PETROKAZAKHSTAN INC.

MANAGEMENT PROXY CIRCULAR

FOR THE ANNUAL MEETING

OF THE SHAREHOLDERS TO BE HELD

ON MAY 3, 2005

THIS MANAGEMENT PROXY CIRCULAR (the "Circular") IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY OR ON BEHALF OF THE MANAGEMENT OF PETROKAZAKHSTAN INC. ("PetroKazakhstan" or the "Corporation") for use at the Annual Meeting of the Class A common shareholders of the Corporation to be held at theAlbany Club of Toronto,91 King Street East, Toronto, Ontario, on Tuesday, May 3, 2005, at11:00 a.m. Toronto time, and any adjournments or postponements thereof (the "Meeting") for the purposes set forth in the accompanying Notice of Meeting. Except as otherwise stated, the information contained herein is given as of March 4, 2005.

SOLICITATION OF PROXIES

Solicitation of proxies by management will be primarily by mail, but may also be in person or by telephone. The cost of solicitation will be borne by the Corporation. The Corporation will reimburse brokers and other entities for permitted fees and costs incurred by them in mailing soliciting materials to the beneficial owners of shares of the Corporation.

RECORD DATE AND QUORUM

Only holders (the "Shareholders") of Class A common shares (the "Common Shares") of record on March 16, 2005 are entitled to notice of and to attend and vote at the Meeting or any adjournments or postponements thereof and to vote thereat unless after the Record Date a holder of record transfers its Common Shares and the transferee, upon producing properly endorsed certificates evidencing such shares or otherwise establishing ownership of such shares, requests, not later than five days before the Meeting, that the transferee's name be included in the list of shareholders entitled to vote, in which case such transferee shall be entitled to vote such shares at the Meeting. The presence, in person or by proxy, of holders of at least 5% of the total number of issued and outstanding Common Shares is necessary for a quorum of Shareholders at the Meeting.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the enclosed form of proxy hold the offices of Senior Vice President and Chief Financial Officer and of Senior Vice President, General Counsel and Corporate Secretary of the Corporation.A SHAREHOLDER SUBMITTING A PROXY HAS THE RIGHT TO APPOINT A PERSON TO REPRESENT HIM OR HER AT THE MEETING OTHER THAN THE PERSON OR PERSONS DESIGNATED IN THE FORM OF PROXY FURNISHED BY THE CORPORATION. TO EXERCISE THIS RIGHT THE SHAREHOLDER SHOULD INSERT THE NAME OF THE DESIRED REPRESENTATIVE (WHO IS NOT REQUIRED TO BE A SHAREHOLDER) IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY AND STRIKE OUT THE OTHER NAMES OR SUBMIT ANOTHER APPROPRIATE PROXY. In order to be effective, unless otherwise extended by the Corporation, the proxy must be mailed so as to be deposited at the office of the Corporation's agent, Computershare Trust Company of Canada ("Computershare"), Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, not later than 4:00 p.m., Toronto time, on April 22, 2005 or at least 48 hours, excluding Saturdays and holidays, prior to any adjournments or postponements of the Meeting at which the proxy is to be used. No instrument appointing a proxy shall be valid after the expiration of 12 months from the date of its execution. The instrument appointing a proxy shall be in writing under the hand of the Shareholder or his or her attorney, or if such Shareholder is a corporation, under its corporate seal and executed by a duly authorized director, officer or attorney.

A Shareholder who has submitted a proxy may revoke it by an instrument in writing executed by the Shareholder or his or her attorney authorized in writing, or, if the Shareholder is a corporation, under its corporate seal and executed by a duly authorized director, officer or attorney thereof and deposited either with Computershare or the Corporation at its offices as aforesaid at any time prior to 4:00 p.m., Toronto time, on the last business day preceding the day of the Meeting, or any adjournments or postponements thereof, at which the proxy is to be used, or with the chairman of the Meeting prior to the commencement of the Meeting on the day of the Meeting, and upon such deposit the previous proxy is revoked.

EXERCISE OF DISCRETION BY PROXIES

All Common Shares represented at the Meeting by properly executed proxies will be voted, and where a choice with respect to any matter to be acted upon has been specified in the instrument of proxy the Common Shares represented by the proxy will be voted in accordance with such specification.IN THE ABSENCE OF SUCH SPECIFICATION, SUCH COMMON SHARES WILL BE VOTED IN FAVOUR OF THE RESOLUTIONS SET FORTH HEREIN. The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing of the Circular, management of the Corporation knows of no such amendment, variation or other matter.

ADVICE TO BENEFICIAL HOLDERS OF SECURITIES

This information set forth in this section is of significant importance to Shareholders who do not hold their Common Shares in their own name. Shareholders who do not hold their shares in their own name (referred to in this Circular as "Beneficial Shareholders") should note that only proxies deposited by Shareholders whose names appear on the records of the Corporation as the registered holders of Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those shares will not be registered in the Shareholder's name on the records of the Corporation. Such shares will more likely be registered under the name of the Shareholder's broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depositary for Securities, which acts as nominee for many Canadian brokerage firms). In the United States, the vast majority of such shares are registered in the name of CEDE & Co., which acts as a nominee for many U.S. brokerage firms. Common Shares held by brokers or their nominees can be only voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers/nominees are prohibited from voting shares for their clients.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its brokers is identical to the form of proxy provided to registered Shareholders. However, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications Corporation ("ICC"). ICC typically applies a special sticker to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the proxy forms to ICC. ICC then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting.

Please note that Beneficial Shareholders who receive their Meeting materials via ICC must return the proxy forms, once voted, to ICC for the proxy to be valid.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation is authorized to issue an unlimited number of Common Shares and Class B Redeemable Preferred Shares. As of March 4, 2005 there were 75,847,355 Common Shares issued and outstanding. No Class B Redeemable Preferred Shares have been issued. The holders of Common Shares are entitled to one vote for each share held.

Any Shareholder who either personally attends the Meeting or who properly completes and delivers a proxy will be entitled to vote or have his or her shares voted at the Meeting. However, a person appointed under the form of proxy will be entitled to vote the shares represented by that form only if it is effectively delivered in the manner set out under the heading "Appointment and Revocation of Proxies." To the best of the knowledge of the directors and officers of the Corporation, no person beneficially owns, directly or indirectly, or exercises control or direction over Common Shares carrying more than 10 percent of the votes attached to all of the issued and outstanding Common Shares of the Corporation.

