QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

CAPITAL CORP OF THE WEST

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CAPITAL CORP OF THE WEST

550 West Main Street

P.0. Box 351

Merced, CA 95341-0351

March 13, 2002

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Capital Corp of the West (the "Company") to consider and vote upon (1) a proposal to elect four Class III directors and one Class I director, totaling five directors; (2) a proposal to approve a new stock option plan; and (3) such other business as may properly come before the meeting.

The meeting will take place at 7:00 p.m. local time on April 23, 2002, at the Capital Corp of the West/County Bank headquarters on the 3rd floor at 550 W. Main Street (between M and Canal streets), Merced, California.

Enclosed are the Secretary's Notice of this meeting, a Proxy Card, the Proxy Statement describing the proposals, and a return envelope. Also enclosed is a copy of the Company's 2001 Annual Report to shareholders.

We encourage you to attend this meeting. Whether or not you are able to attend, please complete, date, sign, and return promptly the enclosed Proxy Card so that your shares will be represented at the meeting. You may also vote your shares by utilizing an 800 number listed on the Proxy Card or via the Internet by utilizing the Control Number listed on the Proxy Card. You may also vote at the meeting if you have not voted prior to the meeting. If you choose to do so, please bring to the meeting the enclosed Proxy Card and proof of your identify. If you chose to vote in this alternative manner, there is no need to return your Proxy Card. I look forward to seeing you.

| | | Very truly yours, |

| | |  |

| | | Thomas T. Hawker

President and Chief Executive Officer |

CAPITAL CORP OF THE WEST

Merced, California 95341-0351

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of the Shareholders of Capital Corp of the West ("Capital Corp") will be held on Tuesday, April 23, 2002, at 7:00 p.m. local time at the Capital Corp of the West/County Bank headquarters on the 3rd floor at 550 W. Main Street (between M and Canal streets), Merced, California. The meeting will be held for the following purposes:

- 1.

- To elect four Class III directors and one Class I director;

- 2.

- To adopt the Capital Corp of the West 2002 Stock Option Plan;

- 3.

- To consider and act upon such other matters as may properly come before such meeting or any adjournment thereof.

Holders of Capital Corp common stock of record at the close of business on March 1, 2002, are entitled to notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. Please sign and date the enclosed Proxy Card and return it promptly in the envelope provided, whether or not you plan to attend the meeting. Shareholders of Record may vote by utilizing an 800 number (800) 816-8908 and the "Control Number" listed on the Proxy Card. Instructions for utilizing the 800 number are listed on the Proxy Card. You may also vote via the Internet by following the instructions listed on the Proxy Card. Voting via telephone and Internet will suspend 24 hours prior to the meeting date. This Proxy Statement is distributed by and the enclosed proxy is solicited on behalf of the Board of Directors of Capital Corp.

| | | By Order of the Board of Directors |

| | |  |

| | | Gloria Lind

Corporate Secretary |

PROXY STATEMENT OF

CAPITAL CORP OF THE WEST

FOR THE ANNUAL MEETING OF SHAREHOLDERS

P.O. Box 351

550 West Main St.

MERCED, CALIFORNIA 95341-0351

(209) 725-2269

This Proxy Statement and the accompanying form of proxy are being mailed to shareholders on or about March 13, 2002.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND THE ANNUAL MEETING

- Q:

- Why am I receiving these materials?

A: The Board of Directors of Capital Corp of the West is providing these proxy materials for you in connection with the Company's annual meeting of shareholders, which will take place on April 23, 2002. As a shareholder, you are invited to attend the meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

- Q:

- What information is contained in these materials?

A: The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and executive officers, and certain other required information. Our 2001 Annual Report is also enclosed.

- Q:

- What shares owned by me can be voted?

A: All shares owned by you as of the close of business on March 1, 2002, theRecord Date, may be voted by you. These shares include (1) shares held directly in your name as theshareholder of record, including shares purchased through the Company's Employee Stock Purchase Plan and (2) shares held for you as thebeneficial owner through a stockbroker or bank or shares purchased through the Company's 401(k) plan.

- Q:

- What is the difference between holding shares as a shareholder of record and as a beneficial owner?

A: Most shareholders hold shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

If your shares are registered directly in your name with the Company's transfer agent, Computershare Investor Services, LLC, you are considered, with respect to those shares, theshareholder of record, and these proxy materials are being sent directly to you by the Company. As theshareholder of record, you have the right to vote by proxy or to vote in person at the meeting. The Company has enclosed a Proxy Card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial owner of shares heldin street name, and these proxy materials are being forwarded to you by your broker or nominee which is considered, with respect to those shares, theshareholder of record. As the beneficial owner, you have the right to direct your broker how to vote and are also invited to attend the meeting. If you wish to vote these shares at the meeting, you must contact your bank or broker for instructions as to how to do so. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares on your behalf.

- Q:

- How can I vote my shares in person at the meeting?

A: Shares held directly in your name as theshareholder of record may be voted in person at the annual meeting. If you choose to do so, please bring to the meeting the enclosed Proxy Card and proof of your identity.

Even if you currently plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the meeting. Shares held in street name may be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

- Q:

- How can I vote my shares without attending the meeting?

A: Whether you hold shares directly as a shareholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting your voting instructions to your broker or nominee. In most instances you will be able to do this by telephone or by mail. Please refer to the summary instructions below and those included on your Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee.

By Internet—If you have Internet access, you may submit your proxy from any location in the world by following the "Vote by Internet" instructions on the Proxy Card.

By Telephone—If you live in the United States or Canada, you may submit your proxy by following the "Vote by Phone" instructions on the Proxy Card.

By Mail—You may do this by returning your signed Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee and mailing it in the enclosed, postage pre-paid and addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct. If you sign the proxy card but do not provide instructions, your shares will be voted as described below in"How are votes counted?".

- Q:

- Can I change my vote?

A: You may change your proxy instructions at any time prior to the vote at the annual meeting. For shares held in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the annual meeting and voting in person. Also, you may file with the Secretary of the Company a written notice of revocation at any time before your proxy is exercised at the Meeting. Attendance at the meeting will not cause your previously granted proxy to be automatically revoked unless you specifically so request. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee.

2

- Q:

- How are votes counted?

A: In the election of directors you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees or all of the nominees. On any other proposal you may vote FOR, AGAINST or ABSTAIN. If you sign your Proxy Card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendation of the Board ("FOR" all of the Company's nominees to the Board; "FOR" adoption of the Capital Corp of the West 2002 Stock Option Plan; and at the discretion of the proxy holders on any other matters that properly come before the meeting).

- Q:

- What does it mean if I receive more than one proxy or voting instruction card?

A: It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive so that all your shares will be represented at the meeting.

- Q:

- Is my vote confidential?

A: Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by our Board.

3

INFORMATION CONCERNING PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Capital Corp of the West ("Capital Corp" or the "Company") of proxies to be voted at the Annual Meeting of Shareholders of Capital Corp (the "Meeting") and any adjournments or postponements thereof. At the Meeting, the Shareholders of Capital Corp will be asked to (1) elect four Class III directors and one Class I director, totaling five directors; (2) approve Capital Corp of the West 2002 Stock Option Plan; and (3) act upon such other matters as may properly come before such meeting or any adjournment thereof.

Date, Time and Place of Meeting

The Meeting will be held on April 23, 2002 at 7:00 p.m. at the headquarters of Capital Corp of the West/County Bank at 550 W. Main Street, 3rd Floor (between M and Canal streets), Merced, California.

