UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-00816 | |||||

| AMERICAN CENTURY MUTUAL FUNDS, INC. | ||||||

| (Exact name of registrant as specified in charter) | ||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||

| Date of fiscal year end: | 10-31 | |||||

| Date of reporting period: | 10-31-2010 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

| Annual Report |

| October 31, 2010 |

American Century Investments®

Capital Value Fund

Table of Contents

| President’s Letter | 2 | |

| Independent Chairman’s Letter | 3 | |

| Market Perspective | 4 | |

| U.S. Stock Index Returns | 4 | |

| Capital Value | ||

| Performance | 5 | |

| Portfolio Commentary | 7 | |

| Top Ten Holdings | 9 | |

| Top Five Industries | 9 | |

| Types of Investments in Portfolio | 9 | |

| Shareholder Fee Example | 10 | |

| Financial Statements | ||

| Schedule of Investments | 12 | |

| Statement of Assets and Liabilities | 15 | |

| Statement of Operations | 16 | |

| Statement of Changes in Net Assets | 17 | |

| Notes to Financial Statements | 18 | |

| Financial Highlights | 24 | |

| Report of Independent Registered Public Accounting Firm | 27 | |

| Other Information | ||

| Proxy Voting Results | 28 | |

| Management | 29 | |

| Additional Information | 33 | |

| Index Definitions | 34 | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

President’s Letter

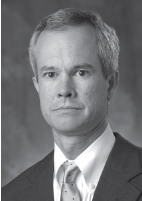

Jonathan Thomas

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended October 31, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

Independent Chairman’s Letter

Don Pratt

Dear Fellow Shareholders,

As regulators and the markets continue to sort out the events of the credit crisis, a consistent theme has been that financial services firms should re-examine their risk management practices. Risk management has been a regular part of American Century Investments’ activities for many years. However, recently American Century and your mutual fund board have been spending additional time focusing on our risk oversight processes.

The board’s efforts are now organized around three categories of risk: investment risk, operational risk, and enterprise risk. This approach has facilitated a realignment of many risk oversight tasks that the board has historically conducted. Investment risk tasks include a review of portfolio risk, monitoring the use of derivatives, and performance assessment. Operational risk focuses on compliance, valuation, shareholder services, and trading activities. Enterprise risk addresses the financial condition of the advisor, human resource development, and reputational risks. Risk oversight tasks are addressed in every quarterly board meeting, and a review of the advisor’s entire risk management program is undertaken annually. We acknowledge and support the approach that American Century Investments takes to its risk management responsibilities. While the board has refocused its efforts in this important oversight area, we recognize that risk oversight is a journey and we expect to continue to improve our processes.

Our September quarterly board meeting was held in the New York offices of American Century Investments. This gave the directors an opportunity to meet with the portfolio management teams for each of the global and international funds overseen by the board. Each team uses sophisticated investment tools and daily risk analysis in managing client assets. We also were impressed with the “bench strength” that has been developed under the leadership of the Global and Non-U.S. Equity CIO Mark Kopinski. These face-to-face meetings provide an opportunity for the directors—working on behalf of shareholders—to validate the advisor’s efforts and the investment management approach being followed.

I thank you for your continued confidence in American Century during this turbulent time in the economy and investment markets. If you have thoughts or questions you would like to share with the board send them to me at dhpratt@fundboardchair.com.

Best regards,

Don Pratt

3

Market Perspective

By Phil Davidson, Chief Investment Officer, U.S. Value Equity

Slow Economy Didn’t Slow Down Stocks

Despite decelerating economic growth, high unemployment, mounting regulatory and political concerns, sovereign debt problems in Europe, and periods of strong market volatility, stocks advanced sharply during the 12-month period ended October 31, 2010. Better-than-expected corporate earnings, driven primarily by cost cutting, combined with improving balance sheets and attractive earnings yields helped fuel the gains. Furthermore, late in the period, indications the Federal Reserve (the Fed) would launch another round of quantitative easing (dubbed QE2) with the purchase of $600 billion in Treasury bonds to help keep the economy afloat eased investors’ fears about a potential “double-dip” recession.

All major stock benchmarks showed strong returns during the period, with small-cap growth stocks leading the charge, as investors positioned their portfolios for an improving economy. Across the capitalization spectrum, growth stocks outperformed their value counterparts, primarily due to stellar performance from the consumer discretionary, industrials, and materials sectors. The still-struggling financials sector, which represents a large weighting in most value indices, was the poorest-performing segment of the stock market.

Companies Boosted Dividend Payments

During the one-year period, a growing number of U.S. public companies increased their dividends, as corporations put their combined record level of cash to use. Investors are demanding dividends for more than just a guaranteed portion of total return. Besides being a good indication that a business is correctly financed, dividends act as a governor on how management chooses to allocate free cash flow.

The recent trend of rising dividend payouts has helped support market valuations. In addition, an increase in mergers and acquisitions activity also indicates valuations are reasonable and balance sheets remain healthy.

Given the experience of investors throughout the past few years, dividends are even more important as a means of demonstrating the companies in which they invest really do have strong and sustainable positions. As value investors, we believe the current environment presents an attractive set of opportunities to identify, research, and select companies likely to outperform in today’s uncertain macroeconomic environment.

| U.S. Stock Index Returns | ||||

| For the 12 months ended October 31, 2010 | ||||

| Russell 1000 Index (Large-Cap) | 17.67% | Russell 2000 Index (Small-Cap) | 26.58% | |

| Russell 1000 Value Index | 15.71% | Russell 2000 Value Index | 24.43% | |

| Russell 1000 Growth Index | 19.65% | Russell 2000 Growth Index | 28.67% | |

| Russell Midcap Index | 27.71% | |||

| Russell Midcap Value Index | 27.49% | |||

| Russell Midcap Growth Index | 28.03% | |||

4

Performance

Capital Value

| Total Returns as of October 31, 2010 | ||||||

| Average Annual Returns | ||||||

Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date | |

Investor Class Return After-Tax on Distributions(1) Return After-Tax on Distributions and Sale of Shares(1) | ACTIX | 9.69%(2) 9.39% 6.68% | -1.07% -1.55% -0.86% | 2.72% 2.28% 2.26% | 3.27% 2.86% 2.75% | 3/31/99 |

Russell 1000 Value Index | — | 15.71% | 0.62% | 2.64% | 3.29% | — |

Institutional Class Return After-Tax on Distributions(1) Return After-Tax on Distributions and Sale of Shares(1) | ACPIX | 10.11%(2) 9.77% 6.99% | -0.86% -1.38% -0.69% | — — — | 2.27% 1.85% 1.93% | 3/1/02 |

