QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

HEALTHTRONICS SURGICAL SERVICES, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 16, 2003

Dear Shareholder,

We cordially invite you to attend the 2003 Annual Meeting of Shareholders of HealthTronics Surgical Services, Inc., which will be held at the Grand Hyatt Atlanta, 3300 Peachtree Road NE, Atlanta, Georgia, on Friday, May 16, 2003, at 2:00 p.m. local time. The enclosed meeting notice and proxy statement contain details concerning the business to be discussed at the meeting.

Please sign, date and return your proxy card in the enclosed envelope at your earliest convenience to assure that your shares will be represented and voted at the meeting, even if you cannot attend.

Thank you for your support of HealthTronics Surgical Services.

| | | Sincerely, |

|

|

Argil J. Wheelock

Chairman and CEO |

This proxy statement and the accompanying proxy card are being mailed to HealthTronics Surgical Services shareholders beginning about April 16, 2003.

HEALTHTRONICS SURGICAL SERVICES, INC.

NOTICE OF 2003 ANNUAL MEETING OF SHAREHOLDERS

| Time: | | 2:00 p.m. (local time) Friday, May 16, 2003 |

Place: |

|

Grand Hyatt Atlanta

3300 Peachtree Road NE

Atlanta, Georgia 30305 |

Agenda: |

|

Consider and act upon the following: |

1. |

|

The election of six directors. The following individuals are nominated by the Board of Directors to serve until the 2004 Annual Meeting of Shareholders: |

|

|

James R. Andrews, MD

Scott A. Cochran

Donny R. Jackson |

|

Timothy J. Lindgren

Russell H. Maddox

Argil J. Wheelock, MD |

|

|

2. |

|

The transaction of such other business as may properly come before the meeting or any adjournments thereof. |

Record Date: |

|

Holders of common stock of HealthTronics at the close of business on March 28, 2003 are entitled to vote. |

More information about the above can be found in the attached proxy statement. A list of shareholders as of the record date will be available for inspection at the annual meeting. |

|

|

|

|

By Order of the Board of Directors |

|

|

|

|

TED S. BIDERMAN

Corporate Secretary |

Marietta, Georgia

April 16, 2003 |

|

|

|

|

EACH SHAREHOLDER IS ENCOURAGED TO EXECUTE AND RETURN THE ENCLOSED PROXY PROMPTLY. A SHAREHOLDER WHO DECIDES TO ATTEND THE MEETING MAY, IF SO DESIRED, REVOKE THE PROXY AND VOTE THE SHARES IN PERSON. |

|

|

|

|

|

|

|

TABLE OF CONTENTS

| Voting | | 1 |

Election of Directors |

|

2 |

Audit Committee |

|

5 |

Security Ownership of Certain Beneficial Owners, Directors and Officers |

|

6 |

Executive Officers |

|

9 |

Executive Compensation |

|

11 |

Performance Graph |

|

14 |

Report of the Compensation Committee |

|

15 |

Certain Relationships and Related Transactions |

|

16 |

Section 16(a) Beneficial Ownership Reporting Compliance |

|

16 |

HEALTHTRONICS SURGICAL SERVICES, INC.

1841 West Oak Parkway, Suite A

Marietta, GA 30062

April 16, 2003

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 16, 2003

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of HealthTronics Surgical Services, Inc. (the "Company") to be voted at the 2003 Annual Meeting of Shareholders of the Company and at any adjournments thereof. The Annual Meeting will be held at the Grand Hyatt Atlanta, 3300 Peachtree Road NE, Atlanta, Georgia 30305, on Friday, May 16, 2003, at 2:00 p.m. local time.

The mailing address of the principal executive offices of the Company is 1841 West Oak Parkway, Suite A, Marietta, Georgia 30062. The approximate date on which this proxy statement and form of proxy are first being sent or given to shareholders is April 16, 2003.

VOTING

Only owners of record of shares of common stock of the Company ("Company Stock") at the close of business on March 28, 2003, are entitled to notice of and to vote at the 2003 Annual Meeting or any adjournments thereof. Each shareholder of record on the record date is entitled to one vote for each share of Company Stock so owned. On March 28, 2003, there were 11,421,934 shares of Company Stock issued and outstanding. Under the Company's bylaws, the holders of a majority of the issued and outstanding shares of Company Stock, present in person or represented by proxy at the Annual Meeting, will constitute a quorum for the transaction of business. Shareholders may vote in favor of all nominees for election as directors, withhold their votes as to all nominees or withhold their votes as to specific nominees. With respect to all other proposals, shareholders may vote in favor of or against each proposal or may abstain from voting. Shareholders should specify their choices on the enclosed proxy card.

Recommendations of the Board of Directors

If no specific instructions are given with respect to the matters to be acted upon, the shares represented by a properly signed proxy card will be voted in accordance with the recommendations of the Board of Directors, which are as follows:

FOR the election of the following six directors nominated by the Board to serve until the 2004 Annual Meeting of Shareholders:

James R. Andrews, MD

Scott A. Cochran

Donny R. Jackson

Timothy J. Lindgren

Russell H. Maddox

Argil J. Wheelock, MD

If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon such matters according to their judgment as to what is in the best interests of the Company.

1

The six nominees for directors receiving the highest vote totals will be elected as directors of the Company. Therefore, abstentions and broker nonvotes* will have no effect on the vote for the election of directors.

*"Broker nonvotes" are limited proxies submitted by brokers who do not have the required voting authority from the beneficial owners.

With respect to all other proposals, the affirmative vote of the holders of a majority of the Company Stock present, or represented and entitled to vote, at the Annual Meeting, will be required to approve such proposals. Abstentions will be counted as present and entitled to vote, and will have the effect of "No" votes. Broker nonvotes will not be included in vote totals and will have no effect on the outcome of each vote.

Proxies and votes will be tabulated by the Company's transfer agent, SunTrust Bank.

All proxies delivered pursuant to this solicitation are revocable at any time prior to the meeting at the option of the persons executing them either by giving written notice to the Secretary of the Company, by delivering a proxy bearing a later date, or by voting in person at the Annual Meeting. All properly executed proxies delivered and not revoked will be voted at the Annual Meeting in accordance with the directions given.

