QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

CAPITAL CORP OF THE WEST |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CAPITAL CORP OF THE WEST

550 West Main Street

P.0. Box 351

Merced, CA 95341-0351

March 17, 2003

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Capital Corp of the West (the Company) to consider and vote upon (1) a proposal to elect three Class I directors; (2) such other business as may properly come before the meeting.

The meeting will take place at 7:00 p.m. local time on April 16, 2003, at the Capital Corp of the West/County Bank headquarters on the 3rd floor at 550 W. Main Street (between M and Canal streets), Merced, California.

Enclosed are the Secretary's Notice of this meeting, a Proxy Card, the Proxy Statement describing the proposals, and a return envelope. Also enclosed is a copy of the Company's 2002 Annual Report to shareholders.

We encourage you to attend this meeting. Whether or not you are able to attend, please complete, date, sign, and return promptly the enclosed Proxy Card so that your shares will be represented at the meeting. You may also vote your shares by utilizing the toll free number listed on the Proxy Card or via the Internet by utilizing the Control Number listed on the Proxy Card. You may also vote at the meeting if you have not voted prior to the meeting. If you choose to do so, please bring to the meeting the enclosed Proxy Card and proof of your identify. If you chose to vote in this alternative manner, there is no need to return your Proxy Card. I look forward to seeing you.

| | | Very truly yours, |

|

|

|

| | | Thomas T. Hawker

President and Chief Executive Officer |

CAPITAL CORP OF THE WEST

Merced, California 95341-0351

March 17, 2003

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of the Shareholders of Capital Corp of the West (Capital Corp) will be held on Wednesday, April 16, 2003, at 7:00 p.m. local time at the Capital Corp of the West/County Bank headquarters on the 3rd floor at 550 W. Main Street (between M and Canal streets), Merced, California. The meeting will be held for the following purposes:

- 1.

- To elect three Class I directors;

- 2.

- To consider and act upon such other matters as may properly come before such meeting or any adjournment thereof.

Holders of Capital Corp common stock of record at the close of business on March 3, 2003 are entitled to notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. Please sign and date the enclosed Proxy Card and return it promptly in the envelope provided, whether or not you plan to attend the meeting. Shareholders of Record may vote by utilizing the toll free number 1-866-416-8422 and the "Control Number" listed on the Proxy Card. Instructions for utilizing for the toll free number are listed on the Proxy Card. You may also vote via the Internet by following the instructions listed on the Proxy Card. Voting via telephone and Internet will be suspended 24 hours prior to the meeting date. This Proxy Statement is distributed by and the enclosed proxy is solicited on behalf of the Board of Directors of Capital Corp.

| By Order of the Board of Directors, | | |

|

|

|

Cherrie Zemanek

Corporate Secretary | | |

PROXY STATEMENT OF

CAPITAL CORP OF THE WEST FOR THE ANNUAL MEETING OF SHAREHOLDERS

P.O. Box 351

550 West Main St.

MERCED, CALIFORNIA 95341-0351

(209) 725-2269

March 17, 2003

This Proxy Statement and the accompanying form of proxy are being mailed to shareholders on or about March 17, 2003.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND THE ANNUAL MEETING

Q: Why am I receiving these materials?

A: The Board of Directors of Capital Corp of the West is providing these proxy materials for you in connection with the Company's annual meeting of shareholders, which will take place on April 16, 2003. As a shareholder, you are invited to attend the meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

Q: What information is contained in these materials?

A: The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and executive officers, and certain other required information. Our 2002 Annual Report is also enclosed.

Q: What shares owned by me can be voted?

A: All shares owned by you as of the close of business on March 3, 2003, theRecord Date, may be voted by you. These shares include (1) shares held directly in your name as theshareholder of record, including shares purchased through the Company's Employee Stock Purchase Plan and (2) shares held for you as thebeneficial owner through a stockbroker or bank or shares purchased through the Company's 401(k) plan. Shares purchased through the Capital Corp of the West ESOP for your account are voted by the trustee(s) of the plan at your direction.

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner?

A: Most shareholders hold shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

If your shares are registered directly in your name with the Company's transfer agent, Computershare Investor Services, LLC, you are considered, with respect to those shares, theshareholder of record, and these proxy materials are being sent directly to you by the Company. As theshareholder of record, you have the right to vote by proxy or to vote in person at the meeting. The Company has enclosed a Proxy Card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial owner of shares heldin street name, and these proxy materials are being forwarded to you by your broker or nominee which is considered, with respect to those shares, theshareholder of record. As the beneficial owner, you have the right to direct your broker how to vote and are also invited to attend the meeting. If you wish to vote these shares at the meeting, you must contact your bank or broker for instructions as to how to do so. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares on your behalf.

Q: How can I vote my shares in person at the meeting?

A: Shares held directly in your name as theshareholder of record may be voted in person at the annual meeting. If you choose to attend the meeting, please bring to the meeting the enclosed Proxy Card and proof of your identity.

Even if you currently plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the meeting. Shares held in street name can be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

Q: How can I vote my shares without attending the meeting?

A: Whether you hold shares directly as a shareholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting your voting instructions to your broker or nominee. In most instances you will be able to do this by telephone or by mail. Please refer to the summary instructions below and those included on your Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee.

By Internet—If you have Internet access, you may submit your proxy from any location in the world by following the "Vote by Internet" instructions on the Proxy Card.

By Telephone—If you live in the United States or Canada, you may submit your proxy by following the "Vote by Phone" instructions on the Proxy Card.

By Mail—You may do this by returning your signed Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee and mailing it in the enclosed, postage pre-paid and addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct. If you sign the proxy card but do not provide instructions, your shares will be voted as described below in "How are votes counted?"

Q: Can I change my vote?

