UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07443

| Name of Registrant: | Vanguard Whitehall Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | John E. Schadl, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2023—October 31, 2024

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

Vanguard Advice Select International Growth Fund

Admiral™ Shares - VAIGX |

| | |

Vanguard Advice Select Dividend Growth Fund

Admiral™ Shares - VADGX |

| | |

Vanguard Advice Select Global Value Fund

Admiral™ Shares - VAGVX |

| | |

Vanguard International Explorer Fund

Investor Shares - VINEX |

| | |

Vanguard High Dividend Yield Index Fund

ETF Shares - VYM |

| | |

Vanguard High Dividend Yield Index Fund

Admiral™ Shares - VHYAX |

| | |

Vanguard Advice Select International Growth Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard Advice Select International Growth Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Admiral Shares | $50 | 0.40% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund outperformed its benchmark, the MSCI ACWI ex USA Growth Index.

Global economic growth appeared relatively stable at around 3% during the period, and U.S. recession fears faded. With inflation continuing to moderate across much of the world, major central banks including the European Central Bank, the Bank of England, and the U.S. Federal Reserve began lowering policy rates. Global stocks posted very strong returns.

The Fund’s solid outperformance was concentrated among three industry sectors. Strong selection in consumer discretionary led the way, with overweight allocations to information technology and communication services also boosting results. Health care and industrials performed poorly.

By region, favorable stock selection in the U.S., notably NVIDIA (+225%) and Spotify (+133%), drove most of the Fund’s performance. Europe and emerging markets also contributed, led by the Netherlands and China, respectively.

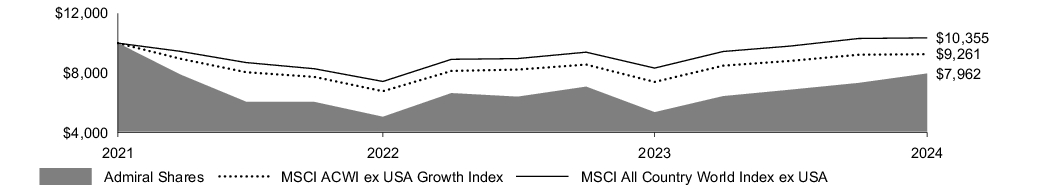

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 9, 2021, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | |

| 1 Year | Since Inception

(11/9/2021) |

| Admiral Shares | 48.33% | -7.37% |

| MSCI ACWI ex USA Growth Index | 25.18% | -2.55% |

| MSCI All Country World Index ex USA | 24.33% | 1.18% |

This table reflects the Fund’s investments, including short-term investments and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $987 |

| Number of Portfolio Holdings | 31 |

| Portfolio Turnover Rate | 25% |

Total Investment Advisory Fees

(in thousands) | $1,582 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Asia | 24.1% |

| Europe | 45.9% |

| North America | 26.3% |

| South America | 1.9% |

| Other Assets and Liabilities—Net | 1.8% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4437

Vanguard Advice Select Dividend Growth Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard Advice Select Dividend Growth Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Admiral Shares | $45 | 0.41% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund underperformed its benchmark, the S&P U.S. Dividend Growers Index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve embarked on a rate-cutting cycle toward the end of the period, and the year-over-year rate of consumer price inflation eased to around 2.5%. U.S. stocks posted very strong returns.

Seven of the Fund’s 11 industry sectors detracted from its performance, particularly industrials and consumer discretionary. Detracting sectors lagged mainly due to negative security selection; an underweight allocation to information technology also hurt.

On the other side of the ledger, positive selection in health care boosted results, as did a lack of exposure to energy, communication services, and utilities.

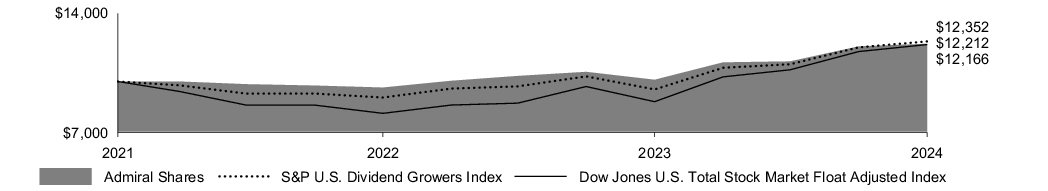

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 9, 2021, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | |

| 1 Year | Since Inception

(11/9/2021) |

| Admiral Shares | 20.91% | 6.95% |

| S&P U.S. Dividend Growers Index | 29.55% | 7.36% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 37.99% | 6.81% |

This table reflects the Fund’s investments, including short-term investments and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $822 |

| Number of Portfolio Holdings | 28 |

| Portfolio Turnover Rate | 32% |

Total Investment Advisory Fees

(in thousands) | $1,517 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) | |

| Consumer Discretionary | 13.9% |

| Consumer Staples | 10.9% |

| Financials | 21.3% |

| Health Care | 12.8% |

| Industrials | 13.0% |

| Information Technology | 20.3% |

| Materials | 4.5% |

| Real Estate | 1.9% |

| Other Assets and Liabilities—Net | 1.4% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4435

Vanguard Advice Select Global Value Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard Advice Select Global Value Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Admiral Shares | $45 | 0.40% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund underperformed its benchmark, the MSCI ACWI Value Index.

Global economic growth appeared relatively stable at around 3% during the period, and U.S. recession fears faded. With inflation continuing to moderate across much of the world, major central banks including the European Central Bank, the Bank of England, and the U.S. Federal Reserve began lowering policy rates. Global stocks posted very strong returns.

Five of the Fund’s 11 industry sectors detracted from relative performance, with financials having by far the biggest impact due to poor security selection and the Fund being underweight in the sector. Materials and health care boosted relative returns.

