Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Millennium Pharmaceuticals, Inc.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

Millennium Pharmaceuticals, Inc.

75 Sidney Street

Cambridge, Massachusetts 02139

617.679.7000

www.millennium.com |

March 19, 2003

To our stockholders:

I invite you to our 2003 annual meeting of stockholders. The meeting is on Wednesday, April 30, 2003 at 10:00 a.m., EDT, at the Hotel@MIT, 20 Sidney Street, Cambridge, Massachusetts 02139. For your convenience, we are also offering a webcast of the meeting. If you choose to listen to the webcast, go to www.millennium.com/investors shortly before the meeting time and follow the instructions. If you miss the meeting, you can listen to a replay of the webcast on that site until May 30, 2003. The annual meeting is a terrific opportunity to learn more about our business and operations. I hope you will join us or listen to the webcast.

On the pages after this letter you will find the notice of our 2003 annual meeting of stockholders, which lists the matters to be considered at the meeting, and the proxy statement, which describes the matters listed in the notice. We have also enclosed your proxy card and our annual report for the year ended December 31, 2002.

Your vote at this meeting is important. Whether or not you plan to attend the meeting, I hope you will vote as soon as possible. If you are a stockholder of record, you may vote over the Internet, by telephone, or by mailing the enclosed proxy card in the envelope provided. You will find voting instructions in the proxy statement and on the enclosed proxy card. If your shares are held in "street name" — that is, held for your account by a broker or other nominee — you will receive instructions from the holder of record that you must follow for your shares to be voted.

Thank you for your ongoing support and continued interest in Millennium.

Sincerely,

MARK J. LEVIN

Chairperson, President and Chief Executive Officer

MILLENNIUM PHARMACEUTICALS, INC.

75 Sidney Street

Cambridge, Massachusetts 02139

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

|

Date |

|

|

|

Wednesday, April 30, 2003 |

Time |

|

|

|

10:00 a.m., EDT |

Place |

|

|

|

Hotel@MIT, 20 Sidney Street, Cambridge Massachusetts 02139 |

Webcast |

|

|

|

www.millennium.com/investors |

Proposals |

|

1. |

|

Elect four Class I directors, each for a term of three years; |

|

|

2. |

|

Approve an amendment to our 1996 Employee Stock Purchase Plan that reserves an additional 3,000,000 shares of Millennium common stock for issuance under the plan to employees; |

|

|

3. |

|

Approve our 2003 Employee Stock Purchase Plan for Employees of Non-U.S. Subsidiaries and Affiliated Entities; and |

|

|

4. |

|

Consider any other business as may properly come before the meeting or any postponement or adjournment of the meeting. |

Record Date |

|

|

|

March 4, 2003 |

On behalf of Millennium's Board of Directors,

JOHN B. DOUGLAS III,Secretary

March 19, 2003

TABLE OF CONTENTS

i

MILLENNIUM PHARMACEUTICALS, INC.

75 Sidney Street

Cambridge, Massachusetts 02139

PROXY STATEMENT—2003 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement contains information about the 2003 annual meeting of stockholders of Millennium Pharmaceuticals, Inc., including any postponements or adjournments of the meeting. The meeting will be held at the Hotel@MIT, 20 Sidney Street, Cambridge, Massachusetts 02139, on Wednesday, April 30, 2003 at 10:00 a.m., EDT.

In this proxy statement, we refer to Millennium Pharmaceuticals, Inc. as "Millennium," "we" or "us."

We are sending you this proxy statement in connection with the solicitation of proxies by our Board of Directors.

Our Annual Report for the year ended December 31, 2002 was first mailed to stockholders, along with these proxy materials, on or about March 19, 2003.

Our Annual Report on Form 10-K for the year ended December 31, 2002 is available on the Internet at our website atwww.millennium.com/investors or through the SEC's electronic data system called EDGAR atwww.sec.gov. To request a printed copy of our Form 10-K, which we will provide to you without charge, either: write to Investor Relations, Millennium Pharmaceuticals, Inc., 75 Sidney Street, Cambridge, Massachusetts 02139, or e-mail Investor Relations at "info@mlnm.com."

YOUR VOTE IS IMPORTANT. PLEASE TAKE THE TIME TO VOTE AS SOON AS POSSIBLE:

- •

- OVER THE INTERNET,

- •

- BY TELEPHONE OR

- •

- BY MAIL

|

| WHO CAN VOTE? | | Each share of our common stock you own as of the close of business on March 4, 2003, the record date, entitles you to one vote on each matter to be voted upon at the meeting. On the record date, there were 292,328,603 shares of Millennium common stock issued, outstanding and entitled to vote. |

|

| HOW DO I VOTE? | | If your shares are registered directly in your name, you may vote: |

| | | • | | Over the Internet. Go to the website of our tabulator, EquiServe, atwww.eproxyvote.com/mlnm. Use the voter control number that is printed on the enclosed proxy card to access your account and vote your shares. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. Your shares will be voted according to your instructions. |

| | | • | | By Telephone. Call 1-877 PRX-VOTE (1-877-779-8683) toll-free from the U.S. and Canada, and follow the instructions on the enclosed proxy card. If you are located outside the U.S. and Canada, see your proxy card for additional instructions. You must specify how you want your shares voted and confirm your vote at the end of the call or your telephone vote cannot be completed. Your shares will be voted according to your instructions. |

| | | • | | By Mail. Complete and sign the enclosed proxy and mail it in the enclosed postage prepaid envelope to EquiServe. Your proxy will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. |

| | | • | | In Person at the Meeting. If you attend the meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting. |

|

|

If your shares are held in "street name" (held for your account by a broker or other nominee) you may vote: |

| | | • | | Over the Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote over the Internet or by telephone. |

| | | • | | By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| | | • | | In Person at the Meeting. Contact the broker or other nominee who holds your shares to obtain a broker's proxy card and bring it with you to the meeting.You will not be able to vote at the meeting unless you have a proxy from your broker issued in your name giving you the right to vote the shares. |

|

| HOW CAN I CHANGE MY VOTE? | | You may revoke your proxy and change your vote at any time before the meeting. To do this, you must do one of the following: |

| | | • | | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. |

| | | • | | Sign a new proxy and submit it as instructed above. |

| | | • | | Attend the meeting and vote in person. Attending the meeting will not revoke your proxy unless you specifically request it. |

|

| WILL MY SHARES BE VOTED IF I DO NOT RETURN MY PROXY? | | If your shares are registered directly in your name, your shares will not be voted if you do not vote over the Internet or by telephone or return your proxy. |

|

|

If your shares are held in "street name," your brokerage firm, under certain circumstances, may vote your shares for you if you do not return your proxy. Brokerage firms have authority under New York Stock Exchange rules to vote customers' unvoted shares on some routine matters. If you do not give a proxy to your brokerage firm to vote your shares, your brokerage firm may either: vote your shares on routine matters, or leave your shares unvoted. Proposal 1, the election of directors, is considered a routine matter. Proposals 2 and 3 are not considered routine matters so your brokerage firm cannot vote your shares if you do not return your proxy. We encourage you to provide voting instructions to your brokerage firm by giving your proxy. This ensures your shares will be voted at the meeting according to your instructions. You should receive directions from your brokerage firm about how to submit your proxy to them at the time you receive this proxy statement. |

|

| HOW DO I VOTE MY 401(K) SHARES? | | You may give voting instructions for the number of shares of Millennium stock equal to the interest in Millennium common stock credited to your 401(k) account as of the record date. To vote these shares, complete and return the proxy sent to you with this proxy statement by Fidelity Management Trust Company. The trustee will vote your shares in accordance with your instructions. If you do not send instructions, the trustee will not vote your shares. |

|

|

You may revoke previously given voting instructions by filing with the trustee either a written revocation or a properly completed and signed proxy bearing a later date. |

