As filed with the Securities and Exchange Commission on March 10, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07685

Frontegra Funds, Inc.

(Exact name of registrant as specified in charter)

400 Skokie Blvd.

Suite 500

Northbrook, Illinois 60062

(Address of principal executive offices) (Zip code)

William D. Forsyth III

400 Skokie Blvd., Suite 500

Northbrook, Illinois 60062

(Name and address of agent for service)

(847) 509-9860

Registrant's telephone number, including area code

Date of fiscal year end: June 30, 2009

Date of reporting period: December 31, 2008

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

Frontegra Columbus Core Plus Fund

Frontegra Columbus Core Fund

Frontegra IronBridge Small Cap Fund

Frontegra IronBridge SMID Fund

Frontegra New Star International Equity Fund

Frontegra Netols Small Cap Value Fund

Frontegra Asset Management, Inc.

__________

December 31, 2008

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Expense Example | 2 |

| Allocation of Portfolio Holdings | 6 |

| Frontegra Columbus Core Plus Fund | |

| Frontegra Columbus Core Fund | |

| Report from Reams Asset Management Company, LLC | 9 |

| Investment Highlights | 13 |

| Schedule of Investments | 14 |

| Statement of Assets and Liabilities | 30 |

| Statement of Operations | 31 |

| Statements of Changes in Net Assets | 32 |

| Financial Highlights | 33 |

| Investment Highlights | 34 |

| Schedule of Investments | 35 |

| Statement of Assets and Liabilities | 47 |

| Statement of Operations | 48 |

| Statements of Changes in Net Assets | 49 |

| Financial Highlights | 50 |

| Frontegra IronBridge Small Cap Fund | |

| Frontegra IronBridge SMID Fund | |

| Report from IronBridge Capital Management, L.P. | 52 |

| Investment Highlights | 55 |

| Schedule of Investments | 56 |

| Statement of Assets and Liabilities | 63 |

| Statement of Operations | 64 |

| Statements of Changes in Net Assets | 65 |

| Financial Highlights | 66 |

| Investment Highlights | 67 |

| Schedule of Investments | 68 |

| Statement of Assets and Liabilities | 74 |

| Statement of Operations | 75 |

| Statements of Changes in Net Assets | 76 |

| Financial Highlights | 77 |

| Frontegra New Star International Equity Fund | |

| Report from New Star Institutional Managers Limited | 79 |

| Investment Highlights | 82 |

| Schedule of Investments | 83 |

| Portfolio Diversification | 87 |

| Statement of Assets and Liabilities | 88 |

| Statement of Operations | 89 |

| Statements of Changes in Net Assets | 90 |

| Financial Highlights | 91 |

| Frontegra Netols Small Cap Value Fund | |

| Report from Netols Asset Management, Inc. | 93 |

| Investment Highlights | 94 |

| Schedule of Investments | 95 |

| Statement of Assets and Liabilities | 100 |

| Statement of Operations | 101 |

| Statements of Changes in Net Assets | 102 |

| Financial Highlights | 103 |

| Notes to Financial Statements | 105 |

| Board of Directors’ Approval of the Advisory Agreement | 120 |

| Additional Information | |

| Foreign Tax Credit | 136 |

| Qualified Dividend Income/Dividends Received Deduction | 136 |

| Additional Information Applicable to Foreign Shareholders Only | 137 |

| Voting Results of Special Meeting of Shareholders | 137 |

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectus may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the Prospectus carefully.

Frontegra Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds’ investment adviser.

| | This page intentionally left blank. |

DEAR FELLOW SHAREHOLDERS:

We appreciate the opportunity to report on the progress of the Frontegra Funds for the first six months of our fiscal year (July 1, 2008, through December 31, 2008). The economy and the financial markets have experienced volatility and downswings of historic magnitudes. While many experts predict a recovery for both, that rebound might not occur for months. Non-U.S. markets, as measured by the MSCI EAFE Index, were down significantly for the six-month period, returning -36.32%. Small capitalization stocks were also down steeply, with the Russell 2000 Index returning -26.94%. Because of the turbulent markets, many investors sought the safety of U.S. Treasury securities and invested heavily in them. With its heavy weighting in Treasuries, the U.S. bond market had a stronger showing in the final six months of 2008 with the Barclays Capital U.S. Aggregate Bond Index up 4.07%.

Fund Results

The Frontegra Columbus Core Plus Fund and the Frontegra Columbus Core Fund, managed by Reams Asset Management, had net returns of -9.24% and -7.47%, respectively, for the six month period, versus the 4.07% return of the Barclays Capital U.S. Aggregate Bond Index. The underperformance came almost entirely from the increased investment in the Corporate sector as spreads were widening late in the year. Corporate spreads are more than 550 basis points above Treasuries, well above historic highs of +250 basis points and the historical average of approximately +110 bps. While the relative performance is striking, we are very confident that the Corporate sector—and the Funds—will recover and perform well in the months and quarters ahead as spreads return to more normal levels.

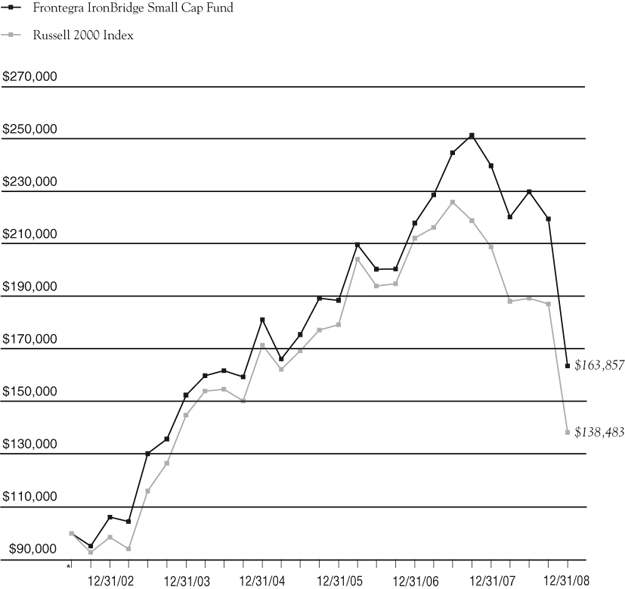

The Frontegra IronBridge Small Cap Fund, managed by IronBridge Capital Management, returned -28.82% (net of fees) versus the benchmark Russell 2000 Index return of - -26.94%. The modest underperformance came primarily from stock selection in the Healthcare sector and an underweight in Financials, which experienced relatively strong performance over the period. The Frontegra IronBridge SMID Fund returned a net -30.65%, slightly better than the benchmark Russell 2500 return of -31.21% primarily due to strong stock selection in the Consumer Discretionary sector.

The Frontegra New Star International Equity Fund, managed by New Star Institutional Managers, returned -36.46% (net of fees) for the six-month period, virtually in line with the benchmark MSCI EAFE return of -36.32%.

Finally, the Frontegra Netols Small Cap Value Fund, managed by Netols Asset Management had a net return of -23.76% versus the benchmark Russell 2000 Value Index return of -21.17% for the six-month period. While stock selection for the period was additive, an underweight in Financials and an overweight in Energy were modest detractors from relative performance.

Summary

We continue to have great confidence in the investment teams at Reams Asset Management, IronBridge Capital Management, New Star Institutional Managers and Netols Asset Management. We believe they are committed to the highest standards of investment decision-making for the shareholders of the Frontegra Funds.

As always, we greatly appreciate your investment and continued confidence in the Frontegra Funds.

Sincerely,

William D. Forsyth, CFA

Frontegra Asset Management, Inc.

Frontegra Funds

EXPENSE EXAMPLE

December 31, 2008 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently the Funds’ transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontegra New Star International Equity Fund.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/08 – 12/31/08).

Actual Expenses

The first line of the tables on the following pages provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

Frontegra Funds

EXPENSE EXAMPLE (continued)

December 31, 2008 (Unaudited)

| Frontegra Columbus Core Plus Fund | | | | | | | | | | | | |

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 907.60 | | | | 0.35 | % | | $ | 1.68 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,023.44 | | | | 0.35 | % | | $ | 1.79 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra Columbus Core Fund

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 925.30 | | | | 0.35 | % | | $ | 1.70 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,023.44 | | | | 0.35 | % | | $ | 1.79 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra IronBridge Small Cap Fund

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 711.80 | | | | 1.08 | % | | $ | 4.67 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.75 | | | | 1.08 | % | | $ | 5.51 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra Funds

EXPENSE EXAMPLE (continued)

December 31, 2008 (Unaudited)

Frontegra IronBridge SMID Fund

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 693.50 | | | | 0.95 | % | | $ | 4.06 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.42 | | | | 0.95 | % | | $ | 4.84 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra New Star International Equity Fund

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 635.40 | | | | 0.75 | % | | $ | 3.09 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.42 | | | | 0.75 | % | | $ | 3.82 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra Netols Small Cap Value Fund – Institutional Class

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 762.40 | | | | 1.10 | % | | $ | 4.89 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,019.66 | | | | 1.10 | % | | $ | 5.60 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra Funds

EXPENSE EXAMPLE (continued)

December 31, 2008 (Unaudited)

Frontegra Netols Small Cap Value Fund – Class Y

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Annualized | | | Expenses | |

| | | Value | | | Value | | | Expense | | | Paid During | |

| | | 7/1/08 | | | 12/31/08 | | | Ratio* | | | the Period* | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 761.50 | | | | 1.50 | % | | $ | 6.66 | |

| Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,017.64 | | | | 1.50 | % | | $ | 7.63 | |

| * | Expenses are equal to each Fund’s annualized expense ratio indicated above , multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