By region, only emerging markets contributed positively to performance. North America, markedly the largest region by weight, was also the biggest detractor.

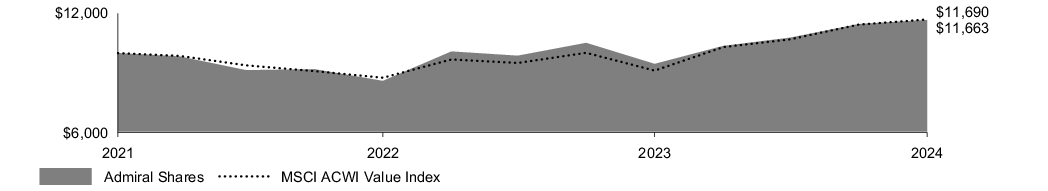

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 9, 2021, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | |

| 1 Year | Since Inception

(11/9/2021) |

| Admiral Shares | 23.36% | 5.31% |

| MSCI ACWI Value Index | 28.19% | 5.39% |

This table reflects the Fund’s investments, including short-term investments and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $1,280 |

| Number of Portfolio Holdings | 109 |

| Portfolio Turnover Rate | 59% |

Total Investment Advisory Fees

(in thousands) | $2,217 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Asia | 17.8% |

| Europe | 21.7% |

| North America | 59.5% |

| Other Assets and Liabilities—Net | 1.0% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR4436

Vanguard International Explorer Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard International Explorer Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Shares | $49 | 0.44% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund outperformed its expense-free benchmark, the MSCI EAFE Small Cap Index.

Global economic growth appeared relatively stable at around 3% during the period, and U.S. recession fears faded. With inflation continuing to moderate across much of the world, major central banks including the European Central Bank, the Bank of England, and the U.S. Federal Reserve began lowering policy rates. Global stocks posted very strong returns.

On a regional basis, stock selection in Europe, an overweight to North America, and an underweight to the Pacific region contributed the most to relative performance. Selection in and an underweight to the Middle East detracted the most.

Eight of the Fund’s 11 sectors contributed positively to performance. Information technology, health care, and real estate added the most due to strong stock selection. Industrials detracted the most.

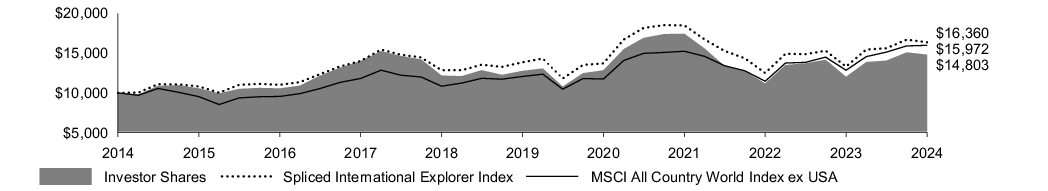

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: October 31, 2014, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | | |

| 1 Year | 5 Years | 10 Years |

| Investor Shares | 23.22% | 3.02% | 4.00% |

| Spliced International Explorer Index | 22.96% | 3.40% | 5.05% |

| MSCI All Country World Index ex USA | 24.33% | 5.78% | 4.79% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $1,356 |

| Number of Portfolio Holdings | 422 |

| Portfolio Turnover Rate | 48% |

Total Investment Advisory Fees

(in thousands) | $3,881 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Asia | 43.0% |

| Europe | 45.3% |

| North America | 2.1% |

| Oceania | 4.5% |

| Other | 1.0% |

| South America | 0.4% |

| Other Assets and Liabilities—Net | 3.7% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR126

Vanguard High Dividend Yield Index Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard High Dividend Yield Index Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| ETF Shares | $7 | 0.06% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund performed in line with its benchmark, the FTSE High Dividend Yield Index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve embarked on a rate-cutting cycle toward the end of the period, and the year-over-year rate of consumer price inflation eased to around 2.5%. U.S. stocks posted very strong returns.

Financials, the Fund's largest sector by weight, was by far the biggest contributor to performance. Technology and industrial stocks also made strong contributions. All industry sectors reported positive returns except for real estate, which represented an insignificant portion of the portfolio.

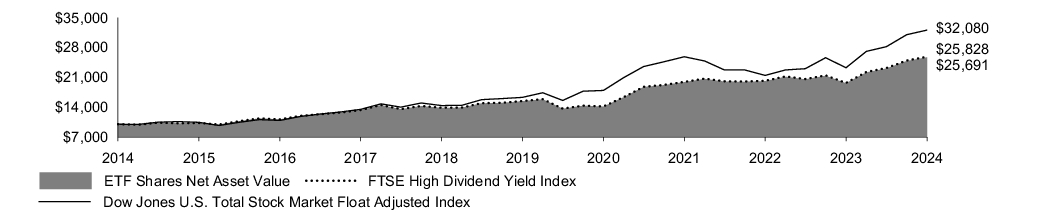

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: October 31, 2014, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | | |

| 1 Year | 5 Years | 10 Years |

| ETF Shares Net Asset Value | 31.15% | 10.79% | 9.90% |

| ETF Shares Market Price | 31.15% | 10.78% | 9.89% |

| FTSE High Dividend Yield Index | 31.23% | 10.84% | 9.95% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 37.99% | 14.51% | 12.36% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $72,659 |

| Number of Portfolio Holdings | 544 |

| Portfolio Turnover Rate | 13% |

Total Investment Advisory Fees

(in thousands) | $1,280 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Basic Materials | 2.0% |

| Consumer Discretionary | 10.1% |

| Consumer Staples | 10.7% |

| Energy | 9.6% |

| Financials | 21.7% |

| Health Care | 11.7% |

| Industrials | 12.6% |

| Real Estate | 0.0% |

| Technology | 9.8% |

| Telecommunications | 4.3% |

| Utilities | 7.2% |

| Other Assets and Liabilities—Net | 0.3% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR923

Vanguard High Dividend Yield Index Fund

Annual Shareholder Report | October 31, 2024

This annual shareholder report contains important information about Vanguard High Dividend Yield Index Fund (the "Fund") for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Admiral Shares | $9 | 0.08% |

How did the Fund perform during the reporting period?

