UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07527 | |||||||

| ||||||||

Turner Funds | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

1205 Westlakes Drive, Suite 100 Berwyn, PA |

| 19312 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Michael P. Malloy Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 1-800-224-6312 |

| ||||||

| ||||||||

Date of fiscal year end: | September 30 |

| ||||||

| ||||||||

Date of reporting period: | March 31, 2015 |

| ||||||

Item 1. Reports to Stockholders.

Semiannual Report

March 31, 2015 (unaudited)

Long/short equity funds

Turner Medical Sciences Long/Short Fund

Turner Spectrum Fund

Turner Titan Fund

U.S. growth equity funds

Turner Emerging Growth Fund

Turner Midcap Growth Fund

Turner Small Cap Growth Fund

Contents

2 | Letter to shareholders | ||||||

3 | Schedules of investments | ||||||

| 19 | Sector Weightings | ||||||

| 20 | Financial statements | ||||||

| 34 | Notes to financial statements | ||||||

| 42 | Board of Trustees considerations in approving the Advisory Agreement | ||||||

| 43 | Disclosure of fund expenses | ||||||

Turner Funds

As of March 31, 2015, the Turner Funds offered a series of six mutual funds to individual and institutional investors. The minimum initial investment for Institutional Class Shares in a Turner Fund is $250,000 (except for $100,000 for the Turner Medical Sciences Long/Short Fund, the Turner Spectrum Fund, and the Turner Titan Fund) for regular accounts and $100,000 for individual retirement accounts. The minimum initial investment for Investor Class Shares, Retirement Class Shares and Class C Shares is $2,500 for regular accounts and $2,000 for individual retirement accounts.

Turner Investments, L.P., based in Berwyn, Pennsylvania, serves as the investment adviser for the Turner Funds. Turner Investments, L.P., founded in 1990, manages approximately $600 million in equity investments as of March 31, 2015.

Shareholder services

Turner Funds shareholders receive annual and semiannual reports, quarterly account statements, and a quarterly newsletter. Shareholders who have questions about their accounts may call a toll-free telephone number, 1.800.224.6312, may visit our website, www.turnerinvestments.com, or may write to Turner Funds, P.O. Box 219805, Kansas City, Missouri 64121-9805.

TURNER FUNDS 2015 SEMIANNUAL REPORT 1

LETTER TO SHAREHOLDERS

To our shareholders

The fourth quarter of 2014 witnessed a resurgence of small-capitalization growth stocks with the Russell 2000 Growth Index leading the market higher coming into year-end (Russell 2000 Growth Index + 10.1% vs. S&P 500 Index 4.9% for the quarter.) With continuing concerns over slowing growth out of China, Europe, and Japan, accompanied by quantitative easing in those economies; a strengthening USD; and falling energy prices as the Northern Hemisphere experienced the winter months, the U.S. economy enjoyed a resurgence in economic growth. The unemployment rate continued to tick lower (5.6%) and the FOMC formally ended their quantitative easing program.

As we welcomed 2015, anticipated weakening global demand, combined with the strength of the USD, weighed on the profitability of many large-capitalization multi-national companies which derive a significant portion of their revenues from outside the U.S. As expected, smaller capitalization names were more richly rewarded by investors than the broad market indices (S&P 500 Index +1.0% for Q1 2015) and growth-oriented portfolios tended to outperform value portfolios. The Russell 2500 Growth Index returned 7.4% in the first quarter of 2015, leading U.S. domestic indices for the quarter.

The current investment background provides a robust environment for active stock selection strategies, particularly those emphasizing companies whose products are introducing transformative and/or disruptive innovation in sectors of the economy where growth prospects are rewarded. Specifically, we note that we have consistently witnessed this phenomenon over the years where we have identified long-term secular trends in sectors such as Technology, Consumer Discretionary and Healthcare. By no means is this idea of transformative and/or disruptive innovation limited to these "tech-rich" sectors of the economy. Indeed, there are many facets of the economy that can benefit from "new" technology, such as transportation and logistics industries, that are experiencing something of a renaissance as a result of the booming natural resources development domestically as well as strong consumer demand from online consumers with expectations of immediate fulfillment.

Merger activity remains alive and well as consolidation to build scale continues in some industries. Q1 saw the announcement of the Kraft-Heinz merger, Expedia's acquisition of Orbitz, Shire's acquisition of NPS Pharmaceuticals and NXP Semiconductor's acquisition of Freescale. Apple replaced AT&T in the Dow Jones Industrial Average and became the largest market capitalization company ever, exceeding $725 billion.

Looking ahead, as the global markets' trajectory remains fueled by the surge in liquidity from foreign monetary authority quantitative easing, Turner grows increasingly

more resolute in our commitment to the "pure growth" philosophy and discipline that have been hallmarks of our investment process since our founding twenty-five years ago this past March. We anticipate that continued, modest economic growth will be driven by innovation, as noted above, and that global monetary authorities will seek to manage their self-induced inflationary tendencies. Should the Fed be successful in draining excess liquidity from the markets, the USD will continue to strengthen, putting additional pressure on margins. Consequently, we expect to see a less homogenous equity market, with greater differentiation among stocks based on their ability to generate sustainable growth in earnings. Under the prevailing conditions, this should reward investors whose portfolios reflect their convictions and allow active portfolio management to lead to better than index returns over time.

We appreciate your investment in the Turner Funds and we look forward to continuing to serve you in the years ahead.

Sincerely,

Bob Turner

Chairman and Chief Investment Officer

Turner Investments

Past performance is no guarantee of future results. The views expressed are those of Turner Investments as of March 31, 2015, and are not intended as a forecast or investment recommendations. The indexes mentioned are not available for investment.

Bob Turner

2 TURNER FUNDS 2015 SEMIANNUAL REPORT

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Medical Sciences Long/Short Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—93.9%† | |||||||||||

Biotechnology—49.5% | |||||||||||

Aegerion Pharmaceuticals*^ | 31,010 | $ | 812 | ||||||||

AMAG Pharmaceuticals*^ | 42,220 | 2,308 | |||||||||

Amarin ADR*^ | 482,820 | 1,130 | |||||||||

ARIAD Pharmaceuticals* | 60,820 | 501 | |||||||||

Avalanche Biotechnologies* | 12,570 | 509 | |||||||||

Cancer Genetics* | 82,360 | 643 | |||||||||

Celladon* | 34,050 | 645 | |||||||||

Concert Pharmaceuticals*^ | 128,710 | 1,949 | |||||||||

CTI BioPharma* | 308,270 | 558 | |||||||||

Discovery Laboratories*^ (a) | 2,668,233 | 3,175 | |||||||||

Dynavax Technologies*^ | 35,144 | 788 | |||||||||

Emergent Biosolutions*^ | 59,710 | 1,717 | |||||||||

Heron Therapeutics*^ | 110,260 | 1,604 | |||||||||

Histogenics* (a) | 27,850 | 278 | |||||||||

Infinity Pharmaceuticals*^ | 55,830 | 781 | |||||||||

Intercept Pharmaceuticals*^ | 5,920 | 1,670 | |||||||||

Keryx Biopharmaceuticals*^ | 32,220 | 410 | |||||||||

NephroGenex* | 100,704 | 793 | |||||||||

Ohr Pharmaceutical* | 241,770 | 614 | |||||||||

Progenics Pharmaceuticals*^ | 293,110 | 1,753 | |||||||||

Prothena*^ | 165,290 | 6,304 | |||||||||

PTC Therapeutics*^ | 23,770 | 1,446 | |||||||||

Puma Biotechnology*^ | 4,035 | 953 | |||||||||

Retrophin*^ | 141,350 | 3,387 | |||||||||

Rigel Pharmaceuticals* | 195,110 | 697 | |||||||||

Trovagene* | 92,960 | 633 | |||||||||

Total Biotechnology | 36,058 | ||||||||||

Health care equipment & supplies—1.1% | |||||||||||

Unilife*^ | 193,888 | 777 | |||||||||

Total Health care equipment & supplies | 777 | ||||||||||

Pharmaceuticals—43.3% | |||||||||||

Actavis* | 3,350 | 997 | |||||||||

Alcobra*^ | 188,350 | 1,060 | |||||||||

Amphastar Pharmaceuticals*^ | 72,850 | 1,090 | |||||||||

Bristol-Myers Squibb^ | 15,000 | 968 | |||||||||

Cardiome Pharma*^ (a) | 252,863 | 2,342 | |||||||||

DepoMed*^ | 146,760 | 3,289 | |||||||||

Dermira*^ | 42,730 | 656 | |||||||||

Flamel Technologies SA ADR*^ | 130,865 | 2,353 | |||||||||

GlaxoSmithKline ADR | 20,860 | 963 | |||||||||

Horizon Pharma PLC*^ | 196,590 | 5,104 | |||||||||

Shares | Value (000) | ||||||||||

IGI Laboratories*^ | 500,442 | $ | 4,084 | ||||||||

Merck^ | 40,700 | 2,339 | |||||||||

Novartis AG ADR | 13,490 | 1,330 | |||||||||

Ocera Therapeutics*^ | 40,799 | 192 | |||||||||

Pfizer^ | 68,430 | 2,381 | |||||||||

Sagent Pharmaceuticals* | 25,220 | 586 | |||||||||

Sanofi ADR^ | 28,450 | 1,407 | |||||||||

SteadyMed* | 52,929 | 450 | |||||||||

Total Pharmaceuticals | 31,591 | ||||||||||

| Total Common stock (Cost $56,839)** | 68,426 | ||||||||||

Cash equivalent—5.4% | |||||||||||

| BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.083%‡ | 4,014,997 | 4,015 | |||||||||

| Total Cash equivalent (Cost $4,015)** | 4,015 | ||||||||||

| Total Investments—99.3% (Cost $60,854)** | 72,441 | ||||||||||

Segregated cash with brokers—64.4% | 46,918 | ||||||||||

| Securities sold short—(66.1)% (Proceeds $(48,373))** | (48,200 | ) | |||||||||

Net Other assets (liabilities)—2.4% | 1,756 | ||||||||||

Net Assets—100.0% | $ | 72,915 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2015.

(a) These securities have been deemed illiquid by the Adviser and represent 6.58% of Net Assets.

