UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-00816 | |||||

AMERICAN CENTURY MUTUAL FUNDS, INC. | ||||||

(Exact name of registrant as specified in charter) | ||||||

4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

(Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

(Name and address of agent for service) | ||||||

Registrant’s telephone number, including area code: | 816-531-5575 | |||||

Date of fiscal year end: | 10-31 | |||||

Date of reporting period: | 10-31-2013 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT | OCTOBER 31, 2013

All Cap Growth Fund

Table of Contents |

President’s Letter | 2 |

Independent Chairman’s Letter | 3 |

Market Perspective | 4 |

Performance | 5 |

Portfolio Commentary | 7 |

Fund Characteristics | 9 |

Shareholder Fee Example | 10 |

Schedule of Investments | 12 |

Statement of Assets and Liabilities | 15 |

Statement of Operations | 16 |

Statement of Changes in Net Assets | 17 |

Notes to Financial Statements | 18 |

Financial Highlights | 24 |

Report of Independent Registered Public Accounting Firm | 26 |

Management | 27 |

Approval of Management Agreement | 30 |

Additional Information | 35 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

President’s Letter |

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the 12 months ended October 31, 2013. It provides investment performance, market analysis, and portfolio information, presented with the expert perspective of our portfolio management team.

Annual reports remain important vehicles for conveying information about fund returns, including key factors that affected fund performance. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Federal Reserve (Fed) Policy-Driven Financial Markets

U.S. stock indices and government bond yields traced similar upward tracks during most of the reporting period, driven by Fed policy and the perceived path of future Fed policy decisions. In September 2012, the Fed announced its third round of quantitative easing (QE3) since the 2008 Financial Crisis, consisting of $85 billion of monthly purchases of U.S. Treasury and mortgage-backed securities. We believe QE3, like its predecessors, helped stimulate the U.S. stock market. Encouraging signs also emerged in the long-depressed U.S. housing and job markets, which supported stocks. The S&P 500 Index advanced 27.18%, a modest gain compared with U.S. mid- and small-cap indices, which posted returns in the 33% to 40% range.

The U.S. stock rally surmounted many obstacles, including the year-end 2012 fiscal cliff, the 2013 fiscal sequester, Congressional discord (over the Affordable Care Act, the federal budget, and the federal debt ceiling), the resulting partial government shutdown, and higher long-term interest rates. Indications of sustainable economic growth and hints from the Fed that it might taper QE3 sent bond yields soaring from May to September. The 10-year Treasury yield reached 3.00% before retreating to finish the reporting period at 2.55%, still well above where it began (at 1.69%). Bond yields declined in September and October on softer economic data, the Fed’s announcement that it would delay tapering, and uncertainty caused by the government shutdown.

A full economic recovery from 2008 remains elusive—economic growth is still subpar compared with past recoveries. In this environment, we continue to believe in a disciplined, diversified, long-term investment approach, using professionally managed stock and bond portfolios—as appropriate—for meeting financial goals. We appreciate your continued trust in us under these challenging conditions.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

Independent Chairman’s Letter |

Don Pratt

Dear Fellow Shareholders,

This is my last letter to shareholders as the funds’ Chairman, as I will retire at the end of 2013.

My personal thanks go to the independent directors that elected me to the Board and subsequently to the Chairman position, and with whom I have worked to reorganize the Board’s committee structure and annually improve our governance processes. Throughout my tenure, the Board has addressed its responsibilities to shareholders diligently in committee work, the annual contract review, and the execution of our oversight responsibilities. I expect that it will continue to do so well into the future.

Thanks also to the American Century Investments management team led by Jonathan Thomas. Its transparency, candor, and open communication with the Board is most appreciated. I have served on more than 20 boards and this is the most productive and enjoyable relationship with management I have experienced.

Finally, thanks to the many shareholders who have written with questions, comments, and suggestions. Each was heard and addressed and enabled the Board to better represent your interests. Keep communicating with us so that the Board can continue to be aware of your interests, concerns, and questions. My best wishes to Jim Olson, my successor as Chairman, and the other independent directors who continue to serve on your behalf.

And remember, as the firm’s founder Jim Stowers, Jr. so often observed, “The best is yet to be.”

Best regards,

Don Pratt

Market Perspective |

By David Hollond, Chief Investment Officer, U.S. Growth Equity — Mid & Small Cap

Improving U.S. Economic Environment, Fed Actions Led Stocks Higher

Stock market performance remained strong during the 12 months ended October 31, 2013. Despite persistent concerns about weak global growth and Europe’s ongoing financial crisis, investors largely focused on central bank stimulus measures and marginally-improving U.S. economic data.

Early in the period, the U.S. Federal Reserve (the Fed) responded to disappointing U.S. economic data by expanding its third—and most aggressive—quantitative easing program from monthly purchases of $40 billion in government agency mortgage-backed securities to $85 billion per month. This unprecedented program, combined with relatively healthy corporate earnings, significant housing market gains, and modest improvements in the labor market, helped keep stocks and other riskier assets in favor.

Late in the period, the Fed’s comments about “tapering” its quantitative easing program rattled markets. Fed Chairman Ben Bernanke said the central bank could begin scaling back its bond buying later in 2013 if the economy continues to improve. After reaching record highs in May, stocks stumbled in June, following Bernanke’s comments. The Fed then toned down its tapering talk in July, and stocks rebounded to new highs. Overall, most U.S. stock benchmarks generated robust 12-month returns, largely aided by strong double-digit gains posted during the first calendar quarter of 2013.

Growth Stocks Outpaced Value Stocks

Small-capitalization shares generated the strongest returns, outpacing the returns of mid- and large-capitalization stocks. Across the capitalization spectrum, growth stocks were the performance leaders for the 12-month period. From a sector perspective, all sectors within the Russell 3000 Index delivered positive results; the health care sector fared the best. Consumer discretionary, industrials, and energy all finished ahead of the Russell 3000 Index. The information technology and utilities sectors achieved more moderate gains.

U.S. Stock Index Returns | ||||

For the 12 months ended October 31, 2013 | ||||

Russell 1000 Index (Large-Cap) | 28.40% | Russell 2000 Index (Small-Cap) | 36.28% | |

Russell 1000 Growth Index | 28.30% | Russell 2000 Growth Index | 39.84% | |

Russell 1000 Value Index | 28.29% | Russell 2000 Value Index | 32.83% | |

Russell Midcap Index | 33.79% | |||

Russell Midcap Growth Index | 33.93% | |||

Russell Midcap Value Index | 33.45% | |||

Performance |

Total Returns as of October 31, 2013 | ||||||

Average Annual Returns | ||||||

Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date | |

Investor Class | TWGTX | 25.72% | 15.62% | 10.87%(1) | 11.61% | 11/25/83 |

Russell 3000 Growth Index | — | 29.16% | 17.64% | 7.81% | 9.81%(2) | — |

Institutional Class | ACAJX | 25.98% | — | — | 23.68% | 9/30/11 |

A Class No sales charge* With sales charge* | ACAQX

| 25.42% 18.22% | — — | — — | 23.14% 19.71% | 9/30/11

|

C Class | ACAHX | 24.45% | — | — | 22.20% | 9/30/11 |

R Class | ACAWX | 25.12% | — | — | 22.83% | 9/30/11 |

*Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

(1) | Returns would have been lower if a portion of the management fee had not been waived. |