|

2

|

| WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD? | | It means that you have more than one account, which may be at the transfer agent, with stockbrokers or at Fidelity in your Millennium 401(k) Plan account. Please vote over the Internet, by telephone or complete and return all proxies for each account to ensure that all of your shares are voted. |

|

| HOW MANY SHARES MUST BE PRESENT TO HOLD THE MEETING? | | A majority of our outstanding shares of common stock as of the record date must be present at the meeting to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if the stockholder votes over the Internet, by telephone, completes and submits a proxy or is present in person at the meeting. Shares that are present that vote to abstain or do not vote on one or more of the matters to be voted upon are counted as present for establishing a quorum. |

|

|

If a quorum is not present, we expect that the meeting will be adjourned until we obtain a quorum. |

|

| WHAT VOTE IS REQUIRED TO APPROVE EACH | | Proposal 1 — Election of Directors |

| MATTER AND HOW ARE VOTES COUNTED? | | The four nominees for director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Abstentions are not counted for purposes of electing directors. If your shares are held by your broker in "street name," and if you do not vote your shares, your brokerage firm has authority under New York Stock Exchange rules to vote your unvoted shares held by the firm on proposal 1. You may vote FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors and will have no effect on the results of the vote. |

|

|

Proposal 2 — Approve an amendment to Millennium's 1996 Employee Stock Purchase Plan |

|

|

Proposal 3 — Approve the 2003 Employee Stock Purchase Plan for Employees of Non-U.S. Subsidiaries and Affiliated Entities |

|

|

To approve proposal 2 and proposal 3, stockholders holding a majority of Millennium common stock present or represented by proxy at the meeting and voting on the matter must vote FOR each proposal. If your shares are held by your broker in "street name," and if you do not vote your shares, your brokerage firm does not have authority under New York Stock Exchange rules to vote your unvoted shares held by the firms on proposals 2 and 3 and there will be no effect on the vote because these "broker non-votes" are not considered present or represented at the meeting and voting on the matter. If you vote to ABSTAIN on proposal 2 or 3, your shares will not be voted in favor of that proposal, although your shares will be considered to have been voted on the matter. As a result, voting to ABSTAIN has the effect of voting AGAINST. |

|

| HOW DOES THE BOARD | | Our Board of Directors recommends that you vote: |

| OF DIRECTORS | | • | | FOR proposal 1 — elect our four nominees to the Board of Directors |

| RECOMMEND THAT I VOTE? | | • | | FOR proposal 2 — approve an amendment to Millennium's 1996 Employee Stock Purchase Plan; and |

| | | • | | FOR proposal 3 — approve the 2003 Employee Stock Purchase Plan for Employees of Non-U.S. Subsidiaries and Affiliated Entities |

|

3

|

| ARE THERE OTHER MATTERS TO BE VOTED ON AT THE MEETING? | | We do not know of any other matters that may come before the meeting other than the election of directors, the approval of an amendment to our 1996 Employee Stock Purchase Plan and the approval of our 2003 Employee Stock Purchase Plan for Employees of Non-U.S. Subsidiaries and Affiliated Entities. If any other matters are properly presented to the meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment. |

|

| WHERE DO I FIND THE VOTING RESULTS OF THE MEETING? | | We will announce preliminary voting results at the meeting. We will publish final results in our quarterly report on Form 10-Q for the second quarter of 2003, which we are required to file with the Securities and Exchange Commission by August 14, 2003. To request a printed copy of the Form 10-Q write to Investor Relations, Millennium Pharmaceuticals, Inc., 75 Sidney Street, Cambridge, Massachusetts 02139, or e-mail Investor Relations at "info@mlnm.com." You will also be able to find a copy on the Internet through Millennium's website atwww.millennium.com/investors or through the SEC's electronic data system called EDGAR atwww.sec.gov. |

|

| WHAT ARE THE COSTS OF SOLICITING THESE PROXIES? | | We will bear the costs of soliciting proxies. In addition to the mailing of these proxy materials, our directors, officers and employees may solicit proxies by telephone, e-mail and in person, without additional compensation. We also have hired Georgeson Shareholder Communications, Inc. to assist us in the distribution of proxy materials and the solicitation of proxies. We will pay Georgeson a fee of $11,000 plus customary out-of-pocket expenses for these services. Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for distributing proxy materials to stockholders. |

|

| HOW CAN I RECEIVE FUTURE PROXY STATEMENTS AND ANNUAL REPORTS OVER THE INTERNET INSTEAD OF RECEIVING PRINTED COPIES IN THE MAIL? | | This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2002 are available on our Internet site atwww.millennium.com/investors. Most stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving printed copies in the mail. If you are a stockholder of record, you can choose this option when you vote over the Internet and save us the cost of producing and mailing these documents. If you are a stockholder of record and choose to view future proxy statements and annual reports over the Internet, you will receive a proxy in the mail next year with instructions containing the Internet address to access those documents. If your shares are held through a broker or other nominee, you should check the information provided by them for instructions on how to elect to view future proxy statements and annual reports over the Internet. |

|

The Board has nominated four people for election as Class I Directors. Each nominee currently serves as a Class I Director. The Board of Directors recommends a vote FOR the nominees named below.

Our Board of Directors is divided into three classes. One class is elected each year and members of each class hold office for three-year terms. The Board of Directors currently consists of twelve directors. Four are Class I Directors (with terms expiring at the 2003 Annual Meeting), four are Class II Directors (with terms expiring at the 2004 Annual Meeting) and four are Class III Directors (with terms expiring at the 2005 Annual Meeting).

4

The persons named in the enclosed proxy will vote to elect as Class I directors Ginger L. Graham, Vaughn M. Kailian, Edward D. Miller, Jr., and Norman C. Selby, the four nominees listed below, unless you indicate on the proxy that your vote should be withheld from any or all of these nominees. If they are elected, Ms. Graham, Mr. Kailian, Dr. Miller and Mr. Selby will hold office until the 2006 Annual Meeting of Stockholders and until their successors are duly elected and qualified. All of the nominees have indicated their willingness to serve, if elected, but if any of them should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by the Board of Directors, unless the Board chooses to reduce the number of directors serving on the Board.

There are no family relationships between or among any of our executive officers or directors.

Below are the names and certain information about each member of the Board of Directors, including the nominees for election as Class I directors.

|

| NOMINEES FOR CLASS I DIRECTORS—TERMS TO EXPIRE IN 2006 |

|

| GINGER L. GRAHAM | Principal occupation: |

Age: 47

Director since February 2002 | | Advisor to the President and CEO, Guidant Corporation, a medical devices company (since April 2002) |

| Compensation and Talent | Prior business experience: |

| Committee | | • | | Group Chairman, Office of the President for Guidant (2000 to April 2002) |

| | | • | | President of the Vascular Intervention Group for Guidant (1995 to 2000) |

| | | • | | President and Chief Executive Officer of Advanced Cardiovascular Systems for Guidant (1993 to 2000) |

| | | • | | Director of COR Therapeutics, Inc., a biotechnology company (February 2001 to February 2002) |

| | Public company directorships: |

| | | Amylin Pharmaceuticals, Inc., a biotechnology company |

|

| VAUGHN M. KAILIAN | Principal occupation: |

| Age: 58 | | Millennium's Vice Chairperson (since February 2002) |

| Director since February 2002 | Prior business experience: |

| | | • | | President, Chief Executive Officer and Director, COR Therapeutics, Inc., a biotechnology company (1990 to February 2002) |

| | | • | | Various U.S. and international general management, product development, marketing and sales positions with Marion Merrell Dow, Inc., a pharmaceutical company (1967 to 1990) |

| | Public company directorships: |

| | | NicOx S.A., a biotechnology company |

|

| EDWARD D. MILLER, JR., M.D. | Principal occupation: |

Age: 60

Director since October 2000

Audit Committee | | Chief Executive Officer and Dean of The Johns Hopkins University School of Medicine, Vice President for Medicine, The Johns Hopkins University (since 1997) |

