Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Millennium Pharmaceuticals, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

Millennium Pharmaceuticals, Inc.

40 Landsdowne Street

Cambridge, Massachusetts 02139

617.679.7000

www.millennium.com |

March 24, 2005

To our stockholders:

I invite you to our 2005 annual meeting of stockholders. The meeting is on Thursday, May 5, 2005 at 10:00 a.m., EDT, at the Hotel@MIT, 20 Sidney Street, Cambridge, Massachusetts 02139. For your convenience, we are also offering a webcast of the meeting. If you choose to listen to the webcast, please go to http://www.millennium.com/investors shortly before the meeting time and follow the instructions. If you miss the meeting, you can listen to a replay of the webcast on that site until June 5, 2005. The annual meeting is a terrific opportunity to learn more about our business and operations. I hope you will join us or listen to the webcast.

On the pages after this letter you will find the notice of our 2005 annual meeting of stockholders, which lists the matters to be considered at the meeting, and the proxy statement, which describes the matters listed in the notice. We have also enclosed your proxy card and our annual report for the year ended December 31, 2004.

Your vote at this meeting is important. Whether or not you plan to attend the meeting, I hope you will vote as soon as possible. If you are a stockholder of record, you may vote over the Internet, by telephone, or by mailing the enclosed proxy card in the envelope provided. You will find voting instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name"—that is, held for your account by a broker or other nominee—you may vote by mailing the enclosed voting instruction card in the envelope provided or by following the instructions for voting by telephone or the Internet.

Thank you for your ongoing support and continued interest in Millennium.

Sincerely,

MARK J. LEVIN

Chairperson, President and Chief Executive Officer

MILLENNIUM PHARMACEUTICALS, INC.

40 Landsdowne Street

Cambridge, Massachusetts 02139

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

|

Date |

|

|

|

Thursday, May 5, 2005 |

Time |

|

|

|

10:00 a.m., EDT |

Place |

|

|

|

the Hotel@MIT, 20 Sidney Street, Cambridge, Massachusetts 02139 |

Webcast |

|

|

|

Go to http://www.millennium.com/investors starting at 10:00 a.m. on May 5, 2005. The webcast will be archived on our website until June 5, 2005. |

Proposals |

|

1. |

|

Elect three Class III directors, each for a term of three years. |

|

|

2. |

|

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005. |

|

|

3. |

|

Consider any other business as may properly come before the meeting or any postponement or adjournment of the meeting. |

Record Date |

|

|

|

You are entitled to vote if you were a stockholder of record on March 8, 2005. |

On behalf of the Millennium Board of Directors,

LAURIE B. KEATING,Secretary

March 24, 2005

TABLE OF CONTENTS

i

MILLENNIUM PHARMACEUTICALS, INC.

40 Landsdowne Street

Cambridge, Massachusetts 02139

PROXY STATEMENT—2005 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement contains information about the 2005 annual meeting of stockholders of Millennium Pharmaceuticals, Inc., including any postponements or adjournments of the meeting. The meeting will be held at the Hotel@MIT, 20 Sidney Street, Cambridge, Massachusetts 02139, on Thursday, May 5, 2005 at 10:00 a.m. EDT.

In this proxy statement, we refer to Millennium Pharmaceuticals, Inc. as "Millennium," "we," "us" or the "Company."

We are sending you this proxy statement in connection with the solicitation of proxies by our Board of Directors.

Our annual report for the year ended December 31, 2004 was first mailed to stockholders, along with these proxy materials, on or about March 24, 2005.

Our annual report on Form 10-K for the year ended December 31, 2004 is available over the Internet at our website, http://www.millennium.com/investors, or through the SEC's EDGAR system at http://www.sec.gov. To request a printed copy of our Form 10-K, which we will provide to you without charge, either: write to Investor Relations, Millennium Pharmaceuticals, Inc., 40 Landsdowne Street, Cambridge, Massachusetts 02139, or e-mail Investor Relations at "info@mlnm.com."

YOUR VOTE IS IMPORTANT. PLEASE TAKE THE TIME TO VOTE AS SOON AS POSSIBLE:

- •

- OVER THE INTERNET,

- •

- BY TELEPHONE OR

- •

- BY MAIL.

|

| WHO CAN VOTE? | | Each share of our common stock that you owned as of the close of business on March 8, 2005, the record date, entitles you to one vote on each matter to be voted upon at the meeting. On the record date, there were 306,722,237 shares of Millennium common stock issued, outstanding and entitled to vote. |

|

| HOW DO I VOTE? | | If your shares are registered directly in your name, you may vote: |

| | | • | | Over the Internet. Go to the website of our tabulator, EquiServe, at http://www.eproxyvote.com/mlnm and follow the instructions you will find there. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. Your shares will be voted according to your instructions. |

| | | • | | By Telephone. Call 1-877 PRX-VOTE (1-877-779-8683) toll-free from the U.S. and Canada and follow the instructions. If you are located outside the U.S. and Canada, see your proxy card for additional instructions. You must specify how you want your shares voted and confirm your vote at the end of the call or your telephone vote cannot be completed. Your shares will be voted according to your instructions. |

| | | • | | By Mail. Complete and sign the enclosed proxy and mail it in the enclosed postage prepaid envelope to EquiServe. Your proxy will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. |

| | | • | | In Person at the Meeting. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting. |

| | | If your shares are held in "street name" (held for your account by a broker or other nominee), you may vote: |

| | | • | | Over the Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote over the Internet or by telephone. |

| | | • | | By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| | | • | | In Person at the Meeting. Contact the broker or other nominee that holds your shares to obtain a broker's proxy card and bring it with you to the meeting.A broker's proxy isnot the form of proxy enclosed with this proxy statement. You will not be able to vote shares you hold in street name at the meeting unless you have a proxy from your broker issued in your name giving you the right to vote the shares. |

|

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES DIRECTLY IN MY NAME AND HOLDING SHARES IN "STREET NAME"? |

|

If your shares are registered directly in your name with our transfer agent, EquiServe Trust Company, N.A., you are considered the "stockholder of record." This proxy statement, annual report and proxy card have been sent directly to you for Millennium by EquiServe.

If your shares are held for you in an account by a broker, bank or other nominee, you are considered the beneficial owner of shares held in "street name." This proxy statement and annual report have been forwarded to you by your broker, bank or nominee who is considered the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or the Internet. |

|

| HOW CAN I CHANGE MY VOTE? | | If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the meeting. To do this, you must do one of the following: |

| | | • | | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. |

| | | • | | Sign a new proxy and submit it as instructed above. |

| | | • | | Attend the meeting and vote in person.Attending the meeting will not revoke your proxy unless you specifically request it. |

| | | If your shares are held in "street name," you may submit new voting instructions by contacting your broker, bank or nominee. You may also vote in person at the annual meeting if you obtain a legal proxy as described in the answer to the "How do I vote?" question above. |

|

2

|

| WILL MY SHARES BE VOTED IF I DO NOT RETURN MY PROXY? | | If your shares are registered directly in your name, your shares will not be voted if you do not vote over the Internet or by telephone or return your proxy or vote by ballot at the meeting. |

|

|

If your shares are held in "street name," your brokerage firm, under certain circumstances, may vote your shares for you if you do not return your proxy. Brokerage firms have authority under the rules of the National Association of Securities Dealers and the New York Stock Exchange to vote customers' unvoted shares on some routine matters. If you do not give a proxy to your brokerage firm to vote your shares, your brokerage firm may either: vote your shares on routine matters, or leave your shares unvoted. Proposal 1, to elect directors, and Proposal 2, to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm, are considered routine matters. We encourage you to provide voting instructions to your brokerage firm by giving your proxy. This ensures your shares will be voted at the meeting according to your instructions. You should receive directions from your brokerage firm about how to submit your proxy to them at the time you receive this proxy statement. |

