QuickLinks -- Click here to rapidly navigate through this document

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 40-F

| [Check one] | | o REGISTRATION STATEMENT PURSUANT TO SECTION 12

OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR |

|

|

ý ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2002 Commission File Number 1-14118

QUEBECOR WORLD INC.

(Exact name of registrant as specified in its charter)

CANADA

(Province or other jurisdiction

of incorporation or organization) | | 2572

(Primary Standard Industrial

Classification Code Number) | | Not applicable

(I.R.S. Employer

Identification Number) |

612 Saint-Jacques Street

Montreal, Quebec

Canada, H3C 4M8

(514) 954-0101

(Address and telephone number of Registrant's principal executive offices)

Quebecor World (USA) Inc.

340 Pemberwick Road

Greenwich, Connecticut 06831

(203) 532-4200

(Name, address and telephone number of agent for service of process in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | | Name of each exchange on which registered |

| Subordinate Voting Shares | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Guarantees of Debt Securities issued by Quebecor World Capital Corporation, an indirect subsidiary of Registrant

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

ý Annual information form ý Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

94,168,067 Subordinate Voting Shares Outstanding

46,987,120 Multiple Voting Shares Outstanding

12,000,000 First Preferred Shares Series 3 Outstanding

8,000,000 First Preferred Shares Series 4 Outstanding

7,000,000 First Preferred Shares Series 5 Outstanding

Indicate by check mark whether the Registrant by filing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934 (the "Exchange Act"). If "Yes" is marked, indicate the filing number assigned to the Registrant in connection with such Rule.

Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

QUEBECOR WORLD INC.

ANNUAL REPORT ON FORM 40-F

CONTROLS AND PROCEDURES

The Registrant's President and Chief Executive Officer and the Registrant's Executive Vice President and Chief Financial Officer have concluded, based on their evaluation as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures (as defined in Rule 13a-14(c) of the Securities Exchange Act of 1934, as amended) are effective. There have been no significant changes in the internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation.

DOCUMENTS FILED PURSUANT TO GENERAL INSTRUCTIONS

In accordance with General Instruction D.(9) of Form 40-F, the Registrant hereby files Exhibit 3 as set forth in the Exhibit Index attached hereto.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to the securities in relation to which the obligation to file an annual report on Form 40-F arises or transactions in said securities.

B. Consent to Service of Process

The Registrant has previously filed with the Commission a written consent to service of process and power of attorney on Form F-X.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| | | QUEBECOR WORLD INC. |

Date: May 12, 2003 |

|

By: |

|

/s/ DENIS AUBIN

Name: Denis Aubin

Title: Senior Vice President, Corporate Finance and Treasury |

|

|

By: |

|

/s/ RAYNALD LECAVALIER

Name: Raynald Lecavalier

Title: Vice President, Corporate General Counsel and Secretary |

CERTIFICATIONS

I, Jean Neveu, President and Chief Executive Officer of Quebecor World Inc., certify that:

- 1.

- I have reviewed this annual report on Form 40-F of Quebecor World Inc.;

- 2.

- Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

- 3.

- Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

- 4.

- The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

- a)

- designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared;

- b)

- evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the "Evaluation Date"); and

- c)

- presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

- 5.

- The registrant's other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (and persons performing the equivalent function):

- a)

- all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and

- b)

- any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and

- 6.

- The registrant's other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: May 12, 2003

/s/ JEAN NEVEU

|

|

Jean Neveu

President and Chief Executive Officer

| |

I, Claude Hélie, Executive Vice President and Chief Financial Officer of Quebecor World Inc., certify that:

- 1.

- I have reviewed this annual report on Form 40-F of Quebecor World Inc.;

- 2.

- Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

- 3.

- Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

- 4.

- The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

- a)

- designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared;

- b)

- evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the "Evaluation Date"); and

- c)

- presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

- 5.

- The registrant's other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (and persons performing the equivalent function):

- a)

- all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and

- b)

- any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and

- 6.

- The registrant's other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: May 12, 2003

/s/ CLAUDE HÉLIE

|

|

Claude Hélie

Executive Vice President and

Chief Financial Officer

| |

EXHIBIT INDEX

Exhibit Number

| | Document

|

|---|

| 1 | | Annual Information Form of the Registrant dated May 12, 2003 |

| 2 | | Management's Discussion and Analysis of Financial Condition and Results of Operations and Audited Consolidated Financial Statements of the Registrant, including the Notes thereto, as at December 31, 2002 and 2001 and for the years ended December 31, 2002, 2001 and 2000 |

| 3 | | Consent of KPMG LLP |

| 4 | | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act |

Exhibit 1

QUEBECOR WORLD INC.

ANNUAL INFORMATION FORM

For the Year Ended

December 31, 2002

May 12, 2003

QUEBECOR WORLD INC.

TABLE OF CONTENTS

| DEFINITIONS | | 3 |

ITEM 1 – |

INCORPORATION |

|

3 |

| | 1.1 | Incorporation of Quebecor World Inc. | | 3 |

| | 1.2 | Subsidiaries | | 3 |

| | 1.3 | Multiple Voting and Subordinate Voting Shares | | 4 |

ITEM 2 – |

GENERAL DEVELOPMENT OF THE BUSINESS |

|

4 |

ITEM 3 – |

NARRATIVE DESCRIPTION OF THE BUSINESS |

|

6 |

| | 3.1 | Description of Products and Segments | | 6 |

| | 3.2 | Manufacturing | | 10 |

| | 3.3 | Sales and Marketing | | 11 |

| | 3.4 | Competitive Strengths | | 12 |

| | 3.5 | Capacity Utilization | | 13 |

| | 3.6 | Technology | | 13 |

| | 3.7 | Purchasing and Raw Materials | | 14 |

| | 3.8 | Competitive Environment | | 15 |

| | 3.9 | Risks associated with changes in interest rates and foreign exchange | | 15 |

| | 3.10 | Customers | | 15 |

| | 3.11 | Seasonality of the Company's business | | 15 |

| | 3.12 | Human Resources | | 15 |

| | 3.13 | Environmental Regulations | | 16 |

ITEM 4 – |

SELECTED CONSOLIDATED FINANCIAL INFORMATION |

|

16 |

| | 4.1 | Annual | | 16 |

| | 4.2 | Quarterly | | 17 |

| | 4.3 | Dividends | | 18 |

ITEM 5 – |

MARKET FOR THE NEGOTIATION OF SECURITIES |

|

19 |

ITEM 6 – |

DIRECTORS AND OFFICERS |

|

19 |

| | 6.1 | Directors | | 20 |

| | 6.2 | Executive Officers Who Are Not Directors | | 21 |

ITEM 7 – |

ADDITIONAL INFORMATION |

|

25 |

ITEM 8 – |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

25 |

DEFINITIONS

In this Annual Information Form, unless the context otherwise requires, "Company" refers to Quebecor World Inc., its partnerships, subsidiaries and divisions and their respective predecessors and, for the relevant periods, refers to Quebecor Inc.'s divisions and subsidiaries involved in the commercial printing business, and "Parent" refers to Quebecor Inc., its subsidiaries and divisions and their respective predecessors other than the Company, its subsidiaries and divisions and their respective predecessors. References to "dollars," "US$" and "$" are to United States dollars. Unless otherwise indicated, the information contained herein is given as at December 31, 2002.

