SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

HEALTHTRONICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

$500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(1) (3).

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

1301 S. Capital of Texas Highway

Suite B-200

Austin, TX 78746

NOTICE OF 2005 ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 26, 2005

To our shareholders:

You are cordially invited to attend our 2005 Annual Meeting of Shareholders to be held at 1301 S. Capital of Texas Highway, Atrium of Suite B-200, Austin, Texas 78746, on Thursday, May 26, 2005 at 8:00 a.m. Austin, Texas time, for the following purposes:

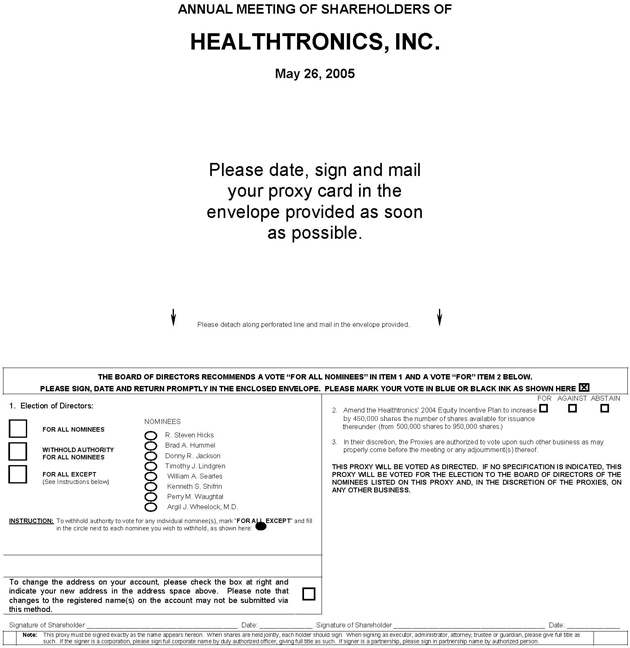

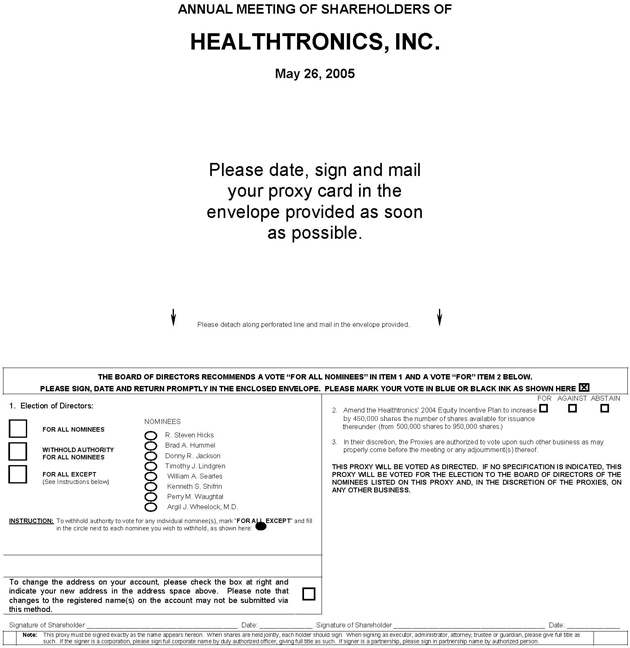

a) To elect eight directors to serve on our board of directors;

b) To consider and vote upon a proposal to amend our 2004 Equity Incentive Plan to increase by 450,000 shares the number of shares available for issuance thereunder (from 500,000 shares to 950,000 shares); and

c) To transact such other business as may properly come before the meeting or any adjournment(s) thereof.

The accompanying proxy statement contains information regarding, and a more complete description of, the items of business to be considered at the meeting.

The close of business on April 18, 2005 has been fixed as the record date for the determination of our shareholders entitled to receive notice of, and to vote at, the meeting or any adjournment(s) thereof.

You are cordially invited and urged to attend the meeting. Whether or not you plan on attending the meeting, we ask that you sign and date the accompanying proxy and return it promptly in the enclosed self-addressed envelope. If you attend the meeting, you may vote in person, if you wish, whether or not you have returned your proxy. In any event, you may revoke your proxy at any time before it is exercised.

By Order of our Board of Directors

JAMES S.B. WHITTENBURG, Secretary

Austin, Texas

April 20, 2005

HEALTHTRONICS, INC.

1301 S. Capital of Texas Highway

Suite B-200

Austin, Texas 78746

PROXY STATEMENT

for

2005 ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 26, 2005

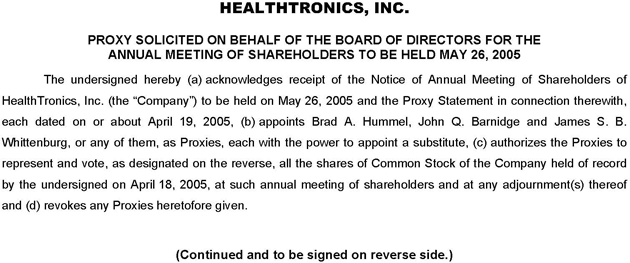

Our board of directors hereby solicits your proxy for use at our 2005 Annual Meeting of Shareholders to be held at 1301 S. Capital of Texas Highway, Atrium of Suite B-200, Austin, Texas 78746, on Thursday, May 26, 2005 at 8:00 a.m. Austin, Texas time, and any adjournment(s) thereof. This solicitation may be made in person or by mail, telephone, or telecopy by our directors, officers, and regular employees, who will receive no extra compensation for participating in this solicitation. We will also reimburse banks, brokerage firms, and other fiduciaries for forwarding solicitation materials to the beneficial owners of our common stock held of record by such persons. We will pay the entire cost of this solicitation. We expect to mail this proxy statement and the enclosed form of proxy to our shareholders on or about April 27, 2005.

Unless the context indicates otherwise, “HealthTronics”, “we”, “us”, “our” or the “Company” means HealthTronics, Inc. and all of our direct and indirect subsidiaries on a consolidated basis.

ANNUAL REPORT

Enclosed is our Annual Report to Shareholders for the year ended December 31, 2004, including our audited financial statements. Such Annual Report to Shareholders does not form any part of the material for the solicitation of proxies.

REVOCATION OF PROXY

Any shareholder returning the accompanying proxy may revoke such proxy at any time before it is voted by (a) giving written notice to our Secretary of such revocation, (b) voting in person at the meeting, or (c) executing and delivering to our Secretary a later dated proxy.

OUTSTANDING COMMON STOCK

Our voting securities are shares of our common stock, each share of which entitles the holder thereof to one vote on each matter properly brought before the meeting. Only shareholders of record at the close of business on April 18, 2005 are entitled to notice of, and to vote at, the meeting and any adjournment(s) thereof. As of April 18, 2005, there were outstanding and entitled to vote 33,563,212 shares of our common stock.

RECENT MERGER

On November 10, 2004, we completed the merger of Prime Medical Services, Inc., or Prime, with and into HealthTronics with HealthTronics being the surviving corporation in the merger. In this proxy statement we will refer to this merger between Prime and HealthTronics as “the Merger”. Prime was deemed to be the acquiring company for accounting purposes in the Merger and the Merger was accounted for as a reverse acquisition under the purchase method of accounting for business combinations in accordance with accounting principles generally accepted in the United States. The assets acquired and liabilities assumed were deemed to be those of HealthTronics because HealthTronics was the surviving legal entity. Our 2005 Annual Meeting of Shareholders will be the first annual meeting of the combined company.

