UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| |

FORM 10-Q |

| |

(Mark One) | |

[ü] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the Quarterly Period Ended June 30, 2005 |

| |

OR |

| |

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from to |

| |

| Commission File Number 1-14174 |

| |

AGL RESOURCES INC. |

| (Exact name of registrant as specified in its charter) |

| |

Georgia | 58-2210952 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

Ten Peachtree Place NE, Atlanta, Georgia 30309 |

| (Address and zip code of principal executive offices) |

| |

404-584-4000 |

| (Registrant's telephone number, including area code) |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ü No __ |

| |

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes ü No __ |

| |

| Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. |

| |

Class | Outstanding as of July 24, 2005 |

| Common Stock, $5.00 Par Value | 77,381,037 |

AGL RESOURCES INC.

Form 10-Q

For the Quarterly Period Ended June 30, 2005

Item Number | | Page(s) |

| | | |

| | PART I - FINANCIAL INFORMATION | 3-48 |

| | | |

| 1 | Condensed Consolidated Financial Statements (Unaudited) | 3-22 |

| | Condensed Consolidated Balance Sheets | 3 |

| | Condensed Consolidated Statements of Income | 4 |

| | Condensed Consolidated Statements of Common Shareholders’ Equity | 5 |

| | Condensed Consolidated Statements of Cash Flows | 6 |

| | Notes to Condensed Consolidated Financial Statements | 7-22 |

| | Note 1 - Accounting Policies and Methods of Application | 7-9 |

| | Note 2 - Acquisition Update | 9-10 |

| | Note 3 - Recent Accounting Pronouncements | 10 |

| | Note 4 - Risk Management | 10-12 |

| | Note 5 - Regulatory Assets and Liabilities | 13-15 |

| | Note 6 - Pension and Other Postretirement Benefits | 15-16 |

| | Note 7 - Compensation Plans | 16 |

| | Note 8 - Financing | 17 |

| | Note 9 - Commitments and Contingencies | 18 |

| | Note 10 - Segment Information | 19-22 |

| 2 | Management's Discussion and Analysis of Financial Condition and Results of Operation | 23-48 |

| | Cautionary Statement Regarding Forward-Looking Statements | 23 |

| | Overview | 23-26 |

| | Results of Operations | 26-42 |

| | AGL Resources | 26-29 |

| | Distribution Operations | 29-33 |

| | Retail Energy Operations | 33-34 |

| | Wholesale Services | 35-39 |

| | Energy Investments | 39-40 |

| | Corporate | 41-42 |

| | Liquidity and Capital Resources | 42-45 |

| | Critical Accounting Policies and Estimates | 45 |

| | Accounting Developments | 46 |

| 3 | Quantitative and Qualitative Disclosures About Market Risk | 46-48 |

| 4 | Controls and Procedures | 48 |

| | | |

| | PART II - OTHER INFORMATION | 49-50 |

| | | |

| 1 | Legal Proceedings | 49 |

| 2 | Unregistered Sales of Equity Securities and Use of Proceeds | 49 |

| 4 | Submission of Matters to a Vote of Security Holders | 50 |

| 6 | Exhibits | 50 |

| | | |

| | SIGNATURE | 51 |

PART I - Financial Information Item 1. Condensed Consolidated Financial Statements (Unaudited) | |

| |

CONDENSED CONSOLIDATED BALANCE SHEETS | |

(UNAUDITED) | |

| | | | | | | | |

In millions except share data | | June 30, 2005 | | December 31, 2004 | | June 30, 2004 | |

Current assets | | | | | | | |

| Cash and cash equivalents | | $ | 45 | | $ | 49 | | $ | 54 | |

| Receivables (less allowance for uncollectible accounts of $18 at June 30, 2005, $15 at Dec. 31, 2004 and $17 at June 30, 2004) | | | 511 | | | 737 | | | 414 | |

| Unbilled revenues | | | 54 | | | 152 | | | 42 | |

| Inventories | | | 381 | | | 332 | | | 259 | |

| Income tax receivable | | | 40 | | | 29 | | | - | |

| Unrecovered environmental remediation costs - current | | | 24 | | | 27 | | | 26 | |

| Unrecovered pipeline replacement program costs - current | | | 24 | | | 24 | | | 24 | |

| Energy marketing and risk management assets | | | 48 | | | 38 | | | 21 | |

| Other | | | 73 | | | 69 | | | 10 | |

| Total current assets | | | 1,200 | | | 1,457 | | | 850 | |

Property, plant and equipment | | | | | | | | | | |

| Property, plant and equipment | | | 4,665 | | | 4,615 | | | 3,476 | |

| Less accumulated depreciation | | | 1,458 | | | 1,437 | | | 1,067 | |

| Property, plant and equipment-net | | | 3,207 | | | 3,178 | | | 2,409 | |

Deferred debits and other assets | | | | | | | | | | |

| Goodwill | | | 401 | | | 354 | | | 177 | |

| Unrecovered pipeline replacement program costs | | | 333 | | | 337 | | | 381 | |

| Unrecovered environmental remediation costs | | | 188 | | | 173 | | | 141 | |

| Other | | | 116 | | | 141 | | | 52 | |

| Total deferred debits and other assets | | | 1,038 | | | 1,005 | | | 751 | |

Total assets | | $ | 5,445 | | $ | 5,640 | | $ | 4,010 | |

Current liabilities | | | | | | | | | | |

| Payables | | $ | 589 | | $ | 728 | | $ | 535 | |

| Accrued expenses | | | 95 | | | 65 | | | 53 | |

| Accrued pipeline replacement program costs - current | | | 41 | | | 85 | | | 90 | |

| Energy marketing and risk management liabilities | | | 37 | | | 15 | | | 11 | |

| Short-term debt | | | 172 | | | 334 | | | 195 | |

| Other | | | 212 | | | 250 | | | 132 | |

| Total current liabilities | | | 1,146 | | | 1,477 | | | 1,016 | |

Accumulated deferred income taxes | | | 425 | | | 437 | | | 413 | |

Long-term liabilities | | | | | | | | | | |

| Accrued pipeline replacement program costs | | | 277 | | | 242 | | | 285 | |

| Accumulated removal costs | | | 92 | | | 94 | | | 104 | |

| Accrued pension obligations | | | 89 | | | 84 | | | 27 | |

| Accrued environmental remediation costs | | | 86 | | | 63 | | | 25 | |

| Accrued postretirement benefit costs | | | 58 | | | 58 | | | 51 | |

| Other | | | 45 | | | 68 | | | 13 | |

| Total long-term liabilities | | | 647 | | | 609 | | | 505 | |

Deferred credits | | | 117 | | | 73 | | | 74 | |

Commitments and contingencies (Note 9) | | | | | | | | | | |

Minority interest | | | 32 | | | 36 | | | 29 | |

Capitalization | | | | | | | | | | |

| Long-term debt | | | 1,621 | | | 1,623 | | | 962 | |

| Shareholders’ equity (Common stock, $5 par value, 750 million shares authorized; 77.3 million shares issued and outstanding at June 30, 2005; 76.7 million shares issued and outstanding at December 31, 2004; 64.9 million shares issued and outstanding at June 30, 2004) | | | 1,457 | | | 1,385 | | | 1,011 | |

| Total capitalization | | | 3,078 | | | 3,008 | | | 1,973 | |

Total liabilities and capitalization | | $ | 5,445 | | $ | 5,640 | | $ | 4,010 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES | |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME | |

(UNAUDITED) | |

| | | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, | |

| | 2005 | | 2004 | | 2005 | | 2004 | |

| Operating revenues | | $ | 431 | | $ | 294 | | $ | 1,343 | | $ | 945 | |

| Operating expenses | | | | | | | | | | | | | |

| Cost of gas | | | 209 | | | 129 | | | 781 | | | 522 | |

| Operation and maintenance | | | 113 | | | 81 | | | 228 | | | 174 | |

| Depreciation and amortization | | | 33 | | | 24 | | | 66 | | | 48 | |

| Taxes other than income | | | 10 | | | 7 | | | 21 | | | 15 | |

| Total operating expenses | | | 365 | | | 241 | | | 1,096 | | | 759 | |

| Operating income | | | 66 | | | 53 | | | 247 | | | 186 | |

| Other income | | | 1 | | | 1 | | | 2 | | | 2 | |

| Interest expense | | | (26 | ) | | (16 | ) | | (52 | ) | | (32 | ) |

| Minority interest | | | (3 | ) | | (3 | ) | | (16 | ) | | (14 | ) |

| Earnings before income taxes | | | 38 | | | 35 | | | 181 | | | 142 | |

| Income taxes | | | 14 | | | 14 | | | 69 | | | 55 | |

| Net income | | $ | 24 | | $ | 21 | | $ | 112 | | $ | 87 | |

| | | | | | | | | | | | | | |

| Basic earnings per common share | | $ | 0.31 | | $ | 0.34 | | $ | 1.45 | | $ | 1.35 | |

| Diluted earnings per common share | | $ | 0.30 | | $ | 0.33 | | $ | 1.44 | | $ | 1.33 | |

| Weighted-average number of common shares outstanding | | | | | | | | | | | | | |

| Basic | | | 77.1 | | | 64.8 | | | 77.0 | | | 64.7 | |

| Diluted | | | 77.8 | | | 65.6 | | | 77.7 | | | 65.5 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES | |

CONDENSED CONSOLIDATED STATEMENTS OF COMMON SHAREHOLDERS’ EQUITY | |

(UNAUDITED) | |

| | | | | | | | | | | | | | |

| | | | | | | Premium on | | | | Other | | | |

| | | Common Stock | | common | | Earnings | | comprehensive | | | |

In millions, except per share amount | | Shares | | Amount | | shares | | reinvested | | income | | Total | |

| Balance as of December 31, 2004 | | | 76.7 | | $ | 384 | | $ | 632 | | $ | 415 | | $ | (46 | ) | $ | 1,385 | |

| Comprehensive income: | | | | | | | | | | | | | | | | | | | |

| Net income | | | - | | | - | | | - | | | 112 | | | - | | | 112 | |

| Unrealized loss from hedging activities (net of taxes) | | | - | | | - | | | - | | | - | | | (4 | ) | | (4 | ) |

| Total comprehensive income | | | | | | | | | | | | | | | | | | 108 | |

| Dividends on common shares ($0.62 per share) | | | - | | | - | | | - | | | (48 | ) | | - | | | (48 | ) |

| Benefit, stock compensation, dividend reinvestment and share purchase plans | | | 0.6 | | | 3 | | | 9 | | | - | | | - | | | 12 | |

| Balance as of June 30, 2005 | | | 77.3 | | $ | 387 | | $ | 641 | | $ | 479 | | $ | (50 | ) | $ | 1,457 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

| |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |

(UNAUDITED) | |

| | | | |

| | | Six months ended | |

| | | June 30, | |

In millions | | 2005 | | 2004 | |

Cash flows from operating activities | | | | | |

| Net income | | $ | 112 | | $ | 87 | |

| Adjustments to reconcile net income to net cash flow provided by operating activities | | | | | | | |

| Depreciation and amortization | | | 66 | | | 48 | |

| Deferred income taxes | | | (12 | ) | | 37 | |

| Changes in certain assets and liabilities | | | | | | | |

| Receivables | | | 324 | | | 105 | |

| Payables | | | (139 | ) | | 74 | |

| Inventories | | | (49 | ) | | (21 | ) |

Change in risk management assets and liabilities | | | 12 | | | (14 | ) |

| Other | | | 31 | | | 28 | |

| Net cash flow provided by operating activities | | | 345 | | | 344 | |

Cash flows from investing activities | | | | | | | |

| Property, plant and equipment expenditures | | | (130 | ) | | (104 | ) |

| Sale of ownership interest in US Propane | | | - | | | 31 | |

| Other | | | 3 | | | 1 | |

| Net cash flow used in investing activities | | | (127 | ) | | (72 | ) |

Cash flows from financing activities | | | | | | | |

| Payments and borrowings of short-term debt | | | (162 | ) | | (151 | ) |

| Payments of Medium-Term notes | | | - | | | (49 | ) |

| Dividends paid on common shares | | | (48 | ) | | (37 | ) |

| Distribution to minority interest | | | (19 | ) | | (14 | ) |

| Other | | | 7 | | | 16 | |

| Net cash flow used in financing activities | | | (222 | ) | | (235 | ) |

| Net (decrease) increase in cash and cash equivalents | | | (4 | ) | | 37 | |

| Cash and cash equivalents at beginning of period | | | 49 | | | 17 | |

| Cash and cash equivalents at end of period | | $ | 45 | | $ | 54 | |

Cash paid during the period for | | | | | | | |

| Interest (net of allowance for funds used during construction) | | $ | 39 | | $ | 24 | |

| Income taxes | | $ | 23 | | $ | 22 | |

See Notes to Condensed Consolidated Financial Statements (Unaudited).

AGL RESOURCES INC. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Note 1

Accounting Policies and Methods of Application

General

AGL Resources Inc. is an energy services holding company that conducts substantially all of its operations through its subsidiaries. Unless the context requires otherwise, references to “we,”“us,”“our” or the “company” are intended to mean consolidated AGL Resources Inc. and its subsidiaries (AGL Resources).

We have prepared the accompanying unaudited condensed consolidated financial statements under the rules of the Securities and Exchange Commission (SEC). Under such rules and regulations, we have condensed or omitted certain information and notes normally included in financial statements prepared in conformity with accounting principles generally accepted in the United States of America (GAAP). However, the condensed consolidated financial statements reflect all adjustments that are, in the opinion of management, necessary for a fair presentation of our financial results for the interim periods. You should read these condensed consolidated financial statements in conjunction with our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2004, filed with the SEC on February 15, 2005, as updated in our Current Report on Form 8-K filed with the SEC on July 28, 2005. All subsequent references to our Form 8-K filed with the SEC on July 28, 2005 herein should also be considered with reference to our Form 10-K as filed on February 15, 2005.

Due to the seasonal nature of our business, our results of operations for the three and six months ended June 30, 2005 and 2004 and our financial position as of December 31, 2004 and June 30, 2005 and 2004 are not necessarily indicative of the results of operations and financial condition to be expected as of or for any other period.

Basis of Presentation

Our condensed consolidated financial statements as of and for the period ended June 30, 2005 include our accounts, the accounts of our majority-owned and controlled subsidiaries and the accounts of variable interest entities for which we are the primary beneficiary. All significant intercompany items have been eliminated in consolidation. Certain amounts for prior periods have been reclassified to conform to the current period presentation. The December 31, 2004 balance sheet amounts are derived from our audited balance sheet as of December 31, 2004.

We utilize the equity method to account for and report our 50% interest in Saltville Gas Storage Company, LLC (Saltville), where we exercise significant influence but do not control the entity and where we are not the primary beneficiary as defined by Financial Accounting Standards Board (FASB) Interpretation No. 46, “Consolidation of Variable Interest Entities” (FIN 46).

In accordance with FIN 46 as revised in December 2003 (FIN 46R), as of January 1, 2004 we consolidated all of the accounts of SouthStar Energy Services LLC (SouthStar), a variable interest entity of which we currently own a noncontrolling 70% financial interest, have a 75% interest in the earnings and have a 50% voting interest, with our subsidiaries’ accounts and eliminated any intercompany balances between segments. We recorded the portion of SouthStar’s earnings that are recognized by our joint venture partner, Piedmont Natural Gas Company, Inc. (Piedmont), as a minority interest in our consolidated statements of income, and we recorded Piedmont’s portion of SouthStar’s capital as a minority interest in our consolidated balance sheet. We determined that SouthStar is a variable interest entity as defined in FIN 46R because:

| · | Our equal voting rights with Piedmont are not proportional to our economic obligation to absorb 75% of any losses or residual returns from SouthStar, and |

| · | SouthStar obtains substantially all its transportation capacity for delivery of natural gas through our wholly-owned subsidiary, Atlanta Gas Light Company (Atlanta Gas Light). |

Comprehensive Income

Our comprehensive income includes net income plus other comprehensive income (OCI), which includes other gains and losses affecting shareholders’ equity that GAAP excludes from net income. Such items consist primarily of unrealized gains and losses on certain derivatives and minimum pension liability adjustments.

For the six months ended June 30, 2005, our OCI decreased by $4 million from December 31, 2004, reflecting our 75% ownership interest in SouthStar’s unrealized loss associated with its cash flow hedges.