Frontegra Funds

ALLOCATION OF PORTFOLIO HOLDINGS

December 31, 2008 (Unaudited)

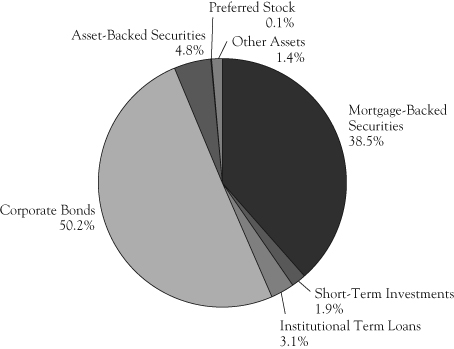

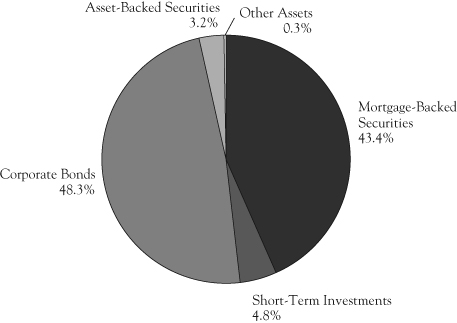

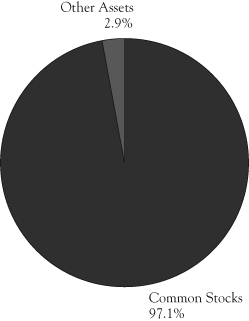

Frontegra Columbus Core Plus Fund*

Frontegra Columbus Core Fund*

*Percentages shown are based on the Fund’s total net assets.

Frontegra Funds

ALLOCATION OF PORTFOLIO HOLDINGS (continued)

December 31, 2008 (Unaudited)

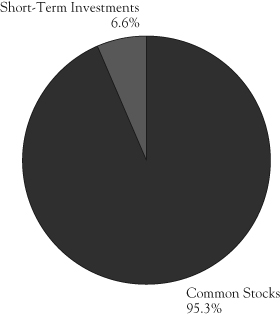

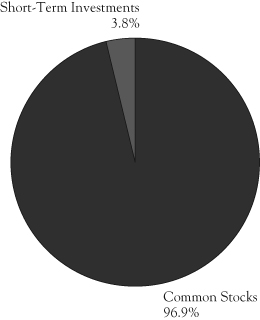

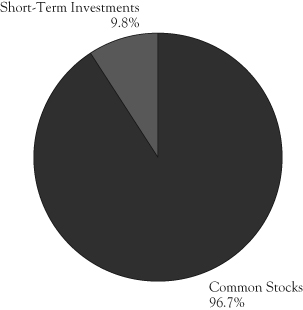

| Frontegra IronBridge Small Cap Fund* | Frontegra IronBridge SMID Fund* |

| |

| | |

| Frontegra New Star | Frontegra Netols |

| International Equity Fund* | Small Cap Value Fund* |

| |

* Percentages shown are based on the Fund’s total net assets.

FRONTEGRA

COLUMBUS CORE PLUS FUND

FRONTEGRA

COLUMBUS CORE FUND

REPORT FROM REAMS ASSET

MANAGEMENT COMPANY, LLC:

Dear Fellow Shareholders:

The Frontegra Columbus Core Plus Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of fixed income securities of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index).

The Frontegra Columbus Core Fund strives to achieve a high level of total return consistent with the preservation of capital by investing in a diversified portfolio of investment grade bonds of varying maturities. This objective is relative to and measured against the Barclays Capital U.S. Aggregate Bond Index.

Performance Review

For the six month period ending December 31, 2008, the Frontegra Columbus Core Plus Fund had a net return of -9.24% compared to a return of 4.07% for the benchmark, the Barclays Capital U.S. Aggregate Bond Index. Duration strategy added 80 basis points to performance for the period as the portfolio duration was positioned aggressively as the Treasury yield curve fell. Yield curve strategy subtracted 58 basis points as the portfolio was underweighted on the short end of the yield curve as the curve steepened. Sector selection subtracted 1,391 basis points while security selection added 56 basis points. Within these categories, commercial mortgage backed securities (“CMBS”) subtracted 659 basis points, high yield holdings subtracted 412 basis points, investment grade credit holdings subtracted 314 basis points and asset backed securities (“ABS”) subtracted 26 basis points as all of these sectors were overweighted in the portfolio and underperformed as spreads widened significantly during the quarter. Mortgage backed securities (“MBS”) holdings also subtracted 7 basis points from performance. Government related holdings added 83 basis points to performance as the sector underperformed and was underweighted in the portfolio.

For the six month period ending December 31, 2008, the Frontegra Columbus Core Fund had a net return of -7.47% compared to a return of 4.07% for the benchmark, the Barclays Capital U.S. Aggregate Bond Index. Duration strategy added 63 basis points to performance for the period as the portfolio duration was positioned aggressively as the Treasury yield curve fell. Yield curve strategy subtracted 56 basis points as the portfolio was underweighted on the short end of the yield curve as the curve steepened. Sector selection subtracted 1,144 basis points while security selection added 1 basis point. Within these categories, CMBS subtracted 709 basis points, investment grade credit holdings subtracted 468 basis points and ABS subtracted 11 basis points as all three sectors were overweighted in the portfolio and underperformed as spreads widened significantly during the quarter. MBS holdings also subtracted 9 basis points from performance. Government related holdings added 54 basis points to performance as the sector underperformed and was underweighted in the portfolio.

Fixed Income Outlook

U.S. fixed income markets continued to experience extremely disruptive conditions during the fourth quarter of 2008. Despite some stabilization in December, spreads widened severely for the quarter in most sectors, while Treasury and government-guaranteed security yields continued to drop as Fed easing and the flight to quality pushed T-Bill rates to zero.

| • | Credit market conditions during the fourth quarter were set in motion by the Lehman, AIG, and Washington Mutual failures and the Treasury rescues of FNMA and FHLMC during September. These events froze activity in the non-government sectors of the credit market and sent yields plummeting in the Treasury and agency sectors. Similar problems spread around the world. Many financial firms were squeezed into a forced deleveraging as credit was cut off and write-offs reduced capital, creating intense pressure on asset prices and forcing spreads wider. |

| • | The fourth quarter was characterized by the rollout of a wide variety of government measures designed to stabilize financial conditions. Deposit insurance was broadened at the beginning of the quarter, money market funds were guaranteed, and the TARP was passed. Under the TARP, capital infusions were made to improve the solvency of a wide range of financial firms. Liquidity was provided through a broad selection of Fed liquidity facilities. Late in the quarter, the Fed started to make direct purchases of problem securities under the TARP. Auto loans were granted. The Fed funds rate was brought to zero, and bank reserves at the Fed were inflated. A massive fiscal stimulus plan is likely early in 2009. The Treasury and Fed have made clear their resolution to do whatever is necessary to stabilize the financial system, and as a result money growth has continued and bank credit has been prevented from falling. These are all textbook measures designed to combat a credit crisis, and they are expected to succeed in preventing deflation and further major financial failures. However, the actual application of these measures in the U.S. is unprecedented, and the timing of their effectiveness is uncertain. |

| • | Treasury yields have been pushed to historic lows. At the same time, gigantic spending and borrowing commitments have been made by the Treasury. Additionally, the extraordinary creation of liquidity by the Fed creates major questions about the government’s ability to restrain future inflation. While these measures all appear necessary to prevent current deflation and economic collapse, they create great risks of much higher interest rates when the current crisis ends. Therefore, we think it prudent to avoid the Treasury and agency market at the current extremely low yields. |

| • | Current economic trends are terrible, with layoffs accelerating, poor prospects for consumer and business spending, housing continuing to plummet, and leading indicators continuing to drop. A severe recession resulting from the credit crisis seems inevitable. Since the current situation is unprecedented, the depth and duration of the recession are unpredictable, and there are certain to be additional negative feedback effects on the credit markets as demand weakens and leveraged credits fail. The reduction in commodity prices, while negative for producers, is one positive factor for real personal income and spending. |

| • | Despite the gloomy state of the markets and economy, we think that unprecedented values are being created in sectors of the bond market that have performed poorly but have good underlying fundamentals and structure. Deleveraging has had a particularly hard impact on “AAA” securities that were purchased on a leveraged basis such as senior CMBS and nonagency mortgage securities, but these securities have little risk of ultimate loss due to highly favorable structures, and they appear to offer tremendous value at current prices. Likewise, many banks and other financial firms have been virtually guaranteed immunity from failure by government capital infusions, guarantees, and liquidity facilities, but their bonds remain at extremely high yields. We think that a portfolio invested in these sectors has the potential for excellent returns even as Treasury returns suffer. |

Core Plus Portfolio Strategy

| • | Credit exposure was increased to a more heavily overweighted position during the quarter in response to much wider spreads. Emphasis remains on investment-grade finance and industrial sector issuers. Most major finance issuers continue to replenish their capital despite heavy mortgage losses, protecting creditors at the expense of shareholders. In attempting to correct the Lehman mistake, the U.S. Treasury and Federal Reserve have shown resolution to take the steps necessary to protect key finance issuers through the required liquidity facilities, guarantees, and capital injections. Spreads are historically very wide, and we think the credit sector remains attractive. |

| • | In the mortgage market, the CMBS sector continued to be heavily overweighted. We think that these securities remain extremely attractive due to their steady underwriting standards, favorable subordination and collateralization levels, and low delinquency rates. All holdings remain at the senior-most structural level with unimpaired “AAA” ratings. Spreads in this sector narrowed in December but remain extremely attractive. |

| • | Mortgage pass-through holdings have been reduced to an underweighted position in order to make room for the overweights in corporate and CMBS holdings. |

| • | Treasury and agency holdings remain low due to the portfolio overweights in corporates and mortgages. |

| • | Due to the disconnect between Treasury rates and the rest of the fixed income market, portfolio duration strategy is being de-emphasized as we seek to avoid Treasury contributions to duration in favor of corporate and mortgage contributions. Resulting overall portfolio duration measurements are close to benchmark levels. |

| • | High yield holdings are being somewhat underemphasized in favor of investment grade holdings. High yield positions are widely diversified over many sectors and industries, with emphasis on senior term loans and auto debt. |

| • | Auto holdings are being concentrated in senior term loans and senior debt of GMAC and Ford Credit. |

