UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[ x ] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2006

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number: 000-32409

UNITED MORTGAGE TRUST

(Exact name of registrant as specified in its charter)

Maryland | 75-6493585 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1702 N. Collins Blvd, Suite 100

Richardson, Texas 75080

(Address of principal executive offices)(Zip Code)

(214) 237-9305

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer___ Accelerated filer____ Non-accelerated filer X__

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes No X__

The number of shares outstanding of the Registrant’s shares of beneficial interest, par value $0.01 per share, as of the close of business on October 16, 2006, was 6,926,392.

UNITED MORTGAGE TRUST

INDEX

PART I - FINANCIAL INFORMATION

| | | Page |

ITEM 1. | Financial Statements | |

| | | |

| | UNITED MORTGAGE TRUST: | |

| | Consolidated Balance Sheets as of September 30, 2006 and December 31, 2005 (unaudited) | 1 |

| | Consolidated Statements of Income for the three and nine months ended September 30, 2006 and 2005 (unaudited) | 3 |

| | Consolidated Statements of Cash Flows for the nine months ended September 30, 2006 and 2005 (unaudited) | 4 |

| | Notes to Consolidated Financial Statements as of September 30, 2006 (unaudited) | 5 |

| | | |

ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 9 |

ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk | 14 |

ITEM 4. | Controls and Procedures | 15 |

| | | |

PART II - OTHER INFORMATION |

| | | |

ITEM 1. | Legal Proceedings | 15 |

ITEM 1A. | Risk Factors | 15 |

ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 15 |

ITEM 3. | Defaults Upon Senior Securities | 16 |

ITEM 4. | Submission of Matters to a Vote of Security Holders | 16 |

ITEM 5. | Other Information | 16 |

ITEM 6. | Exhibits | 16 |

PART I -- FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

UNITED MORTGAGE TRUST

CONSOLIDATED BALANCE SHEETS

| | | September 30, 2006 | | December 31, 2005 | |

| | | (unaudited) | | (audited) | |

Assets |

| Cash and cash equivalents | | $ | 869,140 | | $ | 5,548,421 | |

| Mortgage investments: | | | | | | | |

| Investment in trust receivable | | | 5,660,512 | | | 5,815,712 | |

| Interim mortgages, affiliates | | | 60,177,157 | | | 48,411,728 | |

| Interim mortgages | | | 22,196,251 | | | 24,543,944 | |

| Allowance for loan losses | | | (844,414 | ) | | (698,712 | ) |

| | | | | | | | |

| Total mortgage investments | | | 87,189,506 | | | 78,072,672 | |

| | | | | | | | |

| Line of credit receivable, affiliate | | | 33,806,189 | | | 30,317,037 | |

| Accrued interest receivable | | | 371,735 | | | 251,594 | |

| Accrued interest receivable, affiliate | | | 2,568,599 | | | 1,294,829 | |

| Receivable from affiliate | | | 327,961 | | | 377,685 | |

| Recourse obligations, affiliates | | | 11,534,095 | | | 9,264,233 | |

| Residential mortgages and contracts for deed foreclosed | | | 154,668 | | | 874,602 | |

| Interim mortgages foreclosed | | | 1,259,238 | | | 1,805,340 | |

| Equipment, less accumulated depreciation of $22,120 and $11,709, respectively | | | 3,736 | | | 14,147 | |

| Other assets | | | 692,757 | | | 2,083,731 | |

| | | | | | | | |

| Total assets | | $ | 138,777,624 | | $ | 129,904,291 | |

| | | | | | | | |

Liabilities and Shareholders' Equity |

| Liabilities: | | | | | | | |

| Line of credit payable | | $ | 24,948,542 | | $ | 13,808,080 | |

| Dividend payable | | | 808,582 | | | 822,000 | |

| Accounts payable and accrued liabilities | | | -- | | | 114,583 | |

| | | | | | | | |

| Total liabilities | | | 25,757,124 | | | 14,744,663 | |

| | | | | | | | |

| Commitments and contingencies | | | | | | | |

| | | | | | | | |

| Shareholders' equity: | | | | | | | |

| Shares of beneficial interest; $.01 par value; 100,000,000 shares authorized; 7,954,174 and 7,854,037 shares issued, respectively; and 6,926,392 and 7,055,119 outstanding, respectively | | | 79,542 | | | 78,541 | |

| Additional paid-in capital | | | 140,144,861 | | | 138,130,095 | |

| Advisor's reimbursement | | | 397,588 | | | 397,588 | |

UNITED MORTGAGE TRUST

CONSOLIDATED BALANCE SHEETS - (Continued)

| | | September 30, 2006 | | December 31, 2005 | |

| | | (unaudited) | | (audited) | |

| | | | | | | | |

| Cumulative distributions in excess of earnings | | $ | (7,757,963 | ) | $ | (7,680,676 | ) |

| | | | | | | | |

| | | | 132,864,028 | | | 130,925,548 | |

| Less treasury stock of 1,027,782 and 797,582 shares, respectively, at cost | | | (19,843,528 | ) | | (15,765,920 | ) |

| | | | | | | | |

| Total shareholders' equity | | | 113,020,500 | | | 115,159,628 | |

| | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 138,777,624 | | $ | 129,904,291 | |

See accompanying notes to consolidated financial statements.