Stock-based Compensation

We have several stock-based employee compensation plans and we account for these plans under the recognition and measurement principles of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (APB 25) and Statement of Financial Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation” (SFAS 123). For our stock option plans, we generally do not reflect stock-based employee compensation cost in net income, as options granted under those plans have an exercise price equal to the market value of the underlying common stock on the date of grant. The following table illustrates the effect on our net income and earnings per share as if we had applied the optional fair value recognition provisions of SFAS 123:

| | | Three months ended June 30, | |

In millions, except per share amounts | | 2005 | | 2004 | |

| Net income, as reported | | $ | 24 | | $ | 21 | |

| Total stock-based employee compensation expense determined under fair value-based method for all awards, net of related tax effect | | | (1 | ) | | - | |

| Pro-forma net income | | $ | 23 | | $ | 21 | |

| | | | | | | | |

| Earnings per share: | | | | | | | |

| Basic - as reported | | $ | 0.31 | | $ | 0.34 | |

| Basic - pro-forma | | $ | 0.30 | | $ | 0.34 | |

| | | | | | | | |

| Fully diluted - as reported | | $ | 0.30 | | $ | 0.33 | |

| Fully diluted - pro-forma | | $ | 0.30 | | $ | 0.33 | |

| | | Six months ended June 30, | |

In millions, except per share amounts | | 2005 | | 2004 | |

| Net income, as reported | | $ | 112 | | $ | 87 | |

| Total stock-based employee compensation expense determined under fair value-based method for all awards, net of related tax effect | | | (1 | ) | | (1 | ) |

| Pro-forma net income | | $ | 111 | | $ | 86 | |

| | | | | | | | |

| Earnings per share: | | | | | | | |

| Basic - as reported | | $ | 1.45 | | $ | 1.35 | |

| Basic - pro-forma | | $ | 1.45 | | $ | 1.33 | |

| | | | | | | | |

| Fully diluted - as reported | | $ | 1.44 | | $ | 1.33 | |

| Fully diluted - pro-forma | | $ | 1.43 | | $ | 1.31 | |

Earnings per Common Share

We compute basic earnings per common share by dividing our net income available to common shareholders by the weighted average number of common shares outstanding daily. Diluted earnings per common share reflect the potential reduction in earnings per common share that could occur when potential dilutive common shares are added to common shares outstanding.

We derive our potential dilutive common shares by calculating the number of shares issuable under restricted share units and stock options. The future issuance of shares underlying the restricted share units depends on the satisfaction of certain performance criteria. The future issuance of shares underlying the outstanding stock options depends upon whether the exercise prices of the stock options are less than the average market price of the common shares for the respective periods. The following tables show the calculation of our diluted shares, assuming restricted stock units currently earned under the plan ultimately vest and stock options currently exercisable at prices below the average market prices are exercised. Our weighted average shares outstanding increased by 12 million from the first six months of 2004 to the first six months of 2005, primarily as a result of our 11 million share equity offering completed in November 2004.

| | | Three months ended June 30, | |

In millions | | 2005 | | 2004 | |

| Denominator for basic earnings per share (1) | | | 77.1 | | | 64.8 | |

| Assumed exercise of restricted stock units and stock options | | | 0.7 | | | 0.8 | |

| Denominator for diluted earnings per share | | | 77.8 | | | 65.6 | |

| (1) | Daily weighted average shares outstanding |

| | | Six months ended June 30, | |

In millions | | 2005 | | 2004 | |

| Denominator for basic earnings per share (1) | | | 77.0 | | | 64.7 | |

| Assumed exercise of restricted stock units and stock options | | | 0.7 | | | 0.8 | |

| Denominator for diluted earnings per share | | | 77.7 | | | 65.5 | |

| (1) | Daily weighted average shares outstanding |

Acquisition Update

On November 30, 2004 we acquired NUI Corporation (NUI) for approximately $825 million, including the assumption of $709 million in debt. During the six months ended June 30, 2005, we continued to adjust our purchase price allocation for additional known items. This resulted in an increase in goodwill of $49 million primarily during the first and second quarters of 2005 principally related to pension, severance and lease adjustments. As of June 30, 2005, goodwill related to the NUI acquisition was $205 million in total, and there remains significant open items, including certain environmental matters, valuation adjustments for the sales of certain assets acquired, lease adjustments related to NUI’s corporate offices and certain tax items. We anticipate completing our allocation within a year of the acquisition, with the majority of the remaining significant adjustments to our balance sheet expected to occur during the third quarter of 2005.

During the three months ended June 30, 2005, we recorded a liability of $18 million as a result of an unfavorable long-term lease related to the former headquarters of NUI. We currently occupy a portion of the building and sublease the remainder of the office space, and are evaluating our future options with respect to the property. We arrived at the liability amount based on the committed lease payments, and by assuming a certain level of sublease revenues, including those already contractually committed as well as any anticipated amounts, and assuming a discount rate based on a credit-adjusted risk-free rate of 5.39% on the property. We will revise this liability based on our actual ability to sublease additional space in subsequent periods.

Sale of Virginia assets On April 27, 2005, we announced our agreement to sell our 50% interest in Saltville and our wholly-owned subsidiaries Virginia Gas Pipeline and Virginia Gas Storage to a subsidiary of Duke Energy Corporation (Duke), the other 50% partner in Saltville. We acquired these Virginia assets in November 2004 with our purchase of NUI. The transaction does not include Virginia Gas Distribution Company, another NUI asset, which has 270 customers and annual throughput of 240,000 dekatherms.

We will receive, subject to working capital adjustments, $62 million in cash at closing and will utilize the proceeds to repay debt and for other general corporate purposes. The transaction is not expected to have a material impact on our earnings. Closing of the transaction, which is conditional upon regulatory approvals, including approval from the Virginia State Corporation Commission, is expected by September 30, 2005.

We are marketing certain other related NUI entities for sale with buyers actively being solicited. Excluding our equity investment in Saltville, which does not qualify for treatment as either assets held for sale or discontinued operations under SFAS 144, “Accounting for the Impairment or Disposal of Long-Lived Assets,” these remaining assets and liabilities are not separately classified on the accompanying balance sheet as held for sale due to materiality.

Note 3

Recent Accounting Pronouncements

Issued but not yet adopted

SFAS 123(R) In December 2004, the FASB issued SFAS No 123(R), “Accounting for Stock Based Compensation” (SFAS 123R). SFAS 123R revises the guidance in SFAS No. 123 and supersedes APB 25 and its related implementation guidance. SFAS 123R focuses primarily on the accounting for share-based payments to employees in exchange for services, and it requires a public entity to measure and recognize compensation cost for these payments. Our share-based payments are typically in the form of stock option and restricted share unit awards. The primary change in accounting is related to the requirement to recognize compensation cost for stock option awards that was not recognized under APB 25. Compensation cost will be measured based on the fair value of the equity or liability instruments issued. For stock option awards, fair value would be estimated using an option pricing model such as the Black-Scholes model. In April 2005, the SEC voted to delay the effective date of SFAS 123R from June 30, 2005 to January 1, 2006.

SFAS 154 In June 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections,” a replacement of APB Opinion No. 20 and FASB Statement No. 3. SFAS 154 requires retrospective application to prior periods’ financial statements of a voluntary change in accounting principle, unless it is impractical. Opinion No. 20 previously required that most voluntary changes in accounting principle be recognized by including, in net income, for the period of the change, the cumulative effect of changing to the newly adopted accounting principle. SFAS 154 also requires that a change in the method of depreciation, amortization, or depletion for long-lived, non-financial assets be accounted for as a change in accounting estimate that is effected by a change in accounting principle. Opinion No. 20 previously required that such a change be reported as a change in accounting principle. SFAS 154 also requires that any errors in the financial statements of a prior period shall be reported as a prior-period adjustment by restating the prior period financial statements. SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. We do not currently expect this statement to have an impact on our financial statements.

Risk Management

Our enterprise risk management activities are monitored by our Risk Management Committee (RMC). The RMC is, among other things, charged with the review and enforcement of risk management policies which place limitations on the use of derivative financial instruments and physical transactions. We use the following derivative financial instruments and physical transactions to manage commodity price risks:

| · | Storage and transportation capacity transactions |

Interest Rate Swaps

To maintain an effective capital structure, it is our policy to borrow funds using a mix of fixed-rate and variable-rate debt. We have entered into interest rate swap agreements through our wholly-owned subsidiary, AGL Capital Corporation (AGL Capital), for the purpose of hedging the interest rate risk associated with our fixed-rate and variable-rate debt obligations. We designated these interest rate swaps as fair value hedges and accounted for them using the “shortcut” method prescribed by SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” (SFAS 133), which allows us to designate derivatives that hedge exposure to changes in the fair value of a recognized asset or liability. We record the gain or loss on fair value hedges in earnings in the period of change, together with the offsetting loss or gain on the hedged item attributable to the risk being hedged.

We adjust the carrying value of each interest rate swap to its fair value at the end of each period, with an offsetting and equal adjustment to the carrying value of the debt securities whose fair value is being hedged. Consequently, our earnings are not affected negatively or positively with changes in fair value of the interest swaps each quarter. As of June 30, 2005, a notional principal amount of $175 million of these interest rate swap agreements effectively converted the interest expense associated with a portion of our senior notes and notes payable to the Trusts from fixed rates to variable rates based on an interest rate equal to the London Interbank Offered Rate (LIBOR), plus a spread determined at the swap date. The floating rate swap range for our interest rate swaps for the six months ended June 30, 2005 was 3.61% to 6.27%.