|

| HOW DO I VOTE MY 401(K) SHARES? | | You may give voting instructions for the number of shares of Millennium common stock equal to the interest in Millennium common stock credited to your 401(k) plan account as of the record date. To vote these shares, complete and return the proxy sent to you with this proxy statement by Fidelity Management Trust Company. The 401(k) plan trustee will vote your shares according to your instructions. If you do not send instructions, the trustee will not vote your shares. |

|

|

You may revoke previously given voting instructions by filing with the trustee either a written revocation or a properly completed and signed proxy bearing a later date. |

|

| WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD? | | It means that you have more than one account, which may be at the transfer agent, with stockbrokers or at Fidelity in your Millennium 401(k) plan account. Please vote over the Internet, by telephone or complete and return all proxies for each account to ensure that all of your shares are voted. |

|

| HOW MANY SHARES MUST BE PRESENT TO HOLD THE MEETING? | | A majority of our outstanding shares of common stock as of the record date must be present at the meeting to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if the stockholder votes over the Internet, by telephone, completes and submits a proxy or is present in person at the meeting. Shares that are present that vote to abstain or do not vote on one or more of the matters to be voted upon are counted as present for establishing a quorum. |

|

|

If a quorum is not present, we expect that the meeting will be adjourned until we obtain a quorum. |

|

3

|

WHAT VOTE IS REQUIRED TO APPROVE EACH MATTER AND HOW ARE VOTES COUNTED? |

|

Proposal 1 — To elect three Class III directors, each for a term of three years

The three nominees for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Abstentions are not counted for purposes of electing directors. If your shares are held by your broker in "street name," and if you do not vote your shares, your brokerage firm has authority under the rules of the National Association of Securities Dealers and the New York Stock Exchange to vote your unvoted shares held by the firm on proposal 1. You may vote FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors and will have no effect on the results of the vote. |

|

|

Proposal 2 — To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005 |

|

|

To approve proposal 2, stockholders holding a majority of Millennium common stock present or represented by proxy at the meeting and voting on the matter must vote FOR the proposal. If your shares are held by your broker in "street name," and if you do not vote your shares, your brokerage firm has authority under the rules of the National Association of Securities Dealers and the New York Stock Exchange to vote your unvoted shares held by the firm on proposal 2. If the broker does not vote your unvoted shares, there will be no effect on the vote because these "broker non-votes" are not considered present or represented at the meeting and voting on the matter. If you vote to ABSTAIN on proposal 2, your shares will not be voted in favor of the proposal, although your shares will be considered to have been voted on the matter. As a result, voting to ABSTAIN has the effect of voting AGAINST. |

|

| HOW DOES THE BOARD OF DIRECTORS | | Our Board of Directors recommends that you vote: |

| RECOMMEND THAT I VOTE? | | • | | FOR proposal 1 — to elect three Class III directors, each for a term of three years |

| | | • | | FOR proposal 2 — to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2005 |

|

| ARE THERE OTHER MATTERS TO BE VOTED ON AT THE MEETING? | | We do not know of any other matters that may come before the meeting other than to elect directors and ratify the appointment of our independent registered public accounting firm. If any other matters are properly presented to the meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment. |

|

| WHERE DO I FIND THE VOTING RESULTS OF THE MEETING? | | We will announce preliminary voting results at the meeting. We will publish final results in our quarterly report on Form 10-Q for the second quarter of 2005, which we are required to file with the Securities and Exchange Commission by August 9, 2005. To request a printed copy of the Form 10-Q write to Investor Relations, Millennium Pharmaceuticals, Inc., 40 Landsdowne Street, Cambridge, Massachusetts 02139, or e-mail Investor Relations at info@mlnm.com. You will also be able to find a copy on the Internet through our website at http://www.millennium.com/investors or through the SEC's electronic data system called EDGAR at http://www.sec.gov. |

|

4

|

| WHAT ARE THE COSTS OF SOLICITING THESE PROXIES? | | We will bear the costs of soliciting proxies. In addition to the mailing of these proxy materials, our directors, officers and employees may solicit proxies by telephone, e-mail and in person, without additional compensation. Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for distributing proxy materials to stockholders. |

|

| HOW CAN I RECEIVE FUTURE PROXY STATEMENTS AND ANNUAL REPORTS OVER THE INTERNET INSTEAD OF RECEIVING PRINTED COPIES IN THE MAIL? | | This proxy statement and our Annual Report to Stockholders for the year ended December 31, 2004 are available on our website at http://www.millennium.com/investors. Most stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving printed copies in the mail. If you are a stockholder of record, you can choose this option when you vote over the Internet and save us the cost of producing and mailing these documents. If you are a stockholder of record and choose to view future proxy statements and annual reports over the Internet, you will receive a proxy in the mail next year with instructions containing the Internet address to access those documents. If your shares are held through a broker or other nominee, you should check the information provided by them for instructions on how to elect to view future proxy statements and annual reports over the Internet. |

|

PROPOSAL 1 — ELECTION OF DIRECTORS

|

The Board, upon recommendation of the Board Governance Committee, has nominated the three people listed below for election as Class III Directors. Each nominee currently serves as a Class III Director. The Board of Directors recommends a vote FOR the nominees named below.

Our Board of Directors is divided into three classes. One class is elected each year and members of each class hold office for three-year terms. The number of members of the Board is determined from time to time by the Board of Directors and is presently fixed at twelve. The Board currently has eight members and four vacancies. One current member is a Class I director (with a term expiring at the 2006 annual meeting), three are Class II directors (with terms expiring at the 2007 annual meeting) and four are Class III directors (with terms expiring at the 2005 annual meeting). Shaun Coughlin, who currently serves as a Class III director, has decided not to stand for reelection. The Board is currently working to identify qualified individuals to fill the vacancies on the Board. For more information on nomination of directors, see "Board Governance Committee" below in the section entitled "Committees of the Board" in the discussion of "Our Corporate Governance."

The persons named in the enclosed proxy will vote to elect as Class III directors Mark J. Levin, A. Grant Heidrich, III and Kenneth E. Weg, the three nominees listed below, unless you indicate on the proxy that your vote should be withheld from any or all of these nominees. If they are elected, Mr. Levin, Mr. Heidrich and Mr. Weg will hold office until the 2008 annual meeting of stockholders and until their successors are duly elected and qualified. All of the nominees have indicated their willingness to serve, if elected, but if any of them should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors, unless the Board chooses to reduce the number of directors serving on the Board.

There are no family relationships between or among any of our executive officers or directors.

5

Below are the names and certain information about each member of the Board of Directors, including the nominees for election as Class III directors.

|

| NOMINEES FOR CLASS III DIRECTORS—TERMS TO EXPIRE IN 2008 |

|

MARK J. LEVIN

Age: 54

Chairperson, President and Chief Executive Officer, Millennium Pharmaceuticals, Inc.

Director since January 1993 |

|

Mr. Levin is Chairperson of the Board of Directors of Millennium (since March 1996), President (since 1993) and Chief Executive Officer (since November 1994). Prior to joining Millennium, Mr. Levin was a Partner at Mayfield, a venture capital firm (1987 to 1994) and held various positions with Genentech, Inc., Foxboro Company, Miller Brewing Company and Eli Lilly and Company (1974 to 1987) in biochemical and process engineering, marketing and project leadership. |

|

A. GRANT HEIDRICH, III

Age: 52

Partner Emeritus, Mayfield

Director since January 1993

Lead Outside Director

Audit Committee

Compensation and Talent Committee

Board Governance Committee

Executive Committee |

|

Mr. Heidrich is Partner Emeritus, Mayfield, a venture capital firm (since January 2004). He served as General Partner and Managing Director, Mayfield (1983 to 2004). He is Chairman of the Board of Tularik, Inc., a biotechnology company, and a director of Cytokinetics Inc., a biopharmaceutical company. |

|

KENNETH E. WEG

Age: 66

Chairman, Clearview Projects, Inc.

