As filed with the Securities and Exchange Commission on March 10, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07685

Frontegra Funds, Inc.

(Exact name of registrant as specified in charter)

400 Skokie Blvd.

Suite 500

Northbrook, Illinois 60062

(Address of principal executive offices) (Zip code)

William D. Forsyth III

400 Skokie Blvd., Suite 500

Northbrook, Illinois 60062

(Name and address of agent for service)

(847) 509-9860

Registrant's telephone number, including area code

Date of fiscal year end: June 30, 2008

Date of reporting period: December 31, 2007

Item 1. Report to Stockholders.

SEMI-ANNUAL REPORT

Frontegra Columbus Core Plus Fund

Frontegra Columbus Core Fund

Frontegra IronBridge Small Cap Fund

Frontegra IronBridge SMID Fund

Frontegra New Star International Equity Fund

Frontegra Netols Small Cap Value Fund

Frontegra Asset Management, Inc.

December 31, 2007

TABLE OF CONTENTS

Shareholder Letter | 1 |

Expense Example | 2 |

Allocation of Portfolio Holdings | 6 |

Frontegra Columbus Core Plus Fund | |

Frontegra Columbus Core Fund | |

Report from Reams Asset Management Company, LLC | 9 |

Investment Highlights | 13 |

Schedule of Investments | 14 |

Statement of Assets and Liabilities | 30 |

Statement of Operations | 31 |

Statements of Changes in Net Assets | 32 |

Financial Highlights | 33 |

Investment Highlights | 34 |

Schedule of Investments | 35 |

Statement of Assets and Liabilities | 49 |

Statement of Operations | 50 |

Statements of Changes in Net Assets | 51 |

Financial Highlights | 52 |

Frontegra IronBridge Small Cap Fund | |

Frontegra IronBridge SMID Fund | |

Report from IronBridge Capital Management, L.P. | 54 |

Investment Highlights | 56 |

Schedule of Investments | 57 |

Statement of Assets and Liabilities | 63 |

Statement of Operations | 64 |

Statements of Changes in Net Assets | 65 |

Financial Highlights | 66 |

Investment Highlights | 67 |

Schedule of Investments | 68 |

Statement of Assets and Liabilities | 74 |

Statement of Operations | 75 |

Statements of Changes in Net Assets | 76 |

Financial Highlights | 77 |

Frontegra New Star International Equity Fund | |

Report from New Star Institutional Managers Limited | 79 |

Investment Highlights | 81 |

Schedule of Investments | 82 |

Portfolio Diversification | 87 |

Statement of Assets and Liabilities | 88 |

Statement of Operations | 89 |

Statements of Changes in Net Assets | 90 |

Financial Highlights | 91 |

Frontegra Netols Small Cap Value Fund | |

Report from Netols Asset Management, Inc. | 93 |

Investment Highlights | 94 |

Schedule of Investments | 95 |

Statement of Assets and Liabilities | 100 |

Statement of Operations | 101 |

Statements of Changes in Net Assets | 102 |

Financial Highlights | 103 |

Notes to Financial Statements | 105 |

Board of Directors’ Approval of the Advisory Agreement | 118 |

Additional Information | 128 |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC is an affiliate of Frontegra Asset Management, Inc., the Funds’ Investment Adviser.

| This page intentionally left blank. |

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontegra Funds for the first six months of our fiscal year (July 1, 2007 through December 31, 2007). During the past six months, the U.S equity market, as measured by the S&P 500 Index, was actually down (2.33%). Non-U.S. markets, as measured by the MSCI EAFE Index, were barely positive, returning just 0.51%. In the U.S., small capitalization stocks did significantly worse than large capitalization stocks. The Russell 2000 Index was down (7.53%). In contrast to the equity markets, the U.S. bond market had a relatively strong showing in the final six months of 2007 with the Lehman Brothers Aggregate Bond Index up 5.93%. The bond market benefited from the Federal Reserve’s lowering of the federal-funds rate by a total of 1% over the six-month period.

Fund Results

The Frontegra Columbus Core Plus Fund and the Frontegra Columbus Core Fund, managed by Reams Asset Management, returned 6.74% and 6.72%, net of fees, respectively. The Frontegra IronBridge Small Cap and SMID Funds, both managed by IronBridge Capital Management, returned -2.04% and -3.28%, net of fees, respectively. The Frontegra New Star International Equity Fund, managed by New Star Institutional Managers returned 0.85%, net of fees, for the period. Finally, the Frontegra Netols Small Cap Value Fund, managed by Netols Asset Management, returned -4.64%, net of fees.

Summary

We continue to have great confidence in the investment teams at Reams Asset Management, IronBridge Capital Management, New Star Institutional Managers and Netols Asset Management. We believe they are committed to the highest standards of investment decision-making for the shareholders of the Frontegra Funds.

As always, we greatly appreciate your investment and continued confidence in the Frontegra Funds.

Sincerely,

|  |

| Thomas J. Holmberg, CFA | William D. Forsyth, CFA |

| Frontegra Asset Management, Inc. | Frontegra Asset Management, Inc. |

Frontegra Funds

EXPENSE EXAMPLE

December 31, 2007 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently the Funds’ transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra New Star International Equity Fund.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/07 – 12/31/07).

Actual Expenses

The first line of the tables on the following pages provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

Frontegra Funds

EXPENSE EXAMPLE (CONTINUED)

December 31, 2007 (Unaudited)

Frontegra Columbus Core Plus Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $1,067.40 | $1.35 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,023.83 | $1.32 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.26%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra Columbus Core Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $1,067.20 | $1.35 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,023.83 | $1.32 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.26%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra IronBridge Small Cap Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $979.60 | $5.37 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,019.71 | $5.48 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.08%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra Funds

EXPENSE EXAMPLE (CONTINUED)

December 31, 2007 (Unaudited)

Frontegra IronBridge SMID Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $967.20 | $4.70 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,020.36 | $4.82 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.95%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra New Star International Equity Fund

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $1,008.50 | $3.79 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,021.37 | $3.81 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.75%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra Netols Small Cap Value Fund – Institutional Class

| | | | Expenses Paid |

| | Beginning | Ending | During Period |

| | Account Value | Account Value | July 1, 2007 - |

| | July 1, 2007 | December 31, 2007 | December 31, 2007* |

| Actual | $1,000.00 | $953.50 | $5.40 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,019.61 | $5.58 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.10%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

Frontegra Funds

EXPENSE EXAMPLE (CONTINUED)

December 31, 2007 (Unaudited)

Frontegra Netols Small Cap Value Fund – Class Y

| | | Ending | |

| | Beginning | Account Value | Expenses Paid |

| | Account Value | December 31, 2007 | During Period |

| Actual* | $1,000.00 | $979.10 | $2.56 |

| Hypothetical (5% return | | | |

| before expenses)** | $1,000.00 | $1,017.34 | $7.86 |

| * | | Actual expenses are equal to the Fund’s annualized expense ratio of 1.55%, multiplied by the average account value over the period, multiplied by 61/366 to reflect the most recent fiscal period end since the Class Y Shares commenced operations on November 1, 2007. |

| ** | | Hypothetical expenses are equal to the Fund’s annualized expense ratio of 1.55% multiplied by the average account value over the period commencing July 1, 2007, multiplied by 184/366 to reflect information had the Class Y Shares been in operation for the entire fiscal half year. |

ALLOCATION OF PORTFOLIO HOLDINGS

December 31, 2007 (Unaudited)

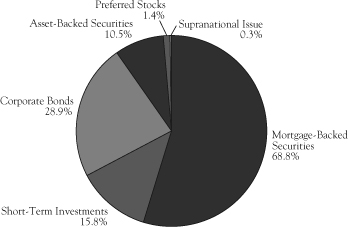

Frontegra Columbus Core Plus Fund*

Frontegra Columbus Core Fund*

* Percentages shown are based on the Fund’s total net assets.

Frontegra Funds

ALLOCATION OF PORTFOLIO HOLDINGS (CONTINUED)

December 31, 2007 (Unaudited)

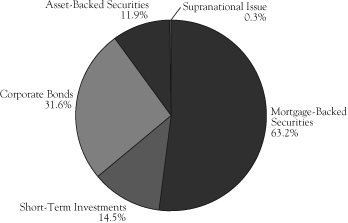

Frontegra IronBridge Small Cap Fund* | Frontegra IronBridge SMID Fund* |

| | |

| |

Frontegra New Star | Frontegra Netols |

International Equity Fund* | Small Cap Value Fund* |

| | |

| |

* Percentages shown are based on the Fund’s total net assets.

FRONTEGRA

COLUMBUS CORE PLUS FUND

FRONTEGRA

COLUMBUS CORE FUND

REPORT FROM REAMS ASSET

MANAGEMENT COMPANY, LLC:

Dear Shareholders:

The Frontegra Columbus Core Plus Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of fixed income securities of varying maturities. This objective is relative to and measured against the Lehman Brothers Aggregate Bond Index.

The Frontegra Columbus Core Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of investment grade bonds of varying maturities. This objective is relative to and measured against the Lehman Brothers Aggregate Bond Index.