Commodity-Related Derivative Instruments

Elizabethtown Gas A program mandated by the New Jersey Board of Public Utilities requires Elizabethtown Gas to utilize certain derivatives to hedge the impact of market fluctuations of natural gas prices associated with natural gas supply and inventory purchases. Pursuant to SFAS 133, such derivative products are marked-to-market each reporting period. In accordance with regulatory requirements, realized gains and losses related to these derivatives are reflected in purchased gas costs and ultimately included in billings to customers. Unrealized gains and losses are reflected as a regulatory asset (loss) or liability (gain), as appropriate, on our consolidated balance sheet. As of June 30, 2005, Elizabethtown Gas had entered into New York Mercantile Exchange (NYMEX) futures contracts to purchase approximately 9.2 billion cubic feet (Bcf) of natural gas. Approximately 90% of these contracts have duration of one year or less, and none of these contracts extends beyond November 2006.

Sequent We are exposed to risks associated with changes in the market price of natural gas. Our wholly-owned energy trading and marketing subsidiary, Sequent Energy Management, L.P. (Sequent), uses derivative financial instruments to reduce our exposure to the risk of changes in the prices of natural gas. The fair value of these derivative financial instruments reflects the estimated amounts that we would receive or pay to terminate or close the contracts at the reporting date, taking into account the current unrealized gains or losses on open contracts. We use external market quotes and indices to value substantially all of the financial instruments we utilize.

We mitigate substantially all of the commodity price risk associated with Sequent’s natural gas portfolio by locking in the economic margin at the time we enter into natural gas purchase transactions for our stored natural gas. We purchase natural gas for storage when the difference in the current market price we pay to buy natural gas plus the cost to store the natural gas is less than the market price we can receive in the future, resulting in a positive net profit margin. We use NYMEX futures contracts and other over the counter derivatives to sell natural gas at that future price to substantially lock in the profit margin we will ultimately realize when the stored gas is actually sold. These futures contracts meet the definition of derivatives under SFAS 133 and are recorded at fair value and marked-to-market in our condensed consolidated balance sheet, with changes in fair value recorded in earnings in the period of change. The purchase, storage and sale of natural gas are accounted for on a historical cost basis rather than on the mark-to-market basis we utilize for the derivatives used to mitigate the commodity price risk associated with our storage portfolio. This difference in accounting can result in volatility in our reported net income, even though the economic margin is essentially unchanged from the date the transactions were consummated.

At June 30, 2005, Sequent’s commodity-related derivative financial instruments, which exclude interest rate swaps, represented purchases (long) of 561 Bcf with maximum maturities less than 2 years. In addition, Sequent’s financial instruments included sales (short) of 589 Bcf with approximately 99% of these scheduled to mature in less than 2 years and the remaining 1% in 3-9 years. Sequent’s unrealized losses were $9 million for the six months ended June 30, 2005, and its unrealized gains were $15 million for the six months ended June 30, 2004.

SouthStar The commodity-related derivative financial instruments (futures, options and swaps) used by SouthStar manage exposures arising from changing commodity prices. SouthStar’s objective for holding these derivatives is to utilize the most effective method to reduce or eliminate the impacts of this exposure. A portion of SouthStar’s derivative transactions are designated as cash flow hedges under SFAS 133. Derivative gains or losses arising from cash flow hedges are recorded in OCI and are reclassified into earnings in the same period as the settlement of the underlying hedged item. Any hedge ineffectiveness, defined as when the gains or losses on the hedging instrument do not perfectly offset the losses or gains on the hedged item, is recorded in our cost of gas on our condensed consolidated income statement in the period in which it occurs. SouthStar currently has minimal hedge ineffectiveness. The remainder of SouthStar’s derivative instruments does not meet the hedge criteria under SFAS 133. Therefore, changes in their fair value are recorded in earnings in the period of change.

At June 30, 2005, the fair value of these SouthStar derivatives was reflected in our condensed consolidated financial statements as an asset and an equal liability of $6 million. The maximum maturity of open positions is 1 year and represents purchases of 6 Bcf and sales of 12 Bcf.

Concentration of Credit Risk

Wholesale Services Sequent has a concentration of credit risk for services it provides to marketers and to utility and industrial customers. This credit risk is measured by 30-day receivable exposure plus forward exposure, which is highly concentrated in 20 of its customers. Sequent evaluates the credit risk of its customers using the Standard & Poor’s Rating Services (S&P) equivalent credit rating which is determined by a process of converting the lower of the S&P or Moody’s Investor Service (Moody’s) rating to an internal rating ranging from 9.00 to 1.00, with 9.00 being equivalent to AAA/Aaa by S&P and Moody’s and 1.00 being equivalent to D or Default by S&P and Moody’s. A customer that does not have an external rating is assigned an internal rating based on Sequent’s analysis of the strength of its financial ratios. At June 30, 2005, Sequent’s top 20 customers represented approximately 61% of the total credit exposure of $211 million, derived by adding the top 20 customers’ exposures and dividing by the total of Sequent’s exposures. Sequent’s customers or the customers’ guarantors had a weighted average S&P equivalent rating of A- at June 30, 2005.

The weighted average credit rating is obtained by multiplying each customer’s assigned internal rating by its credit exposure and the individual results are then summed for all counterparties. That total is divided by the aggregate total exposure. This numeric value is converted to an S&P equivalent.

Sequent has established credit policies to determine and monitor the creditworthiness of counterparties, as well as the quality of pledged collateral. When Sequent is engaged in more than one outstanding derivative transaction with the same counterparty and it also has a legally enforceable netting agreement with that counterparty, the “net” mark-to-market exposure represents the netting of the positive and negative exposures with that counterparty and a reasonable measure of Sequent’s credit risk. Sequent also uses other netting agreements with certain counterparties with whom it conducts significant transactions.

Note 5

Regulatory Assets and Liabilities

We recorded regulatory assets and liabilities in our consolidated balance sheets in accordance with SFAS No. 71, “Accounting for the Effects of Certain Types of Regulation.” Our regulatory assets and liabilities, as well as the liabilities associated with our unrecovered pipeline replacement program (PRP) costs and unrecovered environmental remediation costs (ERC), are summarized in the table below:

In millions | | June 30, 2005 | | Dec. 31, 2004 | | June 30, 2004 | |

Regulatory assets | | | | | | | |

| Unrecovered PRP costs | | $ | 357 | | $ | 361 | | $ | 405 | |

| Unrecovered ERC | | | 212 | | | 200 | | | 167 | |

| Unrecovered postretirement benefit costs | | | 14 | | | 14 | | | 9 | |

| Unrecovered seasonal rates | | | - | | | 11 | | | - | |

| Unamortized purchased gas adjustment | | | 2 | | | 5 | | | - | |

| Regulatory tax asset | | | 1 | | | 2 | | | 3 | |

| Other | | | 6 | | | 20 | | | 7 | |

| Total regulatory assets | | $ | 592 | | $ | 613 | | $ | 591 | |

Regulatory liabilities | | | | | | | | | | |

| Accumulated removal costs | | $ | 92 | | $ | 94 | | $ | 104 | |

| Unamortized investment tax credit | | | 20 | | | 20 | | | 18 | |

| Deferred seasonal rates | | | 9 | | | - | | | 9 | |

| Deferred purchased gas adjustment | | | 57 | | | 37 | | | 36 | |

| Regulatory tax liability | | | 11 | | | 14 | | | 14 | |

| Other | | | - | | | 18 | | | 2 | |

| Total regulatory liabilities | | | 189 | | | 183 | | | 183 | |

Associated liabilities | | | | | | | | | | |

| PRP costs | | | 318 | | | 327 | | | 375 | |

| ERC | | | 96 | | | 90 | | | 62 | |

| Total associated liabilities | | | 414 | | | 417 | | | 437 | |

| Total regulatory and associated liabilities | | $ | 603 | | $ | 600 | | $ | 620 | |

| | | | | | | | | | | |

Our regulatory assets and liabilities are described in Note 5 to our Consolidated Financial Statements in our 2004 Annual Report on Form 10-K, as updated in our Current Report on Form 8-K, filed with the SEC on July 28, 2005. The following represent significant changes to our regulatory assets and liabilities during the six months ended June 30, 2005:

Pipeline Replacement Program

The PRP, ordered by the Georgia Public Service Commission (Georgia Commission), requires that Atlanta Gas Light replace all bare steel and cast iron pipe in its system within a 10-year period that began October 1, 1998. October 1, 2004 marked the beginning of the seventh year of the original 10-year PRP.

