months ended June 30, 2021, our total research and development expenses were approximately $14.8 million comprised of approximately $9.4 million in subcontractor-related expenses, approximately $3.6 million of salary and related expenses, approximately $0.4 million of materials-related expenses and approximately $1.4 million of other expenses.

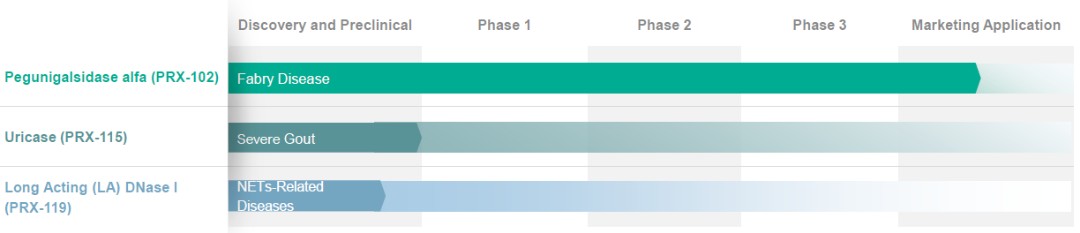

The increase in research and developments expenses of $1.5 million, or 10%, from the six months ended June 30, 2022 compared to the six months ended June 30, 2021 resulted primarily from a $0.8 million increase in subcontractor-related expenses in connection with regulatory submissions for PRX-102, and a $0.5 million increase in materials-related expenses.

We expect research and development expenses to continue to be our primary expense as we enter into a more advanced stage of preclinical and clinical trials for certain of our product candidates.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were $5.8 million for the six months ended June 30, 2022, a decrease of $0.5 million, or 8%, compared to $6.3 million for the six months ended June 30, 2021. The decrease resulted primarily from a decrease in salary-related expenses.

Financial Expenses, Net

Financial expenses, net were $0.2 million for the six months ended June 30, 2022, a decrease of $3.7 million, or 95%, compared to $3.9 million for the six months ended June 30, 2021. The decrease resulted primarily from lower interest and debt amortization costs due to a decrease in our outstanding notes from an aggregate principal amount of $57.92 million of 2021 Notes to an aggregate principal amount of $28.75 million of 2024 Notes, and an increase in the exchange rate of New Israeli Shekels for U.S. Dollars over the period.

Liquidity and Capital Resources

Our sources of liquidity include our cash balances and bank deposits. At June 30, 2022, we had $28.6 million in cash and cash equivalents and short term bank deposits. We have primarily financed our operations through equity and debt financings, business collaborations, and grants funding.

During the year ended December 31, 2021, we raised gross proceeds equal to approximately $8.8 million from sales of common stock under our ATM program through the sale of 1,867,552 shares of our common stock. In addition, we raised gross proceeds of approximately $40.2 million from a public offering of our common stock before deducting the underwriting discount and estimated expenses of the offering. In connection with the offering, we issued 8,749,999 shares of our common stock at a purchase price per share of $4.60. During the six months ended June 30, 2022, we raised gross proceeds equal to approximately $2.8 million from sales of common stock under our ATM program through the sale of 2,395,823 shares of our common stock.

On August 25, 2021, we completed exchanges, or the Exchanges, of a substantial majority of our then outstanding 7.50% Senior Secured Convertible Notes due 2021, or the 2021 Notes, with institutional note holders of a substantial majority of the 2021 Notes. The Exchanges involved the exchange of an aggregate of $54.65 million principal amount of our 2021 Notes for an aggregate of $28.75 million principal amount of newly issued 7.50% Senior Secured Convertible Notes due 2024, or the 2024 Notes, $25.90 million in cash, and approximately $1.1 million in cash representing accrued and unpaid interest through the closing date. The initial conversion rate for the 2024 Notes is 563.2216 shares of our common stock for each $1,000 principal amount of 2024 Notes (equivalent to an initial conversion price of approximately $1.7755 per share of common Stock, subject to adjustment in certain circumstances. This initial conversion price represents a premium of approximately 32.5% relative to the closing price of the common stock on the NYSE American on August 13, 2021. After giving effect to the Exchanges, $3.27 million aggregate principal amount of the 2021 Notes remained outstanding. On November 15, 2021, all of the then outstanding 2021 Notes matured and were paid in full.

The 2024 Notes were issued pursuant to the Indenture dated as of August 24, 2021 between us, the guarantors party thereto, The Bank of New York Mellon Trust Company, N.A., as trustee and Wilmington Savings Fund Society, FSB, as collateral agent, or the 2024 Indenture. Interest on the Notes are payable semi-annually at a rate of 7.50% per annum. The 2024 Notes will mature on September 1, 2024, unless earlier purchased, converted, exchanged or redeemed, and are guaranteed by our subsidiaries. The 2024 Notes are secured by perfected liens on all of our assets, including those of our subsidiaries. Under the terms of the 2024 Indenture, we are required to comply with certain covenants, including the requirement to maintain a minimum cash balance of at least $7.5 million. Failure to comply with such covenants may result in an event of default under the 2024 Indenture and, accordingly, may result in the acceleration of the payment of the notes or in additional interest payments. As of June 30, 2022, we were in compliance with all covenants.