For the 12 months ended October 31, 2024, the Fund performed in line with its benchmark, the FTSE High Dividend Yield Index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve embarked on a rate-cutting cycle toward the end of the period, and the year-over-year rate of consumer price inflation eased to around 2.5%. U.S. stocks posted very strong returns.

Financials, the Fund's largest sector by weight, was by far the biggest contributor to performance. Technology and industrial stocks also made strong contributions. All industry sectors reported positive returns except for real estate, which represented an insignificant portion of the portfolio.

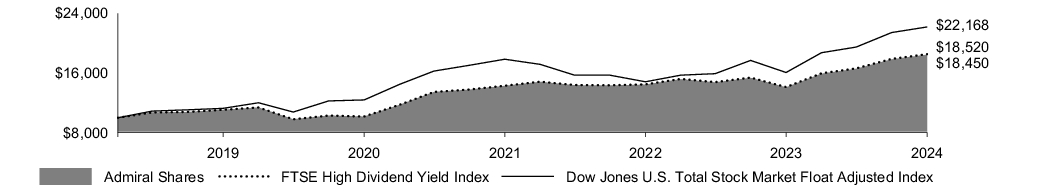

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: February 7, 2019, Through October 31, 2024

Initial Investment of $ 10,000

| Average Annual Total Returns | | | |

| 1 Year | 5 Years | Since Inception

(2/7/2019) |

| Admiral Shares | 31.11% | 10.77% | 11.28% |

| FTSE High Dividend Yield Index | 31.23% | 10.84% | 11.36% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 37.99% | 14.51% | 14.91% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of October 31, 2024) | |

Fund Net Assets

(in millions) | $72,659 |

| Number of Portfolio Holdings | 544 |

| Portfolio Turnover Rate | 13% |

Total Investment Advisory Fees

(in thousands) | $1,280 |

Portfolio Composition % of Net Assets

(as of October 31, 2024) |

| Basic Materials | 2.0% |

| Consumer Discretionary | 10.1% |

| Consumer Staples | 10.7% |

| Energy | 9.6% |

| Financials | 21.7% |

| Health Care | 11.7% |

| Industrials | 12.6% |

| Real Estate | 0.0% |

| Technology | 9.8% |

| Telecommunications | 4.3% |

| Utilities | 7.2% |

| Other Assets and Liabilities—Net | 0.3% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR5023

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant only.

| | | Fiscal Year Ended

October 31, 2024 | | | Fiscal Year Ended

October 31, 2023 | |

| (a) Audit Fees. | | $ | 484,000 | | | $ | 433,000 | |

| (b) Audit-Related Fees. | | | 0 | | | | 0 | |

| (c) Tax Fees. | | | 0 | | | | 0 | |

| (d) All Other Fees. | | | 0 | | | | 0 | |

| Total. | | $ | 484,000 | | | $ | 433,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any preapproval is brought to the attention of the full audit committee at the next scheduled meeting.

(2) No percentage of the principal accountant’s fees or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | For the most recent fiscal year, over 50% of the hours worked under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees of the principal accountant. |

| (g) | Aggregate Non-Audit Fees. |

Includes fees billed for non-audit services provided to the Registrant, other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | | Fiscal Year Ended

October 31, 2024 | | | Fiscal Year Ended

October 31, 2023 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | | | | | | | | |

| Audit-Related Fees. | | $ | 1,517,669 | | | $ | 3,295,934 | |

| Tax Fees. | | $ | 1,916,879 | | | $ | 1,678,928 | |

| All Other Fees. | | $ | 268,000 | | | $ | 25,000 | |

| Total. | | $ | 3,702,548 | | | $ | 4,999,862 | |

| (h) | For the most recent fiscal year, the Audit Committee has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements

For the year ended October 31, 2024

Vanguard Advice Select International Growth Fund

Contents

Financial Statements

| 1 |

Report of Independent Registered

Public Accounting Firm

| 10 |

Tax information

| 11 |

| | |

Advice Select International Growth Fund

Schedule of Investments

As of October 31, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | | | Shares | Market

