UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07655

Driehaus Mutual Funds

(Exact name of registrant as specified in charter)

25 East Erie Street

Chicago, IL 60611

(Address of principal executive offices) (Zip code)

Janet L. McWilliams

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-587-3800

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Driehaus Mutual Funds

Trustees & Officers

Richard H. Driehaus

Trustee

A.R. Umans

Chairman of the Board

Theodore J. Beck

Trustee

Francis J. Harmon

Trustee

Dawn M. Vroegop

Trustee

Daniel F. Zemanek

Trustee

Robert H. Gordon

President

Michelle L. Cahoon

Vice President & Treasurer

Janet L. McWilliams

Assistant Vice President

Michael R. Shoemaker

Chief Compliance Officer &

Assistant Vice President

Diane J. Drake

Secretary

Michael P. Kailus

Assistant Secretary

William H. Wallace, III

Assistant Secretary

Investment Adviser

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

Distributor

Driehaus Securities LLC

25 East Erie Street

Chicago, IL 60611

Administrator

BNY Mellon Investment Servicing (US) Inc.

4400 Computer Drive

Westborough, MA 01581

Transfer Agent

BNY Mellon Investment Servicing (US) Inc.

4400 Computer Drive

Westborough, MA 01581

Custodian

The Northern Trust Company

50 South LaSalle Street

Chicago, IL 60603

Semi-Annual Report to Shareholders

June 30, 2013

Driehaus International Discovery Fund

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus International Small Cap Growth Fund

Driehaus Global Growth Fund

Driehaus Mid Cap Growth Fund

Driehaus Large Cap Growth Fund

Distributed by:

Driehaus Securities LLC

This report has been prepared for the shareholders of the Funds and is not an offering to sell or buy any Fund securities. Such offering is only made by the Funds' prospectus.

Performance Overview and Schedule of Investments: | ||||

| 1 | ||||

| 6 | ||||

| 12 | ||||

| 18 | ||||

| 23 | ||||

| 27 | ||||

| 30 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| 41 | ||||

| 48 | ||||

| 59 | ||||

PROXY VOTING POLICIES AND PROCEDURES AND PROXY VOTING RECORD

A description of the Funds’ policies and procedures with respect to the voting of proxies relating to the Funds’ portfolio securities is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Funds’ website at http://www.driehaus.com.

Information regarding how the Funds voted proxies related to portfolio securities during the 12-month period ended June 30, 2013 is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Each Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available electronically on the SEC’s website at http://www.sec.gov; hard copies may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330. Each Fund’s complete schedule of portfolio holdings is also available on the Fund’s website at http://www.driehaus.com.

Investment Philosophy:

The Adviser seeks to achieve superior investment returns primarily by investing in global companies that are currently demonstrating rapid growth in their sales and earnings and which, in its judgement, have the ability to continue or accelerate their growth rates in the future. The Adviser manages the portfolios actively (above average turnover) to ensure that the Funds are fully invested, under appropriate market conditions, in companies that meet these criteria. Investors should note that investments in overseas markets can pose more risks than U.S. investments, and the international Funds’ share prices are expected to be more volatile than those of the U.S.-only Funds. In addition, the Funds’ returns will fluctuate with changes in stock market conditions, currency values, interest rates, government regulations, and economic and political conditions in countries in which the Funds invest. These risks are generally greater when investing in emerging markets.

Semi-Annual Report to Shareholders June 30, 2013

Driehaus International Discovery Fund

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus International Small Cap Growth Fund

Driehaus Global Growth Fund

Driehaus Mid Cap Growth Fund

Driehaus Large Cap Growth Fund

Driehaus International Discovery Fund

Performance Overview (unaudited)

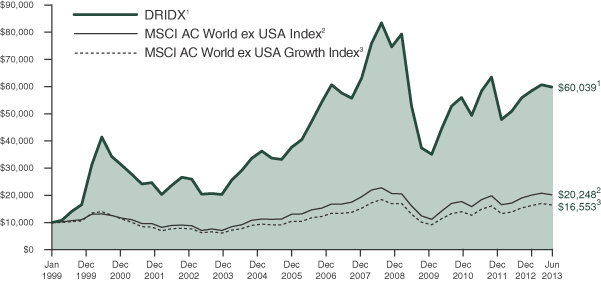

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since December 31, 1998 (the date of the Fund’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 06/30/13 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception (12/31/98 - 06/30/13) | |||||||||||||||

Driehaus International Discovery Fund (DRIDX)1 | 13.12% | 6.62% | –5.46% | 8.89% | 13.16% | |||||||||||||||

MSCI AC World ex USA Index2 | 14.14% | 8.48% | –0.34% | 9.09% | 4.98% | |||||||||||||||

MSCI AC World ex USA Growth Index3 | 14.75% | 9.08% | –0.67% | 8.63% | 3.54% | |||||||||||||||

| 1 | The returns for the periods prior to July 1, 2003, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International All Country World ex USA Index (MSCI AC World ex USA Index) is a market capitalization-weighted index designed to measure equity market performance in 44 global developed and emerging markets, excluding the U.S. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International All Country World ex USA Growth Index (MSCI AC World ex USA Growth Index) is a subset of the MSCI AC World ex USA Index and is composed only of the MSCI AC World ex USA Index stocks which are categorized as growth stocks. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

1

Driehaus International Discovery Fund

Schedule of Investments

June 30, 2013 (unaudited)