On June 10, 2005, Atlanta Gas Light and the Georgia Commission entered into a Settlement Agreement that, among other things, extends Atlanta Gas Light’s PRP by five years to require that all replacements be completed by December 2013, with the timing of such replacements to be subsequently determined through discussions with Georgia Commission staff. Under the Settlement Agreement, rates charged to customers will remain unchanged through April 30, 2010, but Atlanta Gas Light will recognize reduced base rate revenues of $5 million on an annual basis through April 30, 2010. The five-year total reduction in recognized base rate revenues of $25 million will be applied to the amount of costs incurred to replace pipe and subsequently recovered from customers.

The Settlement Agreement also allows Atlanta Gas Light to recover through the PRP $4.3 million of the $32 million capital costs associated with its purchase of 250 miles of pipeline in central Georgia from Southern Natural Gas (SNG), a subsidiary of El Paso Corporation. The remaining capital costs are included in Atlanta Gas Light’s rate base and collected through base rates.

Environmental Remediation Costs

We are subject to federal, state and local laws and regulations governing environmental quality and pollution control. These laws and regulations require us to remove or remedy the effect on the environment of the disposal or release of specified substances at current and former operating sites.

Atlanta Gas Light The presence of coal tar and certain other by-products of a natural gas manufacturing process used to produce natural gas prior to the 1950s has been identified at or near 13 former Atlanta Gas Light operating sites in Georgia and Florida. Atlanta Gas Light has active environmental remediation or monitoring programs in effect at 10 of these sites. Two sites in Florida are currently in the investigation or preliminary engineering design phase, and one Georgia site has been deemed compliant with state standards, subject to approval of a continuing action plan. The required soil remediation at our remaining Georgia sites is scheduled to be completed by August 2005. As of June 30, 2005, Atlanta Gas Light’s remediation program was approximately 96% complete.

Atlanta Gas Light has historically reported estimates of future remediation costs for these former sites based on probabilistic models of potential costs. These estimates are reported on an undiscounted basis. As cleanup options and plans mature and cleanup contracts are entered into, Atlanta Gas Light is increasingly able to provide conventional engineering estimates of the likely costs of many elements at its former sites. These estimates contain various engineering uncertainties, and Atlanta Gas Light continuously attempts to refine and update these engineering estimates.

Our current engineering estimate projects costs associated with Atlanta Gas Light’s engineering estimates and in-place contracts to be $21 million. This is a reduction of $41 million from last year’s estimate of projected engineering and in-place contracts, resulting from $42 million of program expenditures incurred in the twelve months ended March 31, 2005.

For those remaining elements of Atlanta Gas Light’s environmental remediation program where it is unable to perform engineering cost estimates at the current state of investigation, considerable variability remains in the estimates for future remediation costs. For these elements, the current estimate for the remaining cost of future actions at these former operating sites is $17 million, which may increase should additional active measures for groundwater be required. Atlanta Gas Light estimates certain other costs related to administering the remediation program and remediation of sites currently in the investigation phase. To date, Atlanta Gas Light estimates the administrative costs to be $2 million.

For those Florida sites currently in the investigation phase, Atlanta Gas Light’s estimate for remediation is $4 million to $11 million. This estimate is based on preliminary data received during 2004 and 2005 with respect to the existence of contamination at those sites.

The liability does not include other potential expenses, such as unasserted property damage claims, personal injury or natural resource damage claims, unbudgeted legal expenses or other costs for which Atlanta Gas Light may be held liable but with respect to which it cannot reasonably estimate an amount. As of June 30, 2005, the remediation expenditures expected to be incurred over the next 12 months are reflected as a current liability of $10 million.

The ERC liability is included in a corresponding regulatory asset, which is a combination of accrued ERC and unrecovered cash expenditures for investigation and cleanup costs. Atlanta Gas Light has three ways of recovering investigation and cleanup costs. First, the Georgia Commission has approved an ERC recovery rider. The ERC recovery mechanism allows for recovery of expenditures over a five-year period subsequent to the period in which the expenditures are incurred. Atlanta Gas Light expects to collect $24 million in revenues over the next 12 months under the ERC recovery rider, which is reflected as a current asset.

The second way to recover costs is by exercising the legal rights Atlanta Gas Light believes it has to recover a share of its costs from other potentially responsible parties, typically former owners or operators of these sites. The third way to recover costs is from the receipt of net profits from the sale of remediated property. There were no material recoveries from potentially responsible parties or remediated property sales during the six months ended June 30, 2005.

Elizabethtown Gas In New Jersey, Elizabethtown Gas is currently conducting remedial activities with oversight from the New Jersey Department of Environmental Protection. Although the actual total cost of future environmental investigation and remediation efforts cannot be estimated with precision, based on probabilistic models similar to those used at Atlanta Gas Light’s former operating sites, the range of reasonably probable costs is $57 million to $109 million. As of June 30, 2005, no value within this range is a better estimate than any other value, so we have recorded a liability equal to the low end of that range, or $57 million.

Elizabethtown Gas’ prudently incurred remediation costs for the New Jersey properties have been authorized by the New Jersey Board of Public Utilities to be recoverable in rates through its Remediation Adjustment Clause. As a result, Elizabethtown Gas has recorded a regulatory asset of approximately $64 million, inclusive of interest, as of June 30, 2005, reflecting the future recovery of both incurred costs and accrued carrying charges. Elizabethtown Gas has also been successful in recovering a portion of remediation costs incurred in New Jersey from its insurance carriers and continues to pursue additional recovery.

Other We also own a former NUI remediation site in Elizabeth City, North Carolina, which is subject to an order by the North Carolina Department of Energy and Natural Resources. We currently have only limited information regarding environmental impacts at the Elizabeth City site, and therefore quantitative cost estimates can be made only for limited components of a site cleanup, such as investigative efforts. However, experience at other similar sites suggests that costs for remediation of this site will likely range from $4 million to $19 million. As of June 30, 2005, we have recorded a liability of $4 million related to this site.

There is one other site in North Carolina where investigation and remediation is probable, although no regulatory order exists and we do not believe costs associated with this site can be reasonably estimated. In addition, there are as many as six other sites with which NUI had some association, although no basis for liability has been asserted, and accordingly we have not accrued any remediation liability. There are currently no cost recovery mechanisms for the environmental remediation sites in North Carolina. As a result, any change in estimate occurring after our purchase price allocation period ends could impact our reported earnings in future periods.

We are continually evaluating the estimates at Elizabethtown Gas and at NUI’s other former remediation sites. The differences between our estimates and actual costs could be significant, and any such difference within one year of the acquisition of NUI could affect the amount ultimately recorded as part of our purchase price of NUI.

Pension and Other Postretirement Benefits

Pension Benefits We sponsor two defined benefit retirement plans for our eligible employees: the AGL Resources Inc. Retirement Plan and the NUI Corporation Retirement Plan. A defined benefit plan specifies the amount of benefits an eligible participant eventually will receive using information about the participant. The following are the cost components of our two pension plans for the periods indicated:

| | | Three months ended | |

| | | June 30, | |

In millions | | 2005 | | 2004 | |

| Service cost | | $ | 2 | | $ | 1 | |

| Interest cost | | | 6 | | | 5 | |

| Expected return on plan assets | | | (8 | ) | | (6 | ) |

| Net amortization | | | - | | | - | |

| Recognized actuarial loss | | | 2 | | | 1 | |

| Net annual cost | | $ | 2 | | $ | 1 | |

| | | Six months ended | |

| | | June 30, | |

In millions | | 2005 | | 2004 | |

| Service cost | | $ | 5 | | $ | 3 | |

| Interest cost | | | 13 | | | 10 | |

| Expected return on plan assets | | | (16 | ) | | (12 | ) |

| Net amortization | | | (1 | ) | | (1 | ) |

| Recognized actuarial loss | | | 3 | | | 2 | |

| Net annual cost | | $ | 4 | | $ | 2 | |

Other Postretirement Benefits We sponsor two defined benefit postretirement health care plans for our eligible employees: the AGL Resources Inc. Postretirement Health Care Plan and the Employers’ Retirement Plan of NUI Corporation. Eligibility for these benefits is based on age and years of service. The following are the cost components of these two postretirement benefit plans for the periods indicated:

| | | Three months ended | |

| | | June 30, | |

In millions | | 2005 | | 2004 | |

| Service cost | | $ | - | | $ | 1 | |

| Interest cost | | | 2 | | | 2 | |

| Expected return on plan assets | | | (1 | ) | | (1 | ) |

| Net amortization | | | (1 | ) | | - | |

| Recognized actuarial loss | | | 1 | | | - | |

| Net annual cost | | $ | 1 | | $ | 2 | |

| | | Six months ended | |

| | | June 30, | |

In millions | | 2005 | | 2004 | |

| Service cost | | $ | 1 | | $ | 1 | |

| Interest cost | | | 3 | | | 4 | |

| Expected return on plan assets | | | (2 | ) | | (2 | ) |

| Net amortization | | | (2 | ) | | - | |

| Recognized actuarial loss | | | 1 | | | 1 | |

| Net annual cost | | $ | 1 | | $ | 4 | |

Note 7

Compensation Plans

Restricted Stock Units In general, a restricted stock unit is an award that represents the opportunity to receive a specified number of shares of company common stock, subject to the achievement of certain pre-established performance criteria.