Value•

($000) |

| Common Stocks (98.2%) |

| Brazil (1.9%) |

| * | NU Holdings Ltd. Class A | 1,257,319 | 18,973 |

| Canada (3.0%) |

| * | Shopify Inc. Class A | 386,165 | 30,202 |

| China (13.0%) |

| *,1 | Meituan Class B | 2,316,750 | 54,746 |

| | Tencent Holdings Ltd. | 612,800 | 31,953 |

| * | PDD Holdings Inc. ADR | 232,610 | 28,050 |

| | BYD Co. Ltd. Class H | 384,500 | 13,887 |

| | | | | | | 128,636 |

| Denmark (1.2%) |

| | Novo Nordisk A/S Class B | 103,098 | 11,564 |

| France (7.6%) |

| | Hermes International SCA | 17,469 | 39,703 |

| | Kering SA | 70,639 | 17,644 |

| | L'Oreal SA | 46,724 | 17,529 |

| | | | | | | 74,876 |

| Germany (5.1%) |

| *,1 | Delivery Hero SE Class A | 851,193 | 36,135 |

| * | BioNTech SE ADR | 128,323 | 14,513 |

| | | | | | | 50,648 |

| Italy (4.7%) |

| | Ferrari NV | 97,297 | 46,447 |

| Japan (0.7%) |

| | M3 Inc. | 652,100 | 6,702 |

| Netherlands (11.7%) |

| *,1 | Adyen NV | 39,911 | 60,971 |

| | ASML Holding NV | 80,487 | 54,178 |

| | | | | | | 115,149 |

| Singapore (2.1%) |

| * | Sea Ltd. ADR | 221,022 | 20,787 |

| South Korea (3.8%) |

| * | Coupang Inc. | 1,446,580 | 37,307 |

| Sweden (12.1%) |

| * | Spotify Technology SA | 241,488 | 92,997 |

| | Atlas Copco AB Class B | 1,260,753 | 18,331 |

| * | Kinnevik AB Class B | 1,116,359 | 7,945 |

| | | | | | | 119,273 |

| Taiwan (4.5%) |

| | Taiwan Semiconductor Manufacturing Co. Ltd. | 1,405,000 | 44,060 |

| United Kingdom (3.5%) |

| * | Wise plc Class A | 2,036,184 | 18,572 |

| * | Ocado Group plc | 3,484,542 | 15,695 |

| | | | | | | 34,267 |

| United States (23.3%) |

| * | MercadoLibre Inc. | 64,440 | 131,276 |

| | NVIDIA Corp. | 499,766 | 66,349 |

| * | Moderna Inc. | 303,278 | 16,486 |

| * | Tesla Inc. | 59,244 | 14,802 |

| * | SolarEdge Technologies Inc. | 73,554 | 1,255 |

Advice Select International Growth Fund

| | | | | | Shares | Market

Value•

($000) |

| * | Ginkgo Bioworks Holdings Inc. Class A | 41,402 | 316 |

| | | | | | | 230,484 |

| Total Common Stocks (Cost $767,001) | 969,375 |

| Temporary Cash Investments (1.7%) |

| Money Market Fund (1.7%) |

| 2 | Vanguard Market Liquidity Fund, 4.834% (Cost $16,558) | 165,605 | 16,559 |

| Total Investments (99.9%) (Cost $783,559) | | 985,934 |

| Other Assets and Liabilities—Net (0.1%) | | 604 |

| Net Assets (100%) | | 986,538 |

| • | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2024, the aggregate value was $151,852,000, representing 15.4% of net assets. |

| 2 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| | ADR—American Depositary Receipt. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select International Growth Fund

Statement of Assets and Liabilities

|

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value | |

| Unaffiliated Issuers (Cost $767,001) | 969,375 |

| Affiliated Issuers (Cost $16,558) | 16,559 |

| Total Investments in Securities | 985,934 |

| Investment in Vanguard | 27 |

| Receivables for Accrued Income | 397 |

| Receivables for Capital Shares Issued | 1,234 |

| Total Assets | 987,592 |

| Liabilities | |

| Payables for Investment Securities Purchased | 63 |

| Payables for Capital Shares Redeemed | 400 |

| Payables to Investment Advisor | 492 |

| Payables to Vanguard | 99 |

| Total Liabilities | 1,054 |

| Net Assets | 986,538 |

At October 31, 2024, net assets consisted of: |

|

| | |

| Paid-in Capital | 781,899 |

| Total Distributable Earnings (Loss) | 204,639 |

| Net Assets | 986,538 |

| | |

| Net Assets | |

Applicable to 49,618,529 outstanding $.001 par value shares of

beneficial interest (unlimited authorization) | 986,538 |

| Net Asset Value Per Share | $19.88 |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select International Growth Fund

|

| | Year Ended

October 31, 2024 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 3,204 |

| Non-Cash Dividends | 2,252 |

| Interest2 | 759 |

| Total Income | 6,215 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 1,748 |

| Performance Adjustment | (166) |

| The Vanguard Group—Note C | |

| Management and Administrative | 1,373 |

| Marketing and Distribution | 42 |

| Custodian Fees | 53 |

| Auditing Fees | 47 |

| Shareholders' Reports and Proxy Fees | 55 |

| Trustees’ Fees and Expenses | 1 |

| Other Expenses | 31 |

| Total Expenses | 3,184 |

| Net Investment Income | 3,031 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold2 | 9,347 |

| Foreign Currencies | (72) |

| Realized Net Gain (Loss) | 9,275 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities2 | 259,899 |

| Foreign Currencies | 3 |

| Change in Unrealized Appreciation (Depreciation) | 259,902 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 272,208 |

| 1 | Dividends are net of foreign withholding taxes of $404,000. |

| 2 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $759,000, $2,000, less than $1,000, and less than $1,000, respectively. Purchases and sales are for temporary cash investment purposes. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select International Growth Fund

Statement of Changes in Net Assets

|

| | Year Ended October 31, |

| | 2024

($000) | 2023

($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 3,031 | 841 |

| Realized Net Gain (Loss) | 9,275 | (7,342) |

| Change in Unrealized Appreciation (Depreciation) | 259,902 | (26,000) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 272,208 | (32,501) |

| Distributions | | |

| Total Distributions | (837) | — |

| Capital Share Transactions | | |

| Issued | 346,672 | 379,426 |

| Issued in Lieu of Cash Distributions | 562 | — |

| Redeemed | (125,600) | (49,103) |

| Net Increase (Decrease) from Capital Share Transactions | 221,634 | 330,323 |

| Total Increase (Decrease) | 493,005 | 297,822 |

| Net Assets | | |

| Beginning of Period | 493,533 | 195,711 |

| End of Period | 986,538 | 493,533 |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select International Growth Fund

