UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Virtus Opportunities Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9668

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Stone Harbor Emerging Markets Bond Fund

Class A / VSHAX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Bond Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Bond Fund

Class A / VSHAX | $132 | 1.25% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class A shares at NAV returned 10.93%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98% and the J.P. Morgan CEMBI Broad Diversified Index, which serves as the style-specific index, returned 9.46%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The J.P. Morgan CEMBI Broad Diversified Index tracks total returns for U.S. dollar denominated debt instruments issued by corporate entities in emerging markets countries. The index limits the weights of those index countries with larger corporate debt stocks by only including a specified portion of these countries’ eligible current face amounts of debt outstanding. Qualifying corporate bonds have a face amount greater than USD 300 million and maturity greater than 2.5 years. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Country exposures and issue selection contributed positively to Fund performance relative to its style-specific benchmark for the 12-month period ended May 31, 2024. Exposures in Latin America contributed most to relative performance. In other regions, overweight exposures in Ghana, Ukraine, and Macau, as well as underweight exposures in Qatar and China, enhanced performance. Issue selection in Brazil, Colombia, and Mexico were among the top positive contributors. In terms of industry attribution, overweight exposures and issue selection in exploration and production, electric, and gaming contributed positively, as did an underweight exposure and issue selection in financials. Issue selection in wireless was also a top contributor to performance. Underweight exposures in higher-rated credits and overweight exposures in lower-quality credits contributed to relative performance during the period. Some of the positive performance attribution was offset by issue selection decisions in the Philippines and Indonesia.

| FACTOR | IMPACT | SUMMARY |

| Mexico | Positive | Issue selection, particularly in Aeromexico and America Movil, enhanced relative returns. |

| Colombia | Positive | Overweight exposure and issue selection, particularly in Sierracol Energy and Gran Tierra Energy, enhanced relative returns. |

| The Philippines | Negative | Underweight exposure and issue selection, especially in SMC Global Power Holdings, detracted from relative performance. |

| Indonesia | Negative | Issue selection, particularly in Paiton Energy, detracted from relative performance. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

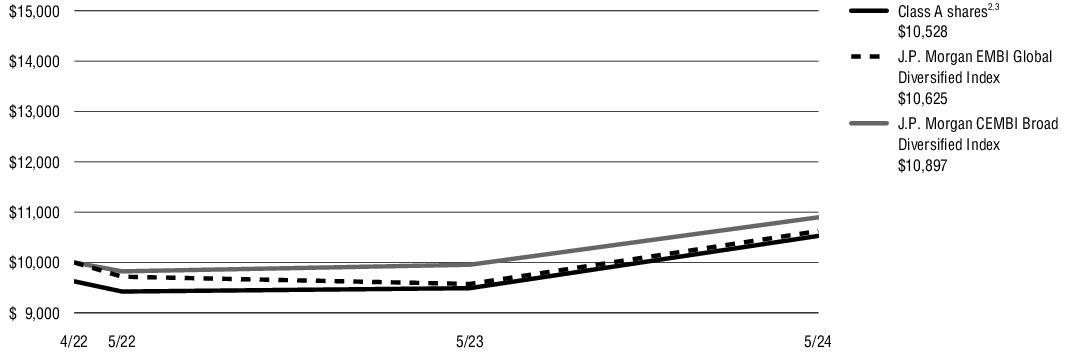

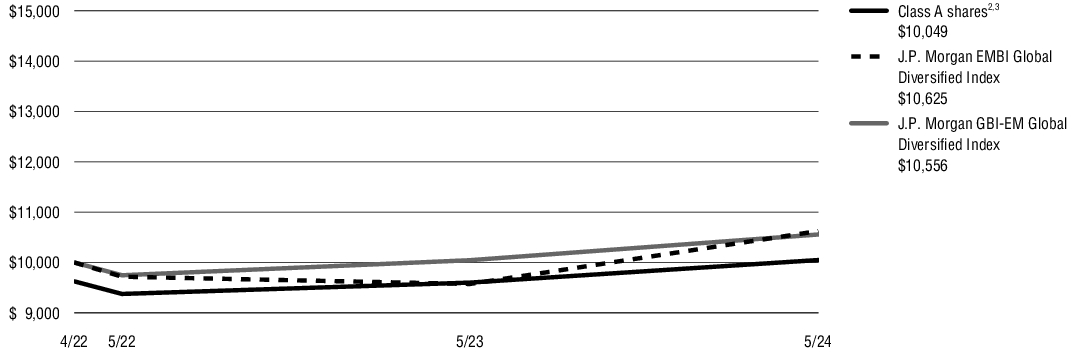

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | Since Inception |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class A/VSHAX) at NAV(1) | 10.93% | 4.28% |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class A/VSHAX) at POP(2),(3) | 6.77% | 2.43% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 2.87% |

| J.P. Morgan CEMBI Broad Diversified Index | 9.46% | 4.10% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) | "CDSC" (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder's fee being paid are 0.50%. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $6,877% |

| Total number of portfolio holdings | $147% |

| Total advisory fee paid (‘000s) | $-% |

| Portfolio turnover rate as of the end of the reporting period | $69% |

| Corporate Bonds and Notes | | 100% |

| Financial & Lease | 21% | |

| Electric | 15% | |

| Exploration & Production | 15% | |

| Gaming | 8% | |

| Metals, Mining & Steel | 5% | |

| Midstream | 4% | |

| Chemicals | 4% | |

| Retail Food & Drug | 3% | |

| Services Other | 3% | |

| Technology | 3% | |

| All other Corporate Bonds and Notes | 19% | |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Stone Harbor Emerging Markets Bond Fund

Class I / SHCDX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Bond Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Bond Fund

Class I / SHCDX | $106 | 1.00% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class I shares at NAV returned 11.17%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98% and the J.P. Morgan CEMBI Broad Diversified Index, which serves as the style-specific index, returned 9.46%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The J.P. Morgan CEMBI Broad Diversified Index tracks total returns for U.S. dollar denominated debt instruments issued by corporate entities in emerging markets countries. The index limits the weights of those index countries with larger corporate debt stocks by only including a specified portion of these countries’ eligible current face amounts of debt outstanding. Qualifying corporate bonds have a face amount greater than USD 300 million and maturity greater than 2.5 years. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Country exposures and issue selection contributed positively to Fund performance relative to its style-specific benchmark for the 12-month period ended May 31, 2024. Exposures in Latin America contributed most to relative performance. In other regions, overweight exposures in Ghana, Ukraine, and Macau, as well as underweight exposures in Qatar and China, enhanced performance. Issue selection in Brazil, Colombia, and Mexico were among the top positive contributors. In terms of industry attribution, overweight exposures and issue selection in exploration and production, electric, and gaming contributed positively, as did an underweight exposure and issue selection in financials. Issue selection in wireless was also a top contributor to performance. Underweight exposures in higher-rated credits and overweight exposures in lower-quality credits contributed to relative performance during the period. Some of the positive performance attribution was offset by issue selection decisions in the Philippines and Indonesia.

| FACTOR | IMPACT | SUMMARY |

| Mexico | Positive | Issue selection, particularly in Aeromexico and America Movil, enhanced relative returns. |

| Colombia | Positive | Overweight exposure and issue selection, particularly in Sierracol Energy and Gran Tierra Energy, enhanced relative returns. |

| The Philippines | Negative | Underweight exposure and issue selection, especially in SMC Global Power Holdings, detracted from relative performance. |

| Indonesia | Negative | Issue selection, particularly in Paiton Energy, detracted from relative performance. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

