American Century Investment Services, Inc., Distributor

©2010 American Century Proprietary Holdings, Inc. All rights reserved.

| Annual Report |

| October 31, 2010 |

American Century Investments®

| | President’s Letter | 2 |

| | Independent Chairman’s Letter | 3 |

| | Market Perspective | 4 |

| | U.S. Stock Index Returns | 4 |

| | | |

| Heritage |

| |

| | Performance | 5 |

| | Portfolio Commentary | 7 |

| | Top Ten Holdings | 9 |

| | Top Five Industries | 9 |

| | Types of Investments in Portfolio | 9 |

| | | |

| | Shareholder Fee Example | 10 |

| | | |

| Financial Statements |

| |

| | Schedule of Investments | 12 |

| | Statement of Assets and Liabilities | 15 |

| | Statement of Operations | 16 |

| | Statement of Changes in Net Assets | 17 |

| | Notes to Financial Statements | 18 |

| | Financial Highlights | 25 |

| | Report of Independent Registered Public Accounting Firm | 31 |

| | | |

| Other Information |

| |

| | Proxy Voting Results | 32 |

| | Management | 33 |

| | Additional Information | 37 |

| | Index Definitions | 38 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended October 31, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

Independent Chairman’s Letter

Don Pratt

Dear Fellow Shareholders,

As regulators and the markets continue to sort out the events of the credit crisis, a consistent theme has been that financial services firms should re-examine their risk management practices. Risk management has been a regular part of American Century Investments’ activities for many years. However, recently American Century and your mutual fund board have been spending additional time focusing on our risk oversight processes.

The board’s efforts are now organized around three categories of risk: investment risk, operational risk, and enterprise risk. This approach has facilitated a realignment of many risk oversight tasks that the board has historically conducted. Investment risk tasks include a review of portfolio risk, monitoring the use of derivatives, and performance assessment. Operational risk focuses on compliance, valuation, shareholder services, and trading activities. Enterprise risk addresses the financial condition of the advisor, human resource development, and reputational risks. Risk oversight tasks are addressed in every quarterly board meeting, and a review of the advisor’s entire risk management program is undertaken annually. We acknowledge and support the approach that American Century Investments takes to its risk management responsibilities. While the board has refocused its efforts in this important oversight area, we recognize that risk oversight is a journey and we expect to continue to improve our processes.

Our September quarterly board meeting was held in the New York offices of American Century Investments. This gave the directors an opportunity to meet with the portfolio management teams for each of the global and international funds overseen by the board. Each team uses sophisticated investment tools and daily risk analysis in managing client assets. We also were impressed with the “bench strength” that has been developed under the leadership of the Global and Non-U.S. Equity CIO Mark Kopinski. These face-to-face meetings provide an opportunity for the directors—working on behalf of shareholders—to validate the advisor’s efforts and the investment management approach being followed.

I thank you for your continued confidence in American Century during this turbulent time in the economy and investment markets. If you have thoughts or questions you would like to share with the board send them to me at dhpratt@fundboardchair.com.

Best regards,

Don Pratt

By David Hollond, Chief Investment Officer, U.S. Growth Equity—Mid & Small Cap

Stocks Rallied Amid Growing Volatility

U.S. stocks advanced for the 12 months ended October 31, 2010, as the broad equity indices posted double-digit gains. Virtually all of the market’s gains occurred in the first six months of the period, when stocks continued to climb after reaching a multi-year low in March 2009. The key factors behind the rally included favorable economic data, which provided evidence of a burgeoning recovery, and better-than-expected corporate earnings, which resulted largely from cost-cutting measures by many businesses to widen profit margins.

Market conditions changed abruptly in late April as evidence of a pullback in economic activity led to concerns about a relapse into recession. These concerns were amplified by a sovereign debt crisis in Greece that began to spread across Europe. In response, the equity market declined sharply throughout May and June as market volatility increased substantially.

The equity market remained volatile in the third quarter, gaining ground in July and falling back in August amid a tug-of-war between positive corporate earnings reports and an increasingly sluggish economic environment. However, stocks staged a resurgence during the final two months of the period as investors expressed confidence in the Federal Reserve’s plan to revive the economic recovery via another round of quantitative easing.

Small- and Mid-Cap Growth Stocks Outperformed

While stocks advanced across the board, the 12-month period was especially favorable for mid- and small-cap growth stocks. The small- and mid-cap segments of the market led the overall advance, returning more than 25% (see the table below). Smaller companies suffered the largest losses during the downturn in late 2008 and early 2009 and thus far have enjoyed the highest returns during the market’s recovery.

In addition, growth-oriented issues outpaced value shares across all market capitalizations. The best-performing sectors in the market were those traditionally associated with growth, such as information technology and consumer discretionary. In addition, the financials sector—a major component in value indices—underperformed during the period.

| U.S. Stock Index Returns |

| For the 12 months ended October 31, 2010 |

| Russell 1000 Index (Large-Cap) | 17.67% | | Russell 2000 Index (Small-Cap) | 26.58% |

| Russell 1000 Growth Index | 19.65% | | Russell 2000 Growth Index | 28.67% |

| Russell 1000 Value Index | 15.71% | | Russell 2000 Value Index | 24.43% |

| Russell Midcap Index | 27.71% | | |

| Russell Midcap Growth Index | 28.03% | | | |

| Russell Midcap Value Index | 27.49% | | | |

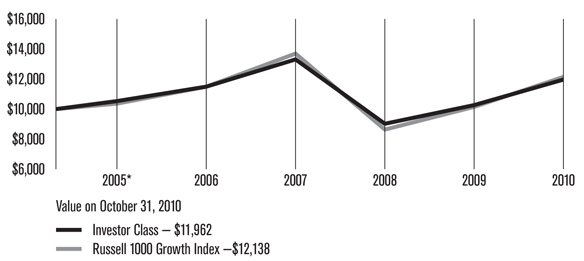

Heritage

| Total Returns as of October 31, 2010 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year(1) | 5 years | 10 years | Since Inception | Inception Date |

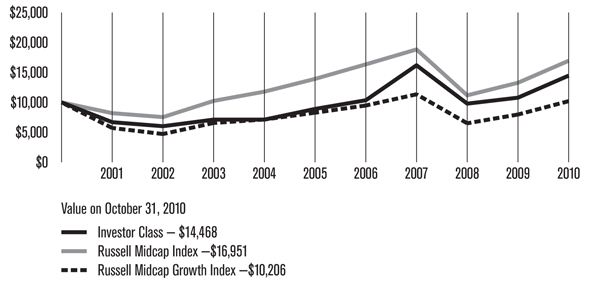

| Investor Class | TWHIX | 34.15% | 10.19% | 3.76% | 11.53% | 11/10/87 |

Russell Midcap Growth Index | — | 28.03% | 4.28% | 0.20% | 10.38%(2) | — |

| Russell Midcap Index | — | 27.71% | 4.01% | 5.42% | 11.70%(2) | — |

| Institutional Class | ATHIX | 34.44% | 10.42% | 3.98% | 8.30% | 6/16/97 |

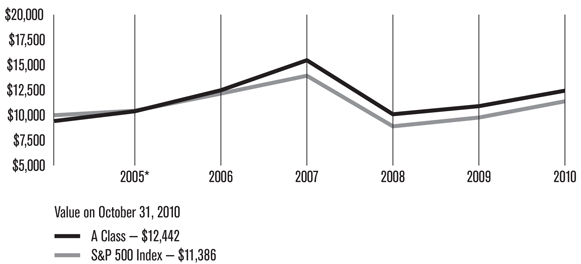

A Class(3) No sales charge* With sales charge* | ATHAX | 33.76% 26.10% | 9.91% 8.61% | 3.49% 2.88% | 7.48% 7.00% | 7/11/97 |