Director since March 2001

Audit Committee

Compensation and Talent Committee (Chairperson)

Board Governance Committee |

|

Mr. Weg is Chairman, Clearview Projects, Inc., a company engaged in partnering and deal transaction services to biopharmaceutical companies and academic institutions (since February 2001). Mr. Weg served as Vice Chairman (1999 to 2001), member of the Office of Chairman (1998 to 2001), Executive Vice President (1995 to 2001), President of the Worldwide Medicines Group (1997 to 1998), President of the Pharmaceutical Group (1993 to 1996) and President of Pharmaceutical Operations (1991 to 1993), Bristol-Myers Squibb Company, a pharmaceutical company. |

CLASS I DIRECTOR—TERM TO EXPIRE IN 2006

|

NORMAN C. SELBY

Age: 52

Chairman, Windhover Information, Inc.

Director since May 2000

Audit Committee (Chairperson)

Compensation and Talent Committee

Executive Committee |

|

Mr. Selby is Chairman, Windhover Information, Inc., a publishing and information company serving the pharmaceutical, biotechnology and medical device industries (since May 2004). He served as President and Chief Executive Officer, TransForm Pharmaceuticals, Inc., a drug development company (June 2001 to May 2004). He was Head of Consumer Internet Business, Citigroup, a financial services company (June 1999 to July 2000), Executive Vice President of Citicorp (September 1997 to July 2000) and Director and Senior Partner, McKinsey & Company, an international management consulting firm (1978 to 1997) and Head of the firm's global pharmaceutical practice. |

|

6

CLASS II DIRECTORS—TERMS TO EXPIRE IN 2007

|

CHARLES J. HOMCY, M.D.

Age: 56

President and Chief Executive Officer, Portola Pharmaceuticals, Inc.

Director since December 2002

Research and Development Committee |

|

Dr. Homcy is President and Chief Executive Officer, Portola Pharmaceuticals, Inc., a biotechnology company (since November 2003). He is also a Clinical Professor of Medicine, University of California, San Francisco Medical School (since 1997) and an attending physician at the San Francisco VA Hospital (since 1997). Dr. Homcy served as Senior Advisor R&D, Millennium Pharmaceuticals, Inc. (January 2003 to November 2003) and President of Research and Development (February 2002 to December 2002). Prior to joining Millennium, Dr. Homcy was Executive Vice President, Research and Development (1995 to February 2002) and Director (1998 to February 2002), COR Therapeutics, Inc., a biotechnology company. He served as President of the Medical Research Division, American Cyanamid Company-Lederle Laboratories, a pharmaceutical company (now a division of Wyeth-Ayerst Laboratories) (1994 to March 1995). He is a director of Kozen Biosciences Incorporated, a biotechnology company and of Cytokinetics Inc., a biopharmaceutical company. |

|

RAJU S. KUCHERLAPATI, PH.D.

Age: 62

Scientific Director, Harvard-Partners Center for Genetics and Genomics and Professor of Genetics, Harvard Medical School

Director since January 1993

Board Governance Committee (Chairperson)

Research and Development Committee |

|

Dr. Kucherlapati is Scientific Director, Harvard-Partners Center for Genetics and Genomics and Professor of Genetics, Harvard Medical School (since September 2001). He was Professor and Chairman of the Department of Molecular Genetics, Albert Einstein College of Medicine (1989 to September 2001). Dr. Kucherlapati is a founder of Millennium. He is a director of Abgenix, Inc., a biotechnology company. |

|

ERIC S. LANDER, PH.D

Age: 48

Director, The Eli and Edythe L. Broad Institute

Director since January 1993

Board Governance Committee

Research and Development Committee (Co-Chairperson) |

|

Dr. Lander is a founder and Director, The Eli and Edythe L. Broad Institute, a biomedical research institute formed by the Whitehead Institute, MIT and Harvard University (since November 2003). He is also a Member of the Whitehead Institute for Biomedical Research (since 1989), a Professor and Associate Professor, Department of Biology, Massachusetts Institute of Technology (since 1989) and a Professor, Harvard Medical School (since January 2004). He was the Director, Whitehead/MIT Center for Genome Research (1993 to November 2003). Dr. Lander is a founder of Millennium. |

|

7

OWNERSHIP OF OUR COMMON STOCK

Ownership By Management

On March 8, 2005 Millennium had 306,722,237 shares of common stock issued and outstanding. This table shows certain information about the beneficial ownership of Millennium common stock, as of that date, by:

- •

- each of our current directors;

- •

- each nominee for director;

- •

- our Chief Executive Officer;

- •

- each of our four other most highly compensated executive officers who were serving as executive officers as of December 31, 2004 and are named in the Summary Compensation Table; and

- •

- all of our current directors and executive officers as a group.

According to SEC rules, we have included in the column "Number of Issued Shares" all shares over which the person has sole or shared voting or investment power, and we have included in the column "Number of Shares Issuable" all shares that the person has the right to acquire within 60 days after March 8, 2005 through the exercise of any stock option or other right. All shares that a person has a right to acquire within 60 days of March 8, 2005 are deemed outstanding for the purpose of computing the percentage beneficially owned by the person, but are not deemed outstanding for the purpose of computing the percentage beneficially owned by any other person.

Unless otherwise indicated, each person has the sole power (or shares the power with a spouse) to invest and vote the shares listed opposite the person's name. Where applicable, ownership is subject to community property laws. Our inclusion of shares in this table as beneficially owned is not an admission of beneficial ownership of those shares by the person listed in the table.

|

|

|

|

|

|

|

|

|

|

|---|

| |

|---|

Name

| | Number of Issued

Shares(1)

| | Number of Shares

Issuable(2)

| | Total

| | Percent

| |

|---|

| |

|---|

| Mark J. Levin | | 3,069,031 | | 2,507,589 | | 5,576,620 | | 1.8 | % |

| Shaun R. Coughlin, Ph.D. | | 32,752 | | 36,738 | | 69,490 | | * | |

| A. Grant Heidrich, III | | 224,564 | | 170,970 | | 395,534 | | * | |

| Charles J. Homcy, M.D. | | 111,838 | | 528,422 | | 640,260 | | * | |

| Raju S. Kucherlapati, Ph.D.(3) | | 712,526 | | 165,494 | | 878,020 | | * | |

| Eric S. Lander, Ph.D.(4) | | 10,000 | | 183,072 | | 193,072 | | * | |

| Norman C. Selby(5) | | 10,163 | | 82,457 | | 92,620 | | * | |

| Kenneth E. Weg | | 10,000 | | 48,867 | | 58,867 | | * | |

| Kenneth M. Bate(6) | | 1,360 | | 149,316 | | 150,676 | | * | |

| Marsha H. Fanucci | | 2,230 | | 259,132 | | 261,362 | | * | |

| Linda K. Pine | | 346,633 | | 243,385 | | 590,018 | | * | |

| Robert I. Tepper(7) | | 23,119 | | 896,810 | | 919,929 | | * | |

| All directors and executive officers as a group (12 persons) | | 4,553,222 | | 5,126,376 | | 9,679,598 | | 3.1 | % |

|

|

- *

- Less than one percent

- (1)

- Includes shares contributed by Millennium to our 401(k) plan for the benefit of the named executive officer as of December 31, 2004 as follows: Mr. Levin, 4,807 shares; Mr. Bate, 1,360 shares; Ms. Fanucci, 2,230 shares; Ms. Pine, 4,619 shares; Dr. Tepper, 4,338 shares and all directors and executive officers as a group, 16,360 shares.

- (2)

- Shares that can be acquired through stock option exercises through May 7, 2005.

8

- (3)

- Includes 1,000 shares held by a custodian under the Uniform Gifts to Minors Act for Dr. Kucherlapati's son. Dr. Kucherlapati disclaims beneficial ownership of these shares.