ADR — American Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 3

FINANCIAL STATEMENTS (Unaudited)

Schedule of securities sold short

Turner Medical Sciences Long/Short Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—36.0% | |||||||||||

Biotechnology—15.9% | |||||||||||

Acadia Pharmaceuticals | 12,660 | $ | 413 | ||||||||

Acorda Therapeutics | 31,270 | 1,041 | |||||||||

Agios Pharmaceuticals | 12,320 | 1,162 | |||||||||

Alnylam Pharmaceuticals | 6,630 | 692 | |||||||||

Bluebird Bio | 11,350 | 1,371 | |||||||||

Gilead Sciences | 10,540 | 1,034 | |||||||||

ImmunoGen | 104,540 | 936 | |||||||||

Juno Therapeutics | 17,070 | 1,035 | |||||||||

Kite Pharma | 25,920 | 1,494 | |||||||||

Ophthotech | 22,500 | 1,047 | |||||||||

Radius Health | 9,310 | 383 | |||||||||

United Therapeutics | 5,590 | 964 | |||||||||

Total Biotechnology | 11,572 | ||||||||||

Food & Staples Retailing—0.9% | |||||||||||

CVS Caremark | 6,590 | 680 | |||||||||

Total Food & Staples Retailing | 680 | ||||||||||

Health care equipment & supplies—3.8% | |||||||||||

Anika Therapeutics | 44,090 | 1,815 | |||||||||

Nevro | 19,900 | 954 | |||||||||

Total Health care equipment & supplies | 2,769 | ||||||||||

Health care providers & services—5.2% | |||||||||||

Aetna | 9,190 | 979 | |||||||||

DaVita | 16,110 | 1,310 | |||||||||

Humana | 4,490 | 799 | |||||||||

WellCare Health Plans | 8,070 | 738 | |||||||||

Total Health care providers & services | 3,826 | ||||||||||

Life sciences tools & services—5.9% | |||||||||||

BIO-Rad Laboratories, Cl A | 12,490 | 1,689 | |||||||||

Icon | 9,390 | 662 | |||||||||

Mettler-Toledo International | 3,930 | 1,292 | |||||||||

PAREXEL International | 9,600 | 662 | |||||||||

Total Life sciences tools & services | 4,305 | ||||||||||

Shares | Value (000) | ||||||||||

Pharmaceuticals—4.3% | |||||||||||

ANI Pharmaceuticals | 23,750 | $ | 1,486 | ||||||||

ENDO International PLC | 9,760 | 875 | |||||||||

Lannett | 11,270 | 763 | |||||||||

Total Pharmaceuticals | 3,124 | ||||||||||

| Total Common stock (Proceeds $26,494)* | 26,276 | ||||||||||

Exchange traded funds—30.1% | |||||||||||

| Health Care Select Sector SPDR Fund | 106,550 | 7,725 | |||||||||

| iShares NASDAQ Biotechnology ETF | 17,480 | 6,003 | |||||||||

iShares Russell 2000 Growth ETF | 65,910 | 8,196 | |||||||||

| Total Exchange traded funds (Proceeds $21,879)* | 21,924 | ||||||||||

| Total Securities sold short—66.1% (Proceeds $48,373)* | $ | 48,200 | |||||||||

Percentages disclosed are based on total net assets of the Fund at March 31, 2015.

* This number is listed in thousands.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

4 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Spectrum Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—93.9%† | |||||||||||

