Exhibit 99.2

Notice of 2013 Annual Meeting

and Management Proxy Circular

Cameco’s vision is to be a dominant energy company producing uranium fuel and generating clean electricity. Our goal is to be the supplier, partner, investment and employer of choice.

We are one of the world’s largest uranium producers accounting for about 14% of the world’s production. Our shares are traded on the Toronto Stock Exchange under the symbolCCO and the New York Stock Exchange under the symbolCCJ.

Visit our website (cameco.com) for more information.

WHAT’S INSIDE

Letter to shareholders

Dear Shareholder,

2012 was a busy year for the board. We spent a significant amount of time working with Cameco’s management team on the company’s growth strategy to ensure it addressed the near-term challenges in the nuclear industry, while also positioning the company to benefit from the strong long-term supply and demand fundamentals.

That work resulted in an adjustment to Cameco’s growth plans to better match market opportunities.

2012 also provided opportunity for Cameco to further strengthen its leadership position in the nuclear industry. The company made three acquisitions—Yeelirrie, NUKEM, and an increased portion of Millennium. The board supported management in these acquisitions.

We believe the decisions made in 2012 will position Cameco to deliver the best value to shareholders and as we move into 2013, we remain confident in a bright future for the company and our industry.

A key responsibility of the board is to ensure its members have the right skills, experience and qualities necessary to guide the company in achieving its strategic goals. Strong board leadership, continuing education and effective succession planning at the board level are important to Cameco’s success. The board added significant financial expertise over the last few years through two new members, enhancing the focus on financial performance for Cameco’s strategic growth and direction. This has assisted the board in its deliberations on financial and financing matters and other business opportunities.

This year, the board will put forward 12 nominees for election as directors at the annual meeting. Oyvind Hushovd is retiring from the board after serving for 10 years. He has been a tremendous resource, bringing valuable operational, financial and general business experience as a mining executive at a time when Cameco saw significant growth and change.

After having served as board chair for the past 10 years and after consultation with the board, I will be stepping down from that role after this year’s annual meeting but will continue to serve as a director.

2012 PERFORMANCE HIGHLIGHTS

Despite the challenging market environment, Cameco delivered another strong year of corporate performance. Production and unit costs were generally on track, its safety and environmental performance remained solid and financial results were again strong.

| | • | | adjusted net earnings of $447 million1 |

| | • | | annual revenue of $2.3 billion |

| | • | | annual gross profit of $723 million from the nuclear business |

| | • | | annual revenue of $1.5 billion from the uranium segment |

Three acquisitions

| | • | | purchase of the Yeelirrie deposit from BHP Billiton |

| | • | | acquisition of AREVA’s 28% interest in the Millennium project |

These acquisitions provide more potential uranium resources and access to unconventional uranium sources, strengthening Cameco’s leadership position in the nuclear fuel business.

Cameco also signed a memorandum of agreement with KazAtomProm agreeing to a framework to expand mine production and extend the lease terms for Inkai.

8.5%

ONE-YEAR TSR

Based on the closing price of Cameco common shares on the TSX, January 1, 2012 to December 31, 2012 (assuming dividends are reinvested)

FIVE AWARDS IN 2012

| | • | | Top 100 Employers in Canada (Mediacorp) |

| | • | | 10 Best Companies to Work For (Financial Post) |

| | • | | Saskatchewan’s Top Employers |

| | • | | Canada’s Best Diversity Employers (Mediacorp) |

| | • | | Canada’s Top Employers for Young People (Mediacorp) |

I am very pleased that Neil McMillan will stand as your incoming chair. Neil will be appointed by the board subsequent to the annual meeting as we have great confidence in his ability to lead the board in the years to come. Neil has been a member of the board for 11 years, and has been chair of our reserves oversight committee for the past four years.

| 1. | Non-IFRS measure. See note 1 on page 73 for more information. |

LETTERTOSHAREHOLDERS 1

Finally, I want to thank Tim Gitzel and former CEO Jerry Grandey and my fellow directors, current and past, for their support over the past 10 years. It has been a pleasure working with you as chair, and I remain very confident in the vision and strategy we have set, and look forward to continuing to contribute to the board as we move forward.

Take some time to read the attached management proxy circular. It provides important information about the meeting, voting, the nominated directors, our governance practices, and director and executive compensation. Be sure to also read the report by the human resources and compensation committee to learn more about Cameco’s executive compensation program and decisions by the committee and the board on executive pay for 2012 (see page 48).

The board and management thank you for your continued confidence.

Sincerely,

Victor Zaleschuk

Chair of the board

Cameco Corporation

2 CAMECOCORPORATION

Notice of our 2013 annual meeting of shareholders

You are invited to our 2013 annual meeting of shareholders

| | | | | | |

| When | | Where | | | | |

| Tuesday, May 14, 2013 | | Cameco Corporation | | | | |

| 1:30 p.m. CST | | 2121 - 11th Street West | | | | |

| | Saskatoon, Saskatchewan | | | | |

Your vote is important

If you held common shares in Cameco on March 15, 2013, you are entitled to receive notice of and to vote at this meeting.

See pages 5 through 11 of the attached management proxy circular for information about what the meeting will cover, who can vote and how to vote.

By order of the board,

Gary Chad, Q.C.

Senior Vice-President,

Chief Legal Officer and Corporate Secretary

Saskatoon, Saskatchewan

April 4, 2013

NOTICEOF 2013ANNUALMEETINGOFSHAREHOLDERS 3

Management proxy circular

You have received this circular because you owned Cameco common shares on March 15, 2013. Management is soliciting your proxy for our 2013 annual meeting of shareholders.

As a shareholder, you have the right to attend the annual meeting of shareholders on May 14, 2013 and to vote your shares in person or by proxy.

To encourage you to vote, you may be contacted directly by Cameco employees or representatives of CST Phoenix Advisors. If you have any concerns or need any help voting, please contact CST Phoenix Advisors at 1.800.823.9047. If you are outside North America, call collect 1.201.806.2222, or email inquiries@phoenixadvisorscst.com.

We are paying CST Phoenix Advisors approximately $32,500 for their services.

The board of directors has approved the contents of this document and has authorized us to send it to you. We have also sent a copy to each of our directors and to our auditors.

Your package may also include ourbusiness overview brochure and2012 annual report(if you requested a copy or one was otherwise required to be sent to you). This information is also available on our website (cameco.com).

Gary Chad, Q.C.

Senior Vice-President,

Chief Legal Officer and Corporate Secretary

April 4, 2013

In this document,youandyourrefer to the shareholder.We,us,our andCameco mean Cameco Corporation.Shares andCameco shares mean Cameco’s common shares, unless otherwise indicated.

The information in this management proxy circular is as of March 8, 2013, unless otherwise indicated.

Your vote is important. This circular describes what the meeting will cover and how to vote. Please read it carefully and vote, either by completing the form included with this package or by attending the meeting in person.

4 CAMECOCORPORATION

About our shareholder meeting

You can vote on items of Cameco business, receive an update on the company, meet face to face with management and interact with our board of directors. Matters other than the election of directors require majority approval. We have a majority voting policy for the election of directors (see page 13).

Business of the meeting

DIRECTORS

You will elect 12 directors to our board to serve for a term of one year. All of the nominated directors currently serve on our board. You can vote for all of the nominated directors, votefor some of them andwithhold votes for others, orwithhold votes for all of them.

The director profiles starting on page 13 give you information about their background and experience and the Cameco board committees they are currently members of.

We recommend that you votefor all of the nominated directors.

AUDITORS

You will vote on reappointing the auditors. The auditors fulfill a critical role, reinforcing the importance of a diligent and transparent financial reporting process that strengthens investor confidence in our financial reporting.

The board, on the recommendation of the audit and finance committee, has proposed that KPMG LLP (KPMG) be reappointed as our auditors. KPMG, or its predecessor firms, have been our auditors since incorporation. You can votefor reappointing KPMG as our auditors until the end of the next annual meeting, or you canwithhold your vote.

WE NEED A QUORUM

We can only hold the meeting and transact business if we have aquorum at the beginning of the meeting — where the people currently in attendance hold, or represent by proxy, at least 25% of our total common shares issued and outstanding.