Record Date and Voting Rights

Only holders of record of Capital Corp common stock at the close of business on March 1, 2002 (the "Record Date") are entitled to notice of and to vote at the Meeting. At the Record Date, there were approximately 1,700 shareholders of record and 4,966,387 shares of Capital Corp common stock outstanding and entitled to vote. Directors and executive officers of Capital Corp and their affiliates owned beneficially as of the Record Date an aggregate of 380,774 shares or approximately 7.25% of the outstanding Capital Corp common stock (including shares subject to vested options).

Each shareholder is entitled to one vote for each share of common stock he or she owns. In the election of directors, the nominees receiving the greatest number of votes will be elected. The new Stock Option Plan must be approved by a majority of all shares represented and voting at the meeting. Broker non-votes (i.e., shares held by brokers or nominees which are represented at the Meeting but with respect to which the nominee is not authorized to vote on a particular proposal) will not be counted, except for quorum purposes, and will have no effect on the election of directors. In determining whether the requisite shareholder approval has been received for the Capital Corp of the West 2002 Stock Option Plan, votes abstaining and broker non-votes will be disregarded and have no effect on the outcome of the vote.

Voting by Proxy; Revocability of Proxies

Shareholders may use the enclosed Proxy Card if they are unable to attend the Meeting in person or wish to have their shares voted by proxy even if they attend the Meeting. All proxies that are properly executed and returned, unless revoked, will be voted at the Meeting in accordance with the instructions indicated thereon or, if no direction is indicated, for the election of the Board's nominees as directors and for approval of the Capital Corp of the West 2002 Stock Option Plan. The execution of a proxy will not affect the right of a shareholder to attend the Meeting and vote in person. A person who has given a proxy may revoke it at any time before it is exercised at the Meeting by filing with the Secretary of the Company a written notice of revocation or a proxy bearing a later date or by attendance at the Meeting and voting in person. Attendance at the Meeting will not, by itself, revoke a proxy.

Shareholders of Record may vote by utilizing an 800 number (800) 816-8908 and the "Control Number" listed on the Proxy Card. Instructions for utilizing the 800 number are listed on the Proxy Card. You may also vote utilizing the Internet by accessingwww.computershare.com/us/proxy, entering the Control Number and following the simple instructions. Voting via telephone and the Internet will suspend 24 hours prior to the Meeting date. We have been advised by counsel that these telephone and Internet voting procedures comply with California law.

4

Quorum and Adjournments

A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. The Meeting may be adjourned, even if a quorum is not present, by the vote of the holders of a majority of the shares represented at the Meeting in person or by proxy. In the absence of a quorum at the Meeting, no other business may be transacted at the Meeting.

Notice of the adjournment of the Meeting need not be given if the time and place thereof are announced at the Meeting, provided that if the adjournment is for more than 45 days, or after the adjournment a new record date is fixed for the adjourned Meeting, a notice of the adjourned Meeting shall be given to each shareholder of record entitled to vote at the Meeting. At an adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

Nomination of Directors

The Company's Bylaws provide that any shareholder must give written notice to the President of Capital Corp of an intention to nominate a director at a shareholder meeting. The notice must be received by 21 days before the meeting or 10 days after the date of mailing of notice of the meeting, whichever is later. The Bylaws contain additional requirements for nominations. A copy of the requirements is available upon request directed to the President of Capital Corp.

Solicitation of Proxies

The proxy relating to the Meeting is being solicited by the Board. Capital Corp will pay the cost of printing and distributing this Proxy Statement. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians holding in their names shares of Capital Corp common stock beneficially owned by others to forward to such beneficial owners. Capital Corp may reimburse such persons for their expenses in forwarding solicitation materials to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of Capital Corp, who will not be additionally compensated therefor. Skinner & Co., Inc. will assist in the distribution of proxy solicitation materials, collection of proxies and the solicitation of proxies by personal interview, telephone and telegram. The Company has agreed to pay Skinner & Co., Inc. a fee for these services of $3,500, plus expenses. The Company has also agreed to indemnify Skinner & Co., Inc. against certain liabilities. The Company will pay the cost of all proxy solicitation.

5

PROPOSAL ONE: ELECTION OF DIRECTORS

The Bylaws of Capital Corp provide that the number of directors of Capital Corp may be no less than nine and no more than twelve. The exact number of directors within this range may be changed by action of the Board of Directors or the shareholders. The number of directors is currently fixed at eleven.

NOMINEES FOR DIRECTOR

The Board of Directors is classified into three classes with staggered three-year terms. The four persons named below will be nominated for election as Class III Directors to serve until the Annual Meeting in the year 2005 and until their successors are duly elected and qualified. The four candidates receiving the greatest number of votes will be elected for three-year terms.

G. Michael Graves

Bertyl W. Johnson

James W. Tolladay

Tom A.L. Van Groningen

The person named below will be nominated for election as a Class I Director to serve until the Annual Meeting in 2003 and until his successor is duly elected and qualified.

Gerald L. Tahajian

If any nominee should become unable or unwilling to serve as a director, the proxies will be voted at the Meeting for such substitute nominees as shall be designated by the Board. The Board presently has no knowledge that any of the nominees will be unable or unwilling to serve.

6

The following table provides information with respect to each person nominated and recommended to be elected by the current Board, as well as existing directors of Capital Corp whose terms do not expire at the time of the Meeting. Reference is made to the section entitled "Security Ownership of Certain Beneficial Owners and Management" for information pertaining to stock ownership of the nominees.

Name/Class

| | Age

| | Director

Since

| | Business Experience During Past Five Years

|

|---|

| Lloyd H. Ahlem, I | | 72 | | 1995 | | Psychologist |

| Dorothy L. Bizzini, I | | 67 | | 1992 | | Co-owner Atwater/Merced Veterinary Clinic, Inc. |

| Jerry E. Callister, I | | 59 | | 1991 | (1) | Partner, Callister & Hendricks, Inc., a professional law corporation |

| Gerald L. Tahajian, I | | 61 | | 2001 | | President, Gerald Lee Tahajian, Inc., a professional law corporation |

| John D. Fawcett, II | | 53 | | 1995 | | President, Fawcett Farms, Inc. |

| Thomas T. Hawker, II | | 59 | | 1991 | | President/CEO Capital Corp and County Bank |

| Curtis A. Riggs, II | | 53 | | 2000 | | President/CEO VIA Adventures, a transportation company |

| G. Michael Graves, III | | 50 | | 2001 | | Principal, Pacific Resources, Inc., a financial, strategic planning, accounting and administrative management firm |

| Bertyl W. Johnson, III | | 70 | | 1977 | | Tree crop farmer and nut processor |

| James W. Tolladay, III | | 70 | | 1991 | | Consultant, Tolladay, Fremming & Parson, a civil engineering consulting firm; Chairman of the Board of Capital Corp |

| Tom A.L. Van Groningen, III | | 68 | | 1999 | | Consultant, educator |

- (1)

- Previously served on Board of Directors from 1977 to 1985.

No family relationships exist among any of the directors or executive officers of the Company.

No director or person nominated or chosen by the Board of Directors to become a director of the Company is a director of any other company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such Act or at any company registered as an investment company under the Investment Company Act of 1940, as amended.

Recommendation of the Board of Directors

The Board of Directors urges you to voteFOR PROPOSAL ONE.