Number of Shares | Market Value (Note A) | |||||||

| EQUITY SECURITIES — 97.6% | ||||||||

| EUROPE — 46.8% | ||||||||

United Kingdom — 13.0% |

| |||||||

African Minerals, Ltd.** | 333,637 | $ | 961,614 | |||||

ARM Holdings PLC | 98,857 | 1,195,342 | ||||||

Ashtead Group PLC | 159,753 | 1,568,421 | ||||||

Associated British Foods PLC | 79,354 | 2,094,044 | ||||||

Barratt Developments PLC** | 350,295 | 1,649,500 | ||||||

Croda International PLC | 52,281 | 1,969,642 | ||||||

Halma PLC | 280,666 | 2,149,348 | ||||||

St. James’s Place PLC | 240,761 | 1,977,413 | ||||||

Subsea 7 SA | 43,927 | 770,161 | ||||||

Telecity Group PLC | 172,399 | 2,658,828 | ||||||

The Weir Group PLC | 46,328 | 1,515,659 | ||||||

Tullow Oil PLC | 102,970 | 1,567,698 | ||||||

|

| |||||||

| 20,077,670 | ||||||||

|

| |||||||

France — 7.3% |

| |||||||

Casino Guichard Perrachon SA | 20,554 | 1,925,483 | ||||||

Edenred | 53,071 | 1,623,368 | ||||||

Eurofins Scientific | 7,769 | 1,641,253 | ||||||

Ingenico SA | 27,002 | 1,799,524 | ||||||

Safran SA | 53,704 | 2,804,875 | ||||||

Sanofi | 15,105 | 1,565,434 | ||||||

|

| |||||||

| 11,359,937 | ||||||||

|

| |||||||

Switzerland — 5.8% |

| |||||||

Cie Financiere Richemont SA — A | 17,466 | 1,544,952 | ||||||

Glencore Xstrata PLC | 477,598 | 1,976,917 | ||||||

Partners Group Holding AG | 9,960 | 2,696,808 | ||||||

Roche Holding AG | 3,314 | 824,509 | ||||||

Temenos Group AG | 80,487 | 1,968,397 | ||||||

|

| |||||||

| 9,011,583 | ||||||||

|

| |||||||

Netherlands — 4.7% |

| |||||||

ASML Holding NV | 9,798 | 773,117 | ||||||

Core Laboratories NV | 10,176 | 1,543,292 | ||||||

LyondellBasell Industries NV — A | 50,171 | 3,324,330 | ||||||

Sensata Technologies Holding NV** | 47,243 | 1,648,781 | ||||||

|

| |||||||

| 7,289,520 | ||||||||

|

| |||||||

Norway — 4.4% |

| |||||||

Gjensidige Forsikring ASA | 156,960 | 2,308,786 | ||||||

Seadrill, Ltd. | 62,389 | 2,518,423 | ||||||

Telenor ASA | 96,213 | 1,907,043 | ||||||

|

| |||||||

| 6,734,252 | ||||||||

|

| |||||||

Ireland — 4.2% |

| |||||||

Covidien PLC | 17,843 | 1,121,254 | ||||||

Eaton Corp. PLC | 35,514 | 2,337,176 | ||||||

Experian PLC | 110,336 | 1,918,143 | ||||||

Jazz Pharmaceuticals PLC** | 16,282 | 1,119,062 | ||||||

|

| |||||||

| 6,495,635 | ||||||||

|

| |||||||

Number of Shares | Market Value (Note A) | |||||||

Denmark — 4.1% |

| |||||||

Christian Hansen Holding AS | 46,369 | $ | 1,587,686 | |||||

Danske Bank AS** | 133,811 | 2,288,525 | ||||||

GN Store Nord AS | 91,481 | 1,729,009 | ||||||

Novo Nordisk AS — B | 4,932 | 768,621 | ||||||

|

| |||||||

| 6,373,841 | ||||||||

|

| |||||||

Germany — 2.0% |

| |||||||

Hugo Boss AG | 14,113 | 1,554,109 | ||||||

SAP AG — SP ADR | 21,299 | 1,551,206 | ||||||

|

| |||||||

| 3,105,315 | ||||||||

|

| |||||||

Italy — 0.8% |

| |||||||

Gtech SpA | 46,769 | 1,170,656 | ||||||

Spain — 0.5% |

| |||||||

Viscofan SA | 15,559 | 779,509 | ||||||

|

| |||||||

Total EUROPE | 72,397,918 | |||||||

|

| |||||||

| FAR EAST — 39.9% | ||||||||

Japan — 20.3% |

| |||||||

Anritsu Corp. | 128,501 | 1,522,370 | ||||||

Astellas Pharma, Inc. | 47,969 | 2,606,906 | ||||||

Calbee, Inc. | 19,973 | 1,894,998 | ||||||

Daikin Industries, Ltd. | 33,212 | 1,342,812 | ||||||

Denso Corp. | 26,893 | 1,264,931 | ||||||

Dentsu, Inc. | 23,637 | 817,452 | ||||||

Fuyo General Lease Co., Ltd. | 29,468 | 1,100,816 | ||||||

Hulic Co., Ltd. | 233,145 | 2,501,172 | ||||||

Japan Tobacco, Inc. | 67,868 | 2,398,441 | ||||||

JTEKT Corp. | 138,139 | 1,554,377 | ||||||

M3, Inc. | 939 | 2,109,389 | ||||||

Modec, Inc. | 32,654 | 952,820 | ||||||

MonotaRO Co., Ltd. | 64,560 | 1,573,316 | ||||||

Nomura Holdings, Inc. | 187,071 | 1,378,795 | ||||||

Rinnai Corp. | 16,268 | 1,158,017 | ||||||

Sawai Pharmaceutical Co., Ltd. | 13,273 | 1,585,854 | ||||||

Sugi Holdings Co., Ltd. | 45,712 | 1,737,591 | ||||||

Sysmex Corp. | 11,880 | 777,387 | ||||||

Taiyo Yuden Co., Ltd. | 53,228 | 810,925 | ||||||

Tokio Marine Holdings, Inc. | 72,689 | 2,304,970 | ||||||

|

| |||||||

| 31,393,339 | ||||||||

|

| |||||||

China — 5.9% |

| |||||||

AIA Group, Ltd. | 759,068 | 3,214,959 | ||||||

Michael Kors Holdings, Ltd.** | 12,858 | 797,453 | ||||||

New Oriental Education & Technology Group, Inc. — SP ADR | 78,662 | 1,742,363 | ||||||

Sands China, Ltd. | 468,487 | 2,207,722 | ||||||

Techtronic Industries Co. | 485,471 | 1,161,718 | ||||||

|

| |||||||

| 9,124,215 | ||||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

2

Driehaus International Discovery Fund

Schedule of Investments

June 30, 2013 (unaudited)

Number of Shares | Market Value (Note A) | |||||||

Philippines — 3.3% |

| |||||||

Puregold Price Club, Inc. | 2,876,785 | $ | 2,417,298 | |||||

SM Investments Corp. | 51,483 | 1,275,158 | ||||||

Universal Robina Corp. | 510,519 | 1,477,196 | ||||||

|

| |||||||

| 5,169,652 | ||||||||

|

| |||||||

Malaysia — 3.1% |

| |||||||

Astro Malaysia Holdings BHD | 1,587,055 | 1,522,006 | ||||||

IHH Healthcare BHD** | 1,272,908 | 1,591,387 | ||||||

Malayan Banking BHD | 485,274 | 1,597,357 | ||||||

|

| |||||||

| 4,710,750 | ||||||||

|

| |||||||

Taiwan — 1.8% |

| |||||||

Chailease Holding Co., Ltd. | 342,000 | 807,901 | ||||||

St. Shine Optical Co., Ltd. | 76,099 | 1,977,949 | ||||||

|

| |||||||

| 2,785,850 | ||||||||

|

| |||||||

Singapore — 1.6% |

| |||||||

Global Logistic Properties, Ltd. | 1,127,031 | 2,445,235 | ||||||

Indonesia — 1.4% |

| |||||||

PT Perusahaan Gas Negara Persero Tbk | 3,613,086 | 2,093,224 | ||||||

Thailand — 1.0% |

| |||||||

Minor International PCL — NVDR | 2,013,574 | 1,610,080 | ||||||

South Korea — 1.0% |

| |||||||

Samsung Electronics Co., Ltd. | 1,324 | 1,555,806 | ||||||

Australia — 0.5% |

| |||||||

CSL, Ltd. | 14,358 | 808,616 | ||||||

|

| |||||||

Total FAR EAST | 61,696,767 | |||||||

|

| |||||||

| NORTH AMERICA — 7.3% | ||||||||

Mexico — 3.7% |

| |||||||

Bolsa Mexicana de Valores SAB de CV | 474,100 | 1,178,897 | ||||||

Fibra Uno Administracion SA de CV — REIT | 927,650 | 3,114,969 | ||||||

Genomma Lab Internacional SAB de CV — B** | 738,660 | 1,458,798 | ||||||

|

| |||||||

| 5,752,664 | ||||||||

|

| |||||||

Canada — 2.9% |

| |||||||

Dollarama, Inc. | 33,352 | 2,334,355 | ||||||

Pacific Rubiales Energy Corp. | 77,512 | 1,367,165 | ||||||

Trilogy Energy Corp. | 28,200 | 841,951 | ||||||

|

| |||||||

| 4,543,471 | ||||||||

|

| |||||||

United States — 0.7% |

| |||||||

Catamaran Corp.** | 21,501 | 1,047,529 | ||||||

|

| |||||||

Total NORTH AMERICA | 11,343,664 | |||||||

|

| |||||||

Number of Shares | Market Value (Note A) | |||||||

| SOUTH AMERICA — 3.6% | ||||||||

Brazil — 1.6% |

| |||||||

Anhanguera Educacional Participacoes SA | 243,018 | $ | 1,422,374 | |||||

Brasil Pharma SA | 224,022 | 1,008,995 | ||||||

|

| |||||||

| 2,431,369 | ||||||||

|

| |||||||

Chile — 1.1% |

| |||||||

SACI Falabella | 151,988 | 1,645,377 | ||||||

Peru — 0.9% |

| |||||||

Credicorp, Ltd. | 10,916 | 1,396,811 | ||||||

|

| |||||||

Total SOUTH AMERICA | 5,473,557 | |||||||

|

| |||||||

Total EQUITY SECURITIES (Cost $137,910,901) | 150,911,906 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS | 97.6 | % | 150,911,906 | |||||

Other Assets In Excess Of Liabilities | 2.4 | % | 3,760,538 | |||||

|

|

|

| |||||

| Net Assets | 100.0 | % | $ | 154,672,444 | ||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

| Basis: | $ | 138,120,986 | ||

|

| |||

| Gross Appreciation | $ | 17,047,789 | ||

| Gross Depreciation | (4,256,869 | ) | ||

|

| |||

Net Appreciation | $ | 12,790,920 | ||

|

|

** Non-income producing security

NVDR — Non-Voting Depository Receipt

REIT — Real Estate Investment Trust

SP ADR — Sponsored American Depository Receipt

Notes to Financial Statements are an integral part of this Schedule.

3

Driehaus International Discovery Fund

Schedule of Investments

June 30, 2013 (unaudited)

Regional Weightings*

Western Europe | 46.8% | |||

Japan | 20.3% | |||

Asia/Far East Ex-Japan | 19.6% | |||

North America | 7.3% | |||

South America | 3.6% |

Top Ten Holdings*

LyondellBasell Industries NV — A | 2.1% | |||

AIA Group, Ltd. | 2.1% | |||

Fibra Uno Administracion SA de CV — REIT | 2.0% | |||

Safran SA | 1.8% | |||

Partners Group Holding AG | 1.7% | |||

Telecity Group PLC | 1.7% | |||

Astellas Pharma, Inc. | 1.7% | |||

Seadrill, Ltd. | 1.6% | |||

Hulic Co., Ltd. | 1.6% | |||

Global Logistic Properties, Ltd. | 1.6% |

| * | All percentages are stated as a percent of net assets at June 30, 2013. |

Notes to Financial Statements are an integral part of this Schedule.

4

Driehaus International Discovery Fund

Schedule of Investments

June 30, 2013 (unaudited)

Industry | Percent of Net Assets | |||

Aerospace & Defense | 1.8% | |||

Auto Components | 0.8% | |||

Biotechnology | 0.5% | |||

Building Products | 0.9% | |||

Capital Markets | 2.6% | |||

Chemicals | 4.5% | |||

Commercial Banks | 3.4% | |||

Commercial Services & Supplies | 1.1% | |||

Diversified Consumer Services | 2.1% | |||

Diversified Financial Services | 2.0% | |||

Diversified Telecommunications | 1.2% | |||

Electrical Equipment | 2.6% | |||

Electronic Equipment, Instruments & Components | 4.1% | |||

Energy Equipment & Services | 3.7% | |||

Food & Staples Retailing | 4.6% | |||

Food Products | 4.0% | |||

Gas Utilities | 1.4% | |||

Health Care Equipment & Supplies | 3.6% | |||

Health Care Providers & Services | 1.7% | |||

Health Care Technology | 1.4% | |||

Hotels, Restaurants & Leisure | 3.2% | |||

Industry | Percent of Net Assets | |||

Household Durables | 2.6% | |||

Industrial Conglomerates | 0.8% | |||

Insurance | 6.3% | |||

Internet Software & Services | 1.7% | |||

Life Sciences Tools & Services | 1.1% | |||

Machinery | 2.0% | |||

Media | 1.5% | |||

Metals & Mining | 1.9% | |||

Multiline Retail | 2.6% | |||

Oil, Gas & Consumable Fuels | 2.4% | |||

Pharmaceuticals | 6.4% | |||

Professional Services | 1.2% | |||

Real Estate Investment Trusts | 2.0% | |||

Real Estate Management & Development | 3.2% | |||

Semiconductors & Semiconductor Equipment | 2.3% | |||

Software | 2.3% | |||

Textiles, Apparel & Luxury Goods | 2.5% | |||

Tobacco | 1.6% | |||

Trading Companies & Distributors | 2.0% | |||

Other Assets in Excess of Liabilities | 2.4% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

5

Driehaus Emerging Markets Growth Fund

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since December 31, 1997 (the date of the Fund’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 06/30/13 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception (12/31/97 - 06/30/13) | |||||||||||||||

Driehaus Emerging Markets Growth Fund (DREGX)1 | 15.17% | 9.24% | 2.60% | 16.44% | 13.73% | |||||||||||||||

MSCI Emerging Markets Index2 | 3.23% | 3.72% | –0.11% | 14.02% | 8.24% | |||||||||||||||