A Class(3) No Sales Charge* With Sales Charge* Return After-Tax on Distributions(1) Return After-Tax on Distributions and Sale of Shares(1) | ACCVX | 9.64%(2) 3.39%(2) 3.15%(2) 2.52%(2) | -1.32% -2.49% -2.94% -2.06% | — — — — | 3.67% 2.84% 2.49% 2.47% | 5/14/03 |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| (1) | After-tax returns are calculated with sales charge, as applicable, using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

| (2) | Returns would have been lower if a portion of the management fee had not been waived. |

| (3) | Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

5

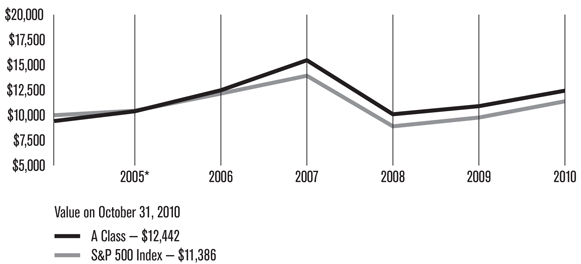

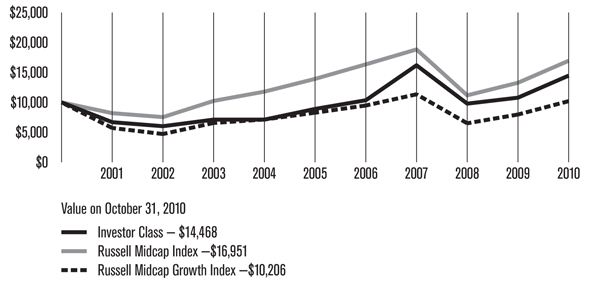

Capital Value

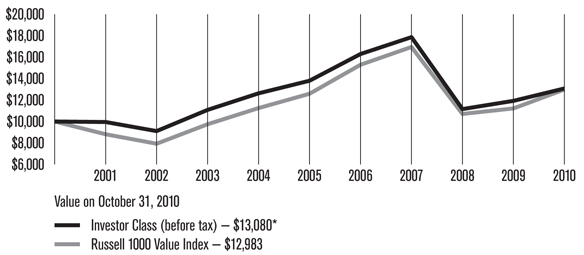

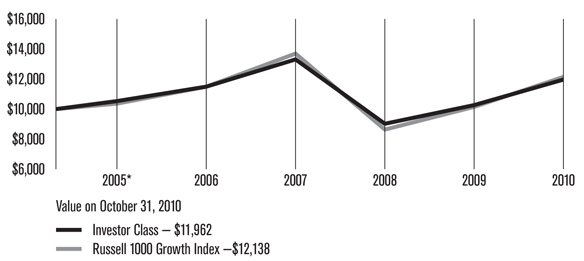

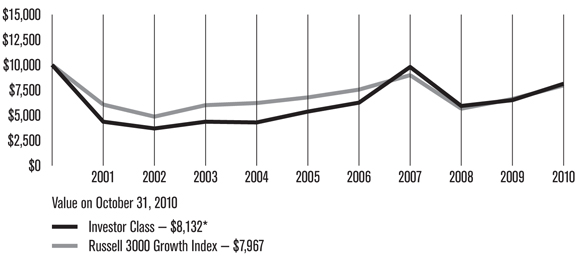

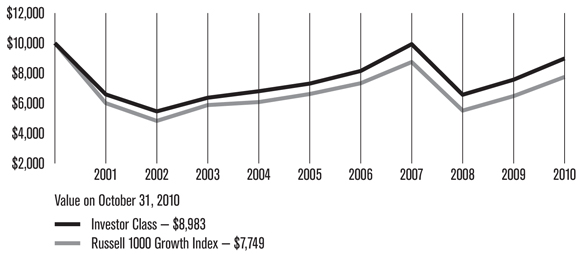

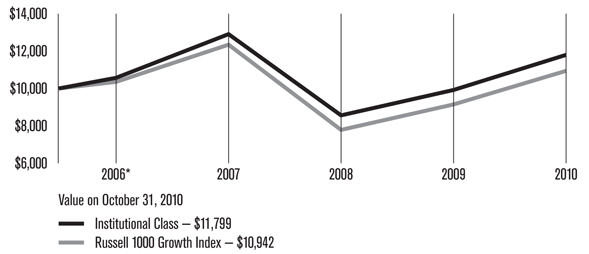

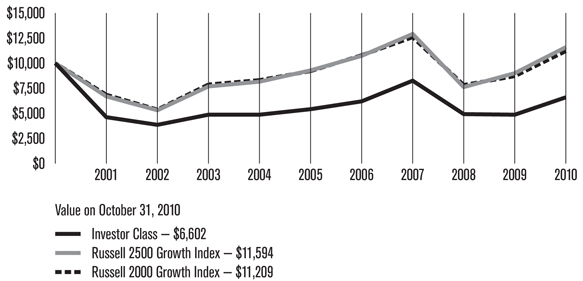

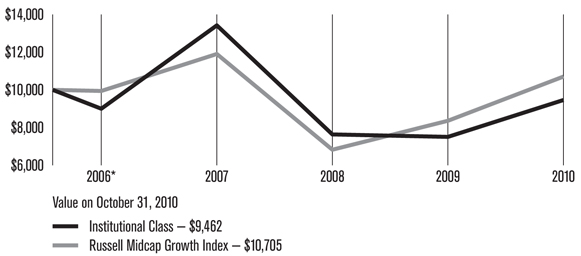

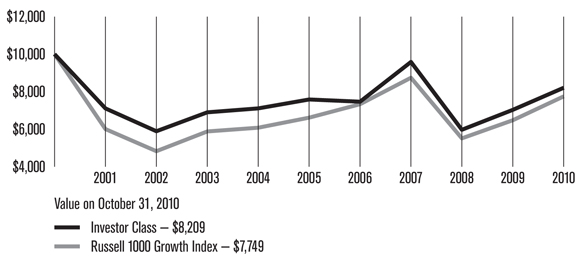

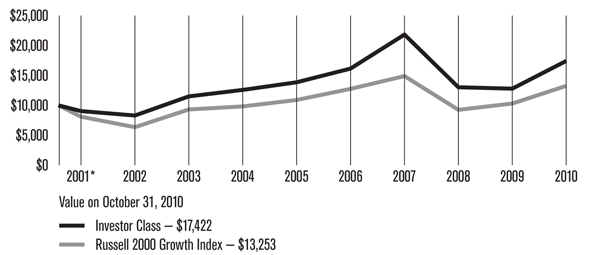

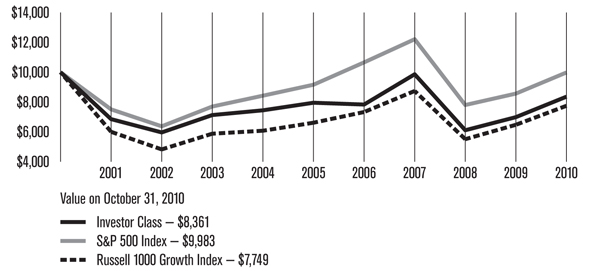

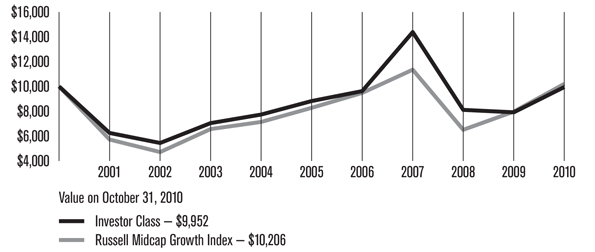

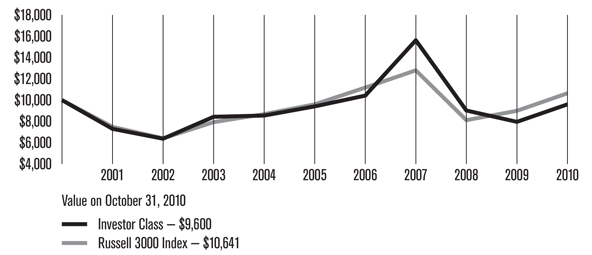

| Growth of $10,000 Over 10 Years |

| $10,000 investment made October 31, 2000 |

*Ending value would have been lower if a portion of the management fee had not been waived.

