UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07655

Driehaus Mutual Funds

(Exact name of registrant as specified in charter)

25 East Erie Street

Chicago, IL 60611

(Address of principal executive offices) (Zip code)

Janet L. McWilliams

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-587-3800

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Driehaus Mutual Funds

Trustees & Officers

Richard H. Driehaus

Trustee

Theodore J. Beck

Trustee

Francis J. Harmon

Trustee

Christopher J. Towle

Trustee

Dawn M. Vroegop

Trustee

Daniel F. Zemanek

Chairman of the Board

Stephen J. Kneeley

President

Michelle L. Cahoon

Vice President & Treasurer

Janet L. McWilliams

Chief Legal Officer &

Assistant Vice President

Michael R. Shoemaker

Chief Compliance Officer &

Assistant Vice President

William H. Wallace, III

Secretary

Michael P. Kailus

Assistant Secretary & Anti-Money

Laundering Compliance Officer

Christine Mason

Assistant Secretary

Investment Adviser

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

Distributor

Driehaus Securities LLC

25 East Erie Street

Chicago, IL 60611

Administrator & Transfer Agent

BNY Mellon Investment Servicing (US) Inc.

4400 Computer Drive

Westborough, MA 01581

Custodian

The Northern Trust Company

50 South LaSalle Street

Chicago, IL 60603

Semi-Annual Report to Shareholders

June 30, 2017

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus Frontier Emerging Markets Fund

Driehaus International Small Cap Growth Fund

Driehaus Micro Cap Growth Fund

Distributed by:

Driehaus Securities LLC

This report has been prepared for the shareholders of the Funds and is not an offer to sell or buy any Fund securities. Such offer is only made by the Funds’ prospectus.

Semi-Annual Report to Shareholders

June 30, 2017

Investment Philosophy:

The Adviser seeks to achieve superior investment returns primarily by investing in global companies that are currently demonstrating rapid growth in their sales and earnings and which, in its judgment, have the ability to continue or accelerate their growth rates in the future. The Adviser manages the portfolios actively (above average turnover) to ensure that the Funds are fully invested, under appropriate market conditions, in companies that meet these criteria. Investors should note that investments in overseas markets can pose more risks than U.S. investments, and the international Funds’ share prices are expected to be more volatile than those of the U.S.-only Funds. In addition, the Funds’ returns will fluctuate with changes in stock market conditions, currency values, interest rates, government regulations, and economic and political conditions in countries in which the Funds invest. These risks are generally greater when investing in emerging markets.

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus Frontier Emerging Markets Fund

Driehaus International Small Cap Growth Fund

Driehaus Micro Cap Growth Fund

Performance Overview and Schedule of Investments: | ||||

| 1 | ||||

| 6 | ||||

| 14 | ||||

| 19 | ||||

| 25 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 41 | ||||

| 53 | ||||

| 55 | ||||

PROXY VOTING POLICIES AND PROCEDURES AND PROXY VOTING RECORD

A description of the Funds’ policies and procedures with respect to the voting of proxies relating to the Funds’ portfolio securities is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Funds’ website at http://www.driehaus.com.

Information regarding how the Funds voted proxies related to portfolio securities during the 12-month period ended June 30, 2017 is available without charge, upon request, by calling 1-800-560-6111. This information is also available on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Each Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available electronically on the SEC’s website at http://www.sec.gov; hard copies may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330. Each Fund’s complete schedule of portfolio holdings is also available on the Fund’s website at http://www.driehaus.com.

Driehaus Emerging Markets Growth Fund

Performance Overview (unaudited)

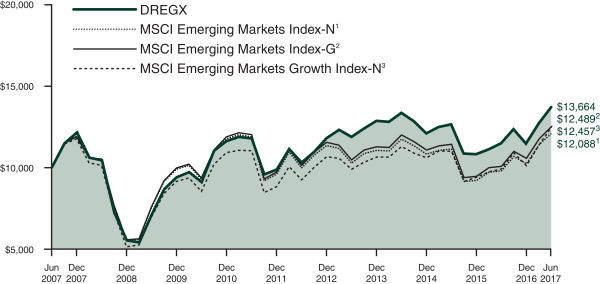

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund over the last 10 fiscal year periods, with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 6/30/17 | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

Driehaus Emerging Markets Growth Fund (DREGX) | 19.23% | 0.87% | 5.85% | 3.17% | ||||||||||||

MSCI Emerging Markets Index-N1 | 23.75% | 1.07% | 3.96% | 1.91% | ||||||||||||

MSCI Emerging Markets Index-G2 | 24.17% | 1.44% | 4.33% | 2.25% | ||||||||||||

MSCI Emerging Markets Growth Index-N3 | 25.99% | 3.42% | 6.18% | 2.22% | ||||||||||||

| 1 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization-weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Emerging Markets Index-Gross (MSCI Emerging Markets Index-G) to the MSCI Emerging Markets Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 2 | The Morgan Stanley Capital International Emerging Markets Index-Gross (MSCI Emerging Markets Index-G) is a market capitalization-weighted index designed to measure equity market performance in global emerging markets. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Growth Index-Net (MSCI Emerging Markets Growth Index-N) is a subset of the MSCI Emerging Markets Index and includes only the MSCI Emerging Markets Index stocks which are categorized as growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

1

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number Shares | Value (Note A) | |||||||

| EQUITY SECURITIES — 94.1% | ||||||||

| FAR EAST — 62.2% | ||||||||

China — 23.7% |

| |||||||

AIA Group, Ltd. | 3,953,613 | $ | 28,889,538 | |||||

Alibaba Group Holding, | 588,876 | 82,972,628 | ||||||

China Construction Bank | 26,766,360 | 20,741,276 | ||||||

China Molybdenum Co., Ltd. — H | 12,848,709 | 4,920,639 | ||||||

Galaxy Entertainment Group, Ltd. | 1,684,175 | 10,224,836 | ||||||

Gridsum Holding, Inc. — ADR1** | 654,785 | 5,604,960 | ||||||

Hangzhou Hikvision Digital Technology Co., Ltd. — A | 1,955,658 | 9,317,465 | ||||||

Jiangsu Hengrui Medicine Co., Ltd. — A | 1,237,334 | 9,233,237 | ||||||

Kweichow Moutai Co., Ltd. — A | 437,004 | 30,415,272 | ||||||

NetEase, Inc. — ADR | 40,563 | 12,194,455 | ||||||

Ping An Insurance Group Co. of China, Ltd. — H | 5,726,386 | 37,736,080 | ||||||

Shanghai International Airport Co., Ltd. — A | 2,918,997 | 16,064,279 | ||||||

Shenzhou International Group Holdings, Ltd. | 1,130,756 | 7,429,799 | ||||||

Silergy Corp. | 487,283 | 9,386,845 | ||||||

SINA Corp.** | 161,216 | 13,698,524 | ||||||

TAL Education Group — ADR | 62,680 | 7,666,391 | ||||||

Tencent Holdings, Ltd. | 1,317,036 | 47,098,150 | ||||||

Weibo Corp. — SP ADR** | 86,518 | 5,750,851 | ||||||

|

| |||||||

| 359,345,225 | ||||||||

|

| |||||||

India — 13.3% |

| |||||||

Apollo Hospitals Enterprise, Ltd. | 394,706 | 7,782,983 | ||||||

Edelweiss Financial Services, Ltd. | 2,667,012 | 7,899,431 | ||||||

Eicher Motors, Ltd. | 21,251 | 8,889,798 | ||||||

Godrej Consumer Products, Ltd. | 543,530 | 8,140,652 | ||||||

HDFC Bank, Ltd. — ADR | 542,037 | 47,140,958 | ||||||

ICICI Bank, Ltd. — SP ADR | 1,006,089 | 9,024,618 | ||||||

ITC, Ltd. | 3,833,179 | 19,193,322 | ||||||

Maruti Suzuki India, Ltd. | 119,555 | 13,349,838 | ||||||

Motherson Sumi Systems, Ltd.** | 1,810,820 | 12,942,933 | ||||||

Power Grid Corp. of India, Ltd. | 6,316,357 | 20,574,882 | ||||||

Reliance Industries, Ltd. | 1,106,864 | 23,631,364 | ||||||

Number Shares | Value (Note A) | |||||||

United Spirits, Ltd.** | 279,685 | $ | 10,377,606 | |||||

UPL, Ltd. | 999,243 | 12,991,898 | ||||||

|

| |||||||

| 201,940,283 | ||||||||

|

| |||||||

Taiwan — 9.3% |

| |||||||

Catcher Technology Co., Ltd. | 1,120,193 | 13,385,607 | ||||||

Cathay Financial Holding Co., Ltd. | 15,325,856 | 25,240,808 | ||||||

Elite Material Co., Ltd. | 1,415,113 | 6,861,577 | ||||||

Hon Hai Precision Industry Co., Ltd. | 4,994,321 | 19,208,927 | ||||||

Hota Industrial Manufacturing Co., Ltd. | 1,592,446 | 7,852,298 | ||||||

Largan Precision Co., Ltd. | 46,979 | 7,490,077 | ||||||

Macronix International Co., Ltd.** | 13,574,155 | 7,451,952 | ||||||

Silicon Motion Technology | 211,604 | 10,205,661 | ||||||

Taiwan Semiconductor Manufacturing Co., | 1,223,319 | 42,767,232 | ||||||

|

| |||||||

| 140,464,139 | ||||||||

|

| |||||||

South Korea — 8.3% |

| |||||||

Hanssem Co., Ltd. | 50,508 | 8,122,599 | ||||||

Macquarie Korea Infrastructure Fund | 948,708 | 7,147,544 | ||||||

NAVER Corp. | 10,676 | 7,819,331 | ||||||

Samsung Electronics Co., Ltd. | 25,677 | 53,344,604 | ||||||

Samsung Electronics Co., | 14,273 | 23,228,009 | ||||||

Shinhan Financial Group Co., Ltd. | 445,007 | 19,174,798 | ||||||

SK Hynix, Inc. | 128,624 | 7,577,029 | ||||||

|

| |||||||

| 126,413,914 | ||||||||

|

| |||||||

Thailand — 2.5% |

| |||||||

Airports of Thailand | 8,429,898 | 11,725,425 | ||||||

IRPC PCL — NVDR | 49,204,138 | 7,749,253 | ||||||

Kasikornbank PCL — NVDR | 1,629,815 | 9,523,647 | ||||||

Minor International PCL — NVDR | 7,191,218 | 8,520,651 | ||||||

|

| |||||||

| 37,518,976 | ||||||||

|

| |||||||

Indonesia — 2.4% |

| |||||||

PT Astra International Tbk | 11,501,561 | 7,702,227 | ||||||

PT Bank Central Asia Tbk | 14,169,003 | 19,295,997 | ||||||

PT Telekomunikasi Indonesia Persero Tbk | 27,430,551 | 9,303,027 | ||||||

|

| |||||||

| 36,301,251 | ||||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

2

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number Shares | Value (Note A) | |||||||