Consumer discretionary—16.8% | |||||||||||

Advance Auto Parts^ | 2,990 | $ | 448 | ||||||||

Amazon.com*^ | 670 | 249 | |||||||||

Ann*^ | 4,650 | 191 | |||||||||

Bloomin' Brands^ | 6,000 | 146 | |||||||||

BorgWarner^ | 4,940 | 299 | |||||||||

CBS, Cl B^ | 12,730 | 772 | |||||||||

Chipotle Mexican Grill*^ | 420 | 273 | |||||||||

Cinemark Holdings, Inc.^ | 3,480 | 157 | |||||||||

Dollar Tree*^ | 5,280 | 428 | |||||||||

General Motors^ | 10,580 | 397 | |||||||||

G-III Apparel Group*^ | 1,610 | 181 | |||||||||

Hanesbrands | 7,000 | 235 | |||||||||

Harley-Davidson^ | 4,990 | 303 | |||||||||

Harman International Industries^ | 1,910 | 255 | |||||||||

Hasbro | 3,000 | 190 | |||||||||

Hilton Worldwide Holdings*^ | 3,340 | 99 | |||||||||

Home Depot^ | 2,420 | 275 | |||||||||

JD.com ADR*^ | 9,000 | 264 | |||||||||

La Quinta Holdings*^ | 11,000 | 260 | |||||||||

MDC Partners^ | 8,000 | 227 | |||||||||

MGM Resorts International*^ | 10,000 | 210 | |||||||||

Mohawk Industries*^ | 1,210 | 225 | |||||||||

Monro Muffler Brake^ | 3,530 | 230 | |||||||||

Nike, Cl B^ | 1,500 | 150 | |||||||||

O'Reilly Automotive*^ | 1,060 | 229 | |||||||||

Oxford Industries | 2,460 | 186 | |||||||||

Signet Jewelers | 1,510 | 210 | |||||||||

Skechers U.S.A., Cl A*^ | 2,000 | 144 | |||||||||

Tractor Supply^ | 3,000 | 255 | |||||||||

Under Armour, Cl A*^ | 3,000 | 242 | |||||||||

Walt Disney^ | 1,240 | 130 | |||||||||

Zoe's Kitchen*^ | 5,400 | 180 | |||||||||

Total Consumer discretionary | 8,040 | ||||||||||

Consumer staples—3.8% | |||||||||||

Constellation Brands, Cl A*^ | 1,750 | 203 | |||||||||

Monster Beverage*^ | 2,720 | 376 | |||||||||

PepsiCo^ | 1,250 | 120 | |||||||||

Rite Aid*^ | 55,170 | 479 | |||||||||

Sprouts Farmers Market* | 8,730 | 308 | |||||||||

WhiteWave Foods, Cl A*^ | 7,410 | 329 | |||||||||

Total Consumer staples | 1,815 | ||||||||||

Shares | Value (000) | ||||||||||

Energy—1.6% | |||||||||||

Concho Resources* | 1,380 | $ | 160 | ||||||||

Independence Contract Drilling*^ | 34,385 | 240 | |||||||||

Range Resources^ | 4,440 | 231 | |||||||||

Whiting Petroleum* | 4,990 | 154 | |||||||||

Total Energy | 785 | ||||||||||

Financials—11.9% | |||||||||||

Ameris Bancorp^ | 9,310 | 246 | |||||||||

Bank of the Ozarks^ | 12,768 | 472 | |||||||||

BlackRock^ | 810 | 296 | |||||||||

Boston Private Financial Holdings | 8,710 | 106 | |||||||||

CME Group^ | 2,030 | 192 | |||||||||

East West Bancorp^ | 3,180 | 129 | |||||||||

Essent Group*^ | 11,410 | 273 | |||||||||

Hanmi Financial^ | 14,200 | 300 | |||||||||

Invesco^ | 9,590 | 381 | |||||||||

Janus Capital Group^ | 12,830 | 221 | |||||||||

Moelis, Cl A^ | 7,900 | 238 | |||||||||

Moody's^ | 4,970 | 516 | |||||||||

PrivateBancorp^ | 10,130 | 356 | |||||||||

Signature Bank*^ | 4,270 | 553 | |||||||||

Simon Property Group^ | 1,690 | 331 | |||||||||

Square 1 Financial, Cl A*^ | 13,660 | 366 | |||||||||

TD Ameritrade Holdings^ | 19,060 | 709 | |||||||||

Total Financials | 5,685 | ||||||||||

Health care—30.4% | |||||||||||

Actavis*^ | 1,480 | 440 | |||||||||

Aegerion Pharmaceuticals*^ | 6,320 | 165 | |||||||||

Alcobra*^ | 38,400 | 216 | |||||||||

AMAG Pharmaceuticals*^ | 8,610 | 471 | |||||||||

Amarin ADR*^ | 98,420 | 230 | |||||||||

Amphastar Pharmaceuticals*^ | 14,850 | 222 | |||||||||

ARIAD Pharmaceuticals* | 12,400 | 102 | |||||||||

Avalanche Biotechnologies* | 2,560 | 104 | |||||||||

Bristol-Myers Squibb^ | 3,060 | 197 | |||||||||

Cancer Genetics* | 15,570 | 122 | |||||||||

Cardiome Pharma*^ | 42,491 | 393 | |||||||||

Celladon* | 5,690 | 108 | |||||||||

Concert Pharmaceuticals*^ | 21,445 | 325 | |||||||||

CTI BioPharma* | 62,830 | 114 | |||||||||

DepoMed*^ | 29,917 | 670 | |||||||||

Dermira*^ | 8,710 | 134 | |||||||||

Discovery Laboratories*^ | 493,996 | 588 | |||||||||

TURNER FUNDS 2015 SEMIANNUAL REPORT 5

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Spectrum Fund

Shares | Value (000) | ||||||||||

Dynavax Technologies*^ | 7,160 | $ | 161 | ||||||||

Emergent Biosolutions*^ | 12,170 | 350 | |||||||||

Flamel Technologies SA ADR*^ | 26,679 | 480 | |||||||||

GlaxoSmithKline ADR | 3,670 | 169 | |||||||||

Heron Therapeutics*^ | 22,480 | 327 | |||||||||

Histogenics* | 5,680 | 57 | |||||||||

Horizon Pharma PLC*^ | 40,080 | 1,041 | |||||||||

IGI Laboratories*^ | 87,330 | 713 | |||||||||

Infinity Pharmaceuticals*^ | 11,380 | 159 | |||||||||

Intercept Pharmaceuticals*^ | 1,210 | 341 | |||||||||

Keryx Biopharmaceuticals* | 6,570 | 84 | |||||||||

McKesson^ | 1,280 | 290 | |||||||||

Medtronic PLC^ | 3,620 | 282 | |||||||||

Merck^ | 7,000 | 402 | |||||||||

NephroGenex*^ | 18,000 | 142 | |||||||||

Novartis AG ADR | 2,320 | 229 | |||||||||

Ocera Therapeutics* | 8,321 | 39 | |||||||||

Ohr Pharmaceutical* | 40,280 | 102 | |||||||||

Pfizer^ | 15,440 | 537 | |||||||||

Progenics Pharmaceuticals*^ | 59,750 | 357 | |||||||||

Prothena*^ | 33,690 | 1,285 | |||||||||

PTC Therapeutics*^ | 4,490 | 273 | |||||||||

Puma Biotechnology*^ | 820 | 194 | |||||||||

Retrophin*^ | 28,630 | 686 | |||||||||

Rigel Pharmaceuticals*^ | 39,770 | 142 | |||||||||

Sagent Pharmaceuticals*^ | 5,140 | 120 | |||||||||

Sanofi ADR | 4,760 | 235 | |||||||||

SteadyMed* | 9,460 | 80 | |||||||||

Thermo Fisher Scientific | 1,430 | 192 | |||||||||

Trovagene*^ | 18,950 | 129 | |||||||||

Unilife*^ | 39,526 | 158 | |||||||||

UnitedHealth Group, Cl B | 1,040 | 123 | |||||||||

Total Health care | 14,480 | ||||||||||

Industrials—9.9% | |||||||||||

AMETEK^ | 4,270 | 224 | |||||||||

Canadian Pacific Railway^ | 2,420 | 442 | |||||||||

Danaher Corp. | 1,420 | 121 | |||||||||

FedEx^ | 1,150 | 190 | |||||||||

Greenbrier^ | 4,630 | 269 | |||||||||

Honeywell International^ | 2,640 | 275 | |||||||||

Hub Group, Cl A*^ | 7,360 | 289 | |||||||||

Ingersoll-Rand^ | 1,810 | 123 | |||||||||

Kansas City Southern | 2,280 | 233 | |||||||||

Louis XIII Holdings* | 600,000 | 225 | |||||||||

Shares | Value (000) | ||||||||||

NN^ | 16,100 | $ | 404 | ||||||||

Ryder System^ | 4,130 | 392 | |||||||||

Spirit Airlines*^ | 7,100 | 550 | |||||||||

Swift Transportation*^ | 20,060 | 522 | |||||||||

TASER International*^ | 4,000 | 96 | |||||||||

United Rentals*^ | 2,230 | 203 | |||||||||

XPO Logistics* | 4,170 | 190 | |||||||||

Total Industrials | 4,748 | ||||||||||

Information technology—13.4% | |||||||||||

Actua*^ | 15,000 | 232 | |||||||||

Alliance Data Systems*^ | 1,280 | 379 | |||||||||

Apple^ | 2,290 | 285 | |||||||||

Applied Materials^ | 4,870 | 110 | |||||||||

Avago Technologies^ | 1,150 | 146 | |||||||||

Benefitfocus* | 2,200 | 81 | |||||||||

Cisco Systems^ | 6,110 | 168 | |||||||||

Criteo SA ADR*^ | 5,000 | 198 | |||||||||

Digimarc^ | 42,000 | 923 | |||||||||

Equinix^ | 620 | 144 | |||||||||

Facebook, Cl A*^ | 8,980 | 738 | |||||||||

Fortinet* | 2,200 | 77 | |||||||||

LinkedIn, Cl A*^ | 750 | 187 | |||||||||

Mobileye NV*^ | 17,160 | 721 | |||||||||

NXP Semiconductors*^ | 1,430 | 144 | |||||||||

Remark Media*^ (a) | 90,000 | 386 | |||||||||

Salesforce.com*^ | 3,040 | 203 | |||||||||

Texas Instruments^ | 5,110 | 292 | |||||||||

Visa, Cl A^ | 8,640 | 565 | |||||||||

WEX*^ | 3,830 | 411 | |||||||||

Total Information technology | 6,390 | ||||||||||

Materials—6.1% | |||||||||||

A. Schulman | 2,880 | 139 | |||||||||

Agnico Eagle Mines^ | 17,380 | 486 | |||||||||

Clearwater Paper Corp.*^ | 4,420 | 289 | |||||||||

Huntsman^ | 25,910 | 574 | |||||||||

Lyondellbasell Industries, Cl A | 850 | 75 | |||||||||

Methanex^ | 3,710 | 199 | |||||||||

Packaging Corp. of America^ | 4,370 | 342 | |||||||||

PolyOne | 2,610 | 97 | |||||||||

Potash Corp. of Saskatchewan^ | 18,060 | 582 | |||||||||

6 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Spectrum Fund

Shares | Value (000) | ||||||||||

Senomyx*^ | 30,000 | $ | 132 | ||||||||

Total Materials | 2,915 | ||||||||||

| Total Common stock (Cost $39,079)** | 44,858 | ||||||||||

Warrant—0.5% | |||||||||||

Financials—0.5% | |||||||||||

Atlas Mara Co-Nvest* (a) | 472,160 | 236 | |||||||||

Total Financials | 236 | ||||||||||

| Total Warrant (Cost $92)** | 236 | ||||||||||

| Total Investments—94.4% (Cost $39,171)** | 45,094 | ||||||||||

Segregated cash with brokers—37.4% | 17,863 | ||||||||||

| Securities sold short—(60.3)% (Proceeds $(28,702))** | (28,805 | ) | |||||||||

Net Other assets (liabilities)—28.5% | 13,629 | ||||||||||

Net Assets—100.0% | $ | 47,781 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

(a) These securities have been deemed illiquid by the Adviser and represent 1.30% of Net Assets.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 7

FINANCIAL STATEMENTS (Unaudited)

Schedule of securities sold short

Turner Spectrum Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—42.5% | |||||||||||