| | Prior business experience: |

| | | • | | Professor and Chairman of the Department of Anesthesiology and Critical Care, The Johns Hopkins University (1994 to 1999) |

|

5

|

| NORMAN C. SELBY | Principal occupation: |

Age: 50

Director since May 2000

Audit Committee (Chair) | | President and Chief Executive Officer, TransForm Pharmaceuticals, Inc., a drug development company (since June 2001) |

| Compensation and Talent | | | | |

| Committee | Prior business experience: |

| Executive Committee | | • | | Head of Consumer Internet Business, Citigroup, a financial services company (June 1999 to July 2000) |

| | | • | | Executive Vice President of Citicorp (September 1997 to July 2000) |

| | | • | | Director and senior partner, McKinsey & Company, an international management consulting firm (1978 to 1997) and head of the firm's global pharmaceutical practice |

|

|

|

|

|

|

|

| CLASS II DIRECTORS—TERMS TO EXPIRE IN 2004 |

|

| EUGENE CORDES, Ph.D. | Principal occupation: |

Age: 66

Director since July 1995 | | Chairman of the Board, Concurrent Pharmaceuticals, Inc., a drug discovery company (since January 2002) |

| Audit Committee | | | | |

| | Prior business experience: |

| | | • | | Professor of Pharmacy and Adjunct Professor of Chemistry, University of Michigan (1995 to 2001) |

| | | • | | Vice President of Sterling Winthrop, Inc., a pharmaceutical company, and President of Sterling's Pharmaceuticals Research Division (1988 to 1994) |

|

| RAJU S. KUCHERLAPATI,Ph.D. | Principal occupation: |

Age: 60

Director since January 1993

Nominating and Board | | Professor of Genetics, Harvard Medical School and Scientific Director, Harvard-Partners Center for Genetics and Genomics (since September 2001) |

| Governance Committee | | | | |

| (Chair) | Prior business experience: |

| | | • | | Professor and Chairman of the Department of Molecular Genetics, Albert Einstein College of Medicine (1989 to September 2001) |

| | | • | | A founder of Millennium |

|

Public company directorships: |

| | | Abgenix, Inc., a biotechnology company

Valentis, Inc., a biotechnology company |

|

6

|

| ERIC S. LANDER,Ph.D. | Principal occupation: |

Age: 46

Director since January 1993

Nominating and Board | | Director, Whitehead/MIT Center for Genome Research (since 1993) and a member of the Whitehead Institute for Biomedical Research (since 1989) |

| Governance Committee | | | | |

| | | Professor and Associate Professor, Department of Biology, Massachusetts Institute of Technology (since 1989) |

|

Prior business experience: |

| | | • | | A founder of Millennium |

|

| CHARLES J. HOMCY, M.D. | Principal occupation: |

Age: 54

Director since December 2002 | | Millennium's Senior R&D Advisor (since January 2003) |

| | | Clinical Professor of Medicine, University of California, San Francisco, San Francisco Medical School (since 1997) |

|

|

Attending physician at the San Francisco VA Hospital (since 1997) |

|

Prior business experience: |

| | | • | | Millennium's President of Research and Development (February 2002 to December 2002) |

| | | • | | Executive Vice President, Research and Development (1995 to February 2002) and Director (1998 to February 2002), COR Therapeutics, Inc., a biotechnology company |

| | | • | | President of the Medical Research Division, American Cyanamid Company-Lederle Laboratories, a pharmaceutical company (now a division of Wyeth-Ayerst Laboratories) (1994 to March 1995) |

| | | • | | Executive Director of the Cardiovascular and Central Nervous System Research Section, Lederle Laboratories, a pharmaceutical company (1990 to 1994) |

|

|

|

|

|

|

|

| CLASS III DIRECTORS—TERMS TO EXPIRE IN 2005 |

|

| MARK J. LEVIN | Principal occupation: |

Age: 52

Director since January 1993

Executive Committee | | Millennium's Chairperson of the Board of Directors (since March 1996), President (since 1993) and Chief Executive Officer (since November 1994) |

|

Prior business experience: |

| | | • | | Partner, Mayfield, a venture capital firm, and co-director of its Life Science Group (1987 to 1994) |

| | | • | | While at Mayfield, founding chief executive officer of several biotechnology and biomedical companies, including Cell Genesys Inc., Stem Cells, Inc., Tularik Inc., Focal, Inc. and Millennium |

|

7

|

| SHAUN R. COUGHLIN, M.D., Ph.D. | Principal occupation: |

Age: 48

Director since February 2002 | | Professor of Medicine (since 1996), Professor of Molecular and Cellular Pharmacology (since 1997) and Director of the UCSF Cardiovascular Research Institute (since 1997), University of California, San Francisco |

|

Prior business experience: |

| | | • | | Director of COR Therapeutics, Inc., a biotechnology company (1994 to February 2002) |

|

| A. GRANT HEIDRICH, III | Principal occupation: |

Age: 50

Director since January 1993 | | Venture Partner, Mayfield, a venture capital firm (since 2000) |

| Lead Outside Director | Prior business experience: |

| Compensation and Talent Committee | | • | | General Partner, Mayfield (1983 to 2000) |

| (Chair) | | | | |

| Nominating and Board Governance | Public company directorships: |

Committee

Executive Committee | | Chairman of the Board, Tularik, Inc., a biotechnology company |

|

| KENNETH E. WEG | Principal occupation: |

Age: 64

Director since March 2001

Audit Committee | | Chairman, Clearview Projects, Inc., a company engaged in partnering and deal transaction services to biopharmaceutical companies and academic institutions (since February 2001) |

| Compensation and Talent Committee | | | | |

| | Prior business experience: |

| | | • | | Vice Chairman (1999 to 2001), member of the Office of Chairman (1998 to 2001), Executive Vice President (1995 to 2001), President of the Worldwide Medicines Group (1997 to 1998), President of the Pharmaceutical Group (1993 to 1996) and President of Pharmaceutical Operations (1991 to 1993) for Bristol-Myers Squibb Company, a pharmaceutical company |

|

8

OWNERSHIP OF OUR COMMON STOCK

Ownership By Management

On March 4, 2003 Millennium had 292,328,603 shares of common stock issued and outstanding. This table shows certain information about the beneficial ownership of Millennium common stock, as of that date, by:

- •

- each of our current directors;

- •

- each nominee for director;

- •

- our Chief Executive Officer;

- •

- each of our four other most highly compensated executive officers and one former executive officer; and

- •

- all of our current directors and executive officers as a group.

According to SEC rules, we have included in the column "Number of Issued Shares" all shares over which the person has sole or shared voting or investment power, and we have included in the column "Number of Shares Issuable" all shares that the person has the right to acquire within 60 days after March 4, 2003 through the exercise of any stock option or other right.

Unless otherwise indicated, each person has the sole power (or shares the power with a spouse) to invest and vote the shares listed opposite the person's name. Where applicable, ownership is subject to community property laws. Our inclusion of shares in this table as beneficially owned is not an admission of beneficial ownership of those shares by the person listed in the table.

|

|

|

|

|

|

|

|

|

|

|---|

| |

|---|

Name(1)

| | Number

of Issued Shares(1)

| | Number

of Shares Issuable(2)

| | Total

| | Percent

| |

|---|

| |

|---|

| Mark J. Levin | | 3,042,310 | | 1,732,555 | | 4,774,865 | | 1.6 | % |

| Vaughn M. Kailian | | 352,083 | | 881,301 | | 1,233,384 | | * | |

| Eugene Cordes, Ph.D. | | 57,580 | | 84,583 | | 142,163 | | * | |

| Shaun R. Coughlin, Ph.D. | | 32,752 | | 61,113 | | 93,865 | | * | |

| Ginger L. Graham | | 5,000 | | 23,266 | | 28,266 | | * | |

| A. Grant Heidrich, III | | 224,564 | | 133,727 | | 358,291 | | * | |

| Charles J. Homcy, M.D. | | 111,641 | | 528,366 | | 640,007 | | * | |

| Raju S. Kucherlapati, Ph.D. (3). | | 687,858 | | 457,670 | | 1,145,528 | | * | |

| Eric S. Lander, Ph.D. (4) | | 10,000 | | 149,205 | | 159,205 | | * | |

| Edward D. Miller, Jr. M.D. | | 10,000 | | 23,439 | | 33,439 | | * | |

| Norman C. Selby | | 7,000 | | 49,752 | | 56,752 | | * | |

| Kenneth E. Weg | | 10,000 | | 18,438 | | 28,438 | | * | |

| John B. Douglas III (5) | | 16,653 | | 394,477 | | 411,130 | | * | |

| Kevin P. Starr (6) | | 28,444 | | 109,677 | | 138,121 | | * | |

| Robert I. Tepper (7) | | 42,496 | | 636,969 | | 679,465 | | * | |

| All directors and executive officers as a group (16 persons) | | 4,955,003 | | 5,337,398 | | 10,292,401 | | 3.5 | % |

|

|

- *

- Less than one percent.