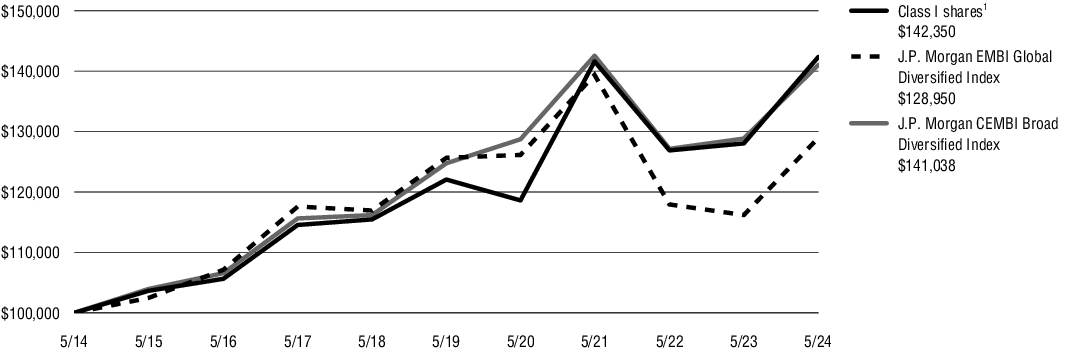

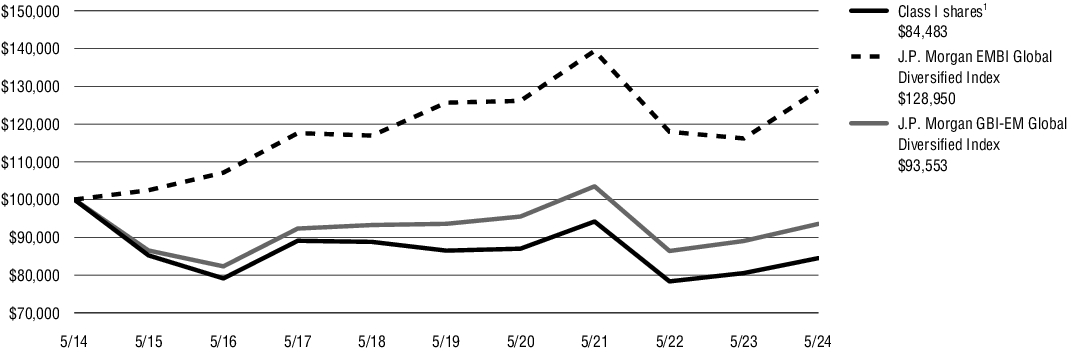

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | 5 Years | 10 Years |

| Virtus Stone Harbor Emerging Markets Bond Fund (Class I/SHCDX) at NAV(1) | 11.17% | 3.12% | 3.59% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 0.52% | 2.58% |

| J.P. Morgan CEMBI Broad Diversified Index | 9.46% | 2.48% | 3.50% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $6,877% |

| Total number of portfolio holdings | $147% |

| Total advisory fee paid (‘000s) | $-% |

| Portfolio turnover rate as of the end of the reporting period | $69% |

| Corporate Bonds and Notes | | 100% |

| Financial & Lease | 21% | |

| Electric | 15% | |

| Exploration & Production | 15% | |

| Gaming | 8% | |

| Metals, Mining & Steel | 5% | |

| Midstream | 4% | |

| Chemicals | 4% | |

| Retail Food & Drug | 3% | |

| Services Other | 3% | |

| Technology | 3% | |

| All other Corporate Bonds and Notes | 19% | |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Stone Harbor Emerging Markets Debt Income Fund

Class A / VSHCX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Debt Income Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Debt Income Fund

Class A / VSHCX | $108 | 1.00% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class A shares at NAV returned 16.31%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Country selection decisions contributed positively to relative performance for the 12-month period ended May 31, 2024, as did issue selection. Out-of-benchmark exposures to hard currency corporate debt also enhanced performance. Some of the positive performance attribution was offset by exposure in local currency debt. Attribution from movements in U.S. Treasuries was negative during the period. In terms of regional performance, Latin America – particularly an overweight in Venezuela – was the top contributor to relative performance, while in Asia, underweights in several countries, including China, Indonesia, Malaysia, and the Philippines also contributed positively.

| FACTOR | IMPACT | SUMMARY |

| Venezuela | Positive | Overweight exposure in Venezuela enhanced relative performance during the period as U.S. sanctions were suspended as part of agreement for the Maduro administration to allow for free and fair elections. |

| China | Positive | Underweight exposure in China enhanced relative returns as the Chinese economy failed to sustain economic momentum and meaningfully ease the property market crisis. |

| Angola | Negative | Issue selection detracted from performance. |

| Indonesia | Negative | Exposures in local currency debt detracted from performance. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

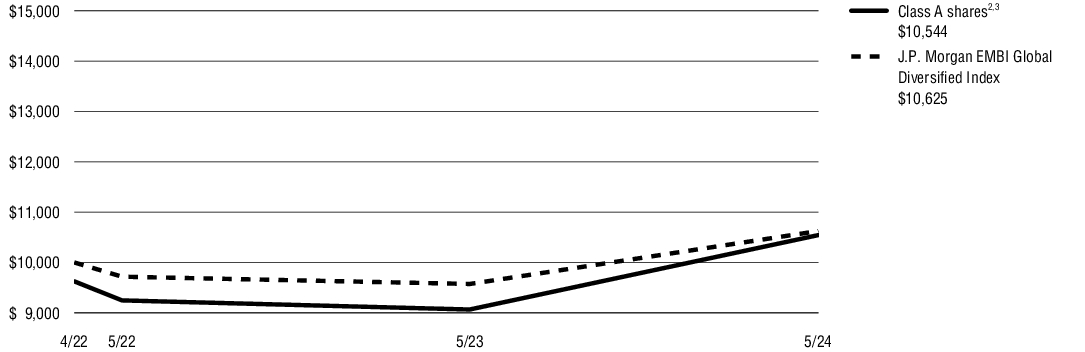

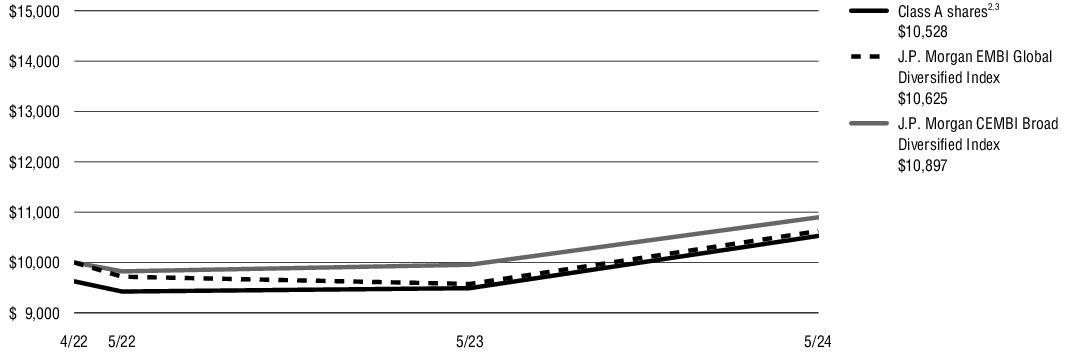

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in an appropriate broad-based securities market index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | Since Inception |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class A/VSHCX) at NAV(1) | 16.31% | 4.35% |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class A/VSHCX) at POP(2),(3) | 11.95% | 2.51% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 2.87% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) | "CDSC" (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder's fee being paid are 0.50%. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $257,124% |

| Total number of portfolio holdings | $283% |

| Total advisory fee paid (‘000s) | $1,451% |

| Portfolio turnover rate as of the end of the reporting period | $123% |

| Foreign Government Securities | | 69% |

| Corporate Bonds and Notes | | 28% |

| Exploration & Production | 11% | |

| Electric | 4% | |

| Metals, Mining & Steel | 3% | |

| Financials | 2% | |

| Industrial Other | 2% | |

| Financial & Lease | 2% | |

| All other Corporate Bonds and Notes | 4% | |

| Affiliated Mutual Funds | | 2% |

| Credit Linked Note | | 1% |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Stone Harbor Emerging Markets Debt Income Fund