Committees of the Board of Directors

For 2001, the Capital Corp Board of Directors held 12 regularly scheduled meetings. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the committees of the Board on which he or she served (during the period for which they served).

7

The Executive Committee functions as the Compensation Committee. Mr. Tolladay (Chairman), Mr. Callister, Mr. Mr. Fawcett, and Mr. Van Groningen are members of the Executive Committee, and Mr. Hawker is a non-voting member as it relates to compensation matters. During 2001, the Executive Committee held a total of nine meetings. The primary function of the Executive Committee is to act as a vehicle for communication between the Board and the President and Chief Executive Officer. It also establishes compensation for the Chief Executive Officer and evaluates and recommends to the Board compensation for other executive officers of Capital Corp, upon the recommendation of the Chief Executive Officer, grants stock options and approves corporate titles.

Report of the Audit Committee

The Audit Committee is comprised of Mr. Van Groningen (Chairman), Mr. Callister, Mr. Riggs and Mr. Graves. During 2001, the Audit Committee held five meetings.

The Audit Committee reviewed and discussed the audited financial statements and related judgements with management and the outside auditors.

The Audit Committee recommended to the full Board the inclusion of the financial statements in the Company's SEC Annual Report.

The Audit Committee operates under a charter adopted by the board that was attached as an appendix to the proxy statement for the 2001 annual meeting of shareholders.

Information About Independent Accountant's Fees

Audit Fees

The aggregate amount of fees billed by KPMG LLP for professional services rendered for the audit of the Company's annual financial statements during the fiscal year ending December 31, 2001 and for reviews of financial statements included in the Company's Forms 10-Q for this fiscal year was $94,650.

Financial Information System Design and Implementation Fees

KPMG LLP did not perform any financial information system design and implementation services for the Company during the fiscal year ended December 31, 2001.

All Other Fees

The aggregate amount of fees billed for all other services rendered to the Company by KPMG LLP during the fiscal year ending December 31, 2001 was $98,500.

The Company's Audit Committee has considered whether KPMG LLP's provisions of the services described above is compatible with maintaining the independence of KPMG LLP.

Director Attendance and Compensation

The Company does not have a nominating committee. The entire Board of Directors performs the function of the nominating committee.

8

During 2001, non-employee directors received $700 per meeting for their attendance at regular Board meetings, $300 per meeting for attendance at Special Board meetings, $300 per Committee meeting, a $500 monthly retainer fee, and a $50-$120 (depending on distance) monthly car allowance. The Chairman of the Board receives $600 per month in addition to fees received for attendance at Board and Committee meetings. Employee directors and committee members do not receive fees. The Chairpersons of the Directors, Loan Committee and Audit Committee receive a chairperson fee of $200 per meeting. Capital Corp directors earned a total of $199,420 in director fees during 2001.

In addition, the Capital Corp of the West and County Bank directors also participated in the Company Stock Option Plan. During 2001 each director was granted 3,000 shares under this plan. The shares granted are non-qualified stock options and issued at an exercise price equal to the fair market value at the date of the grant. All options have a ten-year term and are exercisable as follows: 25% at date of issuance and 25% per year for the subsequent three years; and all must be exercised within 90 days following resignation or retirement from the Board.

The Company also maintains a non-qualified deferred compensation plan for members of the Board of Directors of the Company and County Bank. Under the deferred compensation plan, members of the Board of Directors have the ability to defer compensation they receive as Directors. Deferred amounts are credited with interest at the prime rate. If a Director leaves after ten years of service, the Bank pays a stated benefit in lieu of the actual amount in the Director's account. If a Director leaves before ten years for any other reason, the Bank pays the Director the actual value of the account, including interest. Upon reaching retirement age, the Company will pay these retirement benefits over a ten year period. The plan is funded by several single premium universal life insurance policies that provide life insurance on certain Directors, with the Company named as the owner and beneficiary of these policies.

Executive Officers of Capital Corp

Set forth below is certain information with respect to each of the executive officers of Capital Corp.

Name

| | Age

| | Positions and Offices

| | Executive

Officer Since

|

|---|

| Thomas T. Hawker | | 59 | | President, CEO and Director (Mr. Hawker also serves as President/CEO of County Bank) | | 1991 |

| R. Dale McKinney | | 56 | | Executive Vice President/Chief Financial Officer | | 1999 |

Set forth below is certain information with respect to the executive officers of County Bank, a subsidiary of Capital Corp.

Name

| | Age

| | Positions and Offices

| | Executive

Officer Since

|

|---|

| Ed J. Rocha | | 49 | | Executive Vice President and Chief Banking Officer | | 1997 |

| James M. Sherman | | 65 | | Executive Vice President/Chief Credit Officer | | 1999 |

A brief summary of the background and business experience of the executive officers of Capital Corp and its subsidiaries is set forth below.

THOMAS T. HAWKER became County Bank's President and Chief Executive Officer in 1991 and President and Chief Executive Officer of Capital Corp in 1995. Prior to that he served as President and Chief Executive Officer of Concord Commercial Bank from 1986-1991.

R. DALE MCKINNEY became Capital Corp's Executive Vice President and Chief Financial Officer in 2001. He was the Company's Senior Vice President/Chief Financial Officer from 1999 to

9

2001. During 1998, Mr. McKinney was subject to a non-compete agreement with MBNA Corporation. In 1996-1997 he served as Senior Vice President—Finance for MBNA Corporation, a $60 billion bank based in Delaware and from 1993-1995 he served as Senior Vice President—Finance for MBNA Information Services. He served as Senior Vice President/Corporate Controller for Bank of Oklahoma from 1992-1993.

ED J. ROCHA became County Bank's Executive Vice President/Chief Banking Officer in 1999. He was the Bank's Senior Vice President/Chief Banking Officer from 1997-1999. He served as Vice President and Regional Manager for the Bank from 1995-1997. He served as Senior Vice President/Branch Administrator for Pacific Valley National Bank from 1989-1995.

JAMES M. SHERMAN became Executive Vice President/Chief Credit Officer for County Bank in 2001. He was the Bank's Senior Vice President/Chief Credit Officer from 1999 to 2001. Prior to that he served as Vice President of San Jose National Bank from 1994 to 1998 and was Acting Chief Credit Officer for San Jose National Bank from 1993-1994.

Beneficial Ownership of Management

The following table shows the number and percentage of shares beneficially owned (including shares subject to options exercisable currently or within 60 days) as of the Record Date by each director nominee, current director and named executive officer of the Company.

| | Beneficially Owned(1)

| |

|---|

Name of Beneficial Owner

| |

|---|

| | Amount

| | Percentage

| |

|---|

| Lloyd H. Ahlem | | 13,353 | (2) | * | |

| Dorothy L. Bizzini | | 41,132 | (3) | * | |

| Jerry E. Callister | | 16,177 | (4) | * | |

| John D. Fawcett | | 17,438 | (5) | * | |

| G. Michael Graves | | 6,986 | (6) | * | |

| Thomas T. Hawker | | 112,735 | (7) | 2.15 | % |

| Bertyl W. Johnson | | 63,079 | (8) | 1.20 | % |

| R. Dale McKinney | | 20,305 | (9) | * | |

| Curtis A. Riggs | | 9,348 | (10) | * | |

| Ed J. Rocha | | 22,197 | (11) | * | |

| James M. Sherman | | 14,627 | (12) | * | |

| Gerald L. Tahajian | | 7,025 | (13) | * | |

| James W. Tolladay | | 19,992 | (14) | * | |

| Tom A.L. Van Groningen | | 16,380 | (15) | * | |

| All Directors and Executive Officers of the Company as a Group 12 in number (include all Executive officers, not just the Named executive officers) | | 380,774 | | 7.25 | % |

The address for all persons is: Capital Corp of the West, 550 West Main Street, P.O. Box 351, Merced, California 95341-0351.