Malaysia — 1.0% |

| |||||||

Public Bank BHD | 3,074,925 | $ | 14,555,688 | |||||

Japan — 0.9% |

| |||||||

Keyence Corp. | 30,549 | 13,401,091 | ||||||

Philippines — 0.8% |

| |||||||

SM Prime Holdings, Inc. | 18,601,736 | 12,165,226 | ||||||

|

| |||||||

Total FAR EAST | 942,105,793 | |||||||

|

| |||||||

| EUROPE — 11.7% | ||||||||

Russia — 4.6% |

| |||||||

Mail.Ru Group, Ltd. — GDR** | 364,103 | 9,594,114 | ||||||

Moscow Exchange MICEX- RTS PJSC | 2,616,842 | 4,629,337 | ||||||

Novatek PJSC — SP GDR | 35,119 | 3,912,257 | ||||||

Sberbank of Russia | 4,251,637 | 44,004,443 | ||||||

Yandex NV — A** | 290,922 | 7,633,793 | ||||||

|

| |||||||

| 69,773,944 | ||||||||

|

| |||||||

Switzerland — 1.7% |

| |||||||

Coca-Cola HBC AG | 319,749 | 9,403,647 | ||||||

Nestle SA | 180,054 | 15,669,524 | ||||||

|

| |||||||

| 25,073,171 | ||||||||

|

| |||||||

Turkey — 1.3% |

| |||||||

Arcelik AS | 701,039 | 5,192,365 | ||||||

Aselsan Elektronik Sanayi Ve Ticaret AS | 1,112,194 | 6,910,020 | ||||||

Turk Hava Yollari AO** | 3,333,019 | 7,625,745 | ||||||

|

| |||||||

| 19,728,130 | ||||||||

|

| |||||||

United Kingdom — 1.3% |

| |||||||

KAZ Minerals PLC** | 1,052,161 | 7,091,788 | ||||||

Unilever NV | 221,303 | 12,213,447 | ||||||

|

| |||||||

| 19,305,235 | ||||||||

|

| |||||||

Greece — 0.9% |

| |||||||

Hellenic Telecommunications Organization SA | 1,163,571 | 14,007,399 | ||||||

Jersey — 0.8% |

| |||||||

Randgold Resources Ltd. | 141,378 | 12,530,638 | ||||||

Hungary — 0.7% |

| |||||||

OTP Bank PLC | 331,655 | 11,099,686 | ||||||

Czech Republic — 0.4% |

| |||||||

Moneta Money Bank AS2 | 1,717,453 | 5,752,592 | ||||||

|

| |||||||

Total EUROPE | 177,270,795 | |||||||

|

| |||||||

| SOUTH AMERICA — 10.4% | ||||||||

Brazil — 7.7% |

| |||||||

Banco do Brasil SA | 1,237,467 | 10,018,070 | ||||||

BB Seguridade Participacoes SA | 1,787,689 | 15,443,768 | ||||||

Hypermarcas SA | 887,121 | 7,420,122 | ||||||

Number Shares | Value (Note A) | |||||||

Kroton Educacional SA | 2,662,953 | $ | 11,928,589 | |||||

Lojas Renner SA | 1,289,677 | 10,705,460 | ||||||

MRV Engenharia e Participacoes SA | 2,868,087 | 11,652,767 | ||||||

OdontoPrev SA | 2,111,347 | 7,418,298 | ||||||

Raia Drogasil SA | 708,935 | 15,086,455 | ||||||

Telefonica Brasil SA — ADR | 755,084 | 10,186,083 | ||||||

Vale SA — SP ADR | 1,899,486 | 16,620,503 | ||||||

|

| |||||||

| 116,480,115 | ||||||||

|

| |||||||

Argentina — 1.5% |

| |||||||

Grupo Financiero Galicia SA — ADR | 183,238 | 7,813,268 | ||||||

Pampa Energia SA — SP ADR** | 120,355 | 7,082,892 | ||||||

YPF SA — SP ADR | 346,985 | 7,598,972 | ||||||

|

| |||||||

| 22,495,132 | ||||||||

|

| |||||||

Peru — 1.2% |

| |||||||

Credicorp, Ltd. | 103,700 | 18,602,743 | ||||||

|

| |||||||

Total SOUTH AMERICA | 157,577,990 | |||||||

|

| |||||||

| NORTH AMERICA — 4.2% | ||||||||

Mexico — 3.7% |

| |||||||

Arca Continental SAB | 1,935,261 | 14,558,644 | ||||||

Grupo Aeroportuario del Sureste SAB de CV — B | 245,837 | 5,185,689 | ||||||

Grupo Financiero Banorte SAB de CV — O | 3,797,015 | 24,091,261 | ||||||

Mexichem SAB de CV | 4,457,046 | 11,937,847 | ||||||

|

| |||||||

| 55,773,441 | ||||||||

|

| |||||||

United States — 0.5% |

| |||||||

EPAM Systems, Inc.** | 90,177 | 7,582,984 | ||||||

|

| |||||||

Total NORTH AMERICA | 63,356,425 | |||||||

|

| |||||||

| AFRICA — 3.7% | ||||||||

South Africa — 3.4% |

| |||||||

Aspen Pharmacare Holdings, Ltd. | 389,392 | 8,545,343 | ||||||

Capitec Bank Holdings, Ltd. | 183,206 | 11,623,236 | ||||||

Mr. Price Group, Ltd. | 788,947 | 9,407,662 | ||||||

Naspers, Ltd. — N | 110,982 | 21,589,848 | ||||||

|

| |||||||

| 51,166,089 | ||||||||

|

| |||||||

Egypt — 0.3% |

| |||||||

Commercial International Bank Egypt SAE | 1,012,759 | 4,469,106 | ||||||

|

| |||||||

Total AFRICA | 55,635,195 | |||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

3

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number Shares | Value (Note A) | |||||||

| MIDDLE EAST — 1.9% | ||||||||

United Arab Emirates — 1.9% |

| |||||||

DP World, Ltd. | 471,774 | $ | 9,869,512 | |||||

Emaar Properties PJSC | 9,111,452 | 19,299,509 | ||||||

|

| |||||||

Total MIDDLE EAST | 29,169,021 | |||||||

|

| |||||||

Total EQUITY SECURITIES | 1,425,115,219 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS | 94.1 | % | $ | 1,425,115,219 | ||||

Other Assets In Excess Of Liabilities | 5.9 | % | 89,045,203 | |||||

|

|

|

| |||||

Net Assets | 100.0 | % | $ | 1,514,160,422 | ||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

Basis: | $ | 1,130,636,984 | ||

|

| |||

Gross Appreciation | $ | 312,626,979 | ||

Gross Depreciation | (18,148,744 | ) | ||

|

| |||

Net Appreciation | $ | 294,478,235 | ||

|

|

| 1 | Pursuant to procedures adopted by Driehaus Mutual Funds’ (the “Trust”) Board of Trustees, this security has been determined to be illiquid by Driehaus Capital Management LLC (the “Adviser”), the Fund’s investment adviser. |

| 2 | 144A — This security was purchased pursuant to Rule 144A of the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At June 30, 2017, this security amounted to $5,752,592 or 0.4% of net assets. This 144A security has not been deemed illiquid. |

| ** | Non-income producing security |

ADR — American Depository Receipt

GDR — Global Depository Receipt

NVDR — Non-Voting Depository Receipt

SP ADR — Sponsored American Depository Receipt

SP GDR — Sponsored Global Depository Receipt

Regional Weightings*

Asia/Far East Ex-Japan | 61.3% | |||

South America | 10.4% | |||

Eastern Europe | 7.0% | |||

Western Europe | 4.7% | |||

North America | 4.2% | |||

Africa | 3.7% | |||

Middle East | 1.9% | |||

Japan | 0.9% |

Top Ten Holdings*

Alibaba Group Holding, Ltd. — SP ADR | 5.5% | |||

Samsung Electronics Co., Ltd. | 3.5% | |||

HDFC Bank, Ltd. — ADR | 3.1% | |||

Tencent Holdings, Ltd. | 3.1% | |||

Sberbank of Russia PJSC — SP ADR | 2.9% | |||

Taiwan Semiconductor Manufacturing Co., Ltd. — SP ADR | 2.8% | |||

Ping An Insurance Group Co. of China, Ltd. — H | 2.5% | |||

Kweichow Moutai Co., Ltd. — A | 2.0% | |||

AIA Group, Ltd. | 1.9% | |||

Cathay Financial Holding Co., Ltd. | 1.7% |

| * | All percentages are stated as a percent of net assets at June 30, 2017. |

Notes to Financial Statements are an integral part of this Schedule.

