The following table provides information with respect to each person that is being nominated and recommended to be elected by the current Board, as well as existing directors of Capital Corp whose terms do not expire at the time of the Meeting. Reference is made to the section entitled “Security Ownership of Certain Beneficial Owners and Management” for information pertaining to stock ownership of the nominees.

Name/Class

| | | | Age

| | Director

Since

| | Business Experience During Past Five Years

|

|---|

| Dorothy L. Bizzini, I | | | | | 70 | | | 1992 | | Partner in Atwater/Merced Veterinary Clinic, Inc.; Owner Of Dorothy Lee Apartments; Director of Bloss Memorial Health Care District; Chairman of Central Valley Dental Clinic |

| Jerry E. Callister, I | | | | | 62 | | | 1991(1) | | Partner, Callister & Hendricks, Inc., a professional law corporation, Manager, Tioga Properties, LLC; Callister & Hendricks, General Partnership, a professional law partnership; and Partner, Yosemite Highlands, real estate investments |

| Gerald L. Tahajian, I | | | | | 64 | | | 2001 | | President, Gerald Lee Tahajian, Inc., a professional law corporation |

| John D. Fawcett, II | | | | | 56 | | | 1995 | | President and Manager, Fawcett Farms, Inc. |

| Thomas T. Hawker, II | | | | | 62 | | | 1991 | | President/CEO Capital Corp and County Bank |

| Curtis A. Riggs, II | | | | | 56 | | | 2000 | | CEO VIA Adventures, a transportation company; CEO Merced Transportation Company, school bus service; CEO Carskaddon Enterprises, Inc., a leasing company |

| Roberto Salazar, II | | | | | 67 | | | 2004 | | Owner/director of the Central Valley Employee Assistance Program |

| G. Michael Graves, III | | | | | 53 | | | 2001 | | Principal, Pacific Resources, Inc., a financial, strategic planning, accounting and administrative management firm |

| Curtis R. Grant, III | | | | | 65 | | | New

nominee | | Retired professor, California State University Stanislaus |

| Tom A.L. Van Groningen, III | | | | | 72 | | | 1999 | | Consultant, educator, Director of Modesto Irrigation District; Chairman of the Board of Capital Corp |

| David Bonnar | | | | | 50 | | | New

nominee | | Manager of information service group, Community Medical Centers of Central California, Proprietor of The Special Projects Group |

No family relationships exist among any of the directors or executive officers of the Company. No director or person nominated to become a director is a director of any other public company or registered investment company.

Board Structure and Corporate Governance

Board Independence

Each of the members of the Company’s Board of Directors has been determined by the board to be independent under the rules of NASDAQ governing the independence of directors, with the exception of Thomas T. Hawker.

Therefore, a majority of the directors are independent, as required by the rules of NASDAQ.

Annual Meeting Attendance

All directors are expected to attend each annual meeting of the Company’s shareholders, unless attendance is prevented by an emergency. Ten of the ten directors who were in office at that time attended the Company’s 2004 annual meeting of shareholders.

Contacting the Board

Shareholders may address inquiries to any of the Company’s directors or the full board by writing to:

| | Corporate Secretary

Capital Corp of the West

P.O. Box 351

550 West Main Street

Merced CA 95341-0351 |

All communications are sent directly to the directors to whom they are addressed or to the full board as applicable.

For 2004, the Capital Corp Board of Directors held twelve regularly scheduled meetings. The Company has an Executive Committee, a Strategic Planning Committee, a Director Nomination Committee, Director Loan Committee, a Compensation and Benefits Committee and an Audit Committee. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the committees of the Board on which he or she served (during the period for which they served).

Executive Committee

The primary function of the Executive Committee is to act as a vehicle for communication between the Board and the President and Chief Executive Officer. Mr. Van Groningen (Chairman), Ms. Bizzini, Mr. Fawcett, and Mr. Callister are members of the Executive Committee. During 2004, the Executive Committee held a total of twelve meetings.

Strategic Planning Committee

The primary function of the Strategic Planning Committee is to adopt, update and evaluate short term (three-year) and long term (ten-year) strategic plans and goals and monitor the Company’s progress towards those goals. Mr. Callister (chairman), Mr. Grant, Mr. Salazar, Mr. Riggs, Mr. Hawker and Mr. Graves are members of the Strategic Planning Committee. During 2004, the Strategic Planning Committee held eight meetings.

Nomination of Directors; Director Nomination Committee

The Company has a Director Nomination Committee. The purpose of this committee is to oversee the search for qualified individuals to serve on the board and to recommend to the entire board appropriate replacement(s) when a vacancy(s) occurs on the board. The committee is comprised of Ms. Bizzini (Chairperson), Mr. Tahajian, Mr. Graves, and Mr. Van Groningen. The Committee has a charter which can be accessed on the Company’s website at the following address: http:/www.ccow.com/the company.htm.

7

The Company seeks directors who are of high ethical character and have reputations, both personal and professional, which are consistent with the image and values of the Company. The Director Nomination Committee reviews from time to time the appropriate skills and characteristics required of directors in the context of the current make-up of the board, including such factors as business experience, diversity, and personal skills in finance, marketing, business, and other areas that are expected to contribute to an effective board.

The Company will consider director nominees recommended by shareholders who adhere to the following procedure. The Company’s Bylaws provide that any shareholder must give written notice to the President of Capital Corp of an intention to nominate a director at a shareholder meeting. The notice must be received 21 days before the meeting or 10 days after the date of mailing of notice of the meeting, whichever is later. The Bylaws contain additional requirements for nominations. A copy of the requirements is available upon request directed to the President of Capital Corp.

The Company identifies new director candidates from prominent business persons and professionals in the communities it serves. The Director Nomination Committee also has the authority, to the extent it deems necessary or appropriate, to retain a search firm to be used to identify director candidates. The Company considers nominees of shareholders in the same manner as other nominees.

Compensation and Benefits Committee

The purpose of the Compensation and Benefits Committee is to (i) discharge the Board’s responsibilities relating to the compensation of the Company’s officers, (ii) oversee the administration of the Company’s compensation and benefits plans, in particular the incentive compensation and equity-based plans of the Company (and, to the extent appropriate, the significant subsidiaries of the Company) and (iii) prepare the annual report on executive compensation required by the rules and regulations of the SEC to be included in the Company’s annual proxy statement.

Audit Committee

Composition

The Audit Committee is comprised of Mr. Graves (Chairman), Mr. Riggs, Mr. Tahajian and Mr. Bonnar. Each member of the Audit Committee is independent under the rules of NASDAQ governing the independence of directors and the independence of audit committee members, including the “audit committee financial expert” discussed below.

Audit Committee Financial Expert

The board has determined that Mr. Graves has: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in a connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions.

Therefore, the board has determined that Mr. Graves meets the definition of “audit committee financial expert” under the rules of the SEC and is “financially sophisticated” under NASDAQ rules. The determination is based on Mr. Graves’ experience as a Certified Public Accountant and his business experience.

Designation of a person as an audit committee financial expert does not result in the person being deemed an expert for any purpose, including under Section 11 of the Securities Act of 1933. The designation does not impose on the person any duties, obligations or liability greater than those imposed on any other audit committee

8

member or any other director and does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

Committee Functions

The primary function of the Audit Committee is to monitor the integrity and timeliness of the Company’s financial reporting process.

Meeting Attendance

The Committee held twelve meetings during 2004.

