| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-07605 |

|

| |

| T. Rowe Price Mid-Cap Value Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: December 31, 2009 |

Item 1: Report to Shareholders| Mid-Cap Value Fund | December 31, 2009 |

The views and opinions in this report were current as of December 31, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

2009 was a year investors will scarcely soon forget. The equity market environment was defined by extremes: the worst decline in economic activity since the Great Depression; the highest unemployment rate in 30 years; the weakest housing market since the 1970s; bankruptcies, bank failures, and bailouts; and, for a time, what looked like the bottom falling out of the stock market. In the end, however, all was not lost. Dramatic intervention by the world’s central banks and treasuries rescued the global economy from an even worse fate than what it has experienced thus far.

Equity markets around the world began to anticipate this outcome in early spring, and investors enjoyed one of the most spectacular rallies on record off the market’s lows last March. By the end of 2009, the Russell Midcap Value Index had nearly doubled since mid-March and retraced over half of its losses from its highs in the summer of 2007, leaving it about 28% below its peak. As long-term investors, our goal is never to “shoot the lights out” over short time periods. Still, we are happy to report that our fund performed somewhat better than even the Russell index over the past year, with the large majority of our holdings showing decent gains.

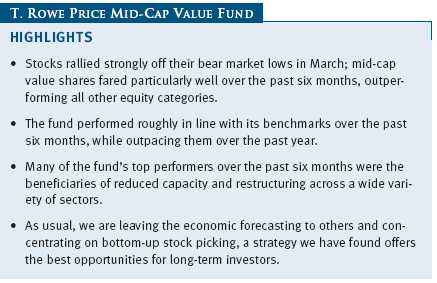

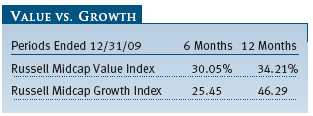

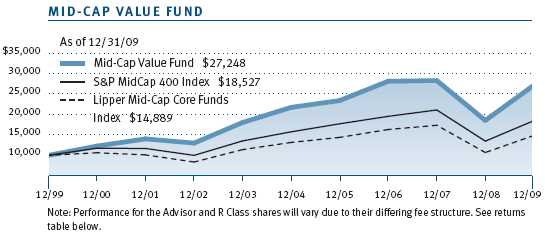

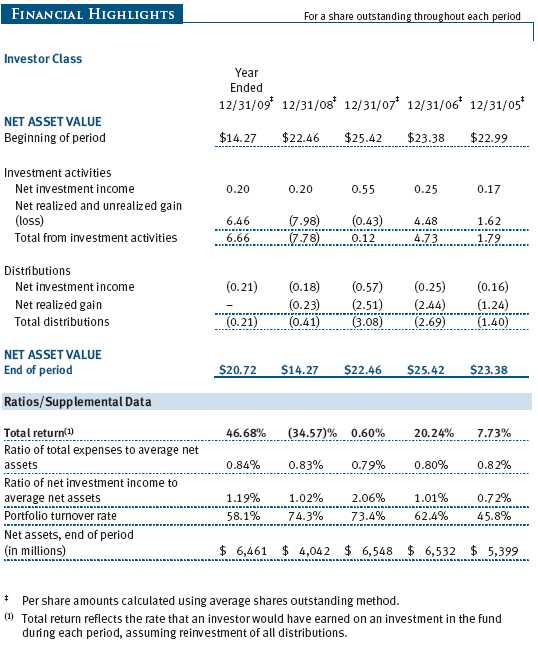

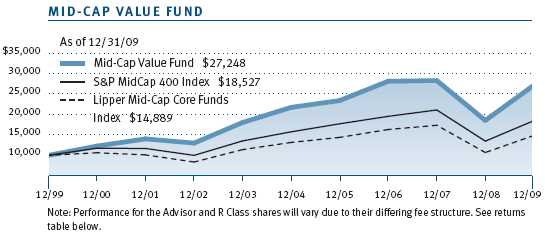

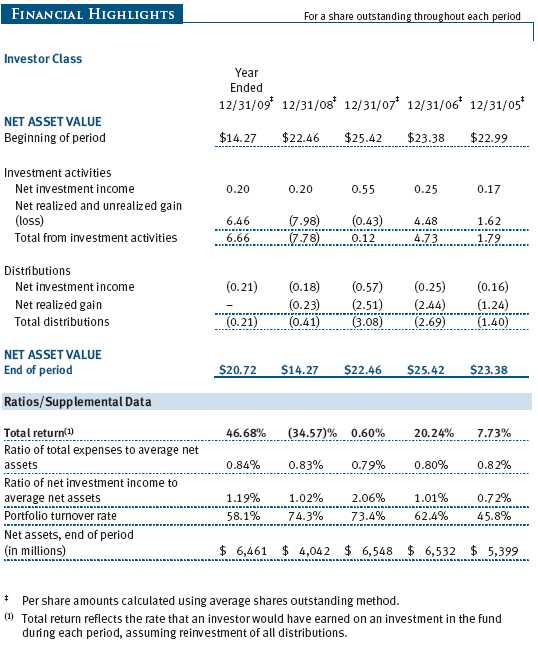

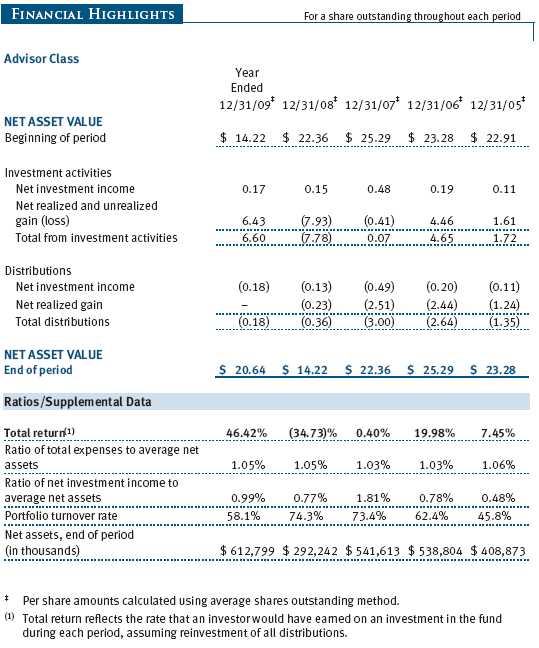

The Mid-Cap Value Fund returned 28.57% for the six months ended December 31, 2009, and 46.68% for the full year. As shown in the Performance Comparison table, the portfolio performed roughly in line with its benchmarks for the six-month period, while outpacing them for the year. (Please note that Lipper classifies the fund as “core” rather than “value.” Lipper’s fund classification has alternated between core and value in the past.) Returns for the fund’s Advisor and R Class shares were slightly lower due to their different cost structures.

The fund’s long-term performance remains favorable, in relative terms, as recognized by Morningstar’s overall five-star rating, as well as its rank among competitive funds as tracked by Lipper over longer time periods. The Mid-Cap Value Fund received an Overall Morningstar Rating™ of five stars for its risk-adjusted performance. This rating is derived from a weighted average of the performance figures associated with a fund’s 3-, 5-, and 10-year (if applicable) Morningstar Rating™ metrics. The fund was rated among 356, 356, 250, and 84 mid-cap value funds for the overall rating and the 3-, 5-, and 10-year periods ended December 31, 2009. Based on cumulative total return, Lipper ranked the Mid-Cap Value Fund 53 out of 369, 38 out of 303, 19 out of 241, and 3 out of 114 mid-cap core funds for the 1-, 3-, 5-, and 10-year periods ended December 31, 2009, respectively. Results will vary for other periods. Past performance cannot guarantee future re sults.