1

CERTAIN SHAREHOLDERS

The following table sets forth certain information regarding beneficial ownership of our common stock as of April 18, 2005 or such other date indicated in the footnotes below by (a) each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of our common stock, (b) each of our directors and nominees for director, (c) each of our executive officers named in the Summary Compensation Table below under “Executive Compensation”, and (d) all of our executive officers and directors as a group. Unless otherwise indicated, we believe that each person or entity named below has sole voting and investment power with respect to all shares shown as beneficially owned by such person or entity, subject to community property laws where applicable and the information set forth in the footnotes to the table below.

| | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership(1)

| | | Percent of Class(2)

| |

Prides Capital Partners, L.L.C. et al 200 High Street, Suite 700 Boston, MA 02110 | | 2,655,443 | (3) | | 7.9 | % |

| | |

Perry Corp. 599 Lexington Avenue New York, NY 10022 | | 1,850,175 | (4) | | 5.5 | % |

| | |

FMR Corp. 82 Devonshire Street Boston, MA 02109 | | 1,747,339 | (5) | | 5.2 | % |

| | |

Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | | 1,670,438 | (6) | | 5.0 | % |

| | |

Argil J. Wheelock, M.D. | | 1,694,364 | | | 5.0 | % |

| | |

Brad A. Hummel | | 473,000 | | | 1.4 | % |

| | |

Kenneth S. Shifrin | | 407,870 | | | 1.2 | % |

| | |

Joseph M. Jenkins, M.D. | | 209,773 | | | * | |

| | |

Scott A. Cochran | | 200,500 | | | * | |

| | |

William A. Searles | | 167,600 | | | * | |

| | |

John Q. Barnidge | | 137,332 | | | * | |

| | |

Perry M. Waughtal | | 110,000 | | | * | |

| | |

R. Steven Hicks | | 97,500 | | | * | |

| | |

Timothy J. Lindgren | | 84,334 | | | * | |

| | |

Donny R. Jackson | | 78,334 | | | * | |

| | |

James Whittenburg | | 8,334 | | | * | |

| (1) | Includes the following number of shares subject to options that are presently exercisable or exercisable within 60 days after April 18, 2005: Dr. Wheelock, 360,000; Mr. Hummel, 418,334; Mr. Shifrin, 275,000; Dr. Jenkins, 180,000; Mr. Cochran, 97,500; Mr. Searles, 152,500; Mr. Barnidge, 91,666; Mr. Waughtal, 50,000; Mr. Hicks, 85,000; Mr. Lindgren, 73,334; Mr. Jackson, 76,334; and Mr. Whittenburg, 8,334. |

| (2) | Based on an aggregate of 33,563,212 shares of HealthTronics common stock issued and outstanding as of April 18, 2005. |

| (3) | Based on the Schedule 13D/A filed with respect to HealthTronics on November 18, 2004, voting and investment power with respect to these shares is held solely by Prides Capital Partners, L.L.C. The |

2

| | managers and directors of Prides Capital Partners, L.L.C. are Kevin A. Richardson, II, Henry J. Lawlor, Jr., Murray A. Indick, Charles E. McCarthy and Christian Puscasiu. |

| (4) | Based on the Schedule 13G filed with respect to HealthTronics on February 10, 2005, voting and investment power with respect to these shares is held by Perry Corp. as a general partner and/or investment advisor for the accounts of two or more private investment funds. Richard C. Perry is the President and sole shareholder of Perry Corp. |

| (5) | Based on the Schedule 13G filed with respect to HealthTronics on February 14, 2005, Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp., is the beneficial owner of these shares as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940 (the “Funds”). Each Fund has sole power to dispose of the shares owned by such Fund. Neither FMR Corp., Edward C. Johnson, III, Chairman of FMR Corp., nor Abigail P. Johnson, a Director of FMR Corp., has the sole power to vote or direct the voting of the shares owned directly by the Funds, which power resides with the Funds’ Boards of Trustees. Fidelity carries out the voting of the shares under written guidelines established by the Funds’ Boards of Trustees. The Johnson family group, through their ownership of voting common stock and the execution of a shareholders’ voting agreement, may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR Corp. |

| (6) | Based on the Schedule 13G filed with respect to HealthTronics on February 9, 2005, Dimensional Fund Advisors Inc. (“Dimensional”) is an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishing investment advice to four investment companies registered under the Investment Company Act of 1940, and serving as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are referred to as the “Dimensional Funds.” In its role as investment advisor or manager, Dimensional possesses investment and/or voting power over these shares that are owned by the Dimensional Funds, and may be deemed to be the beneficial owner of the shares held by the Dimensional Funds. |

3

EXECUTIVE COMPENSATION

Summary Compensation Table

Set forth below is information concerning aggregate compensation for 2004 for our Chief Executive Officer and each of our other most highly compensated executive officers who received in excess of $100,000 in salary and bonuses during the last fiscal year, who we will refer to as our named executive officers.

| | | | | | | | | | | |

| | | | | | | | | | | Long-Term

Compensation

| |

| | | | | Annual Compensation

| | Awards

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($) (1)

| | Other Annual

Compensation ($) (2)

| | Securities

Underlying

Options (#) (3)

| |

Brad A. Hummel— Chief Executive Officer and President (4) | | 2004

2003

2002 | | 400,000

400,000

325,000 | | 400,000

—

325,000 | | 4,400

3,000

6,150 | | 100,000

125,000

100,000 |

|

| | | | | |

Argil J. Wheelock, M.D. Nonexecutive Chairman (5) | | 2004

2003

2002 | | 300,000

262,441

301,349 | | 30,000

102,000

— | | —

10,705

13,331 | | 55,000

50,000

— |

|

| | | | | |

John Q. Barnidge— Chief Financial Officer and Senior Vice President (6) | | 2004

2003

2002 | | 250,000

230,000

205,193 | | 250,000

50,000

175,000 | | 6,150

3,000

4,800 | | 32,500

30,000

40,000 |

|

| | | | | |

Joseph M. Jenkins, M.D.— President of Urology Division (7) | | 2004 | | 270,000 | | 77,490 | | 4,813 | | 25,000 | (9) |

| | | | | |

James S.B. Whittenburg— Senior Vice President—Development, General Counsel and Secretary (8) | | 2004 | | 250,000 | | 87,059 | | 5,204 | | 25,000 | |

| (1) | Reflects bonuses earned during the year. |

| (2) | In addition to their annual remuneration, executive officers who are also employees are entitled to receive the Company’s matching contribution under our 401(k) plan. The Company-sponsored match amounts are shown in the “Other Annual Compensation” column above. Also shown in the “Other Annual Compensation” column is insurance premiums paid by the Company for Dr. Wheelock of $2,331 in 2002. |

| (3) | Long-term compensation amounts are reflected in the year the related stock option is granted. A significant amount of the long-term compensation amounts reflected in any given year may relate to our previous year’s performance. |

| (4) | Mr. Hummel’s compensation figures for the years ended 2002, 2003 and 2004 reflect his compensation received while serving as Chief Executive Officer and President of Prime through November 9, 2004. The compensation figure for the year ended 2004 also includes compensation received from November 10 through December 31, 2004 while serving as our Chief Executive Officer and President. |

| (5) | Dr. Wheelock’s compensation figures for the years ended 2002, 2003 and 2004 reflect his compensation received while serving as our Chairman and Chief Executive Officer through November 9, 2004. The compensation figure for the year ended 2004 also includes compensation received from November 10 through December 31, 2004 while serving as our Nonexecutive Chairman. |

| (6) | Mr. Barnidge’s compensation figures for the years ended 2002, 2003 and 2004 reflect his compensation received while serving as Chief Financial Officer, Senior Vice President and Secretary of Prime through November 9, 2004. The compensation figure for the year ended 2004 also includes compensation received from November 10 through December 31, 2004 while serving as our Chief Financial Officer and Senior Vice President. |

| (7) | Dr. Jenkins became Prime’s President of the Urology Division in April 2004. Dr. Jenkins’ compensation figure for 2004 reflects his compensation received while serving as President of the Urology Division of |

4

| | Prime through November 9, 2004. The compensation figure for the year ended 2004 also includes compensation received from November 10 through December 31, 2004 while serving as our President of the Urology Division. |

| (8) | Mr. Whittenburg joined Prime as Senior Vice President—Development and General Counsel in March 2004. He was appointed as Secretary of HealthTronics in late 2004. Mr. Whittenburg’s compensation figure for 2004 reflects his compensation received while serving as Senior Vice President—Development and General Counsel of Prime through November 9, 2004. The compensation figure for the year ended 2004 also includes compensation received from November 10 through December 31, 2004 while serving as our Senior Vice President—Development, General Counsel and Secretary. |

| (9) | These options were granted to Dr. Jenkins for his service as a director of Prime prior to his appointment as the President of the Urology Division. |