KPMG provides us with three types of services:

| • | | audit services — generally relate to the audit and review of annual and interim financial statements and notes, conducting the annual audits of affiliates, auditing our internal controls over financial reporting and providing other services that may be required by regulators. These may also include services for registration statements, prospectuses, reports and other documents that are filed with securities regulators, or other documents issued for securities offerings. |

| • | | audit-related services — include advising on accounting matters, attest services not directly linked to the financial statements that are required by regulators and conducting audits of employee benefit plans. |

| • | | tax services — relate to tax compliance and tax advice that are beyond the scope of the annual audit. These include reviewing transfer-pricing documentation and correspondence with tax authorities, preparing corporate tax returns, and advice on international tax matters, tax implications of capital market transactions and capital tax. |

The table below shows the fees we paid to KPMG and its affiliates for services in 2011 and 2012.

| | | | | | | | | | | | | | | | |

| | | 2012 ($) | | | % OF TOTAL FEES (%) | | | 2011 ($) | | | % OF TOTAL FEES (%) | |

Audit fees | | | | | | | | | | | | | | | | |

Cameco | | | 1,581,700 | | | | 60.4 | | | | 1,773,600 | | | | 61.4 | |

Subsidiaries | | | 376,400 | | | | 14.4 | | | | 400,700 | | | | 13.9 | |

Total audit fees | | | 1,958,100 | | | | 74.8 | | | | 2,174,300 | | | | 75.3 | |

| | | | | | | | | | | | | | | | |

Audit-related fees | | | | | | | | | | | | | | | | |

Translation services | | | 138,600 | | | | 5.3 | | | | — | | | | — | |

Cameco consultative | | | — | | | | — | | | | 195,100 | | | | 6.8 | |

Pensions and other | | | 68,300 | | | | 2.6 | | | | 21,000 | | | | 0.7 | |

Total audit-related fees | | | 206,900 | | | | 7.9 | | | | 216,100 | | | | 7.5 | |

| | | | | | | | | | | | | | | | |

Tax fees | | | | | | | | | | | | | | | | |

Compliance | | | 125,000 | | | | 4.8 | | | | 62,500 | | | | 2.2 | |

Planning and advice | | | 329,000 | | | | 12.6 | | | | 433,400 | | | | 15.0 | |

Total tax fees | | | 454,000 | | | | 17.3 | | | | 495,900 | | | | 17.2 | |

| | | | | | | | | | | | | | | | |

All other fees | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total fees | | | 2,619,000 | | | | 100.0 | | | | 2,886,300 | | | | 100.0 | |

| | | | | | | | | | | | | | | | |

2013MANAGEMENTPROXYCIRCULAR 5

The board has invited a representative of KPMG to attend the meeting.

We recommend you voteforreappointing KPMG as our auditors.

FINANCIAL STATEMENTS

Your package includes our2012 annual report (which includes our consolidated financial statements for the year ended December 31, 2012 and the auditors’ report) if you requested a copy or one was otherwise required to be sent to you. You can also download a copy from our website (cameco.com/investors/briefcase/).

HAVING A ‘SAY ON PAY’

You will vote on our approach to executive compensation as disclosed in this circular. This is an advisory vote and non-binding, and will provide the board and the human resources and compensation committee with important feedback.

Please take some time to read about our approach to compensation and how we assess performance, make compensation decisions and manage compensation risk (see page 48).

You can votefor oragainst our approach to executive compensation through the following resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in Cameco’s management proxy circular delivered in advance of the 2013 annual meeting of shareholders.

We recommend that you votefor the advisory vote on our approach to executive compensation.

The board believes it is important for shareholders to have an effective way to provide input on our approach to executive compensation. This is the fourth year that shareholders will have an opportunity to have a ‘say on pay’. We are committed to ensuring our shareholders have an effective and timely opportunity to provide input on executive compensation, and we continue to evaluate the most effective means of achieving this objective.

MORE ABOUT HAVING A SAY

We introduced ‘say on pay’ in 2010 and have held an advisory vote every year since. We continue to monitor developments in executive compensation and evolving best practices to make sure our programs and decisions are appropriate.

You can write to the board or committee chair with your views on executive compensation.

Following last year’s vote, the board and the human resources and compensation committee discussed the 2012 results and the overall trend since 2010 for insights on shareholders’ views on our approach to executive compensation. These discussions provided important background information and insights for the compensation review in 2012 and ways to encourage dialogue and outreach with shareholders generally (see pages 25 and 48).

Following this year’s vote, the board will again examine the level of interest and nature of the comments received from shareholders, as well as evolving best practices by other companies, and continue to consider what might be the optimum frequency and approach for shareholders to provide their input on this matter.

OTHER BUSINESS

If other items of business are properly brought before the meeting (or after the meeting is adjourned), you (or your proxyholder) can vote as you see fit.

We did not receive any shareholder proposals for this meeting, and are not aware of any other items of business to be considered at the meeting.

Vote results

We will disclose the voting results, including this year’s advisory vote, in our report on the 2013 annual meeting voting results, available on our website (cameco.com/investors/shareholder_information

/annual_meeting) and on SEDAR.

6 CAMECOCORPORATION

Who can vote

We have common shares and one class B share, but only holders of our common shares have full voting rights.

If you held common shares at the close of business on March 15, 2013 (therecord date), you or the person you appoint as your proxyholder can attend the annual meeting and vote your shares. Each Cameco common share you own represents one vote, except where the ownership and voting restrictions apply.

As of March 8, 2013, we had 395,389,907 common shares issued and outstanding.

Ownership and voting restrictions

There are restrictions on owning, controlling and voting Cameco common shares whether you own the shares as a registered shareholder, hold them beneficially, or control your investment interest in Cameco directly or indirectly. These are described in the Eldorado Nuclear Limited Reorganization and Divestiture Act (Canada) (ENL Reorganization Act) and our company articles.

The following is a summary of the limitations listed in our company articles. See Appendix A on page 93 for the definitions in the ENL Reorganization Act, including definitions ofresident andnon-resident.

RESIDENTS

A Canadian resident, either individually or together with associates, cannot hold, beneficially own or control shares or other Cameco securities, directly or indirectly, representing more than 25% of the votes that can be cast to elect directors.

NON-RESIDENTS

A non-resident of Canada, either individually or together with associates, cannot hold, beneficially own or control shares or other Cameco securities, directly or indirectly, representing more than 15% of the total votes that can be cast to elect directors.

VOTING RESTRICTIONS

All votes cast at the meeting by non-residents, either beneficially or controlled directly or indirectly, will be counted and pro-rated collectively to limit the proportion of votes cast by non-residents to no more than 25% of the total shareholder votes cast at the meeting.

WHAT WE MEAN BY RESIDENCY

Cameco shares have restrictions on ownership and voting for residents and non-residents of Canada. Ownership restrictions were put in place so that Cameco would remain Canadian controlled. The uranium mining industry has restrictions on ownership by non-residents.

Aresidentis anyone who is not anon-resident. Residents can be individuals, corporations, trusts and governments or government agencies.

Anon-residentis:

| | • | | anindividual, other than a Canadian citizen, who is not ordinarily resident in Canada |

| | • | | that was incorporated, formed or otherwise organized outside Canada, or |

| | • | | that is controlled by non-residents, either directly or indirectly |

| | • | | that was established by a non-resident, other than a trust for the administration of a pension fund for individuals where the majority of the individuals are residents or |

| | • | | where non-residents have more than 50% of the beneficial interest |

| | • | | aforeign government orforeign government agency |

ENFORCEMENT

The company articles allow us to enforce the ownership and voting restrictions by:

| • | | suspending voting rights |

| • | | prohibiting the issue and transfer of Cameco shares |

| • | | requiring the sale or disposition of Cameco shares |

| • | | suspending all other shareholder rights. |

To verify compliance with restrictions on ownership and voting of Cameco shares, we require shareholders to declare their residency, ownership of Cameco shares and other things relating to the restrictions. Nominees such as banks, trust companies, securities brokers or other financial institutions who hold the shares on behalf of beneficial shareholders need to make the declaration on their behalf.

2013MANAGEMENTPROXYCIRCULAR 7

If you own the shares in your name, you will need to complete the residency declaration on the enclosed proxy form. Copies will also be available at the meeting if you are planning to attend in person. If we do not receive your residency declaration, we may consider you to be a non-resident of Canada.

The board will use these declarations or other information to decide whether our ownership restrictions have been contravened.

Principal holders of common shares

As of December 31, 2012, management, to the best of its knowledge, is not aware of any shareholder with 5% or more of our common shares.

Our class B share

The province of Saskatchewan holds our one class B share. This entitles the province to receive notices of and attend all meetings of shareholders, for any class or series.

