U.S. Securities and Exchange Commission

Washington, D.C. 20549

FORM 40-F

[ ] Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

[•] Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2003 Commission file number 1-14118

QUEBECOR WORLD INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant's name into English (if applicable))

CANADA

(Province or other jurisdiction of incorporation or organization)

2572

(Primary Standard Industrial Classification Code Number (if applicable))

N/A

(I.R.S. Employer Identification Number (if applicable))

612 Saint-Jacques Street, Montreal, Quebec, Canada, H3C 4M8

Tel: (514) 954-0101

(Address and telephone number of Registrant's principal executive offices)

QUEBECOR WORLD (USA) INC.

291 State Street, North Haven, CT 06473

Telephone: (203) 288-2468

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Subordinate voting shares | | New York Stock Exchange |

______________________ | | _________________________ |

Title of each class | | Name of each exchange on which registered |

Securities Registered or to be registered pursuant to Section 12(g) of the Act

N/A

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Guarantees of Debt Securities issued by Quebecor World Capital Corporation, an indirect subsidiary of Registrant

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

[•] Annual Information form [•] Audited financial statements

Indicate the number of outstanding shares of each of the issuer's classes of capital/or common stock as of the close of the period covered by the annual report.

84,964,837 Subordinate Voting shares Outstanding

46,987,120 Multiple Voting Shares Outstanding

12,000,000 First Preferred Shares Series Outstanding

8,000,000 First Preferred Shares Series 4 Outstanding

7,000,000 First Preferred Shares Series 5 Outstanding

Indicate by check mark whether the Registrant by filling the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under theSecurities Exchange Act of 1934 (the "Exchange Act"). If "Yes" is marked, indicate the filing number assigned to the Registrant in connection with such Rule.

Yes 82- No •

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes • No

Material included in this Form 40-F:

- The Annual Information Form of the Registrant dated May 12, 2004

- Management's Discussion and Analysis of Financial Condition and results of Operation and Audited Consolidated Financial Statements of the Registrant, including the Notes thereto, as at December 31, 2003 and 2002 and for the years ended December 31, 2003, 2002 and 2001.

*************

DISCLOSURE CONTROLS AND PROCEDURES; INTERNAL CONTROL OVER FINANCIAL REPORTING

Disclosure controls and procedures are defined by the Securities and Exchange Commission (the "Commission") as those controls and other procedures that are designed to ensure that information required to be disclosed in our filings and submissions under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Commission. Our Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this annual report on Form 40-F and have determined that such disclosure controls and procedures are effective.

There was no change in our internal control over financial reporting that occurred during the period covered by this annual report on Form 40-F that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

AUDIT COMMITTEE

Quebecor World Inc. (the "Registrant") has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Registrant's audit committee are Robert Coallier (Chairman), Reginald K. Brack, Robert Normand and Alain Rhéaume.

AUDIT COMMITTEE FINANCIAL EXPERT

The Board of Directors of the Registrant has reviewed the definition of "audit committee financial expert" under paragraph 8(b) of General Instruction B to Form 40-F and determined that the Registrant has at least one audit committee financial expert. The names of the audit committee financial experts of the Registrant are Messrs. Robert Coallier, Robert Normand and Alain Rhéaume. The Commission has indicated that the designation of Messrs. Coallier, Normand and Rhéaume as the audit committee financial experts of the Registrant do not (i) make any of Messrs. Coallier, Normand and Rhéaume an "expert" for any purpose, including without limitation for purposes of Section 11 of the Securities Act of 1933, as amended, as a result of this designation; (ii) impose any duties, obligations or liability on Messrs. Coallier, Normand and Rhéaume that are greater than those imposed on them as members of the audit committee and the Board of Directors in the absence of such designation; or (iii) affect the duties, obligations or liability of any other member of the audit committee or the Board of Directors.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Fees payable to the Registrant's independent auditor, KPMG LLP, for the years ended December 31, 2003, and December 31, 2002, totalled $5,760,000 CAD and $7,872,000 CAD, respectively, as detailed in the following table:

Fees | Financial Year Ended December 31, 2003 | Financial Year Ended December 31, 2002 |

| | | |

Audit Fees(1) | $3,459,000 | $3,329,000 |

| | | |

Audit-Related Fees(2) | $774,000 | $730,000 |

| | | |

Tax Fees(3) | $1,441,000 | $3,631,000 |

| | | |

All other Fees(4) | $86,000 | $182,000 |

| | | |

Total Fees: | $5,760,000 | $7,872,000 |

(1) | Refers to all fees incurred in respect of audit services, being the professional services rendered by the Registrant's external auditor for the audit and review of the Registrant's financial statements as well as services normally provided by the external auditor in connection with statutory and regulatory filings and engagements. |

(2) | Includes audit or attest services not required by statute or regulation, employee benefit plan audits, due diligence services, and accounting consultations on proposed transactions. |

(3) | Incurred in respect of tax compliance, tax planning and tax advice. |

(4) | Refers to all fees not included in audit fees, audit-related fees or tax fees. |

Pre-approval policies and procedures

The Registrant's audit committee is responsible for overseeing the work of the independent auditors and has considered whether the provision of services other than audit services is compatible with maintaining the auditors' independence. The audit committee is determining which non-audit services the external auditor are prohibited from providing and, exceptionally, approving and overseeing the disclosure of permitted non-audit services to be performed by the external auditor.

For the year ended December 31, 2003, none of the services described above were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant and its subsidiaries have certain arrangements and commitments that have financial implications. These arrangements are described in Notes 2a), 8 and 18 to our audited consolidated financial statements for the year ended December 31, 2003 included hereto.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

Contractual Cash Obligations($ millions)

| | 2004

| | 2005

| | 2006

| | 2007

| | 2008

| | 2009 and thereafter

|

|---|

| Long-term debt and convertible notes | | $ | 8 | | $ | — | | $ | 530 | | $ | 261 | | $ | 202 | | $ | 949 |

| Capital leases | | | 16 | | | 11 | | | 8 | | | 4 | | | 3 | | | 17 |

| Operating leases | | | 101 | | | 84 | | | 68 | | | 52 | | | 36 | | | 108 |

| | |

| |

| |

| |

| |

| |

|

| Total contractual cash obligations | | $ | 125 | | $ | 95 | | $ | 606 | | $ | 317 | | $ | 241 | | $ | 1,074 |

| | |

| |

| |

| |

| |

| |

|

For further details on our long-term debt and convertible notes, Capital leases and Operating leases, see Notes 12, 14 and 19 of our audited consolidated financial statements for the year ended December 31, 2003 included hereto.

CODE OF ETHICS

The Registrant has adopted a Code of Business Conduct, which is a code of ethics (as defined in paragraph 9(b) of General Instruction B of Form 40-F) that applies to all of the Registrant's employees, directors and officers, including the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The text of the Code of Business Conduct of the Registrant is available on the Registrant's web site at www.quebecorworldinc.com in Investors Center under Corporate Governance.

UNDERTAKING

Quebecor World Inc. undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certified that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

Registrant:

QUEBECOR WORLD INC.

/s/ Raynald Lecavalier

Raynald Lecavalier

Vice President, Corporate General Counsel and

Secretary

May 19, 2004

QUEBECOR WORLD INC.

ANNUAL INFORMATION FORM

For the Year Ended

December 31, 2003

May 12, 2004

QUEBECOR WORLD INC.

