UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM N-CSR |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number: | (811-07513) |

Exact name of registrant as specified in charter: | Putnam Funds Trust |

Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

Name and address of agent for service: | Stephen Tate, Vice President |

100 Federal Street |

Boston, Massachusetts 02110 |

Copy to: | Bryan Chegwidden, Esq. |

Ropes & Gray LLP |

1211 Avenue of the Americas |

New York, New York 10036 |

James E. Thomas, Esq. |

Ropes & Gray LLP |

800 Boylston Street |

Boston, Massachusetts 02199 |

Registrant’s telephone number, including area code: | (617) 292-1000 |

Date of fiscal year end: | June 30, 2024 |

Date of reporting period: | July 1, 2023 – June 30, 2024 |

Item 1. Report to Stockholders: |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: |

Putnam Small Cap Growth Fund |  | |

| Class A [PNSAX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $134 | 1.21% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSA-0824 |

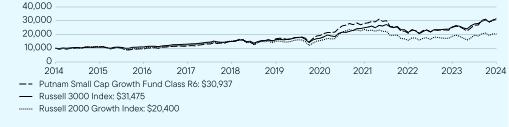

Class A 6/30/2014 — 6/30/2024

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 22.16 | 12.46 | 11.52 |

Class A (with sales charge) | 15.14 | 11.14 | 10.86 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSA-0824 |

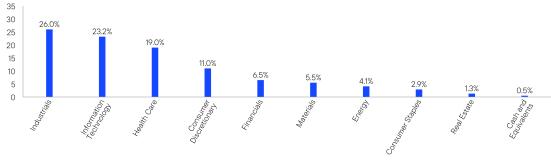

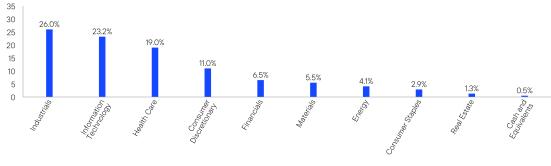

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSA-0824 |

Putnam Small Cap Growth Fund |  | |

| Class B [PNSBX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class B | $217 | 1.96% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSB-0824 |

1 Year | 5 Year | 10 Year | |

Class B (without sales charge) | 21.25 | 11.62 | 10.85 |

Class B (with sales charge) | 16.25 | 11.36 | 10.85 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSB-0824 |

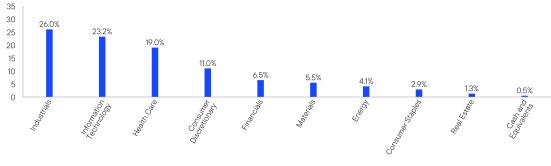

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSB-0824 |

Putnam Small Cap Growth Fund |  | |

| Class C [PNSCX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $217 | 1.96% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSC-0824 |

1 Year | 5 Year | 10 Year | |

Class C (without sales charge) | 21.24 | 11.62 | 10.86 |

Class C (with sales charge) | 20.24 | 11.62 | 10.86 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSC-0824 |

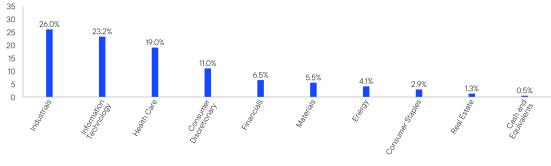

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSC-0824 |

Putnam Small Cap Growth Fund |  | |

| Class R [PSGRX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R | $162 | 1.46% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSR-0824 |

1 Year | 5 Year | 10 Year | |

Class R (without sales charge) | 21.86 | 12.18 | 11.24 |

Class R (with sales charge) | 21.86 | 12.18 | 11.24 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSR-0824 |

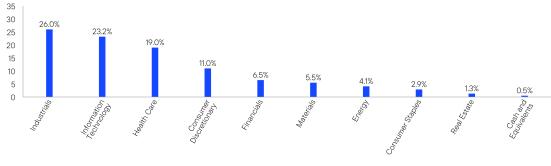

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSR-0824 |

Putnam Small Cap Growth Fund |  | |

| Class R6 [PLKGX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R6 | $90 | 0.81% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSR6-0824 |

1 Year | 5 Year | 10 Year | |

Class R6 (without sales charge) | 22.66 | 12.91 | 11.96 |

Class R6 (with sales charge) | 22.66 | 12.91 | 11.96 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSR6-0824 |

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSR6-0824 |

Putnam Small Cap Growth Fund |  | |

| Class Y [PSYGX] | ||

| Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) 225-1581.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $107 | 0.96% |

Top contributors to performance: | |

| Security selections outside of the benchmark, including: | |

| ↑ | Camtek, a manufacturer of semiconductor inspection equipment |

| ↑ | Nova, a provider of process control systems used in semiconductor manufacturing |

| ↑ | EMCOR Group, a construction and facilities services provider for a range of businesses |

Top detractors from performance: | |

| ↓ | Overweight position in Axcelis Technologies, a semiconductor equipment company |

| ↓ | Overweight position in medical device company InMode |

| ↓ | Out-of-benchmark position in Iridium Communications, a global satellite communications company |

| Putnam Small Cap Growth Fund | PAGE 1 | 38972-ATSY-0824 |

1 Year | 5 Year | 10 Year | |

Class Y (without sales charge) | 22.47 | 12.74 | 11.80 |

Class Y (with sales charge) | 22.47 | 12.74 | 11.80 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Growth Index | 9.14 | 6.17 | 7.39 |

Total Net Assets | $2,020,349,001 |

Total Number of Portfolio Holdings* | 94 |

Total Management Fee Paid | $10,178,534 |

Portfolio Turnover Rate | 40% |

| * | Includes derivatives, if applicable. |

| Putnam Small Cap Growth Fund | PAGE 2 | 38972-ATSY-0824 |

| Cash and Equivalents, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Holdings and allocations may vary over time. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Putnam Small Cap Growth Fund | PAGE 3 | 38972-ATSY-0824 |

Item 2. Code of Ethics: |

a) The fund’s principal executive, financial and accounting officers are employees of Putnam Investment Management, LLC, the Fund’s investment manager, or Franklin Templeton. As such they are subject to a comprehensive Code of Ethics adopted and administered by Putnam Investment Management, LLC and Franklin Templeton which is designed to protect the interests of the firm and its clients. The Fund has adopted a Code of Ethics which incorporates the Code of Ethics of Franklin Templeton with respect to all of its officers and Trustees who are employees of Putnam Investment Management, LLC and Franklin Templeton. For this reason, the Fund has not adopted a separate code of ethics governing its principal executive, financial and accounting officers. |

