UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to Rule §240.14a-12 |

Capital Corp of the West |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x | No fee required. |

| | | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | 1. | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5. | Total fee paid: |

| | | |

| | | |

| | | SEC 1913 (03-04) Persons who are to respond to the Collection of information contained in this form are not required to respond unless the form displays a currently valid OMB cotrol number. |

| | | |

o | Fee paid previously with preliminary materials. |

| | | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | 1. | Amount Previously Paid: |

| | | |

| | | |

| | 2. | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3. | Filing Party: |

| | | |

| | | |

| | 4. | Date Filed: |

| | | |

| | | |

CAPITAL CORP OF THE WEST

550 West Main Street

P.0. Box 351

Merced, CA 95341-0351

March 10, 2006

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Capital Corp of the West (the Company) to consider and vote upon (1) a proposal to elect three Class I directors; (2) such other business as may properly come before the meeting.

The meeting will take place at 5:00 p.m. local time on May 2, 2006, at the new downtown Fresno facility at 2625 Divisadero, 2nd Floor, Fresno, California. We will be providing transportation for shareholders who would like to attend the meeting from the Merced area. Please contact Denise Butler, Corporate Secretary, at (209) 725-2276 if you are interested in complimentary transportation to our annual meeting in Fresno. The bus will be departing from our headquarters building at 550 W. Main Street.

Enclosed are the Secretary's Notice of this meeting, a Proxy Card, the Proxy Statement describing the proposals, and a return envelope. Also enclosed is a copy of the Company's 2005 Annual Report to shareholders and Form 10-K.

We encourage you to attend this meeting. Whether or not you are able to attend, please complete, date, sign, and return promptly the enclosed Proxy Card so that your shares will be represented at the meeting. You may also vote your shares by utilizing the toll free number listed on the Proxy Card or via the Internet by utilizing the Control Number listed on the Proxy Card. You may also vote at the meeting. If you choose to do so, please bring to the meeting the enclosed Proxy Card and proof of your identify. If you chose to vote in this alternative manner, there is no need to return your Proxy Card. I look forward to seeing you.

| | | |

| | | Thomas T. Hawker President and Chief Executive Officer |

CAPITAL CORP OF THE WEST

Merced, California 95341-0351

March 10, 2006

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of the Shareholders of Capital Corp of the West (Capital Corp) will be held on Tuesday, May 2, 2006, at 5:00 p.m. local time at the new downtown Fresno facility at 2625 Divisadero, 2nd Floor, Fresno, California. The meeting will be held for the following purposes:

1. To elect three Class I directors;

| | 2. | To consider and act upon such other matters as may properly come before such meeting or any adjournment thereof. |

Holders of Capital Corp common stock of record at the close of business on March 3, 2006 are entitled to notice of and to vote at the meeting.

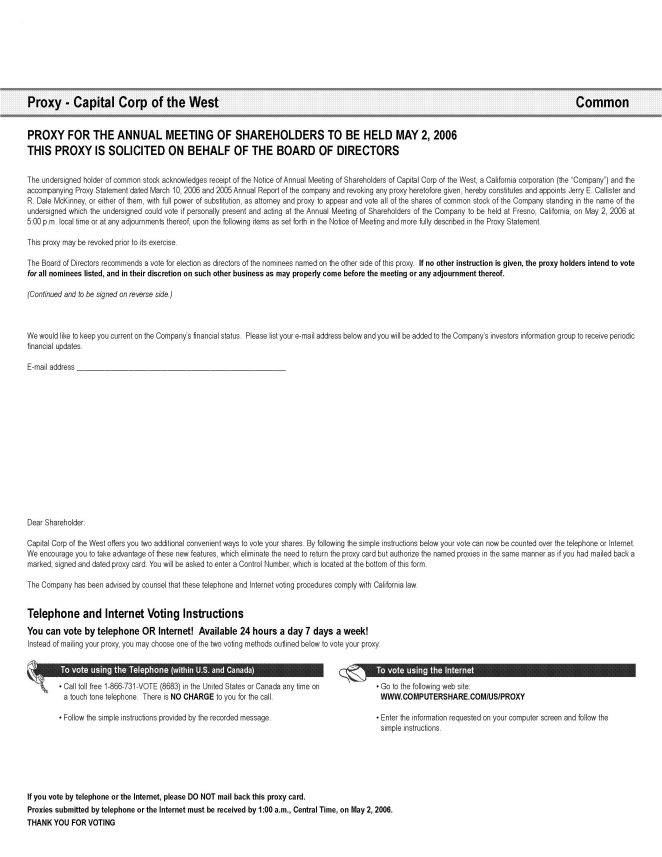

YOUR VOTE IS IMPORTANT. Please sign and date the enclosed Proxy Card and return it promptly in the envelope provided, whether or not you plan to attend the meeting. Shareholders of Record may vote by utilizing the toll free number 1-866-731-VOTE (8683) and the "Control Number" listed on the Proxy Card. Instructions for utilizing the toll free number are listed on the Proxy Card. You may also vote via the Internet by following the instructions listed on the Proxy Card. Voting via telephone and Internet will be suspended 24 hours prior to the meeting date. This Proxy Statement is distributed by and the enclosed proxy is solicited on behalf of the Board of Directors of Capital Corp.

| By Order of the Board of Directors, | | |

| | |

Denise Butler Corporate Secretary | | |

PROXY STATEMENT OF

CAPITAL CORP OF THE WEST FOR THE ANNUAL MEETING OF SHAREHOLDERS

P.O. Box 351

550 West Main St.

MERCED, CALIFORNIA 95341-0351

(209) 725-2269

March 10, 2006

This Proxy Statement and the accompanying form of proxy are being mailed to shareholders on or about March 29, 2006.

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND THE ANNUAL MEETING

Q: Why am I receiving these materials?

A: The Board of Directors of Capital Corp of the West is providing these proxy materials for you in connection with the Company's 2006 annual meeting of shareholders. As a shareholder, you are invited to attend the meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

Q: What information is contained in these materials?

A: The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and executive officers, and certain other required information. Our 2005 Annual Report and Form 10-K is also enclosed.

Q: What shares can I vote?

A: You may vote all shares you owned as of the close of business on March 3, 2006, the Record Date. These shares include (1) shares held directly in your name as the shareholder of record, and (2) shares held for you as the beneficial owner through a stockbroker or bank. Shares purchased through the Capital Corp of the West Employee Stock Ownership Plan for your account are voted by the trustee(s) of the plan at your direction.

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner?

A: Most shareholders hold shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

If your shares are registered directly in your name with the Company's transfer agent, Computershare Investor Services, LLC, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent directly to you by the Company. As the shareholder of record, you have the right to vote by proxy or to vote in person at the meeting. The Company has enclosed a Proxy Card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee which is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker how to vote and are also invited to attend the meeting. If you wish to vote these shares at the meeting, you must contact your bank or broker for instructions as to how to do so. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee how to vote your shares on your behalf.

Q: How can I vote my shares in person at the meeting?

A: Shares held directly in your name as the shareholder of record may be voted in person at the annual meeting. If you choose to attend the meeting, please bring to the meeting the enclosed Proxy Card and proof of your identity.

Even if you currently plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the meeting. Shares held in street name can be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

Q: How can I vote my shares without attending the meeting?

A: Whether you hold shares directly as a shareholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting your voting instructions to your broker or nominee. In most instances you will be able to do this by telephone, internet or by mail. Please refer to the summary instructions below and those included on your Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee.

By Internet—If you have Internet access, you may submit your proxy from any location in the world by following the "Vote by Internet" instructions on the Proxy Card.

By Telephone—If you live in the United States or Canada, you may submit your proxy by following the "Vote by Phone" instructions on the Proxy Card.