ITEM 1 — INCORPORATION

1.1 INCORPORATION OF QUEBECOR WORLD INC.

The Company was incorporated on February 23, 1989 pursuant to theCanada Business Corporations Act under the name "Quebecor Printing Inc.". On January 1, 1990, the Company (as it was then known), Quebecor Printing Group Inc., Quebecor Printing (Canada) Inc., 166599 Canada Inc., Ronalds Printing Atlantic Limited and 148461 Canada Inc. amalgamated under the name "Quebecor Printing Inc." pursuant to theCanada Business Corporations Act. This corporate reorganization was undertaken in order to consolidate the assets of the printing sector of Quebecor Inc., which, prior to such reorganization, consisted of a number of divisions and subsidiaries. The Company's articles were amended: (a) on December 7, 1990, in order to subdivide each outstanding share into five shares; (b) on December 14, 1990, in order to create Series 1 Preferred Shares; (c) on February 24, 1992, in order to delete private company restrictions; (d) on April 10, 1992, in order to (i) create three new classes of shares, namely Subordinate Voting Shares, Multiple Voting Shares and First Preferred Shares, issuable in series, (ii) reclassify and change the 39,965,005 outstanding common shares into 39,965,005 Multiple Voting Shares, (iii) reclassify and change the 5,360 outstanding Series 1 Preferred Shares into 5,360 Series 1 First Preferred Shares, and (iv) cancel the unissued preferred and common shares; (e) on April 25, 1994 in order to split the Subordinate Voting Shares and the Multiple Voting Shares so that each shareholder would receive three shares for each two shares held; (f) on April 25, 1996, in order to permit the appointment of one or more directors during the course of the year; (g) on November 5, 1997, in order to create Series 2 and 3 First Preferred Shares; (h) on April 25, 2000, in order to change the name of the Company to "Quebecor World Inc."; (i) on February 21, 2001, in order to create Series 4 First Preferred Shares; and (j) on August 10, 2001, in order to create Series 5 First Preferred Shares.

The head office of the Company is located at 612 Saint-Jacques Street, Montreal, Quebec, Canada, H3C 4M8, the telephone number of the Company at its head office is (514) 954-0101, the fax number is (514) 954-9624 and its web site is www.quebecorworld.com.

1.2 SUBSIDIARIES

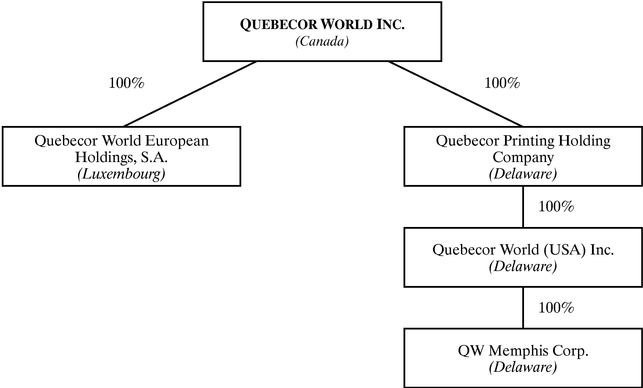

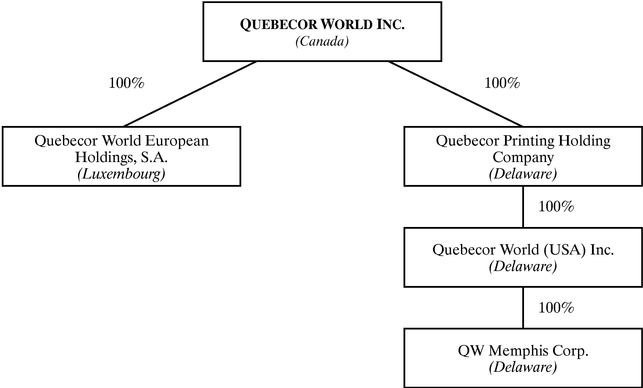

The following organizational chart shows the Company's principal subsidiaries as at March 31, 2003, their jurisdiction of incorporation or continuation and the percentage of voting rights held or controlled, directly or indirectly, by the Company. The Company does not own or control, directly or indirectly, any non-voting securities of such subsidiaries. Subsidiaries whose total assets and revenues represented (a) individually, less than 10% of the consolidated assets and revenues of the Company as at December 31, 2002, and (b) in the aggregate, less than 20% of the consolidated assets and revenues of the Company as at December 31, 2002, have not been included.

1.3 MULTIPLE VOTING AND SUBORDINATE VOTING SHARES

The equity shares of the Company carrying the right to vote are the Multiple Voting Shares and the Subordinate Voting Shares. The Subordinate Voting Shares, each of which carries the right to one vote, are restricted shares (within the meaning of Canadian regulations respecting securities) in that they do not carry equal voting rights to the Multiple Voting Shares, each of which carries the right to ten votes. The articles of the Company do not contain any rights or provisions applicable to holders of Subordinate Voting Shares of the Company where a take-over bid is made for the Multiple Voting Shares. However, the Company's significant shareholder, Quebecor Inc., has provided undertakings in favour of the holders of Subordinate Voting Shares in

3

certain circumstances where a take-over bid is made for the Multiple Voting Shares. Please refer to the Company's Management Proxy Circular dated February 28, 2003 for more details in respect of the foregoing at pages 2-4 under "VOTING SHARES AND PRINCIPAL HOLDERS THEREOF — Undertakings in Favour of Holders of Subordinate Voting Shares", which text is incorporated by reference into this Annual Information Form.

ITEM 2 — GENERAL DEVELOPMENT OF THE BUSINESS

Quebecor World Inc., a diversified global commercial printing company, is the largest commercial print media services company in the world. Its 2002 revenues reached $6.2 billion. The Company offers its customers state-of-the-art web offset, gravure and sheetfed printing capabilities in product categories including magazines, retail inserts, catalogs, specialty printing and direct mail, directories, as well as books, pre-media, logistics and other value-added services. The Company is a market leader in most of its product categories. The Company believes that the diversity of its customer base, geographic coverage and product segments enhance the overall stability and potential growth of its earnings and cash flow. The Company's strategy for growth focuses on increasing its geographic coverage through selective business acquisitions and internal growth.

The Company services its various markets and offers its products through a network of more than 165 printing and related services facilities capable of economically servicing virtually all major markets in the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

Growth Strategy

In an industry characterized by a high degree of fragmentation and consolidation opportunities, the Company has grown historically and will continue to grow primarily through acquisitions.

Since its inception in 1988, the Company has made more than 65 acquisitions valued at more than $5.5 billion, 15 of which had an acquisition price in excess of $50 million. The following table sets forth the Company's most significant acquisitions since 1988.

Year

| | Acquisition

| | Country

| | Consideration (millions)*

|

|---|

| 1988 | | BCE PubliTech Inc. | | Canada | | $ | 191.0 |

| 1990 | | Graphics Holding Enterprises Inc. | | U.S.A. | | $ | 532.1 |

| 1994 | | Arcata Corporation (Book Group) | | U.S.A. | | $ | 180.9 |

| 1995 | | Financière Jean Didier | | France | | $ | 336.7 |

| 1997 | | AmerSig Graphics Inc. | | U.S.A. | | $ | 116.0 |

| 1997 | | Franklin Division of Brown Printing Company | | U.S.A. | | $ | 125.0 |

| 1998 | | TINA | | Sweden and Finland | | $ | 271.8 |

| 1999 | | World Color Press | | U.S.A. | | $ | 2,723.7 |

| 2001 | | Retail Printing Corporation | | U.S.A. | | $ | 127.7 |

| 2002 | | European Graphic Group S.A., a subsidiary of Hachette Filipacchi Medias | | France and Belgium | | $ | 70.7 |

- *

- Including assumption of long-term debt net of cash and cash equivalent

In 1999, a subsidiary of the Company merged with Greenwich, Connecticut-based World Color Press, Inc., the second-largest commercial printer in the United States which operated 58 facilities in the United States and had approximately 16,000 employees. Following this merger, the Company became the largest commercial printer in the world.