MSCI Emerging Markets Growth Index3 | 7.17% | 5.26% | –0.22% | 12.89% | 7.44% | |||||||||||||||

| 1 | The returns for the periods prior to July 1, 2003, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index (MSCI Emerging Markets Index) is a market capitalization-weighted index designed to measure equity market performance in 21 global emerging markets. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Growth Index (MSCI Emerging Markets Growth Index) is a subset of the MSCI Emerging Markets Index and includes only the MSCI Emerging Markets Index stocks which are categorized as growth stocks. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

6

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

| EQUITY SECURITIES — 91.9% | ||||||||

| FAR EAST — 52.5% | ||||||||

China — 17.1% |

| |||||||

AIA Group, Ltd. | 7,560,310 | $ | 32,020,962 | |||||

Anton Oilfield Services Group | 7,134,101 | 5,150,942 | ||||||

Biostime International Holdings, Ltd. | 436,901 | 2,450,370 | ||||||

China Suntien Green Energy Corp., Ltd. — H | 2,374,134 | 869,327 | ||||||

CIMC Enric Holdings, Ltd. | 11,929,117 | 18,548,765 | ||||||

CITIC Securities Co., Ltd. — H | 4,995,132 | 8,874,739 | ||||||

ENN Energy Holdings, Ltd. | 2,241,708 | 11,951,267 | ||||||

Galaxy Entertainment Group, Ltd.** | 2,470,000 | 12,101,521 | ||||||

Hengan International Group Co., Ltd. | 1,093,337 | 11,911,601 | ||||||

HSBC Holdings PLC | 1,560,800 | 16,350,462 | ||||||

Industrial & Commercial Bank of China, Ltd. — H | 7,670,136 | 4,835,833 | ||||||

New Oriental Education & Technology Group, Inc. — SP ADR | 738,890 | 16,366,414 | ||||||

Sands China, Ltd. | 4,605,809 | 21,704,646 | ||||||

Techtronic Industries Co. | 3,703,634 | 8,862,687 | ||||||

Tencent Holdings, Ltd. | 691,600 | 27,125,240 | ||||||

Termbray Petro-King Oilfield Services, Ltd.** | 6,019,053 | 3,957,836 | ||||||

|

| |||||||

| 203,082,612 | ||||||||

|

| |||||||

India — 10.0% |

| |||||||

Ambuja Cements, Ltd. | 1,723,607 | 5,419,537 | ||||||

HCL Technologies, Ltd. | 1,008,168 | 13,165,139 | ||||||

HDFC Bank, Ltd. | 1,601,377 | 18,041,597 | ||||||

ITC, Ltd. | 2,439,535 | 13,315,325 | ||||||

Lupin, Ltd. | 501,745 | 6,598,042 | ||||||

Oil & Natural Gas Corp., Ltd.** | 2,085,450 | 11,619,562 | ||||||

Sun Pharmaceutical Industries, Ltd. | 743,063 | 12,648,639 | ||||||

Tata Motors, Ltd. | 1,416,458 | 6,705,084 | ||||||

Tech Mahindra, Ltd. | 672,449 | 11,992,620 | ||||||

Ultratech Cement, Ltd. | 185,722 | 5,866,221 | ||||||

Zee Entertainment Enterprises, Ltd. | 3,503,175 | 13,915,431 | ||||||

|

| |||||||

| 119,287,197 | ||||||||

|

| |||||||

| Number of Shares | Market Value (Note A) | |||||||

Taiwan — 7.4% |

| |||||||

Delta Electronics, Inc. | 736,000 | $ | 3,352,040 | |||||

E.Sun Financial Holding Co., Ltd. | 16,479,000 | 10,061,917 | ||||||

Ginko International Co., Ltd. | 573,000 | 9,673,951 | ||||||

Hermes Microvision, Inc. | 174,000 | 4,992,826 | ||||||

MediaTek, Inc. | 1,058,000 | 12,302,326 | ||||||

Siliconware Precision Industries Co. — SP ADR | 997,349 | 6,253,378 | ||||||

St. Shine Optical Co., Ltd. | 288,000 | 7,485,636 | ||||||

Taiwan Mobile Co., Ltd. | 1,731,000 | 6,844,066 | ||||||

Taiwan Semiconductor Manufacturing Co., Ltd. — SP ADR | 1,474,284 | 27,008,883 | ||||||

|

| |||||||

| 87,975,023 | ||||||||

|

| |||||||

South Korea — 6.1% |

| |||||||

Cheil Worldwide, Inc.** | 198,844 | 4,283,142 | ||||||

Grand Korea Leisure Co., Ltd. | 110,768 | 3,433,464 | ||||||

Kia Motors Corp. | 374,547 | 20,366,331 | ||||||

Kolao Holdings | 30,264 | 780,417 | ||||||

KT Skylife Co., Ltd. | 73,461 | 2,425,007 | ||||||

Samsung Electronics Co., Ltd. | 25,012 | 29,391,098 | ||||||

Samsung Life Insurance Co., Ltd. | 77,234 | 7,303,771 | ||||||

Sung Kwang Bend Co., Ltd. | 215,589 | 4,964,748 | ||||||

|

| |||||||

| 72,947,978 | ||||||||

|

| |||||||

Philippines — 3.2% |

| |||||||

Ayala Land, Inc. | 11,220,593 | 7,895,973 | ||||||

Bank of Philippine Islands | 1,849,307 | 4,109,571 | ||||||

International Container Terminal Services, Inc. | 2,830,393 | 5,700,097 | ||||||

Philippine Long Distance Telephone Co. | 81,089 | 5,518,557 | ||||||

Puregold Price Club, Inc. | 4,743,741 | 3,986,060 | ||||||

SM Prime Holdings, Inc. | 14,622,583 | 5,517,317 | ||||||

Universal Robina Corp. | 1,843,390 | 5,333,883 | ||||||

|

| |||||||

| 38,061,458 | ||||||||

|

| |||||||

Malaysia — 2.6% |

| |||||||

IHH Healthcare BHD** | 5,237,340 | 6,547,711 | ||||||

Malayan Banking BHD | 4,351,461 | 14,323,530 | ||||||

Sapurakencana Petroleum BHD** | 8,047,300 | 10,417,299 | ||||||

|

| |||||||

| 31,288,540 | ||||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

7

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

Indonesia — 1.8% |

| |||||||

PT Jasa Marga Persero Tbk | 6,967,008 | $ | 4,246,892 | |||||

PT Perusahaan Gas Negara Persero Tbk | 13,425,325 | 7,777,896 | ||||||

PT Telekomunikasi Indonesia Persero Tbk | 7,954,661 | 9,016,618 | ||||||

|

| |||||||

| 21,041,406 | ||||||||

|

| |||||||

Thailand — 1.7% |

| |||||||

Kasikornbank PCL — NVDR | 2,219,289 | 13,667,071 | ||||||

VGI Global Media PCL — NVDR | 1,609,721 | 6,176,263 | ||||||

|

| |||||||

| 19,843,334 | ||||||||

|

| |||||||

Singapore — 1.6% |

| |||||||

Global Logistic Properties, Ltd. | 9,038,000 | 19,609,073 | ||||||

Cambodia — 0.7% |

| |||||||

NagaCorp, Ltd. | 10,433,884 | 8,138,808 | ||||||

Vietnam — 0.3% |

| |||||||

Masan Group Corp.** | 766,850 | 3,218,564 | ||||||

|

| |||||||

Total FAR EAST | 624,493,993 | |||||||

|

| |||||||

| EUROPE — 13.9% | ||||||||

Russia — 6.3% |

| |||||||

Eurasia Drilling Co., Ltd. — GDR | 326,298 | 12,180,704 | ||||||

Magnit — SP GDR | 477,847 | 27,332,848 | ||||||

MegaFon — GDR | 295,421 | 9,231,906 | ||||||

NovaTek — SP GDR | 106,574 | 12,735,593 | ||||||

Sberbank RF — SP ADR | 1,126,516 | 12,831,017 | ||||||

|

| |||||||

| 74,312,068 | ||||||||

|

| |||||||

Netherlands — 2.7% |

| |||||||

LyondellBasell Industries NV — A | 230,387 | 15,265,443 | ||||||

Yandex NV** | 621,167 | 17,162,844 | ||||||

|

| |||||||

| 32,428,287 | ||||||||

|

| |||||||

Turkey — 2.3% |

| |||||||

Aselsan Elektronik Sanayi Ve Ticaret AS | 744,106 | 3,271,644 | ||||||

Ford Otomotiv Sanayi AS | 387,903 | 5,349,831 | ||||||

Otokar Otomotiv Ve Savunma Sanayi AS | 93,864 | 3,272,854 | ||||||

Turk Hava Yollari | 3,151,473 | 12,254,911 | ||||||

Turk Traktor ve Ziraat Makineleri AS | 99,133 | 3,495,123 | ||||||

|

| |||||||

| 27,644,363 | ||||||||

|

| |||||||

| Number of Shares | Market Value (Note A) | |||||||

United Kingdom — 0.9% |

| |||||||

BHP Billiton PLC | 217,735 | $ | 5,570,212 | |||||

Hikma Pharmaceuticals PLC | 393,419 | 5,690,538 | ||||||

|

| |||||||

| 11,260,750 | ||||||||

|

| |||||||

Switzerland — 0.6% |

| |||||||

Cie Financiere Richemont SA — A | 81,656 | 7,222,867 | ||||||

Hungary — 0.6% |

| |||||||

OTP Bank PLC | 336,630 | 7,064,094 | ||||||

France — 0.5% |

| |||||||

Sanofi | 55,852 | 5,788,322 | ||||||

|

| |||||||

Total EUROPE | 165,720,751 | |||||||

|

| |||||||

| SOUTH AMERICA — 10.3% | ||||||||

Brazil — 6.4% |

| |||||||

Brasil Insurance Participacoes e Administracao SA | 931,037 | 9,150,354 | ||||||

BRF SA | 368,200 | 7,955,239 | ||||||

Cyrela Brazil Realty SA Empreendimentos e Participacoes | 690,800 | 4,745,990 | ||||||