Class I / SHMDX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Emerging Markets Debt Income Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Emerging Markets Debt Income Fund

Class I / SHMDX | $78 | 0.72% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class I shares at NAV returned 16.57%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Country selection decisions contributed positively to relative performance for the 12-month period ended May 31, 2024, as did issue selection. Out-of-benchmark exposures to hard currency corporate debt also enhanced performance. Some of the positive performance attribution was offset by exposure in local currency debt. Attribution from movements in U.S. Treasuries was negative during the period. In terms of regional performance, Latin America – particularly an overweight in Venezuela – was the top contributor to relative performance, while in Asia, underweights in several countries, including China, Indonesia, Malaysia, and the Philippines also contributed positively.

| FACTOR | IMPACT | SUMMARY |

| Venezuela | Positive | Overweight exposure in Venezuela enhanced relative performance during the period as U.S. sanctions were suspended as part of agreement for the Maduro administration to allow for free and fair elections. |

| China | Positive | Underweight exposure in China enhanced relative returns as the Chinese economy failed to sustain economic momentum and meaningfully ease the property market crisis. |

| Angola | Negative | Issue selection detracted from performance. |

| Indonesia | Negative | Exposures in local currency debt detracted from performance. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

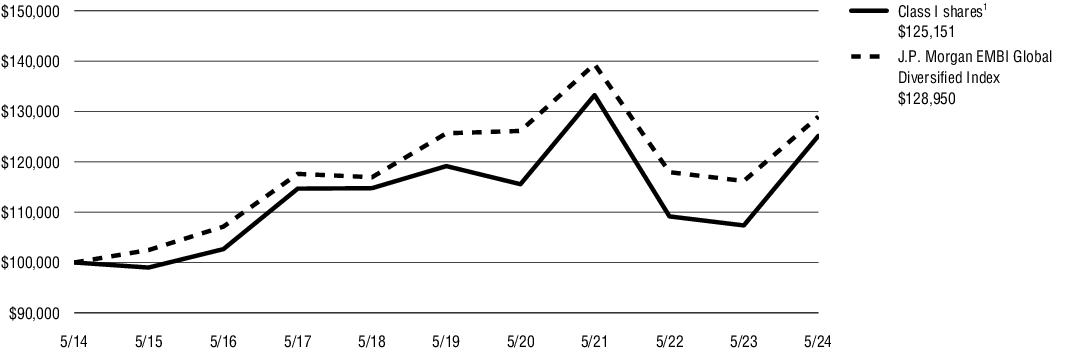

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | 5 Years | 10 Years |

| Virtus Stone Harbor Emerging Markets Debt Income Fund (Class I/SHMDX) at NAV(1) | 16.57% | 0.99% | 2.27% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 0.52% | 2.58% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $257,124% |

| Total number of portfolio holdings | $283% |

| Total advisory fee paid (‘000s) | $1,451% |

| Portfolio turnover rate as of the end of the reporting period | $123% |

| Foreign Government Securities | | 69% |

| Corporate Bonds and Notes | | 28% |

| Exploration & Production | 11% | |

| Electric | 4% | |

| Metals, Mining & Steel | 3% | |

| Financials | 2% | |

| Industrial Other | 2% | |

| Financial & Lease | 2% | |

| All other Corporate Bonds and Notes | 4% | |

| Affiliated Mutual Funds | | 2% |

| Credit Linked Note | | 1% |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Stone Harbor Local Markets Fund

Class A / VSHEX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Local Markets Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Local Markets Fund

Class A / VSHEX | $128 | 1.25% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class A shares at NAV returned 4.68%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98% and the J.P. Morgan GBI-EM Global Diversified Index, which serves as the style-specific index, returned 5.09%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The J.P. Morgan GBI-EM Global Diversified Index consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Foreign exchange (FX) exposure and duration positioning contributed positively to relative performance for the 12 months ended May 31, 2024. Security selection and taxes also enhanced relative returns for the period. In FX, underweights in the Chilean peso and the Chinese yuan enhanced performance, while an underweight exposure in the Egyptian pound and an overweight exposure in the Indonesian rupiah detracted from performance. Within duration positioning, or adjusting the portfolio’s sensitivity to changes in interest rates, underweights to fixed income in countries where rates were rising, such as China, Thailand, and Turkey, enhanced performance, while overweights to fixed income in countries where rates were falling, such as Brazil, Mexico, and South Africa, detracted from relative returns. Allocations to Egypt, Mexico, and South Africa contributed most to relative performance, while some of the positive attribution was offset by allocations to China, Indonesia, and Thailand.

| FACTOR | IMPACT | SUMMARY |

| Egypt | Positive | Security selection and taxes contributed positively. |

| Turkey | Positive | Duration underweight, or reduced sensitivity to changes in interest rates, contributed as the central bank tightened monetary policy significantly. |

| Thailand | Negative | Security selection and taxes detracted from performance, although some of the negative attribution was offset by positive attribution from duration underweight. |

| China | Negative | Security selection and taxes detracted from relative returns, but some of the negative attribution was offset by underweights in FX exposure and duration positioning. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

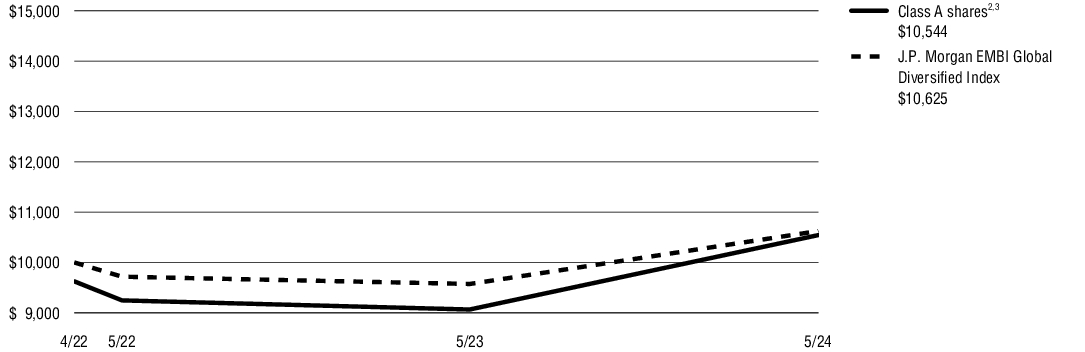

How has the Fund historically performed?

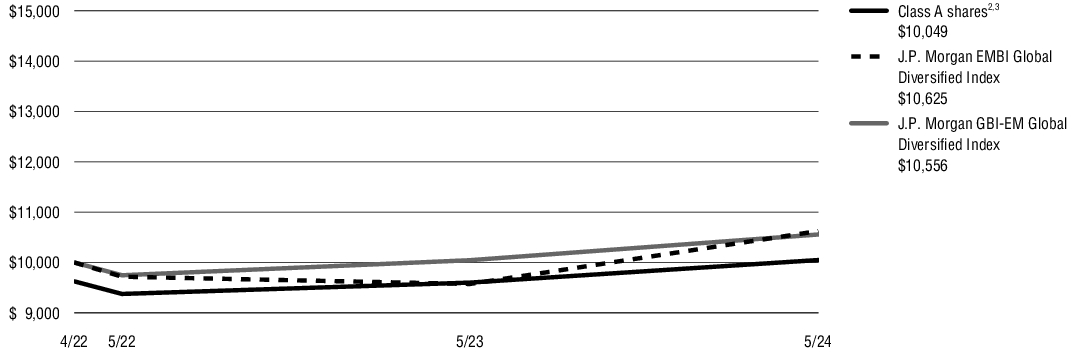

The following graph compares the initial and subsequent account values at the end of each of the most recently completed fiscal years of Class A shares from inception (April 11, 2022) including any applicable sales charges or fees. It assumes a $10,000 initial investment from inception, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | Since Inception |

| Virtus Stone Harbor Local Markets Fund (Class A/VSHEX) at NAV(1) | 4.68% | 2.04% |

| Virtus Stone Harbor Local Markets Fund (Class A/VSHEX) at POP(2),(3) | 0.76% | 0.23% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 2.87% |

| J.P. Morgan GBI-EM Global Diversified Index | 5.09% | 2.56% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| (2) | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 3.75% sales charge. |

| (3) | "CDSC" (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder's fee being paid are 0.50%. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $7,339% |

| Total number of portfolio holdings | $44% |

| Total advisory fee paid (‘000s) | $13% |

| Portfolio turnover rate as of the end of the reporting period | $133% |

| Foreign Government Securities | | 96% |

| Corporate Bonds and Notes | | 4% |

| Financial & Lease | 4% | |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Stone Harbor Local Markets Fund