- *

- Indicates that the percentage of outstanding shares beneficially owned is less than one percent (1%).

10

- (1)

- Includes shares beneficially owned (including options exercisable within 60 days of the Record Date), directly and indirectly together with associates. Subject to applicable community property laws and shared voting and investment power with a spouse, the persons listed have sole voting and investing power with respect to such shares unless otherwise noted.

- (2)

- Includes 8,629 shares held in the Ahlem Family Living Trust and 4,724 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (3)

- Includes 31,674 shares held as trustee in the Bizzini Family Trust and 9,458 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (4)

- Includes 13,795 shares held as trustee in the Callister Family Trust, 20 shares held in children's names; and 2,362 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (5)

- Includes 6,726 shares held individually and 10,712 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (6)

- Includes 3,050 shares held in joint tenancy with spouse and 3,936 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (7)

- Includes 17,431 shares held individually; 3,389 shares held by his spouse; 2,100 shares held in joint tenancy with spouse; 1,695 shares held by his daughter; 6,684 shares held through the Company ESOP; 12,263 in the Company 401(k); and 69,173 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (8)

- Includes 50,067 shares held in joint tenancy with spouse; 10,650 shares held in an IRA; and 2,362 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (9)

- Includes 5,250 shares held individually; 654 shares held through the Company ESOP; 1,188 shares in the Company 401(k); and 13,213 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (10)

- Includes 172 shares held individually; 2,205 shares held in a family trust; 2,247 shares held in the name of spouse and minor children; and 4,724 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (11)

- Includes 1,389 shares held individually; 3,675 shares in an IRA; 1,925 shares held through the Company ESOP; 4,680 shares in the Company 401(k); and 10,528 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (12)

- Includes 550 shares held jointly with spouse; 636 shares held through the Company ESOP; 228 shares in the Company 401(k); and 13,213 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (13)

- Includes 1,525 shares held in a family trust; 4,000 shares held in a corporate profit sharing plan; and 1,500 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (14)

- Includes 14,886 shares held individually in an IRA; 2,744 shares held jointly with his spouse; and 2,362 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

- (15)

- Includes 7,560 shares held in a family trust; 3,150 shares held individually; and 5,670 shares under stock options which are exercisable currently or within 60 days of March 1, 2002.

11

Principal Shareholders

As of December 31, 2001, no individuals known to the Board of Directors of Capital Corp owned of record or beneficially five percent or more of the outstanding shares of common stock of Capital Corp, except as described below:

Name and Address

| | Number of Shares

Beneficially Owned

| | Percentage of

Outstanding Stock

Beneficially Owned

| |

|---|

1867 Western Financial Corporation

P.O. Box 1110

Stockton, CA 95201-1110 | | 589,527 | | 11.87 | % |

Compensation And Other Transactions With Management And Others

Cash Compensation

The following information is furnished with respect to the aggregate cash compensation paid to the Chief Executive Officer, Chief Financial Officer, Chief Banking Officer and Chief Credit Officer of Capital Corp or its subsidiary County Bank during 2001. No other executive officer of Capital Corp or its subsidiaries received aggregate cash compensation of $100,000 or more in 2001.

Summary Compensation Table

| |

| |

| |

| | Long Term Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name & Principal Position

| |

| | Stock Options Granted

(Number of Shares)

| | All Other*

Compensation

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

| Capital Corp of the West | | | | | | | | | | | | | |

Thomas T. Hawker

President/CEO |

|

2001

2000

1999 |

|

$

$

$ |

209,668

181,538

173,115 |

|

$

$

$ |

99,317

73,084

5,046 |

|

7,350

N/A

N/A |

|

$

$

$ |

20,338

12,929

10,443 |

Dale McKinney

EVP/Chief Financial Officer |

|

2001

2000

1999 |

|

$

$

$ |

143,454

132,275

115,250 |

(1) |

$

$

|

51,714

39,000

N/A |

|

3,675

N/A

10,000 |

|

$

$

$ |

18,050

14,675

30,000 |

County Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ed J. Rocha

EVP/Chief Banking Officer |

|

2001

2000

1999 |

|

$

$

$ |

137,129

118,750

104,167 |

|

$

$

$ |

50,000

33,051

5,232 |

|

3,675

N/A

3,500 |

|

$

$

$ |

22,218

16,185

14,157 |

James M. Sherman

SVP/Chief Credit Officer |

|

2001

2000

1999 |

|

$

$

$ |

138,129

123,115

90,462 |

(2) |

$

$

|

50,000

36,000

N/A |

|

3,675

N/A

10,000 |

|

$

$

$ |

23,490

15,528

1,105 |

- (1)

- For the period January 27, 1999 to December 31, 1999 Mr. McKinney's base salary was $130,000.

- (2)

- For the period March 15, 1999 to December 31, 1999 Mr. Sherman's base salary was $120,000.

- *

- (Includes Company contributions to ESOP and 401(k) plans, moving and auto allowances.)

12

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

In the interests of attracting and retaining qualified personnel, the Company furnishes to executive officers certain incidental personal benefits. The incremental cost to the Company of providing such benefits to those executives noted above did not, for the fiscal year ended December 31, 2001, exceed 10% of the compensation to any of them reported above.

Pursuant to his employment contract effective March 1, 1997 through December 31, 2001, Mr. Hawker received a base salary of $210,000, adjusted annually for cost of living allowances and other salary increases if approved by the Board, use of a Company-owned automobile, various forms of insurance benefits and participation in the Company's other compensation plans such as its incentive compensation program, 401(k) plan, stock option plan and ESOP plan. Pursuant to his employment contract, should Mr. Hawker be terminated for reasons other than "for cause", Mr. Hawker would receive a severance payment equal to one year's then-current salary. In addition, in the event of an acquisition of Capital Corp, Mr. Hawker's employment contract will automatically terminate and Mr. Hawker will receive an acquisition payment equal to six months' then-current salary. The contract did expire December 31, 2001. A new contract is currently under discussion, but not yet finalized.

Mr. McKinney, pursuant to his employment "offer letter", entered into a compensatory arrangement with the Company. Should Mr. McKinney be terminated for reasons other than "for cause", he would receive a severance payment equal to one year's then-current salary. In the event of an acquisition of the Company and as a result of such acquisition if his duties, responsibilities and compensation are substantially changed, he will receive an acquisition payment of six months' then-current salary.

In addition, effective February 14, 2001, the executive officers are covered by a one-year severance package in case of a change in control as defined in the Company's salary continuation plans.

In addition, Capital Corp provides Mr. Hawker and selected other executive officers with salary continuation plans. These are a non-qualified executive benefit plans pursuant to which the Company has agreed to pay retirement benefits to the executive officers in return for their continued satisfactory performance. They are unfunded plans; the executive has no rights under the agreements beyond those of a general creditor of the Company. The plans are funded by single premium universal life insurance policies. The Company is the owner and beneficiary of the policies.