The class B shareholder can only vote at a meeting of class B shareholders, and votes as a separate class if there is a proposal to:

| • | | amend Part 1 of Schedule B of the articles, which states that: |

| | • | | Cameco’s registered office and head office operations must be in Saskatchewan |

| | • | | the vice-chairman of the board, chief executive officer (CEO), president, chief financial officer (CFO) and generally all of the senior officers (vice-presidents and above) must live in Saskatchewan |

| | • | | all annual meetings of shareholders must be held in Saskatchewan |

| • | | amalgamate, if it would require an amendment to Part 1 of Schedule B, or |

| • | | amend the articles, in a way that would change the rights of class B shareholders. |

HOW CAMECO WAS FORMED

Cameco Corporation was formed in 1988 by privatizing two crown corporations, combining the uranium mining and milling operations of Saskatchewan Mining Development Corporation and the uranium mining, refining and conversion operations of Eldorado Nuclear Limited.

Cameco received these assets in exchange for:

| | • | | assuming substantially all of the current liabilities and certain other liabilities of the two companies |

| | • | | issuing one class B share |

| | • | | issuing promissory notes. |

The company was incorporated under theCanada Business Corporations Act.

You can find more information about our history in our2012 annual information form, which is available on our website (cameco.com/investors).

QUESTIONS?

If you have questions about completing the proxy form or residency declaration, or about the meeting in general, contact our proxy solicitation agent, CST Phoenix Advisors:

| | |

| Phone: | | 1.800.823.9047 |

| | (toll free within North America) |

| | 1.201.806.2222 |

| | (collect from outside North America) |

| | 1.201.806.2222 |

| | (banks and brokers) |

8 CAMECOCORPORATION

How to vote

You can vote by proxy, or you can attend the meeting and vote your shares in person.

Voting by proxy

Voting by proxy is the easiest way to vote. It means you are giving someone else the authority to attend the meeting and vote for you (called yourproxyholder).

Tim Gitzel, president and CEO of Cameco, or in his absence Gary Chad, senior vice-president, chief legal officer and corporate secretary (theCameco proxyholders), have agreed to act as proxyholders to vote your shares at the meeting according to your instructions.Or, you can appoint someone else to represent you and vote your shares at the meeting.

If you appoint the Cameco proxyholders but do not tell them how you want to vote your shares, your shares will be voted:

| • | | forelecting the nominated directors |

| • | | forappointing KPMG LLP as auditors |

| • | | forthe advisory vote on our approach to executive compensation. |

If for any reason a nominated director becomes unable to serve, the Cameco proxyholders have the right to vote for another nominated director at their discretion, unless you have indicated that your shares are to be withheld from voting.

If there are amendments or other items of business that are properly brought before the meeting, your proxyholder can vote as he or she sees fit.

Registered shareholders

PROXY VOTING PROCESS

Four ways to vote

1 On the internet

Go to https://proxypush.ca/cco and follow the instructions on screen. You will need your control number, which appears below your name and address on your proxy form. CIBC Mellon needs to receive your voting instructionsbefore 1:30 p.m. CST on Friday, May 10, 2013.

2 By fax

Complete the enclosed proxy form, including the section on declaration of residency, sign and date it and fax both pages of the form to:

THE VOTING PROCESS IS DIFFERENT DEPENDING ON WHETHER YOU ARE A REGISTERED OR NON-REGISTERED SHAREHOLDER

You are aregistered shareholder if your name appears on your share certificate. See below for the voting process.

You are anon-registered shareholder if your bank, trust company, securities broker, trustee or other financial institution holds your shares (your nominee). This means the shares are registered in your nominee’s name, and you are the beneficial shareholder. See page 10 for the voting process.

VOTING RESULTS

We report on voting results shortly after the meeting. Go to cameco.com/investors or sedar.com following the meeting to see the voting results.

CIBC Mellon Trust Company

c/o Canadian Stock Transfer Company Inc.

Attention: Proxy department

1.866.781.3111 (toll free within North America) 1.416.368.2502 (from outside North America)

3 By mail

Complete your proxy form, including the section on declaration of residency, sign and date it, and send it to our transfer agent in the envelope provided.

If you did not receive a return envelope, please send the completed form to:

CIBC Mellon Trust Company

c/o Canadian Stock Transfer Company Inc.

Attention: Proxy department

P.O. Box 721

Agincourt, Ontario M1S 0A1

4 By appointing someone else to vote your shares for you

You can appoint someone else to attend the meeting and vote your shares. Print the name of the person you are appointing as your proxyholder in the space provided. This person does not need to be a shareholder. Make sure your appointee is aware and attends the meeting for you as your vote will not be counted unless this person attends. Your proxyholder will need to check in with a CIBC Mellon representative when they arrive at the meeting.

2013MANAGEMENTPROXYCIRCULAR 9

Send your completed proxy form right away. Make sure the proxy form is completed properly and that you allow enough time for it to reach our transfer agent if you are sending it by mail. Your vote will only be counted if CIBC Mellon receives your voting instructionsbefore 1:30 p.m. CST on Friday, May 10, 2013. (The deadline for submitting proxies may be waived by the board chair at his discretion.)

If you are an administrator, trustee, attorney or guardian for a person who beneficially holds or controls Cameco shares, or an authorized officer or attorney acting on behalf of a corporation, estate or trust that beneficially holds or controls our common shares, please follow the instructions on the proxy form.

If the meeting is postponed or adjourned, our transfer agent must receive your voting instructions at least 48 hours, excluding Saturdays, Sundays and statutory holidays, before the meeting is reconvened.

If you change your mind

You can revoke your proxy if you change your mind about how you want to vote your shares. Instructions that are provided on a proxy form with a later date, or at a later time if you are voting on the internet, will revoke any prior instructions. Any new instructions, however, will only take effect if our transfer agent receives them before 1:30 p.m. CST on Friday, May 10, 2013. If the meeting is postponed or adjourned, CIBC Mellon must receive the new voting instructions at least 48 hours, excluding Saturday, Sundays and statutory holidays, before the reconvened meeting.

You may also revoke your proxy without re-voting by either:

| • | | sending a notice in writing to the corporate secretary at Cameco, at 2121 - 11th Street West, Saskatoon, Saskatchewan S7M 1J3, so he receives it by 1:30 p.m. CST on Friday, May 10, 2013. If the meeting is postponed or adjourned, the corporate secretary must receive the notice at least 48 hours before the meeting is reconvened. |

| • | | giving a notice in writing to the chair of the meeting at the start of the meeting. |

The notice can be from you or your attorney, if he or she has your written authorization. If the shares are owned by a corporation, the written notice must be from its authorized officer or attorney.

VOTING IN PERSON

Do not complete the enclosed proxy form if you want to vote in person. Your vote will be taken and counted at the meeting.

Please call Stephanie Oleniuk at Cameco (306.956.6340) to add your name to the attendee list. You also need to check in with a CIBC Mellon representative when you arrive at the meeting.

ABOUT OUR TRANSFER AGENT

Canadian Stock Transfer Company Inc. receives the votes and counts them on our behalf, and acts as the administrative agent for our transfer agent, CIBC Mellon Trust Company.

QUESTIONS?

If you have any questions or need help voting, please contact our proxy solicitation agent, CST Phoenix Advisors, at 1.800.823.9047.

If you are outside North America, call 1.201.806.2222 collect, or email inquiries@phoenixadvisorscst.com.

Non-registered shareholders

PROXY VOTING PROCESS

Follow the instructions on the enclosed voting instruction form to submit your voting instructions on the internet or by mail.

As a non-registered (or beneficial) shareholder, you cannot vote your shares directly but can direct your nominee (the registered shareholder) how to vote your shares.

Submit your voting instructions right away to allow enough time for your nominee to receive them and send them to our transfer agent in time for the meeting. CIBC Mellon will need to receive instructions from your nomineebefore 1:30 p.m. CST on Friday, May 10, 2013or, if the meeting is postponed or adjourned, at least 48 hours, excluding Saturdays, Sundays and statutory holidays, before the meeting is reconvened. Your nominee will likely need to receive instructions from you at least one business day before this date. (The deadline for submitting proxies may be waived by the board chair at his discretion.)

10 CAMECOCORPORATION

If you change your mind

You can revoke your voting instructions if you want to vote your shares differently.

Instructions provided on a voting instruction form with a later date, or at a later time if you are voting on the internet, will revoke any prior instructions. Any new instructions, however, will only take effect if our transfer agent receives them before 1:30 p.m. CST on Friday, May 10, 2013. If the meeting is postponed or adjourned, CIBC Mellon must receive the new voting instructions at least 48 hours, excluding Saturdays, Sundays and statutory holidays, before the reconvened meeting.