B Class No sales charge* With sales charge* | ATHBX | 32.84% 28.84% | — — | — — | -2.70% -3.74% | 9/28/07 |

| C Class | AHGCX | 32.85% | 9.10% | — | 5.19% | 6/26/01 |

| R Class | ATHWX | 33.50% | — | — | -2.21% | 9/28/07 |

*Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

| (1) | Extraordinary performance is attributable in part to unusually favorable market conditions and may not be repeated or consistently achieved in the future. |

| (2) | Since 10/31/87, the date nearest the Investor Class’s inception for which data are available. |

| (3) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

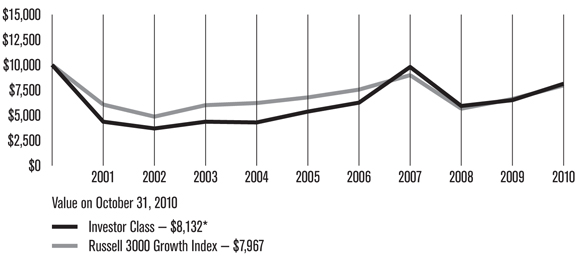

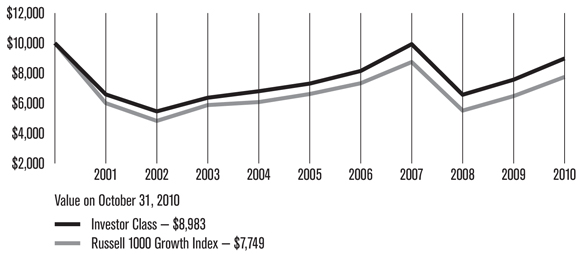

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

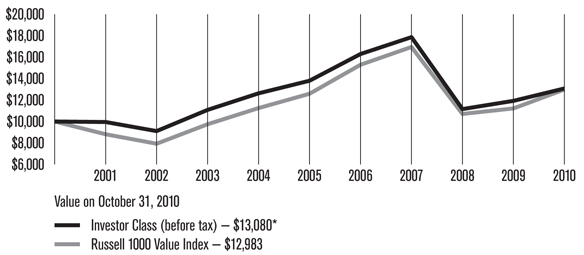

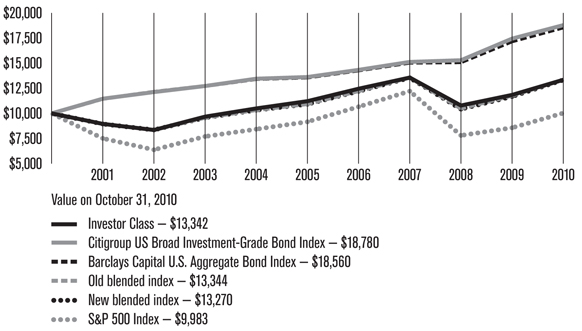

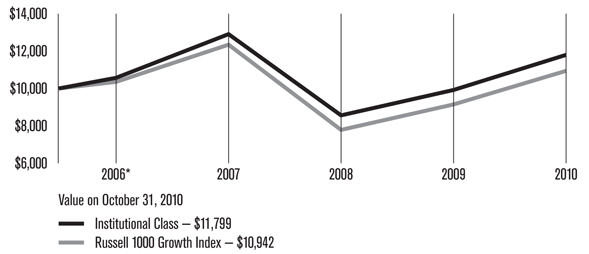

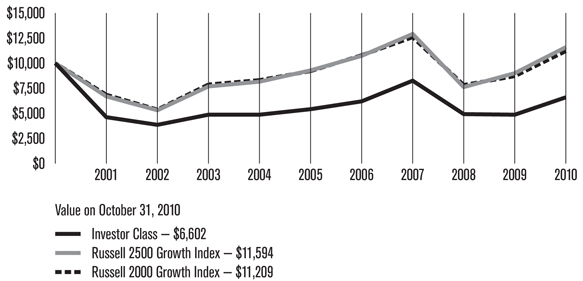

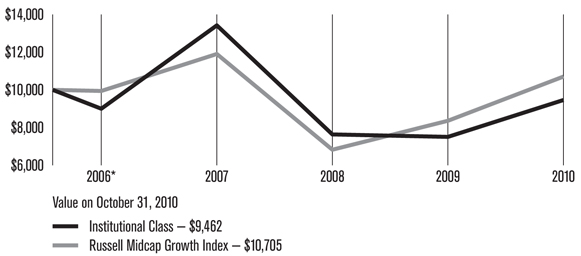

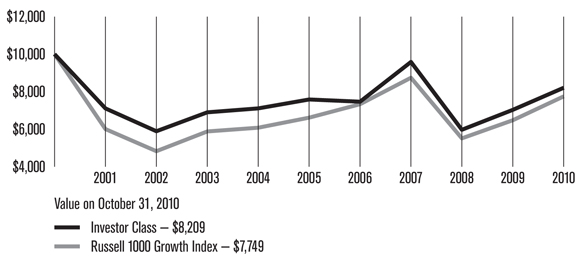

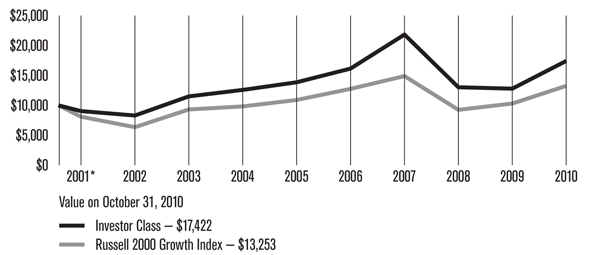

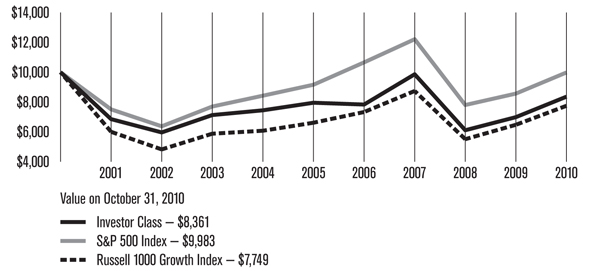

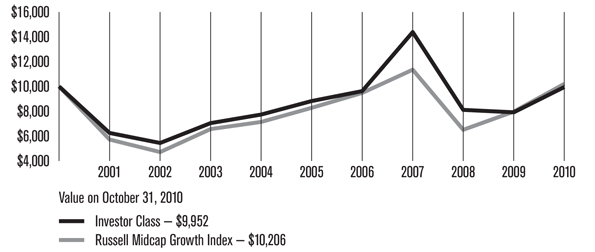

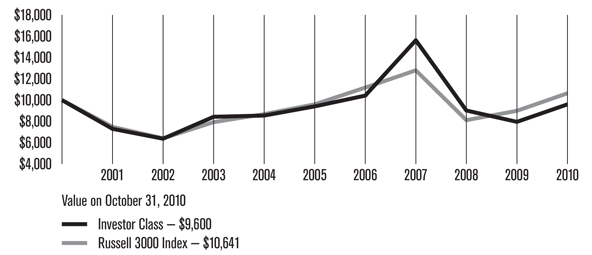

Heritage

| Growth of $10,000 Over 10 Years |

| $10,000 investment made October 31, 2000 |

| Total Annual Fund Operating Expenses |

| Investor Class | Institutional Class | A Class | B Class | C Class | R Class |

| 1.01% | 0.81% | 1.26% | 2.01% | 2.01% | 1.51% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

Heritage

Portfolio Managers: David Hollond and Greg Walsh

Performance Summary

Heritage returned 34.15%* for the 12 months ended October 31, 2010, outpacing the 28.03% return of the portfolio’s benchmark, the Russell Midcap Growth Index.

As discussed in the Market Perspective on page 4, equity indices generally gained during the reporting period, as investors faced a mixture of economic and market information. Price momentum and acceleration, two factors that the Heritage team looks for in portfolio holdings, started to be rewarded toward the end of the reporting period. As the environment for the team’s process has improved, Heritage has delivered portfolio returns that outperformed those of its benchmark.

Heritage derived double-digit returns from all ten major industrial sectors during the reporting period. The portfolio’s relative performance benefited the most from investment decisions in the information technology sector. Stock selection in the industrials and energy sectors also contributed meaningfully to returns, as did the materials and consumer discretionary sectors. These gains were modestly trimmed by holdings in the consumer staples sector. Roughly half of Heritage’s gains for the period, relative to the benchmark, were derived from holdings in foreign securities.

Information Technology Led Gains

The information technology sector was the largest source of Heritage’s outperformance relative to its benchmark. Within the sector, Heritage was rewarded for an overweight stake in personal computer maker Apple, Inc. The company announced higher-than-expected earnings due to solid sales growth during the period, largely from the popularity of its iPhone smart phone and iPad device.

In the communications equipment industry group, Heritage held an overweight stake in networking company F5 Networks, which was the largest single contributor to relative gains. The company, which manages networks to optimize online application use, benefited from increased demand as a result of the popularity of social networking sites and e-commerce. During the reporting period, F5 delivered earnings that were in excess of analysts’ expectations and increased guidance for future earnings.

Heritage also held a significant position in Baidu, Inc., China’s dominant internet search engine. The company experienced acceleration in sales as more Chinese companies increased their internet presence through Web sites and online retail stores. Stock decisions in the IT services industry group also helped Heritage’s relative gains within the information technology sector.

Industrials, Energy Helped

The industrials sector was a key source of outperformance for Heritage. In the sector, Heritage benefited from an overweight position in railroad company Kansas City Southern. An improvement in economic activity during the period led to increased shipping demand, translating into accelerating volumes for the company.

*All fund returns referenced in this commentary are for Investor Class shares.

BE Aerospace also contributed meaningfully to relative returns. The maker of aircraft interiors demonstrated accelerating growth that the investment team expects to continue due to a strong 2011 wide-body delivery cycle, strong passenger travel demand, and record backlog.

Elsewhere in the industrials sector, the portfolio benefited from an overweight stake in Fastenal Co. The distributor of industrial and construction supplies experienced improved earnings during the reporting period as sales climbed.

The energy sector also contributed to outperformance relative to the benchmark, particularly within the energy equipment and services industry group. Here, Heritage successfully avoided a number of underperforming companies while holding overweight stakes in select holdings that outperformed.

Materials, Consumer Discretionary Helped

In the materials sector, an overweight stake in the metals and mining group drove relative outperformance. Cliffs Natural Resources, which benefited from improved pricing for iron ore as global economies improved, was a significant contributor to relative gains for the period. AK Steel Holding Corp., which is not a member of the benchmark, also added to returns as it benefited from improving economic conditions.

In the consumer discretionary sector, Heritage held a beneficial stake in Chinese online travel company Ctrip.com. The company experienced increased demand amid a resurgence in worldwide travel during the reporting period.

Consumer Staples Detracted

Although the consumer staples sector contributed to absolute gains for Heritage, it lagged the sector returns for the benchmark. In particular, Heritage held a detrimental overweight position in membership warehouse chain Costco Wholesale. The company had fared well in the weak economic environment, and investors viewed the company’s stock as a defensive position. As market conditions improved, however, Costco’s share price return was more moderate.

Outlook

Heritage’s investment process focuses on medium-sized and smaller companies with accelerating revenue and earnings growth rates, which are also exhibiting share-price strength. This process, which has historically added value over time, had faced unprecedented headwinds during the market rally that began in March 2009. Despite this challenge, Heritage provided solid absolute and relative returns during the reporting period. Recently, we have seen the relative headwinds from price momentum and acceleration subside as markets appear to have moved past the inflection point driven by market sentiment and into a period where fundamentals, and specifically fundamental improvement, is being recognized and rewarded by investors.

Heritage

| Top Ten Holdings |

| | % of net assets as of 10/31/10 |

| F5 Networks, Inc. | 3.1% |

| O’Reilly Automotive, Inc. | 2.6% |

| priceline.com, Inc. | 2.6% |

| Netflix, Inc. | 2.3% |

| BE Aerospace, Inc. | 2.2% |

| Royal Caribbean Cruises Ltd. | 2.2% |

| SBA Communications Corp., Class A | 2.2% |

| Apple, Inc. | 1.9% |

| Cummins, Inc. | 1.8% |

| NetApp, Inc. | 1.7% |

| Top Five Industries |

| | % of net assets as of 10/31/10 |

| Hotels, Restaurants & Leisure | 7.6% |

| Specialty Retail | 5.6% |

| Internet & Catalog Retail | 5.1% |

| Software | 4.8% |

| Internet Software & Services | 4.5% |

| Types of Investments in Portfolio |

| | % of net assets as of 10/31/10 |

| Domestic Common Stocks | 86.3% |

| Foreign Common Stocks* | 11.3% |

| Total Common Stocks | 97.6% |

| Temporary Cash Investments | 1.2% |

| Other Assets and Liabilities | 1.2% |

*Includes depositary shares, dual listed securities and foreign ordinary shares.