Performance Review

For the six month period ending 12/31/07, the Frontegra Columbus Core Plus Fund had a net return of 6.74% compared to a return of 5.93% for the benchmark, the Lehman Brothers Aggregate Bond Index. The difference in performance was 0.81%. The biggest positive performance factor for the period was the portfolio’s bulleted yield curve strategy, which added 51 basis points to performance as the curve steepened. Duration strategy subtracted 8 basis points as the portfolio was generally invested defensively as interest rates fell. Sector selection added 21 basis points while security selection added 30 basis points. Within these categories, the biggest factor was underweighting and selection in the investment grade credit sector, which added 44 basis points as spreads widened. Mortgage holdings added 29 basis points. High yield holdings subtracted 32 basis points as the high yield market underperformed while it was overweighted in the portfolio. Asset-backed holdings added 3 basis points and government-related holdings added 4 basis points due to their underweightings as these sectors cheapened. TIPS added 3 basis points and fees subtracted 13 basis points.

For the same six month period, the Frontegra Columbus Core Fund had a net return of 6.72% compared to a return of 5.93% for the benchmark, the Lehman Brothers Aggregate Bond Index. The difference in performance was 0.79%. The biggest positive performance factor for the period was the portfolio’s bulleted yield curve strategy, which added 48 basis points to performance as the curve steepened. Duration strategy subtracted 18 basis points as the portfolio was generally invested defensively as interest rates fell. Sector selection added 54 basis points while security selection added 8 basis points. Within these categories, the biggest factor was underweighting of the investment grade credit sector, which added 68 basis points as spreads widened. Mortgage holdings subtracted 14 basis points. Asset-backed holdings added 3 basis points and government-related holdings added 5 basis points due to their underweighting as these sectors cheapened. Fees subtracted 13 basis points.

Fixed Income Outlook

Treasury rates fell sharply during the fourth quarter of 2007 as the Fed funds rate was reduced by 50 basis points to 4.25% and economic indicators weakened. Ten-year Treasury yields fell from 4.55% to 4.00% and 2-year Treasury yields fell from 3.96% to 3.10%, resulting in a steepening of the yield curve.

Corporate, mortgage, and agency spreads widened rapidly during the quarter as subprime mortgage problems continued to spread, particularly in the finance sector, and the flight to quality continued. Forward growth prospects for the U.S. economy continued to weaken.

| • | During the fourth quarter, financial and economic conditions became increasingly stressed by spreading fallout from imprudent mortgage lending. Problem areas include subprime loans, Alt-A (limited documentation) loans, option ARMS, CDOs and SIVs. Major banks and brokers have been crippled by these securities, while FNMA, FHLMC, and the bond insurers (e.g. MBIA, AMBAC) have also suffered losses. |

| • | Housing sector activity and prices continued to decline as a result of the withdrawal of credit, exacerbating the mortgage problems by reducing collateral values. |

| • | The Federal Reserve and Treasury have responded with a variety of measures. The funds rate has been reduced by 100 basis points, the discount window premium has been reduced, and extra liquidity has been supplied to the money market. Attempts are being made to speed up the restructuring of problem mortgages. As a result, money growth remains strong and overall lending does not appear to have been disrupted. While the market expects a 3.0% Funds rate, we are reluctant to lower our forecast below 4.0%. |

| • | Despite bank and broker losses, bank capital is being rapidly replenished through equity offerings and infusions from foreign pools of dollars. As a result, it does not appear that the losses will result in a collapse in lending and money supply. |

| • | Despite very strong U.S. economic growth through third quarter 2007, weakness seems likely going forward due to the mortgage market disruptions. Leading indicators and some employment and new orders statistics have been deteriorating. Housing activity will remain weak for several quarters, and consumption growth is expected to slow dramatically. Our estimate of fourth quarter 2007 and first half 2008 GDP growth has been reduced to 1.0%. While any inventory liquidation could push these numbers negative, they are ameliorated by the shrinking trade deficit. We expect 2.0% growth for the rest of 2008 as housing bottoms, imports shrink, and exports grow. Unemployment is expected to rise, but not dramatically. |

| • | Inflation threats remain persistent due to worldwide pressure on commodity prices and the weak dollar, and this has certainly been a factor in the Fed’s reluctance to lower rates quickly. Furthermore, M2 continues to increase fairly rapidly. We expect long-term monetary inflation of 2.5%, but overall inflation may periodically run higher, as it is now, due to commodity prices and dollar levels. |

| • | With inflation-adjusted Treasury yields having fallen to levels that are well below historical norms, we consider the Treasury market to be unattractive. Rising inflation and capital inflows that shrink along with the trade deficit are also potential negatives for Treasury rates. |

| • | Credit spreads increased rapidly during the quarter, with “BBB” index spreads moving from 169 basis points to 229 basis points, “A” index spreads moving from 133 basis points to 189 basis points, and high yield index spreads moving from 418 basis points to 584 basis points. Expectations of economic weakness, overhanging issuance, disappearance of the CDO bid, |

| and distress in the finance sector are all factors that have widened credit spreads despite low current default rates. We now consider these markets to be reasonably attractive, particularly in the investment grade sector where spreads are historically very high. |

| • | Mortgage and asset-backed spreads also increased during the quarter as poorly-underwritten products deteriorated and FNMA and FHLMC came under pressure. We consider prime, fixed-rate agency pass-throughs and CMBS, which have maintained appropriate underwriting standards, to be particularly attractive. We think FNMA and FHLMC will remain creditworthy since they are key elements of the U.S. financial system. |

Total Return Portfolio Strategy

| • | The major change in portfolio strategy has been an increase in the credit weighting of the portfolio. As recently as six months ago, the investment grade credit sector was heavily underweighted. With the rapid cheapening of the credit sector that has occurred since June, and the decline in Treasury yields, we have moved the portfolio to a substantial overweighting of investment grade credit. Exposure is well-diversified over a wide range of issuers and industries, with an emphasis on seniority of structure. The increased difficulty and cost of buyout financing is also a positive for the investment grade credit market, since buyouts are one of the major threats to high-grade bonds. |

| • | The finance sector of the credit market has been the hardest-hit part of the market due to the involvement of the banks and brokers in the troubled subprime mortgage market. We have increased the portfolio’s weighting in the major finance names from near-zero to a roughly benchmark level, with exposure to additional finance credits bringing total sector exposure to an above-benchmark level. While many of the major finance names have taken huge subprime losses, most of them have easily replenished their capital by tapping foreign equity sources, thereby maintaining the credit worthiness of their bonds. For this reason, we think that a significant exposure to the finance sector is prudent at current spreads. |

| • | High yield credit exposure has been increased slightly since high yield spreads have also gapped out to much higher levels, and well-structured high yield loans are now available at attractive discounts. However, the main portfolio emphasis and overweighting is in the investment grade market, which we find more compelling and less risky. |

| • | Mortgage holdings remain at above-benchmark levels, since well-underwritten mortgage securities remain historically attractive. Emphasis is on Agency pass-throughs, low coupons with discounts, CMBS and short CMOs. The portfolio does not hold subprime issues, Alt-A loans, CDOs, SIVs, or home equity ABS. All mortgage holdings are rated AAA. |

| • | Treasury and Agency holdings have been reduced in order to accommodate the credit and mortgage overweightings. |

| • | With the portfolio’s emphasis shifting to the corporate and mortgage sectors, duration strategy has become just one performance factor among many. We continue to employ a defensive duration strategy due to the unattractive level of inflation-adjusted Treasury yields. |

| • | Yield curve strategy continues to be generally bulleted, since we expect the yield curve to further to steepen over time. |

Investment Grade Portfolio Strategy

| • | The major change in portfolio strategy has been an increase in the credit weighting of the portfolio. As recently as six months ago, the investment grade credit sector was heavily underweighted. With the rapid cheapening of the credit sector that has occurred since June, and the decline in Treasury yields, we have moved the portfolio to a substantial overweighting of investment grade credit. Exposure is well-diversified over a wide range of issuers, with an emphasis on seniority of structure. The increased difficulty and cost of buyout financing is also a positive for the investment grade credit market, since buyouts are one of the major threats to high-grade bonds. |

| • | The finance sector of the credit market has been the hardest-hit part of the market due to the involvement of the banks and brokers in the troubled subprime mortgage market. We have increased the portfolio’s weighting in the major finance names from near-zero to a roughly benchmark level, with exposure to additional finance credits bringing total sector exposure to an above-benchmark level. While many of the major finance names have taken huge subprime losses, most of them have easily replenished their capital by tapping foreign equity sources, thereby maintaining the credit-worthiness of their bonds. For this reason, we think that a significant exposure to the finance sector is prudent at current spreads. |

| • | Mortgage holdings remain at above-benchmark levels, since well-underwritten mortgage securities remain historically attractive. Emphasis is on Agency pass-throughs, low coupons with discounts, CMBS and short CMOs. The portfolio does not hold subprime issues, Alt-A loans, CDOs, SIVs, or home equity ABS. All mortgage holdings are rated AAA. |

| • | Treasury and Agency holdings have been reduced in order to accommodate the credit and mortgage overweightings. |

| • | With the portfolio’s emphasis shifting to the corporate and mortgage sectors, duration strategy has become just one performance factor among many. We continue to employ a defensive duration strategy due to the unattractive level of inflation-adjusted Treasury yields. |

| • | Yield curve strategy continues to be generally bulleted, since we expect the yield curve to further to steepen over time. |

We appreciate your continued support as shareholders in the Funds.