Option Grants During 2004

The following table provides information related to options granted to the named executives officers during 2004. We do not have any outstanding stock appreciation rights.

| | | | | | | | | | | | | | | | | | | |

| | | Number of

Securities Underlying

Options

Granted (#)(1)

| | | Percent of

Total

Options Granted to

Employees in Fiscal Year

| | | Exercise

Price ($/Sh)

| | | Expiration

Date

| | | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term (2)

|

Name

| | | | | | 5 % ($)

| | 10 % ($)

|

Brad A. Hummel— President and Chief Executive Officer | | 100,000 | | | 10.4 | % | | $ | 6.15 | | | 05/26/14 | | | $ | 386,770 | | $ | 980,152 |

| | | | | | |

Argil J. Wheelock, M.D.— Nonexecutive Chairman | | 25,000

30,000 |

| | 2.6

3.1 | %

% | | $

$ | 6.49

7.39 |

| | 01/02/14

12/01/14 |

| | $

$ | 102,038

139,426 | | $

$ | 258,585

353,333 |

| | | | | | |

John Q. Barnidge— Chief Financial Officer and Senior Vice President | | 32,500 | | | 3.4 | % | | $ | 5.69 | | | 02/19/14 | | | $ | 116,298 | | $ | 294,723 |

| | | | | | |

Joseph M. Jenkins, M.D.— President of the Urology Division | | 25,000 | | | 2.6 | % | | $ | 5.69 | | | 02/19/14 | | | $ | 89,460 | | $ | 226,710 |

| | | | | | |

James S.B. Whittenburg— Senior Vice President—Development, General Counsel and Secretary | | 25,000 | | | 2.6 | % | | $ | 5.69 | | | 02/19/14 | | | $ | 89,460 | | $ | 226,710 |

| | | | | | |

| All Employees as a Group | | 965,739 | (3) | | 100 | % | | | (3 | ) | | (3 | ) | | $ | 3,920,149 | | $ | 9,934,428 |

| (1) | These options were granted at an exercise price equal to the closing price on the date of grant. |

| (2) | The dollar amounts in these columns represent potential value that might be realized upon exercise of the options immediately before the expiration of their terms, assuming that the market price of our common stock appreciates in value from the date of grant at the 5% and 10% annual appreciation rates. This disclosure is required by rules of the Securities and Exchange Commission and we make no representation that our common stock will appreciate at these rates or at all. The calculation does not take into account any taxes or other expense that might be owed. |

| (3) | These options represent the aggregate number of stock options granted during 2004 (i) by Prime under its former amended and restated 1993 stock option plan (352,500) and (ii) by us under our 2004 equity incentive plan (604,239). Options to purchase shares of Prime common stock became options to purchase our common stock at the time of the Merger. These options were issued throughout 2004 with various vesting schedules and expiration dates through the year 2014. |

5

Aggregated Option Exercises During 2004 and Option Values at December 31, 2004

The following table provides information related to options exercised by the named executive officers during 2004 and the number and value of unexercised options held at December 31, 2004. We do not have any outstanding stock appreciation rights.

Aggregated Option/SAR Exercises In Last Fiscal Year

And Fiscal Year-End Option Values

| | | | | | | | | | | | |

| | | Shares

Acquired on Exercise (#)

| | Value

Realized ($)(1)

| | Number of Securities

Underlying Unexercised

Options/SAR at Fiscal Year End

| | Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End (2)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable ($)

| | Unexercisable ($)

|

Brad A. Hummel | | — | | — | | 418,334 | | 116,666 | | 1,315,409 | | 454,331 |

| | | | | | |

Argil J. Wheelock, M.D. | | — | | — | | 360,000 | | — | | 1,312,350 | | — |

| | | | | | |

John Q. Barnidge | | — | | — | | 91,666 | | 35,834 | | 351,930 | | 156,020 |

| | | | | | |

Joseph M. Jenkins, M.D. | | — | | — | | 180,000 | | 10,000 | | 501,485 | | 49,400 |

| | | | | | |

James S.B. Whittenburg | | — | | — | | — | | 25,000 | | — | | 123,500 |

| (1) | Calculated by subtracting the per share exercise price of the option from the closing price of our common stock on the date of exercise and multiplying the difference by the number of shares of our common stock purchased upon the exercise of the option. |

| (2) | Calculated by subtracting the per share exercise price of the option from the closing price of our common stock on December 31, 2004 which was $10.63, and multiplying the difference by the number of shares of our common stock underlying the option. |

Employment Agreements

We have entered into employment agreements with Messrs. Hummel, Barnidge, Jenkins and Whittenburg. Each of these agreements provide for the payment of a base salary, performance bonuses and other customary benefits. Mr. Hummel’s agreement provides for an annual salary, currently $400,000, and terminates April 1, 2006 but is subject to automatic renewal at the end of such term for successive one-year terms unless earlier terminated as provided in that agreement. Mr. Barnidge’s agreement provides for an annual salary, currently $250,000, and terminates September 1, 2005 but is subject to automatic renewal at the end of such term for successive one-year terms unless earlier terminated as provided in that agreement. Dr. Jenkins’ agreement provides for an annual salary, currently $275,000, and terminates April 15, 2007. Mr. Whittenburg’s agreement provides for an annual salary, currently $250,000, and terminates March 1, 2007. Each of the agreements entitles the employee to receive severance payments, generally equal to two times the employee’s average compensation for the past two years, if we terminate such individual’s employment without cause or such individual terminates for good reason. Certain of the agreements also give the employee the right to terminate employment and receive severance payments in the event of a direct or indirect change of control as a result of change in ownership of the Company or certain changes in the members of the Company’s board of directors. In addition, under the terms of Mr. Jenkins’ employment agreement, he is entitled to the use of a corporate apartment, the rent for which is paid by us, and a company vehicle.

Board Service and Release Agreement

Dr. Wheelock became our Nonexecutive Chairman on November 10, 2004 pursuant to a board service and release agreement. This agreement entitles Dr. Wheelock to receive $25,000 per month for the first year of his service, $20,833 per month for his second year of service and $16,666 per month for his third year of service,

6

unless he is no longer serving on our board of directors. In the event Dr. Wheelock’s directorship with us is terminated, he will also be entitled to a severance payment of $1,410,000. Dr. Wheelock’s board service and release agreement also provides that Dr. Wheelock will for a period of five years following the date his service as one of our directors is terminated refrain from directly or indirectly (i) soliciting our and our affiliates’ employees and other similar persons; (ii) soliciting vendors, customers, and other similar persons and entities to adversely alter their relationship with us or our affiliates; (iii) advising physicians, hospitals, surgery centers and similar persons to negatively alter their business relationship with us or our affiliates; and (iv) engaging in certain business activities conducted by us.

Prior to the Merger, Dr. Wheelock received compensation during 2004 as our Chairman and Chief Executive Officer pursuant to an amended and restated employment contract effective January 1, 2004. The terms of that contract included an annual base salary of $300,000 and either a corporate automobile or an auto allowance of $600 per month. Dr. Wheelock was also eligible to receive annual bonuses and stock options at the discretion of the Compensation Committee. This agreement was terminated at the time of the Merger.

Indemnity Agreements

We have entered into indemnity agreements with certain of our current and former officers and directors and certain of Prime’s former directors. These agreements generally provide that, to the extent permitted by law, we must indemnify each such person for judgments, expenses, fines, penalties and amounts paid in settlement of claims that result from the fact that such person was an officer, director or employee of ours (or Prime’s, as applicable). In addition, our and certain of our subsidiaries’ organizational documents provide for certain indemnifications and limitations on liability for directors, managers and officers.

7

REPORT OF THE COMPENSATION COMMITTEE

OF THE

BOARD OF DIRECTORS

The Company is engaged in a highly competitive business. For the Company to succeed, the Company believes that it must be able to attract and retain qualified executives. To achieve this objective, we have structured an executive compensation policy tied to operating performance that we believe has enabled the Company to attract and retain key executives.