Pre-approval Policies

The Committee reviews and pre-approves all auditing services provided by the Company’s independent auditors as well as all non-audit services to be performed by auditors (including any management consulting engagements), unless: (i) the aggregate amount of all non-audit services constitutes not more than 5 percent of the total amount of revenues paid by the Company to its independent auditors during the fiscal year in which the non-audit services are provided; (ii) the services were not recognized by the Company at the time of the engagement to be non-audit services; and (iii) the services are promptly brought to the attention of the Committee and approved prior to the completion of the audit by the Committee or by one or more members of the Committee who are members of the Board of Directors to whom authority to grant such approvals has been delegated by the Committee.

In no event may an auditor provide any of the following non-audit services, even with consent of the Committee:(i) bookkeeping or other services related to the accounting records or financial statements of the Company; (ii) financial information systems design and implementation; (iii) appraisal or valuation services, fairness opinions, or contribution-in-kind reports; (iv) actuarial services; (v) internal audit outsourcing services; (vi) management functions or human resources; (vii) broker or dealer, investment adviser, or investment banking services; (viii) legal services and expert services unrelated to the audit; and (ix) any other service that the Board determines, by regulation, is impermissible.

If the Committee approves any non-audit service to be performed by the independent auditor, it shall be disclosed in a report on Form 10-K, 10-Q or 8-K, as appropriate.

Auditor Fees

Category of Services

| | | | Fiscal Year

2003

| | Fiscal Year

2004

|

|---|

| Audit fees (1) | | | | $ | 148,500 | | | $ | 277,000 | |

| Audit-related fees (2) | | | | $ | — | | | $ | 10,000 | |

| Tax fees (3) | | | | $ | 21,970 | | | $ | 31,300 | |

| Subtotal | | | | $ | 170,470 | | | $ | 318,300 | |

| All other fees (4) | | | | $ | — | | | $ | — | |

| (1) | | Services include the audit of the Company’s annual financial statements and review of financial statements included in the Company’s Quarterly Reports on Form 10-Q or services that are normally provided by the accountant in connection with statuary and regulatory filings for engagements. |

| (2) | | Services include assurance and related services by the auditor that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit Fees.” 2004 fees include the purchase of software to support compliance with Sarbanes Oxley. |

| (3) | | Services include tax compliance, tax advice, and tax planning. Services in this category rendered during 2003 and 2004 include time and materials for the preparation, review and filing of the Company’s federal |

9

| | and California state tax returns (including tax returns for the Company’s Real Estate Investment Trust), quarterly review of estimated tax payments and support related to tax audits by federal or state agencies. |

| (4) | | Services include other services (and products) provided by the auditors, other than the services reported above in this table. |

Report of the Audit Committee

The Audit Committee operates under a charter adopted by the board that is attached as Appendix A to this proxy statement.

The Audit Committee reviewed and discussed the audited financial statements and related judgments with management and the outside auditors.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380).

The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Board Standards No. 1,Independence Discussions with Audit Committees), and has discussed with the independent accountant the independent accountant’s independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the full Board the inclusion of the financial statements in the Company’s Annual Report on Form 10-K.

The Company’s Audit Committee has considered whether KPMG LLP’s provisions of the services described above under “Auditor Fees” are compatible with maintaining the independence of KPMG LLP.

/s/ G. Michael Graves

/s/ Curtis A. Riggs

/s/ Jerry L.Tahajian

10

Director Attendance and Compensation

Effective March 2004 non-employee directors receive a $2,500 monthly retainer fee and a $50 – $120 (depending on distance) monthly car allowance. The chairman of the Board receives a $1,000 monthly fee. The audit committee chair receives a $1,000 monthly fee. All other committee chairs receive a $300 fee per meeting for attendance. Members of The Bank Secrecy Act committee of County Bank also receive a $400 fee per meeting for attendance and the chairman receives an additional $400 fee per meeting for attendance. For January and February of 2004, non-employee directors received $700 per meeting for their attendance at regular Board meetings, $400 per meeting for attendance at Special Board meetings, $350 per Committee meeting, a $800 monthly retainer fee, and a $50-$120 (depending on distance) monthly car allowance. The Audit Committee chair received a $500 monthly chair fee. The Chairman of the Board also received an additional $800 monthly fee. Employee directors do not receive fees. Capital Corp directors earned a total of $355,800 in director fees during 2004.

County Bank has replaced its non-qualified deferred compensation plan for members of the board of directors. Five directors participated in the deferred compensation plan, each entering into a Deferred Compensation Agreement and electing to defer a portion of his or her director compensation for payment at a future date. Deferred amounts were credited with interest at a fixed rate of 7%. The five participating directors who entered into Deferred Compensation Agreements with County Bank are Directors, Bizzini, Callister, Fawcett, Bonnar and Salazar. Effective December, 2004 these five directors entered into Director Elective Income Deferral Agreements, which supersede the Deferred Compensation Agreements. Under the Director Elective Income Deferral Agreements, each of these five directors continues to defer compensation previously deferred under the Deferred Compensation Agreements and a designated portion of their future compensation. Interest accrues at a fixed rate of 7%.

Benefits under the Director Elective Income Deferral Agreements are based on each director’s account balance at the end of the month immediately before payments begin. Payments begin on the date selected by each director, or if sooner when the director’s service terminates. Benefits will be paid in the form elected by each director, whether in a lump sum or installments over a period of 3, 5, or 10 years. If a director’s service terminates within 12 months after a change in control, the director’s entire account balance will be paid in a single lump sum within 30 days.

County Bank previously purchased insurance on the lives of participating directors with the goal that income on the insurance policies would support the obligation to pay benefits under the Deferred Compensation Agreements. The Deferred Compensation Agreement have now been replaced by the Director Elective Income Deferral Agreements, but County Bank remains the owner and beneficiary of these life insurance policies. The Bank has a Rabbi trust and specific life insurance contracts have been irrevocably assigned to the trust in support of the deferred compensation benefits.

11

Executive Officers of Capital Corp

Set forth below is certain information with respect to each of the executive officers of Capital Corp.

Name

| | | | Age

| | Position and Offices

| | Executive

Officer Since

|

|---|

| Thomas T. Hawker | | | | | 62 | | | President, CEO and Director* | | | 1991 | |

| R. Dale McKinney | | | | | 59 | | | Executive Vice President/Chief Financial Officer* | | | 1999 | |

| Michael T. Ryan | | | | | 53 | | | Executive Vice President/

Chief Administration Officer* | | | 2003 | |

Set forth below is certain information with respect to the executive officers of County Bank, a subsidiary of Capital Corp.

Name

| | | | Age

| | Position and Offices

| | Executive

Officer Since

|

|---|

| Ed J. Rocha | | | | | 52 | | | Executive Vice President/Chief Operating Officer | | | 1997 | |

| James M. Sherman | | | | | 68 | | | Executive Vice President/Chief Credit Officer | | | 1999 | |

| * | | These individuals also serve in their stated capacities for County Bank. |

A brief summary of the background and business experience of the executive officers of Capital Corp and its subsidiaries is set forth below.

THOMAS T. HAWKER became County Bank’s President and Chief Executive Officer in 1991 and President and Chief Executive Officer of Capital Corp in 1995. Prior to that he served as President and Chief Executive Officer of Concord Commercial Bank from 1986–1991.

R. DALE MCKINNEY became Capital Corp’s Executive Vice President and Chief Financial Officer in 2001. He was the Company’s Senior Vice President/Chief Financial Officer from 1999 to 2001. During 1998, Mr. McKinney was subject to a non-compete agreement with MBNA Corporation. In 1996–1997 he served as Senior Vice President — Finance for MBNA Corporation and from 1993–1995 he served as Senior Vice President — Finance for MBNA Information Services.