Core Portfolio Strategy

| • | Credit exposure was increased to a more heavily overweighted position during the quarter in response to much wider spreads. Emphasis remains on investment-grade finance and industrial sector issuers. Most major finance issuers continue to replenish their capital despite heavy mortgage losses, protecting creditors at the expense of shareholders. In attempting to correct the Lehman mistake, the U.S. Treasury and Federal Reserve have shown resolution to take the steps necessary to protect key finance issuers through the required liquidity facilities, guarantees, and capital injections. Spreads are historically very wide, and we think the credit sector remains attractive. |

| • | In the mortgage market, the CMBS sector continued to be heavily overweighted. We think that these securities remain extremely attractive due to their steady underwriting standards, favorable subordination and collateralization levels, and low delinquency rates. All holdings remain at the senior-most structural level with unimpaired “AAA” ratings. Spreads in this sector narrowed in December but remain extremely attractive. |

| • | Mortgage pass-through holdings remain in an underweighted position in order to make room for the overweights in corporate and CMBS holdings. |

| • | Treasury and agency holdings remain low due to the portfolio overweights in corporates and mortgages. |

| • | Due to the disconnect between Treasury rates and the rest of the fixed income market, portfolio duration strategy is being de-emphasized as we seek to avoid Treasury contributions to duration in favor of corporate and mortgage contributions. Resulting overall portfolio duration measurements are close to benchmark levels. |

We appreciate your continued support as fellow shareholders in the Funds.

Regards,

|  |

| Mark M. Egan, CFA, CPA | Robert A. Crider, CFA |

| Reams Asset Management Company, LLC | Reams Asset Management Company, LLC |

INVESTMENT HIGHLIGHTS

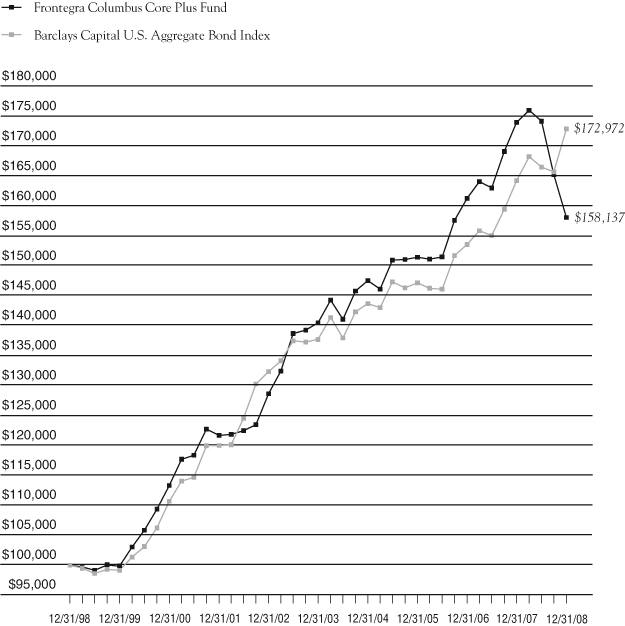

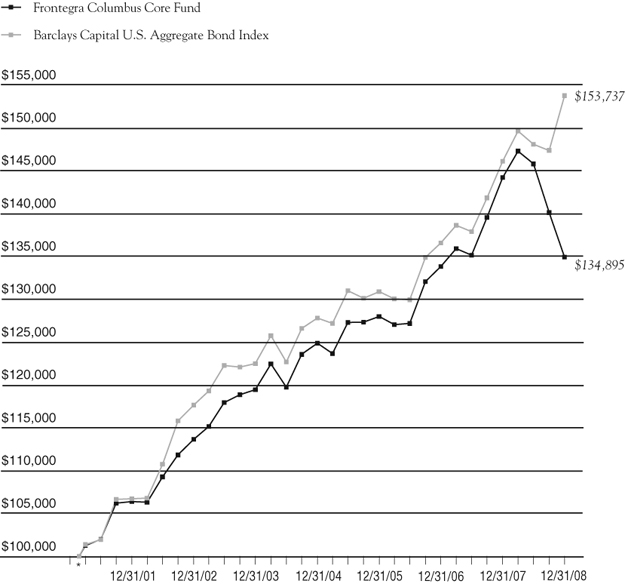

Growth of a $100,000 Investment (Unaudited)

| Portfolio Total Return* | | | | | | |

| FOR PERIODS ENDED 12/31/08 | | FUND | | | INDEX | |

| | | | | | | |

| SIX MONTHS | | | (9.24 | )% | | | 4.07 | % |

| | | | | | | | | |

| ONE YEAR | | | (9.15 | )% | | | 5.24 | % |

| | | | | | | | | |

| | | 2.39 | % | | | 4.65 | % |

| | | | | | | | | |

| | | 4.69 | % | | | 5.63 | % |

This chart assumes an initial gross investment of $100,000 made on 12/31/08. Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The Barclays Capital U.S. Aggregate Bond Index (formerly the Lehman Brothers Aggregate Bond Index) is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset backed and mortgage backed securities, with maturities of at least one year. The Index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in fixed income securities. A direct investment in the index is not possible.

| * | The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | ASSET BACKED SECURITIES 4.8% | | | |

| | | Americredit Automobile Receivables Trust | | | |

| $ | 1,630,000 | | 2008-AF, Class A4, 6.960%, 10/14/2014 | | $ | 1,339,496 | |

| | | | Citibank Credit Card Issuance Trust | | | | |

| | 2,510,000 | | 2008-A1, Class A1, 5.350%, 02/07/2020 | | | 1,982,253 | |

| | | | Countrywide Asset-Backed Certificates | | | | |

| | 687,278 | | 2006-S3, Class A1, 5.460%, 06/25/2021 (c) | | | 563,730 | |

| | 590,000 | | 2006-S2, Class A2, 5.627%, 07/25/2027 | | | 455,582 | |

| | 4,555,000 | | 2006-S2, Class A3, 5.841%, 07/25/2027 | | | 1,094,452 | |

| | 1,955,000 | | 2006-S2, Class A4, 6.091%, 07/25/2027 | | | 295,140 | |

| | 1,200,880 | | 2006-S5, Class A3, 5.762%, 06/25/2035 | | | 309,408 | |

| | 2,435,000 | | 2006-S7, Class A3, 5.712%, 11/25/2035 (c) | | | 349,027 | |

| | | | Ford Credit Auto Owner Trust | | | | |

| | 1,015,000 | | 2006-C, Class A4A, 5.150%, 02/15/2012 | | | 966,571 | |

| | 1,295,000 | | 2007-A, Class A4A, 5.470%, 06/15/2012 | | | 1,201,292 | |

| | 600,000 | | 2007-B, Class A4A, 5.240%, 07/15/2012 | | | 549,117 | |

| | | | GMAC Mortgage Corporation Loan Trust | | | | |

| | 1,295,000 | | 2006-HE2, Class A3, 6.320%, 05/25/2036 | | | 742,631 | |

| | 2,270,000 | | 2006-HE3, Class A3, 5.805%, 10/25/2036 | | | 780,307 | |

| | | | GSAA Home Equity Trust | | | | |

| | 1,458,398 | | 2006-S1, Class 1A1, 2.621%, 01/25/2037 | | | 431,631 | |

| | | | Hertz Vehicle Financing LLC | | | | |

| | 704,167 | | 2004-1, Class A4, 3.230%, 05/25/2010 | | | | |

| | | | (Acquired 2/1/2008, Cost $679,231) (a) | | | 691,831 | |

| | 715,000 | | 2005-1A, Class A4, 2.711%, 11/25/2011 | | | | |

| | | | (Acquired 8/21/2008 and 12/10/2008, Cost $631,730) (a) | | | 561,274 | |

| | 880,000 | | 2005-2A, Class A5, 2.711%, 11/25/2011 | | | | |

| | | | (Acquired 8/1/2008 and 12/10/2008, Cost $797,061) (a) | | | 683,272 | |

| | 1,810,000 | | 2005-2A, Class A6, 5.080%, 11/25/2011 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,749,444) (a) | | | 1,519,091 | |

| | | | Keystone Owner Trust | | | | |

| | 7,784 | | 1998-P1, Class M1, 7.530%, 05/25/2025 | | | | |

| | | | (Acquired 12/10/2008, Cost $6,620) (a) | | | 6,757 | |

| | | | Mid-State Trust | | | | |

| | 892,258 | | 11, Class A1, 4.864%, 07/15/2038 | | | 777,897 | |

| | | | Residential Funding Mortgage Securities | | | | |

| | 380,000 | | 2005-HS1, Class AI2, 4.660%, 07/25/2020 | | | 343,014 | |

| | 865,735 | | 2003-HS1, Class AI6, 3.830%, 02/25/2033 | | | 745,982 | |

| | 630,000 | | 2005-HS1, Class AI4, 5.110%, 09/25/2035 | | | 144,331 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | ASSET BACKED SECURITIES 4.8% (continued) | | | |