- (4)

- Includes 10,000 shares held by the Lander Family Charitable Trust. Dr. Lander disclaims beneficial ownership of these shares.

- (5)

- Includes 1,010 shares held by trusts for each of Mr. Selby's two sons and 1,143 shares held by Mr. Selby's spouse. Mr. Selby disclaims beneficial ownership of these shares.

- (6)

- Mr. Bate's employment with Millennium ended on January 28, 2005.

- (7)

- Includes 333 shares held by a custodian under the Uniform Gifts to Minors Act for each of Dr. Tepper's two sons. Dr. Tepper disclaims beneficial ownership of these shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of our records, we believe that in 2004 our directors and executive officers filed on a timely basis all reports of holdings and transactions in Millennium common stock required to be filed with the SEC pursuant to Section 16(a) of the Securities Exchange Act of 1934, except that on February 11, 2004, Dr. Kucherlapati filed late two Forms 4 reporting open market sales of common stock on January 2, 2004 and February 2, 2004.

Ownership By Principal Stockholders

This table shows certain information, based on filings with the Securities and Exchange Commission, about the beneficial ownership of our common stock as of the date indicated below by each person known to us owning beneficially more than 5% of our common stock.

|

|

|

|

|

|

|---|

| |

|---|

Name and Address

| | Number of Shares

| | Percent

| |

|---|

| |

|---|

Citigroup Global Markets Holdings Inc.

388 Greenwich Street

New York, NY 10013 | | 17,026,560 | (1) | 5.6 | % |

Citigroup, Inc.

399 Park Avenue

New York, NY 10043 | | 17,707,549 | (1) | 5.8 | % |

FMR Corp. (and related entities)

82 Devonshire Street

Boston, Massachusetts 02109 | | 43,728,065 | (2) | 14.3 | % |

Wellington Management Company, LLP

75 State Street

Boston, MA 02109 | | 37,056,534 | (3) | 12.1 | % |

|

|

- (1)

- According to a Schedule 13G filed jointly with the Securities and Exchange Commission on February 10, 2005, Citigroup Global Markets Holdings Inc. reports having shared voting power for 17,026,560 shares and shared dispositive power for 17,026,560 shares and Citigroup, Inc. reports having shared voting power for 17,707,549 shares and shared dispositive power for 17,707,549 shares. The shares reported assume conversion/exercise of certain securities held. The shares reported as held by Citigroup, Inc. include the shares held by Citigroup Global Markets Holdings Inc.

- (2)

- According to a Schedule 13G/A filed jointly with the Securities and Exchange Commission on February 14, 2005, FMR Corp., Edward C. Johnson 3d, Abigail P. Johnson, and Fidelity Management and Research Company report having sole voting power for 2,519,670 shares, and sole dispositive power for 43,728,065 shares.

- (3)

- According to a Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2005, Wellington Management Company, LLP reports having shared voting power for 25,933,800 shares and shared dispositive power for 37,056,534 shares.

9

OUR CORPORATE GOVERNANCE

Our Commitment to Good Corporate Governance

We believe that good corporate governance and an environment of the highest ethical standards are important for Millennium to achieve business success and to create value for our stockholders. Our Board of Directors is committed to high governance standards and to continually work to improve them. We continue to review our corporate governance practices in light of ongoing changes in applicable law and NASDAQ stock market listing standards. We also compare our governance practices to those identified as best practices by various authorities and other public companies.

Role of Our Board of Directors

Our Board of Directors currently consists of eight members, one of whom is not standing for reelection this year. The Board monitors overall corporate performance and the integrity of our financial controls and legal compliance procedures. It elects senior management and oversees succession planning and senior management's performance and compensation. The Board also oversees our long and short term strategic and business planning, and conducts a year-long process which culminates in Board review and approval each year of a business plan, a capital expenditures budget and other key financial and business objectives.

Members of the Board keep informed about our business through discussions with the Chief Executive Officer and other members of our senior management team, by reviewing materials provided to them on a regular basis and in preparation for Board and committee meetings and by participating in meetings of the Board and its committees. We regularly review key portions of our business with the Board. We introduce our executives to the Board so that the Board can become familiar with our key talent. We have a new Board member orientation process which introduces each new member to Millennium's business through a series of meetings with management, tours of facilities, and written materials about Millennium and the biopharmaceutical business.

In 2004, the Board of Directors met five times. During 2004, each of our current directors attended at least 75% of the total number of meetings of the Board of Directors and all committees of the Board on which the director served, except for Dr. Lander who attended 70%. We do not have a policy requiring our Board members to attend our annual meetings of stockholders; in 2004 seven of our then current Board members attended our annual meeting by telephone conference call. We expect our Board members to attend the 2005 annual meeting.

Board Policies

The Board is guided by Board Policies originally adopted in 2001, which we believe demonstrate our continuing commitment to good corporate governance. These policies are reviewed by the Board from time to time, as needed. The policies are posted on the corporate governance section of our website at http://www.millennium.com/investors.

Performance of Our Board

We consider it important to continually evaluate and improve the effectiveness of the Board, its committees and its individual members. We do this in various ways. At the beginning of each year, the Board adopts goals that it considers important for the Board to achieve during that year, monitors progress towards those goals throughout the year and conducts a review to assess whether it has successfully achieved those goals and how well the Board has performed in providing oversight and adding value to Millennium. Each of the Board's standing committees also adopts yearly goals and conducts annual self-evaluations.

The Board Governance Committee, working with the lead outside director, periodically assesses the Board's performance, and the performance of individual members, and reports its conclusions to the full Board. Each Board member annually completes a self-evaluation of his or her contributions. Also, after

10

each Board meeting, each Board member assesses the effectiveness of the materials presented and conduct of the meeting and has the opportunity to offer suggestions for improvement where needed.

Code of Conduct, Business Ethics and Compliance

The Board of Directors originally adopted our code of conduct, the Core Values Handbook, in December 2003, which was revised and updated in February 2005. The Core Values Handbook applies to all members of the Board of Directors and all employees of Millennium, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Handbook also contains additional obligations to which our chief executive officer and senior financial officers are subject. Our Core Values Handbook is posted on the corporate governance section of our website at http://www.millennium.com/investors. We intend to post on our website all disclosures that are required by law or NASDAQ stock market listing standards concerning any amendments to, or waivers from, our code of business conduct and ethics. Stockholders may request a free copy of our Core Values Handbook by writing to Investor Relations, Millennium Pharmaceuticals, Inc., 40 Landsdowne Street, Cambridge, Massachusetts 02139.

Independence of Directors

The Board Policies provide that a substantial majority of the Board as a whole should be composed of independent directors. The Board Governance Committee annually reviews the independence of the directors, reports to the Board which directors it recommends that the Board determine are independent and the Board makes the determination. The Board takes into account NASDAQ stock market listing standards, applicable laws and regulations and other factors in making its determinations. The Board has determined that Dr. Coughlin, Mr. Heidrich, Dr. Kucherlapati, Dr. Lander, Mr. Selby and Mr. Weg are currently independent directors and that Dr. Homcy and Mr. Levin are currently not independent directors.

Executive Sessions of Independent Directors

Directors who are independent under the NASDAQ stock market listing standards and applicable laws and regulations meet in executive session without management present at every regularly scheduled Board meeting. In addition, periodically the Board meets in executive session without the chief executive officer present and in executive session with the non-employee directors only.

Lead Outside Director

Since 2000, the Board has designated a lead outside director who oversees an annual process of Board and director evaluation, including providing appropriate feedback to the Board. The lead outside director provides assistance to the Chairperson and Corporate Secretary in planning Board agendas, acts as the leader of the non-employee directors, acts as Chairperson of the non-employee directors in meetings of the non-employee directors, and acts as Chairperson of the Board in the absence of the Chairperson or a vacancy in the position of Chairperson. Mr. Heidrich is currently serving as our lead outside director.