By Mail—You may do this by returning your signed Proxy Card or, for shares held in street name, the voting instruction card included by your broker or nominee and mailing it in the enclosed, postage pre-paid and addressed envelope. If you provide specific voting instructions on the Proxy Card, your shares will be voted as you instruct. If you sign the Proxy Card but do not provide instructions, your shares will be voted as described below in "How are votes counted?"

Q: Can I change my vote?

A: You may change your proxy instructions at any time prior to the vote at the annual meeting. For shares held in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the annual meeting and voting in person. Also, you may file with the Secretary of the Company a written notice of revocation at any time before your proxy is exercised at the meeting. Attendance at the meeting will not cause your previously granted proxy to be automatically revoked unless you specifically so request or unless you vote at the meeting. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee. Your changed voting instructions must be received sufficiently in advance of the meeting to allow your vote to be changed.

Q: How are votes counted?

A: In the election of directors you may vote "FOR" all of the nominees or your vote may be "WITHHELD" with respect to one or more of the nominees or all of the nominees. If you sign your Proxy Card with no further instructions, your shares will be voted in accordance with the recommendation of the Board ("FOR" all of the Company's nominees to the Board, and at the discretion of the proxy holders on any other matters that properly come before the meeting).

Q: What does it mean if I receive more than one proxy or voting instruction card?

A: It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive so that all your shares will be represented at the meeting.

Q: Is my vote confidential?

A: Generally proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by our Board.

INFORMATION CONCERNING PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Capital Corp of the West ("Capital Corp" or the "Company") of proxies to be voted at the Annual Meeting of Shareholders of Capital Corp (the "Meeting") and any adjournments or postponements thereof. At the Meeting, the Shareholders of Capital Corp will be asked to (1) elect three Class I directors; and (2) act upon such other matters as may properly come before such meeting or any adjournment thereof.

Date, Time and Place of Meeting

The Meeting will be held on May 2, 2006 at 5:00 p.m. at the downtown Fresno facility at 2625 Divisadero, 2nd Floor, Fresno, California.

Record Date and Voting Rights

Only holders of record of Capital Corp common stock at the close of business on March 3, 2006 (the "Record Date") are entitled to notice of the Meeting and to vote at the Meeting. At the Record Date, there were approximately 2,400 shareholders of record and 10,617,520 shares of Capital Corp common stock outstanding and entitled to vote. Directors, executive officers and company sponsored benefit plans of Capital Corp and their affiliates owned beneficially as of the Record Date an aggregate of 1,510,579 shares or approximately 13.4% of the outstanding Capital Corp common stock (including shares subject to vested options).

Each shareholder is entitled to one vote for each share of common stock he or she owns. In the election of directors, the nominees receiving the greatest number of votes will be elected. Broker non-votes (i.e., shares held by brokers or nominees which are represented at the Meeting but with respect to which the nominee is not authorized to vote on a particular proposal) will not be counted, except for quorum purposes, and will have no effect on the election of directors.

Voting by Proxy; Revocability of Proxies

Shareholders may use the enclosed Proxy Card if they are unable to attend the Meeting in person or wish to have their shares voted by proxy even if they attend the Meeting. All proxies that are properly executed and returned, unless revoked, will be voted at the Meeting in accordance with the instructions indicated thereon or, if no direction is indicated, for the election of the Board's nominees as directors. The execution of a proxy will not affect the right of a shareholder to attend the Meeting and vote in person. A person who has given a proxy may revoke it at any time before it is exercised at the Meeting by filing with the Secretary of the Company a written notice of revocation or a proxy bearing a later date or by attendance at the Meeting and voting in person. Your changed voting instructions must be received sufficiently in advance of the meeting to allow your vote to be changed. Attendance at the Meeting will not, by itself, revoke a proxy.

Shareholders of Record may vote by utilizing the toll free number 1-866-731-VOTE (8683) and the "Control Number" listed on the Proxy Card. Instructions for utilizing the toll free number are listed on the Proxy Card. You may also vote utilizing the Internet by accessing www.computershare.com/us/proxy, entering the Control Number and following the simple instructions. Voting via telephone and the Internet will be suspended 24 hours prior to the Meeting date. We have been advised by counsel that these telephone and Internet voting procedures comply with California law.

Quorum and Adjournments

Fifty percent of the shares entitled to vote, represented in person or by proxy, constitutes a quorum. The Meeting may be adjourned, even if a quorum is present, by the vote of the holders of a majority of the shares represented at the Meeting in person or by proxy. In the absence of a quorum at the Meeting, no other business may be transacted at the Meeting.

Notice of the adjournment of the Meeting need not be given if the time and place thereof are announced at the Meeting, provided that if the adjournment is for more than 45 days, or after the adjournment a new record date is fixed for the adjourned Meeting, a notice of the adjourned Meeting shall be given to each shareholder of record entitled to vote at the Meeting. At an adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

Solicitation of Proxies

The proxy relating to the Meeting is being solicited by the Board. Capital Corp will pay the cost of printing and distributing this Proxy Statement. Copies of solicitation material will be furnished to brokerage houses, fiduciaries and custodians holding in their names shares of Capital Corp common stock beneficially owned by others to forward to such beneficial owners. Capital Corp may reimburse such persons for their expenses in forwarding solicitation materials to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of Capital Corp, who will not be additionally compensated therefore. The Company will pay the cost of all proxy solicitation.

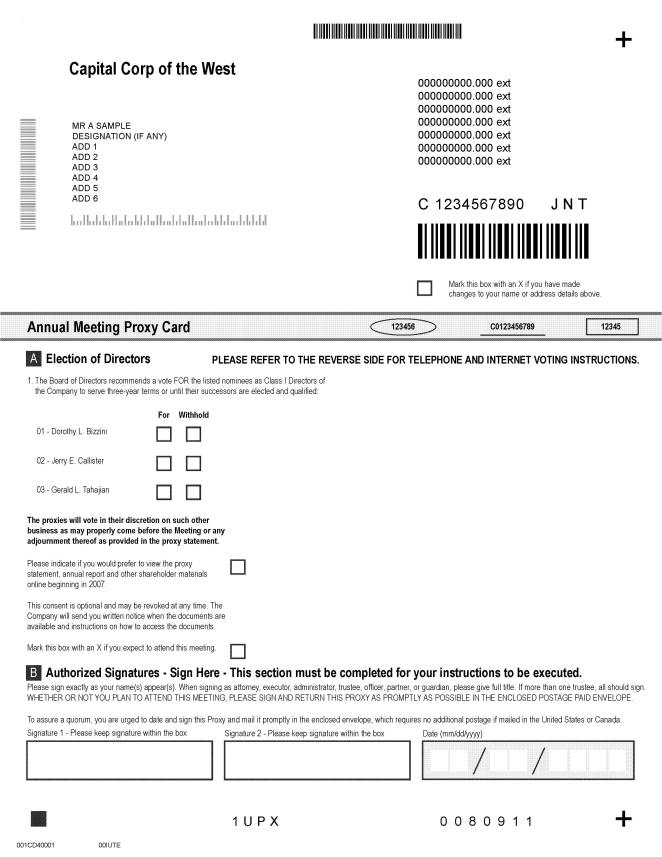

PROPOSAL ONE: ELECTION OF DIRECTORS

The Bylaws of Capital Corp provide that the number of directors of Capital Corp may be no less than nine and no more than twelve. The exact number of directors within this range may be changed by action of the Board of Directors or the shareholders. The number of directors is currently fixed at ten.

NOMINEES FOR DIRECTOR

The Board of Directors is classified into three classes with staggered three-year terms. The three persons named below will be nominated for election as Class I Directors to serve until the Annual Meeting in the year 2009 and until their successors are duly elected and qualified. The three candidates receiving the greatest number of votes will be elected for three-year terms or until they reach the mandatory retirement age of 75.