A: You may change your proxy instructions at any time prior to the vote at the annual meeting. For shares held in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the annual meeting and voting in person. Also, you may file with the Secretary of the Company a written notice of revocation at any time before your proxy is exercised at the meeting. Attendance at the meeting will not cause your previously granted proxy to be automatically revoked unless you specifically so request or unless you vote at the meeting. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee. Your changed voting instructions must be received sufficiently in advance of the meeting to allow your vote to be changed.

Q: How are votes counted?

A: In the election of directors you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees or all of the nominees. If you sign your Proxy Card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendation of the Board ("FOR" all of the Company's nominees to the Board and at the discretion of the proxy holders on any other matters that properly come before the meeting).

2

Q: What does it mean if I receive more than one proxy or voting instruction card?

A: It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive so that all your shares will be represented at the meeting.

Q: Is my vote confidential?

A: Generally proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except (1) as necessary to meet applicable legal requirements, and (2) to allow for the tabulation of votes and certification of the vote.

3

INFORMATION CONCERNING PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Capital Corp of the West ("Capital Corp" or the "Company") of proxies to be voted at the Annual Meeting of Shareholders of Capital Corp (the "Meeting") and any adjournments or postponements thereof. At the Meeting, the Shareholders of Capital Corp will be asked to (1) elect three Class I directors; and (2) act upon such other matters as may properly come before such meeting or any adjournment thereof.

Date, Time and Place of Meeting

The Meeting will be held on April 16, 2003 at 7:00 p.m. at the headquarters of Capital Corp of the West/County Bank at 550 W. Main Street, 3rd Floor (between M and Canal streets), Merced, California.

Record Date and Voting Rights

Only holders of record of Capital Corp common stock at the close of business on March 3, 2003 (the "Record Date") are entitled to notice of the Meeting and to vote at the Meeting. At the Record Date, there were approximately 2,000 shareholders of record and 5,325,082 shares of Capital Corp common stock outstanding and entitled to vote. Directors and executive officers of Capital Corp and their affiliates owned beneficially as of the Record Date an aggregate of 426,978 shares or approximately 7.6% of the outstanding Capital Corp common stock (including shares subject to vested options).

Each shareholder is entitled to one vote for each share of common stock he or she owns. In the election of directors, the nominees receiving the greatest number of votes will be elected. Broker non-votes (i.e., shares held by brokers or nominees which are represented at the Meeting but with respect to which the nominee is not authorized to vote on a particular proposal) will not be counted, except for quorum purposes, and will have no effect on the election of directors.

Voting by Proxy; Revocability of Proxies

Shareholders may use the enclosed Proxy Card if they are unable to attend the Meeting in person or wish to have their shares voted by proxy even if they attend the Meeting. All proxies that are properly executed and returned, unless revoked, will be voted at the Meeting in accordance with the instructions indicated thereon or, if no direction is indicated, for the election of the Board's nominees as directors. The execution of a proxy will not affect the right of a shareholder to attend the Meeting and vote in person. A person who has given a proxy may revoke it at any time before it is exercised at the Meeting by filing with the Secretary of the Company a written notice of revocation or a proxy bearing a later date or by attendance at the Meeting and voting in person. Your changed voting instructions must be received sufficiently in advance of the meeting to allow your vote to be changed. Attendance at the Meeting will not, by itself, revoke a proxy.

Shareholders of Record may vote by utilizing the toll free number 1-866-416-8422 and the "Control Number" listed on the Proxy Card. Instructions for utilizing the toll free number are listed on the Proxy Card. You may also vote utilizing the Internet by accessing www.computershare.com/us/proxy, entering the Control Number and following the simple instructions. Voting via telephone and the Internet will be suspended 24 hours prior to the Meeting date. We have been advised by counsel that these telephone and Internet voting procedures comply with California law.

Quorum and Adjournments

A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. The Meeting may be adjourned, even if a quorum is present, by the vote of the holders of a majority of the

4

shares represented at the Meeting in person or by proxy. In the absence of a quorum at the Meeting, no other business may be transacted at the Meeting.

Notice of the adjournment of the Meeting need not be given if the time and place thereof are announced at the Meeting, provided that if the adjournment is for more than 45 days, or after the adjournment a new record date is fixed for the adjourned Meeting, a notice of the adjourned Meeting shall be given to each shareholder of record entitled to vote at the Meeting. At an adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

Nomination of Directors

The Company's Bylaws provide that any shareholder must give written notice to the President of Capital Corp of an intention to nominate a director at a shareholder meeting. The notice must be received by 21 days before the meeting or 10 days after the date of mailing of notice of the meeting, whichever is later. The Bylaws contain additional requirements for nominations. A copy of the requirements is available upon request directed to the President of Capital Corp.

Solicitation of Proxies

The proxy relating to the Meeting is being solicited by the Board. Capital Corp will pay the cost of printing and distributing this Proxy Statement. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians holding in their names shares of Capital Corp common stock beneficially owned by others to forward to such beneficial owners. Capital Corp may reimburse such persons for their expenses in forwarding solicitation materials to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of Capital Corp, who will not be additionally compensated therefore. The Company will pay the cost of all proxy solicitation.

5

PROPOSAL ONE: ELECTION OF DIRECTORS

The Bylaws of Capital Corp provide that the number of directors of Capital Corp may be no less than nine and no more than twelve. The exact number of directors within this range may be changed by action of the Board of Directors or the shareholders. The number of directors is currently fixed at ten.

NOMINEES FOR DIRECTOR

The Board of Directors is classified into three classes with staggered three-year terms. The three persons named below will be nominated for election as Class I Directors to serve until the Annual Meeting in the year 2006 and until their successors are duly elected and qualified. The three candidates receiving the greatest number of votes will be elected for three-year terms.

Dorothy L. Bizzini

Jerry E. Callister

Gerald L. Tahajian

If any nominee should become unable or unwilling to serve as a director, the proxies will be voted at the Meeting for such substitute nominees as shall be designated by the Board. The Board presently has no knowledge that any of the nominees will be unable or unwilling to serve.