TABLE OF CONTENTS

DEFINITIONS ............................................................................................................................. | 3 |

| | | | |

ITEM 1 - INCORPORATION ........................................................................................................... | 3 |

| | 1.1 | Incorporation of Quebecor World Inc. ................................................................................ | 3 |

| | 1.2 | Subsidiaries ................................................................................................................... | 3 |

| | 1.3 | Multiple Voting and Subordinate Voting Shares .................................................................... | 4 |

| | |

ITEM 2 - GENERAL DEVELOPMENT OF THE BUSINESS ....................................................................... | 4 |

| | |

ITEM 3 - NARRATIVE DESCRIPTION OF THE BUSINESS ..................................................................... | 6 |

| | 3.1 | Description of Segments and Products ............................................................................... | 6 |

| | 3.2 | Manufacturing ................................................................................................................. | 10 |

| | 3.3 | Sales and Marketing ........................................................................................................ | 11 |

| | 3.4 | Competitive Strengths ..................................................................................................... | 12 |

| | 3.5 | Capacity Utilization ......................................................................................................... | 13 |

| | 3.6 | Technology ..................................................................................................................... | 13 |

| | 3.7 | Purchasing and Raw Materials ........................................................................................... | 14 |

| | 3.8 | Competitive Environment ................................................................................................. | 14 |

| | 3.9 | Risks associated with changes in interest rates, foreign

exchange rates and commodity prices ................................................................................ | 14 |

| | 3.10 | Customers...................................................................................................................... | 15 |

| | 3.11 | Seasonality of the Corporation's business .......................................................................... | 15 |

| | 3.12 | Human Resources ........................................................................................................... | 15 |

| | 3.13 | Environmental Regulations ............................................................................................... | 15 |

| | | | |

ITEM 4 - SELECTED CONSOLIDATED FINANCIAL INFORMATION ......................................................... | 16 |

| | 4.1 | Annual .......................................................................................................................... | 16 |

| | 4.2 | Quarterly ...................................................................................................................... | 17 |

| | 4.3 | Dividends ...................................................................................................................... | 17 |

| | | | |

ITEM 5 - MARKET FOR THE NEGOTIATION OF SECURITIES ................................................................ | 18 |

| | | | |

ITEM 6 - DIRECTORS AND OFFICERS ............................................................................................. | 18 |

| | 6.1 | Directors ....................................................................................................................... | 19 |

| | 6.2 | Executive Officers Who Are Not Directors ........................................................................... | 22 |

| | | | |

ITEM 7 - ADDITIONAL INFORMATION ............................................................................................ | 24 |

| | | | |

ITEM 8 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS ....................................................................... |

25

|

| | | | |

| ITEM 9 - FORWARD-LOOKING STATEMENTS .................................................................................... | 25 |

| | | | |

2

DEFINITIONS In this Annual Information Form, unless the context otherwise requires, "Corporation" refers to Quebecor World Inc., its partnerships, subsidiaries and divisions and their respective predecessors and, for the relevant periods, refers to Quebecor Inc.'s divisions and subsidiaries involved in the commercial printing business, and "Parent" refers to Quebecor Inc., its subsidiaries and divisions and their respective predecessors other than the Corporation, its subsidiaries and divisions and their respective predecessors. References to "dollars," "US$" and "$" are in United States dollars. Unless otherwise indicated, the information contained herein is given as at December 31, 2003.

ITEM 1 - INCORPORATION

1.1 Incorporation of Quebecor World Inc.

The Corporation was incorporated on February 23, 1989 pursuant to theCanada Business Corporations Act under the name "Quebecor Printing Inc.". On January 1, 1990, the Corporation (as it was then known), Quebecor Printing Group Inc., Quebecor Printing (Canada) Inc., 166599 Canada Inc., Ronalds Printing Atlantic Limited and 148461 Canada Inc. amalgamated under the name "Quebecor Printing Inc." pursuant to theCanada Business Corporations Act. This corporate reorganization was undertaken in order to consolidate the assets of the printing sector of Quebecor Inc., which, prior to such reorganization, consisted of a number of divisions and subsidiaries. The Corporation's articles were amended: (a) on December 7, 1990, in order to subdivide each outstanding share into five shares; (b) on December 14, 1990, in order to create Series 1 Preferred Shares; (c) on February 24, 1992, in order to delete pri vate company restrictions; (d) on April 10, 1992, in order to (i) create three new classes of shares, namely Subordinate Voting Shares, Multiple Voting Shares and First Preferred Shares, issuable in series, (ii) reclassify and change the 39,965,005 outstanding common shares into 39,965,005 Multiple Voting Shares, (iii) reclassify and change the 5,360 outstanding Series 1 Preferred Shares into 5,360 Series 1 First Preferred Shares, and (iv) cancel the unissued preferred and common shares; (e) on April 25, 1994 in order to split the Subordinate Voting Shares and the Multiple Voting Shares so that each shareholder would receive three shares for each two shares held; (f) on April 25, 1996, in order to permit the appointment of one or more directors during the course of the year; (g) on November 5, 1997, in order to create Series 2 and 3 First Preferred Shares; (h) on April 25, 2000, in order to change the name of the Corporation to "Quebecor World Inc."; (i) on February 21, 2001, in order to create Series 4 First Preferred Shares; and (j) on August 10, 2001, in order to create Series 5 First Preferred Shares.

The head office of the Corporation is located at 612 Saint-Jacques Street, Montreal, Quebec, Canada, H3C 4M8, the telephone number of the Corporation at its head office is (514) 954-0101, the fax number is (514) 954-9624 and its web site is www.quebecorworld.com.

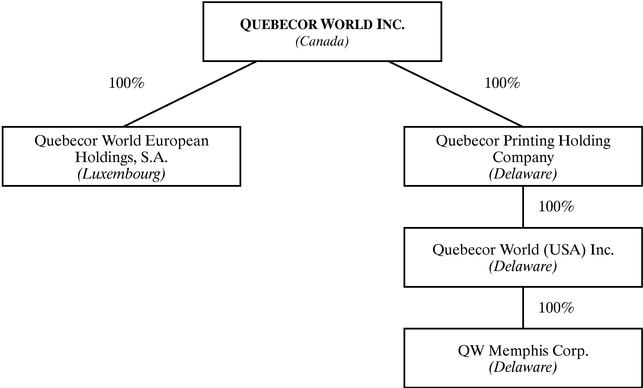

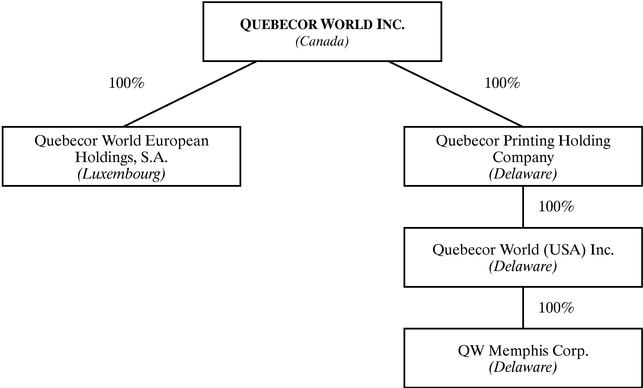

1.2 Subsidiaries The following organizational chart shows the Corporation's principal subsidiaries as at March 31, 2004, their jurisdiction of incorporation or continuation and the percentage of voting rights held or controlled, directly or indirectly, by the Corporation. The Corporation does not own or control, directly or indirectly, any non-voting securities of such subsidiaries. Subsidiaries whose total assets and revenues represented (a) individually, less than 10% of the consolidated assets and revenues of the Corporation as at December 31, 2003, and (b) in the aggregate, less than 20% of the consolidated assets and revenues of the Corporation as at December 31, 2003, have not been included.

3

1.3 Multiple Voting and Subordinate Voting Shares The equity shares of the Corporation carrying the right to vote are the Multiple Voting Shares and the Subordinate Voting Shares. The Subordinate Voting Shares, each of which carries the right to one vote, are restricted shares (within the meaning of Canadian regulations respecting securities) in that they do not carry equal voting rights to the Multiple Voting Shares, each of which carries the right to ten votes. The articles of the Corporation do not contain any rights or provisions applicable to holders of Subordinate Voting Shares of the Corporation where a take-over bid is made for the Multiple Voting Shares. However, the Corporation's significant shareholder, Quebecor Inc., has provided undertakings in favour of the holders of Subordinate Voting Shares in certain circumstances where a take-over bid is made for the Multiple Voting Shares. Please refer to the Corporation's Management Proxy Circular dated March 31, 2004 for more details in respect of the foregoing at pages 3-4 under "Section 1 - VOTING AND PROXIES -Undertakings in Favour of Holders of Subordinate Voting Shares", which text is incorporated by reference into this Annual Information Form.

ITEM 2 - GENERAL DEVELOPMENT OF THE BUSINESS

Quebecor World Inc., a diversified global commercial printing Corporation, is one of the largest commercial print media services company in the world. Its 2003 revenues reached $6.4 billion. The Corporation offers its customers state-of-the-art web offset, gravure and sheetfed printing capabilities in product categories including magazines, retail inserts, catalogs, specialty printing and direct mail, directories, as well as books, pre-media, logistics and other value-added services. The Corporation is a market leader in most of its product categories. The Corporation believes that the diversity of its customer base, geographic coverage and product segments enhance the overall stability and potential growth of its earnings and cash flow. The Corporation's strategy for growth focuses on increasing its geographic coverage through selective business acquisitions and internal growth.

The Corporation services its various markets and offers its products through a network of more than 160 plants and related facilities capable of economically servicing virtually all major markets in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

4

Growth Strategy

In an industry characterized by a high degree of fragmentation and consolidation opportunities, the Corporation has grown historically primarily through acquisitions.