(c) In connection with the acquisition of Putnam Investments by Franklin Templeton, the Putnam Investments Code of Ethics was amended effective January 1, 2024 to reflect revised compliance processes, including: (i) Compliance with the Putnam Investments Code of Ethics will be viewed as compliance with the Franklin Templeton Code for certain Putnam employees who are dual-hatted in Franklin Templeton advisory entities (ii) Certain Franklin Templeton employees are required to hold shares of Putnam mutual funds at Putnam Investor Services, Inc. and (iii) Certain provisions of the Putnam Investments Code of Ethics are amended that are no longer needed due to organizational changes. Effective March 4, 2024, the majority of legacy Putnam employees transitioned to Franklin Templeton policies outlined in the Franklin Templeton Code. |

Item 3. Audit Committee Financial Expert: |

The Funds’ Audit, Compliance and Risk Committee is comprised solely of Trustees who are “independent” (as such term has been defined by the Securities and Exchange Commission (“SEC”) in regulations implementing Section 407 of the Sarbanes-Oxley Act (the “Regulations”)). The Trustees believe that each member of the Audit, Compliance and Risk Committee also possesses a combination of knowledge and experience with respect to financial accounting matters, as well as other attributes, that qualifies him or her for service on the Committee. In addition, the Trustees have determined that each of Mr. McGreevey and Mr. Singh qualifies as an “audit committee financial expert” (as such term has been defined by the Regulations) based on their review of his or her pertinent experience and education.The SEC has stated, and the funds’ amended and restated agreement and Declaration of Trust provides, that the designation or identification of a person as an audit committee financial expert pursuant to this Item 3 of Form N-CSR does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the Audit, Compliance and Risk Committee and the Board of Trustees in the absence of such designation or identification. |

Item 4. Principal Accountant Fees and Services: |

The following table presents fees billed in each of the last two fiscal years for services rendered to the fund by the fund’s independent auditor: |

| Fiscal year ended | Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

| June 30, 2024 | $58,395 | $ — | $7,807 | $ — |

| June 30, 2023 | $77,048 | $ — | $7,579 | $ — |

For the fiscal years ended June 30, 2024 and June 30, 2023, the fund’s independent auditor billed aggregate non-audit fees in the amounts of $922,770 and $249,322 respectively, to the fund, Putnam Management and any entity controlling, controlled by or under common control with Putnam Management that provides ongoing services to the fund. |

Audit Fees represent fees billed for the fund’s last two fiscal years relating to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

Audit-Related Fees represent fees billed in the fund’s last two fiscal years for services traditionally performed by the fund’s auditor, including accounting consultation for proposed transactions or concerning financial accounting and reporting standards and other audit or attest services not required by statute or regulation. |

Tax Fees represent fees billed in the fund’s last two fiscal years for tax compliance, tax planning and tax advice services. Tax planning and tax advice services include assistance with tax audits, employee benefit plans and requests for rulings or technical advice from taxing authorities. |

Pre-Approval Policies of the Audit, Compliance and Risk Committee. The Audit, Compliance and Risk Committee of the Putnam funds has determined that, as a matter of policy, all work performed for the funds by the funds’ independent auditors will be pre-approved by the Committee itself and thus will generally not be subject to pre-approval procedures. |

The Audit, Compliance and Risk Committee also has adopted a policy to pre-approve the engagement by Putnam Management and certain of its affiliates of the funds’ independent auditors, even in circumstances where pre-approval is not required by applicable law. Any such requests by Putnam Management or certain of its affiliates are typically submitted in writing to the Committee and explain, among other things, the nature of the proposed engagement, the estimated fees, and why this work should be performed by that particular audit firm as opposed to another one. In reviewing such requests, the Committee considers, among other things, whether the provision of such services by the audit firm are compatible with the independence of the audit firm. |

The following table presents fees billed by the fund’s independent auditor for services required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2–01 of Regulation S-X. |

| Fiscal year ended | Audit-Related Fees | Tax Fees | All Other Fees | Total Non-Audit Fees |

| June 30, 2024 | $ — | $861,963 | $53,000 | $914,963 |

| June 30, 2023 | $ — | $241,743 | $ — | $241,743 |

(i) Not applicable |

(j) Not applicable |

Item 5. Audit Committee of Listed Registrants |

Not applicable |

Item 6. Investments: |

The registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements and Other Important Information in Item 7 below. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Putnam

Small Cap Growth Fund

Financial Statements and Other Important Information

Annual | June 30, 2024

Table of Contents

| Financial Statements and Other Important Information—Annual | franklintempleton.com |

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Putnam Funds Trust and Shareholders of Putnam Small Cap Growth Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the fund’s portfolio, of Putnam Small Cap Growth Fund (one of the funds constituting Putnam Funds Trust, referred to hereafter as the “Fund”) as of June 30, 2024, the related statement of operations for the year ended June 30, 2024, the statement of changes in net assets for each of the two years in the period ended June 30, 2024, including the related notes, and the financial highlights for each of the five years in the period ended June 30, 2024 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2024, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended June 30, 2024 and the financial highlights for each of the five years in the period ended June 30, 2024 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of JuneÊ30, 2024 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

August 14, 2024

We have served as the auditor of one or more investment companies in the Putnam Funds family of funds since at least 1957. We have not been able to determine the specific year we began serving as auditor.