Consumer discretionary—8.7% | |||||||||||

Autoliv | 4,240 | $ | 499 | ||||||||

AutoZone | 940 | 641 | |||||||||

Bed Bath & Beyond | 1,300 | 100 | |||||||||

Buffalo Wild Wings | 850 | 154 | |||||||||

CarMax | 5,510 | 380 | |||||||||

Discovery Communications, Cl A | 3,600 | 111 | |||||||||

Ford Motor | 28,540 | 461 | |||||||||

Group 1 Automotive, Inc. | 3,050 | 263 | |||||||||

KB Home | 17,700 | 276 | |||||||||

Macy's | 2,740 | 178 | |||||||||

Mattel | 7,430 | 170 | |||||||||

Swatch Group AG, Bearer Shares | 431 | 183 | |||||||||

Tumi Holdings | 15,660 | 383 | |||||||||

Yum! Brands | 4,250 | 335 | |||||||||

Total Consumer discretionary | 4,134 | ||||||||||

Consumer staples—1.7% | |||||||||||

Costco Wholesale | 1,210 | 183 | |||||||||

CVS Caremark | 1,340 | 138 | |||||||||

Hain Celestial Group | 1,510 | 97 | |||||||||

Procter & Gamble | 1,480 | 121 | |||||||||

Wal-Mart Stores | 3,170 | 261 | |||||||||

Total Consumer staples | 800 | ||||||||||

Energy—1.0% | |||||||||||

Continental Resources | 1,790 | 78 | |||||||||

Schlumberger | 4,850 | 405 | |||||||||

Total Energy | 483 | ||||||||||

Financials—5.8% | |||||||||||

Artisan Partners Asset Management | 4,220 | 192 | |||||||||

Camden Property Trust | 4,450 | 348 | |||||||||

Comerica | 2,250 | 102 | |||||||||

Commerce Bancshares, Inc. | 4,350 | 184 | |||||||||

Franklin Resources | 9,550 | 489 | |||||||||

Host Hotels & Resorts | 2,260 | 46 | |||||||||

Prudential Financial, Inc. | 1,450 | 116 | |||||||||

Realogy Holdings | 4,370 | 199 | |||||||||

Royal Bank of Canada | 6,340 | 382 | |||||||||

State Street | 1,310 | 96 | |||||||||

T. Rowe Price Group | 1,550 | 126 | |||||||||

Unum Group | 7,870 | 265 | |||||||||

Shares | Value (000) | ||||||||||

| Waddell & Reed Financial, Inc., Cl A | 4,760 | $ | 236 | ||||||||

Total Financials | 2,781 | ||||||||||

Health care—10.6% | |||||||||||

Acadia Pharmaceuticals | 2,580 | 84 | |||||||||

Acorda Therapeutics | 6,370 | 212 | |||||||||

Aetna | 1,620 | 173 | |||||||||

Agios Pharmaceuticals | 2,510 | 237 | |||||||||

Alnylam Pharmaceuticals | 1,350 | 141 | |||||||||

ANI Pharmaceuticals | 4,840 | 302 | |||||||||

Anika Therapeutics | 8,990 | 369 | |||||||||

Baxter International | 810 | 55 | |||||||||

BIO-Rad Laboratories, Cl A | 2,180 | 295 | |||||||||

Bluebird Bio | 1,900 | 229 | |||||||||

DaVita | 2,880 | 234 | |||||||||

ENDO International PLC | 1,780 | 160 | |||||||||

Express Scripts Holdings | 1,300 | 113 | |||||||||

Gilead Sciences | 1,760 | 173 | |||||||||

Humana | 920 | 164 | |||||||||

Icon | 1,650 | 116 | |||||||||

ImmunoGen | 21,310 | 191 | |||||||||

Johnson & Johnson | 630 | 63 | |||||||||

Juno Therapeutics | 2,850 | 173 | |||||||||

Kite Pharma | 5,280 | 304 | |||||||||

Lannett | 2,050 | 139 | |||||||||

Mettler-Toledo International | 720 | 237 | |||||||||

Nevro | 4,060 | 195 | |||||||||

Ophthotech | 4,590 | 214 | |||||||||

PAREXEL International | 1,690 | 117 | |||||||||

Radius Health | 1,900 | 78 | |||||||||

United Therapeutics | 1,000 | 172 | |||||||||

WellCare Health Plans | 1,650 | 151 | |||||||||

Total Health care | 5,091 | ||||||||||

Industrials—8.4% | |||||||||||

| 3M | 1,930 | 318 | |||||||||

Beacon Roofing Supply | 4,650 | 146 | |||||||||

C.H. Robinson Worldwide | 5,530 | 405 | |||||||||

| CNH Industrial NV | 30,150 | 246 | |||||||||

Deere | 8,960 | 786 | |||||||||

Hunt (JB) Transportation Services | 3,370 | 288 | |||||||||

Norfolk Southern | 3,890 | 400 | |||||||||

Owens Corning | 10,730 | 466 | |||||||||

Parker Hannifin | 590 | 70 | |||||||||

8 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of securities sold short

Turner Spectrum Fund

Shares | Value (000) | ||||||||||

Pentair PLC | 1,560 | $ | 98 | ||||||||

Rockwell Automation | 3,570 | 414 | |||||||||

Stericycle | 710 | 100 | |||||||||

Titan Machinery | 20,241 | 270 | |||||||||

Total Industrials | 4,007 | ||||||||||

Information technology—4.3% | |||||||||||

| ASML Holding NV | 530 | 54 | |||||||||

Cimpress NV | 2,520 | 213 | |||||||||

Citrix Systems | 1,240 | 79 | |||||||||

eBay | 1,250 | 72 | |||||||||

EMC | 2,720 | 70 | |||||||||

| Fairchild Semiconductor International | 5,750 | 105 | |||||||||

KLA-Tencor | 1,860 | 108 | |||||||||

Micron Technology, Inc. | 4,530 | 123 | |||||||||

Microsoft | 4,720 | 192 | |||||||||

Tech Data | 1,290 | 75 | |||||||||

Trimble Navigation | 18,990 | 478 | |||||||||

1,010 | 51 | ||||||||||

Western Union | 17,750 | 368 | |||||||||

Yelp | 1,100 | 52 | |||||||||

Total Information technology | 2,040 | ||||||||||

Materials—2.0% | |||||||||||

Agrium | 1,340 | 140 | |||||||||

Airgas | 2,410 | 256 | |||||||||

Cia de Minas Buenaventura SA ADR | 9,980 | 101 | |||||||||

FMC | 760 | 44 | |||||||||

Monsanto | 850 | 96 | |||||||||

Newmont Mining | 15,130 | 327 | |||||||||

Total Materials | 964 | ||||||||||

| Total Common stock (Proceeds $20,077)* | 20,300 | ||||||||||

Exchange traded funds—17.8% | |||||||||||

| Consumer Staples Select Sector SPDR Fund | 4,940 | 241 | |||||||||

Energy Select Sector SPDR Fund | 7,180 | 557 | |||||||||

| Health Care Select Sector SPDR Fund | 18,330 | 1,329 | |||||||||

| iShares NASDAQ Biotechnology ETF | 3,160 | 1,085 | |||||||||

iShares Russell 2000 Growth ETF | 1,200 | 182 | |||||||||

Shares | Value (000) | ||||||||||

iShares Russell 2000 Growth ETF | 11,340 | $ | 1,410 | ||||||||

iShares U.S. Financials ETF | 5,290 | 471 | |||||||||

Market Vectors Oil Service ETF | 14,730 | 497 | |||||||||

SPDR S&P 500 ETF Trust | 3,600 | 743 | |||||||||

SPDR S&P MidCap 400 ETF Trust | 900 | 250 | |||||||||

| SPDR S&P Oil & Gas Exploration & Production ETF | 4,850 | 251 | |||||||||

Teucrium Corn Fund ETF | 15,092 | 373 | |||||||||

| Vanguard Consumer Discretionary ETF | 2,310 | 283 | |||||||||

Vanguard S&P 500 ETF | 1,940 | 367 | |||||||||

Vanguard Small-Cap Growth ETF | 2,020 | 266 | |||||||||

| VelocityShares Daily Inverse VIX Short-Term ETN | 5,780 | 200 | |||||||||

| Total Exchange traded funds (Proceeds $8,625)* | 8,505 | ||||||||||

| Total Securities sold short—60.3% (Proceeds $28,702)* | $ | 28,805 | |||||||||

Percentages disclosed are based on total net assets of the Fund at March 31, 2015.

* This number is listed in thousands.

ADR — American Depositary Receipt

Cl — Class

ETF — Exchange Traded Fund

ETN — Exchange Traded Note

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 9

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Titan Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—80.7%† | |||||||||||

Consumer discretionary—13.9% | |||||||||||

Amazon.com* | 810 | $ | 301 | ||||||||

Bloomin' Brands | 7,100 | 173 | |||||||||

CBS, Cl B | 5,820 | 353 | |||||||||

Cinemark Holdings | 4,220 | 190 | |||||||||

Dollar Tree* | 2,180 | 177 | |||||||||

Hilton Worldwide Holdings*^ | 4,090 | 121 | |||||||||

Nike, Cl B | 1,840 | 185 | |||||||||

Walt Disney | 1,460 | 153 | |||||||||

Total Consumer discretionary | 1,653 | ||||||||||

Consumer staples—8.9% | |||||||||||

Constellation Brands, Cl A* | 2,190 | 254 | |||||||||

Monster Beverage*^ | 850 | 118 | |||||||||

PepsiCo | 1,550 | 148 | |||||||||

Rite Aid* | 30,500 | 266 | |||||||||

Sprouts Farmers Market* | 4,200 | 148 | |||||||||

WhiteWave Foods, Cl A* | 2,800 | 124 | |||||||||

Total Consumer staples | 1,058 | ||||||||||

Energy—2.7% | |||||||||||

Concho Resources* | 1,690 | 196 | |||||||||

Range Resources | 2,510 | 131 | |||||||||

Total Energy | 327 | ||||||||||

Financials—8.4% | |||||||||||

BlackRock | 1,010 | 370 | |||||||||

CME Group | 2,510 | 238 | |||||||||

East West Bancorp | 3,760 | 152 | |||||||||

TD Ameritrade Holdings^ | 6,580 | 245 | |||||||||

Total Financials | 1,005 | ||||||||||

Health care—13.2% | |||||||||||

Actavis* | 1,110 | 330 | |||||||||

McKesson^ | 1,570 | 355 | |||||||||

Medtronic PLC | 4,440 | 346 | |||||||||

Pfizer | 4,420 | 154 | |||||||||

Thermo Fisher Scientific | 1,770 | 238 | |||||||||

UnitedHealth Group, Cl B | 1,240 | 147 | |||||||||

Total Health care | 1,570 | ||||||||||

Shares | Value (000) | ||||||||||

Industrials—6.6% | |||||||||||

Canadian Pacific Railway | 800 | $ | 146 | ||||||||

Danaher Corp. | 1,740 | 148 | |||||||||

Honeywell International | 3,240 | 338 | |||||||||

Ingersoll-Rand^ | 2,210 | 150 | |||||||||

Total Industrials | 782 | ||||||||||

Information technology—25.2% | |||||||||||

Apple^ | 2,840 | 353 | |||||||||

Applied Materials | 6,040 | 136 | |||||||||

Avago Technologies | 1,400 | 178 | |||||||||

Benefitfocus* | 2,700 | 99 | |||||||||

Cisco Systems | 7,570 | 208 | |||||||||

Equinix | 780 | 182 | |||||||||

Facebook, Cl A*^ | 4,840 | 398 | |||||||||

Fortinet* | 2,700 | 94 | |||||||||

LinkedIn, Cl A*^ | 920 | 230 | |||||||||

Mobileye NV* | 2,100 | 88 | |||||||||

NXP Semiconductors* | 1,740 | 175 | |||||||||

Salesforce.com*^ | 3,770 | 252 | |||||||||

Texas Instruments | 6,210 | 355 | |||||||||

Visa, Cl A | 4,080 | 267 | |||||||||

Total Information technology | 3,015 | ||||||||||

Materials—1.8% | |||||||||||

Lyondellbasell Industries, Cl A | 1,040 | 91 | |||||||||

Potash Corp. of Saskatchewan | 3,690 | 119 | |||||||||

Total Materials | 210 | ||||||||||

| Total Common stock (Cost $8,577)** | 9,620 | ||||||||||

10 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Titan Fund

Shares | Value (000) | ||||||||||

Cash equivalent—18.9% | |||||||||||

| BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.083%‡ | 2,255,827 | $ | 2,256 | ||||||||

| Total Cash equivalent (Cost $2,256)** | 2,256 | ||||||||||

| Total Investments—99.6% (Cost $10,833)** | 11,876 | ||||||||||

Segregated cash with brokers—45.4% | 5,416 | ||||||||||

| Securities sold short—(45.5)% (Proceeds $(5,452))** | (5,431 | ) | |||||||||

Net Other assets (liabilities)—0.5% | 63 | ||||||||||

Net Assets—100.0% | $ | 11,924 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

^ All or a portion of the shares have been committed as collateral for open short positions.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2015.

Cl — Class

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 11

FINANCIAL STATEMENTS (Unaudited)

Schedule of securities sold short

Turner Titan Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—35.4% | |||||||||||

Consumer discretionary—4.6% | |||||||||||

Bed Bath & Beyond | 1,590 | $ | 122 | ||||||||

Discovery Communications, Cl A | 4,440 | 137 | |||||||||

Tumi Holdings | 5,710 | 140 | |||||||||

Yum! Brands | 1,930 | 151 | |||||||||

Total Consumer discretionary | 550 | ||||||||||

Consumer staples—1.0% | |||||||||||

Hain Celestial Group | 1,850 | 118 | |||||||||

Total Consumer staples | 118 | ||||||||||

Energy—2.4% | |||||||||||

Continental Resources | 2,180 | 95 | |||||||||

Schlumberger | 2,270 | 190 | |||||||||

Total Energy | 285 | ||||||||||

Financials—5.8% | |||||||||||

Comerica | 2,660 | 120 | |||||||||

Franklin Resources | 1,920 | 99 | |||||||||

Host Hotels & Resorts | 2,800 | 57 | |||||||||

Prudential Financial | 1,750 | 140 | |||||||||

State Street | 1,590 | 117 | |||||||||

T. Rowe Price Group | 1,900 | 153 | |||||||||

Total Financials | 686 | ||||||||||

Health care—2.4% | |||||||||||

Baxter International | 930 | 64 | |||||||||

Express Scripts Holdings | 1,610 | 140 | |||||||||

Johnson & Johnson | 770 | 77 | |||||||||

Total Health care | 281 | ||||||||||

Industrials—7.0% | |||||||||||

C.H. Robinson Worldwide | 1,610 | 118 | |||||||||

Norfolk Southern | 1,440 | 148 | |||||||||

Parker Hannifin | 720 | 86 | |||||||||

Pentair PLC | 1,840 | 116 | |||||||||

Rockwell Automation | 2,110 | 244 | |||||||||

Stericycle | 870 | 122 | |||||||||

Total Industrials | 834 | ||||||||||

Information technology—10.8% | |||||||||||

| ASML Holding NV | 660 | 67 | |||||||||

Citrix Systems | 1,440 | 92 | |||||||||

eBay | 1,530 | 88 | |||||||||

Shares | Value (000) | ||||||||||

EMC | 3,220 | $ | 82 | ||||||||

| Fairchild Semiconductor International | 7,100 | 129 | |||||||||

KLA-Tencor | 2,300 | 134 | |||||||||

Micron Technology | 5,610 | 153 | |||||||||

Microsoft | 5,840 | 238 | |||||||||

Tech Data | 1,570 | 91 | |||||||||

1,240 | 62 | ||||||||||

Western Union | 4,600 | 96 | |||||||||

Yelp | 1,340 | 63 | |||||||||

Total Information technology | 1,295 | ||||||||||

Materials—1.4% | |||||||||||

FMC | 940 | 54 | |||||||||

Monsanto | 1,050 | 118 | |||||||||

Total Materials | 172 | ||||||||||

| Total Common stock (Proceeds $4,244)* | 4,221 | ||||||||||

Exchange traded funds—10.1% | |||||||||||

SPDR S&P 500 ETF Trust | 4,400 | 908 | |||||||||

SPDR S&P MidCap 400 ETF Trust | 1,090 | 302 | |||||||||

| Total Exchange traded funds (Proceeds $1,208)* | 1,210 | ||||||||||

| Total Securities sold short—45.5% (Proceeds $5,452)* | $ | 5,431 | |||||||||

Percentages disclosed are based on total net assets of the Fund at March 31, 2015.

* This number is listed in thousands.

Cl — Class

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depositary Receipt

The accompanying notes are an integral part of the financial statements.