Since its inception in 1988, the Corporation has made more than 65acquisitions valued at more than $5.5 billion, 15of which had an acquisition price in excess of $50 million. The following table sets forth the Corporation's most significant acquisitions since 1988.

Year | Acquisition | Country | Consideration (millions)* |

1988 | BCE PubliTech Inc. | Canada | $191.0 |

1990 | Graphics Holding Enterprises Inc. | U.S.A. | $532.1 |

1994 | Arcata Corporation (Book Group) | U.S.A. | $180.9 |

1995 | Financière Jean Didier | France | $336.7 |

1997 | AmerSig Graphics Inc. | U.S.A. | $116.0 |

1997 | Franklin Division of Brown Printing Company | U.S.A. | $125.0 |

1998 | TINA | Sweden and Finland | $271.8 |

1999 | World Color Press | U.S.A. | $2,723.7 |

2001 | Retail Printing Corporation | U.S.A. | $127.7 |

2002 | European Graphic Group S.A., a subsidiary of Hachette Filipacchi Medias | France and Belgium | $70.7 |

*Including assumption of long-term debt net of cash and cash equivalent

In 1999, a subsidiary of the Corporation merged with Greenwich, Connecticut-based World Color Press, Inc., the second-largest commercial printer in the United States which operated 58 facilities in the United States and had approximately 16,000 employees.

In order to focus on the integration of operations, from both North American and international perspectives, and on the maximization of free cash flow, the Corporation made no significant business acquisitions since the acquisition of World Color Press, Inc. in August 1999 through the close of 2000. The Corporation resumed its external growth strategy in 2001. The Corporation expanded its U.S. retail platform in July 2001 by acquiring Retail Printing Corporation, a web offset retail printer with locations in Nashville, Tennessee and Taunton, Massachusetts.

In September 2001, the Corporation signed an agreement pending regulatory approval to purchase the European printing business of Hachette Filipacchi Medias (European Graphic Group, or E2G). The acquired assets include printing and bindery facilities in France, as well as Hachette's 50% ownership stake in the rotogravure printing plant of Helio Charleroi in Belgium. Hachette Filipacchi Medias is one of the world's top publishers with 210 magazine titles in 34 countries. All necessary regulatory approvals were obtained and this transaction closed in March 2002 for an aggregate purchase price of $70.7 million. The transaction amount includes a purchase price balance for the 50% stake of the Charleroi Group controlled by the Belgian businessman, Albert Frère. As part of the transaction, Hachette has entered into a long-term agreement with the Corporation for it to print many of Hachette's magazines in Europe, the value of w hich is estimated to be $400 million (excluding paper) over the term of the contracts.

5

ITEM 3 - NARRATIVE DESCRIPTION OF THE BUSINESS

The Corporation has rotogravure, web offset and sheetfed printing capacity for a wide variety of printed materials, such as magazines, retail inserts, catalogs, specialty printing and direct mail, books, directories, pre-media, logistics and other value-added services. Printing services, including design, production and distribution, are offered from more than 160 plants and related facilities located throughout the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

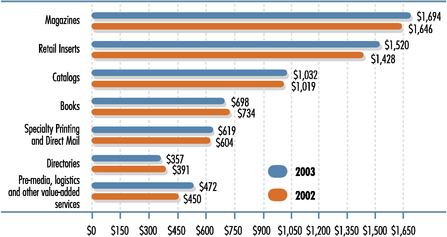

3.1 DESCRIPTION OF SEGMENTS AND PRODUCTSDescription of Segments

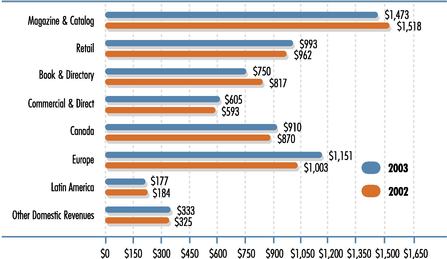

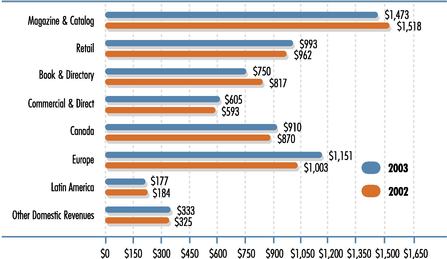

The Corporation operates in the printing industry. Its business units are located in three main geographic segments as follows:

| | Years Ended December 31,

| |

|---|

| | 2003

| | 2002

| |

|---|

| | $

| | %

| | $

| | %

| |

|---|

| | ($ in millions)

| |

|---|

| Revenues: | | | | | | | | | |

| | North America | | 5,062.9 | | 79 | | 5,087.6 | | 81 | |

| | Europe | | 1,151.4 | | 18 | | 1,002.5 | | 16 | |

| | Latin America | | 177.3 | | 3 | | 183.5 | | 3 | |

| | Intersegment and Other | | (0.1 | ) | — | | (1.9 | ) | — | |

| | |

| |

| |

| |

| |

| | | Total | | 6,391.5 | | 100 | | 6,271.7 | | 100 | |

| | |

| |

| |

| |

| |

| Operating income (loss):* | | | | | | | | | |

| | North America | | 311.1 | | 94 | | 527.3 | | 94 | |

| | Europe | | 30.3 | | 9 | | 38.9 | | 7 | |

| | Latin America | | (3.7 | ) | (1 | ) | 14.2 | | 2 | |

| | Other | | (7.3 | ) | (2 | ) | (17.6 | ) | (3 | ) |

| | |

| |

| |

| |

| |

| | | Total | | 330.4 | | 100 | | 562.8 | | 100 | |

| | |

| |

| |

| |

| |

* Before impairment of assets, restructuring and other charges

Commercial printing is a very fragmented, capital-intensive manufacturing industry. The North American, European and Latin American printing industries are highly competitive in most product categories and geographic regions. The Corporation believes that the ten largest competitors in the North American and European commercial printing markets have in aggregate less than 25% of the total share of each of their respective markets. In North America alone, there are more than 32,000 commercial printers.

Commercial printers tend to compete within each product category based on price, quality and the ability to service customers' specialized needs. Small competitors are generally limited to servicing customers for a specific product category within a regional market. Larger and more diversified commercial printers with greater geographic coverage have the ability to serve national and global customers across multiple product segments.

Management believes that both the North American and European printing markets are consolidating and that acquisition targets will continue to be available as larger commercial printers displace medium-size printers and regional competitors. Industry trends in Latin America, which are mirroring historical developments in North America, should also provide acquisition opportunities. Over the past decade, North American and European publishers have outsourced their printing operations. This trend began in the mid-1990s in Europe as demonstrated initially by the decision of Associated Newspapers in 1995 to outsource its printing to the Corporation and, more recently, by the Corporation's acquisition of the European printing assets of Hachette Filipacchi Media in France and Belgium. The Corporation's ongoing partnership with the Brazilian publisher Editora Abril, S.A., which commenced in

6

2000, is a reflection of a similar trend taking root in Latin America. This segregation of publishing and printing activity should provide independent printers greater acquisition opportunities and enable them to seek printing business with previously captive customers. Management believes that the Corporation is well positioned to continue to take advantage of the consolidation of the North American, European and Latin American commercial printing markets.

The Corporation is one of the few commercial printers that has the ability to serve customers on a regional, national and global basis. As a result, the Corporation has been able to build a substantial business within each of the American, Canadian and European segments and to pursue its expansion in Latin America.

In the United States, the Corporation is one of the largest commercial printers with more than 89 plants and related facilities and approximately 23,000 employees operating in 31 states. The Corporation is a leader in the printing of books, magazines, retail inserts, catalogs, specialty printing, and direct mail.

The Corporation is the largest commercial printer in Canada, with 31 facilities in sixprovinces and approximately 5,600 employees. It offers a diversified mix of printed products and related value-added services to the domestic market and internationally, including substantial exports to the United States.

In Europe, the Corporation operates in France, Belgium, Switzerland, the United Kingdom, Spain, Sweden, Austria and Finland, with 31 facilities and approximately 5,900 employees serving customers in 8 European countries. It is the largest independent commercial printer in Europe.

The Corporation also operates in Latin America with eight facilities and approximately 2,500 employees, as well as in India, where it has one facility and 60 employees.