MATTERS TO BE ACTED UPON AT THE MEETING

| 1. | Consolidated Financial Statements and Auditors' Report |

Pursuant to the provisions of theBusiness Corporations Act (Alberta) (the "ABCA") and the Corporation's by-laws, the directors of the Corporation will submit to the Shareholders at the Meeting, the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2004 and the auditors' report thereon. PetroKazakhstan's consolidated financial reporting function is based in Kazakhstan and, accordingly, the primary audit relationship for the auditor of the Corporation is through the auditor's Almaty, Kazakhstan office. Therefore, TOO Deloitte & Touche, Almaty, Kazakhstan has issued the auditor's report.

No vote by the Shareholders with respect to this matter is required.

Action is to be taken at the Meeting with respect to the election of directors. The board of directors of the Corporation (the "Board of Directors") presently consists of six members. In addition to the current directors of the Corporation in 2005, prior to the end of the last financial year Askar Alshinbaev and Jean-Paul Bisnaire ceased to be directors of the Corporation. Neither Mr. Alshinbaev nor Mr. Bisnaire currently hold any shares of the Corporation. It is proposed that at the Meeting, the persons listed below will be nominated by management of the Corporation for election as directors of the Corporation. Each director elected will hold office until the next annual meeting of Shareholders, or until his successor is duly elected or appointed, unless his office is vacated earlier in accordance with the Corporation's by-laws.

The following information relating to the nominees as directors is based on information received by the Corporation from the nominees and sets forth the name and address of each of the persons proposed to be nominated for election as a director, his principal occupation at present, all other positions and offices in the Corporation held by him, the year in which he was first elected a director and the number of securities of the Corporation that he has advised are beneficially owned by him, directly or indirectly, or over which control or direction is exercised by him as of March 4, 2005.

Name and Address of Nominee | | Position Presently Held | | Principal Occupation | | Director Since | | Number of Securities(5) |

| | | | | | | | | Common Shares | Options |

Bernard F. Isautier London, England | | Chairman of the Board, President, Chief Executive Officer and Director | | Chairman of the Board, President, Chief Executive Officer and Director of the Corporation | | 1996 | | 4,072,740 | 200,000 |

Louis W. MacEachern(2)(3) Calgary, Alberta | | Director | | President, Fortune Industries Ltd., a business management consulting company | | 1989 | | 42,700 | 73,000 |

Name and Address of Nominee | | Position Presently Held | | Principal Occupation | | Director Since | | Number of Securities(5) |

| | | | | | | | | Common Shares | Options |

James B.C. Doak(1)(3) Toronto, Ontario | | Director | | President and Managing Partner, Megantic Asset Management Inc., a Canadian private hedge fund | | 2000 | | nil | 176,000 |

Jacques Lefevre(1)(2) Paris, France | | Director | | Vice Chairman of Lafarge S.A | | 2001 | | 50,000 | 76,000 |

Nurlan J. Kapparov(2)(3) Almaty, Kazakhstan | | Director | | Chairman of the Board of Directors of KazInvestBank, private bank in Kazakhstan | | 2003 | | 11,000 | 10,000 |

Jan Bonde Nielsen(1) London, England | | Director | | Chairman and Equity Partner in Greenoak Holdings, international investment company | | 2004 | | nil | 60,000 |

Notes:

| (1) | Member of the Corporation's Audit Committee. |

| (2) | Member of the Corporation's Compensation Committee. |

| (3) | Member of the Corporation's Corporate Governance Committee. |

| (4) | PetroKazakhstan does not have an executive committee. |

| (5) | The number of securities held by each director includes Common Shares and options to acquire Common Shares beneficially owned, directly or indirectly, or over which control or direction is exercised. |

IT IS THE INTENTION OF THE MANAGEMENT DESIGNEES, IF NAMED AS PROXY, TO VOTE "FOR" THE ELECTION TO THE BOARD OF DIRECTORS OF THE PERSONS REFERRED TO ABOVE UNLESS OTHERWISE DIRECTED. EXCEPT AS REFERRED TO ABOVE, MANAGEMENT DOES NOT CONTEMPLATE THAT ANY OF SUCH NOMINEES WILL BE UNABLE TO SERVE AS A DIRECTOR. HOWEVER, IF FOR ANY REASON ANY OF THE PROPOSED NOMINEES DOES NOT STAND FOR ELECTION OR IS UNABLE TO SERVE AS SUCH, THE MANAGEMENT DESIGNEES, IF NAMED AS PROXY, RESERVE THE RIGHT TO VOTE FOR ANY OTHER NOMINEE IN THEIR SOLE DISCRETION.

The management designees, if named as proxy, intend to vote for the appointment of TOO Deloitte & Touche, Almaty, Kazakhstan, as the auditor of the Corporation, to hold office until the next annual meeting of the Shareholders, at a remuneration to be fixed by the Board of Directors. The Corporation has been audited by the member firms of the international audit firm Deloitte Touche Tohmatsu since 1997.

The Corporation is required to have an audit committee. The Audit Committee consists of Messrs. Lefevre, Doak and Nielsen. Further information regarding the Audit Committee and external audit services provided to the Corporation in 2004 can be found under the section titled "External Auditor Services Fees" in the Corporation's Annual Information Form for the year ended 2004.

REPORT TO THE SHAREHOLDERS ON EXECUTIVE COMPENSATION

Structure of the Compensation Committee

The Compensation Committee of the Board of Directors exercises general responsibility regarding the overall employee and executive officer compensation. The Compensation Committee is composed of Mr. MacEachern, Mr. Lefevre and Mr. Kapparov, each of whom are independent directors and are not eligible to participate in any of the Corporation's executive compensation programs other than the Corporation's incentive stock option plan. OnApril 1, 2004 Askar Alshinbaev ceased to be a director of the Corporation. Mr. Alshinbaev was a

former member of the Compensation Committee and his involvement with the Compensation Committee ended on this date as well. Mr. Kapparov was appointed to the Compensation Committee onMarch 3, 2004.

Compensation Strategy and Objectives

The Compensation Committee meets with the President and Chief Executive Officer to review salaries, other than his own, for executive officers of the Corporation and its subsidiaries, as well as any bonuses, if declared. Direct approval of salaries and bonuses is required by the Board of Directors.