Regards,

|  |

| Mark M. Egan, CFA, CPA | Robert A. Crider, CFA |

| Reams Asset Management Company, LLC | Reams Asset Management Company, LLC |

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

| | | | |

| | Portfolio Total Return* | | |

| | FOR THE PERIOD ENDED 12/31/07 | | |

| | | | |

| | SIX MONTHS | 6.74% | |

| | | | |

| | ONE YEAR | 7.86% | |

| | | | |

| | FIVE YEAR | | |

| | AVERAGE ANNUAL | 6.23% | |

| | | | |

| | TEN YEAR | | |

| | AVERAGE ANNUAL | 6.56% | |

| | | | |

This chart assumes an initial gross investment of $100,000 made on 12/31/97. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Lehman Brothers Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

* The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | ASSET BACKED SECURITIES 10.5% | | | |

| | | American Express Credit Account Master Trust | | | |

| $ | 1,875,000 | | 2005-3, Class A, 5.030%, 01/18/2011 (c)(e) | | $ | 1,874,637 | |

| | 855,000 | | 2005-6, Class A, 5.030%, 03/15/2011 (c)(e) | | | 854,457 | |

| | | | Americredit Automobile Receivables Trust | | | | |

| | 594,234 | | 2007-DF, Class A1, 5.914%, 10/06/2008 (c)(e) | | | 595,305 | |

| | | | Bank One Issuance Trust | | | | |

| | 2,955,000 | | 2003-3A, Class A3, 5.140%, 12/15/2010 (c)(e) | | | 2,955,950 | |

| | | | Capital One Auto Trust | | | | |

| | 860,035 | | 2007-A, Class A2, 5.330%, 05/15/2010 (e) | | | 861,148 | |

| | 1,679,569 | | 2007-B, Class A2, 5.270%, 06/15/2010 (e) | | | 1,681,648 | |

| | | | Capital One Master Trust | | | | |

| | 4,030,000 | | 2001-1, Class A, 5.227%, 12/15/2010 (c) | | | 4,031,784 | |

| | | | Carmax Auto Trust | | | | |

| | 92,998 | | 2006-2, Class A2, 5.290%, 06/15/2009 | | | 93,046 | |

| | | | Caterpillar Financial Asset Trust | | | | |

| | 420,961 | | 2007-A, Class A1, 5.672%, 09/25/2008 | | | 421,843 | |

| | | | Chase Issuance Trust | | | | |

| | 3,545,000 | | 2005-1A, Class A1, 5.040%, 12/15/2010 (c)(e) | | | 3,545,105 | |

| | | | Citibank Credit Card Issuance Trust | | | | |

| | 1,550,000 | | 2003-A1, Class A1, 5.343%, 01/15/2010 | | | 1,550,367 | |

| | 2,675,000 | | 2001-A1, Class A1, 5.045%, 02/07/2010 (c) | | | 2,675,691 | |

| | 2,090,000 | | 2003-A8, Class A8, 3.500%, 08/16/2010 | | | 2,073,516 | |

| | | | Discover Card Master Trust I | | | | |

| | 825,000 | | 2001-1, Class A, 5.160%, 01/15/2008 (c) | | | 825,087 | |

| | 4,415,000 | | 2003-2, Class A, 5.250%, 08/15/2010 (c)(e) | | | 4,416,224 | |

| | | | Ford Credit Auto Trust | | | | |

| | 857,008 | | 2006-B, Class A2A, 5.420%, 07/15/2009 (e) | | | 858,063 | |

| | | | GS Auto Loan Trust | | | | |

| | 234,234 | | 2006-1, Class A2, 5.470%, 02/15/2009 | | | 234,374 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 1,055,000 | | 2005-2A, Class A6, 5.080%, 11/25/2011 | | | | |

| | | | (Acquired 12/15/2005 and 08/03/2007, Cost $1,054,872) (a) | | | 1,062,356 | |

| | | | Honda Auto Receivables Owner Trust | | | | |

| | 522,194 | | 2007-3, Class A1, 5.565%, 04/15/2008 | | | 523,133 | |

| | 1,840,896 | | 2006-1, Class A3, 5.070%, 02/18/2010 | | | 1,843,734 | |

| | | | MBNA Master Credit Card Trust | | | | |

| | 3,860,000 | | 1998-E, Class A, 5.390%, 09/15/2010 (c) | | | 3,861,768 | |

| | 1,810,000 | | 2003-A7, Class A7, 2.650%, 11/15/2010 | | | 1,793,537 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | ASSET BACKED SECURITIES 10.5% (continued) | | | |

| | | Mego Mortgage Home Loan Trust | | | |

| $ | 1,105 | | 1996-2, Class A, 7.275%, 08/25/2017 | | $ | 1,102 | |

| | | | Mid-State Trust | | | | |

| | 898,624 | | 11, Class A1, 4.864%, 07/15/2038 | | | 883,959 | |

| | | | Nissan Auto Receivables Owner Trust | | | | |

| | 894,624 | | 2006-B, Class A3, 5.160%, 02/15/2010 | | | 896,399 | |

| | | | SLM Student Loan Trust | | | | |

| | 1,130,326 | | 2007-1, Class A1, 5.050%, 04/25/2012 (c)(e) | | | 1,130,684 | |

| | 1,180,293 | | 2007-2, Class A1, 5.064%, 04/25/2014 (c) | | | 1,178,786 | |

| | | | USAA Auto Owner Trust | | | | |

| | 2,849,004 | | 2006-1, Class A3, 5.010%, 09/15/2010 (e) | | | 2,853,795 | |

| | 2,516,393 | | 2006-3, Class A3, 5.360%, 02/15/2011 (e) | | | 2,527,846 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $48,650,760) | | | 48,105,344 | |

| | | | | | | | |

| | | | CORPORATE BONDS 28.9% | | | | |

| | | | Automobiles 1.4% | | | | |

| | | | Ford Motor Co. | | | | |

| | 800,000 | | 8.320%, 12/15/2013 | | | 738,000 | |

| | 451,175 | | 8.360%, 12/15/2013 | | | 416,209 | |

| | 2,450,000 | | 7.450%, 07/16/2031 | | | 1,819,125 | |

| | | | General Motors Corp. | | | | |

| | 1,881,000 | | 1.375%, 11/01/2013 | | | 1,758,735 | |

| | 2,025,000 | | 8.375%, 07/15/2033 | | | 1,630,125 | |

| | | | | | | 6,362,194 | |

| | | | Auto Components 0.3% | | | | |

| | 2,005,000 | | Delphi Corp. | | | | |

| | | | 6.500%, 08/15/2013 | | | 1,162,900 | |

| | | | | | | | |

| | | | Beverages 0.1% | | | | |

| | 525,000 | | Diageo Capital plc | | | | |

| | | | 5.750%, 10/23/2017 (b) | | | 527,981 | |

| | | | | | | | |

| | | | Building Products 0.2% | | | | |

| | 1,070,000 | | USG Corp. | | | | |

| | | | 7.750%, 01/15/2018 | | | 1,064,120 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Capital Markets 0.4% | | | |

| $ | 890,000 | | Goldman Sachs Group, Inc. | | | |

| | | | 5.625%, 01/15/2017 | | $ | 869,153 | |

| | 1,170,000 | | Morgan Stanley | | | | |

| | | | 5.550%, 04/27/2017 | | | 1,140,946 | |

| | | | | | | 2,010,099 | |

| | | | | | | | |

| | | | Chemicals 0.1% | | | | |

| | 754,000 | | Georgia Gulf Corp. | | | | |

| | | | 9.500%, 10/15/2014 | | | 601,315 | |

| | | | | | | | |

| | | | Commercial Banks 4.4% | | | | |

| | 1,890,000 | | Bank Of New York Mellon | | | | |

| | | | 4.950%, 11/01/2012 | | | 1,889,979 | |

| | 2,135,000 | | BB&T Corp. | | | | |

| | | | 4.900%, 06/30/2017 | | | 1,971,327 | |

| | 1,015,000 | | Countrywide | | | | |

| | | | 5.625%, 07/15/2009 (Acquired 11/19/2007, Cost $837,914) (a) | | | 774,367 | |

| | | | HSBC Bank | | | | |

| | 1,735,000 | | 4.625%, 04/01/2014 | | | 1,662,635 | |

| | 350,000 | | 6.000%, 08/09/2017 | | | 358,687 | |

| | 1,665,000 | | JP Morgan Chase Bank | | | | |

| | | | 6.000%, 10/01/2017 | | | 1,693,340 | |

| | 4,145,000 | | Marshall & Ilsley Bank | | | | |

| | | | 5.401%, 12/04/2012 (c) | | | 3,909,062 | |

| | 965,000 | | U.S. Bank | | | | |

| | | | 4.950%, 10/30/2014 | | | 940,994 | |

| | 830,000 | | UBS AG Stamford | | | | |

| | | | 5.875%, 12/20/2017 (b) | | | 835,847 | |

| | 2,510,000 | | Wachovia Bank | | | | |

| | | | 6.000%, 11/15/2017 | | | 2,526,772 | |

| | | | Wells Fargo Bank | | | | |

| | 655,000 | | 4.750%, 02/09/2015 | | | 625,601 | |

| | 2,030,000 | | 5.750%, 05/16/2016 | | | 2,059,607 | |

| | 985,000 | | 5.625%, 12/11/2017 | | | 985,602 | |

| | | | | | | 20,233,820 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Computers & Peripherals 0.2% | | | |

