6,666

20,000

20,000

20,000

30,000 |

(3)

(4)

(2)

(3)

(4)

(5) |

*

*

*

*

*

* |

|

47.31

41.31

33.25

26.55

37.78

16.13 |

|

1/11/2011

2/12/2011

3/6/2011

4/6/2011

5/4/2011

9/26/2011 |

|

198,363

173,180

418,215

333,943

475,192

304,322 |

|

502,692

438,873

1,059,839

846,277

1,204,232

771,212 |

- *

- Represents less than one percent of total options granted to employees in 2001.

- (1)

- Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date, net of the applicable option exercise price. This table does not take into account any appreciation in the price of the common stock to date. Actual gains, if any, on stock option exercises will depend on the future performance of the common stock and the date on which the options are exercised.

14

- (2)

- One forty-eighth of the total number of shares subject to the option are exercisable one month after the date of grant and an additional one forty-eighth of the total number of shares subject to the option become exercisable monthly thereafter until all of such shares are exercisable.

- (3)

- One forty-eighth of the total number of shares subject to the option are exercisable on the date of grant and an additional one forty-eighth of the total number of shares subject to the option become exercisable monthly thereafter until all of such shares are exercisable.

- (4)

- Two forty-eighths of the total number of shares subject to the option are exercisable on the date of grant and an additional one forty-eighth of the total number of shares subject to the option become exercisable monthly thereafter until all of such shares are exercisable.

- (5)

- One fifty-fourth of the total number of shares subject to the option are exercisable one month after the date of grant and an additional one fifty-fourth of the total number of shares subject to the option become exercisable monthly thereafter until all of such shares are exercisable.

- (6)

- One quarter of the total number of shares subject to the option became exercisable on December 1, 2001 and an additional one forty-eighth of the total number of shares subject to the option become exercisable monthly thereafter until all of such shares are exercisable.

Aggregated Option Exercises and Fiscal Year-End Option Values

This table shows information about stock options exercised in 2001 and stock options held as of December 31, 2001 by our Chief Executive Officer and each of our four other most highly compensated executive officers.

Aggregated Option Exercises in 2001 and 2001 Year-End Option Values

Name

| | Shares Acquired on Exercise(#)

| | Value Realized($)

| | Number of Shares Underlying Unexercised Options Held at 12/31/01 (#)Exercisable/

Unexercisable

| | Value of Unexercised In-The-Money Options at 12/31/01 ($) Exercisable/

Unexercisable(1)

|

|---|

| Mark J. Levin | | — | | — | | 1,184,954/726,046 | | 18,293,461/3,945,772 |

| Kevin P. Starr | | — | | — | | 225,410/410,410 | | 1,896,208/2,207,214 |

| Robert I. Tepper | | — | | — | | 442,423/289,989 | | 7,180,935/1,331,723 |

| John B. Douglas III | | 25,000 | | 736,175 | | 155,106/289,316 | | 1,924,204/2,884,904 |

| John Maraganore | | 18,284 | | 581,266 | | 127,255/197,020 | | 434,636/432,515 |

- (1)

- Value of unexercised in-the-money options to purchase shares of Millennium common stock is based on the closing sales price of Millennium's common stock on December 31, 2001 ($24.51), the last trading day of Millennium's 2001 fiscal year, less the applicable option exercise price.

Employment Agreements

Millennium has employment agreements with Mr. Starr, Dr. Tepper, Mr. Douglas and Mr. Maraganore. Each executive's employment with Millennium is at-will and may be terminated by Millennium at any time with or without cause. If the executive's employment is terminated without Justifiable Cause, as that term is defined in the agreement, then, subject to certain conditions, Millennium is obligated to pay him severance payments equal to twelve months' salary.

15

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During 2001, Millennium and its subsidiaries were a party to certain transactions in which its 5% stockholders, directors and executive officers had an interest.

Dr. Kucherlapati, a director of Millennium, serves as a consultant to Millennium and is compensated for his consulting services at the rate of $23,750 per quarter, based upon two days per month of service. Millennium paid Dr. Kucherlapati $95,000 in 2001.