UNITED MORTGAGE TRUST

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

Revenues: | | | | | | | | | | | | | |

| Interest income derived from affiliates | | $ | 3,380,556 | | $ | 2,583,980 | | $ | 9,477,248 | | $ | 7,780,826 | |

| Interest income | | | 1,053,695 | | | 1,293,188 | | | 3,162,011 | | | 3,362,917 | |

| | | | 4,434,251 | | | 3,877,168 | | | 12,639,259 | | | 11,143,743 | |

Expenses: | | | | | | | | | | | | | |

| Trust administration fee | | | 214,714 | | | 260,449 | | | 641,916 | | | 725,368 | |

| Loan servicing fee | | | 3,434 | | | 8,235 | | | 38,220 | | | 99,919 | |

| General and administrative | | | 392,934 | | | 126,869 | | | 796,363 | | | 453,418 | |

| Provision for loan losses | | | 507,136 | | | 720,568 | | | 1,783,769 | | | 2,444,108 | |

| Interest expense | | | 486,909 | | | 160,606 | | | 1,040,388 | | | 273,547 | |

| Merger costs | | | 11,975 | | | - | | | 1,039,606 | | | - | |

| | | | 1,617,102 | | | 1,276,727 | | | 5,340,262 | | | 3,996,360 | |

| | | | | | | | | | | | | | |

| Net income | | $ | 2,817,149 | | $ | 2,600,441 | | $ | 7,298,997 | | $ | 7,147,383 | |

| | | | | | | | | | | | | | |

| Net income per share of beneficial interest | | $ | 0.40 | | $ | 0.37 | | $ | 1.04 | | $ | 1.02 | |

| | | | | | | | | | | | | | |

| Weighted average shares outstanding | | | 7,001,511 | | | 6,999,276 | | | 6,991,424 | | | 7,022,454 | |

| | | | | | | | | | | | | | |

| Distributions per weighted share outstanding | | $ | 0.35 | | $ | 0.35 | | $ | 1.06 | | $ | 1.15 | |

See accompanying notes to consolidated financial statements.

UNITED MORTGAGE TRUST

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | Nine Months Ended September 30, | |

| | | 2006 | | 2005 | |

| | | | | | | | |

Cash Flows from Operating Activities: | | | | | | | |

| Net income | | $ | 7,298,997 | | $ | 7,147,383 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Provision for loan losses | | | 1,783,769 | | | 2,444,108 | |

| Depreciation | | | 10,411 | | | 2,664 | |

| Net amortization of discount on mortgage investments | | | 166,404 | | | 11,670 | |

| Changes in assets and liabilities: | | | | | | | |

| Accrued interest receivable | | | (1,393,911 | ) | | (606,320 | ) |

| Other assets | | | 1,305,570 | | | (581,966 | ) |

| Accounts payable and accrued liabilities | | | (128,001 | ) | | (75,098 | ) |

| Net cash provided by operating activities | | | 9,043,239 | | | 8,342,441 | |

| | | | | | | | |

Cash Flows from Investing Activities: | | | | | | | |

| Investment in residential mortgages and contracts for deed | | | (762,162 | ) | | (635,893 | ) |

| Principal receipts on residential mortgages and contracts for deed | | | 1,491,000 | | | 863,125 | |

| Proceeds from the sale of mortgage loans, securitization | | | -- | | | 7,260,871 | |

| Investment in interim mortgage notes | | | (70,452,168 | ) | | (56,800,155 | ) |

| Principal receipts on interim mortgage notes | | | 56,827,360 | | | 62,653,375 | |

| Proceeds from recourse obligations, affiliates | | | 910,541 | | | -- | |

| Line of credit receivable, affiliate, net | | | (3,489,152 | ) | | (362,461 | ) |

| Receivable from affiliate | | | 49,724 | | | (7,592 | ) |

| Net cash provided by (used in) investing activities | | | (15,424,857 | ) | | 12,971,270 | |

| | | | | | | | |

Cash Flows from Financing Activities: | | | | | | | |

| Proceeds from issuance of shares of beneficial interest | | | 2,015,767 | | | 2,635,148 | |

| Purchase of treasury stock | | | (4,077,608 | ) | | (3,080,260 | ) |

| Net borrowing (payments) on line of credit payable | | | 11,140,462 | | | (6,823,857 | ) |

| Dividends | | | (7,376,284 | ) | | (8,197,068 | ) |

| Net cash provided by (used in) financing activities | | | 1,702,337 | | | (15,466,037 | ) |

| | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | (4,679,281 | ) | | 5,847,674 | |

| Cash and cash equivalents at beginning of period | | | 5,548,421 | | | 1,331,798 | |

| Cash and cash equivalents at end of period | | $ | 869,140 | | $ | 7,179,472 | |

| | | | | | | | |

Supplemental Disclosure of Cash Flow Information: | | | | | | | |

| Cash paid during the period for interest | | $ | 1,040,388 | | $ | 273,547 | |

| | | | | | | | |

Supplemental Disclosure of Non-Cash Information: | | | | | | | |

| Transfer of loans into recourse obligations, affiliates | | $ | 3,180,403 | | $ | -- | |

See accompanying notes to consolidated financial statements.