(2) | Since 11/30/83, the date nearest the Investor Class’s inception for which data are available. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

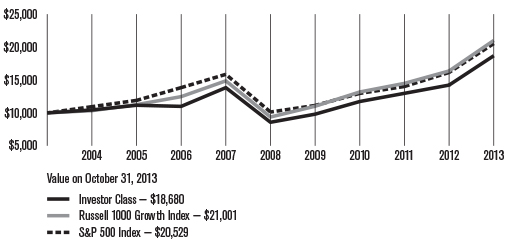

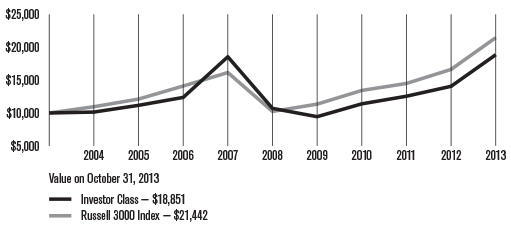

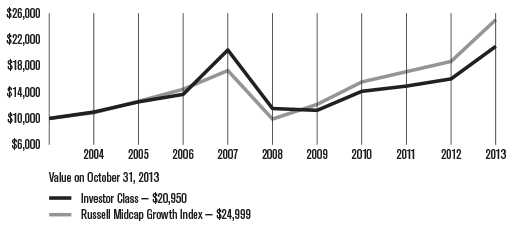

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

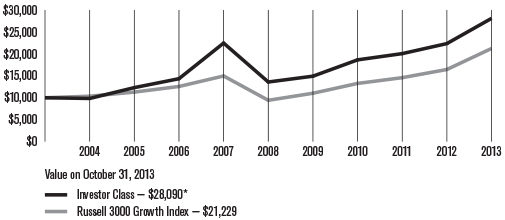

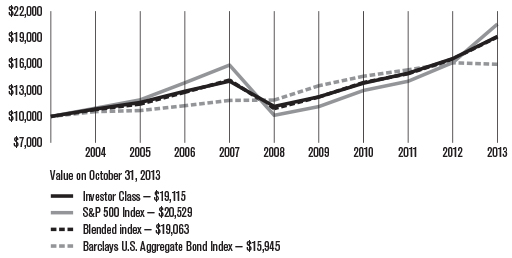

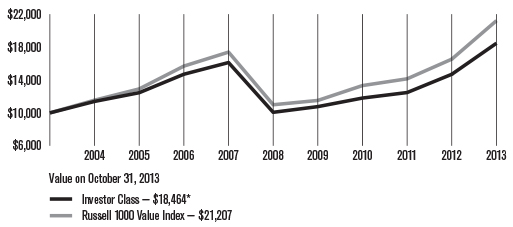

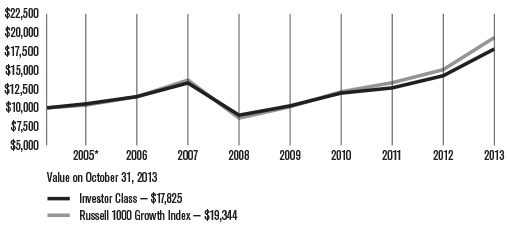

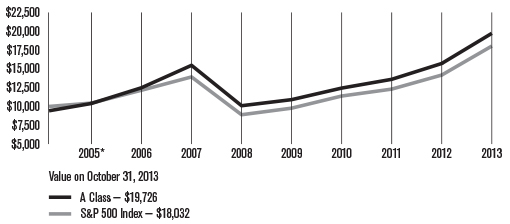

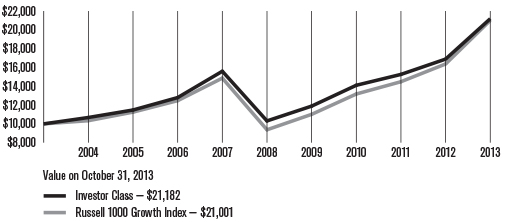

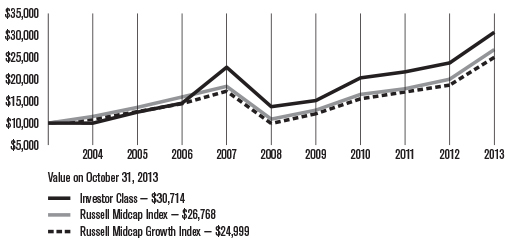

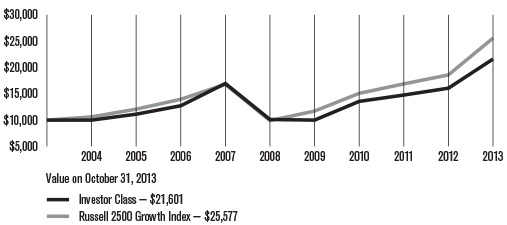

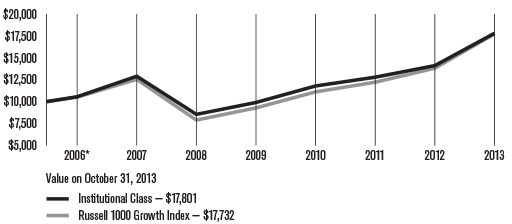

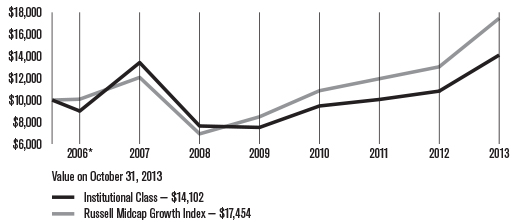

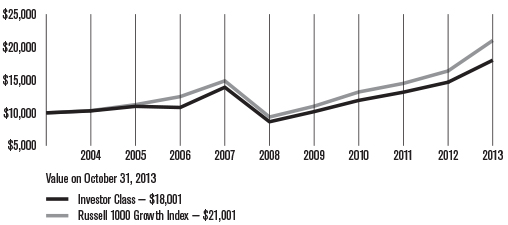

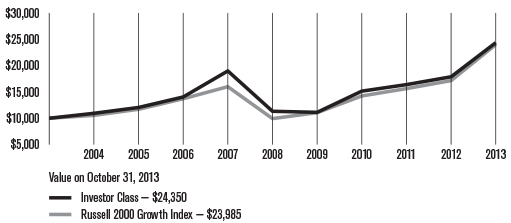

Growth of $10,000 Over 10 Years |

$10,000 investment made October 31, 2003 |

*Ending value would have been lower if a portion of the management fee had not been waived.

Total Annual Fund Operating Expenses | ||||

Investor Class | Institutional Class | A Class | C Class | R Class |

1.00% | 0.80% | 1.25% | 2.00% | 1.50% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index do not.

Portfolio Commentary |

Portfolio Managers: David Hollond, Michael Orndorff, and Marcus Scott

Performance Summary

All Cap Growth returned 25.72%* for the 12 months ended October 31, 2013, lagging the 29.16% return of the portfolio’s benchmark, the Russell 3000 Growth Index.

As discussed in the Market Perspective on page 4, equity indices generally gained during the reporting period. Price momentum and acceleration, two factors that the All Cap Growth team looks for in portfolio holdings, returned to favor during the reporting period.

Although All Cap Growth delivered solid returns and derived positive results from every sector in which it invested, its performance lagged that of the benchmark. Within the portfolio, stock decisions in the health care, energy, and materials sectors accounted for the bulk of underperformance versus the benchmark. Stock selection in the information technology, consumer discretionary, and financials sectors partially offset those relative losses.