| Total Annual Fund Operating Expenses | ||

| Investor Class | Institutional Class | A Class |

| 1.10% | 0.90% | 1.35% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

6

Portfolio Commentary

Capital Value

Portfolio Managers: Chuck Ritter, Brendan Healy and Matt Titus

Performance Summary

Capital Value returned 9.69%(1) for the 12 months ended October 31, 2010. By comparison, its benchmark, the Russell 1000 Value Index, returned 15.71%, while the broader market, as measured by the S&P 500 Index, returned 16.52%.(2) The portfolio’s return reflects operating expenses, while the indices’ returns do not. The average return for Morningstar’s Large Cap Value category (its performance, like Capital Value’s, reflects operating expenses) was 13.93%.(3)

Stock prices posted solid gains during the one-year period (as described in the Market Perspective on page 4) despite persistent economic weakness and significant market volatility. Although the economy expanded in response to government stimulus spending, growth slowed during the spring, raising concern about the sustainability of the recovery. Corporate earnings remained solid but the low rate of economic growth failed to jumpstart hiring. Consumers modestly increased their spending, and inflation was benign. In this environment, investors favored higher-risk stocks as fears of a double-dip recession eased and higher-yielding securities because of very low interest rates. The large, more stable businesses favored by Capital Value tended to lag the rally. Nevertheless, the portfolio received positive results in absolute terms from all 10 of the sectors in which it was invested. On a relative basis, positions in the industrials, health care, utilities, and consumer discretionary sectors detracted. Security selection across a range of sectors contributed.

Industrials Slowed Results

Many industrials stocks outperformed during the reporting period as economic conditions improved. The portfolio was hindered by its lack of exposure to road and rail stocks, which were up more than 56% in the benchmark. However, the machinery industry supplied notable contributor Dover Corp. The equipment manufacturer’s first-quarter profits doubled, driven by higher sales and acquisition gains.

Health Care Detracted

Security selection within the health care sector detracted. Capital Value did not own UnitedHealth Group. The health care provider reported higher-than-expected profits driven by gains in the public sector and senior markets. In pharmaceuticals, an overweight in Abbott Laboratories dampened performance. Earlier in the reporting period, Abbott reported a deceleration in prescription growth for Humira, its blockbuster drug for the treatment of rheumatoid arthritis. Although sales of Humira eventually rebounded strongly, the drugmaker’s shares underperformed other

pharmaceutical names.

| (1) | All fund returns referenced in this commentary are for Investor Class shares. |

| (2) | The S&P 500 Index average annual returns were 1.73% and -0.02% for the five- and 10-year periods ended October 31, 2010, respectively. |

| (3) | The average returns for Morningstar’s Large Cap Value category were 0.78% and 2.53% on an average annualized basis for the five- and 10-year periods ended October 31, 2010, respectively. © 2010 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

7

Capital Value

Utilities Hampered Progress

The portfolio’s underweight position in the utilities sector slowed relative progress. Although we continue to believe that many of these stocks are overvalued, this stance dampened performance during the reporting period when regulated utilities outperformed in the benchmark. The portfolio was also hampered by holdings in Exelon and PPL Corp., which have large unregulated businesses. Shares of Exelon, the nation’s largest nuclear power generator, declined after the company announced a drop in earnings as the slack economy took a toll on its merchant power business. PPL declined on news it would spend $7 billion to acquire the U.S. business of German energy corporation E.ON.

Consumer Discretionary Detracted

The benchmark’s top-performing sector was a source of relative weakness. Many consumer discretionary stocks, which had experienced steep declines during the recession, rallied on optimism about economic growth and improving consumer sentiment. The portfolio’s relative underperformance was largely a result of what it didn’t own rather than what it did. Capital Value had no exposure to automobiles stocks, including Ford Motor which was up significantly in the benchmark. The car maker, which has been able to restructure its business without the help of the U.S. government, continued to gain market share and reported solid profits.

On the positive side, the portfolio benefited from a position in CBS Corp. Shares of the television network rose on news of the record-breaking audiences for its sports programming, including the Masters golf tournament and the NCAA Men’s Division I Basketball Championship (March Madness).

Consumer Staples Provided Top Contributor

The consumer staples sector provided the portfolio’s top contributor, Altria Group. The tobacco company’s stock price rose on news of a substantial increase in earnings on the back of market share gains, cost cutting, and higher sales in its smokeless tobacco business.

Outlook

We continue to be bottom-up investment managers, evaluating each company individually and building our portfolio one stock at a time. Capital Value is broadly diversified, with ongoing overweight positions in the information technology, energy, health care, and consumer staples sectors. Our valuation work is also directing us toward smaller relative weightings in financials and utilities stocks. In addition, we are still finding value opportunities among mega-cap stocks and have maintained our bias toward them.

Senior Portfolio Manager Chuck Ritter, who plans to retire from American Century Investments on December 31, 2010, stepped away from the day-to-day management of Capital Value on November 30th after the end of the reporting period. Portfolio Manager Brendan Healy continues to co-manage Capital Value. On October 1st, Portfolio Manager Matt Titus joined Mr. Healy as co-portfolio manager. Mr. Titus was previously a senior investment analyst for the Large Cap Value portfolios, which includes Capital Value.

8

Capital Value

| Top Ten Holdings | |

% of net assets as of 10/31/10 | |

| Pfizer, Inc. | 3.6% |

| AT&T, Inc. | 3.6% |

| Chevron Corp. | 3.4% |

| JPMorgan Chase & Co. | 3.4% |

| Johnson & Johnson | 3.2% |

| General Electric Co. | 3.1% |

| Merck & Co., Inc. | 2.6% |

| Wells Fargo & Co. | 2.5% |

| Bank of America Corp. | 2.4% |

| Exxon Mobil Corp. | 2.2% |

| Top Five Industries | |

% of net assets as of 10/31/10 | |

| Oil, Gas & Consumable Fuels | 10.7% |

| Pharmaceuticals | 10.7% |

| Insurance | 7.5% |

| Diversified Financial Services | 7.2% |

| Diversified Telecommunication Services | 6.3% |

| Types of Investments in Portfolio | |

% of net assets as of 10/31/10 | |

| Common Stocks | 99.4% |

| Temporary Cash Investments | 0.4% |

| Other Assets and Liabilities | 0.2% |

9

Shareholder Fee Example (Unaudited)

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2010 to October 31, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) regis tered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