UNITED MORTGAGE TRUST

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Nature of Business

United Mortgage Trust (the “Company”) is a Maryland real estate investment trust which qualifies as a real estate investment trust (a “REIT”) under federal income tax laws. The Company invests in: (i)first lien secured interim mortgage loans with initial terms of 12 months or less for the acquisition and renovation of single family homes, (ii)first lien secured construction loans for the acquisition of lots and construction of single family homes, (iii) secured loans to United Development Funding, L.P. (“UDF”), a Nevada limited partnership, that originates and acquires loans for the acquisition and development of single-family home lots, referred to as land development loans, and enters into participation agreements with single-family residential real estate developers, referred to as equity participations, and (iv)in first lien, fixed rate mortgages secured by single-family residential property throughout the United States, all of which are referred to as the Company’s “Mortgage Investments”. Such loans are originated by others to the Company’s specifications or to specifications approved by the Company. Most, if not all, of such loans are not insured or guaranteed by a federally owned or guaranteed mortgage agency.

The Company has no employees. Effective August 1, 2006, the Company entered into a one-year advisory services agreement with UMTH General Services, L.P. (“UMTHGS”), an affiliate of the Company. Under the agreement, UMT pays a monthly trust administration fee for services relating to the Company’s daily operations, including payroll for its employees who are directly and indirectly involved in the day-to-day management of the Company.

Prior to August 1, 2006, UMT Advisors, Inc. (“UMTA”) performed similar functions and was paid a monthly trust administration fee.

These financial statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions for Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair statement have been included. Operating results for the three and nine months ended September 30, 2006 are not necessarily indicative of the results that may be expected for the year ended December 31, 2006. For further information, refer to the consolidated financial statements and footnotes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2005.

3. Line of Credit Payable

On November 8, 2004, with trustee approval, the Company entered into a three year loan agreement for a $15 million revolving credit facility with a commercial bank. The line of credit payable was collateralized by certain interim mortgages. Interest on the outstanding balance accrues at the higher of the Prime Rate or the sum of the Federal Funds rate plus 1/2% per annum. On July 31, 2006 the Company executed the fourth modification of its credit facility to increase the borrowing base to $30,000,000. Outstanding balances on the credit facility at September 30, 2006 and December 31, 2005 were $24,948,542 and $13,808,080, respectively. The interest rate at September 30, 2006 was 8.75% compared to 7.25% at September 30, 2005.

UNITED MORTGAGE TRUST

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued)

(unaudited)

4. Related Party Transactions

The Company relies on affiliates of its Advisor for the sourcing and origination of a majority of its Mortgage Investments.

a) Capital Reserve Group, Inc. (“CRG”) is a Texas corporation that is 50% owned by Todd Etter, an officer and principal shareholder of the former Advisor and shareholder and director of UMT Services, Inc. (“UMTSI”), the General Partner of UMTHGS. CRG was in the business of financing home purchases and renovations by real estate investors. The Company loaned money to CRG to make loans to other borrowers. The unpaid principal balance of the loans at the end of the third quarter was $1,457,974.

b) South Central Mortgage, Inc. (“SCMI”) is a Texas based mortgage bank of which the sole beneficial shareholder is Todd Etter, an officer and principal shareholder of the former Advisor and shareholder and director of UMTSI. Christine “Cricket” Griffin, the Company’s President and one of its trustees, was the Chief Financial Officer of SCMI from June 1995 until July 1996. The Company purchased first lien secured, fixed rate residential real estate mortgage loans sourced by or originated by SCMI. The loans were assigned to the Company when purchased. SCMI provided the Company with limited recourse on loans it sourced or originated and assigned to the Company. At the end of the third quarter, there was no remaining unpaid principal balance on loans sourced or originated by SCMI.

c) Ready America Funding (“RAFC”) is a Texas corporation that is 50% owned by SCMI. RAFC is in the business of financing interim mortgages for the purchase of land and the construction of modular and manufactured single-family homes placed on the land by real estate investors. Although the Company no longer loans money to RAFC, it has continued to fund current projects directly to RAFC’s borrowers. The unpaid principal balance of the loans at the end of the third quarter was $23,842,585.

d) UMT Holdings, LP (“UMTH”) is a Delaware limited partnership which is in the real estate finance business. Christine “Cricket” Griffin, the Company’s President; Todd Etter and Tim Kopacka, who own 100% of the Company's former Advisor; Craig Pettit, who owns 100% of Ready Mortgage Corp. and 100% of Eastern Intercorp Inc. which in turn owns 50% of RAFC; and William Lowe, who owns 50% of CRG, are limited partners in UMTH. Mr. Etter is a shareholder and director of UMTSI, the general partner of UMTH. REO Property Company (“REOPC”) is a subsidiary of UMTH that provides real estate management services to the Company. Prospect Service Corp. (“PSC”) is a subsidiary of UMTH that acts as a mortgage servicer for the Company, and UMTH holds a 99% limited partnership interest in UMTH Land Development, L.P., which holds a 50% profit interest in UDF and acts as UDF's asset manager.

e) UMTH Lending, L.P. (“UMTHL”) is a Delaware limited partnership owned by UMTH. The Company has loaned and will continue to loan money to UMTHL to make loans to other borrowers. The loans are then collaterally assigned to the Company as security for the promissory note between UMTHL and the Company. The unpaid principal balance of the loans at the end of the third quarter was $34,710,228.

f) Recourse Obligations, Affiliates Secured Notes:

Name | | Principal Balance at December 31, 2005 | | Principal Balance at September 30, 2006 | | Maximum Note Amount | |

| | | | | | | | | | | |

| CRG | | $ | 2,725,442 | | $ | 3,310,982 | | $ | 3,372,904 | |

| SCMI | | $ | 3,295,422 | | $ | 3,436,955 | | $ | 3,448,643 | |

| RAFC | | $ | 3,243,369 | | $ | 4,786,157 | | $ | 5,274,436 | |

UNITED MORTGAGE TRUST

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued)

(unaudited)

The Secured Notes bear interest at a rate of 10% per annum. The CRG and RAFC Secured Notes mature in 15 years. The SCMI Secured Note matures in approximately 22 years, which was the initial amortization of the deficiency notes from SCMI that were consolidated. The Secured Notes require the originating company to make monthly payments equal to the greater of (1) principal and interest amortized over 180 months and 264 months, respectively, or 2) the amount of any distributions paid to the originating company with respect to the pledged Class C units of UMTH. UMT Holdings has also guaranteed the obligations of CRG, SCMI and RAFC under the Secured Notes.

g) REOPC’s mission is to manage and sell real estate owned (“REO”), including the Company's, for which it receives a fee. The Company has loaned money to REOPC to acquire foreclosed properties from CRG. The unpaid principal balance of the loans at the end of the third quarter was $166,370. The Company pays a monthly property management fee to REOPC for managing its REO properties. The monthly fee is calculated as 1/12th of 0.8% of the Company’s basis in the property. Fees paid in the three and the nine months ended September 30, 2006 and 2005 were $2,296 and $8,235 and $18,205 and $99,919, respectively. The Company paid real estate sales commissions to REOPC in the three and nine months ended September 30, 2006 and 2005 of $12,227 and $22,965 and $22,427 and $32,233, respectively.

h) UDF is a Nevada real estate finance company in which UMTH holds a limited partnership profit interest. On June 20, 2006, with Trustee approval, the Company extended and modified its line of credit with UDF. The term remained the same but the interest rate is a uniform 15% and the borrowing base increased to $45,000,000. UDF makes loans to real estate developers for single family residential lot development. The principal balance at the end of the third quarter was $33,806,189.

Effective September 1, 2006, United Development Funding III, L.P. (“UDF III”) issued a guaranty to the Company for the UDF debt to a maximum of $30,000,000 subject to reductions based on UDF equity. In conjunction with the issuance of the guaranty, the interest rate on the UDF line was reduced to 14%.

i) The Company had an Advisory Agreement with UMTA which was terminated on July 31, 2006. Under the agreement, UMTA was paid a monthly trust administration fee. The fee was calculated monthly as 1/12 of 1/2 of 1% of the first $50,000,000 in income producing assets and 1/12 of 1% of assets exceeding $50,000,000. Trust administration fees paid during the three and nine months ended September 30, 2006 and 2005 were $101,991 and $260,449 and $529,193 and $725,368, respectively.

j) The Company entered into an Advisory Agreement with UMTHGS effective August 1, 2006. Under the agreement, UMTHGS is paid an advisory fee calculated monthly as 1/12 of 1% of total income producing assets. Advisory services fees paid during the three months ended September 30, 2006 were $196,056.

As consideration for obtaining the advisory agreement, UMTHGS has agreed to pay the Company $500,000 in total over twelve monthly installments, the term of the agreement. The fee will be recognized as a reduction of trust administration fees over the one-year term. The fee recognized during the three months ended September 30, 2006 was $83,333.

The Company also reimburses UMTHGS for miscellaneous costs paid by UMTHGS on the Company’s behalf. These include allocated payroll expenses, rent and other allocated office expenses. Payments of $81,483 were made to UMTHGS for these costs during the nine-month period ended September 30, 2006 and $6,834 was reimbursed during the third quarter.

k) The Company pays loan servicing fees to PSC under the terms of a Mortgage Servicing Agreement. The Company paid loan servicing fees of $1,137 and $8,235 and $20,014 and $36,346 during the three months and nine months ended September 30, 2006 and 2005, respectively.

UNITED MORTGAGE TRUST

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (continued)

(unaudited)

5. Merger Agreement

On June 13, 2006, the Board of Trustees voted to take no action to prevent the Agreement and Plan of Merger dated September 1, 2005 ("Merger Agreement") between the Company and UMTH pursuant to which the Company would merge with and into UMTH ("Merger") from terminating for failure to satisfy the condition contained in that agreement that the Merger would be terminated if the Merger shall not have been consummated by June 30, 2006. On June 13, 2006, the Company received a letter from UMTH in which UMTH also expressed the view that the Merger would terminate on June 30, 2006. On June 30, 2006 the merger terminated and as a result the Company has expensed $1,039,606 of costs related to the merger. The Company believes that it will not incur any termination penalties as a result of the termination of the merger.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following section contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and should be read in conjunction with the consolidated financial statements and related notes appearing in this Form 10-Q. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons including, but not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2005 under the caption “Risk Factors”, as well as those discussed in this report, as well as other unknown and unpredictable factors. You should not place undue reliance on these forward-looking statements. Such forward looking statements may be identified by the words “anticipate,” “believe,” “estimate,” “expect” or “intend” and similar expressions. Forward-looking statements are likely to address such matters as our business strategy, future operating results, future sources of funding for mortgage loans acquired by us, future economic conditions and pending litigation involving us.