Health Care Led Underperformance

The health care sector was a key source of relative underperformance due largely to stock decisions among health care providers and pharmaceuticals companies. Pharmacy benefit manager Catamaran was a meaningful individual detractor. The company lost some of its legacy business as Walgreens shifted its employees to a private exchange rather than provide coverage options. Walgreens is a small part of Catamaran’s customer base and is a less profitable business. The investment team is interested in the company’s relationship with Cigna, which should provide higher margins due to the use of generic drugs in the Cigna pipeline. A position in pharmacy benefits manager Express Scripts also detracted significantly.

Pharmaceutical company Allergan trimmed relative results. The company’s shares sold off after it announced it would delay final studies for its drugs designed to treat age-related medical conditions, such as macular degeneration. Also hurting its share price, the company has several drugs going off-patent in an environment in which the FDA has cleared the path for generic drugs to come to market quickly and easily.

Energy, Materials Lagged

In the energy sector, the energy equipment and services segment was a meaningful source of underperformance. A position in energy equipment company National Oilwell Varco hurt relative returns as it experienced a choppy North American market.

The materials sector was also a source of underperformance as holdings with ties to commodities, including Freeport-Mc-Mo-Ran, detracted amid concerns that rising interest rates would weaken commodities prices.

*All fund returns referenced in this commentary are for Investor Class shares.

In terms of individual holdings, a position in Apple represented the largest detractor from returns versus its benchmark. The company missed analysts’ expectations for sales of its iPhone and achieved lower-than-expected margins.

Information Technology Contributed

The information technology sector was a significant source of relative gains. Within the IT services industry group, it was beneficial for the portfolio to be underrepresented in shares of IBM, which suffered from slower hardware sales. In the internet software and services group segment, Facebook was a top contributing security. Its social media advertising model has proven effective, and investors are now realizing the value of the company.

LinkedIn was also a meaningful contributor to relative gains. Although the company warned that margins would be squeezed as it spends to expand engagement on the web site, LinkedIn continued to gain market share in the recruiter market and benefited from self-service advertising. Elsewhere in the sector, stock decisions in the software and semiconductor groups also added to relative results.

Consumer Discretionary, Financials Added

Positive contributors in the consumer discretionary space included Starbucks, which was not affected by the slowdown that others in the retail space encountered. The company continued to benefit from lower coffee bean prices and posted strong same-store-sales growth. An overweight position in priceline.com also contributed meaningfully. The online travel firm enjoyed accelerating bookings levels and gained market share.

In the financials sector, the portfolio avoided the real estate investment trust (REIT) segment. This allocation decision benefited relative performance as these companies collectively underperformed the benchmark. Stock selection among commercial banks also contributed to relative returns.

Outlook

All Cap Growth’s investment process focuses on companies of all sizes with accelerating revenue and earnings growth rates that are also exhibiting share-price strength. This process has faced unprecedented headwinds in recent reporting periods, but market conditions began to favor these types of companies during the course of the reporting period. We believe such a portfolio can outperform All Cap Growth’s peers and its benchmark, the Russell 3000 Growth Index, over time.

As of October 31, 2013, we saw attractive opportunities in home-related sectors (particularly remodeling-focused stocks such as Lumber Liquidators), media companies, the energy renaissance (represented by companies such as Pioneer Natural Resources and MasTec), and information technology-focused companies that are disruptors/displacers (such as LinkedIn), that are taking the place of more traditional providers.

Fund Characteristics |

OCTOBER 31, 2013

| |

Top Ten Holdings | % of net assets |

Google, Inc. Class A | 3.6% |

Apple, Inc. | 3.2% |

Canadian Pacific Railway Ltd. New York Shares | 3.1% |

Costco Wholesale Corp. | 3.0% |

Twenty-First Century Fox, Inc. | 3.0% |

Facebook, Inc., Class A | 2.6% |

Verizon Communications, Inc. | 2.5% |

Electronic Arts, Inc. | 2.4% |

Lowe’s Cos., Inc. | 2.1% |

Catamaran Corp. | 2.1% |

Top Five Industries | % of net assets |

Internet Software and Services | 8.4% |

Food and Staples Retailing | 6.7% |

Specialty Retail | 5.9% |

Road and Rail | 5.6% |

Software | 5.6% |

Types of Investments in Portfolio | % of net assets |

Domestic Common Stocks | 92.7% |

Foreign Common Stocks* | 6.9% |

Total Common Stocks | 99.6% |

Temporary Cash Investments | 0.5% |

Other Assets and Liabilities | (0.1)% |

*Includes depositary shares, dual listed securities and foreign ordinary shares. | |

Shareholder Fee Example |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2013 to October 31, 2013.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning 5/1/13 | Ending 10/31/13 | Expenses Paid During Period(1) 5/1/13 – 10/31/13 | Annualized | |