| $ | 970,000 | | Tyco Electronics Group S A | | | |

| | | | 6.000%, 10/01/2012 | | | |

| | | | (Acquired 09/20/2007, Cost $969,573) (a)(b) | | $ | 994,007 | |

| | | | | | | | |

| | | | Consumer Finance 2.5% | | | | |

| | 1,930,000 | | American Express Co. | | | | |

| | | | 6.150%, 08/28/2017 | | | 1,980,709 | |

| | 1,990,000 | | ERAC USA Finance Co. | | | | |

| | | | 6.375%, 10/15/2017 (Acquired 10/10/2007, Cost $1,986,518) (a) | | | 1,922,565 | |

| | | | Ford Motor Credit Co. | | | | |

| | 945,000 | | 7.800%, 06/01/2012 | | | 828,446 | |

| | 3,020,000 | | 8.000%, 12/15/2016 | | | 2,565,221 | |

| | 2,950,000 | | GMAC LLC | | | | |

| | | | 6.625%, 05/15/2012 | | | 2,452,385 | |

| | 2,740,000 | | Residential Capital LLC | | | | |

| | | | 6.500%, 04/17/2013 | | | 1,685,100 | |

| | | | | | | 11,434,426 | |

| | | | Diversified Financial Services 6.3% | | | | |

| | 1,950,000 | | Aetna, Inc. | | | | |

| | | | 6.750%, 12/15/2037 | | | 1,945,119 | |

| | | | American General Finance | | | | |

| | 1,370,000 | | 5.900%, 09/15/2012 | | | 1,385,782 | |

| | 1,730,000 | | 6.900%, 12/15/2017 | | | 1,731,730 | |

| | | | Bank of America Corp. | | | | |

| | 1,630,000 | | 5.300%, 03/15/2017 | | | 1,584,973 | |

| | 725,000 | | 6.000%, 09/01/2017 | | | 740,712 | |

| | 1,205,000 | | 5.750%, 12/01/2017 | | | 1,207,764 | |

| | | | Citigroup, Inc. | | | | |

| | 695,000 | | 5.500%, 02/15/2017 | | | 675,435 | |

| | 1,455,000 | | 6.125%, 11/21/2017 | | | 1,494,567 | |

| | | | CIT Group Inc. | | | | |

| | 1,450,000 | | 7.625%, 11/30/2012 | | | 1,469,729 | |

| | 1,615,000 | | 5.310%, 12/21/2012 (c) | | | 1,413,131 | |

| | 1,600,000 | | General Motors Acceptance Corp. | | | | |

| | | | 6.750%, 12/01/2014 (e) | | | 1,290,478 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Diversified Financial Services 6.3% (continued) | | | |

| $ | 1,120,000 | | Genworth Global Funding | | | |

| | | | 5.200%, 10/08/2010 | | $ | 1,136,077 | |

| | 1,920,000 | | International Lease Finance Corp. | | | | |

| | | | 5.350%, 03/01/2012 | | | 1,921,260 | |

| | | | JP Morgan Chase & Co. | | | | |

| | 555,000 | | 6.625%, 03/15/2012 | | | 585,235 | |

| | 740,000 | | 6.000%, 01/15/2018 | | | 752,864 | |

| | 1,235,000 | | Liberty Property LP | | | | |

| | | | 6.625%, 10/01/2017 | | | 1,235,677 | |

| | 865,000 | | Merrill Lynch & Co. | | | | |

| | | | 6.400%, 08/28/2017 | | | 878,804 | |

| | 1,230,000 | | Morgan Stanley | | | | |

| | | | 5.950%, 12/28/2017 | | | 1,229,123 | |

| | | | Pricoa Global Funding I | | | | |

| | 800,000 | | 5.331%, 03/03/2009 | | | | |

| | | | (Acquired 03/01/2006 and 08/03/2007, Cost $800,000) (a) | | | 799,235 | |

| | 1,740,000 | | 5.400%, 10/18/2012 | | | | |

| | | | (Acquired 10/11/2007, Cost $1,736,537) (a) | | | 1,804,542 | |

| | 1,445,000 | | Prudential Financial Inc. | | | | |

| | | | 6.000%, 12/01/2017 | | | 1,439,041 | |

| | 910,000 | | Simon Property Group LP | | | | |

| | | | 5.100%, 06/15/2015 | | | 855,572 | |

| | 1,228,234 | | Windsor Financing LLC | | | | |

| | | | 5.881%, 07/15/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,231,640) (a) | | | 1,291,402 | |

| | | | | | | 28,868,252 | |

| | | | Diversified Telecommunication Services 2.2% | | | | |

| | 2,545,000 | | AT&T, Inc. | | | | |

| | | | 6.300%, 01/15/2038 | | | 2,585,702 | |

| | 1,750,000 | | British Telecom plc | | | | |

| | | | 5.950%, 01/15/2018 (b) | | | 1,763,886 | |

| | 935,000 | | Comcast Cable Communications Holdings, Inc. | | | | |

| | | | 8.375%, 03/15/2013 | | | 1,048,961 | |

| | 1,105,000 | | Deutsche Telekom International Finance BV | | | | |

| | | | 5.750%, 03/23/2016 (b) | | | 1,106,035 | |

| | 1,375,000 | | Sprint Nextel Corp. | | | | |

| | | | 6.000%, 12/01/2016 | | | 1,316,965 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Diversified Telecommunication Services 2.2% (continued) | | | |

| $ | 1,060,000 | | Telecom Italia Capital | | | |

| | | | 5.250%, 11/15/2013 (b) | | $ | 1,047,630 | |

| | 1,200,000 | | Telefonica Emisiones SAU | | | | |

| | | | 6.221%, 07/03/2017 (b) | | | 1,246,791 | |

| | | | | | | 10,115,970 | |

| | | | Electric Utilities 2.9% | | | | |

| | | | Commonwealth Edison Co. | | | | |

| | 790,000 | | 5.950%, 08/15/2016 | | | 801,414 | |

| | 475,000 | | 6.150%, 09/15/2017 | | | 489,494 | |

| | 1,435,000 | | Consumers Energy Co. | | | | |

| | | | 4.400%, 08/15/2009 | | | 1,422,506 | |

| | 1,215,000 | | Entergy Gulf States Inc. | | | | |

| | | | 4.875%, 11/01/2011 | | | 1,172,790 | |

| | 765,000 | | Entergy Louisiana LLC | | | | |

| | | | 5.500%, 04/01/2019 | | | 730,390 | |

| | 415,000 | | Florida Power Corp. | | | | |

| | | | 5.800%, 09/15/2017 | | | 431,049 | |

| | 1,975,000 | | Great River Energy | | | | |

| | | | 5.829%, 07/01/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,976,073) (a)(e) | | | 2,024,987 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 345,000 | | 6.300%, 07/01/2013 | | | | |

| | | | (Acquired 10/17/2006 and 08/03/2007, Cost $355,729) (a) | | | 361,017 | |

| | 735,000 | | 6.050%, 10/01/2036 | | | | |

| | | | (Acquired 10/02/2006 and 08/03/2007, Cost $730,281) (a) | | | 719,051 | |

| | 909,150 | | Mackinaw Power LLC | | | | |

| | | | 6.296%, 10/31/2023 | | | | |

| | | | (Acquired Multiple Dates, Cost $910,598) (a) | | | 973,063 | |

| | 755,000 | | Northern State Power | | | | |

| | | | 6.200%, 07/01/2037 | | | 779,804 | |

| | 550,000 | | Public Service Electric & Gas | | | | |

| | | | 5.000%, 01/01/2013 | | | 546,788 | |

| | 1,295,000 | | Southern California Edison Co. | | | | |

| | | | 4.994%, 02/02/2009 (c) | | | 1,293,184 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Electric Utilities 2.9% (continued) | | | |

| $ | 601,883 | | Tenaska Gateway Partners | | | |

| | | | 6.052%, 12/30/2023 | | | |

| | | | (Acquired 05/31/2007 and 08/03/2007, Cost $607,630) (a) | | $ | 636,672 | |

| | 1,030,000 | | Westar Energy Inc. | | | | |

| | | | 6.000%, 07/01/2014 | | | 1,050,254 | |

| | | | | | | 13,432,463 | |

| | | | Food & Staples Retailing 0.7% | | | | |

| | 965,000 | | Kellogg Co. | | | | |

| | | | 5.125%, 12/03/2012 | | | 973,081 | |

| | 2,180,000 | | Kraft Foods, Inc. | | | | |

| | | | 6.125%, 02/01/2018 | | | 2,196,666 | |

| | | | | | | 3,169,747 | |

| | | | Gas Utilities 0.8% | | | | |

| | 240,839 | | Alliance Pipeline U.S. | | | | |

| | | | 4.591%, 12/31/2025 | | | | |

| | | | (Acquired Multiple Dates, Cost $231,361) (a) | | | 239,006 | |

| | 945,000 | | Gulfstream Natural Gas | | | | |

| | | | 5.560%, 11/01/2015 | | | | |

| | | | (Acquired Multiple Dates, Cost $939,361) (a) | | | 928,832 | |

| | 1,465,000 | | Rockies Express Pipeline | | | | |

| | | | 6.448%, 08/20/2009 (Acquired 09/13/2007, Cost $1,461,371) (a) | | | 1,465,398 | |

| | 680,000 | | Source Gas LLC | | | | |

| | | | 5.900%, 04/01/2017 | | | | |

| | | | (Acquired 04/11/2007 and 08/03/2007, Cost $677,858) (a) | | | 647,988 | |

