UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07527 |

|

Turner Funds |

(Exact name of registrant as specified in charter) |

|

1000 Chesterbrook Boulevard, 1st Floor Berwyn, PA | | 19312 |

(Address of principal executive offices) | | (Zip code) |

|

Jesse Kean Sidley Austin LLP 787 Seventh Avenue New York, NY 10019 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-224-6312 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2017 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

March 31, 2017 (unaudited)

Long/short equity funds

Turner Titan Long/Short Fund

U.S. growth equity funds

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Contents

| | 2 | | | Letter to shareholders | |

| | 4 | | | Schedules of investments | |

| | 11 | | | Sector weightings | |

| | 12 | | | Financial statements | |

| | 20 | | | Notes to financial statements | |

| | 27 | | | Shareholder voting results | |

| | 28 | | | Disclosure of fund expenses | |

Turner Funds

As of March 31, 2017, the Turner Funds offered a series of three mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $100,000 for the Turner Titan Long/Short Fund) for regular accounts and $100,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares and Retirement Class Shares, as applicable, for accounts which are established as part of a Systematic Investment Plan, is $1,000.

Turner Investments LLC, based in Berwyn, Pennsylvania, serves as the investment adviser for the Turner Funds. Turner Investments LLC, founded in 1990, manages approximately $170 million in equity investments as of March 31, 2017.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, and quarterly account statements. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2017 SEMIANNUAL REPORT 1

Elections; the Federal Reserve; Domestic growth; Volatility (or lack thereof); Bitcoin; China growth; Oil; European stability (in the face of great change). You can take your pick as to the markets' focus on any one day, but there has been no shortage of topics to help explain her movements and rotations. And through it all, volatility has been shriveling all-the-while markets have been pressing to all-time highs driving even more debate and analysis. The pattern of slower nominal growth coupled with modest inflation we detailed in our letter last year has played out as we expected and there is a strong probability that it will continue with only modest changes to our assumptions.

Intriguing to many has been the almost pure absence of volatility in the face of all the potential disruptions listed above. New administrations in the United States and France, boisterous advancements from North Korea, collusion among oil producing nations overseas, the continued shaping of Britain's exit from the European Union — any or all should have or could have contributed to market angst and volatility. Instead, the market, as defined by the S&P 500, embarked on a 109 day streak without a 1 percent drop (the record was 112 days set in 1985). The most referenced market volatility index, known as the VIX, found its way into complacency territory not visited since 1993, measured by both depth and duration. It is hard to draw conclusions, and the list of excuses is wide and varied, but complacency is like any metric; it's easy to measure where it is but it's hard to tell how persistent it will be. Time will tell, but active managers like ourselves should be in a superior position to exploit changes in volatility when they unfold.

We are reminded that slower growth and slower inflation makes it difficult for many companies to grow their earnings substantially. Post revenue enhancements, cost efficiencies and stock buybacks, it is critical for active managers to allocate capital to industries and companies within those industries where growth rates are nicely above global growth rates. Here at Turner Investments, we continue to find a feature-rich opportunity set within internet, cloud computing, cybersecurity, next generation biotech, smart-automotive and advanced energy solutions. Our capital allocation process continues to focus on identifying and investing in strong secular growth opportunities that are both innovative and disruptive.

Not all industries are weathering the changes within the economy equally. For example, markets have recently

awarded a higher market capitalization to the 13-year-old, next generation electric car manufacturer Tesla, surpassing the 100-year-old automotive legend, Ford. Henry Ford's company has 20 times the revenue of Elon Musk's; Ford has billions in profits and sells millions of cars per year...Tesla sold 76,000 cars last year. The difference is that investors believe we are truly in the middle of a tectonic shift in transportation, and the ways to profit from such a profound change are limited and hard to find — you see, as complicated as some things may get, the basics of supply and demand still permeate business and investment cycles.

We are also witnessing the beginning of the painful process of rationalization that has begun in "brick-and-mortar" retail. Online retail, dominated by companies like Amazon, is fundamentally changing the way the U.S. consumer shops. The disruption has been building and feels like it has passed its tipping point in the last year. The number of retail closures is accelerating and the rationalization of retail square footage is just beginning. Through April of 2017, there had been nine retail bankruptcies filed (the same number as in all of 2016), and many other chains have listed hundreds of stores slated for closure. There is not much to debate about the "why" of what is happening — Amazon's sales in North America have quintupled from $16 billion in 2010 to $80 billion in 2016; and since 2010, mobile commerce has grown from 2 percent of digital spending to 20 percent. Attitudes and behaviors are changing, causing disruption. At Turner, we have been in front of this trend from an investment standpoint, holding positions in next generation beneficiaries including Shopify, Amazon and Square.

Given the backdrop of modest growth (with an eye for acceleration), low rates (however, anticipating further tightening from the Federal Reserve as the year unfolds) and modest inflation, we would expect the markets to be fairly modest in their return profiles. We are under no false pretenses that the markets won't ever-again contain the joys of volatility or that they will forever be mundane and overly forgiving. We expect, and are ready, for changes in the macro trading environment because we stay true to our active management foundation. Our continued focus will be on a disciplined investment process anchored by an emphasis on momentum, value, quality, profitability, sentiment and management with a goal of creating more predictable outcomes and attractive risk-adjusted returns for our clients.

2 TURNER FUNDS 2017 SEMIANNUAL REPORT

We sincerely appreciate your support and look forward to continuing to serve you in the years ahead.

Sincerely,

Bob Turner

Chairman and Chief Investment Officer

Turner Investments

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of March 31, 2017, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

TURNER FUNDS 2017 SEMIANNUAL REPORT 3

FINANCIAL STATEMENTS (Unaudited)