4

Driehaus Emerging Markets Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Industry | Percent of Net Assets | |||

Aerospace & Defense | 0.5% | |||

Airlines | 0.5% | |||

Auto Components | 1.4% | |||

Automobiles | 1.4% | |||

Beverages | 4.3% | |||

Capital Markets | 1.3% | |||

Chemicals | 1.7% | |||

Commercial Banks | 18.3% | |||

Computers & Peripherals | 5.9% | |||

Diversified Consumer Services | 1.3% | |||

Diversified Telecommunication Services | 2.2% | |||

Electric Utilities | 1.8% | |||

Electronic Equipment, Instruments & Components | 3.7% | |||

Food & Staples Retailing | 1.0% | |||

Food Products | 1.0% | |||

Health Care Providers & Services | 1.0% | |||

Hotels, Restaurants & Leisure | 1.2% | |||

Household Durables | 1.7% | |||

Industry | Percent of Net Assets | |||

Information Technology Services | 0.5% | |||

Insurance | 7.1% | |||

Internet Software & Services | 12.3% | |||

Machinery | 0.6% | |||

Media | 1.4% | |||

Metals & Mining | 2.7% | |||

Multiline Retail | 0.7% | |||

Oil, Gas & Consumable Fuels | 2.8% | |||

Personal Products | 1.3% | |||

Pharmaceuticals | 1.7% | |||

Real Estate Management & Development | 2.1% | |||

Semiconductors & Semiconductor Equipment | 5.1% | |||

Software | 0.4% | |||

Specialty Retail | 0.6% | |||

Textiles, Apparel & Luxury Goods | 0.5% | |||

Tobacco | 1.3% | |||

Transportation Infrastructure | 2.8% | |||

Other Assets in Excess of Liabilities | 5.9% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

5

Driehaus Emerging Markets Small Cap Growth Fund

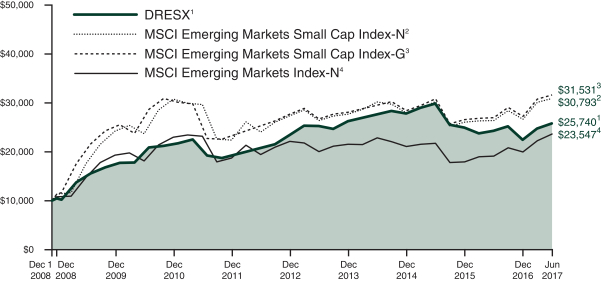

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund since December 1, 2008 (the date of the Predecessor Limited Partnership’s inception), with all dividends and capital gains reinvested, with the indicated indices (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership | |||||||||||||||||||

| Average Annual Total Returns as of 6/30/17 | 1 Year | 3 Years | 5 Years | Since Inception (8/22/11 - 6/30/17) | Since Inception (12/1/08 - 6/30/17) | |||||||||||||||

Driehaus Emerging Markets Small Cap Growth Fund (DRESX)1 | 6.23% | –3.21% | 5.62% | 3.88% | 11.65% | |||||||||||||||

MSCI Emerging Markets Small Cap Index-N2 | 17.03% | 0.81% | 5.15% | 2.99% | 14.00% | |||||||||||||||

MSCI Emerging Markets Small Cap Index-G3 | 17.34% | 1.10% | 5.46% | 3.28% | 14.31% | |||||||||||||||

MSCI Emerging Markets Index-N4 | 23.75% | 1.07% | 3.96% | 3.15% | 10.49% | |||||||||||||||

| 1 | The Driehaus Emerging Markets Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus Emerging Markets Small Cap Growth Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on December 1, 2008, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on August 22, 2011. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods prior to August 21, 2014, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Net (MSCI Emerging Markets Small Cap Index-N) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Emerging Markets Small Cap Index-Gross (MSCI Emerging |

6

Driehaus Emerging Markets Small Cap Growth Fund

Performance Overview (unaudited)

| Markets Small Cap Index-G) to the MSCI Emerging Markets Small Cap Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Emerging Markets Small Cap Index-Gross (MSCI Emerging Markets Small Cap Index-G) is a market capitalization-weighted index designed to measure equity market performance of small cap stocks in emerging markets. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

| 4 | The Morgan Stanley Capital International Emerging Markets Index-Net (MSCI Emerging Markets Index-N) is a market capitalization weighted index designed to measure equity market performance in emerging markets. Data is in U.S. dollars and is calculated with net dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

7

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

| EQUITY SECURITIES — 92.2% | ||||||||

| FAR EAST — 67.1% | ||||||||

China — 17.4% |

| |||||||

Angang Steel Co., | 2,614,000 | $ | 1,948,585 | |||||

Angel Yeast Co., | 548,370 | 2,092,534 | ||||||

Baozun, Inc. — SP ADR1** | 88,560 | 1,963,375 | ||||||

Beijing Enterprises Water Group, Ltd. | 3,048,000 | 2,365,802 | ||||||

China Lodging Group, | 21,634 | 1,745,431 | ||||||

China Medical System Holdings, Ltd. | 1,406,536 | 2,432,066 | ||||||

China Resources Cement Holdings, Ltd. | 3,456,914 | 1,717,952 | ||||||

China State Construction International Holdings, Ltd. | 670,471 | 1,147,301 | ||||||

Guangzhou R&F Properties Co., Ltd. — H | 791,601 | 1,230,880 | ||||||

Haitian International Holdings, Ltd. | 662,000 | 1,856,919 | ||||||

Logan Property Holdings Co., Ltd. | 1,940,000 | 1,279,675 | ||||||

Maanshan Iron & Steel Co., Ltd. — A** | 3,523,633 | 1,839,909 | ||||||

Man Wah Holdings, Ltd. | 1,802,158 | 1,618,086 | ||||||

Minth Group, Ltd. | 712,000 | 3,018,553 | ||||||

O-Net Technologies Group, Ltd.** | 3,093,529 | 1,632,459 | ||||||

Shenzhen Airport Co., | 1,708,348 | 2,356,081 | ||||||

Silergy Corp. | 139,836 | 2,693,751 | ||||||

SINA Corp.1** | 19,519 | 1,658,529 | ||||||

Suofeiya Home Collection Co., Ltd. — A | 305,834 | 1,849,575 | ||||||

TAL Education Group — | 10,028 | 1,226,525 | ||||||

Tongda Group Holdings, Ltd. | 3,982,322 | 1,188,456 | ||||||

Weibo Corp. — SP ADR1** | 2,378 | 158,066 | ||||||

Zhejiang Dahua Technology Co., Ltd. — A | 416,602 | 1,401,680 | ||||||

Zhejiang Supor Cookware Co., Ltd. — A | 307,197 | 1,860,084 | ||||||

|

| |||||||

| 42,282,274 | ||||||||

|

| |||||||

India — 16.2% | ||||||||

Apollo Tyres, Ltd. | 315,191 | 1,173,722 | ||||||

Avenue Supermarts, | 109,902 | 1,385,900 | ||||||

Bajaj Finance, Ltd. | 54,834 | 1,164,843 | ||||||

Bharat Financial Inclusion, Ltd.** | 108,602 | 1,210,815 | ||||||

Bharat Forge, Ltd. | 71,759 | 1,213,034 | ||||||

Number of Shares | Value (Note A) | |||||||

Britannia Industries, Ltd. | 21,455 | $ | 1,224,831 | |||||

Capital First, Ltd. | 111,568 | 1,151,366 | ||||||

Colgate-Palmolive India, Ltd. | 71,072 | 1,221,432 | ||||||

Crompton Greaves Consumer Electricals, Ltd. | 873,993 | 3,061,933 | ||||||

Dalmia Bharat, Ltd.** | 31,404 | 1,199,899 | ||||||

Edelweiss Financial Services, Ltd. | 479,649 | 1,420,674 | ||||||

Eicher Motors, Ltd. | 5,399 | 2,258,530 | ||||||

Fortis Healthcare, Ltd.** | 371,755 | 931,724 | ||||||

India Grid Trust2** | 2,995,461 | 4,495,219 | ||||||

IRB InvIT Fund2** | 715,000 | 1,076,302 | ||||||

MakeMyTrip, Ltd.1** | 37,432 | 1,255,844 | ||||||

Marico, Ltd. | 493,367 | 2,399,380 | ||||||

Natco Pharma, Ltd. | 72,306 | 1,120,540 | ||||||

Petronet LNG, Ltd. | 179,464 | 1,199,573 | ||||||

Phoenix Mills, Ltd. | 281,975 | 1,963,301 | ||||||

SpiceJet, Ltd.** | 879,482 | 1,798,082 | ||||||

Sterlite Technologies, Ltd. | 487,771 | 1,106,658 | ||||||

Tejas Networks, Ltd.** | 389,125 | 1,821,084 | ||||||

United Spirits, Ltd.** | 32,950 | 1,222,597 | ||||||

Zee Entertainment Enterprises, Ltd. | 156,046 | 1,186,203 | ||||||

|

| |||||||

| 39,263,486 | ||||||||

|

| |||||||

Taiwan — 11.2% | ||||||||

Accton Technology Corp. | 938,000 | 2,392,794 | ||||||

Advanced Ceramic X Corp. | 131,972 | 1,605,182 | ||||||

Airtac International Group | 162,526 | 1,920,713 | ||||||

ASPEED Technology, Inc. | 113,052 | 2,512,267 | ||||||

Basso Industry Corp. | 398,470 | 1,113,411 | ||||||

Elite Material Co., Ltd. | 584,000 | 2,831,690 | ||||||

Global Unichip Corp. | 291,000 | 1,234,024 | ||||||

Globalwafers Co., Ltd. | 141,000 | 984,961 | ||||||

Gourmet Master Co., Ltd. | 75,057 | 809,297 | ||||||

Hota Industrial Manufacturing Co., Ltd. | 243,000 | 1,198,225 | ||||||

King Slide Works Co., Ltd. | 94,000 | 1,319,461 | ||||||

Macronix International Co., Ltd.** | 2,555,000 | 1,402,646 | ||||||

Parade Technologies, Ltd. | 93,000 | 1,143,393 | ||||||

Silicon Motion Technology Corp. — ADR1 | 22,689 | 1,094,290 | ||||||

Sunny Friend Environmental Technology Co., Ltd. | 330,896 | 1,707,780 | ||||||

Taiwan Paiho, Ltd. | 365,000 | 1,373,849 | ||||||

TCI Co., Ltd. | 200,000 | 1,272,189 | ||||||

Tong Yang Industry Co., Ltd. | 645,000 | 1,197,978 | ||||||

|

| |||||||

| 27,114,150 | ||||||||

|

| |||||||

South Korea — 8.8% | ||||||||

BGF retail Co., Ltd. | 18,788 | 1,658,513 | ||||||

Eugene Technology Co., Ltd. | 69,214 | 1,100,987 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