Contact your nominee if you want to revoke your voting instructions, or if you want to vote in person instead.

VOTING IN PERSON

If you want to vote in person, your vote will be taken and counted at the meeting. Follow the instructions on the enclosed voting instruction form to appoint yourself as proxyholder, or to appoint someone else to attend the meeting and vote for you.

Please also call Stephanie Oleniuk at Cameco (306.956.6340) to add your name (or your proxyholder’s name) to the attendee list. You (or your proxyholder) will also need to check in with a representative of CIBC Mellon when you (or they) arrive at the meeting.

2013MANAGEMENTPROXYCIRCULAR 11

About the nominated directors

Our board of directors is responsible for overseeing management and our business affairs. As shareholders, you elect the board as your representatives.

SEE THE FOLLOWING PAGES FOR MORE INFORMATION ABOUT THE DIRECTORS:

| | | | |

• Director profiles | | | 13 | |

• Board diversity | | | 19 | |

• Meeting attendance | | | 20 | |

• Skills and experience | | | 21 | |

• Director development | | | 22 | |

This year the board has decided that 12 directors are to be elected. All of the nominated directors currently serve on the board, and Oyvind Hushovd has decided to retire after serving on our board for 10 years.

You can vote for all of these directors, vote for some of them and withhold votes for others, or withhold votes for all of them. Unless otherwise instructed, the named proxyholders will votefor all of the nominated directors (see pages 7 to 11).

Our goal is to assemble a board with the appropriate background, knowledge, skills and diversity to carry out its duties, effectively oversee Cameco’s business affairs and foster a climate that allows the board to constructively guide and challenge management.

We expect all board members to be financially literate, independent minded and team players. The nominating, corporate governance and risk committee also considers four key factors when assessing potential candidates:

| • | | the board’s overall mix of skills and experience |

| • | | how actively the candidates participate in meetings and develop an understanding of our business |

| • | | their character, integrity, judgment and record of achievement |

| • | | diversity (including gender, aboriginal heritage, age and geographic representation such as Canada, the US, Europe and Asia). |

Ian Bruce and Daniel Camus joined the board in the past two years. Ian brings experience in mergers and acquisitions and investment banking, while Daniel has extensive financial and international business experience, including a senior executive position with a major European energy operator with significant transactional experience in China and India. SeeSkills and

SERVING TOGETHER ON OTHER BOARDS

Anne McLellan and Victor Zaleschuk serve together on the board of Agrium Inc., but they do not serve together on any committees. See page 29 for our governance policy on serving on other boards.

John Clappison and Oyvind Hushovd serve together on the board of Inmet Mining Corporation, but they do not serve together on any committees.

experience on page 21 for more information about the board.

All of the nominated directors are independent, except for Tim Gitzel, our president and CEO, and Donald Deranger, president of Points Athabasca Contracting Limited Partnership, a northern Saskatchewan aboriginal contractor, which provides construction and other services to Cameco in northern Saskatchewan. Donald has a valuable mix of skills and experience as an aboriginal and business leader in northern Saskatchewan with direct experience in employee training, economic development and uranium mining. The board has identified a desire to have representation from the Saskatchewan aboriginal community to provide a voice to the communities where a majority of our resources are located. SeeIndependence on page 28 for more information.

Each of the nominated directors is eligible to serve as a director and has expressed their willingness to do so. Directors who are elected will serve until the end of the next annual meeting, or until a successor is elected or appointed.

12 CAMECOCORPORATION

Our policy on majority voting

Directors require a plurality of votes to be elected, however, a director who receives more withheld votes than for votes must offer to resign. Our nominating, corporate governance and risk committee will review the matter and recommend to the board whether to accept the resignation or not. The director does not participate in any board or committee deliberations on the matter.

The board will announce its decision within 90 days of the meeting. If the board rejects the offer, it will disclose the reasons why. If the board accepts the offer, it may appoint a new director to fill the vacancy.

We believe our majority voting policy reflects good governance. The board adopted the policy in 2006 on the recommendation of the nominating, corporate governance and risk committee.

Director profiles

The table below provides information about each nominated director as of March 8, 2013, including their background and experience and other public company boards of which they are members. Information about meeting attendance is for 2012 and holdings of Cameco shares and DSUs are as of December 31, 2012.

Each director has provided the information about the Cameco shares they own or exercise control or direction over.

DSUs are deferred share units under our DSU plan for non-executive directors and are part of their compensation, which aligns the interests of our directors and shareholders. See page 46 for the percentage of compensation each non-executive director was paid in DSUs in 2012. We calculated the total value of Cameco shares and DSUs using $19.59 for 2012 and $18.41 for 2011, the year-end closing prices of Cameco shares on the Toronto Stock Exchange (TSX). When reviewing compliance with our share ownership guidelines, we value each director’s holdings of Cameco shares and DSUs at the higher of the price when they were acquired or the year-end closing price of Cameco shares on the TSX, in accordance with our share ownership guidelines.

Tim Gitzel, as the only executive director, does not receive DSUs or any other director compensation.

| | | | | | | | | | | | | | | | | | | | |

Director since 2012 Calgary, AB Canadian Experience • Finance • Investment banking • Mergers and acquisitions | | Ian Bruce (59) | Independent Ian Bruce is the former co-chairman of the board of Peters & Co. Limited, an independent investment dealer, where he served as vice chairman, president and CEO, and CEO and co-chairman. Ian is a fellow of the Canadian Institute of Chartered Accountants of Alberta, a recognized Specialist in Valuation under Canadian CICA rules, and has his Corporate Finance Specialist designation in Canada and the UK. He is a past member of the Expert Panel on Securities Regulation for the Minister of Finance of Canada. Ian is also a past board member and chair of the Investment Industry Association of Canada. In addition to the public company board listed below, Ian is a director of the private companies Laricina Energy Ltd., Northern Blizzard Resources Inc., Pumpwell Solutions Ltd. and TriAxon Oil Corp. He was a director of the public companies Hardy Oil & Gas plc from 2008 to 2012 and Taylor Gas Liquids Ltd. from 1997 to 2008. | |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | | TELECONFERENCE | | | OVERALL | |

| | | |

| | Board of directors | | | 5 of 5 | * | | | | | | | 100% | |

| | Audit and finance | | | 3 of 3 | * | | | | | | | 100% | |

| | Reserves oversight | | | 2 of 2 | * | | | | | | | 100% | |

| | Safety, health and environment | | | 3 of 3 | * | | | | | | | 100% | |

| | | | | | | | | | | | | | |

| | * Joined the board in May 2012 | |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS | |

| | | |

| | Logan International Inc. | | | Audit | | | | | | | | | |

| | SECURITIES HELD | |

| | | |

| | Year | | Cameco shares | | | DSUs | | Total shares and DSUs | | | Total value of shares and DSUs | | | Meets share

ownership guidelines | |

| | | |

| | 2012 | | | 75,000 | | | 2,988 | | | 77,988 | | | | $1,527,776 | | | | Yes | |

| | | |

| | Options held: nil | |

| |

2013MANAGEMENTPROXYCIRCULAR 13

| | | | | | | | | | | | | | |

Director since 2011 Geneva, Switzerland Canadian and French Experience • Electricity industry • Executive compensation • Finance • International • Mergers and acquisitions • Nuclear industry | | Daniel Camus (60) | Independent Daniel Camus is the former group CFO and head of strategy and international activities of Electricité de France SA (EDF). Based in France, EDF is an integrated energy operator active in the generation (including nuclear generation), distribution, transmission, supply and trading of electrical energy with international subsidiaries. He is the CFO of the humanitarian finance organization, The Global Fund to Fight AIDS, Tuberculosis and Malaria. Daniel holds a PhD in Economics from Sorbonne University, and an MBA in finance and economics from the Institute d’Études Politiques de Paris. Over the past 25 years, he has held various senior roles with the Aventis and Hoechst AG Groups in Germany, the US, Canada and France. He has been chair of several audit committees and brings to Cameco’s board his experience in human resources and executive compensation through his senior executive roles at international companies where he worked on business integrations in Germany, the US, Canada and France. Daniel is also a former member of the boards of EnBW AG, Constellation Energy Group, Inc. and Edison SpA. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Audit and finance | | 5 of 5 | | | | | | 100% |

| | Human resources and compensation | | 5 of 5 | | | 1 of 1 | | | 100% |

| | Safety, health and environment | | 5 of 5 | | | | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Morphosys AG, Munich | | Audit |