In 2000, the Company started building its first plant in Brazil, the largest country in Latin America, with a population of more than 164 million people. The decision to build a greenfield site was made and a 10-year agreement valued at $170 million was signed with Editora Abril, S.A., South America's leading publisher of magazines, includingVEJA, the world's fourth-largest news weekly. Under this agreement, the Company will print 18 titles, or 83 million magazines, a year for Abril. The plant has been expanded to meet the needs of a second key customer, Listel Listas Telefonicas S.A., the largest and fastest growing directory publisher in Brazil, owned by BellSouth Corporation. The 10-year Listel contract is worth $142 million, and the Company will print 11.8 billion directory pages a year, more than half of all the directory pages printed by the Company in Canada annually.

In 2000, the Company completed its program initiated during 1998 to exit non-core operations. In 1998, the Company sold its cheque and credit card businesses. In 1999, this program continued with the sale of the operating assets of the Company's BA Banknote Division. Finally, in 2000, the Company sold its North American CD-ROM replicating and fulfillment facilities to Vancouver-based Q-Media.

In order to focus on the integration of operations, from both North American and international perspectives, and on the maximization of free cash flow, the Company has made no significant business acquisitions since the acquisition of World Color Press, Inc. in August 1999 through the close of 2000. The Company resumed its external growth strategy in 2001. The Company expanded its U.S. retail platform in July 2001 by acquiring Retail Printing Corporation, a web offset retail printer with locations in Nashville, Tennessee and Taunton, Massachusetts.

In September 2001, the Company signed an agreement pending regulatory approval to purchase the European printing business of Hachette Filipacchi Medias (European Graphic Group, or E2G). The acquired assets include printing and bindery facilities in France, as well as Hachette's 50% ownership stake in the rotogravure printing plant of Helio Charleroi in Belgium. Hachette Filipacchi Medias is one of the world's top publishers with 210 magazine titles in 34 countries. All necessary regulatory approvals were obtained and this transaction closed in March 2002 for an aggregate purchase price of $70.7 million. The transaction amount includes a purchase price balance for the 50% stake of the Charleroi Group controlled by the Belgian businessman, Albert Frère. As part of the transaction, Hachette has entered into a long-term agreement with the

4

Company for it to print many of Hachette's magazines in Europe, the value of which is estimated to be $400 million (excluding paper) over the term of the contracts.

In the fourth quarter of 2002, the holders of the Series 2 Preferred Shares exercised their right to convert their shares on a one-for-one basis into Series 3 Preferred Shares. The Series 3 Preferred Shares are entitled to a fixed quarterly dividend of Cdn $0.3845 per share.

ITEM 3 — NARRATIVE DESCRIPTION OF THE BUSINESS

The Company has rotogravure, web offset and sheetfed printing capacity for a wide variety of printed materials, such as magazines, retail inserts, catalogs, specialty printing and direct mail, books, directories, pre-media, logistics and other value-added services. Printing services, including design, production and distribution, are offered from more than 165 printing and related services facilities located throughout the United States, Canada, France, the United Kingdom, Spain, Switzerland, Sweden, Finland, Austria, Belgium, Brazil, Chile, Argentina, Peru, Colombia, Mexico and India.

3.1 DESCRIPTION OF PRODUCTS AND SEGMENTS

Description of Segments

The Company operates in the printing industry. Its business units are located in three main geographic segments as follows:

| | Years Ended December 31,

| |

|---|

| | 2002

| | 2001

| |

|---|

| | $

| | %

| | $

| | %

| |

|---|

| | ($ in millions)

| |

|---|

| Revenues: | | | | | | | | | |

| | North America | | 5,078.6 | | 81 | | 5,268.1 | | 83 | |

| | Europe | | 982.3 | | 16 | | 891.3 | | 14 | |

| | Latin America | | 183.0 | | 3 | | 161.4 | | 3 | |

| | Other and Intersegment | | (1.9 | ) | — | | (0.7 | ) | — | |

| | |

| |

| |

| |

| |

| | | Total | | 6,242.0 | | 100 | | 6,320.1 | | 100 | |

| | |

| |

| |

| |

| |

| Operating income:* | | | | | | | | | |

| | North America | | 527.3 | | 94 | | 564.5 | | 91 | |

| | Europe | | 39.5 | | 7 | | 53.9 | | 9 | |

| | Latin America | | 14.2 | | 2 | | 10.4 | | 2 | |

| | Other | | (18.2 | ) | (3 | ) | (11.0 | ) | (2 | ) |

| | |

| |

| |

| |

| |

| | | Total | | 562.8 | | 100 | | 617.8 | | 100 | |

| | |

| |

| |

| |

| |

- *

- Before restructuring and other charges

Commercial printing is a very fragmented, capital-intensive manufacturing industry. The North American and European printing industries are highly competitive in most product categories and geographic regions. In addition, with economic conditions and consumer spending in Latin America becoming increasingly favourable, the market for print and print advertising will expand dramatically in the near and medium terms. The Company believes that the ten largest competitors in the North American and European commercial printing markets have in aggregate less than 25% of the total share of each of their respective markets. In North America alone, there are more than 32,000 commercial printers.

Commercial printers tend to compete within each product category based on price, quality and the ability to service customers' specialized needs. Small competitors are generally limited to servicing customers for a specific product category within a regional market. Larger and more diversified commercial printers with greater geographic coverage have the ability to serve national and global customers across multiple product segments.

Management believes that both the North American and European printing markets are consolidating and that acquisition targets will continue to be available as larger commercial printers displace medium-size printers and regional competitors. Industry trends in Latin America, which are mirroring historical developments in North America, should also provide acquisition opportunities. Over the past decade, North American and European publishers have outsourced their printing operations. This trend began in the mid-1990s in Europe as demonstrated initially by the decision of Associated Newspapers in 1995 to outsource its printing to the Company and, more recently, by the Company's acquisition of the European printing assets of Hachette Filipacchi Media in France and Belgium. The Company's ongoing partnership with the Brazilian publisher Editora Abril, S.A., which commenced in 2000, is a reflection of a similar trend taking root in Latin America. This segregation of publishing and printing activity should provide independent printers greater acquisition opportunities and enable them to seek printing business with previously captive customers. Management believes that the Company is well positioned to continue to take advantage of the consolidation of the North American, European and Latin American commercial printing markets.

The Company is one of the few commercial printers that has the ability to serve customers on a regional, national and global basis. As a result, the Company has been able to build a substantial business within each of the American, Canadian and European segments and to pursue its expansion in Latin America.

In the United States, the Company is the largest commercial printer with more than 94 facilities and 23,520 employees operating in 31 states. The Company is a leader in the printing of books, magazines, retail inserts, catalogs, specialty printing, and direct mail.

The Company is the largest commercial printer in Canada, with 31 facilities in six provinces and more than 6,780 employees. It offers a diversified mix of printed products and related value-added services to the domestic market and internationally, including substantial exports to the United States.

5

In Europe, the Company operates in France, Belgium, Switzerland, the United Kingdom, Spain, Sweden, Austria and Finland, with 31 facilities and approximately 5,900 employees serving customers in 13 European countries. It is the largest independent commercial printer in Europe.

The Company also operates in Latin America with eight facilities and approximately 2,800 employees, as well as in India, where it has one facility and 60 employees.