For a Share Outstanding

Throughout Each Period | Year Ended October 31, | November 9,

20211 to

October 31, |

| 2024 | 2023 | 2022 |

| Net Asset Value, Beginning of Period | $13.42 | $12.65 | $25.00 |

| Investment Operations | | | |

| Net Investment Income (Loss)2 | .068 | .032 | (.009) |

| Net Realized and Unrealized Gain (Loss) on Investments | 6.413 | .738 | (12.341) |

| Total from Investment Operations | 6.481 | .770 | (12.350) |

| Distributions | | | |

| Dividends from Net Investment Income | (.021) | — | — |

| Distributions from Realized Capital Gains | — | — | — |

| Total Distributions | (.021) | — | — |

| Net Asset Value, End of Period | $19.88 | $13.42 | $12.65 |

| Total Return3 | 48.33% | 6.09% | -49.40% |

| Ratios/Supplemental Data | | | |

| Net Assets, End of Period (Millions) | $987 | $494 | $196 |

| Ratio of Total Expenses to Average Net Assets | 0.40%4 | 0.41%4 | 0.42%5 |

| Ratio of Net Investment Income to Average Net Assets | 0.38% | 0.20% | (0.06%)5 |

| Portfolio Turnover Rate | 25% | 8% | 11% |

| 1 | Inception. |

| 2 | Calculated based on average shares outstanding. |

| 3 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 4 | Includes performance-based investment advisory fee increases (decreases) of (0.02%) and (0.02%). |

| 5 | Annualized. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select International Growth Fund

Notes to Financial Statements

Vanguard Advice Select International Growth Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees.

These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Federal Income Taxes: The fund intends to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Credit Facilities and Interfund Lending Program: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement and an uncommitted credit facility provided by Vanguard. Both facilities may be renewed annually. Each fund is individually liable for its borrowings, if any, under the credit facilities. Borrowings may be utilized for temporary or emergency purposes and are subject to the fund’s regulatory and contractual borrowing restrictions. With respect to the committed credit facility, the participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn committed amount of the facility, which are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under either facility bear interest at an agreed-upon spread plus the higher of the federal funds effective rate, the overnight bank funding rate, or the Daily Simple Secured Overnight Financing Rate inclusive of an additional agreed-upon spread. However, borrowings under the uncommitted credit facility may bear interest based upon an alternate rate agreed to by the fund and Vanguard.

In accordance with an exemptive order (the “Order”) from the SEC, the fund may participate in a joint lending and borrowing program that allows registered open-end Vanguard funds to borrow money from and lend money to each other for temporary or emergency purposes (the “Interfund Lending Program”), subject to compliance with the terms and conditions of the Order, and to the extent permitted by the fund’s investment objective and investment policies. Interfund loans and borrowings normally extend overnight but can have a maximum duration of seven days. Loans may be called on one business day’s notice. The interest rate to be charged is governed by the conditions of the Order and internal procedures adopted by the board of trustees. The board of trustees is responsible for overseeing the Interfund Lending Program.

For the year ended October 31, 2024, the fund did not utilize the credit facilities or the Interfund Lending Program.

6. Other: Dividend income is recorded on the ex-dividend date. Non-cash dividends included in income, if any, are recorded at the fair value of the securities received. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

The fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings within these countries. Amounts related to these reclaims are recorded when there are no significant uncertainties as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment. Such tax reclaims and related professional fees, if any, are included in dividend income and other expenses, respectively.

B. Baillie Gifford Overseas Ltd. provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance relative to the MSCI ACWI ex-USA Growth Index since January 31, 2022. For the year ended October 31, 2024, the investment advisory fee represented an effective annual basic rate of 0.22% of the fund’s average net assets, before a net decrease of $166,000 (0.02%) based on performance.

Advice Select International Growth Fund

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, distribution, and cash management services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees and are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2024, the fund had contributed to Vanguard capital in the amount of $27,000, representing less than 0.01% of the fund’s net assets and 0.01% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Schedule of Investments.

The following table summarizes the market value of the fund's investments as of October 31, 2024, based on the inputs used to value them:

| | Level 1

($000) | Level 2

($000) | Level 3

($000) | Total

($000) |

| Investments | | | | |

| Assets | | | | |

| Common Stocks—North and South America | 279,659 | — | — | 279,659 |

| Common Stocks—Other | 193,654 | 496,062 | — | 689,716 |

| Temporary Cash Investments | 16,559 | — | — | 16,559 |

| Total | 489,872 | 496,062 | — | 985,934 |

E. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for foreign currency transactions and distributions in connection with fund share redemptions were reclassified between the following accounts:

| | Amount

($000) |

| Paid-in Capital | 142 |

| Total Distributable Earnings (Loss) | (142) |

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the deferral of losses from wash sales; and the recognition of unrealized gains from passive foreign investment companies. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| | Amount

