UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07527 |

|

Turner Funds |

(Exact name of registrant as specified in charter) |

|

1205 Westlakes Drive, Suite 100 Berwyn, PA | | 19312 |

(Address of principal executive offices) | | (Zip code) |

|

Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 224-6312 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2011 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Semiannual Report

March 31, 2011 (unaudited)

Long/short equity funds

Turner Market Neutral Fund

Turner Medical Sciences Long/Short Fund

Turner Spectrum Fund

Turner Titan Fund

U.S. growth equity funds

Turner All Cap Growth Fund

(formerly Turner New Enterprise Fund)

Turner Concentrated Growth Fund

Turner Emerging Growth Fund

Turner Large Growth Fund

(formerly Turner Core Growth Fund)

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Quantitative equity funds

Turner Quantitative Broad Market Equity Fund

Turner Quantitative Large Cap Value Fund

Global and international equity funds

Turner Global Opportunities Fund

Turner International Growth Fund

(formerly Turner International Core Growth Fund)

Core equity fund

Turner Small Cap Equity Fund

Contents

| 2 | | | Letter to shareholders | |

|

| 5 | | | Total returns of Turner Funds | |

|

| 9 | | | Investment review:

Turner Market Neutral Fund | |

|

| 10 | | | Investment review:

Turner Medical Sciences Long/Short Fund | |

|

| 11 | | | Investment review:

Turner Spectrum Fund | |

|

| 12 | | | Investment review:

Turner Titan Fund | |

|

| 13 | | | Investment review:

Turner All Cap Growth Fund

(formerly Turner New Enterprise Fund) | |

|

| 14 | | | Investment review:

Turner Concentrated Growth Fund | |

|

| 15 | | | Investment review:

Turner Emerging Growth Fund | |

|

| 16 | | | Investment review:

Turner Large Growth Fund

(formerly Turner Core Growth Fund) | |

|

| 17 | | | Investment review:

Turner Midcap Growth Fund | |

|

| 18 | | | Investment review:

Turner Small Cap Growth Fund | |

|

| 19 | | | Investment review:

Turner Quantitative Broad Market Equity Fund | |

|

| 20 | | | Investment review:

Turner Quantitative Large Cap Value Fund | |

|

| 21 | | | Investment review:

Turner Global Opportunities Fund | |

|

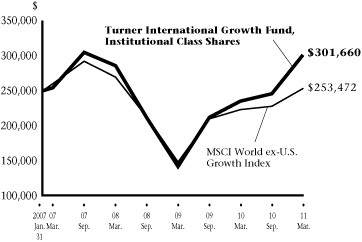

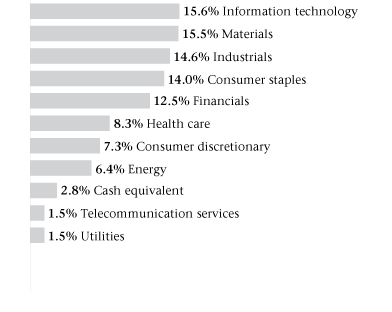

| 22 | | | Investment review:

Turner International Growth Fund

(formerly Turner International Core Growth

Fund) | |

|

| 23 | | | Investment review:

Turner Small Cap Equity Fund | |

|

| 24 | | | Schedules of investments | |

|

| 64 | | | Financial statements | |

|

| 88 | | | Notes to financial statements | |

|

| 98 | | | Board of Trustees considerations in approving the Advisory Agreements | |

|

| 100 | | | Shareholder voting | |

|

| 101 | | | Disclosure of fund expenses | |

|

Turner Funds

As of March 31, 2011, the Turner Funds offered a series of 15 mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $25,000 for the Turner Quantitative Large Cap Value Fund and $100,000 for the Turner Market Neutral Fund, Turner Medical Sciences Long/Short Fund, Turner Spectrum Fund and Turner Titan Fund) for regular accounts and $100,000 (with the exception of $10,000 for the Turner Quantitative Large Cap Value Fund) for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts.

Turner Investments, based in Berwyn, Pennsylvania, serves as the investment adviser for the Funds (other than the Turner Small Cap Equity Fund). Turner Investment Management LLC, a subsidiary of Turner Investments, serves as the investment adviser for the Turner Small Cap Equity Fund. Turner Investments, founded in 1990, manages more than $18 billion in stock investments as of March 31, 2011.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, quarterly account statements, and a quarterly newsletter. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2011 SEMIANNUAL REPORT 1

LETTER TO SHAREHOLDERS

To our shareholders

Managing a stock mutual fund is not unlike being a golfer who makes a breakthrough on the professional tour. When a rising star distinguishes himself from the pack, golfing pundits say things like, "Well, it's no wonder — look at that upright swing of his." But when he inevitably goes through a rough stretch of performance, the pundits tend to change their tune and observe, "You know, that upright swing of his was just bound to bring him down to earth at some point."

Like a standout professional golfer's swing, the stock-investment processes that we — and other money managers — use aren't perfect. They don't work well all the time. And they often are perceived as only being as good as the most recent performance they have wrought. But the best investment processes, like the best pro golfers, do prove to perform well on balance.

Funds outperform

In managing our own eight U.S. and global/international growth funds and four long/short funds, we employ an investment process that prizes earnings, based on the premise that earnings drive stock prices. Happily, the past six months ended March 31, 2011, happened to be one of those times when our growth-investment process — the investing equivalent of a distinctive and skilled golf swing — worked well. All twelve of our growth and long/short funds in operation throughout the entire six-month period outperformed one or more of their benchmarks. And all three new long/short funds that opened on February 7 — the Turner Market Neutral Fund, the Turner Medical Sciences Long/Short Fund, and the Turner Titan Fund — also got off to good starts, beating one or more of their indexes.

Alas, our swing may not have seemed nearly as good when we most recently reported our funds' results, in the 2010 Turner Funds Annual Report last September. Then, during the 12-month period covered by that report, only four of our funds managed to beat par — their benchmarks.

Even so, we remained confident then that our growth-investment process was sound — that there was nothing fundamentally wrong with our swing. We reasoned that it would eventually lead to better performance.

And that's exactly what happened.

We stick with our processes

When our funds undergo spells of less-than-stellar performance, it's undoubtedly frustrating for shareholders — and for us as well, since our portfolio managers (and other Turner Investments employees) are shareholders in our funds, too.

But if there's anything we believe about stock investing, it's this: if you're convinced that your investment process is logical and well constructed, you shouldn't abandon it when it's generating adverse results. There's a natural tendency in investing to succumb to the temptation to alter an investment process out of desperation to do something — anything — to "cure" a spell of unfavorable performance. But that cure can be worse than the disease. In such a circumstance, we think it's prudent to stick with our investment processes and give them the time needed to pay off.

Of course, the key test for an investment process isn't how it performs in just six months, but its ability to generate outperformance and increase shareholders' wealth over time. And we say with a measure of pride that our funds have generally passed that test: all share classes in eight of the nine growth and long/short funds with records longer than 12 months have beaten one or more of their benchmarks since inception.

As for the investment results in the most recent six-month period, they were certainly helped by a strongly rising stock market. The market, as represented by the S&P 500 Index, gained 17.31%. In the wake of the 2000-2009 decade that we call the Terrible 2000s, the worst decade for stock investing in history, with an annualized 0.95% loss, the S&P 500 has been on a tear, rising almost 100% in the past two years — the second-fastest rise in history.

Bull corrected just once

On balance, this bull market has been uncommonly benign: it has suffered only one correction, i.e., a pullback of 10% or more. (Corrections have occurred about once annually since 1900.) The bull market's resilience has been such that it reminds us of those inflatable punching toys that snap back after being knocked down. With pop-up resilience, the market has kept its equilibrium after absorbing some solid whacks.

Those whacks included three crises late in the period. There was the nuclear crisis in Japan, when the Fukushima Daiichi nuclear station had a partial meltdown following an earthquake-induced tsunami, which resulted in a disruption of component supplies to manufacturers around the world. There was a new phase of the European debt crisis, when Portugal's government collapsed and pushed its credit rating lower, fanning winds of anxiety that a second major financial crisis in three years was in the offing. And there were civil uprisings in the Middle East, most notably in Libya and Egypt, which led to a decline in global oil production. But despite all these geo-economic downers, the market generated positive returns in all six months of the period.