As of the date of this report, Mr. Hawker is 100% vested, Mr. Rocha is 60% vested and Messrs. Sherman and McKinney are 0% vested in the plan. Messrs. Sherman and McKinney become 40% vested upon their respective anniversary dates of employment after four years of service. Thereafter, Mr. Sherman becomes vested in an additional 30% of plan payments for each full succeeding year of employment and will be 100% vested as of March 15, 2005. Mr. McKinney becomes vested in an additional 10% of plan payments for each full succeeding year of employment and will be 100% vested as of January 28, 2009. Mr. Rocha becomes vested in an additional 10% of plan payments for each full succeeding year of employment and will be 100% vested as of May 1, 2005. Mr. Hawker's benefits from this plan are $98,600 per year for a period of fifteen years. Mr. McKinney's benefits from this plan are $65,000 per year for a period of fifteen years. Mr. Rocha's benefits from this plan are $60,000 per year for fifteen years. Mr. Sherman's benefits from this plan are $50,000 per year for ten years. Should any of the executive officers terminate their employment or be terminated without cause, the executive would be entitled to distributions equal to the vested amount of the benefits under the terms and conditions of the agreement. Should any executive be terminated for cause, no benefit would be payable under the plan. All benefits under the plan vest immediately in the event of a change of control.

13

Stock Options

Option Grants in the Last Fiscal Year

Name

| | Number of

Securities

Underlying

Options/SARS

Granted(1)

| | % of Total

Options/SARS

Granted to

Employees in

Fiscal Year

| | Exercise or

Base Price

$/Sh(2)

| | Expiration

Date

| | Grant Date

Present Value

|

|---|

| Thomas T. Hawker | | 7,350 | | 7.07 | % | $ | 12.024 | | 1/23/2011 | | $ | 5.02 |

| R. Dale McKinney | | 3,675 | | 3.53 | % | $ | 12.024 | | 1/23/2011 | | $ | 5.02 |

| Ed J. Rocha | | 3,675 | | 3.53 | % | $ | 12.024 | | 1/23/2011 | | $ | 5.02 |

| James M. Sherman | | 3,675 | | 3.53 | % | $ | 12.024 | | 1/23/2011 | | $ | 5.02 |

- (1)

- The material terms of all option grants to named directors during 2001 are as follows: (i) all options are incentive stock options; (ii) all options have an exercise price equal to the fair market value on the date of grant; (iii) all options have a ten-year term and become exercisable as follows: 25% at date of issuance and 25% per year for the subsequent three years; and (iv) all must be exercised within 90 days following termination of employment.

- (2)

- Exercise Price is determined by the average closing bid and ask prices on the date of grant.

- (3)

- In accordance with Securities and Exchange Commission rules, the Black-Scholes option pricing model was used to estimate the Grant Date Present Value assuming (i) an expected dividend yield of 0%; (ii) an expected volatility of 29%; (iii) a risk-free interest rate of 4.75%; (iv) an option term of seven years.

The following table shows the number and estimated value of the exercisable and unexercisable stock options for the executive officers listed previously.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| |

| |

| | Number of

Unexercised Options

at December 31, 2001

| | Value of Unexercised

In-the-Money Options

at December 31, 2001

|

|---|

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable/Unexercisable

| | Exercisable/Unexercisable

|

|---|

| Thomas T. Hawker | | — | | — | | 65,586/5,513 | | $ | 578,347/$15,028 |

| R. Dale McKinney | | — | | — | | 8,794/5,381 | | $ | 47,870/$22,638 |

| Ed J. Rocha | | — | | — | | 7,815/3,676 | | $ | 44,496/$12,810 |

| James M. Sherman | | — | | — | | 8,793/5,382 | | $ | 40,376,$20,136 |

Employee Stock Ownership Plan

The Board of Directors of Capital Corp has established, under Section 401(a) and 501(a) of the Internal Revenue Code of 1986, a qualified Employee Stock Ownership Plan ("ESOP") effective December 31, 1984. The purpose of the ESOP is to provide all eligible employees with additional incentive to maximize their job performance by providing them with an opportunity to acquire or increase their proprietary interest in Capital Corp and to provide supplemental income upon retirement. The ESOP is designed primarily to invest Capital Corp's contributions in shares of Capital Corp's Common Stock. All assets of the ESOP are held in trust for the exclusive benefit of participants and are administered by a committee appointed by the directors of Capital Corp. However, each participant has the right to direct the trustee as to the manner in which these shares of Capital Corp's stock which are credited to the account of each participant are to be voted. The Company has made and in the future intends to make periodic contributions to the ESOP in amounts determined by the

14

Board of Directors. The Company cannot determine the effect, if any, on the market quotations of, or on the market in general for, Capital Corp's Common Stock which could result from future ESOP acquisitions of Capital Corp's shares. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

401(k) Plan

The Board of Directors has established an employee profit sharing plan under Section 401(k) of the Internal Revenue Code of 1986. The purpose of the employee profit-sharing plan is to provide all eligible employees with supplemental income upon retirement and to increase employees, proprietary interest in Capital Corp. Eligible employees may make contributions to the plan subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Company provides discretionary matching contributions equal to a percentage of the amount the employee elects to contribute. For 2001, the Company made contributions to the Plan in the amount equal to 25% of the amount of salary which an employee contributed to the Plan, up to the maximum employee contribution amount of 10% of salary, with the Company's contribution, made payable in the form of Capital Corp Common Stock and subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Plan trustees, consisting of members of Capital Corp's management, administered the Plan. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

Compensation/Benefits Committee Report

The following is the report of Capital Corp's Executive Committee which serves as the Compensation/Benefits Committee with respect to compensation of executive officers of the Company.

It is the duty of the Executive Committee to administer the Company's incentive compensation programs, benefits plans, stock option plan and long-term compensation programs. In addition, the Committee reviews the compensation levels of members of management, provides input on the performance of management and considers management succession and related matters.

The Committee reviews the reasonableness of compensation paid to senior officers of the Company. In doing so, the members of the Committee review surveys from various sources in regard to compensation levels for those senior officers.

The Company's Chief Executive Officer's base salary and other benefits for 2001 were based primarily on the terms established under his employment agreement with the Company dated March 1, 1997, as described above.

The Company's non-executive incentive compensation program is based upon the achievement of certain financial objectives. Those financial objectives are established by management and approved by the Board of Directors prior to the start of the fiscal year. For the year 2001, the incentive program was based on predetermined goals for each individual employee, excluding executive officers. The Committee also has the authority to provide additional incentive compensation based upon the Committee's overall assessment of the Company's performance and the individual officer's performance.

In 1999 the Board established an incentive compensation plan for the Company's executive officers. The plan is reviewed by the Board annually and incentive compensation to be paid under the plan is based on the achievement of a bottom-line earnings target for the year approved in advance by the Board. It is the intent of the Board to renew the plan on an annual basis and to establish annual earnings targets.

15

The granting of stock options is determined at the discretion of the Board based upon an officer's responsibilities and relative position in the Company.

No voting member of the Committee is a former or current officer of the Company or any of its subsidiaries. The Company's Chief Executive Officer is a non-voting member of the Executive committee as it relates to compensation issues.

Indebtedness of Management

Certain of Capital Corp's directors and executive officers, as well as their immediate families, associates and companies in which they have a financial interest, are customers of, and have had banking transactions with, County Bank in the ordinary course of the Bank's business, and the Bank expects to have such ordinary banking transactions with these persons or entities in the future. In the opinion of the Bank's management, the Bank made all loans and commitments to lend included in such transactions in compliance with applicable laws and on substantially the same terms, including interest rates and collateral, as those prevailing for comparable transactions with other persons and entities of similar creditworthiness, and these loans do not involve more than a normal risk of collectibility or present other unfavorable features.