The Corporation's executive and employee compensation policy continues to evolve as the Corporation adjusts to compete within the industry to attract and retain individuals of high calibre to serve as officers. The Compensation Committee continues to review methods to motivate executive performance in order to achieve the strategic objectives of the Corporation and to parallel the interests of executive officers with the interests of the Shareholders. The primary compensation policy is to pay for performance and accordingly, the performance of the Corporation, and that of the executive officers of the Corporation (including the President and Chief Executive Officer) as individuals, are both examined by the Compensation Committee. In assessing performance, many facets are examined by the Committee, including:

| | • | achievement ofPetroKazakhstan's executive officers, as a whole and individually, in reaching corporate objectives for 2004; |

| | | |

| | • | stock market performance of PetroKazakhstan for 2004; and |

| | | |

| | • | the differentiation between executive officers as to relative contributions in reaching PetroKazakhstan's corporate goals. |

The Compensation Committee evaluates the above criteria in the context of certain general considerations, including:

| | • | a comparative analysis of executive compensation with respect to similar-sized Canadian public companies; and |

| | | |

| | • | the level of executive officer compensation required to attract and retain competent executive officers given operating conditions in Kazakhstan. |

Components of Compensation

The principal components in the overall compensation currently consist of a base salary and participation in the Corporation's incentive stock option plan and may or may not include the payment of a bonus based on performance of the individual (as evaluated under the criteria listed above). Base salary is generally the principal component of an executive officer's compensation package, with the incentive stock option plan providing long-term incentives. In accordance with the compensation strategy of the Corporation, grants of stock options for executive officers are primarily performance-based. Grants of stock options also take into account the executive officer's level of responsibility within the Corporation, and the number and exercise price of options previously issued to a particular executive officer. In addition, the Calgary based officer participates in the Canadian Matching Savings Plan and UK based officers participate in the UK Pension Contribution (see "Other Benefit Plans"). For further details regarding executive compensation, see "Summary Compensation Table" below.

| | Presented by the Compensation Committee |

| | |

| | Louis W. MacEachern (Chairman) |

| | Jacques Lefevre |

| | Nurlan J. Kapparov |

During the past fiscal year, the Board of Directors accepted all of the recommendations of the Compensation Committee.

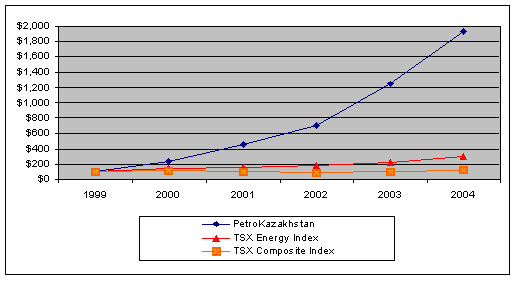

Performance Graph

The Common Shares of the Corporation are listed and posted for trading on the Toronto Stock Exchange (the "TSX"), the New York Stock Exchange (the "NYSE"), the London Stock Exchange and the Frankfurt Stock Exchange under the common trading symbol "PKZ" and on the Kazakhstan Stock Exchange under the symbol "CA_PKZ". The Common Shares of the Corporation were listed on the TSX onApril 18, 1995, on the NYSE on September 12, 2002, on the London Stock Exchange on October 16, 2003 and on the Kazakhstan Stock Exchange on October 21, 2004.

The following graph(1)(2) compares the yearly change in the cumulative total shareholder return over the last five years as at December 31 of a Cdn.$100 investment in the Corporation's Common Shares with the cumulative total return of the S&P/TSX Composite Index and the S&P/TSX Canadian Energy Index, assuming the reinvestment of dividends, where applicable, for the comparable period. On December 31, 2004, the Common Shares closed at Cdn.$44.53 on the TSX.

PetroKazakhstan Stock Price vs. S&P/TSX Indices

Note:

| (1) | The calculation of shareholder return for an investment in the Corporation's Common Shares assumes reinvestment of the special dividend paid August 3, 2001 on each Common Share of Cdn.$4.00. The closing price of the Common Shares on the TSX on August 3, 2001 was Cdn.$9.69. |

| | |

| (2) | Additionally, the calculation above assumes reinvestment of dividends paid May 3, 2004, August 16, 2004 and November 1, 2004 on each Common Share of $0.15 on each date. The closing price of the Common Shares on the TSX on the respective dates was Cdn.37.85, $38.95 and $44.55. |

Summary Compensation Table

The following table provides a summary of compensation earned during the fiscal years ended December 3l, 2002, December 31, 2003 and December 31, 2004 by the Chief Executive Officer, the Chief Financial Officer and each of the Corporation's four most highly compensated executive officers other than the CEO and CFO whose salary and bonus in 2004 exceeded Cdn.$150,000 (collectively the "named executive officers"). The following dollar information is expressed in Canadian currency, unless otherwise indicated. During the fiscal year ended December 31, 2004, the total amounts paid or payable to the five highest paid officers and employees of the Corporation, Messrs. Isautier, Clift, Azancot, Gay and Peart was Cdn.$2,310,033.

Summary Compensation Table

| | | | | | | Long-Term | | |

| | | | | | | Compensation | | |

| | | | | Annual Compensation | | Awards | | |

| | | | | | | | | Other Annual | | Securities Under | | All Other |

| | | | | Salary | | Bonus | | Compensation | | Options Granted(5) | | Compensations |

| Name and Principal Position | | Year | | (Cdn $) | | (Cdn $) | | (Cdn $) | | (#) | | (Cdn $) |

Bernard F. Isautier(1) President, Chief Executive Officer, Chairman of the Board and Director of the Corporation | | 2004 2003 2002 | | 493,850(2) 757,283(2) 796,591(2) | | nil nil nil | | nil nil nil | | 100,000 100,000 50,000 | | nil nil nil |

Clayton J. Clift(3) Senior Vice President Finance & Chief Financial Officer | | 2004 | | 367,881 | | nil | | 230,113(6) | | 50,000 | | 10,524 |

Nicholas Gay(4) Senior Vice President Finance & Chief Financial Officer | | 2004 2003 2002 | | 389,135 413,989 407,025 | | nil nil nil | | 11,900(6) 13,740(6) 14,580(6) | | nil 20,000 20,000 | | 52,231(7) 49,677(7) 48,114(7) |

Michael Azancot Senior Vice President Exploration and Production | | 2004 2003 2002 | | 428,029 413,989 407,025 | | nil nil nil | | 21,420(6) 20,610(6) 21,870(6) | | 15,000 15,000 20,000 | | 68,485(7) 66,239(7) 64,152(7) |