Estacio Participacoes SA | 1,313,500 | 9,500,925 | ||||||

Itau Unibanco Holding SA — Pref. | 891,200 | 11,510,693 | ||||||

Kroton Educacional SA | 438,781 | 6,074,325 | ||||||

Linx SA | 139,551 | 2,335,283 | ||||||

Ultrapar Participacoes SA | 600,600 | 14,338,388 | ||||||

Vale SA — Pref. | 925,700 | 11,221,989 | ||||||

|

| |||||||

| 76,833,186 | ||||||||

|

| |||||||

Argentina — 1.3% |

| |||||||

MercadoLibre, Inc. | 139,186 | 14,998,683 | ||||||

Peru — 1.2% |

| |||||||

Credicorp, Ltd. | 86,350 | 11,049,346 | ||||||

Ferreycorp SAA | 4,143,692 | 3,127,877 | ||||||

|

| |||||||

| 14,177,223 | ||||||||

|

| |||||||

Chile — 0.8% |

| |||||||

SACI Falabella | 874,220 | 9,464,049 | ||||||

Colombia — 0.6% |

| |||||||

Cementos Argos SA — Pref.** | 1,635,684 | 6,877,468 | ||||||

|

| |||||||

Total SOUTH AMERICA | 122,350,609 | |||||||

|

| |||||||

| NORTH AMERICA — 9.2% | ||||||||

Mexico — 6.9% |

| |||||||

Cemex SAB de CV** | 12,631,782 | 13,394,664 | ||||||

Corp Inmobiliaria Vesta SAB de CV | 1,585,723 | 3,145,147 | ||||||

El Puerto de Liverpool SAB de CV | 1,504,803 | 17,804,533 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

8

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

Fibra Uno Administracion SA de CV — REIT | 3,585,666 | $ | 12,040,357 | |||||

Fomento Economico Mexicano SAB de CV — SP ADR | 90,764 | 9,365,937 | ||||||

Grupo Aeroportuario del Centro Norte SAB de CV | 918,789 | 3,013,597 | ||||||

Grupo Financiero Banorte SAB de CV — O | 1,828,265 | 10,920,954 | ||||||

Infraestructura Energetica Nova SAB de CV** | 3,375,204 | 12,214,079 | ||||||

|

| |||||||

| 81,899,268 | ||||||||

|

| |||||||

United States — 1.3% |

| |||||||

Mead Johnson Nutrition Co. | 124,828 | 9,890,122 | ||||||

Samsonite International SA | 2,456,208 | 5,915,636 | ||||||

|

| |||||||

| 15,805,758 | ||||||||

|

| |||||||

Canada — 1.0% |

| |||||||

Gran Tierra Energy, Inc.** | 1,881,974 | 11,488,327 | ||||||

|

| |||||||

Total NORTH AMERICA | 109,193,353 | |||||||

|

| |||||||

| MIDDLE EAST — 3.9% | ||||||||

Qatar — 1.8% |

| |||||||

Industries Qatar QSC | 201,798 | 8,785,876 | ||||||

Qatar National Bank SAQ | 279,583 | 12,210,877 | ||||||

|

| |||||||

| 20,996,753 | ||||||||

|

| |||||||

United Arab Emirates — 1.6% |

| |||||||

Al Noor Hospitals Group PLC** | 1,207,206 | 11,631,762 | ||||||

Emaar Properties PJSC | 5,298,827 | 7,501,743 | ||||||

|

| |||||||

| 19,133,505 | ||||||||

|

| |||||||

Pakistan — 0.5% |

| |||||||

Engro Foods, Ltd.** | 4,270,802 | 6,042,219 | ||||||

|

| |||||||

Total MIDDLE EAST | 46,172,477 | |||||||

|

| |||||||

| AFRICA — 2.1% | ||||||||

South Africa — 2.1% |

| |||||||

MTN Group, Ltd. | 468,272 | 8,716,400 | ||||||

Naspers, Ltd.— N | 124,807 | 9,216,859 | ||||||

Woolworths Holdings, Ltd. | 1,093,637 | 7,126,030 | ||||||

|

| |||||||

| 25,059,289 | ||||||||

|

| |||||||

Total AFRICA | 25,059,289 | |||||||

|

| |||||||

Total EQUITY SECURITIES | 1,092,990,472 | |||||||

|

| |||||||

| ||||||||

| Number of Shares | Market Value (Note A) | |||||||

| EQUITY CERTIFICATES — 2.5% | ||||||||

| MIDDLE EAST — 2.5% | ||||||||

Saudi Arabia — 2.5% |

| |||||||

Etihad Etisalat Co.† | 924,850 | $ | 19,605,513 | |||||

Samba Financial Group† | 825,314 | 10,871,412 | ||||||

|

| |||||||

| 30,476,925 | ||||||||

|

| |||||||

Total MIDDLE EAST | 30,476,925 | |||||||

|

| |||||||

Total EQUITY CERTIFICATES | 30,476,925 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS (COST $1,046,046,667) | 94.4 | % | $ | 1,123,467,397 | ||||

Other Assets In Excess Of Liabilities | 5.6 | % | 66,196,264 | |||||

|

|

|

| |||||

| Net Assets | 100.0 | % | $ | 1,189,663,661 | ||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

| Basis: | $ | 1,050,404,262 | ||

|

| |||

| Gross Appreciation | $ | 106,581,485 | ||

| Gross Depreciation | (33,518,350 | ) | ||

|

| |||

Net Appreciation | $ | 73,063,135 | ||

|

|

| ** | Non-income producing security |

| † | Restricted security — Investments in securities not registered under the Securities Act of 1933, excluding 144A securities. At June 30, 2013, the value of these restricted securities amounted to $30,476,925 or 2.5% of net assets. |

Additional information on each restricted security is as follows (see Note A in Notes to Financial Statements):

Security | Counter- party | Acquisition Date(s) | Acquisition Cost | |||||||||

Etihad Etisalat Co. | MSCO | | 08/27/12 to 04/22/13 | | $ | 17,086,743 | ||||||

Samba Financial Group | MSCO | | 03/26/13 to 06/03/13 | | $ | 10,290,410 | ||||||

GDR — Global Depository Receipt

MSCO — Morgan Stanley

NVDR — Non-Voting Depository Receipt

REIT — Real Estate Investment Trust

SP ADR — Sponsored American Depository Receipt

SP GDR — Sponsored Global Depository Receipt

Notes to Financial Statements are an integral part of this Schedule.

9

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Regional Weightings*

Asia/Far East-Ex Japan | 52.5% | |||

South America | 10.3% | |||

North America | 9.2% | |||

Eastern Europe | 9.2% | |||

Middle East | 6.4% | |||

Western Europe | 4.7% | |||

Africa | 2.1% |

Top Ten Holdings*

AIA Group, Ltd. | 2.7% | |||

Samsung Electronics Co., Ltd. | 2.5% | |||

Magnit — SP GDR | 2.3% | |||

Tencent Holdings, Ltd. | 2.3% | |||

Taiwan Semiconductor Manufacturing Co., Ltd. — SP ADR | 2.3% | |||

Sands China, Ltd. | 1.8% | |||

Kia Motors Corp. | 1.7% | |||

Global Logistic Properties, Ltd. | 1.6% | |||

Etihad Etisalat Co. | 1.6% | |||

CIMC Enric Holdings, Ltd. | 1.6% |

| * | All percentages are stated as a percent of net assets at June 30, 2013. |

Notes to Financial Statements are an integral part of this Schedule.

10

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Industry | Percent of Net Assets | |||

Aerospace & Defense | 0.3% | |||

Airlines | 1.0% | |||

Automobiles | 2.7% | |||

Beverages | 0.8% | |||

Buliding Products | 0.4% | |||

Capital Markets | 0.7% | |||

Chemicals | 1.3% | |||

Commercial Banks | 13.3% | |||

Construction Materials | 2.7% | |||

Diversified Consumer Services | 2.7% | |||

Diversified Telecommunications | 0.8% | |||

Electronic Equipment, Instruments & Components | 0.3% | |||

Energy Equipment & Services | 2.7% | |||

Food & Staples Retailing | 2.6% | |||

Food Products | 2.9% | |||

Gas Utilities | 2.7% | |||

Health Care Equipment & Supplies | 1.4% | |||

Health Care Providers & Services | 1.5% | |||

Hotels, Restaurants & Leisure | 3.8% | |||

Household Durables | 1.1% | |||

Industrial Conglomerates | 0.7% | |||

Industry | Percent of Net Assets | |||

Insurance | 4.1% | |||

Internet Software & Services | 5.0% | |||

IT Services | 2.1% | |||

Machinery | 2.4% | |||

Media | 3.0% | |||

Metals & Mining | 1.4% | |||

Multiline Retail | 2.9% | |||

Oil, Gas & Consumable Fuels | 4.3% | |||

Personal Products | 1.0% | |||

Pharmaceuticals | 2.6% | |||

Real Estate Investment Trusts | 1.0% | |||

Real Estate Management & Development | 3.7% | |||

Semiconductors & Semiconductor Equipment | 6.7% | |||

Software | 0.2% | |||

Specialty Retail | 0.1% | |||

Textiles, Apparel & Luxury Goods | 1.1% | |||

Tobacco | 1.1% | |||

Transportation Infrastructure | 1.1% | |||

Wireless Telecommunication Services | 4.2% | |||

Other Assets in Excess of Liabilities | 5.6% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

11

Driehaus Emerging Markets Small Cap Growth Fund

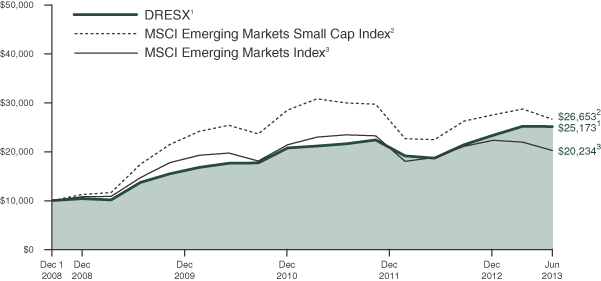

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since December 1, 2008 (the date of the Predecessor Limited Partnership’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership | |||||||||||||||

| Average Annual Total Returns as of 06/30/13 | 1 Year | Since Inception (08/22/11 - 06/30/13) | 3 Years | Since Inception (12/01/08 - 06/30/13) | ||||||||||||