Turner Titan Long/Short Fund

March 31, 2017

| | | Shares | | Value

(000) | |

Common stock—91.8%† | |

Consumer discretionary—4.3% | |

Amazon.com*^ | | | 470 | | | $ | 417 | | |

American Outdoor Brands Corp.* | | | 6,690 | | | | 133 | | |

CBS, Cl B^ | | | 2,530 | | | | 175 | | |

Total Consumer discretionary | | | | | 725 | | |

Consumer staples—1.3% | |

Monster Beverage* | | | 4,740 | | | | 219 | | |

Total Consumer staples | | | | | 219 | | |

Energy—20.7% | |

Antero Resources*^ | | | 31,540 | | | | 719 | | |

Concho Resources* | | | 1,750 | | | | 225 | | |

Continental Resources* | | | 9,590 | | | | 436 | | |

Diamondback Energy* | | | 2,070 | | | | 215 | | |

Marathon Oil^ | | | 42,750 | | | | 675 | | |

Newfield Exploration*^ | | | 12,290 | | | | 454 | | |

Whiting Petroleum*^ | | | 79,010 | | | | 746 | | |

Total Energy | | | | | 3,470 | | |

Financials—8.6% | |

Bank of America | | | 10,800 | | | | 255 | | |

Bank of the Ozarks | | | 5,140 | | | | 268 | | |

Citigroup | | | 4,300 | | | | 257 | | |

Morgan Stanley | | | 5,880 | | | | 252 | | |

Northern Trust | | | 1,940 | | | | 168 | | |

The Goldman Sachs Group^ | | | 1,090 | | | | 250 | | |

Total Financials | | | | | 1,450 | | |

Health care—14.0% | |

Achillion Pharmaceuticals*^ | | | 65,420 | | | | 275 | | |

Alexion Pharmaceuticals*^ | | | 1,360 | | | | 165 | | |

Boston Scientific*^ | | | 8,710 | | | | 217 | | |

Celgene*^ | | | 2,020 | | | | 251 | | |

Johnson & Johnson | | | 1,890 | | | | 235 | | |

Oncomed Pharmaceuticals*^ | | | 38,083 | | | | 351 | | |

Pfizer | | | 4,970 | | | | 170 | | |

Prothena*^ | | | 4,660 | | | | 260 | | |

Vascular Biogenics*^ | | | 79,611 | | | | 438 | | |

Total Health care | | | | | 2,362 | | |

| | | Shares | | Value

(000) | |

Industrials—5.1% | |

Generac Holdings* | | | 5,060 | | | $ | 189 | | |

Southwest Airlines^ | | | 12,410 | | | | 667 | | |

Total Industrials | | | | | 856 | | |

Information technology—19.7% | |

| 2U*^ | | | 8,640 | | | | 343 | | |

Alphabet, Cl A*^ | | | 290 | | | | 246 | | |

Broadcom^ | | | 1,520 | | | | 333 | | |

Electronic Arts*^ | | | 4,390 | | | | 393 | | |

F5 Networks*^ | | | 1,530 | | | | 218 | | |

Monolithic Power Systems^ | | | 3,550 | | | | 327 | | |

NXP Semiconductors*^ | | | 1,970 | | | | 204 | | |

Salesforce.com*^ | | | 3,950 | | | | 326 | | |

ServiceNow*^ | | | 3,540 | | | | 310 | | |

Shopify, Cl A*^ | | | 6,040 | | | | 410 | | |

Vantiv, Cl A*^ | | | 3,160 | | | | 203 | | |

Total Information technology | | | | | 3,313 | | |

Materials—16.6% | |

Cliffs Natural Resources* | | | 71,610 | | | | 587 | | |

Martin Marietta Materials | | | 1,050 | | | | 229 | | |

Mosaic | | | 5,410 | | | | 158 | | |

Senomyx* | | | 212,661 | | | | 211 | | |

Summit Materials, Cl A*^ | | | 18,318 | | | | 453 | | |

Trinseo SA^ | | | 7,230 | | | | 485 | | |

Vulcan Materials | | | 1,860 | | | | 224 | | |

W.R. Grace & Co. | | | 6,570 | | | | 458 | | |

Total Materials | | | | | 2,805 | | |

Real estate—1.5% | |

QTS Realty Trust, Cl A^ | | | 5,210 | | | | 254 | | |

Total Real estate | | | | | 254 | | |

Total Common stock

(Cost $13,979)** | | | | | 15,454 | | |

Exchange traded funds—2.0% | |

SPDR Metals & Mining ETF | | | 11,240 | | | | 342 | | |

Total Exchange traded funds

(Cost $352)** | | | | | 342 | | |

4 TURNER FUNDS 2017 SEMIANNUAL REPORT

Turner Titan Long/Short Fund

March 31, 2017

| | | Shares | | Value

(000) | |

Warrant—0.0% | |

Financials—0.0% | |

Atlas Mara, 8/21/17 (a)(b) | | | 472,160 | | | $ | — | | |

Total Financials | | | | | — | | |

Total Warrant

(Cost $92) ** | | | | | — | | |

Cash equivalent—1.9% | |

BlackRock Liquidity Funds

Fedfund, 0.593%‡ | | | 322,304 | | | | 322 | | |

Total Cash equivalent

(Cost $322)** | | | | | 322 | | |

Total Investments—95.7%

(Cost $14,653)** | | | | | 16,118 | | |

Segregated cash with

brokers—56.4% | | | | | 9,503 | | |

Securities sold short—(52.0)%

(Proceeds $(7,990))** | | | | | (8,768 | ) | |

Net Other assets

(liabilities)—(0.1)% | | | | | (6 | ) | |

Net Assets—100.0% | | | | $ | 16,847 | | |

(a) These securities have been deemed illiquid by the Adviser and represent 0.00% of Net Assets.

(b) Security was valued in good faith pursuant to procedures approved by the Board of Trustees as of March 31, 2017. The total of all such securities represents less than 0.005% of net assets of the Fund.

Amounts designated as "—" have been rounded to $0.

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2017.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2017 SEMIANNUAL REPORT 5

FINANCIAL STATEMENTS (Unaudited)

Schedule of securities sold short

Turner Titan Long/Short Fund

March 31, 2017

| | | Shares | | Value

(000) | |

Common stock—45.2% | |

Consumer discretionary—10.7% | |

CarMax | | | 7,950 | | | $ | 471 | | |

Carnival, Cl A | | | 8,230 | | | | 485 | | |

Priceline Group | | | 300 | | | | 533 | | |

Tiffany | | | 3,220 | | | | 307 | | |

Total Consumer discretionary | | | | | 1,796 | | |

Energy—1.6% | |

Frank's International | | | 26,106 | | | | 276 | | |

Total Energy | | | | | 276 | | |

Financials-4.0% | |

Deutsche Bank | | | 14,090 | | | | 242 | | |

State Street | | | 5,430 | | | | 432 | | |

Total Financials | | | | | 674 | | |

Health care—1.9% | |

Express Scripts Holdings | | | 4,780 | | | | 315 | | |

Total Health care | | | | | 315 | | |

Industrials—17.6% | |

AGCO | | | 8,060 | | | | 484 | | |

Applied Industrial Technologies | | | 7,090 | | | | 439 | | |

Caterpillar | | | 1,960 | | | | 182 | | |

Deere | | | 4,130 | | | | 450 | | |

Heartland Express | | | 13,140 | | | | 263 | | |

J.B. Hunt Transport Services | | | 2,710 | | | | 249 | | |

MSC Industrial Direct, Cl A | | | 4,689 | | | | 482 | | |

PACCAR | | | 6,160 | | | | 414 | | |

Total Industrials | | | | | 2,963 | | |

Information technology—7.1% | |

Cognizant Technology

Solutions, Cl A | | | 4,000 | | | | 238 | | |

Intel | | | 9,470 | | | | 342 | | |

Oracle | | | 7,460 | | | | 333 | | |

Trimble Navigation | | | 9,030 | | | | 289 | | |

Total Information technology | | | | | 1,202 | | |

| | | Shares | | Value

(000) | |

Materials—2.3% | |

Compass Minerals International | | | 4,420 | | | $ | 300 | | |

Kinross Gold | | | 27,180 | | | | 95 | | |

Total Materials | | | | | 395 | | |

Total Common stock

(Proceeds $6,974)* | | | | | 7,621 | | |

Exchange traded funds—6.4% | |

iShares U.S. Technology ETF | | | 1,350 | | | | 182 | | |

SPDR S&P Biotech ETF | | | 9,690 | | | | 672 | | |

VanEck Vectors Gold ETF | | | 10,160 | | | | 232 | | |

Total Exchange traded funds

(Proceeds $1,016)* | | | | | 1,086 | | |

Right—0.4% | |

Financials—0.4% | |

Deutsche Bank AG, 4/18/17 | | | 25,880 | | | | 61 | | |

Total Financials | | | | | 61 | | |

Total Right

(Proceeds $—)* | | | | | 61 | | |

Total Securities sold short—52.0%

(Proceeds $7,990)* | | | | $ | 8,768 | | |

Percentages disclosed are based on total net assets of the Fund at March 31, 2017.

* This number is listed in thousands.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

