QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

| For | | Supplemental Disclosure 2003 Outlook – Factors to Consider |

| | |

|

| | | |

QUEBECOR WORLD INC. (Formerly known as Quebecor Printing Inc.) |

|

| (Translation of Registrant's Name into English) |

| | | |

612 Saint-Jacques Street, Montreal, Quebec, H3C 4M8 |

|

| (Address of Principal Executive Office) |

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

QUEBECOR WORLD INC.

(Formerly known as Quebecor Printing Inc.)

Filed in this Form 6-K

Documents index

- 1.

- Supplemental Disclosure for the 2003 Outlook – Factors to Consider

Quebecor World Inc.

Supplemental Disclosure

As furnished to the Securities and Exchange Commission on October 29th, 2002

2003 Outlook

Factors to Consider

For Public Release on October 29th, 2002

http://www.quebecorworld.com

Quebecor World

2003 Outlook – Factors to Consider

| | Page

|

|---|

| 1. Current Focus of Quebecor World | | 2 |

2. Financial Condition |

|

3 |

3. Market Conditions |

|

4 |

4. Resumption of External Growth Strategy |

|

5 |

5. Conclusions |

|

6 |

6. Attachments |

|

7 |

| |

1. 2002 Earnings Estimates |

|

|

| |

2. 2003 Earnings Estimates |

|

|

| |

3. U.S. Advertising Pages |

|

|

| |

4. U.S. Commercial Print Shipments |

|

|

| |

5. Capacity Utilization |

|

|

| |

6. Public Forecasts of Ad Spending – 2003 |

|

|

| |

7. Debt to Capitalization Ratio |

|

|

| |

8. 2002 Marketplace Successes |

|

|

-1-

1. Current Focus of Quebecor World

The current focus of Quebecor World is to fully implement the 2001-2002 restructuring plan:

- •

- annualized restructuring benefits going into 2003;

- •

- further cost containment initiatives in relation to general and administrative costs, following the proposed integration of corporate services;

- •

- continuing initiatives to improve loading, productivity and automation of manufacturing processes; and

- •

- other supply-chain initiatives to maximize procurement, logistics, distribution and other benefits.

The restructuring plan has been largely implemented in our domestic business, subject to eliminating some duplication of general and administration costs.

European countries other than France have also successfully implemented restructuring initiatives.

The operations of Quebecor World in France have and will be the subject of additional measures during the Fourth Quarter 2002 and into 2003 to reduce costs that will materially improve results of operations going forward.

-2-

2. Financial Condition

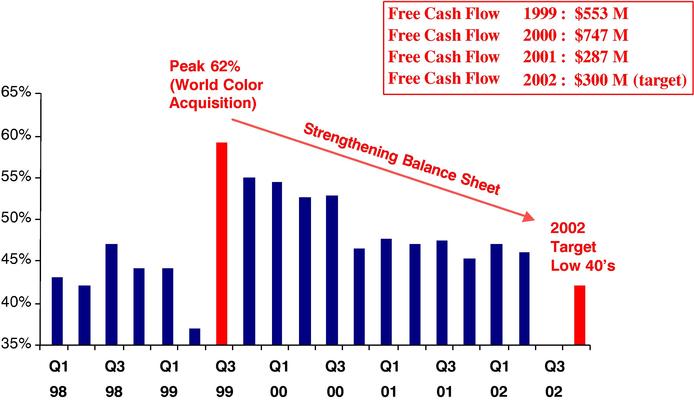

Free cash flow from operations was $97 million for the Third Quarter and $443 million for the trailing 12 months ended September 30, 2002.

On a 2002 year-to-date basis, financial expenses were $127.5 million, a 20% improvement compared with the same period last year. The reduction in financial expense was due half to reduced bank borrowings and half to lower rates of interest on long-term debt and securitization. Long term debt decreased by 12% versus September 30, 2001 representing a decline of $268 million year-over-year.

This improvement reflects management's efforts to strengthen the Company's financial condition through tight management of working capital and capital spending requirements.

This strategy has resulted in lower financial expense that has contributed to earnings per share. Quebecor World intends to continue this strategy in the short-term.

-3-

3. Market Conditions

For the commercial printing industry generally, Quebecor World expects a continuing imbalance in the short-term from a demand-supply perspective.

The recovery in advertising expenditures is generally lagging expectations; however ad page demand is showing some signs of stabilization.

Quebecor World currently expects continuing low advertising demand in the first half of 2003.