RESULTS OF OPERATIONS FOR THE THREE MONTHS AND NINE MONTHS

ENDED SEPTEMBER 30, 2006 AND 2005

In November 2003, we received a merger proposal from UMT Holdings, L.P. (“UMTH”), an entity organized by persons that include some of our officers and owners and our former Advisor. On June 13, 2006, the Board of Trustees voted to take no action to prevent the Agreement and Plan of Merger dated September 1, 2005 from terminating for failure to satisfy the condition contained in that agreement that the Merger would be terminated if the Merger shall not have been consummated by June 30, 2006. On June 13, 2006, the Company received a letter from UMTH in which UMTH also expressed the view that the Merger would terminate on June 30, 2006. On June 30, 2006 the merger terminated and as a result the Company has expensed $1,039,606 of costs related to the merger.

General Investment Information

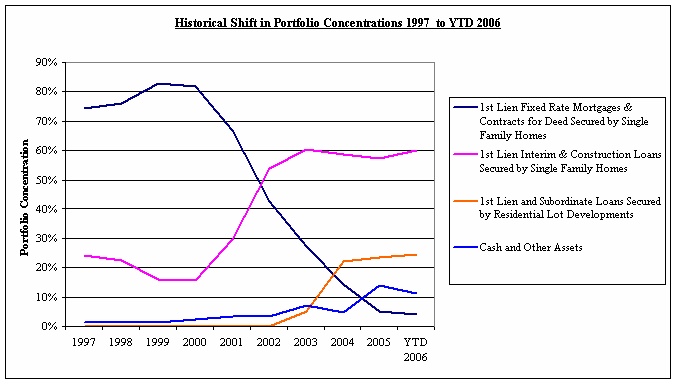

Since 2000 the Company has shifted its investment allocation as it adapted to changes in real estate markets. Our portfolio concentrations have shifted over nine years of investing, as we have sought adequate supplies of suitable loans in a changing real estate finance market. The chart below demonstrates a transition from long term 1st lien single family loans to first lien interim loans of 12 months or less in term for the purchase and renovation of single family homes and the genesis and growth of investment in a loan secured by 1st lien and subordinate single family lot development loans. We now reaffirm that we will continue to adapt to changes in our market. Management estimates that investment in land development loans will grow to at least 35%, or as much as 50%, of our portfolio by the end of 2006.

Loans Purchased

During the three and nine months ended September 30, 2006 and 2005 we acquired interim mortgages from both affiliates and others, and funded draws on the UDF line of credit. In addition, we acquired residential mortgages in 2006 as a result of owner financing on the sale of REO properties. In 2005, we acquired residential mortgages from third parties in conjunction with the Bayview Securitization.

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

Interim Mortgages | | | | | | | | | | | | | |

| Funded with affiliates | | $ | 19,645,000 | | $ | 12,391,000 | | $ | 53,395,000 | | $ | 31,300,000 | |

| Funded with others | | $ | 6,533,000 | | $ | 4,449,000 | | $ | 17,057,000 | | $ | 24,126,000 | |

| Total funded | | $ | 26,178,000 | | $ | 16,840,000 | | $ | 70,452,000 | | $ | 55,426,000 | |

| | | | | | | | | | | | | | |

| Number of loans funded with affiliates | | | 320 | | | 207 | | | 776 | | | 446 | |

| Number of loans funded with others | | | 74 | | | 39 | | | 118 | | | 204 | |

| Total number of loans funded | | | 394 | | | 246 | | | 894 | | | 650 | |

| | | | | | | | | | | | | | |

| Principal paid off with affiliates | | $ | 13,254,000 | | $ | 10,680,000 | | $ | 41,630,000 | | $ | 32,223,000 | |

| Principal paid off with others | | $ | 11,523,000 | | $ | 14,551,000 | | $ | 19,405,000 | | $ | 30,430,000 | |

| Total principal paid off | | $ | 24,777,000 | | $ | 25,231,000 | | $ | 61,035,000 | | $ | 62,653,000 | |

| | | | | | | | | | | | | | |

| Number of loans with affiliates paid off | | | 196 | | | 98 | | | 661 | | | 347 | |

| Number of loans with others paid off | | | 81 | | | 149 | | | 159 | | | 279 | |

| Total number of loans paid off | | | 277 | | | 247 | | | 820 | | | 626 | |

| | | | | | | | | | | | | | |

Line of Credit, Affiliate | | | | | | | | | | | | | |

| Draws funded | | $ | 6,153,000 | | $ | 4,640,000 | | $ | 15,562,000 | | $ | 15,295,000 | |

| Pay downs | | $ | 3,900,000 | | $ | 5,533,000 | | $ | 12,073,000 | | $ | 14,933,000 | |

| Total change in balance | | $ | 2,253,000 | | $ | (893,000 | ) | $ | 3,489,000 | | $ | 362,000 | |

| | | | | | | | | | | | | | |

Investment in Trust Receivable (Residential Mortgages and Contracts for Deed) | | | | | | | | | | | | | |

| Purchase price | | $ | 176,000 | | $ | -- | | $ | 693,000 | | $ | 239,000 | |

| Number purchased from other sources | | | 3 | | | -- | | | 16 | | | 13 | |

| Aggregate principal balance | | $ | 176,000 | | $ | -- | | $ | 693,000 | | $ | 239,000 | |

| Average principal balance | | $ | 58,667 | | $ | -- | | $ | 43,313 | | $ | 18,385 | |