6 TURNER FUNDS 2017 SEMIANNUAL REPORT

Turner Midcap Growth Fund

March 31, 2017

| | | Shares | | Value

(000) | |

Common stock—96.5%† | |

Consumer discretionary—23.4% | |

Chipotle Mexican Grill* | | | 3,750 | | | $ | 1,671 | | |

Dollar Tree* | | | 21,000 | | | | 1,648 | | |

Domino's Pizza | | | 7,500 | | | | 1,382 | | |

Expedia | | | 15,000 | | | | 1,893 | | |

Marriott International, Cl A | | | 25,000 | | | | 2,354 | | |

Mohawk Industries* | | | 4,500 | | | | 1,033 | | |

Newell Rubbermaid | | | 25,000 | | | | 1,179 | | |

Omnicom Group | | | 12,000 | | | | 1,035 | | |

O'Reilly Automotive* | | | 8,000 | | | | 2,158 | | |

Panera Bread, Cl A* | | | 3,000 | | | | 786 | | |

Pool | | | 10,000 | | | | 1,193 | | |

PulteGroup | | | 60,000 | | | | 1,413 | | |

Ross Stores | | | 15,000 | | | | 988 | | |

Ulta Salon, Cosmetics & Fragrance* | | | 2,500 | | | | 713 | | |

Visteon Corp.* | | | 12,000 | | | | 1,175 | | |

Wynn Resorts | | | 18,000 | | | | 2,063 | | |

Total Consumer discretionary | | | | | 22,684 | | |

Consumer staples—4.6% | |

ConAgra Foods | | | 45,000 | | | | 1,815 | | |

Hershey | | | 12,500 | | | | 1,366 | | |

The Clorox Company | | | 10,000 | | | | 1,348 | | |

Total Consumer staples | | | | | 4,529 | | |

Energy—1.7% | |

Pioneer Natural Resources | | | 5,000 | | | | 931 | | |

Southwestern Energy* | | | 90,000 | | | | 735 | | |

Total Energy | | | | | 1,666 | | |

Financials—6.7% | |

CBOE Holdings, Inc. | | | 20,000 | | | | 1,621 | | |

Huntington Bancshares, Inc. | | | 95,000 | | | | 1,272 | | |

Intercontinental Exchange Group | | | 18,000 | | | | 1,078 | | |

Raymond James Financial | | | 20,000 | | | | 1,525 | | |

Zions Bancorp | | | 25,000 | | | | 1,050 | | |

Total Financials | | | | | 6,546 | | |

Health care—15.9% | |

ABIOMED* | | | 8,000 | | | | 1,002 | | |

ACADIA Pharmaceuticals*^ | | | 22,000 | | | | 756 | | |

Align Technology* | | | 9,000 | | | | 1,032 | | |

Alkermes* | | | 22,000 | | | | 1,287 | | |

AmerisourceBergen, Cl A | | | 16,000 | | | | 1,416 | | |

| | | Shares | | Value

(000) | |

C.R. Bard | | | 9,000 | | | $ | 2,237 | | |

IDEXX Laboratories* | | | 17,030 | | | | 2,633 | | |

Incyte* | | | 15,000 | | | | 2,005 | | |

Mettler-Toledo International* | | | 4,000 | | | | 1,916 | | |

Veeva Systems, Cl A* | | | 24,000 | | | | 1,231 | | |

Total Health care | | | | | 15,515 | | |

Industrials—14.5% | |

A.O. Smith Corp. | | | 17,000 | | | | 870 | | |

Copart, Inc.* | | | 20,000 | | | | 1,239 | | |

Equifax | | | 9,000 | | | | 1,231 | | |

Fastenal | | | 24,000 | | | | 1,236 | | |

Fortune Brands Home & Security | | | 22,000 | | | | 1,338 | | |

HD Supply Holdings, Inc.* | | | 26,000 | | | | 1,069 | | |

Huntington Ingalls Industries | | | 6,000 | | | | 1,201 | | |

Nordson | | | 9,000 | | | | 1,106 | | |

Rockwell Automation | | | 8,500 | | | | 1,324 | | |

Roper Technologies | | | 4,650 | | | | 960 | | |

The Middleby Corporation* | | | 9,000 | | | | 1,228 | | |

United Rentals* | | | 10,700 | | | | 1,338 | | |

Total Industrials | | | | | 14,140 | | |

Information technology—23.1% | |

Arista Networks* | | | 7,500 | | | | 992 | | |

Cavium* | | | 21,000 | | | | 1,505 | | |

CDK Global, Inc. | | | 25,000 | | | | 1,625 | | |

CDW Corp. of Delaware | | | 20,000 | | | | 1,154 | | |

Commscope Holding, Inc.* | | | 30,000 | | | | 1,251 | | |

Electronic Arts* | | | 16,000 | | | | 1,432 | | |

Fiserv* | | | 22,200 | | | | 2,561 | | |

Fortinet* | | | 15,420 | | | | 591 | | |

Lam Research | | | 12,500 | | | | 1,605 | | |

Maxim Integrated Products | | | 24,000 | | | | 1,079 | | |

Monolithic Power Systems | | | 12,500 | | | | 1,151 | | |

NVIDIA | | | 24,000 | | | | 2,615 | | |

Paychex | | | 15,000 | | | | 884 | | |

Shopify, Cl A* | | | 15,000 | | | | 1,021 | | |

Square, Cl A* | | | 80,000 | | | | 1,382 | | |

Vantiv, Cl A* | | | 26,000 | | | | 1,667 | | |

Total Information technology | | | | | 22,515 | | |

Materials—4.5% | |

Berry Plastics Group* | | | 17,000 | | | | 826 | | |

Celanese | | | 10,000 | | | | 899 | | |

Eagle Materials, Cl A | | | 14,000 | | | | 1,359 | | |

TURNER FUNDS 2017 SEMIANNUAL REPORT 7

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Midcap Growth Fund

| | | Shares | | Value

(000) | |

Nucor | | | 22,000 | | | $ | 1,314 | | |

Total Materials | | | | | 4,398 | | |

Real estate—2.1% | |

Equinix | | | 5,000 | | | | 2,002 | | |

Total Real estate | | | | | 2,002 | | |

Total Common stock

(Cost $84,078)** | | | | | 93,995 | | |

Cash equivalent—6.2% | |

BlackRock Liquidity Funds

Fedfund, 0.593%‡ (1) | | | 6,069,005 | | | | 6,069 | | |

Total Cash equivalent

(Cost $6,069)** | | | | | 6,069 | | |

Total Investments—102.7%

(Cost $90,147)** | | | | | 100,064 | | |

Net Other assets (liabilities)—(2.7)% | | | | | (2,660 | ) | |

Net Assets—100.0% | | | | $ | 97,404 | | |

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2017 was $762**

^ Security fully or partially on loan at March 31, 2017. The total value of securities on loan at March 31, 2017 was $753**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2017.

Cl — Class

The accompanying notes are an integral part of the financial statements.

8 TURNER FUNDS 2017 SEMIANNUAL REPORT

Turner Small Cap Growth Fund

March 31, 2017

| | | Shares | | Value

(000) | |

Common stock—96.7%† | |

Consumer discretionary—10.0% | |

Dave & Buster's Entertainment* | | | 7,500 | | | $ | 458 | | |

Grand Canyon Education* | | | 3,500 | | | | 251 | | |

iRobot, Inc.* | | | 3,000 | | | | 198 | | |

KB Home^ | | | 17,000 | | | | 338 | | |

Ollie's Bargain Outlet Holdings* | | | 14,000 | | | | 469 | | |

Penn National Gaming* | | | 16,000 | | | | 295 | | |

Tenneco | | | 4,000 | | | | 250 | | |

The Children's Place | | | 2,000 | | | | 240 | | |

Total Consumer discretionary | | | | | 2,499 | | |

Consumer staples—1.5% | |

National Beverage Corp. | | | 4,500 | | | | 380 | | |

Total Consumer staples | | | | | 380 | | |

Energy—3.5% | |

Callon Petroleum* | | | 37,000 | | | | 487 | | |

US Silica Holdings | | | 8,000 | | | | 384 | | |

Total Energy | | | | | 871 | | |

Financials—5.7% | |

Bank of the Ozarks | | | 7,500 | | | | 390 | | |

Essent Group* | | | 11,500 | | | | 415 | | |

Evercore Partners, Cl A | | | 4,000 | | | | 312 | | |

Financial Engine | | | 7,000 | | | | 305 | | |

Total Financials | | | | | 1,422 | | |

Health care—21.3% | |

ACADIA Pharmaceuticals*^ | | | 5,500 | | | | 189 | | |

Aerie Pharmaceuticals* | | | 5,000 | | | | 227 | | |

AMN Healthcare Services* | | | 5,000 | | | | 203 | | |

Chemed | | | 2,000 | | | | 365 | | |

Corcept Therapeutics, Inc.* | | | 31,810 | | | | 349 | | |

Exelixis, Inc.* | | | 17,000 | | | | 368 | | |

Glaukos Corp.* | | | 7,270 | | | | 373 | | |

Inogen* | | | 5,450 | | | | 423 | | |

Integra LifeSciences Holdings* | | | 3,000 | | | | 126 | | |

Kite Pharma* | | | 3,000 | | | | 235 | | |

Medidata Solutions* | | | 7,500 | | | | 433 | | |

NuVasive* | | | 6,000 | | | | 449 | | |

PRA Health Sciences* | | | 6,000 | | | | 391 | | |

Prothena* | | | 5,000 | | | | 279 | | |

Repligen* | | | 12,000 | | | | 422 | | |

Supernus Pharmaceuticals* | | | 7,000 | | | | 219 | | |

| | | Shares | | Value

(000) | |

Tesaro* | | | 1,800 | | | $ | 277 | | |

Total Health care | | | | | 5,328 | | |

Industrials—11.4% | |

Apogee Enterprises | | | 5,450 | | | | 325 | | |

Builders FirstSource, Inc.* | | | 18,000 | | | | 268 | | |

Insperity | | | 4,540 | | | | 402 | | |

MasTec* | | | 6,000 | | | | 240 | | |

Mercury Systems* | | | 9,500 | | | | 371 | | |

The Brink's Co. | | | 9,090 | | | | 487 | | |

Trex* | | | 4,500 | | | | 312 | | |

WageWorks* | | | 4,500 | | | | 325 | | |

Woodward | | | 2,000 | | | | 136 | | |

Total Industrials | | | | | 2,866 | | |

Information technology—33.7% | |

Advanced Energy Industries* | | | 7,000 | | | | 480 | | |

Advanced Micro Devices, Inc.* | | | 20,000 | | | | 291 | | |

Blackhawk Network Holdings* | | | 5,000 | | | | 203 | | |

Cabot Microelectronics Corp. | | | 5,000 | | | | 383 | | |

Cavium* | | | 4,500 | | | | 322 | | |

Coherent, Inc.* | | | 1,270 | | | | 261 | | |

Digimarc*^ | | | 38,170 | | | | 1,030 | | |

Fair Isaac Corp. | | | 3,640 | | | | 469 | | |

HubSpot* | | | 5,910 | | | | 358 | | |

Integrated Device Technology* | | | 12,750 | | | | 302 | | |

Littelfuse | | | 2,270 | | | | 363 | | |

Lumentum Holdings* | | | 6,000 | | | | 320 | | |

MACOM Technology Solutions

Holdings* | | | 4,000 | | | | 193 | | |

Methode Electronics | | | 8,630 | | | | 394 | | |

Microsemi Corp.* | | | 3,500 | | | | 180 | | |

MKS Instruments, Inc. | | | 7,270 | | | | 500 | | |

Monolithic Power Systems | | | 1,820 | | | | 168 | | |

Novanta, Inc.* | | | 10,000 | | | | 266 | | |

RealPage* | | | 6,360 | | | | 222 | | |

Remark Media, Inc. (a)* | | | 291,750 | | | | 863 | | |

Square, Cl A* | | | 13,630 | | | | 236 | | |

Take-Two Interactive Software* | | | 3,000 | | | | 178 | | |

Universal Display | | | 5,000 | | | | 431 | | |

Total Information technology | | | | | 8,413 | | |

Materials—4.7% | |

Balchem Corp. | | | 2,000 | | | | 165 | | |

Chemours Co. (The) | | | 12,000 | | | | 463 | | |

TURNER FUNDS 2017 SEMIANNUAL REPORT 9

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Small Cap Growth Fund

| | | Shares | | Value

(000) | |

Kronos Worldwide, Inc. | | | 15,000 | | | $ | 246 | | |

Louisiana-Pacific* | | | 12,500 | | | | 310 | | |

Total Materials | | | | | 1,184 | | |

Real estate—3.6% | |

CoreSite Realty | | | 5,000 | | | | 451 | | |

DuPont Fabros Technology | | | 9,000 | | | | 446 | | |

Total Real estate | | | | | 897 | | |

Utilities—1.3% | |

Ormat Technologies, Inc. | | | 5,910 | | | | 337 | | |

Total Utilities | | | | | 337 | | |

Total Common stock

(Cost $21,505)** | | | | | 24,197 | | |

Cash equivalent—7.2% | |

BlackRock Liquidity Funds

Fedfund, 0.593%‡ (1) | | | 1,811,642 | | | | 1,812 | | |

Total Cash equivalent

(Cost $1,812)** | | | | | 1,812 | | |

Total Investments—103.9%

(Cost $23,317)** | | | | | 26,009 | | |

Net Other assets (liabilities)—(3.9)% | | | | | (978 | ) | |

Net Assets—100.0% | | | | $ | 25,031 | | |

(a) These securities have been deemed illiquid by the Adviser and represent 3.45% of Net Assets.

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2017 was $1,234**

^ Security fully or partially on loan at March 31, 2017. The total value of securities on loan at March 31, 2017 was $1,228**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2017.

Cl — Class

The accompanying notes are an integral part of the financial statements.