MARKET ENVIRONMENT

The market’s recovery off its March lows reflected a turnaround in economic conditions, although the rebound in real economic indicators was nowhere nearly as decisive. After its longest and steepest period of contraction since World War II, the economy expanded at a rate of 2.2% in the third quarter, a pace most economists expected to improve in the final quarter. Home sales, prices, and construction began to increase, and the manufacturing sector expanded thanks in part to healthy export growth, particularly to emerging markets. The job market remained notably weak, but the pace of job losses slowed substantially as the year ended. Consumers became a bit more optimistic according to sentiment gauges, and retail spending held up better than many predicted.

Massive monetary and fiscal stimulus was key to the recovery. Government intervention was felt in nearly every industry but was particularly important in the banking system. The Troubled Asset Relief Program (TARP) injected enormous amounts of capital into the banking system and began to sort out survivors through so-called stress tests. The Federal Reserve greatly expanded its traditional role through programs such as the Term Asset-Backed Securities Loan Facility (TALF), which restarted markets for bundled student, auto, credit card, and commercial real estate loans. The Fed also began buying long-term Treasury securities in an effort to keep a lid on long-term interest rates and increase liquidity, and it continued its purchases of mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae, which helped keep mortgage rates near multi-decade lows.

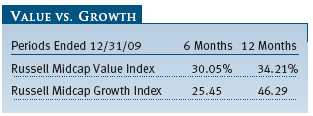

Mid-cap value stocks lagged mid-cap growth shares early in the year but gained ground in the past six months. Mid-caps outperformed smaller and larger shares over both periods. While returns were very strong in most sectors, typical “safe-haven” segments, such as utilities and consumer staples, saw more modest returns as skies brightened elsewhere.

PORTFOLIO AND STRATEGY REVIEW

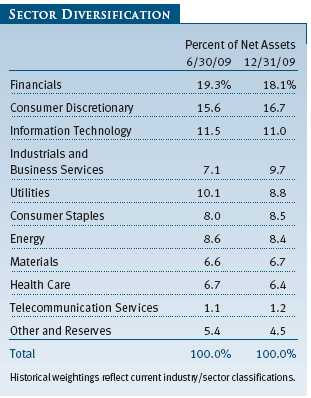

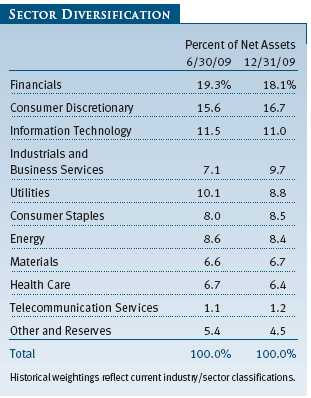

In a year when numerous industry sectors performed well in the stock market, there were a handful that served our shareholders particularly well. In our midyear letter, we discussed our preference for well-run, leading companies in industries where capital has been scarce, where consolidation has reduced the number of market participants, and where excess capacity has been purged. The result has been improved pricing discipline and a smaller number of better-capitalized players well positioned for an upturn in the economy.

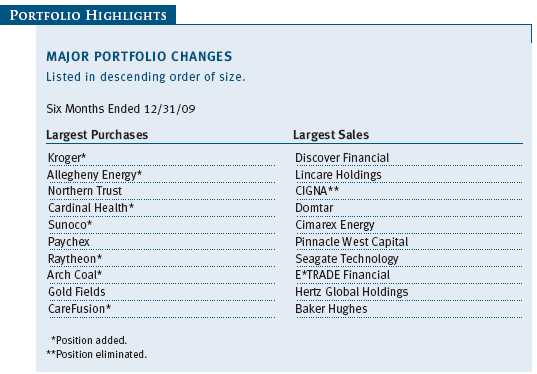

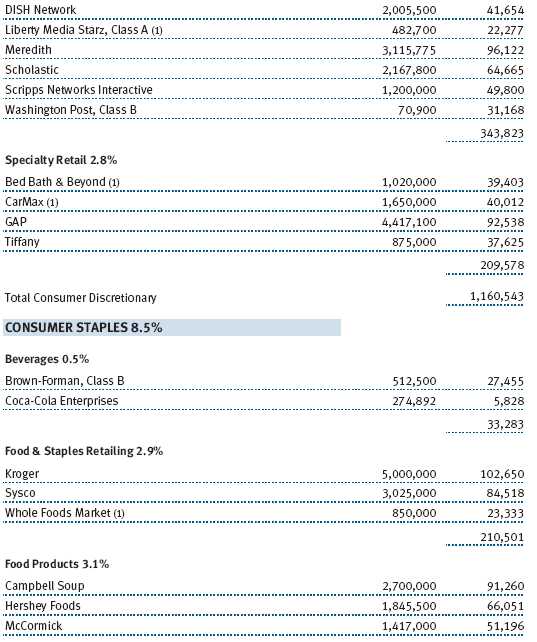

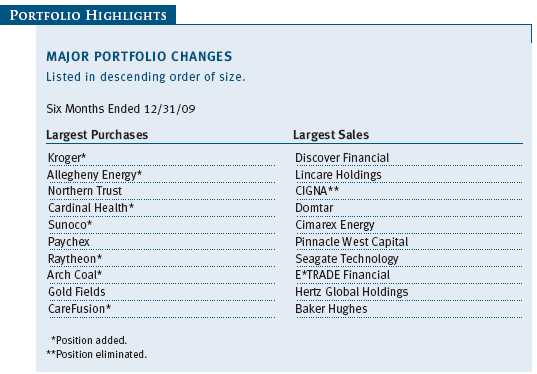

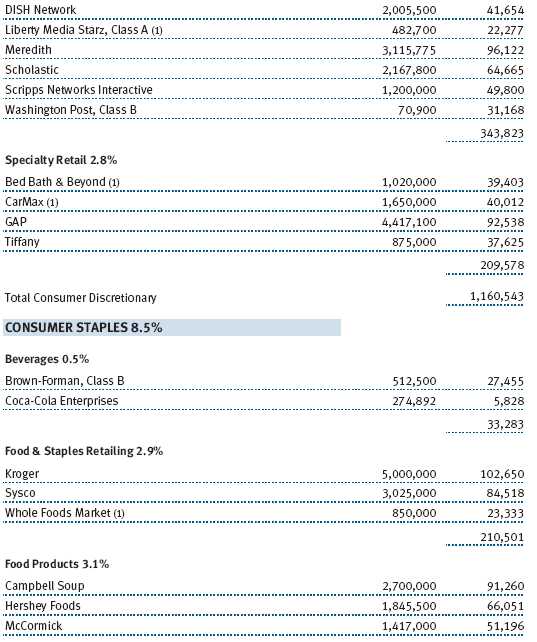

Among the fund’s best performers in the second half of 2009 were Southwest Airlines and Delta Air Lines, two of the largest and strongest companies in an industry that has seen a dramatic scaling back of capacity and a subsequent uptick in demand. Southwest has attained its leadership status primarily through internal growth and a differentiated approach to service. Over its 85-year history, Delta has grown through acquisitions, the most recent being Northwest Airlines. Each carrier dominates its market, is financially strong, and has begun to see a snapback in demand from leisure and business travelers. Another travel-related beneficiary of consolidation in the past six months was Hertz Global Holdings, whose common shares and convertible bonds—both owned in the portfolio—rose sharply during the second half. Like the airlines, the car rental industry is also showing better pricing discipline as fewer competitors vie for business. Values for used rental cars have also risen sharply, driven in part by the popular “Cash for Clunkers” program. Hertz has not only ridden the tailwind of an improved industry environment but has also engineered a significant reduction in its operating costs, further boosting profitability and helping its financial stability. (Please refer to the fund’s portfolio of investments for a complete listing of our holdings and the amount each represents in the portfolio.)