($000) |

| Undistributed Ordinary Income | 3,606 |

| Undistributed Long-Term Gains | — |

| Net Unrealized Gains (Losses) | 200,929 |

| Capital Loss Carryforwards | — |

| Qualified Late-Year Losses | — |

| Other Temporary Differences | 104 |

| Total | 204,639 |

The tax character of distributions paid was as follows:

| | Year Ended October 31, |

| | 2024

Amount

($000) | 2023

Amount

($000) |

| Ordinary Income* | 837 | — |

| Long-Term Capital Gains | — | — |

| Total | 837 | — |

| * | Includes short-term capital gains, if any. |

Advice Select International Growth Fund

As of October 31, 2024, gross unrealized appreciation and depreciation for investments based on cost for U.S. federal income tax purposes were as follows:

| | Amount

($000) |

| Tax Cost | 785,005 |

| Gross Unrealized Appreciation | 292,187 |

| Gross Unrealized Depreciation | (91,258) |

| Net Unrealized Appreciation (Depreciation) | 200,929 |

F. During the year ended October 31, 2024, the fund purchased $408,518,000 of investment securities and sold $194,870,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | Year Ended October 31, |

| | 2024

Shares

(000) | 2023

Shares

(000) |

| Issued | 19,816 | 24,448 |

| Issued in Lieu of Cash Distributions | 34 | — |

| Redeemed | (7,004) | (3,146) |

| Net Increase (Decrease) in Shares Outstanding | 12,846 | 21,302 |

H. Significant market disruptions, such as those caused by pandemics, natural or environmental disasters, war, acts of terrorism, or other events, can adversely affect local and global markets and normal market operations. Any such disruptions could have an adverse impact on the value of the fund’s investments and fund performance.

To the extent the fund’s investment portfolio reflects concentration in a particular market, industry, sector, country or asset class, the fund may be adversely affected by the performance of these concentrations and may be subject to increased price volatility and other risks.

I. Management has determined that no events or transactions occurred subsequent to October 31, 2024, that would require recognition or disclosure in these financial statements.

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Vanguard Whitehall Funds and Shareholders of Vanguard Advice Select International Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Vanguard Advice Select International Growth Fund (one of the funds constituting Vanguard Whitehall Funds, referred to hereafter as the "Fund") as of October 31, 2024, the related statement of operations for the year ended October 31, 2024, the statement of changes in net assets for each of the two years in the period ended October 31, 2024, including the related notes, and the financial highlights for each of the two years in the period ended October 31, 2024 and for the period November 9, 2021 (inception) through October 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2024 and the financial highlights for each of the two years in the period ended October 31, 2024 and for the period November 9, 2021 (inception) through October 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2024 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 20, 2024

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

Tax information (unaudited)

The fund hereby designates $1,649,000, or if subsequently determined to be different, the maximum amount allowable by law, as qualified dividend income for purposes of the maximum rate under section 1(h)(11) for calendar year 2023. Shareholders will be notified in January 2025 via IRS Form 1099 of the amounts for use in preparing their 2024 income tax return.

The fund hereby designates for the fiscal year $145,000, or if subsequently determined to be different, the maximum amount allowable by law, of interest earned from obligations of the U.S. government which is generally exempt from state income tax.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the fund for the fiscal year are qualified short-term capital gains.

The fund designates to shareholders foreign source income of $5,841,000 and foreign taxes paid of $214,000, or if subsequently determined to be different, the maximum amounts allowable by law. Form 1099-DIV reports calendar-year amounts that can be included on the income tax return of shareholders.

Q44370 122024

Financial Statements

For the year ended October 31, 2024

Vanguard Advice Select Dividend Growth Fund

Contents

Financial Statements

| 1 |

Report of Independent Registered

Public Accounting Firm

| 9 |

Tax information

| 10 |

| | |

Advice Select Dividend Growth Fund

Schedule of Investments

As of October 31, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | | | Shares | Market

Value•

($000) |

| Common Stocks (98.6%) |

| Consumer Discretionary (13.9%) |

| | McDonald's Corp. | 147,052 | 42,955 |

| | TJX Cos. Inc. | 326,857 | 36,945 |

| | NIKE Inc. Class B | 446,793 | 34,461 |

| | | | | | | 114,361 |

| Consumer Staples (10.9%) |

| | PepsiCo Inc. | 200,623 | 33,319 |

| | Procter & Gamble Co. | 197,093 | 32,556 |

| | Coca-Cola Co. | 366,629 | 23,945 |

| | | | | | | 89,820 |

| Financials (21.3%) |

| | Marsh & McLennan Cos. Inc. | 160,080 | 34,936 |

| | Visa Inc. Class A | 117,473 | 34,049 |

| | S&P Global Inc. | 66,457 | 31,923 |

| | Chubb Ltd. | 103,921 | 29,351 |

| | American Express Co. | 91,634 | 24,748 |

| | Mastercard Inc. Class A | 41,057 | 20,512 |

| | | | | | | 175,519 |

| Health Care (12.8%) |

| | UnitedHealth Group Inc. | 73,564 | 41,527 |

| | Danaher Corp. | 129,836 | 31,896 |

| | Stryker Corp. | 89,243 | 31,795 |

| | | | | | | 105,218 |

| Industrials (13.0%) |

| | Honeywell International Inc. | 150,208 | 30,895 |

| | Northrop Grumman Corp. | 40,533 | 20,632 |

| | General Dynamics Corp. | 69,600 | 20,296 |

| | Lockheed Martin Corp. | 36,919 | 20,160 |

| | Union Pacific Corp. | 62,676 | 14,545 |

| | | | | | | 106,528 |

| Information Technology (20.3%) |

| | Accenture plc Class A | 115,369 | 39,782 |

| | Apple Inc. | 160,707 | 36,305 |

| | Texas Instruments Inc. | 176,723 | 35,903 |

| | Microsoft Corp. | 83,062 | 33,752 |

| | Intuit Inc. | 34,191 | 20,867 |

| | | | | | | 166,609 |

| Materials (4.5%) |

| | Linde plc | 80,609 | 36,770 |

| Real Estate (1.9%) |

| | American Tower Corp. | 74,015 | 15,805 |

| Total Common Stocks (Cost $696,201) | 810,630 |

| Temporary Cash Investments (1.7%) |

| Money Market Fund (1.7%) |

| 1 | Vanguard Market Liquidity Fund, 4.834% (Cost $14,053) | 140,557 | 14,054 |

| Total Investments (100.3%) (Cost $710,254) | | 824,684 |

| Other Assets and Liabilities—Net (-0.3%) | | (2,456) |

| Net Assets (100%) | | 822,228 |

| • | See Note A in Notes to Financial Statements. |

| 1 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select Dividend Growth Fund