8

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

GS Retail Co., Ltd. | 25,817 | $ | 1,164,320 | |||||

Hanssem Co., Ltd. | 9,418 | 1,514,585 | ||||||

Hyundai Development Co.-Engineering & Construction | 76,372 | 3,133,912 | ||||||

ING Life Insurance Korea, Ltd.2** | 65,385 | 1,943,006 | ||||||

Koh Young Technology, Inc. | 22,629 | 1,186,680 | ||||||

LG Chem, Ltd. — Pref. | 10,379 | 1,832,415 | ||||||

LG Innotek Co., Ltd. | 13,542 | 1,952,917 | ||||||

Mando Corp. | 7,748 | 1,743,749 | ||||||

Medy-Tox, Inc. | 3,552 | 1,738,513 | ||||||

SFA Engineering Corp. | 28,984 | 1,138,689 | ||||||

Vieworks Co., Ltd. | 23,403 | 1,176,133 | ||||||

|

| |||||||

| 21,284,419 | ||||||||

|

| |||||||

Thailand — 6.5% | ||||||||

Beauty Community PCL — NVDR | 14,281,900 | 4,540,610 | ||||||

IRPC PCL — NVDR | 8,074,300 | 1,271,637 | ||||||

Land & Houses PCL — NVDR | 8,938,779 | 2,631,374 | ||||||

Minor International PCL — NVDR | 1,022,800 | 1,211,884 | ||||||

Sino-Thai Engineering & Construction PCL — NVDR | 3,083,200 | 2,518,658 | ||||||

Srisawad Power 1979 PCL — NVDR | 1,556,372 | 2,302,258 | ||||||

Star Petroleum Refining | 3,229,195 | 1,387,879 | ||||||

|

| |||||||

| 15,864,300 | ||||||||

|

| |||||||

Malaysia — 3.5% | ||||||||

AirAsia BHD | 2,299,500 | 1,740,970 | ||||||

Gamuda BHD | 2,956,000 | 3,787,404 | ||||||

Malaysia Airports Holdings BHD | 586,400 | 1,169,344 | ||||||

My EG Services BHD | 3,614,886 | 1,844,222 | ||||||

|

| |||||||

| 8,541,940 | ||||||||

|

| |||||||

Indonesia — 1.8% | ||||||||

PT Bank Danamon Indonesia Tbk | 3,471,600 | 1,334,980 | ||||||

PT Bank Tabungan Negara Persero Tbk | 7,065,300 | 1,378,337 | ||||||

PT Pembangunan Perumahan Persero Tbk | 6,783,406 | 1,598,191 | ||||||

|

| |||||||

| 4,311,508 | ||||||||

|

| |||||||

Philippines — 1.7% | ||||||||

International Container Terminal Services, Inc. | 588,452 | 1,140,519 | ||||||

Metro Pacific Investments Corp. | 9,382,701 | 1,188,178 | ||||||

Security Bank Corp. | 417,000 | 1,793,282 | ||||||

|

| |||||||

| 4,121,979 | ||||||||

|

| |||||||

Total FAR EAST | 162,784,056 | |||||||

|

| |||||||

| SOUTH AMERICA — 8.9% | ||||||||

Brazil — 6.0% | ||||||||

Azul SA1** | 131,059 | 2,762,724 | ||||||

Number of Shares | Value (Note A) | |||||||

Energisa SA | 185,392 | $ | 1,329,065 | |||||

Fleury SA | 335,800 | 2,713,443 | ||||||

Lojas Renner SA | 293,607 | 2,437,198 | ||||||

M Dias Branco SA | 115,799 | 1,731,969 | ||||||

MRV Engenharia e Participacoes SA | 289,300 | 1,175,399 | ||||||

OdontoPrev SA | 332,093 | 1,166,821 | ||||||

Qualicorp SA | 135,039 | 1,175,971 | ||||||

|

| |||||||

| 14,492,590 | ||||||||

|

| |||||||

Argentina — 1.9% | ||||||||

Pampa Energia SA — SP ADR1** | 39,989 | 2,353,353 | ||||||

Telecom Argentina SA — SP ADR1 | 93,365 | 2,365,869 | ||||||

|

| |||||||

| 4,719,222 | ||||||||

|

| |||||||

Uruguay — 1.0% | ||||||||

Arcos Dorados Holdings, | 320,127 | 2,384,946 | ||||||

|

| |||||||

Total SOUTH AMERICA | 21,596,758 | |||||||

|

| |||||||

| EUROPE — 6.1% | ||||||||

Russia — 1.0% | ||||||||

Aeroflot PJSC** | 758,997 | 2,513,474 | ||||||

Luxembourg — 0.9% | ||||||||

Adecoagro SA1** | 220,925 | 2,207,041 | ||||||

Turkey — 0.9% | ||||||||

Migros Ticaret AS** | 126,607 | 991,712 | ||||||

Tofas Turk Otomobil Fabrikasi AS | 139,520 | 1,145,996 | ||||||

|

| |||||||

| 2,137,708 | ||||||||

|

| |||||||

Netherlands — 0.9% | ||||||||

DP Eurasia NV2** | 890,000 | 2,109,719 | ||||||

Czech Republic — 0.8% | ||||||||

Moneta Money Bank AS2 | 548,011 | 1,835,558 | ||||||

Poland — 0.6% | ||||||||

CCC SA | 23,521 | 1,428,150 | ||||||

United Kingdom — 0.5% | ||||||||

BGEO Group PLC | 29,458 | 1,340,570 | ||||||

Greece — 0.5% | ||||||||

OPAP SA | 106,673 | 1,206,184 | ||||||

|

| |||||||

Total EUROPE | 14,778,404 | |||||||

|

| |||||||

| AFRICA — 4.7% | ||||||||

South Africa — 2.6% | ||||||||

AVI, Ltd. | 163,455 | 1,186,946 | ||||||

Capitec Bank Holdings, Ltd. | 40,860 | 2,592,303 | ||||||

Clicks Group, Ltd. | 227,608 | 2,435,706 | ||||||

|

| |||||||

| 6,214,955 | ||||||||

|

| |||||||

Kenya — 1.5% | ||||||||

Safaricom, Ltd. | 17,088,610 | 3,748,948 | ||||||

Egypt — 0.6% | ||||||||

Commercial International Bank Egypt SAE — GDR | 306,618 | 1,379,781 | ||||||

|

| |||||||

Total AFRICA | 11,343,684 | |||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

9

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

| MIDDLE EAST — 2.8% | ||||||||

Pakistan — 1.9% | ||||||||

Lucky Cement, Ltd. | 135,600 | $ | 1,081,515 | |||||

Pak Elektron, Ltd. | 1,107,000 | 1,164,752 | ||||||

United Bank, Ltd. | 1,011,383 | 2,271,826 | ||||||

|

| |||||||

| 4,518,093 | ||||||||

|

| |||||||

United Arab Emirates — 0.9% |

| |||||||

NMC Health PLC | 78,209 | 2,226,743 | ||||||

|

| |||||||

Total MIDDLE EAST | 6,744,836 | |||||||

|

| |||||||

| NORTH AMERICA — 2.6% | ||||||||

Mexico — 1.3% | ||||||||

Alsea SAB de CV | 469,872 | 1,781,235 | ||||||

Grupo Aeroportuario del Centro Norte SAB de CV — ADR1 | 27,839 | 1,341,283 | ||||||

|

| |||||||

| 3,122,518 | ||||||||

|

| |||||||

Canada — 0.8% | ||||||||

Lundin Mining Corp. | 336,167 | 1,910,511 | ||||||

United States — 0.5% | ||||||||

Nexteer Automotive Group, Ltd. | 809,063 | 1,268,395 | ||||||

|

| |||||||

Total NORTH AMERICA | 6,301,424 | |||||||

|

| |||||||

Total EQUITY SECURITIES | 223,549,162 | |||||||

|

| |||||||

| ||||||||

| PURCHASED PUT OPTIONS — 0.2% | ||||||||

CNH Put/USD Call, Strike Price 6.95 CNH/USD, Expiration Date | 55,000,000 | 27,469 | ||||||

iShares MSCI Brazil Capped Index ETF, Exercise Price $32.00, Expiration Date July 21, 2017** | 5,000 | 140,000 | ||||||

iShares MSCI Emerging Markets Index ETF, Exercise Price $40.00, Expiration Date July 21, 2017** | 5,000 | 75,000 | ||||||

iShares MSCI Emerging Markets Index ETF, Exercise Price $40.50, Expiration Date July 21, 2017** | 5,000 | 130,000 | ||||||

iShares MSCI Emerging Markets Index ETF, Exercise Price $41.00, Expiration Date July 21, 2017** | 5,000 | 205,000 | ||||||

|

| |||||||

Total PURCHASED PUT OPTIONS | 577,469 | |||||||

|

| |||||||

| ||||||||

Number of Shares | Value (Note A) | |||||||

TOTAL INVESTMENTS | 92.4 | % | $ | 224,126,631 | ||||

Other Assets In Excess Of Liabilities | 7.6 | % | 18,342,391 | |||||

|

|

|

| |||||

Net Assets | 100.0 | % | $ | 242,469,022 | ||||

| ||||||||

| WRITTEN PUT OPTIONS — (0.1%) | ||||||||

iShares MSCI Brazil Capped Index ETF, Exercise Price $30.00, Expiration Date July 21, 2017** | (5,000 | ) | (50,000 | ) | ||||

iShares MSCI Emerging Markets Index ETF, Exercise Price $38.00, Expiration Date July 21, 2017** | (2,500 | ) | (7,500 | ) | ||||

iShares MSCI Emerging Markets Index ETF, Exercise Price $39.00, Expiration Date July 21, 2017** | (12,500 | ) | (87,500 | ) | ||||

|

| |||||||

Total WRITTEN PUT OPTIONS (Premiums received $205,351) | $ | (145,000 | ) | |||||

|

| |||||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

Basis: | $ | 198,184,246 | ||

|

| |||

Gross Appreciation | $ | 32,105,036 | ||

Gross Depreciation | (6,162,651 | ) | ||

|

| |||

Net Appreciation | $ | 25,942,385 | ||

|

|

| 1 | All or a portion of the security is pledged as collateral for derivatives transactions. |

| 2 | 144A — Security was purchased pursuant to Rule 144A of the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At June 30, 2017, these securities amounted to $12,845,704 or 5.3% of net assets. These 144A securities have not been deemed illiquid. |

| ** | Non-income producing security |

ADR — American Depository Receipt

CNH — Offshore Chinese Renminbi (Yuan)

ETF — Exchange-Traded Fund

GDR — Global Depository Receipt

NVDR — Non-Voting Depository Receipt

SP ADR — Sponsored American Depository Receipt

USD — United States Dollar

Notes to Financial Statements are an integral part of this Schedule.