Anthony R. Peart Senior Vice President, General Counsel and Corporate Secretary | | 2004 2003 2002 | | 443,201 413,989 407,025 | | nil nil nil | | 14,280(6) 13,740(6) 14,580(6) | | 15,000 20,000 20,000 | | 53,183(7) 49,677(7) 48,114(7) |

Dermot A. Hassett(8) Vice President, Marketing and Transportation | | 2004 2003 2002 | | 285,748 256,622 264,928 | | nil nil 3,666 | | 14,280(6) 13,740(6) 202,208(6) | | 11,000 7,000 10,000 | | 34,291(7) 30,794(7) 8,141(7) |

Notes:

| (1) | Mr. Isautier was appointed an officer of the Corporation on September 28, 1999. Prior thereto he was, and remains, a director of the Corporation. |

| | |

| (2) | The Board of Directors approved annual compensation to Mr. Isautier of US$400,000 effective April 1, 2000, US$500,000 effective January 1, 2002, US$530,000 effective October 1, 2002, US$543,250 effectiveApril 1, 2003 and US$700,000 effective April 1, 2004. Mr. Isautier has drawn a portion of his 2002, 2003 and 2004 salary, but has taken none for previous years. See "Employment Contracts and Termination of Employment". |

| | |

| (3) | Mr. Clift joined the Corporation on December 7, 2000 and was appointed Senior Vice President Finance and Chief Financial Officer on November 1, 2004. |

| (4) | Mr. Gay resigned as Senior Vice President Finance and Chief Financial Officer as of October 31, 2004. |

| | |

| (5) | Represents the number of options granted to an executive officer during each fiscal year. |

| | |

| (6) | These amounts relate to travel and housing allowances and payments for other items, including, in the case of Mr. Clift in 2004 and Mr. Hassett in 2002, reimbursement for the payment of taxes. |

| | |

| (7) | These amounts relate to contributions by the Corporation to benefit plans on behalf of the named executive officer. |

| | |

| (8) | Mr. Hassett became an officer of the Corporation on October 1, 2002 prior to which he was an employee of the Corporation. |

Incentive Plans

The following sets forth individual grants of stock options made to the named executive officers during the fiscal year ended December 31, 2004. The following dollar information is expressed in Canadian currency.

Option Grants During the Fiscal Year Ended December 31, 2004

Name | | Securities Under Options Granted (#) | | % of Total Options Granted in Financial Year | | Exercise or Base Price (Cdn $/Share) | | Market Value of Securities Underlying Option on the Date of Grant (Cdn $/Share) | | Expiration Date |

| Bernard F. Isautier | | 100,000 | | 13.8 | | 43.50 | | 43.50 | | December 9, 2009 |

| Michael Azancot | | 15,000 | | 2.1 | | 43.50 | | 43.50 | | December 9, 2009 |

| Anthony R. Peart | | 15,000 | | 2.1 | | 43.50 | | 43.50 | | December 9, 2009 |

| Dermot A. Hassett | | 11,000 | | 1.5 | | 43.50 | | 43.50 | | December 9, 2009 |

| Clayton J. Clift | | 50,000 | | 6.9 | | 44.43 | | 44.43 | | October 20, 2009 |

| Nicholas Gay | | nil | | - - | | - - | | - - | | - - |

The following table sets forth each exercise of options during the fiscal year ended December 31, 2004 by the named executive officers and details of options held by them at year end. The following dollar information is expressed in Canadian currency.

Aggregated Option Exercises During the Fiscal Year Ended December 31, 2004

and Year-End Option Values

Name | | Securities Acquired on Exercise (#) | | Aggregate Value Realized (Cdn. $) | | Unexercised Options at December 31, 2004 (#), Exercisable/Unexercisable | | Value of Unexercised in-the-Money Options at December 31, 2004(1) Exercisable/Unexercisable (Cdn $) |

| Bernard F. Isautier | | 2,641,000 | | 92,621,450.00 | | 133,333/66,667 | | 732,327/1,258,673 |

| Michael Azancot | | 89,000 | | 3,360,791.00 | | 35,000/41,500 | | 1,303,550/733,895 |

| Anthony R. Peart | | 36,000 | | 1,385,952.50 | | 97,999/46,501 | | 2,936,786/1,412,404 |

| Dermot A. Hassett | | 30,900 | | 1,022,554.00 | | 32,500/39,800 | | 717,968/1,012,052 |

| Clayton J. Clift | | 18,716 | | 756,707.70 | | nil/79,583 | | nil/777,465 |

| Nicholas Gay | | 80,000 | | 2,359,472.50 | | nil | | nil |

Notes:

| (1) | Based on the December 31, 2004 closing price of the Common Shares on the TSX of Cdn.$44.53 per share. |

Equity Compensation Plan Information

The chart below provides aggregate information regarding the number of securities to be issued if all outstanding options as of December 31, 2004 were exercised by holders, including options pursuant to the individual arrangements with executives outlined in more detail above in the sections titled "Summary Compensation Table" and "Incentive Plans".

Equity Compensation Plan Information

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price in Cdn.$ of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by shareholders | | 866,903 | | 16.29 | | 3,581,063 |

Equity compensation plans not approved by shareholders | | nil | | nil | | nil |

| Total | | 866,903 | | 16.29 | | 3,581,063 |

Other Benefit Plans

The Corporation does not have a pension plan but does have a Matching Savings Plan (the "Canadian Matching Savings Plan") for employees of the Corporation that are based in the Corporation's Calgary, Alberta office. The Canadian Matching Savings Plan allows an employee to contribute up to 10% of his or her base salary which is then matched by PetroKazakhstan. The Canadian Matching Savings Plan is comprised of a group Registered Retirement Savings Plan and a group Non-Registered Savings Plan both of which are administered by an independent trustee. Employees may select a variety of mutual funds, interest bearing certificates and Common Shares of the Corporation as investments. Contributions are transmitted to the trustee on a monthly basis.

The Corporation pays to its UK-based employees and officers, in addition to their salary, a cash amount equal to 10% of their salary, in the case of employees, and 12% to 16% of their salary, in the case of officers, as a pension contribution (the "UK Pension Contribution"). This amount is paid directly to the UK-based employees on a monthly basis.