Statement of Assets and Liabilities

|

| ($000s, except shares, footnotes, and per-share amounts) | Amount |

| Assets | |

| Investments in Securities, at Value | |

| Unaffiliated Issuers (Cost $696,201) | 810,630 |

| Affiliated Issuers (Cost $14,053) | 14,054 |

| Total Investments in Securities | 824,684 |

| Investment in Vanguard | 23 |

| Receivables for Accrued Income | 979 |

| Receivables for Capital Shares Issued | 834 |

| Total Assets | 826,520 |

| Liabilities | |

| Payables for Investment Securities Purchased | 3,275 |

| Payables for Capital Shares Redeemed | 556 |

| Payables to Investment Advisor | 387 |

| Payables to Vanguard | 74 |

| Total Liabilities | 4,292 |

| Net Assets | 822,228 |

At October 31, 2024, net assets consisted of: |

|

| | |

| Paid-in Capital | 701,149 |

| Total Distributable Earnings (Loss) | 121,079 |

| Net Assets | 822,228 |

| | |

| Net Assets | |

Applicable to 27,751,981 outstanding $.001 par value shares of

beneficial interest (unlimited authorization) | 822,228 |

| Net Asset Value Per Share | $29.63 |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select Dividend Growth Fund

|

| | Year Ended

October 31, 2024 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 11,655 |

| Interest1 | 1,049 |

| Total Income | 12,704 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 1,656 |

| Performance Adjustment | (139) |

| The Vanguard Group—Note C | |

| Management and Administrative | 1,268 |

| Marketing and Distribution | 37 |

| Custodian Fees | 8 |

| Auditing Fees | 33 |

| Shareholders' Reports and Proxy Fees | 51 |

| Trustees’ Fees and Expenses | — |

| Other Expenses | 20 |

| Total Expenses | 2,934 |

| Net Investment Income | 9,770 |

| Realized Net Gain (Loss) on Investment Securities Sold1 | 5,399 |

| Change in Unrealized Appreciation (Depreciation) of Investment Securities1 | 107,974 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 123,143 |

| 1 | Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $1,049,000, $3,000, less than $1,000, and ($1,000), respectively. Purchases and sales are for temporary cash investment purposes. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select Dividend Growth Fund

Statement of Changes in Net Assets

|

| | Year Ended October 31, |

| | 2024

($000) | 2023

($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 9,770 | 5,665 |

| Realized Net Gain (Loss) | 5,399 | (533) |

| Change in Unrealized Appreciation (Depreciation) | 107,974 | 6,343 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 123,143 | 11,475 |

| Distributions | | |

| Total Distributions | (9,329) | (3,953) |

| Capital Share Transactions | | |

| Issued | 318,221 | 354,287 |

| Issued in Lieu of Cash Distributions | 6,194 | 3,139 |

| Redeemed | (140,572) | (50,397) |

| Net Increase (Decrease) from Capital Share Transactions | 183,843 | 307,029 |

| Total Increase (Decrease) | 297,657 | 314,551 |

| Net Assets | | |

| Beginning of Period | 524,571 | 210,020 |

| End of Period | 822,228 | 524,571 |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select Dividend Growth Fund

For a Share Outstanding

Throughout Each Period | Year Ended October 31, | November 9,

20211 to

October 31, |

| 2024 | 2023 | 2022 |

| Net Asset Value, Beginning of Period | $24.85 | $24.00 | $25.00 |

| Investment Operations | | | |

| Net Investment Income2 | .390 | .369 | .295 |

| Net Realized and Unrealized Gain (Loss) on Investments | 4.772 | .763 | (1.187) |

| Total from Investment Operations | 5.162 | 1.132 | (.892) |

| Distributions | | | |

| Dividends from Net Investment Income | (.371) | (.273) | (.108) |

| Distributions from Realized Capital Gains | (.011) | (.009) | — |

| Total Distributions | (.382) | (.282) | (.108) |

| Net Asset Value, End of Period | $29.63 | $24.85 | $24.00 |

| Total Return3 | 20.91% | 4.73% | -3.56% |

| Ratios/Supplemental Data | | | |

| Net Assets, End of Period (Millions) | $822 | $525 | $210 |

| Ratio of Total Expenses to Average Net Assets | 0.41%4 | 0.46%4 | 0.45%5 |

| Ratio of Net Investment Income to Average Net Assets | 1.38% | 1.47% | 1.28%5 |

| Portfolio Turnover Rate | 32% | 15% | 20% |

| 1 | Inception. |

| 2 | Calculated based on average shares outstanding. |

| 3 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 4 | Includes performance-based investment advisory fee increases (decreases) of (0.02%) and 0.02%. |

| 5 | Annualized. |

See accompanying Notes, which are an integral part of the Financial Statements.

Advice Select Dividend Growth Fund

Notes to Financial Statements

Vanguard Advice Select Dividend Growth Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund's pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees.

Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value.

2. Federal Income Taxes: The fund intends to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

3. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial reporting purposes.