Dorothy L. Bizzini

Jerry E. Callister

Gerald L. Tahajian

If any nominee should become unable or unwilling to serve as a director, the proxies will be voted at the Meeting for such substitute nominees as shall be designated by the Board. The Board presently has no knowledge that any of the nominees will be unable or unwilling to serve.

The following table provides information with respect to each person that is being nominated and recommended to be elected by the current Board, as well as existing directors of Capital Corp whose terms do not expire at the time of the Meeting. Reference is made to the section entitled "Security Ownership of Certain Beneficial Owners and Management" for information pertaining to stock ownership of the nominees.

| Name/Class | | Age | | Director Since | | Business Experience During Past Five Years |

| Dorothy L. Bizzini, I | | 71 | | 1992 | | Partner in Atwater/Merced Veterinary Clinic, Inc.; Owner Of Dorothy Lee Apartments; Director of Bloss Memorial Health Care District; Chairman of Central Valley Dental Clinic |

| | | | | | | |

| Jerry E. Callister, I | | 63 | | 1991 1 | | President of Callister & Hendricks, Inc., a professional law corporation, Manager, Tioga Properties, LLC; Manager, Tenaya Properties, a General Partnership; Manager, Whitegate Enterprises, LLC; Chairman of the Board of Directors of Capital Corp of the West |

| | | | | | | |

| Gerald L. Tahajian, I | | 65 | | 2001 | | President, Gerald Lee Tahajian, Inc., a professional law corporation |

| | | | | | | |

| John D. Fawcett, II | | 57 | | 1995 | | President and Manager, Fawcett Farms, Inc. |

| | | | | | | |

| Thomas T. Hawker, II | | 63 | | 1991 | | President/CEO Capital Corp and CEO County Bank |

| | | | | | | |

| Curtis A. Riggs, II | | 57 | | 2000 | | CEO VIA Adventures, a transportation company; CEO Merced Transportation Company, school bus service; Vice President, Carskaddon Enterprises, Inc., a leasing company |

| | | | | | | |

| G. Michael Graves, III | | 54 | | 2001 | | Principal, Pacific Resources, Inc., a financial, strategic planning, accounting and administrative management firm |

| | | | | | | |

| Curtis R. Grant, III | | 66 | | 2005 | | Retired professor, California State University Stanislaus |

| | | | | | | |

| Tom A.L. Van Groningen, III | | 73 | | 1999 | | Consultant, retired educator, Director of Modesto Irrigation District |

| | | | | | | |

| David Bonnar, III | | 51 | | 2005 | | Manager of information service group, Community Medical Centers of Central California, Proprietor of The Special Projects Group, a software development company |

1 Previously served on the Board of Directors from 1977 to 1985.

No family relationships exist among any of the directors or executive officers of the Company. No director or person nominated to become a director is a director of any other public company or registered investment company.

Recommendation of the Board of Directors

The Board of Directors urges you to vote FOR PROPOSAL ONE.

Board Structure and Corporate Governance

Board Independence

Each of the members of the Company's Board of Directors has been determined by the board to be independent under the rules of NASDAQ governing the independence of directors, with the exception of Thomas T. Hawker.

Therefore, a majority of the directors are independent, as required by the rules of NASDAQ.

Annual Meeting Attendance

All directors are expected to attend each annual meeting of the Company's shareholders, unless attendance is prevented by an emergency. All of the directors who were in office at that time attended the Company's 2005 annual meeting of shareholders.

Contacting the Board

Shareholders may address inquiries to any of the Company's directors or the full board by writing to:

Corporate Secretary

Capital Corp of the West

P.O. Box 351

550 West Main Street

Merced CA 95341-0351

All communications are sent directly to the directors to whom they are addressed or to the full board as applicable.

For 2005, the Capital Corp Board of Directors held twelve regularly scheduled meetings. The Company has the following Board Committees: Governance/Executive, Strategic Planning, Director Nomination, Loan, Compensation and Audit. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the committees of the Board on which he or she served (during the period for which they served).

Governance/Executive Committee

The primary function of the Governance/Executive Committee is to facilitate action during intervals between meetings of the Board; to review and approve Board agendas; to recommend to the Board the membership of Board committees; to meet and interact with the Chief Executive Officer as required. Mr. Callister (Chairman), Mr. Riggs, Mr. Fawcett, Mr. Van Groningen and Mr. Hawker are members of the Governance/Executive Committee. Mr. Hawker is a non-voting member of the committee. During 2005, the Governance/Executive Committee held a total of twelve meetings.

Strategic Planning Committee

The primary function of the Strategic Planning Committee is to adopt, update and evaluate short term (five-year) and long term (ten-year) strategic plans and goals and monitor the Company’s progress towards those goals. Mr. Grant (chairman), Mr. Callister, Mr. Graves, Mr. Tahajian, Mr. Hawker and Mr. McKinney are members of the Strategic Planning Committee. During 2005, the Strategic Planning Committee held eight meetings.

Nomination of Directors; Director Nomination Committee

The Company has a Director Nomination Committee. The purpose of this committee is to oversee the search for qualified individuals to serve on the board and to recommend to the entire board appropriate replacement(s) when a vacancy(s) occurs on the board. The committee is comprised of Ms. Bizzini (chairperson), Mr. Graves, Mr. Van Groningen and Mr. Grant. The Committee has a charter which can be accessed on the Company's website at the following address: http:/www.ccow.com.

The Company seeks directors who are of high ethical character and have reputations, both personal and professional, which are consistent with the image and values of the Company. The Director Nomination Committee reviews from time to time the appropriate skills and characteristics required of directors in the context of the current make-up of the board, including such factors as business experience, diversity, and personal skills in finance, marketing, business, and other areas that are expected to contribute to an effective board.

The Company will consider director nominees recommended by shareholders who adhere to the following procedure. The Company's Bylaws provide that any shareholder must give written notice to the President of Capital Corp of an intention to nominate a director at a shareholder meeting. The notice must be received 21 days before the meeting or 10 days after the date of mailing of notice of the meeting, whichever is later. The Bylaws contain additional requirements for nominations. A copy of the requirements is available upon request directed to the President of Capital Corp.

The Company identifies new director candidates from prominent business persons and professionals in the communities it serves. The Director Nomination Committee also has the authority, to the extent it deems necessary or appropriate, to retain a search firm to be used to identify director candidates. The Company considers nominees of shareholders in the same manner as other nominees. During 2005 the Director Search Committee held three meetings.

Compensation Committee

The purpose of the Compensation Committee is to (i) discharge the Board's responsibilities relating to the compensation of the Company's officers, (ii) oversee the administration of the Company's compensation and benefits plans, in particular the incentive compensation and equity-based plans of the Company (and, to the extent appropriate, the significant subsidiaries of the Company) and (iii) prepare the annual report on executive compensation required by the rules and regulations of the SEC to be included in the Company's annual proxy statement. Mr. Van Groningen (chairman), Mr. Callister, Mr. Fawcett and Mr. Riggs are members of the Compensation Committee. During 2005 the Compensation Committee held twelve meetings.

Audit Committee

Composition

The Audit Committee is comprised of Mr. Graves (Chairman), Mr. Riggs, Mr. Tahajian and Mr. Bonnar. Each member of the Audit Committee is independent under the rules of NASDAQ governing the independence of directors and the independence of audit committee members, including the "audit committee financial expert" discussed below.

Audit Committee Financial Expert

The Board has determined that Mr. Graves and Mr. Tahajian have: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in a connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company's financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions.

Therefore, the Board has determined that Mr. Graves and Mr. Tahajian meet the definition of an "audit committee financial expert" under the rules of the SEC and are "financially sophisticated" under NASDAQ rules. The determination is based on Mr. Graves’ and Mr. Tahajian’s experiences as Certified Public Accountants and their business experience.