| | | Residential Funding Mortgage Securities (continued) | | | |

| $ | 1,350,000 | | 2006-HSA1, Class A3, 5.230%, 02/25/2036 | | $ | 383,893 | |

| | 2,300,000 | | 2006-HSA1, Class A5, 5.310%, 02/25/2036 | | | 639,047 | |

| | 1,460,000 | | 2006-HSA1, Class A4, 5.490%, 02/25/2036 | | | 242,716 | |

| | 590,000 | | 2006-HSA2, Class AI3, 5.550%, 03/25/2036 | | | 203,225 | |

| | 820,000 | | 2006-HSA2, Class AI4, 5.810%, 03/25/2036 | | | 110,055 | |

| | | | Saco I Trust | | | | |

| | 1,499,680 | | 2006-9, Class A1, 5.480%, 08/25/2036 | | | 318,104 | |

| | | | Total Asset Backed Securities | | | | |

| | | | (Cost $21,306,833) | | | 18,431,126 | |

| | | | | | | | |

| | | | CORPORATE BONDS 50.2% | | | | |

| | | | Airlines 2.5% | | | | |

| | | | Continental Airlines | | | | |

| | 4,250,000 | | 5.983%, 04/19/2022 | | | 2,847,500 | |

| | | | Delta Air Lines, Inc. | | | | |

| | 5,516,474 | | 6.718%, 07/02/2024 | | | 3,475,378 | |

| | | | United Airlines | | | | |

| | 5,323,411 | | 6.636%, 01/02/2022 (e) | | | 3,300,515 | |

| | | | | | | 9,623,393 | |

| | | | Auto Components 0.4% | | | | |

| | | | Arvinmeritor, Inc. | | | | |

| | 300,000 | | 8.125%, 09/15/2015 | | | 135,000 | |

| | | | Delphi Corp. | | | | |

| | 2,005,000 | | 6.500%, 08/15/2013 | | | 30,075 | |

| | | | Lear Corp. | | | | |

| | 2,895,000 | | 8.750%, 12/01/2016 | | | 839,550 | |

| | | | TRW Automotive Inc. | | | | |

| | 995,000 | | 7.250%, 03/15/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $863,687) (a) | | | 507,450 | |

| | | | | | | 1,512,075 | |

| | | | Building Products 0.2% | | | | |

| | | | USG Corp. | | | | |

| | 1,120,000 | | 7.750%, 01/15/2018 | | | 708,400 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Capital Markets 2.3% | | | |

| | | Goldman Sachs Group, Inc. | | | |

| $ | 1,740,000 | | 5.700%, 09/01/2012 | | $ | 1,659,154 | |

| | 3,855,000 | | 6.150%, 04/01/2018 | | | 3,704,505 | |

| | | | Morgan Stanley | | | | |

| | 4,360,000 | | 5.550%, 04/27/2017 | | | 3,600,423 | |

| | | | | | | 8,964,082 | |

| | | | Commercial Banks 7.8% | | | | |

| | | | Barclays Bank Plc | | | | |

| | 280,000 | | 6.050%, 12/04/2017 | | | | |

| | | | (Acquired 10/31/2008 and 12/10/2008, Cost $223,563) (a)(b) | | | 247,014 | |

| | 5,070,000 | | 7.434%, 12/15/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $4,489,292) (a)(b)(c) | | | 2,563,291 | |

| | | | Credit Suisse New York | | | | |

| | 60,000 | | 6.000%, 02/15/2018 (b) | | | 55,099 | |

| | | | Deutsche Bank, LLC | | | | |

| | 2,200,000 | | 5.375%, 03/02/2015 (b) | | | 1,984,596 | |

| | 1,410,000 | | 6.750%, 08/20/2018 | | | 1,429,754 | |

| | 3,270,000 | | 5.628%, 01/31/2049 | | | | |

| | | | (Acquired Multiple Dates, Cost $2,610,202) (a)(c) | | | 1,397,438 | |

| | | | Manufacturers & Traders Trust Co. | | | | |

| | 2,350,000 | | 3.850%, 04/01/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $2,135,597) (a)(c) | | | 1,962,215 | |

| | | | Marshall & Ilsley Bank | | | | |

| | 6,435,000 | | 5.413%, 12/04/2012 | | | 5,034,158 | |

| | | | Regions Bank | | | | |

| | 2,185,000 | | 7.500%, 05/15/2018 | | | 1,877,859 | |

| | | | Royal Bank of Scotland Group Plc | | | | |

| | 7,240,000 | | 6.990%, 10/29/2049 | | | | |

| | | | (Acquired Multiple Dates, Cost $5,055,503) (a)(b) | | | 3,384,961 | |

| | | | Suntrust Bank | | | | |

| | 3,455,000 | | 5.919%, 05/21/2012 (c) | | | 3,151,617 | |

| | | | Wachovia Corp. | | | | |

| | 5,110,000 | | 5.800%, 08/29/2049 (c) | | | 3,014,900 | |

| | 500,000 | | 7.980%, 12/31/2049 | | | 426,200 | |

| | | | Wells Fargo Alternative Loan Trust | | | | |

| | 4,665,000 | | 7.700%, 12/29/2049 (c) | | | 3,850,076 | |

| | | | | | | 30,379,178 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Computers & Peripherals 0.6% | | | |

| | | Tyco Electronics Group S A | | | |

| $ | 1,385,000 | | 6.000%, 10/01/2012 (b) | | $ | 1,249,413 | |

| | 1,335,000 | | 5.950%, 01/15/2014 (b) | | | 1,156,356 | |

| | | | | | | 2,405,769 | |

| | | | Consumer Finance 4.1% | | | | |

| | | | ERAC USA Finance Co. | | | | |

| | 5,680,000 | | 6.375%, 10/15/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $4,888,439) (a) | | | 3,941,988 | |

| | | | Ford Motor Credit Co. | | | | |

| | 1,330,000 | | 7.800%, 06/01/2012 | | | 933,093 | |

| | 650,000 | | 7.000%, 10/01/2013 | | | 449,103 | |

| | 5,970,000 | | 8.000%, 12/15/2016 | | | 3,888,661 | |

| | | | GMAC LLC | | | | |

| | 2,557,000 | | 6.625%, 05/15/2012 | | | 2,877,672 | |

| | 2,272,000 | | 6.750%, 12/01/2014 | | | 2,222,465 | |

| | | | Household Finance Corp. | | | | |

| | 1,105,000 | | 4.750%, 07/15/2013 | | | 1,008,065 | |

| | | | Residential Capital LLC | | | | |

| | 3,740,000 | | 6.500%, 04/17/2013 | | | 635,800 | |

| | | | | | | 15,956,847 | |

| | | | Diversified Financial Services 12.1% | | | | |

| | | | American Express Credit Co. | | | | |

| | 235,000 | | 7.300%, 08/20/2013 | | | 240,544 | |

| | | | American General Finance | | | | |

| | 3,000,000 | | 3.875%, 10/01/2009 | | | 2,127,633 | |

| | 3,680,000 | | 5.200%, 12/15/2011 | | | 1,563,411 | |

| | 1,615,000 | | 5.900%, 09/15/2012 | | | 693,956 | |

| | 210,000 | | 5.375%, 10/01/2012 | | | 87,448 | |

| | 4,790,000 | | 6.900%, 12/15/2017 | | | 2,072,983 | |

| | | | Bank of America Corp. | | | | |

| | 5,655,000 | | 8.000%, 12/29/2049 | | | 4,067,574 | |

| | | | CIT Group Inc. | | | | |

| | 1,110,000 | | 5.168%, 11/03/2010 | | | 843,284 | |

| | 265,000 | | 5.600%, 11/02/2011 (b) | | | 216,073 | |

| | 990,000 | | 5.610%, 02/13/2012 | | | 777,014 | |

| | 2,150,000 | | 7.625%, 11/30/2012 | | | 1,814,963 | |

| | 1,705,000 | | 5.638%, 12/21/2012 | | | 1,211,781 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Diversified Financial Services 12.1% (continued) | | | |

| | | Citigroup, Inc. | | | |

| $ | 8,645,000 | | 8.400%, 04/29/2049 | | $ | 5,708,207 | |

| | | | Credit Suisse Guernsey | | | | |

| | 7,894,000 | | 5.860%, 05/15/2017 (b)(c) | | | 3,684,390 | |

| | | | Genworth Global Funding | | | | |

| | 1,185,000 | | 5.200%, 10/08/2010 | | | 935,765 | |

| | 430,000 | | 5.250%, 05/15/2012 | | | 305,936 | |

| | | | International Lease Finance Corp. | | | | |

| | 3,075,000 | | 5.350%, 03/01/2012 | | | 2,132,562 | |

| | 1,025,000 | | 5.300%, 05/01/2012 | | | 719,958 | |

| | 1,630,000 | | 5.625%, 09/20/2013 | | | 1,088,472 | |

| | 2,000,000 | | 6.625%, 11/15/2013 | | | 1,347,576 | |

| | | | JP Morgan Chase & Co. | | | | |

| | 4,645,000 | | 7.900%, 10/30/2049 (c) | | | 3,863,850 | |

| | | | Lehman Brothers Holdings | | | | |

| | 7,000,000 | | 6.875%, 05/02/2018 (f) | | | 665,000 | |

| | | | Liberty Property LP | | | | |

| | 2,580,000 | | 6.625%, 10/01/2017 | | | 1,706,128 | |

| | | | Pemex Finance Ltd. | | | | |

| | 9,750 | | 9.690%, 08/15/2009 (b)(e) | | | 9,823 | |

| | | | Pricoa Global Funding I | | | | |

| | 390,000 | | 3.565%, 01/30/2012 | | | | |

| | | | (Acquired 12/18/2008, Cost $299,922) (a)(c) | | | 293,870 | |

| | 1,955,000 | | 5.400%, 10/18/2012 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,944,241) (a) | | | 1,807,642 | |