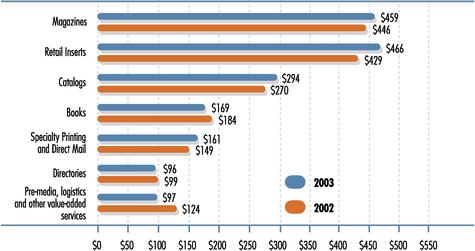

Description of Products

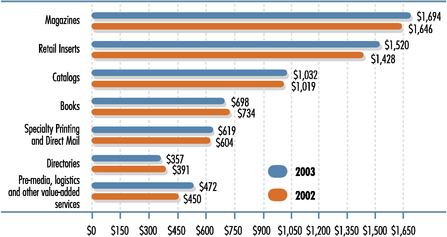

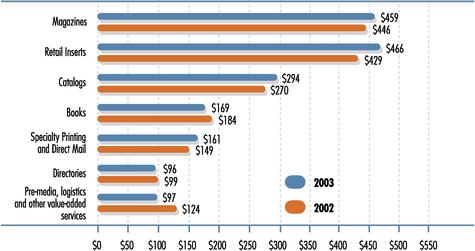

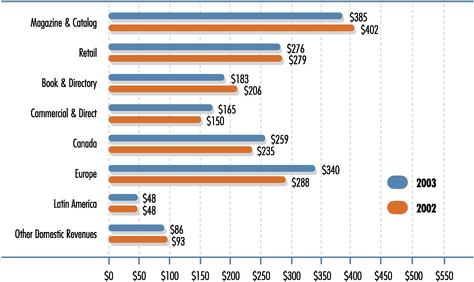

The Corporation's revenues by product are as follows:

| | For the year ended December 31, 2003

|

|---|

| | Canada

| | USA

| | North America

| | Europe

| | Latin America

| |

| | Inter-

segment

| | Total

|

|---|

| | $

| | %

| | $

| | %

| | $

| | %

| | $

| | %

| | $

| | %

| |

| | $

| | %

|

|---|

| Magazines | | 171.3 | | 19 | | 880.2 | | 21 | | 1,051.5 | | 21 | | 616.3 | | 53 | | 26.6 | | 15 | | | | 1,694.4 | | 26 |

| Retail Inserts | | 302.3 | | 33 | | 989.0 | | 24 | | 1,291.3 | | 26 | | 215.4 | | 19 | | 13.1 | | 8 | | | | 1,519.8 | | 24 |

| Catalogs | | 118.6 | | 13 | | 686.5 | | 16 | | 805.1 | | 16 | | 211.7 | | 18 | | 15.0 | | 8 | | | | 1,031.8 | | 16 |

| Books | | 43.4 | | 5 | | 535.2 | | 13 | | 578.6 | | 11 | | 42.4 | | 4 | | 77.1 | | 43 | | | | 698.1 | | 11 |

| Specialty Printing and Direct Mail | | 123.2 | | 14 | | 480.4 | | 12 | | 603.6 | | 12 | | 7.6 | | 1 | | 7.8 | | 4 | | | | 619.0 | | 10 |

| Directories | | 65.0 | | 7 | | 241.2 | | 6 | | 306.2 | | 6 | | 10.0 | | 1 | | 40.4 | | 23 | | | | 356.6 | | 6 |

| Pre-Media, Logistics and other Value-Added Services | | 88.6 | | 10 | | 333.0 | | 8 | | 421.6 | | 8 | | 47.4 | | 4 | | 2.8 | | 2 | | | | 471.8 | | 7 |

| Inter-segment | | (4.6 | ) | (1 | ) | 9.6 | | 0 | | 5.0 | | 0 | | 0.6 | | 0 | | (5.5 | ) | (3 | ) | (0.1 | ) | 0.0 | | 0 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 907.8 | | 100 | | 4,155.1 | | 100 | | 5,062.9 | | 100 | | 1,151.4 | | 100 | | 177.3 | | 100 | | (0.1 | ) | 6,391.5 | | 100 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

7

| | For the year ended December 31, 2003

|

|---|

| | Canada

| | USA

| | North America

| | Europe

| | Latin America

| |

| | Inter-

segment

| | Total

|

|---|

| | $

| | %

| | $

| | %

| | $

| | %

| | $

| | %

| | $

| | %

| |

| | $

| | %

|

|---|

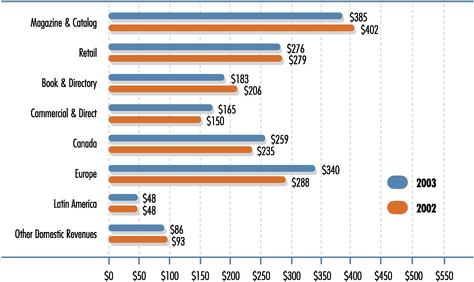

| Magazines | | 153.1 | | 18 | | 963.5 | | 23 | | 1,116.6 | | 22 | | 503.5 | | 50 | | 25.7 | | 14 | | | | 1,645.8 | | 26 |

| Retail Inserts | | 273.0 | | 31 | | 931.6 | | 22 | | 1,204.6 | | 24 | | 214.7 | | 22 | | 8.9 | | 5 | | | | 1,428.2 | | 23 |

| Catalogs | | 146.3 | | 17 | | 684.3 | | 16 | | 830.6 | | 16 | | 173.3 | | 17 | | 14.6 | | 8 | | | | 1,018.5 | | 16 |

| Books | | 43.4 | | 5 | | 574.5 | | 14 | | 617.9 | | 12 | | 38.7 | | 4 | | 77.1 | | 42 | | | | 733.7 | | 12 |

| Specialty Printing and Direct Mail | | 108.4 | | 12 | | 476.7 | | 11 | | 585.1 | | 11 | | 10.4 | | 1 | | 8.5 | | 5 | | | | 604.0 | | 10 |

| Directories | | 58.7 | | 7 | | 278.9 | | 7 | | 337.6 | | 7 | | 4.8 | | 0 | | 49.0 | | 27 | | | | 391.4 | | 6 |

| Pre-Media, Logistics and other Value-Added Services | | 85.4 | | 10 | | 305.9 | | 7 | | 391.3 | | 8 | | 56.1 | | 6 | | 2.7 | | 1 | | | | 450.1 | | 7 |

| Inter-segment | | (1.3 | ) | 0 | | 5.2 | | 0 | | 3.9 | | 0 | | 1.0 | | 0 | | (3.0 | ) | (2 | ) | (1.9 | ) | 0.0 | | 0 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Total | | 867.0 | | 100 | | 4,220.6 | | 100 | | 5,087.6 | | 100 | | 1,002.5 | | 100 | | 183.5 | | 100 | | (1.9 | ) | 6,271.7 | | 100 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Magazines and Catalogs

The Corporation is the world's leading printer of consumer magazines. It prints more than 1,000 magazine titles. The Corporation prints 43 percent of the top 100 magazine titles in the United States. It operates a global print platform with operations in the United States, Canada, Europe and Latin America.

Management believes that the Corporation is the industry leader in producing weekend newspaper magazines. These are four-color magazines inserted in major-market weekend newspapers. In the United States the Corporation prints two syndicated weekend magazines as well as locally edited and distributed weekend newspaper magazines. In the United Kingdom, the Corporation is also an important supplier of weekend supplements. The Corporation also prints comic books for leading companies.

The Corporation has invested in pre-media (computer-to-plate) and post-press technology to enhance its ability to service this market. For the production of medium to long-run magazines, the Corporation is at an advantage because its plants have selective-binding and ink-jet-imaging capabilities and can utilize the Corporation's mail analysis system.

The Corporation is the largest printer of catalogs in the world. It prints several hundred different catalogs on an annual basis for many of North America's direct mail retailers.The Corporation offers special catalog services such as list services, to help customers compile effective lists for distribution, selective-binding capacity to allow customers to vary catalog content to meet their customers' demographic and purchase patterns, and ink-jet addressing and messaging to personalize messages for each recipient. This technology partially offsets postage-cost increases by eliminating pages of products that do not fit a buyer's demographic or purchasing profile. The Corporation's global network also allows the Corporation to offer its customers one-stop shopping for all of their catalog needs in North America, Europe and Latin America.

Retail

The Corporation's major retail inserts customers include large retailers. In North America, the Corporation's 13 rotogravure process printing plants offer both the coast-to-coast manufacturing network and the long-run efficiencies required to serve the larger retail customers. The Corporation has five rotogravure process printing plants in France, one in Belgium and two in Nordic countries. In Canada, the Corporation prints inserts and circulars using web offset and rotogravure processes in accordance with customer requirements. The Corporation also offers digital engraving and related pre-press processes, which both enhances quality and shortens time-to-market.