2 TURNER FUNDS 2011 SEMIANNUAL REPORT

March 31, 2011

| Total returns | | | | | |

| Six-month period ended March 31, 2011 | | | | | |

| Long/short equity funds | | | | | |

Turner Market Neutral Fund,

Investor Class (TMNFX) | | | 3.30 | %† | |

| S&P 500 Index | | | 1.48 | † | |

| Barclays Capital U.S. Aggregate Bond Index | | | 1.34 | † | |

| Lipper Equity Market-Neutral Funds Average | | | 0.79 | † | |

Turner Medical Sciences Long/Short Fund,

Investor Class (TMSFX) | | | 2.60 | † | |

| S&P 500 Healthcare Index | | | 2.86 | † | |

| Barclays Capital U.S. Aggregate Bond Index | | | 1.34 | † | |

| Lipper Long/Short Equity Funds Average | | | 0.70 | † | |

Turner Spectrum Fund,

Institutional Class (TSPEX) | | | 9.24 | | |

| S&P 500 Index | | | 17.31 | | |

| Barclays Capital U.S. Aggregate Bond Index | | | -0.88 | | |

| Lipper Long/Short Equity Funds Average | | | 7.88 | | |

Turner Titan Fund,

Investor Class (TTLFX) | | | 1.50 | † | |

| S&P 500 Index | | | 1.48 | † | |

| Barclays Capital U.S. Aggregate Bond Index | | | 1.34 | † | |

| Lipper Long/Short Equity Funds Average | | | 0.70 | † | |

| U.S. growth equity funds | | | | | |

| Turner All Cap Growth Fund (TBTBX) | | | 34.99 | | |

| NASDAQ Composite Index | | | 17.41 | | |

| Russell 3000® Growth Index | | | 19.33 | | |

Turner Concentrated Growth

Fund (TTOPX) | | | 23.08 | | |

| S&P 500 Index | | | 17.31 | | |

| Russell 1000® Growth Index | | | 18.57 | | |

Turner Emerging Growth Fund,

Investor Class (TMCGX) | | | 33.51 | | |

| Russell 2000® Growth Index | | | 27.93 | | |

Turner Large Growth Fund,

Institutional Class (TTMEX) | | | 20.86 | | |

| Russell 1000® Growth Index | | | 18.57 | | |

Turner Midcap Growth Fund,

Investor Class (TMGFX) | | | 30.47 | | |

| Russell Midcap® Growth Index | | | 22.97 | | |

| Turner Small Cap Growth Fund (TSCEX) | | | 30.24 | | |

| Russell 2000® Growth Index | | | 27.93 | | |

| Quantitative equity funds | | | | | |

Turner Quantitative

Broad Market Equity Fund,

Institutional Class (TBMEX) | | | 19.29 | | |

| Russell 3000® Index | | | 18.71 | | |

| S&P 500 Index | | | 17.31 | | |

Turner Quantitative

Large Cap Value Fund,

Institutional Class (TLVFX) | | | 16.21 | % | |

| Russell 1000® Value Index | | | 17.68 | | |

| Global and international equity funds | | | | | |

Turner Global Opportunities Fund,

Institutional Class (TGLBX) | | | 23.26 | | |

| MSCI World Growth Index | | | 14.33 | | |

| MSCI World Index | | | 14.42 | | |

Turner International Growth Fund,

Institutional Class (TICGX) | | | 22.79 | | |

| MSCI World ex-U.S. Growth Index | | | 11.40 | | |

| Core equity fund | | | | | |

Turner Small Cap Equity Fund,

Investor Class (TSEIX) | | | 29.07 | | |

| Russell 2000® Index | | | 25.48 | | |

† Returns are from the fund's inception date: February 7, 2011.

(Please call 1.800.224.6312 or visit our website at www.turnerinvestments.com for the most recent month-end performance. For more details on the performance of each fund during the six-month period, see the Investment review beginning on page 9.)

Stocks look good to us

In our view, stocks have had a lot of things going for them in the past six months — and have a lot of things going for them in the near term that may help sustain this bull market. For example:

• Despite Japan's nuclear crisis, the European debt crisis, and unrest in the Middle East — plus the prospect that a key stock-market catalyst, the Federal Reserve's quantitative easing, may end soon — we estimate the global economy may grow more than 4% this year. That's more than a point higher than the global economy's average in the past two decades.

• Earnings for the S&P 500 Index companies should rise at least 10% this year and in the high single digits next year, in our estimation. And earnings for the first quarter should be the ninth in a series of better-than-expected quarterly results. We agree with this assessment of the state of earnings and the market by Bank of America Merrill Lynch: "Corporate profit growth remains solid, and valuations provide a significant cushion to absorb some worst-than-expected outcomes" for any crisis du jour that may surface.

• Mergers and acquisitions are picking up, with multi-billion-dollar deals announced recently in the telecommunications, semiconductor, e-commerce, and pharmaceutical industries, among others. The resources are certainly available for more M&A activity this year:

TURNER FUNDS 2011 SEMIANNUAL REPORT 3

LETTER TO SHAREHOLDERS (continued)

Lazard, an investment bank, estimates that corporations and private-equity firms hold nearly $2.4 trillion in cash.

• We think corporate capital spending should increase at a double-digit rate in both 2011 and 2012, outpacing economic growth by a factor of three. That should especially help technology and industrial companies, in our analysis.

Allocations shifting

• We believe the stock market should benefit from a continuing shift in investors' asset allocations from low-yielding money markets and bonds to stocks. U.S. and international stock funds took in a net $13 billion of new investment in February (the latest month for which data are available), on the heels of a $19.7 billion inflow in January, Citigroup Global Markets reported. In contrast, stock funds suffered outflows of $37.6 billion in 2010 and $9.1 billion in 2009.

• Finally, we think the market should benefit in 2011 from the third year of the presidential-election cycle, which has invariably been an up year for stocks. Since 1955 the S&P 500 Index has advanced an average of 18% in the third year of the cycle, with no losing years.

And we think the longer term outlook for stocks is encouraging as well. Two years ago, when the Terrible 2000s were at their most terrible, we said in the 2009 Turner Funds Semiannual Report that stocks offered superior return potential to investors with long time horizons. We noted: "We refuse to believe that the next 10 years for stocks will be as painfully disappointing as the last 10 years. That's because we as investors above all believe in probabilities, in making decisions that are the most likely to produce a constructive result. And based on the probabilities, we think this decade of dreadful performance by stocks is likely to be the exception that proves the rule."

Better returns ahead?

We still stand behind that statement today. The five- and 10-year returns on stocks as of March 31 remain below the norm: the S&P 500 Index is up an annualized 2.62% for the past five years and an annualized 3.29% for the past 10 years. So stock investors could continue to profit from the statistical phenomenon known as reversion to the mean — the tendency for worse-than-average performance to be followed by periods of above-average performance, and vice versa.

In our judgment, the lackluster stock-market results of the most recent five- and 10-year periods may be followed by sparkling results over the next five or 10 years. According to WisdomTree Asset Management, after the worst 10-year periods of performance dating back to 1871, stocks generated much better returns in all subsequent 10-year periods, with a level of inflation-adjusted results 2.32 percentage points above that of all other 10-year periods.

In closing, as a result of the strong performance of our stock funds recently and our optimism about the stock market's course, we think our own upright golf swing is in the groove and should deliver more good scores.

If nothing else, the market's exceptional rally over the past two years is a testament to the perils of trying to time the market — the practice of investing in stocks when the market's prospects appear favorable and getting out of stocks when the prospects seem poor. Indeed, because you as a Turner Funds shareholder have in your hands this report, chances are you're not a market timer and thus have benefited from the gains our funds have produced in the past six months or longer.

To our way of thinking, putting time on your side — five years, 10 years, 20 years, whatever — improves the odds that you will reap the wealth-building rewards that stocks can uniquely provide. As we see it, putting time on your side going forward should be rewarded with additional good results in the stock market and our funds.

Bob Turner

Chairman and Chief Investment Officer

Turner Investments

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of March 31, 2011, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

Bob Turner

4 TURNER FUNDS 2011 SEMIANNUAL REPORT

PERFORMANCE

Total returns of the Turner Funds

Through March 31, 2011

Current performance may be lower or higher than the performance data quoted. Please call 1.800.224.6312 or visit our website at www.turnerinvestments.com for the most recent month-end performance information.

The performance data quoted represents past performance and the principal value and investment return will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns shown, unless otherwise indicated, are total returns, with dividends and income reinvested. Returns spanning more than one year are annualized. Fee waivers are in effect; if they had not been in effect, performance would have been lower. The indices mentioned are unmanaged statistical composites of stock-market performance. Investing in an index is not possible.

The holdings and sector weightings of the Funds are subject to change. Forward-earnings projections are not predictors of stock price or investment performance, and do not represent past performance. There is no guarantee that the forward-earnings projections will accurately predict the actual earnings experience of any of the companies involved, and there is no guarantee that owning securities of companies with relatively high price-to-earnings ratios will cause the portfolio to outperform its benchmark or index.

The Turner Funds are distributed by Foreside Fund Services, LLC, Portland, Maine. The investor should consider the investment objectives, risks, charges, and expenses carefully before investing. This and other information can be found in the prospectus. A free prospectus, which contains detailed information, including fees and expenses, and the risks associated with investing in these Funds, can be obtained by calling 1.800.224.6312. Read the prospectus carefully before investing.

| Fund name/Index | | Six

months | | Year

to

date | | One

year | | Three

years | | Five

years | | 10

years | | (Annualized*)

Since

inception | | Total

net assets

($mil) | |

Turner Market Neutral Fund —

Institutional Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 3.40 | % | | $ | 3.35 | | |

| Investor Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 3.30 | | | | 0.07 | | |

| Class C Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 3.30 | | | | — | | |

| S&P 500 Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.48 | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.34 | | | | |

Lipper Equity Market-Neutral

Funds Average | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 0.79 | | | | |

| Inception date: 2/7/11 | |

Turner Medical Sciences

Long/Short Fund —

Institutional Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 2.60 | | | | 2.25 | | |

| Investor Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 2.60 | | | | 2.49 | | |

| Class C Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 2.50 | | | | 0.45 | | |

| S&P 500 Healthcare Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 2.86 | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.34 | | | | |

| Lipper Long/Short Equity Average | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 0.70 | | | | |

| Inception date: 2/7/11 | |

Turner Spectrum Fund —

Institutional Class Shares | | | 9.24 | % | | | 2.87 | % | | | 6.87 | % | | | n/a | | | | n/a | | | | n/a | | | | 9.59 | | | | 306.10 | | |

| Investor Class Shares | | | 9.09 | | | | 2.89 | | | | 6.62 | | | | n/a | | | | n/a | | | | n/a | | | | 9.30 | | | | 96.84 | | |

| Class C Shares(1) | | | 8.68 | | | | 2.64 | | | | 5.81 | | | | n/a | | | | n/a | | | | n/a | | | | 9.87 | | | | 8.78 | | |

| S&P 500 Index | | | 17.31 | | | | 5.92 | | | | 15.65 | | | | n/a | | | | n/a | | | | n/a | | | | 24.68 | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | -0.88 | | | | 0.42 | | | | 5.12 | | | | n/a | | | | n/a | | | | n/a | | | | 6.46 | | | | |

| Lipper Long/Short Equity Average | | | 7.88 | | | | 2.49 | | | | 6.78 | | | | n/a | | | | n/a | | | | n/a | | | | 13.77 | | | | |

| Inception date: 5/7/09 | |

TURNER FUNDS 2011 SEMIANNUAL REPORT 5

PERFORMANCE (continued)

| Fund name/Index | | Six

months | | Year

to

date | | One

year | | Three

years | | Five

years | | 10

years | | (Annualized*)