ED J. ROCHA became County Bank’s Executive Vice President/Chief Operating Officer in 2003. He was the Bank’s Executive Vice President/Chief Banking Officer from 2000 to 2002. He was the Bank’s Senior Vice President/Chief Banking Officer from 1997–1999. He served as Vice President and Regional Manager for the Bank from 1995–1997. He served as Senior Vice President/Branch Administrator for Pacific Valley National Bank from 1989–1995.

JAMES M. SHERMAN became Executive Vice President/Chief Credit Officer for County Bank in 2001. He was the Bank’s Senior Vice President/Chief Credit Officer from 1999 to 2001. Prior to that he served as Vice President of San Jose National Bank from 1994 to 1998.

MICHAEL T. RYAN became County Bank’s Executive Vice President/Chief Administrative Officer in January, 2003. He was the Bank’s Senior Vice President / Chief Administrative Officer from November, 2000 to January 2003. From 1996–2000, he served as First Vice President for Corus Bank in Chicago, IL. From 1987–1996, he held various regional management and consulting positions for Unisys Corporation in the financial line of business.

12

Beneficial Ownership of Management

The following table shows the number and percentage of shares beneficially owned (including shares subject to options exercisable currently or within 60 days of the Record Date, February 28, 2005) by each director nominee, current director and named executive officer of the Company and all directors and executive officers as a group.

| | | | Beneficially Owned (1)

| |

|---|

Name of Beneficial Owner

| | | | Amount

| | Percentage

|

|---|

| Dorothy L. Bizzini | | | | | 47,913 | (2) | | * |

| Jerry E. Callister | | | | | 17,587 | (3) | | * |

| John D. Fawcett | | | | | 25,058 | (4) | | * |

| G. Michael Graves | | | | | 14,476 | (5) | | * |

| Thomas T. Hawker | | | | | 128,606 | (6) | | 2.11% |

| Roberto Salazar | | | | | 4,848 | (7) | | * |

| R. Dale McKinney | | | | | 46,269 | (8) | | * |

| Curtis A. Riggs | | | | | 16,247 | (9) | | * |

| Ed J. Rocha | | | | | 37,561 | (10) | | * |

| James M. Sherman | | | | | 30,594 | (11) | | * |

| Gerald L. Tahajian | | | | | 19,116 | (12) | | * |

| Curtis R. Grant | | | | | 2,150 | (13) | | * |

| Tom A.L. Van Groningen | | | | | 15,452 | (14) | | * |

| Michael T. Ryan | | | | | 29,280 | (15) | | * |

| David Bonnar | | | | | 2,290 | (16) | | * |

All Directors and Executive Officers of the Company as a

Group (15 in number) | | | | | 437,447 | (17) | | 7.18% |

The address for all persons is Capital Corp of the West, 550 West Main Street, P.O. Box 1191, Merced, California, 95341-0351.*

| * | | Indicates that the percentage of outstanding shares beneficially owned is less than one percent (1%). |

| (1) | | Includes shares beneficially owned (including options exercisable within 60 days of the Record Date, February 28, 2005), directly and indirectly together with associates. Subject to applicable community property laws and shared voting and investment power with a spouse, the persons listed have sole voting and investing power with respect to such shares unless otherwise noted. |

| (2) | | Includes 17,412 shares held as trustee in the Bizzini Family Trust, 6,440 shares held with spouse, 19,089 shares held in pension plan and 4,972 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (3) | | Includes 11,401 shares held as trustee in the Jerry Callister and Kathryn Callister Family Trust, 1,214 shares as trustee of an outside trust; and 4,972 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (4) | | Includes 14,017 shares held individually, 1,380 shares held with spouse and 1,217 held by spouse, and 8,444 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (5) | | Includes 5,282 shares held in joint tenancy with spouse and 9,194 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (6) | | Includes 53,297 shares held in trust; 3,735 shares held by his spouse’s IRA; 19,215 held in Mr. Hawker’s IRA; 1,742 shares held with daughter jointly; 9,302 shares held through the Company ESOP; 14,733 shares held through the Company 401(k); and 26,582 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

13

| (7) | | Includes 2,785 shares held individually and 2,063 shares under stock options which are exercisable currently or within 60 days of February 28, 2005 |

| (8) | | Includes 36,234 shares held in trust; 2,191 shares held through the Company ESOP; 2,417 shares through the Company 401(k); and 5,427 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (9) | | Includes 1,739 shares held in Mr. Riggs’ IRA; 1,500 shares held in corporation’s name; 2,930 shares held in a family trust; 2,240 shares held in the name of spouse and 2,116 shares held in the name of children; and 5,722 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (10) | | Includes 5,782 shares held in an IRA; 3,690 shares held through the Company ESOP, 5,802 shares in the Company 401(k); and 22,287 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (11) | | Includes 11,756 shares held jointly with spouse; 2,170 shares held through the Company ESOP; 621 shares through the Company 401(k); and 16,047 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (12) | | Includes 3,667 shares held in a family trust; 7,335 shares held in a corporate profit sharing plan; and 8,114 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (13) | | Includes 700 shares held with spouse and 1,450 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (14) | | Includes 15,452 shares held in a family trust. |

| (15) | | Includes 2,300 shares held in Ryan Family Trust, 780 shares held through the Company ESOP, 852 shares held in the Company 401(k), and 25,348 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

| (16) | | Includes 1,540 shares held in Mr. Bonnar’s 401(k) plan; and 750 shares under stock options which are exercisable currently or within 60 days of February 28, 2005. |

Principal Shareholders

As of December 31, 2004, no individuals known to the Board of Directors of Capital Corp owned of record or beneficially more than five percent of the outstanding shares of common stock of Capital Corp, except as described below:

Stock

Name and Address

| | | | Number of Shares

Beneficially Owned

| | Percentage of Outstanding

Beneficially Owned

|

|---|

1867 Western Financial Corporation

PO BOX 1110

Stockton, CA 95201-1110 | | | | | 649,951 | | | | 11.3 | % |

Compensation and Other Transactions with Management and Others

The following information is furnished with respect to the aggregate compensation paid to the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Credit Officer and Chief Administrative Officer of Capital Corp or its subsidiary County Bank during 2002–2004. No other executive officer of Capital Corp or its subsidiaries received aggregate annual salary and bonus of $100,000 or more in 2002–2004.

14

Summary Compensation Table

| | | | Annual Compensation (1)

| | Long Term

Compensation

| |

|---|

Name & Principal Position

| | | | Year

| | Salary

| | Bonus

| | Securities Underlying

Stock Options

Granted (Number

of Shares)

| | All Other

Compensation (2)

|

|---|

Capital Corp of the West

| | | | | | | | | | | | | | | | | | | | |

| Thomas T. Hawker | | | | | 2004 | | | $ | 298,553 | | | $ | 150,000 | | | | 7,000 | | | $11,450 |

President/CEO

| | | | | 2003 | | | $ | 264,800 | | | $ | 161,320 | | | | 7,350 | | | $11,000 |

| | | | | | 2002 | | | $ | 257,927 | | | $ | 60,000 | | | | 7,717 | | | $10,750 |

| | | | | | | | | | | | | | | | | | | | | |

| R. Dale McKinney | | | | | 2004 | | | $ | 183,132 | | | $ | 81,328 | | | | 3,500 | | | $11,450 |

