of June 30, 2024, the fair value of the Class C VISA stock was $540,000. The Bank also purchased $63,000 of required additional FHLB - San Francisco stock during the year.

Total deposits decreased $62.3 million, or 7%, to $888.3 million at June 30, 2024 from $950.6 million at June 30, 2023. Transaction accounts decreased $115.1 million, or 16%, to $614.5 million at June 30, 2024 from $729.6 million at June 30, 2023, while time deposits increased $53.0 million, or 24%, to $273.9 million at June 30, 2024 from $220.9 million at June 30, 2023. The increase in time deposits includes the increased utilization of brokered certificates of deposit. Brokered certificates of deposit increased $25.4 million, or 24%, to $131.8 million at June 30, 2024 from $106.4 million at June 30, 2023. As of June 30, 2024 and 2023, the percentage of transaction accounts to total deposits was 69% and 77%, respectively. Total retail deposits, defined as total deposits excluding brokered certificates of deposit, decreased by $87.7 million, or 10% to $756.5 million at June 30, 2024 from $844.2 million at June 30, 2023, due primarily to the decline of transaction account balances related to some customers seeking higher interest rates elsewhere. For additional information on deposits, see Note 6 of the Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

Borrowings, consisting of FHLB – San Francisco advances increased $3.5 million, or 1%, to $238.5 million at June 30, 2024 from $235.0 million at June 30, 2023. The increase was primarily due to new advances to augment the decrease in deposits. The weighted average maturity of the Corporation’s FHLB – San Francisco advances was approximately 13 months at June 30, 2024, up from 12 months at June 30, 2023. For additional information on borrowings, see Note 7 of the Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

Total stockholders’ equity increased slightly to $129.9 million at June 30, 2024 from $129.7 million at June 30, 2023, primarily as a result of net income and the amortization of stock-based compensation in fiscal 2024, partly offset by stock repurchases (see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” of this Form 10-K) and quarterly cash dividends paid to shareholders.

Comparison of Operating Results for the Fiscal Years Ended June 30, 2024 and 2023

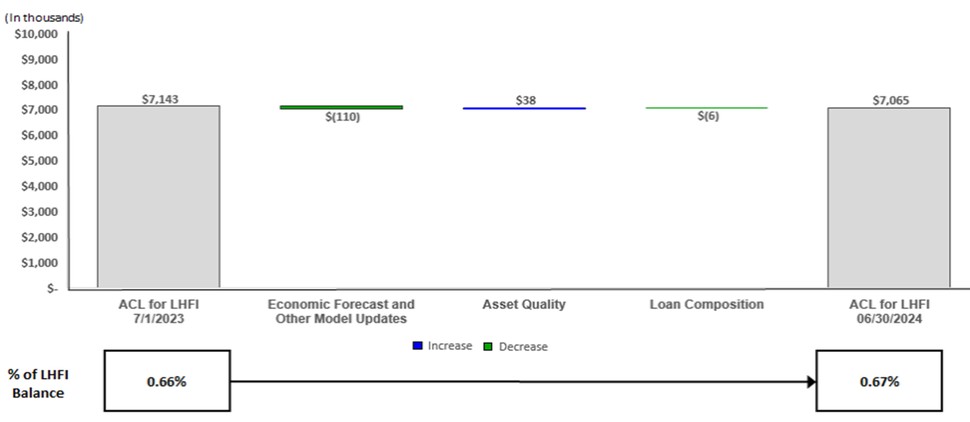

General. The Corporation recorded net income of $7.4 million, or $1.06 per diluted share, for the fiscal year ended June 30, 2024, down $1.2 million, or 14%, from $8.6 million, or $1.19 per diluted share, for the fiscal year ended June 30, 2023. The decrease in net income was primarily attributable to a $2.1 million decrease in net interest income, a $270,000 increase in non-interest expense and a $134,000 decrease in non-interest income, partly offset by a $437,000 change in the provision for credit losses resulting from a $63,000 recovery of credit losses recorded during fiscal 2024 compared to a $374,000 provision for credit losses during fiscal 2023. The Corporation's efficiency ratio, defined as non-interest expense divided by the sum of net interest income and non-interest income, increased to 73% in fiscal 2024 from 69% in fiscal 2023 due to both an increase in non-interest expenses and a decline in revenues. Return on average assets in fiscal 2024 decreased to 0.57% from 0.68% in fiscal 2023 and return on average stockholders' equity in fiscal 2024 decreased to 5.62% from 6.58% in fiscal 2023.

Net Interest Income. Net interest income decreased $2.1 million, or 6%, to $34.9 million in fiscal 2024 from $37.0 million in fiscal 2023. This decrease resulted from interest expense on interest-bearing liabilities increasing at a faster pace than interest income earned on interest-earning assets. Net interest margin decreased 21 basis points to 2.78% in fiscal 2024 from 2.99% in fiscal 2023, due to the decline in net interest income coupled with an increase in average interest earning assets. The average balance of interest-earning assets increased $18.6 million, or 2%, to $1.25 billion in fiscal 2024 from $1.24 billion in fiscal 2023. The average balance of interest-bearing liabilities increased $16.8 million, or 2%, to $1.13 billion during fiscal 2024 as compared to $1.12 billion during fiscal 2023.

Interest Income. Total interest income increased $8.7 million, or 19%, to $54.7 million for fiscal 2024 from $46.0 million for fiscal 2023. The increase was primarily attributable to an increase of interest income from loans receivable.

Interest income on loans receivable increased $8.0 million, or 19%, to $50.2 million in fiscal 2024 from $42.2 million in fiscal 2023. The increase was attributable to a higher average loan yield and, to a lesser extent, a higher average loan balance. The weighted average loan yield during fiscal 2024 increased 59 basis points to 4.69% from 4.10% in fiscal 2023,

reflecting new loans being originated at higher interest rates and adjustable rate loans repricing higher due to overall higher market interest rates resulting from the FOMC increases in the targeted federal funds rate during the latter half of fiscal