10

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning Account Value 5/1/10 | Ending Account Value 10/31/10 | Expenses Paid During Period(1) 5/1/10 – 10/31/10 | Annualized Expense Ratio(1) | |

| Actual | ||||

| Investor Class (after waiver) | $1,000 | $981.20 | $5.29 | 1.06% |

| Investor Class (before waiver) | $1,000 | $981.20(2) | $5.54 | 1.11% |

| Institutional Class (after waiver) | $1,000 | $982.90 | $4.30 | 0.86% |

| Institutional Class (before waiver) | $1,000 | $982.90(2) | $4.55 | 0.91% |

| A Class (after waiver) | $1,000 | $979.50 | $6.54 | 1.31% |

| A Class (before waiver) | $1,000 | $979.50(2) | $6.79 | 1.36% |

| Hypothetical | ||||

| Investor Class (after waiver) | $1,000 | $1,019.86 | $5.40 | 1.06% |

| Investor Class (before waiver) | $1,000 | $1,019.61 | $5.65 | 1.11% |

| Institutional Class (after waiver) | $1,000 | $1,020.87 | $4.38 | 0.86% |

| Institutional Class (before waiver) | $1,000 | $1,020.62 | $4.63 | 0.91% |

| A Class (after waiver) | $1,000 | $1,018.60 | $6.67 | 1.31% |

| A Class (before waiver) | $1,000 | $1,018.35 | $6.92 | 1.36% |

| (1) | Expenses are equal to class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

| (2) | Ending account value assumes the return earned after waiver and would have been lower if a portion of the management fee had not been waived. |

11

Schedule of Investments

Capital Value

OCTOBER 31, 2010

| Shares | Value | |

| Common Stocks — 99.4% | ||

| AEROSPACE & DEFENSE — 2.2% | ||

| Honeywell International, Inc. | 11,000 | $ 518,210 |

| Lockheed Martin Corp. | 13,500 | 962,415 |

| Northrop Grumman Corp. | 27,300 | 1,725,633 |

| 3,206,258 | ||

| BEVERAGES — 1.3% | ||

| Coca-Cola Co. (The) | 30,900 | 1,894,788 |

| BIOTECHNOLOGY — 2.2% | ||

Amgen, Inc.(1) | 39,700 | 2,270,443 |

Gilead Sciences, Inc.(1) | 22,500 | 892,575 |

| 3,163,018 | ||

| CAPITAL MARKETS — 4.0% | ||

| Ameriprise Financial, Inc. | 21,100 | 1,090,659 |

| Bank of New York Mellon Corp. (The) | 45,600 | 1,142,736 |

| Goldman Sachs Group, Inc. (The) | 15,800 | 2,543,010 |

| Morgan Stanley | 42,100 | 1,047,027 |

| 5,823,432 | ||

| CHEMICALS — 0.7% | ||

| E.I. du Pont de Nemours & Co. | 21,000 | 992,880 |

| COMMERCIAL BANKS — 4.7% | ||

| PNC Financial Services Group, Inc. | 24,000 | 1,293,600 |

| U.S. Bancorp. | 82,000 | 1,982,760 |

| Wells Fargo & Co. | 137,100 | 3,575,568 |

| 6,851,928 | ||

| COMMERCIAL SERVICES & SUPPLIES — 0.6% | ||

| Avery Dennison Corp. | 22,000 | 799,700 |

| COMMUNICATIONS EQUIPMENT — 0.8% | ||

Cisco Systems, Inc.(1) | 50,400 | 1,150,632 |

| COMPUTERS & PERIPHERALS — 1.5% | ||

| Hewlett-Packard Co. | 34,500 | 1,451,070 |

Western Digital Corp.(1) | 23,500 | 752,470 |

| 2,203,540 | ||

| CONSTRUCTION & ENGINEERING — 0.3% | ||

Shaw Group, Inc. (The)(1) | 12,900 | 394,224 |

| DIVERSIFIED FINANCIAL SERVICES — 7.2% | ||

| Bank of America Corp. | 302,900 | 3,465,176 |

Citigroup, Inc.(1) | 514,100 | 2,143,797 |

| JPMorgan Chase & Co. | 130,500 | 4,910,715 |

| 10,519,688 | ||

| DIVERSIFIED TELECOMMUNICATION SERVICES — 6.3% | ||

| AT&T, Inc. | 184,100 | 5,246,850 |

| CenturyLink, Inc. | 17,200 | 711,736 |

| Verizon Communications, Inc. | 96,000 | 3,117,120 |

| 9,075,706 | ||

| ELECTRIC UTILITIES — 2.7% | ||

| American Electric Power Co., Inc. | 24,200 | 906,048 |

| Exelon Corp. | 40,700 | 1,661,374 |

| PPL Corp. | 48,400 | 1,301,960 |

| 3,869,382 | ||

| ENERGY EQUIPMENT & SERVICES — 2.4% | ||

| Baker Hughes, Inc. | 24,400 | 1,130,452 |

| National Oilwell Varco, Inc. | 29,000 | 1,559,040 |

Transocean Ltd.(1) | 12,300 | 779,328 |

| 3,468,820 | ||

| FOOD & STAPLES RETAILING — 4.0% | ||

| Kroger Co. (The) | 59,700 | 1,313,400 |

| SYSCO Corp. | 30,400 | 895,584 |

| Walgreen Co. | 35,100 | 1,189,188 |

| Wal-Mart Stores, Inc. | 45,800 | 2,480,986 |

| 5,879,158 | ||

| FOOD PRODUCTS — 1.8% | ||

| Archer-Daniels-Midland Co. | 11,100 | 369,852 |

| Kraft Foods, Inc., Class A | 47,900 | 1,545,733 |

| Unilever NV New York Shares | 25,000 | 742,250 |

| 2,657,835 | ||

| HEALTH CARE EQUIPMENT & SUPPLIES — 0.6% | ||

| Medtronic, Inc. | 23,300 | 820,393 |

| HEALTH CARE PROVIDERS & SERVICES — 1.3% | ||

| Aetna, Inc. | 23,200 | 692,752 |

| Quest Diagnostics, Inc. | 8,100 | 398,034 |

WellPoint, Inc.(1) | 15,500 | 842,270 |

| 1,933,056 | ||

| HOTELS, RESTAURANTS & LEISURE — 0.6% | ||

| Darden Restaurants, Inc. | 9,000 | 411,390 |

| Starbucks Corp. | 15,400 | 438,592 |

| 849,982 | ||

| HOUSEHOLD PRODUCTS — 3.1% | ||

| Clorox Co. | 17,200 | 1,144,660 |

Energizer Holdings, Inc.(1) | 5,300 | 396,334 |

| Procter & Gamble Co. (The) | 46,200 | 2,936,934 |

| 4,477,928 | ||

Capital Value

| Shares | Value |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 0.2% | ||