| | | | Prudential Financial Inc. | | | | |

| | 2,945,000 | | 6.000%, 12/01/2017 | | | 2,362,473 | |

| | | | Simon Property Group LP | | | | |

| | 1,590,000 | | 5.100%, 06/15/2015 | | | 974,710 | |

| | 1,100,000 | | 5.750%, 12/01/2015 | | | 718,513 | |

| | 195,000 | | 6.100%, 05/01/2016 | | | 124,608 | |

| | 810,000 | | 5.250%, 12/01/2016 | | | 517,576 | |

| | | | Societe Generale | | | | |

| | 2,440,000 | | 5.922%, 04/05/2017 | | | | |

| | | | (Acquired 11/26/2008, Cost $1,269,028) (a)(b)(c) | | | 1,140,632 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Diversified Financial Services 12.1% (continued) | | | |

| | | Windsor Financing LLC | | | |

| $ | 1,116,910 | | 5.881%, 07/15/2017 | | | |

| | | | (Acquired 02/07/2006 and 08/03/2007, Cost $1,120,740) (a) | | $ | 1,178,418 | |

| | | | | | | 47,002,773 | |

| | | | Diversified Telecommunication Services 2.2% | | | | |

| | | | British Telecom plc | | | | |

| | 4,085,000 | | 5.950%, 01/15/2018 (b) | | | 3,553,815 | |

| | | | Comcast Cable Communications Holdings, Inc. | | | | |

| | 990,000 | | 8.375%, 03/15/2013 | | | 1,024,179 | |

| | | | Deutsche Telekom International Finance BV | | | | |

| | 1,170,000 | | 5.750%, 03/23/2016 (b) | | | 1,119,969 | |

| | | | Telecom Italia Capital | | | | |

| | 2,420,000 | | 5.250%, 11/15/2013 (b) | | | 1,845,250 | |

| | | | Telefonica Emisiones SAU | | | | |

| | 1,235,000 | | 6.221%, 07/03/2017 (b) | | | 1,216,718 | |

| | | | | | | 8,759,931 | |

| | | | Electric Utilities 3.0% | | | | |

| | | | Commonwealth Edison Co. | | | | |

| | 820,000 | | 5.950%, 08/15/2016 | | | 765,223 | |

| | 475,000 | | 6.150%, 09/15/2017 | | | 441,678 | |

| | | | Entergy Arkansas | | | | |

| | 785,000 | | 4.500%, 06/01/2010 | | | 755,959 | |

| | 1,300,000 | | 5.660%, 02/01/2025 | | | 1,086,121 | |

| | | | Entergy Gulf States Inc. | | | | |

| | 1,590,000 | | 4.875%, 11/01/2011 | | | 1,474,499 | |

| | | | Entergy Louisiana LLC | | | | |

| | 805,000 | | 5.500%, 04/01/2019 | | | 705,905 | |

| | | | Great River Energy | | | | |

| | 1,776,679 | | 5.829%, 07/01/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,758,419) (a) | | | 1,485,766 | |

| | 490,000 | | 7.233%, 07/01/2038 | | | | |

| | | | (Acquired 4/23/2008 and 12/10/2008, Cost $493,632) (a)(e) | | | 571,164 | |

| | | | Indianapolis Power & Light Co. | | | | |

| | 365,000 | | 6.300%, 07/01/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $374,495) (a) | | | 375,052 | |

| | 1,100,000 | | 6.050%, 10/01/2036 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,060,607) (a) | | | 968,231 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Electric Utilities 3.0% (continued) | | | |

| | | Mackinaw Power LLC | | | |

| $ | 965,220 | | 6.296%, 10/31/2023 | | | |

| | | | (Acquired Multiple Dates, Cost $957,844) (a) | | $ | 788,111 | |

| | | | Tenaska Gateway Partners Ltd. | | | | |

| | 578,799 | | 6.052%, 12/30/2023 | | | | |

| | | | (Acquired 05/31/2007 and 8/03/2007, Cost $578,799) (a) | | | 476,479 | |

| | | | Westar Energy Inc. | | | | |

| | 1,080,000 | | 6.000%, 07/01/2014 | | | 1,043,356 | |

| | | | | | | 10,937,544 | |

| | | | Gas Utilities 0.5% | | | | |

| | | | Alliance Pipeline U.S. | | | | |

| | 301,879 | | 4.591%, 12/31/2025 | | | | |

| | | | (Acquired Multiple Dates, Cost $298,633) (a) | | | 311,630 | |

| | | | Gulfstream Natural Gas | | | | |

| | 890,000 | | 5.560%, 11/01/2015 | | | | |

| | | | (Acquired Multiple Dates, Cost $877,035) (a) | | | 746,350 | |

| | | | Source Gas LLC | | | | |

| | 765,000 | | 5.900%, 04/01/2017 | | | | |

| | | | (Acquired Multiple Dates, Cost $743,782) (a) | | | 599,548 | |

| | | | Southern Star Cent Gas | | | | |

| | 210,000 | | 6.000%, 06/01/2016 | | | | |

| | | | (Acquired Multiple Dates, Cost $204,781) (a) | | | 168,000 | |

| | | | | | | 1,825,528 | |

| | | | Health Care Providers & Services 0.4% | | | | |

| | | | United Health Group, Inc. | | | | |

| | 560,000 | | 6.000%, 02/15/2018 | | | 516,674 | |

| | | | Wellpoint, Inc. | | | | |

| | 1,080,000 | | 5.875%, 06/15/2017 | | | 982,946 | |

| | | | | | | 1,499,620 | |

| | | | Hotels, Restaurants & Leisure 0.3% | | | | |

| | | | Harrahs Operating Co., Inc. | | | | |

| | 4,105,000 | | 1.750%, 02/01/2016 | | | | |

| | | | (Acquired Multiple Dates, Cost $2,761,587) (a) | | | 1,169,925 | |

| | 830,000 | | 5.750%, 10/01/2017 | | | 128,650 | |

| | | | | | | 1,298,575 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Household Durables 0.3% | | | |

| | | Mohawk Industries, Inc. | | | |

| $ | 1,445,000 | | 6.125%, 01/15/2016 | | $ | 1,094,606 | |

| | | | | | | | |

| | | | Insurance 4.0% | | | | |

| | | | Genworth Financial, Inc. | | | | |

| | 2,830,000 | | 5.650%, 06/15/2012 | | | 1,195,137 | |

| | | | Hartford Financial Services Group | | | | |

| | 2,230,000 | | 5.375%, 03/15/2017 | | | 1,624,488 | |

| | 2,020,000 | | 6.300%, 03/15/2018 | | | 1,531,720 | |

| | 1,350,000 | | 5.950%, 10/15/2036 | | | 860,119 | |

| | | | Hartford Life Global Funding | | | | |

| | 430,000 | | 2.096%, 03/15/2011 (c) | | | 359,187 | |

| | | | Jackson National Life Global Funding | | | | |

| | 860,000 | | 5.125%, 02/10/2011 | | | | |

| | | | (Acquired Multiple Dates, Cost $855,288) (a) | | | 796,726 | |

| | 930,000 | | 5.375%, 05/08/2013 | | | | |

| | | | (Acquired 5/01/2008 and 12/10/2008, Cost $923,508) (a) | | | 840,457 | |

| | | | Met Life Global Funding | | | | |

| | 2,165,000 | | 5.125%, 04/10/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $2,152,408) (a) | | | 2,017,258 | |

| | 1,870,000 | | 6.817%, 08/15/2018 | | | 1,780,992 | |

| | | | Monumental Global Funding | | | | |

| | 1,495,000 | | 5.254%, 01/25/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,381,158) (a) | | | 1,064,670 | |

| | 1,605,000 | | 5.500%, 04/22/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,603,112) (a) | | | 1,514,170 | |

| | | | Nationwide Life Global Fund | | | | |

| | 435,000 | | 2.296%, 02/27/2012 | | | | |

| | | | (Acquired 12/19/2008, Cost $337,697) (a)(c) | | | 337,799 | |

| | 795,000 | | 5.450%, 10/02/2012 | | | | |

| | | | (Acquired 9/25/2007 and 12/10/2008, Cost $792,710) (a) | | | 620,796 | |

| | | | Protective Life Corp. | | | | |

| | 855,000 | | 5.450%, 09/28/2012 | | | 750,126 | |

| | | | Prudential Financial Inc. | | | | |

| | 390,000 | | 5.150%, 01/15/2013 | | | 316,778 | |

| | | | | | | 15,610,423 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Media 2.3% | | | |

| | | Comcast Corp. | | | |

| $ | 1,055,000 | | 6.300%, 11/15/2017 | | $ | 1,027,036 | |

| | | | Cox Communications Inc. | | | | |

| | 1,070,000 | | 9.375%, 01/15/2019 (Acquired 12/08/2008, Cost $1,061,365) (a) | | | 1,119,542 | |