EVP/Chief Financial Officer

| | | | | 2003 | | | $ | 168,694 | | | $ | 62,205 | | | | 7,350 | | | $11,000 |

| | | | | | 2002 | | | $ | 157,694 | | | $ | 43,500 | | | | 3,858 | | | $10,750 |

| | | | | | | | | | | | | | | | | | | | | |

| Michael T. Ryan | | | | | 2004 | | | $ | 165,944 | | | $ | 74,152 | | | | 3,500 | | | $11,450 |

EVP/Chief Administrative Officer

| | | | | 2003 | | | $ | 153,056 | | | $ | 54,366 | | | | 7,350 | | | $11,000 |

| | | | | | 2002 | | | $ | 136,787 | | | $ | 40,000 | | | | 3,858 | | | $10,131 |

County Bank

| | | | | | | | | | | | | | | | | | | | |

| Ed J. Rocha | | | | | 2004 | | | $ | 188,971 | | | $ | 85,820 | | | | 3,500 | | | $11,450 |

EVP/Chief Operating Officer

| | | | | 2003 | | | $ | 167,882 | | | $ | 60,060 | | | | 7,175 | | | $11,000 |

| | | | | | 2002 | | | $ | 152,256 | | | $ | 43,000 | | | | 3,858 | | | $10,750 |

| | | | | | | | | | | | | | | | | | | | | |

| James M. Sherman | | | | | 2004 | | | $ | 175,382 | | | $ | 83,870 | | | | 3,500 | | | $11,450 |

EVP/Chief Credit Officer

| | | | | 2003 | | | $ | 163,173 | | | $ | 65,604 | | | | 7,350 | | | $11,000 |

| | | | | | 2002 | | | $ | 152,256 | | | $ | 42,000 | | | | 3,858 | | | $10,750 |

| (1) | | The incremental cost to the Company of providing incidental personal benefits to those executives noted above did not exceed 10% of the compensation to any of those reported above for each of the three years disclosed above. |

| (2) | | Includes Company contributions to ESOP and 401(k) plans. |

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

Pursuant to his employment contract effective January 1, 2002 through December 31, 2004, Mr. Hawker received a base salary of $260,000, adjusted annually for cost of living allowances and other salary increases approved by the Board, use of a Company-owned automobile, medical, dental and disability insurance benefits available to the Company’s employees generally and participation in the Company’s other compensation plans such as its incentive compensation program, 401(k) plan, stock option plan and ESOP plan. Pursuant to this employment contract, should Mr. Hawker have been terminated for reasons other than for cause, he would have received a severance payment equal to one year’s then-current salary plus continuation of insurance benefits for one year. He was entitled to receive grants of 7,000 incentive stock options on January 1, 2002, 2003 and 2004 at the then market value of the Company’s stock if still actively employed by the Company. Each stock option vested 25% on grant and 25% each year thereafter. In an acquisition of Capital Corp, the contract would have automatically terminated and Mr. Hawker would have received an acquisition payment equal to eighteen months’ then-current salary plus continuation of insurance benefits for eighteen months.

Pursuant to his new employment contract effective January 1, 2005 through December 31, 2008, Mr. Hawker will receive a base salary of $330,000, adjusted annually for cost of living allowances and other salary increases if approved by the Board, use of a Company-owned automobile, medical, dental and disability insurance benefits available to the Company’s employees generally and participation in the Company’s other compensation plans such as its incentive compensation program, 401(k) plan, stock option plan and ESOP plan.

15

Pursuant to his employment contract, should Mr. Hawker be terminated for reasons other than for cause, he would receive a severance payment equal to one year’s then-current salary plus continuation of insurance benefits for one year. He will be entitled to receive grants of 7,000 incentive stock options on January 1, 2005, 2006, 2007 and 2008 at the then market value of the Company’s stock if he is still actively employed by the Company. Each stock option will vest 25% on grant and 25% each year thereafter. In addition, in the event of an acquisition of Capital Corp, Mr. Hawker’s employment contract will automatically terminate and Mr. Hawker will receive an acquisition payment equal to eighteen months’ then-current salary plus continuation of insurance benefits for eighteen months.

Effective December 21, 2004, Mr. McKinney, Mr. Rocha, Mr. Ryan and Mr. Sherman are covered by a two-year severance agreement in case of a change in control of the Company. The agreement is automatically extended on each anniversary of its date for an additional year unless the Company decides not to do so. The officer is entitled to payment under the agreement if the officer’s employment is involuntarily terminated within one year after a change in control, (except for cause) or if the officer terminates employment within one year after a change in control due to salary reduction, reduced or discontinued participation in employee benefit plans (except for a company-wide reduction of all officers’ awards) or termination of participation in any benefit plan (unless the plan is terminated because of changes in law or loss of tax deductibility to the Company, or as a matter of policy applied equally to all participants), reduced responsibilities or status, failure of the acquirer to assume the Company’s obligations under the agreement, or relocation of the Company’s principal executive offices, or requiring the officer to change this principal work location, to any location that is more than 50 miles away. Under the agreement severance payment would be equal to one year base salary plus the average of the last three years bonuses and incentive compensation for that individual. Participants become fully vested in any qualified and non-qualified employee benefit plans which do not otherwise have their own change in control provisions, and are entitled to Company contributions to the 401(k) plan that would have received had employment not terminated before the end of the plan year, as well as continued life, health and disability insurance coverage for 12 months or until the officer becomes employed by another employer, whichever occurs first. At the end of the 12-month period, the officer may continue health insurance coverage at his own expense for a period not less than the number of months by which the Consolidated Omnibus Budget Reconciliation Act (COBRA) continuation period exceeds 12 months. In addition, based upon Mr. McKinney’s employment letter dated January 21, 1999, Mr. McKinney would receive a 6 month base compensation acquisition payment in the case of a change in control if termination did not occur.

In addition, Capital Corp provides Mr. Hawker and all executive officers with salary continuation plans. This is a non-qualified executive benefit plan pursuant to which the Company has agreed to pay retirement benefits to the executive officers in return for their continued satisfactory performance. It is an unfunded plan; the executive has no rights under the agreements beyond those of a general creditor of the Company. The plan is funded by single premium universal life insurance policies. The Bank has a Rabbi trust and specific life insurance contracts have been irrevocably assigned to the trust in support of the deferred compensation benefits. As of the date of this proxy statement, Mr. Hawker is 79% vested in a benefit of $150,000 per year for a period of fifteen years. Mr. Hawker will be 100% vested as of December 31, 2007. Mr. McKinney is 60% vested in a benefit of $85,000 per year for a period of fifteen years. Mr. McKinney will be 100% vested as of December 31, 2008. Mr. Rocha is 69% vested in a benefit of $85,000 for a period of fifteen years. Mr. Rocha will be 100% vested as of December 31, 2012. Mr. Sherman is 70% vested in a benefit of $60,000 for a period of 10 years. He will be 100% vested as of March 15, 2005. Mr. Ryan is 28% vested in a benefit of $85,000 for a period of fifteen years. He will be 100% vested as of December 31, 2012. Should any of the executive officers terminate their employment or be terminated without cause, the executive would be entitled to distributions equal to the vested amount of the benefits under the terms and conditions of the agreement. Should any executive be terminated for cause, no benefit would be payable under the plan. All benefits under the plan 100% vest in the event of a change of control.