10

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Regional Weightings(a)(b)

Asia/Far East Ex-Japan | 67.1% | |||

South America | 8.9% | |||

Africa | 4.7% | |||

Eastern Europe | 3.3% | |||

Western Europe | 2.8% | |||

Middle East | 2.8% | |||

North America | 2.6% |

Top Ten Holdings(a)

Beauty Community PCL — NVDR | 1.9 | % | ||

India Grid Trust | 1.9 | % | ||

Gamuda BHD | 1.6 | % | ||

Safaricom, Ltd. | 1.5 | % | ||

Hyundai Development Co. Engineering & Construction | 1.3 | % | ||

Crompton Greaves Consumer Electricals, Ltd. | 1.3 | % | ||

Minth Group, Ltd. | 1.2 | % | ||

Elite Material Co., Ltd. | 1.2 | % | ||

Azul SA | 1.1 | % | ||

Fleury SA | 1.1 | % |

| (a) | All percentages are stated as a percent of net assets at June 30, 2017. |

| (b) | Excludes purchased options. |

SWAP CONTRACTS

Credit Default Swaps

| Counterparty | Reference Instrument | Notional Amount(4) | Buy/Sell Protection(1)(2) | Pay (Receive) Fixed Rate | Expiration Date | Implied Credit Spread(3) | Upfront Premium Paid (Received) | Unrealized Appreciation/ (Depreciation) | Value | |||||||||||||||||||||||||

Bank of America | Republic of Turkey, 11.875%, 1/15/30 | $ | 11,250,000 | Buy | 1.00 | % | 6/20/2022 | 1.93 | % | $ | 756,734 | $ | (279,964 | ) | $ | 476,770 | ||||||||||||||||||

Morgan Stanley | Republic of Turkey, 11.875%, 1/15/30 | $ | 11,250,000 | Buy | 1.00 | % | 6/20/2022 | 1.93 | % | 761,051 | (284,281 | ) | 476,770 | |||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||

Total Credit Default Swaps |

| $ | 1,517,785 | $ | (564,245 | ) | $ | 953,540 | ||||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||

| (1) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (2) | If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay to the buyer of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying investments comprising the referenced index or (ii) pay a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index. |

| (3) | An implied credit spread is the spread in yield between a U.S. Treasury security and the referenced obligation or underlying investment that are identical in all respects except for the quality rating. Implied credit spreads, represented in absolute terms, utilized in determining the value of credit default swap agreements on corporate and sovereign issues as of period end serve as an indicator of the current status of the payment/performance risk and represent the likelihood of risk of default for the credit derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads, in comparison to narrower credit spreads, represent a deterioration of the referenced entity’s credit soundness and a greater likelihood of risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

| (4) | The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

Notes to Financial Statements are an integral part of this Schedule.

11

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Interest Rate Swaps

| Counterparty | Notional Amount | Fixed Rate(1) | Floating Rate Index(1) | Expiration Date | Unrealized | |||||||||||||||||

Goldman Sachs | KRW 11,500,000,000 | 1.9925 | % | 3-Month KRW KWCDC | 5/12/2027 | $ | (90,200 | ) | ||||||||||||||

Morgan Stanley | KRW 12,500,000,000 | 1.8725 | % | 3-Month KRW KWCDC | 12/12/2026 | 17,292 | ||||||||||||||||

Morgan Stanley | KRW 12,500,000,000 | 1.89 | % | 3-Month KRW KWCDC | 12/12/2026 | 596 | ||||||||||||||||

|

| |||||||||||||||||||||

Total Interest Rate Swaps |

| $ | (72,312 | ) | ||||||||||||||||||

|

| |||||||||||||||||||||

| (1) | Fund pays the floating rate and receives the fixed rate. |

KRW — South Korean Won

KWCDC — Korean Won 3-month Certificate of Deposit Rate

Notes to Financial Statements are an integral part of this Schedule.

12

Driehaus Emerging Markets Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Industry | Percent of Net Assets | |||

Airlines | 2.5% | |||

Auto Components | 4.5% | |||

Automobiles | 0.5% | |||

Beverages | 0.5% | |||

Biotechnology | 0.7% | |||

Capital Markets | 0.6% | |||

Chemicals | 0.8% | |||

Commercial Banks | 5.7% | |||

Commercial Services & Supplies | 0.7% | |||

Communications Equipment | 3.5% | |||

Construction & Engineering | 5.0% | |||

Construction Materials | 1.7% | |||

Consumer Finance | 2.4% | |||

Diversified Consumer Services | 0.5% | |||

Diversified Financial Services | 0.5% | |||

Diversified Telecommunication Services | 1.0% | |||

Electric Utilities | 3.4% | |||

Electrical Equipment | 0.5% | |||

Electronic Equipment, Instruments & Components | 3.5% | |||

Food & Staples Retailing | 3.1% | |||

Food Products | 3.5% | |||

Health Care Equipment & Supplies | 0.5% | |||

Health Care Providers & Services | 3.4% | |||

Industry | Percent of Net Assets | |||

Hotels, Restaurants & Leisure | 4.6% | |||

Household Durables | 5.0% | |||

Information Technology Services | 0.8% | |||

Insurance | 0.8% | |||

Internet & Catalog Retail | 0.5% | |||

Internet Software & Services | 1.6% | |||

Machinery | 3.0% | |||

Media | 1.6% | |||

Metals & Mining | 2.3% | |||

Multiline Retail | 1.0% | |||

Oil, Gas & Consumable Fuels | 1.6% | |||

Other | 0.2% | |||

Personal Products | 2.0% | |||

Pharmaceuticals | 1.5% | |||

Real Estate Management & Development | 2.9% | |||

Semiconductors & Semiconductor Equipment | 5.5% | |||

Specialty Retail | 1.9% | |||

Textiles, Apparel & Luxury Goods | 1.2% | |||

Transportation Infrastructure | 2.9% | |||

Water Utilities | 1.0% | |||

Wireless Telecommunication Services | 1.5% | |||

Other Assets in Excess of Liabilities | 7.6% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

13

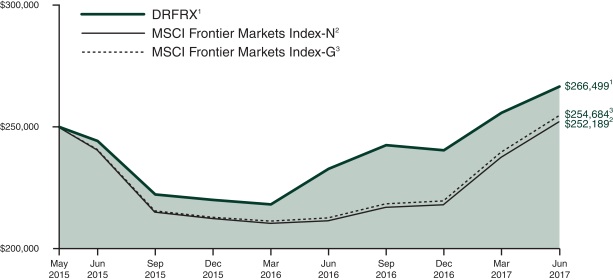

Driehaus Frontier Emerging Markets Fund

Performance Overview (unaudited)

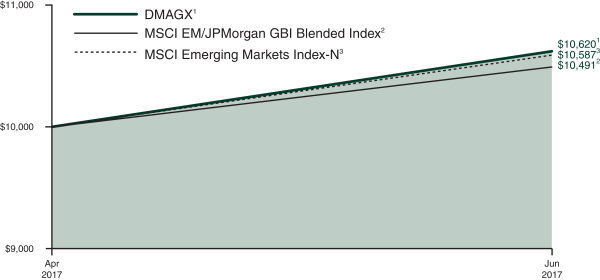

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $250,000 investment (minimum investment) in the Fund since May 4, 2015 (the date of the Fund’s inception), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Average Annual Total Returns as of 6/30/17 | 1 Year | Since Inception (5/4/15 - 6/30/17) | ||||||

Driehaus Frontier Emerging Markets Fund (DRFRX)1 | 14.51% | 3.01% | ||||||

MSCI Frontier Markets Index-N2 | 19.22% | 0.41% | ||||||

MSCI Frontier Markets Index-G3 | 19.70% | 0.86% | ||||||

| 1 | The returns for the period reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International Frontier Markets Index-Net (MSCI Frontier Markets Index-N) provides broad representation of the equity opportunity set in frontier markets while taking investability requirements into consideration within each market. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International Frontier Markets Index-Gross (MSCI Frontier Markets Index-G) to the MSCI Frontier Markets Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International Frontier Markets Index-Gross (MSCI Frontier Markets Index-G) provides broad representation of the equity opportunity set in frontier markets while taking investability requirements into consideration within each market. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International Inc. |