Description of Business Group

The Company's operations are managed by eight distinct business groups. Each business group is accountable primarily for one product, group of products or geographic region. The Company's revenues by business group are as follows:

| | Years Ended December 31,

|

|---|

| | 2002

| | 2001

|

|---|

| | $

| | %

| | $

| | %

|

|---|

| | ($ in millions)

|

|---|

| Magazines and Catalogs | | 1,671.5 | | 27 | | 1,785.4 | | 28 |

| Retail | | 1,172.5 | | 19 | | 1,074.1 | | 17 |

| Commercial and Direct | | 687.2 | | 11 | | 829.3 | | 13 |

| Book | | 512.5 | | 8 | | 532.1 | | 8 |

| Directory | | 473.8 | | 7 | | 500.9 | | 8 |

| Other Revenues | | 559.2 | | 9 | | 545.6 | | 9 |

| Europe | | 982.3 | | 16 | | 891.3 | | 14 |

| Latin America | | 183.0 | | 3 | | 161.4 | | 3 |

| | |

| |

| |

| |

|

| Total | | 6,242.0 | | 100.0 | | 6,320.1 | | 100.0 |

| | |

| |

| |

| |

|

The Company is the world's leading printer of consumer magazines. It prints more than 1,000 magazine titles, including:Time,Sports Illustrated,People Weekly,Fortune,Money,TV Guide,Southern Living,Car and Driver,Le Figaro Magazine,Reader's Digest,Maclean's,L'Actualité,Châtelaine,Flare, 7 Jours,T.V. Magazine,Ebony, ESPN, Woman's Day, Good Housekeeping, Elle, Rolling Stone, Newsweek, US News & World Report, Cosmopolitan, GQ, Vogue, Forbes, Veja, Aftonbladet TV/Sunday, Expressen TV/Sunday, American Profile, Cooking Light, Family Fun, Golf Digest, Maxim, Motor Trend, Parents, Self, Paris Match, Snej Dej andVersion Femme among other magazines, as well as all the magazines published by the Parent. The Company prints 45 percent of the top 125 magazine titles in North America. It operates a global print platform with operations in the United States, Canada, Europe and Latin America.

Management believes that the Company is the industry leader in producing weekend newspaper magazines. These are four-color magazines inserted in major-market weekend newspapers. The Company prints two syndicated weekend magazines,Parade andUSA Weekend, as well as locally edited and distributed weekend newspaper magazines. In the United Kingdom, the Company is an important supplier of weekend supplements forAssociated Newspapers, Mirror Group Newspapers andGuardian Newspapers.

The Company has invested in pre-media (computer-to-plate) and press technology to enhance its ability to service this market. For the production of medium to long-run magazines, the Company is at an advantage because its plants have selective-binding and ink-jet-imaging capabilities and can utilize the Company's mail analysis system.

The Company also prints comic books for leading companies such asD.C. Comics, Marvel Entertainment, Image Comics and Archie Comic Publications. In the comic book market, the Company operates an on-line computer management system that provides publishers with information regarding the production and distribution status of each of their titles.

The Company is the largest printer of catalogs in the world. It prints several hundred different catalogs on an annual basis for many of North America's direct mail retailers such asL.L. Bean, Spiegel, Ikea, Victoria's Secret, BryLane, Office Depot, Scholastic, Blair, Sears, Avon, Circuit City, JC Penney, Oriental Trading Co., Seton,United Stationers andWilliams-Sonoma. The Company offers special catalog services such as list services, to help customers compile effective lists for distribution, selective-binding capacity to allow customers to vary catalog content to meet their customers' demographic and purchase patterns, and ink-jet addressing and messaging to personalize messages for each recipient. This technology partially offsets postage-cost increases by eliminating pages of products that do not fit a buyer's demographic or purchasing profile. The Company's global network also allows the Company to offer its customers one-stop shopping for all of their catalog needs in North America, Europe and Latin America.

The Company's major retail inserts customers include large retailers, such asSears,Walgreen's,Home Depot, Staples, Rite-Aid, Wal-Mart, CVS,JC Penney,Shoppers Drug Mart,Canadian Tire,Radio Shack,Carrefour,RONA,Conforama,Leclerc, A & P, Albertsons, Casino, Castorama, Intermarché, Jean Coutu, Kvickly, Value City andLoblaw's. In North America, the Company's 13 rotogravure process printing plants offer both the coast-to-coast manufacturing network and the long-run efficiencies required to serve the larger retail customers. The Company has five rotogravure process printing plants in France, one in Belgium and two in Nordic countries. In Canada, the Company prints inserts and circulars using heatset and coldset web offset and rotogravure processes in accordance with customer requirements. The Company also offers digital engraving and related pre-press processes, which both enhances quality and shortens time-to-market.

6

Products in these categories include annual reports, corporate prospectuses, promotional literature, calendars, posters, direct-mail products, highly personalized catalog wraps and promotions for the auto industry and other custom items. The Company's web and sheetfed printing presses of a smaller size permit the Company to offer custom colors, coatings, finishes and specialized binding required to produce a wide variety of print products. The Company provides numerous print-related services to customers, including typesetting, pre-press, circulation fulfillment, list management, mailing and distribution, in particular through desktop-publishing and electronic pre-media technology.

Quebecor Merrill Canada Inc., a subsidiary of the Company, offers services of manufacturing operations to serve the market for financial documents, prospectuses, annual reports and related printing.

The Company's Direct division is established as international leader in the application of versioning, ink jet addressing, print-on-demand technology and computer-to-plate techniques which are critical to the customized production and compressed cycle times that customers demand today.

The Company is the North American industry leader in book manufacturing. The Book Group is an industry leader in the application of new technologies for book production including electronic pre-media, information networking, digital printing, computer-to-plate and electronic data interchange. With plants in the United States, Spain, and Latin America, the Company serves internationally more than 1,000 publisher customers, includingSimon & Schuster, Scholastic, Thomas Nelson Publishers, AOL/Time Warner, McGraw-Hill, Pearson, Houghton-Mifflin,Harlequin,Reed Elsevier, MacMillan, Random House, Santillana, Thomson Publishing, Walt Disney andReader's Digest.

In keeping with its full-service approach, the Company also provides on-demand printing services for small quantities of books, brochures, technical documents and similar products to be produced quickly and at a relatively low cost.

The Company specializes in telephone directories and is the largest directory printer in Canada and among the largest directory printers in North America and Latin America. The presence of the Company's directory group in the North American market dates back to the late nineteenth century with the printing of Bell Canada's first directories. The Company prints telephone and other directories for a large number of companies includingPacific Bell, Qwest-Dex, BellSouth, Listel, Telmex, Verizon Information Services,SBC Smart Yellow Pages Group, Telefonicà de España, TransWestern Publishing, MTS Advanced, Yellow Book USA andYellow Pages Group Co. In 1994, the Company began production of directories for the Indian domestic market at its directory facility near New Delhi, India.

Pre-Media, Logistics and Other Value-Added Services

The Company is a leader in the transition from conventional pre-press to an all-digital workflow, providing a complete spectrum of film, and digital preparation services, from traditional past-up and colour separation to state-of-the-art, all-digital pre-media, as well as digital emerging and digital archiving. Such pre-media services include the colour electronic pre-media system, which takes art work from idea to final product, and desktop publishing, giving the customer greater control over the finished product. These pre-media services are especially helpful to smaller customers, who may not have the capital to employ such equipment or who may have to rely on third-party vendors, which may result in coordination and delay problems. Our specialized digital and pre-media facilities, which are strategically located close to and, in certain cases, onsite at, customers' facilities, provide our customers high quality, twenty-four hour preparatory services linked directly to the Company's various printing facilities. In addition, our computer systems enable the Company to electronically exchange both images and textual material directly between the Company and the customers' business locations. The integrated pre-media operations provide the Company with competitive advantages over traditional pre-press shops that are not able to provide the same level of integrated services. Que-Net Media, a division of the Company, brings together the full range of digital technologies and pre-media assets within the Company that allows it to focus on providing a more comprehensive range of solutions to the customer base of the Company. Other value-added services, including mail list, shipping and distribution expertise, ink-jet personalizing and customer-targeted binding, are rapidly becoming requirements of numerous customers.

The establishment of Quebecor World Logistics Inc., a subsidiary of the Company, has made the Company the largest and most technologically advanced print transport company, as well as the largest customer by volume of the U.S. Postal Service. Quebecor World Logistics Inc. provides complete logistics services including customized door-to-door planning, management, transportation, delivery and tracking solutions, thereby providing customers with cost-effective, efficient and trackable distribution services.