In January 2005, we granted to a group of officers a total of 85,900 restricted stock units. The awards were made pursuant to our Amended and Restated Long-Term Incentive Plan (1999) (Incentive Plan), as amended.

The restricted stock units have a twelve-month performance measurement period. If the performance goal set forth in the restricted stock unit agreement is achieved, the performance units are converted to an equal number of shares of company common stock and thereafter are subject to the vesting schedule set forth in the restricted stock unit agreement. If the performance goal set forth in the agreement is not attained, the restricted units will be forfeited and returned to the company. The performance goal is related to management’s success in integrating its acquisitions and generating improvement in earnings from these acquired businesses.

Performance Cash Units In general, a performance cash unit award is an award that represents the opportunity to receive an incentive payment, in cash, subject to the achievement of certain pre-established performance criteria.

In January 2005, we granted performance cash units to a select group of officers pursuant to our Incentive Plan. The performance cash units represent a maximum aggregate payout of $5 million. The performance cash units have a performance measurement period that ranges from 12 to 36 months. The performance criteria relate to our internal measure of total shareholder return. Based on our anticipated performance and the related vesting schedules, as of June 30, 2005, we recorded a liability of $1 million for these performance cash units.

Note 8

Financing

Our financing consists of short and long-term debt as indicated in the following table. There have been no significant changes to our financing which was described in Note 8 to our Consolidated Financial Statements in our 2004 Annual Report on Form 10-K, as updated in our Current Report on Form 8-K filed with the SEC on July 28, 2005, other than the refinancing of our Gas Facility Revenue Bonds described below.

| | | | | | | Outstanding as of: | |

Dollars in millions | | Year(s) due | | Int. rate (1) | | June 30, 2005 | | Dec. 31, 2004 | | June 30, 2004 | |

Short-term debt | | | | | | | | | | | |

| Commercial paper | | | 2005 | | | 3.4%(2 | ) | $ | 156 | | $ | 314 | | $ | 161 | |

| Current portion of long-term debt | | | - | | | - | | | - | | | - | | | 34 | |

| Sequent line of credit | | | 2005 | | | 3.9(3 | ) | | 15 | | | 18 | | | - | |

| Current portion of capital leases | | | 2005 | | | 4.9 | | | 1 | | | 2 | | | - | |

Total short-term debt | | | | | | 3.4%(4 | ) | $ | 172 | | $ | 334 | | $ | 195 | |

Long-term debt - net of current portion | | | | | | | | | | | | | | | | |

| Medium-term notes | | | 2012-2027 | | | 6.6 - 9.1 | % | $ | 208 | | $ | 208 | | $ | 208 | |

| Senior notes | | | 2011-2034 | | | 4.5 - 7.1 | | | 975 | | | 975 | | | 525 | |

| Gas facility revenue bonds, net of unamortized issuance costs | | | 2022-2033 | | | 2.4 - 5.7 | | | 199 | | | 199 | | | - | |

| Notes payable to trusts | | | 2037-2041 | | | 8.0 - 8.2 | | | 232 | | | 232 | | | 232 | |

| Capital leases | | | 2013 | | | 4.9 | | | 7 | | | 8 | | | - | |

| Interest rate swaps | | | 2041 | | | 4.6 - 6.3 | | | - | | | 1 | | | (3 | ) |

Total long-term debt | | | | | | 5.9%(4 | ) | $ | 1,621 | | $ | 1,623 | | $ | 962 | |

| | | | | | | | | | | | | | | | | |

Total short-term and long-term debt | | | | | | 5.6%(4 | ) | $ | 1,793 | | $ | 1,957 | | $ | 1,157 | |

| (2) | The daily weighted average rate was 2.7% for the six months ended June 30, 2005. |

| (3) | The daily weighted average rate was 3.2% for the six months ended June 30, 2005. |

| (4) | Weighted average interest rate, including interest rate swaps if applicable and excluding debt issuance and other financing related costs. |

Gas Facility Revenue Bonds On April 19, 2005, our wholly-owned subsidiary Pivotal Utility Holdings, Inc. (Pivotal Utility) refinanced $20 million of its Gas Facility Revenue Bonds due October 1, 2024. The original bonds had a fixed interest rate of 6.4% per year and were refunded with $20 million of adjustable rate Gas Facility Revenue Bonds. The maturity date of these bonds remains October 1, 2024. The new bonds were issued at an initial annual interest rate of 2.8% and initially have a 35-day auction period where the interest rate will adjust every 35 days.

On May 5, 2005, Pivotal Utility refinanced an additional $47 million in Gas Facility Revenue Bonds due October 1, 2022 and bearing interest at an annual fixed rate of 6.35%. The new bonds were issued at an initial annual interest rate of 2.9% and initially have a 35-day auction period where the interest rate will adjust every 35 days. The maturity date remains October 1, 2022.

Note 9

Commitments and Contingencies

Contractual Obligations and Commitments We have incurred various contractual obligations and financial commitments in the normal course of our operations and financing activities. Contractual obligations include future cash payments required under existing contractual arrangements, such as debt and lease agreements. These obligations may result from both general financing activities and from commercial arrangements that are directly supported by related revenue-producing activities. There were no significant changes to our contractual obligations which were described in Note 10 to our Consolidated Financial Statements in our 2004 Annual Report on Form 10-K, as updated in our Current Report on Form 8-K, filed with the SEC on July 28, 2005.

SouthStar has natural gas purchase commitments related to the supply of minimum natural gas volumes to its customers. These commitments are priced on an index plus premium basis. At June 30, 2005, SouthStar had obligations under these arrangements for 8 Bcf through December 31, 2005. SouthStar also had capacity commitments related to the purchase of transportation rights on interstate pipelines.

We have also incurred various contingent financial commitments in the normal course of business. The following table illustrates our expected contingent financial commitments representing obligations that become payable only if certain pre-defined events occur, such as financial guarantees, reflecting the maximum potential amount of future payments that could be required of us as of June 30, 2005:

| | | | | Commitments due before December 31, | |

| | | | | | | 2006 & | | 2008 & | | 2010 & | |

In millions | | Total | | 2005 | | 2007 | | 2009 | | thereafter | |

| Guarantees (1) | | $ | 7 | | $ | 7 | | $ | - | | $ | - | | $ | - | |

| Standby letters of credit, performance / surety bonds | | | 20 | | | 17 | | | 3 | | | - | | | - | |

| Total | | $ | 27 | | $ | 24 | | $ | 3 | | $ | - | | $ | - | |

| (1) We provide guarantees on behalf of SouthStar. We guarantee 70% of SouthStar's obligations to SNG, under certain agreements between the parties, up to a maximum of $7 million if SouthStar fails to make payments to SNG. |

Litigation We are involved in litigation arising in the normal course of business. There has been no significant change in the litigation which was described in Note 10 to our Consolidated Financial Statements in our 2004 Annual Report on Form 10-K, as updated in our Current Report on Form 8-K, filed with the SEC on July 28, 2005. We believe the ultimate resolution of such litigation will not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Note 10

Segment Information

Prior to 2005 our business was organized into three operating segments based on similarities in economic characteristics, products and services, types of customers, methods of distribution and regulatory environments as well as the manner in which we manage these segments and our internal management information flows.

Beginning in 2005, we added an additional segment, retail energy operations, which consists of the operations of SouthStar, our retail gas marketing subsidiary that conducts business primarily in Georgia. We added this segment due to our application of accounting guidance in SFAS No. 131, “Disclosures About Segments of an Enterprise and Related Information” (SFAS 131) in consideration of the impact of our acquisitions of NUI and Jefferson Island Storage & Hub, LLC (Jefferson Island) in the fourth quarter of 2004. The addition of this segment also is consistent with our desire to provide transparency and visibility to SouthStar on a stand-alone basis and to provide additional visibility to the remaining businesses in the energy investments segment, principally Jefferson Island and Pivotal Propane of Virginia, Inc. (Pivotal Propane), which are more closely related in structure and operation.

We have recast the segment information for the three and six months ended June 30, 2004 in accordance with the guidance set forth in SFAS 131 as shown in the tables below. Additionally, we have recast the segment information for the years ended December 31, 2004, 2003 and 2002 in our Current Report on Form 8-K, filed with the SEC on July 28, 2005.