Designation of a person as an audit committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations or liability greater than those imposed on any other audit committee member or any other director and does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

Committee Functions

The primary function of the Audit Committee is to monitor the integrity and timeliness of the Company's financial reporting process.

Meeting Attendance

The Committee held twelve meetings during 2005.

Pre-approval Policies

The Committee reviews and pre-approves all auditing services provided by the Company's independent auditors as well as all non-audit services to be performed by auditors (including any management consulting engagements), unless: (i) the aggregate amount of all non-audit services constitutes not more than 5 percent of the total amount of revenues paid by the Company to its independent auditors during the fiscal year in which the non-audit services are provided; (ii) the services were not recognized by the Company at the time of the engagement to be non-audit services; and (iii) the services are promptly brought to the attention of the Committee and approved prior to the completion of the audit by the Committee or by one or more members of the Committee who are members of the Board of Directors to whom authority to grant such approvals has been delegated by the Committee.

In no event may an auditor provide any of the following non-audit services, even with consent of the Committee: (i) bookkeeping or other services related to the accounting records or financial statements of the Company; (ii) financial information systems design and implementation; (iii) appraisal or valuation services, fairness opinions, or contribution-in-kind reports; (iv) actuarial services; (v) internal audit outsourcing services; (vi) management functions or human resources; (vii) broker or dealer, investment adviser, or investment banking services; (viii) legal services and expert services unrelated to the audit; and (ix) any other service that the Board determines, by regulation, is impermissible.

If the Committee approves any non-audit service to be performed by the independent auditor, it will be disclosed in a report on Form 10-K, 10-Q or 8-K, as appropriate.

Auditor Fees

| | | Fiscal Year | | Fiscal Year | |

Category of Services | | 2004 | | 2005 | |

| Audit fees (1) | | $ | 277,000 | | $ | 341,510 | |

| Audit-related fees (2) | | $ | 10,000 | | $ | - | |

| Tax fees (3) | | $ | 31,300 | | $ | 29,700 | |

Subtotal | | $ | 318,300 | | $ | 371,210170 | |

| All other fees (4) | | $ | - | | $ | - | |

(1) | Services include the audit of the Company's annual financial statements and review of financial statements included in the Company's Quarterly Reports on Form 10-Q or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

(2) | Services include assurance and related services by the auditor that are reasonably related to the performance of the audit or review of the Company's financial statements and are not reported under "Audit Fees." 2004 fees include the purchase of software to support compliance with Sarbanes Oxley. |

(3) | Services include tax compliance, tax advice, and tax planning. Services in this category rendered during 2004 and 2005 include time and materials for the preparation, review and filing of the Company's federal and California state tax returns (including tax returns for the Company's Real Estate Investment Trust), quarterly review of estimated tax payments and support related to tax audits by federal or state agencies. |

(4) | Services include other services (and products) provided by the auditors, other than the services reported above in this table. |

Report of the Audit Committee

The Audit Committee operates under a charter adopted by the board that is attached as Appendix A to this proxy statement, as amended by the Board on January 21, 2006.

The Audit Committee reviewed and discussed the audited financial statements and related judgments with management and the outside auditors.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380).

The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Board Standards No. 1, Independence Discussions with Audit Committees), and has discussed with the independent accountant the independent accountant's independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the full Board the inclusion of the financial statements in the Company's Annual Report on Form 10-K.

The Company's Audit Committee has considered whether KPMG LLP's provisions of the services described above under "Auditor Fees" are compatible with maintaining the independence of KPMG LLP.

| | | /s/ G. Michael Graves /s/ Curtis A. Riggs /s/ Gerald L. Tahajian /s/ David Bonnar |

Director Attendance and Compensation

Non-employee directors receive a $1,300 monthly retainer fee, a $800 fee per Board Meeting, a $500 fee per special Board Meeting for attendance and a $50 - $150 (depending on distance) monthly car allowance. The chairman of the Board receives a $1,000 monthly fee. The audit committee chair receives a $1,000 monthly fee. All other committee chairs receive a $300 fee per meeting for attendance. All committee members, including the committee chair, receive a $400 fee per meeting for attendance. Employee directors do not receive fees. Capital Corp directors earned a total of $588,410 in director fees during 2005.

Four directors participate in the deferred compensation plan, each entering into a Director Elective Income Deferral Agreement and electing to defer a portion of his or her director compensation for payment at a future date. Deferred amounts were credited with interest at a fixed rate of 7%. The four participating directors are Ms. Bizzini, Mr. Callister, Mr. Fawcett and Mr. Bonnar.

Benefits under the Director Elective Income Deferral Agreements are based on each director’s account balance at the end of the month immediately before payments begin. Payments begin on the date selected by each director, or if sooner when the director’s service terminates. Benefits will be paid in the form elected by each director, whether in a lump sum or installments over a period of 3, 5, or 10 years. If a director’s service terminates within 12 months after a change in control, the director’s entire account balance will be paid in a single lump sum within 30 days.

Executive Officers of Capital Corp

Set forth below is certain information with respect to each of the executive officers of Capital Corp.

Name | | Age | | Position and Offices | | Executive Officer Since |

| | | | | | | |

| Thomas T. Hawker | | 63 | | President, CEO* and Director | | 1991 |

| | | | | | | |

| R. Dale McKinney | | 60 | | Executive Vice President/ Chief Financial Officer* | | 1999 |

| | | | | | | |

| Michael T. Ryan | | 54 | | Executive Vice President/ Chief Administrative Officer* | | 2003 |

Set forth below is certain information with respect to the executive officers of County Bank, a subsidiary of Capital Corp.

Name | | Age | | Position and Offices | | Executive Officer Since |

| | | | | | | |

| Ed J. Rocha | | 53 | | President/Chief Operating Officer | | 1997 |

| | | | | | | |

| John J. Incandela | | 44 | | Executive Vice President / Chief Credit Officer | | 2005 |

* These individuals also serve in their stated capacities for County Bank.

A brief summary of the background and business experience of the executive officers of Capital Corp and its subsidiaries is set forth below.

THOMAS T. HAWKER became County Bank's President and Chief Executive Officer in 1991 and President and Chief Executive Officer of Capital Corp in 1995. Prior to that he served as President and Chief Executive Officer of Concord Commercial Bank from 1986-1991. In 2005 he transferred the President’s role of County Bank to Ed Rocha. He remains as the Chief Executive Officer of County Bank.

R. DALE MCKINNEY became Capital Corp's Executive Vice President and Chief Financial Officer in 2001. He was the Company's Senior Vice President/Chief Financial Officer from 1999 to 2001. During 1998, Mr. McKinney was subject to a non-compete agreement with MBNA Corporation. In 1996-1997 he served as Senior Vice President-Finance for MBNA Corporation and from 1993-1995 he served as Senior Vice President-Finance for MBNA Information Services.

MICHAEL T. RYAN became County Bank's Executive Vice President / Chief Administrative Officer in January, 2003. He was the Bank's Senior Vice President / Chief Administrative Officer from November, 2000 to January 2003. From 1996 - 2000, he served as First Vice President for Corus Bank in Chicago, IL. From 1987 - 1996, he held various regional management and consulting positions for Unisys Corporation in the financial line of business. Mr. Ryan has tendered his resignation from the company to be effective May 1, 2006. The company is in the process of finding a qualified replacement.

ED J. ROCHA became County Bank's President in December 2005. He was the Bank’s Executive Vice President/Chief Operating Officer from 2003 to 2004. He was the Bank's Executive Vice President/Chief Banking Officer from 2000 to 2002. He was the Bank's Senior Vice President/Chief Banking Officer from 1997-1999. He served as Vice President and Regional Manager for the Bank from 1995-1997. He served as Senior Vice President/Branch Administrator for Pacific Valley National Bank from 1989-1995.