NRG Energy, Inc.(1) | 18,100 | $ 360,371 |

| INDUSTRIAL CONGLOMERATES — 3.7% | ||

| General Electric Co. | 281,100 | 4,503,222 |

| Tyco International Ltd. | 22,000 | 842,160 |

| 5,345,382 | ||

| INSURANCE — 7.5% | ||

| Allstate Corp. (The) | 52,700 | 1,606,823 |

Berkshire Hathaway, Inc., Class B(1) | 18,100 | 1,440,036 |

| Chubb Corp. (The) | 30,100 | 1,746,402 |

| Loews Corp. | 43,800 | 1,729,224 |

| Principal Financial Group, Inc. | 30,300 | 813,252 |

| Torchmark Corp. | 17,800 | 1,019,584 |

| Travelers Cos., Inc. (The) | 36,300 | 2,003,760 |

| XL Group plc | 26,200 | 554,130 |

| 10,913,211 | ||

| IT SERVICES — 1.8% | ||

Fiserv, Inc.(1) | 12,200 | 665,144 |

| International Business Machines Corp. | 13,100 | 1,881,160 |

| 2,546,304 | ||

| MACHINERY — 1.5% | ||

| Dover Corp. | 13,400 | 711,540 |

| Ingersoll-Rand plc | 35,500 | 1,395,505 |

| 2,107,045 | ||

| MEDIA — 5.0% | ||

| CBS Corp., Class B | 68,400 | 1,158,012 |

| Comcast Corp., Class A | 101,100 | 2,080,638 |

| Time Warner Cable, Inc. | 11,900 | 688,653 |

| Time Warner, Inc. | 56,300 | 1,830,313 |

| Viacom, Inc., Class B | 37,900 | 1,462,561 |

| 7,220,177 | ||

| METALS & MINING — 0.8% | ||

| Freeport-McMoRan Copper & Gold, Inc. | 4,200 | 397,656 |

| Nucor Corp. | 20,600 | 787,332 |

| 1,184,988 | ||

| MULTILINE RETAIL — 1.2% | ||

Kohl’s Corp.(1) | 14,800 | 757,760 |

| Macy’s, Inc. | 43,800 | 1,035,432 |

| 1,793,192 | ||

| MULTI-UTILITIES — 0.7% | ||

| PG&E Corp. | 22,600 | 1,080,732 |

| OIL, GAS & CONSUMABLE FUELS — 10.7% | ||

| Apache Corp. | 22,900 | 2,313,358 |

| Chevron Corp. | 59,600 | 4,923,556 |

| ConocoPhillips | 42,600 | 2,530,440 |

| Devon Energy Corp. | 12,400 | 806,248 |

| Exxon Mobil Corp. | 47,100 | 3,130,737 |

| Occidental Petroleum Corp. | 13,700 | 1,077,231 |

| Valero Energy Corp. | 44,800 | 804,160 |

| 15,585,730 | ||

| PAPER & FOREST PRODUCTS — 0.5% | ||

| International Paper Co. | 27,400 | 692,672 |

| PHARMACEUTICALS — 10.7% | ||

| Abbott Laboratories | 26,300 | 1,349,716 |

| Eli Lilly & Co. | 14,300 | 503,360 |

| Johnson & Johnson | 73,200 | 4,660,644 |

| Merck & Co., Inc. | 103,900 | 3,769,492 |

| Pfizer, Inc. | 303,100 | 5,273,940 |

| 15,557,152 | ||

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 1.1% | ||

| Applied Materials, Inc. | 45,200 | 558,672 |

| Intel Corp. | 49,600 | 995,472 |

| 1,554,144 | ||

| SOFTWARE — 3.3% | ||

| Activision Blizzard, Inc. | 43,700 | 501,239 |

| Microsoft Corp. | 111,900 | 2,981,016 |

| Oracle Corp. | 43,900 | 1,290,660 |

| 4,772,915 | ||

| SPECIALTY RETAIL — 0.4% | ||

| Best Buy Co., Inc. | 15,200 | 653,296 |

| TEXTILES, APPAREL & LUXURY GOODS — 0.6% | ||

| VF Corp. | 10,400 | 865,696 |

| TOBACCO — 1.4% | ||

| Altria Group, Inc. | 63,500 | 1,614,170 |

| Lorillard, Inc. | 5,100 | 435,234 |

| 2,049,404 | ||

TOTAL COMMON STOCKS (Cost $119,963,461) | 144,314,759 | |

Capital Value

| Shares | Value |

| Temporary Cash Investments — 0.4% | ||

| JPMorgan U.S. Treasury Plus Money Market Fund Agency Shares | 85,857 | $ 85,857 |

Repurchase Agreement, Bank of America Securities, LLC, (collateralized by various U.S. Treasury obligations, 1.375%, 5/15/12, valued at $510,199), in a joint trading account at 0.18%, dated 10/29/10, due 11/1/10 (Delivery value $500,008) | 500,000 | |

TOTAL TEMPORARY CASH INVESTMENTS (Cost $585,857) | 585,857 | |

TOTAL INVESTMENT SECURITIES — 99.8% (Cost $120,549,318) | 144,900,616 | |

| OTHER ASSETS AND LIABILITIES — 0.2% | 246,757 | |

| TOTAL NET ASSETS — 100.0% | $145,147,373 | |

Notes to Schedule of Investments

| (1) | Non-income producing. |

See Notes to Financial Statements.

12

Statement of Assets and Liabilities

| OCTOBER 31, 2010 | |

| Assets | |

| Investment securities, at value (cost of $120,549,318) | $144,900,616 |

| Cash | 6,660 |

| Receivable for investments sold | 303,913 |

| Receivable for capital shares sold | 14,149 |

| Dividends and interest receivable | 231,415 |

| 145,456,753 | |

| Liabilities | |

| Payable for investments purchased | 150,929 |

| Payable for capital shares redeemed | 33,657 |

| Accrued management fees | 123,917 |

| Distribution and service fees payable | 877 |

| 309,380 | |

| Net Assets | $145,147,373 |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $151,162,411 |

| Undistributed net investment income | 1,897,090 |

| Accumulated net realized loss | (32,263,426) |

| Net unrealized appreciation | 24,351,298 |

| $145,147,373 | |

| Net assets | Shares outstanding | Net asset value per share | ||||

| Investor Class, $0.01 Par Value | $137,036,628 | 23,922,318 | $5.73 | |||

| Institutional Class, $0.01 Par Value | $3,980,290 | 693,902 | $5.74 | |||

| A Class, $0.01 Par Value | $4,130,455 | 722,674 | $5.72* | |||

* Maximum offering price $6.07 (net asset value divided by 0.9425)

See Notes to Financial Statements.

13

Statement of Operations

| YEAR ENDED OCTOBER 31, 2010 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $693) | $ 4,341,753 |

| Interest | 822 |

| 4,342,575 | |

| Expenses: | |

| Management fees | 1,790,529 |

| Distribution and service fees — A Class | 11,076 |

| Directors’ fees and expenses | 5,172 |

| Other expenses | 13,698 |

| 1,820,475 | |

| Fees waived | (37,290) |

| 1,783,185 | |

| Net investment income (loss) | 2,559,390 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment transactions | 1,237,403 |

| Change in net unrealized appreciation (depreciation) on investments | 11,294,260 |

| Net realized and unrealized gain (loss) | 12,531,663 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $15,091,053 |

See Notes to Financial Statements.