Our four operating segments are now as follows:

| · | Distribution operations consists primarily of: |

| o | Atlanta Gas Light Company |

| o | Virginia Natural Gas Company |

| o | Chattanooga Gas Company |

| · | Retail energy operations consists of SouthStar |

| · | Wholesale services consists of Sequent |

| · | Energy investments consists primarily of: |

| o | Pivotal Jefferson Island |

| o | Pivotal Propane of Virginia, Inc. |

| o | 50% ownership interest in Saltville Gas Storage Company, LLC |

We treat corporate, our fifth segment, as a non-operating business segment, and it includes AGL Resources Inc., AGL Services Company, Pivotal Energy Development, nonregulated financing subsidiaries and the effect of intercompany eliminations. We eliminated intersegment sales for the three and six months ended June 30, 2005 and 2004 from our condensed consolidated statements of income.

We evaluate segment performance based on earnings before interest and taxes (EBIT), which includes the effects of corporate expense allocations. EBIT is a non-GAAP measure that includes operating income, other income, minority interest and gain on sales of assets. Items that are not included in EBIT are financing costs, including interest and debt expense, income taxes and the cumulative effect of changes in accounting principles, each of which is evaluated at the consolidated level. Management believes EBIT is useful to investors as a measurement of our operating segments’ performance because it can be used to evaluate the effectiveness of our businesses from an operational perspective, exclusive of the costs to finance those activities and exclusive of income taxes, neither of which is directly relevant to the efficiency of those operations.

You should not consider EBIT as an alternative to, or a more meaningful indicator of our operating performance than, operating income or net income as determined in accordance with GAAP. In addition, our EBIT may not be comparable to a similarly titled measure of another company. The reconciliations of EBIT to operating income and net income for the three and six months ended June 30, 2005 and 2004 are presented in the following table.

| | | Three months ended June 30, | | Six months ended June 30, | |

In millions | | 2005 | | 2004 | | 2005 | | 2004 | |

| Operating revenues | | $ | 431 | | $ | 294 | | $ | 1,343 | | $ | 945 | |

| Operating expenses | | | 365 | | | 241 | | | 1,096 | | | 759 | |

| Operating income | | | 66 | | | 53 | | | 247 | | | 186 | |

| Other income | | | 1 | | | 1 | | | 2 | | | 2 | |

| Minority interest | | | (3 | ) | | (3 | ) | | (16 | ) | | (14 | ) |

| EBIT | | | 64 | | | 51 | | | 233 | | | 174 | |

| Interest expense | | | 26 | | | 16 | | | 52 | | | 32 | |

| Earnings before income taxes | | | 38 | | | 35 | | | 181 | | | 142 | |

| Income taxes | | | 14 | | | 14 | | | 69 | | | 55 | |

| Net income | | $ | 24 | | $ | 21 | | $ | 112 | | $ | 87 | |

Summarized income statement information and capital expenditures by segment for the periods indicated are shown in the following tables:

Three months ended June 30, 2005 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 245 | | $ | 160 | | $ | 9 | | $ | 17 | | $ | - | | $ | 431 | |

| Intersegment revenues (1) | | | 48 | | | - | | | - | | | - | | | (48 | ) | | - | |

| Total revenues | | | 293 | | | 160 | | | 9 | | | 17 | | | (48 | ) | | 431 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 114 | | | 136 | | | - | | | 5 | | | (46 | ) | | 209 | |

| Operation and maintenance | | | 91 | | | 14 | | | 6 | | | 5 | | | (3 | ) | | 113 | |

| Depreciation and amortization | | | 29 | | | 1 | | | 1 | | | 1 | | | 1 | | | 33 | |

| Taxes other than income taxes | | | 8 | | | - | | | - | | | 1 | | | 1 | | | 10 | |

| Total operating expenses | | | 242 | | | 151 | | | 7 | | | 12 | | | (47 | ) | | 365 | |

| Operating income (loss) | | | 51 | | | 9 | | | 2 | | | 5 | | | (1 | ) | | 66 | |

| Other income | | | 1 | | | - | | | - | | | - | | | - | | | 1 | |

| Minority interest | | | - | | | (3 | ) | | - | | | - | | | - | | | (3 | ) |

| EBIT | | $ | 52 | | $ | 6 | | $ | 2 | | $ | 5 | | $ | (1 | ) | $ | 64 | |

| | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 37 | | $ | 1 | | $ | - | | $ | 3 | | $ | 6 | | $ | 47 | |

Three months ended June 30, 2004 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 144 | | $ | 148 | | $ | 1 | | $ | 1 | | $ | - | | $ | 294 | |

| Intersegment revenues (1) | | | 40 | | | - | | | - | | | - | | | (40 | ) | | - | |

| Total revenues | | | 184 | | | 148 | | | 1 | | | 1 | | | (40 | ) | | 294 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 44 | | | 124 | | | 1 | | | - | | | (40 | ) | | 129 | |

| Operation and maintenance | | | 66 | | | 13 | | | 5 | | | - | | | (3 | ) | | 81 | |

| Depreciation and amortization | | | 21 | | | - | | | - | | | - | | | 3 | | | 24 | |

| Taxes other than income taxes | | | 5 | | | 1 | | | - | | | - | | | 1 | | | 7 | |

| Total operating expenses | | | 136 | | | 138 | | | 6 | | | - | | | (39 | ) | | 241 | |

| Operating income (loss) | | | 48 | | | 10 | | | (5 | ) | | 1 | | | (1 | ) | | 53 | |

| Other income | | | 1 | | | - | | | - | | | 1 | | | (1 | ) | | 1 | |

| Minority interest | | | - | | | (3 | ) | | - | | | - | | | - | | | (3 | ) |

| EBIT | | $ | 49 | | $ | 7 | | $ | (5 | ) | $ | 2 | | $ | (2 | ) | $ | 51 | |

| | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 49 | | $ | 3 | | $ | 2 | | $ | 4 | | $ | - | | $ | 58 | |

Six months ended June 30, 2005 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 820 | | $ | 474 | | $ | 20 | | $ | 29 | | $ | - | | $ | 1,343 | |

| Intersegment revenues (1) | | | 107 | | | - | | | - | | | - | | | (107 | ) | | - | |

| Total revenues | | | 927 | | | 474 | | | 20 | | | 29 | | | (107 | ) | | 1,343 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 495 | | | 384 | | | - | | | 8 | | | (106 | ) | | 781 | |

| Operation and maintenance | | | 184 | | | 27 | | | 13 | | | 8 | | | (4 | ) | | 228 | |

| Depreciation and amortization | | | 57 | | | 1 | | | 1 | | | 3 | | | 4 | | | 66 | |

| Taxes other than income taxes | | | 17 | | | - | | | - | | | 1 | | | 3 | | | 21 | |

| Total operating expenses | | | 753 | | | 412 | | | 14 | | | 20 | | | (103 | ) | | 1,096 | |

| Operating income (loss) | | | 174 | | | 62 | | | 6 | | | 9 | | | (4 | ) | | 247 | |

| Other income | | | 1 | | | - | | | - | | | 1 | | | - | | | 2 | |

| Minority interest | | | - | | | (16 | ) | | - | | | - | | | - | | | (16 | ) |

| EBIT | | $ | 175 | | $ | 46 | | $ | 6 | | $ | 10 | | $ | (4 | ) | $ | 233 | |

| | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 109 | | $ | 1 | | $ | 2 | | $ | 6 | | $ | 12 | | $ | 130 | |

Six months ended June 30, 2004 | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations | | Consolidated AGL Resources | |

| Operating revenues from external parties | | $ | 466 | | $ | 455 | | $ | 21 | | $ | 3 | | | - | | $ | 945 | |

| Intersegment revenues (1) | | | 107 | | | - | | | - | | | - | | | (107 | ) | | - | |

| Total revenues | | | 573 | | | 455 | | | 21 | | | 3 | | | (107 | ) | | 945 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | |

| Cost of gas | | | 253 | | | 375 | | | 1 | | | - | | | (107 | ) | | 522 | |

| Operation and maintenance | | | 136 | | | 26 | | | 13 | | | 2 | | | (3 | ) | | 174 | |

| Depreciation and amortization | | | 42 | | | - | | | - | | | 1 | | | 5 | | | 48 | |

| Taxes other than income taxes | | | 12 | | | 1 | | | - | | | - | | | 2 | | | 15 | |

| Total operating expenses | | | 443 | | | 402 | | | 14 | | | 3 | | | (103 | ) | | 759 | |

| Operating income (loss) | | | 130 | | | 53 | | | 7 | | | - | | | (4 | ) | | 186 | |

| Other income | | | 1 | | | - | | | - | | | 2 | | | (1 | ) | | 2 | |

| Minority interest | | | - | | | (14 | ) | | - | | | - | | | - | | | (14 | ) |

| EBIT | | $ | 131 | | $ | 39 | | $ | 7 | | $ | 2 | | | (5 | ) | $ | 174 | |

| | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 85 | | $ | 6 | | $ | 5 | | $ | 7 | | $ | 1 | | $ | 104 | |

| (1) | Intersegment revenues - Wholesale services records its energy marketing and risk management revenues on a net basis. The following table provides information regarding wholesale services’ gross revenues from distribution operations and total gross revenues: |

| | | Three months ended June 30, | | Six months ended June 30, | |

In millions | | 2005 | | 2004 | | 2005 | | 2004 | |

| Third-party gross revenues | | $ | 1,186 | | $ | 1,013 | | $ | 2,469 | | $ | 2,056 | |

| Intersegment revenues | | | 162 | | | 101 | | | 249 | | | 197 | |

| Total gross revenues | | $ | 1,348 | | $ | 1,114 | | $ | 2,718 | | $ | 2,253 | |