10 TURNER FUNDS 2017 SEMIANNUAL REPORT

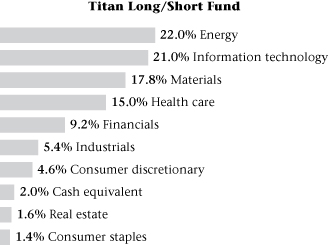

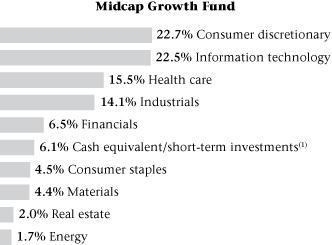

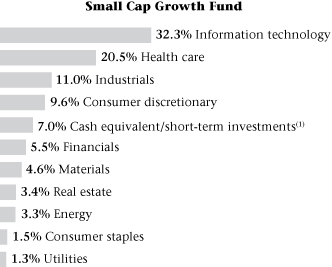

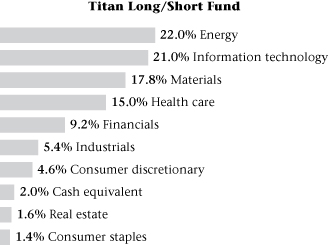

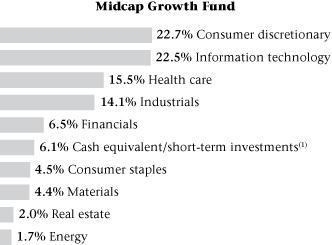

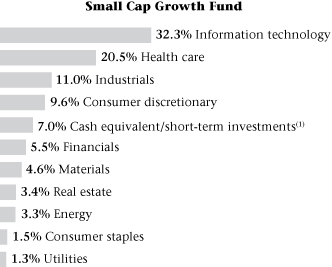

SECTOR WEIGHTINGS (Unaudited)

The following tables show the fund composition allocated by sector. The fund composition is subject to change, and the percentages are based on total investments of long positions.

1 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in the Notes to financial statements for more detailed information.

TURNER FUNDS 2017 SEMIANNUAL REPORT 11

FINANCIAL STATEMENTS (Unaudited)

Statements of assets and liabilities (000)

March 31, 2017

| | | Turner

Titan

Long/Short

Fund | | Turner

Midcap

Growth

Fund | | Turner

Small Cap

Growth

Fund | |

Assets: | |

Investment securities, at cost | | $ | 14,653 | | | $ | 90,147 | | | $ | 23,317 | | |

Investment securities, at value | | $ | 16,118 | | | $ | 100,064 | | | $ | 26,009 | | |

Deposits with brokers for securities sold short | | | 9,503 | | | | — | | | | — | | |

Foreign currency, at value | | | 3 | | | | — | | | | — | | |

Receivable for investment securities sold | | | — | | | | 2,237 | | | | 1,312 | | |

Receivable for capital shares sold | | | — | | | | 1 | | | | 3 | | |

Prepaid expenses | | | 84 | | | | 355 | | | | 115 | | |

Receivable for dividend income | | | 6 | | | | 40 | | | | 18 | | |

Receivable from investment adviser | | | — | | | | 46 | | | | 24 | | |

Total assets | | | 25,714 | | | | 102,743 | | | | 27,481 | | |

Liabilities: | |

Securities sold short, at proceeds | | | 7,990 | | | | — | | | | — | | |

Securities sold short, at value | | | 8,768 | | | | — | | | | — | | |

Payable for investment securities purchased | | | — | | | | 1,602 | | | | 463 | | |

Obligation to return securities lending collateral | | | — | | | | 3,415 | | | | 1,523 | | |

Payable for capital shares redeemed | | | 45 | | | | 191 | | | | 432 | | |

Dividends payable on securities sold short (Note 2) | | | 7 | | | | — | | | | — | | |

Payable due to investment adviser | | | 4 | | | | — | | | | — | | |

Payable due to administrator | | | 3 | | | | 25 | | | | 3 | | |

Payable due to shareholder servicing | | | 1 | | | | 18 | | | | 6 | | |

Payable due to distributor | | | 1 | | | | — | | | | — | | |

Payable due to transfer agent | | | 9 | | | | 20 | | | | 4 | | |

Payable due to custodian | | | 7 | | | | 3 | | | | 3 | | |

Payable due to compliance services | | | 2 | | | | 5 | | | | 1 | | |

Other accrued expenses | | | 20 | | | | 60 | | | | 15 | | |

Total liabilities | | | 8,867 | | | | 5,339 | | | | 2,450 | | |

Net assets | | $ | 16,847 | | | $ | 97,404 | | | $ | 25,031 | | |

* Includes market value of securities on loan | | $ | — | | | $ | 1,228 | | | $ | 753 | | |

Net assets: | |

Portfolio capital | | $ | 19,576 | | | $ | 84,157 | | | $ | 22,201 | | |

Accumulated net investment loss | | | (893 | ) | | | (514 | ) | | | (16 | ) | |

Accumulated net realized gain (loss) from investments,

securities sold short and foreign currency transactions | | | (2,523 | ) | | | 3,844 | | | | 154 | | |

Net unrealized appreciation on investments, securities sold short,

foreign currencies and translation of other assets and liabilities

denominated in foreign currencies | | | 687 | | | | 9,917 | | | | 2,692 | | |

Net assets | | $ | 16,847 | | | $ | 97,404 | | | $ | 25,031 | | |

Outstanding shares of beneficial interest — Institutional Class Shares (1) | | | 1,635 | | | | 704 | | | | — | | |

Outstanding shares of beneficial interest — Investor Class Shares (1) | | | 329 | | | | 4,438 | | | | 1,911 | | |

Outstanding shares of beneficial interest — Class C Shares (1) | | | 124 | | | | — | | | | — | | |

Outstanding shares of beneficial interest — Retirement Class Shares (1) | | | — | | | | 24 | | | | — | | |

Net assets — Institutional Class Shares | | $ | 13,318 | | | $ | 13,820 | | | $ | — | | |

Net assets — Investor Class Shares | | $ | 2,610 | | | $ | 83,181 | | | $ | 25,031 | | |

Net assets — Class C Shares | | $ | 919 | | | $ | — | | | $ | — | | |

Net assets — Retirement Class Shares | | $ | — | | | $ | 403 | | | $ | — | | |

Net asset value, offering and redemption price per share — Institutional Class Shares | | $ | 8.15 | † | | $ | 19.64 | † | | $ | — | | |

Net asset value, offering and redemption price per share — Investor Class Shares | | $ | 7.93 | † | | $ | 18.74 | † | | $ | 13.10 | | |

Net asset value, offering and redemption price per share — Class C Shares | | $ | 7.39 | † | | $ | — | | | $ | — | | |

Net asset value, offering and redemption price per share — Retirement Class Shares | | $ | — | | | $ | 16.54 | † | | $ | — | | |

(1) Unlimited authorization — par value $0.00001.

† Differences in net asset value recalculation and net asset value stated are caused by rounding differences.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

12 Turner Funds 2017 SemiAnnual Report

FINANCIAL STATEMENTS (Unaudited)

Statements of operations (000)

| | | Turner

Titan

Long/Short

Fund | | Turner

Midcap

Growth

Fund | | Turner

Small Cap

Growth

Fund | |

| | | period ended

3/31/17 | | period ended

3/31/17 | | period ended

3/31/17 | |

Investment income: | |

Dividend | | $ | 47 | | | $ | 352 | | | $ | 171 | | |

Securities lending | | | — | | | | 102 | | | | 124 | | |

Total investment income | | | 47 | | | | 454 | | | | 295 | | |

Expenses: | |

Investment advisory fees | | | 155 | | | | 382 | | | | 160 | | |

Administration fees | | | 15 | | | | 76 | | | | 24 | | |

Shareholder service fees (1) | | | 5 | | | | 109 | | | | 40 | | |

Shareholder service fees (2) | | | 1 | | | | — | | | | — | | |

Shareholder service fees (3) | | | — | | | | 1 | | | | — | | |

Distribution fees (2) | | | 4 | | | | — | | | | — | | |

Distribution fees (3) | | | — | | | | 1 | | | | — | | |

Accounting agent fees | | | 1 | | | | 1 | | | | 1 | | |

Dividend expense | | | 80 | | | | — | | | | — | | |

Broker fees and charges on short sales | | | 26 | | | | — | | | | — | | |

Custodian fees | | | 8 | | | | 6 | | | | 12 | | |

Transfer agent fees | | | 29 | | | | 108 | | | | 34 | | |

Registration fees | | | 17 | | | | 16 | | | | 10 | | |

Professional fees | | | 20 | | | | 62 | | | | 21 | | |

Trustees' fees | | | 24 | | | | 101 | | | | 32 | | |

Compliance service fees | | | 11 | | | | 47 | | | | 15 | | |

Insurance and other fees | | | 17 | | | | 74 | | | | 25 | | |

Total expenses | | | 413 | | | | 984 | | | | 374 | | |

Less: | |

Investment advisory fee waiver | | | (101 | ) | | | (400 | ) | | | (173 | ) | |

Net expenses | | | 312 | | | | 584 | | | | 201 | | |

Net investment income (loss) | | | (265 | ) | | | (130 | ) | | | 94 | | |

Net realized gain (loss) from securities sold | | | (1,886 | ) | | | 15,074 | | | | 1,788 | | |

Net realized gain from securities sold short | | | 1,059 | | | | — | | | | — | | |

Net change in unrealized appreciation (depreciation)

on investments | | | (270 | ) | | | (10,053 | ) | | | (2,765 | ) | |

Net change in unrealized (depreciation) on investments

sold short | | | (533 | ) | | | — | | | | — | | |

Net realized and unrealized gain (loss) from investments | | | (1,630 | ) | | | 5,021 | | | | (977 | ) | |

Net increase (decrease) in net assets resulting from operations | | $ | (1,895 | ) | | $ | 4,891 | | | $ | (883 | ) | |

(1) Attributable to Investor Class Shares only.

(2) Attributable to Class C Shares only.