8

Commercial and Direct

Products in these categories include annual reports, corporate prospectuses, promotional literature, calendars, posters, direct-mail products, highly personalized catalog wraps and promotions for the auto industry and other custom items. The Corporation's web and sheetfed printing presses of a smaller size permit the Corporation to offer custom colors, coatings, finishes and specialized binding required to produce a wide variety of print products. The Corporation provides numerous print-related services to customers, including typesetting, pre-press, circulation fulfillment, list management, mailing and distribution, in particular through desktop-publishing and electronic pre-media technology.

Quebecor Merrill Canada Inc., a subsidiary of the Corporation, offers services of manufacturing operations to serve the market for financial documents, prospectuses, annual reports and related printing.

The Corporation's Direct division is a leader in the application of versioning, ink jet addressing, print-on-demand technology and computer-to-plate techniques which are critical to the customized production and compressed cycle times that customers demand today.

Book

The Corporation is a North American industry leader in book manufacturing. The Book Group is an industry leader in the application of new technologies for book production including electronic pre-media, information networking, digital printing, computer-to-plate and electronic data interchange. With plants in the United States, Spain, and Latin America, the Corporation serves internationally more than 1,000 publisher customers.

In keeping with its full-service approach, the Corporation also provides on-demand digital printing services for small quantities of books, brochures, technical documents and similar products to be produced quickly and at a relatively low cost.

Directory

The Corporation specializes in telephone directories and is the largest directory printer in Canada and among the largest directory printers in North America and Latin America. The presence of the Corporation's directory group in the North American market dates back to the late nineteenth century with the printing of Bell Canada's first directories. The Corporation prints telephone and other directories for a large number of companies. In 1994, the Corporation began production of directories for the Indian domestic market at its directory facility near New Delhi, India and in 2002, it started printing directories in Spain.

Pre-Media, Logistics and Other Value-Added Services

The Corporation is a leader in the transition from conventional pre-press to an all-digital workflow, providing a complete spectrum of film, and digital preparation services, from traditional past-up and colour separation to state-of-the-art, all-digital pre-media, as well as digital emerging and digital archiving. Such pre-media services include the colour electronic pre-media system, which takes art work from idea to final product, and desktop publishing, giving the customer greater control over the finished product. These pre-media services are especially helpful to smaller customers, who may not have the capital to employ such equipment or who may have to rely on third-party vendors, which may result in coordination and delay problems. Our specialized digital and pre-media facilities, which are strategically located close to and, in certain cases, onsite at, customers' facilities, provide our customers high quality, twenty - -four hour preparatory services linked directly to the Corporation's various printing facilities. In addition, its computer systems enable the Corporation to electronically exchange both images and textual material directly between the Corporation and the customers' business locations. The integrated pre-media operations provide the Corporation with competitive advantages over traditional pre-press shops that are

9

not able to provide the same level of integrated services. Quebecor World Premedia Service brings together the full range of digital technologies and pre-media assets within the Corporation that allows it to focus on providing a more comprehensive range of solutions to the customer base of the Corporation.

Other value-added services, including mail list, shipping and distribution expertise, ink-jet personalizing and customer-targeted binding, are rapidly becoming requirements of numerous customers.

The establishment of Quebecor World Logistics Inc., a subsidiary of the Corporation, has made the Corporation one of the largest and most technologically advanced print transport companies, as well as one of the largest customers by volume of the U.S. Postal Service. Quebecor World Logistics Inc. provides complete logistics services including customized door-to-door planning, management, transportation, delivery and tracking solutions, thereby providing customers with cost-effective, efficient and trackable distribution services.

3.2 MANUFACTURING

Description of Processes and Equipment

The Corporation uses principally two types of printing processes, rotogravure and offset, which are the most commonly used commercial printing processes. Both processes have undergone substantial technological advances over the past decade, resulting in significant improvements in speed and print quality. The Corporation estimates that in 2003 approximately 75 percent of its revenues by volume were printed using offset and the remainder using the rotogravure process.

Rotogravure

With 101 rotogravure presses, the Corporation is one of the largest world-wide printers using the rotogravure process. The process uses a copper-coated printing cylinder which is mechanically engraved using high-precision, computer-controlled and diamond-cutting heads. Although the engraving of the printing cylinder is relatively expensive, the printing cylinder itself is extremely durable and cost effective per long run. The rotogravure process has an excellent reputation for the quality of its four-color reproductions on various grades of paper and the very high speed at which it is capable of running.

The rotogravure process is well suited to long-run printing of advertising inserts and circulars, Sunday newspaper magazines and other high-circulation magazines and catalogs. The Corporation believes that its coast-to-coast network of rotogravure facilities in the United States offers both the capacity and locations required by large merchandisers and publishers. The acquisition in March 2002 of the European printing assets of Hachette Filipacchi Medias provides an advantageous position in the rotogravure market in Europe. The Corporation's advanced ability in rotogravure digital pre-media also ensures more efficient and accurate production of the same insert simultaneously in multiple locations, thereby offering the customer the efficiency and cost savings of manufacturing and distribution closer to its end-use markets in reduced time frames.

Offset

In the offset process, an inked impression from a thin metal plate is first made on a rubber cylinder, after which it is offset to paper. There are several types of offset printing processes: sheetfed and web, heatset and coldset. Sheetfed presses print on sheets of paper, whereas web presses print on rolls of paper. Short-run printing is generally best served by sheetfed offset, whereas web offset is generally the best process for longer runs.

Heatset web offset involves a press which uses an oven to instantly set or dry the oil-based inks. This permits high speed and better quality and is best suited for printing on glossier papers (coated paper). Heatset web offset is used to print retail inserts, magazines, catalogs and books. The Corporation owns 443 heatset web offset presses.

10

Coldset web offset involves a press that does not use an oven to dry the ink, instead using oil-based inks that are absorbed into the paper and dried by oxidation. Coldset web offset is used mainly to print newspapers, books, directories, and some retail inserts. The Corporation owns 55 coldset web offset presses.

The Corporation owns 182 sheetfed offset presses, which print books, promotional material, covers and direct-mail products.

3.3 SALES AND MARKETING

The sales and marketing activities of the Corporation are highly integrated and reflect an increasingly global approach to meeting customers' needs that is complemented by product-specific sales efforts. Sales representatives are located in plants or in regional offices throughout North America, Europe, and Latin America, generally close to their customers and prospects. Each sales representative has the ability to sell into any plant in the Corporation's global network. This enables the customer to coordinate simultaneous printing throughout the Corporation's network through one sales representative. Certain of the larger customers centralize the purchase of printing services and, in this regard, the Corporation's ability to provide broad geographical services is clearly an advantage over smaller regional competitors.

Since 1995, the Corporation has proceeded to complete ISO 9000 series certification at various plants where it operates and it is continuing to ensure that more and more plants will be ISO 9000 series certified. The ISO 9000 series of international standards certify that a company meets quality control requirements in its production processes.

As of the date of this Annual Information Form, twelve of the Corporation's plants have or are about to receive the ISO-14001 certification, an internationally recognized environmental management system, the goal of which is the continuous improvement in environmental management.

The Corporation believes that its size and network of locations throughout North America, Europe and Latin America is an advantage over smaller competitors in terms of shipping and distribution. Because of its volume, the Corporation is able to set up pool-shipping systems, which enable customers to ship their products at significant discounts. The discount is achieved through agreements with the postal services, which provides the mailer/customer with a discount if the mailer/customer pays the freight costs to transport the mail closer to the postal services delivery office. The Corporation uses its custom-built mail analysis system, which automatically combines different customers into truck-load shipments and analyzes the cost-savings benefit to the customer. The mail analysis system then generates the necessary forms, bills of lading and freight invoices for the customer.

Ink-jet personalizing is increasingly being used by many publishers and catalogers. Ink-jet addressing eliminates the additional process of printing paper labels and improves mailing efficiency. Catalogers use ink-jet personalizing in a number of ways. Ink-jet addressing allows both the cover and the order form to be labelled and to show customer-coding information. Furthermore, as catalogers continue to look for methods to increase the level of personalization, the ink-jet process is being used more frequently to add personal messages, specific inserts to frequent buyers, or unique coding information for order entry. Another advantage to ink-jet printing and selective binding is the Corporation's ability to merge lists of names for the same customer or to co-mail different customers to achieve increased postal pre-sort discounts.

11

3.4 COMPETITIVE STRENGTHS

Management believes it has certain competitive strengths which enable it to provide enhanced customer service while maintaining a low-cost position in the industry. Such advantages include broad geographic coverage, a single source of printing services, technological capabilities, economies of scale and a large manufacturing base.