Employment Contracts and Termination of Employment

The Board of Directors approved annual compensation to Mr. Bernard Isautier of US$400,000 effective April 1, 2000, US$500,000 effective January 1, 2002,US$530,000effective October 1, 2002, US$543,250 effectiveApril 1, 2003 andUS$700,000 effective April 1, 2004. The Board of Directors also approved a severance provision of the payment of an amount equal to three years salary and benefits to Mr. Isautier in the event of termination by the Board of Directors of his employment (without cause) with PetroKazakhstan or of his resignation upon a change of control of PetroKazakhstan. Mr. Isautier has drawn a portion of his 2002, 2003 and 2004 salary but has taken none for earlier years.

The Corporation and each of Messrs. Michael Azancot, Clayton Clift, Anthony Peart andDermot Hassett have entered into agreements which provide for payments to each of these individuals in the event that: (a) their employment with PetroKazakhstan is terminated without just cause within six months after the occurrence of a change of control of PetroKazakhstan, or (b) such executive officer, after a change of control of PetroKazakhstan,

does not continue to be employed by PetroKazakhstan at a level of responsibility or of compensation at least commensurate with such executive officer's level of responsibility and compensation immediately prior to the change of control and such executive officer elects, within six months after the occurrence of the change of control, to treat his employment as being terminated as a result thereof, or (c) such executive officer is required by PetroKazakhstan to relocate his base of operations to a city other than in the United Kingdom, except for required travel, and such executive officer elects, within six months after the occurrence of a change of control of PetroKazakhstan, to treat his employment as being terminated as a result thereof, or (d) such executive officer elects in writing within six months after the occurrence of a change of control of PetroKazakhstan, to treat his employment as being terminated, such termination to take effect at the end of the six month period following such change of control (paragraph (d) does not apply to the change of control agreement for Dermot Hassett). The amount to be paid to the executive officer upon such occurrence will be equal to 12 times each of (i) such executive officer's monthly salary at the time of the termination of employment and (ii) PetroKazakhstan's monthly contributions paid on behalf of the executive officer to any group benefits plan of PetroKazakhstan. The agreements also provide that upon termination of employment, all unexercised and unvested stock options then held by the executive officer shall forthwith vest and become exercisable for a period of 60 days after termination, after which period such options will terminate.

For the purposes of the above agreements, a "change of control" of PetroKazakhstan is defined to mean: (i) the sale, lease or transfer of all or substantially all of PetroKazakhstan's assets; (ii) any change in the registered holdings or beneficial ownership of Common Shares of PetroKazakhstan which result in any person or group of persons, acting jointly or in concert, or any affiliate of such persons or group of persons, owning, holding or controlling, directly or indirectly, more than 30% of the outstanding Common Shares; (iii) the "incumbent directors" of PetroKazakhstan no longer constituting a majority of the Board of Directors; or (iv) any determination by a majority of non-management "incumbent directors" that a change of control has or is about to occur. The "incumbent directors" are defined as, at any time, the directors of PetroKazakhstan at the time of the execution of the agreements with the executive officers who continue to be directors at that time plus any other director at that time whose election to the Board of Directors was approved by a majority of the incumbent directors at the time of such election.

Compensation of Directors

In 2004, the annual directors' fees were: (i) US$12,000 per year for outside directors, (ii) an annual fee of US$3,500 for chairmen of committees of the Board of Directors other than the Chairman of the Audit Committee, (iii) an annual fee of US$10,000 for the Chairman of the Audit Committee, (iv) an additional fee of US$1,000 for each meeting of the Board of Directors or of a committee of the Board of Directors attended in person and US$750 for each meeting of the Board of Directors or of a committee of the Board of Directors attended by telephone for outside directors, and (v) for each occasion on which an outside director was required to attend a meeting of the Board of Directors or of a committee of the Board of Directors outside of his home country, a fee of US$2,000 was paid for each two days of travel time per trip. During the fiscal year ended December 31, 2004, the total amounts paid or payable to PetroKazakhstan's directors for such directors' fees was US$181,500.00.

In addition, each of the directors is entitled to participate in the Corporation's incentive stock option plan. On December 10, 2004, the Corporation granted each of the directors options to acquire10,000 Common Shares at an exercise price of Cdn.$43.50. Jan Bonde Nielsen who on becoming a director of the Corporation on January 29, 2004 was granted options to acquire 50,000 Common Shares at an exercise price of Cdn.$31.62, and Jean-Paul Bisnaire who on becoming a director of the Corporation on January 29, 2004 was granted options to acquire 10,000 Common Shares at an exercise price of Cdn.$31.62. Mr. Bisnaire is no longer a director of the Corporation.

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

At no time during the year ended December 31, 2004 was there any indebtedness of any director or officer, or any associate of any such director or officer, to (a) the Corporation or (b) any other entity which is or, at any time since the beginning of the most recently completed fiscal year, has been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation, and which was not repaid prior to the date of this Circular or for routine indebtedness as defined by National Instrument 51-102 -Continuous Disclosure Obligations.

DIRECTORS' AND OFFICERS' INSURANCE

The premium paid for the directors' and officers' liability insurance policy purchased by the Corporation for the year on April 1, 2004 was US$786,250. The aggregate insurance coverage obtained under the policy is US$20,000,000. The deductible under this insurance policy for claims against directors and officers originating outside the U.S. is US$100,000 and a US$2,500,000 deductible is applicable for claims originating or maintained in whole or in part within the U.S.

SECURITY BASED COMPENSATION ARRANGEMENTS

The Corporation currently has in place an incentive stock option plan (the "Plan") under which its officers, directors, employees and other personnel who provide on-going services to the Corporation (the "Eligible Persons") are eligible to receive grants of stock options (the "Options") that may be exercised to purchase Common Shares from treasury. The Plan was effective March 29, 2000 as amended May 8, 2002 and approved by the shareholders of the Corporation on both dates. The Plan has not been amended in the last financial year.

Under the May 8, 2002 amendment of the Plan a total of386,459 Common Shares have been issued under the Plan and the maximum number of Common Shares reserved for issuance under the Plan is limited to 8,076,050, which represents respectively 0.5% and 10.6% of the Corporation's currently outstanding Common Share capital. The total number of Common Shares issuable upon the exercise of all outstanding Options granted under the plan is 2,086,656, which represents 2.7% of the Corporation's currently outstanding Common Share capital.