Shareholder Fee Example (Unaudited)

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2010 to October 31, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) regis tered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning Account Value 5/1/10 | Ending Account Value 10/31/10 | Expenses Paid During Period* 5/1/10 - 10/31/10 | Annualized Expense Ratio* |

| Actual |

| Investor Class | $1,000 | $1,070.80 | $5.27 | 1.01% |

| Institutional Class | $1,000 | $1,072.10 | $4.23 | 0.81% |

| A Class | $1,000 | $1,069.20 | $6.57 | 1.26% |

| B Class | $1,000 | $1,065.10 | $10.46 | 2.01% |

| C Class | $1,000 | $1,065.60 | $10.46 | 2.01% |

| R Class | $1,000 | $1,068.00 | $7.87 | 1.51% |

| Hypothetical |

| Investor Class | $1,000 | $1,020.11 | $5.14 | 1.01% |

| Institutional Class | $1,000 | $1,021.12 | $4.13 | 0.81% |

| A Class | $1,000 | $1,018.85 | $6.41 | 1.26% |

| B Class | $1,000 | $1,015.07 | $10.21 | 2.01% |

| C Class | $1,000 | $1,015.07 | $10.21 | 2.01% |

| R Class | $1,000 | $1,017.59 | $7.68 | 1.51% |

*Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period.