Broad Geographic Coverage. Certain of the Corporation's largest customers utilize simultaneous printing in several of the Corporation's locations. The Corporation is one of the few commercial printers that can service these customers in virtually all of their markets, allowing them to coordinate their requirements. In addition, multi-plant simultaneous printing makes delivery more efficient and lowers distribution costs for national products.

Single Sourcing. By providing its customers a wide variety of printing, pre-press, post-press and distribution services, the Corporation is able to become a more integral element in its customers' publishing process while simultaneously expanding its sources of revenues. As large customers have centralized their purchasing of printing services, the Corporation's ability to provide a single source for comprehensive printing services and broad geographical coverage is a competitive advantage, since customers are not required to contract with numerous smaller specialized and regional competitors.

Technological Capabilities. The Corporation is committed to the effective use of state-of-the-art technology, including the development of new printing technologies, upgrade of existing printing assets and further development of integrated services. The Corporation's technological capabilities have enabled it to lower its cost position and to better serve its customers by improving quality, flexibility, speed and cost of production. Keeping pace with the technological developments in the industry requires substantial capital expenditures. Thus, in 2003, the Corporation spent $243.1 million on capital expenditures, including for faster and more efficient presses and pre-press and post-press technologies. In 2004, capital expenditures will be made in order to maintain the Corporation's existing assets and to invest in new projects for expansion in selected markets. The breadth of the Corporation's business enables it to spread technological investments over numerous facilities and product segments and its size enables it to lower its relative cost position by spreading fixed capital investment over a greater base of revenues.

Economies of Scale. The Corporation enjoys significant economies of scale which, in the opinion of management, provide the Corporation with a cost advantage. The Corporation also purchases a significant amount of printing equipment. Management believes that such purchasing power enables the Corporation to purchase both raw materials, primarily paper and ink, and equipment, on enhanced terms. This purchasing power also ensures availability of raw materials in tight markets. In 1998, the Corporation opened a global procurement office in Fribourg, Switzerland. Global procurement allows the Corporation to achieve economies of scale for materials and equipment.

By consolidating platforms into fewer but larger and more specialized plants, the Corporation reduces administrative costs and achieves better economies of scale. In addition, increased plant specialization allows for greater efficiency and improved distribution reduces the final cost to customers and improves speed of delivery.

The growth of new media provides the Corporation with further opportunities to exploit its economies of scale. Increasingly, clients seek to repurpose information so that it can be used in both printed and electronic forms. The Corporation has implemented digital workflows and has provided tools such as its Digital Asset Management System and Automated Publishing System to facilitate the re-use of information in a more cost effective manner than its competitors.

Large Manufacturing Base. The Corporation's diversity and breadth of plant and press capability, product mix and large customer base facilitate greater capacity utilization. Most presses can produce a variety of printed products, and the Corporation frequently allocates orders among its facilities to optimize their equipment utilization. In addition, the Corporation's large manufacturing base combined with its technological capabilities frequently enable the Corporation to improve customer service and operating margins by transferring technology and maximizing the printing capabilities of its facilities.

12

Management believes that further consolidation of the fragmented printing industry will occur due to the advantages of size, the high cost of capital equipment and technology and the demand of many large customers for broad, technologically advanced, continent-wide and international printing services. The Corporation's competitive and financial strengths and its substantial experience in integrating acquired businesses provide it with the ability to take advantage of this industry dynamic. Having established a critical size and the geographic and product diversity required to compete, the Corporation is focused on continuing the expansion of its customer base, markets and scope of services in North America, Europe and Latin America.

3.5 CAPACITY UTILIZATION

The Corporation's diversity in plant and press capability, product mix and large customer base facilitate greater capacity utilization. Most presses can produce a variety of printed products and the Corporation will frequently allocate orders among its facilities to optimize their utilization. Because the Corporation serves a wide variety of markets, it is able to redeploy equipment, thereby maximizing its utility and extending its useful life. Diversity in plant and press capability enables the Corporation, through central scheduling of the Corporation's presses, to assign a particular order to the machine best suited for it.

3.6 TECHNOLOGY

The Corporation cooperates with large suppliers in the area of research and development of new printing technologies, materials and processes. The Corporation's capital-improvement programs include adding, replacing and/or upgrading existing equipment.

The Corporation has continued to invest in faster, more efficient and higher quality presses. Pre-media has continued to witness dramatic enhancements in the digital electronic area, with new computer software and hardware installed to help customers create their pages more quickly and more efficiently. The Corporation has been an industry leader in bringing new imaging services on-line that streamline the process of preparing pages for print. The Corporation was one of the first printers to install desktop publishing, direct-to-film and computer-to-plate systems for offset printing, which eliminates entirely the costly and time-consuming film step in print production. It has furthermore established one of the industry's most sophisticated data communications networks, capable of transmitting a customer's publication files quickly and efficiently from the customer's location to multiple plant locations.

Management believes that only printers capable of investing and integrating new technology will continue to expand. The Corporation continues to upgrade its U.S. rotogravure network to produce magazines, catalogs, inserts and flyers, and Sunday Magazines. The Corporation became the first commercial printer to install the latest generation of short cut-off tabloid offset presses. These presses print more pages at faster speeds and use less paper than conventional tabloid presses. The Corporation has also invested in new and emerging digital and web-based technologies to improve services, cut costs and expand its range of products.

The Corporation operates a North American-wide telecommunications network, which enhances the Corporation's ability to move digital files between its facilities and customers quickly, share work among plants, and expand distribution and printing operations.

3.7 PURCHASING AND RAW MATERIALS

The principal raw materials used in the Corporation's products are paper and ink. In 2003, the Corporation spent approximately $2.3 billion on raw materials.The Corporation exercises its purchasing power to obtain pricing, terms, quality, quality control and service in line with its status as one of the largest industry customers.

13

The Corporation negotiates with a limited number of suppliers to maximize its purchasing power, but does not rely on any one supplier. Purchasing activity at both the local plant and corporate level is coordinated in order to increase and benefit from economies of scale. Inventory-control operations are also integrated into the purchasing functions of the Corporation, which has resulted in improvements in inventory turns. Plant inventories are also managed and tracked on a regional basis, increasing the utilization of existing inventories. In addition, most of the Corporation's long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper and ink.

The Corporation takes pride in offering world-wide procurement service to its customers. The procurement office, located in Fribourg, Switzerland, gives the Corporation a major competitive advantage. By consolidating the activities formerly carried out at four regional offices, the Corporation has been able to reduce administrative costs, standardize procurement and provide customers with assured supply at attractive prices.

3.8 COMPETITIVE ENVIRONMENT

The commercial printing business in North America and Europe is highly competitive in most product categories and geographic segments. Industry analysts consider most of the industry's markets to be currently oversupplied, and competition is significant. Competition is largely based on price, quality, range of services offered, distribution capabilities, customer service, availability of printing time on appropriate equipment and state-of-the-art technology.

3.9 RISKS ASSOCIATED WITH CHANGES IN INTEREST RATES, FOREIGN EXCHANGE RATES AND

COMMODITY PRICES

In the normal course of business, the Corporation is exposed to changes in interest rates, foreign exchange rates and commodity prices.

The Corporation manages the interest rate exposure by having a balanced schedule of debt maturities as well as a combination of fixed and floating rate obligations. In addition, the Corporation enters into interest rate swap agreements to manage this exposure.

The Corporation also enters into foreign exchange forward contracts and cross-currency swaps to hedge the settlement of raw materials and equipment purchases, to set the exchange rate for cross-border sales and to manage its foreign exchange exposure on net investments and foreign denominated assets.

The Corporation also enters into natural gas swap contracts to manage the exposure on this commodity.

While the counterparties to these agreements expose the Corporation to credit loss in the event of non-performance, the Corporation believes that the possibility of incurring such a loss is remote due to the creditworthiness of the counterparties. The Corporation does not hold or issue any derivative financial instruments for speculative or trading purposes.

Concentrations of credit risk with respect to trade receivables are limited due to the Corporation's diverse operations and large customer base. As at March 31, 2004, the Corporation had no significant concentrations of credit risk.

Additional information is presented in section entitled "Risk Management" the Management's discussion and analysis of Financial Conditions and Results of Operations at page 29 of the Corporation's 2003 Annual Report.

14

3.10 CUSTOMERS

The Corporation believes that the product and geographical diversity of its customer base serve to reduce the impact on the Corporation of dramatic fluctuations in local markets or product-line demand. Many of the Corporation's large customers are under contract. These contracts include price adjustment clauses based on the cost of paper, ink and labor.