14

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

| EQUITY SECURITIES — 94.7% | ||||||||

| FAR EAST — 26.7% | ||||||||

Vietnam — 12.4% |

| |||||||

Airports Corp. of Vietnam | 385,300 | $ | 864,471 | |||||

Bank for Foreign Trade of Vietnam JSC | 363,236 | 615,221 | ||||||

Coteccons Construction | 87,000 | 828,626 | ||||||

Ho Chi Minh City Infrastructure Investment JSC | 379,220 | 620,606 | ||||||

Kinh Bac City Development Share Holding Corp.** | 1,168,510 | 866,191 | ||||||

Masan Group Corp. | 326,230 | 602,774 | ||||||

Mobile World Investment Corp. | 100,000 | 547,750 | ||||||

Nam Long Investment Corp. | 177,123 | 222,076 | ||||||

Saigon Beer Alcohol Beverage Corp. | 96,620 | 885,396 | ||||||

Saigon Securities, Inc. | 354,340 | 431,019 | ||||||

Vietnam Dairy Products JSC | 270,584 | 1,876,030 | ||||||

|

| |||||||

| 8,360,160 | ||||||||

|

| |||||||

Bangladesh — 12.1% | ||||||||

Beximco Pharmaceuticals, Ltd. | 739,079 | 1,036,242 | ||||||

BRAC Bank, Ltd. | 2,166,854 | 2,169,677 | ||||||

British American Tobacco Bangladesh Co., Ltd. | 10,360 | 363,689 | ||||||

Delta Brac Housing Finance Corp., Ltd. | 733,126 | 1,037,902 | ||||||

GrameenPhone, Ltd. | 243,319 | 1,039,755 | ||||||

IDLC Finance, Ltd. | 930,346 | 817,278 | ||||||

Singer Bangladesh, Ltd. | 247,072 | 584,916 | ||||||

Square Pharmaceuticals, Ltd. | 293,447 | 1,056,256 | ||||||

|

| |||||||

| 8,105,715 | ||||||||

|

| |||||||

Sri Lanka — 2.2% | ||||||||

Access Engineering PLC | 2,320,756 | 388,924 | ||||||

Ceylon Cold Stores PLC | 56,423 | 324,730 | ||||||

Chevron Lubricants Lanka PLC | 712,830 | 776,255 | ||||||

|

| |||||||

| 1,489,909 | ||||||||

|

| |||||||

Total FAR EAST | 17,955,784 | |||||||

|

| |||||||

| MIDDLE EAST — 25.1% | ||||||||

Pakistan — 10.8% | ||||||||

Adamjee Insurance Co., Ltd. | 795,549 | 518,681 | ||||||

Akzo Nobel Pakistan, Ltd. | 162,100 | 371,044 | ||||||

DG Khan Cement Co., Ltd. | 176,400 | 358,621 | ||||||

Habib Bank, Ltd. | 413,900 | 1,062,442 | ||||||

Hascol Petroleum, Ltd. | 127,797 | 415,752 | ||||||

HUB Power Co., Ltd. | 534,500 | 598,630 | ||||||

Hum Network, Ltd.** | 3,302,151 | 369,740 | ||||||

Lucky Cement, Ltd. | 135,100 | 1,077,527 | ||||||

Pak Elektron, Ltd. | 923,500 | 971,679 | ||||||

Number of Shares | Value (Note A) | |||||||

United Bank, Ltd. | 670,293 | $ | 1,505,650 | |||||

|

| |||||||

| 7,249,766 | ||||||||

|

| |||||||

Kuwait — 5.4% | ||||||||

Human Soft Holding Co. KSC | 104,499 | 1,446,353 | ||||||

National Bank of Kuwait SAKP | 986,272 | 2,193,882 | ||||||

|

| |||||||

| 3,640,235 | ||||||||

|

| |||||||

United Arab Emirates — 3.7% | ||||||||

Abu Dhabi Commercial Bank PJSC | 317,304 | 605,582 | ||||||

Aramex PJSC | 463,615 | 653,832 | ||||||

Dubai Islamic Bank PJSC | 259,639 | 402,925 | ||||||

NMC Health PLC | 28,143 | 801,279 | ||||||

|

| |||||||

| 2,463,618 | ||||||||

|

| |||||||

Saudi Arabia — 2.9% | ||||||||

Fawaz Abdulaziz Al Hokair & Co.** | 40,521 | 454,567 | ||||||

Mouwasat Medical Services Co. | 9,637 | 406,454 | ||||||

Saudi Co. For Hardware LLC | 37,365 | 1,056,128 | ||||||

|

| |||||||

| 1,917,149 | ||||||||

|

| |||||||

Jordan — 0.9% | ||||||||

Al-Eqbal Investment Co. PLC | 16,473 | 609,982 | ||||||

Kazakhstan — 0.9% | ||||||||

KazMunaiGas Exploration Production JSC — GDR | 64,262 | 605,991 | ||||||

Qatar — 0.5% | ||||||||

Ooredoo QSC | 13,510 | 339,189 | ||||||

|

| |||||||

Total MIDDLE EAST | 16,825,930 | |||||||

|

| |||||||

| AFRICA — 15.0% | ||||||||

Egypt — 4.0% | ||||||||

Arabian Food Industries Co. DOMTY** | 960,506 | 478,133 | ||||||

Commercial International Bank Egypt SAE — GDR | 93,379 | 420,206 | ||||||

Egyptian Financial Group- Hermes Holding Co. | 588,222 | 792,736 | ||||||

Egyptian International Pharmaceuticals EIPICO | 11,781 | 71,856 | ||||||

ElSewdy Electric Co. | 173,389 | 898,810 | ||||||

|

| |||||||

| 2,661,741 | ||||||||

|

| |||||||

Nigeria — 3.8% | ||||||||

Dangote Cement PLC | 445,770 | 250,276 | ||||||

Diamond Bank PLC** | 26,776,601 | 90,940 | ||||||

Guaranty Trust Bank PLC | 7,305,888 | 696,752 | ||||||

Nigerian Breweries PLC | 1,257,926 | 554,699 | ||||||

Zenith Bank PLC | 16,821,700 | 962,464 | ||||||

|

| |||||||

| 2,555,131 | ||||||||

|

| |||||||

Kenya — 2.8% | ||||||||

Jubilee Holdings, Ltd. | 3,030 | 12,856 | ||||||

Safaricom, Ltd. | 8,371,661 | 1,836,599 | ||||||

|

| |||||||

| 1,849,455 | ||||||||

|

| |||||||

Notes to Financial Statements are an integral part of this Schedule.

15

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

Morocco — 1.9% | ||||||||

Maroc Telecom | 28,874 | $ | 420,277 | |||||

Societe d’Exploitation des Ports | 57,677 | 854,164 | ||||||

|

| |||||||

| 1,274,441 | ||||||||

|

| |||||||

Tanzania — 1.0% | ||||||||

Tanzania Breweries, Ltd. | 113,833 | 681,269 | ||||||

Senegal — 0.9% | ||||||||

Sonatel | 15,108 | 631,344 | ||||||

Botswana — 0.6% | ||||||||

Letshego Holdings, Ltd. | 2,066,739 | 432,331 | ||||||

|

| |||||||

Total AFRICA | 10,085,712 | |||||||

|

| |||||||

| EUROPE — 14.3% | ||||||||

Romania — 7.9% | ||||||||

Banca Transilvania | 3,432,464 | 2,309,151 | ||||||

BRD-Groupe Societe Generale SA | 297,304 | 1,004,136 | ||||||

Fondul Proprietatea SA | 5,757,658 | 1,197,363 | ||||||

Transgaz SA Medias | 9,033 | 810,246 | ||||||

|

| |||||||

| 5,320,896 | ||||||||

|

| |||||||

Georgia — 1.9% | ||||||||

Georgia Healthcare Group PLC1** | 142,195 | 658,859 | ||||||

TBC Bank Group PLC | 28,022 | 578,119 | ||||||

|

| |||||||

| 1,236,978 | ||||||||

|

| |||||||

United Kingdom — 1.6% | ||||||||

BGEO Group PLC | 8,358 | 380,354 | ||||||

KAZ Minerals PLC** | 96,200 | 648,408 | ||||||

|

| |||||||

| 1,028,762 | ||||||||

|

| |||||||

Luxembourg — 0.9% | ||||||||

Adecoagro SA** | 61,061 | 609,999 | ||||||

Poland — 0.8% | ||||||||

KRUK SA | 6,604 | 548,900 | ||||||

Croatia — 0.6% | ||||||||

Valamar Riviera DD | 61,979 | 418,825 | ||||||

Estonia — 0.6% | ||||||||

Tallink Grupp AS | 385,750 | 400,933 | ||||||

|

| |||||||

Total EUROPE | 9,565,293 | |||||||

|

| |||||||

| SOUTH AMERICA — 13.6% | ||||||||

Argentina — 12.7% | ||||||||

Banco Macro SA — ADR | 14,095 | 1,299,418 | ||||||

Grupo Financiero Galicia | 35,285 | 1,504,552 | ||||||

Holcim Argentina SA | 234,029 | 691,302 | ||||||

Pampa Energia SA — SP ADR** | 26,417 | 1,554,641 | ||||||

Telecom Argentina SA — SP ADR | 25,131 | 636,820 | ||||||

YPF SA — SP ADR | 128,902 | 2,822,954 | ||||||

|

| |||||||

| 8,509,687 | ||||||||

|

| |||||||

Number of Shares | Value (Note A) | |||||||

Colombia — 0.9% | ||||||||

Banco Davivienda SA — Pref. | 56,314 | $ | 618,672 | |||||

|

| |||||||

Total SOUTH AMERICA | 9,128,359 | |||||||

|

| |||||||

Total EQUITY SECURITIES (Cost $53,850,859) | 63,561,078 | |||||||

|

| |||||||

| ||||||||

| EQUITY CERTIFICATES — 0.3% | ||||||||

| FAR EAST — 0.3% | ||||||||

Vietnam — 0.3% | ||||||||

Ho Chi Minh City Infrastructure Investment JSC2 | 93,200 | 152,525 | ||||||

Nam Long Investment Corp.2 | 58,487 | 73,331 | ||||||

|

| |||||||

Total FAR EAST | 225,856 | |||||||

|

| |||||||

Total EQUITY CERTIFICATES (Cost $160,882) | 225,856 | |||||||

|

| |||||||

| ||||||||

TOTAL INVESTMENTS | 95.0 | % | $ | 63,786,934 | ||||

Other Assets In Excess Of Liabilities | 5.0 | % | 3,350,836 | |||||

|

|

|

| |||||

Net Assets | 100.0 | % | $ | 67,137,770 | ||||

| ||||||||

The federal income tax basis and unrealized appreciation (depreciation) for all investments is as follows:

Basis: | $ | 54,171,203 | ||

|

| |||

Gross Appreciation | $ | 10,819,289 | ||

Gross Depreciation | (1,203,558 | ) | ||

|

| |||

Net Appreciation | $ | 9,615,731 | ||

|

|

| 1 | 144A — This security was purchased pursuant to Rule 144A of the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At June 30, 2017, this security amounted to $658,859 or 1.0% of net assets. This 144A security has not been deemed illiquid. |

| 2 | Restricted security — Investments in securities not registered under the Securities Act of 1933, excluding 144A securities. At June 30, 2017, the value of these restricted securities amounted to $225,856 or 0.3% of net assets. This 144A security has not been deemed illiquid. |

| ** | Non-income producing security |

Notes to Financial Statements are an integral part of this Schedule.