14

Statement of Changes in Net Assets

| YEARS ENDED OCTOBER 31, 2010 AND OCTOBER 31, 2009 | ||

| Increase (Decrease) in Net Assets | 2010 | 2009 |

| Operations | ||

| Net investment income (loss) | $ 2,559,390 | $ 3,819,622 |

| Net realized gain (loss) | 1,237,403 | (24,311,422) |

| Change in net unrealized appreciation (depreciation) | 11,294,260 | 27,203,273 |

| Net increase (decrease) in net assets resulting from operations | 15,091,053 | 6,711,473 |

| Distributions to Shareholders | ||

| From net investment income: | ||

| Investor Class | (2,997,083) | (5,825,919) |

| Institutional Class | (160,186) | (358,398) |

| A Class | (74,678) | (211,371) |

| Decrease in net assets from distributions | (3,231,947) | (6,395,688) |

| Capital Share Transactions | ||

| Net increase (decrease) in net assets from capital share transactions | (38,059,437) | (33,570,658) |

| Net increase (decrease) in net assets | (26,200,331) | (33,254,873) |

| Net Assets | ||

| Beginning of period | 171,347,704 | 204,602,577 |

| End of period | $145,147,373 | $171,347,704 |

| Undistributed net investment income | $1,897,090 | $2,661,811 |

See Notes to Financial Statements.

15

Notes to Financial Statements

OCTOBER 31, 2010

1. Organization

American Century Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act) as an open-end management investment company and is organized as a Maryland corporation. Capital Value Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth. The fund pursues its objective by investing primarily in common stocks that management believes to be undervalued at the time of purchase. The fund also seeks to minimize the impact of federal income taxes on shareholder returns by attempting to minimize taxable distributions to shareholders. The fund is authorized to issue the Investor Class, the Institutional Class and the A Class (formerly Advisor Cla ss). The A Class may incur an initial sales charge. The A Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

16

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2007. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

17

3. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain a ssets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.90% to 1.10% for the Investor Class and A Class. The Institutional Class is 0.20% less at each point within the range. Effective August 1, 2010, the investment advisor voluntarily agreed to waive 0.10% of its management fee. The investment advisor expects the fee waiver to continue through July 31, 2011, and cannot terminate it without consulting the Board of Directors. The total amount of the waiver for each class for the year ended October 31, 2010 was $35,020, $1,240 and $1,030 for the Investor Class, Institutional Class and A Class, respectively. The effective annual management fee before waiver for each class for the year ended October 31, 2010 was 1.10% for the Investor Class and A Class and 0.90% for the Inst itutional Class. The effective annual management fee after waiver for each class for the year ended October 31, 2010 was 1.08% for the Investor Class and A Class and 0.88% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a Master Distribution and Individual Shareholder Services Plan for the A Class, pursuant to Rule 12b-1 of the 1940 Act. The plan provides that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The fees are computed and accrued daily based on A Class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plan during the year ended October 31, 2010, are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a securities lending agreement with JPMorgan Chase Bank (JPMCB) and a mutual funds services agreement with J.P. Morgan Investor Services Co. (JPMIS). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended October 31, 2010, were $43,647,582 and $80,687,798, respectively.

18

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| Year ended October 31, 2010 | Year ended October 31, 2009 | |||

| Shares | Amount | Shares | Amount | |

| Investor Class/Shares Authorized | 200,000,000 | 200,000,000 | ||

| Sold | 1,955,169 | $ 10,850,916 | 3,022,048 | $ 13,900,445 |

| Issued in reinvestment of distributions | 451,737 | 2,507,145 | 1,062,378 | 4,759,452 |

| Redeemed | (8,285,413) | (45,868,497) | (10,206,660) | (46,370,846) |

| (5,878,507) | (32,510,436) | (6,122,234) | (27,710,949) | |

| Institutional Class/Shares Authorized | 15,000,000 | 15,000,000 | ||

| Sold | 390,590 | 2,170,864 | 156,615 | 674,936 |

| Issued in reinvestment of distributions | 8,418 | 46,637 | 31,585 | 141,500 |

| Redeemed | (1,214,410) | (6,689,788) | (1,004,483) | (4,643,987) |

| (815,402) | (4,472,287) | (816,283) | (3,827,551) | |

| A Class/Shares Authorized | 50,000,000 | 50,000,000 | ||

| Sold | 116,151 | 650,738 | 171,780 | 781,303 |

| Issued in reinvestment of distributions | 13,441 | 74,594 | 47,147 | 211,217 |

| Redeemed | (327,159) | (1,802,046) | (657,655) | (3,024,678) |

| (197,567) | (1,076,714) | (438,728) | (2,032,158) | |

| Net increase (decrease) | (6,891,476) | $(38,059,437) | (7,377,245) | $(33,570,658) |

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| Level 1 | Level 2 | Level 3 | |

| Investment Securities | |||

| Common Stocks | $144,314,759 | — | — |

| Temporary Cash Investments | 85,857 | $500,000 | — |

| Total Value of Investment Securities | $144,400,616 | $500,000 | — |

19

7. Federal Tax Information

On December 14, 2010, the fund declared and paid the following per-share distributions from net investment income to shareholders of record on December 13, 2010:

| Investor | Institutional | A |

| $0.0942 | $0.1062 | $0.0791 |

The tax character of distributions paid during the years ended October 31, 2010 and October 31, 2009 were as follows:

| 2010 | 2009 | |

| Distributions Paid From | ||

| Ordinary income | $3,231,947 | $6,395,688 |

| Long-term capital gains | — | — |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of October 31, 2010, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| Federal tax cost of investments | $122,677,635 |

| Gross tax appreciation of investments | $29,818,174 |

| Gross tax depreciation of investments | (7,595,193) |

| Net tax appreciation (depreciation) of investments | $22,222,981 |

| Undistributed ordinary income | $1,897,090 |

| Accumulated capital losses | $(30,135,109) |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

The accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations. Capital loss carryovers of $(5,984,250) and $(24,150,859) expire in 2016 and 2017, respectively.

8. Corporate Event

As part of a long-standing estate and business succession plan established by James E. Stowers, Jr., the founder of American Century Investments, ACC Chairman Richard W. Brown succeeded Mr. Stowers as trustee of a trust that holds a greater-than-25% voting interest in ACC, the parent corporation of the fund’s advisor. Under the 1940 Act, this is presumed to represent control of ACC even though it is less than a majority interest. The change of trustee was considered a change of control of ACC and therefore also a change of control of the fund’s advisor even though there has been no change to its management and none is anticipated. The change of control resulted in the assignment of the fund’s investment advisory agreement. As required by the 1940 Act, the assignment automatically terminated such agreem ent, making the approval of a new agreement necessary.

20

On February 18, 2010, the Board of Directors approved an interim investment advisory agreement under which the fund was managed until a new agreement was approved. The new agreement for the fund was approved by the Board of Directors on March 29, 2010, and by shareholders at a Special Meeting of Shareholders on June 16, 2010. It went into effect on July 16, 2010. The new agreement, which is substantially identical to the terminated agreement (with the exception of different effective and termination dates), did not result in changes in the management of American Century Investments, the fund, its investment objectives, fees or services provided.

9. Other Tax Information (Unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code.

The fund hereby designates up to the maximum amount allowable as qualified dividend income for the fiscal year ended October 31, 2010.