The following table provides information with respect to each person that is being nominated and recommended to be elected by the current Board, as well as existing directors of Capital Corp whose terms do not expire at the time of the Meeting. Reference is made to the section entitled "Security Ownership of Certain Beneficial Owners and Management" for information pertaining to stock ownership of the nominees.

6

Name/Class

| | Age

| | Director Since

| | Business Experience During Past Five Years

|

|---|

| Dorothy L. Bizzini, I | | 68 | | 1992 | | Partner in Atwater/Merced Veterinary Clinic, Inc.; Owner Of Dorothy Lee Apartments; Director of Bloss Memorial Health Care District; Chairman of Central Valley Dental Clinic |

Jerry E. Callister, I |

|

60 |

|

1991 |

(1) |

Partner, Callister & Hendricks, Inc., a professional law corporation, Manager, Tioga Properties, LLC; Callister & Hendricks, General Partnership, a professional law partnership; and Partner, Yosemite Highlands, real estate investments |

Gerald L. Tahajian, I |

|

62 |

|

2001 |

|

President, Gerald Lee Tahajian, Inc., a professional law corporation |

John D. Fawcett, II |

|

54 |

|

1995 |

|

President and Manager, Fawcett Farms, Inc. |

Thomas T. Hawker, II |

|

60 |

|

1991 |

|

President/CEO Capital Corp and County Bank |

Curtis A. Riggs, II |

|

54 |

|

2000 |

|

CEO VIA Adventures, a transportation company; CEO Merced Transportation Company, school bus service; CEO Carskaddon Enterprises, Inc., a leasing company |

G. Michael Graves, III |

|

51 |

|

2001 |

|

Principal, Pacific Resources, Inc., a financial, strategic planning, accounting and administrative management firm |

Bertyl W. Johnson, III |

|

71 |

|

1977 |

|

Tree crop farmer and nut processor |

James W. Tolladay, III |

|

71 |

|

1991 |

|

Consultant, Tolladay, Fremming & Parson, a civil engineering consulting firm; Former senior partner |

Tom A.L. Van Groningen, III |

|

69 |

|

1999 |

|

Consultant, educator, Director of Modesto Irrigation District; Chairman of the Board of Capital Corp |

- (1)

- Previously served on the Board of Directors from 1977 to 1985.

No family relationships exist among any of the directors or executive officers of the Company. No director or person nominated to become a director is a director of any other public company or registered investment company. All Company directors are independent as defined in the rules of NASDAQ.

Recommendation of the Board of Directors

The Board of Directors urges you to voteFOR PROPOSAL ONE.

Committees of the Board of Directors; Meeting Attendance

For 2002, the Capital Corp Board of Directors held twelve regularly scheduled meetings. The Company has an Executive Committee and an Audit Committee. Each director attended at least 75% of

7

the aggregate of the total number of meetings of the Board of Directors and the committees of the Board on which he or she served (during the period for which they served).

The primary function of the Executive Committee is to act as a vehicle for communication between the Board and the President and Chief Executive Officer. The Executive Committee also functions as the Compensation Committee. Mr. Van Groningen (Chairman), Mr. Callister, Mr. Fawcett, and Mr. Tolladay are members of the Executive Committee. During 2002, the Executive Committee held a total of twelve meetings. It establishes compensation for the Chief Executive Officer and evaluates and recommends to the Board benefits for other executive officers of Capital Corp. Upon the recommendation of the Chief Executive Officer, the Executive Committee grants stock options and approves corporate titles to employees of the Company.

The primary function of the Audit Committee is to monitor the integrity and timeliness of the Company's financial reporting process.

The Company does not have a nominating committee. The entire Board of Directors performs the function of the nominating committee.

Report of the Audit Committee

The Audit Committee is comprised of Mr. Graves (Chairman), Mr. Callister, Mr. Riggs and Mr. Tolladay. During 2002, the Audit Committee held six meetings.

The Audit Committee reviewed and discussed the audited financial statements and related judgements with management and the outside auditors.

Based on the review and discussions referred to above, the Audit Committee recommended to the full Board the inclusion of the financial statements in the Company's SEC Annual Report.

The Audit Committee operates under a charter adopted by the Board that was attached as an appendix to the proxy statement for the 2001 annual meeting of shareholders.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380).

The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Board Standards No. 1,Independence Discussions with Audit Committees), and has discussed with the independent accountant the independent accountant's independence.

The Company's Audit Committee has considered whether KPMG LLP's provisions of the services described below under "Information about Independent Accountant's Fees" are compatible with maintaining the independence of KPMG LLP.

| | | /s/ G. Michael Graves

/s/ Jerry E. Callister

/s/ Curtis A. Riggs

/s/ James W. Tolladay |

Information about Independent Accountant's Fees

Audit Fees

The aggregate amount of fees billed by KPMG LLP for professional services rendered for the audit of the Company's annual financial statements during the fiscal year ending December 31, 2002 and for reviews of financial statements included in the Company's Forms 10-Q for this fiscal year was $108,150.

8

Financial Information System Design and Implementation Fees

KPMG LLP did not perform any financial information system design and implementation services for the Company during the fiscal year ended December 31, 2002.

All Other Fees

The aggregate amount of fees billed for all other services rendered to the Company by KPMG LLP during the fiscal year ending December 31, 2002 was $241,800.

Director Attendance and Compensation

During 2002, non-employee directors received $700 per meeting for their attendance at regular Board meetings, $300 per meeting for attendance at Special Board meetings, $300 per Committee meeting, a $700 monthly retainer fee, and a $50-$120 (depending on distance) monthly car allowance. The Chairman of the Board receives $600 per month in addition to fees received for attendance at Board and Committee meetings, the $700 monthly retainer fee and monthly car allowance. Employee directors do not receive fees. Capital Corp directors earned a total of $236,361 in director fees during 2002.