Committees of the Board

The Board currently has five standing committees: the Audit Committee, the Compensation and Talent Committee, the Board Governance Committee, the Research and Development Committee and the

11

Executive Committee. The Board also appoints from time to time ad hoc committees to address specific matters.

|

| Audit Committee | | |

|

Members:

Norman C. Selby, Chairperson

A. Grant Heidrich, III

Kenneth E. Weg | | Meetings in 2004: 8 |

|

The Audit Committee consists entirely of independent directors within the meaning of Securities and Exchange Commission regulations and the NASDAQ stock market listing standards.

The Board of Directors has determined that Norman C. Selby, chairperson of the committee, qualifies as an audit committee financial expert, who is independent within the meaning of SEC regulations and NASDAQ stock market listing standards.

The Audit Committee's primary function is to assist the Board in monitoring the integrity of our financial statements and our systems of internal control. The Audit Committee has direct responsibility for the appointment, independence and monitoring the performance of our independent registered public accounting firm. The Committee is responsible for pre-approving any engagements of our independent registered public accounting firm.

The Committee also reviews our risk management practices, strategic tax planning, preparation of quarterly and annual financial reports and our ethics and compliance processes.

The Committee members meet regularly with our independent registered public accounting firm without management present and with members of management in separate private sessions, to discuss any matters that the Committee or these individuals believe should be discussed privately with the Audit Committee, including any significant issues or disagreements concerning our accounting practices or financial statements.

The Committee conducts a meeting each quarter to review the financial statements prior to the public release of earnings.

The Audit Committee also meets regularly with our chief compliance officer, including a separate private session with the chief compliance officer without management present.

The Audit Committee charter is included as Appendix A to this proxy statement. The charter is also posted on the corporate governance section of our website at http://www.millennium.com/investors.

Please also see the Audit Committee Report at page 25 below.

|

| Compensation and Talent Committee | | |

|

Members:

Kenneth E. Weg, Chairperson

A. Grant Heidrich, III

Norman C. Selby | | Meetings in 2004: 5 |

|

The Compensation and Talent Committee consists entirely of independent directors within the meaning of SEC regulations and NASDAQ stock market listing standards.

The Committee's primary responsibilities are to address chief executive officer, executive officer, and senior talent development, retention, performance, succession planning, and to oversee compensation and benefit matters. It reviews the qualifications of the executive officers and nominates executive officers for election by the Board. It reviews and approves compensation policy for Millennium to ensure that our

12

compensation strategy supports organizational objectives and stockholder interests, and considers appropriate companies for compensation comparison purposes. The Committee determines the compensation of the chief executive officer and reviews and approves the compensation of all other executive officers. It approves and recommends, and suggests material changes to, any employee incentive compensation or retirement plans.

The Compensation and Talent Committee engages an outside compensation consultant, sets the budget for the consultant and reviews the services provided by the consultant. The Committee also meets regularly with the consultant in private sessions without management present.

The Committee has the authority to retain special legal, accounting or other consultants to advise the Committee.

The Compensation and Talent Committee charter is posted on the corporate governance section of our website at http://www.millennium.com/investors.

Please also see the Compensation and Talent Committee Report on Executive Compensation at page 22 below.

|

| Board Governance Committee | | |

|

Members:

Raju S. Kucherlapati, Chairperson

A. Grant Heidrich, III

Eric S. Lander

Kenneth E. Weg | | Meetings in 2004: 5 |

|

The Board Governance Committee consists entirely of independent directors within the meaning of SEC regulations and applicable NASDAQ stock market listing standards.

The Board Governance Committee is responsible for Board governance issues. It recommends to the Board policies relating to the conduct of Board affairs. It periodically evaluates the composition of the Board, the contribution of individual directors, and the Board's effectiveness as a whole. The Committee also recommends to the Board assignment of Board members to committees. It also reviews compensation for non-employee directors and recommends to the Board changes as appropriate.

The Committee also recommends to our full Board individuals to serve as directors. The Committee recommends to the Board guidelines and criteria for Board membership and reviews with the Board, on a periodic basis, the appropriate skills and characteristics required of Board members in the context of the then current needs of Millennium. See the discussion under Board Membership Criteria at page 15 below.

The Board Governance Committee's process to identify and evaluate candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Board Governance Committee and the Board. Assuming that appropriate biographical and background material is provided for candidates recommended by stockholders and the process for submitting the recommendation discussed below is followed, the Board Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members. The Committee also from time to time utilizes the services of a search firm to help identify candidates for Director.

The Committee will consider qualified candidates for Director recommended and submitted by stockholders. Submissions that meet the then current criteria for Board membership are forwarded to the chairperson of the Board Governance Committee for further review and consideration. The Committee will consider a recommendation only if appropriate biographical information and background material is provided on a timely basis, accompanied by a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for

13

at least one year as of the date that the recommendation is made. To submit a recommendation for a nomination, a stockholder may write to the Board Governance Committee, Millennium Pharmaceuticals, Inc., 40 Landsdowne Street, Cambridge, Massachusetts 02139, Attention: Corporate Secretary. In addition, our By-laws permit stockholders to nominate individuals, without any action or recommendation by the Committee or the Board, for election as directors at an annual stockholder meeting. For a description of this By-law provision, see Additional Information on page 28 of this proxy statement.

Dr. Kucherlapati and Dr. Lander were appointed to the Board Governance Committee as of January 1, 2005.

The charter of the Board Governance Committee is posted on the corporate governance section of our website at http://www.millennium.com/investors.

|

| Research and Development Committee | | |

|

Members:

Shaun R. Coughlin, Co-Chairperson

Eric S. Lander, Co-Chairperson

Charles J. Homcy

Raju S. Kucherlapati | | Meetings in 2004: 2 |

|

The Board of Directors appointed the Research and Development Committee as a standing committee of the Board in April 2004. The Committee is a successor to ad hoc committees appointed by the Board to address drug discovery and pipeline review issues. The Committee is responsible for assisting Millennium in evaluating research and development issues and decisions and providing a detailed perspective on research and development efforts to the Board of Directors.

The charter of the Research and Development Committee is posted on the corporate governance section of our website at http://www.millennium.com/investors.

|

| Executive Committee | | |

|

Members:

A. Grant Heidrich, III

Norman C. Selby | | Meetings in 2004: None |

|

The Executive Committee may exercise, when the Board of Directors is not in session, all powers of the Board of Directors in the management of Millennium's business and affairs to the extent permitted by law, our By-laws and as specifically granted by the Board of Directors. The Executive Committee did not meet in 2004.

The Committee consists entirely of independent directors within the meaning of SEC regulations and NASDAQ stock market listing standards.

Communications with the Board

You may contact the Board of Directors or any committee of the Board by writing to Board of Directors (or specified committee), Millennium Pharmaceuticals, Inc., 40 Landsdowne Street, Cambridge, MA 02139, Attn: Corporate Secretary or by sending an e-mail to "corporate secretary@mlnm.com." You should indicate on your correspondence that you are a Millennium stockholder. Communications will be distributed to the chairperson, lead outside director, the appropriate committee chairperson or other members of the Board, as appropriate, depending on the facts and circumstances stated in the communication received.

14

Anyone may express financial, internal auditing controls, or auditing concerns to the Audit Committee by calling the Corporate Secretary's helpline voicemail box at 866-469-6566, or sending an e-mail to "corporate secretary@mlnm.com." Messages to the Audit Committee will be received by our Corporate Secretary who will promptly report all appropriate messages received to the Audit Committee or a designated member. You may report your concern anonymously or confidentially.