Actual | ||||

Investor Class | $1,000 | $1,151.60 | $5.42 | 1.00% |

Institutional Class | $1,000 | $1,153.20 | $4.34 | 0.80% |

A Class | $1,000 | $1,150.50 | $6.78 | 1.25% |

C Class | $1,000 | $1,145.90 | $10.82 | 2.00% |

R Class | $1,000 | $1,149.10 | $8.13 | 1.50% |

Hypothetical | ||||

Investor Class | $1,000 | $1,020.16 | $5.09 | 1.00% |

Institutional Class | $1,000 | $1,021.17 | $4.08 | 0.80% |

A Class | $1,000 | $1,018.90 | $6.36 | 1.25% |

C Class | $1,000 | $1,015.12 | $10.16 | 2.00% |

R Class | $1,000 | $1,017.64 | $7.63 | 1.50% |

(1) | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

Schedule of Investments |

OCTOBER 31, 2013

Shares | Value | |||||

Common Stocks — 99.6% | ||||||

AEROSPACE AND DEFENSE — 1.9% | ||||||

Precision Castparts Corp. | 61,503 | $ 15,587,935 | ||||

TransDigm Group, Inc. | 33,584 | 4,883,450 | ||||

| 20,471,385 | ||||||

AUTOMOBILES — 2.0% | ||||||

Ford Motor Co. | 458,285 | 7,841,257 | ||||

Harley-Davidson, Inc. | 101,977 | 6,530,607 | ||||

Tesla Motors, Inc.(1) | 50,313 | 8,047,061 | ||||

| 22,418,925 | ||||||

BEVERAGES — 1.7% | ||||||

Brown-Forman Corp., Class B | 65,598 | 4,787,342 | ||||

Constellation Brands, Inc., Class A(1) | 207,000 | 13,517,100 | ||||

| 18,304,442 | ||||||

BIOTECHNOLOGY — 5.0% | ||||||

Aegerion Pharmaceuticals, Inc.(1) | 42,800 | 3,544,696 | ||||

Biogen Idec, Inc.(1) | 27,200 | 6,641,968 | ||||

Celgene Corp.(1) | 68,600 | 10,186,414 | ||||

Gilead Sciences, Inc.(1) | 288,391 | 20,472,877 | ||||

Grifols SA | 130,847 | 5,366,142 | ||||

Regeneron Pharmaceuticals, Inc.(1) | 30,409 | 8,745,629 | ||||

| 54,957,726 | ||||||

BUILDING PRODUCTS — 0.9% | ||||||

Fortune Brands Home & Security, Inc. | 119,200 | 5,135,136 | ||||

Lennox International, Inc. | 61,685 | 4,815,131 | ||||

| 9,950,267 | ||||||

CAPITAL MARKETS — 1.0% | ||||||

Charles Schwab Corp. (The) | 239,400 | 5,422,410 | ||||

Lazard Ltd., Class A | 145,759 | 5,633,585 | ||||

| 11,055,995 | ||||||

CHEMICALS — 3.7% | ||||||

FMC Corp. | 91,847 | 6,682,788 | ||||

Monsanto Co. | 208,862 | 21,905,446 | ||||

Sherwin-Williams Co. (The) | 63,066 | 11,856,408 | ||||

| 40,444,642 | ||||||

COMMERCIAL BANKS — 1.1% | ||||||

East West Bancorp., Inc. | 137,927 | 4,646,761 | ||||

SVB Financial Group(1) | 79,649 | 7,628,781 | ||||

| 12,275,542 | ||||||

COMMUNICATIONS EQUIPMENT — 2.7% | ||||||

Cisco Systems, Inc. | 440,251 | 9,905,647 | ||||

Palo Alto Networks, Inc.(1) | 109,686 | 4,624,362 | ||||

QUALCOMM, Inc. | 213,258 | 14,815,033 | ||||

| 29,345,042 | ||||||

COMPUTERS AND PERIPHERALS — 4.4% | ||||||

Apple, Inc. | 66,560 | 34,767,616 | ||||

NetApp, Inc. | 360,871 | 14,005,403 | ||||

| 48,773,019 | ||||||

CONSTRUCTION AND ENGINEERING — 2.0% | ||||||

MasTec, Inc.(1) | 323,991 | 10,357,992 | ||||

Quanta Services, Inc.(1) | 373,584 | 11,285,973 | ||||

| 21,643,965 | ||||||

CONSUMER FINANCE — 1.5% | ||||||

Discover Financial Services | 324,580 | 16,839,210 | ||||

DIVERSIFIED TELECOMMUNICATION SERVICES — 2.5% | ||||||

Verizon Communications, Inc. | 547,234 | 27,640,789 | ||||

ELECTRICAL EQUIPMENT — 0.5% | ||||||

Acuity Brands, Inc. | 56,000 | 5,628,560 | ||||

ELECTRONIC EQUIPMENT, INSTRUMENTS AND COMPONENTS — 0.7% | ||||||

FLIR Systems, Inc. | 255,283 | 7,270,460 | ||||

ENERGY EQUIPMENT AND SERVICES — 3.3% | ||||||

Atwood Oceanics, Inc.(1) | 53,953 | 2,866,523 | ||||

Frank’s International NV(1) | 112,629 | 3,445,321 | ||||

Halliburton Co. | 221,100 | 11,724,933 | ||||

Schlumberger Ltd. | 195,400 | 18,312,888 | ||||

| 36,349,665 | ||||||

FOOD AND STAPLES RETAILING — 6.7% | ||||||

Costco Wholesale Corp. | 278,801 | 32,898,518 | ||||

Natural Grocers by Vitamin Cottage, Inc.(1) | 108,926 | 4,346,147 | ||||

Sprouts Farmers Market, Inc.(1) | 31,226 | 1,438,270 | ||||

Wal-Mart Stores, Inc. | 85,841 | 6,588,297 | ||||

Walgreen Co. | 122,700 | 7,268,748 | ||||

Whole Foods Market, Inc. | 339,342 | 21,422,660 | ||||

| 73,962,640 | ||||||

FOOD PRODUCTS — 0.6% | ||||||

Mondelez International, Inc. Class A | 208,700 | 7,020,668 | ||||

HEALTH CARE EQUIPMENT AND SUPPLIES — 1.6% | ||||||

Cooper Cos., Inc. (The) | 40,311 | 5,208,584 | ||||

Teleflex, Inc. | 132,937 | 12,254,133 | ||||

| 17,462,717 | ||||||

Shares | Value | |||||

HEALTH CARE PROVIDERS AND SERVICES — 3.2% | ||||||

Catamaran Corp.(1) | 481,484 | $ 22,610,489 | ||||

Express Scripts Holding Co.(1) | 163,185 | 10,202,326 | ||||

Surgical Care Affiliates, Inc.(1) | 72,399 | 1,900,474 | ||||

| 34,713,289 | ||||||

HEALTH CARE TECHNOLOGY† | ||||||

Veeva Systems, Inc. Class A(1) | 12,998 | 505,752 | ||||

HOTELS, RESTAURANTS AND LEISURE — 2.9% | ||||||

Chipotle Mexican Grill, Inc.(1) | 10,800 | 5,691,276 | ||||

Noodles & Co.(1) | 126,224 | 5,527,349 | ||||

Starbucks Corp. | 259,469 | 21,029,962 | ||||

| 32,248,587 | ||||||

HOUSEHOLD DURABLES — 0.4% | ||||||

Mohawk Industries, Inc.(1) | 33,800 | 4,475,796 | ||||

INTERNET AND CATALOG RETAIL — 3.9% | ||||||

Amazon.com, Inc.(1) | 45,490 | 16,559,725 | ||||

Ctrip.com International Ltd. ADR(1) | 55,300 | 3,000,025 | ||||

priceline.com, Inc.(1) | 16,991 | 17,905,625 | ||||

TripAdvisor, Inc.(1) | 64,300 | 5,318,253 | ||||

| 42,783,628 | ||||||

INTERNET SOFTWARE AND SERVICES — 8.4% | ||||||

CoStar Group, Inc.(1) | 21,464 | 3,798,913 | ||||

Criteo SA ADR(1) | 14,805 | 522,765 | ||||

Facebook, Inc., Class A(1) | 561,402 | 28,216,065 | ||||

Google, Inc. Class A(1) | 38,087 | 39,251,700 | ||||

LinkedIn Corp., Class A(1) | 77,624 | 17,362,160 | ||||

Rocket Fuel, Inc.(1) | 15,194 | 775,502 | ||||

Xoom Corp.(1) | 79,378 | 2,361,495 | ||||

| 92,288,600 | ||||||

IT SERVICES — 3.6% | ||||||

Alliance Data Systems Corp.(1) | 89,821 | 21,292,966 | ||||

MasterCard, Inc., Class A | 25,953 | 18,610,897 | ||||

| 39,903,863 | ||||||

LIFE SCIENCES TOOLS AND SERVICES — 0.6% | ||||||

Covance, Inc.(1) | 76,718 | 6,847,849 | ||||

MACHINERY — 2.9% | ||||||

Flowserve Corp. | 152,398 | 10,587,089 | ||||

Middleby Corp.(1) | 33,600 | 7,649,040 | ||||