12 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Emerging Growth Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—96.8%† | |||||||||||

Consumer discretionary—13.8% | |||||||||||

Black Diamond*^ | 29,390 | $ | 278 | ||||||||

Boot Barn Holdings* | 68,580 | 1,640 | |||||||||

Carmike Cinemas* | 63,680 | 2,140 | |||||||||

Kona Grill* | 85,000 | 2,415 | |||||||||

LGI Homes*^ | 34,290 | 571 | |||||||||

Lithia Motors, Cl A | 11,760 | 1,169 | |||||||||

Rentrak*^ | 20,000 | 1,111 | |||||||||

The Habit Restaurants, Cl A*^ | 56,960 | 1,831 | |||||||||

The New Home* | 24,490 | 391 | |||||||||

Zoe's Kitchen*^ | 68,580 | 2,283 | |||||||||

Total Consumer discretionary | 13,829 | ||||||||||

Consumer staples—2.9% | |||||||||||

Boston Beer, Cl A* | 3,260 | 872 | |||||||||

Boulder Brands* | 63,340 | 604 | |||||||||

Smart & Final Stores* | 78,370 | 1,379 | |||||||||

Total Consumer staples | 2,855 | ||||||||||

Energy—2.5% | |||||||||||

Callon Petroleum* | 58,780 | 439 | |||||||||

Diamondback Energy* | 7,500 | 576 | |||||||||

Independence Contract Drilling* | 83,270 | 580 | |||||||||

Panhandle Oil & Gas, Cl A | 20,400 | 404 | |||||||||

PDC Energy* | 8,820 | 477 | |||||||||

Total Energy | 2,476 | ||||||||||

Financials—6.7% | |||||||||||

Banc of California | 117,560 | 1,447 | |||||||||

Bryn Mawr Bank | 53,880 | 1,638 | |||||||||

Hanmi Financial | 59,580 | 1,260 | |||||||||

Square 1 Financial, Cl A* | 88,170 | 2,361 | |||||||||

Total Financials | 6,706 | ||||||||||

Health care—31.0% | |||||||||||

Acadia Healthcare*^ | 10,780 | 772 | |||||||||

Akorn* | 20,000 | 950 | |||||||||

AMAG Pharmaceuticals* | 15,000 | 820 | |||||||||

Anacor Pharmaceuticals* | 15,000 | 868 | |||||||||

Atricure*^ | 78,370 | 1,606 | |||||||||

Avalanche Biotechnologies* | 14,690 | 595 | |||||||||

| Biodelivery Sciences International*^ | 75,000 | 788 | |||||||||

Biotelemetry* | 79,980 | 708 | |||||||||

Shares | Value (000) | ||||||||||

Cardiovascular Systems*^ | 35,000 | $ | 1,366 | ||||||||

DepoMed* | 63,680 | 1,427 | |||||||||

Discovery Laboratories* | 367,030 | 437 | |||||||||

Fluidigm*^ | 24,490 | 1,031 | |||||||||

HealthEquity*^ | 68,580 | 1,714 | |||||||||

Horizon Pharma PLC* | 73,470 | 1,908 | |||||||||

IGI Laboratories*^ | 97,960 | 799 | |||||||||

Inogen* | 19,590 | 627 | |||||||||

Intersect ENT*^ | 71,510 | 1,847 | |||||||||

LDR Holding*^ | 65,000 | 2,382 | |||||||||

NanoString Technologies*^ | 85,000 | 866 | |||||||||

Natus Medical* | 42,120 | 1,662 | |||||||||

Prothena* | 24,490 | 934 | |||||||||

PTC Therapeutics* | 18,000 | 1,095 | |||||||||

Receptos* | 17,000 | 2,804 | |||||||||

Repligen* | 48,980 | 1,487 | |||||||||

Ultragenyx Pharmaceutical* | 10,000 | 621 | |||||||||

Vascular Solutions* | 29,390 | 891 | |||||||||

Total Health care | 31,005 | ||||||||||

Industrials—7.8% | |||||||||||

Astronics* | 22,530 | 1,661 | |||||||||

Covenant Transport Group, Cl A* | 42,120 | 1,397 | |||||||||

Echo Global Logistics*^ | 35,000 | 954 | |||||||||

Multi-Color | 19,590 | 1,358 | |||||||||

PGT* | 68,580 | 766 | |||||||||

TASER International*^ | 44,080 | 1,063 | |||||||||

WageWorks*^ | 12,190 | 650 | |||||||||

Total Industrials | 7,849 | ||||||||||

Information technology—29.0% | |||||||||||

Actua* | 122,460 | 1,897 | |||||||||

Ambarella*^ | 40,000 | 3,026 | |||||||||

BroadSoft* | 30,000 | 1,004 | |||||||||

Callidus Software* | 90,000 | 1,141 | |||||||||

Canadian Solar* | 24,490 | 818 | |||||||||

Criteo SA ADR* | 48,980 | 1,935 | |||||||||

Demandware*^ | 17,630 | 1,074 | |||||||||

Digimarc^ | 58,000 | 1,273 | |||||||||

FARO Technologies*^ | 22,530 | 1,400 | |||||||||

Fleetmatics Group PLC*^ | 24,000 | 1,076 | |||||||||

Immersion* | 68,580 | 630 | |||||||||

Inphi* | 88,170 | 1,572 | |||||||||

Manhattan Associates* | 21,550 | 1,091 | |||||||||

Monolithic Power Systems | 39,190 | 2,063 | |||||||||

TURNER FUNDS 2015 SEMIANNUAL REPORT 13

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Emerging Growth Fund

Shares | Value (000) | ||||||||||

Pixelworks*^ | 160,000 | $ | 803 | ||||||||

Proofpoint* | 44,080 | 2,610 | |||||||||

SPS Commerce* | 14,690 | 986 | |||||||||

Textura*^ | 34,290 | 932 | |||||||||

The Rubicon Project* | 137,150 | 2,458 | |||||||||

TubeMogul*^ | 53,520 | 740 | |||||||||

Workiva*^ | 34,330 | 494 | |||||||||

Total Information technology | 29,023 | ||||||||||

Materials—2.0% | |||||||||||

Headwaters* | 48,980 | 899 | |||||||||

KapStone Paper & Packaging | 19,590 | 643 | |||||||||

Senomyx*^ | 108,680 | 479 | |||||||||

Total Materials | 2,021 | ||||||||||

Telecommunication services—1.1% | |||||||||||

inContact* | 97,960 | 1,068 | |||||||||

Total Telecommunication services | 1,068 | ||||||||||

| Total Common stock (Cost $73,825)** | 96,832 | ||||||||||

Cash equivalent — 28.6% | |||||||||||

| BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.083%‡ (1) | 28,597,054 | 28,597 | |||||||||

| Total Cash equivalent (Cost $28,597)** | 28,597 | ||||||||||

| Total Investments—125.4% (Cost $102,422)** | 125,429 | ||||||||||

Net Other assets (liabilities)—(25.4)% | (25,400 | ) | |||||||||

Net Assets—100.0% | $ | 100,029 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2015 was $25,835**.

^ Security fully or partially on loan at March 31, 2015. The total value of securities on loan at March 31, 2015 was $23,173**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2015.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

14 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Midcap Growth Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—97.4%† | |||||||||||