JOHN J. INCANDELA became County Bank’s Executive Vice President/Chief Credit Officer in June 2005. He was Senior Vice President/Head of Credit Policy for Banco Popular North America in Chicago, Illinois from 2002 to 2005. He was Regional Senior Credit Officer for Banco Popular North America’s New York Metro Region in New York City from 1997 to 2002.

Beneficial Ownership of Management

The following table shows the number and percentage of shares beneficially owned (including shares subject to options exercisable currently or within 60 days of the Record Date, March 3, 2006) by each director nominee, current director and named executive officer of the Company and all directors and executive officers as a group.

| | | Beneficially Owned(1) |

| | |

Name of Beneficial Owner | | Amount | | | | Percentage |

| Dorothy L. Bizzini | | 89,443 | | (2) | | * |

| David Bonnar | | 8,562 | | (3) | | * |

| Jerry E. Callister | | 29,151 | | (4) | | * |

| John D. Fawcett | | 47,802 | | (5) | | * |

| Curtis R. Grant | | 7,425 | | (6) | | * |

| G. Michael Graves | | 32,805 | | (7) | | * |

| Thomas T. Hawker | | 256,241 | | (8) | | 2.27% |

| John J. Incandela | | 12,378 | | (9) | | |

| R. Dale McKinney | | 100,929 | | (10) | | * |

| Curtis A. Riggs | | 38,383 | | (11) | | * |

| Ed J. Rocha | | 104,189 | | (12) | | * |

| Michael T. Ryan | | 54,362 | | (13) | | * |

| Gerald L. Tahajian | | 41,630 | | (14) | | * |

| Tom A.L. Van Groningen | | 44,859 | | (15) | | * |

| All Directors and Executive Officers of the Company as a Group (14 in number) | | 868,158 | | | | 7.70% |

The address for all persons is Capital Corp of the West, 550 West Main Street, P.O. Box 1191, Merced, California, 95341-0351.

* Indicates that the percentage of outstanding shares beneficially owned is less than one percent (1%).

| 1) | Includes shares beneficially owned (including options exercisable within 60 days of the Record Date, March 3, 2006), directly and indirectly together with associates. Subject to applicable community property laws and shared voting and investment power with a spouse, the persons listed have sole voting and investing power with respect to such shares unless otherwise noted. |

2) | Includes 47,199 shares held as trustee in the Bizzini Family Trust, 34,844 shares held in pension plan and 7,400 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

3) | Includes 3,162 shares held in Mr. Bonnar’s 401(k) plan,; and 5,400 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

4) | Includes 23,751 shares held as trustee in the Jerry Callister and Kathryn Callister Family Trust, and 5,400 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

5) | Includes 13,347 shares held individually, 2,484 shares held with spouse, and 14,073 held by spouse, and 17,898 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

6) | Includes 5,340 shares held in Mr. Grant’s trust and 2,085 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

7) | Includes 9,107 shares held in joint tenancy with spouse; , 400 are held through IRA and 23,298 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

8) | Includes 77,735 shares held in Mr. Hawker’s trust; , 6,723 shares held by his spouse's IRA; , 34,587 held in Mr. Hawker's IRA; , 2,635 shares held with daughter jointly; , 17,217 shares held through the Company ESOP; , 54,244 shares held through the Company 401(k); ), and 63,100 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

| 9) | Includes 12,378 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

10) | Includes 63,600 shares held in Mr. McKinney’s trust; , 4,423 shares held through the Company ESOP;, 10,706 shares through the Company 401(k); and 22,200 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

11) | Includes 3,130 shares held in Mr. Riggs’ IRA;, 2,700 shares held in corporation’s name,; 5,274 shares held in a family trust,; 4,032 shares held in the name of spouse and 6,198 shares held in the name of children,; and 17,049 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

12) | Includes 10,607 shares held in an IRA,; 7,121 shares held through the Company ESOP, 19,059 shares in the Company 401(k); and 67,042 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

13) | Includes 4,140 shares held in Ryan Family Trust, 1,883 shares held through the Company ESOP, 4,574 shares held in the Company 401(k), and 43,765 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

14) | Includes 8,158 shares held in a family trust;, 15,043 shares held in a corporate profit sharing plan; and 18,429 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

15) | Includes 39,459 shares held in a family trust and 5,400 shares under stock options which are exercisable currently or within 60 days of March 3, 2006. |

Principal Shareholders

As of December 31, 2005, no individuals known to the Board of Directors of Capital Corp owned of record or beneficially more than five percent of the outstanding shares of common stock of Capital Corp, except as described below:

Stock | | Number of Shares | | Percentage of Outstanding |

Name and Address | | Beneficially Owned | | Beneficially Owned |

| 1867 Western Financial Corporation | | 1,169,912 | | 11.1% |

| PO BOX 1110 | | | | |

| Stockton, CA 95201-1110 | | | | |

| | | | | |

| The Banc Funds Co. LLC | | 719,144 | | 6.8% |

| 208 S. La Salle Street, Suite 1680 | | | | |

| Chicago, IL 06604 | | | | |

Compensation and Other Transactions with Management and Others

The following information is furnished with respect to the aggregate compensation paid to the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Credit Officer and Chief Administrative Officer of Capital Corp or its subsidiary County Bank during 2003 - 2005. No other executive officer of Capital Corp or its subsidiaries received aggregate annual salary and bonus of $100,000 or more in 2003 - 2005.

Summary Compensation Table

| | | Annual Compensation(1) | | Long Term Compensation | | | |

Name & Principal Position | | Year | | Salary | | Bonus(2) | | Securities Underlying Stock Options Granted (Number of Shares)(3) | | All Other Compensation(4) | |

Capital Corp of the West | | | | | | | | | | | |

| | | | | | | | | | | | |

| Thomas T. Hawker | | | 2005 | | $ | 326,843 | | $ | 250,000 | | | 22,599 | | $ | 27,304 | |

| President/CEO | | | 2004 | | $ | 298,553 | | $ | 100,000 | | | 12,600 | | $ | 11,450 | |

| | | | 2003 | | $ | 264,800 | | $ | 150,000 | | | 13,230 | | $ | 11,000 | |

| | | | | | | | | | | | | | | | | |

| R. Dale McKinney | | | 2005 | | $ | 193,757 | | $ | 102,765 | | | 11,300 | | $ | 24,221 | |

| EVP/Chief Financial Officer | | | 2004 | | $ | 183,132 | | $ | 58,320 | | | 6,300 | | $ | 11,450 | |

| | | | 2003 | | $ | 168,694 | | $ | 81,328 | | | 13,230 | | $ | 11,000 | |

| | | | | | | | | | | | | | | | | |

| Michael T. Ryan | | | 2005 | | $ | 174,944 | | $ | 90,640 | | | 11,300 | | $ | 21,287 | |

| EVP/Chief Administrative Officer | | | 2004 | | $ | 165,944 | | $ | 60,300 | | | 6,300 | | $ | 11,450 | |

| | | | 2003 | | $ | 153,056 | | $ | 74,152 | | | 13,230 | | $ | 11,000 | |

| | | | | | | | | | | | | | | | | |

County Bank | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Ed J. Rocha | | | 2005 | | $ | 210,842 | | $ | 140,000 | | | 26,300 | | $ | 35,665 | |

| President/Chief Operating Officer | | | 2004 | | $ | 188,971 | | $ | 72,540 | | | 6,300 | | $ | 11,450 | |

| | | | 2003 | | $ | 167,882 | | $ | 85,820 | | | 12,915 | | $ | 11,000 | |

| | | | | | | | | | | | | | | | | |

| John Incandela | | | 2005 | | $ | 97,504 | | $ | 69,365 | | | 20,000 | | $ | 32,977 | |

| EVP/Chief Credit Officer | | | | | | | | | | | | | | | | |

| (1) | The incremental cost to the Company of providing incidental personal benefits to those executives noted above did not exceed 10% of the compensation to any of those reported above for each of the three years disclosed above. |

| (2) | Bonus amounts are shown for the year earned and are paid in the following year. |

| (3) | Stock option grants have been restated to reflect the 2005 9/5 stock split. |

| (4) | Includes Company contributions to ESOP and 401(k) plans. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Pursuant to his employment contract effective January 1, 2005 through December 31, 2008, (and as amended on November 8, 2005) Mr. Hawker will receive a base salary of $330,000, adjusted annually for cost of living allowances and other salary increases if approved by the Board, use of a Company-owned automobile, medical, dental and disability insurance benefits available to the Company's employees generally and participation in the Company's other compensation plans such as its incentive compensation program, 401(k) plan, stock option plan and ESOP plan. Pursuant to his employment contract, should Mr. Hawker be terminated for reasons other than for cause, he would receive a severance payment equal to one year's then-current salary plus continuation of insurance benefits for one year.