Class I / SHLMX

Annual SHAREHOLDER REPORT | May 31, 2024

This annual shareholder report contains important information about the Virtus Stone Harbor Local Markets Fund (“Fund”) for the period of June 1, 2023 to May 31, 2024. You can find additional information about the Fund at https://www.virtus.com/investor-resources/mutual-fund-documents. You can also request this information by contacting us at 1‑800‑243‑1574.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Virtus Stone Harbor Local Markets Fund

Class I / SHLMX | $102 | 1.00% |

Portfolio Manager Commentary by Stone Harbor Investment Partners

For the fiscal year ended May 31, 2024, the Fund’s Class I shares at NAV returned 4.92%. For the same period, the J.P. Morgan EMBI Global Diversified Index, a broad-based securities market index, returned 10.98% and the J.P. Morgan GBI-EM Global Diversified Index, which serves as the style-specific index, returned 5.09%.

The J.P. Morgan EMBI Global Diversified Index tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. The index limits the weights of those index countries with larger debt stocks by only including specified portions of these countries' eligible current face amounts outstanding. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

The J.P. Morgan GBI-EM Global Diversified Index consists of regularly traded, liquid fixed-rate, domestic currency government bonds to which international investors can gain exposure. The weightings among the countries are more evenly distributed within this index. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

What impacted Fund performance over the reporting period?

Foreign exchange (FX) exposure and duration positioning contributed positively to relative performance for the 12 months ended May 31, 2024. Security selection and taxes also enhanced relative returns for the period. In FX, underweights in the Chilean peso and the Chinese yuan enhanced performance, while an underweight exposure in the Egyptian pound and an overweight exposure in the Indonesian rupiah detracted from performance. Within duration positioning, or adjusting the portfolio’s sensitivity to changes in interest rates, underweights to fixed income in countries where rates were rising, such as China, Thailand, and Turkey, enhanced performance, while overweights to fixed income in countries where rates were falling, such as Brazil, Mexico, and South Africa, detracted from relative returns. Allocations to Egypt, Mexico, and South Africa contributed most to relative performance, while some of the positive attribution was offset by allocations to China, Indonesia, and Thailand.

| FACTOR | IMPACT | SUMMARY |

| Egypt | Positive | Security selection and taxes contributed positively. |

| Turkey | Positive | Duration underweight, or reduced sensitivity to changes in interest rates, contributed as the central bank tightened monetary policy significantly. |

| Thailand | Negative | Security selection and taxes detracted from performance, although some of the negative attribution was offset by positive attribution from duration underweight. |

| China | Negative | Security selection and taxes detracted from relative returns, but some of the negative attribution was offset by underweights in FX exposure and duration positioning. |

The preceding information is the opinion of portfolio management only through the end of the period stated. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

How has the Fund historically performed?

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of Class I shares. It assumes a $100,000 initial investment at the beginning of the first fiscal year, in an appropriate broad-based securities market index and style-specific index for the same period. Performance assumes reinvestment of dividends and capital gain distributions.

GROWTH OF $100,000

| AVERAGE ANNUAL TOTAL RETURNS for periods ended 5/31/24 | 1 Year | 5 Years | 10 Years |

| Virtus Stone Harbor Local Markets Fund (Class I/SHLMX) at NAV(1) | 4.92% | (0.46)% | (1.67)% |

| J.P. Morgan EMBI Global Diversified Index | 10.98% | 0.52)% | 2.58)% |

| J.P. Morgan GBI-EM Global Diversified Index | 5.09% | -)% | (0.66)% |

| (1) | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. Please visit https://www.virtus.com/mutual-funds-monthly-performance for performance data current to the most recent month end. Average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains.

KEY FUND STATISTICS (as of May 31, 2024)

| Fund net assets (‘000s) | $7,339% |

| Total number of portfolio holdings | $44% |

| Total advisory fee paid (‘000s) | $13% |

| Portfolio turnover rate as of the end of the reporting period | $133% |

| Foreign Government Securities | | 96% |

| Corporate Bonds and Notes | | 4% |

| Financial & Lease | 4% | |

| Total | | 100% |

(1) | Percentage of total investments as of May 31, 2024. |

Where can I find more information?

For more information about the Fund including its Prospectus, Financial Information, Fund holdings, and proxy voting information, please contact us at 1-800-243-1574, or visit https://www.virtus.com/investor-resources/mutual-fund-documents.

Householding

Shareholders who have consented to receive a single annual or semi-annual shareholder report at a shared address may revoke this consent or request additional copies by calling Mutual Fund Services at 1-800-243-1574.

Item 2. Code of Ethics.

| | (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | (c) | There have been no amendments during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics described in Item 2(b) of the instructions for completion of Form N-CSR. A copy of the currently applicable code is included as an exhibit. |

| | (d) | The registrant has not granted any waivers, during the period covered by this report, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this Item. |

| | (f) | A copy of the Code of Ethics is filed as an Exhibit. |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Registrant’s Board of Trustees has determined that the Registrant has an “audit committee financial expert” serving on its Audit Committee. |

| (a)(2) | The Registrant’s Board of Trustees has determined that each of Donald C. Burke and Brian T. Zino possesses the technical attributes identified in Instruction 2(b) of Item 3 to Form N-CSR to qualify as an “audit committee financial expert.” Each such individual is an “independent” trustee pursuant to paragraph (a)(2) of Item 3 to Form N-CSR. |

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $234,900 for 2023 and $77,738 for 2024. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $0 for 2023 and $12,021 for 2024. Such audit-related fees include the out of pocket expenses. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $67,595 for 2023 and $34,221 for 2024. |

“Tax Fees” are those primarily associated with review of the Trust’s tax provision and qualification as a regulated investment company (RIC) in connection with audits of the Trust’s financial statement, review of year-end distributions by the Fund to avoid excise tax for the Trust, periodic discussion with management on tax issues affecting the Trust, and reviewing and signing the Fund’s federal income returns.

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2023 and $0 for 2024. |

| | (e)(1) | Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

The Board of Trustees of Virtus Opportunities Trust (the “Fund”) has adopted policies and procedures with regard to the pre-approval of services provided by its independent auditors. Audit, audit-related and tax compliance services provided to the Fund on an annual basis require specific pre-approval by the Audit Committee. The Audit Committee must also approve other non-audit services provided to the Fund and those non-audit services provided to the Fund’s Affiliated Service Providers that relate directly to the operations and financial reporting of the Fund. Certain of these non-audit services that the Audit Committee believes are a) consistent with the SEC’s auditor independence rules and b) routine and recurring services that will not impair the independence of the independent auditors may be approved by the Audit Committee without consideration on a specific case-by-case basis (“general pre-approval”).

The Audit Committee has determined that the Chair of the Audit Committee, may provide pre-approval for such services that meet the above requirements but are not included in the general pre-approval in the event such approval is sought between regularly scheduled meetings. In any event, the Audit Committee is informed of, and ratifies, each service approved at the next regularly scheduled in-person Audit Committee meeting.

| | (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: |

(b) 0%

(c) 0%

(d) N/A

| | (f) | The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was less than fifty percent. |

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $67,595 for 2023 and $46,242 for 2024. |

| | (h) | The registrant’s audit committee of the board of directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

Item 5. Audit Committee of Listed Registrants.