(3) Attributable to Retirement Class Shares only.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

Turner Funds 2017 SemiAnnual Report 13

Statements of changes in net assets (000)

| | | Turner

Titan Long/Short

Fund | | Turner

Midcap Growth

Fund | |

| | | period ended

3/31/17

(Unaudited) | | year ended

9/30/16 | | period ended

3/31/17

(Unaudited) | | year ended

9/30/16 | |

Investment activities: | |

Net investment income (loss) | | $ | (265 | ) | | $ | (775 | ) | | $ | (130 | ) | | $ | (643 | ) | |

Net realized gain (loss) from securities sold and securities sold short | | | (827 | ) | | | (193 | ) | | | 15,074 | | | | (6,069 | ) | |

Net change in unrealized appreciation (depreciation) on investment and securities sold short | | | (803 | ) | | | (205 | ) | | | (10,053 | ) | | | 5,384 | | |

Net increase (decrease) in net assets resulting from operations | | | (1,895 | ) | | | (1,173 | ) | | | 4,891 | | | | (1,328 | ) | |

Dividends and distributions to shareholders: | |

Net investment income: | |

Investor Class Shares | | | — | | | | — | | | | — | | | | — | | |

Realized capital gains: | |

Institutional Class Shares | | | — | | | | (1,929 | ) | | | — | | | | (4,537 | ) | |

Investor Class Shares | | | — | | | | (1,621 | ) | | | — | | | | (18,204 | ) | |

Class C Shares | | | — | | | | (92 | ) | | | — | | | | — | | |

Retirement Class Shares | | | — | | | | — | | | | — | | | | (424 | ) | |

Total dividends and distributions | | | — | | | | (3,642 | ) | | | — | | | | (23,165 | ) | |

Capital share transactions: | |

Institutional Class Shares | |

Proceeds from shares issued | | | 84 | | | | 9,532 | | | | 311 | | | | 760 | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | 1,502 | | | | — | | | | 4,273 | | |

Cost of shares redeemed | | | (6,568 | ) | | | (21,651 | ) | | | (3,353 | ) | | | (19,487 | ) | |

Net decrease in net assets from Institutional Class Shares transactions | | | (6,484 | ) | | | (10,617 | ) | | | (3,042 | ) | | | (14,454 | ) | |

Investor Class Shares | |

Proceeds from shares issued | | | 79 | | | | 8,469 | | | | 1,014 | | | | 4,704 | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | 1,595 | | | | — | | | | 17,080 | | |

Cost of shares redeemed | | | (3,570 | ) | | | (26,876 | ) | | | (18,176 | ) | | | (40,199 | ) | |

Net decrease in net assets from Investor Class Shares transactions | | | (3,491 | ) | | | (16,812 | ) | | | (17,162 | ) | | | (18,415 | ) | |

Class C Shares | |

Proceeds from shares issued | | | — | | | | 71 | | | | — | | | | — | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | 89 | | | | — | | | | — | | |

Cost of shares redeemed | | | (211 | ) | | | (372 | ) | | | — | | | | — | | |

Net decrease in net assets from Class C Shares transactions | | | (211 | ) | | | (212 | ) | | | — | | | | — | | |

Retirement Class Shares | |

Proceeds from shares issued | | | — | | | | — | | | | 3 | | | | 186 | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | — | | | | — | | | | 424 | | |

Cost of shares redeemed | | | — | | | | — | | | | (16 | ) | | | (2,505 | ) | |

Net decrease in net assets from Retirement Class Shares transactions | | | — | | | | — | | | | (13 | ) | | | (1,895 | ) | |

Net decrease in net assets from capital share transactions | | | (10,186 | ) | | | (27,641 | ) | | | (20,217 | ) | | | (34,764 | ) | |

Total increase (decrease) in net assets | | | (12,081 | ) | | | (32,456 | ) | | | (15,326 | ) | | | (59,257 | ) | |

Net assets: | |

Beginning of period | | | 28,928 | | | | 61,384 | | | | 112,730 | | | | 171,987 | | |

End of period | | $ | 16,847 | | | $ | 28,928 | | | $ | 97,404 | | | $ | 112,730 | | |

Accumulated net investment loss | | $ | (893 | ) | | $ | (628 | ) | | $ | (514 | ) | | $ | (384 | ) | |

Institutional Class Shares | |

Issued | | | 10 | | | | 1,074 | | | | 16 | | | | 42 | | |

Issued in lieu of cash distributions | | | — | | | | 169 | | | | — | | | | 227 | | |

Redeemed | | | (813 | ) | | | (2,451 | ) | | | (183 | ) | | | (1,059 | ) | |

Net decrease in Institutional Class Shares | | | (803 | ) | | | (1,208 | ) | | | (167 | ) | | | (790 | ) | |

Investor Class Shares | |

Issued | | | 10 | | | | 961 | | | | 58 | | | | 268 | | |

Issued in lieu of cash distributions | | | — | | | | 183 | | | | — | | | | 948 | | |

Redeemed | | | (450 | ) | | | (3,172 | ) | | | (1,028 | ) | | | (2,256 | ) | |

Net decrease in Investor Class Shares | | | (440 | ) | | | (2,028 | ) | | | (970 | ) | | | (1,040 | ) | |

Class C Shares | |

Issued | | | — | | | | 8 | | | | — | | | | — | | |

Issued in lieu of cash distributions | | | — | | | | 11 | | | | — | | | | — | | |

Redeemed | | | (29 | ) | | | (45 | ) | | | — | | | | — | | |

Net decrease in Class C Shares | | | (29 | ) | | | (26 | ) | | | — | | | | — | | |

Retirement Class Shares | |

Issued | | | — | | | | — | | | | — | | | | 12 | | |

Issued in lieu of cash distributions | | | — | | | | — | | | | — | | | | 26 | | |

Redeemed | | | — | | | | — | | | | (1 | ) | | | (160 | ) | |

Net decrease in Retirement Class Shares | | | — | | | | — | | | | (1 | ) | | | (122 | ) | |

Net decrease in share transactions | | | (1,272 | ) | | | (3,262 | ) | | | (1,138 | ) | | | (1,952 | ) | |

14 Turner Funds 2017 SemiAnnual Report

| | | Turner

Small Cap Growth

Fund | |

| | | period ended

3/31/17

(Unaudited) | | year ended

9/30/16 | |

Investment activities: | |

Net investment income (loss) | | $ | 94 | | | $ | (156 | ) | |

Net realized gain (loss) from securities sold and securities sold short | | | 1,788 | | | | 1,087 | | |

Net change in unrealized appreciation (depreciation) on investment and securities sold short | | | (2,765 | ) | | | 696 | | |

Net increase (decrease) in net assets resulting from operations | | | (883 | ) | | | 1,627 | | |

Dividends and distributions to shareholders: | |

Net investment income: | |

Investor Class Shares | | | (36 | ) | | | — | | |

Realized capital gains: | |

Institutional Class Shares | | | — | | | | — | | |

Investor Class Shares | | | (787 | ) | | | (14,893 | ) | |

Class C Shares | | | — | | | | — | | |

Retirement Class Shares | | | — | | | | — | | |

Total dividends and distributions | | | (823 | ) | | | (14,893 | ) | |

Capital share transactions: | |

Institutional Class Shares | |

Proceeds from shares issued | | | — | | | | — | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | |

Net decrease in net assets from Institutional Class Shares transactions | | | — | | | | — | | |

Investor Class Shares | |

Proceeds from shares issued | | | 5,399 | | | | 5,054 | | |

Proceeds from shares issued in lieu of cash distributions | | | 792 | | | | 14,328 | | |

Cost of shares redeemed | | | (15,785 | ) | | | (40,627 | ) | |

Net decrease in net assets from Investor Class Shares transactions | | | (9,594 | ) | | | (21,245 | ) | |

Class C Shares | |

Proceeds from shares issued | | | — | | | | — | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | |

Net decrease in net assets from Class C Shares transactions | | | — | | | | — | | |

Retirement Class Shares | |

Proceeds from shares issued | | | — | | | | — | | |

Proceeds from shares issued in lieu of cash distributions | | | — | | | | — | | |

Cost of shares redeemed | | | — | | | | — | | |

Net decrease in net assets from Retirement Class Shares transactions | | | — | | | | — | | |

Net decrease in net assets from capital share transactions | | | (9,594 | ) | | | (21,245 | ) | |

Total increase (decrease) in net assets | | | (11,300 | ) | | | (34,511 | ) | |

Net assets: | |

Beginning of period | | | 36,331 | | | | 70,842 | | |

End of period | | $ | 25,031 | | | $ | 36,331 | | |

Accumulated net investment loss | | $ | (16 | ) | | $ | (74 | ) | |

Institutional Class Shares | |

Issued | | | — | | | | — | | |

Issued in lieu of cash distributions | | | — | | | | — | | |

Redeemed | | | — | | | | — | | |

Net decrease in Institutional Class Shares | | | — | | | | — | | |

Investor Class Shares | |

Issued | | | 408 | | | | 373 | | |

Issued in lieu of cash distributions | | | 64 | | | | 1,155 | | |

Redeemed | | | (1,246 | ) | | | (2,765 | ) | |

Net decrease in Investor Class Shares | | | (774 | ) | | | (1,237 | ) | |

Class C Shares | |

Issued | | | — | | | | — | | |

Issued in lieu of cash distributions | | | — | | | | — | | |

Redeemed | | | — | | | | — | | |

Net decrease in Class C Shares | | | — | | | | — | | |

Retirement Class Shares | |

Issued | | | — | | | | — | | |

Issued in lieu of cash distributions | | | — | | | | — | | |

Redeemed | | | — | | | | — | | |

Net decrease in Retirement Class Shares | | | — | | | | — | | |

Net decrease in share transactions | | | (774 | ) | | | (1,237 | ) | |

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

Turner Funds 2017 SemiAnnual Report 15

For a share outstanding throughout each period

| | | Net asset

value,

beginning

of period | | Net

investment

income

(loss)(1) | | Realized and

unrealized

gains (losses)

on investments | | Total

from

investment

operations | | Dividends

from net

investment

income | | Distributions

from

capital

gains | | Total

dividends and

distributions | |

Turner Titan Long/Short Fund — Institutional Class Shares | | | |

| 2017^ | | $ | 8.69 | | | | (0.10 | ) | | | (0.44 | ) | | | (0.54 | ) | | | — | | | | — | | | | — | | |