The Company also maintains a non-qualified deferred compensation plan for members of the Board of Directors of the Company and County Bank. Under the deferred compensation plan, members of the Board of Directors have the ability to defer compensation they receive as Directors. Deferred amounts are credited with interest at the prime rate. If a Director leaves after ten years of service and reaching the age of 70, the Bank pays a stated benefit based on individual contributions in lieu of the actual amount in the Director's account. If a Director leaves before ten years and reaching the age of 70 for any other reason, the Bank pays the Director the actual value of the account, including interest. Upon reaching retirement age, the Company will pay these retirement benefits over a ten-year period. The plan is funded by several single premium universal life insurance policies that provide life insurance on certain Directors, with the Company named as the owner and beneficiary of these policies. The Bank has a Rabbi trust and specific life insurance contracts have been irrevocably assigned to the trust in support of the deferred compensation benefits.

Executive Officers of Capital Corp

Set forth below is certain information with respect to each of the executive officers of Capital Corp.

Name

| | Age

| | Positions and Offices

| | Executive Officer Since

|

|---|

| Thomas T. Hawker | | 60 | | President, CEO and Director

(Mr. Hawker also serves as President/CEO of County Bank) | | 1991 |

R. Dale McKinney |

|

57 |

|

Executive Vice President/Chief Financial Officer |

|

1999 |

Set forth below is certain information with respect to the executive officers of County Bank, a subsidiary of Capital Corp.

Name

| | Age

| | Positions and Offices

| | Executive Officer Since

|

|---|

| Ed J. Rocha | | 50 | | Executive Vice President and Chief Banking Officer | | 1997 |

James M. Sherman |

|

66 |

|

Executive Vice President/Chief Credit Officer |

|

1999 |

9

A brief summary of the background and business experience of the executive officers of Capital Corp and its subsidiaries is set forth below.

THOMAS T. HAWKER became County Bank's President and Chief Executive Officer in 1991 and President and Chief Executive Officer of Capital Corp in 1995. Prior to that he served as President and Chief Executive Officer of Concord Commercial Bank from 1986-1991.

R. DALE MCKINNEY became Capital Corp's Executive Vice President and Chief Financial Officer in 2001. He was the Company's Senior Vice President/Chief Financial Officer from 1999 to 2001. During 1998, Mr. McKinney was subject to a non-compete agreement with MBNA Corporation. In 1996-1997 he served as Senior Vice President-Finance for MBNA Corporation and from 1993-1995 he served as Senior Vice President-Finance for MBNA Information Services.

ED J. ROCHA became County Bank's Executive Vice President/Chief Banking Officer in 1999. He was the Bank's Senior Vice President/Chief Banking Officer from 1997-1999. He served as Vice President and Regional Manager for the Bank from 1995-1997. He served as Senior Vice President/Branch Administrator for Pacific Valley National Bank from 1989-1995.

JAMES M. SHERMAN became Executive Vice President/Chief Credit Officer for County Bank in 2001. He was the Bank's Senior Vice President/Chief Credit Officer from 1999 to 2001. Prior to that he served as Vice President of San Jose National Bank from 1994 to 1998 and was Acting Chief Credit Officer for San Jose National Bank from 1993-1994.

10

Beneficial Ownership of Management

The following table shows the number and percentage of shares beneficially owned (including shares subject to options exercisable currently or within 60 days) as of the Record Date by each director nominee, current director and named executive officer of the Company.

| | Beneficially

Owned(1)

|

|---|

Name of Beneficial Owner

|

|---|

| | Amount

| | Percentage

|

|---|

| Dorothy L. Bizzini | | 44,014 | (2) | * |

| Jerry E. Callister | | 17,810 | (3) | * |

| John D. Fawcett | | 19,964 | (4) | * |

| G. Michael Graves | | 8,989 | (5) | * |

| Thomas T. Hawker | | 125,334 | (6) | 2.2% |

| Bertyl W. Johnson | | 62,259 | (7) | 1.1% |

| R. Dale McKinney | | 31,024 | (8) | * |

| Curtis A. Riggs | | 12,667 | (9) | * |

| Ed J. Rocha | | 30,445 | (10) | * |

| James M. Sherman | | 9,689 | (11) | * |

| Gerald L. Tahajian | | 13,940 | (12) | * |

| James W. Tolladay | | 22,819 | (13) | * |

| Tom A.L. Van Groningen | | 18,024 | (14) | * |

All Directors and Executive Officers of the Company as a Group (13 in number) |

|

426,978 |

|

7.6% |

The address for all persons is Capital Corp of the West, 550 West Main Street, P.O. Box 1191, Merced, California, 95341-0351.

- *

- Indicates that the percentage of outstanding shares beneficially owned is less than one percent (1%).

- 1)

- Includes shares beneficially owned (including options exercisable within 60 days of the Record Date), directly and indirectly together with associates. Subject to applicable community property laws and shared voting and investment power with a spouse, the persons listed have sole voting and investing power with respect to such shares unless otherwise noted.

- 2)

- Includes 37,235 shares held as trustee in the Bizzini Family Trust and 6,779 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 3)

- Includes 14,483 shares held as trustee in the Jerry Callister and Kathryn Callister Family Trust, 20 shares held in children's names; and 3,307 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 4)

- Includes 7,062 shares held individually and 12,902 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 5)

- Includes 3,202 shares held in joint tenancy with spouse and 5,787 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 6)

- Includes 53,044 shares held individually; 3,558 shares held by his spouse; 18,301 held in Mr. Hawker's IRA; 2,205 shares held in joint tenancy with spouse; 1,779 shares held as custodian for daughter; 7,633 shares held through the Company ESOP; 13,712 shares held through the Company 401(k); and 25,102 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 7)

- Includes 48,795 shares held individually; 2,698 shares held in joint tenancy with spouse; 7,459 shares held in an IRA; and 3,307 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

11

- 8)