| | | | Time Warner, Inc. | | | | |

| | 1,965,000 | | 6.750%, 07/01/2018 | | | 1,891,912 | |

| | 1,010,000 | | 8.750%, 02/14/2019 | | | 1,098,208 | |

| | 1,995,000 | | 7.700%, 05/01/2032 | | | 1,997,460 | |

| | | | Viacom, Inc. | | | | |

| | 2,030,000 | | 6.250%, 04/30/2016 | | | 1,682,653 | |

| | | | | | | 8,816,811 | |

| | | | Metals & Mining 1.6% | | | | |

| | | | Alcoa Inc. | | | | |

| | 2,065,000 | | 6.000%, 07/15/2013 | | | 1,867,138 | |

| | 3,275,000 | | 6.750%, 07/15/2018 | | | 2,679,392 | |

| | | | U.S. Steel Corp. | | | | |

| | 2,240,000 | | 5.650%, 06/01/2013 | | | 1,675,433 | |

| | | | | | | 6,221,963 | |

| | | | Multi-Utilities & Unregulated Power 1.8% | | | | |

| | | | Aes Eastern Energy | | | | |

| | 720,411 | | 9.000%, 01/02/2017 | | | 682,590 | |

| | | | Borger Energy Funding | | | | |

| | 2,607,861 | | 7.260%, 12/31/2022 | | | | |

| | | | (Acquired 08/14/2008 and 12/10/2008, Cost $2,551,838) (a)(e) | | | 2,281,879 | |

| | | | Homer City Funding LLC | | | | |

| | 2,156,700 | | 8.137%, 10/01/2019 | | | 2,038,082 | |

| | | | Kern River Funding Corp. | | | | |

| | 1,197,560 | | 4.893%, 04/30/2018 | | | | |

| | | | (Acquired Multiple Dates, Cost $1,165,425) (a) | | | 940,779 | |

| | | | Kiowa Power Partners LLC | | | | |

| | 783,420 | | 4.811%, 12/30/2013 | | | | |

| | | | (Acquired Multiple Dates, Cost $778,587) (a) | | | 732,497 | |

| | | | Midwest Generation LLC | | | | |

| | 237,944 | | Series 2000, 8.300%, 07/02/2009 | | | 236,755 | |

| | | | | | | 6,912,582 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Oil, Gas & Consumable Fuels 0.7% | | | |

| | | Tennessee Gas Pipeline Co. | | | |

| $ | 1,055,000 | | 7.500%, 04/01/2017 | | $ | 930,599 | |

| | | | Valero Energy Corp. | | | | |

| | 2,395,000 | | 6.625%, 06/15/2037 | | | 1,761,530 | |

| | | | | | | 2,692,129 | |

| | | | Real Estate Investment Trusts 0.7% | | | | |

| | | | AMB Property LP | | | | |

| | 2,445,000 | | 6.300%, 06/01/2013 | | | 1,539,577 | |

| | | | Prologis Trust | | | | |

| | 1,230,000 | | 5.625%, 11/15/2016 | | | 589,959 | |

| | 1,310,000 | | 6.625%, 05/15/2018 | | | 626,603 | |

| | | | | | | 2,756,139 | |

| | | | Transportation 1.9% | | | | |

| | | | Burlington North Santa Fe | | | | |

| | 251,341 | | 6.230%, 07/02/2018 (e) | | | 255,378 | |

| | 8,648 | | 6.462%, 01/15/2021 (e) | | | 8,874 | |

| | 20,109 | | 8.251%, 01/15/2021 | | | 22,502 | |

| | 12,717 | | 5.943%, 01/15/2022 | | | 12,751 | |

| | 669,665 | | 4.830%, 01/15/2023 | | | 770,114 | |

| | 1,170,383 | | 5.996%, 04/01/2024 (e) | | | 1,171,413 | |

| | | | Chicago & North | | | | |

| | 310,750 | | 8.910%, 01/01/2015 | | | 340,474 | |

| | | | CSX Transportation, Inc. | | | | |

| | 1,060,000 | | 5.750%, 03/15/2013 | | | 995,998 | |

| | 1,991,270 | | 6.251%, 01/15/2023 | | | 1,864,638 | |

| | | | Union Pacific Corp. | | | | |

| | 1,127,760 | | 6.061%, 01/17/2023 (e) | | | 1,132,756 | |

| | 327,820 | | 5.082%, 01/02/2029 (e) | | | 308,345 | |

| | 694,595 | | 5.866%, 07/02/2030 | | | 648,849 | |

| | | | | | | 7,532,092 | |

| | | | Utilities 0.5% | | | | |

| | | | Appalachian Power Co. | | | | |

| | 1,145,000 | | 5.650%, 08/15/2012 | | | 1,086,010 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | CORPORATE BONDS 50.2% (continued) | | | |

| | | Utilities 0.5% (continued) | | | |

| | | Indiantown Cogeneration | | | |

| $ | 510,363 | | 9.260%, 12/15/2010 | | $ | 465,874 | |

| | 590,000 | | 9.770%, 12/15/2020 | | | 467,386 | |

| | | | | | | 2,019,270 | |

| | | | Total Corporate Bonds | | | | |

| | | | (Cost $230,084,720) | | | 194,529,730 | |

| | | | | | | | |

| | | | MORTGAGE BACKED SECURITIES 38.5% | | | | |

| | | | Banc of America Commercial Mortgage Inc. | | | | |

| | 4,495,000 | | Series 2006-5, Class A4, 5.414%, 09/10/2016 | | | 3,553,235 | |

| | 3,365,000 | | Series 2006-3, Class A4, 5.889%, 07/10/2044 | | | 2,742,306 | |

| | 3,385,000 | | Series 2006-1, Class A4, 5.372%, 09/10/2045 | | | 2,708,911 | |

| | 1,500,000 | | Series 2006-4, Class A4, 5.634%, 07/10/2046 | | | 1,199,704 | |

| | 3,860,000 | | Series 2007-3, Class A2, 5.659%, 06/10/2049 | | | 3,048,135 | |

| | | | Bear Stearns Commercial Mortgage Securities | | | | |

| | 1,165,000 | | Series 2005-PWR10, Class A4, 5.405%, 12/11/2040 | | | 990,728 | |

| | | | Citigroup/Deutsche Bank Commercial Mortgage Trust | | | | |

| | 3,650,000 | | Series 2006-CD2, Class A4, 5.545%, 01/15/2046 | | | 2,927,487 | |

| | 8,175,000 | | Series 2006-CD3, Class A5, 5.617%, 10/15/2048 | | | 6,511,115 | |

| | 1,845,000 | | Series 2006-C5, Class A2, 5.378%, 10/15/2049 | | | 1,526,301 | |

| | 3,945,000 | | Series 2006-C5, Class A1, 5.720%, 10/15/2049 | | | 3,092,233 | |

| | 4,130,000 | | Series 2007-CD4, Class A4, 5.322%, 12/11/2049 | | | 2,883,139 | |

| | | | CitiMortgage Alternative Loan Trust | | | | |

| | 2,055,582 | | Series 2007-A4, Class 2A1, 5.500%, 04/25/2022 | | | 1,397,154 | |

| | | | Commercial Mortgage Pass-Through Certificate | | | | |

| | 8,390,000 | | Series 2006-C7, Class A4, 5.768%, 06/10/2046 | | | 6,838,028 | |

| | | | Credit Suisse First Boston Mortgage Securities Corp. | | | | |

| | 454,446 | | Pool # 2005-10, 5.000%, 09/25/2015 | | | 375,486 | |

| | 98,272 | | Pool # 2003-1, 7.000%, 02/25/2033 | | | 91,986 | |

| | 815,000 | | Pool # 2005-C5, 5.100%, 08/15/2038 | | | 666,917 | |

| | 540,000 | | Pool # 2006-C5, 5.246%, 12/15/2039 | | | 438,996 | |

| | 2,545,000 | | Pool # 2007-C2, 5.448%, 01/15/2049 | | | 1,934,804 | |

| | | | Credit Suisse Mortgage Capital Certificates | | | | |

| | 1,140,000 | | Series 2007-C1, Class A3, 5.383%, 02/15/2040 | | | 684,141 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 38.5% (continued) | | | |

| | | CWCapital Cobalt | | | |

| $ | 3,110,000 | | Series 2007-C3, Class A4, 6.015%, 05/15/2046 (c) | | $ | 2,286,812 | |

| | 1,575,000 | | Series 2006-C1, Class A2, 5.174%, 08/15/2048 | | | 1,290,664 | |

| | | | FHLMC Remic | | | | |

| | 21,778 | | Series 2508, Class CR, 4.500%, 03/15/2016 | | | 21,772 | |

| | | | FNMA Pool | | | | |

| | 101 | | Pool # 545121, 6.500%, 08/01/2031 | | | 105 | |

| | | | FNMA Remic | | | | |

| | 83,237 | | Series 1994-3, Class PL, 5.500%, 01/25/2024 | | | 86,660 | |

| | | | GE Capital Mortgage Corporation | | | | |

| | 2,855,000 | | Series 2005-C4, Class A4, 5.333%, 11/10/2045 (c) | | | 2,365,159 | |

| | | | GMAC Commercial Mortgage Securities Inc. | | | | |

| | 2,000,000 | | Pool # 2006-C1, 5.238%, 11/10/2045 | | | 1,593,754 | |

| | 5,721 | | Pool # 2003-C1, 9.500%, 10/15/2009 | | | 5,868 | |

| | | | Greenwich Capital Commercial Funding Corp. | | | | |

| | 2,070,000 | | Series 2005-GG5, Class A5, 5.224%, 04/10/2037 | | | 1,701,132 | |

| | 795,000 | | Series 2006-GG7, Class A2, 5.914%, 07/10/2038 | | | 686,368 | |

| | 7,565,000 | | Series 2006-GG7, Class A4, 6.110%, 07/10/2038 (c) | | | 5,904,174 | |