4. Credit Facilities and Interfund Lending Program: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement and an uncommitted credit facility provided by Vanguard. Both facilities may be renewed annually. Each fund is individually liable for its borrowings, if any, under the credit facilities. Borrowings may be utilized for temporary or emergency purposes and are subject to the fund’s regulatory and contractual borrowing restrictions. With respect to the committed credit facility, the participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn committed amount of the facility, which are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under either facility bear interest at an agreed-upon spread plus the higher of the federal funds effective rate, the overnight bank funding rate, or the Daily Simple Secured Overnight Financing Rate inclusive of an additional agreed-upon spread. However, borrowings under the uncommitted credit facility may bear interest based upon an alternate rate agreed to by the fund and Vanguard.

In accordance with an exemptive order (the “Order”) from the SEC, the fund may participate in a joint lending and borrowing program that allows registered open-end Vanguard funds to borrow money from and lend money to each other for temporary or emergency purposes (the “Interfund Lending Program”), subject to compliance with the terms and conditions of the Order, and to the extent permitted by the fund’s investment objective and investment policies. Interfund loans and borrowings normally extend overnight but can have a maximum duration of seven days. Loans may be called on one business day’s notice. The interest rate to be charged is governed by the conditions of the Order and internal procedures adopted by the board of trustees. The board of trustees is responsible for overseeing the Interfund Lending Program.

For the year ended October 31, 2024, the fund did not utilize the credit facilities or the Interfund Lending Program.

5. Other: Dividend income is recorded on the ex-dividend date. Non-cash dividends included in income, if any, are recorded at the fair value of the securities received. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. Wellington Management Company llp provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. The basic fee is subject to quarterly adjustments based on the fund’s performance relative to the S&P U.S. Dividend Growers Index since January 31, 2022. For the year ended October 31, 2024, the investment advisory fee represented an effective annual basic rate of 0.23% of the fund’s average net assets, before a net decrease of $139,000 (0.02%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees and are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2024, the fund had contributed to Vanguard capital in the amount of $23,000, representing less than 0.01% of the fund’s net assets and 0.01% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

Advice Select Dividend Growth Fund

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Schedule of Investments.

At October 31, 2024, 100% of the market value of the fund's investments was determined based on Level 1 inputs.

E. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for distributions in connection with fund share redemptions were reclassified between the following accounts:

| | Amount

($000) |

| Paid-in Capital | 154 |

| Total Distributable Earnings (Loss) | (154) |

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the deferral of losses from wash sales. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| | Amount

($000) |

| Undistributed Ordinary Income | 6,193 |

| Undistributed Long-Term Gains | 2,965 |

| Net Unrealized Gains (Losses) | 111,921 |

| Capital Loss Carryforwards | — |

| Qualified Late-Year Losses | — |

| Other Temporary Differences | — |

| Total | 121,079 |

The tax character of distributions paid was as follows:

| | Year Ended October 31, |

| | 2024

Amount

($000) | 2023

Amount

($000) |

| Ordinary Income* | 9,181 | 3,953 |

| Long-Term Capital Gains | 148 | — |

| Total | 9,329 | 3,953 |

| * | Includes short-term capital gains, if any. |

As of October 31, 2024, gross unrealized appreciation and depreciation for investments based on cost for U.S. federal income tax purposes were as follows:

| | Amount

($000) |

| Tax Cost | 712,763 |

| Gross Unrealized Appreciation | 123,571 |

| Gross Unrealized Depreciation | (11,650) |

| Net Unrealized Appreciation (Depreciation) | 111,921 |

F. During the year ended October 31, 2024, the fund purchased $417,306,000 of investment securities and sold $220,571,000 of investment securities, other than temporary cash investments.

The fund purchased securities from and sold securities to other funds or accounts managed by its investment advisors or their affiliates, in accordance with procedures adopted by the board of trustees in compliance with Rule 17a-7 of the Investment Company Act of 1940. For the year ended October 31, 2024, such purchases were $2,211,000 and sales were $0; these amounts, other than temporary cash investments, are included in the purchases and sales of investment securities noted above.

Advice Select Dividend Growth Fund

G. Capital shares issued and redeemed were:

| | Year Ended October 31, |

| | 2024

Shares

(000) | 2023

Shares

(000) |

| Issued | 11,394 | 14,241 |

| Issued in Lieu of Cash Distributions | 227 | 126 |

| Redeemed | (4,976) | (2,011) |

| Net Increase (Decrease) in Shares Outstanding | 6,645 | 12,356 |

H. Significant market disruptions, such as those caused by pandemics, natural or environmental disasters, war, acts of terrorism, or other events, can adversely affect local and global markets and normal market operations. Any such disruptions could have an adverse impact on the value of the fund’s investments and fund performance.

To the extent the fund’s investment portfolio reflects concentration in a particular market, industry, sector, country or asset class, the fund may be adversely affected by the performance of these concentrations and may be subject to increased price volatility and other risks.

I. Management has determined that no events or transactions occurred subsequent to October 31, 2024, that would require recognition or disclosure in these financial statements.

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Vanguard Whitehall Funds and Shareholders of Vanguard Advice Select Dividend Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Vanguard Advice Select Dividend Growth Fund (one of the funds constituting Vanguard Whitehall Funds, referred to hereafter as the "Fund") as of October 31, 2024, the related statement of operations for the year ended October 31, 2024, the statement of changes in net assets for each of the two years in the period ended October 31, 2024, including the related notes, and the financial highlights for each of the two years in the period ended October 31, 2024 and for the period November 9, 2021 (inception) through October 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2024 and the financial highlights for each of the two years in the period ended October 31, 2024 and for the period November 9, 2021 (inception) through October 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2024 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 20, 2024

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

Tax information (unaudited)

For corporate shareholders, 72.7%, or if subsequently determined to be different, the maximum percentage allowable by law, of ordinary income (dividend income plus short-term gains, if any) for the fiscal year qualified for the dividends-received deduction.