16

Stock Options

Option/SAR Grants in the Last Fiscal Year

Name

| | | | Number of

Securites

Underlying

Options/SARS

Granted (1)

| | % of Total

Options/SARs

Granted to

Employees

in Fiscal Year

| | Exercise or

Base Price

$/Sh (2)

| | Expiration

Date

| | Full Grant

Amount

|

|---|

| Thomas T. Hawker | | | | | 7,000 | | | | 6.50 | % | | $ | 37.90 | | | | 1/13/2014 | | | $ | 95,517 | |

| R. Dale McKinney | | | | | 3,500 | | | | 3.29 | % | | $ | 37.90 | | | | 1/13/2014 | | | $ | 47,758 | |

| Ed J. Rocha | | | | | 3,500 | | | | 3.29 | % | | $ | 37.90 | | | | 1/13/2014 | | | $ | 47,758 | |

| James M Sherman | | | | | 3,500 | | | | 3.29 | % | | $ | 37.90 | | | | 1/13/2014 | | | $ | 47,758 | |

| Michael T. Ryan | | | | | 3,500 | | | | 3.29 | % | | $ | 37.90 | | | | 1/13/2014 | | | $ | 47,758 | |

| (1) | | The material terms of all option grants to named officers during 2004 are as follows: (i) of the options granted, 2,654 of those granted to Mr. Hawker were nonqualified stock options and 4,346 were incentive stock options; 203 of those granted to Mr. Rocha were nonqualified stock options and 3,297 were incentive stock options; all stock options granted to Mr. McKinney, Mr. Sherman and Mr. Ryan were incentive stock options (ii) all options have an exercise price equal to the fair market value on the date of grant; (iii) all options have a ten-year term and become exercisable as follows: 25% at date of issuance and 25% per year for the subsequent three years; and (iv) all must be exercised within 90 days following termination of employment or they expire. |

| (2) | | Exercise price is determined by the average closing bid and ask prices on the date of grant. |

| (3) | | The Black-Scholes option pricing model was used to estimate the grant date present value assuming (i) an expected dividend yield of .4%; (ii) an expected volatility of 26%; (iii) a risk-free interest rate of 4.13%; (iv) an option term of seven years. |

The following table shows the number and estimated value of the exercisable and unexercisable stock options for the executive officers listed previously and the number and value of shares received on exercise of options during 2004.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | |

| |

| | Number of Securities

Underlying

Unexercised Options

at December 31, 2004

| | Value of Unexercised

In-the-money

Options at

December 31, 2004

|

|---|

Name

| | | | Shares acquired

on exercise (#)

| | Value

realized ($)

| | Exercisable/

unexercisable

| | Exercisable/

unexercisable

|

|---|

| Thomas T. Hawker | | | | | 14,585 | | | $ | 355,466 | | | | 19,316/ 10,853 | | | $ | 588,689/$201,693 | |

| R. Dale McKinney | | | | | 7,582 | | | $ | 238,466 | | | | 875/ 7,263 | | | $ | 8,190/$146,079 | |

| Ed J. Rocha | | | | | 4,717 | | | $ | 174,096 | | | | 18,654/ 7,176 | | | $ | 605,167/$125,526 | |

| James M. Sherman | | | | | 11,576 | | | $ | 314,196 | | | | 11,495/ 7,263 | | | $ | 340,545/$147,042 | |

| Michael T. Ryan | | | | | — | | | $ | — | | | | 20,796/ 7,263 | | | $ | 686,049/$147,042 | |

Employee Stock Ownership Plan

The Board of Directors of Capital Corp has established, under Section 401(a) and 501(a) of the Internal Revenue Code of 1986, a qualified Employee Stock Ownership Plan (“ESOP”) effective December 31, 1984. The purpose of the ESOP is to provide all eligible employees with additional incentive to maximize their job performance by providing them with an opportunity to acquire or increase their proprietary interest in Capital Corp and to provide supplemental income upon retirement. The ESOP is designed primarily to invest Capital Corp’s contributions in shares of Capital Corp’s Common Stock. All assets of the ESOP are held in trust for the

17

exclusive benefit of participants and are administered by a committee appointed by the directors of Capital Corp. However, each participant has the right to direct the trustee as to the manner in which these shares of Capital Corp’s stock which are credited to the account of each participant are to be voted. The Company has made and in the future intends to make periodic contributions to the ESOP in amounts determined by the Board of Directors. The Company cannot determine the effect, if any, on the market quotations of, or on the market in general for, Capital Corp’s Common Stock which could result from future ESOP acquisitions of Capital Corp’s shares. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled “All Other Compensation.”

401(k) Plan

The Board of Directors has established an employee profit sharing plan under Section 401(k) of the Internal Revenue Code of 1986. The purpose of the employee profit-sharing plan is to provide all eligible employees with supplemental income upon retirement and to increase employees’ proprietary interest in Capital Corp. Eligible employees may make contributions to the plan subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Company provides discretionary matching contributions equal to a percentage of the amount the employee elects to contribute. For 2004, the Company made contributions to the Plan in the amount equal to 25% of the amount of salary which an employee contributed to the Plan, up to the maximum employee contribution amount of 10% of salary, with the Company’s contribution made payable in the form of Capital Corp Common Stock and subject to the limitations of Section 401(k) of the Internal Revenue Code of 1986. The Plan trustees, consisting of members of Capital Corp’s management, administered the Plan. The amount of contributions for the benefit of the executive officers noted above is included in the Summary Cash Compensation table in the column entitled “All Other Compensation.”

Compensation Committee Report

The following is the report of the Company’s Compensation and Benefits Committee. It is the duty of this Committee to administer the Company’s incentive compensation programs, benefits plans, stock option plan and long-term compensation programs. In addition, the Committee reviews the compensation levels of members of management, provides input on the performance of management and considers management succession and related matters.

The Committee reviews the reasonableness of compensation paid to senior officers of the Company. In doing so, the members of the Committee review surveys from various sources in regard to compensation levels for those senior officers.

The Company’s Chief Executive Officer’s base salary and other benefits for 2004 were based primarily on the terms established under his employment agreement with the Company dated January 1, 2005, as described previously.

In 1999 the Board established an incentive compensation plan for the Company’s executive officers. The plan is reviewed by the Board annually and cash incentive compensation to be paid under the plan is based on the achievement of a bottom-line earnings target for the year approved in advance by the Board. It is the intent of the Board to renew the plan on an annual basis and to establish annual earnings targets.

The granting of stock options is determined at the discretion of the Board based upon an officer’s responsibilities and relative position in the Company.

No voting member of the Committee is a former or current officer of the Company or any of its subsidiaries.

/s/ Tom A.L. Van Groningen — Chairman

/s/ Dorothy Bizzini

/s/ John D. Fawcett

/s/ Jerry E. Callister

18

Indebtedness of Management

Certain of Capital Corp’s directors and executive officers, as well as their immediate families, associates and companies in which they have a financial interest, are customers of, and have had banking transactions with, County Bank in the ordinary course of the Bank’s business, and the Bank expects to have such ordinary banking transactions with these persons or entities in the future. In the opinion of the Bank’s management, the Bank made all loans and commitments to lend included in such transactions in compliance with applicable laws and on substantially the same terms, including interest rates and collateral, as those prevailing for comparable transactions with other persons and entities of similar creditworthiness, and these loans do not involve more than a normal risk of collectibility or present other unfavorable features.

Transactions with Management

There are no other existing or proposed material transactions between Capital Corp and any of its directors, executive officers, nominees for election as a director, or the immediate families or associates of any of the foregoing persons. In accordance with its policies, Capital Corp obtains competitive bids for products and services from independent parties before selecting a vendor of such products and services.

Code of Ethics

The Company has adopted a code of conduct governing the conduct of all its employees and directors. The Company has posted the code on its website and it may be accessed at the following address: http://www.ccow.com/thecompany.htm.