| | Valeo SA, Paris | | Audit (chair) |

| | Vivendi SA, Paris | | Audit (chair) |

| | SGL Carbon AG, Wiesbaden | | Nomination, Strategy/technology |

| | SECURITIES HELD |

| | |

| | Year | | Cameco

shares | | DSUs | | Total shares and DSUs | | Total value of shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | — | | 15,058 | | 15,058 | | | $294,985 | | | Has until |

| | 2011 | | — | | 4,898 | | 4,898 | | | $ 90,181 | | | May 27, 2016 to |

| | Change | | — | | 10,160 | | 10,160 | | | $204,804 | | | acquire additional |

| | | | | | | | | | | | | | shares and DSUs |

| | | | | | | | | | | | | | equal to $420,000 |

| | |

| | Options held: nil |

|

| |

Director since 2006 Toronto, ON Canadian Experience • Executive compensation • Finance • International | | John Clappison (66) | Independent John Clappison is the former managing partner of the Greater Toronto Area office of PricewaterhouseCoopers LLP, where he spent 37 years. He is a fellow of the Canadian Institute of Chartered Accountants of Ontario. In addition to his extensive financial experience, John brings to Cameco’s board his experience in human resources and executive compensation as a senior member of the PwC executive team. He is also a former member of the compensation committee at Canadian Real Estate Investment Trust. In addition to the public company boards listed below, John serves as a director of the private company, Summitt Energy Holdings GP Inc. and was a director of the public company Canadian Real Estate Investment from 2007 to 2011. He is actively involved with the Canadian Foundation for Facial Plastic and Reconstructive Surgery and the Shaw Festival Theatre Endowment Foundation. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Audit and finance (chair) | | 5 of 5 | | | | | | 100% |

| | Human resources and compensation | | 5 of 5 | | | 1 of 1 | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Inmet Mining Corporation | | Audit (chair) |

| | Rogers Communications Inc. | | Audit (chair), Pension |

| | Sun Life Financial Inc. | | Risk review(chair), Audit |

| | SECURITIES HELD |

| | |

| | Year | | Cameco

shares | | DSUs | | Total shares and DSUs | | Total value of shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | 3,000 | | 25,160 | | 28,160 | | | $551,651 | | | Yes |

| | 2011 | | 2,000 | | 19,279 | | 21,279 | | | $391,743 | | | |

| | Change | | 1,000 | | 5,881 | | 6,881 | | | $159,908 | | | |

| | |

| | Options held: nil |

|

14 CAMECOCORPORATION

| | | | | | | | | | | | | | |

Director since 1999 Santa Fe, NM, USA American Experience • Executive compensation • International • Nuclear industry | | Joe Colvin (70) | Independent Joe Colvin is the past president of the American Nuclear Society, a not-for-profit organization that promotes the awareness and understanding of the application of nuclear science and technology. He was elected president emeritus of the Nuclear Energy Institute Inc. in 2005, after serving as the Institute’s president and CEO from 1996 to 2005. Joe has also held senior management positions with the Nuclear Management and Resources Committee and the Institute for Nuclear Power Operations, and served as a line officer with the US Navy nuclear submarine program for 20 years. Joe has a bachelor of science degree in electrical engineering from the University of New Mexico and is a graduate of Harvard University’s advanced management program. He serves as a director of the American Nuclear Society and the Foundation for Nuclear Studies. Other than the public company board listed below, he has not served on any other public company boards over the past five years. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | �� | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Nominating, corporate governance and risk | | 4 of 4 | | | 1 of 1 | | | 100% |

| | Safety, health and environment (chair) | | 5 of 5 | | | | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | US Ecology Inc. | | Compensation (chair) |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares

and DSUs | | Total value of

shares and

DSUs | | | Meets share ownership guidelines |

| | |

| | 2012 2011 Change | | 4,000 4,000 — | | 85,096 83,459 1,637 | | 89,096 87,459 1,637 | |

| $ 1,745,392

$ 1,610,112 $ 135,280 |

| | Yes |

| | |

| | | Options held: nil |

| |

Director since 1994 Brookeville, MD, USA American Experience • Executive compensation • Government relations • Legal • Nuclear industry | | James Curtiss (59) | Independent James Curtiss has been the principal of Curtiss Law since 2008. Prior to this, he was a partner with the law firm Winston & Strawn LLP in Washington, DC, where he concentrated on energy policy and nuclear regulatory law. He was a commissioner with the US Nuclear Regulatory Commission from 1988 to 1993. James received a bachelor of arts and a juris doctorate from the University of Nebraska. He is a frequent speaker at nuclear industry conferences and has spoken on topics such as licensing and regulatory reform, advanced reactors and fuel cycle issues. He brings his legal experience in this field to the board. In addition to his extensive energy and nuclear regulatory experience as a lawyer, he has served on our human resources and compensation committee for the past 13 years and as the committee chair since 2002. James served on the board of Constellation Energy Group from 1994 to 2012. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Human resources and compensation (chair) | | 5 of 5 | | | 1 of 1 | | | 100% |

| | Nominating, corporate governance and risk | | 4 of 4 | | | 1 of 1 | | | 100% |

| | Other public company boards and committee memberships: none |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares

and DSUs | | Total value of

shares and

DSUs | | | Meets share ownership guidelines |

| | |

| | 2012 | | 17,321 | | 105,884 | | 123,205 | | | $ 2,413,577 | | | Yes |

| | 2011 | | 17,321 | | 94,331 | | 111,652 | | | $ 2,055,519 | | | |

| | Change | | — | | 11,553 | | 11,553 | | | $ 358,058 | | | |

| | OPTIONS HELD1,2 |

| | |

| | Date granted | | Expiry date | | Exercise

price | | Total unexercised | | | Value of in-the-money

options2 |

| | |

| | Sept 21/04 | | Sept 20/14 | | $ 15.792 | | | 3,300 | | | $ 12,533 |

| | |

2013MANAGEMENTPROXYCIRCULAR 15

| | | | | | | | | | | | | | | | |

Director since 2009 Prince Albert, SK Canadian Experience • Aboriginal affairs • First Nations governance | | Donald Deranger (57) | Not independent Donald Deranger is an advisor to the Athabasca Basin Development Corporation and president of Points Athabasca Contracting Limited Partnership, a northern Saskatchewan aboriginal contractor, which does business with Cameco. He is the past president of Learning Together, a non-profit aboriginal organization that works to build relationships with the mining industry. He was the Athabasca Vice Chief of the Prince Albert Grand Council from 2003 to 2012. Donald also serves as a director of Northern Resource Trucking Limited Partnership, Mackenzie River Basin Board and Keepers of the Athabasca Watershed Council. An award-winning leader in the Saskatchewan aboriginal community, Donald brings to the board a deep understanding of the culture and peoples of northern Saskatchewan where our richest assets are located. Donald has not served on any other public company boards over the past five years. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Reserves oversight | | 3 of 3 | | | | | | 100% |

| | Safety, health and environment | | 5 of 5 | | | | | | 100% |

| | Other public company boards and committee memberships: none |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares and DSUs | | Total value of

shares and

DSUs | | Meets share ownership guidelines |

| | |

| | 2012 2011 Change | | — — — | | 15,676 10,315 5,361 | | 15,676 10,315 5,361 | | $ 307,096 $ 189,905 $ 117,191 | |

| Has until May 27, 2016 to

acquire additional shares and

DSUs equal to $420,000 |

| | |

| | | Options held: nil |

| |

Director since 2011 Saskatoon, SK Canadian Experience •��International • Mining • Nuclear industry | | Tim Gitzel (50) | President and CEO | Not independent Tim Gitzel is president and CEO of Cameco since 2011. He was appointed president in 2010 and served as senior vice president and COO from 2007 to 2010. Tim has 19 years of senior management experience in Canadian and international uranium activities. Prior to joining Cameco, he was executive vice president, mining business unit for AREVA in Paris, France, where he was responsible for global uranium, gold, exploration and decommissioning operations in 11 countries. Tim received his bachelor of arts and law degrees from the University of Saskatchewan. He serves on the board of the Canadian Nuclear Association and became chair of the World Nuclear Association in 2012. He is a director of the Nuclear Energy Institute for 2011 through 2013 and is vice chair of the 2013 Memorial Cup Organizing Committee for the Canadian Junior Hockey Championship. Tim is also past president of the Saskatchewan Mining Association, and has served on the boards of SaskEnergy Corporation, the Saskatchewan Chamber of Commerce and Junior Achievement of Saskatchewan. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Other public company boards and committee memberships: none |

| | SECURITIES HELD |

| | |

| | Year | | Cameco

shares | | PSUs* | | RSUs | | Total shares,

PSUs and

RSUs | | Total value of

shares, PSUs

and RSUs** | | | Meets share

ownership guidelines |

| | |

| | 2012 2011 Change | | 33,173 22,300 10,873 | | 97,100 45,000 52,100 | | 70,000 70,000 — | | 200,273 137,300 62,973 | |

| $ 3,923,348

$ 2,527,693 $ 1,395,655 |

| | Has met 29% of the target for the CEO. Has until December 31, 2016 to acquire additional shares and qualifying PSUs (see page 61) |

| | |

| | | * Tim’s 20,000 PSUs from 2010 vested on December 31, 2012, and were paid out on March 1, 2013. These 2010 PSUs are included in the PSU totals. ** Value of shares, PSUs and restricted share units (RSUs) are calculated using $19.59 for 2012 and $18.41 for 2011, the year-end closing prices of Cameco shares on the TSX.This is the total value of Tim’s accumulated shares and other equity-based holdings. Options held: SeeIncentive plan awards on page 83. |