Since

inception | | Total

net assets

($mil) | |

Turner Titan Fund —

Institutional Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.50 | % | | $ | 4.08 | | |

| Investor Class Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.50 | | | | 0.07 | | |

| Class C Shares | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.40 | | | | 0.02 | | |

| S&P 500 Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.48 | | | | |

Barclays Capital U.S. Aggregate

Bond Index | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.34 | | | | |

| Lipper Long/Short Equity Average | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 0.70 | | | | |

| Inception date: 2/7/11 | |

| Turner All Cap Growth Fund(2) | | | 34.99 | % | | | 7.96 | % | | | 38.34 | % | | | 9.88 | % | | | 5.52 | % | | | 8.02 | % | | | -0.48 | | | | 58.97 | | |

| NASDAQ Composite Index | | | 17.41 | | | | 4.83 | | | | 15.98 | | | | 6.86 | | | | 3.52 | | | | 4.22 | | | | -3.25 | | | | |

| Russell 3000® Growth Index | | | 19.33 | | | | 6.30 | | | | 19.24 | | | | 5.58 | | | | 4.32 | | | | 3.26 | | | | -1.86 | | | | |

| Inception date: 6/30/00 | |

Turner Concentrated

Growth Fund | | | 23.08 | | | | 5.97 | | | | 23.64 | | | | -0.55 | | | | -0.38 | | | | 0.88 | | | | 1.33 | | | | 55.65 | | |

| S&P 500 Index | | | 17.31 | | | | 5.92 | | | | 15.65 | | | | 2.35 | | | | 2.62 | | | | 3.29 | | | | 1.51 | | | | |

| Russell 1000® Growth Index | | | 18.57 | | | | 6.03 | | | | 18.26 | | | | 5.19 | | | | 4.34 | | | | 2.99 | | | | -0.06 | | | | |

| Inception date: 6/30/99 | |

Turner Emerging Growth Fund(2) —

Institutional Class Shares(3) | | | 33.64 | | | | 11.28 | | | | 31.75 | | | | n/a | | | | n/a | | | | n/a | | | | 37.65 | | | | 375.78 | | |

| Investor Class Shares | | | 33.51 | | | | 11.22 | | | | 31.43 | | | | 6.13 | | | | 4.22 | | | | 10.71 | | | | 20.06 | | | | 222.66 | | |

| Russell 2000® Growth Index | | | 27.93 | | | | 9.24 | | | | 31.04 | | | | 10.16 | | | | 4.34 | | | | 6.44 | | | | 3.93 | | | | |

| Inception date: 2/27/98 | |

Turner Large Growth Fund —

Institutional Class Shares | | | 20.86 | | | | 6.97 | | | | 16.77 | | | | 0.87 | | | | 1.72 | | | | 3.67 | | | | 2.64 | | | | 544.16 | | |

| Investor Class Shares(4) | | | 20.78 | | | | 6.92 | | | | 16.56 | | | | 0.61 | | | | 1.48 | | | | n/a | | | | 3.45 | | | | 115.17 | | |

| Russell 1000® Growth Index | | | 18.57 | | | | 6.03 | | | | 18.26 | | | | 5.19 | | | | 4.34 | | | | 2.99 | | | | 1.80 | | | | |

| Inception date: 2/28/01 | |

Turner Midcap Growth Fund(2) —

Institutional Class Shares(5) | | | 30.67 | | | | 10.21 | | | | 30.54 | | | | n/a | | | | n/a | | | | n/a | | | | 4.38 | | | | 258.93 | | |

| Investor Class Shares | | | 30.47 | | | | 10.14 | | | | 30.21 | | | | 7.13 | | | | 4.86 | | | | 6.09 | | | | 11.48 | | | | 955.15 | | |

| Retirement Class Shares(6) | | | 30.30 | | | | 10.06 | | | | 29.90 | | | | 6.86 | | | | 4.56 | | | | n/a | | | | 8.44 | | | | 5.25 | | |

| Russell Midcap® Growth Index | | | 22.97 | | | | 7.85 | | | | 26.60 | | | | 7.63 | | | | 4.93 | | | | 6.94 | | | | 7.68 | | | | |

| Inception date: 10/1/96 | |

Turner Small Cap

Growth Fund(2) | | | 30.24 | | | | 11.36 | | | | 32.29 | | | | 10.35 | | | | 4.90 | | | | 7.62 | | | | 12.16 | | | | 345.17 | | |

| Russell 2000® Growth Index | | | 27.93 | | | | 9.24 | | | | 31.04 | | | | 10.16 | | | | 4.34 | | | | 6.44 | | | | 6.29 | | | | |

| Inception date: 2/7/94 | |

Turner Quantitative Broad

Market Equity Fund —

Institutional Class Shares | | | 19.29 | | | | 6.80 | | | | 14.41 | | | | n/a | | | | n/a | | | | n/a | | | | 2.95 | | | | 12.00 | | |

| Investor Class Shares | | | 19.24 | | | | 6.70 | | | | 14.10 | | | | n/a | | | | n/a | | | | n/a | | | | 2.72 | | | | 0.03 | | |

| Russell 3000® Index | | | 18.71 | | | | 6.38 | | | | 17.41 | | | | n/a | | | | n/a | | | | n/a | | | | 4.38 | | | | |

| S&P 500 Index | | | 17.31 | | | | 5.92 | | | | 15.65 | | | | n/a | | | | n/a | | | | n/a | | | | 3.61 | | | | |

| Inception date: 6/30/08 | |

6 TURNER FUNDS 2011 SEMIANNUAL REPORT

PERFORMANCE (continued)

| Fund name/Index | | Six

months | | Year

to

date | | One

year | | Three

years | | Five

years | | 10

years | | (Annualized*)

Since

inception | | Total

net assets

($mil) | |

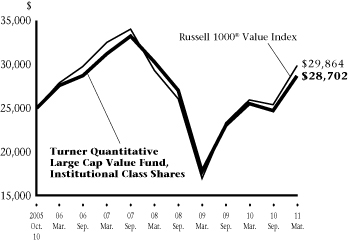

Turner Quantitative Large Cap

Value Fund —

Institutional Class Shares | | | 16.21 | % | | | 6.25 | % | | | 12.49 | % | | | -1.80 | % | | | 0.79 | % | | | n/a | | | | 2.56 | % | | $ | 0.81 | | |

| Investor Class Shares(7) | | | 15.99 | | | | 6.13 | | | | 12.13 | | | | n/a | | | | n/a | | | | n/a | | | | 10.14 | | | | 0.01 | | |

| Russell 1000® Value Index | | | 17.68 | | | | 6.46 | | | | 15.15 | | | | 0.60 | | | | 1.38 | | | | n/a | | | | 3.30 | | | | |

| Inception date: 10/10/05 | |

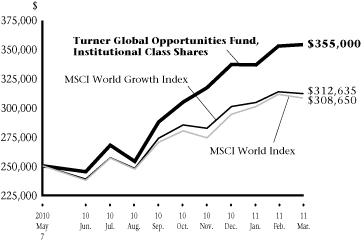

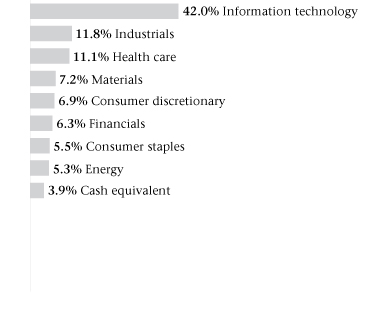

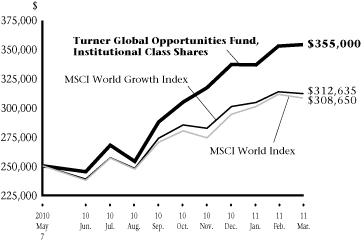

Turner Global Opportunities

Fund —

Institutional Class Shares | | | 23.26 | | | | 5.19 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 42.00 | | | | 1.34 | | |

| Investor Class Shares | | | 23.13 | | | | 5.12 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 41.60 | | | | 0.71 | | |

| MSCI World Growth Index | | | 14.33 | | | | 3.79 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | �� | | | 28.66 | | | | |

| MSCI World Index | | | 14.42 | | | | 4.91 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 27.03 | | | | |

| Inception date: 5/7/10 | |

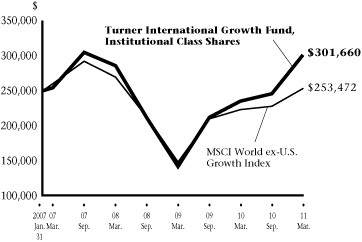

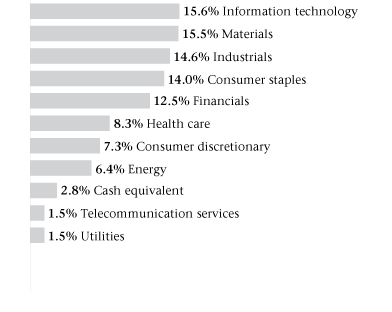

Turner International

Growth Fund —

Institutional Class Shares | | | 22.79 | | | | 4.47 | | | | 28.24 | | | | 1.76 | | | | n/a | | | | n/a | | | | 4.61 | | | | 6.37 | | |

| Investor Class Shares(7) | | | 22.67 | | | | 4.47 | | | | 27.99 | | | | n/a | | | | n/a | | | | n/a | | | | 30.46 | | | | 0.51 | | |

| MSCI World ex-U.S. Growth Index | | | 11.40 | | | | 2.66 | | | | 14.16 | | | | -1.70 | | | | n/a | | | | n/a | | | | 0.70 | | | | |

| Inception date: 1/31/07 | |

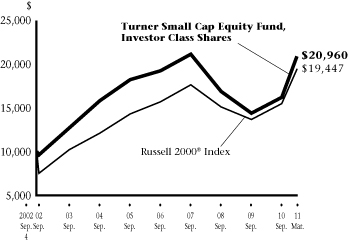

Turner Small Cap

Equity Fund(2) —

Institutional Class Shares(3) | | | 29.26 | | | | 11.34 | | | | 31.63 | | | | n/a | | | | n/a | | | | n/a | | | | 33.02 | | | | — | | |

| Investor Class Shares | | | 29.07 | | | | 11.26 | | | | 31.21 | | | | 4.71 | | | | -0.16 | % | | | n/a | | | | 8.09 | | | | 5.70 | | |

| Russell 2000® Index | | | 25.48 | | | | 7.94 | | | | 25.79 | | | | 8.57 | | | | 3.35 | | | | n/a | | | | 7.61 | | | | |

| Inception date: 3/4/02 | |

(1) Commenced operations on July 14, 2009.

(2) Investing in technology and science companies and small- and mid-capitalization companies may subject the Funds to specific inherent risks, including above-average price fluctuations.

(3) Commenced operations on February 1, 2009.

(4) Commenced operations on August 1, 2005.