- Includes 10,513 shares held individually; 1,234 shares held through the Company ESOP; 1,772 shares through the Company 401(k); and 17,505 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 9)

- Includes 1,180 shares held individually; 2,315 shares held in a family trust; 2,558 shares held in the name of spouse and minor children; and 6,614 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 10)

- Includes 5,317 shares held in an IRA; 2,583 shares held through the Company ESOP; 5,543 shares in the Company 401(k); and 17,002 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 11)

- Includes 551 shares held jointly with spouse; 417 shares held through the Company ESOP; 1,216 shares through the Company 401(k); and 17,505 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 12)

- Includes 3,302 shares held in a family trust; 6,700 shares held in a corporate profit sharing plan; and 3,938 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 13)

- Includes 16,631 shares held individually in an IRA; 2,881 shares held jointly with his spouse; and 3,307 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

- 14)

- Includes 7,938 shares held in a family trust; 3,307 shares held individually; and 6,779 shares under stock options which are exercisable currently or within 60 days of March 3, 2003.

Principal Shareholders

As of December 31, 2002, no individuals known to the Board of Directors of Capital Corp owned of record or beneficially more than five percent of the outstanding shares of common stock of Capital Corp, except as described below:

Stock

Name and Address

| | Number of Shares

Beneficially Owned

| | Percentage of Outstanding

Beneficially Owned

|

|---|

1867 Western Financial Corporation

P.O. Box 1110

Stockton, CA 95201-1110 | | 618,942 | | 11.6% |

Heartland Advisors

789 North Water Street

Milwaukee, WI 53202-3508 |

|

274,721 |

|

5.2% |

Compensation and Other Transactions with Management and Others

Cash Compensation

The following information is furnished with respect to the aggregate cash compensation paid to the Chief Executive Officer, Chief Financial Officer, Chief Banking Officer and Chief Credit Officer of Capital Corp or its subsidiary County Bank during 2002. No other executive officer of Capital Corp or its subsidiaries received aggregate cash compensation of $100,000 or more in 2002.

12

Summary Compensation Table

| |

| |

| |

| | Long Term

Compensation

| |

|

|---|

| |

| | Annual Compensation(1)

| |

|

|---|

Name & Principal Position

| |

| | Stock Options

Granted (Number

of Shares)

| | All Other

Compensation(2)

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

| | Capital Corp of the West | | | | | | | | | | | | | |

Thomas T. Hawker

President/CEO |

|

2002

2001

2000 |

|

$

$

$ |

257,927

209,668

181,538 |

|

$

$

$ |

60,000

99,317

73,084 |

|

7,350

7,350

N/A |

|

$

$

$ |

10,750

9,425

9,425 |

Dale McKinney

EVP/Chief Financial Officer |

|

2002

2001

2000 |

|

$

$

$ |

157,694

143,454

132,275 |

|

$

$

$ |

43,500

51,714

39,000 |

|

3,675

3,675

N/A |

|

$

$

$ |

10,750

9,425

9,425 |

| |

County Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ed J. Rocha

EVP/Chief Banking Officer |

|

2002

2001

2000 |

|

$

$

$ |

152,256

137,129

118,750 |

|

$

$

$ |

43,000

50,000

33,051 |

|

3,675

3,675

N/A |

|

$

$

$ |

10,750

9,425

8,985 |

James M. Sherman

EVP/Chief Credit Officer |

|

2002

2001

2000 |

|

$

$

$ |

152,256

138,129

123,115 |

|

$

$

$ |

42,000

50,000

36,000 |

|

3,675

3,675

N/A |

|

$

$

$ |

10,750

9,425

9,231 |

- 1)

- The incremental cost to the Company of providing such incidental personal benefits to those executives noted above did not, for the fiscal year ending December 31, 2002, exceed 10% of the compensation to any of those reported above.

- (2)

- Includes Company contributions to ESOP and 401(k) plans.

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Pursuant to his employment contract effective January 1, 2002 through December 31, 2004, Mr. Hawker received a base salary of $260,000, adjusted annually for cost of living allowances and other salary increases if approved by the Board, use of a Company-owned automobile, medical, dental and disability insurance benefits available to the Company's employees generally and participation in the Company's other compensation plans such as its incentive compensation program, 401(k) plan, stock option plan and ESOP plan. Pursuant to his employment contract, should Mr. Hawker be terminated for reasons other than for cause, he would receive a severance payment equal to one year's then-current salary plus continuation of insurance benefits for one year. He will be entitled to receive grants of 7,000 incentive stock options on January 1, 2002, 2003 and 2004 at the then market value of the Company's stock if he is still actively employed by the Company. Each stock options will vest 25% on grant and 25% each year thereafter. In addition, in the event of an acquisition of Capital Corp, Mr. Hawker's employment contract will automatically terminate and Mr. Hawker will receive an acquisition payment equal to eighteen months' then-current salary plus continuation of insurance benefits for eighteen months.

Effective February 14, 2001, the executive officers are covered by a one-year severance package in case of a change in control of the Company.

In addition, Capital Corp provides Mr. Hawker and all executive officers with salary continuation plans. These are a non-qualified executive benefit plans pursuant to which the Company has agreed to pay retirement benefits to the executive officers in return for their continued satisfactory performance. They are unfunded plans; the executive has no rights under the agreements beyond those of a general creditor of the Company. The plans are funded by single premium universal life insurance policies. The Bank has a

13

Rabbi trust and specific life insurance contracts have been irrevocably assigned to the trust in support of the deferred compensation benefits. As the date of this proxy, Mr. Hawker is 100% vested, Mr. Rocha is 70% vested and Messrs. Sherman and McKinney are 40% vested in the plan. Mr. Sherman becomes vested in an additional 30% of plan payments for each full succeeding year of employment and will be 100% vested as of March 15, 2005. Mr. McKinney becomes vested in an additional 10% of plan payments for each full succeeding year of employment and will be 100% vested as of January 28, 2009. Mr. Rocha becomes vested in an additional 10% of plan payments for each full succeeding year of employment and will be 100% vested as of May 1, 2005. Mr. Hawker's benefits from this plan are $98,600 per year for a period of fifteen years. Mr. McKinney's benefits from this plan are $65,000 per year for a period of fifteen years. Mr. Rocha's benefits from this plan are $60,000 per year for fifteen years. Mr. Sherman's benefits from this plan are $50,000 per year for ten years. Should any of the executive officers terminate their employment or be terminated without cause, the executive would be entitled to distributions equal to the vested amount of the benefits under the terms and conditions of the agreement. Should any executive be terminated for cause, no benefit would be payable under the plan. All benefits under the plan vest immediately in the event of a change of control. The Board is currently in the process of revising salary continuation plans for the executive officers. The details of the revisions have not yet been finalized.