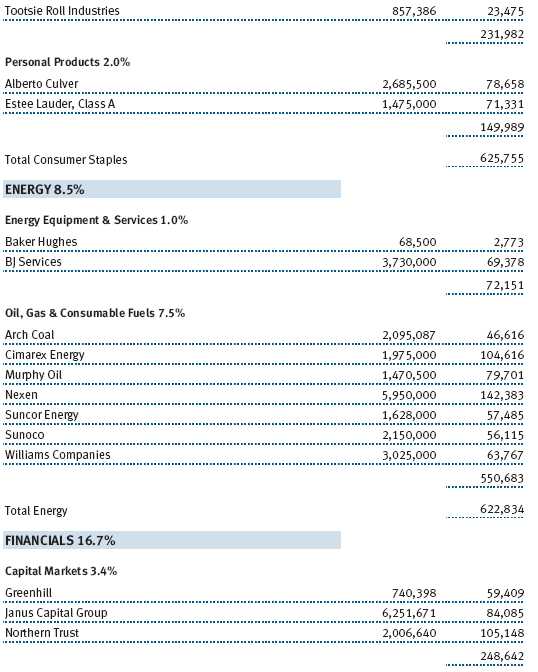

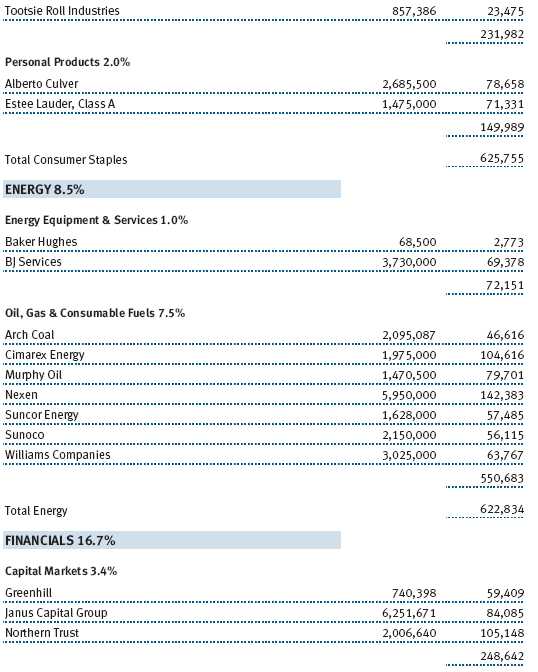

The energy sector was another source of strength for the portfolio in the second half. Oil prices rose as growth in emerging countries spurred demand, domestic natural gas prices strengthened with the onset of colder weather, and reduced drilling activity threatened to further restrict supplies. Cimarex Energy, an independent oil and gas producer and a large position in the fund, performed particularly well, aided by continued success with its natural gas exploratory drilling program in western Oklahoma. Another winner in the portfolio was BJ Services, a pressure pumping company with a large presence in the natural gas-producing basins of North America. The shares were rewarded by investors for the company’s exposure to improved natural gas drilling and production activity and its soon-to-be-consummated merger with Baker Hughes.

While energy producers and service companies performed well for the portfolio, the independent power producers, or IPPs, were another story. These owners of unregulated generating plants, which sell power to electric utilities and other users, are highly sensitive to changes in the supply/demand balance for electric power. With electricity consumption contracting last year at its fastest rate in 70 years, the independent power producers’ earnings were hit hard. As a result, NRG Energy, Calpine, and Mirant were among the biggest detractors to the portfolio’s overall performance. Though these stocks were disappointing, we are still believers in their long-term potential. Planned additions to the country’s power-generating capacity are modest, electricity demand has begun to rebound, some consolidation has occurred, the stocks are valued cheaply, and we think the risk/reward outlook here is favorable.

The materials sector, with particular emphasis on the paper and forest products industry, was an especially strong area for the Mid-Cap Value Fund in the past six months. We were pleased to see some of our earlier investments in this long-suffering industry realize their potential. Major fund holding Weyerhaeuser, the country’s largest owner of timber and manufacturer of pulp and building products, rebounded from concerns about weakness in timber values and home construction and announced plans to form a tax-advantaged real estate investment trust (REIT). Domtar and Temple Inland operate in the containerboard (brown paper) and uncoated free sheet (white paper) segments, respectively. Each has seen a dramatic reduction in the number of industry players over the years, and both companies saw substantial gains as paper demand improved and pricing for their products demonstrated unusual resilience.

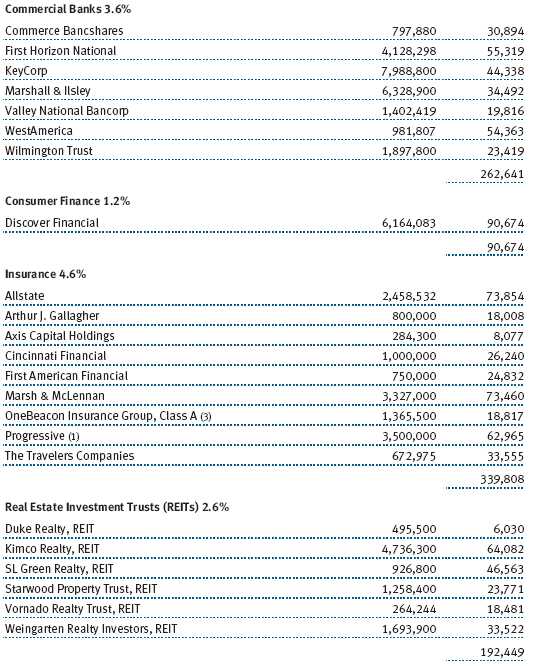

Our financial services holdings delivered mixed results in the second half. Ironically, those tied to the fortunes of real estate were among both the fund’s worst and best contributors. Regional bank holdings such as Wilmington Trust and BB&T saw their shares decline as investors focused on the remaining risks associated with continuing weakness in their residential and commercial loan portfolios. Yet some of the best performers in the fund were the purest plays on real estate, the REITs. Up until 2009, our commitment to the REIT sector had been quite modest, as valuations in past years appeared high and the exposure of many to excessive amounts of debt financing made them appear potentially vulnerable in a recession. These stocks were largely absent from the portfolio in the mid-2000s, and the fund missed some opportunities, in hindsight, as many REITs rose to stratospheric levels during the boom economic years.

However, it is not uncommon for us to forgo such opportunities when risks abound. In the late ’90s, the fund avoided many expensive technology stocks despite their tremendous recent performance, enabling us to largely sidestep the subsequent devastation in the technology sector. Similarly, the fund missed the big upswing in REITs to a large degree, but it then managed to sidestep the debacle in real estate shares that followed the onset of the “Great Recession.” In 2009, the chickens came home to roost among the REITs and many were effectively forced to issue shares at prices as much as 80% below their peaks to satisfy worried lenders. At last, prices for real estate stocks had withdrawn to levels where good value appeared, and the fund participated in many of these financings. In the second half, as concerns about their business fundamentals and balance sheet leverage began to ease, real estate holdings such as SL Green, Vornado, Kimco, and Weingarten Realty performed well for the portfolio.

Many of the fund’s other winners in the second half were the beneficiaries of reduced capacity and industry restructuring across a wide variety of industries. In health care, HealthSouth, the country’s largest provider of inpatient rehabilitation, continued to increase its share of the market through internal expansion and several small acquisitions. Apparel retailer Gap gained market share as competitors closed stores and its Old Navy brand staged an impressive turnaround in sales. Longstanding portfolio holding Molex, which manufactures tens of billions of electronic connectors each year, advanced its own multiyear efforts to reorganize and improve its efficiency. Finally, Estee Lauder’s well-recognized brands generated stronger-than-expected sales, while its ambitious profit improvement efforts began to bear fruit.