| | 2,250,000 | | Series 2007-GG9, Class A2, 5.381%, 03/10/2039 | | | 1,773,583 | |

| | 5,485,000 | | Series 2007-GG9, Class A4, 5.444%, 03/10/2039 | | | 4,174,809 | |

| | 1,613,378 | | Series 2007-GG11, Class A1, 5.358%, 12/10/2049 | | | 1,442,898 | |

| | | | GS Mortgage Securities Corp. II | | | | |

| | 3,341,416 | | Series 2007-EOP, Class A1, 5.410%, 03/06/2020 | | | | |

| | | | (Acquired Multiple Dates, Cost $3,246,651) (a)(c) | | | 2,458,054 | |

| | | | Home Equity Mortgage Trust | | | | |

| | 1,440,000 | | 2005-5, Class A1F2, 5.150%, 04/25/2036 | | | 530,555 | |

| | 471,310 | | 2006-5, Class A1, 5.500%, 01/25/2037 | | | 110,385 | |

| | | | JP Morgan Chase Commercial Mortgage Securities Corp. | | | | |

| | 2,205,000 | | Series 2006-LDP9, Class A3, 5.336%, 05/15/2047 | | | 1,654,139 | |

| | | | LB-UBS Commercial Mortgage Trust | | | | |

| | 84,608 | | Series 2003-C, Class A2, 3.086%, 05/15/2027 | | | 84,424 | |

| | 1,545,000 | | Series 2005-C7, Class A4, 5.197%, 11/15/2030 | | | 1,275,569 | |

| | 9,300,000 | | Series 2006-C1, Class A4, 5.156%, 02/15/2031 | | | 7,383,305 | |

| | 4,170,000 | | Series 2006-C4, Class A4, 6.080%, 06/15/2038 (c) | | | 3,430,297 | |

| | 4,075,000 | | Series 2006-C6, Class A4, 5.372%, 09/15/2039 | | | 3,196,862 | |

| | 715,000 | | Series 2007-C1, Class A2, 5.318%, 02/15/2040 | | | 570,167 | |

| | 4,270,000 | | Series 2007-C2, Class A2, 5.330%, 02/15/2040 | | | 3,367,438 | |

| | 1,650,000 | | Series 2007-C1, Class A4, 5.424%, 02/15/2040 | | | 1,224,121 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | MORTGAGE BACKED SECURITIES 38.5% (continued) | | | |

| | | LB-UBS Commercial Mortgage Trust (continued) | | | |

| $ | 5,275,000 | | Series 2007-C2, Class A3, 5.430%, 02/15/2040 | | $ | 3,791,166 | |

| | 5,340,000 | | Series 2007-C3, Class A4, 6.136%, 07/15/2044 (c) | | | 4,090,672 | |

| | | | Master Alternative Loans Trust | | | | |

| | 470,515 | | Pool # 2004-6, 4.500%, 07/25/2014 | | | 410,230 | |

| | | | Master Asset Securitization Trust | | | | |

| | 440,848 | | Pool # 2004-3, 4.750%, 01/25/2014 | | | 430,378 | |

| | | | Merrill Lynch Commercial Mortgage Trust | | | | |

| | 3,500,000 | | Series 2005-LC1, Class A4, 5.291%, 01/12/2044 | | | 2,871,121 | |

| | 2,575,000 | | Series 2006-2, Class A4, 5.910%, 06/12/2046 | | | 2,063,129 | |

| | 2,440,000 | | Series 2006-3, Class A4, 5.414%, 07/12/2046 | | | 1,919,898 | |

| | 755,000 | | Series 2007-7, Class A2, 5.693%, 06/12/2050 | | | 591,127 | |

| | 1,960,000 | | Series 2007-C1, Class A2, 5.725%, 06/12/2050 | | | 1,528,071 | |

| | | | Morgan Stanley Capital I | | | | |

| | 7,610,000 | | Series 2006-IQ11, Class A4, 5.944%, 10/15/2042 | | | 6,246,334 | |

| | 260 | | Series 2007-HQ13, Class A1, 5.357%, 12/15/2044 | | | 241 | |

| | | | NYC Mortgage Loan Trust | | | | |

| | 92 | | Series 1996, 6.750%, 09/25/2019 | | | | |

| | | | (Acquired 12/10/2008, Cost $85) (a)(e) | | | 74 | |

| | | | Residential Accredit Loans, Inc. | | | | |

| | 1,523,373 | | Series 2004-QS4, Class A1, 4.350%, 03/25/2034 | | | 1,338,541 | |

| | | | Wachovia Bank Commercial Mortgage Trust | | | | |

| | 3,790,000 | | Series 2005-C22, Class A4, 5.445%, 12/15/2044 | | | 3,036,123 | |

| | 6,555,000 | | Series 2006-C23, Class A4, 5.418%, 01/15/2045 | | | 5,111,824 | |

| | 9,870,000 | | Series 2006-C24, Class A3, 5.558%, 03/15/2045 (e) | | | 7,820,818 | |

| | 1,950,000 | | Series 2006-C27, Class A3, 5.765%, 07/15/2045 | | | 1,557,488 | |

| | 1,915,000 | | Series 2007-C34, Class A3, 5.680%, 05/15/2046 | | | 1,388,462 | |

| | 5,365,000 | | Series 2007-C31, Class A2, 5.421%, 04/15/2047 | | | 4,161,692 | |

| | 6,750,000 | | Series 2006-C29, Class A4, 5.380%, 11/15/2048 | | | 5,058,389 | |

| | | | Wells Fargo Alternative Loan Trust | | | | |

| | 1,691,427 | | Series 2007-PA3, Class 6A1, 5.500%, 07/25/2037 | | | 1,065,072 | |

| | | | Wells Fargo Mortgage Backed Securities Trust | | | | |

| | 2,514,809 | | Pool # 2006-3, 5.500%, 03/25/2036 | | | 2,196,612 | |

| | | | Total Mortgage Backed Securities | | | | |

| | | | (Cost $177,238,584) | | | 148,907,342 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | INSTITUTIONAL TERM LOANS 3.1% | | | |

| | | Chrysler LLC | | | |

| $ | 10,537,450 | | 6.467%, 11/29/2013 (e) | | $ | 2,700,221 | |

| | | | Community Health Systems, Inc. | | | | |

| | 51,353 | | 7.848%, 07/02/2014 (e) | | | 39,979 | |

| | 753,081 | | 7.570%, 07/25/2014 (e) | | | 586,273 | |

| | | | Ford Motor Co. | | | | |

| | 1,195,980 | | 8.320%, 12/15/2013 | | | 479,385 | |

| | 7,654,470 | | 8.360%, 12/15/2013 (e) | | | 3,068,141 | |

| | | | General Motors Corp. | | | | |

| | 5,325,703 | | 1.375%, 11/01/2013 | | | 2,400,986 | |

| | 360,000 | | 5.059%, 11/27/2013 (e) | | | 162,299 | |

| | | | Georgia Pacific Corp. | | | | |

| | 869,159 | | 7.800%, 12/20/2012 (e) | | | 654,042 | |

| | | | HCA Inc. | | | | |

| | 825,000 | | 4.946%, 11/17/2013 (e) | | | 643,731 | |

| | 628,736 | | 8.110%, 11/17/2013 | | | 490,590 | |

| | | | Lyondell Chemical Co. | | | | |

| | 1,241,738 | | 6.396%, 12/20/2014 (e) | | | 558,782 | |

| | | | Total Loans | | | | |

| | | | (Cost $11,821,130) | | | 11,784,429 | |

| | | | | | | | |

| | | | PREFERRED STOCKS 0.1% | | | | |

| | | | Thrifts & Mortgage Finance 0.1% | | | | |

| | | | Fannie Mae | | | | |

| | 169,732 | | 8.25%, 12/31/2010 (c) | | | 140,878 | |

| | | | Freddie Mac | | | | |

| | 141,065 | | 8.375%, 12/31/2012 (c) | | | 55,015 | |

| | | | Total Preferred Stocks | | | | |

| | | | (Cost $4,155,967) | | | 195,893 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

| Principal Amount | | | | Value | |

| | | SHORT-TERM INVESTMENTS 1.9% | | | |

| | | Commercial Paper 0.4% | | | |

| $ | 1,740,000 | | US Bancorp 01/02/2009 | | $ | 1,739,999 | |

| | | | | | | | |

| | | | Variable Rate Demand Notes (d) 1.5% | | | | |

| | 5,114,460 | | U.S. Bank Demand Note, 2.233% | | | 5,114,460 | |

| | 591,524 | | Wisconsin Corporate Central Credit Union, 4.869% | | | 591,524 | |

| | | | | | | 5,705,984 | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $7,445,983) | | | 7,445,983 | |

| | | | | | | | |

| | | | Total Investments 98.6% | | | | |

| | | | (Cost $452,053,217) | | | 381,294,503 | |

| | | | | | | | |

| | | | Other Assets in Excess of Liabilities 1.4% | | | 5,492,530 | |

| | | | | | | | |

| | | | TOTAL NET ASSETS 100.0% | | $ | 386,787,033 | |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities amounted to $44,272,101 (11.4% of net assets) at December 31, 2008. |

| (b) | U.S.-dollar denominated security of foreign issuer. |

| (d) | Variable rate demand notes are considered short-term obligations and are payable upon demand. Interest rates change periodically on specified dates. The rates listed are as of December 31, 2008. |

| (e) | Security is fair valued. As of December 31, 2008, the fair value of these investments was $25,765,654 or 6.7% of total net assets. |

| (f) | Security is in default. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

SCHEDULE OF INVESTMENTS (continued)

December 31, 2008 (Unaudited)