The Compensation Committee is comprised of Timothy J. Lindgren, William A. Searles and Perry M. Waughtal, all of whom are “independent” directors as defined in Rule 4200(a)(15) of the Nasdaq listing standards.

The Compensation Committee has primary responsibility for determining executive compensation levels, including compensation for key divisional executives. The Board as a whole maintains a philosophy that compensation of executive officers, including that of the Chief Executive Officer and President, should be linked to both operating and stock price performance. A portion of management compensation has been comprised of bonuses, based on operating and stock performance, with a particular emphasis on the attainment of planned financial and strategic business objectives. Accordingly, in years in which performance goals are achieved or exceeded, executive compensation tends to be higher than in years in which performance is below expectations. The Committee also feels that stock options are an effective incentive compensation tool and have the benefit of linking long-term reward to the price of the Company’s stock.

The Compensation Committee engaged during 2002 the services of a nationally recognized executive compensation consulting firm. The objective was to determine the competitiveness of the Company’s executive compensation and, as appropriate, make recommendations for the Compensation Committee and Board to consider. The study reaffirmed that a significant component of both annual and long term compensation should be linked to measurable performance. It further recognized that long term performance was becoming an increasingly important component of overall executive compensation. The Compensation Committee will continue to utilize outside resources as it considers appropriate to keep abreast of matters impacting the competitiveness of the Company’s executive compensation.

On an annual basis, the Compensation Committee approves performance-based compensation for the named executive officers and other officers. The Compensation Committee typically makes these compensation decisions in the first quarter of a particular fiscal year for the prior fiscal year’s performance and sets annual targeted performance goals for the current year. The Compensation Committee sets annual targeted goals for the following measures of the Company’s performance: earnings per share growth, stock price growth, revenue growth, return on capital, and adjusted EBITDA growth. In determining the amount of performance-based compensation for a particular year, the Compensation Committee will evaluate to what extent the annual targeted goals for such year were achieved. In addition, the Compensation Committee will consider the performance of the officer’s unit, division or function for such year and other performance factors the Compensation Committee deems relevant. The amount of the compensation will be determined by the Compensation Committee on a discretionary basis taking into account its evaluation of the above factors. In addition, the allocation of such compensation between cash and equity awards will be determined by the Committee on a discretionary basis.

For 2004, our executive compensation program consisted of base salary, a cash bonus, and long term stock option awards, all of which relate to the achievement of specific current and long term goals and the other factors described above. A substantial portion of overall executive bonus compensation for the Company was driven by specific performance achievements. Senior executives also receive bonus compensation for achievement of actions that enhance the strategic growth of the company, such as mergers, acquisitions or significant financing activities. The Committee believes that compensation levels during 2004 adequately reflected our compensation goals and the performance of management against those goals, as well as recognition for unanticipated achievements.

8

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1 million for compensation paid to certain executives of public companies. The Compensation Committee has considered these requirements and believes that the Company’s 2004 Equity Incentive Plan and bonus arrangements for senior officers meet the requirement that they be “performance based” and, therefore, are exempt from the limitations on deductibility. The Compensation Committee’s present intention is to comply with Section 162(m) unless the Compensation Committee feels that compliance in a particular instance would not be in our best interest or the best interest of our shareholders.

Compensation Committee: William A. Searles, Chairman

Timothy J. Lindgren

Perry M. Waughtal

9

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Randy Wheelock is a principal of US Orthotripsy, LLC, a limited partner in Orthotripsy Services of Eastern Tennessee, L.P. (“East Tennessee”) and OssaTron Services of the Carolinas, L.P. (“Carolinas”), both of which are limited partnerships that we control by virtue of controlling the general partner and in which we own a limited partner interest. East Tennessee provides Orthotripsy services in East Tennessee and Carolinas provides Orthotripsy services in North Carolina and South Carolina. We engaged US Orthotripsy, LLC to manage East Tennessee and Carolinas and Randy Wheelock was paid a monthly management fee of $4,333 plus reimbursement for reasonable expenses during 2004. Randy Wheelock is the brother of Dr. Wheelock, the Company’s Nonexecutive Chairman.

Prior to March 31, 2004, Dr. Wheelock directly owned a 2.78% interest and indirectly owned an additional 3.3% interest (through 9% ownership in a corporate partner, NGST, Inc.) in Tenn-Ga Stone Group Two, a Tennessee general partnership. Tenn-Ga Stone Group Two provides lithotripsy services in Tennessee and North Georgia. Dr. Wheelock purchased his interests in Tenn-Ga Stone Group Two in or about 1990. We manage Tenn-Ga Stone Group Two and are a 28% owner and managing partner of Tenn-Ga Stone Group Three, a Tennessee general partnership that has a 38.25% ownership interest in Tenn-Ga Stone Group Two. Tenn-Ga Stone Group Two pays us a management fee of $40,000 per year. We also supply services, parts and consumables to Tenn-Ga Stone Group Two at standard rates. During 2004, Tenn-Ga Stone Group Two paid us $293,525 for such services, parts and consumables. On March 31, 2004, Dr. Wheelock sold his interest in NGST, Inc. to Tenn-Ga Stone Group Three for $120,000.

In 1998, Dr. Wheelock purchased a 3% ownership interest in Lincolnland Lithotripsy, Inc., a corporation that provides mobile lithotripsy services in Illinois. We also supply services, parts and consumables to Lincolnland Lithotripsy, Inc. at standard rates. During 2004, Lincolnland Lithotripsy, Inc. paid us $200,561 for such services, parts and consumables. On December 31, 2004, Dr. Wheelock sold his interest in Lincolnland Lithotripsy, Inc. back to Lincolnland Lithotripsy, Inc. for $30,000.

During 2001 and early 2002, Prime made full recourse loans totaling approximately $975,000 to 12 members of its management. The loans bear interest at 6.5% and require annual payments of principal and interest due April 1 of each year. We assumed these loans after the Merger and there are currently 5 of our employees that still have obligations under these loans. All 5 of these loans are current and the net principal balance outstanding as of April 18, 2005 is approximately $479,000.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission, or the SEC, and the Nasdaq National Market. Such persons are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms received by us with respect to 2004, or written representations from certain reporting persons, we believe that all filing requirements applicable to our directors, executive officers and persons who own more than 10% of a registered class of our equity securities have been complied with, except that each current director filed one late Form 4 during 2004.

QUORUM; VOTING

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote is necessary to constitute a quorum at the meeting. Abstentions and “broker non-votes” (shares held by brokers or nominees as to which they have no discretionary power to vote on a particular matter

10

and have received no instructions from the beneficial owners thereof or persons entitled to vote thereon) will be counted in determining whether a quorum is present at the meeting. If a quorum is not present or represented at the meeting, the shareholders entitled to vote thereat, present in person or represented by proxy, have the power to adjourn the meeting from time to time, without notice other than an announcement at the meeting, until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally notified.

Cumulative voting is not permitted in the election of our directors. On all matters (including election of directors) submitted to a vote of the shareholders at the meeting or any adjournment(s) thereof, each holder of our common stock will be entitled to one vote for each share of our common stock owned of record by such shareholder at the close of business on April 18, 2005.

Proxies in the accompanying form that are properly executed and returned and that are not revoked will be voted at the meeting and any adjournment(s) thereof and will be voted in accordance with the instructions thereon. Any proxy upon which no instructions have been indicated with respect to a specified matter will be voted according to the recommendations of our board of directors, which are contained in this proxy statement. Our board of directors knows of no matters, other than those presented in this proxy statement, to be presented for consideration at the meeting. If, however, other matters properly come before the meeting or any adjournment(s) thereof, the persons named in the accompanying proxy will vote such proxy in accordance with their judgment on any such matters. The persons named in the accompanying proxy may also, if they believe it advisable, vote such proxy to adjourn the meeting from time to time.