All expenses incurred in connection with the solicitation of proxies will be borne by the Company. Such costs include charges by brokers, banks, fiduciaries and custodians for forwarding proxy materials to beneficial owners of Company Stock held in their names. Solicitations may be undertaken by mail, telephone and personal contact by directors, officers and employees of the Company without additional compensation.

ELECTION OF DIRECTORS

(PROPOSAL NO. 1)

Nominees

Pursuant to the bylaws of the Company, the Board of Directors has set the number of directors of the Company at six.

The Board of Directors has namedJames R. Andrews, MD, Scott A. Cochran, Donny R. Jackson, Timothy J. Lindgren, Russell H. Maddox andArgil J. Wheelock, MD to stand for election as directors at the Annual Meeting. Each of the nominees has consented to serve as a director if elected at the Annual Meeting. Should any one or more of these nominees become unable to serve for any reason, or choose not to serve (which is not anticipated), the Board of Directors may designate a substitute nominee or nominees (in which event the persons named in the enclosed proxy card will vote all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancy or vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

Recommendation of the Board of Directors

The Board of Directors of the Company recommends a vote FOR the election of James R. Andrews, MD, Scott A. Cochran, Donny R. Jackson, Timothy J. Lindgren, Russell H. Maddox and Argil J. Wheelock, MD as directors to hold office until the 2004 Annual Meeting of Shareholders, and until their respective successors are elected and qualified.

2

Information Concerning Directors

Set forth below with respect to the directors and nominees for director of the Company is information regarding their principal occupations (which have continued for at least the past five years unless otherwise noted) and certain other information.

JAMES R. ANDREWS, MD, age 60—Dr. Andrews has served as a director of HealthTronics Surgical Services since July 2000. Dr. Andrews is one of the founding members of the Alabama Sports Medicine and Orthopaedic Center and the American Sports Medicine Institute (ASMI), located at HealthSouth Medical Center in Birmingham, Alabama. He serves also as Chairman and Medical Director of ASMI. Dr. Andrews was a member of the Sports Medicine Committee of the United States Olympic Committee during the quadrennials from 1992 to 1996 and from 1996 to 2000. He currently serves on the Medical and Safety Advisory Committee of USA Baseball and is the Medical Director for the Tampa Bay Devil Rays professional baseball team. Dr. Andrews holds positions as senior orthopaedic consultant for the Cincinnati Reds professional baseball team, orthopaedic consultant for the Toronto Blue Jays professional baseball team and team physician for the Birmingham Barons Double A professional baseball team, an affiliate of the Chicago White Sox. He is the Co-Medical Director for Auburn University's Intercollegiate Athletic program. He is also the orthopaedic consultant for the athletic teams of University of Alabama, Troy State University, University of West Alabama, Tuskegee University and Grambling University. Dr. Andrews is Co-Medical Director for the PGA Tour and the Senior PGA Tour and Co-Medical Director of the Ladies Professional Golf Association. Dr. Andrews serves on the Board of Directors of The Banc Corporation, a holding company for a full service bank.

SCOTT A. COCHRAN, age 41—Mr. Cochran has served as a director of HealthTronics Surgical Services since May 31, 1996. Mr. Cochran is a partner with the law firm of Cochran, Camp and Snipes in Smyrna, Georgia and has held this position since 1988. He received an AA degree from Young Harris College, a BA from Emory University and a JD from Mercer Law School.

DONNY R. JACKSON, age 54—Mr. Jackson is the Director of the Technical Services Group of InterCept, Inc., a publicly traded company which provides technology, products and services to financial institutions. Prior to this he served as President and Chief Executive Officer of Netzee, Inc., a publicly traded company providing integrated Internet banking and e-commerce products and services to financial institutions, from 2000 to 2002; President and Chief Operating Officer of The Intercept Group, Inc., from 1996 to 2000; Chief Executive Officer of Provesa, Inc., a data processing and check imaging services company, from 1993 to 1996; Chief Executive Officer of Bank Atlanta, from 1990 to 1992 and Chief Financial Officer, from 1988 to 1990; Audit Manager at Evans, Porter, Bryan, from 1986 to 1987; Audit Partner at Womble, Jackson, Gunn, from 1978 to 1986; Staff Accountant at Alexander Grant & Company, from 1976 to 1978 where he became a certified public accountant. Mr. Jackson has served on the Board of Directors of Intercept, Inc. and Bank Atlanta.

TIMOTHY J. LINDGREN, age 56—Mr. Lindgren is a divisional vice president for Hyatt Hotels & Resorts, overseeing the management and operations of 24 Hyatt hotels in 10 states. Throughout his 31-year career with Hyatt, Mr. Lindgren has held a variety of management positions including general manager of several Hyatt Regency hotels. In 1984, he received the Donald M. Pritzker Award for Excellence as Hyatt's General Manager of the Year. Mr. Lindgren is a member of the Board of Directors and Executive Committee for the Atlanta Convention & Visitors Bureau; a member of the Board of Directors and Executive Committee for Central Atlanta Progress; and a member of the Board of Directors of the Atlanta Downtown Improvement District. He has also served on the Board of Directors and the Executive Committee of the Metro Atlanta Chamber of Commerce. In 2000, Mr. Lindgren was a member of the Atlanta Super Bowl Executive Committee; and in 2002, he served on the Executive Committee of the Final Four.

3

RUSSELL H. MADDOX, age 62—Mr. Maddox serves as Vice-Chairman and Lead Director of the Company. He is a retired healthcare professional, having most recently served as President and Chief Operating Officer of HealthSouth Corporation's Diagnostic Division, from 1995 to 1998. Mr. Maddox was Founder and President of Russ Pharmaceuticals, Inc., which was recognized in December 1987, by INC. magazine as one of the 500 fastest growing privately held companies in the United States. Mr. Maddox was named Small Business Person of the Year in 1987 for the city of Birmingham and the State of Alabama. In March 1989, Russ Pharmaceuticals was acquired by Ethyl Corporation of Richmond, Virginia. Mr. Maddox has 30 years of executive level experience in the healthcare industry. From January 1992 until May 1995, he served as Chairman of the Board, President and Chief Executive Officer of Diagnostic Health Corporation, an outpatient diagnostic imaging company. He is very active in business and civic affairs throughout the United States. He currently serves on the University of Alabama at Birmingham's Research Foundation Board, as well as the Board of the American Sports Medicine Institute. He has served on the Board of Directors of MedPartners, Inc., Oclassen Pharmaceuticals, Inc., North Hampton Medical, Bradford Health Service, Scandipharm Pharmaceuticals, Cebert Pharmaceuticals and Imageon Solutions, Inc.