He will be entitled to receive grants of 7,000 incentive stock options on January 1, 2005, 2006, 2007 and 2008 at the then market value of the Company's stock if he is still actively employed by the Company. Each stock option will vest 25% on grant and 25% each year thereafter. In addition, in the event of a change in control of Capital Corp, Mr. Hawker's employment contract will automatically terminate and Mr. Hawker will receive an acquisition payment equal to eighteen months' then-current salary and the average of the bonuses earned for the three years preceding the change in control plus continuation of insurance benefits for eighteen months. On June 25, 2005, the Board approved an increase in the stock option granted to Mr. Hawker to 10,000 annually, primarily as a result of the 2005 9 for 5 stock split.

Effective December 21, 2004, Mr. McKinney, Mr. Rocha and Mr. Ryan are covered by a two-year severance agreement in case of a change in control of the Company. The agreement is automatically extended on each anniversary of its date for an additional year unless the Company decides not to do so. The officer is entitled to payment under the agreement if the officer’s employment is involuntarily terminated within one year after a change in control, (except for cause) or if the officer terminates employment within one year after a change in control due to salary reduction, reduced or discontinued participation in employee benefit plans (except for a company-wide reduction of all officers’ awards) or termination of participation in any benefit plan (unless the plan is terminated because of changes in law or loss of tax deductibility to the Company, or as a matter of policy applied equally to all participants), reduced responsibilities or status, failure of the acquirer to assume the Company’s obligations under the agreement, or relocation of the Company’s principal executive offices, or requiring the officer to change this principal work location, to any location that is more than 50 miles away. Under the agreement severance payment would be equal to one year base salary plus the average of the last three years bonuses and incentive compensation for that individual. Participants become fully vested in any qualified and non-qualified employee benefit plans which do not otherwise have their own change in control provisions, and are entitled to Company contributions to the 401(k) plan that would have received had employment not terminated before the end of the plan year, as well as continued life, health and disability insurance coverage for 12 months or until the officer becomes employed by another employer, whichever occurs first. At the end of the 12-month period, the officer may continue health insurance coverage at his own expense for a period not less than the number of months by which the Consolidated Omnibus Budget Reconciliation Act (COBRA) continuation period exceeds 12 months. Effective June 20, 2005 Mr. Incandela is covered by a two year severance contract with identical terms as disclosed above. In addition, based upon Mr. McKinney’s employment letter dated January 21, 1999, Mr. McKinney would receive a 6 month base compensation acquisition payment in the case of a change in control if termination did not occur.

In addition, Capital Corp provides Mr. Hawker and all executive officers with salary continuation plans. This is a non-qualified executive benefit plan pursuant to which the Company has agreed to pay retirement benefits to the executive officers in return for their continued satisfactory performance. It is an unfunded plan; the executive has no rights under the agreements beyond those of a general creditor of the Company. The plan is funded by single premium universal life insurance policies. The Bank has a Rabbi trust and specific life insurance contracts have been irrevocably assigned to the trust in support of the deferred compensation benefits. As of the date of this proxy statement, Mr. Hawker is 86% vested in a benefit of $150,000 per year for a period of fifteen years. Mr. Hawker will be 100% vested as of December 31, 2007. Mr. McKinney is 70% vested in a benefit of $85,000 per year for a period of fifteen years. Mr. McKinney will be 100% vested as of December 31, 2008. Mr. Rocha is 69% vested in a benefit of $85,000 for a period of fifteen years. Mr. Rocha will be 100% vested as of December 31, 2012. Mr. Ryan is 35% vested in a benefit of $85,000 for a period of fifteen years. He will be 100% vested as of December 31, 2012. Mr. Incandela is 0% vested in a benefit of $85,000 per year for a period of fifteen years. Mr. Incandela will be 100% vested as of July 20, 2015. Should any of the executive officers terminate their employment or be terminated without cause, the executive would be entitled to distributions equal to the vested amount of the benefits under the terms and conditions of the agreement. Should any executive be terminated for cause, no benefit would be payable under the plan. All benefits under the plan 100% vest in the event of a change of control.

Stock Options

Option/SAR Grants in the Last Fiscal Year

| Name | | Number of Securities Underlying Options/SARS Granted (1) | | % of Total Options/SARs Granted to Employees in Fiscal Year | | Exercise or Base Price $/Sh(2) | | Expiration Date | | Grant Date Present Value(3) | |

| Thomas T. Hawker | | | 10,000 | | | 3.94 | % | $ | 32.84 | | | 12/13/2015 | | $ | 106,049 | |

| | | | 12,599 | | | 4.97 | % | $ | 26.06 | | | 1/3/2015 | | $ | 120,288 | |

| R. Dale McKinney | | | 5,000 | | | 1.97 | % | $ | 32.84 | | | 12/13/2015 | | $ | 53,024 | |

| | | | 6,300 | | | 2.49 | % | $ | 26.06 | | | 1/3/2015 | | $ | 60,148 | |

| Ed J. Rocha | | | 5,000 | | | 1.97 | % | $ | 32.84 | | | 12/13/2015 | | $ | 53,024 | |

| | | | 15,000 | | | 5.92 | % | $ | 34.45 | | | 11/29/2015 | | $ | 166,702 | |

| | | | 6,300 | | | 2.49 | % | $ | 26.06 | | | 1/3/2015 | | $ | 60,148 | |

| John J. Incandela | | | 5,000 | | | 1.97 | % | $ | 32.84 | | | 12/13/2015 | | $ | 53,024 | |

| | | | 15,000 | | | 5.92 | % | $ | 25.82 | | | 5/24/2015 | | $ | 145,948 | |

| Michael T. Ryan | | | 5,000 | | | 1.97 | % | $ | 32.84 | | | 12/13/2015 | | $ | 53,024 | |

| | | | 6,300 | | | 2.49 | % | $ | 26.06 | | | 1/3/2015 | | $ | 60,148 | |

(1) | The material terms of all option grants to named officers during 2005 are as follows: (i) of the options granted, 15,807 of those granted to Mr. Hawker were nonqualified stock options and 6,792 were incentive stock options; all stock options granted to Mr. Rocha were nonqualified stock options; 7,550 of those granted to Mr. McKinney were nonqualified stock options and 3,750 were incentive stock options; 7,550 of those granted to Mr. Ryan were nonqualified stock options and 3,750 were incentive stock options; 12,378 of those granted to Mr. Incandela were nonqualified stock options and 7,622 were incentive stock options; (ii) all options have an exercise price equal to the fair market value on the date of grant; (iii) all options have a ten-year term and become exercisable as follows: 25% at date of issuance and 25% per year for the subsequent three years; and (iv) all must be exercised within 90 days following termination of employment or they expire. On November 29, 2005, the Board of Directors accelerated the exercisability of all stock options outstanding and unexercised under the Company’s Stock Option Plan effective November 29, 2005. |