Pentair Ltd. | 116,200 | 7,795,858 | ||||

WABCO Holdings, Inc.(1) | 72,700 | 6,228,936 | ||||

| 32,260,923 | ||||||

MEDIA — 4.5% | ||||||

AMC Networks, Inc.(1) | 71,809 | 5,033,093 | ||||

Time Warner, Inc. | 170,057 | 11,689,718 | ||||

Twenty-First Century Fox, Inc. | 955,300 | 32,556,624 | ||||

| 49,279,435 | ||||||

OIL, GAS AND CONSUMABLE FUELS — 0.8% | ||||||

Antero Resources Corp.(1) | 101,911 | 5,756,952 | ||||

Cobalt International Energy, Inc.(1) | 107,400 | 2,492,754 | ||||

| 8,249,706 | ||||||

PHARMACEUTICALS — 2.2% | ||||||

Johnson & Johnson | 170,100 | 15,752,961 | ||||

Zoetis, Inc. | 261,215 | 8,270,067 | ||||

| 24,023,028 | ||||||

ROAD AND RAIL — 5.6% | ||||||

Canadian Pacific Railway Ltd. New York Shares | 237,113 | 33,923,757 | ||||

Kansas City Southern | 159,082 | 19,331,645 | ||||

Union Pacific Corp. | 58,500 | 8,856,900 | ||||

| 62,112,302 | ||||||

SEMICONDUCTORS AND SEMICONDUCTOR EQUIPMENT — 1.0% | ||||||

ARM Holdings plc | 393,496 | 6,217,827 | ||||

NXP Semiconductor NV(1) | 101,100 | 4,258,332 | ||||

| 10,476,159 | ||||||

SOFTWARE — 5.6% | ||||||

CommVault Systems, Inc.(1) | 112,193 | 8,760,029 | ||||

Electronic Arts, Inc.(1) | 993,600 | 26,082,000 | ||||

NetSuite, Inc.(1) | 136,603 | 13,780,511 | ||||

Splunk, Inc.(1) | 101,733 | 6,379,676 | ||||

VMware, Inc., Class A(1) | 75,100 | 6,104,128 | ||||

| 61,106,344 | ||||||

SPECIALTY RETAIL — 5.9% | ||||||

Home Depot, Inc. (The) | 103,169 | 8,035,833 | ||||

Lowe’s Cos., Inc. | 466,122 | 23,203,553 | ||||

Lumber Liquidators Holdings, Inc.(1) | 83,000 | 9,477,770 | ||||

O’Reilly Automotive, Inc.(1) | 36,100 | 4,469,541 | ||||

Restoration Hardware Holdings, Inc.(1) | 49,683 | 3,464,893 | ||||

TJX Cos., Inc. (The) | 275,654 | 16,757,007 | ||||

| 65,408,597 | ||||||

TEXTILES, APPAREL AND LUXURY GOODS — 0.8% | ||||||

Fifth & Pacific Cos., Inc.(1) | 126,900 | 3,361,581 | ||||

Michael Kors Holdings Ltd.(1) | 68,568 | 5,276,308 | ||||

| 8,637,889 | ||||||

Shares | Value | |||||

TOBACCO — 2.6% | ||||||

Altria Group, Inc. | 195,164 | $ 7,265,956 | ||||

Philip Morris International, Inc. | 236,602 | 21,085,970 | ||||

| 28,351,926 | ||||||

WIRELESS TELECOMMUNICATION SERVICES — 0.9% | ||||||

SBA Communications Corp., Class A(1) | 109,372 | 9,566,769 | ||||

TOTAL COMMON STOCKS (Cost $734,510,198) | 1,095,056,101 | |||||

Temporary Cash Investments — 0.5% | ||||||

Repurchase Agreement, Bank of America Merrill Lynch, (collateralized by various U.S. Treasury obligations, 1.25%, 10/31/18, valued at $1,199,766), in a joint trading account at 0.07%, dated 10/31/13, due 11/1/13 (Delivery value $1,177,617) | 1,177,615 | |||||

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 2.75%, 11/15/42, valued at $1,442,718), in a joint trading account at 0.03%, dated 10/31/13, due 11/1/13 (Delivery value $1,413,140) | 1,413,139 | |||||

Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 1.75%, 5/15/22, valued at $1,442,438), in a joint trading account at 0.02%, dated 10/31/13, due 11/1/13 (Delivery value $1,413,140) | $ 1,413,139 | |||||

Repurchase Agreement, Goldman Sachs & Co., (collateralized by various U.S. Treasury obligations, 1.625%, 8/15/22, valued at $1,442,446), in a joint trading account at 0.05%, dated 10/31/13, due 11/1/13 (Delivery value $1,413,141) | 1,413,139 | |||||

SSgA U.S. Government Money Market Fund | 392,417 | 392,417 | ||||

TOTAL TEMPORARY CASH INVESTMENTS (Cost $5,809,449) | 5,809,449 | |||||

TOTAL INVESTMENT SECURITIES — 100.1% (Cost $740,319,647) | 1,100,865,550 | |||||

OTHER ASSETS AND LIABILITIES — (0.1)% | (1,490,864 | ) | ||||

TOTAL NET ASSETS — 100.0% | $1,099,374,686 | |||||

Forward Foreign Currency Exchange Contracts | ||||||||||||

Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Gain (Loss) | ||||||||

USD | 3,918,934 | EUR | 2,841,506 | UBS AG | 11/29/13 | $60,668 | ||||||

USD | 118,079 | EUR | 86,850 | UBS AG | 11/29/13 | 153 | ||||||

USD | 4,581,016 | GBP | 2,834,647 | Credit Suisse AG | 11/29/13 | 36,796 | ||||||

USD | 144,231 | GBP | 90,012 | Credit Suisse AG | 11/29/13 | (67 | ) | |||||

| $97,550 | ||||||||||||

Notes to Schedule of Investments

ADR = American Depositary Receipt

EUR = Euro

GBP = British Pound

USD = United States Dollar

† | Category is less than 0.05% of total net assets. |

(1) | Non-income producing. |

See Notes to Financial Statements.

Statement of Assets and Liabilities |

OCTOBER 31, 2013 | |||

Assets | |||

Investment securities, at value (cost of $740,319,647) | $1,100,865,550 | ||

Foreign currency holdings, at value (cost of $56,844) | 58,385 | ||

Receivable for investments sold | 4,352,298 | ||

Receivable for capital shares sold | 371,200 | ||

Unrealized gain on forward foreign currency exchange contracts | 97,617 | ||

Dividends and interest receivable | 553,819 | ||

| 1,106,298,869 | |||

Liabilities | |||

Payable for investments purchased | 5,721,999 | ||

Payable for capital shares redeemed | 277,905 | ||

Unrealized loss on forward foreign currency exchange contracts | 67 | ||

Accrued management fees | 917,164 | ||

Distribution and service fees payable | 7,048 | ||

| 6,924,183 | |||

Net Assets | $1,099,374,686 | ||

Net Assets Consist of: | |||

Capital (par value and paid-in surplus) | $600,600,926 | ||

Distributions in excess of net investment income | (97,550 | ) | |

Undistributed net realized gain | 138,226,316 | ||

Net unrealized appreciation | 360,644,994 | ||

| $1,099,374,686 | |||

Net assets | Shares outstanding | Net asset value per share | ||||||

Investor Class, $0.01 Par Value | $1,081,599,053 | 30,353,567 | $35.63 | |||||

Institutional Class, $0.01 Par Value | $109,848 | 3,072 | $35.76 | |||||

A Class, $0.01 Par Value | $8,516,743 | 240,137 | $35.47 | * | ||||

C Class, $0.01 Par Value | $3,320,572 | 94,977 | $34.96 | |||||

R Class, $0.01 Par Value | $5,828,470 | 165,126 | $35.30 | |||||

*Maximum offering price $37.63 (net asset value divided by 0.9425).

See Notes to Financial Statements.