16 CAMECOCORPORATION

| | | | | | | | | | | | | | |

Director since 2009 Toronto, ON Canadian Experience • CEO experience • Executive compensation • Exploration • International • Mining | | James Gowans (61) | Independent James Gowans is the managing director of the Debswana Diamond Company in Botswana. He is the former COO and chief technical officer of DeBeers SA, and the former CEO of DeBeers Canada Inc. Prior to that, he was the senior vice-president and COO of PT Inco in Indonesia, a nickel producing company, and served on the board of Bison Gold Resources Inc., a junior exploration public company. James is the past chair of The Mining Association of Canada. James received a bachelor of applied science degree in mineral engineering from the University of British Columbia and attended the Banff School of Advanced Management. He has extensive mining knowledge and perspective on the importance of corporate social responsibility. His human resources experience includes a previous position as vice president, human resources at Placer Dome. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Nominating, corporate governance and risk | | 3 of 4 | | | 1 of 1 | | | 80% |

| | Reserves oversight | | 3 of 3 | | | | | | 100% |

| | Safety, health and environment | | 5 of 5 | | | | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | PhosCan Chemical Corp. | | Compensation (chair), Corporate governance and nominating, Corporate finance |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares and DSUs | | Total value of

shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | 1,000 | | 24,936 | | 25,936 | | | $ 508,088 | | | Yes |

| | 2011 | | 1,000 | | 15,280 | | 16,180 | | | $ 297,875 | | | |

| | Change | | — | | 9,756 | | 9,756 | | | $ 210,213 | | | |

| | |

| | | Options held: nil |

| |

Director since 1992 Saskatoon, SK Canadian Experience • Board governance • Legal | | Nancy Hopkins (58) | Independent Nancy Hopkins, Q.C., is a partner with the law firm McDougall Gauley LLP in Saskatoon, where she concentrates on corporate and commercial law and taxation. Nancy was chair of the board of governors of the University of Saskatchewan from 2010 to 2013, chair of the board of the Saskatoon Airport Authority from 2009 to 2012, and serves as a director of the Canada Pension Plan Investment Board. Nancy received her bachelor of commerce and laws degrees from the University of Saskatchewan, and is an honorary member of the Institute of Chartered Accountants of Saskatchewan. She brings to the board extensive experience in the Saskatchewan business community, and her board experience with a wide range of respected organizations has provided her with a strong governance background and a wealth of knowledge. Except for the public companies listed below, she has not served on any other public company boards over the past five years. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Audit and finance | | 5 of 5 | | | | | | 100% |

| | Nominating, corporate governance and risk (chair) | | 4 of 4 | | | 1 of 1 | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Growthworks Canadian Fund Ltd. | | Audit and valuation (chair) |

| | Growthworks Commercialization Fund Ltd. | | Audit and valuation (chair) |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares and DSUs | | Total value of

shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | 38,500 | | 20,183 | | 58,683 | | | $ 1,149,598 | | | Yes |

| | 2011 | | 38,500 | | 17,586 | | 56,086 | | | $ 1,032,535 | | | |

| | Change | | — | | 2,597 | | 2,597 | | | $ 117,063 | | | |

| | |

| | Options held: nil |

2013MANAGEMENTPROXYCIRCULAR 17

| | | | | | | | | | | | | | |

Director since 2006 Edmonton, AB Canadian Experience • Corporate social responsibility • Executive compensation • Government relations | | Anne McLellan (62) | Independent The Honourable Anne McLellan is a former Deputy Prime Minister of Canada and has held several senior cabinet positions, including federal Minister of Natural Resources, Minister of Health, Minister of Justice and Attorney General of Canada, and federal interlocutor of Métis and non-status Indians. Since leaving politics, she has been appointed distinguished scholar in residence at the University of Alberta in the Alberta Institute for American Studies and is counsel in the national law firm Bennett Jones LLP. Anne holds a bachelor of arts degree and a law degree from Dalhousie University, and a master of laws degree from King’s College, University of London. She serves as chair of the Royal Alexandra Hospital Foundation and is a director on the boards of Canadian Business for Social Responsibility and the Edmonton Regional Airport Authority, among others. She is also a member of the TD Securities Energy Advisory Board. In addition to her extensive experience in federal administration and policy, she has served on the compensation committee of other public company boards and on Cameco’s human resources and compensation committee for the past six years. Anne served on the board of Nexen Inc. from 2006 to 2013. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Human resources and compensation | | 5 of 5 | | | 1 of 1 | | | 100% |

| | Nominating, corporate governance and risk | | 4 of 4 | | | 1 of 1 | | | 100% |

| | Safety, health and environment | | 5 of 5 | | | | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Agrium Inc. | | Audit, Health, safety and security |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares

and DSUs | | Total value of

shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | 100 | | 21,376 | | 21,476 | | | $ 420,714 | | | Yes |

| | 2011 | | 100 | | 18,691 | | 18,791 | | | $ 345,943 | | | |

| | Change | | — | | 2,685 | | 2,685 | | | $ 74,771 | | | |

| | |

| | | Options held: nil |

| |

Director since 2002 Saskatoon, SK Canadian Experience • CEO experience • Executive compensation • Government relations • Investment industry • Mining | | Neil McMillan (61) | Independent Neil McMillan is the president and CEO of Claude Resources Inc., a Saskatchewan-based gold mining and oil and gas producing company. He previously served on the board of Atomic Energy Canada Ltd., a Canadian government nuclear reactor production and services company. Neil holds a bachelor of arts degree from the University of Saskatchewan, and is a former member of the Saskatchewan legislature. Neil’s CEO experience gives the board access to a ground level view of many of the daily mining risks and opportunities faced by Cameco. His background as an investment adviser and legislator, and his knowledge of the political and business environment in Saskatchewan, are valuable when the board is reviewing investment opportunities. In addition to his extensive experience as a senior executive, he has served on the compensation committee of other public company boards and on Cameco’s human resources and compensation committee for the past two years. Except for the public company boards listed below, Neil has not served on any other public company boards over the past five years. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL |

| | |

| | Board of directors | | 6 of 6 | | | 2 of 2 | | | 100% |

| | Audit and finance | | 2 of 2 | | | | | | 100% |

| | Human resources and compensation | | 5 of 5 | | | 1 of 1 | | | 100% |

| | Reserves oversight (chair) | | 3 of 3 | | | | | | 100% |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Claude Resources Inc. | | CEO |

| | Shore Gold Inc. | | Audit, Compensation |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares

and DSUs | | Total value of

shares and DSUs | | | Meets share

ownership guidelines |

| | |

| | 2012 | | 600 | | 33,910 | | 34,510 | | | $ 676,051 | | | Yes |

| | 2011 | | 600 | | 26,520 | | 27,120 | | | $ 499,283 | | | |

| | Change | | — | | 7,390 | | 7,390 | | | $ 176,768 | | | |

| | |

| | | Options held: nil |

18 CAMECOCORPORATION

| | | | | | | | | | | | | | |

Director since 2001 Calgary, AB Canadian Experience • Board governance • CEO experience • Executive compensation • Finance • International • Mergers and acquisitions | | Victor Zaleschuk (69) | Chair of the board | Independent Victor Zaleschuk is the former president and CEO of Nexen Inc., a formerly publicly-traded independent global energy and chemicals company. In 2012, Victor became the chair of the board of Agrium Inc. He brings to the board his vast experience in the resource industry as the former CEO of a major Canadian oil and gas company with international holdings, a financial background as a former CFO, and experience in mergers and acquisitions. He has gained human resources expertise through his participation on the boards of Nexen Inc., Agrium Inc. and Cameco. Victor holds a bachelor of commerce degree from the University of Saskatchewan and has been a chartered accountant since 1967. Victor served on the board of Nexen Inc. from 1997 to 2013. |

| | BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE | | IN PERSON | | TELECONFERENCE | | | OVERALL* |

| | |

| | Board of directors (chair) | | 6 of 6 | | | 2 of 2 | | | 100% |

| | |

| | * As board chair, Victor also attended 23 committee meetings in an ex-officio capacity |

| | OTHER PUBLIC COMPANY BOARDS AND COMMITTEE MEMBERSHIPS |

| | |

| | Agrium Inc. | | Board chair, Corporate governance and nominating |

| | SECURITIES HELD |

| | |

| | Year | | Cameco shares | | DSUs | | Total shares and DSUs | | Total value of

shares and DSUs | | | Meets share ownership guidelines |

| | |

| | 2012 | | 28,615 | | 69,523 | | 98,138 | | | $ 1,922,517 | | | Yes |

| | 2011 | | 28,615 | | 58,688 | | 87,303 | | | $ 1,607,245 | | | |

| | Change | | — | | 10,835 | | 10,835 | | | $ 315,272 | | | |

| | |

| | | Options held: nil |

| 1. | Options held refers to options under our stock option plan that have not been exercised. The board stopped granting options to directors on October 28, 2003. In 2004, James Curtiss exercised reload options to receive additional options with a 10-year term. The exercise price and number of options have been adjusted to reflect stock splits of Cameco shares. |

| 2. | Thevalue of in-the-money options is calculated as the difference between $19.59 (the 2012 year-end closing price of Cameco shares on the TSX) and the exercise price of the options, multiplied by the number of options held at December 31, 2012. |

Board diversity

We are subject to terms of theInvestment Canada Act, theUranium Non-Resident Ownership Policy and theCanada Business Corporations Act, which require at least two-thirds of our directors to be Canadian citizens and half to be Canadian residents.

We believe our board should include:

| • | | at least one aboriginal director from Saskatchewan |

| • | | two directors who are US residents |

| • | | one or two directors from Europe and/or Asia |

| • | | at least two female directors |

| • | | directors of various ages |

| • | | directors with differing backgrounds and experience. |

The nominating, corporate governance and risk committee surveyed its members, the board chair and our senior executives about board diversity in 2009, and confirmed the importance of the board having these characteristics. In its 2012 assessment, the board identified the desire to have another female director.

Four non-executive directors have joined the board since 2009, bringing experience in Canadian aboriginal affairs, mining and exploration, investment banking, mergers and acquisitions, financial and international experience in energy and the nuclear industry.

2013MANAGEMENTPROXYCIRCULAR 19

Meeting attendance

We believe that an active board governs more effectively. We expect our directors to attend all board meetings, all of their respective committee meetings, and the annual meeting of shareholders. Directors can participate by teleconference if they are unable to attend board and committee meetings in person.

The board must have a majority of directors in attendance to hold a meeting and transact business. In 2012, the board and committees met in camera without management present at all meetings. The independent directors also met in camera at one meeting in 2012.

The table below shows the number of meetings each director attended in 2012. All directors attended the 2012 annual meeting. Victor Zaleschuk, our board chair, is an ex-officio member of each board committee and attended 23 committee meetings in 2012. Board committees operate independently of management, so Tim Gitzel, our president and CEO, is not a member of any board committee.

SeeOur expectations for directors on page 29 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NAME | | INDEPENDENT | | BOARD | | | AUDIT

AND

FINANCE

COMMITTEE | | | HUMAN

RESOURCES AND

COMPENSATION

COMMITTEE | | | NOMINATING,

CORPORATE

GOVERNANCE

AND RISK

COMMITTEE | | | RESERVES

OVERSIGHT

COMMITTEE | | | SAFETY,

HEALTH AND

ENVIRONMENT

COMMITTEE | |

Ian Bruce1 | | yes | | | 5 of 5 | | | | 100 | % | | | 3 of 3 | | | | 100 | % | | | | | | | | | | | | | | | | | | | 2 of 2 | | | | 100 | % | | | 4 of 4 | | | | 100 | % |

Daniel Camus | | yes | | | 8 of 8 | | | | 100 | % | | | 5 of 5 | | | | 100 | % | | | 6 of 6 | | | | 100 | % | | | | | | | | | | | | | | | | | | | 5 of 5 | | | | 100 | % |

John Clappison | | yes | | | 8 of 8 | | | | 100 | % | |

| 5 of 5

Chair |

| | | 100 | % | | | 6 of 6 | | | | 100 | % | | | | | | | | | | | | | | | | | | | | | | | | |

Joe Colvin | | yes | | | 8 of 8 | | | | 100 | % | | | | | | | | | | | | | | | | | | | 5 of 5 | | | | 100 | % | | | | | | | | | |

| 5 of 5

Chair |

| | | 100 | % |

James Curtiss | | yes | | | 8 of 8 | | | | 100 | % | | | | | | | | | |

| 6 of 6

Chair |

| | | 100 | % | | | 5 of 5 | | | | 100 | % | | | | | | | | | | | | | | | | |

Donald Deranger | | no | | | 8 of 8 | | | | 100 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | 3 of 3 | | | | 100 | % | | | 5 of 5 | | | | 100 | % |

Tim Gitzel | | no | | | 8 of 8 | | | | 100 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

James Gowans | | yes | | | 8 of 8 | | | | 100 | % | | | | | | | | | | | | | | | | | | | 4 of 5 | | | | 80 | % | | | 3 of 3 | | | | 100 | % | | | 5 of 5 | | | | 100 | % |

Nancy Hopkins | | yes | | | 8 of 8 | | | | 100 | % | | | 5 of 5 | | | | 100 | % | | | | | | | | | |

| 5 of 5

Chair |

| | | 100 | % | | | | | | | | | | | | | | | | |

Oyvind Hushovd | | yes | | | 8 of 8 | | | | 100 | % | | | 5 of 5 | | | | 100 | % | | | 6 of 6 | | | | 100 | % | | | | | | | | | | | 3 of 3 | | | | 100 | % | | | | | | | | |

Anne McLellan | | yes | | | 8 of 8 | | | | 100 | % | | | | | | | | | | | 6 of 6 | | | | 100 | % | | | 5 of 5 | | | | 100 | % | | | | | | | | | | | 5 of 5 | | | | 100 | % |

Neil McMillan | | yes | | | 8 of 8 | | | | 100 | % | | | 2 of 2 | | | | 100 | % | | | 6 of 6 | | | | 100 | % | | | | | | | | | |

| 3 of 3

Chair |

| | | 100 | % | | | | | | | | |

Victor Zaleschuk | | yes | |

| 8 of 8

Chair |

| | | 100 | % | | | 5 of 5 | | | | 100 | % | | | 6 of 6 | | | | 100 | % | | | 5 of 5 | | | | 100 | % | | | 3 of 3 | | | | 100 | % | | | 4 of 5 | | | | 80 | % |

83% of the nominated directors are independent | |

| Total #

of meetings |

| | | 8 | | | | | | | | 5 | | | | | | | | 6 | | | | | | | | 5 | | | | | | | | 3 | | | | | | | | 5 | |

| 1. | Ian Bruce joined the board on May 15, 2012. |

20 CAMECOCORPORATION

Skills and experience

A board that has a broad mix of skills and experience can effectively oversee issues that arise with a company of our size and complexity, and make more informed decisions.

SKILLS MATRIX

We use a skills matrix with categories of skills and attributes. Each director must be financially literate, independent minded and a team player.