OUTLOOK

After the trauma of the previous year, 2009 ended on a note of welcome relief for investors. Of course, plenty of risks remain, as they do after every recession. We acknowledge the widely held concerns of many market participants, such as fiscal deficits; high consumer leverage; underfunded “legacy” costs such as pension benefits, health care, and Social Security; and the potential for higher taxes and inflation. These issues concern us too, but we have concluded over the years that we are neither experts in forecasting the economy nor in creating a portfolio around economic assumptions. Underlying our investment strategy is the faith that our country’s economic diversity, entrepreneurialism, and open markets will, as they have always in the past, prevail in the long run and that a disciplined, long-term investment approach will reward investors in common stocks. In the meantime, we will continue to do what has worked for our investors in the past: build a diversified portfolio of stocks from the bottom up, with a vigilant approach toward identifying risk and reward.

Respectfully submitted,

David J. Wallack

President of the fund and chairman of its Investment Advisory Committee

Heather M. McPherson

Executive vice president of the fund

January 21, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

The fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Mid-caps typically offer greater return potential than larger established firms and involve less risk than small-caps. Value investors seek to invest in companies whose stock prices are low in relation to their real worth or future prospects. By identifying companies whose stocks are currently out of favor or misunderstood, value investors hope to realize significant appreciation as other investors recognize the stock’s intrinsic value and the price rises accordingly. The value approach carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

Russell Midcap Growth Index: Unmanaged index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

Russell Midcap Value Index: Unmanaged index that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

S&P MidCap 400 Index: Unmanaged index that tracks the stocks of 400 mid-size U.S. companies.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

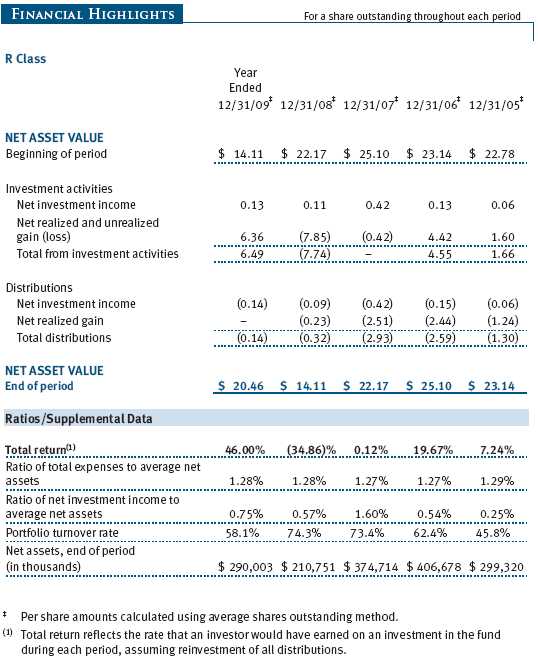

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns had been earned at a constant rate.

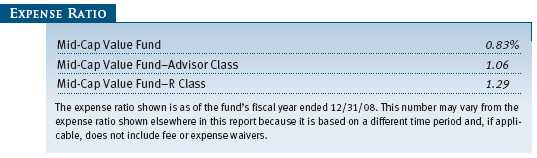

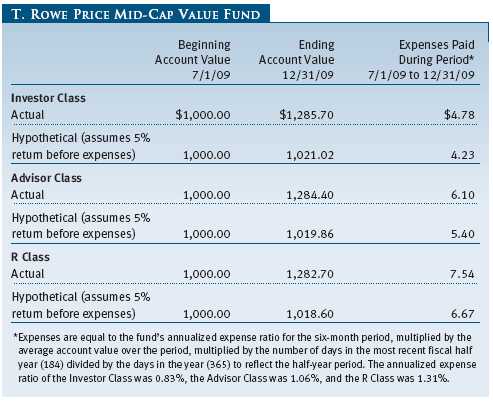

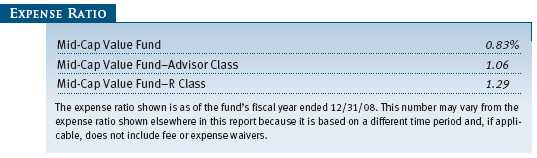

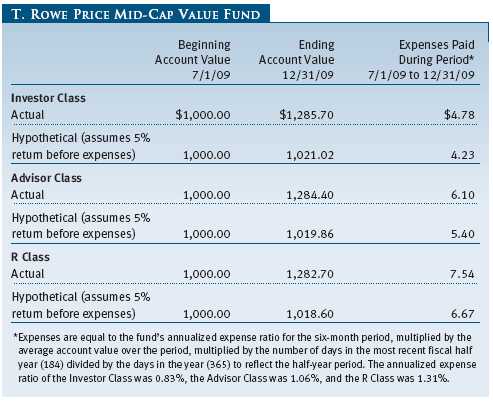

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

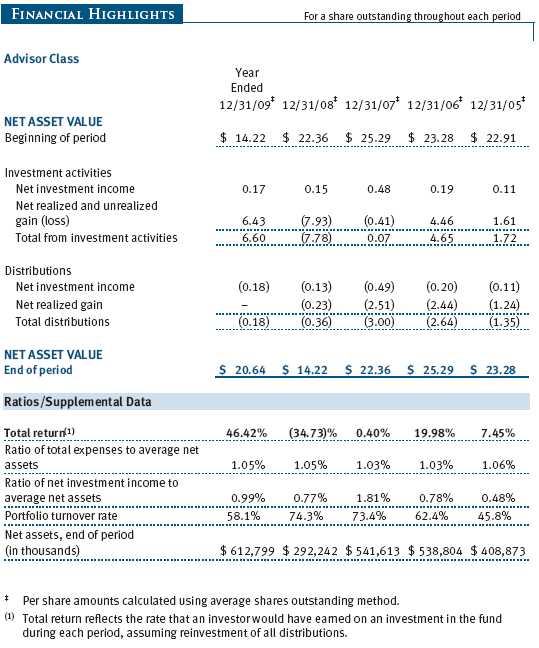

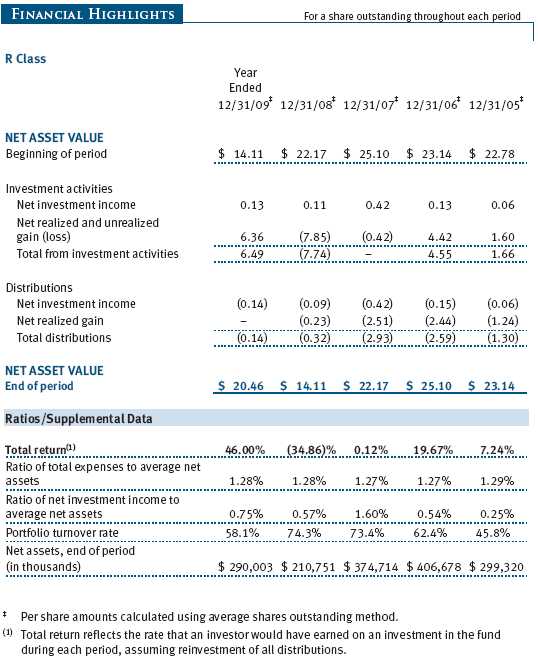

Please note that the fund has three share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee; Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee; and R Class shares are available to retirement plans serviced by intermediaries and charge a 0.50% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