Statement of Operations |

YEAR ENDED OCTOBER 31, 2013 | |||

Investment Income (Loss) | |||

Income: | |||

Dividends (net of foreign taxes withheld of $58,676) | $ 14,042,226 | ||

Interest | 4,183 | ||

| 14,046,409 | |||

Expenses: | |||

Management fees | 10,179,497 | ||

Distribution and service fees: | |||

A Class | 27,806 | ||

C Class | 25,658 | ||

R Class | 13,888 | ||

Directors’ fees and expenses | 35,309 | ||

Other expenses | 135 | ||

| 10,282,293 | |||

Net investment income (loss) | 3,764,116 | ||

Realized and Unrealized Gain (Loss) | |||

Net realized gain (loss) on: | |||

Investment transactions | 146,488,455 | ||

Foreign currency transactions | (486,500 | ) | |

| 146,001,955 | |||

Change in net unrealized appreciation (depreciation) on: | |||

Investments | 86,333,052 | ||

Translation of assets and liabilities in foreign currencies | 108,472 | ||

| 86,441,524 | |||

Net realized and unrealized gain (loss) | 232,443,479 | ||

Net Increase (Decrease) in Net Assets Resulting from Operations | $236,207,595 | ||

See Notes to Financial Statements.

Statement of Changes in Net Assets |

YEARS ENDED OCTOBER 31, 2013 AND OCTOBER 31, 2012 | ||||||

Increase (Decrease) in Net Assets | October 31, 2013 | October 31, 2012 | ||||

Operations | ||||||

Net investment income (loss) | $3,764,116 | $376,319 | ||||

Net realized gain (loss) | 146,001,955 | 67,135,793 | ||||

Change in net unrealized appreciation (depreciation) | 86,441,524 | 35,926,811 | ||||

Net increase (decrease) in net assets resulting from operations | 236,207,595 | 103,438,923 | ||||

Distributions to Shareholders | ||||||

From net investment income: | ||||||

Investor Class | (2,987,737 | ) | — | |||

Institutional Class | (460 | ) | — | |||

A Class | (23,405 | ) | — | |||

C Class | (653 | ) | — | |||

R Class | (2,856 | ) | — | |||

From net realized gains: | ||||||

Investor Class | (64,330,394 | ) | (23,595,114 | ) | ||

Institutional Class | (8,390 | ) | (705 | ) | ||

A Class | (650,947 | ) | (705 | ) | ||

C Class | (145,569 | ) | (1,880 | ) | ||

R Class | (112,134 | ) | (705 | ) | ||

Decrease in net assets from distributions | (68,262,545 | ) | (23,599,109 | ) | ||

Capital Share Transactions | ||||||

Net increase (decrease) in net assets from capital share transactions | (44,384,524 | ) | (39,887,723 | ) | ||

Net increase (decrease) in net assets | 123,560,526 | 39,952,091 | ||||

Net Assets | ||||||

Beginning of period | 975,814,160 | 935,862,069 | ||||

End of period | $1,099,374,686 | $975,814,160 | ||||

Distributions in excess of net investment income | $(97,550 | ) | $(200,949 | ) | ||

See Notes to Financial Statements.

Notes to Financial Statements |

OCTOBER 31, 2013

1. Organization

American Century Mutual Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. All Cap Growth Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class and the R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange-Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost. Forward foreign currency exchange contracts are valued at the mean of the latest bid and asked prices of the forward currency rates as provided by an independent pricing service.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund’s tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income and net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The annual management fee is 1.00% for the Investor Class, A Class, C Class and R Class and 0.80% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended October 31, 2013 are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation’s distributor, ACIS, and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended October 31, 2013 were $611,238,039 and $715,017,122, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

Year ended October 31, 2013 | Year ended October 31, 2012 | |||||||||||

Shares | Amount | Shares | Amount | |||||||||

Investor Class/Shares Authorized | 200,000,000 | 200,000,000 | ||||||||||

Sold | 1,333,460 | $41,078,263 | 1,442,712 | $43,890,074 | ||||||||

Issued in reinvestment of distributions | 2,273,872 | 65,874,089 | 873,776 | 23,207,496 | ||||||||

Redeemed | (4,842,756 | ) | (151,874,064 | ) | (4,078,501 | ) | (121,343,490 | ) | ||||

| (1,235,424 | ) | (44,921,712 | ) | (1,762,013 | ) | (54,245,920 | ) | |||||

Institutional Class/Shares Authorized | 25,000,000 | 25,000,000 | ||||||||||

Sold | 3,302 | 101,354 | 1,317 | 40,379 | ||||||||

Issued in reinvestment of distributions | 305 | 8,850 | 27 | 705 | ||||||||

Redeemed | (2,550 | ) | (81,844 | ) | (316 | ) | (9,915 | ) | ||||

| 1,057 | 28,360 | 1,028 | 31,169 | |||||||||

A Class/Shares Authorized | 25,000,000 | 25,000,000 | ||||||||||

Sold | 150,961 | 4,648,002 | 396,764 | 12,260,804 | ||||||||

Issued in reinvestment of distributions | 22,308 | 644,487 | 27 | 705 | ||||||||

Redeemed | (306,496 | ) | (10,032,622 | ) | (24,414 | ) | (751,345 | ) | ||||

| (133,227 | ) | (4,740,133 | ) | 372,377 | 11,510,164 | |||||||

C Class/Shares Authorized | 25,000,000 | 25,000,000 | ||||||||||

Sold | 38,907 | 1,224,286 | 68,891 | 2,084,611 | ||||||||

Issued in reinvestment of distributions | 4,234 | 121,389 | 71 | 1,880 | ||||||||

Redeemed | (14,351 | ) | (451,908 | ) | (3,762 | ) | (115,245 | ) | ||||

| 28,790 | 893,767 | 65,200 | 1,971,246 | |||||||||

R Class/Shares Authorized | 25,000,000 | 25,000,000 | ||||||||||

Sold | 156,475 | 4,980,335 | 32,043 | 986,202 | ||||||||

Issued in reinvestment of distributions | 3,990 | 114,990 | 27 | 705 | ||||||||

Redeemed | (23,884 | ) | (740,131 | ) | (4,512 | ) | (141,289 | ) | ||||

| 136,581 | 4,355,194 | 27,558 | 845,618 | |||||||||

Net increase (decrease) | (1,202,223 | ) | $(44,384,524 | ) | (1,295,850 | ) | $(39,887,723 | ) | ||||

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

• | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

• | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

• | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

Level 1 | Level 2 | Level 3 | |||||||

Investment Securities | |||||||||

Domestic Common Stocks | $1,019,156,764 | — | — | ||||||

Foreign Common Stocks | 64,315,368 | $11,583,969 | — | ||||||

Temporary Cash Investments | 392,417 | 5,417,032 | — | ||||||

Total Value of Investment Securities | $1,083,864,549 | $17,001,001 | — | ||||||

Other Financial Instruments | |||||||||

Total Unrealized Gain (Loss) on Forward Foreign Currency Exchange Contracts | — | $97,550 | — | ||||||

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund’s exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The foreign currency risk derivative instruments held at period end as disclosed on the Schedule of Investments are indicative of the fund’s typical volume during the period.