19

Stock Performance Graph

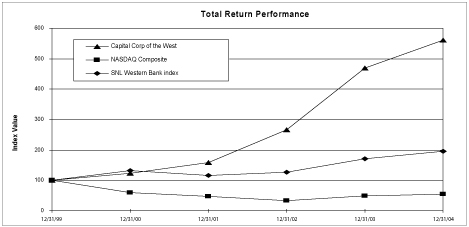

The following graph compares the change on an annual basis in Capital Corp’s cumulative total return on its common stock with (a) the change in the cumulative total return on stocks of companies included in the NASDAQ Composite Index for U.S. Companies, (b) the change in the cumulative total return on stocks as included in the SNL Securities “Western Bank Index”, a peer industry group, and assuming an initial investment of $100 on December 31, 1999. All of these cumulative total returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the period. The common stock price performance shown below should not be viewed as being indicative of future performance.

Capital Corp of the West

| | | | Period Ending

| |

|---|

Index

| | | | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

|---|

| Capital Corp of the West | | | | | 100.00 | | | | 123.08 | | | | 158.85 | | | | 266.30 | | | | 469.34 | | | | 560.81 | |

| NASDAQ Composite | | | | | 100.00 | | | | 60.82 | | | | 48.16 | | | | 33.11 | | | | 49.93 | | | | 54.49 | |

| SNL Western Bank Index | | | | | 100.00 | | | | 132.40 | | | | 115.78 | | | | 126.67 | | | | 171.59 | | | | 195.00 | |

20

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 (a) of the Securities Exchange Act of 1934 (“Exchange Act”) requires each person (i) who owns more than 10% of any class of equity security which is registered under the Exchange Act or (ii) who is a director or one of certain officers of the issuer of such security to file with the Securities and Exchange Commission certain reports regarding the beneficial ownership of such persons of all equity securities of the issuer. Capital Corp has established a procedure to aid persons who are officers and directors of Capital Corp in timely filing reports required by the Exchange Act.

The Board of Directors is required to disclose unreported filings from prior years of which the Board of Directors has knowledge.

In 2004, Mr. Bonnar filed one SEC Form 4 late, reporting one transaction.

Independent Public Accountants

The Audit Committee has selected KPMG LLP as the independent certified public accountants of Capital Corp for the fiscal year ended December 31, 2004. A representative of KPMG LLP is expected to attend the Meeting. The representative will have the opportunity to make a statement, if desired, and is expected to be available to respond to appropriate shareholder inquiries.

Shareholder Proposals

The deadline for submitting shareholder proposals for inclusion in Capital Corp’s proxy statement and form of proxy for the 2006 annual meeting is November 10, 2005. The proposal must be received at Capital Corp’s principal executive offices, 550 W. Main Street, Merced, California 95341-0351 by that date to be eligible for inclusion. Proposals must meet the requirements of applicable law, including Rule 14a-8 of the SEC’s proxy rules.

The proxies for the 2006 annual meeting may use their discretion in voting on any proposal raised from the floor of the 2005 annual meeting of which Capital Corp had no notice by February 1, 2006.

Other Matters

The Board of Directors of Capital Corp knows of no other matters which will be brought before the Meeting, but if such matters are properly presented, proxies solicited hereby relating to the Meeting will be voted in accordance with the judgment of the persons holding such proxies. All shares represented by duly executed proxies will be voted at the Meeting.

21

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

(As amended by the Board of Directors on December 21st, 2004)

INTRODUCTION

The Board of Directors of Capital Corp of the West (the “Company”) recognizes that management is responsible for preparing the Company’s financial statements and providing an appropriate system of internal accounting controls, and that independent auditors are responsible for auditing the financial statements and reviewing the Company’s internal accounting controls. In fulfilling these responsibilities, the independent auditors are ultimately accountable to the Audit Committee and management is ultimately accountable to the Audit Committee and the Board of Directors.

Nothing in this Charter should be construed to imply that the Audit Committee is required to provide or does provide any assurance or certification as to the Company’s financial statements or as to its compliance with laws, rules or regulations. In order to fulfill its oversight responsibility, the Audit Committee must be capable of conducting free and open discussions with management, independent auditors, employees and others regarding the quality of the financial statements and the system of internal controls.

| I. | | AUDIT COMMITTEE PURPOSE |

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee’s primary duties and responsibilities are to:

| • | | Monitor the integrity of the Company’s financial reporting process and systems of internal accounting controls |

| • | | Monitor the independence and performance of the Company’s independent auditors and internal auditing department |

| • | | Provide an avenue of communication among the independent auditors, management and the internal auditing department |

| • | | Review areas of potential significant financial risk to the Company. |

The Audit Committee has the specific responsibilities and authority necessary to comply with Rule 10A-3(b)(2), (3), (4) and (5) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which rule is summarized below:

| (i) | | responsibilities relating to registered public accounting firms. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any registered public accounting firm engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company, and each such registered public accounting firm must report directly to the Audit Committee; |

| (ii) | | complaints. The Audit Committee must establish procedures for: |

| | the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and |

| | the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| (iii) | | authority to engage advisers. The Audit Committee has the authority to engage independent counsel and other advisers, as it determines necessary to carry out its duties. |

A-1

| (iv) | | funding. The Audit Committee has the authority to expend appropriate corporate funds, as determined by the Audit Committee, for payment of: |

| (a) | | compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company; |

| (b) | | compensation to any advisers employed by the Audit Committee under this Charter; and |

| (c) | | ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties, |

all as described in more detail in the provisions of this Charter.

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties. The Chair of the Audit Committee is authorized and empowered to expend corporate funds to retain and secure independent auditors for the Company and such consultants, advisors, attorneys, investigatory services or other expert advice and assistance as the Audit Committee deems appropriate to carry out its duties under these resolutions and the Amended Charter, and in connection therewith the Chair of the Audit Committee is authorized and empowered to sign, execute and deliver any and all such checks, drafts, vouchers, receipts, notes, documents, contracts and any other instruments whatsoever as the Committee shall deem appropriate, in the name and on behalf of the Company.

Each of the officers of the Company, acting in consultation with and under the direction of the Chair of the Audit Committee, is authorized, empowered and directed to execute any and all documents and to take any and all actions as are necessary or appropriate to assist the Audit Committee in the execution of its duties and responsibilities under this Charter.

Prior to the beginning of each fiscal year, the Chairman shall draft a proposed schedule of the Committee’s activities for the coming year, and the times at which such activities shall occur, including preliminary agendas for each proposed meeting of the Committee, which shall be submitted to the Committee for its review and approval, with such changes as the Committee shall determine to be appropriate.

| II. | | AUDIT COMMITTEE COMPOSITION AND MEETINGS |

The Audit Committee shall be comprised of not less than three (3) nor more than six (6) directors as determined by the Board, all of whom shall be “independent directors.” For purposes of determining independence, the following criteria shall be applied:

“Family Member” means any person who is a relative by blood, marriage or adoption or who has the same residence.

“Parent or subsidiary” is intended to cover entities that are consolidated with the Company’s financial statements.