- (1)

- Includes shares contributed by Millennium to the 401(k) plan for the benefit of the named executive officer as of December 31, 2002 as follows: Mr. Levin, 3,086 shares; Mr. Kailian, 39 shares; Dr. Homcy, 33 shares; Mr. Douglas, 711 shares; Mr. Starr, 1,256 shares; Dr. Tepper, 2,529 shares and all directors and executive officers as a group, 9,450 shares.

- (2)

- Shares that can be acquired through stock option exercises through May 3, 2003.

9

- (3)

- Includes 400 shares held by a custodian under the Uniform Gifts to Minors Act for Dr. Kucherlapati's son. Dr. Kucherlapati disclaims beneficial ownership of these shares.

- (4)

- Includes 10,000 shares held by the Lander Family Charitable Trust. Dr. Lander disclaims beneficial ownership of these shares.

- (5)

- Includes 800 shares held by a custodian under the Uniform Transfer to Minors Act for each of Mr. Douglas' three children. Mr. Douglas disclaims beneficial ownership of these shares.

- (6)

- The number of shares listed in the column "Number of Issued Shares" for Mr. Starr is as of December 17, 2002, the date he ceased to be a Millennium executive officer except for 1,256 shares, the number of shares contributed by Millennium to the 401(k) plan for his benefit as of December 31, 2002. The number of shares listed in the column, "Number of Shares Issuable" are shares exercisable on March 4, 2003 under his stock options.

- (7)

- Includes 333 shares held by a custodian under the Uniform Gifts to Minors Act for each of Dr. Tepper's two sons and 5,416 shares held by The Tepper Family Irrevocable Trust 2002. Dr. Tepper disclaims beneficial ownership of these shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of our records, we believe that in 2002 our directors and executive officers filed on a timely basis all reports of holdings and transactions in Millennium common stock required to be filed with the SEC pursuant to Section 16(a) of the Securities Exchange Act of 1934.

Ownership By Principal Stockholders

This table shows certain information, based on filings with the Securities and Exchange Commission, about the beneficial ownership of Millennium common stock as of the dates indicated below by each person owning beneficially more than 5% of Millennium common stock.

|

|

|

|

|

|

|

|

|

|---|

|

|---|

Name and Address

| |

| | Number of Shares

| | Percent

| |

|

|---|

|

|---|

Bayer AG and Agfa Holding GmbH

D51368 Leverkusen

Federal Republic of Germany | | | | 19,830,640(1) | | 6.8% | | |

AXA Financial, Inc. (and related entities)

1290 Avenue of the Americas

New York, New York 10104 |

|

|

|

16,317,146(2) |

|

5.6% |

|

|

Abbott Laboratories

100 Abbott Park Road

Abbott Park, Illinois 60064 |

|

|

|

15,507,914(3) |

|

5.3% |

|

|

|

- (1)

- According to an amendment to Schedule 13D filed with the Securities and Exchange Commission on July 6, 2000, Bayer AG and Agfa Holding GmbH, a wholly owned subsidiary of Bayer AG, hold these shares. Bayer reported having sole voting power and sole dispositive power for 1,038,960 shares and shared voting power and shared dispositive power for 18,791,680 shares. Agfa Holding reported having shared voting power and shared dispositive power for 18,791,680 shares.

10

- (2)

- According to a Schedule 13G filed jointly with the Securities and Exchange Commission on February 12, 2003 by AXA Assurances I.A.R.D. Mutuelle; AXA Assurances Vie Mutuelle; AXA Conseil Vie Assurance Mutuelle; AXA Courtage Assurance Mutuelle, as a group, AXA and AXA Financial, Inc. hold these shares. AXA Assurances I.A.R.D. Mutuelle; AXA Assurances Vie Mutuelle; AXA Conseil Vie Assurance Mutuelle; AXA Courtage Assurance Mutuelle and AXA report having sole voting power for 8,568,306 shares, shared voting power for 7,268,485 shares and sole dispositive power for 16,317,146 shares. AXA and AXA Financial, Inc. report having sole voting power for 8,566,551 shares, shared voting power for 7,268,485 shares and sole dispositive power for 16,315,791 shares.

- (3)

- According to a Schedule 13D filed with the Securities and Exchange Commission on March 12, 2003, Abbott Laboratories holds these shares. Abbott reported having sole voting power and sole dispositive power for 15,507,914 shares.

OUR CORPORATE GOVERNANCE

Our Commitment to Good Corporate Governance

We believe that good corporate governance and an environment of the highest ethical standards are important for Millennium to achieve business success and to create value for its stockholders. Our Board of Directors is committed to high governance standards and to continually work to improve them. During the past year we have reviewed our corporate governance practices in view of the Sarbanes-Oxley Act of 2002, new final and proposed rules of the Securities and Exchange Commission and proposed Nasdaq listing rules. We have also compared our governance practices against those identified as best practices by various authorities and other public companies. As a result, we have implemented several new procedures and strengthened several existing procedures.

Role of Our Board of Directors

Our Board of Directors currently consists of twelve members. The Board monitors overall corporate performance and the integrity of Millennium's financial controls and legal compliance procedures. It elects senior management and oversees succession planning and senior management's performance and compensation. The Board oversees Millennium's long and short term strategic and business planning, and conducts a year-long process which culminates in Board review and approval each year of a business plan, a capital expenditures budget and other key financial and business objectives.

Members of the Board keep informed about Millennium's business through discussions with the Chairperson and other members of Millennium's senior management team, by reviewing materials provided to them on a regular basis and in preparation for Board and Committee meetings and by participating in meetings of the Board and its committees. We regularly review key portions of the business with the Board. We introduce our executives to the Board so that the Board can become familiar with Millennium's key talent. We have a new Board member orientation process which introduces the new member to Millennium's business through a series of meetings with management, tours of facilities, and written materials about Millennium and the biopharmaceutical business. We also conduct Board education sessions on topics such as corporate finance.

In 2002, the Board of Directors met six times. During 2002, each director attended at least 75% of the total number of meetings of the Board of Directors and all committees of the Board on which the director served.

Performance of Our Board

We consider it important to continually evaluate and improve the effectiveness of the Board, its committees and its individual members. We do this in various ways. At the beginning of each year, the

11

Board adopts goals that it considers important for the Board to achieve during that year, monitors progress towards those goals throughout the year and conducts a review to assess whether it has successfully achieved those goals and how well the Board has performed in providing oversight and adding value to Millennium. Beginning in 2003, each of the Board's standing committees will also adopt yearly goals and conduct annual self-evaluations. The Nominating and Board Governance Committee, working with the lead outside director, also periodically assesses the Board's performance, and the performance of individual members, and reports its conclusions to the full Board. Each Board member annually completes a self-evaluation of his or her contributions. Also, after each Board meeting, each Board member assesses the effectiveness of the materials presented and conduct of the meeting and offers suggestions for improvement where needed.