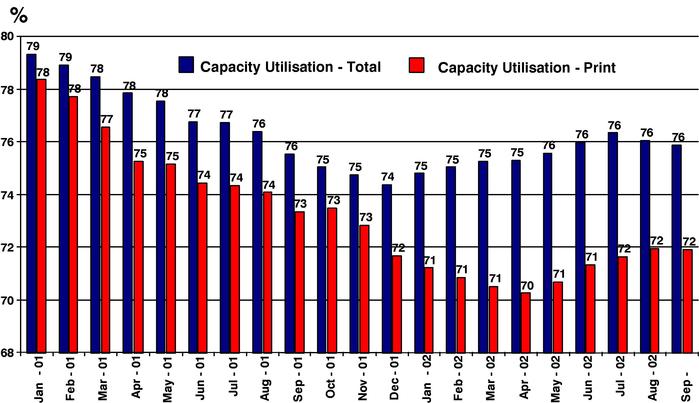

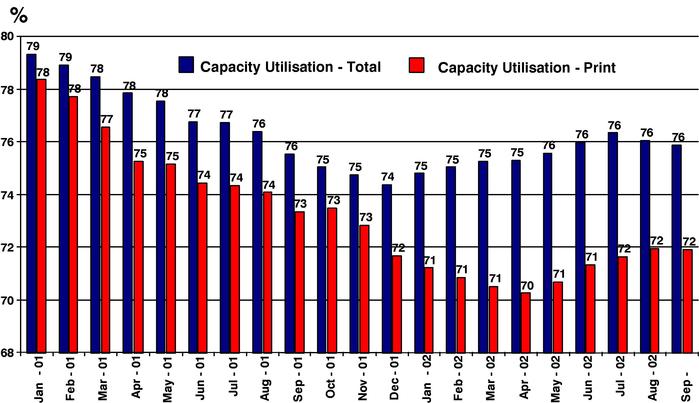

It is also expected that the current under-utilization of industry capacity (currently 72% according to U.S. Federal Reserve Board data) will also continue throughout 2003.

Excess capacity is negatively affecting price, more acutely in some market segments than others – commercial for example.

A modest recovery in advertising is expected in the second half of 2003, which should lead to higher capacity utilization – as demand strengthens, unused capacity will be absorbed and prices should solidify.

Recent initiatives by the industry to lower capacity should result in improved loading, higher capacity utilization and a more stable pricing environment.

Following the full implementation of the 2001-2002 restructuring plan and other cost containment initiatives, Quebecor World is uniquely positioned to benefit from an improving economic environment, a recovery in advertising demand and significant operating leverage.

-4-

4. Resumption of External Growth Strategy

Quebecor World has not pursued external growth or business acquisitions since mid-2001, except for the closing of the Hachette transaction in France and Belgium. The Hachette transaction was a unique opportunity to secure long-run gravure commercial printing, with the support of an enabling contract from Hachette, as well as the renewal of our relationship with a leading publisher in the U.S. The Company is always open for acquisitions that come with an appropriate level of contract work.

When deemed appropriate to resume acquisitions, the Company's criteria will remain:

- •

- complement existing product lines;

- •

- extend geographical reach;

- •

- meet or exceed internal financial hurdle rates and payback requirements;

- •

- be accretive to net income and earnings per share.

-5-

5. Conclusion

Quebecor World expects the advertising recovery to lag expectations – management of Quebecor World remains cautious and internally focused.

Investment analysts covering Quebecor World are providing earnings estimates that range from a low of $2.15 to an average of $2.30 diluted earnings per share.

Management of Quebecor World believes that this range is appropriate given the limited visibility in the marketplace.

-6-

6. ATTACHMENTS

Attachment 1: 2002 Earnings Estimates

DILUTED EARNINGS PER SHARE1

| | First Quarter

| | Second Quarter

| | Third Quarter

| | Fourth Quarter

| | Full Year

|

|---|

| | EPS

|

| %

| | EPS

|

| %

| | EPS

|

| %

| | EPS

|

| %

| | EPS

|

| %

|

|---|

| 1999 | | $ | 0.18 | | +13% | | $ | 0.36 | | +16% | | $ | 0.43 | | +13% | | $ | 0.58 | | +32% | | $ | 1.55 | | +20% |

| 2000 | | $ | 0.24 | | +33% | | $ | 0.40 | | +11% | | $ | 0.58 | | +35% | | $ | 0.69 | | +19% | | $ | 1.90 | | +23% |

| 2001 | | $ | 0.27 | | +13% | | $ | 0.41 | | +2% | | $ | 0.46 | | -21% | | $ | 0.45 | | -35% | | $ | 1.58 | | -17% |