3.2 MANUFACTURING

The Company uses principally two types of printing processes, rotogravure and offset, which are the most commonly used commercial printing processes. Both processes have undergone substantial technological advances over the past decade, resulting in significant improvements in speed and print quality. The Company estimates that in 2002 approximately 75 percent of its revenues by volume were printed using offset and the remainder using the rotogravure process.

With 102 rotogravure presses, the Company is one of the largest world-wide printers using the rotogravure process. The process uses a copper-coated printing cylinder which is mechanically engraved using high-precision,

7

computer-controlled and diamond-cutting heads. Although the engraving of the printing cylinder is relatively expensive, the printing cylinder itself is extremely durable and cost effective per long run. The rotogravure process has an excellent reputation for the quality of its four-color reproductions on various grades of paper and the very high speed at which it is capable of running.

The rotogravure process is well suited to long-run printing of advertising inserts and circulars, Sunday newspaper magazines and other high-circulation magazines and catalogs. The Company believes that its coast-to-coast network of rotogravure facilities in the United States offers both the capacity and locations required by large merchandisers and publishers. The acquisition in March 2002 of the European printing assets of Hachette Filipacchi Medias provides an advantageous position in the rotogravure market in Europe. The Company's advanced ability in rotogravure digital pre-media also ensures more efficient and accurate production of the same insert simultaneously in multiple locations, thereby offering the customer the efficiency and cost savings of manufacturing and distribution closer to its end-use markets in reduced time frames.

In the offset process, an inked impression from a thin metal plate is first made on a rubber cylinder, after which it is offset to paper. There are several types of offset printing processes: sheetfed and web, heatset and coldset. Sheetfed presses print on sheets of paper, whereas web presses print on rolls of paper. Short-run printing is generally best served by sheetfed offset, whereas web offset is generally the best process for longer runs.

Heatset web offset involves a press which uses an oven to instantly set or dry the oil-based inks. This permits high speed and better quality and is best suited for printing on glossier papers (coated paper). Heatset web offset is used to print retail inserts, magazines, catalogs and books. The Company owns 468 heatset web offset presses.

Coldset web offset involves a press that does not use an oven to dry the ink, instead using oil-based inks that are absorbed into the paper and dried by oxidation. Coldset web offset is used mainly to print newspapers, books, directories, and some retail inserts. The Company owns 60 coldset web offset presses.

The Company owns 193 sheetfed offset presses, which print books, promotional material and direct-mail products and form a network of smaller regional facilities that constitutes an advantage in the Company's overall business strategy. Most of these facilities are large suppliers in their local markets.

3.3 SALES AND MARKETING

The sales and marketing activities of the Company are highly integrated and reflect an increasingly global approach to meeting customers' needs that is complemented by product-specific sales efforts. Sales representatives are located in plants or in regional offices throughout North America, Europe, and Latin America, generally close to their customers and prospects. Each sales representative has the ability to sell into any plant in the Company's global network. This enables the customer to coordinate simultaneous printing throughout the Company's network through one sales representative. Certain of the larger customers centralize the purchase of printing services and, in this regard, the Company's ability to provide broad geographical services is clearly an advantage over smaller regional competitors.

Since 1995, the Company has proceeded to complete ISO 9000 series certification at various plants where it operates and it is continuing to ensure that more and more plants will be ISO 9000 series certified. The ISO 9000 series of international standards certify that a company meets quality control requirements in its production processes.

As of the date hereof, twelve of the Company's plants have received the ISO-14001 certification, an internationally recognized environmental management system, the goal of which is the continuous improvement in environmental management.

The Company supports its sales efforts with marketing programs that involve advertising and trade shows to reinforce the corporate image in the buyer's mind. It also provides technical seminars and printing consulting services to make customers aware of market opportunities and the Company's capabilities.

The Company believes that its size and network of locations throughout North America, Europe and Latin America is an advantage over smaller competitors in terms of shipping and distribution. Because of its volume, the Company is able to set up pool-shipping systems, which enable customers to ship their products at significant discounts. The discount is achieved through agreements with the postal services, which provides the mailer/customer with a discount if the mailer/customer pays the freight costs to transport the mail closer to the postal services delivery office. The Company uses its custom-built mail analysis system, which automatically combines different customers into truck-load shipments and analyzes the cost-savings benefit to the customer. The mail analysis system then generates the necessary forms, bills of lading and freight invoices for the customer.

Ink-jet personalizing is increasingly being used by many publishers and catalogers. Ink-jet addressing eliminates the additional process of printing paper labels and improves mailing efficiency. Catalogers use ink-jet personalizing in a number of ways. Ink-jet addressing allows both the cover and the order form to be labelled and to show customer-coding information. Furthermore, as catalogers continue to look for methods to increase the level of personalization, the ink-jet process is being used more frequently to add personal messages, specific inserts to frequent buyers, or unique coding information for order entry. Another advantage to ink-jet printing and selective binding is the Company's ability to merge lists of names for the same customer or to co-mail different customers to achieve increased postal pre-sort discounts.

3.4 COMPETITIVE STRENGTHS

Management believes it has certain competitive strengths which enable it to provide enhanced customer service while maintaining a low-cost position in the industry. Such advantages include broad geographic coverage, a single source of printing services, technological capabilities, economies of scale and a large manufacturing base.

8

Broad Geographic Coverage. Certain of the Company's largest customers utilize simultaneous printing in several of the Company's locations. The Company is one of the few commercial printers that can service these customers in virtually all of their markets, allowing them to coordinate their requirements. In addition, multi-plant simultaneous printing makes delivery more efficient and lowers distribution costs for national products such as Paradeand USA Weekend.

Single Sourcing. By providing its customers a wide variety of printing, pre-press, post-press and distribution services, the Company is able to become a more integral element in its customers' publishing process while simultaneously expanding its sources of revenues. As large customers have centralized their purchasing of printing services, the Company's ability to provide a single source for comprehensive printing services and broad geographical coverage is a competitive advantage, since customers are not required to contract with numerous smaller specialized and regional competitors.

Technological Capabilities. The Company is committed to the effective use of state-of-the-art technology, including the development of new printing technologies, upgrade of existing printing assets and further development of integrated services. The Company's technological capabilities have enabled it to lower its cost position and to better serve its customers by improving quality, flexibility, speed and cost of production. Keeping pace with the technological developments in the industry requires substantial capital expenditures. Hence, in 2002, the Company spent $184.5 million on capital expenditures, including faster and more efficient presses and pre-press and post-press technologies. In 2003, capital expenditures will be made in order to maintain the Company's existing assets and to invest in new projects for expansion in selected markets. The breadth of the Company's business enables it to spread technological investments over numerous facilities and product segments and its size enables it to lower its relative cost position by spreading fixed capital investment over a greater base of revenues.

Economies of Scale. The Company enjoys significant economies of scale which, in the opinion of management, provides the Company with a cost advantage. The Company also purchases a significant amount of printing equipment. Management believes that such purchasing power enables the Company to purchase both raw materials, primarily paper and ink, and equipment, on enhanced terms. This purchasing power also ensures availability of raw materials in tight markets. In 1998, the Company opened a global procurement office in Fribourg, Switzerland. Global procurement allows the Company to achieve economies of scale for materials and equipment.

The Company has realized more cost savings from synergies resulting from its merger with World Color than it had originally anticipated. By consolidating platforms into fewer but larger and more specialized plants, the Company reduces administrative costs and achieves better economies of scale. In addition, increased plant specialization allows for greater efficiency and improved distribution reduces the final cost to customers and improves speed of delivery.

The growth of new media provides the Company with further opportunities to exploit its economies of scale. Increasingly, clients seek to repurpose information so that it can be used in both printed and electronic forms. The Company has implemented digital workflows and has provided tools such as its Digital Asset Management System and Automated Publishing System to facilitate the re-use of information in a more cost effective manner than its competitors.