| Small Cap Growth Fund 1 |

| The fund’s portfolio 6/30/24 | ||

| COMMON STOCKS (97.3%)* | Shares | Value |

| Aerospace and defense (1.2%) | ||

| Kratos Defense & Security Solutions, Inc. † S | 502,300 | $10,051,023 |

| Leonardo DRS, Inc. † | 575,460 | 14,679,985 |

| 24,731,008 | ||

| Automobile components (0.7%) | ||

| Modine Manufacturing Co. † | 147,457 | 14,773,717 |

| 14,773,717 | ||

| Banks (1.0%) | ||

| Bancorp, Inc. (The) † | 555,263 | 20,966,731 |

| 20,966,731 | ||

| Beverages (0.5%) | ||

| Vita Coco Co., Inc. (The) † S | 356,900 | 9,939,665 |

| 9,939,665 | ||

| Biotechnology (6.5%) | ||

| Ascendis Pharma A/S ADR (Denmark) † | 103,800 | 14,156,244 |

| Cytokinetics, Inc. † | 190,300 | 10,310,454 |

| Halozyme Therapeutics, Inc. † S | 387,700 | 20,299,972 |

| Insmed, Inc. † | 326,000 | 21,842,000 |

| Krystal Biotech, Inc. † S | 54,400 | 9,990,016 |

| Rhythm Pharmaceuticals, Inc. † S | 203,400 | 8,351,604 |

| Vaxcyte, Inc. † | 270,800 | 20,448,108 |

| Viking Therapeutics, Inc. † S | 288,300 | 15,282,783 |

| Xenon Pharmaceuticals, Inc. (Canada) † | 270,100 | 10,531,199 |

| 131,212,380 | ||

| Building products (1.3%) | ||

| Simpson Manufacturing Co., Inc. | 158,775 | 26,758,351 |

| 26,758,351 | ||

| Capital markets (2.5%) | ||

| Hamilton Lane, Inc. Class A | 160,385 | 19,820,378 |

| StepStone Group, Inc. Class A | 682,207 | 31,306,479 |

| 51,126,857 | ||

| Commercial services and supplies (3.6%) | ||

| Brink’s Co. (The) | 192,600 | 19,722,240 |

| Casella Waste Systems, Inc. Class A † | 91,000 | 9,029,020 |

| Clean Harbors, Inc. † | 137,000 | 30,982,550 |

| VSE Corp. S | 139,100 | 12,279,748 |

| 72,013,558 | ||

| Construction and engineering (4.2%) | ||

| Comfort Systems USA, Inc. | 143,000 | 43,489,160 |

| Dycom Industries, Inc. † | 118,600 | 20,014,936 |

| IES Holdings, Inc. † | 77,500 | 10,798,075 |

| MDU Resources Group, Inc. | 403,900 | 10,137,890 |

| 84,440,061 | ||

| Construction materials (2.7%) | ||

| Eagle Materials, Inc. | 133,500 | 29,030,910 |

| Knife River Corp. † | 359,100 | 25,187,274 |

| 54,218,184 | ||

| Consumer staples distribution and retail (0.7%) | ||

| Sprouts Farmers Market, Inc. † | 160,800 | 13,452,528 |

| 13,452,528 | ||

| Diversified consumer services (1.0%) | ||

| Duolingo, Inc. † S | 97,600 | 20,366,192 |

| 20,366,192 | ||

| Electrical equipment (0.8%) | ||

| Atkore, Inc. | 120,975 | 16,323,157 |

| 16,323,157 | ||

| Electronic equipment, instruments, and components (2.0%) | ||

| Fabrinet (Thailand) † | 81,900 | 20,048,301 |

| Novanta, Inc. † S | 124,005 | 20,226,456 |

| 40,274,757 |

2 Small Cap Growth Fund | |

| COMMON STOCKS (97.3%)* cont. | Shares | Value |

| Energy equipment and services (3.3%) | ||

| CES Energy Solutions Corp. (Canada) | 2,169,500 | $12,210,921 |

| ChampionX Corp. | 516,400 | 17,149,644 |

| Oceaneering International, Inc. † | 420,500 | 9,949,030 |

| Weatherford International PLC † S | 220,600 | 27,012,470 |

| 66,322,065 | ||

| Ground transportation (2.5%) | ||

| Saia, Inc. † | 52,961 | 25,118,873 |

| TFI International, Inc. (Canada) | 175,600 | 25,497,010 |

| 50,615,883 | ||

| Health care equipment and supplies (4.7%) | ||

| CONMED Corp. | 110,700 | 7,673,724 |

| Lantheus Holdings, Inc. † | 382,300 | 30,694,867 |

| Merit Medical Systems, Inc. † | 363,300 | 31,225,635 |

| PROCEPT BioRobotics Corp. † S | 152,300 | 9,304,007 |

| UFP Technologies, Inc. † | 58,900 | 15,541,943 |

| 94,440,176 | ||

| Health care providers and services (5.2%) | ||

| Encompass Health Corp. | 470,600 | 40,372,774 |

| Ensign Group, Inc. (The) | 242,500 | 29,994,825 |

| Hims & Hers Health, Inc. † | 161,000 | 3,250,590 |

| NeoGenomics, Inc. † | 569,687 | 7,901,559 |

| Option Care Health, Inc. † | 306,200 | 8,481,740 |

| RadNet, Inc. † S | 257,300 | 15,160,116 |

| 105,161,604 | ||

| Health care technology (0.6%) | ||

| Evolent Health, Inc. Class A † S | 604,500 | 11,558,040 |

| 11,558,040 | ||

| Hotels, restaurants, and leisure (2.8%) | ||

| Churchill Downs, Inc. | 175,200 | 24,457,920 |

| Texas Roadhouse, Inc. | 187,300 | 32,161,283 |

| 56,619,203 | ||

| Household durables (3.3%) | ||

| Century Communities, Inc. | 215,100 | 17,565,066 |

| Installed Building Products, Inc. | 149,400 | 30,728,592 |

| M/I Homes, Inc. † | 156,080 | 19,063,611 |

| 67,357,269 | ||

| Insurance (3.0%) | ||

| Kinsale Capital Group, Inc. | 76,154 | 29,340,613 |

| Skyward Specialty Insurance Group, Inc. † | 841,600 | 30,449,088 |

| 59,789,701 | ||

| Life sciences tools and services (2.1%) | ||

| Medpace Holdings, Inc. † | 102,300 | 42,132,255 |

| 42,132,255 | ||

| Machinery (2.1%) | ||

| Federal Signal Corp. | 311,700 | 26,079,939 |

| RBC Bearings, Inc. † S | 59,637 | 16,088,870 |

| 42,168,809 | ||

| Metals and mining (2.7%) | ||

| ATI, Inc. † | 362,000 | 20,072,900 |

| Carpenter Technology Corp. | 311,417 | 34,125,075 |

| 54,197,975 | ||

| Oil, gas, and consumable fuels (0.8%) | ||

| Northern Oil and Gas, Inc. | 425,400 | 15,812,118 |

| 15,812,118 | ||

| Personal care products (2.5%) | ||

| BellRing Brands, Inc. † | 516,900 | 29,535,666 |

| e.l.f. Beauty, Inc. † | 94,300 | 19,870,896 |

| 49,406,562 |

Small Cap Growth Fund 3 | |

| COMMON STOCKS (97.3%)* cont. | Shares | Value |

| Pharmaceuticals (1.0%) | ||

| Axsome Therapeutics, Inc. † S | 99,300 | $7,993,650 |

| Intra-Cellular Therapies, Inc. † | 190,600 | 13,054,194 |

| 21,047,844 | ||

| Professional services (7.2%) | ||

| Huron Consulting Group, Inc. † | 310,500 | 30,584,250 |

| ICF International, Inc. | 227,009 | 33,701,756 |

| Maximus, Inc. | 62,362 | 5,344,423 |

| Parsons Corp. † S | 492,944 | 40,327,749 |

| Verra Mobility Corp. † | 1,287,752 | 35,026,854 |

| 144,985,032 | ||

| Real estate management and development (1.3%) | ||

| Colliers International Group, Inc. (Canada) | 153,080 | 17,094,428 |

| FirstService Corp. (Canada) | 63,100 | 9,603,026 |

| 26,697,454 | ||

| Semiconductors and semiconductor equipment (8.0%) | ||