(2) | Exercise price is determined by the average closing bid and ask prices on the date of grant. |

(3) | The Black-Scholes option pricing model was used to estimate the grant date present value assuming (i) an expected dividend yield of .4%; (ii) an expected volatility of 30%; (iii) a risk-free interest rate of 3.86%; (iv) an option term of 6.32 years. |

The following table shows the number and estimated value of the exercisable and unexercisable stock options for the executive officers listed previously and the number and value of shares received on exercise of options during 2005.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | Number of Securities Underlying Unexercised Options at December 31, 2005 | | Value of Unexercised In-the-money Options at December 31, 2005 | |

Name | | Shares acquired on exercise (#) | | Value realized ($) | | Exercisable/ unexercisable | | Exercisable/ unexercisable | |

| | | | | | | | | | |

| Thomas T. Hawker | | | 1,880 | | $ | 16,215 | | | 63,100/7,500 | | $ | 1,140,597/- | |

| R. Dale McKinney | | | -- | | | -- | | | 22,200/3,750 | | $ | 286,569/- | |

| Ed J. Rocha | | | -- | | | -- | | | 69,042/3,750 | | $ | 959,421/- | |

| Michael T. Ryan | | | -- | | | -- | | | 58,055/3,750 | | $ | 1,201,261/- | |

| John J. Incandela | | | -- | | | -- | | | 16,250/3,750 | | $ | 99,375/- | |

Employee Stock Ownership Plan

The Board of Directors of Capital Corp has established, under Section 401(a) and 501(a) of the Internal Revenue Code of 1986, a qualified Employee Stock Ownership Plan ("ESOP") effective December 31, 1984. The purpose of the ESOP is to provide all eligible employees with additional incentive to maximize their job performance by providing them with an opportunity to acquire or increase their proprietary interest in Capital Corp and to provide supplemental income upon retirement. The ESOP is designed primarily to invest Capital Corp's contributions in shares of Capital Corp's Common Stock. All assets of the ESOP are held in trust for the exclusive benefit of participants and are administered by a committee appointed by the directors of Capital Corp. However, each participant has the right to direct the trustee as to the manner in which these shares of Capital Corp's stock which are credited to the account of each participant are to be voted. The Company has made and in the future intends to make periodic contributions to the ESOP in amounts determined by the Board of Directors. The Company cannot determine the effect, if any, on the market quotations of, or on the market in general for, Capital Corp's Common Stock which could result from future ESOP acquisitions of Capital Corp's shares. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

401(k) Plan

The Board of Directors has established an employee profit sharing plan under Section 401(k) of the Internal Revenue Code of 1986. The purpose of the employee profit-sharing plan is to provide all eligible employees with supplemental income upon retirement and to increase employees' proprietary interest in Capital Corp. Eligible employees may make contributions to the plan subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Company provides discretionary matching contributions equal to a percentage of the amount the employee elects to contribute. For 2005, the Company made contributions to the Plan in the amount equal to 25% of the amount of salary which an employee contributed to the Plan, up to the maximum employee contribution amount of 10% of salary, with the Company's contribution made payable in the form of Capital Corp Common Stock and subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Plan trustees, consisting of members of Capital Corp's management, administered the Plan. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled "All Other Compensation."

Compensation Committee Report

The following is the report of the Company's Compensation and Benefits Committee. It is the duty of this Committee to administer the Company's incentive compensation programs, benefits plans, stock option plan and long-term compensation programs. In addition, the Committee reviews the compensation levels of members of management, provides input on the performance of management and related matters.

In 1999 the Board established an incentive compensation plan for the Company's executive officers. The plan is reviewed by the Board annually and cash incentive compensation to be paid under the plan is based on the achievement of a bottom-line earnings target for the year approved in advance by the Board. It is the practice of the Board to review the plan on an annual basis and to establish annual earnings targets.

The Committee reviews the reasonableness of compensation paid to senior officers of the Company. In doing so, the members of the Committee review surveys from various sources in regard to compensation levels for those senior officers.

During 2005 the Committee retained the services of a compensation consultant to conduct a review of the Company’s current compensation practices and to conduct a survey of compensation practices in comparably sized banking institutions. In the future it is the intent of the Committee to recommend performance based compensation levels comparable to the median paid in the above referenced comparably sized institutions.

The Company's Chief Executive Officer's base salary and other benefits for 2005 were based primarily on the terms established under his employment agreement with the Company dated January 1, 2005, as described previously.

The granting of stock options is determined at the discretion of the Board based upon an officer's responsibilities and relative position in the Company.

No voting member of the Committee is a former or current officer of the Company or any of its subsidiaries.

| | | /s/ Tom A.L. Van Groningen—Chairman /s/ Jerry E. Callister /s/ John D. Fawcett /s/ Curtis A. Riggs |

Indebtedness of Management

Certain of Capital Corp's directors and executive officers, as well as their immediate families, associates and companies in which they have a financial interest, are customers of, and have had banking transactions with, County Bank in the ordinary course of the Bank's business, and the Bank expects to have such ordinary banking transactions with these persons or entities in the future. In the opinion of the Bank's management, the Bank made all loans and commitments to lend included in such transactions in compliance with applicable laws and on substantially the same terms, including interest rates and collateral, as those prevailing for comparable transactions with other persons and entities of similar creditworthiness, and these loans do not involve more than a normal risk of collectibility or present other unfavorable features.

Transactions with Management

There are no other existing or proposed material transactions between Capital Corp and any of its directors, executive officers, nominees for election as a director, or the immediate families or associates of any of the foregoing persons. In accordance with its policies, Capital Corp obtains competitive bids for products and services from independent parties before selecting a vendor of such products and services.

Code of Ethics

The Company has adopted a code of conduct governing the conduct of all its employees and directors. The Company has posted the code on its website and it may be accessed at the following address: http://www.ccow.com.

Stock Performance Graph

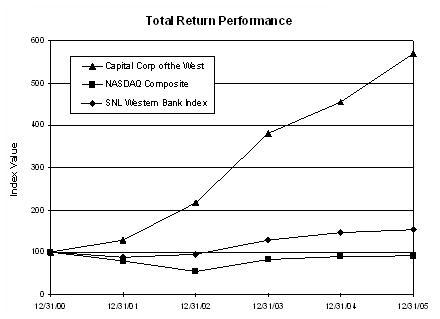

The following graph compares the change on an annual basis in Capital Corp's cumulative total return on its common stock with (a) the change in the cumulative total return on stocks of companies included in the NASDAQ Composite Index for U.S. Companies, (b) the change in the cumulative total return on stocks as included in the SNL Securities "Western Bank Index", a peer industry group, and assuming an initial investment of $100 on December 31, 2000. All of these cumulative total returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the period. The common stock price performance shown below should not be viewed as being indicative of future performance.

Capital Corp of the West

| | Period Ending | |

Index | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | |

| Capital Corp of the West | | | 100.00 | | | 129.06 | | | 216.37 | | | 381.34 | | | 455.66 | | | 569.87 | |

| NASDAQ Composite | | | 100.00 | | | 79.18 | | | 54.44 | | | 82.09 | | | 89.59 | | | 91.54 | |

| SNL Western Bank Index | | | 100.00 | | | 87.45 | | | 95.68 | | | 129.61 | | | 147.29 | | | 153.35 | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 (a) of the Securities Exchange Act of 1934 ("Exchange Act") requires each person (i) who owns more than 10% of any class of equity security which is registered under the Exchange Act or (ii) who is a director or one of certain officers of the issuer of such security to file with the Securities and Exchange Commission certain reports regarding the beneficial ownership of such persons of all equity securities of the issuer. Capital Corp has established a procedure to aid persons who are officers and directors of Capital Corp in timely filing reports required by the Exchange Act.