At the end of the September 2006 and 2005 quarters, and with the culmination of the two Bayview Securitizations, our mortgage portfolio changed significantly to a concentration in interim mortgages and the UDF secured loans. Below is a table that summarizes our mortgage portfolio at the end of each quarter indicated:

| | | 2006 | | 2005 | |

Interim Mortgages | | | | | | | |

| Unpaid principal balance, affiliates | | $ | 60,177,157 | | $ | 44,678,231 | |

| Unpaid principal balance, others | | $ | 22,196,251 | | $ | 21,924,513 | |

| | | | | | | | |

| Loans foreclosed, others | | $ | 1,259,238 | | $ | 2,426,532 | |

| | | | | | | | |

| Number of loans outstanding, affiliates | | | 819 | | | 685 | |

| Number of loans outstanding, others | | | 268 | | | 338 | |

| | | | | | | | |

| Average unpaid principal balance | | $ | 75,781 | | $ | 65,105 | |

| Remaining term in months: less than | | | 12 | | | 12 | |

| Yield on investments | | | 13.60 | % | | 13.51 | % |

| | | | | | | | |

Line of Credit, Affiliate | | | | | | | |

| Term remaining in months | | | 39 | | | 51 | |

| Yield on investments | | | 13.86 | % | | 14.87 | % |

| | | | | | | | |

Recourse Obligations, Affiliates | | $ | 11,534,095 | | $ | -- | |

| | | | | | | | |

Investment in Trust Receivable | | | | | | | |

| Loans owned outright | | | | | | | |

| Rental properties | | | 2 | | | 2 | |

| Unpaid principal balance on loans owned outright | | $ | 1,763,171 | | $ | 3,751,855 | |

| Securitized loans “B” piece balance | | $ | 3,759,966 | | $ | 4,443,440 | |

| Foreclosed properties | | $ | 154,668 | | $ | 1,648,737 | |

| Term remaining: less than | | | 360 months | | | 360 months | |

| Yield on investments | | | 13.98 | % | | 7.44 | % |

| | | | | | | | |

The following table illustrates percentage of our portfolio dedicated to each loan category:

| | | September 30, | |

| | | 2006 | | 2005 | |

| Interim mortgages with affiliates | | | 45 | % | | 43 | % |

| Interim mortgages with others | | | 17 | % | | 21 | % |

| Line of Credit, Affiliate | | | 25 | % | | 28 | % |

| Recourse obligations, affiliates | | | 9 | % | | -- | % |

| Trust receivable - loans owned outright | | | 1 | % | | 4 | % |

| Trust receivable - securitized loans “B” piece | | | 3 | % | | 4 | % |

All of the properties that are security for the mortgage investments are located in the United States. Each of the properties was adequately covered by a mortgagee’s title insurance policy and hazard insurance.

During the three-month and nine-month periods ended September 30, 2006 and 2005, our investments generated approximately $4,434,000 and $3,877,000 and $12,639,000 and $11,144,000 of interest income, respectively, representing 14% and 13% increases over the prior periods, respectively. The increase was attributed to increased use of our bank line of credit. We used our bank line to increase our mortgage investments which had higher yields than our bank debt.

Operating expenses for the three-month and nine-month periods ended September 30, 2006 and 2005 were approximately $1,617,000 and $1,277,000 and $5,340,000 and $3,996,000, respectively, 27% and 34% increases between comparable periods. Changes in major categories of operating expenses are explained below:

Trust administration fee - $215,000 and $260,000 (a 17% decrease) between the comparable three-month periods and $642,000 and $725,000 (an 11% decrease) between the comparable nine-month periods of 2006 and 2005, respectively. The change in fees is a result of the new advisory services agreement with UMTHGS, effective August 1, 2006. Annual fees were increased to 1% of invested assets versus ½ of 1% of the first $50 million of invested assets and 1% on invested assets in excess of $50 million or an approximate blended rate of .8% of invested assets paid to the former Advisor. As consideration for obtaining the advisory agreement, UMTHGS has agreed to pay the Company $500,000 in total over twelve monthly installments, the term of the agreement. The fee will be recognized as a reduction of trust administration fees over the one-year term. The fee recognized during the three months ended September 30, 2006 was $83,333.

General and administrative - $393,000 and $127,000 (a 209% increase) between the comparable three-month periods and $796,000 and $453,000 (a 76% increase) between the comparable nine-month periods of 2006 and 2005, respectively. The increase is primarily due to the full amortization of the loan securitization interest advance, amortization of additional bank loan costs and allocated payroll from UMTHGS.

Loan servicing fees - $3,000 and $8,000 (a 63% decrease) between the comparable three-month periods and $38,000 and $100,000 (a 62% decrease) between the comparable nine-month periods of 2006 and 2005, respectively. Loan servicing fees are calculated as a percentage of the unpaid principal balances of residential mortgages, contracts for deed and REO properties. The three-month decrease was due to fees paid to REO Property Company to coordinate sales of foreclosed properties. The nine-month decrease reflects the shrinking number of residential mortgages/contracts for deed in our portfolio.

Interest expense - $487,000 and $161,000 (a 202% increase) between the comparable three-month periods and $1,040,000 and $274,000 (a 280% increase) between the comparable nine-month periods of 2006 and 2005, respectively. We have used our bank line of credit extensively during 2006 to fund growth in our mortgage investments resulting in increased interest expense.