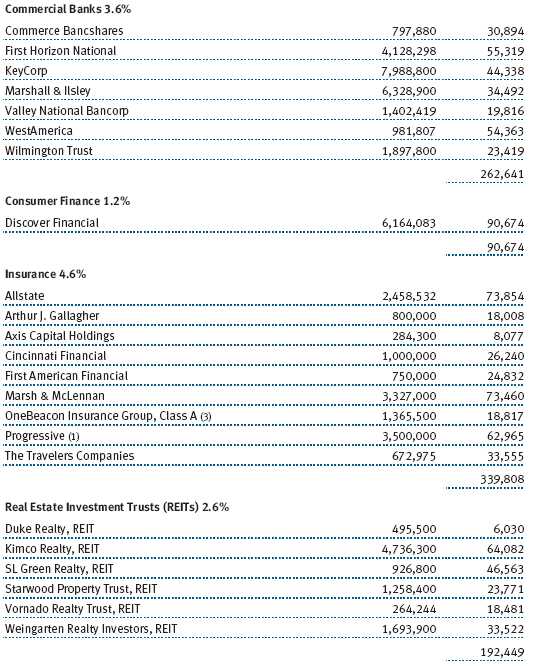

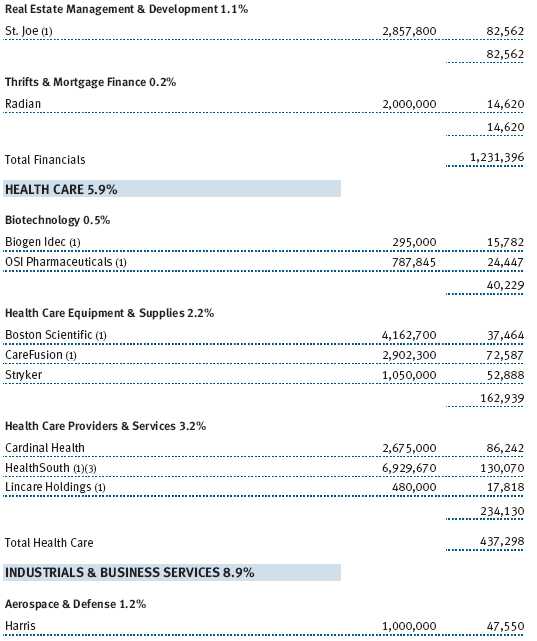

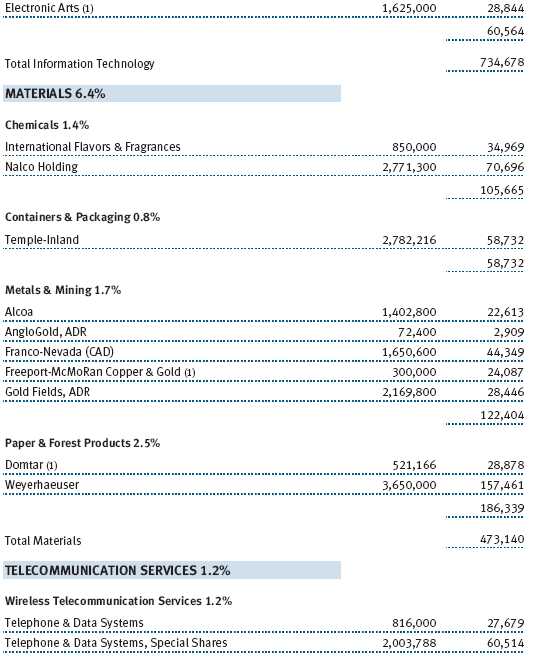

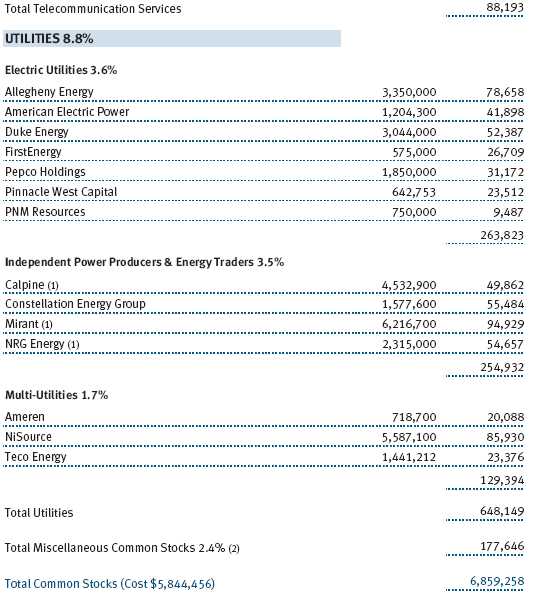

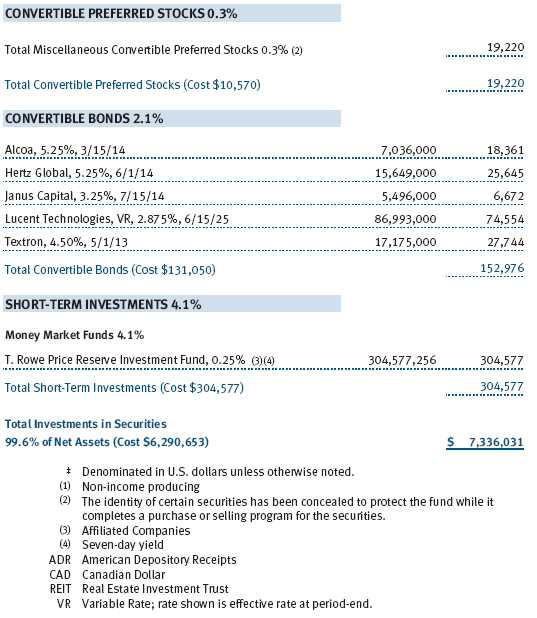

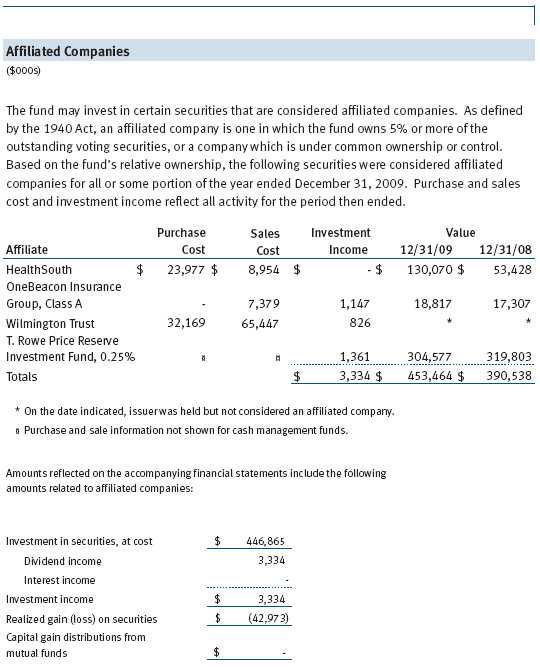

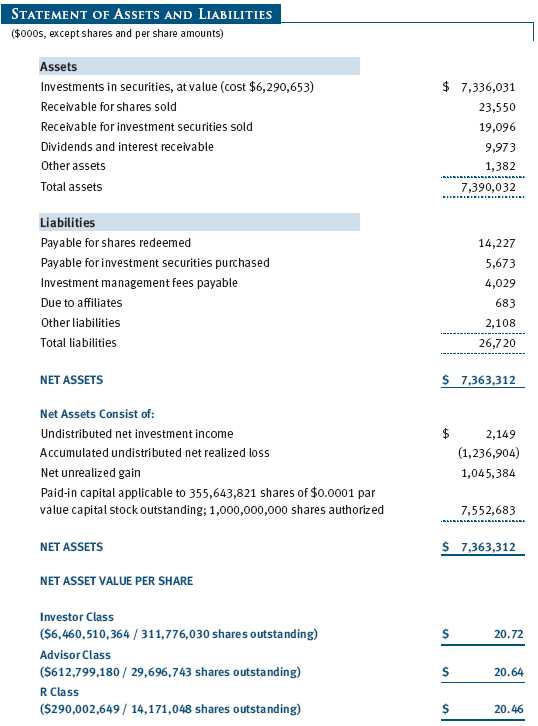

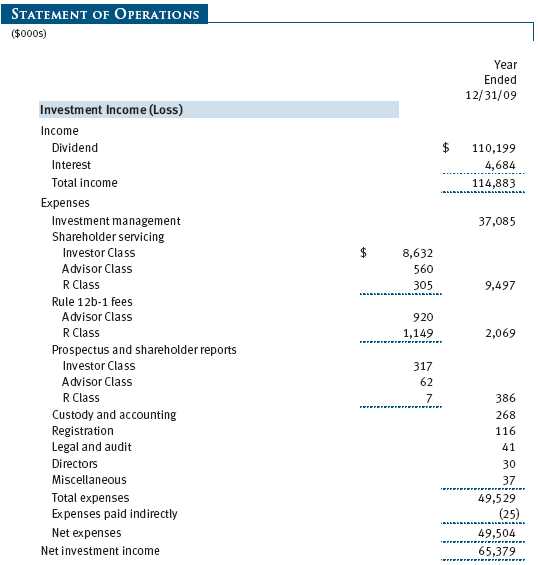

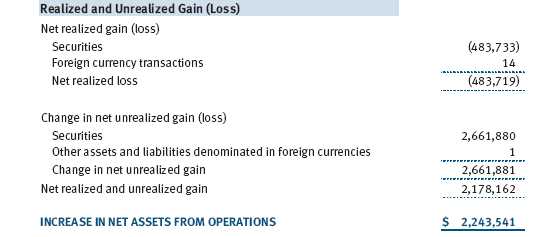

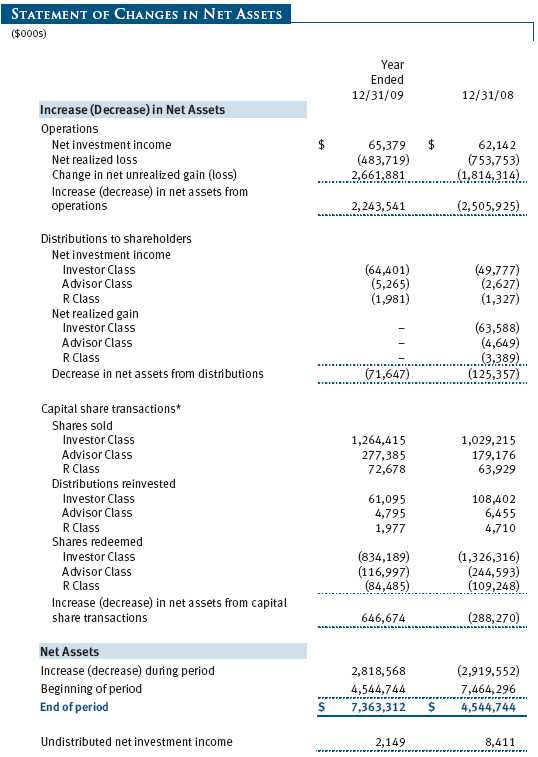

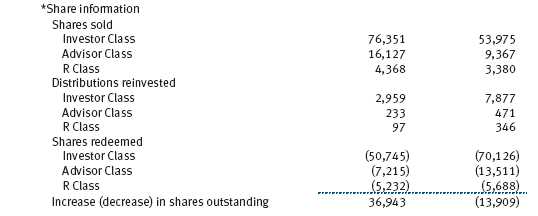

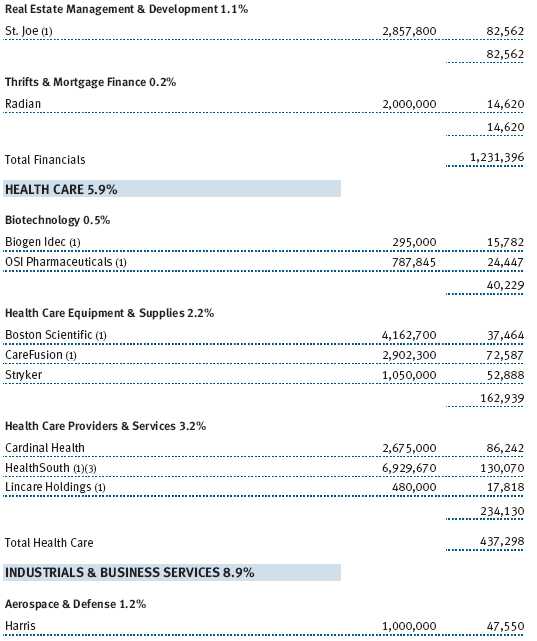

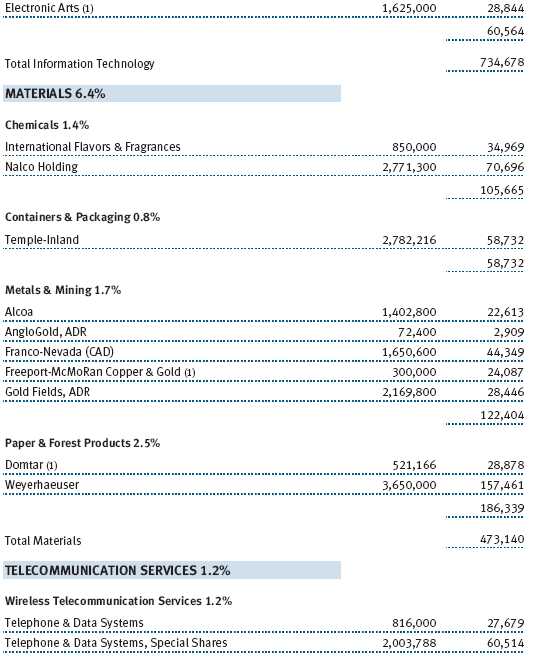

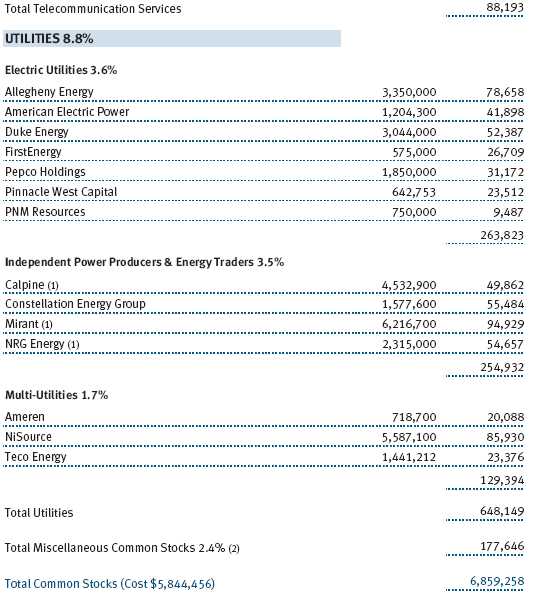

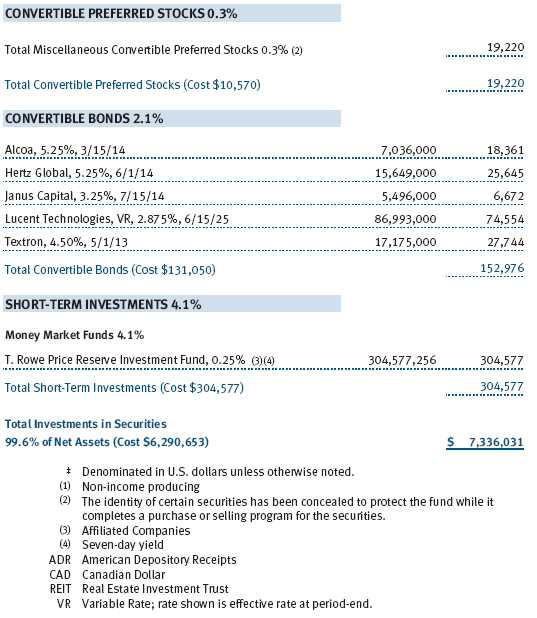

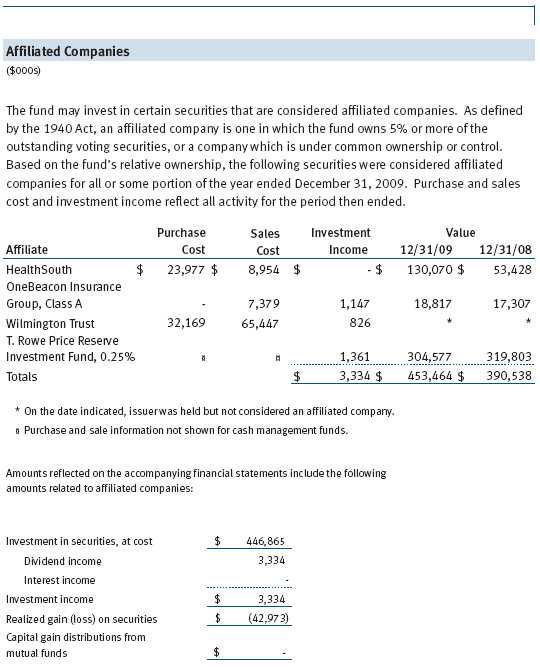

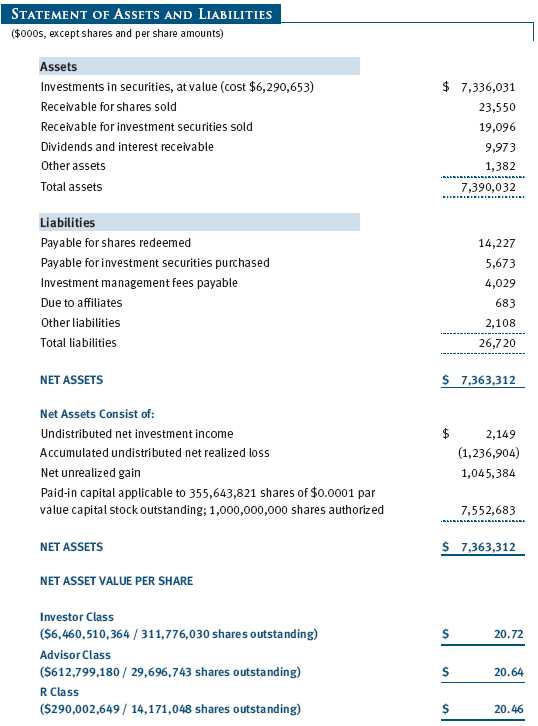

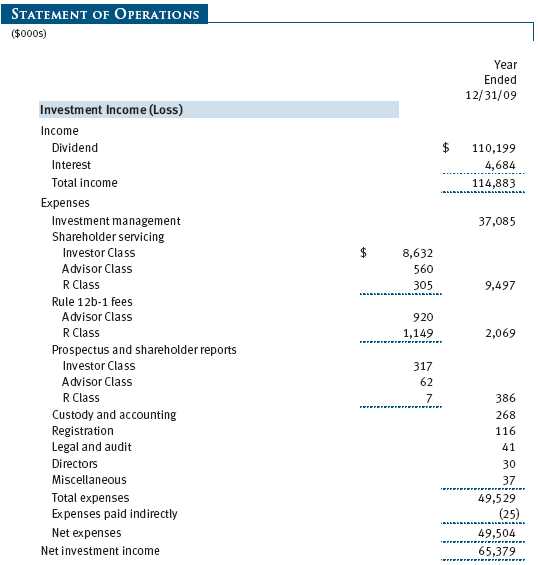

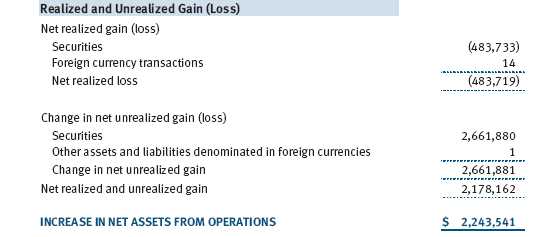

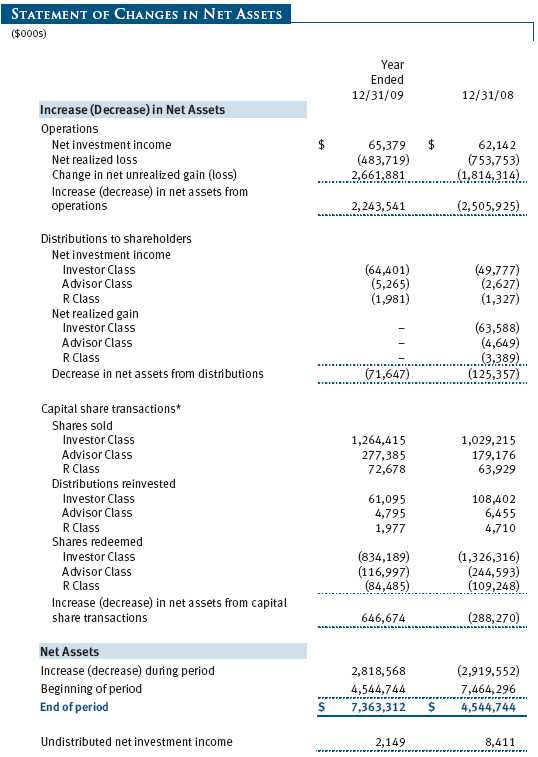

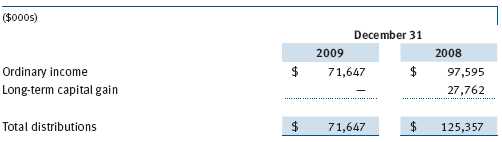

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Mid-Cap Value Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital appreciation by investing primarily in mid-sized companies that appear to be undervalued. The