Consumer discretionary—15.8% | |||||||||||

Advance Auto Parts | 34,360 | $ | 5,143 | ||||||||

Bloomin' Brands | 67,790 | 1,649 | |||||||||

BorgWarner | 62,670 | 3,790 | |||||||||

Chipotle Mexican Grill* | 6,270 | 4,079 | |||||||||

Dollar Tree* | 84,700 | 6,874 | |||||||||

GoPro, Cl A* | 49,790 | 2,161 | |||||||||

Home Depot | 13,000 | 1,477 | |||||||||

Nike, Cl B | 11,790 | 1,183 | |||||||||

Polaris Industries^ | 18,310 | 2,584 | |||||||||

| Starwood Hotels & Resorts Worldwide | 42,040 | 3,510 | |||||||||

Walt Disney | 21,180 | 2,222 | |||||||||

Wynn Resorts | 14,675 | 1,847 | |||||||||

Total Consumer discretionary | 36,519 | ||||||||||

Consumer staples—10.3% | |||||||||||

Hershey | 35,530 | 3,585 | |||||||||

Keurig Green Mountain | 24,220 | 2,706 | |||||||||

Mead Johnson Nutrition, Cl A | 53,450 | 5,373 | |||||||||

Monster Beverage* | 24,830 | 3,436 | |||||||||

Sprouts Farmers Market* | 70,190 | 2,473 | |||||||||

WhiteWave Foods, Cl A* | 141,890 | 6,292 | |||||||||

Total Consumer staples | 23,865 | ||||||||||

Energy—0.8% | |||||||||||

Concho Resources* | 16,698 | 1,936 | |||||||||

Total Energy | 1,936 | ||||||||||

Financials—10.2% | |||||||||||

Affiliated Managers Group* | 24,980 | 5,365 | |||||||||

Intercontinental Exchange Group | 12,770 | 2,979 | |||||||||

Moody's | 45,810 | 4,755 | |||||||||

Signature Bank* | 43,600 | 5,650 | |||||||||

TD Ameritrade Holdings | 130,145 | 4,849 | |||||||||

Total Financials | 23,598 | ||||||||||

Health care—18.3% | |||||||||||

Actavis* | 12,020 | 3,577 | |||||||||

Alexion Pharmaceuticals* | 28,084 | 4,867 | |||||||||

AmerisourceBergen, Cl A | 26,080 | 2,965 | |||||||||

Celgene* | 14,560 | 1,678 | |||||||||

Cooper | 16,910 | 3,169 | |||||||||

HCA Holdings* | 25,020 | 1,882 | |||||||||

Shares | Value (000) | ||||||||||

Horizon Pharma PLC* | 106,610 | $ | 2,769 | ||||||||

Intercept Pharmaceuticals* | 8,270 | 2,332 | |||||||||

Jazz Pharmaceuticals* | 26,610 | 4,598 | |||||||||

McKesson | 7,770 | 1,758 | |||||||||

Mylan NV* | 83,310 | 4,945 | |||||||||

Regeneron Pharmaceuticals* | 9,030 | 4,077 | |||||||||

Veeva Systems, Cl A*^ | 85,360 | 2,179 | |||||||||

Vertex Pharmaceuticals* | 14,680 | 1,732 | |||||||||

Total Health care | 42,528 | ||||||||||

Industrials—6.7% | |||||||||||

AMETEK | 70,010 | 3,678 | |||||||||

Honeywell International | 22,480 | 2,345 | |||||||||

Ingersoll-Rand | 43,440 | 2,957 | |||||||||

Kansas City Southern | 19,390 | 1,979 | |||||||||

Roper Industries | 26,280 | 4,521 | |||||||||

Total Industrials | 15,480 | ||||||||||

Information technology—28.8% | |||||||||||

Adobe Systems* | 17,180 | 1,270 | |||||||||

Alliance Data Systems*^ | 19,950 | 5,910 | |||||||||

Apple | 36,080 | 4,489 | |||||||||

Applied Materials | 174,990 | 3,948 | |||||||||

Avago Technologies | 53,620 | 6,809 | |||||||||

Cavium*^ | 109,769 | 7,774 | |||||||||

Facebook, Cl A* | 29,230 | 2,403 | |||||||||

HomeAway* | 93,930 | 2,834 | |||||||||

LinkedIn, Cl A* | 23,240 | 5,807 | |||||||||

Mobileye NV* | 27,680 | 1,163 | |||||||||

NXP Semiconductors* | 67,050 | 6,729 | |||||||||

Salesforce.com* | 33,600 | 2,245 | |||||||||

ServiceNow*^ | 66,530 | 5,241 | |||||||||

SunEdison* | 154,620 | 3,711 | |||||||||

Visa, Cl A | 39,440 | 2,580 | |||||||||

Workday, Cl A*^ | 45,992 | 3,882 | |||||||||

Total Information technology | 66,795 | ||||||||||

Materials—4.9% | |||||||||||

International Flavors & Fragrances | 16,310 | 1,915 | |||||||||

Methanex | 58,560 | 3,137 | |||||||||

PolyOne | 66,100 | 2,469 | |||||||||

PPG Industries | 17,280 | 3,897 | |||||||||

Total Materials | 11,418 | ||||||||||

TURNER FUNDS 2015 SEMIANNUAL REPORT 15

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Midcap Growth Fund

Shares | Value (000) | ||||||||||

Telecommunication services—1.6% | |||||||||||

SBA Communications, Cl A* | 31,230 | $ | 3,657 | ||||||||

Total Telecommunication services | 3,657 | ||||||||||

| Total Common stock (Cost $187,110)** | 225,796 | ||||||||||

Cash equivalent—11.% | |||||||||||

| BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.083%‡ (1) | 26,121,486 | 26,121 | |||||||||

| Total Cash equivalent (Cost $26,121)** | 26,121 | ||||||||||

| Total Investments—108.7% (Cost $213,231)** | 251,917 | ||||||||||

Net Other assets (liabilities)—(8.7)% | (20,083 | ) | |||||||||

Net Assets—100.0% | $ | 231,834 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2015 was $20,421**.

^ Security fully or partially on loan at March 31, 2015. The total value of securities on loan at March 31, 2015 was $19,709**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2015.

Cl — Class

The accompanying notes are an integral part of the financial statements.

16 TURNER FUNDS 2015 SEMIANNUAL REPORT

Schedule of investments

Turner Small Cap Growth Fund

March 31, 2015

Shares | Value (000) | ||||||||||

Common stock—98.5%† | |||||||||||

Consumer discretionary—16.6% | |||||||||||

Burlington Stores* | 9,500 | $ | 564 | ||||||||

Core-Mark Holding | 12,290 | 790 | |||||||||

Gentherm* | 8,000 | 404 | |||||||||

G-III Apparel Group*^ | 8,000 | 901 | |||||||||

La Quinta Holdings* | 39,170 | 928 | |||||||||

Lithia Motors, Cl A | 10,000 | 995 | |||||||||

MDC Partners | 26,000 | 737 | |||||||||

Monro Muffler Brake | 10,000 | 651 | |||||||||

Papa John's International | 8,000 | 494 | |||||||||

Restoration Hardware Holdings* | 4,730 | 469 | |||||||||

Skechers U.S.A., Cl A* | 10,000 | 719 | |||||||||

TRI Pointe Homes* | 50,000 | 772 | |||||||||

Zoe's Kitchen* | 28,350 | 944 | |||||||||

Total Consumer discretionary | 9,368 | ||||||||||

Consumer staples—0.7% | |||||||||||

Boston Beer, Cl A* | 1,390 | 372 | |||||||||

Total Consumer staples | 372 | ||||||||||

Energy—1.9% | |||||||||||

Diamondback Energy* | 14,180 | 1,090 | |||||||||

Total Energy | 1,090 | ||||||||||

Financials—6.3% | |||||||||||

Bank of the Ozarks^ | 26,500 | 978 | |||||||||

Essent Group* | 31,230 | 747 | |||||||||

Kennedy-Wilson Holdings | 14,000 | 366 | |||||||||

MarketAxess Holdings | 7,500 | 622 | |||||||||

PrivateBancorp | 23,000 | 809 | |||||||||

Total Financials | 3,522 | ||||||||||

Health care—30.1% | |||||||||||

ABIOMED* | 9,450 | 676 | |||||||||

Acadia Healthcare*^ | 9,450 | 677 | |||||||||

Akorn* | 6,000 | 285 | |||||||||

AMAG Pharmaceuticals* | 14,180 | 775 | |||||||||

Amphastar Pharmaceuticals* | 38,120 | 570 | |||||||||

Celldex Theraputics*^ | 18,000 | 502 | |||||||||

Cepheid* | 5,500 | 313 | |||||||||

CTI BioPharma* | 145,000 | 262 | |||||||||

DepoMed* | 19,000 | 426 | |||||||||

Dyax* | 30,000 | 503 | |||||||||

ExamWorks Group* | 11,340 | 472 | |||||||||

Shares | Value (000) | ||||||||||

Fluidigm*^ | 20,790 | $ | 875 | ||||||||

Horizon Pharma PLC* | 40,000 | 1,039 | |||||||||

Insys Therapeutics* | 10,000 | 581 | |||||||||

Isis Pharmaceuticals*^ | 3,500 | 223 | |||||||||

LDR Holding* | 43,200 | 1,582 | |||||||||

LifePoint Hospitals* | 9,000 | 661 | |||||||||

NxStage Medical* | 35,000 | 606 | |||||||||

Prothena* | 26,460 | 1,009 | |||||||||

PTC Therapeutics* | 6,500 | 396 | |||||||||

Puma Biotechnology*^ | 4,200 | 992 | |||||||||

Receptos* | 6,140 | 1,012 | |||||||||

Repligen* | 38,460 | 1,167 | |||||||||

Spectranetics Corp.* | 20,000 | 695 | |||||||||

Veeva Systems, Cl A*^ | 25,000 | 638 | |||||||||

Total Health care | 16,937 | ||||||||||

Industrials—10.9% | |||||||||||

Apogee Enterprises | 14,180 | 613 | |||||||||

Chart Industries* | 12,290 | 431 | |||||||||

Forward Air | 9,450 | 513 | |||||||||

Greenbrier^ | 18,630 | 1,081 | |||||||||

Insperity | 7,090 | 371 | |||||||||

Knight Transportation^ | 12,290 | 396 | |||||||||

TASER International*^ | 21,770 | 525 | |||||||||

Trex* | 12,130 | 661 | |||||||||

WageWorks* | 5,000 | 267 | |||||||||

XPO Logistics*^ | 28,350 | 1,288 | |||||||||

Total Industrials | 6,146 | ||||||||||

Information technology—27.9% | |||||||||||

Ambarella* | 12,000 | 909 | |||||||||

Belden | 11,340 | 1,061 | |||||||||

Cavium*^ | 19,000 | 1,346 | |||||||||

CoreLogic* | 20,000 | 705 | |||||||||

Criteo SA ADR* | 20,000 | 790 | |||||||||

Demandware*^ | 13,000 | 792 | |||||||||

Digimarc^ (a) | 95,000 | 2,084 | |||||||||

| Endurance International Group Holdings*^ | 18,900 | 360 | |||||||||

Envestnet*^ | 15,000 | 841 | |||||||||

Guidewire Software* | 20,790 | 1,094 | |||||||||

HubSpot* | 24,000 | 958 | |||||||||

Integrated Device Technology* | 34,000 | 681 | |||||||||

Manhattan Associates* | 8,000 | 405 | |||||||||

Monolithic Power Systems | 15,120 | 796 | |||||||||

TURNER FUNDS 2015 SEMIANNUAL REPORT 17

FINANCIAL STATEMENTS (Unaudited)

Schedule of investments

Turner Small Cap Growth Fund

Shares | Value (000) | ||||||||||

Proofpoint* | 11,340 | $ | 672 | ||||||||

Qorvo* | 8,510 | 678 | |||||||||

Synaptics* | 8,000 | 650 | |||||||||

The Ultimate Software Group* | 5,200 | 884 | |||||||||

Total Information technology | 15,707 | ||||||||||

Materials—4.1% | |||||||||||

Headwaters* | 55,420 | 1,016 | |||||||||

Platform Specialty Products* | 25,000 | 642 | |||||||||

PolyOne | 6,000 | 224 | |||||||||

Senomyx*^ | 100,000 | 441 | |||||||||

Total Materials | 2,323 | ||||||||||

| Total Common stock (Cost $43,536)** | 55,464 | ||||||||||

Cash equivalent—22.6% | |||||||||||

| BlackRock Liquidity Funds TempCash Portfolio, Dollar Shares, 0.083%‡ (1) | 12,693,853 | 12,694 | |||||||||

| Total Cash equivalent (Cost $12,694)** | 12,694 | ||||||||||

| Total Investments—121.1% (Cost $56,230)** | 68,158 | ||||||||||

Net Other assets (liabilities)—(21.1)% | (11,857 | ) | |||||||||

Net Assets—100.0% | $ | 56,301 | |||||||||

* Non-income producing security.

** This number is listed in thousands.

(1) A portion of the Fund's position in this security was purchased with cash collateral received from securities lending. The total value of such security at March 31, 2015 was $11,842**.

^ Security fully or partially on loan at March 31, 2015. The total value of securities on loan at March 31, 2015 was $10,703**. Certain of these securities may have been sold prior to period end.

† More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes.

‡ Rate shown is the 7-day effective yield as of March 31, 2015.

(a) These securities have been deemed illiquid by the Adviser and represent 3.70% of Net Assets.

ADR — American Depositary Receipt

Cl — Class

The accompanying notes are an integral part of the financial statements.

18 TURNER FUNDS 2015 SEMIANNUAL REPORT

SECTOR WEIGHTINGS (Unaudited)

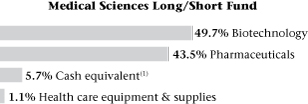

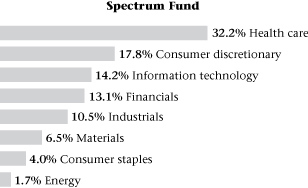

The following tables show the fund composition allocated by sector. The fund composition is subject to change, and the percentages are based on total investments.

1 Cash equivalent includes short-term investment held as collateral for securities lending activity. Please see Note 8 in the Notes to financial statements for more detailed information.