ARGIL J. WHEELOCK, MD, age 55—Dr. Wheelock has served as Chairman and Chief Executive Officer of HealthTronics Surgical Services since July 1, 1996. From 1979 until 1996 Dr. Wheelock was a practicing, board-certified urologist in Chattanooga, Tennessee. While in practice, he was engaged as a consultant by various public companies. Since July 1, 1996, Dr. Wheelock has worked exclusively as Chief Executive Officer of HealthTronics Surgical Services.

Committees and Meetings of the Board of Directors

The Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee and a Nominating Committee.

The Audit Committee recommends to the Board of Directors the engagement of the independent auditors of the Company and reviews with the independent auditors the scope and results of the audits, reviews the adequacy and effectiveness of the Company's internal controls, reviews the quality and integrity of the Company's annual and interim external financial reports, reviews the professional services furnished by the independent auditors to the Company and handles any other matters the Board of Directors deems appropriate. Members are Messrs. Cochran, Jackson and Lindgren. The Audit Committee met four times in 2002.

The Compensation Committee reviews and approves all salary arrangements for officers of the Company, including annual and long-term incentive awards and other remuneration. It also is responsible for administration of the Company's stock option and restricted stock plans, incentive plans, and certain other compensation plans. Members are Messrs. Andrews and Maddox. The Compensation Committee met four times in 2002.

The Company has a new Nominating Committee, which is responsible for identifying individuals qualified to be board members, and recommending to the board the director nominees for the next annual meeting of shareholders. It leads the board in its annual review of the board's performance and recommends to the board director candidates for each committee for appointment by the board. Nominations from shareholders, properly submitted in writing to HealthTronics' Corporate Secretary, will be referred to the committee for consideration. Members are Messrs. Jackson and Maddox.

In 2002, the Board of Directors held six meetings. Every director attended at least 83% percent of the total of all meetings of the Board and each committee on which such director served.

4

Compensation of Directors

The Company pays all expenses for Directors to attend board meetings. The Company also pays each Director $5,000 per board meeting attended and $1,000 per committee meeting attended. Directors also receive stock options at the discretion of the Compensation Committee of the Board of Directors as compensation for their service on the Board of Directors.

AUDIT COMMITTEE

Identification of Members and Functions of Committee

The Audit Committee of the Board of Directors is currently composed of three non-employee directors, Scott A. Cochran, Donny R. Jackson and Timothy J. Lindgren. Messrs. Cochran, Jackson and Lindgren are "independent directors" as defined by Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards.

Audit Committee Charter and Meetings

The Company's Audit Committee has an Audit Committee Charter, a copy of which was attached as an Appendix to the Company's 2001 Proxy Statement. In accordance with the Company's bylaws, the Audit Committee assists the Board in fulfilling its responsibility for overseeing the accounting, auditing and financial reporting processes of the Company. Each audit committee meeting was conducted so as to encourage communication among the members of the committee, management, and HealthTronics' independent auditors, Ernst & Young LLP. Among other things, the Audit Committee discussed with HealthTronics' independent auditors the overall scope, procedures and plans for its audit. On certain occasions, the Audit Committee met separately with the independent auditors, with and without management, to discuss the results of their examinations and their observations and recommendations regarding HealthTronics' internal controls.

At one meeting during 2002 and one meeting in early 2003, the Audit Committee met with members of senior management and the independent auditors to review the certifications provided by the Chief Executive Officer and Chief Financial Officer under the Sarbanes-Oxley Act of 2002, the rules and regulations of the Securities and Exchange Commission and the overall certification process. At these meetings, Company officers reviewed each of the Sarbanes-Oxley certification requirements concerning internal controls and any fraud, whether or not material, involving management or other employees with a significant role in internal controls.

Auditor Independence

The Audit Committee received from Ernst & Young LLP written disclosures and a letter regarding its independence as required by Independence Standards Board Standard No. 1, describing all relationships between the auditors and the Company that might bear on the auditors' independence, and discussed this information with Ernst & Young LLP. The Audit Committee specifically considered the provision of non-audit services by Ernst & Young LLP and concluded that the nature and scope of such services provided to the Company did not compromise Ernst & Young LLP's independence. The discussions with Ernst & Young LLP also included the matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended.

Review of Audited Financial Statements

The Audit Committee has reviewed the audited financial statements of the Company as of and for the fiscal year ended December 31, 2002 and has discussed the audited financial statements with management and with Ernst & Young LLP. Based on all of the foregoing reviews and discussions with management and Ernst & Young LLP, and subject to the limitations on its role and responsibilities

5

described in the Audit Committee Charter, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission. Representatives of Ernst & Young LLP will attend the Annual Meeting of Shareholders and will answer questions. Representatives of Ernst & Young LLP will also have the opportunity to make a statement at the Annual Meeting of Shareholders if they so desire.

Audit Fees

The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2002 and the reviews of the financial statements included in the Company's Forms 10-Q for fiscal year 2002 were $234,500.

Audit-Related Fees

The aggregate fees billed by Ernst & Young LLP for assurance and related services for fiscal year 2002 were $23,500.

Financial Information Systems Design and Implementation Fees

No fees related to financial information systems design and implementation services were paid to Ernst & Young LLP for fiscal year 2002.

Tax Fees

No fees related to tax services were paid to Ernst & Young LLP for fiscal year 2002.

All Other Fees

The aggregate fees billed for services rendered by Ernst & Young LLP, other than fees for the audit and financial information systems design and implementation, for fiscal year 2002 were $0.

The foregoing report is submitted by the Audit Committee, consisting of Scott A. Cochran, Donny R. Jackson and Timothy J. Lindgren.