For corporate taxpayers, the fund hereby designates $3,231,947, or up to the maximum amount allowable, of ordinary income distributions paid during the fiscal year ended October 31, 2010 as qualified for the corporate dividends received deduction.

21

Financial Highlights

Capital Value

| Investor Class | |||||

| For a Share Outstanding Throughout the Years Ended October 31 | |||||

| 2010 | 2009 | 2008 | 2007 | 2006 | |

| Per-Share Data | |||||

| Net Asset Value, Beginning of Period | $5.32 | $5.17 | $8.78 | $8.23 | $7.15 |

| Income From Investment Operations | |||||

Net Investment Income (Loss)(1) | 0.09 | 0.11 | 0.14 | 0.13 | 0.12 |

| Net Realized and Unrealized Gain (Loss) | 0.42 | 0.21 | (3.28) | 0.65 | 1.14 |

| Total From Investment Operations | 0.51 | 0.32 | (3.14) | 0.78 | 1.26 |

| Distributions | |||||

| From Net Investment Income | (0.10) | (0.17) | (0.13) | (0.12) | (0.10) |

| From Net Realized Gains | — | — | (0.34) | (0.11) | (0.08) |

| Total Distributions | (0.10) | (0.17) | (0.47) | (0.23) | (0.18) |

| Net Asset Value, End of Period | $5.73 | $5.32 | $5.17 | $8.78 | $8.23 |

Total Return(2) | 9.69% | 6.85% | (37.52)% | 9.66% | 18.03% |

| Ratios/Supplemental Data | |||||

Ratio of Operating Expenses to Average Net Assets | 1.09%(3) | 1.10% | 1.10% | 1.10% | 1.10% |

Ratio of Net Investment Income (Loss) to Average Net Assets | 1.56%(3) | 2.33% | 1.98% | 1.52% | 1.55% |

| Portfolio Turnover Rate | 27% | 19% | 26% | 15% | 16% |

| Net Assets, End of Period (in thousands) | $137,037 | $158,431 | $185,569 | $461,413 | $466,803 |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

| (3) | The ratio of operating expenses to average net assets and ratio of net investment income (loss) to average net assets would have been 1.11% and 1.54%, respectively, if a portion of the management fee had not been waived. |

See Notes to Financial Statements.

22

Capital Value

| Institutional Class | |||||

| For a Share Outstanding Throughout the Years Ended October 31 | |||||

| 2010 | 2009 | 2008 | 2007 | 2006 | |

| Per-Share Data | |||||

| Net Asset Value, Beginning of Period | $5.32 | $5.17 | $8.79 | $8.24 | $7.16 |

| Income From Investment Operations | |||||

Net Investment Income (Loss)(1) | 0.10 | 0.12 | 0.15 | 0.15 | 0.13 |

| Net Realized and Unrealized Gain (Loss) | 0.43 | 0.21 | (3.28) | 0.65 | 1.15 |

| Total From Investment Operations | 0.53 | 0.33 | (3.13) | 0.80 | 1.28 |

| Distributions | |||||

| From Net Investment Income | (0.11) | (0.18) | (0.15) | (0.14) | (0.12) |

| From Net Realized Gains | — | — | (0.34) | (0.11) | (0.08) |

| Total Distributions | (0.11) | (0.18) | (0.49) | (0.25) | (0.20) |

| Net Asset Value, End of Period | $5.74 | $5.32 | $5.17 | $8.79 | $8.24 |

Total Return(2) | 10.11% | 7.07% | (37.46)% | 9.88% | 18.24% |

| Ratios/Supplemental Data | |||||

Ratio of Operating Expenses to Average Net Assets | 0.89%(3) | 0.90% | 0.90% | 0.90% | 0.90% |

Ratio of Net Investment Income (Loss) to Average Net Assets | 1.76%(3) | 2.53% | 2.18% | 1.72% | 1.75% |

| Portfolio Turnover Rate | 27% | 19% | 26% | 15% | 16% |

| Net Assets, End of Period (in thousands) | $3,980 | $8,035 | $12,030 | $28,077 | $31,141 |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

| (3) | The ratio of operating expenses to average net assets and ratio of net investment income (loss) to average net assets would have been 0.91% and 1.74%, respectively, if a portion of the management fee had not been waived. |

See Notes to Financial Statements.

23

Capital Value

A Class(1) | |||||

| For a Share Outstanding Throughout the Years Ended October 31 | |||||

| 2010 | 2009 | 2008 | 2007 | 2006 | |

| Per-Share Data | |||||

| Net Asset Value, Beginning of Period | $5.30 | $5.15 | $8.76 | $8.21 | $7.14 |

| Income From Investment Operations | |||||

Net Investment Income (Loss)(2) | 0.07 | 0.10 | 0.12 | 0.11 | 0.10 |

| Net Realized and Unrealized Gain (Loss) | 0.44 | 0.21 | (3.28) | 0.65 | 1.13 |

| Total From Investment Operations | 0.51 | 0.31 | (3.16) | 0.76 | 1.23 |

| Distributions | |||||

| From Net Investment Income | (0.09) | (0.16) | (0.11) | (0.10) | (0.08) |

| From Net Realized Gains | — | — | (0.34) | (0.11) | (0.08) |

| Total Distributions | (0.09) | (0.16) | (0.45) | (0.21) | (0.16) |

| Net Asset Value, End of Period | $5.72 | $5.30 | $5.15 | $8.76 | $8.21 |

Total Return(3) | 9.64% | 6.59% | (37.78)% | 9.40% | 17.62% |

| Ratios/Supplemental Data | |||||

Ratio of Operating Expenses to Average Net Assets | 1.34%(4) | 1.35% | 1.35% | 1.35% | 1.35% |

Ratio of Net Investment Income (Loss) to Average Net Assets | 1.31%(4) | 2.08% | 1.73% | 1.27% | 1.30% |

| Portfolio Turnover Rate | 27% | 19% | 26% | 15% | 16% |

| Net Assets, End of Period (in thousands) | $4,130 | $4,881 | $7,004 | $16,059 | $16,973 |

| (1) | Prior to March 1, 2010, the A Class was referred to as the Advisor Class. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

| (4) | The ratio of operating expenses to average net assets and ratio of net investment income (loss) to average net assets would have been 1.36% and 1.29%, respectively, if a portion of the management fee had not been waived. |

See Notes to Financial Statements.

24

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders,

American Century Mutual Funds, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Capital Value Fund, one of the funds constituting American Century Mutual Funds, Inc. (the “Corporation”), as of October 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Corporation is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting . Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2010, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Capital Value Fund of American Century Mutual Funds, Inc., as of October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri

December 20, 2010

25

Proxy Voting Results

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Mutual Funds, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Mutual Funds, Inc.):

| John R. Whitten | For: | 13,907,426,552 | ||

| Withhold: | 629,801,798 | |||

| Abstain: | 0 | |||

| Broker Non-Vote: | 0 |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, and M. Jeannine Strandjord.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| Investor and A Classes | For: | 93,733,695 | ||

| Against: | 2,412,320 | |||

| Abstain: | 2,984,219 | |||

| Broker Non-Vote: | 11,334,632 | |||

| Institutional Class | For: | 8,005,791 | ||

| Against: | 71,405 | |||

| Abstain: | 0 | |||

| Broker Non-Vote: | 140,246 |

Proposal 3:

To approve an amendment to the Articles of Incorporation to limit certain director liability to the extent permitted by Maryland law (the proposal was voted on by all shareholders of funds issued by American Century Mutual Funds, Inc.):

| For: | 12,112,932,038 | |||

| Against: | 769,504,652 | |||

| Abstain: | 420,034,445 | |||

| Broker Non-Vote: | 1,234,757,216 |

26

Management

The Board of Directors

The individuals listed below serve as directors of the fund. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors), is 72. However, the mandatory retirement age for an individual director may be extended with the approval of the remaining independent directors.