(5) Commenced operations on June 16, 2008.

(6) Commenced operations on September 24, 2001.

(7) Commenced operations on October 31, 2008.

* Returns of less than one year are cumulative, and not annualized.

Amounts designated as "—" have been rounded to $0 ($mil)

TURNER FUNDS 2011 SEMIANNUAL REPORT 7

Expense Ratio†

| | | Gross

expense

ratio | | Net

expense

ratio* | |

| Turner Market Neutral Fund | |

| Institutional Class Shares | | | 2.13 | % | | | 1.95 | % | |

| Investor Class Shares | | | 2.38 | % | | | 2.20 | % | |

| Class C Shares | | | 3.13 | % | | | 2.95 | % | |

Turner Medical Sciences

Long/Short Fund | |

| Institutional Class Shares | | | 2.13 | % | | | 1.95 | % | |

| Investor Class Shares | | | 2.38 | % | | | 2.20 | % | |

| Class C Shares | | | 3.13 | % | | | 2.95 | % | |

| Turner Spectrum Fund | |

| Institutional Class Shares | | | 2.88 | % | | | 1.95 | % | |

| Investor Class Shares | | | 3.15 | % | | | 2.20 | % | |

| Class C Shares | | | 3.85 | % | | | 2.95 | % | |

| Turner Titan Fund | |

| Institutional Class Shares | | | 2.13 | % | | | 1.95 | % | |

| Investor Class Shares | | | 2.38 | % | | | 2.20 | % | |

| Class C Shares | | | 3.13 | % | | | 2.95 | % | |

| Turner All Cap Growth Fund | |

| Investor Class Shares | | | 2.15 | % | | | 1.64 | % | |

| Turner Concentrated Growth Fund | |

| Investor Class Shares | | | 1.94 | % | | | 1.51 | % | |

| Turner Emerging Growth Fund | |

| Institutional Class Shares | | | 1.30 | % | | | 1.17 | % | |

| Investor Class Shares | | | 1.55 | % | | | 1.42 | % | |

| Turner Large Growth Fund | |

| Institutional Class Shares | | | 0.87 | % | | | 0.69 | % | |

| Investor Class Shares | | | 1.12 | % | | | 0.94 | % | |

| | | Gross

expense

ratio | | Net

expense

ratio* | |

| Turner Midcap Growth Fund | |

| Institutional Class Shares | | | 1.03 | % | | | 0.93 | % | |

| Investor Class Shares | | | 1.28 | % | | | 1.18 | % | |

| Retirement Class Shares | | | 1.53 | % | | | 1.43 | % | |

| Turner Small Cap Growth Fund | |

| Investor Class Shares | | | 1.52 | % | | | 1.25 | % | |

Turner Quantitative Broad Market

Equity Fund | |

| Institutional Class Shares | | | 2.29 | % | | | 0.65 | % | |

| Investor Class Shares | | | 6.73 | % | | | 0.90 | % | |

Turner Quantitative Large Cap

Value Fund | |

| Institutional Class Shares | | | 12.61 | % | | | 0.69 | % | |

| Investor Class Shares | | | 12.82 | % | | | 0.94 | % | |

| Turner Global Opportunities Fund | |

| Institutional Class Shares | | | 8.34 | % | | | 1.11 | % | |

| Investor Class Shares | | | 8.59 | % | | | 1.36 | % | |

| Turner International Growth Fund | |

| Institutional Class Shares | | | 3.93 | % | | | 1.10 | % | |

| Investor Class Shares | | | 4.18 | % | | | 1.35 | % | |

| Turner Small Cap Equity Fund | |

| Institutional Class Shares | | | 1.79 | % | | | 1.20 | % | |

| Investor Class Shares | | | 2.04 | % | | | 1.45 | % | |

† These expense ratios are based on the most recent prospectus and may differ from those shown in the financial highlights.

* Net expense ratio reflects contractual waivers of certain fees and/or expense reimbursements. Turner may discontinue this arrangement at any time after January 31, 2012.

8 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner Market Neutral Fund

Fund profile

March 31, 2011

g Ticker symbol TMNFX

Investor Class Shares

g CUSIP #900297581

Investor Class Shares

g Top five holdings1

(1) Martin Marietta Materials

(2) Arch Capital Group

(3) ACE

(4) Ensco SP ADR

(5) Salesforce.com

g % in five largest holdings 23.4%2

g Number of holdings 711

g Price/earnings ratio 31.9

g Weighted average market capitalization $25.39 billion

g % of holdings with positive earnings surprises 65.7%

g % of holdings with negative earnings surprises 32.9%

g Net assets $0.1 million, Investor Class Shares

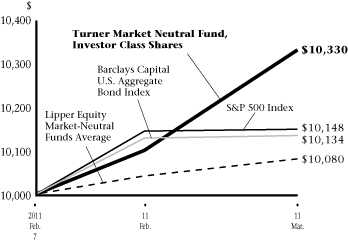

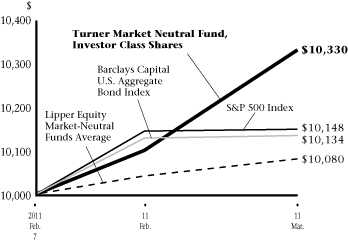

Growth of a $10,000 investment in the

Turner Market Neutral Fund,

Investor Class Shares:

February 7, 2011-March 31, 20113,4

Cumulative total returns (Period ended March 31, 2011)

| | | Since

inception4 | |

| Turner Market Neutral Fund, Institutional Class Shares5 | | | 3.40 | % | |

| Turner Market Neutral Fund, Investor Class Shares5 | | | 3.30 | % | |

| Turner Market Neutral Fund, Class C Shares5 | | | 3.30 | % | |

| S&P 500 Index6 | | | 1.48 | % | |

| Barclays Capital U.S. Aggregate Bond Index7 | | | 1.34 | % | |

| Lipper Equity Market-Neutral Funds Average8 | | | 0.79 | % | |

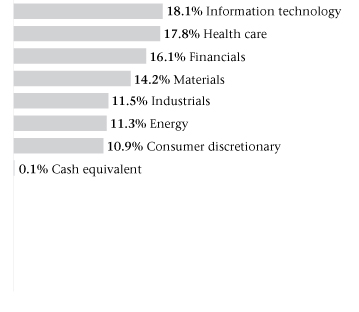

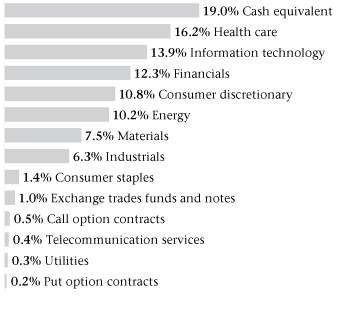

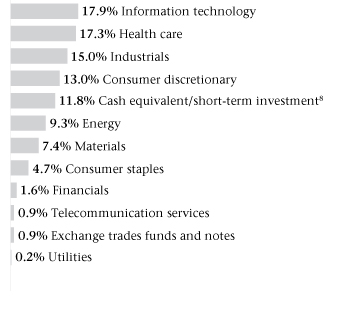

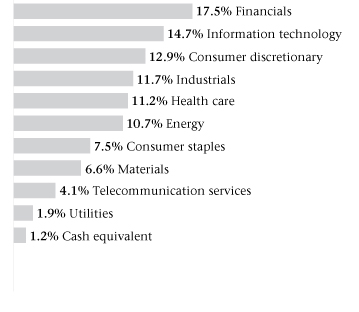

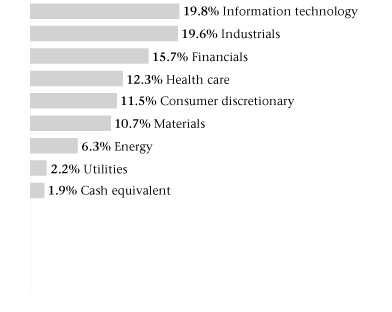

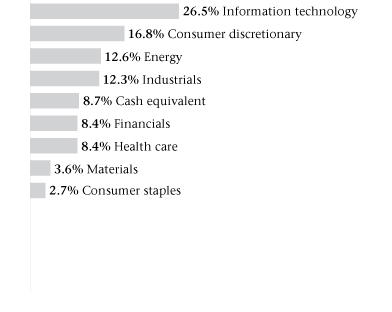

Sector weightings2:

Manager's discussion and analysis

Generally good stock selection helped the Turner Market Neutral Fund, Investor Class Shares (TMNFX) to get off to a good start in its first two months of operation. After opening on February 7, the fund gained 3.30%, beating the S&P 500 Index, the Barclays Capital U.S. Aggregate Bond Index, and the Lipper Equity Market-Neutral Funds Average. The fund seeks to generate returns that have historically been associated with stocks, with relatively low volatility and a correlation unlike that of the broad market.

Six of the seven sectors in which the fund was invested contributed extra return. The information-technology and financials sectors added the most extra return. In those sectors, long and short positions in semiconductor, data-networking, wireless-communications, banking, insurance, and investment-management shares generated favorable relative results. The prime deflator of performance was the energy sector. In that sector, long and short positions in energy-production, natural-gas, and energy-services shares recorded the poorest relative performance.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Market Neutral Fund was February 7, 2011. Cumulative returns, not annualized.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

7 The Barclays Capital U.S. Aggregate Bond Index (prior to November 2008, the Index was known as the "Lehman Brothers U.S. Aggregate Bond Index") represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities.

8 The Lipper Equity Market-Neutral Funds Average represents the average annualized total return for all reporting funds in the Lipper Equity Market-Neutral Fund category.