We are currently in the final stages of completing a transaction in which we anticipate that a recently created subsidiary may issue shares of restricted common stock to Dr. Kucherlapati for fair value. Dr. Kucherlapati is helping to lead the development of business strategy for this subsidiary. These shares would represent approximately 4% of the subsidiary's equity interest on a fully-diluted basis.

Dr. Lander, a director of Millennium, serves as a consultant to Millennium and is compensated for his consulting services at the rate of $2,375 (plus travel and other appropriate expenses) per day. Millennium paid Dr. Lander $95,000 in 2001.

In April 1997, Millennium entered into a corporate consortium to fund a five-year research program in functional genomics at the Whitehead Institute for Biomedical Research. Millennium terminated its participation in this consortium effective as of July 1, 2001. Dr. Lander is a Research Program Director of Whitehead. In 2001, Millennium paid $625,000 to Whitehead in connection with this consortium.

Millennium's former subsidiary, Millennium BioTherapeutics, Inc., made loans to its employees to fund exercises of stock options for shares of its common stock before their vesting dates, subject to certain restrictions. Millennium assumed the loans and Millennium BioTherapeutics' common stock was converted into Millennium common stock when MBio was merged into Millennium in 1999. In 2001 the largest principal balance amount outstanding under a loan to Mr. Maraganore, Millennium's Senior Vice President, Strategic Product Development, was $76,394 at an interest rate of 5.60% per year. The principal balance of Mr. Maraganore's loan as of December 31, 2001 was $56,670.

In January 2001, Millennium made a loan of $250,000 to Paul R. Hamelin, Millennium's Senior Vice President, Commercial Operations, for the purchase of a home in the Boston area. The loan bears interest at a rate of 5.87% per year. Under the terms of his September 29, 2000 employment agreement, Millennium forgave one-fourth of the loan on December 1, 2001, the one year anniversary of the date of his employment with Millennium, and will forgive one forty-eighth of the loan at the end of each full month after that date, if Mr. Hamelin remains employed by Millennium.

16

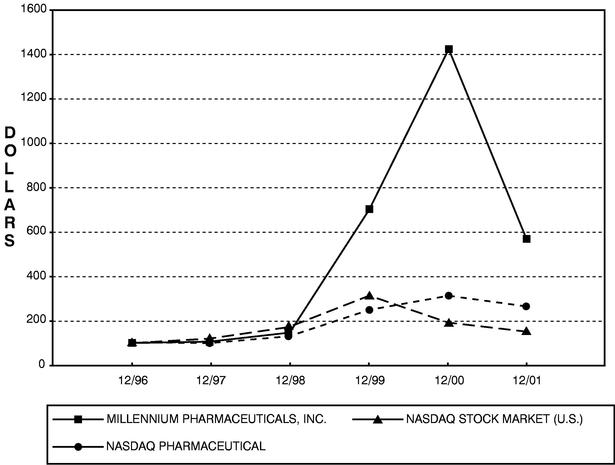

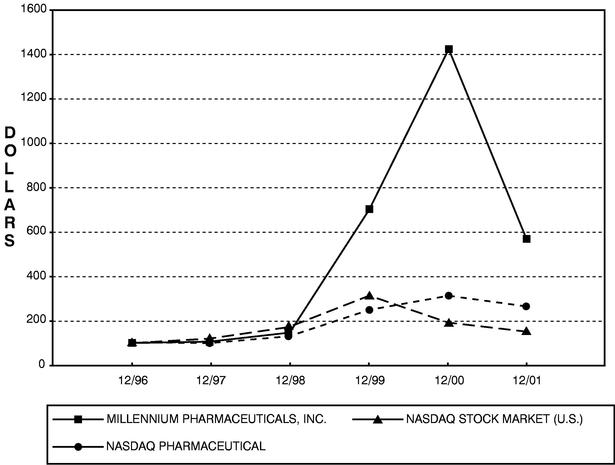

STOCK PERFORMANCE GRAPH

This graph compares the performance of Millennium common stock with the performance of the Nasdaq Stock Market (U.S. Companies) Index and the Nasdaq Pharmaceuticals Index (assuming reinvestment of dividends). The graph assumes $100 invested at the per share closing price on the Nasdaq National Market in Millennium and each of the indices on December 31, 1996. Measurement points are on the last trading days of the years ended December 31, 1997, December 31, 1998, December 31, 1999, December 31, 2000 and December 31, 2001.