Business Ethics and Compliance

During 2003, our Audit Committee and the Board of Directors will be involved in development of a company-wide ethics awareness program and an enhanced compliance program. By year end, we will post a newly revised Code of Business Conduct on our website.

Independence of Non-Employee Directors

Good corporate governance requires that a majority of the Board consist of members who are independent. There are different measures of director independence—independence under Nasdaq rules, under Section 16 of the Securities Exchange Act of 1934 and under Section 162(m) of the Internal Revenue Code of 1986. Our Nominating and Board Governance committee has recently reviewed information about each of our non-employee directors and determined that we do have a majority of independent directors on our Board.

Lead Outside Director

Since 2000, the Board has designated a lead outside director who oversees an annual process of Board and director evaluation, including providing appropriate feedback to the Board. He provides assistance to the Chairperson and Corporate Secretary in planning Board agendas, acts as the leader of the non-employee directors, acts as Chairperson of the non-employee directors in meetings of the non-employee directors, and acts as Chairperson of the Board in the absence of the Chairperson or Vice Chairperson or a vacancy in the position of Chairperson or Vice Chairperson. Mr. Heidrich is currently serving as our lead outside director.

Committees of the Board

The Board currently has four standing committees: an Audit Committee, a Compensation and Talent Committee, a Nominating and Board Governance Committee and an Executive Committee. You may find copies of the charters of the Audit Committee, the Compensation and Talent Committee and the

12

Nominating and Board Governance Committee on our website atwww.millennium.com/investors. The Board also appoints from time to time ad hoc committees to address specific matters.

|

| AUDIT COMMITTEE |

Members |

|

Responsibilities |

|

Meetings in 2002 |

|

Norman C. Selby, Chair*

Eugene Cordes

Edward D. Miller, Jr.

Kenneth E. Weg | | The Audit Committee consists entirely of independent directors. Its primary functions are to assist the Board in monitoring the integrity of our financial statements, our systems of internal control, and the appointment, independence and performance of our independent auditors. The Committee is responsible for pre-approving any engagements of our independent auditors for non-audit services. | | 2 |

* The Board of Directors has determined that Norman C. Selby qualifies as an audit committee financial expert, who is independent from management, as that term is defined by new rules issued in January 2003 by the Securities and Exchange Commission. |

|

The Committee also reviews our risk management practices, strategic tax planning, preparation of quarterly and annual financial reports and our ethics and compliance processes.

At each Audit Committee meeting, the Committee members meet with Millennium's independent auditors without management present. In addition to regular Committee meetings, representatives of management, the independent auditors and the Chairman of the Audit Committee (with other Audit Committee members also invited to participate) meet once each quarter to review the financial statements prior to the public release of earnings. |

|

|

|

|

You may find a more detailed description of the functions of the Audit Committee in the Audit Committee Charter included as Appendix A to this proxy statement. Please see also the Audit Committee Report at page 27 below. |

|

|

|

| COMPENSATION AND TALENT COMMITTEE |

Members |

|

Responsibilities |

|

Meetings in 2002 |

|

A. Grant Heidrich, III, Chair

Ginger L. Graham

Norman C. Selby

Kenneth E. Weg | | The Compensation and Talent Committee consists entirely of independent directors. Its primary responsibilities are to oversee compensation and employee benefit matters and management performance. | | 4 |

|

|

The Committee is also involved in senior personnel evaluation and the development of key talent and management succession planning. |

|

|

13

|

|

You may find a more detailed description of the functions of the Compensation and Talent Committee in its charter which is posted on our website atwww.millennium.com/investors. |

|

|

|

|

Please see also the Compensation and Talent Committee Report on Executive Compensation at page 23 below. |

|

|

|

| NOMINATING AND BOARD GOVERNANCE COMMITTEE |

Members |

|

Responsibilities |

|

Meetings in 2002 |

|

Raju S. Kucherlapati, Chair

A. Grant Heidrich, III

Eric S. Lander | | The Nominating and Board Governance Committee is responsible for Board governance issues. The Committee also recommends individuals to serve as directors and will consider nominees recommended by stockholders. | | 2 |

|

|

You may find a more detailed description of the functions of the Nominating and Board Governance Committee in its charter which is posted on our website atwww.millennium.com/investors. |

|

|

|

| EXECUTIVE COMMITTEE |

Members |

|

Responsibilities |

|

Meetings in 2002 |

|

Mark J. Levin

A. Grant Heidrich, III

Norman C. Selby | | The Executive Committee may exercise, when the Board of Directors is not in session, all powers of the Board of Directors in the management of Millennium's business and affairs to the extent permitted by law, our By-laws and as specifically granted by the Board of Directors. The Executive Committee did not meet in 2002 but did take action through several written consents of all of the members of the Committee. | | None |

|

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation and Talent Committee are Mr. Heidrich, Ms. Graham, Mr. Selby and Mr. Weg. No member of the Compensation and Talent Committee was at any time during 2002, or formerly, an officer or employee of Millennium or any subsidiary of Millennium. No executive officer of Millennium has served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity while an executive officer of that other entity served as a director of or member of Millennium's Compensation and Talent Committee.

14

Indemnification of Officers and Directors

We indemnify our directors and officers to the fullest extent permitted by law for their acts and omissions in their capacity as a director or officer of Millennium, so that they will serve free from undue concerns for liability for actions taken on behalf of Millennium. This indemnification is required under our corporate charter.

DIRECTOR COMPENSATION

We do not pay directors who are also Millennium employees any additional compensation for their service as a director. We do pay our non-employee directors for their service as a director.

During 2002, the Nominating and Board Governance Committee reviewed the compensation we pay to our non-employee directors. The Committee compared our Board compensation to compensation paid to non-employee directors by similarly sized public companies in similar businesses. The Committee also considered the responsibilities we ask our Board members to assume and the amount of time required to perform those responsibilities. The Committee determined, and the Board approved, an increase in compensation for our non-employee directors beginning January 1, 2003. Below we show the rate of compensation paid to our non-employee directors in 2002 and the rate approved for 2003.

Cash compensation

Each director who is not an employee of Millennium receives:

| |

| |

| |

|

|---|

Fees

| | 2002 rate

| | 2003 rate

| | For each

|

|---|

|

|---|

| Annual retainer: | | $15,000 | | $25,000 | | |

| Attendance: | | $1,500 | | $2,000 | | Board meeting |

| | | $750 | | $1,000 | | Board meeting by conference telephone |

| | | $750 | | $1,000 | | Board committee meeting attended in person (in 2002 not paid if meeting was held along with a Board meeting) |

| | | $0 | | $750 | | Board committee meeting by conference telephone |

|

Millennium also reimburses non-employee directors for reasonable travel and out-of-pocket expenses in connection with their service as directors.

15

Stock compensation

Directors also participate in Millennium's 2000 Stock Incentive Plan. The Board increased the number of shares to be granted to the directors beginning in 2003. Under the option program for directors adopted by the Board, our non-employee directors receive stock option grants as follows:

| | 2002

shares

| | 2003

shares

| | Granted in three

installments on

| | Vesting

Schedule

|

|---|

|

|---|

| Initial Option Grant: | | 30,000 | | 35,000 | | the date the director is first elected, one month later and two months later | | vest on a monthly basis beginning one month from the date of election and become fully vested on the fourth anniversary of the date of election |

Annual Option Grant: |

|

7,500 |

|

15,000 |

|

May 1st, June 1st and July 1st of each year, prorated for service on the Board of less than one year |

|

vest on a monthly basis beginning as of June 1st in the year granted and become fully vested on May 1st of the fourth year after the grant date |

Committee Chair: |

|

500 |

|

500 |

|

the dates of the annual option grant |

|

same as annual grant |

Lead Outside Director: |

|

1,500 |

|

1,500 |

|

the dates of the annual option grant |

|

same as annual grant |

|

Each option terminates on the earlier of

- •

- ten years after the date of grant or

- •

- the date 90 days after the option holder ceases to serve as a director (or one year in the case of disability and three years in the event of death).