| | | |

| | Shares | Value |

| Common Stocks — 97.6% |

| AEROSPACE & DEFENSE — 3.3% |

BE Aerospace, Inc.(1) | 1,755,785 | $64,542,657 |

| Precision Castparts Corp. | 83,600 | 11,418,088 |

TransDigm Group, Inc.(1) | 294,500 | 19,516,515 |

| | | 95,477,260 |

| AIR FREIGHT & LOGISTICS — 1.1% |

| Expeditors International of Washington, Inc. | 668,300 | 32,987,288 |

| AIRLINES — 1.4% |

AMR Corp.(1) | 2,374,000 | 18,707,120 |

United Continental Holdings, Inc.(1) | 814,900 | 23,664,696 |

| | | 42,371,816 |

| AUTO COMPONENTS — 0.5% |

BorgWarner, Inc.(1) | 264,400 | 14,835,484 |

| AUTOMOBILES — 0.8% |

| Bayerische Motoren Werke AG | 205,800 | 14,754,135 |

Brilliance China Automotive Holdings Ltd.(1) | 9,672,000 | 8,485,031 |

| | | 23,239,166 |

| BIOTECHNOLOGY — 2.6% |

Alexion Pharmaceuticals, Inc.(1) | 454,600 | 31,049,180 |

United Therapeutics Corp.(1) | 467,700 | 28,062,000 |

Vertex Pharmaceuticals, Inc.(1) | 404,200 | 15,492,986 |

| | | 74,604,166 |

| CAPITAL MARKETS — 0.7% |

| Lazard Ltd., Class A | 553,612 | 20,428,283 |

| CHEMICALS — 3.0% |

| Albemarle Corp. | 847,600 | 42,490,188 |

| CF Industries Holdings, Inc. | 178,900 | 21,920,617 |

| Ecolab, Inc. | 232,700 | 11,476,764 |

| Sigma-Aldrich Corp. | 181,900 | 11,536,098 |

| | | 87,423,667 |

| COMMERCIAL BANKS — 0.2% |

| Comerica, Inc. | 160,400 | 5,739,112 |

| COMMERCIAL SERVICES & SUPPLIES — 0.8% |

Stericycle, Inc.(1) | 344,500 | 24,714,430 |

| COMMUNICATIONS EQUIPMENT — 3.6% |

F5 Networks, Inc.(1) | 778,900 | 91,676,530 |

JDS Uniphase Corp.(1) | 1,264,600 | 13,290,946 |

| | | 104,967,476 |

| COMPUTERS & PERIPHERALS — 4.5% |

Apple, Inc.(1) | 185,427 | $55,789,421 |

Lexmark International, Inc., Class A(1) | 622,500 | 23,673,675 |

NetApp, Inc.(1) | 946,600 | 50,406,450 |

| | | 129,869,546 |

| CONSUMER FINANCE — 1.2% |

| Discover Financial Services | 1,940,104 | 34,242,836 |

| ELECTRICAL EQUIPMENT — 1.8% |

American Superconductor Corp.(1) | 393,800 | 13,251,370 |

| Cooper Industries plc | 577,300 | 30,262,066 |

| Rockwell Automation, Inc. | 167,500 | 10,446,975 |

| | | 53,960,411 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 2.5% |

Agilent Technologies, Inc.(1) | 682,500 | 23,751,000 |

| Amphenol Corp., Class A | 371,200 | 18,608,256 |

Dolby Laboratories, Inc., Class A(1) | 481,100 | 29,674,248 |

| | | 72,033,504 |

| ENERGY EQUIPMENT & SERVICES — 3.7% |

Atwood Oceanics, Inc.(1) | 272,838 | 8,869,964 |

Complete Production Services, Inc.(1) | 1,042,905 | 24,435,264 |

| Core Laboratories NV | 331,500 | 25,780,755 |

Dril-Quip, Inc.(1) | 259,500 | 17,931,450 |

FMC Technologies, Inc.(1) | 430,200 | 31,017,420 |

| | | 108,034,853 |

| FOOD & STAPLES RETAILING — 1.7% |

| Costco Wholesale Corp. | 206,100 | 12,936,897 |

Whole Foods Market, Inc.(1) | 958,300 | 38,092,425 |

| | | 51,029,322 |

| FOOD PRODUCTS — 1.1% |

| Mead Johnson Nutrition Co. | 547,900 | 32,227,478 |

| GAS UTILITIES — 0.6% |

| National Fuel Gas Co. | 313,100 | 17,276,858 |

| HEALTH CARE EQUIPMENT & SUPPLIES — 3.1% |

| C.R. Bard, Inc. | 453,200 | 37,669,984 |

| Masimo Corp. | 647,200 | 19,526,024 |

Varian Medical Systems, Inc.(1) | 522,500 | 33,032,450 |

| | | 90,228,458 |

| HEALTH CARE PROVIDERS & SERVICES — 1.5% |

Express Scripts, Inc.(1) | 918,100 | 44,546,212 |

Heritage

| HEALTH CARE TECHNOLOGY — 1.5% |

SXC Health Solutions Corp.(1) | 1,105,370 | $43,065,215 |

| HOTELS, RESTAURANTS & LEISURE — 7.6% |

Chipotle Mexican Grill, Inc.(1) | 123,400 | 25,939,914 |

Ctrip.com International Ltd. ADR(1) | 734,240 | 38,231,877 |

Home Inns & Hotels Management, Inc. ADR(1) | 492,500 | 25,196,300 |

Las Vegas Sands Corp.(1) | 688,500 | 31,588,380 |

Panera Bread Co., Class A(1) | 160,372 | 14,354,898 |

Royal Caribbean Cruises Ltd.(1) | 1,600,200 | 63,271,908 |

| Starwood Hotels & Resorts Worldwide, Inc. | 440,000 | 23,821,600 |

| | | 222,404,877 |

| HOUSEHOLD PRODUCTS — 0.5% |

| Church & Dwight Co., Inc. | 215,700 | 14,203,845 |

| INTERNET & CATALOG RETAIL — 5.1% |

MakeMyTrip Ltd.(1) | 134,100 | 4,847,715 |

Netflix, Inc.(1) | 393,400 | 68,254,900 |

priceline.com, Inc.(1) | 197,111 | 74,273,396 |

| | | 147,376,011 |

| INTERNET SOFTWARE & SERVICES — 4.5% |

Akamai Technologies, Inc.(1) | 587,300 | 30,345,791 |

Baidu, Inc. ADR(1) | 398,500 | 43,838,985 |

OpenTable, Inc.(1) | 61,700 | 3,785,295 |

VeriSign, Inc.(1) | 962,800 | 33,457,300 |

WebMD Health Corp.(1) | 386,189 | 20,189,961 |

| | | 131,617,332 |

| IT SERVICES — 1.4% |