Stock Options

Option/SAR Grants in the Last Fiscal Year

Name

| | Number of

Securities

Underlying

Options/SARS

Granted(1)

| | % of Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | Exercise

or Base

Price

$/Sh(2)

| | Expiration

Date

| | Grant Date

Present

Value

|

|---|

| Thomas T. Hawker | | 7,350 | | 9.59% | | $ | 15.24 | | 1/22/2012 | | $ | 6.36 |

| R. Dale McKinney | | 3,675 | | 4.80% | | $ | 15.24 | | 1/22/2012 | | $ | 6.36 |

| Ed J. Rocha | | 3,675 | | 4.80% | | $ | 15.24 | | 1/22/2012 | | $ | 6.36 |

| James M. Sherman | | 3,675 | | 4.80% | | $ | 15.24 | | 1/22/2012 | | $ | 6.36 |

- (1)

- The material terms of all option grants to named officers during 2002 are as follows: (i) all options are incentive stock options; (ii) all options have an exercise price equal to the fair market value on the date of grant; (iii) all options have a ten-year term and become exercisable as follows: 25% at date of issuance and 25% per year for the subsequent three years; and (iv) all must be exercised within 90 days following termination of employment or they expire.

- (2)

- Exercise Price is determined by the average closing bid and ask prices on the date of grant.

- (3)

- The Black-Scholes option pricing model was used to estimate the Grant Date Present Value assuming (i) an expected dividend yield of 0%; (ii) an expected volatility of 29%; (iii) a risk-free interest rate of 4.75%; (iv) an option term of seven years.

14

The following table shows the number and estimated value of the exercisable and unexercisable stock options for the executive officers listed previously.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| |

| |

| | Number of

Securities Underlying

Unexercised Options

at December 31, 2002

| |

|

|---|

| |

| |

| | Value of Unexercised

in-the-money Options

at December 31, 2002

|

|---|

Name

| | Shares acquired

on exercise (#)

| | Value

realized ($)

|

|---|

| | Exercisable/unexercisable

| | Exercisable/unexercisable

|

|---|

| Thomas T. Hawker | | 53,044 | | $ | 777,784 | | 19,586/9,372 | | $219,164/$128,196 |

| R. Dale McKinney | | — | | | — | | 13,871/4,687 | | $140,450/ $64,112 |

| Ed J. Rocha | | — | | | — | | 14,243/4,687 | | $127,026/ $64,112 |

| James M. Sherman | | — | | | — | | 13,871/4,687 | | $130,451/ $64,112 |

Employee Stock Ownership Plan

The Board of Directors of Capital Corp has established, under Section 401(a) and 501(a) of the Internal Revenue Code of 1986, a qualified Employee Stock Ownership Plan ("ESOP") effective December 31, 1984. The purpose of the ESOP is to provide all eligible employees with additional incentive to maximize their job performance by providing them with an opportunity to acquire or increase their proprietary interest in Capital Corp and to provide supplemental income upon retirement. The ESOP is designed primarily to invest Capital Corp's contributions in shares of Capital Corp's Common Stock. All assets of the ESOP are held in trust for the exclusive benefit of participants and are administered by a committee appointed by the directors of Capital Corp. However, each participant has the right to direct the trustee as to the manner in which these shares of Capital Corp's stock which are credited to the account of each participant are to be voted. The Company has made and in the future intends to make periodic contributions to the ESOP in amounts determined by the Board of Directors. The Company cannot determine the effect, if any, on the market quotations of, or on the market in general for, Capital Corp's Common Stock which could result from future ESOP acquisitions of Capital Corp's shares. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

401(k) Plan

The Board of Directors has established an employee profit sharing plan under Section 401(k) of the Internal Revenue Code of 1986. The purpose of the employee profit-sharing plan is to provide all eligible employees with supplemental income upon retirement and to increase employees' proprietary interest in Capital Corp. Eligible employees may make contributions to the plan subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Company provides discretionary matching contributions equal to a percentage of the amount the employee elects to contribute. For 2002, the Company made contributions to the Plan in the amount equal to 25% of the amount of salary which an employee contributed to the Plan, up to the maximum employee contribution amount of 10% of salary, with the Company's contribution made payable in the form of Capital Corp Common Stock and subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Plan trustees, consisting of members of Capital Corp's management, administered the Plan. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

15

Compensation Committee Report

The following is the report of Capital Corp's Executive Committee. It is the duty of the Executive Committee to administer the Company's incentive compensation programs, benefits plans, stock option plan and long-term compensation programs. In addition, the Committee reviews the compensation levels of members of management, provides input on the performance of management and considers management succession and related matters.

The Committee reviews the reasonableness of compensation paid to senior officers of the Company. In doing so, the members of the Committee review surveys from various sources in regard to compensation levels for those senior officers.

The Company's Chief Executive Officer's base salary and other benefits for 2002 were based primarily on the terms established under his employment agreement with the Company dated January 1, 2002, as described above.