The foregoing report of the Audit Committee shall not be deemed to be incorporated by reference into any of the Company's previous or future filings with the Securities and Exchange Commission, except as otherwise explicitly specified by the language in any such filing.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND OFFICERS

HealthTronics encourages stock ownership by its directors, officers, and employees to align their interests with the interests of shareholders. To achieve this goal, we pay a large percentage of our director fees in HealthTronics' stock options, and include common stock and options in compensation for our senior management and employees.

6

The number of shares of Company Stock owned beneficially by each person who holds greater than 5% of the Company's stock, by each director, each nominee for director, and each other executive officer named in the table titled "Summary of Cash and Certain Other Compensation" below under "Executive Compensation" and by all directors and named executive officers as a group, as of February 28, 2003, is set forth in the table below. Unless otherwise indicated, all persons shown in the table have sole voting and investment power with regard to the shares shown.

Name of Owner and

Current Address

| | Amount of Beneficial Ownership

| | Percentage of

class (%)

|

|---|

Argil J. Wheelock, MD

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | 1,601,064 shares | | 14.16 |

Martin J. McGahan

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

48,504 shares |

|

0.43 |

Victoria W. Beck

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

91,016 shares |

|

0.80 |

Ted S. Biderman

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

21,666 shares |

|

0.19 |

Bradley G. Devine

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

40,190 shares |

|

0.36 |

W. Price Dunaway

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

16,666 shares |

|

0.15 |

Ronald N. Gully

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

10,000 shares |

|

0.09 |

James R. Andrews, MD

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

65,333 shares |

|

0.58 |

Scott A. Cochran

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

180,000 shares |

|

1.59 |

Donny R. Jackson

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

0 shares |

|

0.00 |

Timothy J. Lindgren

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

15,000 shares |

|

0.13 |

Russell H. Maddox

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

213,000 shares |

|

1.88 |

|

|

|

|

|

7

Roy S. Brown

841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

1,028,980 shares |

|

9.10 |

Sheila J. Brown

1841 West Oak Parkway, Suite A

Marietta, GA 30062 |

|

592,100 shares |

|

5.24 |

All officers and directors as a group—12 persons |

|

2,302,439 shares |

|

20.36 |

Dr. Wheelock's beneficial ownership includes presently exercisable options to purchase up to 20,000 shares of Company stock at a purchase price of $8.50 per share, 25,000 shares at $10.50 per share and 126,000 shares at $6.50 per share.

Mr. McGahan's beneficial ownership includes presently exercisable options to purchase up to 33,000 shares of Company stock at a purchase price of $9.00 per share.

Ms. Beck's beneficial ownership includes presently exercisable options to purchase up to 5,000 shares of Company stock at a purchase price of $1.00 per share, 5,000 shares at $6.00 per share, 18,000 shares at $6.50 per share, 20,000 shares at $6.969 per share, 5,000 shares at $8.50 per share, 6,000 shares at $10.50 per share and 10,000 shares at $12.0625 per share.

Mr. Biderman's beneficial ownership includes presently exercisable options to purchase up to 21,666 shares of Company stock at a purchase price of $9.50 per share.

Mr. Devine's beneficial ownership includes presently exercisable options to purchase up to 6,000 shares of Company stock at a purchase price of $6.00 per share, 18,000 shares at $6.50 per share, 5,000 shares at $10.50 per share and 1,000 shares at $12.0625 per share.

Mr. Dunaway's beneficial ownership includes presently exercisable options to purchase up to 16,666 shares of Company stock at a purchase price of $11.12 per share.

Mr. Gully's beneficial ownership includes presently exercisable options to purchase up to 10,000 shares of Company stock at a purchase price of $5.099 per share.

Dr. Andrews's beneficial ownership includes presently exercisable options to purchase up to 12,000 shares of Company stock at a purchase price of $6.50 per share, 20,000 shares at $8.25 and 33,333 shares at $12.0625 per share.

Mr. Cochran's beneficial ownership includes presently exercisable options to purchase up to 15,000 shares of Company stock at a purchase price of $6.50 per share and 20,000 shares at $8.25 per share.

Mr. Maddox's beneficial ownership includes presently exercisable options to purchase up to 100,000 shares of Company stock at a purchase price of $6.00 per share, 15,000 shares at $6.50 per share, 20,000 shares at $8.25 per share and 5,000 shares at $8.50 per share.

Mr. Brown's beneficial ownership includes presently exercisable options to purchase up to 15,000 shares of Company stock at a purchase price of $8.50 per share, 25,000 shares at $10.50 per share and 120,000 shares at $6.50 per share.

8

EXECUTIVE OFFICERS

The name and positions of the Company's executive officers are set forth below.

Name

| | Position Held

| | Date First

Employed

|

|---|

| Argil J. Wheelock, MD | | Chairman and Chief Executive Officer | | July 1, 1996 |

Roy S. Brown(1) |

|

President and Chief Operating Officer |

|

May 31, 1996 |

Martin J. McGahan |

|

Chief Financial Officer |

|

June 19, 2001 |

Victoria W. Beck |

|

Executive Vice President and Vice President of Finance |

|

August 1, 1997 |

Ted S. Biderman |

|

Senior Vice President, General Counsel and Secretary |

|

April 15, 2002 |

Bradley G. Devine |

|

Senior Vice President and Chief Operating Officer of Equipment Sales and Service |

|

September 1, 1999 |

W. Price Dunaway |

|

Senior Vice President and Chief Operating Officer of Lithotripsy Operations |

|

March 14, 2003 |

Ronald N. Gully |

|

Senior Vice President and Chief Operating Officer of Orthopaedic Division |

|

October 1, 2001 |

- (1)

- Mr. Brown resigned as President and Chief Operating Officer on December 31, 2002.

Biographical information

Please see the biographical information under the "Directors" section for the biographical information of Dr. Wheelock.

ROY S. BROWN, age 55—Mr. Brown served as HealthTronics Surgical Services' President and Chief Operating Officer from June 1, 1996 until December 31, 2002. Previously he was the president of ServiceTrends, Inc., a medical equipment service company in Kennesaw, Georgia, from 1995 to 1996. Prior to this he served as: vice president of Sales and Marketing for Intra-Sonix of Burlington, Massachusetts, a medical equipment manufacturing company, from 1994 to 1995; owner of Andex products, an international business consulting firm in Lawrenceville, Georgia, from 1992 through 1994; and executive vice president of Sales and Marketing for Dornier Medical Systems, a manufacturer of medical equipment located in Munich, Germany, from 1984 to 1992.