Cognizant Technology Solutions Corp., Class A(1) | 632,700 | 41,245,713 |

| LEISURE EQUIPMENT & PRODUCTS — 0.5% |

| Polaris Industries, Inc. | 200,200 | 14,232,218 |

| LIFE SCIENCES TOOLS & SERVICES — 1.8% |

Illumina, Inc.(1) | 608,000 | 33,020,480 |

Life Technologies Corp.(1) | 363,700 | 18,250,466 |

| | | 51,270,946 |

| MACHINERY — 4.3% |

AGCO Corp.(1) | 582,500 | 24,738,775 |

ArvinMeritor, Inc.(1) | 918,600 | 15,230,388 |

| Bucyrus International, Inc. | 257,500 | 17,551,200 |

| Cummins, Inc. | 610,700 | 53,802,670 |

| Flowserve Corp. | 136,187 | 13,618,700 |

| | | 124,941,733 |

| MEDIA — 1.1% |

Imax Corp.(1) | 1,441,700 | $31,212,805 |

| MULTILINE RETAIL — 1.3% |

Dollar Tree, Inc.(1) | 766,600 | 39,334,246 |

| OIL, GAS & CONSUMABLE FUELS — 2.3% |

Concho Resources, Inc.(1) | 537,300 | 36,896,391 |

| Pioneer Natural Resources Co. | 425,100 | 29,671,980 |

| | | 66,568,371 |

| PHARMACEUTICALS — 1.4% |

Salix Pharmaceuticals Ltd.(1) | 324,300 | 12,268,269 |

| Shire plc ADR | 397,700 | 27,878,770 |

| | | 40,147,039 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 1.1% |

| AvalonBay Communities, Inc. | 131,300 | 13,958,503 |

| Digital Realty Trust, Inc. | 332,700 | 19,872,171 |

| | | 33,830,674 |

| REAL ESTATE MANAGEMENT & DEVELOPMENT — 1.8% |

CB Richard Ellis Group, Inc., Class A(1) | 2,029,900 | 37,248,665 |

| Jones Lang LaSalle, Inc. | 179,400 | 14,003,964 |

| | | 51,252,629 |

| ROAD & RAIL — 1.4% |

| J.B. Hunt Transport Services, Inc. | 539,400 | 19,396,824 |

Kansas City Southern(1) | 476,600 | 20,884,612 |

| | | 40,281,436 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 2.5% |

| Analog Devices, Inc. | 337,800 | 11,373,726 |

| ARM Holdings plc | 2,874,800 | 16,735,181 |

Cavium Networks, Inc.(1) | 642,200 | 20,466,914 |

Veeco Instruments, Inc.(1) | 553,000 | 23,143,050 |

| | | 71,718,871 |

| SOFTWARE — 4.8% |

Citrix Systems, Inc.(1) | 526,692 | 33,745,156 |

Intuit, Inc.(1) | 595,200 | 28,569,600 |

Rovi Corp.(1) | 446,600 | 22,620,290 |

salesforce.com, inc.(1) | 382,600 | 44,408,382 |

VanceInfo Technologies, Inc. ADR(1) | 251,253 | 9,138,072 |

| | | 138,481,500 |

| SPECIALTY RETAIL — 5.6% |

AutoZone, Inc.(1) | 52,200 | $12,404,286 |

O’Reilly Automotive, Inc.(1) | 1,286,100 | 75,236,850 |

| PetSmart, Inc. | 913,100 | 34,177,333 |

| Williams-Sonoma, Inc. | 1,246,500 | 40,349,205 |

| | | 162,167,674 |

| TEXTILES, APPAREL & LUXURY GOODS — 1.4% |

Fossil, Inc.(1) | 345,500 | 20,381,045 |

Lululemon Athletica, Inc.(1) | 436,300 | 19,336,816 |

| | | 39,717,861 |

| TRADING COMPANIES & DISTRIBUTORS — 2.2% |

| Fastenal Co. | 910,200 | 46,857,096 |

| MSC Industrial Direct Co., Class A | 325,464 | 18,531,920 |

| | | 65,389,016 |

| WIRELESS TELECOMMUNICATION SERVICES — 3.8% |

NII Holdings, Inc.(1) | 1,141,500 | 47,726,115 |

SBA Communications Corp., Class A(1) | 1,609,332 | 63,182,374 |

| | | 110,908,489 |

TOTAL COMMON STOCKS (Cost $2,066,149,519) | 2,841,606,127 |

| Temporary Cash Investments — 1.2% |

| JPMorgan U.S. Treasury Plus Money Market Fund Agency Shares | 82,476 | $82,476 |

Repurchase Agreement, Bank of America Securities, LLC, (collateralized by various U.S. Treasury obligations, 1.375%, 5/15/12, valued at $35,305,771), in a joint trading account at 0.18%, dated 10/29/10, due 11/1/10 (Delivery value $34,600,519) | 34,600,000 |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $34,682,476) | 34,682,476 |

TOTAL INVESTMENT SECURITIES — 98.8% (Cost $2,100,831,995) | 2,876,288,603 |

| OTHER ASSETS AND LIABILITIES — 1.2% | 36,315,701 |

| TOTAL NET ASSETS — 100.0% | $2,912,604,304 |

| Geographic Diversification |

| (as a % of net assets) | |

| United States | 86.3% |

| People’s Republic of China | 4.0% |

| Canada | 3.2% |

| Ireland | 0.9% |

| Netherlands | 0.9% |

| Bermuda | 0.7% |

| United Kingdom | 0.6% |

| Germany | 0.5% |

| Hong Kong | 0.3% |

| India | 0.2% |

| Cash and Equivalents* | 2.4% |

*Includes temporary cash investments and other assets and liabilities.

| Forward Foreign Currency Exchange Contracts |

| Contracts to Sell | Counterparty | Settlement Date | Value | Unrealized Gain (Loss) |

| 7,785,414 | EUR for USD | UBS AG | 11/30/10 | $10,832,833 | $(110,216) |

| 7,895,638 | GBP for USD | Bank of America | 11/30/10 | 12,649,365 | (190,048) |

| | | | | $23,482,198 | $(300,264) |

(Value on Settlement Date $23,181,934)

Notes to Schedule of Investments

ADR = American Depositary Receipt

EUR = Euro

USD = United States Dollar

See Notes to Financial Statements.