16

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

June 30, 2017 (unaudited)

Additional information on each restricted security is as follows:

Security | Counter- party | Acquisition Date(s) | Acquisition Cost | |||||||||

Ho Chi Minh City Infrastructure Investment JSC | MACQ | 08/03/15 | $ | 113,080 | ||||||||

Nam Long Investment Corp. | MACQ | | 05/04/15 to 05/07/15 | | $ | 47,802 | ||||||

ADR — American Depository Receipt

GDR — Global Depository Receipt

MACQ — Macquarie Capital Group, Ltd.

SP ADR — Sponsored American Depository Receipt

Regional Weightings*

Asia/Far East Ex-Japan | 27.0% | |||

Middle East | 25.1% | |||

Africa | 15.0% | |||

South America | 13.6% | |||

Eastern Europe | 11.8% | |||

Western Europe | 2.5% |

Top Ten Holdings*

YPF SA — SP ADR | 4.2% | |||

Banca Transilvania | 3.4% | |||

National Bank of Kuwait SAKP | 3.3% | |||

BRAC Bank, Ltd. | 3.2% | |||

Vietnam Dairy Products JSC | 2.8% | |||

Safaricom, Ltd. | 2.7% | |||

Pampa Energia SA — SP ADR | 2.3% | |||

United Bank, Ltd. | 2.2% | |||

Grupo Financiero Galicia SA — ADR | 2.2% | |||

Human Soft Holding Co. KSC | 2.2% |

| * | All percentages are stated as a percent of net assets at June 30, 2017. |

Notes to Financial Statements are an integral part of this Schedule.

17

Driehaus Frontier Emerging Markets Fund

Schedule of Investments

June 30, 2017 (unaudited)

Industry | Percent of Net Assets | |||

Air Freight & Logistics | 1.0% | |||

Beverages | 3.6% | |||

Capital Markets | 1.8% | |||

Chemicals | 1.7% | |||

Commercial Banks | 27.4% | |||

Construction & Engineering | 1.8% | |||

Construction Materials | 3.5% | |||

Consumer Finance | 4.2% | |||

Diversified Consumer Services | 2.2% | |||

Diversified Financial Services | 1.8% | |||

Diversified Telecommunication Services | 3.0% | |||

Electric Utilities | 2.3% | |||

Electrical Equipment | 2.8% | |||

Food Products | 5.3% | |||

Health Care Providers & Services | 2.8% | |||

Hotels, Restaurants & Leisure | 0.6% | |||

Industry | Percent of Net Assets | |||

Household Durables | 0.9% | |||

Independent Power Producers & Energy Traders | 0.9% | |||

Insurance | 0.8% | |||

Marine | 0.6% | |||

Media | 0.6% | |||

Metals & Mining | 1.0% | |||

Oil, Gas & Consumable Fuels | 6.3% | |||

Pharmaceuticals | 3.2% | |||

Real Estate Management & Development | 1.7% | |||

Specialty Retail | 3.7% | |||

Tobacco | 1.5% | |||

Transportation Infrastructure | 3.7% | |||

Wireless Telecommunication Services | 4.3% | |||

Other Assets in Excess of Liabilities | 5.0% | |||

|

| |||

TOTAL | 100.0% | |||

|

| |||

Notes to Financial Statements are an integral part of this Schedule.

18

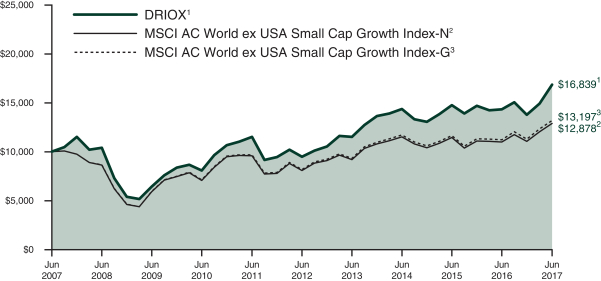

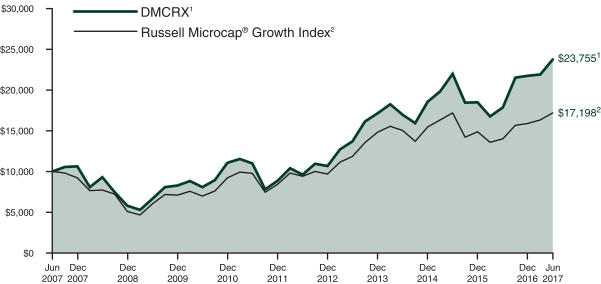

Driehaus International Small Cap Growth Fund

Performance Overview (unaudited)

The performance summarized below is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Performance data presented measures the change in the value of an investment in the Fund, assuming reinvestment of all dividends and capital gains. Average annual total return reflects annualized change.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph compares the results of a $10,000 investment in the Fund over the last 10 fiscal year periods (which includes performance of the Predecessor Limited Partnership), with all dividends and capital gains reinvested, with the indicated index (and dividends reinvested) for the same period.

| Fund Only | Including Predecessor Limited Partnership | |||||||||||||||||||

| Average Annual Total Returns as of 6/30/17 | 1 Year | 3 Years | 5 Years | Since Inception (9/17/07 - 6/30/17) | 10 Years | |||||||||||||||

Driehaus International Small Cap Growth Fund (DRIOX)1 | 17.36% | 5.42% | 12.15% | 5.80% | 5.35% | |||||||||||||||

MSCI AC World ex USA Small Cap Growth Index-N2 | 17.17% | 3.78% | 9.77% | 3.08% | 2.56% | |||||||||||||||

MSCI AC World ex USA Small Cap Growth Index-G3 | 17.48% | 4.04% | 10.04% | 3.34% | 2.81% | |||||||||||||||

| 1 | The Driehaus International Small Cap Growth Fund (the “Fund”) performance shown above includes the performance of the Driehaus International Opportunities Fund, L.P. (the “Predecessor Limited Partnership”), the Fund’s predecessor, for the periods before the Fund’s registration statement became effective. The Predecessor Limited Partnership, which was established on August 1, 2002, was managed with substantially the same investment objective, policies and philosophies as are followed by the Fund. The Fund succeeded to the Predecessor Limited Partnership’s assets on September 17, 2007. The Predecessor Limited Partnership was not registered under the Investment Company Act of 1940, as amended (“1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Limited Partnership had been registered under the 1940 Act, its performance may have been adversely affected. The Predecessor Limited Partnership’s performance has been restated to reflect estimated expenses of the Fund. The returns for the periods prior to January 1, 2010, reflect fee waivers and/or reimbursements without which performance would have been lower. |

| 2 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Net (MSCI AC World ex USA Small Cap Growth Index-N) is a market capitalization-weighted index designed to measure equity market performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which |

19

Driehaus International Small Cap Growth Fund

Performance Overview (unaudited)

| are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with net dividend reinvestment. The benchmark has changed from the Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Gross (MSCI AC World ex USA Small Cap Growth Index-G) to the MSCI AC World ex USA Small Cap Growth Index-N because the net index is more commonly used industry wide and is a more representative comparison versus the fund because it is presented net of foreign withholding taxes. Source: Morgan Stanley Capital International Inc. |

| 3 | The Morgan Stanley Capital International All Country World ex USA Small Cap Growth Index-Gross (MSCI AC World ex USA Small Cap Growth Index-G) is a market capitalization-weighted index designed to measure equity performance in global developed markets and emerging markets, excluding the U.S., and is composed of stocks which are categorized as small capitalization growth stocks. Data is in U.S. dollars and is calculated with gross dividend reinvestment. Source: Morgan Stanley Capital International, Inc. |

20

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number Shares | Value (Note A) | |||||||