Transactions with Management

There are no other existing or proposed material transactions between Capital Corp and any at its directors, executive officers, nominees for election as a director, or the immediate families or associates of any of the foregoing persons. In accordance with its policies, Capital Corp obtains competitive bids for products and services from independent parties before selecting a vendor of such products and services.

16

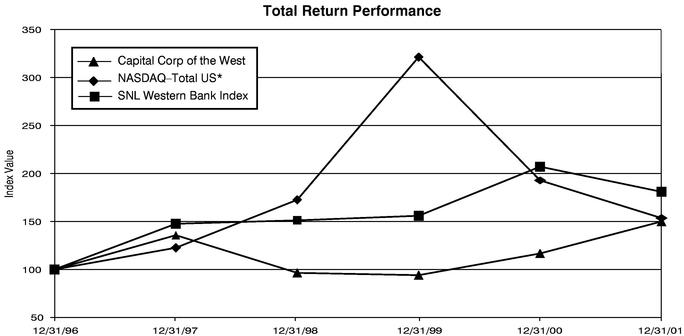

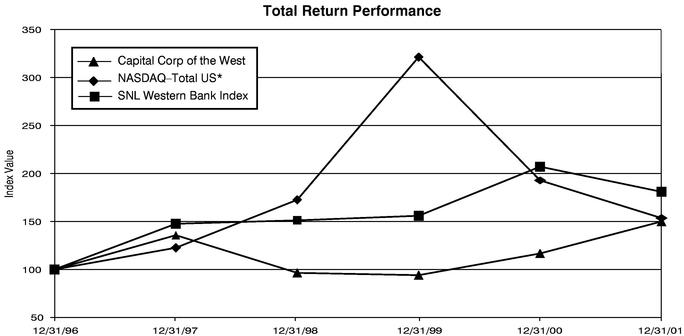

Stock Performance Graph

The following graph compares the change on an annual basis in Capital Corp's cumulative total return on its common stock with (a) the change in the cumulative total return on the stock included in the NASDAQ Composite Index for U.S. Companies, (b) the change in the cumulative total return on the stock as included in the SNL Securities "Western Bank Index", a peer industry group, and (c) the change in the cumulative total return on stock included in the "NASDAQ Bank Index", a peer industry group, assuming an initial investment of $100 on December 31, 1996. All of these cumulative total returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the period. The common stock price performance shown below should not be viewed as being indicative of future performance.

Capital Corp of the West

Index

| | 12/31/96

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

|---|

| Capital Corp of the West | | 100.00 | | 136.16 | | 95.72 | | 94.50 | | 116.31 | | 150.12 |

| NASDAQ—Total US* | | 100.00 | | 122.48 | | 172.68 | | 320.89 | | 193.01 | | 153.15 |

| SNL Western Bank Index | | 100.00 | | 147.41 | | 151.05 | | 156.10 | | 206.67 | | 180.73 |

17

Reports Required Under Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 ("Exchange Act") requires each person (i) who owns more than 10% of any class of equity security which is registered under the Exchange Act or (ii) who is a director or one of certain officers of the issuer of such security to file with the Securities and Exchange Commission certain reports regarding the beneficial ownership of such persons of all equity securities of the issuer. Capital Corp has established a procedure to aid persons who are officers and directors of Capital Corp in timely filing reports required by the Exchange Act.

The Board of Directors is required to disclose unreported filings from prior years of which the Board of Directors has knowledge.

For 2001, the following directors filed SEC Forms 4 late: Jerry Callister, G. Michael Graves; Gerald L. Tahajian; and James W. Tolladay.

PROPOSAL TWO:

APPROVE CAPITAL CORP OF THE THE WEST 2002 STOCK OPTION PLAN

The Board of Directors has adopted the Capital Corp of the West 2002 Stock Option Plan ("Plan"). The Plan replaces the County Bank of Merced 1992 Stock Option Plan, which was adopted as the stock option plan of Capital Corp of the West at the time Capital Corp of the West was formed as the bank holding company for County Bank. The purpose of the Plan is to encourage officers, employees and directors of the Company to acquire stock in the Company and to provide such persons with an additional incentive to promote the financial success of the Company, thereby creating shareholder value. A copy of the Plan is attached as Exhibit A to this Proxy Statement. The following discussion is qualified in its entirety by reference to the Plan.

The Plan authorizes the Company to grant options that qualify as incentive stock options ("ISO") under the Internal Revenue Code of 1986 and nonqualified stock options ("NQSO") to officers and employees of the Company. Nonemployee directors are only eligible to receive NQSOs. To the extent that the aggregate fair market value of stock with respect to which ISOs are exercisable for the first time by any individual during any calendar year exceeds $100,000, such options will be treated as NQSOs.

The Plan sets aside 250,000 authorized, but unissued, shares of the Company's Common Stock ("Shares") for grant at not less than an amount per share that approximates the fair market value of the Company's Common Stock on the date the option is granted. In addition, if an ISO is granted to an officer or employee of the Company who, at the time of the grant, owns more than 10 percent of the Company's Common Stock, the exercise price of the options must be not less than 110 percent of the fair market value of the Company's Common Stock at the time the option is granted. As of March 1, 2002, the Company's Common Stock was reported to be trading for approximately $17.90 per share. The 250,000 options authorized under the Plan are equal to approximately five percent of the total number of Shares currently outstanding.

Upon receipt of cash (or, with the consent of the Board of Directors, common stock already owned by the optionee) which equals the total consideration for the exercise of a stock option, share certificates will be issued to the exercising optionee. Options will expire as specified in the Plan, or on such date as the Board of Directors may determine at the time the Company grants the option; provided, however, an option may not have a term in excess of ten years.

Options may only be transferred by will or the laws of descent and distribution, and only the optionee may exercise an ISO during the optionee's lifetime. In the event of the termination of the employee's or nonemployee director's service because of death, the optionee's estate or any person who acquired the right to exercise the option by bequest or inheritance will be entitled, but only within 12 months from the date of termination, to exercise all options the optionee would have been entitled

18

to exercise had the optionee remained employed for one year from the date of such termination. In the event of the optionee's termination because of disability, the optionee may, within 12 months from the date of termination (and in no event later than the expiration date of the term of the option) exercise his or her option to the extent that the optionee was entitled to exercise it at the date of termination; provided, however, that the Board of Directors may on a case-by-case basis extend the period during which a NQSO may be exercised following such termination. All options granted pursuant to the Plan become exercisable in full in the event of a change in control with respect to the Company.

The Board of Directors may amend, suspend or terminate the Plan at any time and for any reason. An amendment of the Plan is subject to shareholder approval only to the extent required by law, regulation or rule.

Unless the Board of Directors terminates the Plan earlier, the Plan will terminate on April 23, 2012. The Company may not grant any options under the Plan after the termination date, but termination will not affect any option previously granted by the Company.

The Plan will be administered by the Board of Directors or by a committee appointed by the Board. The Board or the committee will have the authority to construe and interpret the Plan; define the terms used therein; prescribe, amend and rescind rules and regulations related to administration of the Plan; select from the eligible class of individuals the persons to whom and the times at which options should be granted, the terms of stock option agreements and the number of shares subject to each option; and make all other determinations necessary or advisable for administration of the Plan. Also, the Board or the committee may adopt such rules or guidelines as it deems appropriate to implement the Plan. The determinations of the Board of Directors under the Plan will be final and binding on all persons.