|

|---|

| | 12/31/96

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

|---|

|

|---|

| Millennium Pharmaceuticals, Inc. | | 100.00 | | 109.35 | | 148.92 | | 702.16 | | 1424.46 | | 564.26 |

|

| NASDAQ Stock Market (U.S.) | | 100.00 | | 122.48 | | 172.68 | | 320.89 | | 193.01 | | 153.15 |

|

| NASDAQ Pharmaceuticals Index | | 100.00 | | 103.05 | | 130.81 | | 246.64 | | 307.65 | | 262.17 |

|

17

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is currently composed of three independent, outside directors and operates under a written charter. The Committee's primary function is to act on behalf of the Board of Directors with respect to Millennium's general compensation and benefit practices. In particular, the Committee:

- •

- reviews and approves compensation policy and philosophy for Millennium;

- •

- sets the annual salary and other elements of total compensation of the Chief Executive Officer, subject to approval by the full Board of Directors, and annually reviews the total compensation of all other executive officers;

- •

- approves and recommends to the full Board of Directors the adoption of, and suggested changes to: (a) any equity incentive plans; (b) any qualified or non-qualified employee pension, profit-sharing or retirement plans; and (c) any employee incentive compensation plans;

- •

- administers Millennium's equity incentive plans and the issuance of awards pursuant to those plans, including the approval of all equity grants to executive officers;

- •

- administers Millennium's success sharing bonus program and determines overall funding and specific awards under the plan for executive officers;

- •

- examines on a periodic basis Millennium's total compensation structure (both short-term and long-term) to determine that Millennium is properly rewarding its personnel; and

- •

- conducts an annual review of the Chief Executive Officer's performance based on objective and subjective criteria, such as performance of the business, accomplishment of long-term strategic objectives, management development, and similar criteria.

General Compensation Philosophy

Millennium's compensation philosophy is based on the principles of competitive and fair compensation consistent with performance. The executive compensation program is designed to motivate and reward executive officers by aligning a substantial portion of their compensation with the achievement of priority strategic business goals as well as individual performance objectives.

To ensure that compensation is competitive, the Committee compares Millennium compensation practices with those of other companies in the biotechnology and pharmaceutical industries with whom Millennium competes for executive talent. Over the past several years, the Committee has shifted its primary focus for compensation comparison purposes from a group of high value developing biotech companies (such as Alkermes, Celgene Corp., COR Therapeutics, Gilead, Human Genome Sciences, ICOS, IDEC, Imclone Systems, Incyte, Protein Design Labs and Vertex) to also include a group composed of product based biotech companies (Alza Corp., Amgen, Biogen, Chiron, Genentech, Genzyme Corp., Immunex and MedImmune). The Committee believes this is appropriate in light of Millennium's growth and development. In addition, the Committee considers compensation levels at pharmaceutical companies (such as Abbott Laboratories, Astrazeneca, Aventis Pharmaceuticals, Bayer Corporation, Bristol-Myers Squibb Pharm Group, Dupont Pharmaceuticals, Eli Lilly and Company, Glaxosmithkline Pharmaceuticals, Hoffman-La Roche Inc., Janssen Pharmaceutica, L.P., Merck & Company, Novartis Pharmaceuticals, Pfizer and Pharmacia) in determining appropriate total compensation levels.

Our compensation target is to pay employees, including our executive officers, at the 65th percentile of the range of annual compensation paid for comparable positions by these companies. Actual compensation may vary above or below this level depending on Millennium's performance relative to goals, individual employee performance, and the market price for Millennium's publicly traded equity. To ensure fairness, Millennium also strives to achieve equitable pay relationships between individual employees and between different organization levels within Millennium, including the executive officers.

18

Key Elements of Compensation

The major elements of Millennium's compensation program are base salary, annual bonus and stock options.

Salary. Base salary levels are designed to recognize an individual's ongoing contribution, to be commensurate with an individual's experience and organization level and to be competitive with market benchmarks. Increases in annual salaries are based on demonstrated levels of competency in skill, effectiveness, and leadership, and by comparing how an individual has performed essential job requirements against what was envisioned with the job. Salary adjustments are based also on general market competitiveness. The Committee does not use a specific formula based on these criteria, but instead makes an evaluation of each executive officer's contributions in light of all such criteria.