Balance sheet information at June 30, 2005 and 2004 and December 31, 2004 by segment is shown in the following tables:

As of June 30, 2005 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | |

| Goodwill | | $ | 386 | | $ | 1 | | $ | - | | $ | 14 | | $ | - | | $ | 401 | |

| Identifiable assets (1) | | $ | 4,585 | | $ | 169 | | $ | 653 | | $ | 319 | | $ | (321 | ) | $ | 5,405 | |

| Investment in joint ventures | | | 35 | | | - | | | - | | | 28 | | | (23 | ) | | 40 | |

| Total assets | | $ | 4,620 | | $ | 169 | | $ | 653 | | $ | 347 | | $ | (344 | ) | $ | 5,445 | |

As of December 31, 2004 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | |

| Goodwill | | $ | 340 | | $ | - | | $ | - | | $ | 14 | | $ | - | | $ | 354 | |

| Identifiable assets (1) | | $ | 4,386 | | $ | 244 | | $ | 696 | | $ | 386 | | $ | (86 | ) | $ | 5,626 | |

| Investment in joint ventures | | | - | | | - | | | - | | | 235 | | | (221 | ) | | 14 | |

| Total assets | | $ | 4,386 | | $ | 244 | | $ | 696 | | $ | 621 | | $ | (307 | ) | $ | 5,640 | |

As of June 30, 2004 | | | | | | | | | | | | | |

In millions | | Distribution operations | | Retail energy operations | | Wholesale services | | Energy investments | | Corporate and intersegment eliminations (2) | | Consolidated AGL Resources | |

| | | | | | | | | | | | | | |

| Goodwill | | $ | 177 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 177 | |

| Identifiable assets (1) | | $ | 3,297 | | $ | 163 | | $ | 546 | | $ | 128 | | $ | (124 | ) | $ | 4,010 | |

| Investment in joint ventures | | | - | | | - | | | - | | | - | | | - | | | - | |

| Total assets | | $ | 3,297 | | $ | 163 | | $ | 546 | | $ | 128 | | $ | (124 | ) | $ | 4,010 | |

| (1) | Identifiable assets are those assets used in each segment’s operations. |

| (2) | Our corporate segment’s assets consist primarily of intercompany eliminations, cash and cash equivalents and property, plant and equipment. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain expectations and projections regarding our future performance referenced in this “Management’s Discussion and Analysis of Financial Condition and Results of Operation” section and elsewhere in this report, as well as in other reports and proxy statements we file with the Securities and Exchange Commission (SEC) are forward-looking statements. Officers and other key employees may also make verbal statements to analysts, investors, regulators, the media and others that are forward-looking.

Forward-looking statements involve matters that are not historical facts, and because these statements involve anticipated events or conditions, forward-looking statements often include words such as "anticipate," "assume," "can," "could," "estimate," "expect," "forecast," "future," "indicate," "intend," "may," "plan," "predict," "project, "seek," "should," "target," "will," "would," or similar expressions. Our expectations are not guarantees and are based on currently available competitive, financial and economic data along with our operating plans. While we believe that our expectations are reasonable in view of the currently available information, our expectations are subject to future events, risks and uncertainties, and there are several factors - many beyond our control - that could cause results to differ significantly from our expectations. Such events, risks and uncertainties include, but are not limited to, changes in price, supply and demand for natural gas and related products, impact of changes in state and federal legislation and regulation, actions taken by government agencies on rates and other matters, concentration of credit risk, utility and energy industry consolidation, impact of acquisitions and divestitures, direct or indirect effects on AGL Resources' business, financial condition or liquidity resulting from a change in our credit ratings or the credit ratings of our counterparties or competitors, interest rate fluctuations, financial market conditions and general economic conditions, uncertainties about environmental issues and the related impact of such issues, impacts of changes in weather upon the temperature-sensitive portions of the business, acts of war or terrorism, and other factors can be found in our filings with the SEC.

We caution readers that, in addition to the important factors described elsewhere in this report, the factors set forth in our 2004 Annual Report on Form 10-K, as updated in our Current Report on Form 8-K filed with the SEC on July 28, 2005 under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the caption “Risk Factors,” among others, could cause our business, results of operations or financial condition in 2005 and thereafter to differ significantly from those expressed in any forward-looking statements. There also may be other factors not described in this report that could cause results to differ significantly from our expectations.

Forward-looking statements are only as of the date they are made, and we do not undertake any obligation to update these statements to reflect subsequent changes.

We are a Fortune 1000 energy services holding company whose principal business is the distribution of natural gas in six states - Florida, Georgia, Maryland, New Jersey, Tennessee and Virginia. Our six utilities serve more than 2.3 million end-use customers, making us the largest distributor of natural gas in the Southeast and mid-Atlantic regions of the United States based on customer count. We also are involved in various related businesses, including retail natural gas marketing to end-use customers in Georgia; natural gas asset management and related logistics activities for our own utilities as well as for other non-affiliated companies; natural gas storage arbitrage and related activities; operation of high-deliverability underground natural gas storage assets; and construction and operation of telecommunications conduit and fiber infrastructure within select metropolitan areas. We manage these businesses through four operating segments - distribution operations, retail energy operations, wholesale services and energy investments - and a non-operating corporate segment.

The distribution operations segment is the largest component of our business and is regulated by regulatory agencies in six states. These agencies approve rates designed to provide us the opportunity to generate revenues to recover the cost of natural gas delivered to our customers and our fixed and variable costs such as depreciation, interest, maintenance and overhead costs, and to earn a reasonable return for our shareholders. With the exception of Atlanta Gas Light Company (Atlanta Gas Light), our largest utility, the earnings of our regulated utilities are weather-sensitive to varying degrees. Although various regulatory mechanisms provide a reasonable opportunity to recover our fixed costs regardless of volumes sold, the effect of weather manifests itself in terms of higher earnings during periods of colder weather and lower earnings with warmer weather. Our retail energy operations segment, which consists of SouthStar Energy Services LLC (SouthStar), also is weather sensitive and uses a variety of hedging strategies to mitigate potential weather impacts.

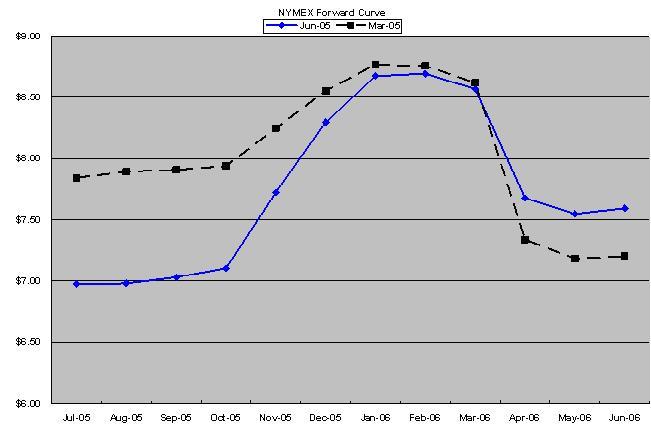

We derived approximately 95% of our earnings before interest and taxes (EBIT) during the six months ended June 30, 2005 from our regulated natural gas distribution business and from the sale of natural gas to end-use customers in Georgia by SouthStar. This statistic is significant because it represents the portion of our earnings that results directly from the underlying business of supplying natural gas to retail customers. Although SouthStar is not subject to the same regulatory framework as our utilities, it is an integral part of the retail framework for providing gas service to end-use customers in the state of Georgia. For more information regarding our measurement of EBIT and the items it excludes from operating income and net income, see “Results of Operations - AGL Resources.”