TURNER FUNDS 2011 SEMIANNUAL REPORT 9

INVESTMENT REVIEW

Turner Medical Sciences Long/Short Fund

Fund profile

March 31, 2011

g Ticker symbol TMSFX

Investor Class Shares

g CUSIP #900297557

Investor Class Shares

g Top five holdings1

(1) Allergan

(2) Watson Pharmaceuticals International

(3) Jazz Pharmaceuticals

(4) Pfizer

(5) HCA Holdings

g % in five largest holdings 11.8%2

g Number of holdings 621

g Price/earnings ratio 13.6

g Weighted average market capitalization $34.45 billion

g % of holdings with positive earnings surprises 54.1%

g % of holdings with negative earnings surprises 36.1%

g Net assets $2 million, Investor Class Shares

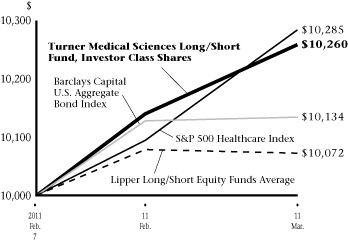

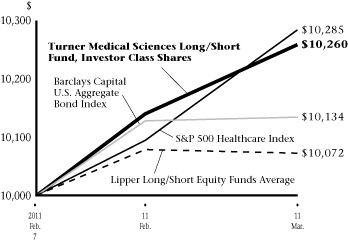

Growth of a $10,000 investment in the

Turner Medical Sciences Long/Short Fund,

Investor Class Shares:

February 7, 2011-March 31, 20113,4

Cumulative total returns (Period ended March 31, 2011)

| | | Since

inception4 | |

| Turner Medical Sciences Long/Short Fund, Institutional Class Shares5 | | | 2.60 | % | |

| Turner Medical Sciences Long/Short Fund, Investor Class Shares5 | | | 2.60 | % | |

| Turner Medical Sciences Long/Short Fund, Class C Shares5 | | | 2.50 | % | |

| S&P 500 Healthcare Index6 | | | 2.86 | % | |

| Barclays Capital U.S. Aggregate Bond Index7 | | | 1.34 | % | |

| Lipper Long/Short Equity Funds Average8 | | | 0.70 | % | |

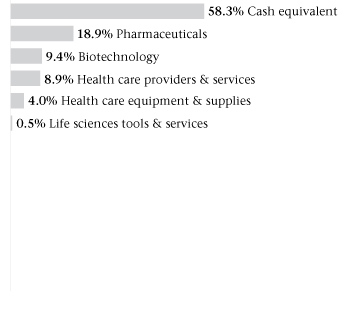

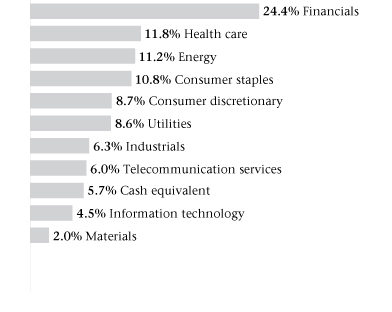

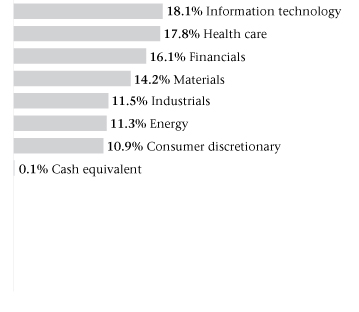

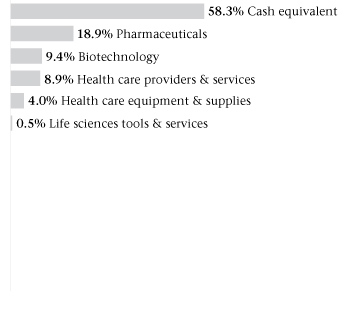

Sector weightings2:

Manager's discussion and analysis

The Turner Medical Sciences Long/Short Fund, Investor Class Shares (TMSFX) got off to a good start in its first two months of operation. Opening on February 7, the fund went on to gain 2.60% through March 31 to outperform the Lipper Long/Short Equity Funds Average and the Barclays Capital U.S. Aggregate Bond Index, but it slightly trailed the S&P 500 Healthcare Index. The fund seeks to capture alpha (the estimated amount of risk-adjusted excess return expected from an investment's fundamentals), reduce volatility, and preserve capital in declining markets.

In the fund's long and short positions, stocks in three health-care industries — biotechnology, specialty pharmaceutical, and health care services — produced the greatest extra return. The main detractors were long and short positions in the stocks of medical-device companies.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Medical Sciences Long/Short Fund was February 7, 2011. Cumulative returns, not annualized.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Healthcare Index is an unmanaged index which includes the stocks in the health care sector of the S&P 500 Index.

7 The Barclays Capital U.S. Aggregate Bond Index (prior to November 2008, the Index was known as the "Lehman Brothers U.S. Aggregate Bond Index") represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities.

8 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

10 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner Spectrum Fund

Fund profile

March 31, 2011

g Ticker symbol TSPEX

Institutional Class Shares

g CUSIP #900297664

Institutional Class Shares

g Top five holdings1

(1) HCA Holdings

(2) Google, Cl A

(3) Cubist Pharmaceuticals

(4) Citigroup

(5) CF Industries Holdings

g % in five largest holdings 5.3%2

g Number of holdings 5171

g Price/earnings ratio 17.6

g Weighted average market capitalization $17.16 billion

g % of holdings with positive earnings surprises 54.0%

g % of holdings with negative earnings surprises 24.2%

g Net assets $306 million, Institutional Class Shares

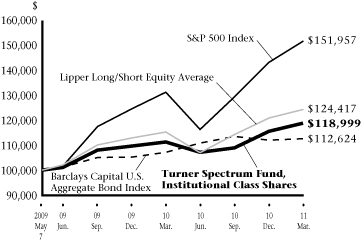

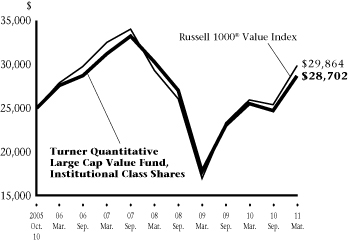

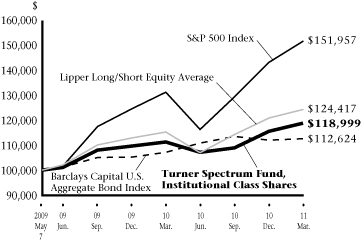

Growth of a $100,000 investment in the

Turner Spectrum Fund, Institutional Class Shares:

May 7, 2009-March 31, 20113,4

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Since

inception | |

| Turner Spectrum Fund, Institutional Class Shares5 | | | 9.24 | % | | | 6.87 | % | | | 9.59 | %4 | |

| Turner Spectrum Fund, Investor Class Shares5 | | | 9.09 | % | | | 6.62 | % | | | 9.30 | %4 | |

| Turner Spectrum Fund, Class C Shares5 | | | 8.68 | % | | | 5.81 | % | | | 9.87 | %6 | |

| S&P 500 Index7 | | | 17.31 | % | | | 15.65 | % | | | 24.68 | %4 | |

| Barclays Capital U.S. Aggregate Bond Index8 | | | -0.88 | % | | | 5.12 | % | | | 6.46 | %4 | |

| Lipper Long/Short Equity Average9 | | | 7.88 | % | | | 6.78 | % | | | 13.77 | %4 | |

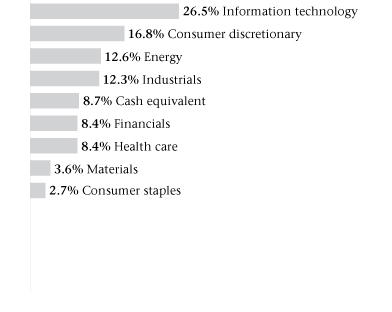

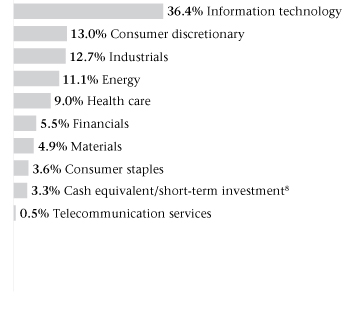

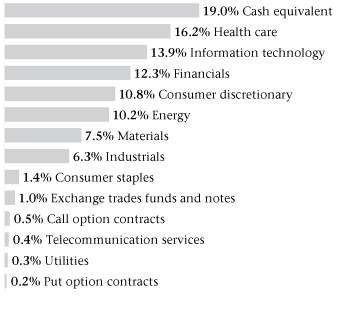

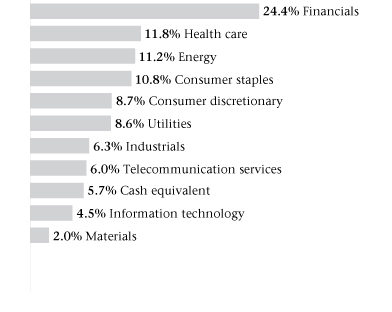

Sector weightings2:

Manager's discussion and analysis

In the six-month period ended March 31, the Turner Spectrum Fund, Institutional Class Shares (TSPEX) produced a 9.24% gain. That return underperformed the S&P 500 Index but outperformed the Barclays Capital U.S. Aggregate Bond Index and the Lipper Long/Short Equity Funds Average. The fund seeks to generate returns that have historically been associated with stocks, with relatively low volatility and a correlation unlike that of the broad market.

Overall, seven of the 10 sectors in which the fund held positions contributed extra return, with the health-care and information-technology sectors making the greatest contributions. In those sectors, long and short positions in drug, medical-device, medical-distribution, data-networking, semiconductor, and wireless-communications shares generated the best relative results. Detracting most from long and short results were holdings in the energy sector. In that sector, energy-production, natural-gas, and energy-services shares performed unsatisfactorily. The fund kept a modest net long exposure, mainly in U.S. stocks.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Spectrum Fund (Institutional Class Shares and Investor Class Shares) was May 7, 2009. Index returns are based on Institutional Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Spectrum Fund (Class C Shares) was July 14, 2009.

7 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

8 The Barclays Capital U.S. Aggregate Bond Index (prior to November 2008, the Index was known as the "Lehman Brothers U.S. Aggregate Bond Index") represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities.