fund has three classes of shares: the Mid-Cap Value Fund original share class, referred to in this report as the Investor Class, offered since June 28, 1996; the Mid-Cap Value Fund—Advisor Class (Advisor Class), offered since September 30, 2002; and the Mid-Cap Value Fund—R Class (R Class), offered since September 30, 2002. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries, and R Class shares are available to retirement plans serviced by intermediaries. The Advisor Class and R Class each operate under separate Board-approved Rule 12b-1 plans, pursuant to which each class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to all classes; and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of the securities. Further, fund management believes that no events have occurred between December 31, 2009, the date of this report, and February 25, 2010, the date of issuance of the financial statements, that require adjustment of, or disclosure in, the accompanying financial statements.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund, annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class and R Class each pay distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% and 0.50%, respectively, of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $350,000 for the year ended December 31, 2009. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

New Accounting Pronouncement On January 1, 2009, the fund adopted new accounting guidance that requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance, and cash flows. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Debt securities are generally traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

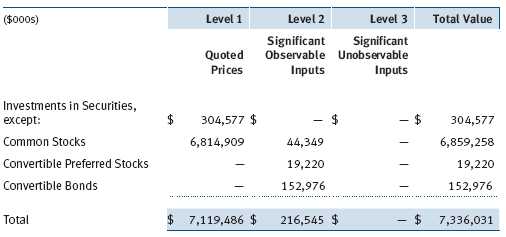

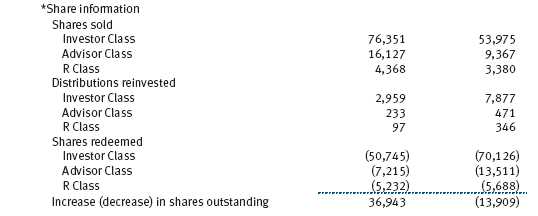

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2009:

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Purchases and sales of portfolio securities other than short-term securities aggregated $3,717,059,000 and $3,081,898,000, respectively, for the year ended December 31, 2009.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after filing of the tax return but could be longer in certain circumstances.