The Plan does not permit the number of Common Shares reserved for issuance pursuant to Options granted to insiders to exceed 10% of the Corporation's outstanding capital at any time. The Plan also does not permit the issuance to insiders within a one year period, Common Shares exceeding 10% of the Corporation's outstanding capital. The issuance of Common Shares to any one insider or such person's associates within a one year period is limited to 5% of the Corporation's outstanding capital. No holder of Options may purchase greater than 5% of the outstanding Common Shares of the Corporation.

The price at which an Option may be exercised to acquire a Common Share may not be less than the market price of the Common Shares of the Corporation on the trading day immediately preceding the date of the grant of the Option. The Compensation Committee of the Board of Directors determines (i) which Eligible Persons are granted Options; (ii) the number of Common Shares covered by each Option grant; (iii) the price per share at which Common Shares may be purchased; (iv) the time the Options will be granted; (v) the time the Options will vest; and (vi) the time at which the Options will be exercisable within ten years of the grant. The exercise price of Options granted to executive officers of the Corporation in the 2004 fiscal year was Cdn.$43.50 per Common Share with an expiration date of December 9, 2009 except the grant made to Clayton Clift on October 21, 2004 of Options with an exercise price of Cdn.$44.43per Common Share with an expiration date of October 20, 2009. Additional information regarding securities based compensation arrangements between the Corporation and its Chief Executive Officer, Chief Financial Officer and its four highest paid employees is summarized in the Report to the Shareholders on Executive Compensation under the sections titled "Summary Compensation Table, Incentive Plans and Equity Compensation Plan Information". The exercise price of Options granted to directors of the Corporation in the 2004 fiscal year was Cdn.$43.50 per Common Share with an expiration date of December 9, 2009 except the grants of Options made onJanuary 29, 2004toJan Bonde Nielsen and Jean-Paul Bisnaire at an exercise price of Cdn.$31.62 with an expiry date of January 29, 2009. Additional information regarding Options granted to the directors is discussed in the section titled "Compensation of Directors".

Options granted under the Plan are personal to the Eligible Person to whom the grant is made and cannot be assigned, other than by bequeath or the laws of descent and distribution. In the event that a person ceases to be an Eligible Person, the Plan will no longer be available to such person. The grant of Options does not confer any right upon an Eligible Person to continue employment or to continue to provide services to the Corporation. Unless otherwise specifically addressed in an option agreement, in the event that a person ceases to be employed by the Corporation for any reason other than death, the right to exercise any Options by such person is limited to 60 days after the termination of employment. In the event of death, the right to exercise any Options is limited to six months after the date of death of the person.

The Corporation may give financial assistance to persons exercising Options. To date, the Corporation has

not given any executive officer or director financial assistance to fund all or part of the exercise price for Common Shares being purchased pursuant to an Option granted under the Plan, apart from normal course salary, bonuses and incentives disclosed herein.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no informed person of the Corporation as defined in National Instrument 51-102 -Continuous Disclosure Obligations, any proposed director, nor any associate of such person has any substantial interest, either direct or indirect, by way of beneficial ownership of shares or otherwise, in any transaction since the commencement of the Corporation's last financial year or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries, apart from any interest arising from the ownership of Common Shares where each such Shareholder has or will receive no extra or special benefit or advantage not shared on apro rata basis by all Shareholders of the Corporation.

OTHER MATTERS COMING BEFORE THE MEETING

Management knows of no other matters to come before the Meeting other than those referred to in the Notice of Meeting. Should any other matters properly come before the Meeting, the Common Shares represented by proxy solicited hereby will be voted on such matters in accordance with the best judgement of the person voting such proxy.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Board of Directors and senior management of the Corporation consider good corporate governance to be central to the effective and efficient operation of the Corporation and its business. The Board of Directors and management are committed not only to satisfying legal and regulatory requirements, but also to developing and maintaining corporate governance practices that reflect evolving best practices standards as appropriate to the Corporation and its business.

The Board of Directors and management have been following developments in corporate governance requirements and best practices standards in both Canada and the United States closely. The Corporation is listed on the NYSE. Although it is not required to comply with many of the corporate governance listing requirements imposed by the NYSE for domestic listed issuers, the Corporation has aligned its governance practices with those requirements. The Board of Directors and management have reviewed the corporate governance policy (Multilateral Instrument 58-201) released by certain of the Canadian securities regulators for comment in January 2004. To the extent necessary, the Corporation intends to adapt its governance practices to the best practices set out in the final form of that policy.

TSX Corporate Governance Policy Guidelines

The 14 corporate governance guidelines set out in the TSX Corporate Governance Policy and a brief discussion of the Corporation's corporate governance practices with reference to each guideline is set out below.

| 1. | The Board of Directors should explicitly assume responsibility for the stewardship of the Corporation, and specifically for: (a) adoption of a strategic planning process, (b) identification of principal risks and ensuring the implementation of appropriate systems to manage these risks, (c) succession planning, including appointing, training and monitoring senior management, (d) communications policy for the Corporation, and (e) integrity of the Corporation's internal control and management information systems. |

| | |

| | The mandate of the Board of Directors is to manage the business and affairs of the Corporation. Pursuant to this mandate, it has explicitly assumed responsibility for the stewardship of the Corporation and, as part of the overall stewardship responsibility, has assumed the responsibilities described below. |

| | |

| | (a) | The Board of Directors provides input to management in the development of the Corporation's strategic plan, approves that plan and monitors management's execution of that plan. As part of the Board of Directors' responsibility for the strategic planning process, the Board of Directors |

| | | establishes the goals of the business of the Corporation with the input of management and strategies and policies within which the Corporation is managed. Management is required to seek approval of the Board of Directors for material deviations, financial or otherwise, from the approved business goals, strategies and policies. |

| | | |

| | (b) | It is management's responsibility to identify the principal risks to the Corporation's business and to develop strategies to manage those risks. The Board of Directors receives regular reports from management on those risks, the systems in place to manage those risks and the effectiveness of those systems. |

| | | |

| | (c) | The Board of Directors is responsible for the appointment, appraisal and monitoring of the Corporation's senior management. The Corporation's policy is to attract management personnel whose prior experience results in them having been well trained for their responsibilities with the Corporation. The Board of Directors discusses succession issues with the Chief Executive Officer on a regular basis and becomes acquainted with other members of senior management, their experience and skill sets. The Board of Directors encourages senior management to participate in appropriate professional and personal development activities, courses and programs, and supports management's commitment to the training and development of all permanent employees. |