Disclosure not required for open-end management investment companies.

Item 6. Investments.

| (a) | Please refer to Item 7a. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

FINANCIALS

VIRTUS OPPORTUNITIES TRUST

| Virtus Stone Harbor Emerging Markets Bond Fund |

| Virtus Stone Harbor Emerging Markets Debt Income Fund |

| Virtus Stone Harbor Local Markets Fund |

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

| 1 |

| Fund | Schedule

of

Investments |

| 2 |

| 7 |

| 16 |

| 20 |

| 22 |

| 23 |

| 25 |

| 27 |

| 42 |

| 43 |

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadviser votes proxies, if any, relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees”, or the “Board”). You may obtain a description of these procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at https://www.sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The Trust files a complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT-P. Form N-PORT-P is available on the SEC’s website at https://www.sec.gov.

This report is not authorized for distribution to prospective investors in the Funds presented in this book unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

VIRTUS OPPORTUNITIES TRUST

KEY INVESTMENT TERMS (Unaudited)

May 31, 2024

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Credit Default Swap (“CDS”)

A CDS is a financial derivative contract that shifts the credit risk of a fixed income product to a counterparty in exchange for a premium. The buyer of the CDS makes a series of payments (the CDS “fee” or “spread”) to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Funds Rate

The target interest rate set by the Fed at which commercial banks borrow and lend their extra reserves to one another overnight.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world. The one-, three-, and six- month LIBOR reference rates are published by ICE Benchmark Administration under a synthetic methodology.

Secured Overnight Financing Rate (“SOFR”)

The Secured Overnight Financing Rate is a benchmark interest rate for dollar-denominated derivatives and loans that is replacing the LIBOR.

Stone Harbor Emerging Markets Bond Fund

SCHEDULE OF INVESTMENTS

May 31, 2024

($ reported in thousands)

| | Par Value | | Value |

| Corporate Bonds and Notes—98.0% |

| Argentina—2.5% | | |

MSU Energy S.A. 144A

6.875%, 2/1/25(1) | $ 46 | | $ 38 |

| YPF S.A. | | | |

| 144A 9.500%, 1/17/31(1) | 75 | | 75 |

| RegS 6.950%, 7/21/27(2) | 67 | | 61 |

| | | | 174 |

| | | | |

| |

| Brazil—9.9% | | |

3R Lux S.a.r.l. 144A

9.750%, 2/5/31(1) | 58 | | 61 |

Banco do Brasil S.A. 144A

6.000%, 3/18/31(1) | 46 | | 45 |

| Braskem Netherlands Finance B.V. | | | |

| 144A 5.875%, 1/31/50(1) | 35 | | 26 |

| RegS 4.500%, 1/31/30(2) | 54 | | 45 |

BRF S.A. 144A

5.750%, 9/21/50(1) | 27 | | 21 |

FORESEA Holding S.A. 144A

7.500%, 6/15/30(1) | 55 | | 51 |

FS Luxembourg S.a.r.l. 144A

8.875%, 2/12/31(1) | 45 | | 44 |

Iochpe-Maxion Austria GmbH 144A

5.000%, 5/7/28(1) | 22 | | 20 |

JBS USA Holding Lux S.a.r.l.

4.375%, 2/2/52 | 51 | | 38 |

MC Brazil Downstream Trading S.a.r.l. 144A

7.250%, 6/30/31(1) | 37 | | 33 |

Minerva Luxembourg S.A. 144A

4.375%, 3/18/31(1) | 47 | | 39 |

Movida Europe S.A. 144A

7.850%, 4/11/29(1) | 66 | | 62 |

MV24 Capital B.V. 144A

6.748%, 6/1/34(1) | 30 | | 28 |

Samarco Mineracao S.A. PIK 144A

9.000%, 6/30/31(1)(3) | 55 | | 51 |

Simpar Europe S.A. 144A

5.200%, 1/26/31(1) | 67 | | 54 |

Suzano Austria GmbH

3.750%, 1/15/31 | 40 | | 34 |

Trident Energy Finance plc 144A

12.500%, 11/30/29(1) | 27 | | 28 |

| | | | 680 |

| | | | |

| |

| Chile—2.0% | | |

ATP Tower Holdings LLC 144A

4.050%, 4/27/26(1) | 63 | | 59 |

Banco de Chile RegS

2.990%, 12/9/31(2) | 28 | | 24 |

Banco de Credito e Inversiones S.A. 144A

8.750% (1)(4) | 24 | | 25 |

| Cencosud S.A. | | | |

| 144A 5.150%, 2/12/25(1) | 16 | | 16 |

| 144A 4.375%, 7/17/27(1) | 11 | | 10 |

| | | | 134 |

| | | | |

| |

| China—2.9% | | |

Bank of China Ltd. RegS

5.000%, 11/13/24(2) | 46 | | 46 |

| | Par Value | | Value |

| | | | |

| China—continued | | |

ENN Clean Energy International Investment Ltd. 144A

3.375%, 5/12/26(1) | $ 54 | | $ 51 |

| Tencent Holdings Ltd. | | | |

| 144A 2.390%, 6/3/30(1) | 11 | | 10 |

| 144A 3.240%, 6/3/50(1) | 11 | | 7 |

| RegS 3.975%, 4/11/29(2) | 93 | | 88 |

| | | | 202 |

| | | | |

| |

| Colombia—3.9% | | |

AI Candelaria Spain S.A. 144A

5.750%, 6/15/33(1) | 54 | | 43 |

Bancolombia S.A.

4.625%, 12/18/29 | 38 | | 37 |

Ecopetrol S.A.

7.375%, 9/18/43 | 60 | | 53 |

Geopark Ltd. 144A

5.500%, 1/17/27(1) | 28 | | 25 |

Gran Tierra Energy, Inc. 144A

9.500%, 10/15/29(1) | 61 | | 58 |

SierraCol Energy Andina LLC 144A

6.000%, 6/15/28(1) | 62 | | 55 |

| | | | 271 |

| | | | |

| |

| Ghana—2.0% | | |

Kosmos Energy Ltd. RegS

7.750%, 5/1/27(2) | 50 | | 48 |

Tullow Oil plc 144A

7.000%, 3/1/25(1) | 94 | | 91 |

| | | | 139 |

| | | | |

| |

| Guatemala—1.3% | | |

CT Trust 144A

5.125%, 2/3/32(1) | 30 | | 26 |

Investment Energy Resources Ltd. 144A

6.250%, 4/26/29(1) | 66 | | 64 |

| | | | 90 |

| | | | |

| |

| Hong Kong—4.5% | | |

Goodman HK Finance RegS

3.000%, 7/22/30(2) | 200 | | 169 |

| Standard Chartered plc | | | |

| 144A 6.301%, 1/9/29(1) | 65 | | 66 |

| 144A 2.678%, 6/29/32(1) | 20 | | 16 |

| 144A 6.097%, 1/11/35(1) | 46 | | 47 |

| RegS 6.000%(2)(4) | 13 | | 13 |

| | | | 311 |

| | | | |

| |

| India—6.8% | | |

Adani Electricity Mumbai Ltd. 144A

3.949%, 2/12/30(1) | 132 | | 111 |

Adani Green Energy UP Ltd. 144A

6.700%, 3/12/42(1) | 45 | | 42 |

Adani Ports & Special Economic Zone Ltd. RegS

3.375%, 7/24/24(2) | 22 | | 22 |

Adani Renewable Energy RJ Ltd. 144A

4.625%, 10/15/39(1) | 56 | | 45 |

Adani Transmission Step-One Ltd. 144A

4.000%, 8/3/26(1) | 19 | | 18 |

See Notes to Financial Statements

Stone Harbor Emerging Markets Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