Other than the election of directors, which requires a plurality of the votes cast, each matter submitted to the shareholders requires the affirmative vote of a majority of the votes cast and entitled to vote on such matter. If you abstain from voting in the election of directors, your abstention will not affect the outcome of this election. Abstention is not a vote cast. Broker non-votes will not affect the outcome of the election of directors.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our nominating committee and board of directors have nominated eight directors for election at the 2005 annual meeting. All nominees will be elected to hold office until our next annual meeting of shareholders or until his successor is duly elected and qualified, or until his earlier death, resignation or removal. The following is a description of the nominees:

| | | | |

Name

| | Age

| | Director

Since(1)

|

R. Steven Hicks | | 55 | | 2004 |

Brad A. Hummel | | 48 | | 2004 |

Donny R. Jackson | | 56 | | 2003 |

Timothy J. Lindgren | | 58 | | 2003 |

William A. Searles | | 63 | | 2004 |

Kenneth S. Shifrin | | 56 | | 2004 |

Perry M. Waughtal | | 69 | | 2004 |

Argil J. Wheelock, M.D. | | 57 | | 1996 |

| (1) | Messrs. Hicks, Hummel, Searles, Shifrin and Waughtal became directors in November 2004 following the Merger with Prime. Details regarding these directors’ service as directors of Prime is provided in the biographical information below. |

Mr. Hicks became a director of Prime in December 2002 and a director of the Company in November 2004 upon the closing of the Merger. In June 2000, Mr. Hicks became Chairman of Capstar Partners, LLC, an Austin based private investment company. Previously he founded Capstar Broadcasting and served as Vice Chairman of AMFM, Inc.

11

Mr. Hummel became Prime’s President and Chief Executive Officer and a director in June 2000, and the Company’s President and Chief Executive Officer and a director in November 2004 upon the closing of the Merger. From October 1999 until June 2000, Mr. Hummel was Prime’s Executive Vice President and Chief Operating Officer. From 1984 to 1999, Mr. Hummel was with Diagnostic Health Services, Inc., a multi-state provider of mobile and fixed base imaging services. Subsequent to Mr. Hummel’s departure, DHS filed for Chapter 11 bankruptcy reorganization in March 2000 and shortly thereafter re-emerged from bankruptcy in October 2000. From 1981 to 1984, Mr. Hummel was an associate with Covert, Crispin and Murray, a Washington, D.C. and London-based management consulting firm.

Mr. Jackson has served as a director of the Company since January 2003. Since 2002, Mr. Jackson has served as the Director of the Technical Services Group of InterCept, Inc., a publicly traded company that provides technology, products and services to financial institutions. Prior to this he served as: President and Chief Executive Officer of Netzee, Inc., a publicly traded company providing integrated Internet banking and e-commerce products and services to financial institutions, from 2000 to 2002; President and Chief Operating Officer of The Intercept Group, Inc., from 1996 to 2000; Chief Executive Officer of Provesa, Inc., a data processing and check imaging services company, from 1993 to 1996; Chief Executive Officer of Bank Atlanta, from 1990 to 1992 and Chief Financial Officer, from 1988 to 1990; and Audit Manager at Evans, Porter, Bryan, from 1986 to 1987; and Audit Partner at Womble, Jackson, Gunn, from 1978 to 1986. Mr. Jackson has served on the Board of Directors of Intercept, Inc. and Bank Atlanta.

Mr. Lindgren has served as a director of the Company since January 2003. Mr. Lindgren is a divisional vice president for Hyatt Hotels & Resorts, overseeing the management and operations of 24 Hyatt hotels in 10 states. Throughout his 33-year career with Hyatt, Mr. Lindgren has held a variety of management positions including general manager of several Hyatt Regency hotels.

Mr. Searles became a director of Prime in 1989 and a director of the Company in November 2004 upon the closing of the Merger. He has been an independent business consultant since 1989. Before then, he spent 25 years with various Wall Street firms, the last ten of which were with Bear Stearns. In 1989, he became a director of American Physicians Service Group, Inc. (NASDAQ: AMPH), a management and financial services firm. From 1972 to 1999, Mr. Searles was the sole owner of Travelmart, Inc., a small privately-held New Jersey based travel agency, which liquidated in early 1999 under Chapter 7 of the Bankruptcy Code.

Mr. Shifrin became Prime’s Chairman of the Board in 1989 and served as Executive Chairman until December 30, 2001. Mr. Shifrin became Nonexecutive Vice Chairman of the Company in November 2004 upon the closing of the Merger. Mr. Shifrin has served in various capacities with AMPH since 1985, and is currently the Chairman of the Board and Chief Executive Officer of AMPH. In June of 2003, he became a director of Financial Industries Corporation (NASDAQ: FNINE), a Texas-based insurance company.

Mr. Waughtal became a director of Prime in December 2003 and a director of the Company in November 2004 upon the closing of the Merger. Since April 2000, he has been a director of KMR and Kinder Morgan G.P., Inc. He is also the Chairman and a limited partner of Songy Partners Limited, an Atlanta, Georgia based real estate investment company. Previously, he served for over 30 years as Vice Chairman of Development and Operations and as Chief Financial Officer for Hines Interests Limited Partnership, a real estate and development entity based in Houston, Texas.

Dr. Wheelock served as Chairman and Chief Executive Officer of the Company from July 1996 until November 2004 when he became the Nonexecutive Chairman of the Company. From 1979 until 1996 Dr. Wheelock was a practicing, board-certified urologist in Chattanooga, Tennessee. While in practice, he was engaged as a consultant by various public companies.

No family relationships exist among our officers or directors. Except as indicated above, no director of ours is a director of any company with a class of securities registered pursuant to Section 12 of the Securities

12

Exchange Act of 1934, or subject to the requirements of Section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Should any nominee for director become unwilling or unable to accept nomination or election, the proxies will be voted for the election, in his stead, of such other persons as our board of directors may recommend or our board of directors may reduce the number of directors to be elected. We have no reason to believe that any nominee named above will be unwilling or unable to serve.

The Board recommends that you vote FOR each nominee for director.

CERTAIN INFORMATION REGARDING OUR BOARD OF DIRECTORS

Our Board compensation consists of both cash and common stock options. Except for the nonexecutive Chairman of the Board, officers who are also directors do not receive any fee or remuneration for services as members of the Board or of any Committee of the Board. Currently, our Board cash compensation consists of an annual retainer of $30,000, $1,500 for Board meetings lasting in excess of two hours and $400 for each Committee meeting. Each non-management director receives 20,000 stock options and 5,000 additional stock options for serving as a Committee Chairman. In addition, the nonexecutive Chairman receives 10,000 additional stock options and the nonexecutive Vice Chairman receives 5,000 additional stock options. All of such options would have an exercise price equal to the fair market value on the date of grant and would be fully vested upon grant. The following table reflects Board compensation paid during 2004 to our current non-management directors.

| | | | |

| | | Directors

Compensation In 2004(1)

|

| | | Cash

Paid ($)

| | Stock

Options (#)

|

Mr. Cochran | | 34,500 | | 35,000 |

Mr. Hicks | | 37,900 | | 45,000 |

Mr. Jackson | | 34,500 | | 38,000 |

Mr. Lindgren | | 34,500 | | 35,000 |

Mr. Searles | | 39,900 | | 45,000 |

Mr. Shifrin (2) | | 96,663 | | 50,000 |

Mr. Waughtal | | 39,500 | | 50,000 |

| (1) | This table reflects the compensation paid to our current non-management directors during 2004 by Prime and us, as applicable, prior to the Merger, as well as by us following the Merger. Prime directors, prior to the Merger, were entitled to cash compensation consisting of an annual retainer of $30,000, $1,500 for Board meetings lasting in excess of two hours and $400 for each Committee meeting. Prime Board members received 20,000 stock options and 5,000 additional stock options for serving as a Committee Chairman, with an exercise price equal to the fair market value on the date of grant. Prior to the Merger, our non-management directors were entitled to receive a fee of $5,000 for each Board meeting attended and $1,000 per Committee meeting attended and our directors received stock options at the discretion of the Compensation Committee of the Board of Directors as compensation for their service on the Board of Directors. Following the Merger, our directors became entitled to the same compensation that formerly applied to Prime’s directors. |

| (2) | Mr. Shifrin received a monthly fee of $8,333 for serving as Chairman of the Board of Prime prior to November 10, 2004. Mr. Shifrin received additional payments from Prime and us as described below under “Kenneth S. Shifrin.” |

Kenneth S. Shifrin

Mr. Shifrin became our Nonexecutive Vice Chairman on November 10, 2004 pursuant to a board service, amendment and release agreement. That agreement entitled Mr. Shifrin to receive a one time payment of

13

$180,000 at the time of the Merger and also currently entitles him to have life insurance policies maintained on his behalf by us. Mr. Shifrin’s current compensation for his service as a director is otherwise as determined by HealthTronics’ board of directors for non-management directors.