TURNER FUNDS 2015 SEMIANNUAL REPORT 19

FINANCIAL STATEMENTS (Unaudited)

Statements of assets and liabilities (000)

March 31, 2015

| Turner Medical Sciences Long/Short Fund | Turner Spectrum Fund | Turner Titan Fund | |||||||||||||

Assets: | |||||||||||||||

Investment securities, at cost | $ | 60,854 | $ | 39,171 | $ | 10,833 | |||||||||

Investment securities, at value | $ | 72,441 | $ | 45,094 | $ | 11,876 | |||||||||

Cash | — | 14,740 | — | ||||||||||||

Deposits with brokers for securities sold short | 46,918 | 17,863 | 5,416 | ||||||||||||

Foreign currency, at value | — | 3 | — | ||||||||||||

Receivable for investment securities sold | 3,499 | 2,359 | 1,123 | ||||||||||||

Receivable for capital shares sold | 2,716 | 61 | — | ||||||||||||

Prepaid expenses | 26 | 16 | 19 | ||||||||||||

Receivable for dividend income | 11 | 14 | 6 | ||||||||||||

Reclaim receivable | 2 | 2 | — | ||||||||||||

Total assets | 125,613 | 80,152 | 18,440 | ||||||||||||

Liabilities: | |||||||||||||||

Securities sold short, at proceeds | 48,373 | 28,702 | 5,452 | ||||||||||||

Securities sold short, at value | 48,200 | 28,805 | 5,431 | ||||||||||||

Foreign currency overdraft, at value | 2 | — | — | ||||||||||||

Payable for investment securities purchased | 4,322 | 2,686 | 1,060 | ||||||||||||

Obligation to return securities lending collateral | — | — | — | ||||||||||||

Payable for capital shares redeemed | 53 | 583 | — | ||||||||||||

Dividends payable on securities sold short (Note 2) | 22 | 41 | 6 | ||||||||||||

Payable due to investment adviser | 74 | 35 | 6 | ||||||||||||

Payable due to administrator | 4 | 3 | 1 | ||||||||||||

Payable due to shareholder servicing | 7 | 2 | — | ||||||||||||

Payable due to distributor | 2 | 1 | — | ||||||||||||

Payable due to transfer agent | 1 | 66 | 3 | ||||||||||||

Payable due to custodian | — | 19 | 2 | ||||||||||||

Payable for trustee fees | 1 | 7 | 1 | ||||||||||||

Other accrued expenses | 10 | 123 | 6 | ||||||||||||

Total liabilities | 52,698 | 32,371 | 6,516 | ||||||||||||

Net assets | $ | 72,915 | $ | 47,781 | $ | 11,924 | |||||||||

*Includes market value of securities on loan of: | $ | — | $ | — | $ | — | |||||||||

Net assets: | |||||||||||||||

Portfolio capital | $ | 65,638 | $ | 51,237 | $ | 10,757 | |||||||||

Distributions in excess of investment income | (481 | ) | (7,194 | ) | (64 | ) | |||||||||

| Accumulated net realized gain (loss) from investments, securities sold short, written options and foreign currency transactions | (4,002 | ) | (2,081 | ) | 167 | ||||||||||

| Net unrealized appreciation on investments, securities sold short, foreign currencies and translation of other assets and liabilities denominated in foreign currencies | 11,760 | 5,819 | 1,064 | ||||||||||||

Net assets | $ | 72,915 | $ | 47,781 | $ | 11,924 | |||||||||

Outstanding shares of beneficial interest — Institutional Class Shares (1) | 2,059 | 3,984 | 1,071 | ||||||||||||

Outstanding shares of beneficial interest — Investor Class Shares (1) | 2,727 | 927 | 24 | ||||||||||||

Outstanding shares of beneficial interest — Class C Shares (1) | 281 | 227 | 26 | ||||||||||||

Outstanding shares of beneficial interest — Retirement Class Shares (1) | — | — | — | ||||||||||||

Net assets — Institutional Class Shares | $ | 29,860 | $ | 37,295 | $ | 11,405 | |||||||||

Net assets — Investor Class Shares | $ | 39,153 | $ | 8,508 | $ | 258 | |||||||||

Net assets — Class C Shares | $ | 3,902 | $ | 1,978 | $ | 261 | |||||||||

Net assets — Retirement Class Shares | $ | — | $ | — | $ | — | |||||||||

Net asset value, offering and redemption price per share — Institutional Class Shares | $ | 14.50 | $ | 9.36 | $ | 10.65 | |||||||||

Net asset value, offering and redemption price per share — Investor Class Shares | $ | 14.36 | $ | 9.17 | † | $ | 10.52 | † | |||||||

Net asset value, offering and redemption price per share — Class C Shares | $ | 13.89 | $ | 8.71 | $ | 10.14 | † | ||||||||

Net asset value, offering and redemption price per share — Retirement Class Shares | $ | — | $ | — | $ | — | |||||||||

20 TURNER FUNDS 2015 SEMIANNUAL REPORT

| Turner Emerging Growth Fund | Turner Midcap Growth Fund | Turner Small Cap Growth Fund | |||||||||||||

Assets: | |||||||||||||||

Investment securities, at cost | $ | 102,422 | $ | 213,231 | $ | 56,230 | |||||||||

Investment securities, at value | $ | 125,429 | * | $ | 251,917 | * | $ | 68,158 | * | ||||||

Cash | — | — | — | ||||||||||||

Deposits with brokers for securities sold short | — | — | — | ||||||||||||

Foreign currency, at value | — | — | — | ||||||||||||

Receivable for investment securities sold | 7,136 | 4,877 | 2,308 | ||||||||||||

Receivable for capital shares sold | 40 | 82 | 10 | ||||||||||||

Prepaid expenses | 29 | 49 | 21 | ||||||||||||

Receivable for dividend income | 107 | 60 | 31 | ||||||||||||

Reclaim receivable | — | — | — | ||||||||||||

Total assets | 132,741 | 256,985 | 70,528 | ||||||||||||

Liabilities: | |||||||||||||||

Securities sold short, at proceeds | — | — | — | ||||||||||||

Securities sold short, at value | — | — | — | ||||||||||||

Foreign currency overdraft, at value | — | — | — | ||||||||||||

Payable for investment securities purchased | 3,835 | 4,271 | 2,220 | ||||||||||||

Obligation to return securities lending collateral | 25,835 | 20,421 | 11,842 | ||||||||||||

Payable for capital shares redeemed | 2,870 | 115 | 68 | ||||||||||||

Dividends payable on securities sold short (Note 2) | — | — | — | ||||||||||||

Payable due to investment adviser | 48 | 61 | 16 | ||||||||||||

Payable due to administrator | 5 | 25 | 2 | ||||||||||||

Payable due to shareholder servicing | 18 | 40 | 12 | ||||||||||||

Payable due to distributor | — | 1 | — | ||||||||||||

Payable due to transfer agent | 19 | 49 | 14 | ||||||||||||

Payable due to custodian | 2 | 4 | 3 | ||||||||||||

Payable for trustee fees | 5 | 10 | 7 | ||||||||||||

Other accrued expenses | 75 | 154 | 43 | ||||||||||||

Total liabilities | 32,712 | 25,151 | 14,227 | ||||||||||||

Net assets | $ | 100,029 | $ | 231,834 | $ | 56,301 | |||||||||

*Includes market value of securities on loan of: | $ | 23,173 | $ | 19,709 | $ | 10,703 | |||||||||

Net assets: | |||||||||||||||

Portfolio capital | $ | 62,954 | $ | 172,996 | $ | 33,788 | |||||||||

Distributions in excess of investment income | (364 | ) | (626 | ) | (1,429 | ) | |||||||||

| Accumulated net realized gain (loss) from investments, securities sold short, written options and foreign currency transactions | 14,432 | 20,778 | 12,014 | ||||||||||||

| Net unrealized appreciation on investments, securities sold short, foreign currencies and translation of other assets and liabilities denominated in foreign currencies | 23,007 | 38,686 | 11,928 | ||||||||||||

Net assets | $ | 100,029 | $ | 231,834 | $ | 56,301 | |||||||||

Outstanding shares of beneficial interest — Institutional Class Shares (1) | 569 | 1,743 | — | ||||||||||||

Outstanding shares of beneficial interest — Investor Class Shares (1) | 2,602 | 7,779 | 2,999 | ||||||||||||

Outstanding shares of beneficial interest — Class C Shares (1) | — | — | — | ||||||||||||

Outstanding shares of beneficial interest — Retirement Class Shares (1) | — | 194 | — | ||||||||||||

Net assets — Institutional Class Shares | $ | 18,488 | $ | 42,903 | $ | — | |||||||||

Net assets — Investor Class Shares | $ | 81,541 | $ | 184,758 | $ | 56,301 | |||||||||

Net assets — Class C Shares | $ | — | $ | — | $ | — | |||||||||

Net assets — Retirement Class Shares | $ | — | $ | 4,173 | $ | — | |||||||||

Net asset value, offering and redemption price per share — Institutional Class Shares | $ | 32.51 | † | $ | 24.62 | † | $ | — | |||||||

Net asset value, offering and redemption price per share — Investor Class Shares | $ | 31.34 | $ | 23.75 | $ | 18.77 | |||||||||

Net asset value, offering and redemption price per share — Class C Shares | $ | — | $ | — | $ | — | |||||||||

Net asset value, offering and redemption price per share — Retirement Class Shares | $ | — | $ | 21.46 | † | $ | — | ||||||||

(1) Unlimited authorization — par value $0.00001.

† Differences in net asset value recalculation and net asset value stated are caused by rounding differences.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 21

FINANCIAL STATEMENTS (Unaudited)

Statements of operations (000)

Turner | Turner | Turner | |||||||||||||

period ended | period ended | period ended | |||||||||||||

Investment income: | |||||||||||||||

Dividend | $ | 12 | $ | 308 | $ | 64 | |||||||||

Securities lending | — | — | — | ||||||||||||

Foreign taxes withheld | — | (3 | ) | (2 | ) | ||||||||||

Total investment income | 12 | 305 | 62 | ||||||||||||

Expenses: | |||||||||||||||

Investment advisory fees | 295 | 623 | 90 | ||||||||||||

Administration fees | 29 | 62 | 9 | ||||||||||||

Shareholder service fees (1) | 15 | 13 | 1 | ||||||||||||

Shareholder service fees (2) | 4 | 3 | — | ||||||||||||

Shareholder service fees (3) | — | — | — | ||||||||||||

Distribution fees (2) | 11 | 9 | 1 | ||||||||||||

Distribution fees (3) | — | — | — | ||||||||||||

Accounting agent fees | — | 5 | 1 | ||||||||||||

Dividend expense | 60 | 140 | 10 | ||||||||||||

Broker fees and charges on short sales | 242 | 317 | 11 | ||||||||||||

Custodian fees | 5 | 54 | 9 | ||||||||||||

Transfer agent fees | 13 | 112 | 7 | ||||||||||||

Registration fees | 23 | 27 | 24 | ||||||||||||

Professional fees | 17 | 75 | 7 | ||||||||||||

Trustees' fees | 10 | 38 | 4 | ||||||||||||

Insurance and other fees | 21 | 65 | 6 | ||||||||||||

Total expenses | 745 | 1,542 | 180 | ||||||||||||

Less: | |||||||||||||||

Investment advisory fee waiver | (252 | ) | (593 | ) | (54 | ) | |||||||||

Net expenses | 493 | 949 | 126 | ||||||||||||

Net investment income (loss) | (481 | ) | (644 | ) | (64 | ) | |||||||||

Net realized gain from securities sold | 6,497 | 8,009 | 595 | ||||||||||||

Net realized loss from securities sold short | (8,509 | ) | (4,737 | ) | (178 | ) | |||||||||