($ reported in thousands)

| | Par Value | | Value |

| | | | |

| India—continued | | |

Clean Renewable Power Mauritius Pte Ltd. 144A

4.250%, 3/25/27(1) | $ 37 | | $ 34 |

Greenko Dutch B.V. 144A

3.850%, 3/29/26(1) | 47 | | 44 |

JSW Hydro Energy Ltd. RegS

4.125%, 5/18/31(2) | 37 | | 32 |

| Reliance Industries Ltd. | | | |

| 144A 3.750%, 1/12/62(1) | 26 | | 18 |

| RegS 3.625%, 1/12/52(2) | 35 | | 24 |

ReNew Wind Energy AP2 RegS

4.500%, 7/14/28(2) | 24 | | 21 |

Summit Digitel Infrastructure Ltd. RegS

2.875%, 8/12/31(2) | 49 | | 40 |

Vedanta Resources Finance II plc 144A

13.875%, 12/9/28(1) | 14 | | 13 |

| | | | 464 |

| | | | |

| |

| Indonesia—4.7% | | |

| Freeport Indonesia PT | | | |

| RegS 5.315%, 4/14/32(2) | 90 | | 87 |

| RegS 6.200%, 4/14/52(2) | 19 | | 18 |

Indika Energy Capital IV Pte Ltd. 144A

8.250%, 10/22/25(1) | 5 | | 5 |

Indika Energy Tbk PT 144A

8.750%, 5/7/29(1) | 32 | | 32 |

Medco Maple Tree Pte Ltd. 144A

8.960%, 4/27/29(1) | 37 | | 38 |

| Minejesa Capital B.V. | | | |

| 144A 4.625%, 8/10/30(1) | 126 | | 119 |

| 144A 5.625%, 8/10/37(1) | 22 | | 20 |

Star Energy Geothermal Darajat II 144A

4.850%, 10/14/38(1) | 4 | | 4 |

| | | | 323 |

| | | | |

| |

| Israel—3.0% | | |

Altice Financing S.A. 144A

5.000%, 1/15/28(1) | 25 | | 20 |

| Energean Israel Finance Ltd. | | | |

| 144A, RegS 4.875%, 3/30/26(1)(2) | 33 | | 32 |

| 144A, RegS 5.375%, 3/30/28(1)(2) | 50 | | 45 |

Leviathan Bond Ltd. 144A, RegS

6.750%, 6/30/30(1)(2) | 35 | | 32 |

Teva Pharmaceutical Finance Netherlands III B.V.

3.150%, 10/1/26 | 84 | | 78 |

| | | | 207 |

| | | | |

| |

| Macau—7.3% | | |

| Melco Resorts Finance Ltd. | | | |

| 144A 5.750%, 7/21/28(1) | 26 | | 24 |

| 144A 7.625%, 4/17/32(1) | 40 | | 40 |

| RegS 5.625%, 7/17/27(2) | 30 | | 29 |

| RegS 5.750%, 7/21/28(2) | 91 | | 85 |

| RegS 5.375%, 12/4/29(2) | 24 | | 22 |

| Sands China Ltd. | | | |

| 5.400%, 8/8/28 | 33 | | 32 |

| 3.250%, 8/8/31 | 100 | | 84 |

Studio City Co., Ltd. 144A

7.000%, 2/15/27(1) | 23 | | 23 |

| | Par Value | | Value |

| | | | |

| Macau—continued | | |

| Studio City Finance Ltd. | | | |

| 144A 6.000%, 7/15/25(1) | $ 64 | | $ 63 |

| 144A 5.000%, 1/15/29(1) | 113 | | 98 |

| | | | 500 |

| | | | |

| |

| Malaysia—1.4% | | |

Resorts World Las Vegas LLC RegS

4.625%, 4/6/31(2) | 50 | | 43 |

Yinson Boronia Production B.V. 144A

8.947%, 7/31/42(1) | 52 | | 53 |

| | | | 96 |

| | | | |

| |

| Mexico—7.3% | | |

| Banco Mercantil del Norte S.A. | | | |

| 144A 6.750%(1)(4) | 23 | | 23 |

| 144A 7.500%(1)(4) | 35 | | 34 |

| BBVA Bancomer S.A. | | | |

| 144A 5.125%, 1/18/33(1) | 20 | | 18 |

| RegS 5.350%, 11/12/29(2) | 26 | | 26 |

Braskem Idesa SAPI 144A

6.990%, 2/20/32(1) | 20 | | 15 |

Buffalo Energy Mexico Holdings 144A

7.875%, 2/15/39(1) | 31 | | 33 |

| Cemex SAB de C.V. | | | |

| 144A 5.125%(1)(4) | 47 | | 45 |

| 144A 9.125%(1)(4) | 16 | | 17 |

Grupo Aeromexico SAB de C.V. 144A

8.500%, 3/17/27(1) | 56 | | 56 |

| Petroleos Mexicanos | | | |

| 6.625%, 6/15/35 | 74 | | 57 |

| 7.690%, 1/23/50 | 39 | | 28 |

Poinsettia Finance Ltd. RegS

6.625%, 6/17/31(2) | 52 | | 45 |

Sitios Latinoamerica SAB de C.V. 144A

5.375%, 4/4/32(1) | 19 | | 17 |

Sixsigma Networks Mexico S.A. de C.V. 144A

7.500%, 5/2/25(1) | 38 | | 36 |

Southern Copper Corp.

6.750%, 4/16/40 | 9 | | 10 |

Tierra Mojada Luxembourg II S.a.r.l. 144A

5.750%, 12/1/40(1) | 42 | | 39 |

| | | | 499 |

| | | | |

| |

| Morocco—1.2% | | |

| OCP S.A. | | | |

| 144A 3.750%, 6/23/31(1) | 45 | | 38 |

| 144A 6.875%, 4/25/44(1) | 23 | | 22 |

| 144A 7.500%, 5/2/54(1) | 24 | | 24 |

| | | | 84 |

| | | | |

| |

| Nigeria—1.4% | | |

Access Bank plc 144A

6.125%, 9/21/26(1) | 56 | | 53 |

IHS Holding Ltd. 144A

6.250%, 11/29/28(1) | 16 | | 15 |

See Notes to Financial Statements

Stone Harbor Emerging Markets Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

($ reported in thousands)