Board Membership Criteria

The Board Governance Committee reviews with the Board on a periodic basis the appropriate skills and characteristics required of Board members in the context of Millennium's current and future needs. The Committee regularly assesses the skills and characteristics of current Board members, identifies opportunities for enhancing the skill sets represented on the Board and prepares appropriate recruiting plans. To be considered as a prospective nominee for director a person should possess the highest personal and professional ethics, have excellent business judgment and the ability to act in the interests of our stockholders, and possess knowledge and abilities that will enable the Board to fulfill its responsibilities. The Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation and Talent Committee are Mr. Weg, Mr. Heidrich and Mr. Selby. No member of the Compensation and Talent Committee was at any time during 2004, or formerly, an officer or employee of Millennium or any subsidiary of Millennium. No executive officer of Millennium has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity while an executive officer of that other entity served as a director of Millennium or member of our Compensation and Talent Committee.

Indemnification of Officers and Directors

We indemnify our directors and officers to the fullest extent permitted by law for their acts and omissions in their capacity as a director or officer of Millennium, so that they will serve free from undue concerns for liability for actions taken on behalf of Millennium. This indemnification is required under our corporate charter.

DIRECTOR COMPENSATION

We do not pay directors who are also Millennium employees any additional compensation for their service as a director. We do pay our non-employee directors for their service as directors.

Each year, the Board Governance Committee reviews the compensation we pay to our non-employee directors. The Committee compares our Board compensation to compensation paid to non-employee directors by similarly sized public companies in similar businesses. The Committee also considers the responsibilities that we ask our Board members to assume and the amount of time required to perform those responsibilities. On December 17, 2004, the Board of Directors approved an increase in the compensation to be paid to the lead outside director effective January 1, 2005. The lead outside director will receive an annual retainer of $35,000, an increase of $10,000. The lead outside director previously received the same $25,000 annual retainer paid to all outside directors. The Board also approved an increase in the additional annual stock option grant for the lead outside director from 1,500 shares to 5,000 shares.

Below we show the rate of compensation that we pay to our non-employee directors.

15

Cash Compensation

Each director who is not an employee of Millennium receives:

|

|

|

|

|

|---|

Type of Fee

| | Amount

| | For each

|

|---|

|

|---|

| Annual retainer: | | $25,000 | | Year of service |

| Additional annual retainer for lead outside director: | | $10,000 | | Year of service |

| Attendance: | | $2,000 | | Board meeting attended in person |

| | | $1,000 | | Board meeting by conference telephone |

| | | $1,000 | | Board committee meeting attended in person |

| | | $750 | | Board committee meeting by conference telephone |

Millennium also reimburses non-employee directors for reasonable travel and out-of-pocket expenses in connection with their service as directors.

Stock Compensation

Directors also participate in our 2000 Stock Incentive Plan. Under the option program for directors adopted by the Board, our non-employee directors receive stock option grants as follows:

|

|

|

|

|

|

|

|---|

|

|---|

| | Number

of shares

| | Granted in three

installments on

| | Vesting

schedule

|

|---|

|

|---|

| Initial Option Grant: | | 35,000 | | the date the director is first elected, one month later and two months later | | vest on a monthly basis beginning one month from the date of election and become fully vested on the fourth anniversary of the date of election |

Annual Option Grant: |

|

15,000 |

|

May 1st, June 1st and July 1st of each year, prorated for service on the Board of less than one year |

|

vest on a monthly basis beginning as of June 1st in the year granted and become fully vested on May 1st of the fourth year after the grant date |

Committee Chair: |

|

500 |

|

the dates of the annual option grant |

|

same as annual grant |

Lead Outside Director: |

|

5,000 |

|

the dates of the annual option grant |

|

same as annual grant |

Each option terminates on the earlier of ten years after the date of grant or the date 90 days after the option holder ceases to serve as a director or employee (or one year in the case of disability and three years in the event of death).

Under the 2000 Plan, an option becomes fully vested in the event of the death of the director. The exercise price of options granted under the 2000 Plan is equal to the closing price of Millennium common stock as quoted on the NASDAQ stock market on the date of grant.

Compensation Paid to Non-Employee Directors for 2004

Millennium paid the annual retainer amount and meeting fees to current non-employee directors for service on the Board in 2004 as follows: Shaun R. Coughlin, $36,750; A. Grant Heidrich, III, $42,500; Charles J. Homcy, $36,000; Raju S. Kucherlapati, $39,250; Eric S. Lander, $34,750; Norman C. Selby, $47,500 and Kenneth E. Weg, $46,000.

Under our 2000 Stock Incentive Plan, Millennium granted stock options to current non-employee directors in three equal installments on May 1, 2004, June 1, 2004 and July 1, 2004 for a total of 17,000 shares to Mr. Heidrich, for a total of 15,500 shares to each of Dr. Coughlin, Dr. Lander, Mr. Selby and Mr. Weg, for a total of 15,000 shares to Dr. Kucherlapati and for a total of 7,500 shares to Dr. Homcy. The option exercise prices per share were: $15.02 for the grants on May 1, 2004, $15.20 for the grants on June 1, 2004, and $13.28 for the grants on July 1, 2004.

16

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation

This table shows certain information about the compensation we paid our Chief Executive Officer and each of our four other most highly compensated executive officers who were serving as executive officers as of December 31, 2004.

Summary Compensation Table

| |

| | ANNUAL COMPENSATION

| | LONG-TERM COMPENSATION AWARDS

| |

|

|---|

|

|

|

|

|

|

|

|

|

OTHER

ANNUAL

COMPENSATION

($)

|

|

SECURITIES

UNDERLYING

OPTIONS

GRANTED (#)

|

|

ALL OTHER

COMPENSATION

($)(2)

|

|---|

NAME AND

PRINCIPAL POSITION

| | YEAR

| | SALARY ($)

| | BONUS ($)(1)

|

|---|

|

|---|

Mark J. Levin

Chairperson, Chief Executive

Officer and President | | 2004

2003

2002 | | 519,231

500,000

482,001 | | 200,000

250,000

— | | | —

—

— | | 400,000

400,000

387,500 | | 11,709

11,356

11,356 |

Robert I. Tepper

President, Research and Development |

|

2004

2003

2002 |

|

457,486

417,462

369,790 |

|

128,059

194,336

131,076 |

|

|

—

—

— |

|

201,250

191,666

158,334 |

|

10,347

10,080

9,580 |

Kenneth M. Bate(3)

Former Executive Vice President, Head of Commercial Operations and Chief Financial Officer |

|

2004

2003

2002 |

|

413,653

359,423

6,731 |

|

146,327

154,000

50,000 |

(4)

(4) |

|

—

—

— |

|

267,500

175,000

50,000 |

|

10,945

10,656

32 |

Marsha H. Fanucci

Senior Vice President and Chief Financial Officer |

|

2004

2003

2002 |

|

333,795

268,274

240,564 |

|

127,400

72,500

47,094 |

|

|

—

—

— |

|

275,000

100,000

51,990 |

|

10,863

10,335

9,276 |

Linda K. Pine

Senior Vice President, Human Resources |

|

2004

2003

2002 |

|

300,472

257,919

245,122 |

|

72,590

78,159

59,638 |

|

|

—

—

— |

|

57,500

48,880

56,625 |

|

10,726

10,286

10,215 |

|

- (1)

- The amounts in the bonus column were all awarded under the Company's Success Sharing Bonus Program unless otherwise noted.