| | 195,000 | | Southern Star Cent Gas | | | | |

| | | | 6.000%, 06/01/2016 | | | | |

| | | | (Acquired Multiple Dates, Cost $192,317) (a) | | | 190,613 | |

| | | | | | | 3,471,837 | |

| | | | Health Care Providers & Services 0.1% | | | | |

| | 675,000 | | Tenet Healthcare Corp. | | | | |

| | | | 9.875%, 07/01/2014 | | | 642,937 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure 0.1% | | | | |

| | 1,000,000 | | Harrahs Operating Co., Inc. | | | | |

| | | | 5.750%, 10/01/2017 | | | 677,500 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Insurance 1.0% | | | |

| $ | 810,000 | | Jackson National Life Global Funding | | | |

| | | | 5.125%, 02/10/2011 | | | |

| | | | (Acquired 02/03/2006 and 08/03/2007, Cost $809,328) (a) | | $ | 843,319 | |

| | 1,065,000 | | Monumental Global Funding | | | | |

| | | | 5.254%, 01/25/2013 (Acquired 12/14/2007, Cost $1,019,341) (a) | | | 1,031,166 | |

| | 745,000 | | Nationwide Life Global Fund | | | | |

| | | | 5.450%, 10/02/2012 (Acquired 09/25/2007, Cost $744,069) (a)(e) | | | 769,324 | |

| | 1,200,000 | | New York Life Global Funding | | | | |

| | | | 5.250%, 10/16/2012 (Acquired 10/09/2007, Cost $1,199,484) (a) | | | 1,227,816 | |

| | 800,000 | | Protective Life Corp. | | | | |

| | | | 5.450%, 09/28/2012 | | | 824,830 | |

| | | | | | | 4,696,455 | |

| | | | Media 0.7% | | | | |

| | 1,095,000 | | Comcast Corp. | | | | |

| | | | 6.300%, 11/15/2017 | | | 1,136,092 | |

| | | | Time Warner Inc. | | | | |

| | 995,000 | | 7.700%, 05/01/2032 | | | 1,105,500 | |

| | 965,000 | | 6.500%, 11/15/2036 | | | 938,952 | |

| | | | | | | 3,180,544 | |

| | | | Medical Supplies & Services 0.3% | | | | |

| | | | Community Health Systems, Inc. | | | | |

| | 51,353 | | 7.848%, 07/02/2014 | | | 49,428 | |

| | 778,647 | | 7.570%, 07/25/2014 | | | 749,447 | |

| | 643,500 | | HCA Inc. | | | | |

| | | | 8.110%, 11/17/2013 | | | 620,977 | |

| | | | | | | 1,419,852 | |

| | | | Multi-Utilities & Unregulated Power 1.1% | | | | |

| | 704,624 | | Aes Eastern Energy | | | | |

| | | | 9.000%, 01/02/2017 | | | 762,755 | |

| | 289,663 | | Edison Mission Energy Funding | | | | |

| | | | 7.330%, 09/15/2008 | | | | |

| | | | (Acquired 10/23/2002 and 08/03/2007, Cost $283,457) (a) | | | 289,663 | |

| | 1,462,000 | | Homer City Funding LLC | | | | |

| | | | 8.137%, 10/01/2019 | | | 1,549,720 | |

| | 1,011,360 | | Kern River Funding Corp. | | | | |

| | | | 4.893%, 04/30/2018 (Acquired Multiple Dates, Cost $989,769) (a) | | | 990,465 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Multi-Utilities & Unregulated Power 1.1% (continued) | | | |

| $ | 805,203 | | Kiowa Power Partners LLC | | | |

| | | | 4.811%, 12/30/2013 | | | |

| | | | (Acquired Multiple Dates, Cost $830,439) (a) | | $ | 806,604 | |

| | 457,285 | | Midwest Generation LLC | | | | |

| | | | 8.300%, 07/02/2009 | | | 464,144 | |

| | | | | | | 4,863,351 | |

| | | | Natural Gas Transmission 0.2% | | | | |

| | 860,000 | | Tennessee Gas Pipeline Co. | | | | |

| | | | 7.500%, 04/01/2017 | | | 938,650 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels 0.2% | | | | |

| | 1,010,000 | | Sabine Pass LNG LP | | | | |

| | | | 7.250%, 11/30/2013 | | | 964,550 | |

| | | | | | | | |

| | | | Paper & Forest Products 0.3% | | | | |

| | 510,000 | | Abitibi-Consolidated, Inc. | | | | |

| | | | 8.500%, 08/01/2029 (b) | | | 348,075 | |

| | 850,000 | | Georgia Pacific Corp. | | | | |

| | | | 7.800%, 12/20/2012 | | | 808,605 | |

| | | | | | | 1,156,680 | |

| | | | Real Estate Investment Trusts 0.3% | | | | |

| | 1,185,000 | | CPG Partners LP | | | | |

| | | | 3.500%, 03/15/2009 | | | 1,159,006 | |

| | | | | | | | |

| | | | Transportation 1.3% | | | | |

| | | | Burlington North Santa Fe | | | | |

| | 149,549 | | 6.230%, 07/02/2018 | | | 156,560 | |

| | 728,662 | | 4.830%, 01/15/2023 (e) | | | 724,801 | |

| | | | CSX Transportation, Inc. | | | | |

| | 990,000 | | 5.750%, 03/15/2013 | | | 1,002,268 | |

| | 1,970,000 | | 6.251%, 01/15/2023 | | | 2,000,082 | |

| | | | Union Pacific Railroad Co. | | | | |

| | 1,425,000 | | 5.450%, 01/31/2013 | | | 1,437,427 | |

| | 699,951 | | 5.866%, 07/02/2030 | | | 759,097 | |

| | | | | | | 6,080,235 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount/Shares | | | | Value | |

| | | CORPORATE BONDS 28.9% (continued) | | | |

| | | Utilities 0.8% | | | |

| $ | 1,075,000 | | Appalachian Power Co. | | | |

| | | | 5.650%, 08/15/2012 | | $ | 1,092,393 | |

| | 678,524 | | Indiantown Cogeneration | | | | |

| | | | 9.260%, 12/15/2010 | | | 707,565 | |

| | 1,860,000 | | West Penn Power Co. | | | | |

| | | | 5.950%, 12/15/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,856,095) (a) | | | 1,869,069 | |

| | | | | | | 3,669,027 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $133,292,363) | | | 132,897,918 | |

| | | | | | | | |

| | | | PREFERRED STOCKS 1.4% | | | | |

| | | | Thrifts & Mortgage Finance 1.4% | | | | |

| | 126,180 | | Fannie Mae | | | | |

| | | | 8.25%, 12/31/2010 | | | 3,217,590 | |

| | 127,757 | | Freddie Mac | | | | |

| | | | 8.375%, 12/31/2012 | | | 3,340,846 | |

| | | | Total Preferred Stocks | | | | |

| | | | (Cost $6,395,049) | | | 6,558,436 | |

| | | | | | | | |

| | | | MORTGAGE BACKED SECURITIES 68.8% | | | | |

| | | | Banc of America Commercial Mortgage Inc. | | | | |

| | 3,135,000 | | Series 2004-2, Class A3, 4.050%, 11/10/2038 | | | 3,092,976 | |

| | 1,328,375 | | Series 2005-2, Class A2, 4.247%, 07/10/2043 | | | 1,326,437 | |

| | 3,370,000 | | Series 2005-5, Class A2, 5.001%, 10/10/2045 | | | 3,364,207 | |

| | 956,460 | | Series 2006-6, Class A1, 5.226%, 10/10/2045 | | | 960,058 | |

| | 1,190,000 | | Series 2006-4, Class A4, 5.634%, 07/10/2046 | | | 1,215,097 | |

| | 1,550,000 | | Series 2005-6, Class A2, 5.165%, 09/10/2047 | | | 1,554,008 | |

| | 1,610,000 | | Series 2007-2, Class A2, 5.634%, 04/10/2049 | | | 1,632,824 | |

| | 4,645,000 | | Citigroup/Deutsche Bank Commercial Mortgage Trust | | | | |

| | | | Series 2007-CD4, Class A4, 5.322%, 12/11/2049 | | | 4,631,285 | |

| | | | CNH Equipment Trust | | | | |

| | 801,348 | | Series 2007-B, Class A1, 5.816%, 10/09/2008 | | | 802,999 | |

| | 1,340,000 | | Series 2007-B, Class A2A, 5.460%, 06/15/2010 | | | 1,348,110 | |

| | 2,859,153 | | Commercial Mortgage Pass-Through Certificate | | | | |

| | | | Series 2003-LB1A, Class A1, 3.251%, 06/10/2038 | | | 2,758,148 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 68.8% (continued) | | | |