“Independent director” means a person other than an officer or employee of the Company or its subsidiaries or any other individual having a relationship which, in the opinion of the Company’s Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The following persons shall not be considered independent:

| (a) | | a director who is, or at any time during the past three years was, employed by the Company or by any parent or subsidiary of the Company; |

| (b) | | a director who accepts or who has a Family Member who accepts any payments from the Company or any parent or subsidiary of the Company in excess of $60,000 during the current fiscal year or any of the past three fiscal years, other than: |

| (i) | | compensation for Board service; |

A-2

| (ii) | | payments arising solely from investments in the Company’s securities; |

| (iii) | | compensation paid to a Family Member who is an employee of the Company or a parent or subsidiary of the Company (but not if such person is an executive officer of the Company or any parent or subsidiary of the Company); |

| (iv) | | benefits under a tax-qualified retirement plan, or non-discretionary compensation; |

| (v) | | loans from the Company or any of its affiliates which is a bank, savings and loan association, or broker-dealer extending credit under Federal Reserve Regulation T provided that the loans (1) were made in the ordinary course of business, (2) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the general public, (3) did not involve more than a normal degree of risk or other unfavorable factors, and (4) were not otherwise subject to the specific disclosure requirements of SEC Regulation S-K, Item 404; |

| (vi) | | payments from the Company or any of its affiliates which is a bank, savings and loan association, or broker-dealer extending credit under Federal Reserve Regulation T in connection with the deposit of funds acting in an agency capacity, provided such payments were (1) made in the ordinary course of business; (2) made on substantially the same terms as those prevailing at the time for comparable transactions with the general public; and (3) not otherwise subject to the disclosure requirements of SEC Regulation S-K, Item 404; or |

| (vii) | | loans permitted under Section 13(k) of the Exchange Act; |

| (c) | | a director who is a Family Member of an individual who is, or at any time during the past three years was, employed by the Company or by any parent or subsidiary of the Company as an executive officer; |

| (d) | | a director who is, or has a Family Member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services (other than those arising solely from investments in the Company’s securities or under non-discretionary charitable contribution matching programs) that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, in the current fiscal year or any of the past three fiscal years; |

| (e) | | a director of the Company who is, or has a Family Member who is, employed as an executive officer of another entity where any of the executive officers of the Company serve on the compensation committee of such other entity, or if such relationship existed at any time during the past three years; |

| (f) | | a director who is or was a partner or employee of the Company’s outside auditor, and worked on the Company’s audit, at any time during the past three years; or |

| (g) | | a director who owns or controls more than 10% of any class of the Company’s voting securities (or such lower measurement as may be established by the SEC in rulemaking under Section 10A(m) of the Exchange Act; |

| (h) | | a director who is an affiliated person of the Company or any of its subsidiaries; |

| (i) | | a director who directly or indirectly accepts any consulting, advisory, or other compensatory fee from the Company or any of its subsidiaries, except for fees and other compensation provided to directors for service on the Board or on committees of the Board and fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with |

A-3

| | the Company (provided that such compensation is not contingent in any way on continued service); and |

| (j) | | a director who has participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years. |

All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement, and cash flow statement.

At least one member of the Committee shall have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. At least one member of the Committee shall be an “audit committee financial expert” as defined by the SEC. At least one member of the Committee shall have expertise in the regulatory requirements of the Company’s industry.

Audit Committee members shall be appointed by the Board on recommendation of the Executive Committee. The Audit Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting. The Audit Committee should meet privately in executive sessions at least annually with each of the Chief Executive Officer, the Chief Financial Officer, the Controller or Chief Accounting Officer (the meetings with each of the foregoing officers preferably to occur following the presentation of the annual audit report or at the time the audit engagement letter is presented for approval); the independent auditors; and, in executive session as a Committee without the presence of non-members to discuss any matters that the Committee believes should be discussed.

| III. | | AUDIT COMMITTEE RESPONSIBILITIES AND DUTIES |

Review Procedures

| A. | | Review and reassess the adequacy of this Charter, and any provisions of the Company’s by-laws which refer to the Audit Committee, at least annually and propose to the Board of Directors necessary or appropriate revisions. Publish the Charter in the Company’s proxy statement at least every three years or otherwise in accordance with regulations of the SEC or of any market on which or through which the Company’s securities may be traded. |

| B. | | Review the Company’s annual audited financial statements prior to filing or distribution. Review should include discussion with management and independent auditors of significant issues regarding accounting principles, practices, and judgments. If the Committee finds the annual financial statements acceptable, to recommend to the Board of Directors that they be included in the Company’s annual report on Form 10-K. |

| C. | | In consultation with management and the independent auditors consider the integrity of the Company’s financial reporting processes and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control and report such exposures. Review significant findings prepared by the independent auditors together with management’s responses. |

| D. | | Review with financial management and the independent auditors the Company’s quarterly financial results prior to the release of earnings and/or the Company’s quarterly financial statements prior to filing or distribution, including the type and presentation of information to be included in earnings press releases (paying particular attention to any use of “pro forma,” or “adjusted” non-GAAP, information), as well as review any financial information and earnings guidance provided to analysts and rating agencies, and including the Management’s Discussion and Analysis of Financial Condition and Results of Operations to be included in the Company’s reports under the Exchange Act. The Chair of the Committee, or his or her designee, may represent the entire Audit Committee for purposes of this review. Discuss any significant changes to the Company’s accounting principles and any items |

A-4

| | required to be communicated by the independent auditors in accordance with SAS 61(see Independent Auditors’ section, item E). |

| E. | | Review prior to publication or filing and approve such other Company financial information, including appropriate regulatory filings and releases that include financial information, as the Committee deems desirable. The Chair of the Committee, or his or her designee, may represent the entire Audit Committee for purposes of this review. |

| F. | | Review management’s proposed annual report on internal control over financial reporting and the attestation report of the Company’s auditors which are required to be included in the Company’s 10-K pursuant to rules of the SEC. |

Independent Auditors

| A. | | Appoint independent auditors, subject, if appropriate, to shareholder ratification, and review and evaluate their performance throughout the year. The evaluation should include the review and evaluation of the lead partner of the independent auditor. |

| B. | | Approve any discharge of auditors when circumstances warrant. |

| C. | | Approve the fees and other compensation to be paid to the independent auditors. |

| D. | | On an annual basis, the Committee shall review and actively engage in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditors. |

| E. | | The Committee shall review and pre-approve all auditing services (which may entail providing comfort letters in connection with securities underwritings) and non-audit services to be provided to the Company (including any management consulting engagements or any other non-audit services proposed to be undertaken by such auditors on behalf of the Company by the independent auditors), unless: |

| (i) | | the aggregate amount of all such non-audit services provided to the Company constitutes not more than 5 percent of the total amount of revenues paid by the Company to its independent auditors during the fiscal year in which the nonaudit services are provided; |

| (ii) | | such services were not recognized by the Company at the time of the engagement to be non-audit services; and |

| (iii) | | such services are promptly brought to the attention of the Committee and approved prior to the completion of the audit by the Committee or by 1 or more members of the Committee who are members of the Board of directors to whom authority to grant such approvals has been delegated by the Committee. |

In no event may an auditor provide any of the following non-audit services, even with consent of the Committee:

| (i) | | bookkeeping or other services related to the accounting records or financial statements of the Company; |

| (ii) | | financial information systems design and implementation; |

| (iii) | | appraisal or valuation services, fairness opinions, or contribution-in-kind reports; |

| (v) | | internal audit outsourcing services; |

| (vi) | | management functions or human resources; |

| (vii) | | broker or dealer, investment adviser, or investment banking services; |