Success Sharing Bonus Program. Millennium's executive officers, along with all other employees, are eligible to participate in a success sharing bonus program. The success sharing bonus program is designed to promote the achievement of priority Millennium goals while fostering teamwork. At the beginning of the year, Millennium establishes a set of priority goals for the year, which are then reviewed and approved by the Committee and by the Board. At the end of the year, the level of funding for the program is based on the Committee's evaluation of Millennium's achievement of these priority goals. For 2001, the success sharing bonus program was funded above the target level of funding established at the beginning of the year, based on the Committee's assessment of Millennium's achievements in 2001, especially related to product and pipeline development.

Each executive officer has a target bonus opportunity that is set by the Committee each year based on its review of total compensation at the companies in the comparison group identified above. For 2001, target bonus levels for Millennium's executive officers ranged from 30 - 40% of base salary, although actual bonus awards can range from zero to well above the target bonus level.

The actual bonuses awarded for 2001 were based on the funding for the year as described above and assessments of the individual's achievement of priority goals for himself or herself and his or her department or group that were also established at the beginning of the year.

Stock Option Program. Substantially all employees are eligible to participate in Millennium's stock option program. Our stock option program is designed to directly align the long-term interests of Millennium's employees and its shareholders, and to assist in the retention of employees by providing a meaningful ownership stake in Millennium. The size of option grants is generally intended to reflect the individual's position with Millennium, the degree to which his or her contributions impacted our results in the past year, and the importance of his or her critical skills for Millennium's future success. Millennium generally uses a four-year vesting period and a ten-year exercise period to encourage key employees to continue their employment with us. Millennium generally grants options to new employees when they start employment and to continuing employees on an annual basis and upon promotions to positions of greater responsibility. For 2001, the Committee decided to award these options in increments of one-third each over a three month period and also decided to bring forward to September 2001 a portion of the annual stock option grant that would have been granted in early 2002 to support retention. The exercise price for all stock options granted in 2001 equaled the market value of the underlying shares on the dates of grant. Therefore, ultimately the stock options have value only if the value of the underlying shares increases.

Executive officers are also eligible to participate in our 1996 Employee Stock Purchase Plan. The Purchase Plan is available to virtually all employees of Millennium and generally permits participants to purchase shares at a discount of approximately 15% from the fair market value at the beginning or end of the applicable purchase period.

Based on available public data, we believe that the 2001 compensation for Millennium's executive officers is slightly above the target level of the 65th percentile of the comparison companies, consistent with the Committee's view of Millennium's performance in 2001.

19

Mr. Levin's 2001 Compensation

Mr. Levin is eligible to participate in the same executive compensation plans available to Millennium's executive officers. In determining Mr. Levin's 2001 compensation, including whether to grant stock options to him, the Committee considered Mr. Levin's overall compensation package relative to that of other chief executives in the biotechnology and pharmaceutical industries, past option grants, and the effectiveness of Mr. Levin's leadership of Millennium and our resulting success in the attainment of our priority goals.

In March 2001, Mr. Levin's salary level was increased to $406,406, approximately 1.5% higher than his previous salary level, and his target bonus opportunity was set at 40% of his salary level. The resulting base salary and bonus target level was below the 65th percentile of competitive cash compensation levels. Mr. Levin was granted stock options to purchase an aggregate of 300,000 shares of Millennium's common stock based on the Committee's assessment of how his contributions impacted Millennium's results in 2000 and the importance of his leadership to Millennium's future success. These stock options were granted in equal installments in March, April and May 2001 at exercise prices of $33.25, $26.55 and $37.78 per share respectively. In September 2001, Mr. Levin was granted an additional stock option to purchase 75,000 shares of Millennium's common stock at an exercise price of $16.13 per share pursuant to the Committee's decision to award a portion of the 2002 stock option grants at that time as described above. In March 2002, Mr. Levin was awarded a success sharing bonus of $365,765, based on the funding of the success sharing bonus program for the year 2001 as described above and on the Committee's assessment of his achievement of individual priority goals and the critical importance of his efforts and leadership to Millennium's organizational growth and product and pipeline development in 2001.