| | Par Value | | Value |

| | | | |

| Nigeria—continued | | |

IHS Netherlands Holdco B.V. 144A

8.000%, 9/18/27(1) | $ 29 | | $ 28 |

| | | | 96 |

| | | | |

| |

| Peru—2.7% | | |

| Banco de Credito del Peru S.A. | | | |

| 144A 5.850%, 1/11/29(1) | 41 | | 41 |

| RegS 3.125%, 7/1/30(2) | 28 | | 27 |

Banco Internacional del Peru SAA Interbank RegS

4.000%, 7/8/30(2) | 35 | | 33 |

Inkia Energy Ltd. 144A

5.875%, 11/9/27(1) | 68 | | 66 |

Kallpa Generacion S.A. 144A

4.125%, 8/16/27(1) | 21 | | 20 |

| | | | 187 |

| | | | |

| |

| Philippines—2.9% | | |

Royal Capital B.V. RegS

5.000% (2)(4) | 200 | | 197 |

| Saudi Arabia—4.0% | | |

Acwa Power Management & Investments One Ltd. 144A

5.950%, 12/15/39(1) | 83 | | 80 |

EIG Pearl Holdings S.a.r.l. 144A

3.545%, 8/31/36(1) | 154 | | 131 |

Greensaif Pipelines Bidco S.a.r.l. 144A

6.129%, 2/23/38(1) | 21 | | 21 |

Saudi Arabian Oil Co. 144A

4.375%, 4/16/49(1) | 53 | | 43 |

| | | | 275 |

| | | | |

| |

| Singapore—2.9% | | |

BOC Aviation Ltd. (3 month LIBOR + 1.300%) RegS

6.887%, 5/21/25(2)(5)(6) | 200 | | 201 |

| South Africa—4.2% | | |

| Anglo American Capital plc | | | |

| 144A 2.625%, 9/10/30(1) | 8 | | 6 |

| RegS 2.625%, 9/10/30(2) | 7 | | 6 |

Eskom Holdings SOC Ltd. 144A

7.125%, 2/11/25(1) | 45 | | 45 |

| Prosus N.V. | | | |

| 144A 3.832%, 2/8/51(1) | 134 | | 84 |

| RegS 3.061%, 7/13/31(2) | 38 | | 31 |

Sasol Financing USA LLC

4.375%, 9/18/26 | 124 | | 116 |

| | | | 288 |

| | | | |

| |

| South Korea—3.2% | | |

Kookmin Bank 144A

5.375%, 5/8/27(1) | 60 | | 60 |

LG Chem Ltd. RegS

2.375%, 7/7/31(2) | 33 | | 27 |

Shinhan Bank Co., Ltd. RegS

3.875%, 3/24/26(2) | 49 | | 47 |

| | Par Value | | Value |

| | | | |

| South Korea—continued | | |

Woori Bank RegS

4.250% (2)(4) | $ 90 | | $ 89 |

| | | | 223 |

| | | | |

| |

| Taiwan—1.1% | | |

TSMC Arizona Corp.

3.875%, 4/22/27 | 17 | | 17 |

| TSMC Global Ltd. | | | |

| RegS 1.375%, 9/28/30(2) | 29 | | 23 |

| RegS 2.250%, 4/23/31(2) | 39 | | 33 |

| | | | 73 |

| | | | |

| |

| Tanzania—0.1% | | |

HTA Group Ltd. 144A

7.500%, 6/4/29(1) | 10 | | 10 |

| Thailand—2.1% | | |

Bangkok Bank PCL 144A

3.733%, 9/25/34(1) | 90 | | 79 |

PTT Treasury Center Co., Ltd. 144A

4.500%, 10/25/42(1) | 42 | | 36 |

Thaioil Treasury Center Co., Ltd. RegS

4.875%, 1/23/43(2) | 33 | | 29 |

| | | | 144 |

| | | | |

| |

| Turkey—4.4% | | |

Aydem Yenilenebilir Enerji AS 144A

7.750%, 2/2/27(1) | 51 | | 49 |

Sisecam UK plc 144A

8.250%, 5/2/29(1) | 60 | | 61 |

| Turkiye Garanti Bankasi AS | | | |

| 144A 7.177%, 5/24/27(1) | 24 | | 24 |

| 144A 8.375%, 2/28/34(1) | 67 | | 67 |

WE Soda Investments Holding plc 144A

9.500%, 10/6/28(1) | 96 | | 99 |

| | | | 300 |

| | | | |

| |

| Ukraine—1.2% | | |

Metinvest B.V. 144A

7.750%, 10/17/29(1) | 61 | | 39 |

VF Ukraine PAT via VFU Funding plc 144A

6.200%, 2/11/25(1) | 50 | | 43 |

| | | | 82 |

| | | | |

| |

| United Arab Emirates—5.0% | | |

Abu Dhabi Crude Oil Pipeline LLC 144A

3.650%, 11/2/29(1) | 24 | | 22 |

Abu Dhabi National Energy Co. PJSC 144A

4.696%, 4/24/33(1) | 26 | | 25 |

DP World Ltd. 144A

4.700%, 9/30/49(1) | 72 | | 59 |

Galaxy Pipeline Assets Bidco Ltd. 144A

1.750%, 9/30/27(1) | 39 | | 36 |

MAF Global Securities Ltd. RegS

7.875% (2)(4) | 200 | | 205 |

| | | | 347 |

| | | | |

| |

See Notes to Financial Statements

Stone Harbor Emerging Markets Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

($ reported in thousands)

| | Par Value | | Value |

| | | | |

| Vietnam—1.2% | | |

Mong Duong Finance Holdings B.V. 144A

5.125%, 5/7/29(1) | $ 84 | | $ 80 |

| Zambia—0.9% | | |

First Quantum Minerals Ltd. 144A

8.625%, 6/1/31(1) | 65 | | 65 |

Total Corporate Bonds and Notes

(Identified Cost $6,743) | | 6,742 |

| | | | |

| |

| | | | |

| |

Total Long-Term Investments—98.0%

(Identified Cost $6,743) | | 6,742 |

| | | | |

| |

| | | | |

| |

TOTAL INVESTMENTS—98.0%

(Identified Cost $6,743) | | $6,742 |

| Other assets and liabilities, net—2.0% | | 135 |

| NET ASSETS—100.0% | | $6,877 |

| Abbreviations: |

| LIBOR | London Interbank Offered Rate |

| LLC | Limited Liability Company |

| PCL | Public Company Limited |

| PIK | Payment-in-Kind Security |

| PJSC | Public Joint Stock Company |

| Footnote Legend: |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2024, these securities amounted to a value of $4,222 or 61.3% of net assets. |

| (2) | Regulation S security. Security is offered and sold outside of the United States; therefore, it is exempt from registration with the SEC under Rules 903 and 904 of the Securities Act of 1933. |

| (3) | 100% of the income received was in PIK. |

| (4) | No contractual maturity date. |

| (5) | At May 31, 2024, the one-, three-, and six-month reference rates are published by ICE Benchmark Administration under a synthetic methodology. See Note 9 in Notes to Financial Statements. |

| (6) | Variable rate security. Rate disclosed is as of May 31, 2024. Information in parenthesis represents benchmark and reference rate for each security. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| Country Weightings (Unaudited)† |

| Brazil | 10% |

| Macau | 8 |

| Mexico | 7 |

| India | 7 |

| United Arab Emirates | 5 |

| Indonesia | 5 |

| Hong Kong | 5 |

| Other | 53 |

| Total | 100% |

| † % of total investments as of May 31, 2024. |

For information regarding the abbreviations, see the Key Investment Terms starting on page 1.

See Notes to Financial Statements

Stone Harbor Emerging Markets Bond Fund

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

($ reported in thousands)

The following table summarizes the value of the Fund’s investments as of May 31, 2024, based on the inputs used to value them (See Security Valuation Note 2A in the Notes to Financial Statements):

| | Total

Value at

May 31, 2024 | | Level 2

Significant

Observable

Inputs |

| Assets: | | | |

| Debt Instruments: | | | |

| Corporate Bonds and Notes | $6,742 | | $6,742 |

| Total Investments | $6,742 | | $6,742 |

There were no securities valued using quoted prices (Level 1) or significant unobservable inputs (Level 3) at May 31, 2024.

There were no transfers into or out of Level 3 related to securities held at May 31, 2024.