Driehaus Emerging Markets Small Cap Growth | 28.54% | 11.40% | 12.36% | 22.33% | ||||||||||||

MSCI Emerging Markets Small Cap Index2 | 10.22% | 1.11% | 4.02% | 23.85% | ||||||||||||

MSCI Emerging Markets Index3 | 3.23% | 1.19% | 3.72% | 16.62% | ||||||||||||

| 1 | The Driehaus Emerging Markets Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Emerging Markets Small Cap Growth Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on December 1, 2008, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on August 22, 2011. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Small Cap Index (MSCI Emerging Markets Small Cap Index) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in 21 global emerging markets. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Index (MSCI Emerging Markets Index) is a market capitalization weighted index designed to measure equity market performance in 21 global emerging markets. Data is in U.S. dollars. Source: Morgan Stanley Capital International Inc. |

12

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

| EQUITY SECURITIES — 79.0% | ||||||||

| FAR EAST — 47.6% | ||||||||

China — 16.8% |

| |||||||

Ajisen China Holdings, Ltd. | 1,530,000 | $ | 1,197,401 | |||||

Anton Oilfield Services Group | 2,652,000 | 1,914,789 | ||||||

Biostime International Holdings, Ltd. | 251,000 | 1,407,740 | ||||||

Bonjour Holdings, Ltd. | 14,834,000 | 2,715,851 | ||||||

China Hongqiao Group, Ltd. | 2,894,000 | 1,455,199 | ||||||

China Suntien Green Energy Corp., Ltd. — H | 5,013,394 | 1,835,733 | ||||||

CIMC Enric Holdings, Ltd. | 1,892,000 | 2,941,900 | ||||||

Haitian International Holdings, Ltd. | 1,302,000 | 1,903,634 | ||||||

Hilong Holding, Ltd. | 3,738,808 | 2,198,150 | ||||||

LightInTheBox Holding Co., Ltd. — ADR** | 65,702 | 884,349 | ||||||

New Oriental Education & Technology Group, | 89,153 | 1,974,739 | ||||||

Prince Frog International Holdings, Ltd. | 3,015,000 | 2,083,586 | ||||||

Termbray Petro-King Oilfield Services, Ltd.** | 4,072,000 | 2,677,548 | ||||||

Tiangong International Co., Ltd. | 4,042,000 | 1,000,592 | ||||||

Wison Engineering Services Co., Ltd.** | 2,220,000 | 1,030,421 | ||||||

|

| |||||||

| 27,221,632 | ||||||||

|

| |||||||

Malaysia — 6.1% |

| |||||||

Dialog Group BHD | 902,900 | 805,880 | ||||||

Guinness Anchor BHD | 114,123 | 688,458 | ||||||

KPJ Healthcare BHD | 1,205,400 | 2,613,385 | ||||||

Oldtown BHD | 2,587,200 | 2,251,875 | ||||||

Top Glove Corp. BHD | 1,183,000 | 2,336,420 | ||||||

UEM Sunrise BHD | 1,188,894 | 1,174,030 | ||||||

|

| |||||||

| 9,870,048 | ||||||||

|

| |||||||

Thailand — 4.8% |

| |||||||

Amata Corp. PCL — NVDR | 3,161,600 | 1,855,267 | ||||||

Beauty Community PCL — NVDR | 4,429,800 | 3,556,409 | ||||||

Robinson Department Store PCL — NVDR | 409,200 | 804,811 | ||||||

VGI Global Media PCL — NVDR | 391,618 | 1,502,581 | ||||||

|

| |||||||

| 7,719,068 | ||||||||

|

| |||||||

Philippines — 4.4% |

| |||||||

East West Banking Corp.** | 1,708,503 | 1,180,528 | ||||||

GT Capital Holdings, Inc. | 44,993 | 827,996 | ||||||

Metro Pacific Investments Corp. | 6,543,200 | 799,724 | ||||||

| Number of Shares | Market Value (Note A) | |||||||

Pepsi-Cola Products Philippines, Inc. | 8,208,200 | $ | 1,088,727 | |||||

Philippine Seven Corp. | 245,479 | 517,097 | ||||||

Security Bank Corp. | 392,080 | 1,372,280 | ||||||

Vista Land & Lifescapes, Inc. | 9,652,300 | 1,255,693 | ||||||

|

| |||||||

| 7,042,045 | ||||||||

|

| |||||||

Sri Lanka — 3.6% |

| |||||||

Commercial Bank of Ceylon PLC | 1,689,221 | 1,493,613 | ||||||

Hatton National Bank PLC | 1,695,335 | 2,094,467 | ||||||

John Keells Holdings PLC | 1,134,433 | 2,187,959 | ||||||

|

| |||||||

| 5,776,039 | ||||||||

|

| |||||||

Taiwan — 3.6% |

| |||||||

Chailease Holding Co., Ltd. | 572,000 | 1,351,227 | ||||||

Cleanaway Co., Ltd. | 87,000 | 664,743 | ||||||

Ginko International Co., Ltd. | 51,000 | 861,032 | ||||||

Hermes Microvision, Inc. | 58,000 | 1,664,275 | ||||||

St. Shine Optical Co., Ltd. | 47,000 | 1,221,614 | ||||||

|

| |||||||

| 5,762,891 | ||||||||

|

| |||||||

Indonesia — 3.2% |

| |||||||

PT Bumi Serpong Damai Tbk | 6,567,793 | 1,191,136 | ||||||

PT Express Transindo Utama Tbk** | 5,079,000 | 690,846 | ||||||

PT Kawasan Industri Jababeka Tbk | 20,257,500 | 724,576 | ||||||

PT Malindo Feedmill Tbk | 5,109,095 | 1,878,912 | ||||||

PT Tempo Scan Pacific Tbk | 1,701,000 | 711,249 | ||||||

|

| |||||||

| 5,196,719 | ||||||||

|

| |||||||

Singapore — 1.9% |

| |||||||

Ezion Holdings, Ltd. | 492,000 | 822,912 | ||||||

First REIT | 1,042,000 | 998,840 | ||||||

Religare Health Trust | 1,776,000 | 1,191,006 | ||||||

|

| |||||||

| 3,012,758 | ||||||||

|

| |||||||

Cambodia — 1.3% |

| |||||||

NagaCorp, Ltd. | 2,704,892 | 2,109,914 | ||||||

South Korea — 1.0% |

| |||||||

Kolao Holdings | 64,526 | 1,663,930 | ||||||

Vietnam — 0.9% |

| |||||||

Masan Group Corp.** | 339,410 | 1,424,546 | ||||||

Military Commercial Joint Stock Bank | 65,690 | 40,892 | ||||||

|

| |||||||

| 1,465,438 | ||||||||

|

| |||||||

Total FAR EAST | 76,840,482 | |||||||

|

| |||||||

| NORTH AMERICA — 7.2% | ||||||||

Mexico — 4.7% |

| |||||||

Alsea SAB de CV | 599,300 | 1,420,843 | ||||||

Asesor de Activos Prisma SAPI de CV — REIT | 988,000 | 1,452,554 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

13

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

Banregio Grupo Financiero SAB de CV | 184,260 | $ | 973,386 | |||||

Fibra Uno Administracion SA de CV — REIT | 333,900 | 1,121,207 | ||||||

Grupo Aeroportuario del Centro Norte SAB de CV — ADR | 45,963 | 1,203,311 | ||||||