Statement of Assets and Liabilities

| OCTOBER 31, 2010 |

| Assets |

| Investment securities, at value (cost of $2,100,831,995) | $2,876,288,603 |

| Receivable for investments sold | 80,975,297 |

| Receivable for capital shares sold | 28,071,039 |

| Dividends and interest receivable | 948,190 |

| | 2,986,283,129 |

| |

| Liabilities |

| Payable for investments purchased | 68,297,813 |

| Payable for capital shares redeemed | 2,487,783 |

| Unrealized loss on forward foreign currency exchange contracts | 300,264 |

| Accrued management fees | 2,348,577 |

| Distribution and service fees payable | 244,388 |

| | 73,678,825 |

| Net Assets | $2,912,604,304 |

| | |

| Net Assets Consist of: |

| Capital (par value and paid-in surplus) | $2,412,592,100 |

| Undistributed net investment income | 300,264 |

| Accumulated net realized loss | (275,444,448) |

| Net unrealized appreciation | 775,156,388 |

| | $2,912,604,304 |

| | | | |

| | Net assets | Shares outstanding | Net asset value per share |

| Investor Class, $0.01 Par Value | $1,886,728,985 | | 98,234,972 | | $19.21 | |

| Institutional Class, $0.01 Par Value | $115,261,180 | | 5,875,698 | | $19.62 | |

| A Class, $0.01 Par Value | $803,691,828 | | 42,972,259 | | $18.70* | |

| B Class, $0.01 Par Value | $3,997,087 | | 212,476 | | $18.81 | |

| C Class, $0.01 Par Value | $85,380,884 | | 4,865,749 | | $17.55 | |

| R Class, $0.01 Par Value | $17,544,340 | | 923,039 | | $19.01 | |

*Maximum offering price $19.84 (net asset value divided by 0.9425)

See Notes to Financial Statements.

| YEAR ENDED OCTOBER 31, 2010 |

| Investment Income (Loss) |

| Income: | |

| Dividends (net of foreign taxes withheld of $216,375) | $13,486,970 |

| Interest | 39,960 |

| | 13,526,930 |

| Expenses: | |

| Management fees | 23,980,129 |

| Distribution and service fees: | |

| A Class | 1,624,800 |

| B Class | 38,647 |

| C Class | 686,535 |

| R Class | 50,737 |

| Directors’ fees and expenses | 97,380 |

| Other expenses | 116,862 |

| | 26,595,090 |

| | |

| Net investment income (loss) | (13,068,160) |

| | |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on: | |

| Investment transactions | 210,300,299 |

| Foreign currency transactions | (1,047,545) |

| | 209,252,754 |

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | 502,492,777 |

| Translation of assets and liabilities in foreign currencies | (278,192) |

| | 502,214,585 |

| | |

| Net realized and unrealized gain (loss) | 711,467,339 |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $698,399,179 |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| YEARS ENDED OCTOBER 31, 2010 AND OCTOBER 31, 2009 |

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations |

| Net investment income (loss) | $(13,068,160) | $(4,438,326) |

| Net realized gain (loss) | 209,252,754 | (269,812,367) |

| Change in net unrealized appreciation (depreciation) | 502,214,585 | 446,528,478 |

| Net increase (decrease) in net assets resulting from operations | 698,399,179 | 172,277,785 |

| | | |

| Distributions to Shareholders |

| From net investment income: | | |

| Investor Class | — | (11,939,054) |

| Institutional Class | (45,786) | (936,743) |

| A Class | — | (2,902,861) |

| B Class | — | (2,133) |

| C Class | — | (43,759) |

| R Class | — | (4,033) |

| Decrease in net assets from distributions | (45,786) | (15,828,583) |

| | | |

| Capital Share Transactions |

| Net increase (decrease) in net assets from capital share transactions | 200,776,280 | 121,367,022 |

| | | |

| Net increase (decrease) in net assets | 899,129,673 | 277,816,224 |

| | | |

| Net Assets |

| Beginning of period | 2,013,474,631 | 1,735,658,407 |

| End of period | $2,912,604,304 | $2,013,474,631 |

| | | |

| Undistributed net investment income | $300,264 | $23,333 |

See Notes to Financial Statements.

Notes to Financial Statements

OCTOBER 31, 2010

1. Organization

American Century Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company and is organized as a Maryland corporation. Heritage Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth. The fund pursues its objective by investing in companies that are medium-sized and smaller at the time of purchase that management believes will increase in value over time. The fund is authorized to issue the Investor Class, the Institutional Class, the A Class, the B Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class, B Class and C Class may be subject to a contin gent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost. Forward foreign currency exchange contracts are valued at the mean of the latest bid and asked prices of the forward currency rates as provided by an independent pricing service.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2007. Additionally, non-U.S. tax returns filed by the fund due to investments in certain foreign securities remain subject to examination by the relevant taxing authority for 7 years from the date of the filing. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The annual management fee for each class is 1.000% for the Investor Class, A Class, B Class, C Class and R Class and 0.800% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the B Class and C Class will each pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended October 31, 2010, are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a mutual funds services agreement with J.P. Morgan Investor Services Co. (JPMIS). JPMorgan Chase Bank (JPMCB) is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended October 31, 2010, were $2,814,119,528 and $2,693,391,781, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | Year ended October 31, 2010 | Year ended October 31, 2009 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 400,000,000 | | 400,000,000 | |

| Sold | 24,446,309 | $416,217,265 | 21,287,744 | $269,895,757 |

| Issued in reinvestment of distributions | — | — | 1,038,518 | 11,506,781 |

| Redeemed | (19,973,254) | (330,354,418) | (24,501,467) | (300,017,434) |

| | 4,473,055 | 85,862,847 | (2,175,205) | (18,614,896) |

| Institutional Class/Shares Authorized | 40,000,000 | | 40,000,000 | |

| Sold | 1,592,345 | 27,658,160 | 1,465,590 | 18,547,939 |

| Issued in reinvestment of distributions | 2,804 | 45,786 | 83,029 | 936,563 |

| Redeemed | (2,044,059) | (34,815,396) | (1,699,463) | (20,369,382) |

| | (448,910) | (7,111,450) | (150,844) | (884,880) |

| A Class/Shares Authorized | 200,000,000 | | 200,000,000 | |

| Sold | 16,547,628 | 270,449,421 | 20,552,782 | 250,958,298 |

| Issued in reinvestment of distributions | — | — | 257,512 | 2,791,428 |

| Redeemed | (10,692,346) | (173,010,082) | (11,102,089) | (132,976,948) |

| | 5,855,282 | 97,439,339 | 9,708,205 | 120,772,778 |

| B Class/Shares Authorized | 35,000,000 | | 35,000,000 | |

| Sold | 17,058 | 265,517 | 139,787 | 1,746,511 |

| Issued in reinvestment of distributions | — | — | 178 | 1,969 |

| Redeemed | (46,411) | (756,266) | (34,173) | (415,624) |

| | (29,353) | (490,749) | 105,792 | 1,332,856 |

| C Class/Shares Authorized | 35,000,000 | | 35,000,000 | |

| Sold | 2,174,035 | 33,791,342 | 2,011,575 | 24,044,708 |

| Issued in reinvestment of distributions | — | — | 3,445 | 35,514 |

| Redeemed | (1,225,116) | (18,799,544) | (802,497) | (9,141,997) |

| | 948,919 | 14,991,798 | 1,212,523 | 14,938,225 |

| R Class/Shares Authorized | 30,000,000 | | 30,000,000 | |

| Sold | 873,774 | 14,881,532 | 385,148 | 5,060,155 |

| Issued in reinvestment of distributions | — | — | 364 | 4,030 |

| Redeemed | (286,027) | (4,797,037) | (88,131) | (1,241,246) |

| | 587,747 | 10,084,495 | 297,381 | 3,822,939 |

| Net increase (decrease) | 11,386,740 | $200,776,280 | 8,997,852 | $121,367,022 |