MARTIN MCGAHAN, age 37—Mr. McGahan has served as HealthTronics Surgical Services, Inc.'s Chief Financial Officer since June 2001. He has over ten years experience in financial positions working with health care services, physicians and health insurance reimbursement. Mr. McGahan joined HealthTronics Surgical Services after working for HealthMarket Inc., a privately held health insurance company focusing on improving reimbursement to health care providers as well as increasing patient choice and patient care. Prior to this position he served as Chief Financial Officer and Senior Vice President for Saks Direct, the direct-to-consumer division of Saks Incorporated, the fourth largest retail department store chain in the country. Mr. McGahan has also held the positions of: Executive Director of Alabama Sports Medicine and Orthopaedic Center, the world-renowned orthopaedic practice and teaching program in Birmingham, Alabama; Regional Vice President for

9

HealthSouth Corporation; and Assistant Treasurer for Chase Manhattan Bank. Mr. McGahan received an MBA from the University of Virginia and a BA from Villanova University.

VICTORIA W. BECK, age 47—Ms. Beck served as HealthTronics Surgical Services, Inc.'s Chief Financial Officer from August 1997 until June 2001, when she was promoted to Executive Vice President and Vice President of Finance. Ms. Beck, a certified public accountant, graduated from Georgia State University with a degree in accounting. Before coming to HealthTronics Surgical Services, from mid 1994 until July of 1997, Ms. Beck was the owner of a CPA and consultancy firm that specialized in growth-oriented, emerging companies in the high-tech sector as well as businesses with foreign parent companies. From mid 1987 until mid 1994 she was the controller of Miller/Zell, a privately held Georgia company. From 1982 until mid 1987 Ms. Beck worked for the international accounting firm of Price Waterhouse, where she was an auditor for emerging companies.

TED S. BIDERMAN, age 34—Mr. Biderman has served as HealthTronics Surgical Services, Inc.'s Senior Vice President, General Counsel and Secretary since April 2002. Mr. Biderman came to HealthTronics after practicing law at Miller & Martin LLP, from 1996 to 2002. He was a member of the firm's corporate practice group with an emphasis on securities and mergers and acquisitions. Mr. Biderman is a member of the Business and Health Law Sections of the American Bar Association and is licensed to practice law in Georgia and Tennessee. Mr. Biderman received concurrent JD and MBA degrees from Drake University and a BS in Accounting from the University of Tennessee at Chattanooga.

BRADLEY G. DEVINE, age 43—Since September 1999, Mr. Devine has served as HealthTronics Surgical Services, Inc.'s Vice President and, currently, Senior Vice President and Chief Operating Officer of Equipment Sales and Service. Mr. Devine started his career in Biomedical Technology Service in 1979 in the United States Air Force, where he spent 81/2 years as a Department of Defense inspector for x-ray systems. In June 1987, Mr. Devine received the Meritorious Service Medal for his many contributions to the Air Force. Prior to joining HealthTronics he served as: Technical Support Manager, for ServiceTrends, a medical device service company, from 1998 to 1999; a consultant to hospitals and independent biomedical/ imaging equipment service companies, from 1996 through 1997; a service engineer for Dornier Medical Systems, a manufacturer of medical equipment, from 1994 to 1996; a service engineer at Georgetown University Hospital, from 1991 through 1993; Service Manager and Director of Operations for Mid-Atlantic Clinical Engineering, from 1987 through 1990. Mr. Devine has a degree in Electronics Technology from Los Angeles Metropolitan College.

W. PRICE DUNAWAY, age 51—In March 2003, Mr. Dunaway joined HealthTronics Surgical Services, Inc. as Senior Vice President and Chief Operating Officer of Lithotripsy Operations. Prior to this, from 2001 to 2003, he was Chief Operating Officer of Lexicor Health Services, Inc., a telemedicine information and equipment business; cofounder and Chief Executive Officer of Accelerated Pharmaceuticals, a company that performs computer modeling of small molecules based on gene structures, from 1998 to 2001; Chief Financial Officer of Osbon Medical Systems, Inc., a medical device and diagnostic equipment supplier, from 1989 to 1997; and Chief Operating Officer of Lenox Optical, Inc., a chain of one hour superopticals from 1986 to 1989. Mr. Dunaway currently serves as lead advisor to Rhodes, Enoch & Taylor, P.C., a law firm, and Johnson, Laschober & Associates, consulting engineers.

RONALD N. GULLY, age 45—Mr. Gully joined HealthTronics Surgical Services, Inc. as Senior Vice President of Reimbursement and Insurance in October 2001. In April 2002, he was promoted to Senior Vice President and Chief Operating Officer of Orthopaedic Division. Mr. Gully has more than 15 years experience in the management and marketing of healthcare services. Prior to joining HealthTronics Surgical Services, Mr. Gully had served as Chief Executive Officer and President of Ascension Corporation, a healthcare information technology company, from 2000 to 2001, and as Vice President of Managed Care for HealthSouth Corporation, from 1993 to 2000.

10

EXECUTIVE COMPENSATION

Summary of Cash And Certain Other Compensation

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company's Chief Executive Officer and each of the four other executive officers whose compensation exceeded $100,000 for the fiscal year ended December 31, 2002 (hereafter referred to as the named executive officers).