| EQUITY SECURITIES — 96.2% | ||||||||

| EUROPE — 54.9% | ||||||||

United Kingdom — 14.5% | ||||||||

Abcam PLC | 215,195 | $ | 2,728,546 | |||||

Balfour Beatty PLC | 1,044,097 | 3,679,865 | ||||||

Clinigen Group PLC | 319,786 | 3,586,128 | ||||||

Croda International PLC | 56,625 | 2,865,250 | ||||||

Dechra Pharmaceuticals PLC | 65,278 | 1,445,370 | ||||||

Fevertree Drinks PLC | 101,712 | 2,258,706 | ||||||

GKN PLC | 494,218 | 2,098,454 | ||||||

JD Sports Fashion PLC | 534,030 | 2,434,428 | ||||||

Rentokil Initial PLC | 631,512 | 2,247,939 | ||||||

Scapa Group PLC | 444,861 | 2,743,516 | ||||||

Sophos Group PLC1 | 644,109 | 3,719,789 | ||||||

Spirax-Sarco Engineering PLC | 25,542 | 1,779,803 | ||||||

SSP Group PLC | 254,247 | 1,575,591 | ||||||

Vesuvius PLC | 593,595 | 4,101,463 | ||||||

Worldpay Group PLC1 | 902,126 | 3,698,836 | ||||||

|

| |||||||

| 40,963,684 | ||||||||

|

| |||||||

Germany — 10.8% | ||||||||

ADO Properties SA1 | 65,918 | 2,788,306 | ||||||

AIXTRON SE** | 416,088 | 2,925,077 | ||||||

Carl Zeiss Meditec AG | 83,847 | 4,351,609 | ||||||

CTS Eventim AG & Co., KGaA | 70,537 | 3,119,438 | ||||||

Deutsche Lufthansa AG | 142,610 | 3,245,431 | ||||||

Hypoport AG** | 10,348 | 1,341,456 | ||||||

KION Group AG | 38,505 | 2,943,046 | ||||||

Puma SE | 14,003 | 5,381,033 | ||||||

Vapiano SE1** | 104,243 | 2,714,599 | ||||||

zooplus AG** | 7,835 | 1,557,085 | ||||||

|

| |||||||

| 30,367,080 | ||||||||

|

| |||||||

France — 5.6% | ||||||||

Air France-KLM** | 347,815 | 4,959,762 | ||||||

Alten SA | 19,001 | 1,568,840 | ||||||

IPSOS | 36,319 | 1,362,678 | ||||||

Maisons du Monde SA1 | 93,210 | 3,626,560 | ||||||

Teleperformance | 33,322 | 4,268,294 | ||||||

|

| |||||||

| 15,786,134 | ||||||||

|

| |||||||

Austria — 3.8% | ||||||||

ams AG | 43,394 | 2,817,058 | ||||||

BUWOG AG | 79,957 | 2,297,232 | ||||||

RHI AG | 59,332 | 2,199,013 | ||||||

S&T AG | 48,305 | 726,887 | ||||||

Wienerberger AG | 119,503 | 2,714,799 | ||||||

|

| |||||||

| 10,754,989 | ||||||||

|

| |||||||

Finland — 3.2% | ||||||||

Cramo OYJ | 75,040 | 2,245,526 | ||||||

Orion OYJ — B | 21,725 | 1,387,061 | ||||||

Outokumpu OYJ | 172,368 | 1,376,125 | ||||||

Valmet OYJ | 207,325 | 4,027,912 | ||||||

|

| |||||||

| 9,036,624 | ||||||||

|

| |||||||

Number Shares | Value (Note A) | |||||||

Switzerland — 3.1% | ||||||||

Coca-Cola HBC AG | 86,286 | $ | 2,537,625 | |||||

Dufry AG** | 11,601 | 1,900,633 | ||||||

Wizz Air Holdings PLC1** | 77,515 | 2,444,239 | ||||||

Ypsomed Holding AG | 9,643 | 1,949,919 | ||||||

|

| |||||||

| 8,832,416 | ||||||||

|

| |||||||

Sweden — 2.7% | ||||||||

Com Hem Holding AB | 241,138 | 3,348,861 | ||||||

Probi AB | 23,327 | 1,605,952 | ||||||

Saab AB — B | 55,781 | 2,754,388 | ||||||

|

| |||||||

| 7,709,201 | ||||||||

|

| |||||||

Italy — 2.1% | ||||||||

Azimut Holding SpA | 161,062 | 3,228,451 | ||||||

Maire Tecnimont SpA | 576,556 | 2,678,838 | ||||||

|

| |||||||

| 5,907,289 | ||||||||

|

| |||||||

Luxembourg — 1.7% | ||||||||

APERAM SA | 42,332 | 1,967,828 | ||||||

B&M European Value Retail SA | 608,697 | 2,685,218 | ||||||

|

| |||||||

| 4,653,046 | ||||||||

|

| |||||||

Denmark — 1.7% | ||||||||

Christian Hansen Holding AS | 19,351 | 1,407,405 | ||||||

FLSmidth & Co., AS | 51,276 | 3,240,217 | ||||||

|

| |||||||

| 4,647,622 | ||||||||

|

| |||||||

Turkey — 1.4% | ||||||||

Turk Hava Yollari AO** | 1,776,025 | 4,063,437 | ||||||

Belgium — 1.2% | ||||||||

Bekaert SA | 64,113 | 3,261,888 | ||||||

Russia — 1.0% | ||||||||

X5 Retail Group NV — GDR** | 78,220 | 2,710,323 | ||||||

Netherlands — 0.8% | ||||||||

Aalberts Industries NV | 59,701 | 2,377,021 | ||||||

Norway — 0.8% | ||||||||

Skandiabanken ASA1 | 238,039 | 2,252,443 | ||||||

Jersey — 0.5% | ||||||||

Sanne Group PLC | 177,796 | 1,477,426 | ||||||

|

| |||||||

Total EUROPE | 154,800,623 | |||||||

|

| |||||||

| FAR EAST — 27.8% | ||||||||

Japan — 19.6% | ||||||||

Asahi Intecc Co., Ltd. | 30,625 | 1,391,365 | ||||||

Daifuku Co., Ltd. | 90,175 | 2,689,817 | ||||||

Itochu Techno-Solutions Corp. | 102,924 | 3,596,278 | ||||||

Izumi Co., Ltd. | 67,162 | 3,809,678 | ||||||

Japan Lifeline Co., Ltd. | 83,911 | 3,547,427 | ||||||

Koito Manufacturing Co., Ltd. | 38,725 | 1,990,047 | ||||||

Kose Corp. | 26,796 | 2,923,200 | ||||||

Kusuri no Aoki Holdings Co., Ltd. | 28,932 | 1,515,088 | ||||||

M&A Capital Partners Co., Ltd.** | 38,015 | 1,754,148 | ||||||

Notes to Financial Statements are an integral part of this Schedule.

21

Driehaus International Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (unaudited)

Number of Shares | Value (Note A) | |||||||

Minebea Mitsumi, Inc. | 134,891 | $ | 2,164,732 | |||||

Morinaga & Co., Ltd. | 39,503 | 2,240,757 | ||||||

Nichias Corp. | 140,508 | 1,622,760 | ||||||

Nichirei Corp. | 50,176 | 1,405,240 | ||||||

Nifco, Inc. | 35,698 | 1,913,838 | ||||||

Nihon M&A Center, Inc. | 65,083 | 2,378,227 | ||||||

NOK Corp. | 111,600 | 2,355,531 | ||||||

PALTAC Corp. | 77,460 | 2,606,678 | ||||||

Pola Orbis Holdings, Inc. | 55,127 | 1,451,755 | ||||||

Ryohin Keikaku Co., Ltd. | 14,271 | 3,561,565 | ||||||

Seria Co., Ltd. | 29,717 | 1,434,659 | ||||||

Sinfonia Technology Co., Ltd. | 354,755 | 1,460,338 | ||||||

Start Today Co., Ltd. | 90,129 | 2,215,663 | ||||||

TechnoPro Holdings, Inc. | 75,649 | 3,040,084 | ||||||

Tokyo Tatemono Co., Ltd. | 164,269 | 2,149,846 | ||||||

|

| |||||||

| 55,218,721 | ||||||||

|

| |||||||

China — 2.8% | ||||||||

China Medical System Holdings, Ltd. | 1,200,782 | 2,076,293 | ||||||

China Railway Signal & Communication Corp., Ltd. — H1 | 2,798,226 | 2,157,596 | ||||||

Haier Electronics Group Co., Ltd. | 1,388,062 | 3,609,073 | ||||||

|

| |||||||

| 7,842,962 | ||||||||

|

| |||||||

Australia — 2.4% | ||||||||

ALS, Ltd. | 229,706 | 1,315,309 | ||||||

BlueScope Steel, Ltd. | 170,257 | 1,728,650 | ||||||

NEXTDC, Ltd.** | 1,074,889 | 3,725,971 | ||||||

|

| |||||||

| 6,769,930 | ||||||||

|

| |||||||

South Korea — 2.0% | ||||||||

BGF retail Co., Ltd. | 12,355 | 1,090,639 | ||||||

Hugel, Inc.** | 6,423 | 3,140,907 | ||||||

Koh Young Technology, Inc. | 30,404 | 1,594,406 | ||||||

|

| |||||||

| 5,825,952 | ||||||||

|

| |||||||

Philippines — 0.5% | ||||||||

Metro Pacific Investments Corp. | 11,183,384 | 1,416,207 | ||||||

Indonesia — 0.5% | ||||||||

PT Bumi Serpong Damai Tbk | 9,833,519 | 1,350,241 | ||||||

|

| |||||||

Total FAR EAST | 78,424,013 | |||||||

|

| |||||||

| NORTH AMERICA — 12.3% | ||||||||

Canada — 11.1% | ||||||||

Advantage Oil & Gas, Ltd.** | 165,237 | 1,117,465 | ||||||

CAE, Inc. | 168,855 | 2,911,473 | ||||||

Canada Goose Holdings, Inc.** | 122,477 | 2,418,921 | ||||||

CCL Industries, Inc. — B | 49,130 | 2,485,672 | ||||||

Number of Shares | Value (Note A) | |||||||

CES Energy Solutions Corp. | 515,126 | $ | 2,295,981 | |||||

Dollarama, Inc. | 35,534 | 3,395,295 | ||||||

Enerflex, Ltd. | 91,997 | 1,335,120 | ||||||

Hudbay Minerals, Inc. | 368,522 | 2,131,335 | ||||||

Kelt Exploration, Ltd.** | 314,685 | 1,523,922 | ||||||

Kinaxis, Inc.** | 36,555 | 2,275,949 | ||||||

New Flyer Industries, Inc. | 79,262 | 3,315,215 | ||||||

Parex Resources, Inc.** | 213,344 | 2,426,607 | ||||||

Parkland Fuel Corp. | 160,086 | 3,667,609 | ||||||

|

| |||||||

| 31,300,564 | ||||||||

|

| |||||||

Mexico — 0.7% | ||||||||

Promotora y Operadora de Infraestructura SAB de CV | 171,814 | 2,052,443 | ||||||

United States — 0.5% | ||||||||

Nexteer Automotive Group, Ltd. | 855,039 | 1,340,473 | ||||||

|

| |||||||

Total NORTH AMERICA | 34,693,480 | |||||||

|

| |||||||

| SOUTH AMERICA — 0.6% | ||||||||

Uruguay — 0.6% | ||||||||

Arcos Dorados Holdings, Inc. — A** | 222,013 | 1,653,997 | ||||||

|

| |||||||

Total SOUTH AMERICA | 1,653,997 | |||||||

|

| |||||||