Credit Default Swaps

| | | | | Implied | | | | | | | | | | | |

| | | | | Credit | | | (Pay)/ | | | | | | | | |

| | | | | Spread at | | | Receive | | | | | | | Unrealized | |

| | Reference | Buy/Sell | | December | | | Fixed | | Expiration | | Notional | | | Appreciation/ | |

| Counterparty | Entity | Protection(1) | | | 31, 2008(2) | | | Rate | | Date | | Amount(3) | | | (Depreciation) | |

| JP Morgan | Ford Motor | | | | | | | | | | | | | | | |

| | Credit Co. | Sell | | | 16.50% | | | | 5.15% | | 3/20/11 | | $ | 2,250,000 | | | $ | (382,146 | ) |

| JP Morgan | Dow Jones | | | | | | | | | | | | | | | | | | |

| | North | | | | | | | | | | | | | | | | | | |

| | American | | | | | | | | | | | | | | | | | | |

| | High | | | | | | | | | | | | | | | | | | |

| | Yield Index | Sell | | | 21.00% | | | | 3.25% | | 6/20/13 | | | 23,397,500 | | | | 631,910 | |

| | | | | | | | | | | | | | $ | 25,647,500 | | | $ | 249,764 | |

| (1) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (2) | Implied credit spreads, represented in absolute terms, utilized in determining the market value of credit default swap agreements on corporate issues or sovereign issues of an emerging country as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

| (3) | The maximum potential amount the Fund could be required to make as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2008 (Unaudited)

| Assets: | | | |

| Investments at value (cost $452,053,217) | | $ | 381,294,503 | |

| Cash | | | 2,236,502 | |

| Interest receivable | | | 5,051,582 | |

| Deposits with broker and custodian for swaps | | | 10,254,713 | |

| Unrealized appreciation on swaps | | | 249,764 | |

| Receivable for Fund shares sold | | | 138,630 | |

| Receivable for investments sold | | | 5,265,408 | |

| Prepaid expenses and other assets | | | 39,934 | |

| Total assets | | | 404,531,036 | |

| | | | | |

| Liabilities: | | | | |

| Payable for investments purchased | | | 11,883,371 | |

| Payable for Fund shares purchased | | | 221,521 | |

| Payable for swap agreements | | | 5,473,968 | |

| Accrued investment advisory fee | | | 80,281 | |

| Accrued expenses | | | 84,862 | |

| Total liabilities | | | 17,744,003 | |

| Net Assets | | $ | 386,787,033 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid in capital | | $ | 461,253,134 | |

| Undistributed net investment income | | | 88,526 | |

| Accumulated net realized loss on investments sold, | | | | |

| swap contracts and foreign currency | | | (4,045,677 | ) |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (70,758,714 | ) |

| Swap contracts | | | 249,764 | |

| Net Assets | | $ | 386,787,033 | |

| | | | | |

| Capital Stock, $0.01 Par Value | | | | |

| Authorized | | | 100,000,000 | |

| Issued and outstanding | | | 14,766,346 | |

| Net Asset Value, Redemption Price and Offering Price Per Share | | $ | 26.19 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENT OF OPERATIONS

| | Six Months Ended | |

| | | December 31, 2008 | |

| | | (Unaudited) | |

| Investment Income: | | | |

| Interest | | $ | 15,676,487 | |

Dividends(1) | | | 83,337 | |

| | | | 15,759,824 | |

| | | | | |

| Expenses: | | | | |

| Investment advisory fees (Note 3) | | | 841,454 | |

| Fund administration and accounting fees | | | 78,568 | |

| Custody fees | | | 26,680 | |

| Audit fees | | | 16,560 | |

| Legal fees | | | 16,192 | |

| Federal and state registration fees | | | 15,456 | |

| Shareholder servicing fees | | | 10,304 | |

| Directors’ fees and related expenses | | | 4,232 | |

| Compliance related expenses | | | 4,048 | |

| Reports to shareholders | | | 4,048 | |

| Other | | | 8,096 | |

| Total expenses before waiver | | | 1,025,638 | |

| Waiver of expenses by Adviser (Note 3) | | | (289,366 | ) |

| Net expenses | | | 736,272 | |

| Net Investment Income | | | 15,023,552 | |

| | | | | |

| Realized and Unrealized | | | | |

| Gain on Investments: | | | | |

| Realized gain on: | | | | |

| Investments | | | 1,167,437 | |

| Swap contracts | | | 570,927 | |

| Change in net unrealized appreciation/depreciation on: | | | | |

| Investments | | | (61,898,337 | ) |

| Swap contracts | | | 1,218,326 | |

| Net Realized and Unrealized | | | | |

| Loss on Investments | | | (58,941,647 | ) |

| Net Decrease in Net Assets | | | | |

| Resulting from Operations | | $ | (43,918,095 | ) |

| (1) | Net of $40 in foreign withholding taxes. |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | Six Months Ended | | | | |

| | | December 31, 2008 | | | Year Ended | |

| | | (Unaudited) | | | June 30, 2008 | |

| Operations: | | | | | | |

| Net investment income | | $ | 15,023,552 | | | $ | 21,156,499 | |

| Net realized gain on: | | | | | | | | |

| Investments | | | 1,167,437 | | | | 14,888,690 | |

| Swap contracts | | | 570,927 | | | | 513,045 | |

| Foreign currency translation | | | — | | | | 24,984 | |

| Change in net unrealized appreciation/depreciation on: | | | | | | | | |

| Investments | | | (61,898,337 | ) | | | (7,299,904 | ) |

| Swap contracts | | | 1,218,326 | | | | (1,217,325 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (43,918,095 | ) | | | 28,065,989 | |

| | | | | | | | | |

| Distributions | | | | | | | | |

| Paid From: | | | | | | | | |

| Net investment income | | | (15,903,564 | ) | | | (21,303,876 | ) |

| Net realized gain on investments | | | (9,661,730 | ) | | | (3,906,915 | ) |

| Net decrease in net assets resulting | | | | | | | | |

| from distributions paid | | | (25,565,294 | ) | | | (25,210,791 | ) |

| | | | | | | | | |

| Capital Share | | | | | | | | |

| Transactions: | | | | | | | | |

| Shares issued in connection with acquisition of | | | | | | | | |

| Columbus Core Plus Fund (see Note 7) | | | — | | | | 139,917,106 | |

| Shares sold | | | 77,915,090 | | | | 106,418,312 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of distributions | | | 21,068,888 | | | | 23,395,411 | |

| Shares redeemed | | | (76,628,400 | ) | | | (115,500,980 | ) |

| Net increase in net assets resulting | | | | | | | | |

| from capital share transactions | | | 22,355,578 | | | | 154,229,849 | |

| Total Increase (Decrease) in Net Assets | | | (47,127,811 | ) | | | 157,085,047 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 433,914,844 | | | | 276,829,797 | |

| End of period | | | | | | | | |

| (includes undistributed net investment | | | | | | | | |

| income of $88,526 and $968,538, respectively) | | $ | 386,787,033 | | | $ | 433,914,844 | |

The accompanying notes are an integral part of these financial statements.

Frontegra Columbus Core Plus Fund

FINANCIAL HIGHLIGHTS

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | December 31, | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 2008 | | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | (Unaudited) | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Net Asset Value, | | | | | | | | | | | | | | | | | | |

| Beginning of Period | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | | | $ | 30.51 | | | $ | 31.92 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (Loss) | | | | | | | | | | | | | | | | | | | | | | | | |

| from Investment | | | | | | | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 1.01 | | | | 1.48 | | | | 1.54 | | | | 1.41 | | | | 1.13 | | | | 0.99 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (3.82 | ) | | | 0.61 | | | | 0.68 | | | | (1.30 | ) | | | 0.98 | | | | (0.45 | ) |

| Total Income (Loss) from | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations | | | (2.81 | ) | | | 2.09 | | | | 2.22 | | | | 0.11 | | | | 2.11 | | | | 0.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| Paid: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (1.07 | ) | | | (1.49 | ) | | | (1.54 | ) | | | (1.45 | ) | | | (1.12 | ) | | | (0.98 | ) |

| From net realized gain on investments | | | (0.66 | ) | | | (0.27 | ) | | | — | | | | (0.44 | ) | | | — | | | | (0.97 | ) |

| Total Distributions Paid | | | (1.73 | ) | | | (1.76 | ) | | | (1.54 | ) | | | (1.89 | ) | | | (1.12 | ) | | | (1.95 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 26.19 | | | $ | 30.73 | | | $ | 30.40 | | | $ | 29.72 | | | $ | 31.50 | | | $ | 30.51 | |

| Total Return | | | (9.24 | )%(2) | | | 6.92 | % | | | 7.52 | % | | | 0.36 | % | | | 7.00 | % | | | 1.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | $ | 386,787 | | | $ | 433,915 | | | $ | 276,830 | | | $ | 313,880 | | | $ | 316,474 | | | $ | 346,733 | |

| Ratio of expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Before waivers | | | | | | | | | | | | | | | | | | | | | | | | |

| and reimbursements | | | 0.49 | %(1) | | | 0.49 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % | | | 0.51 | % |

| Net of waivers | | | | | | | | | | | | | | | | | | | | | | | | |

| and reimbursements | | | 0.35 | %(1) | | | 0.30 | % | | | 0.20 | % | | | 0.20 | % | | | 0.41 | % | | | 0.43 | % |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Before waivers | | | | | | | | | | | | | | | | | | | | | | | | |

| and reimbursements | | | 7.00 | %(1) | | | 4.68 | % | | | 4.65 | % | | | 4.29 | % | | | 3.21 | % | | | 2.63 | % |