9 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

Cl — Class

TURNER FUNDS 2011 SEMIANNUAL REPORT 11

INVESTMENT REVIEW

Turner Titan Fund

Fund profile

March 31, 2011

g Ticker symbol TTLFX

Investor Class Shares

g CUSIP #900297524

Investor Class Shares

g Top five holdings1

(1) Marathon Oil

(2) Parker Hannifin

(3) Check Point Software Technologies

(4) Las Vegas Sands

(5) Viacom, Cl B

g % in five largest holdings 12.6%2

g Number of holdings 1101

g Price/earnings ratio 15.7

g Weighted average market capitalization $50.33 billion

g % of holdings with positive earnings surprises 79.0%

g % of holdings with negative earnings surprises 24.0%

g Net assets $0.1 million, Investor Class Shares

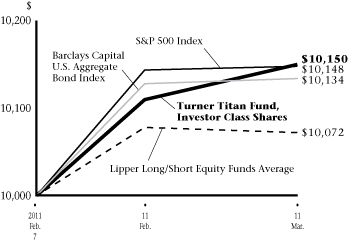

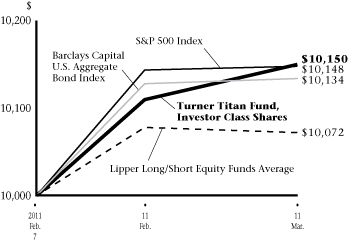

Growth of a $10,000 investment in the

Turner Titan Fund, Investor Class Shares:

February 7, 2011-March 31, 20113,4

Cumulative total returns (Period ended March 31, 2011)

| | | Since

inception4 | |

| Turner Titan Fund, Institutional Class Shares5 | | | 1.50 | % | |

| Turner Titan Fund, Investor Class Shares5 | | | 1.50 | % | |

| Turner Titan Fund, Class C Shares5 | | | 1.40 | % | |

| S&P 500 Index6 | | | 1.48 | % | |

| Barclays Capital U.S. Aggregate Bond Index7 | | | 1.34 | % | |

| Lipper Long/Short Equity Funds Average8 | | | 0.70 | % | |

Sector weightings2:

Manager's discussion and analysis

In its first two months of operation, the Turner Titan Fund, Investor Class Shares (TTLFX) produced a 1.50% gain. That return outperformed the S&P 500 Index, the Barclays Capital U.S. Aggregate Bond Index, and the Lipper Long/Short Equity Funds Average. The fund seeks to generate returns that have historically been associated with stocks, with relatively low volatility and a correlation unlike that of the broad market.

Overall, six of the eight sectors in which the fund was invested made positive contributions to performance. Information-technology and financials holdings, in their long and short positions, contributed the most extra return. In those two sectors, semiconductor, data-networking, wireless-communications, insurance, investment-management, and investment-bank shares were among the winners. Detracting most from results were long and short holdings in the consumer-discretionary sector. In that sector, gaming, entertainment, e-commerce, and Internet-search shares performed unsatisfactorily.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Class C Shares will differ due to differences in fees.

4 The inception date of the Turner Titan Fund was February 7, 2011. Cumulative returns, not annualized.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

7 The Barclays Capital U.S. Aggregate Bond Index (prior to November 2008, the Index was known as the "Lehman Brothers U.S. Aggregate Bond Index") represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities.

8 Lipper Long/Short Equity Funds Average represents the average annualized total return for all reporting funds in the Lipper Long/Short Equity Fund category.

Cl — Class

12 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner All Cap Growth Fund

(formerly Turner New Enterprise Fund)

Fund profile

March 31, 2011

g Ticker symbol TBTBX

g CUSIP #87252R797

g Top five holdings1

(1) Apple

(2) Las Vegas Sands

(3) TIBCO Software

(4) Concho Resources

(5) Alexion Pharmaceuticals

g % in five largest holdings 17.4%2

g Number of holdings 361

g Price/earnings ratio 19.7

g Weighted average market capitalization $23.09 billion

g % of holdings with positive earnings surprises 82.9%

g % of holdings with negative earnings surprises 17.1%

g Net assets $59 million

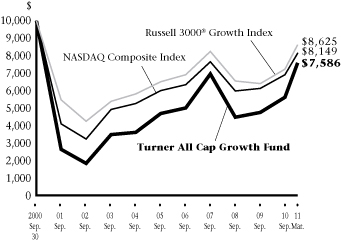

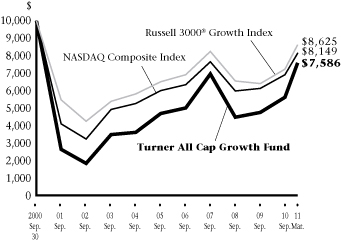

Growth of a $10,000 investment in the

Turner All Cap Growth Fund:

September 30, 2000-March 31, 20113

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

| Turner All Cap Growth Fund4 | | | 34.99 | % | | | 38.34 | % | | | 9.88 | % | | | 5.52 | % | | | 8.02 | % | | | -0.48 | % | |

| NASDAQ Composite Index5 | | | 17.41 | % | | | 15.98 | % | | | 6.86 | % | | | 3.52 | % | | | 4.22 | % | | | -3.25 | % | |

| Russell 3000® Growth Index6 | | | 19.33 | % | | | 19.24 | % | | | 5.58 | % | | | 4.32 | % | | | 3.26 | % | | | -1.86 | % | |

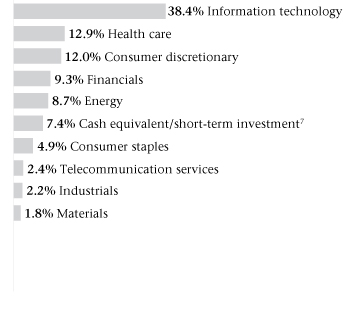

Sector weightings2:

Manager's discussion and analysis

Strong stock selection led to a substantial margin of outperformance for the Turner All Cap Growth Fund (TBTBX), formerly the Turner New Enterprise Fund, in the six months ended March 31. The fund gained 34.99%, beating the NASDAQ Composite Index return of 17.41% by 17.58 percentage points. The fund's gain was the biggest of any of our funds.

Altogether, eight of the fund's nine sector positions produced good relative returns. The information-technology, energy, consumer-staples, and materials sectors, which accounted for 54% of the fund's holdings, performed best. Winners here included data-networking, energy-services, supermarket, and metals shares. The lone sector that impaired performance was financials, a 9% weighting. Stocks in that sector producing unfavorable relative returns included securities-exchange, investment-management, and insurance shares.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner All Cap Growth Fund, formerly the Turner New Enterprise Fund, was June 30, 2000.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The NASDAQ Composite Index includes the more than 5,000 domestic and non-U.S. based common stocks listed on the NASDAQ stock market. The index is market-value weighted. This means that each company's security affects the index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the index. Because it is so broad-based, the Index is one of the most widely followed and quoted major market indices.

6 The Russell 3000® Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values.

7 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

TURNER FUNDS 2011 SEMIANNUAL REPORT 13

INVESTMENT REVIEW

Turner Concentrated Growth Fund

Fund profile

March 31, 2011

g Ticker symbol TTOPX

g CUSIP #87252R862

g Top five holdings1

(1) Apple

(2) Las Vegas Sands

(3) Salesforce.com

(4) Google, Cl A

(5) Acme Packet

g % in five largest holdings 25.4%2

g Number of holdings 241

g Price/earnings ratio 20.6

g Weighted average market capitalization $50.55 billion

g % of holdings with positive earnings surprises 73.9%

g % of holdings with negative earnings surprises 26.1%

g Net assets $56 million

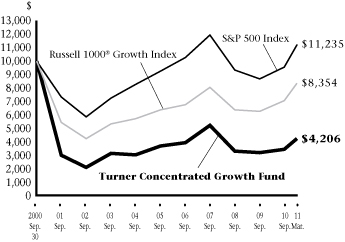

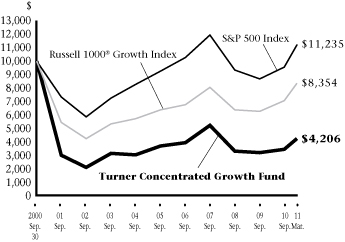

Growth of a $10,000 investment in the

Turner Concentrated Growth Fund:

September 30, 2000-March 31, 20113

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

| Turner Concentrated Growth Fund4 | | | 23.08 | % | | | 23.64 | % | | | -0.55 | % | | | -0.38 | % | | | 0.88 | % | | | 1.33 | % | |

| S&P 500 Index5 | | | 17.31 | % | | | 15.65 | % | | | 2.35 | % | | | 2.62 | % | | | 3.29 | % | | | 1.51 | % | |

| Russell 1000® Growth Index6 | | | 18.57 | % | | | 18.26 | % | | | 5.19 | % | | | 4.34 | % | | | 2.99 | % | | | -0.06 | % | |

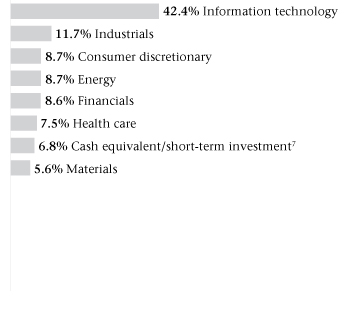

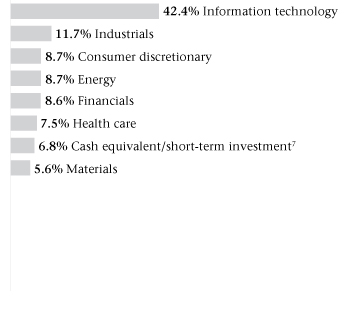

Sector weightings2:

Manager's discussion and analysis

Good results in three major sectors enhanced the performance of the Turner Concentrated Growth Fund (TTOPX) in the six-month period ended March 31. The fund rose 23.08%, outperforming the S&P 500 Index and the Russell 1000® Growth Index returns of 17.31% and 18.57% by 5.77 and 4.51 percentage points, respectively.

About 57% of the fund's holdings were concentrated in three sectors, information technology, consumer discretionary, and materials, whose returns added the most value to performance. In those sectors, semiconductor, data-networking, food-processing, gaming, and metals stocks performed well. Altogether, six of seven sector positions added extra return. The health-care sector, an 8% weighting, was the only detractor from performance, with health-services and medical-equipment shares recording lagging returns.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner Concentrated Growth Fund was June 30, 1999.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The S&P 500 Index is a widely-recognized, market value-weighted (higher market value stocks have more influence than lower market value stocks) index of 500 stocks designed to mimic the overall equity market's industry weightings.

6 The Russell 1000® Growth Index measures the performance of those Russell 1000 Companies with higher price-to-book ratios and higher forecasted growth values.