A-5

| (viii) | | legal services and expert services unrelated to the audit; |

| (ix) | | expert services unrelated to the audit; and |

| (x) | | any other service that the Audit Committee determines, by resolution, is impermissible. If the Committee approves any non-audit service to be performed by the independent auditor, it shall be disclosed in a report on Form 10-K, 10-Q or 8-K, and its proxy statement, as appropriate and as required by law and the rules of the SEC. These pre-approval policies shall be disclosed in the Company’s 10-K and proxy statement to the extent required by the law and the rules of the SEC. |

| F. | | Ensure that it receives from the independent auditors a formal written statement delineating all relationships between the auditor and the Company, consistent with Independence Standards Board Standard 1. Discuss any significant changes to the Company’s accounting principles and any items required to be communicated by the independent auditors in accordance with SAS 61(see Independent Auditors’ section, item E). |

| G. | | Review the independent auditors’ audit plan, including scope, staffing, locations, budget, changes to plan, reliance upon management and internal audit and general audit approach and qualifications of auditors. |

| H. | | Prior to releasing year-end earnings, discuss the results of the audit with the independent auditors. |

| I. | | Consider the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applies in its financial reporting. |

| J. | | Annually require the auditors to confirm in writing their understanding of the fact that they are ultimately accountable to the Audit Committee. |

| K. | | Require the Company’s auditors to timely report to the Committee: |

| (i) | | all critical accounting policies and practices to be used; |

| (ii) | | all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management officials of the issuer, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the registered public accounting firm; and |

| (iii) | | other material written communications between the registered public accounting firm and the management of the issuer, such as any management letter or schedule of unadjusted differences. |

| L. | | Require the auditors to rotate every five years the lead or coordinating audit partner in charge of the Company’s audit and the audit partner responsible for reviewing the audit. |

| M. | | Set clear policies defining the circumstances under which the Company is permitted to hire former employees of the independent auditors. |

| N. | | On at least an annual basis, review with the Company’s counsel any legal matters that could have a significant impact on the Company’s financial statements. |

Other Audit Committee Responsibilities

| A. | | Annually prepare a report to shareholders as required by the Securities and Exchange Commission to be included in the Company’s annual proxy statement. |

| B. | | Perform any other activities consistent with this Charter, the Company’s By-laws and governing law, as the Committee or the Board deems necessary or appropriate. |

| C. | | Maintain minutes of meetings and periodically report to the Board of Directors on significant results of the Committee’s activities. |

A-6

Complaints

| A. | | At least annually, management shall ensure that each employee of the Company is advised in writing (including by any form of electronic transmission which provides the employee the ability to reproduce a written copy of such transmission) that he or she may submit, on a confidential and anonymous basis, complaints regarding accounting, internal accounting controls, or auditing matters and concerns regarding questionable accounting or auditing matters. The advice shall include the name and business address of the Chair of the Committee and shall inform employees that they should direct their complaints to the Chair, in writing, at such address. |

| B. | | Upon receipt of a complaint, the Chair of the Committee shall assign the complaint to any one or more members of the Committee (including the Chair) for preliminary review, and may authorize the use or engagement of such counsel, accountants, investigators or other assistance as the Chair, in the exercise of his or her discretion, shall determine to be appropriate under the circumstances. |

| C. | | Management shall retain the original of all such complaints until further notice by the Committee. |

Self-Assessment

The Committee shall conduct an annual self-evaluation of its performance.

General

| A. | | Annually review policies and procedures as well as audit results associated with directors’ and officers’ expense accounts and perquisites. Annually review a summary of directors’ and officers’ related party transactions and potential conflicts of interest. The term “related party transaction” shall refer to transactions required to be disclosed pursuant to SEC Regulation S-K, Item 404. |

| B. | | The Board of Directors reserves all authority permitted under the rules of the Commission and any exchange or market on or through which the Company’s securities may be traded or listed for trading in connection with any matter referred to in this Charter, including but not limited to the determination of independence of Audit Committee members. |

A-7

| | | | | |

| | |  |

| | | | | + |

| | | | MMMMMMMMMMMM |

| | Capital Corp of the West | | | |

|

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6 | | 000000000.000 ext

000000000.000 ext

000000000.000 ext

000000000.000 ext

000000000.000 ext

000000000.000 ext

000000000.000 ext |

| |  |

| | | |

| | | | |

| | | | o | Mark this box with an X if you have made changes to your name or address details above. |

| | | |

| |

Annual Meeting Proxy Card | | Common |

| |

| | |

| A | Election of Directors | PLEASE REFER TO THE REVERSE SIDE FOR TELEPHONE AND INTERNET VOTING INSTRUCTIONS. |

| | | | | | | |

1. The Board of Directors recommends a vote FOR the listed nominees as Class III Directors of

the Company to serve three-year terms or until their successors are elected and qualified: |

| | | | | | | |

| | For | | Withhold | | | |

| 01 - G. Michael Graves | o | | o | | | |

| | | | | | |

| 02 - Tom A. L. Van Groningen | o | | o | | | |

| | | | | | | |

| 03 - Curtis R. Grant | o | | o | | | |

| | | | | | | |

| 04 - David Bonnar | o | | o | | | |

| | | | | | | |

| The proxies will vote in their discretion on such other business as may properly come before the Meeting or any adjournment thereof as provided in the proxy statement. | | | | | | |

| | | | | | | |

| Mark this box with an X if you expect to attend this meeting. | | o | |

| |

| B | Authorized Signatures - Sign Here - This section must be completed for your instructions to be executed. |

| Please sign exactly as your name(s) appear(s). When signing as attorney, executor, administrator, trustee, officer, partner, or guardian, please give full title. If more than one trustee, all should sign. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE SIGN AND RETURN THIS PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE PAID ENVELOPE. |

| |

| To assure a quorum, you are urged to date and sign this Proxy and mail it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States or Canada. |

| | | | | |

| Signature 1 - Please keep signature within the box | | Signature 2 - Please keep signature within the box | | Date (mm/dd/yyyy) |

| | | | | |

| | | | | |

| | | | | / / |

| |

| |

|

| | | | | | |

| | 1 U P X | H H H | P P P P | 0051881 | + |

| | Proxy - Capital Corp of the West |

PROXY FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD APRIL 26, 2005

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned holder of common stock acknowledges receipt of the Notice of Annual Meeting of Shareholders of Capital Corp of the West, a California corporation (the “Company”) and the accompanying Proxy Statement dated March 11, 2005 and 2004 Annual Report of the company and revoking any proxy heretofore given, hereby constitutes and appoints Tom Van Groningen and R. Dale McKinney, or either of them, with full power of substitution, as attorney and proxy to appear and vote all of the shares of common stock of the Company standing in the name of the undersigned which the undersigned could vote if personally present and acting at the Annual Meeting of Shareholders of the Company to be held at Merced, California, on April 26, 2005 at 5:30 p.m. local time or at any adjournments thereof, upon the following items as set forth in the Notice of Meeting and more fully described in the Proxy Statement.

This proxy may be revoked prior to its exercise.

The Board of Directors recommends a vote for election as directors of the nominees named on the other side of this proxy.If no other instruction is given, the proxy holders intend to voteforall nominees listed, and in their discretion on such other business as may properly come before the meeting or any adjournment thereof.

(Continued and to be signed on reverse side.)

We would like to keep you current on the Company’s financial status. Please list your e-mail address below and you will be added to the Company’s investors information group to receive periodic financial updates.

E-mail address _____________________________________________________

Dear Shareholder:

Capital Corp of the West offers you two additional convenient ways to vote your shares. By following the simple instructions below your vote can now be counted over the telephone or Internet. We encourage you to take advantage of these new features, which eliminate the need to return the proxy card but authorize the named proxies in the same manner as if you had mailed back a marked, signed and dated proxy card. You will be asked to enter a Control Number, which is located at the bottom of this form.