- (2)

- All Other Compensation includes:

| | Term life insurance premiums paid by Millennium

| | Dollar value of Millennium

common stock contributed by

Millennium to the executive's

account under 401(k) Plan

| | Other

|

|---|

Name

| | 2004

| | 2003

| | 2002

| | 2004

| | 2003

| | 2002

| | 2004

| | 2003

| | 2002

|

|---|

|

|---|

| Mark J. Levin | | $ | 1,784 | | $ | 1,656 | | $ | 1,656 | | $ | 9,225 | | $ | 9,000 | | $ | 9,000 | | $700 | | $700 | | $700 |

| Robert I. Tepper | | $ | 1,122 | | $ | 1,080 | | $ | 1,080 | | $ | 9,225 | | $ | 9,000 | | $ | 8,500 | | — | | — | | — |

| Kenneth M. Bate | | $ | 1,720 | | $ | 1,656 | | $ | 32 | | $ | 9,225 | | $ | 9,000 | | | — | | — | | — | | — |

| Marsha H. Fanucci | | $ | 1,638 | | $ | 1,335 | | $ | 776 | | $ | 9,225 | | $ | 9,000 | | $ | 8,500 | | — | | — | | — |

| Linda K. Pine | | $ | 1,501 | | $ | 1,286 | | $ | 1,215 | | $ | 9,225 | | $ | 9,000 | | $ | 9,000 | | — | | — | | — |

|

- (3)

- Mr. Bate joined Millennium in December 2002 and his employment ended on January 28, 2005.

- (4)

- Includes sign-on bonuses paid to Mr. Bate in accordance with the terms of his employment offer letter of $50,000 in 2002 and $50,000 in 2004.

17

Option Grants in 2004

This table shows all options to purchase our common stock granted in 2004 by us to our Chief Executive Officer and each of our four other most highly compensated executive officers.

| |

|

| | PERCENT OF

TOTAL

OPTIONS

GRANTED TO

EMPLOYEES

IN 2004(2)

| |

| |

| |

| |

|

|---|

| | NUMBER OF

SHARES

UNDERLYING

OPTIONS

GRANTED (#)(1)

| |

| |

| | POTENTIAL REALIZABLE VALUE AT ASSUMED ANNUAL RATES OF STOCK PRICE APPRECIATION FOR OPTION TERM (3)

|

|---|

| | EXERCISE

OR BASE

PRICE

($/sh)

| |

|

|---|

| | EXPIRATION

DATE

|

|---|

NAME

| | 5%($)

| | 10%($)

|

|---|

|

|---|

| Mark J. Levin | | 200,000

200,000 | (4)

(5) | | 4.40 | % | $

| 18.64

12.09 | | 03/03/2014

09/01/2014 | | $

| 2,344,519

1,520,667 | | $

| 5,941,472

3,853,669 |

Robert I. Tepper |

|

100,625

100,625 |

(4)

(5) |

|

2.22 |

% |

|

17.77

12.09 |

|

02/25/2014

09/01/2014 |

|

|

1,124,530

765,086 |

|

|

2,849,781

1,938,877 |

Kenneth M. Bate |

|

71,250

71,250

125,000 |

(4)

(5)

(6) |

|

2.95 |

% |

|

17.77

12.09

13.36 |

|

04/28/2005

04/28/2005

04/28/2005 |

|

|

63,306

43,071

83,500 |

|

|

126,611

86,141

167,000 |

Marsha H. Fanucci |

|

37,500

25,000

25,000

37,500

125,000

25,000 |

(4)

(6)

(7)

(5)

(6)

(8) |

|

3.03 |

% |

|

17.77

11.15

11.89

12.09

13.36

13.67 |

|

02/25/2014

07/28/2014

08/31/2014

09/01/2014

09/23/2014

09/30/2014 |

|

|

419,080

175,304

186,939

285,125

1,050,254

214,925 |

|

|

1,062,030

444,256

473,740

722,563

2,661,550

544,661 |

Linda K. Pine |

|

28,750

28,750 |

(4)

(5) |

|

0.63 |

% |

|

17.77

12.09 |

|

02/25/2014

09/01/2014 |

|

|

321,294

218,596 |

|

|

814,223

553,965 |

|

- (1)

- Options shown in the table have a term of ten years, subject to earlier termination if the optionee ceases his or her relationship with Millennium (as defined in the 2000 Stock Incentive Plan and the terms of the options). The 2000 Plan provides that an employee's outstanding unvested stock options will immediately vest in full if, during the period one month before through twelve months after the date of a Change of Control, either an employee voluntarily terminates his or her employment with us for Good Reason or we terminate his or her employment involuntarily without Cause (capitalized terms are as defined in the 2000 Plan.) In addition, under the 2000 Plan, outstanding options vest in full upon the death of the optionee.

- (2)

- The percentage is calculated by dividing the total number of shares underlying options granted to the executive officer in 2004 by the total number of shares underlying options granted to all employees in 2004.

- (3)

- Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date, net of the applicable option exercise price. This table does not take into account any appreciation or depreciation in the price of the common stock to date. Actual gains, if any, on stock option exercises will depend on the future performance of the common stock and the date on which the options are exercised.

- (4)

- Becomes exercisable in 48 equal monthly installments beginning March 25, 2004.

- (5)

- Became exercisable for 6/48ths of the total number of shares subject to the option on the date of grant and becomes exercisable for an additional 1/48th of the total number of shares subject to the option monthly over the following 42 months.

- (6)

- Becomes exercisable in 48 equal monthly installments beginning one month from the date of grant.

- (7)

- Becomes exercisable in 48 equal monthly installments beginning on the date of grant.

- (8)

- Became exercisable for 2/48ths of the total number of shares subject to the option on the date of grant and becomes exercisable for an additional 1/48th of the total number of shares subject to the option monthly over the following 46 months.

18

Aggregated Option Exercises and Fiscal Year-End Option Values

This table shows information about stock options exercised in 2004 and stock options held as of December 31, 2004 by our Chief Executive Officer and each of our four other most highly compensated executive officers.

Aggregated Option Exercises in 2004 and 2004 Year-End Option Values

| |

| |

| | NUMBER OF SHARES UNDERLYING UNEXERCISED OPTIONS HELD AT 12/31/2004 (#)

| | VALUE OF UNEXERCISED

IN-THE-MONEY OPTIONS AT

12/31/2004 ($)(1)

|

|---|

| | SHARES

ACQUIRED ON

EXERCISE (#)

| |

|

|---|

| | VALUE

REALIZED ($)

|

|---|

NAME

| | EXERCISABLE

| | UNEXERCISABLE

| | EXERCISABLE

| | UNEXERCISABLE

|

|---|

|

|---|

| Mark J. Levin | | — | | | — | | 2,393,344 | | 705,156 | | $8,195,544 | | $740,161 |

| Robert I. Tepper | | 80,000 | | $ | 1,048,067 | | 827,139 | | 353,123 | | 2,429,229 | | 474,970 |

| Kenneth M. Bate | | — | | | — | | 139,058 | | 353,442 | | 348,733 | | 350,830 |

| Marsha H. Fanucci | | 32,990 | | | 183,763 | | 212,540 | | 326,865 | | 43,102 | | 123,436 |

| Linda K. Pine | | 20,000 | | | 269,744 | | 222,782 | | 102,479 | | 318,664 | | 118,457 |

|

- (1)

- Value of unexercised in-the-money options to purchase shares of our common stock is based on the closing sales price of Millennium's common stock on December 31, 2004 ($12.14), the last trading day of Millennium's 2004 fiscal year, less the applicable option exercise price.

Employment Agreements and Change in Control Arrangements

Millennium has employment agreements with Dr. Tepper, Ms. Fanucci and Ms. Pine. Each executive's employment with Millennium is at-will and may be terminated by Millennium at any time with or without cause. If the executive's employment is terminated without Justifiable Cause, as that term is defined in each of their agreements, then, subject to certain conditions, Millennium is obligated to pay the executive severance payments equal to twelve months' salary. The form of Dr. Tepper's and Ms. Pine's employment agreements and Ms. Fanucci's employment agreement are filed as exhibits to our Annual Report on Form 10-K that we filed with the Securities and Exchange Commission.

Mr. Levin, Dr. Tepper, Ms. Fanucci and Ms. Pine hold stock options granted under various Millennium equity compensation plans. These plans provide that an employee's outstanding unvested stock options or awards will immediately vest in full if, during the period one month before through twelve months after the date of a Change of Control, either an employee voluntarily terminates his or her employment with us for Good Reason or we terminate his or her employment involuntarily without Cause. Change of Control, Good Reason and Cause are defined in the plans which are filed as exhibits to our Annual Report on Form 10-K that we filed with the Securities and Exchange Commission.