The Committee believes that Mr. Levin's 2001 total compensation was competitive, fair, consistent with Millennium's results in 2001, and reflective of Millennium's executive compensation philosophy.

Tax Policy

Section 162(m) of the Internal Revenue Code generally disallows the deductibility of compensation paid to Millennium's Chief Executive Officer and four other most highly compensated individuals to the extent it exceeds $1 million per executive. The law exempts compensation paid under plans that relate compensation to performance (for example, our 2000 Stock Incentive Plan, which was approved by our shareholders at the 2000 Annual Meeting). However, the Committee believes that it is appropriate to retain discretion in determining executive compensation and will reserve the right to exercise this discretion in determining compensation in excess of the limit when such payment is deemed appropriate. The Compensation Committee will continue to monitor the requirements of the Internal Revenue Code to determine what actions, if any, should be taken with respect to Section 162(m) relative to Millennium's executive compensation programs.

|

By the Compensation Committee |

|

A. Grant Heidrich, III,Chairman

Norman C. Selby

Kenneth E. Weg |

20

AUDIT COMMITTEE REPORT

The Audit Committee's primary function is to assist the Board of Directors in monitoring the integrity of Millennium's financial statements, systems of internal control and the audit process. The Committee is currently composed of three of our outside directors. The Board of Directors and the Committee believe that the Committee's current member composition satisfies the rule of the National Association of Securities Dealers, Inc. that governs audit committee composition, including the requirements that:

- •

- all audit committee members are "independent directors" as that term is defined by NASD Rule 4200(a)(14);

- •

- all audit committee members are able to read and understand fundamental financial statements; and

- •

- at least one audit committee member is financially sophisticated.

In 2001, Millennium, with the independent auditors, organized a financial education program for Committee members that reviewed Millennium's overall presentation of our fundamental financial statements and the selection and disclosure of critical accounting policies for Millennium's significant transactions.

The Committee operates under a written Charter adopted by the Board of Directors that reflects standards contained in the NASD rules. The Audit Committee reviews this Charter annually. A complete copy of the current Charter is attached to this Proxy Statement as Appendix A.

We have reviewed and discussed with management and the independent auditors Millennium's audited financial statements as of and for the year ended December 31, 2001.

In general, Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, issued by the Auditing Standards Board of the American Institute of Certified Public Accountants, requires the independent auditors to provide the Committee with additional information regarding the scope and results of the audit, including:

- •

- the independent auditors' responsibilities under generally accepted auditing standards;

- •

- the independent auditors' judgments about the quality of Millennium's accounting principles;

- •

- the adoption of, or a change in, accounting policies;

- •

- sensitive accounting estimates;

- •

- accounting for significant unusual transactions and for controversial or emerging areas;

- •

- significant audit adjustments;

- •

- unadjusted audit differences considered to be immaterial;

- •

- other information in documents containing audited financial statements;

- •

- total fees for management consulting services and types of services rendered;

- •

- disagreements with management on financial accounting and reporting matters;

- •

- major issues discussed with management prior to retention;

- •

- consultation with other accountants;

- •

- difficulties encountered in performing the audit; and

- •

- material errors, fraud and illegal acts.

21

We have discussed with the independent auditors the matters required to be discussed by this Statement.

In general, Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as amended, requires the independent auditors to communicate, at least annually, with the Committee regarding all relationships between the independent auditors and Millennium that, in the professional judgment of the independent auditors, may reasonably be thought to bear on their independence. We have received and reviewed the written disclosures and the letter from the independent auditors required by this Standard, and we have discussed with the independent auditors the independent auditors' independence. When considering the auditors' independence, we considered whether their provision of services to Millennium beyond those rendered in connection with their audit and review of Millennium's consolidated financial statements was compatible with maintaining their independence and discussed with the auditors any relationships that may impact their objectivity and independence. We also reviewed, among other things, the amount of fees paid to the auditors for audit and non-audit services in 2001. Information about the auditors' fees for 2001 is listed below in this proxy statement under Independent Auditors. Based on these discussions and considerations, we are satisfied as to the auditors' independence.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the audited financial statements referred to above be included in Millennium's Annual Report on Form 10-K for the year ended December 31, 2001. We have also recommended to the Board of Directors that Ernst & Young LLP be selected as Millennium's independent auditors for the fiscal year ending December 31, 2002.