Net realized gain on foreign currency transactions | — | 1 | — | ||||||||||||

Net change in unrealized appreciation (depreciation) on investments | 8,406 | (2,828 | ) | 445 | |||||||||||

Net change in unrealized appreciation (depreciation) on securities sold short | 405 | (2,175 | ) | (148 | ) | ||||||||||

Net change in unrealized appreciation (depreciation) on foreign currencies and translation of | — | (1 | ) | — | |||||||||||

Net realized and unrealized gain (loss) from investments, options and foreign currencies | 6,799 | (1,731 | ) | 714 | |||||||||||

Net increase (decrease) in net assets resulting from operations | $ | 6,318 | $ | (2,375 | ) | $ | 650 | ||||||||

22 TURNER FUNDS 2015 SEMIANNUAL REPORT

Turner | Turner | Turner | |||||||||||||

period ended | period ended | period ended | |||||||||||||

Investment income: | |||||||||||||||

Dividend | $ | 112 | $ | 627 | $ | 105 | |||||||||

Securities lending | 302 | 17 | 82 | ||||||||||||

Foreign taxes withheld | — | — | — | ||||||||||||

Total investment income | 414 | 644 | 187 | ||||||||||||

Expenses: | |||||||||||||||

Investment advisory fees | 591 | 837 | 425 | ||||||||||||

Administration fees | 88 | 166 | 63 | ||||||||||||

Shareholder service fees (1) | 123 | 222 | 106 | ||||||||||||

Shareholder service fees (2) | — | — | — | ||||||||||||

Shareholder service fees (3) | — | 6 | — | ||||||||||||

Distribution fees (2) | — | — | — | ||||||||||||

Distribution fees (3) | — | 6 | — | ||||||||||||

Accounting agent fees | 1 | 1 | 1 | ||||||||||||

Dividend expense | — | — | — | ||||||||||||

Broker fees and charges on short sales | — | — | — | ||||||||||||

Custodian fees | 11 | 18 | 16 | ||||||||||||

Transfer agent fees | 60 | 140 | 47 | ||||||||||||

Registration fees | 22 | 30 | 11 | ||||||||||||

Professional fees | 65 | 124 | 48 | ||||||||||||

Trustees' fees | 36 | 72 | 26 | ||||||||||||

Insurance and other fees | 71 | 131 | 49 | ||||||||||||

Total expenses | 1,068 | 1,753 | 792 | ||||||||||||

Less: | |||||||||||||||

Investment advisory fee waiver | (266 | ) | (483 | ) | (263 | ) | |||||||||

Net expenses | 802 | 1,270 | 529 | ||||||||||||

Net investment income (loss) | (388 | ) | (626 | ) | (342 | ) | |||||||||

Net realized gain from securities sold | 15,779 | 32,530 | 16,899 | ||||||||||||

Net realized loss from securities sold short | — | — | — | ||||||||||||

Net realized gain on foreign currency transactions | — | — | — | ||||||||||||

Net change in unrealized appreciation (depreciation) on investments | (2,942 | ) | (12,014 | ) | (8,591 | ) | |||||||||

Net change in unrealized appreciation (depreciation) on securities sold short | — | — | — | ||||||||||||

Net change in unrealized appreciation (depreciation) on foreign currencies and translation of | — | — | — | ||||||||||||

Net realized and unrealized gain (loss) from investments, options and foreign currencies | 12,837 | 20,516 | 8,308 | ||||||||||||

Net increase (decrease) in net assets resulting from operations | $ | 12,449 | $ | 19,890 | $ | 7,966 | |||||||||

(1) Attributable to Investor Class Shares only.

(2) Attributable to Class C Shares only.

(3) Attributable to Retirement Class Shares only.

Amounts designated as "—" are either not applicable, $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

TURNER FUNDS 2015 SEMIANNUAL REPORT 23

FINANCIAL STATEMENTS

Statements of changes in net assets (000)

| Turner Medical Sciences Long/Short Fund | Turner Spectrum Fund | ||||||||||||||||||

| period ended 3/31/15 (Unaudited) | year ended 9/30/14 | period ended 3/31/15 (Unaudited) | year ended 9/30/14 | ||||||||||||||||

Investment activities: | |||||||||||||||||||

Net investment loss | $ | (481 | ) | $ | (587 | ) | $ | (644 | ) | $ | (3,760 | ) | |||||||

Net realized gain (loss) from securities sold and securities sold short | (2,012 | ) | 2,405 | 3,272 | 61,738 | ||||||||||||||

Net realized gain on written options contracts | — | — | — | 207 | |||||||||||||||

Net realized gain (loss) on foreign currency transactions | — | (2 | ) | 1 | (58 | ) | |||||||||||||

Net change in unrealized appreciation (depreciation) on investments and securities sold short | 8,811 | 1,547 | (5,003 | ) | (38,384 | ) | |||||||||||||

Net change in unrealized appreciation (depreciation) on written options contracts | — | — | — | (31 | ) | ||||||||||||||

| Net change in unrealized appreciation (depreciation) on foreign currencies and translation of other assets and liabilities denominated in foreign currencies | — | — | (1 | ) | 2 | ||||||||||||||

Net increase (decrease) in net assets resulting from operations | 6,318 | 3,363 | (2,375 | ) | 19,714 | ||||||||||||||

Dividends and distributions to shareholders: | |||||||||||||||||||

Realized capital gains: | |||||||||||||||||||

Institutional Class Shares | (1,619 | ) | (524 | ) | (20,550 | ) | — | ||||||||||||

Investor Class Shares | (454 | ) | (145 | ) | (2,460 | ) | — | ||||||||||||

Class C Shares | (176 | ) | (47 | ) | (595 | ) | — | ||||||||||||

Total dividends and distributions | (2,249 | ) | (716 | ) | (23,605 | ) | — | ||||||||||||

Capital share transactions: | |||||||||||||||||||

Institutional Class Shares | |||||||||||||||||||

Proceeds from shares issued | 12,109 | 33,366 | 4,758 | 82,515 | |||||||||||||||

Proceeds from shares issued in lieu of cash distributions | 1,166 | 472 | 14,745 | — | |||||||||||||||

Cost of shares redeemed | (12,566 | ) | (25,607 | ) | (79,427 | ) | (462,399 | ) | |||||||||||

Net increase (decrease) in net assets from Institutional Class Shares transactions | 709 | 8,231 | (59,924 | ) | (379,884 | ) | |||||||||||||

Investor Class Shares | |||||||||||||||||||

Proceeds from shares issued | 36,545 | 31,610 | 1,059 | 4,871 | |||||||||||||||

Proceeds from shares issued in lieu of cash distributions | 400 | 141 | 2,346 | — | |||||||||||||||

Cost of shares redeemed | (6,302 | ) | (28,345 | ) | (7,960 | ) | (34,856 | ) | |||||||||||

Net increase (decrease) in net assets from Investor Class Shares transactions | 30,643 | 3,406 | (4,555 | ) | (29,985 | ) | |||||||||||||

Class C Shares | |||||||||||||||||||

Proceeds from shares issued | 708 | 1,987 | 7 | 42 | |||||||||||||||

Proceeds from shares issued in lieu of cash distributions | 142 | 42 | 565 | — | |||||||||||||||

Cost of shares redeemed | (139 | ) | (708 | ) | (910 | ) | (2,865 | ) | |||||||||||

Net increase (decrease) in net assets from Class C Shares transactions | 711 | 1,321 | (338 | ) | (2,823 | ) | |||||||||||||

Net increase (decrease) in net assets from capital share transactions | 32,063 | 12,958 | (64,817 | ) | (412,692 | ) | |||||||||||||

Total increase (decrease) in net assets | 36,132 | 15,605 | (90,797 | ) | (392,978 | ) | |||||||||||||

Net assets: | |||||||||||||||||||

Beginning of period | 36,783 | 21,178 | 138,578 | 531,556 | |||||||||||||||

End of period | $ | 72,915 | $ | 36,783 | $ | 47,781 | $ | 138,578 | |||||||||||

Undistributed net investment income (accumulated net investment loss) | $ | (481 | ) | $ | — | $ | (7,194 | ) | $ | (6,550 | ) | ||||||||

Share issued and redeemed: | |||||||||||||||||||

Institutional Class Shares | |||||||||||||||||||

Issued | 882 | 2,739 | 358 | 7,042 | |||||||||||||||

Issued in lieu of cash distributions | 104 | 41 | 1,695 | — | |||||||||||||||

Redeemed | (1,018 | ) | (2,139 | ) | (8,113 | ) | (39,139 | ) | |||||||||||

Net increase (decrease) in Institutional Class Shares | (32 | ) | 641 | (6,060 | ) | (32,097 | ) | ||||||||||||

Investor Class Shares | |||||||||||||||||||

Issued | 2,738 | 2,555 | 108 | 419 | |||||||||||||||

Issued in lieu of cash distributions | 36 | 12 | 275 | — | |||||||||||||||

Redeemed | (499 | ) | (2,382 | ) | (783 | ) | (2,998 | ) | |||||||||||

Net increase (decrease) in Investor Class Shares | 2,275 | 185 | (400 | ) | (2,579 | ) | |||||||||||||

Class C Shares | |||||||||||||||||||

Issued | 53 | 163 | 1 | 4 | |||||||||||||||

Issued in lieu of cash distributions | 13 | 4 | 70 | — | |||||||||||||||

Redeemed | (12 | ) | (62 | ) | (101 | ) | (254 | ) | |||||||||||

Net increase (decrease) in Class C Shares | 54 | 105 | (30 | ) | (250 | ) | |||||||||||||

Net increase (decrease) in share transactions | 2,297 | 931 | (6,490 | ) | (34,926 | ) | |||||||||||||

24 TURNER FUNDS 2015 SEMIANNUAL REPORT

| Turner Titan Fund | Turner Emerging Growth Fund | ||||||||||||||||||

| period ended 3/31/15 (Unaudited) | year ended 9/30/14 | period ended 3/31/15 (Unaudited) | year ended 9/30/14 | ||||||||||||||||

Investment activities: | |||||||||||||||||||

Net investment loss | $ | (64 | ) | $ | (211 | ) | $ | (388 | ) | $ | (2,154 | ) | |||||||

Net realized gain (loss) from securities sold and securities sold short | 417 | 3,293 | 15,779 | 74,679 | |||||||||||||||