| Axcelis Technologies, Inc. † | 108,700 | 15,456,053 |

| Camtek, Ltd. (Israel) S | 298,145 | 37,339,680 |

| FormFactor, Inc. † | 341,700 | 20,683,101 |

| Nova, Ltd. (Israel) † S | 185,697 | 43,551,517 |

| Onto Innovation, Inc. † | 133,400 | 29,289,304 |

| Rambus, Inc. † | 271,000 | 15,923,960 |

| 162,243,615 | ||

| Software (9.9%) | ||

| ACI Worldwide, Inc. † | 262,400 | 10,388,416 |

| Altair Engineering, Inc. Class A † S | 323,900 | 31,768,112 |

| Descartes Systems Group, Inc. (The) (Canada) † | 417,500 | 40,430,700 |

| Intapp, Inc. † S | 336,355 | 12,334,138 |

| Manhattan Associates, Inc. † | 120,700 | 29,774,276 |

| SPS Commerce, Inc. † | 91,600 | 17,235,456 |

| Tenable Holdings, Inc. † S | 394,800 | 17,205,384 |

| Vertex, Inc. Class A † S | 1,143,374 | 41,218,633 |

| 200,355,115 | ||

| Specialty retail (3.1%) | ||

| Boot Barn Holdings, Inc. † | 187,428 | 24,165,092 |

| Murphy USA, Inc. | 83,800 | 39,340,748 |

| 63,505,840 | ||

| Trading companies and distributors (2.5%) | ||

| Applied Industrial Technologies, Inc. | 163,158 | 31,652,652 |

| FTAI Aviation, Ltd. | 188,500 | 19,458,853 |

| 51,111,505 | ||

| Total common stocks (cost $1,393,886,424) | $1,966,125,211 | |

| SHORT-TERM INVESTMENTS (8.9%)* | Shares | Value | |

| Putnam Cash Collateral Pool, LLC 5.54% d | 172,261,153 | $172,261,153 | |

| Putnam Short Term Investment Fund Class P 5.48% L | 7,469,562 | 7,469,562 | |

| Total short-term investments (cost $179,730,715) | $179,730,715 | ||

| TOTAL INVESTMENTS | ||

| Total investments (cost $1,573,617,139) | $2,145,855,926 | |

| Key to holding’s abbreviations | |||

| ADR | American Depository Receipts: Represents ownership of foreign securities on deposit with a custodian bank. | ||

| Notes to the fund’s portfolio | |||

| Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from July 1, 2023 through June 30, 2024 (the reporting period). Within the following notes to the portfolio, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Franklin Resources, Inc., and references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures. | |||

| * | Percentages indicated are based on net assets of $2,020,349,001. | ||

4 Small Cap Growth Fund | |

| † | This security is non-income-producing. | ||

| d | Affiliated company. See Notes 1 and 5 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period. | ||

| L | Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period. | ||

| S | Security on loan, in part or in entirety, at the close of the reporting period (Note 1). | ||

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| Valuation inputs | |||

| Investments in securities: | Level 1 | Level 2 | Level 3 |

| Common stocks*: | |||

| Consumer discretionary | $222,622,221 | $— | $— |

| Consumer staples | 72,798,755 | — | — |

| Energy | 82,134,183 | — | — |

| Financials | 131,883,289 | — | — |

| Health care | 405,552,299 | — | — |

| Industrials | 513,147,364 | — | — |

| Information technology | 402,873,487 | — | — |

| Materials | 108,416,159 | — | — |

| Real estate | 26,697,454 | — | — |

| Total common stocks | 1,966,125,211 | — | — |

| Short-term investments | — | 179,730,715 | — |

| Totals by level | $1,966,125,211 | $179,730,715 | $— |

* Common stock classifications are presented at the sector level, which may differ from the fund’s portfolio presentation.

The accompanying notes are an integral part of these financial statements.

Small Cap Growth Fund 5 | |

Financial Statements

Statement of assets and liabilities

6/30/24

| ASSETS | |

| Investment in securities, at value, including $96,811,499 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $1,393,886,424) | $1,966,125,211 |

| Affiliated issuers (identified cost $179,730,715) (Notes 1 and 5) | 179,730,715 |

| Cash | 2,607,993 |

| Dividends, interest and other receivables | 829,523 |

| Receivable for shares of the fund sold | 7,395,029 |

| Receivable for investments sold | 104,057,237 |

| Prepaid assets | 86,194 |

| Total assets | 2,260,831,902 |

| LIABILITIES | |

| Payable for investments purchased | 61,594,083 |

| Payable for shares of the fund repurchased | 2,804,920 |

| Payable for compensation of Manager (Note 2) | 2,250,493 |

| Payable for custodian fees (Note 2) | 15,144 |

| Payable for investor servicing fees (Note 2) | 752,553 |

| Payable for Trustee compensation and expenses (Note 2) | 149,707 |

| Payable for administrative services (Note 2) | 4,301 |

| Payable for distribution fees (Note 2) | 366,131 |

| Collateral on securities loaned, at value (Note 1) | 172,261,153 |

| Other accrued expenses | 284,416 |

| Total liabilities | 240,482,901 |

| Net assets | $2,020,349,001 |

| Represented by | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $1,518,701,062 |

| Total distributable earnings (Note 1) | 501,647,939 |

| Total — Representing net assets applicable to capital shares outstanding | $2,020,349,001 |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

| Net asset value and redemption price per class A share ($501,769,872 divided by 7,287,611 shares) | $68.85 |

| Offering price per class A share (100/94.25 of $68.85)* | $73.05 |

| Net asset value and offering price per class B share ($627,308 divided by 11,278 shares)** | $55.62 |

| Net asset value and offering price per class C share ($22,177,027 divided by 400,594 shares)** | $55.36 |

| Net asset value, offering price and redemption price per class R share ($20,938,063 divided by 323,520 shares) | $64.72 |

| Net asset value, offering price and redemption price per class R6 share ($422,360,332 divided by 5,699,894 shares) | $74.10 |

| Net asset value, offering price and redemption price per class Y share ($1,052,476,399 divided by 14,398,822 shares) | $73.09 |

| * | On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced. |

| ** | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

The accompanying notes are an integral part of these financial statements.

6 Small Cap Growth Fund

Statement of operations

Year ended 6/30/24

| Investment income | |

| Dividends (net of foreign tax of $131,844) | $5,546,046 |

| Interest (including interest income of $2,171,696 from investments in affiliated issuers) (Note 5) | 2,171,696 |

| Securities lending (net of expenses) (Notes 1 and 5) | 225,251 |

| Total investment income | 7,942,993 |

| EXPENSES | |

| Compensation of Manager (Note 2) | 10,178,534 |

| Investor servicing fees (Note 2) | 2,494,958 |

| Custodian fees (Note 2) | 51,047 |

| Trustee compensation and expenses (Note 2) | 70,077 |

| Distribution fees (Note 2) | 1,383,203 |

| Administrative services (Note 2) | 38,853 |

| Other | 638,798 |

| Total expenses | 14,855,470 |

| Expense reduction (Note 2) | (14,206) |

| Net expenses | 14,841,264 |

| Net investment loss | (6,898,271) |

| REALIZED AND UNREALIZED GAIN (LOSS) | |

| Net realized gain (loss) on: | |

| Securities from unaffiliated issuers (Notes 1 and 3) | 45,971,035 |

| Foreign currency transactions (Note 1) | 2,048 |

| Total net realized gain | 45,973,083 |

| Change in net unrealized appreciation (depreciation) on: | |

| Securities from unaffiliated issuers | 287,014,457 |

| Assets and liabilities in foreign currencies | 36 |

| Total change in net unrealized appreciation | 287,014,493 |

| Net gain on investments | 332,987,576 |

| Net increase in net assets resulting from operations | $326,089,305 |

The accompanying notes are an integral part of these financial statements.

Small Cap Growth Fund 7

Statement of changes in net assets

| Year ended 6/30/24 | Year ended 6/30/23 | |

| Increase in net assets | ||

| Operations | ||

| Net investment loss | $(6,898,271) | $(3,064,048) |

| Net realized gain (loss) on investments and foreign currency transactions | 45,973,083 | (68,046,605) |

| Change in net unrealized appreciation of investments and assets and liabilities in foreign currencies | 287,014,493 | 231,776,790 |

| Net increase in net assets resulting from operations | 326,089,305 | 160,666,137 |

| Increase from capital share transactions (Note 4) | 603,353,155 | 236,863,154 |

| Total increase in net assets | 929,442,460 | 397,529,291 |

| Net assets | ||

| Beginning of year | 1,090,906,541 | 693,377,250 |

| End of year | $2,020,349,001 | $1,090,906,541 |

The accompanying notes are an integral part of these financial statements.

8 Small Cap Growth Fund

Financial highlights

(For a common share outstanding throughout the period)

| INVESTMENT OPERATIONS | LESS DISTRIBUTIONS | RATIOS AND SUPPLEMENTAL DATA | ||||||||||

| Period ended | Net asset value, beginning of period | Net investment income (loss) a | Net realized and unrealized gain (loss) on investments | Total from investment operations | From net realized gain on investments | Total distributions | Net asset value, end of period | Total return at net asset value (%) b | Net assets, end of period (in thousands) | Ratio of expenses to average net assets (%) c | Ratio of net investment income (loss) to average net assets (%) | Portfolio turnover (%) |

| Class A | ||||||||||||

| June 30, 2024 | $56.31 | (.40) | 12.94 | 12.54 | — | — | $68.85 | 22.27 | $501,770 | 1.21 | (.66) | 40 |

| June 30, 2023 | 46.89 | (.25) | 9.67 | 9.42 | — | — | 56.31 | 20.09 | 422,911 | 1.25 | (.48) | 48 |

| June 30, 2022 | 73.13 | (.62) | (15.28) | (15.90) | (10.34) | (10.34) | 46.89 | (25.78) | 383,000 | 1.24 d | (.97) | 39 |

| June 30, 2021 | 53.07 | (.66) | 24.06 | 23.40 | (3.34) | (3.34) | 73.13 | 44.93 | 549,842 | 1.21 | (1.00) | 70 |

| June 30, 2020 | 47.49 | (.42) | 6.95 | 6.53 | (.95) | (.95) | 53.07 | 13.99 | 415,702 | 1.24 | (.88) | 56 |

| Class B | ||||||||||||

| June 30, 2024 | $45.84 | (.67) | 10.45 | 9.78 | — | — | $55.62 | 21.34 | $627 | 1.96 | (1.42) | 40 |

| June 30, 2023 | 38.46 | (.51) | 7.89 | 7.38 | — | — | 45.84 | 19.19 | 1,751 | 2.00 | (1.23) | 48 |

| June 30, 2022 | 62.19 | (.93) | (12.46) | (13.39) | (10.34) | (10.34) | 38.46 | (26.33) | 2,974 | 1.99 d | (1.73) | 39 |

| June 30, 2021 | 45.85 | (.99) | 20.67 | 19.68 | (3.34) | (3.34) | 62.19 | 43.86 | 5,956 | 1.96 | (1.74) | 70 |

| June 30, 2020 | 41.46 | (.68) | 6.02 | 5.34 | (.95) | (.95) | 45.85 | 13.15 | 5,835 | 1.99 | (1.63) | 56 |

| Class C | ||||||||||||

| June 30, 2024 | $45.62 | (.69) | 10.43 | 9.74 | — | — | $55.36 | 21.35 | $22,177 | 1.96 | (1.41) | 40 |

| June 30, 2023 | 38.28 | (.51) | 7.85 | 7.34 | — | — | 45.62 | 19.17 | 13,906 | 2.00 | (1.23) | 48 |

| June 30, 2022 | 61.94 | (.92) | (12.40) | (13.32) | (10.34) | (10.34) | 38.28 | (26.32) | 11,761 | 1.99 d | (1.72) | 39 |

| June 30, 2021 | 45.68 | (.99) | 20.59 | 19.60 | (3.34) | (3.34) | 61.94 | 43.84 | 17,120 | 1.96 | (1.74) | 70 |

| June 30, 2020 | 41.31 | (.67) | 5.99 | 5.32 | (.95) | (.95) | 45.68 | 13.15 | 13,869 | 1.99 | (1.63) | 56 |

| Class R | ||||||||||||

| June 30, 2024 | $53.06 | (.51) | 12.17 | 11.66 | — | — | $64.72 | 21.98 | $20,938 | 1.46 | (.91) | 40 |

| June 30, 2023 | 44.30 | (.35) | 9.11 | 8.76 | — | — | 53.06 | 19.77 | 16,874 | 1.50 | (.73) | 48 |

| June 30, 2022 | 69.79 | (.74) | (14.41) | (15.15) | (10.34) | (10.34) | 44.30 | (25.96) | 15,995 | 1.49 d | (1.22) | 39 |

| June 30, 2021 | 50.89 | (.81) | 23.05 | 22.24 | (3.34) | (3.34) | 69.79 | 44.56 | 23,571 | 1.46 | (1.26) | 70 |

| June 30, 2020 | 45.69 | (.52) | 6.67 | 6.15 | (.95) | (.95) | 50.89 | 13.71 | 12,669 | 1.49 | (1.13) | 56 |

| Class R6 | ||||||||||||

| June 30, 2024 | $60.36 | (.17) | 13.91 | 13.74 | — | — | $74.10 | 22.76 | $422,360 | .81 | (.26) | 40 |

| June 30, 2023 | 50.07 | (.04) | 10.33 | 10.29 | — | — | 60.36 | 20.55 | 161,550 | .85 | (.08) | 48 |

| June 30, 2022 | 77.13 | (.39) | (16.33) | (16.72) | (10.34) | (10.34) | 50.07 | (25.49) | 58,592 | .85 d | (.58) | 39 |

| June 30, 2021 | 55.62 | (.46) | 25.31 | 24.85 | (3.34) | (3.34) | 77.13 | 45.49 | 59,840 | .83 | (.64) | 70 |

| June 30, 2020 | 49.53 | (.24) | 7.28 | 7.04 | (.95) | (.95) | 55.62 | 14.45 | 24,596 | .84 | (.48) | 56 |

| Class Y | ||||||||||||

| June 30, 2024 | $59.63 | (.26) | 13.72 | 13.46 | — | — | $73.09 | 22.57 | $1,052,476 | .96 | (.41) | 40 |

| June 30, 2023 | 49.54 | (.12) | 10.21 | 10.09 | — | — | 59.63 | 20.37 | 473,914 | 1.00 | (.23) | 48 |

| June 30, 2022 | 76.51 | (.47) | (16.16) | (16.63) | (10.34) | (10.34) | 49.54 | (25.58) | 221,055 | .99 d | (.70) | 39 |

| June 30, 2021 | 55.27 | (.54) | 25.12 | 24.58 | (3.34) | (3.34) | 76.51 | 45.29 | 181,762 | .96 | (.77) | 70 |

| June 30, 2020 | 49.29 | (.31) | 7.24 | 6.93 | (.95) | (.95) | 55.27 | 14.30 | 83,884 | .99 | (.63) | 56 |

a Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

b Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

c Includes amounts paid through expense offset and/or brokerage/service arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any.

d Includes one-time proxy cost of 0.01%.

The accompanying notes are an integral part of these financial statements.

Small Cap Growth Fund 9

Notes to financial statements 6/30/24

Unless otherwise noted, the “reporting period” represents the period from July 1, 2023 through June 30, 2024. The following table defines commonly used references within the Notes to financial statements:

| References to | Represent |

| 1940 Act | Investment Company Act of 1940, as amended |

| Franklin Advisers | Franklin Advisers, Inc., a wholly-owned subsidiary of Franklin Templeton |

| Franklin Templeton | Franklin Resources, Inc. |

| Franklin Templeton Services | Franklin Templeton Services, LLC, a wholly-owned subsidiary of Franklin Templeton and an affiliate of Putnam Management |

| JPMorgan | JPMorgan Chase Bank, N.A. |

| OTC | Over-the-counter |

| PIL | Putnam Investments Limited, an affiliate of Putnam Management |

| Putnam Management | Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Franklin Templeton |

| SEC | Securities and Exchange Commission |

| State Street | State Street Bank and Trust Company |

Putnam Small Cap Growth Fund (the fund) is a diversified series of Putnam Funds Trust (the Trust), a Massachusetts business trust registered under the 1940 Act as an open-end management investment company. The goal of the fund is to seek capital appreciation. The fund invests mainly in common stocks of small U.S. companies, with a focus on growth stocks. Growth stocks are stocks of companies whose earnings are expected to grow faster than those of similar firms, and whose business growth and other characteristics may lead to an increase in stock price. Under normal circumstances, Putnam Management invests at least 80% of the fund’s net assets in companies of a size similar to those in the Russell 2000 Growth Index. This policy may be changed only after 60 days’ notice to shareholders. As of August 31, 2023, the index was composed of companies having market capitalizations of between approximately $38.2 million and $14.4 billion. Putnam Management may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments.

The fund offers the following share classes. The expenses for each class of shares may differ based on the distribution and investor servicing fees of each class, which are identified in Note 2.

| Share class | Sales charge | Contingent deferred sales charge | Conversion feature |

| Class A | Up to 5.75% | 1.00% on certain redemptions of shares bought with no initial sales charge | None |

| Class B* | None | 5.00% phased out over six years | Converts to class A shares on September 5, 2024 |

| Class C | None | 1.00% eliminated after one year | Converts to class A shares after 8 years |

| Class R† | None | None | None |

| Class R6 † | None | None | None |

| Class Y† | None | None | None |

| * Purchases of class B shares are closed to new and existing investors except by exchange from class B shares of another Putnam fund or through dividend and/or capital gains reinvestment. | |||

| † Not available to all investors. | |||

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, shareholder servicing agent and custodian, who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s Agreement and Declaration of Trust, any claims asserted by a shareholder against or on behalf of the Trust (or its series), including claims against Trustees and Officers, must be brought in courts located within the Commonwealth of Massachusetts.

Note 1: Significant accounting policies

The fund follows the accounting and reporting guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP), including, but not limited to, ASC 946. The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized and unrealized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. If the fund were liquidated, shares of each class would receive their pro-rata share of the net assets of the fund. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees (Trustees). The Trustees have formed a Pricing Committee to oversee the implementation of these procedures. Under compliance policies and procedures approved by the Trustees, the Trustees have designated the fund’s investment manager as the valuation designee and has responsibility for oversight of valuation. The investment manager is assisted by the fund’s administrator in performing this responsibility, including leading the cross-functional Valuation Committee (VC). The VC is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Trustees.

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets, and are classified as Level 1 securities under Accounting Standards Codification 820 Fair Value Measurements and Disclosures (ASC 820). If no sales are reported, as in the case of some securities that are traded OTC, a security is valued at its last reported bid price and is generally categorized as a Level 2 security.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

Many securities markets and exchanges outside the U.S. close prior to the scheduled close of the New York Stock Exchange and therefore the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the scheduled close of the New York Stock Exchange. Accordingly, on certain days, the fund will fair value certain foreign equity securities taking into account multiple factors including movements in the U.S. securities markets, currency valuations and comparisons to the valuation of American Depository Receipts, exchange-traded funds and futures contracts. The foreign equity securities, which would generally be classified as Level 1 securities,

10 Small Cap Growth Fund

will be transferred to Level 2 of the fair value hierarchy when they are valued at fair value. The number of days on which fair value prices will be used will depend on market activity and it is possible that fair value prices will be used by the fund to a significant extent. Securities quoted in foreign currencies, if any, are translated into U.S. dollars at the current exchange rate. Short-term securities with remaining maturities of 60 days or less are valued using an independent pricing service approved by the Trustees, and are classified as Level 2 securities.

To the extent a pricing service or dealer is unable to value a security or provides a valuation that Putnam Management does not believe accurately reflects the security’s fair value, the security will be valued at fair value by Putnam Management, which has been designated as valuation designee pursuant to Rule 2a–5 under the 1940 Act, in accordance with policies and procedures approved by the Trustees. Certain investments, including certain restricted and illiquid securities and derivatives, are also valued at fair value following procedures approved by the Trustees. These valuations consider such factors as significant market or specific security events such as interest rate or credit quality changes, various relationships with other securities, discount rates, U.S. Treasury, U.S. swap and credit yields, index levels, convexity exposures, recovery rates, sales and other multiples and resale restrictions. These securities are classified as Level 2 or as Level 3 depending on the priority of the significant inputs.

To assess the continuing appropriateness of fair valuations, the Valuation Committee reviews and affirms the reasonableness of such valuations on a regular basis after considering all relevant information that is reasonably available. Such valuations and procedures are reviewed periodically by the Trustees. The fair value of securities is generally determined as the amount that the fund could reasonably expect to realize from an orderly disposition of such securities over a reasonable period of time. By its nature, a fair value price is a good faith estimate of the value of a security in a current sale and does not reflect an actual market price, which may be different by a material amount.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income, net of any applicable withholding taxes, if any, is recorded on the accrual basis. Amortization and accretion of premiums and discounts on debt securities, if any, is recorded on the accrual basis.

Dividend income, net of any applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain.

Foreign currency translation The accounting records of the fund are maintained in U.S. dollars. The fair value of foreign securities, currency holdings, and other assets and liabilities is recorded in the books and records of the fund after translation to U.S. dollars based on the exchange rates on that day. The cost of each security is determined using historical exchange rates. Income and withholding taxes are translated at prevailing exchange rates when earned or incurred. The fund does not isolate that portion of realized or unrealized gains or losses resulting from changes in the foreign exchange rate on investments from fluctuations arising from changes in the market prices of the securities. Such gains and losses are included with the net realized and unrealized gain or loss on investments. Net realized gains and losses on foreign currency transactions represent net realized exchange gains or losses on disposition of foreign currencies, currency gains and losses realized between the trade and settlement dates on securities transactions and the difference between the amount of investment income and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized appreciation and depreciation of assets and liabilities in foreign currencies arise from changes in the value of assets and liabilities other than investments at the period end, resulting from changes in the exchange rate.

Options contracts The fund uses options contracts for gaining exposure to securities.

The potential risk to the fund is that the change in value of options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments if there is an illiquid secondary market for the contracts, if interest or exchange rates move unexpectedly or if the counterparty to the contract is unable to perform. Realized gains and losses on purchased options are included in realized gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a reduction to the cost of investments.

Exchange-traded options are valued at the last sale price or, if no sales are reported, the last bid price for purchased options and the last ask price for written options. OTC traded options are valued using prices supplied by dealers.

Options on swaps are similar to options on securities except that the premium paid or received is to buy or grant the right to enter into a previously agreed upon interest rate or credit default contract. Forward premium swap option contracts include premiums that have extended settlement dates. The delayed settlement of the premiums is factored into the daily valuation of the option contracts. In the case of interest rate cap and floor contracts, in return for a premium, ongoing payments between two parties are based on interest rates exceeding a specified rate, in the case of a cap contract, or falling below a specified rate in the case of a floor contract.

Written option contracts outstanding at period end, if any, are listed after the fund’s portfolio.

Master agreements The fund is a party to ISDA (International Swaps and Derivatives Association, Inc.) Master Agreements (Master Agreements) with certain counterparties that govern OTC derivative and foreign exchange contracts entered into from time to time. The Master Agreements may contain provisions regarding, among other things, the parties’ general obligations, representations, agreements, collateral requirements, events of default and early termination. With respect to certain counterparties, in accordance with the terms of the Master Agreements, collateral pledged to the fund is held in a segregated account by the fund’s custodian and, with respect to those amounts which can be sold or repledged, is presented in the fund’s portfolio.

Collateral pledged by the fund is segregated by the fund’s custodian and identified in the fund’s portfolio. Collateral can be in the form of cash or debt securities issued by the U.S. Government or related agencies or other securities as agreed to by the fund and the applicable counterparty. Collateral requirements are determined based on the fund’s net position with each counterparty.

Termination events applicable to the fund may occur upon a decline in the fund’s net assets below a specified threshold over a certain period of time. Termination events applicable to counterparties may occur upon a decline in the counterparty’s long-term and short-term credit ratings below a specified level. In each case, upon occurrence, the other party may elect to terminate early and cause settlement of all derivative and foreign exchange contracts outstanding, including the payment of any losses and costs resulting from such early termination, as reasonably determined by the terminating party. Any decision by one or more of the fund’s counterparties to elect early termination could impact the fund’s future derivative activity.

At the close of the reporting period, the fund did not have a net liability position on open derivative contracts subject to the Master Agreements.

Securities lending The fund may lend securities, through its agent, to qualified borrowers in order to earn additional income. The loans are collateralized by cash in an amount at least equal to the fair value of the securities loaned. The fair value of securities loaned is determined daily and any additional required collateral is allocated to the fund on the next business day. The remaining maturities of the securities lending transactions are considered overnight and continuous. The risk of borrower default will be borne by the fund’s agent; the fund will bear the risk of loss with respect to the investment of the cash collateral. Income from securities lending, if any, is net of expenses and is included in investment income on the Statement of operations. Cash collateral is invested in Putnam Cash Collateral Pool, LLC, a limited liability company managed by an affiliate of Putnam Management. Investments in Putnam Cash Collateral Pool, LLC are valued at its closing net asset value each business day. There are no management fees charged to Putnam Cash Collateral Pool, LLC. At the close of the reporting period, the fund received cash collateral of $172,261,153 and the value of securities loaned amounted to $163,679,151. Certain of these securities were sold prior to the close of the reporting period and are included in Receivable for investments sold on the Statement of assets and liabilities.

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to borrow from or lend to other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Small Cap Growth Fund 11

Lines of credit The fund participates, along with other Putnam funds, in a $320 million syndicated unsecured committed line of credit, provided by State Street ($160 million) and JPMorgan ($160 million), and a $235.5 million unsecured uncommitted line of credit, provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to 1.25% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the committed line of credit and 1.30% plus the higher of (1) the Federal Funds rate and (2) the Overnight Bank Funding Rate for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds and a $75,000 fee has been paid by the participating funds to State Street as agent of the syndicated committed line of credit. In addition, a commitment fee of 0.21% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

The fund may also be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned. In some cases, the fund may be entitled to reclaim all or a portion of such taxes, and such reclaim amounts, if any, are reflected as an asset on the fund’s books. In many cases, however, the fund may not receive such amounts for an extended period of time, depending on the country of investment.

Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred for an unlimited period and the carry forwards will retain their character as either short-term or long-term capital losses. At June 30, 2024, the fund had the following capital loss carryovers available, to the extent allowed by the Code, to offset future net capital gain, if any:

| Loss carryover | ||

| Short-term | Long-term | Total |

| $60,660,687 | $— | $60,660,687 |

Pursuant to federal income tax regulations applicable to regulated investment companies, the fund has elected to defer $4,341,445 to its fiscal year ending June 30, 2025 of late year ordinary losses ((i) ordinary losses recognized between January 1, 2024 and June 30, 2024, and/or (ii) specified ordinary and currency losses recognized between November 1, 2023 and June 30, 2024).

Distributions to shareholders Distributions to shareholders from net investment income, if any, are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences include temporary and/or permanent differences from losses on wash sale transactions, from late year loss deferrals, from unrealized gains and losses on passive foreign investment companies and from net operating loss. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fund reclassified $4,203,623 to decrease accumulated net investment loss, $1,387,301 to decrease paid-in capital and $2,816,322 to increase accumulated net realized loss.

Tax cost of investments includes adjustments to net unrealized appreciation (depreciation) which may not necessarily be final tax cost basis adjustments, but closely approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. The tax basis components of distributable earnings and the federal tax cost as of the close of the reporting period were as follows:

| Unrealized appreciation | $594,642,649 |

| Unrealized depreciation | (27,992,618) |

| Net unrealized appreciation | 566,650,031 |

| Capital loss carryforward | (60,660,687) |

| Late year ordinary loss deferral | (4,341,445) |

| Cost for federal income tax purposes | $1,579,205,895 |

Expenses of the Trust Expenses directly charged or attributable to any fund will be paid from the assets of that fund. Generally, expenses of the Trust will be allocated among and charged to the assets of each fund on a basis that the Trustees deem fair and equitable, which may be based on the relative assets of each fund or the nature of the services performed and relative applicability to each fund.

Note 2: Management fee, administrative services and other transactions

The fund pays Putnam Management a management fee (base fee) (based on the fund’s average net assets and computed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets of all open-end mutual funds sponsored by Putnam Management (excluding net assets of funds that are invested in, or that are invested in by, other Putnam funds to the extent necessary to avoid “double counting” of those assets). Such annual rates may vary as follows:

| 0.780% | of the first $5 billion, |

| 0.730% | of the next $5 billion, |

| 0.680% | of the next $10 billion, |

| 0.630% | of the next $10 billion, |

| 0.580% | of the next $50 billion, |

| 0.560% | of the next $50 billion, |

| 0.550% | of the next $100 billion and |

| 0.545% | of any excess thereafter. |

In addition, the monthly management fee consists of the monthly base fee plus or minus a performance adjustment for the month. The performance adjustment is determined based on performance over the thirty-six month period then ended. Each month, the performance adjustment is calculated by multiplying the performance adjustment rate and the fund’s average net assets over the performance period and dividing the result by twelve. The resulting dollar amount is added to, or subtracted from the base fee for that month. The performance adjustment rate is equal to 0.03 multiplied by the difference between the fund’s annualized performance (measured by the fund’s class A shares) and the annualized performance of the Russell 2000 Growth Index each measured over the performance period. The maximum annualized performance adjustment rate is +/- 0.18%. The monthly base fee is determined based on the fund’s average net assets for the month, while the performance adjustment is determined based on the fund’s average net assets over the thirty-six month performance period. This means it is possible that, if the fund underperforms significantly over the performance period, and the fund’s assets have declined significantly over that period, the negative performance adjustment may exceed the base fee. In this event, Putnam Management would make a payment to the fund.

Because the performance adjustment is based on the fund’s performance relative to its applicable benchmark index, and not its absolute performance, the performance adjustment could increase Putnam Management’s fee even if the fund’s shares lose value during the performance period provided that the fund outperformed its benchmark index, and could decrease Putnam Management’s fee even if the fund’s shares increase in value during the performance period provided that the fund underperformed its benchmark index.

For the reporting period, the management fee represented an effective rate (excluding the impact of any expense waiver in effect) of 0.703% of the fund’s average net assets, which included an effective base fee of 0.616% and an increase of 0.087% ($1,259,061) based on performance.

Effective July 15, 2024, Franklin Advisers was retained by Putnam Management as a sub-adviser for the fund pursuant to a new sub-advisory agreement between Putnam Management and Franklin Advisers.

Putnam Management has contractually agreed, through October 30, 2025, to waive fees and/or reimburse the fund’s expenses to the extent necessary to limit the cumulative expenses of the fund, exclusive of brokerage, interest, taxes, investment-related expenses, extraordinary expenses, acquired fund fees and expenses and payments under the fund’s investor servicing contract, investment management contract and distribution plans, on a fiscal year-to-date basis to an annual rate of 0.20% of the fund’s average net assets over such fiscal year-to-date

12 Small Cap Growth Fund

period. During the reporting period, the fund’s expenses were not reduced as a result of this limit.

PIL is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Putnam Management from time to time. PIL did not manage any portion of the assets of the fund during the reporting period. If Putnam Management were to engage the services of PIL, Putnam Management would pay a quarterly sub-management fee to PIL for its services at an annual rate of 0.25% of the average net assets of the portion of the fund managed by PIL.

On January 1, 2024, a subsidiary of Franklin Templeton acquired Putnam U.S. Holdings I, LLC (“Putnam Holdings”), the parent company of Putnam Management and PIL, in a stock and cash transaction (the “Transaction”). As a result of the Transaction, Putnam Management and PIL became indirect, wholly-owned subsidiaries of Franklin Templeton. The Transaction also resulted in the automatic termination of the investment management contract between the fund and Putnam Management and the sub-management contract for the fund between Putnam Management and PIL that were in place for the fund before the Transaction (together, the “Previous Advisory Contracts”). However, for the period from January 1, 2024 until January 31, 2024, Putnam Management and PIL continued to provide uninterrupted services with respect to the fund pursuant to interim investment management and sub-management contracts (together, the “Interim Advisory Contracts”) that were approved by the Board of Trustees. The terms of the Interim Advisory Contracts were identical to those of the Previous Advisory Contracts, except for the term of the contracts and those provisions required by regulation. On January 31, 2024, new investment management and sub-management contracts were approved by fund shareholders at a shareholder meeting held in connection with the Transaction (together, the “New Advisory Contracts”). The New Advisory Contracts took effect on January 31, 2024 and replaced the Interim Advisory Contracts. The terms of the New Advisory Contracts are substantially similar to those of the Previous Advisory Contracts, and the fee rates payable under the New Advisory Contracts are the same as the fee rates under the Previous Advisory Contracts.

Effective June 1, 2024, under an agreement with Putnam Management, Franklin Templeton Services provides certain administrative services to the fund. The fee for those services is paid by Putnam Management based on the fund’s average daily net assets and is not an additional expense of the fund.

The fund reimburses Putnam Management an allocated amount for the compensation and related expenses of certain officers of the fund and their staff who provide administrative services to the fund. The aggregate amount of all such reimbursements is determined annually by the Trustees.