Prior to the Merger, Mr. Shifrin received compensation as a director of Prime during 2004 under a board service agreement that provided for the monthly payment of $8,333 to Mr. Shifrin for as long as he was elected to serve as Prime’s Chairman of the Board of Directors. This agreement was terminated at the time of the Merger.

Mr. Shifrin also has a noncompetition, release and severance agreement dated December 30, 2001, which was entered into with Prime and assumed by us in connection with the Merger. This agreement originally terminated Mr. Shifrin’s employment agreement with Prime and provided that Mr. Shifrin would not own, manage or control any business that competed with Prime and would not advise any of Prime’s customers or suppliers to cancel or curtail their dealings with Prime, or influence any of Prime’s employees to terminate his or her employment with Prime, for a period of five years. At the time of the Merger we assumed this agreement with Mr. Shifrin and amended it to extend the non-competition and related covenants in that agreement for one year. Under this agreement, Mr. Shifrin was paid $200,000 on January 1, 2004. In addition, on January 1, 2005, we made the remaining $200,000 payment due to Mr. Shifrin under this agreement.

BOARD COMMITTEES; CORPORATE GOVERNANCE

General

There are presently nine members of our board of directors, including six directors who the board has determined to be independent under Rule 4200(a)(15) of the Nasdaq listing standards.

Our board of directors held 13 meetings during 2004, and during that year each incumbent director attended at least 75% of (a) the total number of our board meetings (held during the period for which he has been a director) and (b) the total number of meetings held by all committees of the board on which he served (during the periods that he served).

In regard to directors’ attendance at annual shareholders meetings, although we do not have a formal policy regarding such attendance, our board of directors encourages all board members to attend such meetings, but such attendance is not mandatory. All of our board members serving as directors at the time attended the 2004 annual shareholders meeting. In addition, our board of directors holds its regular annual meeting immediately following the annual shareholders meeting.

Our board of directors has an audit committee, a compensation committee and a nominating committee. Our board of directors has adopted a written charter for each of these committees which charters are attached hereto as follows:

Audit Committee Charter—Appendix A

Compensation Committee Charter—Appendix B

Nominating Committee Charter—Appendix C

Audit Committee

The audit committee’s functions include engaging our independent public accountants, reviewing with such accountants the plans for and the results and scope of their auditing engagement and certain other matters relating to their services to us, including matters relating to the independence of such accountants. Mr. Cochran, Mr. Jackson and Mr. Lindgren served on the audit committee during 2004 prior to the Merger. Mr. Jackson, Mr. Nicolais, and Mr. Waughtal were appointed as the members of the audit committee following the Merger. Mr. Jackson, Mr. Hicks and Mr. Waughtal are the current members of the audit committee. The chairman of the committee is Mr. Waughtal. Our board has determined that the committee members are “independent” as defined

14

in Rule 4200(a)(15) of the Nasdaq listing standards. In addition, our board has determined that the committee members meet the independence standards set forth in Rule 10A-3(b)(1) of the Exchange Act. Our board has further determined that Mr. Waughtal is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC. The audit committee held twelve meetings during 2004.

The audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent auditors. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget.

Biographical information for Mr. Cochran is available in Amendment No. 1 to HealthTronics’ 2004 Proxy Statement on Schedule 14A filed with the SEC on May 3, 2004. Biographical information for Mr. Nicolais is available in Prime’s 2004 Proxy Statement on Schedule 14A filed with the SEC on April 28, 2004.

Compensation Committee

The compensation committee makes recommendations to our board of directors with respect to the compensation of our executive officers, including issuance of stock options. James R. Andrews and Russell H. Maddox served on the compensation committee during 2004 prior to the Merger. Mr. Cochran, Mr. Lindgren, and Mr. Searles were appointed as the members of the compensation committee following the Merger. Mr. Lindgren, Mr. Searles and Mr. Waughtal are the current members of the compensation committee. Our board has determined that the committee members are “independent” as defined in Rule 4200(a)(15) of the Nasdaq listing standards. The chairman of the committee is Mr. Searles. The compensation committee held four meetings during 2004.

Biographical information for Mr. Andrews and Mr. Maddox is available in Amendment No. 1 to HealthTronics’ 2004 Proxy Statement on Schedule 14A filed with the SEC on May 3, 2004.

Nominating Committee

The nominating committee has primary responsibility for making recommendations to our board of directors for nominees for election to our board of directors. The nominating committee did not meet during 2004. Rather, the members approved the slate of director nominees for the 2004 annual shareholders meeting by unanimous consent in lieu of meeting. Mr. Jackson and Mr. Maddox served on the nominating committee during 2004 prior to the Merger. Mr. Cochran, Mr. Hicks, and Mr. Nicolais were appointed as the members of the nominating committee following the Merger. Mr. Hicks, Mr. Jackson and Mr. Lindgren are the current members of the nominating committee. Our board has determined that the committee members are “independent” as defined in Rule 4200(a)(15) of the Nasdaq listing standards. The chairman of the committee is Mr. Hicks.

The nominating committee identifies nominees by first evaluating the current members of the board who are willing to continue in service. Current members of the board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the board with that of obtaining a new perspective. If any member of the board does not wish to continue in service or if the nominating committee decides not to recommend a member for re-election, the nominating committee will identify the desired skills and experience of a new nominee in light of the criteria below. Research may be performed to identify qualified individuals. The nominating committee has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although it may do so in the future if it considers doing so necessary or desirable.

The consideration of any candidate for service on our board is based on the nominating committee’s assessment of the candidate’s professional and personal experiences and expertise relevant to our operations and goals. The committee evaluates each candidate on his or her ability to devote sufficient time to board activities to effectively carry out the work of the board. The ability to contribute positively to the existing collaborative culture among board members is also considered by the committee. In addition, the committee considers the

15

composition of the board as a whole; the status of the nominee as “independent” under the Nasdaq’s listing standards and the rules and regulations of the SEC; and the nominee’s experience with accounting rules and practices. Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating committee may also consider such other factors as it may deem are in our and our shareholders’ best interests.

After completing its evaluation, the nominating committee makes a recommendation to the full board of directors as to the persons who should be nominated by the board, and the board determines the nominees after considering the recommendation and report of the nominating committee.

The nominating committee will consider director candidates recommended by our shareholders. The nominating committee does not have a formal policy on shareholder nominees, but intends to assess them in the same manner as other nominees, as described above. To recommend a prospective nominee for the nominating committee’s consideration, shareholders should submit in writing the candidate’s name and qualifications, and otherwise comply with our bylaws’ and nominating committee charter’s requirements for shareholder nominations, which are described below, to:

HealthTronics, Inc.

1301 S. Capital of Texas Hwy, Suite B-200

Austin, TX 78746

Attention: Corporate Secretary

Our nominating committee charter provides that any shareholder wishing to recommend a nominee should submit a recommendation in writing, indicating the nominee’s qualifications and other relevant biographical information and provide confirmation of the nominee’s consent to serve as a director if elected and to being named in the proxy statement and certain information regarding the status of the shareholder submitting the recommendation, to our Corporate Secretary at the address provided above. Such nomination recommendation must be received by us at the address provided above not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting (provided, that, if the annual meeting is called for a date that is not within 45 days before or after such anniversary date, notice by the shareholder to be timely must be so received by us not more than 120 days before the annual meeting and not less than the later of (1) 90 days before the annual meeting and (2) the 10th day following the day on which we first make a public announcement of the date of the annual meeting).