In connection with Mr. Bate's termination of employment with Millennium, Mr. Bate and Millennium entered into a letter agreement in which Millennium agreed to continue his base salary at the annual rate of $401,362.50 for a period of twelve months and pay him a bonus for 2004 of $96,327 under Millennium's 2004 Success Sharing Bonus Program, as well as to provide continued health-related benefits for a period of twelve months. The agreement, dated February 15, 2005, is filed as an exhibit to our Annual Report on Form 10-K that we filed with the Securities and Exchange Commission.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Millennium has agreements with Dr. Homcy, a former executive officer of Millennium and current member of our Board of Directors, under which he was entitled to certain benefits upon his termination of employment. Dr. Homcy's employment with Millennium terminated on November 7, 2003. Under a

19

Key Employee Change of Control Severance Plan, assumed by Millennium in our merger with COR Therapeutics, Inc., and two letter agreements dated December 24, 2002 and November 7, 2003:

- •

- Millennium pays his base salary at the rate he was receiving as of the date of the COR merger ($381,600) for eighteen months after his termination date and paid him $154,700, the pro rata portion of his target bonus for 2003 at the rate set as of the date of the merger (50%);

- •

- stock options outstanding as of the date of the COR merger immediately vested and became exercisable as of the date of his termination of employment;

- •

- stock options granted to him after our merger with COR that were held by him on his termination date ceased vesting on November 7, 2004, one year from his termination date;

- •

- Millennium continued his health benefits for twelve months; and

- •

- the payments under these agreements to be received by Dr. Homcy upon termination of employment will be adjusted if necessary to result in the greater amount of payment possible after taking into consideration the excise tax imposed by Section 4999 of the Internal Revenue Code.

The Key Employee Change of Control Severance Plan and the letter agreements with Dr. Homcy are filed as exhibits to our Annual Report on Form 10-K that we filed with the Securities and Exchange Commission. Dr. Homcy continues to serve on our Board of Directors.

In November 2003 we entered into a transaction with Portola Pharmaceuticals, Inc., a new biopharmaceutical company focused on the discovery and development of novel therapeutics for the treatment and prevention of severe cardiovascular diseases. Charles Homcy, who serves on our Board of Directors, is Portola's President, Chief Executive Officer and a member of Portola's Board of Directors. In connection with this transaction we licensed to Portola certain rights in the areas of thrombosis research, sold to Portola certain assets and subleased to Portola a portion of our leased property in South San Francisco. Under the license, we are entitled to receive milestone and royalty payments upon the achievement of certain events. Under the sublease with us, Portola pays us monthly rent at a rate beginning at approximately $55,000 and increasing to approximately $100,000 over a period of three years, after which the rate will be set at the then-current fair market value for the remainder of the term. Portola also paid us $16,000 per month through the second quarter of 2004 for certain transitional services. As a part of this transaction, we were granted shares of Portola's Series A Preferred Stock valued at $1.0 million. In August 2004 we entered into an additional transaction with Portola to license our Factor Xa inhibitor program in return for milestone and royalty payments upon achievement of certain events. These transactions were negotiated on an arm's-length basis and were reviewed by an independent committee of the Board of Directors.

20

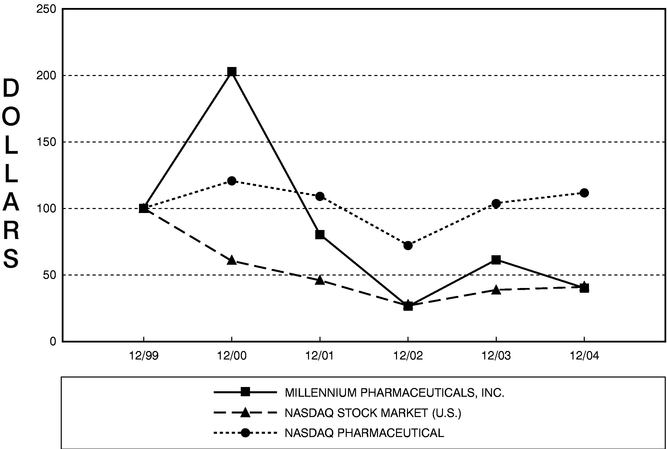

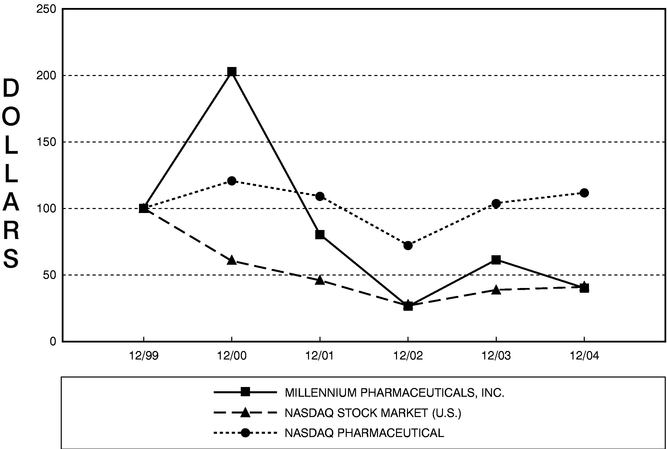

STOCK PERFORMANCE GRAPH

This graph compares the performance of Millennium common stock with the performance of the NASDAQ Stock Market (U.S. Companies) Index and the NASDAQ Pharmaceuticals Index (assuming reinvestment of dividends). The graph assumes $100 invested at the per share closing price on the NASDAQ Stock Market in Millennium and each of the indices on December 31, 1999. Measurement points are on the last trading days of the years ended December 31, 2000, December 31, 2001, December 31, 2002, December 31, 2003 and December 31, 2004.

| | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

|

|---|

|

|---|

| Millennium Pharmaceuticals, Inc. | | 100.00 | | 202.87 | | 80.36 | | 26.03 | | 61.15 | | 39.74 |

| NASDAQ Stock Market (U.S.) | | 100.00 | | 60.30 | | 45.49 | | 26.40 | | 38.36 | | 40.51 |

| NASDAQ Pharmaceuticals Index | | 100.00 | | 120.50 | | 109.11 | | 72.38 | | 104.08 | | 111.76 |

|

21

COMPENSATION AND TALENT COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation and Talent Committee is currently composed of three independent, non-employee directors and operates under a written charter. The Committee's primary functions are to act on behalf of the Board of Directors to address Millennium's general and executive compensation and benefit practices as well as CEO, executive officer and senior executive talent development, retention, performance and succession planning. In particular, the Committee:

- •

- conducts an annual review of the Chief Executive Officer's performance based on objective and subjective criteria, such as performance of the business, accomplishment of long-term strategic objectives and management development;

- •

- reviews with the Chief Executive Officer Millennium's organizational strategies, the development and potential for promotion of the senior members of Millennium's management and the availability of replacements for these management positions;

- •

- reviews the qualifications of the executive officers of Millennium and nominates executive officers for election by the Board of Directors;

- •

- reviews and approves compensation policy and philosophy for Millennium to ensure that the compensation strategy supports organizational objectives and stockholder interests, and selects appropriate companies for compensation comparison purposes;

- •

- determines all elements of total compensation of the Chief Executive Officer, and reviews and approves annually the total compensation of all other executive officers;

- •

- administers Millennium's annual success sharing bonus program including establishment of goals and determination of program funding based on review of Millennium's annual performance versus the established goals for the year;

- •

- administers Millennium's equity incentive plans and the issuance of awards pursuant to those plans, including approving all equity grants to executive officers, establishing equity grant guidelines and monitoring the availability of shares under those plans; and

- •