In 1999 the Board established an incentive compensation plan for the Company's executive officers. The plan is reviewed by the Board annually and incentive compensation to be paid under the plan is based on the achievement of a bottom-line earnings target for the year approved in advance by the Board. It is the intent of the Board to renew the plan on an annual basis and to establish annual earnings targets.

The granting of stock options is determined at the discretion of the Board based upon an officer's responsibilities and relative position in the Company.

No voting member of the Committee is a former or current officer of the Company or any of its subsidiaries.

| | | /s/ Tom A.L. Van Groningen—Chairman

/s/ Jerry E. Callister

/s/ John D. Fawcett

/s/ James W. Tolladay |

Indebtedness of Management

Certain of Capital Corp's directors and executive officers, as well as their immediate families, associates and companies in which they have a financial interest, are customers of, and have had banking transactions with, County Bank in the ordinary course of the Bank's business, and the Bank expects to have such ordinary banking transactions with these persons or entities in the future. In the opinion of the Bank's management, the Bank made all loans and commitments to lend included in such transactions in compliance with applicable laws and on substantially the same terms, including interest rates and collateral, as those prevailing for comparable transactions with other persons and entities of similar creditworthiness, and these loans do not involve more than a normal risk of collectibility or present other unfavorable features.

Transactions with Management

There are no other existing or proposed material transactions between Capital Corp and any of its directors, executive officers, nominees for election as a director, or the immediate families or associates of any of the foregoing persons. In accordance with its policies, Capital Corp obtains competitive bids for products and services from independent parties before selecting a vendor of such products and services.

16

Stock Performance Graph

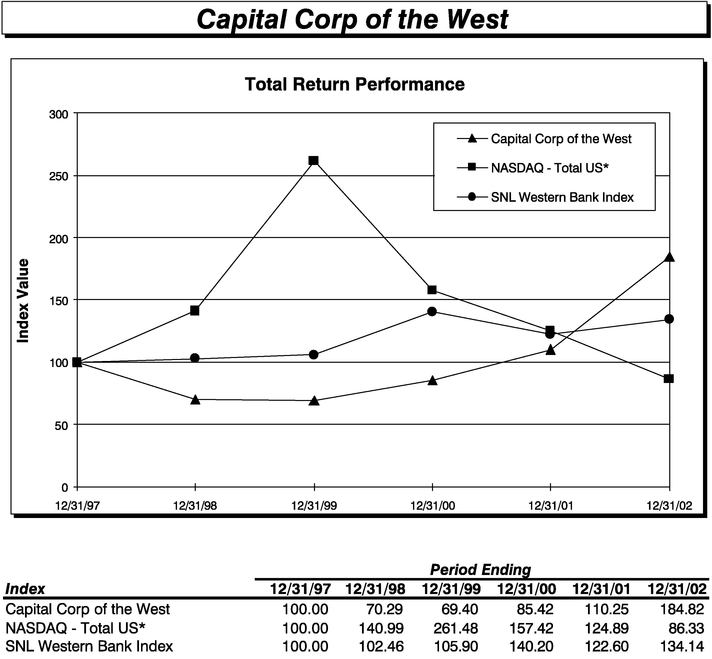

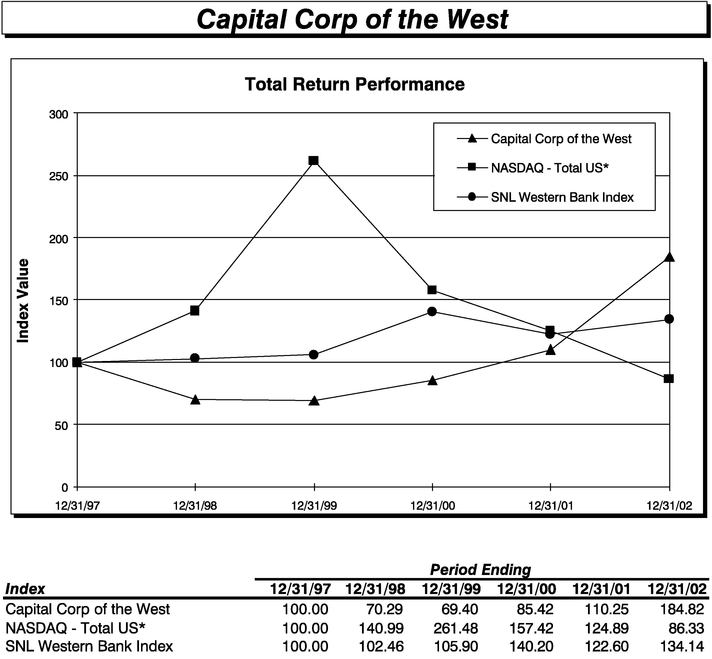

The following graph compares the change on an annual basis in Capital Corp's cumulative total return on its common stock with (a) the change in the cumulative total return on stocks of companies included in the NASDAQ Composite Index for U.S. Companies, (b) the change in the cumulative total return on stocks as included in the SNL Securities "Western Bank Index", a peer industry group, and assuming an initial investment of $100 on December 31, 1997. All of these cumulative total returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the period. The common stock price performance shown below should not be viewed as being indicative of future performance.

17

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 (a) of the Securities Exchange Act of 1934 ("Exchange Act") requires each person (i) who owns more than 10% of any class of equity security which is registered under the Exchange Act or (ii) who is a director or one of certain officers of the issuer of such security to file with the Securities and Exchange Commission certain reports regarding the beneficial ownership of such persons of all equity securities of the issuer. Capital Corp has established a procedure to aid persons who are officers and directors of Capital Corp in timely filing reports required by the Exchange Act.

The Board of Directors is required to disclose unreported filings from prior years of which the Board of Directors has knowledge.

For 2002, the following directors filed SEC Forms 4 late: Bertyl W. Johnson (1 late filing).

Independent Public Accountants

Management selected KPMG LLP as the independent certified public accountants of Capital Corp for the fiscal year ended December 31, 2002. A representative of KPMG LLP is expected to attend the Meeting. The representative will have the opportunity to make a statement, if desired, and is expected to be available to respond to appropriate shareholder inquiries.