Shareholder Communications with the Board of Directors

If a shareholder desires to send a communication to our board of directors, such shareholder should send the communication to:

HealthTronics, Inc.

1301 S. Capital of Texas Hwy, Suite B-200

Austin, TX 78746

Attention: Chairman of the Board

The chairman of the board will forward the communication to the other board members.

If a shareholder desires to send a communication to a specific board member, such shareholder should send the communication to the above address with attention to the specific board member.

Code of Ethics

We have established a Code of Ethics for our chief executive officer, senior finance officers and all other employees. A current copy of this code is available on our web site athttp://www.healthtronics.com. The contents of this web site are not incorporated by reference and the web site address provided in this proxy statement is intended to be an inactive textual reference only.

16

EQUITY COMPENSATION PLANS

At December 31, 2004, we had seven separate equity compensation plans: the Prime 1993 and 2003 stock option plans, the HealthTronics general, 2000, 2001 and 2002 stock option plans, and the HealthTronics 2004 equity incentive plan. The plans, and all amendments thereto, had been approved by Prime’s and HealthTronics shareholders, as the case may be. The following table sets forth certain information as of December 31, 2004 about our equity compensation plans:

| | | | | | | |

| | | (a)

| | (b)

| | (c)

|

Plan Category

| | Number of shares of our

common stock to be issued

upon exercise of

outstanding options,

warrants and rights

| | Weighted-average exercise

price of outstanding

options, warrants and rights

| | Number of shares of our

common stock remaining

available for future

issuance under equity

compensation plans

(exceeding securities

reflected in column (a))

|

Prime 1993 stock option plan | | 1,669,751 | | $ | 7.39 | | — |

| | | |

Prime 2003 stock option plan | | 337,500 | | $ | 5.80 | | — |

| | | |

HealthTronics equity incentive plan and stock option plans | | 2,320,514 | | $ | 7.63 | | 251,605 |

| | | |

Other equity compensation plans approved by our security holders | | N/A | | | N/A | | N/A |

| | | |

Equity compensation plans not approved by our security holders | | N/A | | | N/A | | N/A |

PROPOSAL NO. 2

AMENDMENT TO 2004 EQUITY INCENTIVE PLAN

In April 2005, our board of directors approved an amendment to our 2004 Equity Incentive Plan, or the Plan, to increase by 450,000 shares the number of shares available for issuance thereunder (from 500,000 shares to 950,000) subject to approval by our shareholders. Our board of directors believes that approval of this amendment is in our best interest because the availability of an adequate number of shares under the Plan is an important factor in attracting, motivating and retaining qualified officers, employers, directors and consultants essential to our success and in aligning their long-term interests with those of our shareholders. The full text of the amendment is attached to this Proxy Statement asAppendix D.

The following is a summary of the material terms of the Plan.

Purpose

To attract and retain individuals eligible to participate in the Plan and to further our growth, development and financial success by aligning the personal interests of participants in the Plan, through the ownership of shares of our common stock and other incentives, with those of us and our shareholders.

Administration

Our board of directors or a committee designated by the board of directors, such as the Compensation Committee (in either case, we refer to such body as the Administrator).

Eligibility

Officers, employees, directors, consultants and other persons selected by the board of directors or the committee designated to administer the Plan.

17

Stock Subject to the Plan

Originally, 500,000 shares of our common stock were reserved and available for issuance under the Plan. If our stockholders approve the amendment, the number of shares reserved and available for issuance under the Plan would increase by 450,000 shares (from 500,000 to 950,000). There are no pre-established limits on what number of the shares of our common stock reserved for the Plan will be allocated as stock options, stock appreciation rights (or SARs), restricted stock grants, stock purchase rights, and other stock based awards.

Awards under the Plan

| | • | | Options. We will have the ability to award “Incentive Stock Options” and “Non-Statutory Stock Options” under the Plan (in either case we refer to such awards as the Option(s)). |

| | • | | Incentive Stock Options.Only our key managerial employees (or certain of our affiliates) may be eligible to receive an award of Incentive Stock Options. Incentive Stock Options awarded under the Plan must have an exercise price of at least 100% of the fair market value of our common stock on the date of grant. In the case of an employee who owns stock representing more than 10% of our voting power, the exercise price will be at least 110% of the fair market value of our common stock on the date of grant. |

| | • | | Non-Statutory Stock Options. We can award Non-Statutory Stock Options to any person eligible under the Plan. The Plan does not establish a minimum exercise price for Non-Statutory Stock Options granted under the Plan. |

| | • | | Other Terms Applicable to Options. Options may contain other provisions the Administrator decides are appropriate relating to when the Options will become exercisable, the times and circumstances the Options may be exercised, and the methods the exercise price may be paid. Options that become exercisable will expire no later than 10 years from the date the Options were granted; however, in certain cases the Options will expire 5 years from the date they were granted (i.e., in the case of Options granted to an employee who owns stock representing more than 10% of our voting power). |

| | • | | Stock Appreciation Rights. SARs granted under the Plan will entitle the participant to receive, in either cash or stock, the excess of the fair market value of one share of our common stock over the exercise price of the SAR. The Administrator will determine the terms under which SARs are awarded, including the times and circumstances under which a SAR may be exercised. SARs may be granted at a price determined by the Administrator, and may be granted in tandem with an Option, such that the exercise of the SAR or related Option will result in a forfeiture of the right to exercise the related Option for an equivalent number of shares, or independently of any Option. Any SAR may be exercised at the times specified in the document awarding the SAR, and the SAR will expire at the time designated at the time the SAR is awarded. |

| | • | | Restricted Stock. Restricted Stock may be granted alone or in conjunction with other awards under the Plan and may be conditioned upon continued employment for a specified period, the attainment of specific performance goals or such factors as the Administrator may determine. In making an award of Restricted Stock, the Administrator will determine the restrictions that will apply, the period during which the award will be subject to such restrictions, and the price, if any, payable by a recipient. The Administrator may amend any award of Restricted Stock to accelerate the dates after which such award may be executed in whole or in part. Shares of Restricted Stock shall not be transferable until after removal of the legend with respect to such shares. |

| | • | | Stock Purchase Rights. Stock Purchase Rights may be issued either alone, in addition to, or in tandem with other awards granted under the Plan and/or cash awards made outside of the Plan. The Administrator will determine the terms, conditions and restrictions related to the Stock Purchase Rights, including the number of shares that such person shall be entitled to purchase, the price to be paid, and the time within which such person must accept such offer (all in accordance with a Restricted Stock purchase agreement). Unless the Administrator determines otherwise, the Restricted Stock purchase agreement shall grant us a repurchase option exercisable upon the voluntary or involuntary termination of the purchaser’s service with us for any reason (including death or disability). |

18

| | • | | Other Stock-Based Awards. The Administrator shall have complete discretion in determining the number of shares subject to “Other Stock Based Awards”, the consideration for such awards and the terms, conditions and limitations pertaining to same including, without limitation, restrictions based upon the achievement of specific business objectives, tenure, and other measurements of individual or business performance, and/or restrictions under applicable federal or state securities laws, and conditions under which such awards will lapse. Payment of Other Stock Based Awards may be in the form of cash, shares, other awards, or in such combinations thereof as the Administrator shall determine at the time of grant, and with such restrictions as it my impose. |

Performance Awards

The Administrator may condition the receipt of an award or the vesting of an award on certain business criteria. If the Administrator determines that such performance conditions should be considered “performance-based compensation” under Section 162(m) of the Internal Revenue Code, the performance goals must relate to one of the following business criteria: (1) fair market value of shares of our common stock; (2) operating profit; (3) sales volume of our products; (4) earnings per share; (5) revenues; (6) cash flow; (7) cash flow return on investment; (8) return on assets, return on investment, return on capital, return on equity; (9) economic value added; (10) operating margin; (11) net income; pretax earnings; pretax earnings before interest, depreciation and amortization; pretax operating earnings after interest expense and before incentives, service fees, and extraordinary or special items; or (12) any of the above goals as compared to the performance of a published index, such as the Standard & Poor’s 500 Stock Index or a group of comparable companies.