Provision for loan losses - $507,000 compared to $721,000 (a 30% decrease) between the comparable three-month periods and $1,784,000 and $2,444,000 (a 27% decrease) between comparable nine-month periods of 2006 and 2005, respectively. Fluctuations in the provision for loan losses result from changes in foreclosure rates and changes in estimated recoveries on sales of real estate owned.

Merger costs - As a result of the termination of the proposed merger between the Company and UMTH, we recorded an expense of approximately $1,040,000. The costs were comprised primarily of legal fees (39%), Independent Committee member fees (29%), and fees relating to a fairness opinion (21%).

Operating expenses, less interest expense, provision for loan losses and merger expenses, as a percentage of income were 13.8% and 10.2% for the comparable three-month periods of 2006 and 2005 and 11.7% and 11.5% for the comparable nine-month periods of 2006 and 2005. As a percentage of average invested assets they were 2.06% and 1.47% for the comparable three-month periods and 1.72% and 1.54% for the comparable nine- month periods, respectively.

We recorded allowances for loan losses of approximately $507,000 and $721,000 during the third quarters of 2006 and 2005, and $1,784,000 and $2,444,000 in the comparable nine-month periods of 2006 and 2005, respectively. We realized loan losses of approximately $424,000 and $622,000 and $2,217,000 and $2,164,000 during the comparable three-month and nine-month periods, respectively. Loss reserves are estimates of future losses based on historical default rates and estimated loss on sale of real estate owned.

From inception through September 30, 2006 we have acquired approximately $496,906,000 of loans. We have recorded losses of 1.79% of those assets to date. We anticipate loan losses to continue, primarily in our long-term loan portfolio, and therefore continue to assess the adequacy of our loan loss reserve.

Total foreclosed loans as a percentage of income producing assets, as of September 30, 2006 and December 31, 2005, was approximately 1.06% and 2.26%, respectively.

Net income was approximately $2,817,000 and $2,600,000 for the three months and $7,299,000 and $7,147,000 for the nine months ended September 30, 2006 and 2005, respectively, 8% and 2% increases, respectively. The increases were due to the positive impact of leveraged portfolio growth, partially offset by one time merger costs expensed after the termination of the proposed merger between the Company and UMTH. Excluding the merger costs, net income increased by 9% and 17% for the three-month and nine-month comparable periods. Earnings per weighted average share were $0.40 and $0.37 for the three-month periods and $1.04 and $1.02 for the comparable nine-month periods. Excluding the merger expense, earnings were $0.40 and $1.19 per weighted share, for the three months and nine months ended September 30, 2006, respectively.

Distributions to shareholders per share of beneficial interest in the 2006 and 2005 three-month periods were $0.35 and $0.35 and $1.06 and $1.15 for the nine-month periods, respectively. We distributed in excess of earnings in all comparable periods except the June 2005 quarter.

CAPITAL RESOURCES AND LIQUIDITY FOR

THE THREE MONTHS AND NINE MONTHS ENDED SEPTEMBER 30, 2006 AND 2005

We utilize funds made available from our dividend reinvestment plan, from our bank line of credit and repayment of principal on our loans to purchase mortgage investments.

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | | | | | |

| Shares issued in dividend reinvestment | | | 30,717 | | | 40,727 | | | 100,137 | | | 132,352 | |

| Gross proceeds | | $ | 628,000 | | $ | 815,000 | | $ | 2,016,000 | | $ | 2,647,000 | |

| Share repurchases | | $ | (1,002,000 | ) | $ | (1,112,000 | ) | $ | (4,078,000 | ) | $ | (3,080,000 | ) |

| Principal receipts from Residential Mortgages and Contracts for Deed | | $ | 433,000 | | $ | 83,000 | | $ | 1,491,000 | | $ | 863,000 | |

| Principal receipts from Interim Mortgages | | $ | 23,593,000 | | $ | 25,254,000 | | $ | 56,827,000 | | $ | 62,653,000 | |

| Securitization proceeds | | | -- | | | -- | | | -- | | $ | 7,261,000 | |

| Fundings on Line of Credit, Affiliate | | $ | 3,900,000 | | $ | 5,533,000 | | $ | 12,073,000 | | $ | 9,400,000 | |

| Net advances (payments) on Line of Credit payable | | $ | 4,499,000 | | $ | (3,460,000 | ) | $ | 11,140,000 | | $ | (6,824,000 | ) |

| | | | | | | | | | | | | | |

We are not currently offering shares in the public markets except to existing shareholders through our dividend reinvestment plan. In July 2006 we registered an additional 1,000,000 shares to be offered through our dividend reinvestment plan.

Shares issued in the aggregate, as of September 30, 2006 and 2005, were 7,954,174 and 7,815,392, respectively. Shares retired to treasury through our share redemption plan in the aggregate were 1,027,782 and 792,532, respectively. Total shares outstanding were 6,926,392 and 7,022,860, respectively. Inception to date gross offering proceeds were approximately $159,000,000 and net proceeds after fees, marketing reallowance and commissions were approximately $140,000,000.

Since entering into a into a three year loan agreement on November 8, 2004 with our lending bank, we have amended and restated the original $15 million revolving credit facility four times. The most recent amendment was effective July 31, 2006, increasing the borrowing base to $30,000,000. The line of credit was collateralized by certain interim mortgages and construction loans. Interest on the outstanding balance accrues at prime plus 0.5% per annum, or 8.75% and 7.25% at September 30, 2006 and 2005, respectively. The outstanding balance on the line of credit was approximately $24,949,000 and $5,206,000 at September 30, 2006 and 2005, respectively.