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| | | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Domestic Common Stocks | $2,512,676,187 | — | — |

| Foreign Common Stocks | 288,955,593 | $39,974,347 | — |

| Temporary Cash Investments | 82,476 | 34,600,000 | — |

| Total Value of Investment Securities | $2,801,714,256 | $74,574,347 | — |

| | | | |

| Other Financial Instruments |

Total Unrealized Gain (Loss) on Forward Foreign Currency Exchange Contracts | — | $(300,264) | — |

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund’s exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily using prevailing exchange rates. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The risk of loss from non-performance by the counterparty may be reduced by the use of master netting agreements. The fund participated in foreign currency risk derivative instruments during the period consistent with its exposure to foreign denominated securities. The foreign currency risk derivative instruments held at period end as disclosed on the Schedule of Investments are indicative of the fund’s typical volume.

The value of foreign currency risk derivative instruments as of October 31, 2010, is disclosed on the Statement of Assets and Liabilities as a liability of $300,264 in unrealized loss on forward foreign currency exchange contracts. For the year ended October 31, 2010, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(1,014,185) in net realized gain (loss) on foreign currency transactions and $(276,931) in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

8. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions. Investing in emerging markets may accentuate these risks.

9. Federal Tax Information

The tax character of distributions paid during the years ended October 31, 2010 and October 31, 2009 were as follows:

| | 2010 | 2009 |

| Distributions Paid From |

| Ordinary income | $45,786 | $15,828,583 |

| Long-term capital gains | — | — |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of October 31, 2010, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| Federal tax cost of investments | $2,102,020,154 |

| Gross tax appreciation of investments | $778,814,758 |

| Gross tax depreciation of investments | (4,546,309) |

| Net tax appreciation (depreciation) of investments | $774,268,449 |

Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | $44 |

| Net tax appreciation (depreciation) | $774,268,493 |

| Undistributed ordinary income | — |

| Accumulated capital losses | $(274,256,289) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales and the realization for tax purposes of unrealized gains (losses) on certain forward foreign currency exchange contracts.

The accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers expire in 2017.

10. Corporate Event

As part of a long-standing estate and business succession plan established by James E. Stowers, Jr., the founder of American Century Investments, ACC Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisor. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee was considered a change of control of ACC and therefore also a change of control of the fund’s advisor even though there has been no change to its management and none is anticipated. The change of control resulted in the assignment of the fund’s investment advisory agreement. As required by the 1940 Act, the assignment automatically terminated such agreem ent, making the approval of a new agreement necessary.

On February 18, 2010, the Board of Directors approved an interim investment advisory agreement under which the fund was managed until a new agreement was approved. The new agreement for the fund was approved by the Board of Directors on March 29, 2010, and by shareholders at a Special Meeting of Shareholders on June 16, 2010. It went into effect on July 16, 2010. The new agreement, which is substantially identical to the terminated agreement (with the exception of different effective and termination dates), did not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided.

11. Other Tax Information (Unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code.

The fund hereby designates up to the maximum amount allowable as qualified dividend income for the fiscal year ended October 31, 2010.

For corporate taxpayers, the fund hereby designates $45,786, or up to the maximum amount allowable, of ordinary income distributions paid during the fiscal year ended October 31, 2010 as qualified for the corporate dividends received deduction.

Heritage

| Investor Class |

| For a Share Outstanding Throughout the Years Ended October 31 |

| | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $14.32 | $13.15 | $22.83 | $15.58 | $13.48 |

| Income From Investment Operations | | | | | |

Net Investment Income (Loss)(1) | (0.07) | (0.02) | (0.09) | (0.10) | (0.03) |

| Net Realized and Unrealized Gain (Loss) | 4.96 | 1.32 | (8.53) | 8.42 | 2.22 |

| Total From Investment Operations | 4.89 | 1.30 | (8.62) | 8.32 | 2.19 |

| Distributions | | | | | |

| From Net Investment Income | — | (0.13) | — | — | — |

| From Net Realized Gains | — | — | (1.06) | (1.07) | (0.09) |

| Total Distributions | — | (0.13) | (1.06) | (1.07) | (0.09) |

| Net Asset Value, End of Period | $19.21 | $14.32 | $13.15 | $22.83 | $15.58 |

| | | | | | |

Total Return(2) | 34.15% | 10.16% | (39.54)% | 56.41% | 16.26% |

| | | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 1.01% | 1.01% | 1.00% | 1.00% | 1.00% |

Ratio of Net Investment Income (Loss) to Average Net Assets | (0.45)% | (0.19)% | (0.47)% | (0.56)% | (0.22)% |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128% | 230% |

| Net Assets, End of Period (in millions) | $1,887 | $1,342 | $1,262 | $2,478 | $1,037 |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Heritage

| Institutional Class |

| For a Share Outstanding Throughout the Years Ended October 31 |

| | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $14.60 | $13.41 | $23.21 | $15.80 | $13.63 |

| Income From Investment Operations | | | | | |

Net Investment Income (Loss)(1) | (0.04) | —(2) | (0.05) | (0.07) | —(2) |

| Net Realized and Unrealized Gain (Loss) | 5.07 | 1.34 | (8.69) | 8.55 | 2.26 |

| Total From Investment Operations | 5.03 | 1.34 | (8.74) | 8.48 | 2.26 |

| Distributions | | | | | |

| From Net Investment Income | (0.01) | (0.15) | — | — | — |

| From Net Realized Gains | — | — | (1.06) | (1.07) | (0.09) |

| Total Distributions | (0.01) | (0.15) | (1.06) | (1.07) | (0.09) |

| Net Asset Value, End of Period | $19.62 | $14.60 | $13.41 | $23.21 | $15.80 |

| | | | | | |

Total Return(3) | 34.44% | 10.33% | (39.41)% | 56.66% | 16.59% |

| | | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 0.81% | 0.81% | 0.80% | 0.80% | 0.80% |