Adjustments Upon Changes in Capitalization, Merger or Asset Sale

| | • | | Changes in Capitalization. Subject to any required action by our shareholders, the number of shares of common stock subject to the Plan (whether awarded or reserved but not awarded) as well as the price per share of common stock subject to the Plan (whether awarded or reserved but not awarded) shall be proportionately adjusted for any increase or decrease in the number of issued shares of common stock resulting from a stock split, reverse stock split, stock dividend, combination or reclassification of the common stock, or any other increase or decrease in the number of issued shares of common stock effected without receipt of consideration by us. |

| | • | | Dissolution or Liquidation. In the event of our proposed dissolution or liquidation, the Administrator in its discretion may provide for a participant to have the right to exercise his or her award until 15 days prior to such transaction as to all of the shares covered thereby. To the extent it has not been previously exercised, an award will terminate immediately prior to the consummation of such proposed action. |

| | • | | Merger or Asset Sale. In the event of our merger with or into another corporation, or the sale of substantially all of our assets, each outstanding award shall be assumed or an equivalent option or right substituted by the successor corporation. In the event that the successor corporation refuses to assume or substitute for the award, the Participant shall fully vest in and have the right to exercise the award as to all of the shares, including shares as to which it would not otherwise be vested or exercisable. |

Transferability of Awards

Awards may not be pledged, assigned or transferred while the Plan participant is still living, except that Options may be transferred to a Plan participant’s spouse as directed by a court, provided such transfer is “incident to divorce” within the meaning of Section 1041 of the Internal Revenue Code of 1986, as amended.

Termination, Amendment or Suspension

Our board of directors or the committee can terminate, suspend or amend the Plan at any time, subject to shareholder approval required under federal or state law or by the stock exchange on which our common stock is listed.

19

Federal Income Tax Consequences

| | • | | Incentive Stock Options. In general, no taxable income for Federal income tax purposes will be recognized by an option holder upon receipt or exercise of an incentive stock option and we will not then be entitled to any tax deduction. Assuming that the option holder does not dispose of the option shares before the later of (i) two years after the date of grant or (ii) one year after the exercise of the option, upon any such disposition, the option holder will recognize capital gain equal to the difference between the sale price on disposition and the exercise price. |

If, however, the option holder disposes of his option shares prior to the expiration of the required holding period, he will recognize ordinary income for Federal income tax purposes in the year of disposition equal to the lesser of (i) the difference between the fair market value of the shares at date of exercise and the exercise price, or (ii) the difference between the sale price upon disposition and the exercise price. Any additional gain on such disqualifying disposition will be treated as capital gain. In addition, if such a disqualifying disposition is made by the option holder, we will be entitled to a deduction equal to the amount of ordinary income recognized by the option holder provided such amount constitutes an ordinary and reasonable expense of ours.

| | • | | Nonqualified Stock Options.No taxable income will be recognized by an option holder upon receipt of a nonqualified stock option, and we will not be entitled to a tax deduction for such grant. |

Upon the exercise of a nonqualified stock option, the option holder will include in taxable income for Federal income tax purposes the excess in value on the date of exercise of the shares acquired upon exercise of the nonqualified stock option over the exercise price. Upon a subsequent sale of the shares, the option holder will derive short-term or long-term gain or loss, depending upon the option holder’s holding period for the shares, commencing upon the exercise of the option, and depending upon the subsequent appreciation or depreciation in the value of the shares.

We generally will be entitled to a corresponding deduction at the time that the participant is required to include the value of the shares in his income.

| | • | | Restricted Stock. Under current federal income tax regulations, there will be no income tax consequences upon the award of restricted stock to either the grantee or us. A grantee will recognize ordinary income when the restrictions on the transferability of the shares expire, which is referred to as the vesting of the shares. The amount of income recognized will be equal to the fair market value of such shares on the date of vesting over the amount paid, if any, at the time of the grant. Dividends on shares of restricted stock that are paid (or are payable) to grantees prior to the time the shares are vested will be treated as additional compensation, and not dividend income, for federal income tax purposes. |

In addition to the general rules described above, the deductibility of the income realized by certain executive officers is conditioned on the satisfaction of the requirements of Section 162(m) of the Internal Revenue Code. It is our intention that the Plan is administered in a manner that maximizes the deductibility of the payments under Section 162(m). The federal income tax consequences described in this section are based on U.S. laws in effect on the date of this document, and there is no assurance that they will not change in the future and affect the tax consequences of awards made under this Plan. Tax consequences may be different in other countries.

The board of directors recommends a vote FOR the proposal to amend our 2004 Equity Incentive Plan to increase by 450,000 shares the total number of shares of common stock available for issuance thereunder (from 500,000 shares to 950,000 shares).

20

PERFORMANCE GRAPH

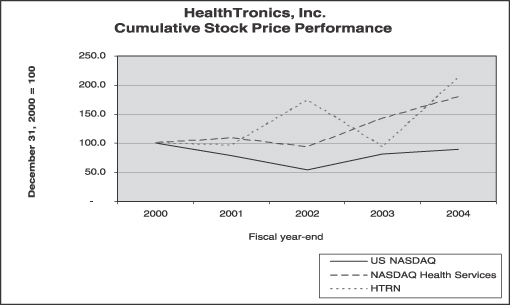

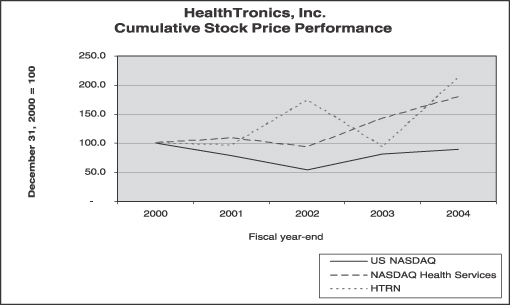

The following graph compares our cumulative total shareholder return with the cumulative total shareholder returns of the Nasdaq Market Index and the Nasdaq Health Services Index, for the period from December 31, 2000 through December 31, 2004.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors was comprised of three directors at the conclusion of 2004 and operates under a written charter adopted by the Board. The Committee, among other things,

| | • | | reviews with the independent auditors and management the adequacy of the Company’s accounting and financial reporting controls; |

| | • | | reviews with management and the independent auditors significant accounting and reporting principles, practices and procedures applied in preparing the Company’s financial statements; |

| | • | | discusses with the independent auditors their judgment about the quality, not just the acceptability, of the Company’s accounting principles used in the Company’s financial reporting; |

| | • | | reviews the activities and independence of the independent auditors; |

| | • | | reviews and discusses the audited financial statements with management and the independent auditors and the results of the audit; and |

| | • | | appoints the independent auditors. |

It is the responsibility of our executive management to prepare financial statements in accordance with accounting principles generally accepted in the United States of America and of our independent auditors to audit those financial statements.

In this context, the Committee has reviewed and held discussions with management and the independent auditors regarding the Company’s 2004 financial statements. Management represented to the Committee that our

21

consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees).

In addition, the Committee has discussed with the independent auditors the auditor’s independence from the Company and management and has received the written disclosure and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees). Further, the Committee has considered whether the provision of non-audit services by the independent auditors is compatible with maintaining the auditor’s independence.

The Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of our internal controls, and the overall quality of our financial reporting.

Based on the reviews and discussions referred to above, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission. The Committee believes that the provision of services by the independent auditors for matters other than the annual audit and quarterly reviews is compatible with maintaining the auditor’s independence.

Audit Committee: Perry M. Waughtal, Chairman

R. Steven Hicks

Donny R. Jackson

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee designated KPMG LLP, or KPMG, as our Independent Registered Public Accounting Firm for the year ending December 31, 2004. KPMG LLP has advised us that, in accordance with professional standards, they will not perform any non-audit service that would impair their independence for purposes of expressing an opinion on our financial statements. A representative of KPMG will attend the meeting with the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions. No accountants have been selected for the year ending December 31, 2005 and the Audit Committee intends to consider proposals for the 2005 audit.

Fees to Independent Registered Public Accounting Firm for Fiscal 2004 and 2003