TF Administradora Industrial S de RL de CV — REIT | 690,000 | 1,438,315 | ||||||

|

| |||||||

| 7,609,616 | ||||||||

|

| |||||||

Canada — 2.5% |

| |||||||

Africa Oil Corp.** | 322,102 | 2,161,404 | ||||||

Gran Tierra Energy, Inc.** | 312,236 | 1,876,538 | ||||||

|

| |||||||

| 4,037,942 | ||||||||

|

| |||||||

Total NORTH AMERICA | 11,647,558 | |||||||

|

| |||||||

| MIDDLE EAST — 7.1% | ||||||||

Pakistan — 3.5% | ||||||||

Engro Foods, Ltd.** | 1,071,297 | 1,515,643 | ||||||

HUB Power Co. | 1,509,500 | 935,283 | ||||||

Lucky Cement, Ltd. | 955,417 | 2,013,769 | ||||||

PAK Suzuki Motor Co., Ltd. | 302,500 | 452,139 | ||||||

United Bank, Ltd. | 721,000 | 779,550 | ||||||

|

| |||||||

| 5,696,384 | ||||||||

|

| |||||||

United Arab Emirates — 2.0% |

| |||||||

Al Noor Hospitals Group PLC** | 173,121 | 1,668,068 | ||||||

Aldar Properties PJSC | 2,707,467 | 1,577,452 | ||||||

|

| |||||||

| 3,245,520 | ||||||||

|

| |||||||

Qatar — 0.9% |

| |||||||

Gulf International Services OSC | 127,794 | 1,462,057 | ||||||

Egypt — 0.7% |

| |||||||

Juhayna Food Industries | 811,850 | 1,071,001 | ||||||

|

| |||||||

Total MIDDLE EAST | 11,474,962 | |||||||

|

| |||||||

| SOUTH AMERICA — 6.5% | ||||||||

Brazil — 4.9% |

| |||||||

All America Latina Logistica SA | 135,400 | 575,254 | ||||||

Alpargatas SA — Pref. | 107,600 | 686,680 | ||||||

Brasil Insurance Participacoes e Administracao SA | 89,800 | 882,566 | ||||||

Kroton Educacional SA | 220,400 | 3,051,138 | ||||||

Linx SA | 114,541 | 1,916,759 | ||||||

Mills Estruturas e Servicos de Engenharia SA | 60,500 | 819,916 | ||||||

|

| |||||||

| 7,932,313 | ||||||||

|

| |||||||

Chile — 1.0% |

| |||||||

Forus SA | 276,136 | 1,574,038 | ||||||

| Number of Shares | Market Value (Note A) | |||||||

Peru — 0.6% |

| |||||||

Alicorp SAA | 181,725 | $ | 610,758 | |||||

Ferreycorp SAA | 516,738 | 390,061 | ||||||

|

| |||||||

| 1,000,819 | ||||||||

|

| |||||||

Total SOUTH AMERICA | 10,507,170 | |||||||

|

| |||||||

| EUROPE — 6.4% | ||||||||

Turkey — 3.1% |

| |||||||

Anadolu Hayat Emeklilik AS | 602,060 | 1,329,795 | ||||||

Bizim Toptan Satis Magazalari AS | 73,534 | 1,197,163 | ||||||

Otokar Otomotiv Ve Savunma Sanayi AS | 25,649 | 894,331 | ||||||

Tofas Turk Otomobil Fabrikasi AS | 130,915 | 817,922 | ||||||

Turkiye Sise Ve Cam Fabrikalari AS | 562,000 | 786,748 | ||||||

|

| |||||||

| 5,025,959 | ||||||||

|

| |||||||

Norway — 1.5% |

| |||||||

DNO International ASA** | 1,357,111 | 2,479,925 | ||||||

Austria — 0.7% |

| |||||||

C.A.T. oil AG | 71,224 | 1,090,248 | ||||||

Kazakhstan — 0.6% |

| |||||||

Halyk Savings Bank of Kazakhstan — GDR | 125,008 | 922,559 | ||||||

United Kingdom — 0.5% |

| |||||||

Ophir Energy PLC** | 138,185 | 750,320 | ||||||

|

| |||||||

Total EUROPE | 10,269,011 | |||||||

|

| |||||||

| AFRICA — 4.2% | ||||||||

Nigeria — 2.9% |

| |||||||

Guaranty Trust Bank PLC | 8,462,772 | 1,265,276 | ||||||

Guinness Nigeria PLC | 548,613 | 847,476 | ||||||

Nestle Nigeria PLC | 127,530 | 753,269 | ||||||

Unilever Nigeria PLC | 1,372,681 | 489,851 | ||||||

Zenith Bank PLC | 11,122,363 | 1,354,967 | ||||||

|

| |||||||

| 4,710,839 | ||||||||

|

| |||||||

Kenya — 1.3% |

| |||||||

Safaricom, Ltd. | 28,050,000 | 2,141,346 | ||||||

|

| |||||||

Total AFRICA | 6,852,185 | |||||||

|

| |||||||

Total EQUITY SECURITIES (Cost $117,034,223) | 127,591,368 | |||||||

|

| |||||||

| ||||||||

| EQUITY CERTIFICATES — 14.8% | ||||||||

| FAR EAST — 8.7% | ||||||||

India — 8.7% |

| |||||||

Cummins India, Ltd.† | 101,120 | 775,608 | ||||||

Eicher Motors, Ltd.† | 13,214 | 728,666 | ||||||

Emami, Ltd.† | 231,657 | 1,872,358 | ||||||

Ipca Laboratories, Ltd.† | 150,139 | 1,655,382 | ||||||

Jain Irrigation Systems, Ltd.† | 1,578,118 | 1,380,936 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

14

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

| Number of Shares | Market Value (Note A) | |||||||

Kaveri Seed Co., Ltd.† | 65,751 | $ | 1,756,218 | |||||

Mahindra & Mahindra Financial Services, Ltd.† | 623,982 | 2,741,636 | ||||||

Shree Cement, Ltd.† | 13,785 | 1,082,665 | ||||||

Yes Bank, Ltd.† | 253,412 | 1,966,315 | ||||||

|

| |||||||

| 13,959,784 | ||||||||

|

| |||||||

Total FAR EAST | 13,959,784 | |||||||

|

| |||||||

| MIDDLE EAST — 6.1% | ||||||||

Saudi Arabia — 6.1% |

| |||||||

Al Mouwasat Medical Services† | 86,056 | 1,571,851 | ||||||

Bank Al-Jazira†** | 328,042 | 2,283,020 | ||||||

Emaar Economic City†** | 859,418 | 2,291,629 | ||||||

Fawaz Abdulaziz Alhokair & Co.† | 40,015 | 1,675,183 | ||||||

Herfy Food Services Co., Ltd.† | 65,910 | 2,091,405 | ||||||

|

| |||||||

| 9,913,088 | ||||||||

|

| |||||||

Total MIDDLE EAST | 9,913,088 | |||||||

|

| |||||||

Total EQUITY CERTIFICATES (Cost $23,270,905) | 23,872,872 | |||||||

|

| |||||||

| ||||||||

| PURCHASED CALL OPTIONS — 0.1% | ||||||||

CurrencyShares Japanese Yen Trust, Exercise Price: $105.00, Expiration Date July, 2013** | 5,000 | 65,000 | ||||||

iShares FTSE China 25 Index Fund, Exercise Price: $36.00, Expiration Date July, 2013** | 6,815 | 27,260 | ||||||

|

| |||||||

Total PURCHASED CALL OPTIONS | 92,260 | |||||||

|

| |||||||

| ||||||||

| PURCHASED PUT OPTIONS — 1.1% | ||||||||

iShares MSCI Emerging Markets Index Fund, Exercise Price: $35.00, Expiration Date July, 2013** | 2,140 | 36,380 | ||||||

iShares MSCI Emerging Markets Index Fund, Exercise Price: $38.00, Expiration Date July, 2013** | 5,000 | 350,000 | ||||||

Industrial Select Sector SPDR Fund, Exercise Price: $41.00, Expiration Date July, 2013** | 7,225 | 144,500 | ||||||

Industrial Select Sector SPDR Fund, Exercise Price: $42.00, Expiration Date July, 2013** | 5,775 | 236,775 | ||||||

| Number of Shares | Market Value (Note A) | |||||||

Materials Select Sector SPDR Trust Fund, Exercise Price: $38.00, Expiration Date July, 2013** | 5,765 | $ | 276,720 | |||||

Energy Select Sector SPDR Fund, Exercise Price: $76.00, Expiration Date July, 2013** | 5,500 | 308,000 | ||||||

Energy Select Sector SPDR Fund, Exercise Price: $78.00, Expiration Date July, 2013** | 4,125 | 499,125 | ||||||

|

| |||||||

Total PURCHASED PUT OPTIONS | 1,851,500 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS (COST $143,634,053) | 95.0 | % | $ | 153,408,000 | ||||

Other Assets In Excess Of Liabilities | 5.0 | % | 8,130,248 | |||||

|

|

|

| |||||

| Net Assets | 100.0 | % | $ | 161,538,248 | ||||

| ||||||||

| ||||||||

| WRITTEN PUT OPTIONS — (0.1%) | ||||||||

Energy Select Sector SPDR Fund, Exercise Price: $75.00, Expiration Date July, 2013** | (5,500 | ) | (231,000 | ) | ||||

|

| |||||||

Total WRITTEN PUT OPTIONS (Premiums received $395,786) | (231,000 | ) | ||||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

| Basis: | $ | 144,519,248 | ||

|

| |||

| Gross Appreciation | $ | 16,280,586 | ||

| Gross Depreciation | (7,391,834 | ) | ||

|

| |||

Net Appreciation | $ | 8,888,752 | ||

|

|

| ** | Non-income producing security |

| † | Restricted security — Investments in securities not registered under the Securities Act of 1933, excluding 144A securities. At June 30, 2013, the value of these restricted securities amounted to $23,872,872 or 14.8% of net assets. |

Notes to Financial Statements are an integral part of this Schedule.

15

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Additional information on each restricted security is as follows (see Note A in Notes to Financial Statements):

Security | Counter- party | Acquisition Date(s) | Acquisition Cost | |||||||||

Al Mouwasat Medical Services | MLCO | | 03/11/13 to 05/28/13 | | $ | 1,573,201 | ||||||

Bank Al-Jazira | MSCO | | 02/19/13 to 06/04/13 | | $ | 2,405,233 | ||||||

Cummins India, Ltd | MLCO | | 09/28/12 to 06/06/13 | | $ | 943,390 | ||||||

Eicher Motors, Ltd. | MLCO | | 04/29/13 to 05/02/13 | | $ | 735,545 | ||||||

Emaar Economic City | MSCO | | 05/29/13 to 06/17/13 | | $ | 2,248,970 | ||||||

Emami, Ltd. | MLCO | | 02/13/13 to 06/25/13 | | $ | 1,766,596 | ||||||

Fawaz Abdulaziz Alhokair & Co. | MLCO | | 10/09/12 to 05/08/13 | | $ | 1,185,636 | ||||||

Herfy Food Services Co., Ltd. | MSCO | | 09/11/12 to 05/22/13 | | $ | 1,780,294 | ||||||

Ipca Laboratories, Ltd. | MLCO | | 03/04/13 to 04/26/13 | | $ | 1,399,901 | ||||||

Security | Counter- party | Acquisition Date(s) | Acquisition Cost | |||||||||

Jain Irrigation Systems, Ltd | MLCO | | 04/02/13 to 05/16/13 | | $ | 1,832,897 | ||||||

Kaveri Seed Co., Ltd. | MLCO | | 10/05/12 to 06/04/13 | | $ | 1,558,743 | ||||||

Mahindra & Mahindra Financial Services, Ltd. | MLCO | | 04/23/13 to 06/19/13 | | $ | 2,717,954 | ||||||

Shree Cement, Ltd. | MLCO | | 05/03/13 to 06/07/13 | | $ | 1,200,464 | ||||||

Yes Bank, Ltd. | MLCO | | 01/28/11 to 06/26/13 | | $ | 1,922,081 | ||||||

ADR — American Depository Receipt

GDR — Global Depository Receipt

MLCO — Merrill Lynch & Co., Inc.