Neither the optionee nor the Company will incur any federal tax consequences as a result of the grant of an option. The optionee will have no taxable income upon exercising an ISO (except that the alternative minimum tax may apply), and the Company will receive no deduction when an ISO is exercised. Upon exercising an NQSO, the optionee generally must recognize ordinary income equal to the "spread" between the exercise price and the fair market value of the Company's Common Stock on the date of exercise; the Company will be entitled to a business expense deduction for the same amount. In the case of an employee, the option spread at the time an NQSO is exercised is subject to income tax withholding, but the optionee generally may elect to satisfy the withholding tax obligation by having shares of Common Stock withheld from those purchased under the NQSO. The tax treatment of a disposition of option shares acquired under the Plan depends on how long the shares have been held and on whether such shares were acquired by exercising an ISO or by exercising an NQSO. The Company will not be entitled to a deduction in connection with a disposition of option shares, except in the case of a disposition of shares acquired under an ISO before the applicable ISO holding period has been satisfied.

Recommendation of the Board of Directors

The Board of Directors urges you to voteFOR PROPOSAL TWO.

Change of Control

Management is not aware of any arrangements, including the pledge by any person of shares of Capital Corp, the operation of which may at a subsequent date result in a change of control of Capital Corp.

19

Shareholder Proposals

Subject to regulations promulgated under the Exchange Act, proposals of shareholders must be received by Capital Corp not later than November 13, 2002 in a form that complies with applicable regulations, to be included in the 2003 proxy statement. Shareholders who only wish to raise proposals from the floor of the 2003 Annual Meeting must provide notice to the Company no later than January 27, 2003.

Independent Public Accountants

Management selected KPMG LLP as the independent certified public accountants of Capital Corp for the fiscal year ended December 31, 2001. A representative of KPMG LLP is expected to attend the Meeting. The representative will have the opportunity to make a statement, if desired, and is expected to be available to respond to appropriate shareholder inquiries.

Other Matters

The Board of Directors of Capital Corp knows of no other matters which will be brought before the Meeting, but if such matters are properly presented, proxies solicited hereby relating to the Meeting will be voted in accordance with the judgment of the persons holding such proxies. All shares represented by duly executed proxies will be voted at the Meeting.

If any shareholder would like a copy of Capital Corp's Annual Report on Form of 10-K for the fiscal year ended December 31, 2001, it can be obtained without charge (except for certain exhibits) by contacting Gloria Lind, Corporate Secretary, Capital Corp of the West, 550 West Main St., P.O. Box 351, Merced, California 95341-0351.

20

Exhibit A

CAPITAL CORP OF THE WEST 2002 STOCK OPTION PLAN

1. Purpose of the Plan.

The purpose of the Capital Corp of the West 2002 Stock Option Plan is to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to Directors, Employees and Consultants of the Company, and to promote the success of the Company's business. Options granted under the Plan may be Incentive Stock Options or Nonstatutory Stock Options, as determined by the Administrator at the time of grant of an Option and subject to the applicable provisions of Section 422 of the Code and the regulations promulgated thereunder. The Options offered pursuant to the Plan are a matter of separate inducement and are not in lieu of salary or other compensation.

2. Definitions.

As used herein, the following definitions shall apply:

(a) "Administrator" means the Board or any of its Committees appointed pursuant to Section 4 of the Plan.

(b) "Board" means the Board of Directors of the Company.

(c) "Code" means the Internal Revenue Code of 1986, as amended.

(d) "Committee" means a Committee appointed by the Board in accordance with Section 4 of the Plan.

(e) "Common Stock" means the common stock, no par value, of the Company.

(f) "Company" means Capital Corp of the West, a California corporation.

(g) "Consultant" means any person who is engaged by the Company to render consulting or advisory services and is compensated for such services.

(h) "Continuous Status as a Director, Employee or Consultant" means that the director, employment or consulting relationship with the Company is not interrupted or terminated. Continuous Status as a Director, Employee or Consultant shall not be considered interrupted in the case of (i) any leave of absence approved by the Company or (ii) transfers between locations of the Company or transfers to any subsidiary of the Company, or between a subsidiary and the Company or any successor. A leave of absence shall include sick leave or any other personal leave approved by an authorized representative of the Company. For purposes of Incentive Stock Options, no such leave may exceed 90 days, unless reemployment upon expiration of such leave is guaranteed by statute or contract, including policies of the Company. If reemployment upon expiration of a leave of absence approved by the Company is not so guaranteed, on the day which is three months after the 91st day of such leave any Incentive Stock Option held by the Optionee shall cease to be treated as an Incentive Stock Option and shall be treated for tax purposes as a Nonstatutory Stock Option.

(i) "Director" means a member of the Board of Directors of the Company.

(j) "Employee" means any person, including an Officer or Director, employed by the Company. The payment of a director's fee by the Company shall not be sufficient to constitute "employment."

(k) "Exchange Act" means the Securities Exchange Act of 1934, as amended.

(l) "Fair Market Value" means, as of any date, the value of the Common Stock determined as follows:

(i) If the Common Stock is listed on any established stock exchange or a national market system, including without limitation the Nasdaq National Market of the National Association of

21

Securities Dealers, Inc. Automated Quotation ("NASDAQ") System, its Fair Market Value shall be the closing sales price for such stock (or the closing bid, if no sales were reported) as quoted on such exchange or system for the last market trading day prior to the time of determination and reported inThe Wall Street Journal or such other source as the Administrator deems reliable;

(ii) If the Common Stock is quoted on the NASDAQ System (but not on the Nasdaq National Market thereof) or regularly quoted by a recognized securities dealer but selling prices are not reported, its Fair Market Value shall be the mean between the high bid and low asked prices for the Common Stock on the last market trading day prior to the day of determination; or

(iii) In the absence of an established market for the Common Stock, the Fair Market Value thereof shall be determined in good faith by the Administrator.

(m) "Incentive Stock Option" means an Option intended to qualify as an incentive stock option within the meaning of Section 422 of the Code.

(n) "Nonstatutory Stock Option" means an option not intended to qualify as an Incentive Stock Option.

(o) "Notice of Grant" means the notice of stock option grant to be given to each of the Optionees.

(p) "Officer" means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

(q) "Option" means a stock option granted pursuant to the Plan.

(r) "Optionee" means a Director, Employee or Consultant who receives an Option.

(s) "Plan" means the Capital Corp of the West 2002 Stock Option Plan.

(t) "Rule 16b-3" means Rule 16b-3 promulgated under the Exchange Act or any successor thereto.

(u) "Section 16(b)" means Section 16(b) of the Exchange Act.

(v) "Share" means each of the shares of Common Stock subject to an Option, as adjusted in accordance with Section 11 below.

3. Stock Subject to the Plan.

Subject to the provisions of Section 11 of the Plan, the maximum number of shares of Common Stock that may be issued under this Plan is 250,000 unless amended by the Board or the shareholders of the Company.

If an Option expires or becomes unexercisable without having been exercised in full, or is surrendered pursuant to an option exchange pursuant to Section 4(c)(vi) or otherwise, the unpurchased Shares which were subject thereto shall become available for future grant or sale under the Plan (unless the Plan has terminated). However, Shares that have actually been issued under the Plan upon exercise of an Option shall not be returned to the Plan and shall not become available for future distribution under the Plan.