| | | Credit Suisse First Boston Mortgage Securities Corp. | | | |

| $ | 602,872 | | Pool # 2005-10, 5.000%, 09/25/2015 | | $ | 593,492 | |

| | 119,914 | | Pool # 2003-1, 7.000%, 02/25/2033 (e) | | | 120,091 | |

| | 2,613 | | Pool # 2003-C3, 2.079%, 05/15/2038 (e) | | | 2,613 | |

| | | | FHLMC PC GOLD CASH | | | | |

| | 1,497,035 | | Pool # E0-1418, 4.000%, 07/01/2018 | | | 1,441,459 | |

| | 1,423,000 | | Pool # G1-1678, 4.500%, 04/01/2020 | | | 1,398,667 | |

| | | | FHLMC Pools | | | | |

| | 151,682 | | Pool # M80779, 5.000%, 11/01/2009 | | | 152,097 | |

| | 1,881,530 | | Pool # B14039, 4.000%, 05/01/2014 | | | 1,866,428 | |

| | 1,717,337 | | Pool # G11672, 5.000%, 03/01/2015 | | | 1,745,760 | |

| | 492,002 | | Pool # B19614, 5.000%, 07/01/2015 | | | 500,654 | |

| | 1,499,760 | | Pool # G11970, 5.000%, 04/01/2016 | | | 1,502,330 | |

| | 1,198,985 | | Pool # E01647, 4.000%, 05/01/2019 | | | 1,153,235 | |

| | 117,979 | | Pool # 2692, 3.500%, 01/15/2023 (e) | | | 117,777 | |

| | 764,464 | | Pool # A45788, 6.500%, 05/01/2035 | | | 789,337 | |

| | | | FHLMC Remic | | | | |

| | 979,222 | | Series 2773, Class EB, 4.500%, 08/15/2013 | | | 977,138 | |

| | 5,571,505 | | Series R001, Class AE, 4.375%, 04/15/2015 | | | 5,544,411 | |

| | 586,461 | | Series 2848, Class CG, 5.000%, 06/15/2015 (e) | | | 586,200 | |

| | 160,433 | | Series 2508, Class CR, 4.500%, 03/15/2016 (e) | | | 160,015 | |

| | 1,714,835 | | Series 2786, Class GA, 4.000%, 08/15/2017 | | | 1,689,002 | |

| | 61,930 | | Series 2912, Class EQ, 5.500%, 12/15/2020 (e) | | | 61,829 | |

| | 596,015 | | Series 2695, Class GU, 3.500%, 11/15/2022 (e) | | | 592,041 | |

| | 1,101,985 | | Series 2731, Class AB, 4.500%, 11/15/2028 | | | 1,092,186 | |

| | 679,380 | | Series 2793, Class BA, 4.500%, 09/15/2029 | | | 668,313 | |

| | 1,495,000 | | Series 3200, Class ED, 5.000%, 12/15/2031 | | | 1,480,889 | |

| | 3,014,954 | | Series 2990, Class EN, 4.500%, 02/15/2033 | | | 2,972,861 | |

| | 2,210,023 | | Series 3031, Class LN, 4.500%, 08/15/2033 | | | 2,179,429 | |

| | 1,952,481 | | Series 3114, Class HN, 5.000%, 09/15/2033 | | | 1,955,021 | |

| | 3,918,528 | | Series 3169, Class BN, 5.000%, 06/15/2034 | | | 3,927,350 | |

| | 2,296,069 | | Series 3202, Class LN, 4.500%, 03/15/2035 | | | 2,264,853 | |

| | 1,413,570 | | Series 3114, Class KZ, 5.000%, 02/15/2036 | | | 1,130,352 | |

| | | | FNMA Pools | | | | |

| | 385,621 | | Pool # 380542, 6.150%, 08/01/2008 | | | 385,268 | |

| | 434,825 | | Pool # 254659, 4.500%, 02/01/2013 | | | 436,184 | |

| | 916,759 | | Pool # 555648, 4.543%, 06/01/2013 | | | 914,470 | |

| | 840,684 | | Pool # 768008, 5.000%, 06/01/2013 | | | 851,463 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 68.8% (continued) | | | |

| | | FNMA Pools (continued) | | | |

| $ | 514,148 | | Pool # 768009, 5.000%, 06/01/2013 | | $ | 520,569 | |

| | 861,983 | | Pool # 254806, 4.500%, 07/01/2013 | | | 864,735 | |

| | 760,448 | | Pool # 735065, 4.498%, 08/01/2013 | | | 757,729 | |

| | 1,386,992 | | Pool # 386341, 3.810%, 08/01/2013 | | | 1,337,047 | |

| | 1,148,173 | | Pool # 386441, 3.980%, 08/01/2013 | | | 1,125,933 | |

| | 445,384 | | Pool # 763019, 5.000%, 08/01/2013 | | | 450,946 | |

| | 1,591,941 | | Pool # 254909, 4.000%, 09/01/2013 | | | 1,579,526 | |

| | 537,933 | | Pool # 255450, 4.500%, 10/01/2014 | | | 539,563 | |

| | 1,167,439 | | Pool # 745659, 5.000%, 04/01/2016 | | | 1,186,977 | |

| | 1,293,062 | | Pool # 745444, 5.500%, 04/01/2016 | | | 1,314,686 | |

| | 4,412,704 | | Pool # 357312, 5.000%, 12/01/2017 | | | 4,423,328 | |

| | 159,923 | | Pool # 254759, 4.500%, 06/01/2018 | | | 157,352 | |

| | 971,221 | | Pool # 254919, 4.000%, 09/01/2018 | | | 934,704 | |

| | 2,808,619 | | Pool # 254865, 4.500%, 09/01/2018 | | | 2,763,465 | |

| | 1,862,496 | | Pool # 725546, 4.500%, 06/01/2019 | | | 1,831,825 | |

| | 4,061,616 | | Pool # 735841, 4.500%, 11/01/2019 | | | 3,994,730 | |

| | 2,944,701 | | Pool # 888105, 5.000%, 08/01/2020 | | | 2,951,790 | |

| | 27,487 | | Pool # 433043, 6.500%, 06/01/2028 | | | 28,491 | |

| | 57,476 | | Pool # 447704, 6.500%, 11/01/2028 | | | 59,573 | |

| | 28,363 | | Pool # 448235, 6.500%, 11/01/2028 | | | 29,398 | |

| | 74,715 | | Pool # 448635, 6.500%, 11/01/2028 | | | 77,442 | |

| | 3,946 | | Pool # 449012, 6.500%, 11/01/2028 | | | 4,090 | |

| | 26,164 | | Pool # 487778, 6.500%, 03/01/2029 | | | 27,112 | |

| | 1,030,290 | | Pool # 555203, 7.000%, 09/01/2032 | | | 1,072,936 | |

| | 2,211,741 | | Pool # 730839, 5.000%, 07/01/2033 | | | 2,161,322 | |

| | 1,694,341 | | Pool # 727181, 5.000%, 08/01/2033 | | | 1,655,717 | |

| | 2,815,390 | | Pool # 739821, 5.000%, 09/01/2033 | | | 2,751,210 | |

| | 2,433,263 | | Pool # 740255, 5.000%, 10/01/2033 | | | 2,377,794 | |

| | 7,407,845 | | Pool # 725027, 5.000%, 11/01/2033 | | | 7,238,975 | |

| | 1,578,370 | | Pool # 952768, 7.000%, 09/01/2037 (e) | | | 1,641,893 | |

| | | | FNMA Remic | | | | |

| | 1,014,072 | | Series 2002-74, Class PJ, 5.000%, 03/25/2015 | | | 1,012,328 | |

| | 4,384,672 | | Series 2005-35, Class AC, 4.000%, 08/25/2018 | | | 4,315,733 | |

| | 3,817,880 | | Series 2004-93, Class DG, 4.250%, 04/25/2019 | | | 3,767,899 | |

| | 97,102 | | Series 2003-58, Class PN, 3.500%, 10/25/2021 (e) | | | 96,836 | |

| | 85,000 | | Series 1994-3, Class PL, 5.500%, 01/25/2024 | | | 86,409 | |

| | 772,235 | | Series 2005-27, Class NA, 5.500%, 01/25/2024 | | | 772,391 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 68.8% (continued) | | | |

| | | FNMA Remic (continued) | | | |

| $ | 2,266,839 | | Series 2005-95, Class LN, 4.500%, 03/25/2033 | | $ | 2,238,070 | |

| | 44,933 | | Series 2004-64, Class BA, 5.000%, 03/25/2034 | | | 44,895 | |

| | 960,000 | | Series 2004-26, Class PE, 4.500%, 04/25/2034 | | | 872,911 | |

| | 760,357 | | Series 2002-T4, Class A3, 7.500%, 12/25/2041 | | | 807,328 | |

| | 415,866 | | Series 2003-W19, Class IA5, 5.500%, 11/25/2043 (e) | | | 414,713 | |

| | 917,696 | | Series 2004-T2, Class IA3, 7.000%, 11/25/2043 | | | 984,575 | |

| | | | FNMA TBA | | | | |

| | 12,280,000 | | 6.000%, 01/01/2029 (d) | | | 12,468,031 | |

| | 24,705,000 | | 6.000%, 02/01/2033 (d) | | | 25,060,134 | |

| | 56,460,000 | | 5.000%, 01/01/2034 (d) | | | 55,083,788 | |

| | 13,350,000 | | 5.500%, 01/01/2034 (d) | | | 13,333,313 | |

| | 30,790,000 | | 6.500%, 01/01/2035 (d) | | | 31,646,333 | |

| | 13,151 | | 9.500%, 10/15/2009 (d) | | | 13,584 | |

| | 2,926,022 | | GMAC Commercial Mortgage Securities Inc. | | | | |

| | | | Pool # 2003-C1, 3.337%, 05/10/2036 | | | 2,843,935 | |

| | 2,001,697 | | GNMA Pool | | | | |

| | | | Pool # 2005-21, 5.000%, 03/20/2035 | | | 1,768,118 | |

| | | | Greenwich Capital Commercial Funding Corp. | | | | |

| | 2,945,000 | | Series 2005-GG5, Class A2, 5.117%, 04/10/2037 | | | 2,950,002 | |