7 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

Cl — Class

14 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner Emerging Growth Fund

Fund profile

March 31, 2011

g Ticker symbol TMCGX

Investor Class Shares

g CUSIP #872524301

Investor Class Shares

g Top five holdings1

(1) Deckers Outdoor

(2) Ariba

(3) AMERIGROUP

(4) Huntsman

(5) Hypercom

g % in five largest holdings 10.5%2

g Number of holdings 1211

g Price/earnings ratio 20.1

g Weighted average market capitalization $1.89 billion

g % of holdings with positive earnings surprises 61.7%

g % of holdings with negative earnings surprises 31.7%

g Net assets $223 million, Investor Class Shares

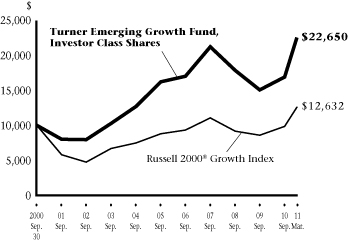

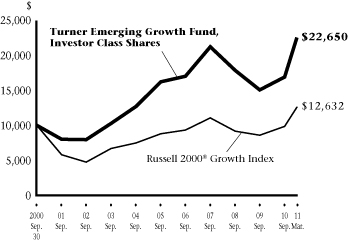

Growth of a $10,000 investment in the

Turner Emerging Growth Fund, Investor Class Shares:

September 30, 2000-March 31, 20113,4

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

Turner Emerging Growth Fund,

Institutional Class Shares5 | | | 33.64 | % | | | 31.75 | % | | | — | | | | — | | | | — | | | | 37.65 | %6 | |

Turner Emerging Growth Fund,

Investor Class Shares5 | | | 33.51 | % | | | 31.43 | % | | | 6.13 | % | | | 4.22 | % | | | 10.71 | % | | | 20.06 | %4 | |

| Russell 2000® Growth Index7 | | | 27.93 | % | | | 31.04 | % | | | 10.16 | % | | | 4.34 | % | | | 6.44 | % | | | 3.93 | %4 | |

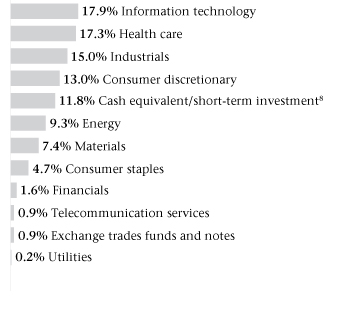

Sector weightings2:

Manager's discussion and analysis

Ample outperformance in most sectors helped the Turner Emerging Growth Fund, Investor Class Shares (TMCGX) to produce favorable results in the six-month period ended March 31. The fund rose 33.51%, a return that beat the 27.93% advance by its benchmark, the Russell 2000® Growth Index, by 5.58 percentage points.

Six of the fund's 10 sector positions outperformed their corresponding index sectors. Outperforming the most were health-care, consumer-discretionary, energy, and materials stocks, which represented 47% of all holdings. In those sectors, medical-equipment, health-services, retailing, energy-services, and metals shares did relatively well. The primary detractor from results was the fund's financials position, a 2% weighting. Underperformers here included insurance and diversified financial stocks.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Emerging Growth Fund (Investor Class Shares) was February 27, 1998. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Emerging Growth Fund (Institutional Class Shares) was February 1, 2009.

7 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

8 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

TURNER FUNDS 2011 SEMIANNUAL REPORT 15

INVESTMENT REVIEW

Turner Large Growth Fund

(formerly Turner Core Growth Fund)

Fund profile

March 31, 2011

g Ticker symbol TTMEX

Institutional Class Shares

g CUSIP #900297847

Institutional Class Shares

g Top five holdings1

(1) Apple

(2) Google, Cl A

(3) Oracle

(4) Schlumberger

(5) QUALCOMM

g % in five largest holdings 19.6%2

g Number of holdings 761

g Price/earnings ratio 18.2

g Weighted average market capitalization $58.24 billion

g % of holdings with positive earnings surprises 84.0%

g % of holdings with negative earnings surprises 16.0%

g Net assets $544 million, Institutional Class Shares

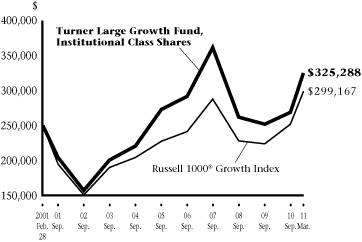

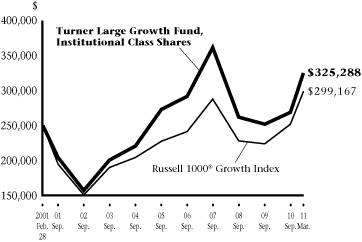

Growth of a $250,000 investment in the

Turner Large Growth Fund, Institutional Class Shares:

February 28, 2001-March 31, 20113,4

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

Turner Large Growth Fund,

Institutional Class Shares5 | | | 20.86 | % | | | 16.77 | % | | | 0.87 | % | | | 1.72 | % | | | 3.67 | % | | | 2.64 | %4 | |

Turner Large Growth Fund,

Investor Class Shares5 | | | 20.78 | % | | | 16.56 | % | | | 0.61 | % | | | 1.48 | % | | | — | | | | 3.45 | %6 | |

| Russell 1000® Growth Index7 | | | 18.57 | % | | | 18.26 | % | | | 5.19 | % | | | 4.34 | % | | | 2.99 | % | | | 1.80 | %4 | |

Sector weightings2:

Manager's discussion and analysis

In the six-month period ended March 31, good stock picking fueled the performance of the Turner Large Growth Fund, Institutional Class Shares (TTMEX), formerly the Turner Core Growth Fund. As a result the fund advanced 20.86%, which outpaced the Russell 1000® Growth Index return of 18.57% by 2.29 percentage points.

Six of the fund's nine sector positions beat their corresponding index sectors. Providing the most extra return were information-technology, industrials, and consumer-discretionary shares, which accounted for 62% of holdings. Semiconductor, data-networking, industrial-equipment, automotive, gaming, and e-commerce stocks performed especially well. Financials stocks, a 6% weighting, were the greatest detriment to performance; diversified financial, insurance, and investment-management stocks were notable laggards.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. On February 25, 2005, the Constellation TIP Core Growth Fund reorganized into the Turner Large Growth Fund, formerly the Turner Core Growth Fund. Performance of the Institutional and Investor Class Shares will differ due to differences in fees.

4 The inception date of the Turner Large Growth Fund (Institutional Class Shares) was February 28, 2001. Index returns are based on Institutional Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Large Growth Fund (Investor Class Shares) was August 1, 2005.

7 The Russell 1000® Growth Index measures the performance of those Russell 1000 Companies with higher price-to-book ratios and higher forecasted growth values.

8 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

Cl — Class

Amounts designated as "—" are not applicable.

16 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner Midcap Growth Fund

Fund profile

March 31, 2011

g Ticker symbol TMGFX

Investor Class Shares

g CUSIP #900297409

Investor Class Shares

g Top five holdings1

(1) Salesforce.com

(2) Joy Global

(3) Varian Semiconductor Equipment Associates

(4) Cummins

(5) Green Mountain Coffee Roasters

g % in five largest holdings 9.0%2

g Number of holdings 1001

g Price/earnings ratio 18.7

g Weighted average market capitalization $9.71 billion

g % of holdings with positive earnings surprises 80.8%

g % of holdings with negative earnings surprises 19.2%

g Net assets $955 million, Investor Class Shares

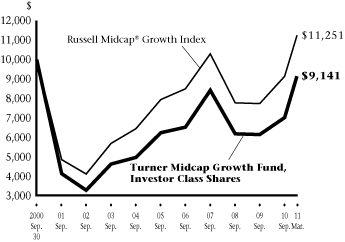

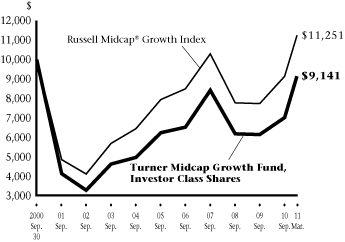

Growth of a $10,000 investment in the

Turner Midcap Growth Fund, Investor Class Shares:

September 30, 2000-March 31, 20113,4

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

Turner Midcap Growth Fund,

Institutional Class Shares5 | | | 30.67 | % | | | 30.54 | % | | | — | | | | — | | | | — | | | | 4.38 | %6 | |

Turner Midcap Growth Fund,

Investor Class Shares5 | | | 30.47 | % | | | 30.21 | % | | | 7.13 | % | | | 4.86 | % | | | 6.09 | % | | | 11.48 | %4 | |

Turner Midcap Growth Fund,

Retirement Class Shares5 | | | 30.30 | % | | | 29.90 | % | | | 6.86 | % | | | 4.56 | % | | | — | | | | 8.44 | %7 | |

| Russell Midcap® Growth Index8 | | | 22.97 | % | | | 26.60 | % | | | 7.63 | % | | | 4.93 | % | | | 6.94 | % | | | 7.68 | %4 | |

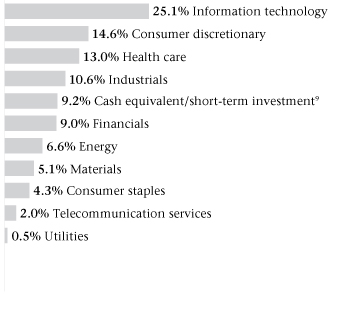

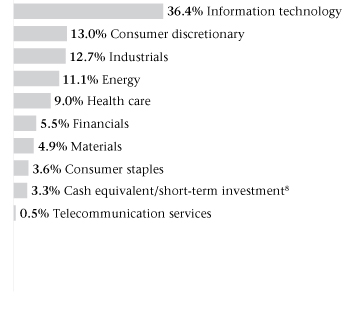

Sector weightings2:

Manager's discussion and analysis

Reflecting the strong performance of smaller stocks, the Turner Midcap Growth Fund, Investor Class Shares (TMGFX) gained 30.47% in the six-month period ended March 31. The fund outperformed the Russell Midcap® Growth Index return of 22.97% by a substantial margin — 7.50 percentage points.

Stock selection was excellent: superior relative returns in nine of 10 sectors added value to the fund's results. Adding the most value were the information-technology, materials, and consumer-staples sectors, a 35% weighting. Semiconductor, data-networking, software, metals, mining, coffee-roasting, and supermarket stocks were notable contributors. A 1% position in utilities stocks, especially in the telecommunications industry, was the sole detractor from performance.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. Performance of the Institutional, Investor and Retirement Class Shares will differ due to differences in fees.