Ratio of Net Investment Income (Loss) to Average Net Assets | (0.25)% | 0.01% | (0.27)% | (0.36)% | (0.02)% |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128% | 230% |

| Net Assets, End of Period (in thousands) | $115,261 | $92,343 | $86,835 | $155,885 | $57,039 |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Per-share amount was less than $0.005. |

| (3) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Heritage

A Class(1) |

| For a Share Outstanding Throughout the Years Ended October 31 |

| | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $13.98 | $12.84 | $22.37 | $15.32 | $13.29 |

| Income From Investment Operations | | | | | |

Net Investment Income (Loss)(2) | (0.11) | (0.06) | (0.13) | (0.15) | (0.08) |

| Net Realized and Unrealized Gain (Loss) | 4.83 | 1.30 | (8.34) | 8.27 | 2.20 |

| Total From Investment Operations | 4.72 | 1.24 | (8.47) | 8.12 | 2.12 |

| Distributions | | | | | |

| From Net Investment Income | — | (0.10) | — | — | — |

| From Net Realized Gains | — | — | (1.06) | (1.07) | (0.09) |

| Total Distributions | — | (0.10) | (1.06) | (1.07) | (0.09) |

| Net Asset Value, End of Period | $18.70 | $13.98 | $12.84 | $22.37 | $15.32 |

| | | | | | |

Total Return(3) | 33.76% | 9.89% | (39.69)% | 56.05% | 15.96% |

| | | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 1.26% | 1.26% | 1.25% | 1.25% | 1.25% |

Ratio of Net Investment Income (Loss) to Average Net Assets | (0.70)% | (0.44)% | (0.72)% | (0.81)% | (0.47)% |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128% | 230% |

| Net Assets, End of Period (in thousands) | $803,692 | $518,768 | $351,962 | $291,674 | $57,995 |

| (1) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Heritage

| B Class |

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) |

| | 2010 | 2009 | 2008 | 2007(1) |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $14.16 | $13.01 | $22.82 | $21.52 |

| Income From Investment Operations | | | | |

Net Investment Income (Loss)(2) | (0.24) | (0.16) | (0.26) | (0.03) |

| Net Realized and Unrealized Gain (Loss) | 4.89 | 1.33 | (8.49) | 1.33 |

| Total From Investment Operations | 4.65 | 1.17 | (8.75) | 1.30 |

| Distributions | | | | |

| From Net Investment Income | — | (0.02) | — | — |

| From Net Realized Gains | — | — | (1.06) | — |

| Total Distributions | — | (0.02) | (1.06) | — |

| Net Asset Value, End of Period | $18.81 | $14.16 | $13.01 | $22.82 |

| | | | | |

Total Return(3) | 32.84% | 8.99% | (40.16)% | 6.04% |

| | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 2.01% | 2.01% | 2.00% | 2.00%(4) |

Ratio of Net Investment Income (Loss) to Average Net Assets | (1.45)% | (1.19)% | (1.47)% | (1.81)%(4) |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128%(5) |

| Net Assets, End of Period (in thousands) | $3,997 | $3,425 | $1,770 | $83 |

| (1) | September 28, 2007 (commencement of sale) through October 31, 2007. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2007. |

See Notes to Financial Statements.

Heritage

| C Class |

| For a Share Outstanding Throughout the Years Ended October 31 |

| | 2010 | 2009 | 2008 | 2007 | 2006 |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $13.21 | $12.13 | $21.35 | $14.77 | $12.91 |

| Income From Investment Operations | | | | | |

Net Investment Income (Loss)(1) | (0.22) | (0.14) | (0.26) | (0.29) | (0.18) |

| Net Realized and Unrealized Gain (Loss) | 4.56 | 1.24 | (7.90) | 7.94 | 2.13 |

| Total From Investment Operations | 4.34 | 1.10 | (8.16) | 7.65 | 1.95 |

| Distributions | | | | | |

| From Net Investment Income | — | (0.02) | — | — | — |

| From Net Realized Gains | — | — | (1.06) | (1.07) | (0.09) |

| Total Distributions | — | (0.02) | (1.06) | (1.07) | (0.09) |

| Net Asset Value, End of Period | $17.55 | $13.21 | $12.13 | $21.35 | $14.77 |

| | | | | | |

Total Return(2) | 32.85% | 9.07% | (40.16)% | 54.88% | 15.11% |

| | | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 2.01% | 2.01% | 2.00% | 2.00% | 2.00% |

Ratio of Net Investment Income (Loss) to Average Net Assets | (1.45)% | (1.19)% | (1.47)% | (1.56)% | (1.22)% |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128% | 230% |

| Net Assets, End of Period (in thousands) | $85,381 | $51,745 | $32,812 | $21,692 | $2,334 |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Heritage

| R Class |

| For a Share Outstanding Throughout the Years Ended October 31 (except as noted) |

| | 2010 | 2009 | 2008 | 2007(1) |

| Per-Share Data |

| Net Asset Value, Beginning of Period | $14.24 | $13.08 | $22.83 | $21.52 |

| Income From Investment Operations | | | | |

Net Investment Income (Loss)(2) | (0.16) | (0.11) | (0.17) | (0.02) |

| Net Realized and Unrealized Gain (Loss) | 4.93 | 1.34 | (8.52) | 1.33 |

| Total From Investment Operations | 4.77 | 1.23 | (8.69) | 1.31 |

| Distributions | | | | |

| From Net Investment Income | — | (0.07) | — | — |

| From Net Realized Gains | — | — | (1.06) | — |

| Total Distributions | — | (0.07) | (1.06) | — |

| Net Asset Value, End of Period | $19.01 | $14.24 | $13.08 | $22.83 |

| | | | | |

Total Return(3) | 33.50% | 9.58% | (39.86)% | 6.09% |

| | | | | |

| Ratios/Supplemental Data |

Ratio of Operating Expenses to Average Net Assets | 1.51% | 1.51% | 1.50% | 1.50%(4) |

Ratio of Net Investment Income (Loss) to Average Net Assets | (0.95)% | (0.69)% | (0.97)% | (1.22)%(4) |

| Portfolio Turnover Rate | 114% | 155% | 172% | 128%(5) |

| Net Assets, End of Period (in thousands) | $17,544 | $4,775 | $496 | $27 |

| (1) | September 28, 2007 (commencement of sale) through October 31, 2007. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2007. |

See Notes to Financial Statements.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders,

American Century Mutual Funds, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Heritage Fund, one of the funds constituting American Century Mutual Funds, Inc. (the “Corporation”), as of October 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Corporation is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a te st basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2010, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Heritage Fund of American Century Mutual Funds, Inc., as of October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri

December 20, 2010

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Mutual Funds, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Mutual Funds, Inc.):

| | | | | |

| | John R. Whitten | For: | 13,907,426,552 | |

| | | Withhold: | 629,801,798 | |

| | | Abstain: | 0 | |

| | | Broker Non-Vote: | 0 | |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, and M. Jeannine Strandjord.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| | | | | |

| | Investor, A, B, C and R Classes | | | |

| | | For: | 1,213,738,072 | |

| | | Against: | 21,233,769 | |

| | | Abstain: | 56,109,237 | |

| | | Broker Non-Vote: | 384,641,177 | |

| | | | | |

| | Institutional Class | | | |

| | | For: | 77,278,883 | |

| | | Against: | 27,552 | |

| | | Abstain: | 100,016 | |

| | | Broker Non-Vote: | 1,282,102 | |

Proposal 3: