basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The full extent to which the COVID-19 pandemic will directly or indirectly impact our financial condition, liquidity, or results of operations will depend on future developments that are highly uncertain, including as a result of new information that may emerge concerning COVID-19 and its variants and the actions taken to contain or treat COVID-19 and its variants, as well as the economic impact on local, regional, national and international customers and markets.

Results of Operations

Three months ended September 30, 2021 compared to the three months ended September 30, 2020

Revenues from Selling Goods

We recorded revenues from selling goods of $4.5 million during the three months ended September 30, 2021, an increase of $1.2 million, or 36%, compared to revenues of $3.3 million for the three months ended September 30, 2020. The increase of $3.2 million in sales to Brazil, resulting from timing differences, was partially offset by a decrease of $2.0 million in sales to Pfizer.

Revenues from License and R&D Services

We recorded revenues from license and R&D services of $7.5 million for the three months ended September 30, 2021 and September 30, 2020. Revenues from license and R&D services are comprised primarily of revenues we recognized in connection with the Chiesi Agreements. A revenue increase of $1.0 million recognized from the Kirin feasibility study was offset by a $1.0 million decrease in revenue generated under the Chiesi Agreements.

Cost of Goods Sold

Cost of goods sold was $3.7 million for the three months ended September 30, 2021, an increase of $0.8 million, or 28%, from cost of goods sold of $2.9 million for the three months ended September 30, 2020. The increase in cost of goods sold was primarily the result of higher sales.

Research and Development Expenses

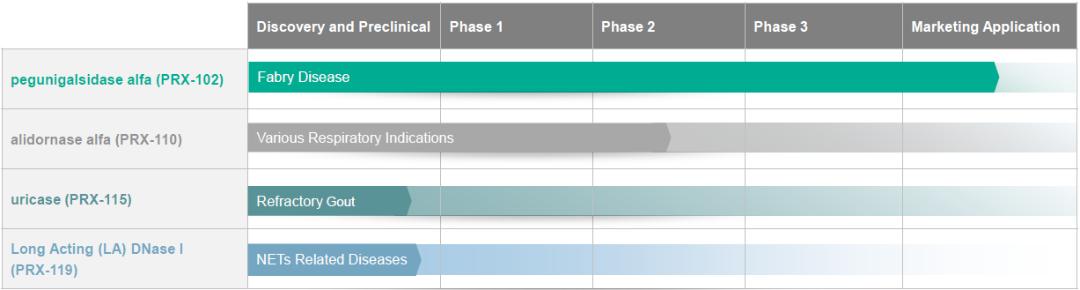

Research and development expenses were $7.3 million for the three months ended September 30, 2021, a decrease of $0.4 million, or 5%, compared to $7.7 million of research and development expenses for the three months ended September 30, 2020. The decrease is primarily the result of the completion of two out of the three phase III clinical trials of PRX-102 and reduced costs related to the BALANCE study.

We expect research and development expenses to continue to be our primary expense as we enter into a more advanced stage of preclinical and clinical trials for certain of our product candidates.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $3.0 million for the three months ended September 30, 2021, an increase of $0.2 million, or 7%, compared to $2.8 million for the three months ended September 30, 2020. The increase is primarily the result of an increase of $0.4 million in corporate costs mainly related to insurance and a $0.2 million increase in sales and marketing costs, partially offset by a decrease of $0.5 million in share-based compensation.

Financial Expenses, Net

Financial expenses, net were $2.3 million for the three months ended September 30, 2021 and $1.9 million for the three months ended September 30, 2020. The increase resulted primarily from loss on extinguishment related to the Exchanges of our 2021 Notes.

Nine months ended September 30, 2021 compared to the nine months ended September 30, 2020

Revenues from Selling Goods

We recorded revenues from selling goods of $12.3 million during the nine months ended September 30, 2021, an increase of $0.3 million, or 3%, compared to revenues of $12.0 million for the nine months ended September 30, 2020. The increase of