|

By the Audit Committee |

|

Norman C. Selby,Chairman

Eugene Cordes

Edward D. Miller, Jr. |

22

INDEPENDENT AUDITORS

The Board of Directors, as recommended by the Audit Committee, has selected the firm of Ernst & Young LLP as Millennium's independent auditors for 2002. Ernst & Young LLP has served as our independent auditors since Millennium's inception.

Representatives of Ernst & Young LLP are expected to be present at the meeting and will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Aggregate Fees for 2001

This table shows the aggregate fees billed to Millennium for the fiscal year ended December 31, 2001 by Ernst & Young LLP.

• |

|

Audit Fees: |

|

$ |

325,000 |

(a) |

| • | | Financial Information Systems

Design and Implementation Fees: | | |

— | |

| • | | All Other Fees: | | | 1,544,615 | (b) |

- (a)

- All of these fees are for the audit of our financial statements for 2001, and for quarterly reviews.

- (b)

- These fees are for:

Audit-related fees of $837,480 for: |

|

|

|

| | • | | employee benefit plan audits | | $ | 18,000 |

| | • | | support for mergers and acquisitions | | | 591,537 |

| | • | | accounting consultations | | | 227,943 |

Non-audit related fees of $707,135 for: |

|

|

|

| | • | | tax consulting services | | $ | 635,085 |

| | • | | employee education | | | 72,050 |

The Audit Committee has considered whether the provision of non-audit services by Ernst & Young is compatible with maintaining auditor independence.

ADDITIONAL INFORMATION

All costs of solicitation of proxies will be paid by Millennium. In addition to solicitations by mail, Millennium's directors, officers and employees, without additional pay, may solicit proxies by telephone, or personal meetings. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and, as required by law, Millennium will reimburse them for their out-of-pocket expenses in this regard.

Stockholder Proposals for 2003 Annual Meeting

Proposals to be included in the proxy statement. Under SEC rules, if a shareholder wants us to include a proposal in our Proxy Statement and form of proxy for presentation at our 2003 Annual Meeting of Stockholders, the proposal must be received by us, attention: Mr. John B. Douglas III, Secretary, at our principal executive offices by November 13, 2002.

Other proposals (not to be included in the proxy statement). Under our By-laws, as permitted by the SEC, a stockholder must follow certain procedures to nominate persons for election as directors or to introduce an item of business at an annual meeting of stockholders. Among other requirements, these procedures require any nomination or proposed item of business must be submitted in writing to our

23

Secretary at our principal executive offices. We must receive the notice of your intention to introduce a nomination or proposed item of business at our 2003 Annual Meeting:

- •

- no later than 60 days before the 2003 Annual Meeting; and

- •

- no earlier than 90 days before the 2003 Annual Meeting.

However, if less than 70 days' notice or prior public disclosure of the date of the 2003 Annual Meeting is given or made, notice by the stockholder must be received no later than the close of business on the 10th day following the date on which the notice of the date of the meeting was mailed or public disclosure was made, whichever occurs first. If a stockholder fails to provide timely notice of a proposal to be presented at the 2003 Annual Meeting, the proxies designated by the Board of Directors will have discretionary authority to vote on the proposal.

|

By Order of the Board of Directors |

|

|

|

JOHN B. DOUGLAS III

Secretary |

March 13, 2002 |

|

24

APPENDIX A

MILLENNIUM PHARMACEUTICALS, INC.

Audit Committee Charter

The Audit Committee is a standing committee of the Board of Directors. Its primary function is to assist the Board in monitoring the integrity of the financial statements of the Company, the Company's systems of internal control, and the independence and performance of the Company's external auditor. The Audit Committee shall discharge its responsibilities, and shall assess the information provided by the Company's management and the independent auditor, in accordance with its business judgement. In exercising its business judgment, the Audit Committee shall rely on the information and advice provided by the Company's management and/or its independent auditor.