|

|---|

| IQW 2002 Guidance – July 30, 2002 | | | $1.90 – 2.00 |

|

|---|

| 2002 | | $ | 0.28 | | +4% | | $ | 0.40 | | -2% | | $ | 0.64 | | +39% | | $ | 0.67 | 2 | +49% | | $ | 1.96 | 2 3 | +24% |

|

|---|

| 1 | Before restructuring & other special charges. |

2 |

Based on management's survey of 13 sell-side analysts as at October 27, 2002. |

3 |

Based on management's survey of 13 sell-side analysts as at October 27, 2002. |

-7-

6. ATTACHMENTS

Attachment 2: 2003 Earnings Estimates

| High: | | $ | 2.64 |

| Low: | | $ | 2.15 |

| Average | | $ | 2.31 |

| Average (excluding high and low) | | $ | 2.30 |

Firm

| | Analyst

| | Recommendation

| | 2003 EPS

|

|---|

| Canada | | | | | | |

| BMO Nesbitt Burns | | Tim Casey | | Outperform | | $2.30 |

| Canaccord Capital | | Megan Anderson | | Buy | | $2.29 |

| National Bank Financial | | David McFadgen | | Outperform | | $2.43 |

| RBC Dominion Securities | | Andrea Horan | | Outperform | | $2.64 |

| Scotia Capital | | Andrew Mitchell | | Buy | | $2.36 |

| TD Newcrest | | Vince Valentini | | Buy | | $2.15 |

| CIBC World Markets | | Adam Shine | | Sector Outperformer | | $2.28 |

| CSFB (Canada) | | Randal Rudinski | | Outperform | | $2.50 |

United States |

|

|

|

|

|

|

| Goldman Sachs | | Tim Newington | | Market Outperformer | | $2.25 |

| Merrill Lynch | | Karl Choi | | Buy | | $2.30 |

| Morgan Stanley DW | | Doug Arthur | | Equal-Weight | | $2.20 |

| Salomon Smith Barney | | Mike Millman | | Underperform | | $2.21 |

| Bank of America | | William Gibson | | Buy | | $2.15 |

-8-

6. ATTACHMENTS

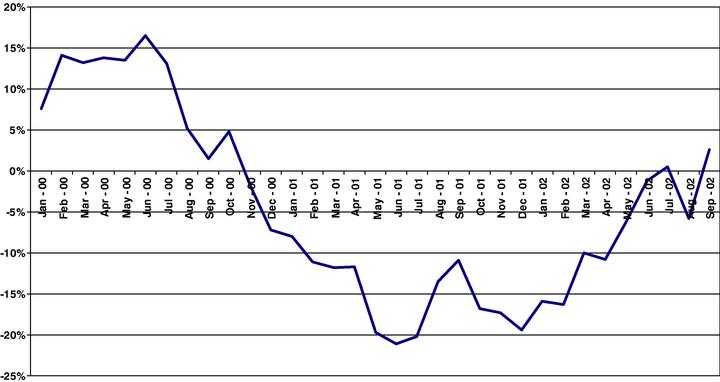

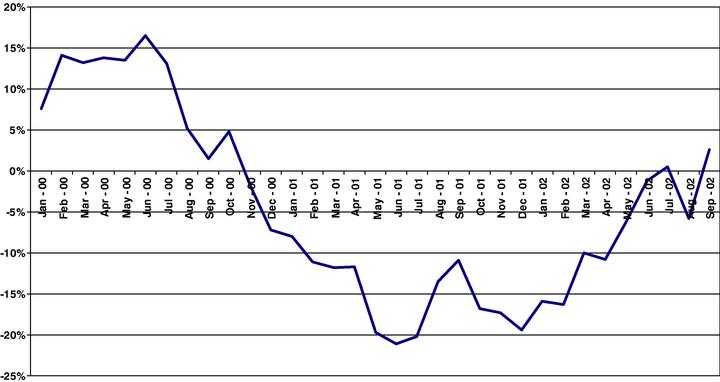

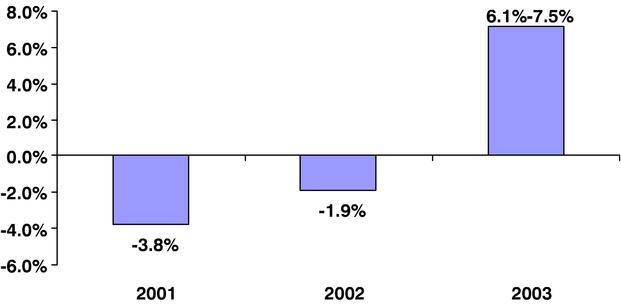

Attachment 3: U.S. Advertising Pages

U.S. Magazine Advertising Pages 2000-2002(Monthly)