2016 | | $ | 9.37 | | | | (0.15 | ) | | | 0.02 | (2) | | | (0.13 | ) | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2015 | | $ | 11.95 | | | | (0.18 | ) | | | 0.23 | | | | 0.05 | | | | — | | | | (2.63 | ) | | | (2.63 | ) | |

2014 | | $ | 11.43 | | | | (0.14 | ) | | | 0.66 | | | | 0.52 | | | | — | | | | — | | | | — | | |

2013 | | $ | 10.89 | | | | (0.07 | ) | | | 0.61 | | | | 0.54 | | | | — | | | | — | | | | — | | |

2012 | | $ | 11.45 | | | | (0.13 | ) | | | 0.04 | | | | (0.09 | ) | | | — | | | | (0.47 | ) | | | (0.47 | ) | |

Turner Titan Long/Short Fund — Investor Class Shares | | | |

| 2017^ | | $ | 8.47 | | | | (0.11 | ) | | | (0.43 | ) | | | (0.54 | ) | | | — | | | | — | | | | — | | |

2016 | | $ | 9.17 | | | | (0.17 | ) | | | 0.02 | (2) | | | (0.15 | ) | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2015 | | $ | 11.78 | | | | (0.20 | ) | | | 0.22 | | | | 0.02 | | | | — | | | | (2.63 | ) | | | (2.63 | ) | |

2014 | | $ | 11.30 | | | | (0.17 | ) | | | 0.65 | | | | 0.48 | | | | — | | | | — | | | | — | | |

2013 | | $ | 10.80 | | | | (0.09 | ) | | | 0.59 | | | | 0.50 | | | | — | | | | — | | | | — | | |

2012 | | $ | 11.38 | | | | (0.16 | ) | | | 0.05 | | | | (0.11 | ) | | | — | | | | (0.47 | ) | | | (0.47 | ) | |

Turner Titan Long/Short Fund — Class C Shares | | | |

| 2017^ | | $ | 7.93 | | | | (0.13 | ) | | | (0.41 | ) | | | (0.54 | ) | | | — | | | | — | | | | — | | |

2016 | | $ | 8.68 | | | | (0.22 | ) | | | 0.02 | (2) | | | (0.20 | ) | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2015 | | $ | 11.36 | | | | (0.26 | ) | | | 0.21 | | | | (0.05 | ) | | | — | | | | (2.63 | ) | | | (2.63 | ) | |

2014 | | $ | 10.98 | | | | (0.25 | ) | | | 0.63 | | | | 0.38 | | | | — | | | | — | | | | — | | |

2013 | | $ | 10.57 | | | | (0.17 | ) | | | 0.58 | | | | 0.41 | | | | — | | | | — | | | | — | | |

2012 | | $ | 11.23 | | | | (0.24 | ) | | | 0.05 | | | | (0.19 | ) | | | — | | | | (0.47 | ) | | | (0.47 | ) | |

16 TURNER FUNDS 2017 SEMIANNUAL REPORT

| | | Net asset

value, end

of period | | Total

return | | Net

assets end

of period

(000) | | Ratio of

net expenses

to average

net assets*† | | Ratio of total

expenses

to average

net assets† | | Ratio of net

investment

income (loss)

to average

net assets*† | | Portfolio

turnover

rate** | |

Turner Titan Long/Short Fund — Institutional Class Shares | |

| 2017^ | | $ | 8.15 | | | | (6.21 | )%†† | | $ | 13,318 | | | | 2.93 | % | | | 3.91 | % | | | (2.48 | )% | | | 229 | % | |

2016 | | $ | 8.69 | | | | (1.58 | )% | | $ | 21,204 | | | | 2.82 | % | | | 3.35 | % | | | (1.66 | )% | | | 572 | % | |

2015 | | $ | 9.37 | | | | 2.13 | % | | $ | 34,179 | | | | 2.56 | % (3) | | | 3.37 | % | | | (1.83 | )% | | | 510 | % | |

2014 | | $ | 11.95 | | | | 4.55 | % | | $ | 120,032 | | | | 1.93 | % (4) | | | 2.82 | % | | | (1.18 | )% | | | 443 | % | |

2013 | | $ | 11.43 | | | | 4.96 | % | | $ | 481,845 | | | | 1.93 | % (5) | | | 2.75 | % | | | (0.64 | )% | | | 580 | % | |

2012 | | $ | 10.89 | | | | (0.77 | )% | | $ | 832,857 | | | | 1.89 | % (6) | | | 2.34 | % | | | (1.15 | )% | | | 996 | % | |

Turner Titan Long/Short Fund — Investor Class Shares | |

| 2017^ | | $ | 7.93 | | | | (6.38 | )%†† | | $ | 2,610 | | | | 3.18 | % | | | 4.16 | % | | | (2.73 | )% | | | 229 | % | |

2016 | | $ | 8.47 | | | | (1.84 | )% | | $ | 6,511 | | | | 3.07 | % | | | 3.60 | % | | | (1.91 | )% | | | 572 | % | |

2015 | | $ | 9.17 | | | | 1.86 | % | | $ | 25,651 | | | | 2.81 | % (3) | | | 3.62 | % | | | (2.08 | )% | | | 510 | % | |

2014 | | $ | 11.78 | | | | 4.25 | % | | $ | 15,630 | | | | 2.18 | % (4) | | | 3.07 | % | | | (1.42 | )% | | | 443 | % | |

2013 | | $ | 11.30 | | | | 4.63 | % | | $ | 44,139 | | | | 2.18 | % (5) | | | 3.00 | % | | | (0.89 | )% | | | 580 | % | |

2012 | | $ | 10.80 | | | | (0.95 | )% | | $ | 126,533 | | | | 2.14 | % (6) | | | 2.59 | % | | | (1.40 | )% | | | 996 | % | |

Turner Titan Long/Short Fund — Class C Shares | |

| 2017^ | | $ | 7.39 | | | | (6.81 | )%†† | | $ | 919 | | | | 3.93 | % | | | 4.91 | % | | | (3.48 | )% | | | 229 | % | |

2016 | | $ | 7.93 | | | | (2.55 | )% | | $ | 1,213 | | | | 3.82 | % | | | 4.35 | % | | | (2.66 | )% | | | 572 | % | |

2015 | | $ | 8.68 | | | | 1.17 | % | | $ | 1,554 | | | | 3.56 | % (3) | | | 4.37 | % | | | (2.83 | )% | | | 510 | % | |

2014 | | $ | 11.36 | | | | 3.46 | % | | $ | 2,916 | | | | 2.93 | % (4) | | | 3.82 | % | | | (2.18 | )% | | | 443 | % | |

2013 | | $ | 10.98 | | | | 3.88 | % | | $ | 5,572 | | | | 2.93 | % (5) | | | 3.75 | % | | | (1.64 | )% | | | 580 | % | |

2012 | | $ | 10.57 | | | | (1.71 | )% | | $ | 10,391 | | | | 2.89 | % (6) | | | 3.34 | % | | | (2.15 | )% | | | 996 | % | |

* Inclusive of fees paid indirectly, waivers and/or reimbursements.

** Excludes effect of in-kind transfers and mergers, as applicable. Not annualized for periods less than one year.

^ For the six-month period ended March 31, 2017 (unaudited). All ratios for the periods have been annualized unless otherwise noted.

† Does not include acquired fund fees or expenses.

†† Total return is for the period indicated and has not been annualized.

(1) Based on average shares outstanding.

(2) The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of the sales and purchases of fund shares in relation to fluctuating market values during the period.

(3) Dividend expense totaled 0.46% of average net assets for the year ended September 30, 2015, 0.14% of which was waived. Broker fees and charges on short sales totaled 0.68% of average net assets for the year ended September 30, 2015, 0.35% of which was waived. If dividend expense and broker fees and charges on short sales had not been contractually waived, the ratios of net expenses to average net assets would have been 3.05%, 3.30% and 4.05% for the Institutional, Investor and Class C Shares, respectively.

(4) Dividend expense totaled 0.40% of average net assets for the year ended September 30, 2014, 0.40% of which was waived. Broker fees and charges on short sales totaled 0.44% of average net assets for the year ended September 30, 2014, 0.44% of which was waived. If dividend expense and broker fees and charges on short sales had not been contractually waived, the ratios of net expenses to average net assets would have been 2.77%, 3.01% and 3.77% for the Institutional, Investor and Class C Shares, respectively.

(5) Dividend expense totaled 0.45% of average net assets for the year ended September 30, 2013, 0.45% of which was waived. Broker fees and charges on short sales totaled 0.45% of average net assets for the year ended September 30, 2013, 0.45% of which was waived. If dividend expense and broker fees and charges on short sales had not been contractually waived, the ratios of net expenses to average net assets would have been 2.83%, 3.08% and 3.83% for the Institutional, Investor and Class C Shares, respectively.