Under the 2000 Plan, an option becomes fully vested in the event of the death of the director. The exercise price of options granted under the 2000 Plan is equal to the closing price of Millennium common stock as quoted on the Nasdaq National Market on the date of grant.

Compensation Paid to Non-Employee Directors for 2002

This table shows the compensation paid to our non-employee directors for their Board service in 2002.

| |

| | Number of

shares

underlying

options

granted

| |

| |

| |

|

|---|

| |

| | Option

exercise

price per share

| |

| |

|

|---|

| | Cash compensation

| |

| |

|

|---|

Name

| | Option grant date

| |

|

|---|

|

|---|

| Eugene Cordes | | $23,250 | | 2,500

2,500

2,500 | | $19.76

$15.09

$11.00 | | 5/1/02

6/1/02

7/1/02 | | |

Shaun R. Coughlin |

|

$21,458 |

|

2,500

2,500

2,500 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

16

| |

| | Number of

shares

underlying

options

granted

| |

| |

| |

|

|---|

| |

| | Option

exercise

price per share

| |

| |

|

|---|

| | Cash compensation

| |

| |

|

|---|

Name

| | Option grant date

| |

|

|---|

|

|---|

| Ginger L. Graham | | $21,458 | | 2,500

2,500

2,500 | | $19.76

$15.09

$11.00 | | 5/1/02

6/1/02

7/1/02 | | |

A. Grant Heidrich, III |

|

$23,250 |

|

3,167

3,167

3,166 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

Raju S. Kucherlapati |

|

$23,250 |

|

2,667

2,667

2,666 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

Eric S. Lander |

|

$24,750 |

|

2,500

2,500

2,500 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

Edward D. Miller, Jr. |

|

$21,750 |

|

2,500

2,500

2,500 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

Norman C. Selby |

|

$23,250 |

|

2,667

2,667

2,666 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

Kenneth E. Weg |

|

$23,250 |

|

2,500

2,500

2,500 |

|

$19.76

$15.09

$11.00 |

|

5/1/02

6/1/02

7/1/02 |

|

|

|

17

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation

This table shows certain information about the compensation we pay our Chief Executive Officer, each of our four other most highly compensated executive officers and one former executive officer.

Summary Compensation Table

| |

| | ANNUAL COMPENSATION

| | LONG-TERM COMPENSATION AWARDS

| |

|

|---|

|

|

|

|

|

|

|

|

OTHER

ANNUAL

COMPENSATION

($)

|

|

SECURITIES

UNDERLYING

OPTIONS

GRANTED (#)

|

|

ALL OTHER

COMPENSATION

($)(1)

|

|---|

NAME AND

PRINCIPAL POSITION

| | YEAR

| | SALARY ($)

| | BONUS ($)

|

|---|

|

|---|

Mark J. Levin

Chairperson, President and Chief Executive Officer | | 2002

2001

2000 | | 482,001

405,997

400,575 | | —

365,765

— | | —

—

— | | 387,500

375,000

400,000 | | 11,356

9,368

7,281 |

Vaughn M. Kailian(2)

Vice Chairperson |

|

2002

2001

2000 |

|

428,846

—

— |

|

245,000

—

— |

|

134,374

—

— |

(3)

|

275,000

—

— |

|

3,763

—

— |

Robert I. Tepper

President, Research and Development |

|

2002

2001

2000 |

|

369,790

327,813

300,490 |

|

131,076

229,688

— |

|

—

—

— |

|

158,334

210,000

96,000 |

|

9,580

8,060

4,161 |

Charles J. Homcy(2)

Senior R&D Advisor

Former President of

Research and Development |

|

2002

2001

2000 |

|

362,349

—

— |

|

154,700

—

— |

|

45,059

—

— |

(3)

|

212,500

—

— |

|

2,401

—

— |

John B. Douglas III

Senior Vice President, General Counsel and Secretary |

|

2002

2001

2000 |

|

316,487

307,339

300,000 |

|

50,128

139,050

25,000 |

|

—

—

— |

|

70,800

90,000

81,000 |

|

9,549

8,028

6,090 |

Kevin P. Starr

Former Chief Operating Officer and Chief Financial Officer |

|

2002

2001

2000 |

|

394,231

328,557

285,577 |

|

—

275,626

— |

|

—

—

— |

|

162,500

207,200

228,000 |

|

9,220

7,642

5,021 |

|

- (1)

- All Other Compensation includes:

| | Term life insurance premiums paid by Millennium

| | Dollar value of Millennium

common stock contributed by

Millennium to the executive's

account under 401(k) Plan

| | Other

|

|---|

Name

| | 2002

| | 2001

| | 2000

| | 2002

| | 2001

| | 2000

| | 2002

| | 2001

| | 2000

|

|---|

|

|---|

| Mark J. Levin | | $ | 1,656 | | $ | 1,656 | | $ | 1,656 | | $ | 9,000 | | $ | 7,012 | | $ | 5,100 | | $700 | | $700 | | $525 |

| Vaughn M. Kailian | | $ | 2,620 | | | — | | | — | | $ | 1,143 | | | — | | | — | | — | | — | | — |

| Robert I. Tepper | | $ | 1,080 | | $ | 1,048 | | | $991 | | $ | 8,500 | | $ | 7,012 | | $ | 3,170 | | — | | — | | — |

| Charles J. Homcy | | $ | 1,401 | | | — | | | — | | $ | 1,000 | | | — | | | — | | — | | — | | — |

| John B. Douglas III | | $ | 1,049 | | $ | 1,016 | | | $990 | | $ | 8,500 | | $ | 7,012 | | $ | 5,100 | | — | | — | | — |

| Kevin P. Starr | | | $720 | | | $630 | | | $574 | | $ | 8,500 | | $ | 7,012 | | $ | 4,447 | | — | | — | | — |

|

- (2)

- Mr. Kailian and Dr. Homcy joined Millennium on February 12, 2002.

- (3)

- In 2002, Millennium provided apartments for Mr. Kailian and Dr. Homcy to use when they were in the Boston area. Millennium paid Mr. Kailian $134,374 and Dr. Homcy $45,059 in 2002 for housing and utilities expenses and the related tax liability.

18

Option Grants in 2002

This table shows all options to purchase our common stock granted in 2002 by us to our Chief Executive Officer, each of our four other most highly compensated executive officers and one former executive officer.

Option Grants in 2002

| |

| | PERCENT OF

TOTAL

OPTIONS

GRANTED TO

EMPLOYEES

IN 2002(1)

| |

| |

| |

| |

|

|---|

| | NUMBER OF

SHARES

UNDERLYING

OPTIONS

GRANTED (#)

| |

| |

| | POTENTIAL REALIZABLE VALUE AT ASSUMED ANNUAL RATES OF STOCK PRICE APPRECIATION FOR OPTION TERM (2)

|

|---|

| | EXERCISE

OR BASE

PRICE

($/sh)

| |

|

|---|

| | EXPIRATION

DATE

|

|---|

NAME

| | 5%($)

| | 10%($)

|

|---|

|

|---|

| Mark J. Levin | | 100,000

100,000

100,000

29,167

29,167

29,166 | (3)

(4)

(5)

(6)

(7)

(8) | 3.3 | % | $

$

$

$

$

$ | 19.49

22.04

18.42

7.99

8.27

9.35 | | 2/27/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012 | | 1,225,716

1,386,084

1,158,424

146,560

151,696

171,501 | | 3,106,204

3,512,608

2,935,674

371,413

384,428

434,617 |

Vaughn M. Kailian |

|

66,667

66,667

66,666

25,000

25,000

25,000 |

(3)

(4)

(5)

(6)

(7)

(8) |

2.3 |

% |

$

$

$

$

$

$ |

19.49

22.04

18.42

7.99

8.27

9.35 |

|

2/27/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012 |

|

817,148

924,060

772,275

125,622

130,024

147,004 |

|

2,070,813

2,341,751

1,957,096

318,350

329,506

372,537 |

Robert I. Tepper |

|

25,000

25,000

25,000

16,667

16,667

16,666

33,334 |

(3)