MSCO — Morgan Stanley

NVDR — Non-Voting Depository Receipt

REIT — Real Estate Investment Trust

SP ADR — Sponsored American Depository Receipt

Regional Weightings(a)(b)

Asia/Far East Ex-Japan | 56.3% | |||

Middle East | 13.2% | |||

North America | 7.2% | |||

South America | 6.5% | |||

Africa | 4.2% | |||

Eastern Europe | 3.7% | |||

Western Europe | 2.7% |

Top Ten Holdings(b)

Beauty Community PCL — NVDR | 2.2% | |||

Kroton Educacional SA | 1.9% | |||

CIMC Enric Holdings, Ltd. | 1.8% | |||

Mahindra & Mahindra Financial Services, Ltd. | 1.7% | |||

Bonjour Holdings, Ltd. | 1.7% | |||

Termbray Petro-King Oilfield Services, Ltd. | 1.7% | |||

KPJ Healthcare BHD | 1.6% | |||

DNO International ASA | 1.5% | |||

Top Glove Corp. BHD | 1.4% | |||

Emaar Economic City | 1.4% |

| (a) | All percentages are stated as a percent of net assets at June 30, 2013. |

| (b) | Excludes purchased options. |

Notes to Financial Statements are an integral part of this Schedule.

16

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Industry | Percent of Net Assets | |||

Automobiles | 0.8% | |||

Beverages | 1.6% | |||

Commercial Banks | 9.7% | |||

Commercial Services & Supplies | 0.4% | |||

Construction & Engineering | 0.5% | |||

Construction Materials | 1.9% | |||

Consumer Finance | 1.7% | |||

Diversified Consumer Services | 3.1% | |||

Diversified Financial Services | 1.9% | |||

Energy Equipment & Services | 6.9% | |||

Food & Staples Retailing | 1.1% | |||

Food Products | 7.9% | |||

Health Care Equipment & Supplies | 2.7% | |||

Health Care Providers & Services | 3.6% | |||

Hotels, Restaurants & Leisure | 4.2% | |||

Household Products | 0.3% | |||

Independent Power Produce | 0.6% | |||

Industrial Conglomerates | 1.9% | |||

Insurance | 1.4% | |||

Internet & Catalog Retail | 0.6% | |||

Industry | Percent of Net Assets | |||

Machinery | 5.6% | |||

Media | 0.9% | |||

Metals & Mining | 1.5% | |||

Multiline Retail | 0.5% | |||

Oil, Gas & Consumable Fuels | 5.6% | |||

Other | 1.2% | |||

Personal Products | 2.5% | |||

Pharmaceuticals | 1.5% | |||

Real Estate Investment Trusts | 3.8% | |||

Real Estate Management & Development | 6.2% | |||

Road & Rail | 0.8% | |||

Semiconductors & Semiconductor Equipment | 1.0% | |||

Software | 1.2% | |||

Specialty Retail | 6.0% | |||

Textiles, Apparel & Luxury Goods | 1.4% | |||

Trading Companies & Distributors | 0.5% | |||

Transportation Infrastructure | 0.7% | |||

Wireless Telecommunication Services | 1.3% | |||

Other Assets in Excess of Liabilities | 5.0% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

17

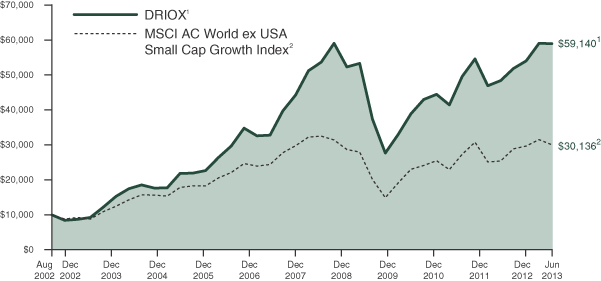

Driehaus International Small Cap Growth Fund

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since August 1, 2002 (the date of the Predecessor Limited Partnership’s inception), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership | |||||||||||||||||||||||

| Average Annual Total Returns as of 06/30/13 | 1 Year | 3 Years | 5 Years | Since Inception (09/17/07 - 06/30/13) | 10 Years | Since Inception (08/1/02 - 06/30/13) | ||||||||||||||||||

Driehaus International Small Cap | 21.37% | 12.50% | 2.07% | 3.02% | 17.10% | 17.69% | ||||||||||||||||||

MSCI AC World ex USA Small Cap Growth Index2 | 14.12% | 9.43% | 1.49% | –0.43% | 10.68% | 10.63% | ||||||||||||||||||

| 1 | The Driehaus International Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus International Opportunities Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on August 1, 2002, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on September 17, 2007. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods prior to January 1, 2010, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index (MSCI AC World ex USA Small Cap Growth Index) is a market capitalization-weighted index designed to measure equity performance in 44 global developed markets and emerging markets, excluding the U.S., and is composed of stocks which are categorized as small capitalization growth stocks. Data is in U.S. dollars. Source: Morgan Stanley Capital International, Inc. |

In 2012, the Morgan Stanley Capital International World ex USA Small Cap Index (MSCI World ex USA Small Cap Index) was removed as a benchmark for the Fund as it is less representative of the Fund’s investment universe. The MSCI All Country World ex USA Small Cap Growth Index includes the emerging markets, which the Fund invests in, whereas the MSCI World ex USA Small Cap Index does not. |

18

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Number of Shares | Market Value (Note A) | |||||||

| EQUITY SECURITIES — 99.2% | ||||||||

| FAR EAST — 47.2% | ||||||||

Japan — 26.9% |

| |||||||

Anritsu Corp. | 198,546 | $ | 2,352,204 | |||||

Avex Group Holdings, Inc. | 82,200 | 2,589,988 | ||||||

Calbee, Inc. | 26,919 | 2,554,021 | ||||||

Century Tokyo Leasing Corp. | 117,700 | 3,064,140 | ||||||

Disco Corp. | 42,570 | 2,940,154 | ||||||

GLP J — REIT | 2,141 | 2,093,940 | ||||||

Hulic Co., Ltd. | 343,383 | 3,683,802 | ||||||

Izumi Co., Ltd. | 107,200 | 2,895,632 | ||||||

J Trust Co., Ltd. | 91,700 | 1,697,532 | ||||||

M3, Inc. | 791 | 1,776,919 | ||||||

MISUMI Group, Inc. | 109,317 | 3,005,722 | ||||||

Modec, Inc. | 35,946 | 1,048,878 | ||||||

MonotaRO Co., Ltd. | 69,013 | 1,681,835 | ||||||

NTN Corp.** | 831,000 | 2,563,884 | ||||||

Santen Pharmaceutical Co., Ltd. | 27,900 | 1,201,180 | ||||||

Sawai Pharmaceutical Co., Ltd. | 19,700 | 2,353,751 | ||||||

SCSK Corp. | 142,023 | 2,735,067 | ||||||

Seven Bank, Ltd. | 865,400 | 3,141,198 | ||||||

Shinko Electric Industries Co., Ltd. | 99,900 | 1,170,436 | ||||||

Sumitomo Real Estate Sales Co., Ltd. | 43,969 | 2,442,722 | ||||||

Taiyo Yuden Co., Ltd. | 142,982 | 2,178,320 | ||||||

Takashimaya Co., Ltd. | 208,200 | 2,109,710 | ||||||

Takeuchi Manufacturing Co., Ltd. | 46,253 | 825,447 | ||||||

Tokai Tokyo Financial Holdings, Inc. | 176,800 | 1,205,049 | ||||||

Tokyo Seimitsu Co., Ltd. | 71,408 | 1,590,444 | ||||||

Tokyo Tatemono Co., Ltd. | 442,621 | 3,686,277 | ||||||

United Arrows, Ltd. | 52,416 | 2,190,606 | ||||||

Wacom Co., Ltd. | 221,200 | 2,437,705 | ||||||

Zenkoku Hosho Co., Ltd. | 51,755 | 1,648,980 | ||||||

|

| |||||||

| 64,865,543 | ||||||||

|

| |||||||

China — 6.0% |

| |||||||

Biostime International Holdings, Ltd. | 403,781 | 2,264,616 | ||||||

China Wireless Technologies, Ltd. | 3,344,577 | 1,267,792 | ||||||

Haier Electronics Group Co., Ltd. | 1,539,430 | 2,453,227 | ||||||

Hilong Holding, Ltd. | 5,144,869 | 3,024,813 | ||||||

Prince Frog International Holdings, Ltd. | 2,749,298 | 1,899,967 | ||||||

SA SA International Holdings, Ltd. | 1,168,000 | 1,159,559 | ||||||

Techtronic Industries Co. | 1,006,490 | 2,408,501 | ||||||

|

| |||||||

| 14,478,475 | ||||||||

|

| |||||||

Number of Shares | Market Value (Note A) | |||||||

Malaysia — 3.7% |

| |||||||

Dialog Group BHD | 2,668,400 | $ | 2,381,671 | |||||

KPJ Healthcare BHD | 867,474 | 1,880,740 | ||||||

Top Glove Corp. BHD | 1,199,453 | 2,368,915 | ||||||

UEM Sunrise BHD | 2,355,100 | 2,325,657 | ||||||

|

| |||||||

| 8,956,983 | ||||||||

|

| |||||||

Singapore — 3.4% |

| |||||||

Ezion Holdings, Ltd. | 1,005,000 | 1,680,947 | ||||||

M1, Ltd. | 806,114 | 1,914,322 | ||||||

Mapletree Commercial Trust — REIT | 2,534,885 | 2,369,892 | ||||||

Mapletree Industrial Trust — REIT | 2,191,000 | 2,281,751 | ||||||

|

| |||||||

| 8,246,912 | ||||||||

|

| |||||||

South Korea — 3.0% |

| |||||||

Grand Korea Leisure Co., Ltd. | 63,861 | 1,979,492 | ||||||

Kolao Holdings | 100,853 | 2,600,692 | ||||||

KT Skylife Co., Ltd. | 80,125 | 2,644,991 | ||||||

|

| |||||||

| 7,225,175 | ||||||||

|

| |||||||

Philippines — 1.8% |

| |||||||

East West Banking Corp.** | 2,019,574 | 1,395,470 | ||||||

GT Capital Holdings, Inc. | 73,742 | 1,357,058 | ||||||

Vista Land & Lifescapes, Inc. | 12,329,474 | 1,603,973 | ||||||

|

| |||||||

| 4,356,501 | ||||||||

|

| |||||||

Australia — 1.8% |

| |||||||

carsales.com, Ltd. | 332,837 | 2,870,464 | ||||||

M2 Telecommunications Group, Ltd. | 251,634 | 1,346,276 | ||||||

|

| |||||||

| 4,216,740 | ||||||||

|

| |||||||

Indonesia — 0.6% |

| |||||||

PT Malindo Feedmill Tbk | 3,947,088 | 1,451,574 | ||||||

|

| |||||||

Total FAR EAST | 113,797,903 | |||||||

|

| |||||||

| EUROPE — 41.6% | ||||||||

United Kingdom — 17.4% |

| |||||||

ASOS PLC** | 46,577 | 2,865,547 | ||||||

Aveva Group PLC | 46,115 | 1,580,934 | ||||||

Barratt Developments PLC** | 522,547 | 2,460,616 | ||||||

Booker Group PLC | 1,540,819 | 2,847,380 | ||||||

Britvic PLC | 156,330 | 1,219,768 | ||||||

Dixons Retail PLC** | 4,358,724 | 2,724,037 | ||||||

Domino’s Pizza UK & IRL PLC | 250,088 | 2,550,405 | ||||||

Essentra PLC | 250,696 | 2,674,808 | ||||||

eSure Group PLC** | 446,754 | 2,207,678 | ||||||

Great Portland Estates PLC — REIT | 299,367 | 2,420,052 | ||||||

Halma PLC | 327,322 | 2,506,641 | ||||||

IG Group Holdings PLC | 270,243 | 2,383,965 | ||||||

Ocado Group PLC** | 291,856 | 1,324,157 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