| | | |

| | (d) | The Board of Directors oversees the policy of communications by the Corporation with its shareholders and, in conjunction with management, continues to review the Corporation's approach to communications with its shareholders, regulatory bodies, governments, media and the public. |

| | | |

| | (e) | The Board of Directors oversees the integrity of the Corporation's internal control and management information systems, including through reports from management, from the external auditors and from the Audit Committee. In addition, a Disclosure Committee, composed of non-director members including financial officers of the Corporation, has been established to assist and advise the Chief Executive Officer and Chief Financial Officer with respect to the Corporation's internal controls and disclosure of financial information. |

| 2. | Majority of directors should be "unrelated" (free from conflicting interest). |

| | |

| | The TSX Guidelines provide that the term "unrelated director" means a director who is independent of management and is free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director's ability to act with a view to the best interests of the Corporation, other than interests and relationships arising from shareholdings. The Board of Directors consists of six members, five of whom are unrelated directors and one who is a related director. |

| | |

| 3. | Disclose for each director whether he or she is related, and how that conclusion was reached. |

| | |

| | The current Board of Directors is comprised of six directors, five of whom are unrelated to management. As the Corporation's chief executive officer, Bernard F. Isautier is a related director. The remaining directors, Louis W. MacEachern, James B.C. Doak, Jacques Lefevre, Nurlan J. Kapparov and Jan Bonde Nielsen have no relationship with the Corporation other than as a director or a security holder and accordingly are all unrelated directors. The Corporation does not have a significant shareholder. |

| | |

| 4. | Appointment of a committee responsible for appointment/assessment of directors and that is comprised exclusively of outside (i.e., non-management) directors, a majority of whom are unrelated directors. |

| | |

| | The Corporate Governance Committee of the Board of Directors, which is comprised entirely of outside and unrelated directors, has been given the responsibility of assessing the effectiveness of the Board of Directors and its individual members as well as the committees of the Board of Directors. In addition, the Corporate Governance Committee has responsibility for identifying prospective nominees for the Board of Directors and recommending them to the Board of Directors and for establishing criteria for Board of Directors membership and retirement therefrom. |

| 5. | Implement a process for assessing the effectiveness of the Board of Directors as a whole and its committees and individual directors. |

| | |

| | The Corporate Governance Committee of the Board of Directors assesses, at least annually, the effectiveness of the Board of Directors and the committees of the Board of Directors. The assessments are carried out through one-on-one discussions between the Chair of the Corporate Governance Committee and each individual director. This process does not focus specifically on assessing the effectiveness of individual directors, but it provides an opportunity for each director to provide feedback on the effectiveness of the other directors. The Chair of the Corporate Governance Committee reports on the results of this process to the full Board of Directors. |

| | |

| 6. | Provide orientation and education programs for new directors. |

| | |

| | The directors who joined the Board of Directors most recently were provided with an orientation to the Corporation and education about the Corporation's business and the environment in which it operates through discussions with the Chief Executive Officer and other members of management and a review of certain corporate records. As new directors join the Board of Directors in the future, they will receive similar orientation and education. |

| | |

| 7. | Consider the size of the Board of Directors and the impact of the number on the Board of Directors' effectiveness. |

| | |

| | The Corporation's articles require that the Board of Directors be comprised of three to nine directors. The number of directors is currently set at six. The Board of Directors is satisfied that this number allows for the balance of skill sets and experience appropriate to the effective discharge of the Board of Directors' oversight responsibilities. |

| | |

| 8. | The Board of Directors should review the adequacy and form of the compensation of directors to ensure compensation realistically reflects responsibilities and risks involved. |

| | |

| | The Compensation Committee, which is comprised entirely of outside and unrelated directors, regularly reviews the adequacy and form of compensation of directors of the Corporation. Based on a review of the compensation paid to directors of Canadian companies of comparable size and on discussions among the directors, the Board of Directors is satisfied that it realistically reflects the responsibilities and risks involved. |

| | |

| 9. | Committees of the Board of Directors should generally be composed of outside directors, a majority of whom are unrelated, although some committees, such as the executive committee, may include one or more inside directors. |

| | |

| | The Board of Directors has established three committees: the Audit Committee, the Compensation Committee and the Corporate Governance Committee. All committees are comprised of outside directors, all of whom are also unrelated directors. |

| | |

| 10. | The Board of Directors should expressly assume responsibility for, or assign to a committee of directors, the general responsibility for developing the Corporation's approach to governance issues. |

| | |

| | The Corporate Governance Committee has the responsibility of developing the Corporation's approach to governance issues, and administering the Board of Directors' relationship with management. This includes responsibility for: (i) assessing, at least annually, the effectiveness of the Board of Directors as a whole and the committees of the Board of Directors, (ii) reviewing annually the mandates of the Board of Directors and its committees and making recommendations for change, (iii) recommending procedures to permit the Board of Directors to function independently from management, (iv) reviewing and, if appropriate, approving requests from directors for the engagement of outside advisors, (v) preparing and maintaining corporate governance policies for the Corporation, and (vi) identifying prospective nominees for the Board of Directors and recommending them to the Board of Directors and establishing criteria for the Board of Directors' membership and retirement therefrom. |

| 11. | The Board of Directors should define limits to management's responsibilities by developing (a) mandates for the Board of Directors and the Chief Executive Officer of the Corporation and (b) the corporate objectives for which the Chief Executive Officer is responsible. |

| | |

| | The Board of Directors is responsible for the overall stewardship of the Corporation and in furtherance thereof supervises the officers of the Corporation in their management of the business and affairs of the Corporation and manages the Corporation's strategic planning process. The Board of Directors has developed mandates and corporate objectives for which the Chief Executive Officer is responsible. The Board of Directors requires the Chief Executive Officer and other management of the Corporation to keep the Board of Directors informed in a timely and candid manner of the progress towards the achievement of the established goals and of any material deviation from such goals and from the Corporation's strategies and policies as approved by the Board of Directors. |

| | |

| 12. | Establish procedures to enable the Board of Directors to function independently of management. |