| | 2,470,000 | | Series 2007-GG9, Class A2, 5.381%, 03/10/2039 | | | 2,482,818 | |

| | 2,550,000 | | Series 2007-GG9, Class A4, 5.444%, 03/10/2039 | | | 2,565,055 | |

| | 2,998,326 | | GS Mortgage Securities Corp. II | | | | |

| | | | Series 2007-EOP, Class A1, 5.340%, 03/06/2020 | | | | |

| | | | (Acquired 09/17/2007 and 11/19/2007, Cost $2,973,206) (a)(c) | | | 2,866,244 | |

| | 5,040,000 | | JP Morgan Chase Commercial Mortgage Securities Corp. | | | | |

| | | | Series 2006-LDP9, Class A3, 5.336%, 05/15/2047 | | | 5,021,211 | |

| | | | LB-UBS Commercial Mortgage Trust | | | | |

| | 503,804 | | Series 2003-C3, Class A1, 2.599%, 05/15/2027 | | | 502,227 | |

| | 3,550,000 | | Series 2003-C3, Class A2, 3.086%, 05/15/2027 | | | 3,523,493 | |

| | 1,590,000 | | Series 2005-C5, Class A2, 4.885%, 09/15/2030 | | | 1,586,691 | |

| | 4,300,000 | | Series 2005-C7, Class A25.103%, 11/15/2030 | | | 4,307,184 | |

| | 642,331 | | Series 1998-C4, Class A2, 6.300%, 10/15/2035 | | | 645,944 | |

| | 2,440,000 | | Series 2006-C6, Class A4, 5.372%, 09/15/2039 | | | 2,448,405 | |

| | 4,100,000 | | Series 2007-C2, Class A2, 5.303%, 02/15/2040 | | | 4,111,548 | |

| | 745,378 | | Master Alternative Loans Trust | | | | |

| | | | Pool # 2004-6, 4.500%, 07/25/2014 | | | 732,267 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 68.8% (continued) | | | |

| $ | 593,067 | | Master Asset Securitization Trust | | | |

| | | | Pool # 2004-3, 4.750%, 01/25/2014 | | $ | 591,467 | |

| | 1,550,000 | | MBNA Credit Card Master Trust | | | | |

| | | | Series 2005-A7, Class A7, 4.300%, 02/15/2011 | | | 1,548,042 | |

| | | | Merrill Lynch Commercial Mortgage Trust | | | | |

| | 279,345 | | Series 2002-MW1, Class A2, 4.929%, 07/12/2034 (e) | | | 278,519 | |

| | 1,632,150 | | Series 2006-C2, Class A1, 5.601%, 08/12/2043 | | | 1,648,472 | |

| | 1,404,416 | | Series 2006-3, Class A1, 4.711%, 07/12/2046 | | | 1,395,279 | |

| | | | Morgan Stanley Capital I | | | | |

| | 1,019,725 | | Series # 2003-IQ4, Class A1, 3.270%, 05/15/2040 | | | 999,489 | |

| | 1,375,000 | | Series 2006-HQ8, Class A4, 5.565%, 03/12/2044 | | | 1,388,398 | |

| | 2,260,000 | | SLM Student Loan Trust | | | | |

| | | | Series 2007-7, Class A1, 5.038%, 10/25/2012 (c) | | | 2,248,700 | |

| | | | Wachovia Bank Commercial Mortgage Trust | | | | |

| | 1,185,815 | | Series # 2003-C5, Class A1, 2.986%, 06/15/2035 | | | 1,145,975 | |

| | 1,300,000 | | Series 2006-C24, Class A3, 5.558%, 03/15/2045 | | | 1,318,899 | |

| | 2,796,592 | | Wells Fargo Mortgage Backed Securities Trust | | | | |

| | | | Pool # 2006-3, 5.500%, 03/25/2036 | | | 2,805,950 | |

| | | | Total Mortgage Backed Securities | | | | |

| | | | (Cost $312,913,574) | | | 316,543,825 | |

| | | | | | | | |

| | | | SUPRANATIONAL ISSUE 0.3% | | | | |

| | | | European Investment Bank | | | | |

| | 1,270,000 | | 4.875%, 02/15/2036 (b) | | | 1,249,495 | |

| | | | Total Supranational Issue | | | | |

| | | | (Cost $1,259,548) | | | 1,249,495 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Principal Amount | | | | Value | |

| | | SHORT-TERM INVESTMENTS 15.8% | | | |

| | | US Government Agency Issue (f) 13.8% | | | |

| $ | 63,578,000 | | Federal Home Loan Bank Discount Note, | | | |

| | | | 2.920%, 01/02/2008 | | $ | 63,567,686 | |

| | | | | | | | |

| | | | Variable Rate Demand Note (g) 2.0% | | | | |

| | 9,138,122 | | U.S. Bank Demand Note, 4.949%, 12/31/2031 | | | 9,138,122 | |

| | | | | | | | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $72,705,808) | | | 72,705,808 | |

| | | | | | | | |

| | | | Total Investments 125.7% | | | | |

| | | | (Cost $575,217,102) | | | 578,060,826 | |

| | | | | | | | |

| | | | Liabilities in Excess of Other Assets (25.7)% | | | (118,055,426 | ) |

| | | | | | | | |

| | | | TOTAL NET ASSETS 100.0% | | $ | 460,005,400 | |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities amounted to $27,528,771 (6.0% of net assets) at December 31, 2007. |

| (b) | U.S.-dollar denominated security of foreign issuer. |

| (c) | Adjustable Rate. |

| (d) | When-issued security. |

| (e) | Security marked as segregated to cover when-issued security. |

| (f) | The obligations of certain U.S. Government-sponsored entities are neither issued nor guaranteed by the United States Treasury. |

| (g) | Variable rate demand notes are considered short-term obligations and are payable upon demand. Interest rates change periodically on specified dates. The rates listed are as of December 31, 2007. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (CONTINUED)

December 31, 2007 (Unaudited)

Credit Default Swaps

| | Expiration | | Notional | | | | |

| | Date | | Amount | | | Value(a) | |

| Receive quarterly a fixed annual rate of 5.15% | | | | | | | |

| multiplied by the notional amount and pay to JP | | | | | | | |

| Morgan Chase upon default event of Ford Motor | | | | | | | |

| Credit Co., par value of the notional amount of | | | | | | | |

| Ford Motor Credit Co. 7.000%, 10/01/13 | 3/20/11 | | $ | 2,250,000 | | | $ | (115,080 | ) |

| | | | | | | | | | |

| Receive quarterly a fixed annual rate of 2.75% | | | | | | | | | |

| multiplied by the notional amount and pay to JP | | | | | | | | | |

| Morgan Chase upon default event of a Dow Jones | | | | | | | | | |

| CDX North America High Yield Index reference | | | | | | | | | |

| obligation, par value of the notional amount of | | | | | | | | | |

| Dow Jones CDX North America High Yield Index | | | | | | | | | |

| reference obligation | 6/20/12 | | | 1,577,800 | | | | (2,367 | ) |

| | | | | | | | | | |

| Receive quarterly a fixed annual rate of 1.20% | | | | | | | | | |

| multiplied by the notional amount and pay to | | | | | | | | | |

| Goldman Sachs upon default event of a Dow Jones | | | | | | | | | |

| CDX North America High Yield Index reference | | | | | | | | | |

| obligation, par value of the notional amount of | | | | | | | | | |

| Dow Jones CDX North America High Yield Index | | | | | | | | | |

| reference obligation | 6/20/12 | | | 21,640,000 | | | | (16,373 | ) |

| | | | | | | | | | |

| Receive quarterly a fixed annual rate of 0.60% | | | | | | | | | |

| multiplied by the notional amount and pay to JP | | | | | | | | | |

| Morgan Chase upon default event of a Dow Jones | | | | | | | | | |

| CDX North America High Yield Index reference | | | | | | | | | |

| obligation, par value of the notional amount of | | | | | | | | | |

| Dow Jones CDX North America High Yield Index | | | | | | | | | |

| reference obligation | 12/20/12 | | | 46,820,000 | | | | 6,989 | |

| | | | $ | 72,287,800 | | | $ | (126,831 | ) |

| (a) | Includes interest paid or received by the Fund on the notional amount. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2007 (Unaudited)