The table below lists the 11 other categories that are essential for the board to effectively govern and to act as a strategic resource for Cameco, and the level of expertise the current directors indicated in their 2012 self-assessments. The directors complete the self-assessment of skills and attributes every year.

| | | | | | | | | | | | |

SELF-ASSESSMENT OF SKILLS AND EXPERIENCE | | EXPERT | | | STRONG WORKING

KNOWLEDGE | | | BASIC LEVEL OF

KNOWLEDGE | |

| | | |

Board experience Prior or current experience as a board member for a major organization with a current governance mindset, including a focus on corporate social responsibility | | | 8 | | | | 5 | | | | 0 | |

| | | |

Business judgment Track record of leveraging own experience and wisdom in making sound strategic and operational business decisions; demonstrates business acumen and a mindset for risk oversight | | | 8 | | | | 5 | | | | 0 | |

| | | |

Financial expertise Experience as a professional accountant, CFO or CEO in financial accounting and reporting and corporate finance | | | 4 | | | | 7 | | | | 2 | |

| | | |

Government relations Experience in, or a thorough understanding of, the workings of government and public policy both domestically and internationally | | | 5 | | | | 7 | | | | 1 | |

| | | |

Human capital Experience in executive compensation and the oversight of significant, sustained succession planning and talent development and retention programs. | | | 8 | | | | 4 | | | | 1 | |

| | | |

Industry knowledge Knowledge of the uranium/nuclear industries, market and business imperatives, international regulatory environment and stakeholder management | | | 4 | | | | 7 | | | | 2 | |

| | | |

International Experience working in a major organization that carries on business in one or more international jurisdictions, preferably in countries or regions where we have or are developing operations | | | 6 | | | | 5 | | | | 2 | |

| | | |

Investment banking/mergers and acquisitions Experience in the field of investment banking or in mergers and acquisitions | | | 3 | | | | 5 | | | | 5 | |

| | | |

Managing/leading growth Experience driving strategic direction and leading growth of an organization, preferably including the management of multiple significant projects | | | 8 | | | | 4 | | | | 1 | |

| | | |

Mining, exploration and operations Experience with a leading mining or resource company with reserves, exploration and operations expertise | | | 3 | | | | 5 | | | | 5 | |

| | | |

Operational excellence Experience in a complex chemical or nuclear operating environment creating and maintaining a culture focused on safety, the environment and operational excellence | | | 4 | | | | 4 | | | | 5 | |

2013MANAGEMENTPROXYCIRCULAR 21

Director development

Our directors must be knowledgeable about issues affecting our business, the nuclear industry, governance, compensation disclosure and related matters. Continuing education helps them keep abreast of industry and other developments, and to understand issues within the context of our business.

ORIENTATION

We have an orientation program for new directors to familiarize them with the uranium and nuclear industries, Cameco, and what we expect of the board and committees. They receive an educational manual with information on our corporate and organizational structure, Cameco, the uranium and nuclear industries, recent regulatory filings, our financial statements, governance documents and key policies. New directors attend a nuclear industry seminar presented by Cameco. Another part of their orientation for each committee which they join is a round table meeting with the committee chair and management representatives. They also meet senior management through presentations and informal social gatherings.

CONTINUING EDUCATION

The board and committees receive presentations on topical issues when making key business decisions, during strategic planning meetings and in response to director requests. Directors also have an annual site visit to a facility we operate or other nuclear facility, and attend external conferences and seminars.

Directors identify educational needs through the board and committee process and self-assessment surveys. The corporate secretary arranges internal presentations for the board after consulting with the board or committee chairs, and notifies directors of pertinent conferences, seminars and other educational opportunities.

New committee members receive a copy of the committee’s mandate and minutes of the four most recent committee meetings. They also meet with the committee’s key management representatives to discuss recent activities and other issues or concerns. The audit and finance committee has an ongoing education program, while the other committees receive education on relevant matters that are identified by the committee, committee chair, corporate secretary or management.

We pay the fees and expenses for directors to attend conferences or other events that are important for enhancing their knowledge for serving on our board.

The table below details our director development program in 2012.

| | | | | | | | |

2012 | | TOPIC | | PRESENTED/HOSTED BY | | ATTENDED BY |

| | | | |

| Various dates | | Audit committee chairs: preparation of best practices guidelines for CAC40 companies | | Institute of Corporate Directors (ICD) | | Daniel Camus | | |

| | | | |

| January 24 | | First year of audited IFRS financial statements: questions directors should ask auditors and management | | KPMG | | Anne McLellan | | |

| | | | |

| January 25-27 | | Macroeconomic and specific oil and gas industry topics | | Peters & Co. Limited | | Ian Bruce | | |

| | | | |

| April 12 | | Director series: the board’s role in growth and strategy | | Deloitte | | Nancy Hopkins | | |

| | | | |

| May 11 | | Board dynamics: a peek inside the boardroom | | ICD | | John Clappison Nancy Hopkins | | |

| | | | |

| May 15 | | Exploration and beyond | | Darryl Clark Vice President, Exploration, Cameco | | All directors | | |

| | | | |

| May 30 | | Sustainable development: embracing environmental, social and geopolitical challenges responsibly (co-host and panel participant) | | ICD | | Anne McLellan | | |

22 CAMECOCORPORATION

| | | | | | | | |

2012 | | TOPIC | | PRESENTED/HOSTED BY | | ATTENDED BY |

| | | | |

| May 31 | | The board’s role in strategy oversight | | Canadian Audit Committee Network (CACN) | | John Clappison | | |

| | | | |

| June 5 | | Compensating committee executive breakfast briefing | | Meridian Compensation Partners | | Donald Deranger | | |

| | | | |

| June 14 | | Strategic risk oversight for board directors | | The Directors College/ The Conference Board of Canada | | Nancy Hopkins | | |

| | | | |

| June 25 | | Audit committee orientation | | Cameco management | | Ian Bruce | | |

| | | | |

| June 26-27 | | Nuclear industry seminar | | Cameco | | Ian Bruce | | Donald Deranger |

| | | | |

| July 24 | | Wyoming operations and head office site visit | | Cameco management | | All directors | | |

| | | | |

| August 22 | | Current trends in the mining industry | | Phil Hopwood Partner and Global Mining Leader Deloitte Australia | | All directors | | |

| | | | |

| September 11 | | Advanced program: board risk oversight | | RIMS Canada Conference | | Nancy Hopkins | | |

| | | | |

| September 12 | | Current market conditions and the macroeconomic outlook: web seminar series | | The NASDAQ OMX Group, Inc. | | Nancy Hopkins | | |

| | | | |

| September 11-13 | | Oil and gas company presentations and panel discussions on current energy-related topics | | Peters & Co. Limited | | Ian Bruce | | |

| | | | |

| September 13 | | Annual corporate directors survey results: webcast series | | PwC: Centre for Board Governance | | Nancy Hopkins | | |

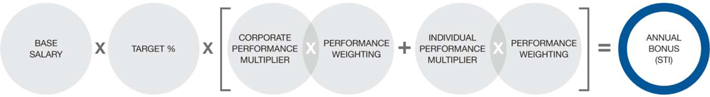

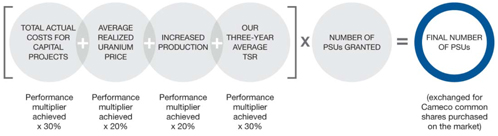

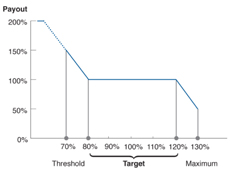

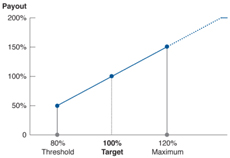

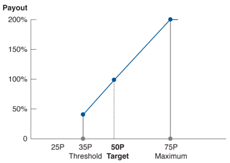

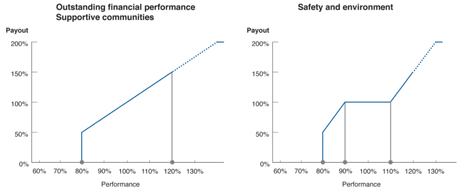

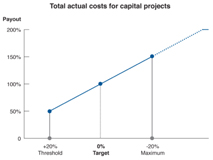

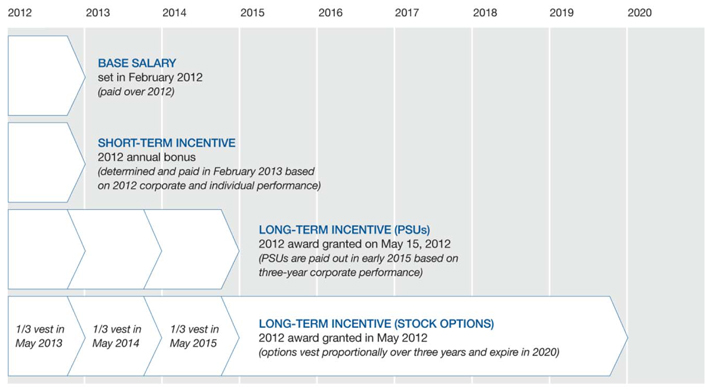

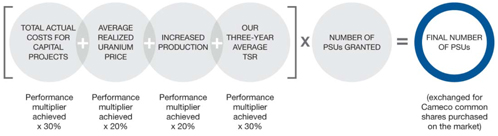

| | | | |