We are monitoring the gradual increase in the prime lending rate. We are aware that higher consumer interest rates may negatively impact home building, sales of real estate and real estate development, and therefore may negatively impact our ability to acquire a sufficient number of suitable loans to support our dividend at the current rate. At the time of this report, analysts agree that the real estate market has slowed to what is being characterized as normal growth rates. Historically, the residential real estate lending segment has experienced a prime lending rate as high as 10% and home loan rates as high as 9% without negative effects on real estate markets and our business.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to accrual of interest income, loan loss reserves and valuation of foreclosed properties. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Significant accounting policies are described in the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2005. The following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Interest is accrued monthly on outstanding principal balances. Payments are either received monthly for interest or at payoff. Any deficiencies in unpaid interest are either charged off to the reserve for loan losses or charged against the related recourse obligations.

We maintain a reserve for loan losses for estimated losses resulting from the inability of our borrowers to make required payments ultimately resulting in property foreclosure. If the financial condition of our borrowers was to deteriorate, resulting in an impairment of their ability to make payments, additional reserves may be required.

We record foreclosed properties at an estimated net realizable value based on our assessment of real estate market conditions and historical discount percentages on the sale of foreclosed properties. Should market conditions deteriorate or loss percentages increase, additional valuation adjustments may be required.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to interest rate changes primarily as a result of the method by which our bank credit facility is calculated at 1/2% over bank prime lending rate. A higher interest rate may have a negative impact on earnings, but we do not anticipate a significant impact during the remainder of 2006.

We have no long-term borrowings.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

An evaluation was performed by the Company’s management, consisting of the individual who serves as our Chief Executive Officer and Chief Financial Officer, of the effectiveness of Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934) as of September 30, 2006. Based on such evaluation, management has concluded that, as of the end of such period, the Company’s disclosure controls and procedures are effective.

Changes in Internal Controls Over Financial Reporting

There have been no changes in the Company’s internal control over financial reporting that occurred during the third quarter of 2006, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 1A. RISK FACTORS

We have not had any material changes from the risk factors previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2005.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On July 28, 2006 our registration on Form S-3 relating to our offering up to 1,000,000 shares of beneficial interest at $20 per share through our dividend reinvestment plan became effective. There are no commissions or fees paid from the proceeds. We use proceeds from the plan primarily to repurchase shares in our share redemption plan. Absent applications for repurchase, we use the proceeds to buy mortgage investments.

The following table sets forth information relating to shares of beneficial interest issued during the nine months ended September 30, 2006:

| Shares issued | | | 100,137 | |

| Gross proceeds | | $ | 2,015,767 | |

There is currently no established public trading market for our shares. As an alternative means of providing limited liquidity for our shareholders, we maintain a share redemption plan. We suspended that plan on September 1, 2005 when we announced entry into a merger agreement with UMT Holdings, L.P. The merger agreement was terminated on June 30, 2006 and we resumed the plan.

Under our plan, shareholders who have held the shares for at least one year are eligible to request that we repurchase their shares. In any consecutive 12 month period we may not repurchase more than 5% of the outstanding shares at the beginning of the 12 month period. The repurchase price is based on the value of our assets less our obligations or a fixed pricing schedule, as determined by the trustees' business judgment based on our book value, operations to date and general market and economic conditions and may not, in any event, exceed any current public offering price. We have also purchased a limited number of shares outside of our share redemption plan from shareholders with special hardship considerations.

Share repurchases have been at prices between $16.34 and $20 per share. Shares repurchased at the lower price were 1) shares held by shareholders for less than 12 months or 2) shares purchased outside of our Share Repurchase Program (“SRP”). Before the suspension of the SRP, the limit set by our trustees for shares purchased at $20 per share were limited to an amount equal to the proceeds we received from our monthly dividend reinvestment or an amount equal to 5% of shares outstanding in any 12-month period. Shares repurchased outside of that limit were at the lower price. Our trustees currently allow us to liquidate shares on a case-by-case basis when a request is accompanied by proof of hardship. Subsequent to the merger termination our Trustees have set a hardship liquidation price to approximate our Net Asset Value, or approximately $16.34 per share for shares repurchased outside of the repurchase plan.

The following table sets forth information relating to shares of beneficial interest repurchased into treasury during the period covered by this report.

| | | Total number of shares purchased | | Average price per share | | Total number of shares purchased as part of publicly announced plan | | Total number of shares purchased outside of publicly announced plan | |

| | | | | | | | | | | | | | |

| July | | | 25,634 | | $ | 17.61 | | | 8,886 | | | 16,748 | |

| August | | | 22,384 | | $ | 18.42 | | | 12,695 | | | 9,689 | |

| September | | | 8,428 | | $ | 16.34 | | | -- | | | 8,428 | |

| | | | | | | | | | | | | | |

| Total | | | 56,446 | | $ | 17.74 | | | 21,581 | | | 34,865 | |

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

Not applicable.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

Exhibit 31. Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

Exhibit 32. Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

| | | |

| | UNITED MORTGAGE TRUST |

|

|

|

| Date: November 14, 2006 | By: | /s/ Christine A. Griffin |

| |

Christine A. Griffin |

| | President and Chief Executive Officer |