(4)

(5)

(6)

(7)

(8)

(3) |

1.3 |

% |

$

$

$

$

$

$

$ |

19.49

22.04

18.42

7.99

8.27

9.35

9.35 |

|

2/27/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012

12/17/2012 |

|

306,429

346,521

289,606

83,749

86,684

97,999

196,009 |

|

776,551

878,152

733,918

212,238

219,675

248,348

496,726 |

Charles J. Homcy |

|

50,000

50,000

50,000

20,834

20,833

20,833 |

(3)

(4)

(5)

(6)

(7)

(8) |

1.8 |

% |

$

$

$

$

$

$ |

19.49

22.04

18.42

7.99

8.27

9.35 |

|

2/27/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012 |

|

612,858

693,042

579,212

104,688

108,352

122,501 |

|

1,553,102

1,756,304

1,467,837

265,300

274,584

310,443 |

John B. Douglas III |

|

11,100

11,100

11,100

12,500

12,500

12,500 |

(3)

(4)

(5)

(6)

(7)

(8) |

..59 |

% |

$

$

$

$

$

$ |

19.49

22.04

18.42

7.99

8.27

9.35 |

|

2/27/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012 |

|

136,054

153,855

128,585

62,811

65,012

73,502 |

|

344,789

389,900

325,860

159,175

164,753

186,269 |

Kevin P. Starr |

|

16,667

16,667

16,667

16,666

16,667

16,666

20,834

20,833

20,833 |

(3)

(4)

(3)

(5)

(4)

(5)

(6)

(7)

(8) |

1.4 |

% |

$

$

$

$

$

$

$

$

$ |

20.40

20.45

19.49

25.28

22.04

18.42

7.99

8.27

9.35 |

|

1/18/2012

2/18/2012

2/27/2012

3/18/2012

3/27/2012

4/26/2012

10/17/2012

11/15/2012

12/17/2012 |

|

213,828

214,353

204,290

264,964

231,019

193,063

104,688

108,352

122,501 |

|

541,883

543,211

517,711

671,470

585,446

489,259

265,300

274,584

310,443 |

|

- (1)

- The percent is calculated by dividing the total number of shares underlying options granted to the executive officer in 2002 by the total number of shares underlying options granted to all employees in 2002.

- (2)

- Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date, net of the applicable option exercise price. This table does not take

19

into account any appreciation or depreciation in the price of the common stock to date. Actual gains, if any, on stock option exercises will depend on the future performance of the common stock and the date on which the options are exercised.

- (3)

- 1/48th of the total number of shares subject to the option are exercisable one month after the date of grant and an additional 1/48th of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

- (4)

- 1/48th of the total number of shares subject to the option are exercisable on the date of grant and an additional 1/48th of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

- (5)

- 2/48ths of the total number of shares subject to the option are exercisable on the date of grant and an additional 1/48th of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

- (6)

- 1/53rd of the total number of shares subject to the option are exercisable one month after the date of grant and an additional 1/53rd of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

- (7)

- 1/53rd of the total number of shares subject to the option are exercisable on the date of grant and an additional 1/53rd of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

- (8)

- 2/53rds of the total number of shares subject to the option are exercisable on the date of grant and an additional 1/53rd of the total number of shares subject to the option become exercisable monthly thereafter until all of the shares are exercisable.

Aggregated Option Exercises and Fiscal Year-End Option Values

This table shows information about stock options exercised in 2002 and stock options held as of December 31, 2002 by our Chief Executive Officer, each of our four other most highly compensated executive officers and one former executive officer.

Aggregated Option Exercises in 2002 and 2002 Year-End Option Values

| |

| |

| | NUMBER OF SHARES UNDERLYING UNEXERCISED OPTIONS HELD AT 12/31/02 (#)

| | VALUE OF UNEXERCISED IN-THE-MONEY OPTIONS AT 12/31/02 ($)

|

|---|

| | SHARES

ACQUIRED ON

EXERCISE (#)

| |

|

|---|

| | VALUE

REALIZED ($)

|

|---|

NAME

| | EXERCISABLE

| | UNEXERCISABLE

| | EXERCISABLE

| | UNEXERCISABLE(1)

|

|---|

|

|---|

| Mark J. Levin | | — | | — | | 1,607,739 | | 690,761 | | $2,838,675 | | $7,738 |

| Vaughn M. Kailian | | — | | — | | 1,052,526 | | 452,646 | | $2,031,794 | | 0 |

| Robert I. Tepper | | — | | — | | 579,045 | | 311,701 | | $1,025,947 | | $3,070 |

| Charles J. Homcy | | — | | — | | 444,030 | | 300,658 | | $708,418 | | $33,849 |

| John B. Douglas III | | — | | — | | 330,375 | | 184,847 | | 0 | | 0 |

| Kevin P. Starr | | — | | — | | 445,630 | | 352,690 | | $335,030 | | $14,880 |

|

- (1)

- Value of unexercised in-the-money options to purchase shares of Millennium common stock is based on the closing sales price of Millennium's common stock on December 31, 2002 ($7.94), the last trading day of Millennium's 2002 fiscal year, less the applicable option exercise price.

Employment Agreements and Change in Control Arrangements

Millennium has employment agreements with Dr. Tepper and Mr. Douglas. Each executive's employment with Millennium is at-will and may be terminated by Millennium at any time with or without cause. If the executive's employment is terminated without Justifiable Cause, as that term is defined in the agreement, then, subject to certain conditions, Millennium is obligated to pay him severance payments equal to twelve months' salary. The form of these employment agreements is filed as an exhibit to our Annual Report on Form 10-K with the Securities and Exchange Commission.

Millennium has a Key Employee Change of Control Severance Plan, assumed in our merger with COR Therapeutics, Inc., under which Mr. Kailian and Dr. Homcy would be entitled to certain benefits upon termination of employment for certain specified reasons upon a Change of Control. The plan provides

20

that if we terminate the executive's employment without cause or if the executive voluntary terminates his employment for good reason within twelve months following a Change in Control, we will continue to pay the executive his base salary for eighteen months, pay the pro rata portion of his target bonus for the year in which termination occurs and continue health benefits for twelve months. Change of Control, Involuntary Termination and Cause are defined in the Key Employee Change of Control Severance.

Millennium also has agreements with Mr. Kailian and Dr. Homcy which acknowledge their entitlement of benefits under the Key Employee Change of Control Severance Plan and provide that notwithstanding the provisions of that plan, if the executive's employment terminates for any reason within two years of February 12, 2002, the date of the merger of Millennium and COR, and if the Key Employee Change of Control Severance Plan does not otherwise provide them with benefits for the termination, then (1) Millennium will pay the executive his base salary (as of the date of the merger) for eighteen months and the pro rata portion of his target bonus (as of the date of the merger) for the year in which termination occurs (2) any stock options outstanding as of the date of the COR merger will immediately vest and become exercisable as of the date of the termination and (3) the payment under this agreement combined with payment under any other agreement to be received upon termination of employment will be adjusted if necessary to result in the greater amount of payment possible after taking into consideration the excise tax imposed by Section 4999 of the Internal Revenue Code. The Key Employee Change of Control Severance Plan and these agreements with Mr. Kailian and Dr. Homcy are filed as exhibits to our Annual Report on Form 10-K with the Securities and Exchange Commission.