Large Manufacturing Base. The Company's diversity and breadth of plant and press capability, product mix and large customer base facilitate greater capacity utilization. Most presses can produce a variety of printed products, and the Company frequently allocates orders among its facilities to optimize their equipment utilization. In addition, the Company's large manufacturing base combined with its technological capabilities frequently enable the Company to improve customer service and operating margins by transferring technology and maximizing the printing capabilities of its facilities.

Management believes that further consolidation of the fragmented printing industry will occur due to the advantages of size, the high cost of capital equipment and technology and the demand of many large customers for broad, technologically advanced, continent-wide and international printing services. The Company's competitive and financial strengths and its substantial experience in integrating acquired businesses provide it with the ability to take advantage of this industry dynamic. Having established a critical size and the geographic and product diversity required to compete, the Company is focused on continuing the expansion of its customer base, markets and scope of services in North America, Europe and Latin America.

3.5 CAPACITY UTILIZATION

The Company's diversity in plant and press capability, product mix and large customer base facilitate greater capacity utilization. Most presses can produce a variety of printed products and the Company will frequently allocate orders among its facilities to optimize their utilization. Because the Company serves a wide variety of markets, it is able to redeploy equipment, thereby maximizing its utility and extending its useful life. Diversity in plant and press capability enables the Company, through central scheduling of the Company's presses, to assign a particular order to the machine best suited for it. Through its most recent restructuring initiatives, the Company has relocated 20 pieces of equipment in an effort to maximize utility.

9

3.6 TECHNOLOGY

The Company is committed to the effective use of state-of-the-art technology to provide cost-effective customer service. The Company is active in, among others, the following areas: rotogravure computer-aided pre-press and cylinder processing, which improves time and cost efficiencies and the quality of pre-media page preparation and cylinder engraving; wide-web heatset web offset presses, where the Company collaborated on the engineering and subsequent installation of nine "Sunday Press" 54-inch, 48-page presses, which are twice as productive as standard 36-inch, 32-page presses; ink-jet-addressing and messaging systems, with the Company offering a 72-line messaging capability for the customization of catalogs and magazines.

The Company also cooperates with large suppliers in the area of research and development of new printing technologies, materials and processes. The Company's capital-improvement programs include adding, replacing and/or upgrading existing equipment.

The Company continues to invest in Target Bound™ selective binding equipment, which enables publishers and catalog merchandisers to produce multiple versions of a magazine or catalog in a single bindery run. It also acquired colour electronic pre-media and desktop-publishing equipment, invested in its mail analysis system, acquired new equipment for answer-card printing and insertion.

The Company has continued to invest in faster, more efficient and higher-quality presses. Pre-media has continued to witness dramatic enhancements in the digital electronic area, with new computer software and hardware installed to help customers create their pages more quickly and more efficiently. The Company has been an industry leader in bringing new imaging services on-line that streamline the process of preparing pages for print. The Company was one of the first printers to install desktop publishing, direct-to-film and computer-to-plate systems for offset printing, which eliminates entirely the costly and time-consuming film step in print production. It has furthermore established one of the industry's most sophisticated data communications networks, capable of transmitting a customer's publication files quickly and efficiently from the customer's location to multiple plant locations.

Management believes that only printers capable of investing and integrating new technology will continue to expand. One important technological change was the arrival of the "Sunday Press". These new machines compete with presses that run at 2,000 feet per minute on a 36 inch-wide cylinder by offering speeds of 3,000 feet per minute on 54 inch-wide cylinders. Using the same crew, these new presses have brought about a significant improvement at the margin level. The Company currently owns 16 Sunday presses.

The Company continues to upgrade its U.S. rotogravure network to produce magazines, catalogs, inserts and flyers, and Sunday Magazines. The Company became the first commercial printer to install the latest generation of short cut-off tabloid offset presses. These presses print more pages at faster speeds and use less paper than conventional tabloid presses. The Company has also invested in new and emerging digital and web-based technologies to improve services, cut costs and expand its range of products.

The Company operates a North American-wide telecommunications network, which enhances the Company's ability to move digital files between its facilities and customers quickly, share work among plants, and expand distribution and printing operations.

3.7 PURCHASING AND RAW MATERIALS

The principal raw materials used in the Company's products are paper and ink. In 2002, the Company spent approximately $2.3 billion on raw materials. The Company exercises its purchasing power to obtain pricing, terms, quality, quality control and service in line with its status as one of the largest industry customers.

The Company negotiates with a limited number of suppliers to maximize its purchasing power, but does not rely on any one supplier. Purchasing activity at both the local plant and corporate level is coordinated in order to increase and benefit from economies of scale. Inventory-control operations are also integrated into the purchasing functions of the Company, which has resulted in improvements in inventory turns. Plant inventories are also managed and tracked on a regional basis, increasing the utilization of existing inventories. In addition, most of the Company's long-term contracts with its customers include price-adjustment clauses based on the cost of materials in order to minimize the effects of fluctuation in the price of paper and ink.

The Company takes pride in offering world-wide procurement service to its customers. The procurement office, located in Fribourg, Switzerland, gives the Company a major competitive advantage. By consolidating the activities formerly carried out at four regional offices, the Company is able to reduce administrative costs, standardize procurement and provide customers with assured supply at attractive prices.

During 2000, the Company created a private web-enabled business-to-business (B2B) exchange, expanding on the Company's existing global procurement activities. Based in Fribourg, Switzerland, the exchange allows the Company to reduce costs and improve operating margins by aggregating demand for items such as ink and paper across the Company's 165-plant network, thereby creating a virtual warehouse for such items. The Company is currently evaluating a move beyond ink and paper to include additional materials in this global procurement activity.

3.8 COMPETITIVE ENVIRONMENT

The commercial printing business in North America and Europe is highly competitive in most product categories and geographic segments. Industry analysts consider most of the industry's markets to be currently oversupplied, and competition is significant. Competition is largely based on price, quality, range of services offered, distribution capabilities, customer service, availability of printing time on appropriate equipment and state-of-the-art technology.

3.9 RISKS ASSOCIATED WITH CHANGES IN INTEREST RATES AND FOREIGN EXCHANGE

In the normal course of business, the Company is exposed to changes in interest rates. However, the Company manages this exposure by having a balanced schedule of debt maturities as well as a combination of

11

fixed and variable rate obligations. In addition, the Company enters into interest rate swap agreements and cross-currency interest rate swap agreements to manage both its interest rate and foreign exchange exposure.

The Company also enters into foreign exchange forward contracts and interest rate swaps to hedge the settlement of raw materials and equipment purchases, to set the exchange rate for cross-border sales and to manage its foreign exchange exposure on certain liabilities, based in part on the Company's operations in a number of countries.

While the counterparties to these agreements expose the Company to credit loss in the event of non-performance, the Company believes that the possibility of incurring such a loss is remote due to the creditworthiness of the counterparties. The Company does not hold or issue any derivative financial instruments for trading purposes.

Concentrations of credit risk with respect to trade receivables are limited due to the Company's diverse operations and large customer base. As at March 31, 2003, the Company had no significant concentrations of credit risk.

3.10 CUSTOMERS

The Company believes that the product and geographical diversity of its customer base serve to reduce the impact on the Company of dramatic fluctuations in local markets or product-line demand. Many of the Company's large customers are under contract. These contracts include price adjustment clauses based on the cost of paper, ink and labor.

3.11 SEASONALITY OF THE COMPANY'S BUSINESS

The operations of the Company's business are seasonal, with approximately two-thirds of historical operating income recognized in the second half of the fiscal year, primarily due to the higher number of magazine pages, new product launches and back-to-school, retail and holiday catalog promotions.