The deadline for submitting shareholder proposals for inclusion in Capital Corp's proxy statement and form of proxy for the 2004 annual meeting is November 18, 2003. The proposal must be received at Capital Corp's principal executive offices, 550 W. main Street, Merced, California 95341-0351 by that date to be eligible for inclusion. Proposals must meet the requirements of applicable law, including Rule 14a-8 of the SEC's proxy rules.

The proxies for the 2004 annual meeting may use their discretion in voting on any proposal raised from the floor of the 2004 annual meeting of which Capital Corp had no notice by February 1, 2004.

Other Matters

The Board of Directors of Capital Corp knows of no other matters which will be brought before the Meeting, but if such matters are properly presented, proxies solicited hereby relating to the Meeting will be voted in accordance with the judgment of the persons holding such proxies. All shares represented by duly executed proxies will be voted at the Meeting.

If any shareholder would like a copy of Capital Corp's Annual Report on Form of 10-K for the fiscal year ended December 31, 2002, it can be obtained without charge (except for certain exhibits) by contacting Cherrie Zemanek, Corporate Secretary, Capital Corp of the West, 550 West Main St., P.O. Box 351, Merced, California 95341-0351.

18

| |

| |

|

|---|

| REVOCABLE | | | | REVOCABLE |

| PROXY | | | | PROXY |

CAPITAL CORP OF THE WEST

PROXY FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD APRIL 16, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS |

The undersigned holder of common stock acknowledges receipt of the Notice of Annual Meeting of Shareholders of Capital Corp of the West, a California corporation (the "Company") and the accompanying Proxy Statement dated March 17, 2002, and revoking any proxy heretofore given, hereby constitutes and appoints Tom Van Groningen and R. Dale McKinney, or either of them, with full power of substitution, as attorney and proxy to appear and vote all of the shares of common stock of the Company standing in the name of the undersigned which the undersigned could vote if personally present and acting at the Annual Meeting of Shareholders of the Company to be held at Merced, California, on April 16, 2003 at 7:00 p.m. local time or at any adjournments thereof, upon the following item as set forth in the Notice of Meeting and more fully described in the Proxy Statement.

This proxy may be revoked prior to its exercise.

The Board of Directors recommends a votefor election as directors of the nominees named on the other side of this proxy. If no other instruction is given, the proxy holders intend to votefor all nominees listed and in their discretion on such other business as may properly come before the meeting or any adjournment thereof.

(Continued and to be signed on reverse side.)

- 1.

- Election of Directors. To vote for the election of the following persons as Class I Directors of the Company to serve three-year terms or until their successors are elected and qualified:

| |

| |

|

|---|

| | | Nominees: Class I Directors | | 01—Dorothy L. Bizzini

02—Jerry E. Callister

03—Gerald L. Tahajian |

[Instructions: To withhold a vote for one or more nominees, strike a line through that nominee's name above. To vote for all nominees (except one whose name is struck) check "FOR" below. To withhold a vote as to all nominees, check "WITHHOLD" below.]

SHAREHOLDER(S)

(Signature)

(Signature)

(Number of Common Shares)

Date , 2003

I/We will or will not attend this meeting.

Please sign exactly as your name(s) appear(s). When signing as attorney, executor, administrator, trustee, officer, partner, or guardian, please give full title. If more than one trustee, all should sign. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE SIGN AND RETURN THIS PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POST-PAID ENVELOPE.

To assure a quorum, you are urged to date and sign this Proxy and mail it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States or Canada. To vote promptly by telephone or Internet refer to accompanying instructions.

Dear Shareholder:

Capital Corp of the West offers you two additional convenient ways to vote your shares. By following the simple instructions below your vote can now be counted over the telephone or Internet. We encourage you to take advantage of these new features, which eliminate the need to return the proxy card but authorize the named proxies in the same manner as if you had mailed back a marked, signed and dated proxy card. You will be asked to enter a Control Number, which is located in the box on the left side of this form.

TELEPHONE VOTING INSTRUCTIONS

On a touch-tone telephone, call the toll-free number 1-866-416-8422 that is available twenty-four hours per day, seven days a week. You will hear these instructions:

| |

| |

|

|---|

| OPTION #1: | | To vote as the Board of Directors recommends on ALL proposals: | | Press 1 |

| | | When asked to CONFIRM YOUR VOTE | | Press 1 |

OPTION #2: |

|

If you choose to vote on each nominee separately:

Press 0 and you will hear these instructions:

Proposal 1: To vote FOR ALL nominees,

To WITHHOLD FOR ALL nominees

To WITHHOLD FOR AN INDIVIDUAL nominee

and listen to the instructions. |

|

Press 1

Press 9

Press 0 |

|

|

When asked to CONFIRM YOUR VOTE

Thank you for voting. |

|

Press 1 |

If you vote by telephone, DO NOT mail back your proxy.

INTERNET VOTING INSTRUCTIONS

- •

- Read the accompanying Proxy Statement.

- •

- Go to the following website:www.computershare.com/us/proxy

- •

- Enter the information requested on your computer screen, including your 6-digit Control Number located in the box on the left side of this form.

- •

- Follow the simple instructions on the screen.

If you vote by Internet, DO NOT mail back your proxy.

We have been advised by counsel that these telephone and Internet voting procedures comply with California law.

QuickLinks

CAPITAL CORP OF THE WEST Merced, California 95341-0351 March 17, 2003 NOTICE OF ANNUAL MEETING OF SHAREHOLDERSPROXY STATEMENT OF CAPITAL CORP OF THE WEST FOR THE ANNUAL MEETING OF SHAREHOLDERS P.O. Box 351 550 West Main St. MERCED, CALIFORNIA 95341-0351 (209) 725-2269 March 17, 2003INFORMATION CONCERNING PROXY STATEMENT