4. Administration of the Plan.

(a) Administration by Board or Committee of Board. The Plan shall be administered as follows:

(i) Multiple Administrative Bodies. If permitted by Rule 16b-3, the Plan may be administered by different bodies with respect to Directors, Officers and Employees who are neither Directors nor Officers.

(ii) Administration With Respect to Directors and Officers. With respect to grants of Options to Directors or Employees who are also Officers or Directors, the Plan shall be

22

administered by (A) the Board if the Board may administer the Plan in compliance with any applicable laws, including the rules under Rule 16b-3 relating to the disinterested administration of employee benefit plans under which Section 16(b) exempt discretionary grants and awards of equity securities are to be made, or (B) a Committee designated by the Board to administer the Plan, which Committee shall be constituted to comply with any applicable laws, including the rules under Rule 16b-3 relating to the disinterested administration of employee benefit plans under which Section 16(b) exempt discretionary grants and awards of equity securities are to be made. Once appointed, such Committee shall continue to serve in its designated capacity until otherwise directed by the Board. From time to time the Board may increase the size of the Committee and appoint additional members thereof, remove members (with or without cause) and appoint new members in substitution therefor, fill vacancies, however caused, and remove all members of the Committee and thereafter directly administer the Plan, all to the extent permitted by any applicable laws, including the rules under Rule 16b-3 relating to the disinterested administration of employee benefit plans under which Section 16(b) exempt discretionary grants and awards of equity securities are to be made.

(iii) Administration With Respect to Other Employees and Consultants. With respect to grants of Options to Employees or Consultants who are neither Directors nor Officers, the Plan shall be administered by (A) the Board or (B) a Committee designated by the Board, which committee shall be constituted in such a manner as to satisfy the legal requirements relating to the administration of stock option plans, if any, of United States securities laws, of California corporate and securities laws, of the Code, and of any applicable stock exchange (the"Applicable Laws"). Once appointed, such Committee shall continue to serve in its designated capacity until otherwise directed by the Board. From time to time the Board may increase the size of the Committee and appoint additional members thereof, remove members (with or without cause) and appoint new members in substitution therefor, fill vacancies, however caused, and remove all members of the Committee and thereafter directly administer the Plan, all to the extent permitted by the Applicable Laws.

(iv) Compliance with Section 162(m). If, at any time, awards made under the Plan shall be subject to Section 162(m) of the Code, the Plan shall be administered by a committee comprised solely of "outside directors" (within the meaning of Treas. Reg. § 1.162-27(e)(3)) or such other persons as may be permitted from time to time under Section 162(m) of the Code and the Treasury Regulations promulgated thereunder.

(b) Powers of the Administrator. Subject to the provisions of the Plan and, in the case of a Committee, the specific duties delegated by the Board to such Committee, and subject to the approval of any relevant authorities, including the approval, if required, of any stock exchange upon which the Common Stock is listed, the Administrator shall have the authority in its discretion:

(i) to determine the Fair Market Value of the Common Stock in accordance with Section 2(l) of the Plan;

(ii) to select the Directors, Consultants and Employees to whom Options may from time to time be granted hereunder;

(iii) to determine whether and to what extent Options are granted hereunder;

(iv) to determine the number of Shares to be covered by each such award granted hereunder;

(v) to approve forms of agreement for use under the Plan;

(vi) to construe and interpret the terms of the Plan and awards granted pursuant to the Plan.

(c) Effect of Administrator's Decision. All decisions, determinations and interpretations of the Administrator shall be final and binding on all Optionees and any other holders of any Options.

23

5. Eligibility.

(a) Nonstatutory Stock Options may be granted to Directors, Employees and Consultants. Incentive Stock Options may be granted only to Employees. A Director, Employee or Consultant who has been granted an Option may, if otherwise eligible, be granted additional Options.

(b) Each Option shall be designated in the written option agreement as either an Incentive Stock Option or a Nonstatutory Stock Option. However, notwithstanding such designation, to the extent that the aggregate Fair Market Value of the Shares with respect to which Incentive Stock Options are exercisable for the first time by the Optionee during any calendar year (under all plans of the Company) exceeds $100,000, such Options shall be treated as Nonstatutory Stock Options. For purposes of this Section 5(b), Incentive Stock Options shall be taken into account in the order in which they were granted. The Fair Market Value of the Shares shall be determined as of the time the Option with respect to such Shares is granted.

(c) Neither the Plan nor any Option shall confer upon any Optionee any right with respect to continuation of his or her employment or consulting relationship with the Company, nor shall it interfere in any way with his or her right or the Company's right to terminate his or her employment or consulting relationship at any time, with or without cause.

6. Term of Plan.

The Plan shall become effective upon the earlier to occur of its adoption by the Board or its approval by the shareholders of the Company, as described in Section 18 of the Plan. It shall continue in effect for a term of ten years unless sooner terminated under Section 13 of the Plan.

7. Term of Option.

The term of each Option shall be the term stated in the Option Agreement; provided, however, that the term shall be no more than ten years from the date of grant thereof. In the case of an Incentive Stock Option granted to an Optionee who, at the time the Option is granted, owns stock representing more than ten percent of the voting power of all classes of stock of the Company, the term of the Option shall be five years from the date of grant thereof or such shorter term as may be provided in the Option Agreement.

8. Option Exercise Price and Consideration.

(a) The per share exercise price for the Shares to be issued upon exercise of any Option shall be such price as is determined by the Administrator, but shall be subject to the following:

(i) In the case of an Incentive Stock Option

(A) granted to an Employee who, at the time of grant of such Option, owns stock representing more than ten percent of the voting power of all classes of stock of the Company, the per Share exercise price shall be no less than 110 percent of the Fair Market Value per Share on the date of grant.

(B) granted to any other Employee, the per Share exercise price shall be no less than 100 percent of the Fair Market Value per Share on the date of grant.

(ii) In the case of a Nonstatutory Stock Option granted to any person, the per Share exercise price shall be no less than 100 percent of the Fair Market Value per Share on the date of grant.

(b) The consideration to be paid for the Shares to be issued upon exercise of an Option, including the method of payment, shall be determined by the Administrator (and, in the case of an Incentive Stock Option, shall be determined at the time of grant). Such consideration may consist of (i) cash, (ii) check or (iii) any combination of those methods of payment. In addition, if there is a public market

24

for the Shares, the Administrator may allow the Optionee to elect to pay the exercise price through either of the following procedures:

(i) A special sale and remittance procedure under which the Optionee provides irrevocable written instructions to a designated brokerage firm to effect the immediate sale of a portion of the purchased Shares and remit to the Company, out of the sale proceeds available on the settlement date, an amount sufficient to cover the aggregate option price payable for the purchased Shares plus all applicable Federal and State income and employment taxes required to be withheld by the Company by reason of such purchase and/or sale. The Optionee must also provide such irrevocable written instructions to the Company to deliver the certificates for the purchased Shares directly to such brokerage firm to effect the sale transaction. In making its determination as to the type of consideration to accept, the Administrator shall consider if acceptance of such consideration may be reasonably expected to benefit the Company. Optionee shall also deliver a properly executed exercise notice together with such other documentation as the Administrator and a broker, if applicable, shall require to effect an exercise of the Option.

(ii) The surrender to the Company of shares of the Company's common stock which have already been owned by the Optionee for more than six months. The shares of the Company's common stock which are surrendered to the Company as payment for Shares issued upon the exercise of an Option shall be valued at their Fair Market Value on the date of exercise of the Option.

9. Exercise of Option.