Reclassifications from paid-in capital relate primarily to the tax treatment of cash received from certain regulatory settlements. For the year ended December 31, 2009, the following reclassifications were recorded to reflect tax character; there was no impact on results of operations or net assets:

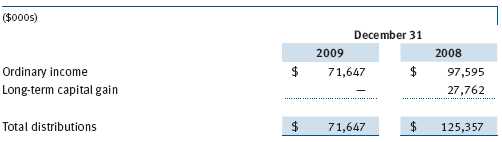

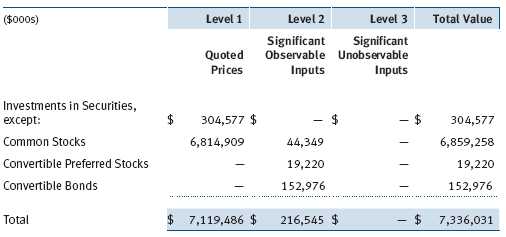

Distributions during the years ended December 31, 2009 and December 31, 2008 were characterized for tax purposes as follows:

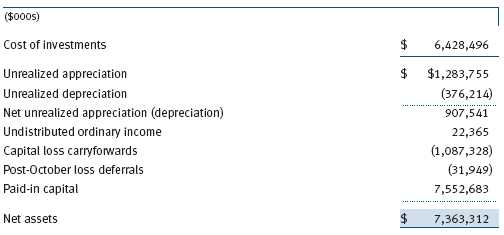

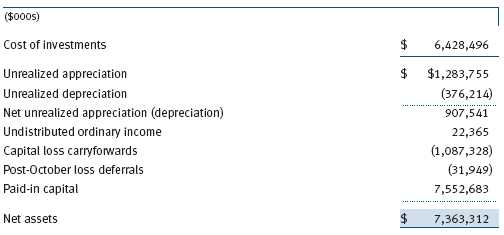

At December 31, 2009, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales and the realization of unrealized gains/losses on passive foreign investment companies for tax purposes.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. The fund’s unused capital loss carryforwards as of December 31, 2009, expire: $340,260,000 in fiscal 2016 and, $747,068,000 in fiscal 2017. In accordance with federal income tax regulations applicable to investment companies, recognition of capital losses on certain transactions realized between November 1 and the fund’s fiscal year end is deferred for tax purposes until the subsequent year (post-October loss deferrals); however, such losses are recognized for financial reporting purposes in the year realized.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.35% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2009, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class and R Class. For the year ended December 31, 2009, expenses incurred pursuant to these service agreements were $97,000 for Price Associates; $1,747,000 for T. Rowe Price Services, Inc.; and $1,270,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2009, the fund was charged $404,000 for shareholder servicing costs related to the college savings plans, of which $301,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2009, approximately 3% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) and T. Rowe Price Retirement Funds (Retirement Funds) may invest. Neither the Spectrum Funds nor the Retirement Funds invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to separate special servicing agreements, expenses associated with the operation of the Spectrum and Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum and Retirement Funds, respectively. Expenses allocated under these agreements are reflected as shareholder servicing expenses in the accompanying financial statements. For the year ended December 31, 2009, the fund was allocated $176,000 of Spectrum Funds’ expenses and $2,803,000 of Retirement Funds’ expenses. Of these amounts, $2,008,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2009, approximately 2% of the outstanding shares of the Investor Class were held by the Spectrum Funds and 24% were held by the Retirement Funds.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2009, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 169,796 shares of the Investor Class, aggregating less than 1% of the fund’s net assets.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of

T. Rowe Price Mid-Cap Value Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Mid-Cap Value Fund, Inc. (the “Fund”) at December 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2009 by correspondence with the custodian, and confirmation of the underlying fund by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 25, 2010

| TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/09 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

For taxable non-corporate shareholders, $80,791,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $80,791,000 of the fund’s income qualifies for the dividends-received deduction.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is governed by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name | |

| (Year of Birth) | Principal Occupation(s) During Past Five Years and Directorships of |

| Year Elected* | Other Public Companies |

| | |

| William R. Brody, M.D., Ph.D. | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | |

| Jeremiah E. Casey | Director, National Life Insurance (2001 to 2005); Director, The Rouse |

| (1940) | Company, real estate developers (1990 to 2004) |

| 2005 | |

| | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 to |

| (1945) | present); Director, Under Armour (2008 to present); Director, Vornado |

| 2001 | Real Estate Investment Trust (2004 to present); Director, Mercantile |

| | Bankshares (2002 to 2007); Member, Advisory Board, Deutsche Bank |

| | North America (2004 to present); Director, Chairman of the Board, |

| | and Chief Executive Officer, The Rouse Company, real estate develop- |

| | ers (1997 to 2004) |

| | |

| Donald W. Dick, Jr. | Principal, EuroCapital Advisors, LLC, an acquisition and management |

| (1943) | advisory firm (1995 to present) |

| 1996 | |

| | |

| Karen N. Horn | Director, Eli Lilly and Company (1987 to present); Director, Simon |

| (1943) | Property Group (2004 to present); Director, Norfolk Southern (2008 |

| 2003 | to present); Director, Georgia Pacific (2004 to 2005) |

| | |

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) |

| (1941) | |

| 2005 | |

| | |

John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate invest- | | (1946) | ment company (1991 to present); Partner, Blackstone Real Estate |

| 2001 | Advisors, L.P. (1992 to present) |

| | |

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | (1984 to 2008) |

| |

| *Each independent director oversees 124 T. Rowe Price portfolios and serves until retirement, resignation, |

| or election of a successor. | |

| Inside Directors | |

| |

| Name | |

| (Year of Birth) | |

| Year Elected* | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past Five Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, |

| (1956) | Director, and Vice President, T. Rowe Price Group, Inc.; Chairman of |

| 2006 | the Board, Director, and President, T. Rowe Price Investment Services, |

| [124] | Inc.; Chairman of the Board and Director, T. Rowe Price Global Asset |

| | Management Limited, T. Rowe Price Global Investment Services |

| | Limited, T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price |

| | Savings Bank, and T. Rowe Price Services, Inc.; Director, T. Rowe Price |

| | International, Inc.; Chief Executive Officer, Chairman of the Board, |

| | Director, and President, T. Rowe Price Trust Company; Chairman of the |

| | Board, all funds |

| | |

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [69] | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Year of Birth) | |

| Position Held With Mid-Cap Value Fund | Principal Occupation(s) |

| | |

| Peter J. Bates, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Christopher W. Carlson (1967) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Jonathan Chou (1980) | Employee, T. Rowe Price; student, Darden |

| Vice President | Graduate School of Business Administration, |

| | University of Virginia (to 2008); Principal, |

| | Gladstone Management Corporation (to 2006) |

| | |

| Henry M. Ellenbogen (1973) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., T. Rowe Price International, Inc., |

| | and T. Rowe Price Trust Company |

| | |

| Mark S. Finn, CFA, CPA (1963) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Trust Company |

| | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary | T. Rowe Price Investment Services, Inc. |

| | |

| Gregory A. McCrickard, CFA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Heather K. McPherson, CPA (1967) | Vice President, T. Rowe Price and T. Rowe Price |

| Executive Vice President | Group, Inc. |

| | |

| Joseph M. Milano, CFA (1972) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

David Oestreicher (1967) | Director and Vice President, T. Rowe Price | | Vice President | Investment Services, Inc., T. Rowe Price Trust |

| | Company, and T. Rowe Price Services, Inc.; Vice |

| | President, T. Rowe Price, T. Rowe Price Global |

| | Asset Management Limited, T. Rowe Price Global |

| | Investment Services Limited, T. Rowe Price |

| | Group, Inc., T. Rowe Price International, Inc., and |

| | T. Rowe Price Retirement Plan Services, Inc. |

| | |

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | |

| J. David Wagner, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| David J. Wallack (1960) | Vice President, T. Rowe Price, T. Rowe Price |

| President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for |

| at least five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

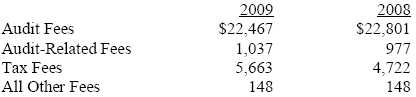

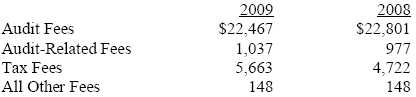

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,879,000 and $1,922,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Mid-Cap Value Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | February 25, 2010 |