The value of foreign currency risk derivative instruments as of October 31, 2013, is disclosed on the Statement of Assets and Liabilities as an asset of $97,617 in unrealized gain on forward foreign currency exchange contracts and a liability of $67 in unrealized loss on forward foreign currency exchange contracts. For the year ended October 31, 2013, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(450,754) in net realized gain (loss) on foreign currency transactions and $106,931 in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

8. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

9. Federal Tax Information

The tax character of distributions paid during the years ended October 31, 2013 and October 31, 2012 were as follows:

2013 | 2012 | |||||

Distributions Paid From | ||||||

Ordinary income | $3,015,111 | — | ||||

Long-term capital gains | $65,247,434 | $23,599,109 |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of October 31, 2013, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

Federal tax cost of investments | $739,767,956 | ||

Gross tax appreciation of investments | $364,535,364 | ||

Gross tax depreciation of investments | (3,437,770 | ) | |

Net tax appreciation (depreciation) of investments | $361,097,594 | ||

Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | $1,543 | ||

Net tax appreciation (depreciation) | $361,099,137 | ||

Undistributed ordinary income | $12,016,581 | ||

Accumulated long-term gains | $125,658,042 |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to return of capital dividends received.

Financial Highlights |

For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | |||||||||||||||||||||||||||||||||||||||

Per-Share Data | Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||

Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||

Net Asset | Net | Net Realized | Total From | Net | Net | Total | Net Asset | Total | Operating | Net | Portfolio | Net Assets, | |||||||||||||||||||||||||||

Investor Class | |||||||||||||||||||||||||||||||||||||||

2013 | $30.44 | 0.12 | 7.22 | 7.34 | (0.10 | ) | (2.05 | ) | (2.15 | ) | $35.63 | 25.72 | % | 1.00 | % | 0.38 | % | 60 | % | $1,081,599 | |||||||||||||||||||

2012 | $28.06 | 0.01 | 3.08 | 3.09 | — | (0.71 | ) | (0.71 | ) | $30.44 | 11.40 | % | 1.00 | % | 0.04 | % | 55 | % | $961,562 | ||||||||||||||||||||

2011 | $26.07 | (0.02 | ) | 2.01 | 1.99 | — | — | — | $28.06 | 7.63 | % | 1.00 | % | (0.08 | )% | 75 | % | $935,751 | |||||||||||||||||||||

2010 | $20.86 | (0.05 | ) | 5.26 | 5.21 | — | — | — | $26.07 | 24.98 | % | 1.01 | % | (0.22 | )% | 88 | % | $959,447 | |||||||||||||||||||||

2009 | $19.08 | 0.03 | 1.81 | 1.84 | (0.06 | ) | — | (0.06 | ) | $20.86 | 9.72 | % | 1.00 | % | 0.19 | % | 167 | % | $837,839 | ||||||||||||||||||||

Institutional Class | |||||||||||||||||||||||||||||||||||||||

2013 | $30.50 | 0.16 | 7.26 | 7.42 | (0.11 | ) | (2.05 | ) | (2.16 | ) | $35.76 | 25.98 | % | 0.80 | % | 0.58 | % | 60 | % | $110 | |||||||||||||||||||

2012 | $28.06 | 0.09 | 3.06 | 3.15 | — | (0.71 | ) | (0.71 | ) | $30.50 | 11.62 | % | 0.80 | % | 0.24 | % | 55 | % | $61 | ||||||||||||||||||||

| 2011(3) | $25.32 | (0.01 | ) | 2.75 | 2.74 | — | — | — | $28.06 | 10.82 | % | 0.80% | (4) | (0.28 | )%(4) | 75% | (5) | $28 | |||||||||||||||||||||

A Class | |||||||||||||||||||||||||||||||||||||||

2013 | $30.36 | 0.04 | 7.19 | 7.23 | (0.07 | ) | (2.05 | ) | (2.12 | ) | $35.47 | 25.42 | % | 1.25 | % | 0.13 | % | 60 | % | $8,517 | |||||||||||||||||||

2012 | $28.05 | (0.02 | ) | 3.04 | 3.02 | — | (0.71 | ) | (0.71 | ) | $30.36 | 11.15 | % | 1.25 | % | (0.21 | )% | 55 | % | $11,334 | |||||||||||||||||||

| 2011(3) | $25.32 | (0.02 | ) | 2.75 | 2.73 | — | — | — | $28.05 | 10.78 | % | 1.25% | (4) | (0.73 | )%(4) | 75% | (5) | $28 | |||||||||||||||||||||

C Class | |||||||||||||||||||||||||||||||||||||||

2013 | $30.11 | (0.20 | ) | 7.11 | 6.91 | (0.01 | ) | (2.05 | ) | (2.06 | ) | $34.96 | 24.45 | % | 2.00 | % | (0.62 | )% | 60 | % | $3,321 | ||||||||||||||||||

2012 | $28.03 | (0.25 | ) | 3.04 | 2.79 | — | (0.71 | ) | (0.71 | ) | $30.11 | 10.32 | % | 2.00 | % | (0.96 | )% | 55 | % | $1,993 | |||||||||||||||||||

| 2011(3) | $25.32 | (0.03 | ) | 2.74 | 2.71 | — | — | — | $28.03 | 10.70 | % | 2.00% | (4) | (1.48 | )%(4) | 75% | (5) | $28 | |||||||||||||||||||||

For a Share Outstanding Throughout the Years Ended October 31 (except as noted) | |||||||||||||||||||||||||||||||||||||||

Per-Share Data | Ratios and Supplemental Data | ||||||||||||||||||||||||||||||||||||||

Income From Investment Operations: | Distributions From: | Ratio to Average Net Assets of: | |||||||||||||||||||||||||||||||||||||

Net Asset | Net | Net Realized | Total From | Net | Net | Total | Net Asset | Total | Operating | Net | Portfolio | Net Assets, | |||||||||||||||||||||||||||

R Class | |||||||||||||||||||||||||||||||||||||||

2013 | $30.27 | (0.09 | ) | 7.22 | 7.13 | (0.05 | ) | (2.05 | ) | (2.10 | ) | $35.30 | 25.12 | % | 1.50 | % | (0.12 | )% | 60 | % | $5,828 | ||||||||||||||||||

2012 | $28.04 | (0.08 | ) | 3.02 | 2.94 | — | (0.71 | ) | (0.71 | ) | $30.27 | 10.86 | % | 1.50 | % | (0.46 | )% | 55 | % | $864 | |||||||||||||||||||

| 2011(3) | $25.32 | (0.02 | ) | 2.74 | 2.72 | — | — | — | $28.04 | 10.74 | % | 1.50% | (4) | (0.98 | )%(4) | 75% | (5) | $28 | |||||||||||||||||||||

Notes to Financial Highlights

(1) | Computed using average shares outstanding throughout the period. |

(2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized. |

(3) | September 30, 2011 (commencement of sale) through October 31, 2011. |

(4) | Annualized. |

(5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2011. |

See Notes to Financial Statements.

Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

American Century Mutual Funds, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of All Cap Growth Fund (the “Fund”), one of the funds constituting American Century Mutual Funds, Inc. as of October 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2013, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of All Cap Growth Fund of American Century Mutual Funds, Inc. as of October 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri

December 19, 2013

Management |

The Board of Directors

The individuals listed below serve as directors of the funds. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors). Independent directors shall retire by December 31 of the year in which they reach their 75th birthday. Mr. Pratt may serve until December 31 of the year in which he reaches his 76th birthday based on an extension granted under previous retirement guidelines.