The Board of Directors is required to disclose unreported filings from prior years of which the Board of Directors has knowledge.

In 2005, Mr. Callister and Mr. Rocha each filed one SEC Form 4 late, each reporting one transaction.

Independent Public Accountants

The Audit Committee has selected KPMG LLP as the independent certified public accountants of Capital Corp for the fiscal year ended December 31, 2005. A representative of KPMG LLP is expected to attend the Meeting. The representative will have the opportunity to make a statement, if desired, and is expected to be available to respond to appropriate shareholder inquiries.

Shareholder Proposals

The deadline for submitting shareholder proposals for inclusion in Capital Corp's proxy statement and form of proxy for the 2007 annual meeting is November 10, 2006. The proposal must be received at Capital Corp's principal executive offices, 550 W. Main Street, Merced, California 95340 by the that date to be eligible for inclusion. Proposals must meet the requirements of applicable law, including Rule 14a-8 of the SEC's proxy rules.

The proxies for the 2007 annual meeting may use their discretion in voting on any proposal raised from the floor of the 2007 annual meeting of which Capital Corp had no notice by February 5, 2007.

Other Matters

The Board of Directors of Capital Corp knows of no other matters which will be brought before the Meeting, but if such matters are properly presented, proxies solicited hereby relating to the Meeting will be voted in accordance with the judgment of the persons holding such proxies. All shares represented by duly executed proxies will be voted at the Meeting.

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

(As amended by the Board of Directors on January 21, 2006)

INTRODUCTION

The Board of Directors of Capital Corp of the West (the “Company”) recognizes that management is responsible for preparing the Company's financial statements and providing an appropriate system of internal accounting controls, and that independent auditors are responsible for auditing the financial statements and reviewing the Company’s internal accounting controls. In fulfilling these responsibilities, the independent auditors are ultimately accountable to the Audit Committee and management is ultimately accountable to the Audit Committee and the Board of Directors.

Nothing in this Charter should be construed to imply that the Audit Committee is required to provide or does provide any assurance or certification as to the Company’s financial statements or as to its compliance with laws, rules or regulations. In order to fulfill its oversight responsibility, the Audit Committee must be capable of conducting free and open discussions with management, independent auditors, employees and others regarding the quality of the financial statements and the system of internal controls.

I. AUDIT COMMITTEE PURPOSE

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee’s primary duties and responsibilities are to:

| A. | Monitor the integrity of the Company’s financial reporting process and systems of internal accounting controls |

| B. | Monitor the independence and performance of the Company’s independent auditors and internal auditing department |

| C. | Provide an avenue of communication among the independent auditors, management and the internal auditing department |

| D. | Review areas of potential significant financial risk to the Company. |

The Audit Committee has the specific responsibilities and authority necessary to comply with Rule 10A-3(b)(2), (3), (4) and (5) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which rule is summarized below:

| A. | responsibilities relating to registered public accounting firms. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any registered public accounting firm engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company, and each such registered public accounting firm must report directly to the Audit Committee; |

| B. | complaints. The Audit Committee must establish procedures for: |

| (i) | the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and |

| (ii) | the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| C. | authority to engage advisers. The Audit Committee has the authority to engage independent counsel and other advisers, as it determines necessary to carry out its duties. |

| D. | funding. The Audit Committee has the authority to expend appropriate corporate funds, as determined by the Audit Committee, for payment of: |

| (i) | compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company; |

| (ii) | compensation to any advisers employed by the Audit Committee under this Charter; and |

| (iii) | ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties, all as described in more detail in the provisions of this Charter. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties. The Chair of the Audit Committee is authorized and empowered to expend corporate funds to retain and secure independent auditors for the Company and such consultants, advisors, attorneys, investigatory services or other expert advice and assistance as the Audit Committee deems appropriate to carry out its duties under these resolutions and the Amended Charter, and in connection therewith the Chair of the Audit Committee is authorized and empowered to sign, execute and deliver any and all such checks, drafts, vouchers, receipts, notes, documents, contracts and any other instruments whatsoever as the Committee shall deem appropriate, in the name and on behalf of the Company.

Each of the officers of the Company, acting in consultation with and under the direction of the Chair of the Audit Committee, is authorized, empowered and directed to execute any and all documents and to take any and all actions as are necessary or appropriate to assist the Audit Committee in the execution of its duties and responsibilities under this Charter.

Prior to the beginning of each fiscal year, the Chairman shall draft a proposed schedule of the Committee’s activities for the coming year, and the times at which such activities shall occur, including preliminary agendas for each proposed meeting of the Committee, which shall be submitted to the Committee for its review and approval, with such changes as the Committee shall determine to be appropriate.

II. AUDIT COMMITTEE COMPOSITION AND MEETINGS

The Audit Committee shall be comprised of not less than three (3) nor more than six (6) directors as determined by the Board, all of whom shall be “independent directors.” For purposes of determining independence, the following criteria shall be applied:

“Family Member” means any person who is a relative by blood, marriage or adoption or who has the same residence.

“Parent or subsidiary” is intended to cover entities that are consolidated with the Company’s financial statements.

“Independent director" means a person other than an officer or employee of the Company or its subsidiaries or any other individual having a relationship which, in the opinion of the Company's Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The following persons shall not be considered independent:

| A. | a director who is, or at any time during the past three years was, employed by the Company or by any parent or subsidiary of the Company; |

| B. | a director who accepts or who has a Family Member who accepts any payments from the Company or any parent or subsidiary of the Company in excess of $60,000 during the current fiscal year or any of the past three fiscal years, other than: |

| (i) | compensation for Board service; |

| | (ii) | payments arising solely from investments in the Company’s securities; |

| | (iii) | compensation paid to a Family Member who is an employee of the Company or a parent or subsidiary of the Company (but not if such person is an executive officer of the Company or any parent or subsidiary of the Company); |

| | (iv) | benefits under a tax-qualified retirement plan, or non-discretionary compensation; |

| | (v) | loans from the Company or any of its affiliates which is a bank, savings and loan association, or broker-dealer extending credit under Federal Reserve Regulation T provided that the loans (1) were made in the ordinary course of business, (2) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the general public, (3) did not involve more than a normal degree of risk or other unfavorable factors, and (4) were not otherwise subject to the specific disclosure requirements of SEC Regulation S-K, Item 404; |

| (vi) | payments from the Company or any of its affiliates which is a bank, savings and loan association, or broker-dealer extending credit under Federal Reserve Regulation T in connection with the deposit of funds acting in an agency capacity, provided such payments were (1) made in the ordinary course of business; (2) made on substantially the same terms as those prevailing at the time for comparable transactions with the general public; and (3) not otherwise subject to the disclosure requirements of SEC Regulation S-K, Item 404; or |

| (vi) | loans permitted under Section 13(k) of the Exchange Act; |

| C. | a director who is a Family Member of an individual who is, or at any time during the past three years was, employed by the Company or by any parent or subsidiary of the Company as an executive officer; |

| D. | a director who is, or has a Family Member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services (other than those arising solely from investments in the Company's securities or under non-discretionary charitable contribution matching programs) that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, in the current fiscal year or any of the past three fiscal years; |

| E. | a director of the Company who is, or has a Family Member who is, employed as an executive officer of another entity where any of the executive officers of the Company serve on the compensation committee of such other entity, or if such relationship existed at any time during the past three years; |

| F. | a director who is or was a partner or employee of the Company’s outside auditor, and worked on the Company’s audit, at any time during the past three years; or |

| G. | a director who owns or controls more than 10% of any class of the Company’s voting securities (or such lower measurement as may be established by the SEC in rulemaking under Section 10A(m) of the Exchange Act; |

| H. | a director who is an affiliated person of the Company or any of its subsidiaries; |