3.11 SEASONALITY OF THE CORPORATION'S BUSINESS

The operations of the Corporation's business are seasonal, with approximately two-thirds of historical operating income recognized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions.

3.12 HUMAN RESOURCES

As of March 31, 2004, the Corporation employed approximately 37,000 people, 10,500 of whom were covered by71 separate collective agreements. Of these, 15 collective agreements covering 2,200 employees are or will expire in 2004. These agreements are limited to single plants and groups of employees within these plants.

The Corporation believes that its relations with its employees are generally good.

3.13 ENVIRONMENTAL REGULATIONS

The Corporation is subject to various laws, regulations and government policies in North America, Europe and Latin America relating to the generation, storage, transportation, disposal and environmental emission of various substances, and to environmental protection in general. The Corporation believes that it is in compliance with such laws, regulations and government policies in all material respects. Furthermore, the Corporation does not anticipate that compliance with such environmental statutes will have a material adverse effect upon the Corporation's competitive or consolidated financial position.

Energy and pollution control also continue to be the heart of Corporation's commitment to the environment. In addition to the expanded installation of regenerative thermal oxidizers for the lithographic offset printing process, the Corporation is now in the middle of upgrading and optimizing the solvent recovery systems used to recover the solvent from the gravure printing process by means of activated carbon. The recovered solvent is then reused in the printing process. The upgrade and optimization program includes an exhaustive assessment of the solvent recovery systems and implementation of improvement measures that will allow the Corporation to have more reliable and efficient systems with additional operating flexibility and standardization across the plants. Furthermore, it will ensure lower energy consumption and strong compliance with regulatory air emission requirements. Since 2002 and until the end of 2004, nearly US$10M will have been invested in this program.

ITEM 4 - SELECTED CONSOLIDATED FINANCIAL INFORMATION

4.1 ANNUAL

Set forth below are selected consolidated financial data which have been derived from the Corporation's consolidated financial statements for the three most recent financial years ended December 31.

15

The data below should be read in conjunction with the consolidated financial statements and related notes thereto as well as the items included hereafter. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations" at item 8 of this Annual Information Form.

(in millions of US dollars, except per share data & other statistics)

| | 2003

| | 2002

| | 2001

| |

|---|

| Consolidated Results | | | | | | | | | | |

| Revenues | | $ | 6,391.5 | | $ | 6,271.7 | | $ | 6,442.7 | |

| Operating income before depreciation and amortization and before IAROC | | | 689.8 | | | 898.4 | | | 955.6 | |

| Operating income before IAROC | | | 330.4 | | | 562.8 | | | 617.8 | |

| IAROC | | | 98.3 | | | 19.6 | | | 270.0 | |

| Operating income (loss) | | | 232.1 | | | 543.2 | | | 347.8 | |

| Net income (loss)* | | | (31.4 | ) | | 279.3 | | | 22.4 | |

| Cash provided by operating activities | | | 461.3 | | | 513.4 | | | 576.5 | |

| Free cash flow from operations** | | | 183.3 | | | 319.8 | | | 287.2 | |

| Operating margin before depreciation and amortization and before IAROC*** | | | 10.8% | | | 14.3% | | | 14.8% | |

| Operating margin before IAROC*** | | | 5.2% | | | 9.0% | | | 9.6% | |

| Operating margin*** | | | 3.6% | | | 8.7% | | | 5.4% | |

| | |

| |

| |

| |

| Financial Position | | | | | | | | | | |

| Working capital | | $ | (193.0 | ) | $ | (213.8 | ) | $ | (194.5 | ) |

| Property, plant and equipment | | | 2,581.0 | | | 2,610.6 | | | 2,634.0 | |

| Total assets | | | 6,213.8 | | | 6,207.4 | | | 6,186.5 | |

| Long-term debt (including convertible notes) | | | 2,009.0 | | | 1,822.1 | | | 2,132.2 | |

| First Preferred Shares | | | 456.6 | | | 456.6 | | | 456.6 | |

| Equity Multiple and Subordinate Voting Shares | | | 1,236.5 | | | 1,357.3 | | | 1,336.7 | |

| Debt-to-capitalization | | | 44:56 | | | 40:60 | | | 46:54 | |

| | |

| |

| |

| |

| Per Share Data | | | | | | | | | | |

| Earnings (losses)* | | | | | | | | | | |

| | Diluted | | $ | (0.50 | ) | $ | 1.76 | | $ | — | |

| | Diluted before IAROC | | $ | 0.03 | | $ | 1.92 | | $ | 1.58 | |

| Dividends on equity shares | | $ | 0.52 | | $ | 0.49 | | $ | 0.46 | |

| Book value | | $ | 15.51 | | $ | 15.92 | | $ | 14.39 | |

| Market price — TSX close in CDN$ | | $ | 26.75 | | $ | 35.00 | | $ | 35.88 | |

| Market price — NYSE close | | $ | 20.59 | | $ | 22.32 | | $ | 22.56 | |

| | |

| |

| |

| |

IAROC: Impairment of assets, restructuring and other charges

- *

- Effective January 1, 2002, net income and earnings per share reflect the new accounting policy adopted by the Corporation under which goodwill is no longer amortized.

- **

- Cash provided from operating activities, less capital expenditures net of proceeds from disposals and preferred share dividends.

- ***

- Margins calculated on revenues.

16

4.2 QUARTERLY

The table below presents selected financial information for the last eight quarters ending with the most recent fiscal year of the Corporation.

(In millions of US dollars, except per share amounts)

| | 2003

| |

|---|

| | First

| | Second

| | Third

| | Fourth

| |

|---|

| Consolidated Results | | | | | | | | | | | | | |

| Revenues | | $ | 1,539.6 | | $ | 1,513.5 | | $ | 1,596.8 | | $ | 1,741.6 | |

| Operating income before depreciation and amortization and before IAROC | | | 165.2 | | | 133.3 | | | 208.5 | | | 182.8 | |

| Operating income before IAROC | | | 77.8 | | | 42.5 | | | 120.0 | | | 90.1 | |

| IAROC | | | — | | | 81.8 | | | (5.0 | ) | | 21.5 | |

| Operating income (loss) | | | 77.8 | | | (39.3 | ) | | 125.0 | | | 68.6 | |

| Net income (loss) | | | 24.5 | | | (61.7 | ) | | 59.7 | | | (53.9 | ) |

| | |

| |

| |

| |

| |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (losses) | | | | | | | | | | | | | |

| | Diluted | | $ | 0.12 | | $ | (0.51 | ) | $ | 0.38 | | $ | (0.48 | ) |

| | Diluted before IAROC | | $ | 0.12 | | $ | (0.07 | ) | $ | 0.34 | | $ | (0.36 | ) |

| | |

| |

| |

| |

| |

(In millions of US dollars, except per share amounts)

| | 2002

|

|---|

| | First

| | Second

| | Third

| | Fourth

|

|---|

| Consolidated Results | | | | | | | | | | | | |

| Revenues | | $ | 1,475.8 | | $ | 1,469.7 | | $ | 1,624.7 | | $ | 1,701.5 |

| Operating income before depreciation and amortization and before IAROC | | | 189.7 | | | 211.2 | | | 251.3 | | | 246.2 |

| Operating income before IAROC | | | 106.8 | | | 127.8 | | | 167.9 | | | 160.3 |

| IAROC | | | — | | | — | | | — | | | 19.6 |

| Operating income | | | 106.8 | | | 127.8 | | | 167.9 | | | 140.7 |

| Net income | | | 46.0 | | | 64.2 | | | 98.5 | | | 70.6 |

| | |

| |

| |

| |

|

Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings | | | | | | | | | | | | |

| | Diluted | | $ | 0.28 | | $ | 0.40 | | $ | 0.64 | | $ | 0.44 |

| | Diluted before IAROC | | $ | 0.28 | | $ | 0.40 | | $ | 0.64 | | $ | 0.61 |

| | |

| |

| |

| |

|

IAROC: Impairment of assets, restructuring and other charges

4.3 DIVIDENDS

On May 5, 2004, the Corporation declared a dividend of $0.13 per share on the Multiple Voting Shares and the Subordinate Voting Shares, a dividend of CA$0.3845 per share on the Series 3 Preferred Shares, a dividend of CA$0.4219 per share on the Series 4 Preferred Shares, and a dividend of CA$0.43125 per share on the Series 5 Preferred Shares, which dividends are payable on June 1, 2004 to the shareholders of record at the close of business on May 14, 2004.