Percentage Year-Over-Year Change

Source: Publishers Information Bureau

-9-

6. ATTACHMENTS

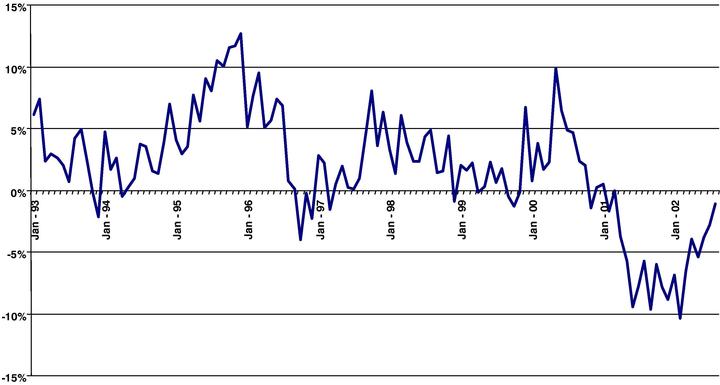

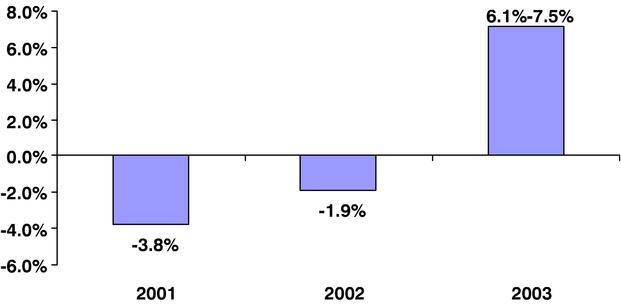

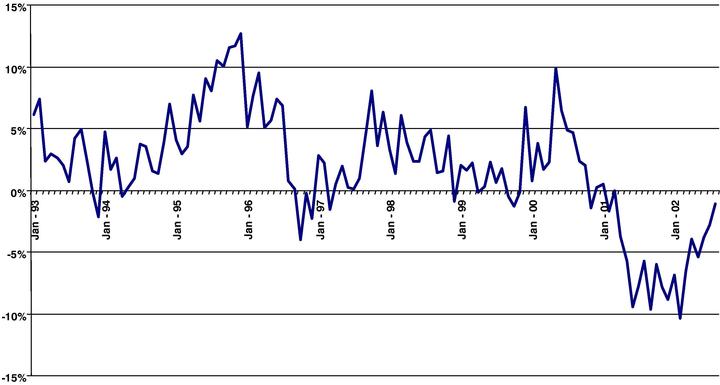

Attachment 4: Commercial Print Shipments (U.S.A.)

Commercial Print Value of Shipments 1993-2002(Monthly)