Mr. Thomas is the only director who is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor).

The other directors (more than three-fourths of the total number) are independent; that is, they have never been employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS). The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

Independent Directors

Thomas A. Brown

Year of Birth: 1940

Position(s) with the Fund: Director

Length of Time Served: Since 1980

Principal Occupation(s) During the Past Five Years: Managing Member, Associated Investments, LLC (real estate investment company); Brown Cascade Properties, LLC (real estate investment company) (2001 to 2009)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Mechanical Engineering, University of Kansas; formerly, Chief Executive Officer, Associated Bearings Company; formerly, Area Vice President, Applied Industrial Technologies (bearings and power transmission company)

Andrea C. Hall

Year of Birth: 1945

Position(s) with the Fund: Director

Length of Time Served: Since 1997

Principal Occupation(s) During the Past Five Years: Retired as advisor to the President, Midwest Research Institute (not-for-profit research organization) (June 2006)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Biology, Florida State University; PhD in Biology, Georgetown University; formerly, Senior Vice President and Director of Research Operations, Midwest Research Institute

27

James A. Olson

Year of Birth: 1942

Position(s) with the Fund: Director

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: Member, Plaza Belmont LLC (private equity fund manager); Chief Financial Officer, Plaza Belmont LLC (September 1999 to September 2006)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: Saia, Inc. and Entertainment Properties Trust

Education/Other Professional Experience: BS in Business Administration and MBA, St. Louis University; CPA; 21 years of experience as a partner in the accounting firm of Ernst & Young LLP

Donald H. Pratt

Year of Birth: 1937

Position(s) with the Fund: Director, Chairman of the Board

Length of Time Served: Since 1995 (Chairman since 2005)

Principal Occupation(s) During the Past Five Years: Chairman and Chief Executive Officer, Western Investments, Inc. (real estate company)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BS in Industrial Engineering, Wichita State University; MBA, Harvard Business School; serves on the Board of Governors of the Independent Directors Council and Investment Company Institute; formerly, Chairman of the Board, Butler Manufacturing Company (metal buildings producer)

M. Jeannine Strandjord

Year of Birth: 1945

Position(s) with the Fund: Director

Length of Time Served: Since 1994

Principal Occupation(s) During the Past Five Years: Retired, formerly, Senior Vice President, Process Excellence, Sprint Corporation (telecommunications company) (January 2005 to September 2005)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: DST Systems Inc., Euronet Worldwide Inc., Charming Shoppes, Inc.

Education/Other Professional Experience: BS in Business Administration and Accounting, University of Kansas; CPA; formerly, Senior Vice President of Financial Services and Treasurer and Chief Financial Officer, Global Markets Group; Sprint Corporation; formerly, with the accounting firm of Ernst and Whinney

John R. Whitten

Year of Birth: 1946

Position(s) with the Fund: Director

Length of Time Served: Since 2008

Principal Occupation(s) During the Past Five Years: Project Consultant, Celanese Corp. (industrial chemical company)

Number of Funds in Fund Complex Overseen by Director: 61

Other Directorships Held by Director During the Past Five Years: Rudolph Technologies, Inc.

Professional Education/Experience: BS in Business Administration, Cleveland State University; CPA; formerly, Chief Financial Officer and Treasurer, Applied Industrial Technologies, Inc.; thirteen years of experience with accounting firm Deloitte & Touche LLP

28

Interested Director

Jonathan S. Thomas

Year of Birth: 1963

Position(s) with the Fund: Director and President

Length of Time Served: Since 2007

Principal Occupation(s) During the Past Five Years: President and Chief Executive Officer, ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to February 2007); Executive Vice President, ACC (November 2005 to February 2007). Also serves as: Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries

Number of Funds in Fund Complex Overseen by Director: 101

Other Directorships Held by Director During the Past Five Years: None

Education/Other Professional Experience: BA in Economics, University of Massachusetts; MBA, Boston College; formerly held senior leadership roles with Fidelity Investments, Boston Financial Services, Bank of America and Morgan Stanley; serves on the Board of Governors of the Investment Company Institute

29

Officers

The following table presents certain information about the executive officers of the fund. Each officer serves as an officer for each of the 15 investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the fund. The listed officers are interested persons of the fund and are appointed or re-appointed on an annual basis. The mailing address for each of the officers listed below is 4500 Main Street, Kansas City, Missouri 64111.

Name (Year of Birth) | Offices with the Fund | Principal Occupation(s) During the Past Five Years | |

Jonathan S. Thomas (1963) | Director and President since 2007 | President and Chief Executive Officer, ACC (March 2007 to present); Chief Administrative Officer, ACC (February 2006 to February 2007); Executive Vice President, ACC (November 2005 to February 2007). Also serves as: Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries | |

Barry Fink (1955) | Executive Vice President since 2007 | Chief Operating Officer and Executive Vice President, ACC (September 2007 to present); President, ACS (October 2007 to present); Managing Director, Morgan Stanley (2000 to 2007); Global General Counsel, Morgan Stanley (2000 to 2006). Also serves as: Manager, ACS and Director, ACC and certain ACC subsidiaries | |

Maryanne L. Roepke (1956) | Chief Compliance Officer since 2006 and Senior Vice President since 2000 | Chief Compliance Officer, American Century funds, ACIM and ACS (August 2006 to present); Assistant Treasurer, ACC (January 1995 to August 2006); and Treasurer and Chief Financial Officer, various American Century funds (July 2000 to August 2006). Also serves as: Senior Vice President, ACS | |

Charles A. Etherington (1957) | General Counsel since 2007 and Senior Vice President since 2006 | Attorney, ACC (February 1994 to present); Vice President, ACC (November 2005 to present), General Counsel, ACC (March 2007 to present); Also serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and Senior Vice President, ACIM and ACS | |

Robert J. Leach (1966) | Vice President, Treasurer and Chief Financial Officer since 2006 | Vice President, ACS (February 2000 to present); and Controller, various American Century funds (1997 to September 2006) | |

David H. Reinmiller (1963) | Vice President since 2000 | Attorney, ACC (January 1994 to present); Associate General Counsel, ACC (January 2001 to present); Chief Compliance Officer, American Century funds and ACIM (January 2001 to February 2005). Also serves as Vice President, ACIM and ACS | |

Ward D. Stauffer (1960) | Secretary since 2005 | Attorney, ACC (June 2003 to present) |

The Statement of Additional Information has additional information about the fund’s directors and is available without charge, upon request, by calling 1-800-345-2021.

30

Additional Information

Retirement Account Information