17

The Corporation has declared and paid semi-annual dividends since October 23, 1992 and quarterly dividends since 1998. The following table presents the annual dividends declared and paid by the Corporation on all of its shares since 1998:

| | Multiple Voting Shares and Subordinate Voting Shares | Series 2 Preferred Shares | Series 3 Preferred Shares | Series 4 Preferred Shares | Series 5 Preferred Shares |

1998 | $0.24 | CA$1.3151 | N/A | N/A | N/A |

1999 | $0.28 | CA$1.2500 | N/A | N/A | N/A |

2000 | $0.33 | CA$1.2500 | N/A | N/A | N/A |

2001 | $0.46 | CA$1.2500 | N/A | CA$1.2703 | CA$0.5069 |

2002 | $0.49 | CA$1.2500 | N/A | CA$1.6875 | CA$1.7250 |

2003 | $0.52 | N/A | CA$1.5380 | CA$1.6875 | CA$1.7250 |

As of March 1, 2004 | $0.13 | N/A | CA$0.3845 | CA$0.4219 | CA$0.43125 |

As of June 1, 2004 | $0.13 | N/A | CA$0.3845 | CA$0.4219 | CA$0.43125 |

ITEM 5 - MARKET FOR THE NEGOTIATION OF SECURITIES

The Corporation's Subordinate Voting Shares are listed and posted for trading on The Toronto Stock Exchange and the New York Stock Exchange under the symbol "IQW". The Corporation's Series 3 Cumulative Redeemable First Preferred Shares, Series 4 Cumulative Redeemable First Preferred Shares and Series 5 Cumulative Redeemable First Preferred Shares are listed and posted for trading on The Toronto Stock Exchange.

ITEM 6 - DIRECTORS AND OFFICERS

The following tables set forth the name, municipality of residence and position held within the Corporation of its directors and executive officers, the principal occupation and the term of office of each director, as well as the number of voting shares beneficially held or over which control or direction is exercised by each director of the Corporation. As of May 6, 2004, the directors and executive officers of the Corporation, as a group, beneficially owned, directly or indirectly, or exercised control or direction over, 33,028 Subordinate Voting Shares and 46,911,277 Multiple Voting Shares of the Corporation, representing 0.04% and 99.84%, respectively, of the outstanding shares of each such class. The shares so owned or controlled by the directors and executive officers of the Corporation represented 84.50% of all voting rights attached to all the outstanding common shares of the Corporation. The following information is gi ven as of May 6, 2004, except as otherwise noted.

The principal occupations over the past five years of the Corporation's directors and executive officers are given below, except in certain cases when a director or an executive officer has held more than one position in the same firm or an affiliated firm, in which case only the date of appointment to the most recent position is indicated.

18

6.1 Directors

Name | Principal Occupation | Director

since | Subordinate Voting Shares Owned or Controlled Directly

or Indirectly(1) | Units held under

the DSU Plan(2) |

A. Charles Baillie (C), (D)

Toronto, Ontario | Retired Chairman of the Board and Chief Executive Officer of TD Bank Financial Group (Financial services conglomerate) | 2003 | 1,000(3) | 2,610 |

Reginald K. Brack(A), (B), (E)

Greenwich, Connecticut | Former Chairman and Chief Executive Officer, Time Inc. (Magazines and books publisher) | 2000 | 2,000 | 5,805 |

Derek H. Burney, O.C.(B), (D), (E)

Toronto, Ontario | President and Chief Executive Officer of CAE Inc. (Flight and navigation simulation and controls equipment company) | 2003 | — | 2,925 |

Robert Coallier(A), (B), (E)

Sao Paulo, Brazil | President and Chief Executive Officer, Cervejarias Kaiser (Brewing company) | 1991 | — | 9,857 |

James Doughan(C)

Scottsdale, Arizona | Corporate Director, Consultant | 2001 | — | 6,145 |

The Honourable Richard C. Holbrooke(C)

New York, New York | Vice-Chairman of the Board of Perseus, llc (Merchant bank and private equity fund management company) | 2003 | — | 2,133 |

Eileen A. Mercier(C)

Toronto, Ontario | Corporate Director | 1999 | 2,300 | 2,764 |

The Right Honourable

Brian Mulroney, P.C., C.C., LL.D.(B)

Montreal, Quebec | Chairman of the Board of the Corporation and Senior Partner, Ogilvy Renault (Barristers and Solicitors) | 1997 | 4,900(4) | 30,608(5) |

Jean Neveu

Longueuil, Quebec | Chairman of the Board of Quebecor Inc. (communications holding company) and Chairman of the Board of Groupe TVA Inc. (Television broadcasting company) | 1989 | 3,626(6) | 3,394(7) |

Robert Normand(A), (D)

Rosemère, Quebec | Corporate Director | 1999 | 1,000 | 10,055 |

Érik Péladeau

Rosemère, Quebec | Vice Chairman of the Board of the Corporation, Chairman of the Board of Quebecor Media Inc. (communications company) and Vice Chairman of the Board of Quebecor Inc. (communications holding company) | 1989 | — (8)(9) | 1,693(10) |

Pierre Karl Péladeau(B)

Montreal, Quebec | President and Chief Executive Officer of the Corporation, President and Chief Executive Officer of Quebecor Inc. (communications holding company), and Chairman of the Board of Nurun Inc. (information technology management consultants) | 1989 | — (9)(11) | 6,635 |

Alain Rhéaume(A), (D),(E)

Montreal, Quebec | President and Chief Operating Officer, Microcell Solutions Inc. (Personal communications services company)(11) | 1997 | — | 8,815 |

(A) Member of the Audit Committee.

(B) Member of the Executive Committee.

(C) Member of the Pension Committee. | (D) Member of the Human Resources and Compensation Committee.

(E) Member of the Nominating and Corporate Governance Committee. | |

(1) | This information has been provided to the Corporation by the above directors. This information excludes shares of subsidiaries of the Corporation that may be owned by a director in order to qualify as a director of such subsidiaries under applicable law. |

19

(2) | The amounts in this column are as of March 31, 2004. In 2000, the Corporation implemented a Directors Deferred Stock Unit Plan for the benefit of its directors, which plan was amended in February 2003. |

(3) | Shares held by 1260154 Ontario Inc., a company controlled by Mr. Baillie. |

(4) | Mr. Mulroney also owns 1,000 Class A Multiple Voting Shares of Quebecor Inc. |

(5) | Includes units attributed to The Right Honourable Brian Mulroney in his capacity as Chairman of the Board of Directors of the Corporation. |

(6) | Mr. Neveu also owns 65,614 Class B Subordinate Voting Shares of Quebecor Inc. |

(7) | No compensation paid for services rendered as director from March 2003 to March 2004, when Mr. Neveu acted as President and Chief Executive Officer of the Corporation. |

(8) | Mr. Érik Péladeau directly and indirectly exercises control over 5,340 Class B Subordinate Voting Shares of Quebecor Inc. |

(9) | Les Placements Péladeau Inc., a corporation controlled by a trust constituted for the benefit of Messrs. Érik Péladeau and Pierre Karl Péladeau, has voting control over Quebecor Inc., the Corporation's parent company, with 17,465,264 Class A Multiple Voting Shares and 19,800 Class B Subordinate Voting Shares of Quebecor Inc. The aforementioned trust also exercises control over Gestion Péladeau Inc., which holds 43,700 Class A Multiple Voting Shares of Quebecor Inc. |

(10) | No compensation paid for services rendered as director from October 2001 to March 2004, when Mr. Péladeau acted as Senior Executive Vice president of the Corporation. |

(11) | Mr. Pierre Karl Péladeau owns 3,200 Class A Multiple Voting Shares of Quebecor Inc. |

Each director serves until the next annual meeting of shareholders or until a successor is elected or appointed.

A. Charles Bailliewas the Chairman of the Board of TD Bank Financial Group until April 4, 2003. From February 1998 until December 2002, Mr. Baillie served as Chairman of the Board and Chief Executive Officer of TD Bank Financial Group. He has been a director of the Corporation since 2003.

Reginald K. Brack was the Chairman and CEO of Time Inc., the world's largest magazine publisher. He served as Chairman until June 1997. He has been a director of the Corporation since 2000.

Derek H. Burney, O.C.has been the President and Chief Executive Officer of CAE Inc. since October 1999. From January 1993 until October 1999, he was Chairman of the Board and Chief Executive Officer of Bell Canada International. He has been a director of the Corporation since 2003.