4 The inception date of the Turner Midcap Growth Fund (Investor Class Shares) was October 1, 1996. Index returns are based on Investor Class Shares inception date.

5 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

6 The inception date of the Turner Midcap Growth Fund (Institutional Class Shares) was June 16, 2008.

7 The inception date of the Turner Midcap Growth Fund (Retirement Class Shares) was September 24, 2001.

8 The Russell Midcap® Growth Index is a capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 800 smallest U.S. companies out of the 1,000 largest companies with higher growth rates and price-to-book ratios.

9 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

Amounts designated as "—" are not applicable.

TURNER FUNDS 2011 SEMIANNUAL REPORT 17

INVESTMENT REVIEW

Turner Small Cap Growth Fund

Fund profile

March 31, 2011

g Ticker symbol TSCEX

g CUSIP #900297300

g Top five holdings1

(1) TIBCO Software

(2) Cooper

(3) Sotheby's

(4) HealthSouth

(5) Genesee & Wyoming, Cl A

g % in five largest holdings 5.5%2

g Number of holdings 1381

g Price/earnings ratio 21.7

g Weighted average market capitalization $2.10 billion

g % of holdings with positive earnings surprises 67.2%

g % of holdings with negative earnings surprises 29.9%

g Net assets $345 million

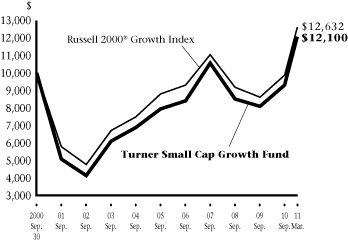

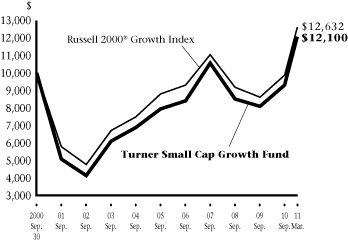

Growth of a $10,000 investment in the

Turner Small Cap Growth Fund:

September 30, 2000-March 31, 20113

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Three

years | | Five

years | | 10

years | | Since

inception | |

| Turner Small Cap Growth Fund4 | | | 30.24 | % | | | 32.29 | % | | | 10.35 | % | | | 4.90 | % | | | 7.62 | % | | | 12.16 | % | |

| Russell 2000® Growth Index5 | | | 27.93 | % | | | 31.04 | % | | | 10.16 | % | | | 4.34 | % | | | 6.44 | % | | | 6.29 | % | |

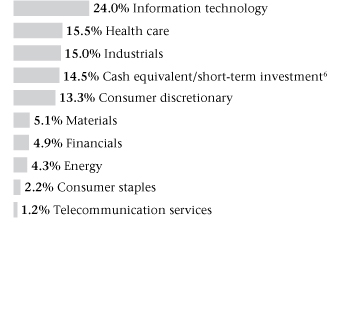

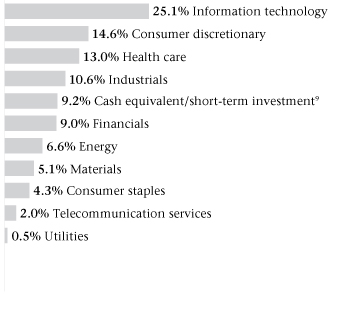

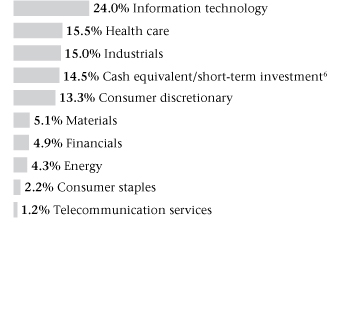

Sector weightings2:

Manager's discussion and analysis

Good stock selection, especially in the larger market sectors, and strong performance by small-cap stocks propelled the Turner Small Cap Growth Fund (TSCEX) to a 30.24% return in the six-month period ended March 31. The fund's results represented a margin of outperformance of 2.31 percentage points over the index, the Russell 2000® Growth Index, which gained 27.93%.

Seven of the fund's nine sector positions beat their index-sector counterparts. The fund's consumer-discretionary, information-technology, and health-care stocks, a 53% weighting, performed best in relative terms. Winners included cosmetics, mattress, electrical-supply, restaurant, photographic-services, digital-networking, wireless-communications, semiconductor, software, information-systems, health-benefits, vision-care, and drug-services stocks. A 5% position in financials stocks, particularly investment-bank, investment-management, and securities-trading services shares, were a drag on performance.

1 Cash equivalent and short-term investment are not being considered a holding for the top five holdings, but are counted in the number of holdings. The fund composition is subject to change.

2 Percentages based on total investments.

3 These figures represent past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate, so an investor's shares, when redeemed, may be worth more or less than their original cost. The performance in the above graph and table does not reflect the deduction of taxes the shareholder will pay on fund distributions or the redemptions of fund shares. The inception date of the Turner Small Cap Growth Fund was February 7, 1994.

4 Fee waivers are in effect; if they had not been in effect, performance would have been lower.

5 The Russell 2000® Growth Index is a widely-recognized, capitalization-weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of the 2,000 smallest U.S. companies out of the 3,000 largest U.S. companies with higher growth rates and price-to-book ratios.

6 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 11 in Notes to Financial Statements for more detailed information.

Cl — Class

18 TURNER FUNDS 2011 SEMIANNUAL REPORT

INVESTMENT REVIEW

Turner Quantitative Broad Market Equity Fund

Fund profile

March 31, 2011

g Ticker symbol TBMEX

Institutional Class Shares

g CUSIP #900297730

Institutional Class Shares

g Top five holdings1

(1) Apple

(2) General Electric

(3) International Business Machines

(4) Williams

(5) Caterpillar

g % in five largest holdings 9.5%2

g Number of holdings 1091

g Price/earnings ratio 14.7

g Weighted average market capitalization $69.75 billion

g % of holdings with positive earnings surprises 82.4%

g % of holdings with negative earnings surprises 16.7%

g Net assets $12 million, Institutional Class Shares

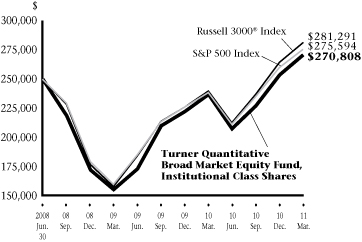

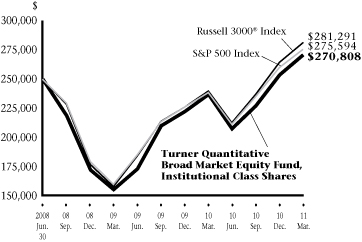

Growth of a $250,000 investment in the

Turner Quantitative Broad Market Equity Fund,

Institutional Class Shares:

June 30, 2008-March 31, 20113

Average annual total returns (Periods ended March 31, 2011)

| | | Six months

(not annualized) | | One

year | | Since

inception | |

| Turner Quantitative Broad Market Equity Fund, Institutional Class Shares4 | | | 19.29 | % | | | 14.41 | % | | | 2.95 | % | |

| Turner Quantitative Broad Market Equity Fund, Investor Class Shares4 | | | 19.24 | % | | | 14.10 | % | | | 2.72 | % | |

| Russell 3000® Index5 | | | 18.71 | % | | | 17.41 | % | | | 4.38 | % | |

| S&P 500 Index6 | | | 17.31 | % | | | 15.65 | % | | | 3.61 | % | |

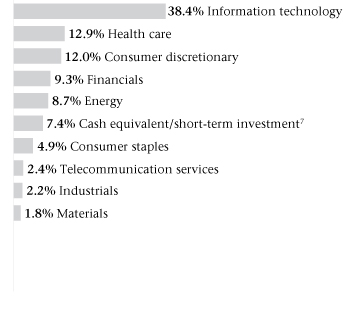

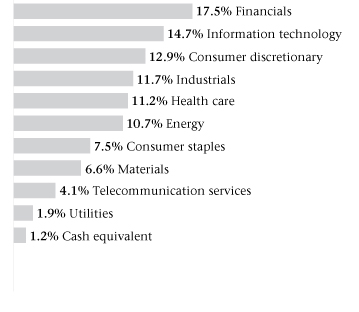

Sector weightings2:

Manager's discussion and analysis

In the six-month period ended March 31, the Turner Quantitative Broad Market Equity Fund, Institutional Class Shares (TBMEX) rose 19.29%. That return was good enough to outdistance the Russell 3000® Index and the S&P 500 Index by 0.58 and 1.98 percentage points, respectively.

The fund's proprietary quantitative model selected stocks that did well in relative terms in seven of the 10 market sectors. Utilities and industrials stocks, a 14% weighting, enhanced performance to the greatest degree. Winners here included telecommunications, electric-utility, industrial-equipment, and heavy-equipment shares. Hurting results the most were energy and consumer-staples stocks, which represented 18% of the portfolio; energy-exploration, energy-services, convenience-store, and food-processing stocks were among the detractors.

1 Cash equivalent is not being considered a holding for the top five holdings, but is counted in the number of holdings. The fund composition is subject to change.

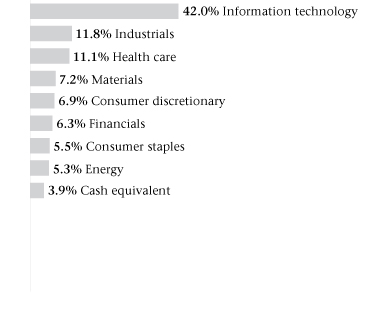

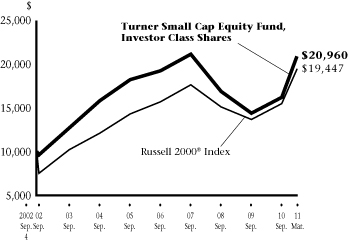

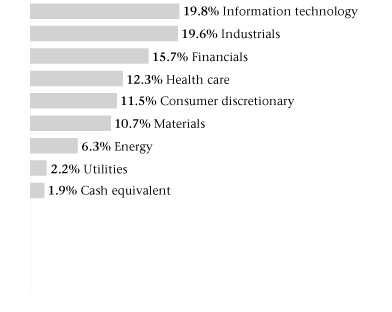

2 Percentages based on total investments.