Assets: | | | |

| Investments at value (cost $575,217,102) | | $ | 578,060,826 | |

| Interest receivable | | | 2,748,331 | |

| Deposits with broker and custodian for swaps | | | 4,190,000 | |

| Receivable for Fund shares sold | | | 594,778 | |

| Receivable for investments sold | | | 443,343,539 | |

| Unrealized appreciation on swaps | | | 6,989 | |

| Other assets | | | 30,312 | |

| Total assets | | | 1,028,974,775 | |

| | | | | |

Liabilities: | | | | |

| Payable to custodian | | | 1,122,175 | |

| Payable for investments purchased | | | 566,124,403 | |

| Payable to broker | | | 1,446,128 | |

| Accrued investment advisory fee | | | 92,638 | |

| Unrealized depreciation on swaps | | | 133,820 | |

| Accrued expenses | | | 50,211 | |

| Total liabilities | | | 568,969,375 | |

Net Assets | | $ | 460,005,400 | |

| | | | | |

Net Assets Consist of: | | | | |

| Paid in capital | | $ | 452,858,391 | |

| Undistributed net investment income | | | 91,567 | |

| Accumulated net realized gain on investments sold, | | | | |

| swap contracts and foreign currency | | | 4,338,549 | |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 2,843,724 | |

| Swap contracts | | | (126,831 | ) |

Net Assets | | $ | 460,005,400 | |

| | | | | |

Capital Stock, $0.01 Par Value | | | | |

| Authorized | | | 100,000,000 | |

| Issued and outstanding | | | 14,613,260 | |

Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 31.48 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF OPERATIONS

| | | Six Months Ended | |

| | | December 31, 2007 | |

| | | (Unaudited) | |

Investment Income: | | | |

| Interest | | $ | 10,750,070 | |

| | | | | |

Expenses: | | | | |

| Investment advisory fees (Note 3) | | | 824,666 | |

| Fund administration and accounting fees | | | 61,084 | |

| Custody fees | | | 28,982 | |

| Audit fees | | | 16,095 | |

| Federal and state registration fees | | | 13,760 | |

| Legal fees | | | 10,950 | |

| Shareholder servicing fees | | | 5,940 | |

| Compliance support expenses | | | 3,517 | |

| Directors’ fees and related expenses | | | 3,640 | |

| Reports to shareholders | | | 2,444 | |

| Other | | | 4,636 | |

| Total expenses before waiver | | | 975,714 | |

| Waiver of expenses by Adviser (Note 3) | | | (449,467 | ) |

| Net expenses | | | 526,247 | |

Net Investment Income | | | 10,223,823 | |

| | | | | |

Realized and Unrealized | | | | |

Gain (Loss) on Investments: | | | | |

| Realized gain (loss) on: | | | | |

| Investments | | | 9,935,077 | |

| Swap contracts | | | 2,740,341 | |

| Foreign currency translation | | | (92,836 | ) |

| Change in net unrealized appreciation/depreciation on: | | | | |

| Investments | | | 4,489,648 | |

| Swap contracts | | | (375,594 | ) |

Net Realized and Unrealized | | | | |

Gain on Investments | | | 16,696,636 | |

Net Increase in Net Assets | | | | |

Resulting from Operations | | $ | 26,920,459 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | December 31, 2007 | | | Year Ended | |

| | | (Unaudited) | | | June 30, 2007 | |

Operations: | | | | | | |

| Net investment income | | $ | 10,223,823 | | | $ | 14,451,056 | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 9,935,077 | | | | 5,102,933 | |

| Swap contracts | | | 2,740,341 | | | | 68,819 | |

| Foreign currency translation | | | (92,836 | ) | | | 75,201 | |

| Change in net unrealized appreciation/depreciation on: | | | | | | | | |

| Investments | | | 4,489,648 | | | | 2,437,286 | |

| Swap contracts | | | (375,594 | ) | | | 254,715 | |

| Net increase in net assets resulting from operations | | | 26,920,459 | | | | 22,390,010 | |

| | | | | | | | | |

Distributions | | | | | | | | |

Paid From: | | | | | | | | |

| Net investment income | | | (10,042,359 | ) | | | (14,405,929 | ) |

| Net realized gain on investments | | | (3,906,915 | ) | | | — | |

| Net decrease in net assets resulting | | | | | | | | |

| from distributions paid | | | (13,949,274 | ) | | | (14,405,929 | ) |

| | | | | | | | | |

Capital Share | | | | | | | | |

Transactions: | | | | | | | | |

| Shares issued in connection with acquisition of | | | | | | | | |

| Columbus Core Plus Fund (see Note 7) | | | 139,917,196 | | | | — | |

| Shares sold | | | 74,712,699 | | | | 31,004,977 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of distributions | | | 13,095,168 | | | | 13,258,827 | |

| Shares redeemed | | | (57,520,645 | ) | | | (89,297,680 | ) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from capital share transactions | | | 170,204,418 | | | | (45,033,876 | ) |

| | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 183,175,603 | | | | (37,049,795 | ) |

| | | | | | | | | |

Net Assets: | | | | | | | | |

| Beginning of period | | | 276,829,797 | | | | 313,879,592 | |

| End of period | | | | | | | | |

| (includes undistributed net investment income (loss) | | | | | | | | |

| of $91,567 and $(89,897), respectively) | | $ | 460,005,400 | | | $ | 276,829,797 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

FINANCIAL HIGHLIGHTS

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | December 31, | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 2007 | | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | (Unaudited) | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Net Asset Value, | | | | | | | | | | | | | | | | | | |

Beginning of Period | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | | | $ | 30.51 | | | $ | 31.92 | | | $ | 30.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (Loss) | | | | | | | | | | | | | | | | | | | | | | | | |

from Investment | | | | | | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.78 | (4) | | | 1.54 | | | | 1.41 | | | | 1.13 | | | | 0.99 | | | | 1.80 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 1.28 | | | | 0.68 | | | | (1.30 | ) | | | 0.98 | | | | (0.45 | ) | | | 2.06 | |

Total Income from | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Operations | | | 2.06 | | | | 2.22 | | | | 0.11 | | | | 2.11 | | | | 0.54 | | | | 3.86 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Paid: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.71 | ) | | | (1.54 | ) | | | (1.45 | ) | | | (1.12 | ) | | | (0.98 | ) | | | (1.87 | ) |

| From net realized gain on investments | | | (0.27 | ) | | | — | | | | (0.44 | ) | | | — | | | | (0.97 | ) | | | (0.28 | ) |

Total Distributions Paid | | | (0.98 | ) | | | (1.54 | ) | | | (1.89 | ) | | | (1.12 | ) | | | (1.95 | ) | | | (2.15 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 31.48 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | | | $ | 30.51 | | | $ | 31.92 | |

Total Return(1) | | | 6.74 | % | | | 7.52 | % | | | 0.36 | % | | | 7.00 | % | | | 1.71 | % | | | 13.29 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | $ | 460,005 | | | $ | 276,830 | | | $ | 313,880 | | | $ | 316,474 | | | $ | 346,733 | | | $ | 358,052 | |

| Ratio of expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets(2)(3) | | | 0.26 | % | | | 0.20 | % | | | 0.20 | % | | | 0.408 | % | | | 0.425 | % | | | 0.425 | % |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets(2)(3) | | | 4.96 | % | | | 4.95 | % | | | 4.59 | % | | | 3.30 | % | | | 2.71 | % | | | 5.78 | % |

| Portfolio turnover rate(1) | | | 472 | % | | | 978 | % | | | 1,247 | % | | | 1,222 | % | | | 1,409 | % | | | 489 | % |

| (1) | Not annualized for periods less than a full year. |

| (2) | Net of waivers and reimbursements by Adviser. Without waivers and reimbursements of expenses, the ratio of expenses to average net assets would have been 0.48%, 0.50%, 0.50%, 0.501%, 0.507% and 0.505%, and the ratio of net investment income to average net assets would have been 4.74%, 4.65%, 4.29%, 3.21%, 2.63% and 5.70% for the periods ended December 31, 2007, June 30, 2007, June 30, 2006, June 30, 2005, June 30, 2004 and June 30, 2003, respectively. |

| (3) | Annualized for periods less than a full year. |

| (4) | Per share net investment income has been calculated using the daily average share method. |

The accompanying notes are an integral part of these financial statements.

Growth of a $100,000 Investment (Unaudited)

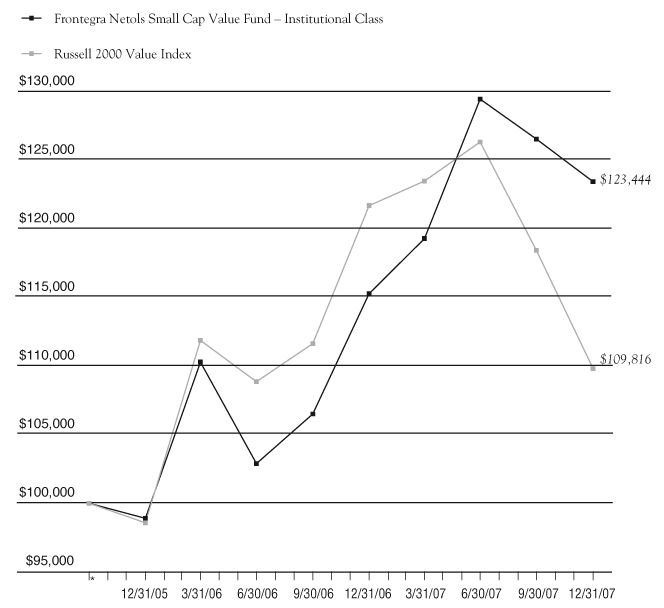

* 2/23/01 commencement of operations.

| | | | |

| | Portfolio Total Return** | | |

| | FOR THE PERIOD ENDED 12/31/07 | | |

| | | | |

| | SIX MONTHS | 6.72% | |

| | | | |

| | ONE YEAR | 7.76% | |

| | | | |

| | FIVE YEAR | | |

| | AVERAGE ANNUAL | 4.88% | |

| | | | |

| | SINCE COMMENCEMENT | | |

| | AVERAGE ANNUAL | 5.49% | |

| | | | |