3.12 HUMAN RESOURCES

As at December 31, 2002, the Company employed approximately 39,000 people, 10,541 of whom were covered by 74 separate collective agreements. Of these, ten collective agreements covering 1,458 employees will expire in 2003. These agreements are limited to single plants and groups of employees within these plants. In all its operations, the Company had 56 nonunionized plants at the end of its last financial year.

The Company believes that its relations with its employees and unions are generally good.

3.13 ENVIRONMENTAL REGULATIONS

The Company is subject to various laws, regulations and government policies, in North America, Europe and Latin America relating to employee health and safety, to the generation, storage, transportation, disposal and environmental emission of various substances, and to environmental protection in general. The Company believes that it is in compliance with such laws, regulations and government policies in all material respects. Furthermore, the Company does not anticipate that compliance with such environmental statutes will have a material adverse effect upon the Company's competitive or consolidated financial position.

Energy and pollution control is at the heart of the Company's commitment to the environment, and this has been particularly important in a year where energy costs have risen significantly. The Company has accelerated its program of replacing existing recuperative thermal oxidizer equipment with newer, more efficient regenerative thermal oxidizer equipment. This equipment not only reduces emissions, but also significantly reduces energy consumption.

ITEM 4 — SELECTED CONSOLIDATED FINANCIAL INFORMATION

4.1 Annual

Set forth below are selected consolidated financial data which have been derived from the Company's consolidated financial statements for the most recent three financial years ended December 31.

12

The data below should be read in conjunction with the consolidated financial statements and related notes thereto as well as the items included hereafter. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations" at item 8 of this Annual Information Form.

| | 2002

| | 2001

| | 2000

| |

|---|

| | (in millions of US dollars,

except per share data & other statistics)

| |

|---|

| Consolidated Results | | | | | | | | | | |

| Revenues | | $ | 6,242.0 | | $ | 6,320.1 | | $ | 6,521.1 | |

| Operating income before depreciation and amortization* | | | 898.4 | | | 955.6 | | | 1,069.9 | |

| Operating income before restructuring and other charges | | | 562.8 | | | 617.8 | | | 724.8 | |

| Restructuring and other charges | | | 19.6 | | | 270.0 | | | (2.7 | ) |

| Operating income | | | 543.2 | | | 347.8 | | | 727.5 | |

| Net income** | | | 279.3 | | | 22.4 | | | 295.4 | |

| Cash provided from operating activities | | | 513.4 | | | 576.5 | | | 917.8 | |

| Free cash flow from operations*** | | | 319.8 | | | 287.2 | | | 747.3 | |

| Operating margin before depreciation and amortization* | | | 14.4% | | | 15.1% | | | 16.4% | |

| Operating margin before restructuring and other charges | | | 9.0% | | | 9.8% | | | 11.1% | |

| Operating margin | | | 8.7% | | | 5.5% | | | 11.2% | |

| |

| Financial Position | | | | | | | | | | |

| Working Capital | | $ | (209.3 | ) | $ | (194.5 | ) | $ | (66.5 | ) |

| Property, plant and equipment | | | 2,610.6 | | | 2,634.0 | | | 2,683.0 | |

| Total assets | | | 6,205.5 | | | 6,186.5 | | | 6,520.8 | |

| Long-term debt (including convertible notes) | | | 1,822.1 | | | 2,132.2 | | | 2,208.7 | |

| First Preferred Shares | | | 456.6 | | | 456.6 | | | 212.5 | |

| Equity Multiple and Subordinate Voting Shares | | | 1,357.3 | | | 1,336.7 | | | 1,418.7 | |

| Debt-to-capitalization | | | 40:60 | | | 46:54 | | | 47:53 | |

| |

Per Share Data |

|

|

|

|

|

|

|

|

|

|

| Earnings** | | | | | | | | | | |

| | Diluted | | $ | 1.76 | | $ | — | | | 1.91 | |

| | Diluted before restructuring and other special charges | | $ | 1.92 | | $ | 1.58 | | | 1.90 | |

| Dividends on equity shares | | $ | 0.49 | | $ | 0.46 | | | 0.33 | |

| Book value | | $ | 15.92 | | $ | 14.39 | | | 15.47 | |

| Market price — TSX close in CDN$ | | $ | 35.00 | | $ | 35.88 | | | 37.60 | |

| Market price — NYSE close | | $ | 22.32 | | $ | 22.56 | | | 25.19 | |

| |

- *

- Before restructuring and other charges.

- **

- Effective January 1, 2002, net income and earnings per share reflect the new accounting policy adopted by the Company under which goodwill is no longer amortized.

- ***

- Cash provided from operating activities, less capital expenditures net of proceeds from disposals, and preferred share dividends.

4.2 Quarterly

The table below presents selected financial information for the last eight quarters ending with the most recent fiscal year of the Company.

| | 2002

|

|---|

| | First

| | Second

| | Third

| | Fourth

|

|---|

| | (In millions of US dollars, except per share amounts)

|

|---|

| Consolidated Results | | | | | | | | | | | | |

| Revenues | | $ | 1,459.2 | | $ | 1,471.5 | | $ | 1,617.9 | | $ | 1,693.4 |

| Operating income before depreciation and amortization* | | | 189.7 | | | 211.2 | | | 251.3 | | | 246.2 |

| Operating income before restructuring and other charges | | | 106.8 | | | 127.8 | | | 167.9 | | | 160.3 |

| Restructuring and other charges | | | — | | | — | | | — | | | 19.6 |

| Operating income | | | 106.8 | | | 127.8 | | | 167.9 | | | 140.7 |

| Net income** | | | 46.0 | | | 64.2 | | | 98.5 | | | 70.6 |

|

| Per Share Data | | | | | | | | | | | | |

| Earnings (losses)** | | | | | | | | | | | | |

| | Diluted | | $ | 0.28 | | $ | 0.40 | | $ | 0.64 | | $ | 0.44 |

| | Diluted before restructuring and other special charges | | $ | 0.28 | | $ | 0.40 | | $ | 0.64 | | $ | 0.61 |

|

13

| | 2001

| |

|---|

| | First

| | Second

| | Third

| | Fourth

| |

|---|

| | (In millions of US dollars, except per share amounts)

| |

|---|

| Consolidated Results | | | | | | | | | | | | | |

| Revenues | | $ | 1,576.7 | | $ | 1,502.3 | | $ | 1,625.2 | | $ | 1,615.9 | |

| Operating income before depreciation and amortization* | | | 219.2 | | | 243.0 | | | 258.5 | | | 234.9 | |

| Operating income before restructuring and other charges | | | 136.4 | | | 159.0 | | | 172.7 | | | 149.7 | |

| Restructuring and other charges | | | — | | | — | | | — | | | 270.0 | |

| Operating income | | | 136.4 | | | 159.0 | | | 172.7 | | | (120.3 | ) |

| Net income** | | | 42.5 | | | 63.2 | | | 70.8 | | | (154.1 | ) |

| |

| Per Share Data | | | | | | | | | | | | | |

| Earnings (losses)** | | | | | | | | | | | | | |

| | Diluted | | $ | 0.27 | | $ | 0.41 | | $ | 0.46 | | $ | (1.16 | ) |

| | Diluted before restructuring and other special charges | | $ | 0.27 | | $ | 0.41 | | $ | 0.46 | | $ | 0.45 | |

| |

- *

- Before restructuring and other charges.

- **

- Effective January 1, 2002, net income and earnings per share reflect the new accounting policy adopted by the Company under which goodwill is no longer amortized.

4.3 DIVIDENDS

On April 24, 2003, the Company declared a dividend of $0.13 per share on the Multiple Voting Shares and the Subordinate Voting Shares, a dividend of CA$0.3845 per share on the Series 3 Preferred Shares, a dividend of CA$0.4219 per share on the Series 4 Preferred Shares, and a dividend of CA$0.43125 per share on the Series 5 Preferred Shares, which dividends are payable on June 2, 2003 to the shareholders of record at the close of business on May 16, 2003.