Summary Compensation Table

| |

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

| |

| | Securities

Underlying

Options

(#)

| |

|

|---|

Name and

Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation ($) (1)

| | All Other

Compensation($)(2)

|

|---|

Argil J. Wheelock, MD

Chief Executive Officer | | fiscal year

ended 12/31/02 | | 301,349 | | 0 | | 13,331 | | 0 | | 0 |

|

|

fiscal year

ended 12/31/01 |

|

110,315 |

|

67,809 |

|

12,823 |

|

210,000 |

|

350,003 |

|

|

fiscal year

ended 12/31/00 |

|

105,153 |

|

35,000 |

|

10,452 |

|

25,000 |

|

0 |

Roy S. Brown

President and Chief Operating Officer |

|

fiscal year

ended 12/31/02 |

|

234,426 |

|

0 |

|

19,770 |

|

0 |

|

0 |

|

|

fiscal year

ended 12/31/01 |

|

110,315 |

|

174,550 |

|

18,065 |

|

200,000 |

|

112,501 |

|

|

fiscal year

ended 12/31/00 |

|

105,153 |

|

25,000 |

|

14,114 |

|

25,000 |

|

0 |

Martin J. McGahan

Chief Financial Officer |

|

fiscal year

ended 12/31/02 |

|

202,878 |

|

0 |

|

13,869 |

|

15,000 |

|

0 |

|

|

fiscal year

ended 12/31/01 |

|

78,114 |

|

100,000 |

|

8,221 |

|

120,000 |

|

100,001 |

Victoria W. Beck

Executive Vice President and Vice President of Finance |

|

fiscal year

ended 12/31/02 |

|

116,679 |

|

0 |

|

8,485 |

|

7,500 |

|

0 |

|

|

fiscal year

ended 12/31/01 |

|

112,069 |

|

96,481 |

|

11,981 |

|

50,000 |

|

50,000 |

|

|

fiscal year

ended 12/31/00 |

|

97,079 |

|

20,000 |

|

6,439 |

|

31,000 |

|

0 |

Bradley G. Devine

Senior Vice President and Chief Operating Officer of Equipment Sales and Service |

|

fiscal year

ended 12/31/02 |

|

121,728 |

|

16,000 |

|

16,847 |

|

7,500 |

|

0 |

- (1)

- In addition to their annual remuneration, executive officers who are also employees may be entitled to participate in the Company's 401(k) plan. These amounts are shown in the "Other Annual Compensation"

11

column above. Also shown in the "Other Annual Compensation" column is an auto allowance for Mr. Brown of $6,000 in 2000, $6,000 in 2001 and $7,200 in 2002 and for Mr. Devine of $5,847 in 2002; insurance premiums paid by the Company for Dr. Wheelock of $2,148 in 2000, $2,323 in 2001 and $2,331 in 2002, for Mr. Brown of $1,445 in 2000 and $1,565 in 2001and $1,570 in 2002, for Mr. McGahan of $2,870 in 2002 and for Ms. Beck of $614 in 2000, $1,481 in 2001 and $1,484 in 2002 and relocation expenses for Mr. McGahan of $8,221 in 2001.

- (2)

- In 2001, a total of 94,962 shares of Company common stock were issued under the Company's deferred compensation plan in lieu of a cash bonus.

The following table contains information concerning the grant of stock options during 2002 to the named executive officers.

Option/SAR grants in last fiscal year

[individual grants]

Name and Title

| | Number of

Securities

Underlying

Options/SARs

(#)

| | Percent of Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | Exercise or

Base Price

| | Expiration

Date

| | Grant Date

Present Value

($)(1)

|

|---|

Martin J. McGahan

Chief Financial Officer | | 15,000 | | 5.13 | % | $ | 7.70 | | 9/20/2012 | | 77,400 |

Victoria W. Beck

Executive Vice President and Vice President of Finance |

|

7,500 |

|

2.56 |

% |

$ |

7.70 |

|

9/20/2012 |

|

38,700 |

Bradley G. Devine

Senior Vice President and Chief Operating Officer of Equipment Sales and Service |

|

7,500 |

|

2.56 |

% |

$ |

7.70 |

|

9/20/2012 |

|

38,700 |

- (1)

- The "grant date present value" is based upon the Black-Scholes option pricing model adapted for use in valuing executive stock options. The actual value, if any, the executive may realize upon exercise of the option will depend on the excess of the stock price over the exercise price on the date the option is exercised, so there is no assurance the value realized by the executive will be at or near the value estimated by the Black-Scholes model. The principal assumptions incorporated into the valuation model by HealthTronics are as follows: (i) dividend yield of 0%; (ii) expected volatility of .827% (iii) risk-free interest rate of 2.86%; and (iv) expected life of 5 years. No assumptions were made regarding nontransferability or risk of forfeiture. The assumptions chosen materially impact the resulting valuations.

12

The following chart details the exercise of any outstanding options and the number and value of unexercised stock options.

Aggregated option/SAR exercises in last fiscal year and FY-end option/SAR values

Name

| | Shares

Acquired

on

Exercise

| | Value

Realized

| | Number of Securities

Underlying Unexercised

Options/SARs

at FY-End

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money

Options/SARs

at FY-End

Exercisable/Unexercisable

|

|---|

Argil J. Wheelock, MD

Chairman and Chief Executive Officer | | 0 | | $ | 0 | | 129,000/126,000 | | $126,924/$190,386 |

Roy S. Brown

President and Chief Operating Officer |

|

0 |

|

$ |

0 |

|

120,000/120,000 |

|

$120,880/$181,320 |

Martin J. McGahan

Chief Financial Officer |

|

27,000 |

|

$ |

137,480 |

|

33,000/75,000 |

|

$0/$4,665 |

Victoria W. Beck

Executive Vice President and Vice President of Finance |

|

10,000 |

|

$ |

113,192 |

|

63,000/40,500 |

|

$84,082/$29,531 |

Bradley G. Devine

Senior Vice President and Chief Operating Officer of Equipment Sales and Service |

|

1,200 |

|

$ |

6,720 |

|

24,000/25,500 |

|

$30,198/$29,531 |

Employment Contracts

Dr. Wheelock entered into an employment contract with the Company effective January 1, 2002. The terms of the contract include an annual base salary of at least $300,000 and either a corporate automobile or an auto allowance of $600 per month. Dr. Wheelock may also receive annual bonuses and stock options at the discretion of the Compensation Committee. The length of the contract is 3 years and shall automatically renew for 3 years upon each anniversary date of the contract unless written notice of intention to terminate the contract is given at least 60 days prior to the anniversary date. The contract may be terminated by either party for cause or the incapacity of Dr. Wheelock. All unvested options shall vest and become exercisable immediately upon a change of control or termination of the contract, other than for cause or incapacity.