Percentage Change Year over Year

Source: US Census Bureau

-10-

6. ATTACHMENTS

Attachment 5: Capacity Utilization

Source: The Federal Reserve Board

-11-

6. ATTACHMENTS

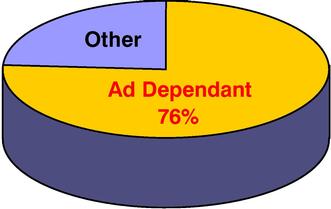

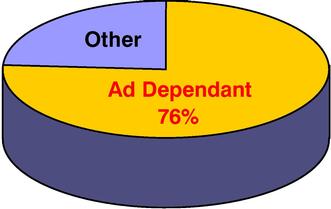

Attachment 6: Forecasts of U.S. Advertising Spending

| |

|

|---|

FORECAST OF U.S. AD SPENDING

| | 2002E

| | 2003E

| | QUEBECOR WORLD

|

|---|

| |

|

|---|

| Merrill Lynch | | 0.7% | | 4.0% | | |

| Standard and Poor's | | -3.8% | | 9.0% | | Revenues dependant on

Advertising Expenditures

|

| Universal MacCann | | 2.1% | | 5.5% | | |

1 Data source OECD Economic Outlook, No 71 June 2002

2 Source: Merrill Lynch Estimate, Advertising & Publishing – On the Cusp; But Which Direction?, 6 September 2002

3 Standard & Poor's Industry Surveys, Publishing, August 22 2002. 2002E range (2.5%) to (5%); 2003E range 8% to 10%

4 Universal McCann, Goldman Sachs Media: Printing North America

-12-

6. ATTACHMENTS

Attachment 7: 2003 Forecast Demand for Paper

*Source: GAPTRAC June 2002, Jaakko Pöyry Consulting

-13-

6. ATTACHMENTS

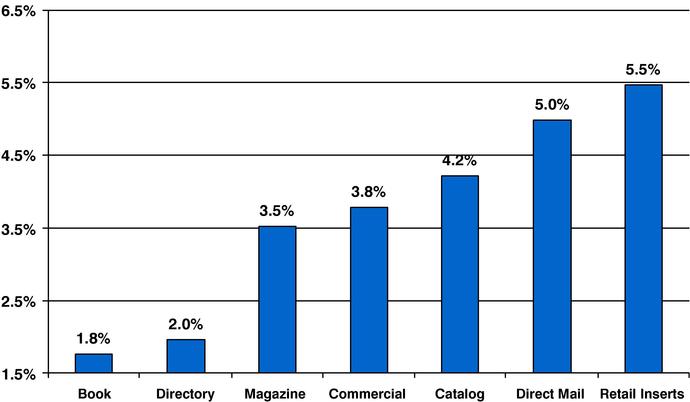

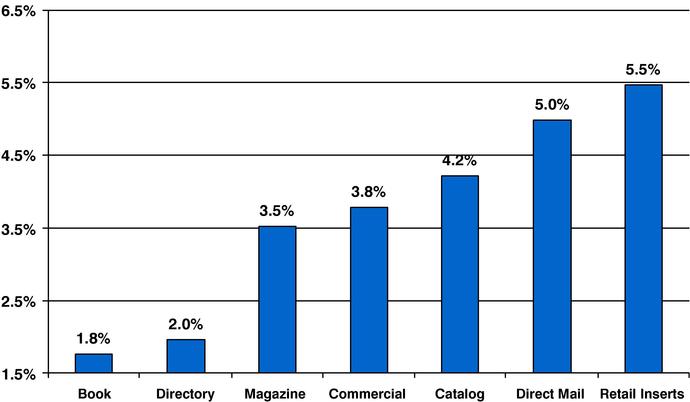

Attachment 8: Forecasts of U.S. Print Sales

*Source: National Association for Printing Leadership

-14-

6. ATTACHMENTS

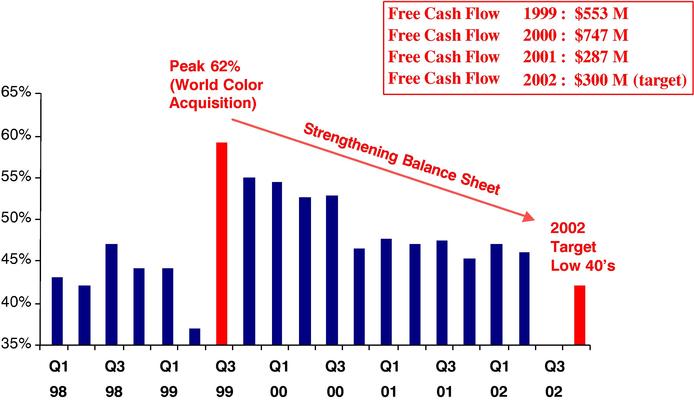

Attachment 9: Debt to Capitalization ratio

-15-

6. ATTACHMENTS

Attachment 10: 2002 Success in the Marketplace

| Catalog | | Magazines | | Books | | Retail |

| | | | | | | |

| Brylane | | Rogers | | Simon & Schuster | | Sears (Paper & Logistics) |

| L.L. Bean | | Dennis Publishing | | Kensington Publishers | | Albertsons |

| Avon | | Hachette | | Holtzbrinck | | CVS |

| United Stationers | | Forbes | | AOL/Time-Warner | | Kmart |

| Blair Corp. | | Primedia | | Microsoft Press | | Walgreens |

| Costco | | | | Disney Hyperion | | |

| Spiegel | | | | | | |

| Williams Sonoma | | | | | | |

| Cornerstone | | | | | | |

-16-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | QUEBECOR WORLD INC. |

|

|

By: |

/s/ CHRISTIAN M. PAUPE

|

| | | Name: | Christian M. Paupe |

| | | Title: | Executive Vice President, Chief Administrative Officer

And Chief Financial Officer |

Date: October 29, 2002

QuickLinks

QUEBECOR WORLD INC. (Formerly known as Quebecor Printing Inc.)Filed in this Form 6-KDILUTED EARNINGS PER SHARE1U.S. Magazine Advertising Pages 2000-2002 (Monthly) Percentage Year-Over-Year ChangeCommercial Print Value of Shipments 1993-2002 (Monthly) Percentage Change Year over YearSIGNATURES