Mr. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). Mr. Fink is treated as an “interested person” because of his recent employment with ACC and American Century Services, LLC (ACS). The other directors (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and ACS, and do not have any other affiliations, positions, or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

Name | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years | |

Independent Directors | ||||||

Thomas A. Brown (1940) | Director | Since 1980 | Managing Member, Associated Investments, LLC (real estate investment company); Brown Cascade Properties, LLC (real estate investment company) (2001 to 2009) | 75 | None | |

Andrea C. Hall (1945) | Director | Since 1997 | Retired | 75 | None | |

Jan M. Lewis (1957) | Director | Since 2011 | President and Chief Executive Officer, Catholic Charities of Northeast Kansas (human services organization) | 75 | None | |

James A. Olson (1942) | Director | Since 2007 | Member, Plaza Belmont LLC (private equity fund manager) | 75 | Saia, Inc. (2002 to 2012) and EPR Properties (2003 to 2013) | |

Donald H. Pratt (1937) | Director and Chairman of the Board | Since 1995 (Chairman since 2005) | Chairman and Chief Executive Officer, Western Investments, Inc. (real estate company) | 75 | None | |

Name | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years | |

Independent Directors | ||||||

M. Jeannine Strandjord | Director | Since 1994 | Retired | 75 | Euronet Worldwide Inc.; Charming Shoppes, Inc. (2006 to 2010); and DST Systems Inc. (1996 to 2012) | |

John R. Whitten (1946) | Director | Since 2008 | Retired | 75 | Rudolph Technologies, Inc. | |

Stephen E. Yates (1948) | Director | Since 2012 | Retired; Executive Vice President, Technology & Operations, KeyCorp. (computer services)(2004 to 2010) | 75 | Applied Industrial Technologies, Inc. (2001 to 2010) | |

Interested Directors | ||||||

Barry Fink | Director | Since 2012 | Retired; Executive Vice President, ACC (September 2007 to February 2013); President, ACS (October 2007 to February 2013); Chief Operating Officer, ACC (September 2007 to (November 2012) | 75 | None | |

Jonathan S. Thomas | Director and President | Since 2007 | President and Chief Executive Officer, ACC (March 2007 to present). Also serves as Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries | 117 | None | |

Officers

The following table presents certain information about the executive officers of the funds. Each officer serves as an officer for each of the 15 investment companies in the American Century family of funds, unless otherwise noted. No officer is compensated for his or her service as an officer of the funds. The listed officers are interested persons of the funds and are appointed or re-appointed on an annual basis. The mailing address for each officer listed below is 4500 Main Street, Kansas City, Missouri 64111.

Name | Offices with the Funds | Principal Occupation(s) During the Past Five Years | |

Jonathan S. Thomas | Director and President since 2007 | President and Chief Executive Officer, ACC (March 2007 to present). Also serves as Chief Executive Officer and Manager, ACS; Executive Vice President, ACIM; Director, ACC, ACIM and other ACC subsidiaries | |

Maryanne L. Roepke | Chief Compliance Officer since 2006 and Senior Vice President since 2000 | Chief Compliance Officer, American Century funds, ACIM and ACS (August 2006 to present). Also serves as Senior Vice President, ACS | |

Charles A. Etherington (1957) | General Counsel since 2007 and Senior Vice President since 2006 | Attorney, ACC (February 1994 to present); Vice President, ACC (November 2005 to present); General Counsel, ACC (March 2007 to present). Also serves as General Counsel, ACIM, ACS, ACIS and other ACC subsidiaries; and Senior Vice President, ACIM and ACS | |

C. Jean Wade (1964) | Vice President, Treasurer and Chief Financial Officer since 2012 | Vice President, ACS (February 2000 to present) | |

Robert J. Leach (1966) | Vice President since 2006 and Assistant Treasurer since 2012 | Vice President, ACS (February 2000 to present) | |

David H. Reinmiller (1963) | Vice President since 2000 | Attorney, ACC (January 1994 to present); Associate General Counsel, ACC (January 2001 to present). Also serves as Vice President, ACIM and ACS | |

Ward D. Stauffer (1960) | Secretary since 2005 | Attorney, ACC (June 2003 to present) |

The Statement of Additional Information has additional information about the fund’s directors and is available without charge, upon request, by calling 1-800-345-2021.

Approval of Management Agreement |

At a meeting held on June 20, 2013, the Fund’s Board of Directors unanimously approved the renewal of the management agreement pursuant to which American Century Investment Management, Inc. (the “Advisor”) acts as the investment advisor for the Fund. Under Section 15(c) of the Investment Company Act, contracts for investment advisory services are required to be reviewed, evaluated, and approved by a majority of a fund’s directors (the “Directors”), including a majority of the independent Directors, each year.

Prior to its consideration of the renewal of the management agreement, the Board requested and reviewed extensive data and information compiled by the Advisor and certain independent providers of evaluation data concerning the Fund and the services provided to the Fund by the Advisor. This review was in addition to the oversight and evaluation undertaken by the Board and its committees on a continuous basis throughout the year.

In connection with its consideration of the renewal of the management agreement, the Board’s review and evaluation of the services provided by the Advisor included, but was not limited to, the following:

• | the nature, extent, and quality of investment management, shareholder services, and other services provided by the Advisor to the Fund; |

• | the wide range of other programs and services the Advisor provides to the Fund and its shareholders on a routine and non-routine basis; |

• | the investment performance of the Fund, including data comparing the Fund’s performance to appropriate benchmarks and/or a peer group of other mutual funds with similar investment objectives and strategies; |

• | data comparing the cost of owning the Fund to the cost of owning similar funds; |

• | the Advisor’s compliance policies, procedures, and regulatory experience; |

• | financial data showing the cost of services provided to the Fund, the profitability of the Fund to the Advisor, and the overall profitability of the Advisor; |

• | possible economies of scale associated with the Advisor’s management of the Fund and other accounts under its management; |

• | data comparing services provided and charges to other investment management clients of the Advisor; and |

• | consideration of collateral benefits derived by the Advisor from the management of the Fund. |

In keeping with its practice, the Board held two in-person meetings and one telephonic meeting to review and discuss the information provided. The Directors also had the benefit of the advice of independent counsel throughout the period.

Factors Considered

The Directors considered all of the information provided by the Advisor, the independent data providers, and independent counsel, and evaluated such information for the Fund. In connection with their review, the Directors did not identify any single factor as being all-important or controlling, and each Director may have attributed different levels of importance to different factors. In deciding to renew the management agreement, the Board based its decision on a number of factors, including the following:

Nature, Extent and Quality of Services — Generally. Under the management agreement, the Advisor is responsible for providing or arranging for all services necessary for the operation of the Fund. The Board noted that under the management agreement, the Advisor provides or arranges at its own expense a wide variety of services including:

• | constructing and designing the Fund |

• | portfolio research and security selection |

• | initial capitalization/funding |

• | securities trading |

• | Fund administration |

• | custody of Fund assets |

• | daily valuation of the Fund’s portfolio |

• | shareholder servicing and transfer agency, including shareholder confirmations, recordkeeping, and communications |

• | legal services |

• | regulatory and portfolio compliance |

• | financial reporting |

• | marketing and distribution |

The Board noted that many of these services have expanded over time both in terms of quantity and complexity in response to shareholder demands, competition in the industry, changing distribution channels, and the changing regulatory environment.