See Notes to Financial Statements

Stone Harbor Emerging Markets Debt Income Fund

SCHEDULE OF INVESTMENTS

May 31, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| Foreign Government Securities—66.4% |

| Angola —2.4% | | |

| Republic of Angola | | | |

144A

8.000%, 11/26/29(2) | $ 109 | | $ 99 |

144A

8.750%, 4/14/32(2) | 2,388 | | 2,133 |

144A

9.375%, 5/8/48(2) | 1,147 | | 975 |

Republic of Angola Via Avenir Issuer II Ireland DAC RegS

6.927%, 2/19/27(3)(4) | 2,983 | | 2,861 |

| | | | 6,068 |

| | | | |

| |

| Argentina—2.4% | | |

Provincia De Buenos Aires RegS

6.375%, 9/1/37(4)(5) | 2,378 | | 1,046 |

| Republic of Argentina | | | |

| 1.000%, 7/9/29 | 1,016 | | 592 |

| 0.750%, 7/9/30(5) | 6,713 | | 3,820 |

| 3.625%, 7/9/35(5) | 1,366 | | 601 |

| | | | 6,059 |

| | | | |

| |

| Armenia—0.4% | | |

Republic of Armenia RegS

3.600%, 2/2/31(4) | 1,181 | | 964 |

| Bahrain—1.8% | | |

| Kingdom of Bahrain | | | |

144A

5.625%, 9/30/31(2) | 368 | | 347 |

144A

5.250%, 1/25/33(2) | 1,753 | | 1,569 |

144A

5.625%, 5/18/34(2) | 122 | | 110 |

144A

7.500%, 2/12/36(2) | 1,655 | | 1,688 |

RegS

5.625%, 9/30/31(4) | 1,000 | | 942 |

| | | | 4,656 |

| | | | |

| |

| Bermuda—0.2% | | |

Government of Bermuda 144A

4.750%, 2/15/29(2) | 661 | | 636 |

| Brazil—2.3% | | |

| Federative Republic of Brazil | | | |

| 6.250%, 3/18/31 | 349 | | 347 |

| 6.000%, 10/20/33 | 239 | | 231 |

| 5.000%, 1/27/45 | 2,619 | | 2,017 |

| 5.625%, 2/21/47 | 59 | | 49 |

| 4.750%, 1/14/50 | 3,396 | | 2,445 |

| 7.125%, 5/13/54 | 953 | | 930 |

| | | | 6,019 |

| | | | |

| |

| Chile—0.9% | | |

| Republic of Chile | | | |

| 4.950%, 1/5/36 | 1,925 | | 1,833 |

| | Par Value(1) | | Value |

| | | | |

| Chile—continued | | |

| 3.860%, 6/21/47 | $ 649 | | $ 500 |

| | | | 2,333 |

| | | | |

| |

| Colombia—2.6% | | |

| Republic of Colombia | | | |

| 4.500%, 3/15/29 | 1,065 | | 963 |

| 3.000%, 1/30/30 | 387 | | 314 |

| 3.250%, 4/22/32 | 3 | | 2 |

| 7.500%, 2/2/34 | 1,194 | | 1,183 |

| 8.000%, 11/14/35 | 637 | | 650 |

| 6.125%, 1/18/41 | 2,271 | | 1,888 |

| 4.125%, 2/22/42 | 153 | | 100 |

| 5.200%, 5/15/49 | 2,277 | | 1,592 |

| | | | 6,692 |

| | | | |

| |

| Costa Rica—1.1% | | |

| Costa Rica Government | | | |

144A

6.550%, 4/3/34(2) | 308 | | 315 |

144A

7.300%, 11/13/54(2) | 978 | | 1,024 |

RegS

6.550%, 4/3/34(4) | 804 | | 822 |

RegS

7.000%, 4/4/44(4) | 720 | | 731 |

| | | | 2,892 |

| | | | |

| |

| Dominican Republic—2.3% | | |

| Dominican Republic | | | |

144A

4.500%, 1/30/30(2) | 639 | | 579 |

144A

4.875%, 9/23/32(2) | 1,214 | | 1,083 |

RegS

5.950%, 1/25/27(4) | 1,327 | | 1,318 |

RegS

4.875%, 9/23/32(4) | 1,751 | | 1,562 |

RegS

5.300%, 1/21/41(4) | 1,336 | | 1,131 |

RegS

6.500%, 2/15/48(4) | 259 | | 244 |

| | | | 5,917 |

| | | | |

| |

| Ecuador—2.3% | | |

| Republic of Ecuador | | | |

144A

0.000%, 7/31/30(2)(6) | 1,341 | | 680 |

144A

6.000%, 7/31/30(2)(5) | 1,131 | | 757 |

RegS

6.000%, 7/31/30(4)(5) | 5,206 | | 3,483 |

RegS

3.500%, 7/31/35(4)(5) | 543 | | 278 |

RegS

2.500%, 7/31/40(4)(5) | 1,588 | | 740 |

| | | | 5,938 |

| | | | |

| |

See Notes to Financial Statements

Stone Harbor Emerging Markets Debt Income Fund

SCHEDULE OF INVESTMENTS (Continued)

May 31, 2024

($ reported in thousands)

| | Par Value(1) | | Value |

| | | | |

| Egypt—2.7% | | |

| Arab Republic of Egypt | | | |

144A

3.875%, 2/16/26(2) | $ 155 | | $ 144 |

144A

5.875%, 2/16/31(2) | 1 | | 1 |

144A

7.903%, 2/21/48(2) | 24 | | 18 |

144A

8.875%, 5/29/50(2) | 469 | | 379 |

144A

7.500%, 2/16/61(2) | 7,799 | | 5,479 |

RegS

4.750%, 4/16/26(4) | 257EUR | | 265 |

RegS

8.700%, 3/1/49(4) | 847 | | 673 |

| | | | 6,959 |

| | | | |

| |

| El Salvador—1.2% | | |

| Republic of El Salvador | | | |

RegS

6.375%, 1/18/27(4) | 483 | | 424 |

RegS

8.250%, 4/10/32(4) | 2,766 | | 2,144 |

RegS

7.650%, 6/15/35(4) | 824 | | 589 |

| | | | 3,157 |

| | | | |

| |

| Ethiopia—0.5% | | |

Federal Republic of Ethiopia 144A

6.625%, 12/11/24(2)(7) | 1,785 | | 1,258 |

| Gabon—0.3% | | |

| Republic of Gabon | | | |

144A

6.950%, 6/16/25(2) | 402 | | 379 |

144A

7.000%, 11/24/31(2) | 505 | | 402 |

| | | | 781 |

| | | | |

| |

| Ghana—0.9% | | |

| Republic of Ghana | | | |

144A

10.750%, 10/14/30(2) | 1,232 | | 840 |

RegS

10.750%, 10/14/30(4) | 1,481 | | 1,009 |

RegS

8.625%, 4/7/34(4)(7) | 1,032 | | 531 |

| | | | 2,380 |

| | | | |

| |

| Guatemala—1.0% | | |

| Republic of Guatemala | | | |

144A

3.700%, 10/7/33(2) | 1,890 | | 1,528 |

144A

6.600%, 6/13/36(2) | 1,040 | | 1,042 |

| | | | 2,570 |

| | | | |

| |

| | Par Value(1) | | Value |

| | | | |

| Honduras—0.2% | | |

| Honduras Government | | | |

RegS

6.250%, 1/19/27(4) | $ 305 | | $ 292 |

RegS

5.625%, 6/24/30(4) | 292 | | 252 |

| | | | 544 |

| | | | |

| |

| Hungary—2.7% | | |

| Hungary Government International Bond | | | |

144A

5.500%, 3/26/36(2) | 2,810 | | 2,676 |

RegS

2.125%, 9/22/31(4) | 1,409 | | 1,107 |

RegS

1.750%, 6/5/35(4) | 1,739EUR | | 1,453 |

RegS

1.500%, 11/17/50(4) | 1,169EUR | | 724 |

Magyar Export-Import Bank Zrt 144A

6.125%, 12/4/27(2) | 943 | | 948 |

| | | | 6,908 |

| | | | |

| |

| India—1.0% | | |

| Export-Import Bank India | | | |

RegS

2.250%, 1/13/31(4) | 1,569 | | 1,288 |

RegS

5.500%, 1/18/33(4) | 1,183 | | 1,186 |

| | | | 2,474 |

| | | | |

| |

| Indonesia—0.8% | | |

| Republic of Indonesia | | | |

| 4.850%, 1/11/33 | 301 | | 292 |

144A

5.250%, 1/8/47(2) | 425 | | 412 |

RegS

6.750%, 1/15/44(4) | 898 | | 1,028 |

RegS

5.125%, 1/15/45(4) | 332 | | 318 |

| | | | 2,050 |

| | | | |

| |