Mr. McGahan entered into an employment contract with the Company effective January 1, 2002. The terms of the contract include an annual base salary of at least $200,000. Mr. McGahan also receives a "whole" life insurance policy. If his employment is terminated for cause or due to Mr. McGahan's incapacity, any equity in the insurance policy will remain property of the Company. Mr. McGahan may also receive annual bonuses and stock options at the discretion of the Compensation Committee. The length of the contract is 3 years and shall automatically renew for 3 years upon each anniversary date of the contract unless written notice of intention to terminate the contract is given at least 60 days prior to the anniversary date. The contract may be terminated by either party for cause or the incapacity of Mr. McGahan. All unvested options shall vest and become exercisable immediately upon a change of control or termination of the contract, other than for cause or incapacity.

13

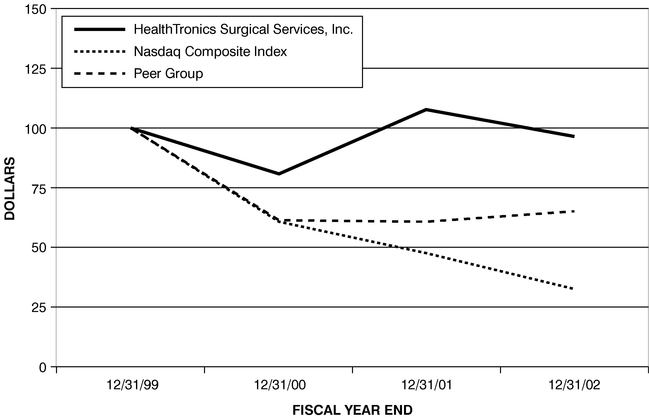

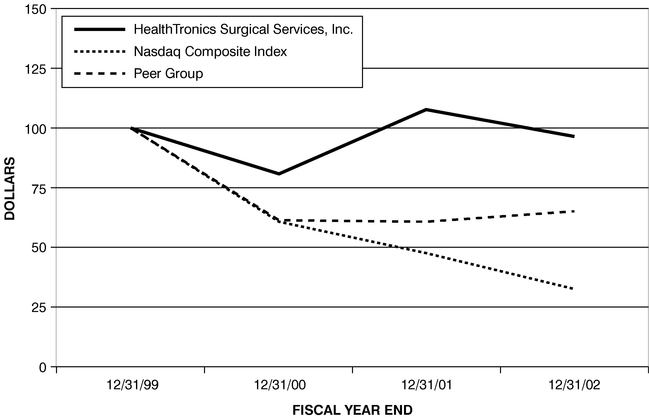

PERFORMANCE GRAPH

Fiscal Year End

| | Nasdaq Composite

Index

| | Peer Group

| | HealthTronics

Surgical Services, Inc.

|

|---|

| 12/31/99 | | 100.00 | | 100.00 | | 100.00 |

| 12/31/00 | | 60.71 | | 61.69 | | 80.83 |

| 12/31/01 | | 47.93 | | 60.64 | | 108.26 |

| 12/31/02 | | 32.82 | | 65.34 | | 96.37 |

The graph compares our cumulative total stockholder return with the cumulative total stockholder returns of the Nasdaq Composite Index and to an index of peer group companies we selected, for the period from December 31, 1999 through December 31, 2002. The peer group consists of Prime Medical Services, Inc., Medstone International, Inc., Urologix, Inc. and Candela Corporation. The graph assumes $100 invested on December 31, 1999, in our common stock and in each index, with the subsequent reinvestment of dividends on a quarterly basis.

14

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee, among its various functions, establishes and reviews the salaries and other compensation paid to our executive officers. This report summarizes the policies followed in setting compensation for our executive officers in 2002.

The Compensation Committee has established a compensation program for executive officers that is intended to reward performance in a growth stage entity in a developing industry. For 2002, the executive officer compensation included a conservative annual base salary with the potential for an annual bonus in cash or equity based on Company performance. The 2002 annual base salaries for executive officers were increased from 2001 to be in line with peer firms. The annual bonus was based on the Company meeting revenue and earning growth targets. As a result of the annual bonus utilizing year-end results, bonuses for 2002 performance are paid in 2003. No annual bonus was paid during 2002 as the 2001 bonuses were paid prior to year-end as special bonuses following the consummation of the Litho Group, Inc. acquisition. During 2002, the compensation committee granted 402,433 stock options. Of these, 115,000 options were granted to executive officers.

Russell H. Maddox

James R. Andrews, M.D.

Equity Compensation Plan Information

Plan Category

| | Number of

Securities

to be issued

upon exercise

of outstanding

options, warrants

and rights

(a)

| | Weighted

average

exercise

price of

outstanding

options, warrants

and rights

(b)

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 2,000,000 | | $ | 6.01 | | 564,213 |

| Equity compensation plans not approved by security holders | | 900,000 | | | 2.01 | | — |

| | |

| | | | |

|

| Total | | 2,900,000 | | | | | 564,213 |

| | |

| | | | |

|

Narrative Description of Equity Compensation Plans Not Approved by Security Holders

The stock option plans not approved by shareholders provided for the grant of compensation based stock options to employees or directors at the discretion of the board of directors. The options were issued at market value at the time of the grant. The options vest over a period of service, as specified at the time of the grant with terms of 3 to 10 years. If an employee, director or consultant left the Company, any unvested options terminated and vested options must have been exercised within a specified time period.

15

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Relationships and Transactions with Management and Others

Randy Wheelock is a principal of US Orthotripsy, LLC, a limited partner in Orthotripsy Services of Eastern Tennessee, L.P. ("East Tennessee") and OssaTron Services of the Carolinas, L.P. ("Carolinas"). East Tennessee provides Orthotripsy services in East Tennessee and Carolinas provides Orthotripsy services in North Carolina and South Carolina. US Orthotripsy, LLC also manages East Tennessee and Carolinas and Randy Wheelock was paid a monthly management fee of $4,333 during 2002 and will be paid at the same rate in 2003. Randy Wheelock is the brother of Dr. Argil Wheelock, Company CEO and Chairman.