(6) Dividend expense totaled 0.20% of average net assets for the year ended September 30, 2012, 0.20% of which was waived. Broker fees and charges on short sales totaled 0.33% of average net assets for the year ended September 30, 2012, 0.33% of which was waived. If dividend expense and broker fees and charges on short sales had not been contractually waived, the ratios of net expenses to average net assets would have been 2.42%, 2.67% and 3.42% for the Institutional, Investor and Class C Shares, respectively.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2017 SEMIANNUAL REPORT 17

For a share outstanding throughout each period

| | Net asset

value,

beginning

of period | | Net

investment

income

(loss)(1) | | Realized and

unrealized

gains (losses)

on investments | | Total

from

investment

operations | | Dividends

from net

investment

income | | Distributions

from

capital

gains | | Total

dividends and

distributions | |

Turner Midcap Growth Fund — Institutional Class Shares | | | |

| 2017^ | | $ | 18.61 | | | | — | | | | 1.03 | | | | 1.03 | | | | — | | | | — | | | | — | | |

2016 | | $ | 21.49 | | | | (0.05 | ) | | | 0.13 | (2) | | | 0.08 | | | | — | | | | (2.96 | ) | | | (2.96 | ) | |

2015 | | $ | 38.57 | | | | (0.10 | ) | | | (0.82 | ) | | | (0.92 | ) | | | — | | | | (16.16 | ) | | | (16.16 | ) | |

2014 | | $ | 43.43 | | | | (0.08 | ) | | | 4.58 | | | | 4.50 | | | | — | | | | (9.36 | ) | | | (9.36 | ) | |

2013 | | $ | 35.39 | | | | (0.09 | ) | | | 8.68 | | | | 8.59 | | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2012 | | $ | 30.42 | | | | (0.05 | ) | | | 5.02 | | | | 4.97 | | | | — | | | | — | | | | — | | |

Turner Midcap Growth Fund — Investor Class Shares | | | |

| 2017^ | | $ | 17.78 | | | | (0.03 | ) | | | 0.99 | | | | 0.96 | | | | — | | | | — | | | | — | | |

2016 | | $ | 20.71 | | | | (0.09 | ) | | | 0.12 | (2) | | | 0.03 | | | | — | | | | (2.96 | ) | | | (2.96 | ) | |

2015 | | $ | 37.79 | | | | (0.16 | ) | | | (0.76 | ) | | | (0.92 | ) | | | — | | | | (16.16 | ) | | | (16.16 | ) | |

2014 | | $ | 42.85 | | | | (0.17 | ) | | | 4.47 | | | | 4.30 | | | | — | | | | (9.36 | ) | | | (9.36 | ) | |

2013 | | $ | 35.03 | | | | (0.18 | ) | | | 8.55 | | | | 8.37 | | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2012 | | $ | 30.16 | | | | (0.13 | ) | | | 5.00 | | | | 4.87 | | | | — | | | | — | | | | — | | |

Turner Midcap Growth Fund — Retirement Class Shares | | | |

| 2017^ | | $ | 15.71 | | | | (0.04 | ) | | | 0.87 | | | | 0.83 | | | | — | | | | — | | | | — | | |

2016 | | $ | 18.69 | | | | (0.12 | ) | | | 0.10 | (2) | | | (0.02 | ) | | | — | | | | (2.96 | ) | | | (2.96 | ) | |

2015 | | $ | 35.75 | | | | (0.21 | ) | | | (0.69 | ) | | | (0.90 | ) | | | — | | | | (16.16 | ) | | | (16.16 | ) | |

2014 | | $ | 41.07 | | | | (0.25 | ) | | | 4.29 | | | | 4.04 | | | | — | | | | (9.36 | ) | | | (9.36 | ) | |

2013 | | $ | 33.65 | | | | (0.25 | ) | | | 8.22 | | | | 7.97 | | | | — | | | | (0.55 | ) | | | (0.55 | ) | |

2012 | | $ | 29.05 | | | | (0.20 | ) | | | 4.80 | | | | 4.60 | | | | — | | | | — | | | | — | | |

Turner Small Cap Growth Fund — Investor Class Shares | | | |

| 2017^ | | $ | 13.53 | | | | 0.04 | | | | (0.15 | ) | | | (0.11 | ) | | | (0.01 | ) | | | (0.31 | ) | | | (0.32 | ) | |

2016 | | $ | 18.06 | | | | (0.05 | ) | | | 0.74 | | | | 0.69 | | | | — | | | | (5.22 | ) | | | (5.22 | ) | |

2015 | | $ | 37.23 | | | | (0.17 | ) | | | 1.25 | | | | 1.08 | | | | — | | | | (20.25 | ) | | | (20.25 | ) | |

2014 | | $ | 44.76 | | | | (0.33 | ) | | | 0.76 | | | | 0.43 | | | | — | | | | (7.96 | ) | | | (7.96 | ) | |

2013 | | $ | 35.96 | | | | (0.16 | ) | | | 11.47 | | | | 11.31 | | | | — | | | | (2.51 | ) | | | (2.51 | ) | |

2012 | | $ | 27.83 | | | | (0.23 | ) | | | 8.36 | | | | 8.13 | | | | — | | | | — | | | | — | | |

18 TURNER FUNDS 2017 SEMIANNUAL REPORT

| | | Net asset

value, end

of period | | Total

return | | Net

assets end

of period

(000) | | Ratio of

net expenses

to average

net assets*† | | Ratio of total

expenses

to average

net assets† | | Ratio of net

investment

income (loss)

to average

net assets*† | | Portfolio

turnover

rate** | |

Turner Midcap Growth Fund — Institutional Class Shares | |

| 2017^ | | $ | 19.64 | | | | 5.53 | %†† | | $ | 13,820 | | | | 0.93 | % | | | 1.71 | % | | | (0.04 | )% | | | 113 | % | |

2016 | | $ | 18.61 | | | | 0.22 | % | | $ | 16,205 | | | | 0.93 | % | | | 1.50 | % | | | (0.26 | )% | | | 165 | % | |

2015 | | $ | 21.49 | | | | (4.63 | )% | | $ | 35,704 | | | | 0.93 | % | | | 1.33 | % | | | (0.39 | )% | | | 119 | % (3) | |

2014 | | $ | 38.57 | | | | 12.25 | % | | $ | 46,253 | | | | 0.93 | % | | | 1.17 | % | | | (0.21 | )% | | | 89 | % (4) | |

2013 | | $ | 43.43 | | | | 24.69 | % | | $ | 205,679 | | | | 0.93 | % | | | 1.08 | % | | | (0.24 | )% | | | 84 | % | |

2012 | | $ | 35.39 | | | | 16.34 | % | | $ | 236,147 | | | | 0.93 | % | | | 1.04 | % | | | (0.14 | )% | | | 121 | % | |

Turner Midcap Growth Fund — Investor Class Shares | |

| 2017^ | | $ | 18.74 | | | | 5.40 | %†† | | $ | 83,181 | | | | 1.18 | % | | | 1.96 | % | | | (0.29 | )% | | | 113 | % | |

2016 | | $ | 17.78 | | | | (0.04 | )% | | $ | 96,130 | | | | 1.18 | % | | | 1.75 | % | | | (0.51 | )% | | | 165 | % | |

2015 | | $ | 20.71 | | | | (4.81 | )% | | $ | 133,541 | | | | 1.18 | % | | | 1.58 | % | | | (0.64 | )% | | | 119 | % (3) | |

2014 | | $ | 37.79 | | | | 11.88 | % | | $ | 187,974 | | | | 1.18 | % | | | 1.42 | % | | | (0.44 | )% | | | 89 | % (4) | |

2013 | | $ | 42.85 | | | | 24.31 | % | | $ | 257,240 | | | | 1.18 | % | | | 1.33 | % | | | (0.49 | )% | | | 84 | % | |

2012 | | $ | 35.03 | | | | 16.15 | % | | $ | 404,427 | | | | 1.18 | % | | | 1.29 | % | | | (0.39 | )% | | | 121 | % | |

Turner Midcap Growth Fund — Retirement Class Shares | |

| 2017^ | | $ | 16.54 | | | | 5.28 | %†† | | $ | 403 | | | | 1.43 | % | | | 2.21 | % | | | (0.54 | )% | | | 113 | % | |

2016 | | $ | 15.71 | | | | (0.35 | )% | | $ | 395 | | | | 1.43 | % | | | 2.00 | % | | | (0.76 | )% | | | 165 | % | |

2015 | | $ | 18.69 | | | | (5.11 | )% | | $ | 2,742 | | | | 1.43 | % | | | 1.83 | % | | | (0.89 | )% | | | 119 | % (3) | |

2014 | | $ | 35.75 | | | | 11.74 | % | | $ | 4,674 | | | | 1.43 | % | | | 1.67 | % | | | (0.68 | )% | | | 89 | % (4) | |

2013 | | $ | 41.07 | | | | 24.11 | % | | $ | 4,235 | | | | 1.43 | % | | | 1.58 | % | | | (0.74 | )% | | | 84 | % | |

2012 | | $ | 33.65 | | | | 15.83 | % | | $ | 4,811 | | | | 1.43 | % | | | 1.54 | % | | | (0.64 | )% | | | 121 | % | |

Turner Small Cap Growth Fund — Investor Class Shares | |

| 2017^ | | $ | 13.10 | | | | (0.69 | )%†† | | $ | 25,031 | | | | 1.25 | % | | | 2.33 | % | | | (0.59 | )% | | | 242 | % | |

2016 | | $ | 13.53 | | | | 6.47 | % | | $ | 36,331 | | | | 1.25 | % | | | 2.04 | % | | | (0.35 | )% | | | 372 | % | |

2015 | | $ | 18.06 | | | | 6.55 | % | | $ | 70,842 | | | | 1.25 | % | | | 1.83 | % | | | (0.77 | )% | | | 280 | % | |

2014 | | $ | 37.23 | | | | 0.99 | % | | $ | 130,085 | | | | 1.25 | % | | | 1.66 | % | | | (0.83 | )% | | | 127 | % | |

2013 | | $ | 44.76 | | | | 33.79 | % | | $ | 233,039 | | | | 1.25 | % | | | 1.56 | % | | | (0.43 | )% | | | 82 | % | |

2012 | | $ | 35.96 | | | | 29.21 | % | | $ | 250,099 | | | | 1.25 | % | | | 1.53 | % | | | (0.68 | )% | | | 100 | % | |

* Inclusive of fees paid indirectly, waivers and/or reimbursements.