| | |

| | The importance of the independence of the Board of Directors from management is fully endorsed by the Corporation and its management. The Board of Directors considers it important to the ability of the Chief Executive Officer to function most effectively in Kazakhstan, that the Chief Executive Officer also be the Chairman of the Board of Directors. The Board of Directors discharges the responsibilities which are central to its oversight function through the Audit, Compensation and Corporate Governance Committees, each of which is comprised entirely of unrelated directors. Well-developed mandates for these committees, position descriptions for the Board of Directors and the Chief Executive Officer, Board of Directors assessment processes and ongoing discussions about effective governance and evolving best practices also support the independence of the Board of Directors from management. In addition to the Chief Executive Officer, each of the other directors are established businesspersons who are each satisfied that they discharge their responsibilities to the Corporation in an independent-minded way and do not believe that other, more formal procedures are necessary. |

| | |

| 13. | Establish an audit committee with a specifically defined mandate and direct communication channels with internal and external auditors, with all members being outside directors. The audit committee's duties should include oversight responsibility for management reporting on internal control and should ensure that management has designed and implemented an effective system of internal control. |

| | |

| | The Board of Directors has an Audit Committee, all the members of which are outside directors. The roles and responsibilities of the Audit Committee include responsibility for reviewing and making recommendations to the Board of Directors on (i) financial statements and the related reports of management and external auditors, (ii) accounting and financial reporting procedures and methods, (iii) internal audit procedures and reports, and (iv) matters relating to external auditors, including the appointment and terms of engagement of external auditors and their reports relating to accounting, financial and internal audit matters. The Audit Committee has direct communication channels with the external auditors. The Corporation has an internal audit function and the Audit Committee has a direct communication channel with internal audit. |

| | |

| | The U.S. Securities and Exchange Commission (the "SEC") requires that a company filing under the U.S.Securities Exchange Act of 1934 (the "Act") disclose whether its board of directors has determined that there is at least one "audit committee financial expert" as defined by the SEC, on its audit committee. The Board of Directors of the Company has determined that Jacques Lefevre is such an "audit committee financial expert" fulfilling this requirement. The SEC further requires, pursuant to Rule 10A-3 of the Act, that each member of the audit committee be "independent" as that term is defined by the SEC. All of the members of the audit committee are "independent" as required by the SEC. |

| | |

| 14. | Implement a system to enable an individual director to engage outside advisors at the Corporation's expense. The engagement of the outside advisor should be subject to the approval of an appropriate committee of the Board of Directors. |

| | |

| | Any member of the Board of Directors may engage an outside advisor at the expense of the Corporation in |

| | appropriate circumstances, subject to the approval of the Corporate Governance Committee. |

Differences in Corporate Governance Practices of the Corporation Compared to NYSE Standard Applicable to U.S. Domestic Issuers

As a Canadian company, the Corporation is not required to comply with many of the corporate governance listing requirements imposed by the NYSE for U.S. domestic issuers. The Corporation must however, provide a brief description of any significant difference between its corporate governance practices and those followed by U.S. companies under the NYSE listing standards. The following provides a summary of the significant differences between the Corporation’s domestic practice and the NYSE rules.

Section 303A.01 of the NYSE corporate governance rules requires a majority of directors of a U.S. domestic issuer to be "independent" and Section 303A.02 sets forth the independence standards for such directors. The TSX guidelines provide that the board of directors of a company should have a majority of "unrelated" directors. The principles for determining whether a director is "unrelated" differ significantly from the NYSE’s "independence" standards. The Corporation follows the TSX guidelines. The board of directors of the Corporation is not required to and has not otherwise analyzed and made a determination whether the majority of its members meet the NYSE "independence" requirements.

Section 303A.03 of the NYSE corporate governance rules requires non-management directors of a U.S. domestic issuer to meet at regularly scheduled executive sessions without management. Although non-management directors of the Corporation meet without management, such meetings do not currently follow a regular schedule.

Section 303A.09 of the NYSE corporate governance rules requires a U.S. domestic issuer to adopt and disclose a set of corporate governance guidelines and to post such guidelines on the company's website. The Corporation has aligned its corporate governance practices with TSX guidelines as well as the policies released by certain Canadian securities regulators for comment in January 2004. The Corporate Governance Committee has not however, codified its corporate governance principles into formal guidelines in order to post them on its website.

Section 303A.12(a) of the NYSE corporate governance rules requires the chief executive officer of a U.S. domestic issuer to annually certify that he or she is not aware of any violation by the company of NYSE corporate governance standards. As a Canadian company, the Corporation (and its chief executive officer) is not subject to this requirement. However, in accordance with NYSE rules applicable to both U.S. domestic and foreign private issuers, the chief executive officer is required to promptly notify the NYSE in writing after any executive officer becomes aware of any material non-compliance with the NYSE corporate governance standards applicable to the Corporation.

AVAILABILITY OF CERTAIN DOCUMENTS

Additional documents and information regarding the Company are available through the System for Electronic Document Analysis and Retrieval ("SEDAR"). These documents can be accessed through the Internet at www.sedar.com. Financial information regarding the Company is contained in the Company's comparative financial statements and Management Discussion and Analysis for its most recently completed financial year.

The Corporation will provide to any person, without charge, following a written or oral request to Mr. Ihor Wasylkiw, Vice President, Investor Relations of PetroKazakhstan at Suite 1460 Sun Life Plaza, North Tower, 140 -4th Avenue S.W., Calgary, Alberta, T2P 3N3 (telephone: 403-221-8435) or to Mr. Anthony Peart, Senior Vice President, General Counsel and Corporate Secretary of PetroKazakhstan at Hogarth House, 31 Sheet Street, Windsor, Berkshire, SL4 1BY United Kingdom (telephone: 441753 410020) a copy of this Circular, the Corporation's latest Annual Information Form, the Corporation's Annual Report, any interim financial statements since December 31, 2004, and any other documents incorporated therein by reference.

Under National Instrument 54-102, adopted by the Canadian Securities Administrators, a registered holder or beneficial owner of securities of the Corporation who wishes to receive interim financial statements from the Corporation must deliver a written request for such material to the Corporation. Shareholders who wish to receive interim financial statements are encouraged to send the enclosed request form, in the addressed envelope provided, to the Corporation. The Corporation will maintain a supplemental mailing list of persons and companies wishing to receive interim financial statements.

DIRECTORS APPROVAL

The contents and the sending of this Circular have been approved by the directors of the Corporation.

CERTIFICATE

The foregoing contains no untrue statement of a material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in the light of the circumstances in which it was made.

(signed) Bernard F. Isautier President, Chief Executive Officer and Chairman of the Board | (signed) Anthony R. Peart Senior Vice President, General Counsel and Corporate Secretary |

17