Dr. Wheelock directly owns a 2.78% interest and indirectly owns an additional 3.3% interest (through 9% ownership in a corporate partner, NGST, Inc.) in Tenn-Ga Stone Group Two, a Tennessee general partnership. Tenn-Ga Stone Group Two provides lithotripsy services in Tennessee and North Georgia. Dr. Wheelock purchased his interests in Tenn-Ga Stone Group Two in or about 1990. The Company manages Tenn-Ga Stone Group Two and is a 28% owner and managing partner of Tenn-Ga Stone Group Three, a Tennessee general partnership that has a 38.25% ownership interest in Tenn-Ga Stone Group Two. Tenn-Ga Stone Group Two pays the Company a management fee of $40,000 per year. The Company also supplies service, parts and consumables to Tenn-Ga Stone Group Two at standard rates. During 2002, Tenn-Ga Stone Group Two paid $98,638 to the Company for such services, parts and consumables.

Dr. Wheelock purchased a 3% ownership interest in or about 1998 in Lincolnland Lithotripsy, Inc., a corporation that provides mobile lithotripsy services in Illinois. The Company also supplies service, parts and consumables to Lincolnland Lithotripsy, Inc. at standard rates. During 2002, Lincolnland Lithotripsy, Inc. paid $196,604 to the Company for such services, parts and consumables.

SHAREHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Director nominations and other proposals of shareholders intended to be presented at the 2004 Annual Meeting of Shareholders must be made in writing and received by the Company on or before December 17, 2003, to be eligible for inclusion in the Company's proxy statement and form of proxy relating to that meeting. If not received within such time period, director nominations and other shareholder proposals may be submitted to shareholders at the 2004 Annual Meeting (although excluded from the Company's proxy statement and form of proxy relating to that meeting) only if submitted in writing in accordance with the bylaws of the Company and received by the Company not less than 30 days nor more than 60 days prior to the 2004 Annual Meeting. All shareholder proposals should be submitted by certified mail, return receipt requested, to the Chief Financial Officer of the Company, 1841 West Oak Parkway, Suite A, Marietta, GA 30062.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based upon a review of filings with the Securities and Exchange Commission and written representations that no other reports were required, the Company believes that all of the Company's directors and executive officers complied with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934 during 2002 except:

Martin McGahan's stock option grant on September 20, 2002, subsequently reported on Form 5.

Victoria Beck's stock option grant on September 20, 2002, subsequently reported on Form 5.

Bradley Devine's stock option grant on September 20, 2002, subsequently reported on Form 5.

Ronald Gully's stock option grant on September 20, 2002, subsequently reported on Form 5.

16

OTHER MATTERS

Management does not know of any matters other than those referred to in the accompanying notice of the Annual Meeting of Shareholders that may properly come before the meeting or any adjournments thereof. As to any other matters that may properly come before the meeting, it is intended that all properly executed proxies delivered pursuant to this solicitation will be voted on any such matters in accordance with the discretion of the persons named on the enclosed proxy.

|

|

ARGIL J. WHEELOCK

Chairman |

Marietta, Georgia

April 16, 2003 | | |

The Company's 2002 Annual Report, which includes audited financial statements, has been mailed to shareholders of the Company. The Annual Report does not form any part of the material for the solicitation of proxies.

17

HEALTHTRONICS SURGICAL SERVICES, INC.

PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

MAY 16, 2003

The undersigned, having received the Notice of Annual Meeting and the Proxy Statement dated April 16, 2003, appoints Argil Wheelock and Martin McGahan, and each of them proxies, with full power of substitution and revocation to represent the undersigned and to vote all shares of HealthTronics Surgical Services, Inc., which the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held on May 16, 2003, at the Grand Hyatt Atlanta, 3300 Peachtree Road NE, Atlanta, Georgia, at 2:00 p.m. local time, and any adjournment(s) thereof, as specified in this Proxy:

1. Election of Directors

| o FOR | | o AGAINST | | o ABSTAIN |

INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ONE OR MORE OF THE NOMINEES, STRIKE A LINE THROUGH HIS NAME IN THE LIST BELOW:

JAMES R. ANDREWS, M.D.

SCOTT A. COCHRAN

DONNY R. JACKSON | | TIMOTHY J. LINDGREN

RUSSELL H. MADDOX

ARGIL J. WHEELOCK, M.D. |

2. Such other matters as may properly come before the meeting. This proxy will be voted as specified above.

The Board of Directors recommends affirmative votes for Item 1, andIF NOT CONTRARY SPECIFICATION IS MADE, THIS PROXY WILL BE VOTED FOR ITEM 1.

(SEE REVERSE SIDE)

(CONTINUED FROM OTHER SIDE)

The Board of Directors knows of no other matters that may properly be or which are likely to come or be brought before the meeting. However, if any other matters are properly brought before the meeting, the persons named in this proxy or their substitutes will vote in accordance with their best judgment on such matters.THIS PROXY SHOULD BE DATED, SIGNED BY THE SHAREHOLDER AS THE NAME APPEARS BELOW AND RETURNED PROMPTLY IN THE ENCLOSED ENVELOPE. JOINT OWNERS SHOULD EACH SIGN PERSONALLY, AND TRUSTEES AND OTHERS SIGNING IN A REPRESENTATIVE CAPACITY SHOULD INDICATE THEIR CAPACITY IN WHICH THEY SIGN.

| | Dated: | | | , 2003 |

| | | |

| |

|

Signature of Shareholder |

|

Signature of Shareholder

|

PLEASE SIGN, DATE AND PROMPTLY RETURN IN THE ACCOMPANYING ENVELOPE—NO POSTAGE REQUIRED.

QuickLinks

HEALTHTRONICS SURGICAL SERVICES, INC. NOTICE OF 2003 ANNUAL MEETING OF SHAREHOLDERSTABLE OF CONTENTSPROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 16, 2003VOTINGRecommendations of the Board of DirectorsELECTION OF DIRECTORS (PROPOSAL NO. 1)AUDIT COMMITTEESECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND OFFICERSEXECUTIVE OFFICERSEXECUTIVE COMPENSATIONSummary Compensation TableOption/SAR grants in last fiscal year [individual grants]Aggregated option/SAR exercises in last fiscal year and FY-end option/SAR valuesPERFORMANCE GRAPHREPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORSEquity Compensation Plan InformationCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSHAREHOLDER PROPOSALS FOR 2004 ANNUAL MEETINGSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEOTHER MATTERS