** Excludes effect of in-kind transfers and mergers, as applicable. Not annualized for periods less than one year.

^ For the six-month period ended March 31, 2017 (unaudited). All ratios for the periods have been annualized unless otherwise noted.

† Does not include acquired fund fees or expenses.

†† Total return is for the period indicated and has not been annualized.

(1) Based on average shares outstanding.

(2) The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of the sales and purchases of fund shares in relation to fluctuating market values during the

(3) If purchases of portfolio securities in connection with the reorganization of the Turner Large Growth Fund into the Turner Midcap Growth Fund had been included, the portfolio turnover rate would have been 133%.

(4) If purchases of portfolio securities in connection with the reorganization of the Turner All Cap Growth Fund into the Turner Midcap Growth Fund had been included, the portfolio turnover rate would have been 93%.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2017 SEMIANNUAL REPORT 19

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Notes to financial statements

March 31, 2017

1. Organization:

Turner Funds (the "Trust"), a Massachusetts business trust, is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust meets the definition as an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946, "Financial Services—Investment Companies." The funds included herein are Turner Titan Long/Short Fund ("Titan Long/Short Fund"), Turner Midcap Growth Fund ("Midcap Growth Fund") and Turner Small Cap Growth Fund ("Small Cap Growth Fund"), each a "Fund" and collectively the "Funds."

Each Fund is registered as a diversified portfolio of the Trust.

The Funds are registered to offer different classes of shares: Institutional Class Shares, Investor Class Shares, Retirement Class Shares, Class C Shares, or a combination of the four. The assets of each Fund are segregated, and a shareholder's interest is limited to the Fund in which shares are held. The Funds' prospectuses provide a description of each Fund's investment objectives, policies and strategies along with information on the classes of shares currently being offered.

2. Significant accounting policies:

The following is a summary of the significant accounting policies followed by the Funds.

Use of estimates—The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities valuation—In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market.

The Trust has a three-tier fair value hierarchy that is dependent upon the various "inputs" used to determine the value of the Funds' investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical investments

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risks, etc.)

Level 3 – significant unobservable inputs (including a Fund's own assumptions in determining the fair value of investments)

Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including American Depositary Receipts ("ADRs"), are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded, or, if there is no such reported sale, at the most recent quoted bid price for long positions and the most recent quoted ask price for short positions. For securities traded on NASDAQ, the NASDAQ Official Closing Price is used. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. To the extent these securities are valued at the last sales price or NASDAQ Official Closing Price, they are categorized as Level 1 in the fair value hierarchy.

Investments in other open-end investment companies are valued at net asset value. These valuations are typically categorized as Level 1 in the fair value hierarchy.

If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain bid and ask prices from two broker-dealers who make a market in the security and determine the average of the two. In this situation, valuations are typically categorized as Level 2 in the fair value hierarchy.

Securities for which market prices are not "readily available" are valued in accordance with Fair Value Procedures established by the Board of Trustees of the Trust (the "Board"). The Funds' Fair Value Procedures are implemented through a Fair Value Committee (the "Committee") designated by the Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security's trading has been halted or suspended; the security has been delisted from a national exchange; the security's primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking

20 TURNER FUNDS 2017 SEMIANNUAL REPORT

into consideration relevant information reasonably available to the Committee. Depending on the source or relative significance of the valuation inputs, these securities may be categorized as Level 2 or Level 3 in the fair value hierarchy.

For securities that principally trade on a foreign market or exchange, a significant gap in time can exist between the time of a particular security's last trade and the time at which a Fund calculates its net asset value. The closing prices of such securities may no longer reflect their market value at the time a Fund calculates net asset value if an event that could materially affect the value of those securities (a "Significant Event") has occurred between the time of the security's last close and the time that a Fund calculates net asset value. A Significant Event may relate to a single issuer or to an entire market sector.

In the event that Turner Investments LLC ("Turner" or the "Adviser") believes that the fair values provided by a third party fair valuation vendor are not reliable, or believes that a foreign security held by a Fund should be fair valued for any other reason, the Adviser shall contact the sub-administrator, Citi Fund Services Ohio, Inc. ("Citi" or the "Sub-administrator"), and request that a meeting of the Committee be held. Depending on the source or relative significance of the valuation inputs, these securities may be categorized as Level 2 or Level 3 in the fair value hierarchy.

For the six months ended March 31, 2017, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value.

The following table is a summary of inputs used to value the Funds' investments as of March 31, 2017. The breakdown, by sub-category, of the "common stock" category is disclosed in the Schedule of investments and Schedule of securities sold short for each Fund, as applicable.

| | | Level 1

(000) | | Level 2

(000) | | Total

(000) | |

Titan Long/Short Fund | |

Investments in Securities | |

Common stock | | $ | 15,454 | | | $ | — | | | $ | 15,454 | | |

Cash equivalent | | | 322 | | | | — | | | | 322 | | |

Exchange traded funds | | | 342 | | | | — | | | | 342 | | |

Warrant | | | — | * | | | — | | | | — | * | |

Total Investments in securities | | $ | 16,118 | | | $ | — | | | $ | 16,118 | | |

Securities Sold Short | |

Common stock | | $ | 7,621 | | | $ | — | | | $ | 7,621 | | |

Right | | | 61 | | | | — | | | | 61 | | |

Exchange traded funds | | | 1,086 | | | | — | | | | 1,086 | | |

Total Securities sold short | | $ | 8,768 | | | $ | — | | | $ | 8,768 | | |

| | | Level 1

(000) | | Level 2

(000) | | Total

(000) | |

Midcap Growth Fund | |

Investments in Securities | |

Common stock | | $ | 93,995 | | | $ | — | | | $ | 93,995 | | |

Cash equivalent | | | 6,069 | | | | — | | | | 6,069 | | |

Total Investments in securities | | $ | 100,064 | | | $ | — | | | $ | 100,064 | | |

Small Cap Growth Fund | |

Investments in Securities | |

Common stock | | $ | 24,197 | | | $ | — | | | $ | 24,197 | | |

Cash equivalent | | | 1,812 | | | | — | | | | 1,812 | | |

Total Investments in securities | | $ | 26,009 | | | $ | — | | | $ | 26,009 | | |

* Represents interest in securities that were determined to have a value of zero at March 31, 2017.

For each Fund, there were no transfers between the levels as of March 31, 2017 based on the input levels assigned at September 30, 2016.

Security transactions and related income—Security transactions are accounted for on the date the security is purchased or sold (trade date). Dividend income is recognized on the ex-dividend date. Costs used in determining realized gains and losses on the sales of investment securities are those of the specific securities lots sold.

Securities sold short—Consistent with each Fund's investment objectives, the Funds may engage in short sales. Short sales are transactions under which a Fund sells a security it does not own. To complete such a transaction, the Fund must borrow the security to make delivery to the buyer. The Fund is then obligated to replace the security borrowed by purchasing the security at the market price at the time of the replacement. The price at such time may be more or less than the price at which the security was sold by the Fund. Until the security is replaced, the Fund is required to pay the lender amounts equal to any dividends that accrue during the period of the loan. Dividends declared on open short positions are recorded on the ex-date and shown as an expense for financial reporting purposes. To borrow the security, the Fund also may be required to pay a fee, which is shown as an expense for financial reporting purposes. The proceeds of the short sale are retained by the broker, to the extent necessary to meet margin requirements, until the short position is closed. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the close of a short sale.

Until a Fund closes its short position or replaces the borrowed security, the Fund will: (a) maintain a segregated account containing cash or liquid securities at such a level that (i) the amount deposited in the account plus the amount deposited with the brokers as

TURNER FUNDS 2017 SEMIANNUAL REPORT 21

NOTES TO FINANCIAL STATEMENTS (Unaudited)

collateral will equal the current value of the security sold short; and (ii) the amount deposited in the segregated account plus the amount deposited with the broker as collateral will not be less than the market value of the security at the time the security was sold short, or (b) otherwise cover the short positions. The Titan Long/Short Fund engaged in short sales during the six months ended March 31, 2017.

Option transactions—Consistent with each Fund's investment objectives, the Funds may write covered call options and sell put options as a means of increasing the yield on their portfolios and as a means of providing limited protection against decreases in their market value. The Funds may purchase put and call options to protect against a decline in the market value of the securities in their portfolios or to anticipate an increase in the market value of securities that the Funds may seek to purchase in the future. A put option gives the purchaser of the option the right to sell, and the writer of the option the obligation to buy, the underlying security at any time during the option period. A call option gives the purchaser of the option the right to buy, and the writer of the option the obligation to sell, the underlying security at any time during the option period. The premium paid to the writer is the consideration for undertaking the obligations under the option contract. The initial purchase (sale) of an option contract is an "opening transaction." In order to close an option position, the Fund may enter into a "closing transaction," which is simply the sale (purchase) of an option contract on the same security with the same exercise price and expiration date as the option contract originally opened. If the Fund is unable to effect a closing purchase transaction with respect to an option it has written, it will not be able to sell the underlying security until the option expires or the Fund delivers the security upon exercise. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of assets and liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the option written.

Option contracts are valued at the last quoted sales price. If there is no such reported sale on the valuation date, long positions are valued at the most recent bid price, and short positions are valued at the most recent ask price. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the

premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security). The primary risk exposure from written and purchased options contracts is equity exposure.

During the six months ended March 31, 2017, the Funds held no written or purchased options.