Mr. Levin, Mr. Kailian, Dr. Homcy, Dr. Tepper and Mr. Douglas hold stock options granted under various Millennium equity compensation plans. These plans provide that an employee's outstanding unvested stock options or awards will immediately vest in full if, during the period one month before through twelve months after the date of a Change of Control, either an employee voluntarily terminates his or her employment with us for Good Reason or we terminate his or her employment involuntarily without Cause. Change of Control, Good Reason and Cause are defined in the plans which are filed as exhibits to our Annual Report on Form 10-K with the Securities and Exchange Commission

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Millennium entered into an arrangement with Paul R. Hamelin, a former Millennium Senior Vice President, Commercial Operations, in May 2002. Under the arrangement, Millennium agreed to pay Mr. Hamelin his base salary and continue his medical and dental insurance for seventeen months after his termination date and pay him a pro-rata share of his target 2002 bonus in the amount of $22,500. Under the terms of the arrangement, Millennium forgave the then outstanding principal amount, and corresponding interest, of a loan of $250,000 bearing an interest rate of 5.87% which Millennium made to Mr. Hamelin in January 2001 for the purchase of a home in the Boston area. Under Mr. Hamelin's employment agreement, Millennium had forgiven one-fourth of the loan on December 1, 2001, the one year anniversary of the date of his employment, and was forgiving one-forty eighth of the remaining amount of the loan monthly after that date as long as he remained a Millennium employee. The largest principal balance of the loan outstanding in 2002 was $187,500.

21

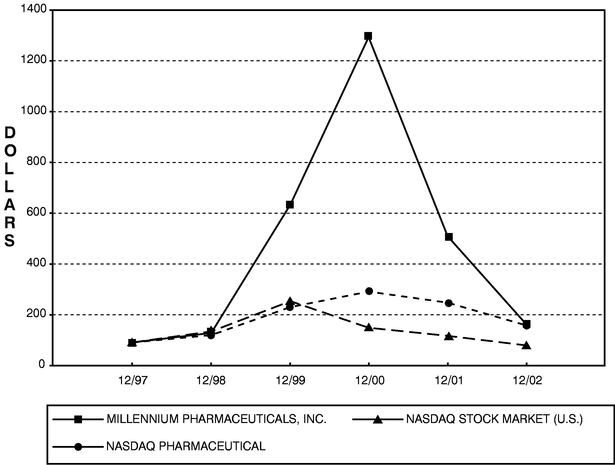

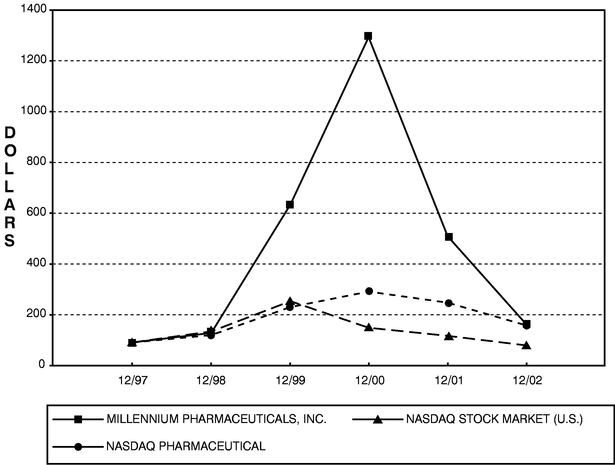

STOCK PERFORMANCE GRAPH

This graph compares the performance of Millennium common stock with the performance of the Nasdaq Stock Market (U.S. Companies) Index and the Nasdaq Pharmaceuticals Index (assuming reinvestment of dividends). The graph assumes $100 invested at the per share closing price on the Nasdaq National Market in Millennium and each of the indices on December 31, 1997. Measurement points are on the last trading days of the years ended December 31, 1998, December 31, 1999, December 31, 2000, December 31, 2001 and December 31, 2002.

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

|

|---|

|

|---|

| Millennium Pharmaceuticals, Inc. | | 100.00 | | 136.18 | | 642.11 | | 1302.63 | | 516.00 | | 167.16 |

| NASDAQ Stock Market (U.S.) | | 100.00 | | 140.99 | | 261.48 | | 157.42 | | 124.89 | | 86.33 |

| NASDAQ Pharmaceuticals Index | | 100.00 | | 126.94 | | 239.34 | | 298.55 | | 254.43 | | 164.36 |

|

22

COMPENSATION AND TALENT COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation and Talent Committee is currently composed of four independent, non-employee directors and operates under a written charter. The Committee's primary functions are to address CEO, executive officer and senior executive talent development, retention, performance and succession planning, and to act on behalf of the Board of Directors with respect to Millennium's general and executive compensation and benefit practices. In particular, the Committee will:

- •

- conduct an annual review of the Chief Executive Officer's performance based on objective and subjective criteria, such as performance of the business, accomplishment of long-term strategic objectives and management development;

- •

- review with the Chief Executive Officer Millennium's organization concepts, the development and potential for promotion of the senior members of Millennium's management and the availability of replacements for these management positions;

- •

- review the qualifications of the executive officers of Millennium and nominate executive officers for election by the full Board of Directors;

- •

- review and approve compensation policy and philosophy for Millennium to ensure that the compensation strategy supports organizational objectives and stockholder interests, and consider appropriate companies for compensation comparative purposes;

- •

- determine the annual salary and other elements of total compensation of the Chief Executive Officer, and annually review the total compensation of all other executive officers;

- •

- administer Millennium's equity incentive plans and the issuance of awards pursuant to those plans, including approving of all equity grants to executive officers, establishing equity grant guidelines and monitoring the availability of shares under those plans; and

- •

- approve and recommend to the full Board of Directors the adoption of, and suggested material changes to: (a) any equity incentive plans; (b) any qualified or non-qualified employee pension, profit-sharing or retirement plans; and (c) any broad-based employee incentive compensation plans; and approve changes to these plans that do not require stockholder approval or do not involve material amounts of money or other consideration.

General Compensation Philosophy

Millennium's compensation philosophy is based on the principles of competitive and fair compensation consistent with performance. The executive compensation program is designed to motivate and reward executive officers by aligning a substantial portion of their compensation with the achievement of priority strategic business goals as well as individual performance objectives.

To ensure that compensation is competitive, the Committee compares Millennium compensation practices and levels annually with those of other leading companies in the biotechnology and pharmaceutical industries with whom Millennium competes for executive talent and that are at a similar stage of development as Millennium. Over the past several years, the Committee has shifted its primary focus for compensation comparison purposes from a group of high value developing biotech companies (such as Alkermes, Human Genome Sciences, ICOS, Imclone Systems, Incyte, Protein Design Labs and Vertex) to a group of product based biotech companies (Amgen, Biogen, Celgene Corp., Cephalon, Chiron, Genentech, Genzyme Corp., Gilead, IDEC and MedImmune). The Committee believes this is appropriate in light of Millennium's growth and development. In addition, the Committee considers compensation levels at pharmaceutical companies (such as Abbott Laboratories, Astrazeneca, Aventis Pharmaceuticals, Bayer Corporation, Bristol-Myers Squibb Pharm Group, Dupont Pharmaceuticals, Eli Lilly and Company, Glaxosmithkline Pharmaceuticals, Hoffman-La Roche Inc., Janssen Pharmaceutica, L.P., Merck &

23

Company, Novartis Pharmaceuticals, Pfizer and Pharmacia) in determining appropriate total compensation levels.

Our compensation target is to pay employees, including our executive officers, at the 65th percentile of the range of annual compensation paid for comparable positions by these companies. Actual compensation may vary above or below this level depending on Millennium's performance relative to goals, individual employee performance, and the market price for Millennium's publicly traded equity. To ensure fairness, Millennium also strives to achieve equitable pay relationships between individual employees and between different organization levels within Millennium, including the executive officers.

Key Elements of Compensation

The major elements of Millennium's compensation program are base salary, annual bonus and stock options.

Salary. Base salary levels are designed to recognize an individual's ongoing contribution, to be commensurate with an individual's experience and organization level and to be competitive with market benchmarks. Increases in annual salaries are based on demonstrated levels of competency in skill, effectiveness, and leadership, and by comparing how an individual has performed essential job requirements against what was envisioned with the job. Salary adjustments also are based on general market competitiveness. The Committee does not use a specific formula based on these criteria, but instead makes an evaluation of each executive officer's contributions in light of all such criteria.