The Company has declared and paid semi-annual dividends since October 23, 1992 and quarterly dividends since 1998. The table below presents the annual dividends declared and paid by the Company on all of its shares since 1998:

| | Multiple Voting Shares and Subordinate Voting Shares

| | Series 2 Preferred Shares

| | Series 3 Preferred Shares

| | Series 4 Preferred Shares

| | Series 5 Preferred Shares

|

|---|

| 1998 | | $ | 0.24 | | CA$1.3151 | | N/A | | N/A | | N/A |

1999 |

|

$ |

0.28 |

|

CA$1.2500 |

|

N/A |

|

N/A |

|

N/A |

2000 |

|

$ |

0.33 |

|

CA$1.2500 |

|

N/A |

|

N/A |

|

N/A |

2001 |

|

$ |

0.46 |

|

CA$1.2500 |

|

N/A |

|

CA$1.2703 |

|

CA$0.5069 |

2002 |

|

$ |

0.49 |

|

CA$1.2500 |

|

N/A |

|

CA$1.6876 |

|

CA$1.7250 |

As of March 1, 2003 |

|

$ |

0.13 |

|

N/A |

|

CA$0.3845 |

|

CA$0.4219 |

|

CA$0.43125 |

ITEM 5 — MARKET FOR THE NEGOTIATION OF SECURITIES

The Company's Subordinate Voting Shares are listed and posted for trading on The Toronto Stock Exchange and the New York Stock Exchange under the symbol "IQW". The Company's Series 3 Cumulative Redeemable First Preferred Shares, Series 4 Cumulative Redeemable First Preferred Shares and Series 5 Cumulative Redeemable First Preferred Shares are listed on The Toronto Stock Exchange.

ITEM 6 — DIRECTORS AND OFFICERS

The tables below set forth the name, municipality of residence, and position held within the Company of its directors and executive officers, the principal occupation and the term of office of each director, as well as the number of voting shares beneficially held or over which control or direction is exercised by each director of the Company. As of April 30, 2003, the directors and executive officers of the Company, as a group, beneficially owned, directly or indirectly, or exercised control or direction over, 62,205 Subordinate Voting Shares and 46,911,277 Multiple Voting Shares of the Company, representing 0.06% and 99.84%, respectively, of the outstanding shares of each such class. The shares so owned or controlled by the directors and executive officers of the Company represented 83.12% of all voting rights attached to all the outstanding common shares of the Company. The following information is given as of April 30, 2003, except as otherwise noted.

14

6.1 DIRECTORS

Name

| | Principal Occupation

| | Director since

| | Subordinate Voting Shares Owned or Controlled Directly or Indirectly(1)

| | Units held under the DSU Plan(2)

| |

|---|

A. Charles Baillie(C),(D)

Toronto, Ontario | | Chairman of the Board of TD Bank Financial Group (Financial services conglomerate) | | 2003 | | 1,000 | (3) | — | |

Reginald K. Brack(A),(B),(E)

Greenwich, Connecticut |

|

Former Chairman and Chief Executive Officer, Time Inc. (Magazines and books publisher) |

|

2000 |

|

2,000 |

|

4,345.744 |

|

Derek H. Burney, O.C.(B),(D),(E)

Toronto, Ontario |

|

President and Chief Executive Officer of CAE Inc. (Flight and navigation simulation and controls equipment company) |

|

2003 |

|

— |

|

— |

|

Charles G. Cavell(C)

Montreal, Quebec |

|

Deputy Chairman of the Board of the Company |

|

1989 |

|

36,403 |

(4) |

— |

(5) |

Robert Coallier(A),(B)

Longueuil, Quebec |

|

President and Chief Executive Officer, Cervejarias Kaiser (Brewing company) |

|

1991 |

|

— |

|

4,971.492 |

|

James Doughan(C)

Scottsdale, Arizona |

|

Corporate Director, Consultant |

|

2001 |

|

— |

|

3,224.225 |

|

The Honourable Richard C. Holbrooke(E)

New York, New York |

|

Vice-Chairman of the Board of Perseus,LLC (Merchant bank and private equity fund management company) |

|

2003 |

|

— |

|

— |

|

Eileen A. Mercier(C)

Toronto, Ontario |

|

Vice-Chair of the Board, Workplace Safety and Insurance Board (Ontario) (Workers' compensation system) |

|

1999 |

|

1,300 |

|

1,389.963 |

|

The Right Honourable

Brian Mulroney, P.C., C.C., LL.D.(B)

Montreal, Quebec |

|

Chairman of the Board of the Company and Senior Partner, Ogilvy Renault (Barristers and Solicitors) |

|

1997 |

|

4,900 |

(6) |

13,521.024 |

|

Jean Neveu

Longueuil, Quebec |

|

President and Chief Executive Officer of the Company, Chairman of the Board of Quebecor Inc. (communications holding company) and Chairman of the Board of Groupe TVA Inc. (Television broadcasting company) |

|

1989 |

|

1,800 |

(7) |

3,467.651 |

|

Robert Normand(A),(D)

Rosemère, Quebec |

|

Corporate Director |

|

1999 |

|

1,000 |

|

4,728.608 |

|

Érik Péladeau

Rosemère, Quebec |

|

Vice Chairman of the Board and Senior Executive Vice President of the Company, Vice Chairman of the Board of Quebecor Inc. (communications holding company) and Vice Chairman of the Board of Quebecor Media Inc. (communications company) |

|

1989 |

|

— |

(8)(9) |

1,645.909 |

|

Pierre Karl Péladeau(B),(E)

Montreal, Quebec |

|

President and Chief Executive Officer of Quebecor Inc. (communications holding company), President and Chief Executive Officer of Quebecor Media Inc. (communications Company) and Chairman of the Board of nurun Inc. (information technology management consultants) |

|

1989 |

|

— |

(9) |

3,922.986 |

|

Alain Rhéaume(A),(D)

Montreal, Quebec |

|

President and Chief Operating Officer, Microcell Solutions Inc. (Personal communications services company) |

|

1997 |

|

— |

|

6,498.041 |

|

15

| (A) Member of the Audit Committee. | | (D) Member of the Human Resources and Compensation Committee. |

| (B) Member of the Executive Committee. | | (E) Member of the Nominating and Corporate Governance Committee |

| (C) Member of the Pension Committee. | | |

- (1)

- This information has been provided to the Company by the above directors. This information excludes shares of subsidiaries of the Company that may be owned by a director in order to qualify as a director of such subsidiaries under applicable law.

- (2)

- The amounts in this column are as of March 31, 2003. In 2000, the Company implemented a Directors Deferred Stock Unit Plan for the benefit of its directors, which plan was amended in February 2003.

- (3)

- Shares held by 1260154 Ontario Inc., a company controlled by Mr. Baillie.

- (4)

- Mr. Cavell also owns 6,000 Class B Subordinate Voting Shares of Quebecor Inc.

- (5)

- No compensation paid for services rendered as director up to March 31, 2003.

- (6)

- Mr. Mulroney also owns 1,000 Class A Multiple Voting Shares of Quebecor Inc.

- (7)

- Mr. Neveu also owns 65,614 Class B Subordinate Voting Shares of Quebecor Inc.

- (8)

- Mr. Érik Péladeau directly and indirectly exercises control over 5,340 Class B Subordinate Voting Shares of Quebecor Inc.

- (9)

- Les Placements Péladeau Inc., a corporation controlled by a trust constituted for the benefit of Messrs. Érik Péladeau and Pierre Karl Péladeau, has voting control over Quebecor Inc., the Company's parent company, with 17,465,264 Class A Multiple Voting Shares and 19,800 Class B Subordinate Voting Shares of Quebecor Inc. The aforementioned trust also exercises control over Gestion Péladeau Inc., which holds 43,700 Class A Multiple Voting Shares of Quebecor Inc.