19

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Number of Shares | Market Value (Note A) | |||||||

Phoenix Group Holdings | 248,787 | $ | 2,406,591 | |||||

Rightmove PLC | 65,364 | 2,071,829 | ||||||

Spirax-Sarco Engineering PLC | 61,584 | 2,516,825 | ||||||

SuperGroup PLC** | 109,101 | 1,190,606 | ||||||

Telecity Group PLC | 265,232 | 4,090,547 | ||||||

|

| |||||||

| 42,042,386 | ||||||||

|

| |||||||

Germany — 11.3% |

| |||||||

Duerr AG | 38,378 | 2,315,638 | ||||||

Freenet AG | 116,953 | 2,554,436 | ||||||

GAGFAH SA** | 205,479 | 2,537,128 | ||||||

Gerresheimer AG | 41,053 | 2,377,917 | ||||||

KUKA AG | 55,079 | 2,328,953 | ||||||

Leoni AG | 27,662 | 1,377,411 | ||||||

Norma Group SE | 67,030 | 2,429,015 | ||||||

Sky Deutschland AG** | 401,907 | 2,798,795 | ||||||

TAG Immobilien AG | 214,295 | 2,337,759 | ||||||

Wincor Nixdorf AG | 58,526 | 3,173,656 | ||||||

Wirecard AG | 109,529 | 2,981,089 | ||||||

|

| |||||||

| 27,211,797 | ||||||||

|

| |||||||

Italy — 3.5% |

| |||||||

Banca Generali SpA | 109,713 | 2,364,885 | ||||||

Brembo SpA | 140,102 | 2,500,193 | ||||||

Yoox SpA** | 162,853 | 3,499,731 | ||||||

|

| |||||||

| 8,364,809 | ||||||||

|

| |||||||

Switzerland — 3.4% |

| |||||||

DKSH Holding, Ltd. | 22,136 | 1,820,937 | ||||||

GAM Holding AG | 78,077 | 1,198,578 | ||||||

Tecan Group AG | 27,386 | 2,531,150 | ||||||

Temenos Group AG | 107,048 | 2,617,976 | ||||||

|

| |||||||

| 8,168,641 | ||||||||

|

| |||||||

Sweden — 2.3% |

| |||||||

Axis Communications AB | 92,000 | 2,274,586 | ||||||

Intrum Justitia AB | 156,622 | 3,211,334 | ||||||

|

| |||||||

| 5,485,920 | ||||||||

|

| |||||||

Norway — 1.1% |

| |||||||

Opera Software ASA | 338,151 | 2,616,428 | ||||||

Netherlands — 1.1% | ||||||||

AerCap Holdings NV** | 147,300 | 2,571,858 | ||||||

France — 1.0% | ||||||||

Ingenico SA | 37,020 | 2,467,165 | ||||||

Ireland — 0.5% | ||||||||

Henderson Group PLC | 539,723 | 1,203,434 | ||||||

|

| |||||||

Total EUROPE | 100,132,438 | |||||||

|

| |||||||

| NORTH AMERICA — 8.4% | ||||||||

Canada — 6.5% |

| |||||||

Cineplex, Inc. | 113,150 | 3,967,834 | ||||||

Constellation Software, Inc. | 19,112 | 2,635,010 | ||||||

Element Financial Corp.** | 236,342 | 2,689,944 | ||||||

Number of Shares | Market Value (Note A) | |||||||

Open Text Corp. | 34,437 | $ | 2,354,303 | |||||

Secure Energy Services, Inc. | 207,290 | 2,656,907 | ||||||

ShawCor, Ltd. | 31,530 | 1,245,970 | ||||||

|

| |||||||

| 15,549,968 | ||||||||

|

| |||||||

United States — 1.0% |

| |||||||

Samsonite International SA | 1,021,225 | 2,459,562 | ||||||

Mexico — 0.9% |

| |||||||

Mexico Real Estate Management SA de CV — REIT | 1,027,207 | 2,219,711 | ||||||

|

| |||||||

Total NORTH AMERICA | 20,229,241 | |||||||

|

| |||||||

| SOUTH AMERICA — 2.0% | ||||||||

Brazil — 2.0% |

| |||||||

Arezzo Industria e Comercio SA | 59,854 | 917,385 | ||||||

Brasil Insurance Participacoes e Administracao SA | 114,900 | 1,129,252 | ||||||

Cyrela Brazil Realty SA Empreendimentos e Participacoes | 144,000 | 989,320 | ||||||

Mills Estruturas e Servicos de Engenharia SA | 137,359 | 1,861,535 | ||||||

|

| |||||||

| 4,897,492 | ||||||||

|

| |||||||

Total SOUTH AMERICA | 4,897,492 | |||||||

|

| |||||||

Total EQUITY SECURITIES (Cost $222,820,241) | 239,057,074 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS (COST $222,820,241) | 99.2 | % | $ | 239,057,074 | ||||

Other Assets In Excess Of Liabilities | 0.8 | % | 1,955,727 | |||||

|

|

|

| |||||

| Net Assets | 100.0 | % | $ | 241,012,801 | ||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

| Basis: | $ | 225,453,245 | ||

|

| |||

| Gross Appreciation | $ | 22,569,784 | ||

| Gross Depreciation | (8,965,955 | ) | ||

|

| |||

Net Appreciation | $ | 13,603,829 | ||

|

|

| ** | Non-income producing security |

REIT — Real Estate Investment Trust

Notes to Financial Statements are an integral part of this Schedule.

20

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Regional Weightings*

Western Europe | 41.6% | |||

Japan | 26.9% | |||

Asia/Far East Ex-Japan | 20.3% | |||

North America | 8.4% | |||

South America | 2.0% |

Top Ten Holdings*

Telecity Group PLC | 1.7% | |||

Cineplex, Inc. | 1.6% | |||

Tokyo Tatemono Co., Ltd. | 1.5% | |||

Hulic Co., Ltd. | 1.5% | |||

Yoox SpA | 1.5% | |||

Intrum Justitia AB | 1.3% | |||

Wincor Nixdorf AG | 1.3% | |||

Seven Bank, Ltd. | 1.3% | |||

Century Tokyo Leasing Corp. | 1.3% | |||

Hilong Holding, Ltd. | 1.3% |

| * | All percentages are stated as a percent of net assets at June 30, 2013. |

Notes to Financial Statements are an integral part of this Schedule.

21

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2013 (unaudited)

Industry | Percent of Net Assets | |||

Auto Components | 1.6% | |||

Beverages | 0.5% | |||

Capital Markets | 2.5% | |||

Chemicals | 1.1% | |||

Commercial Banks | 1.9% | |||

Commercial Services & Supplies | 1.3% | |||

Communications Equipment | 1.5% | |||

Computers & Peripherals | 2.3% | |||

Construction & Engineering | 1.0% | |||

Consumer Finance | 0.7% | |||

Diverdified Financial Services | 4.6% | |||

Diverdified Telecommunications | 0.6% | |||

Electronic Equipment, Instruments & Components | 3.9% | |||

Energy Equipment & Services | 4.0% | |||

Food & Staples Retailing | 1.2% | |||

Food Products | 2.6% | |||

Health Care Equipment & Supplies | 1.0% | |||

Health Care Providers & Services | 0.8% | |||

Health Care Technology | 0.7% | |||

Hotels, Restaurants & Leisure | 1.9% | |||

Household Durables | 3.4% | |||

Industry | Percent of Net Assets | |||

Insurance | 2.4% | |||

Internet & Catalog Retail | 3.2% | |||

Internet Software & Services | 4.0% | |||

IT Services | 2.4% | |||

Life Sciences Tools & Services | 2.0% | |||

Machinery | 5.4% | |||

Media | 5.8% | |||

Multiline Retail | 2.1% | |||

Personal Products | 0.8% | |||

Pharmaceuticals | 1.5% | |||

Professional Services | 0.8% | |||

Real Estate Investment Trusts | 4.7% | |||

Real Estate Management & Development | 7.7% | |||

Semiconductors & Semiconductor Equipment | 2.4% | |||

Software | 3.8% | |||

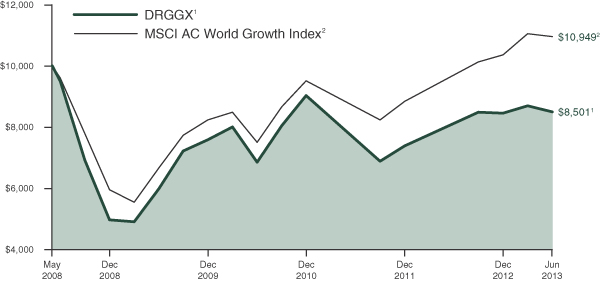

Specialty Retail | 4.1% | |||