Name of Owner and Current Address | | Amount of Beneficial Ownership | | Percentage of

Class (%) | |

| |

| |

| |

| | | | | | | | | |

Argil J. Wheelock, M.D.

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 1,597,364 shares | | | | 13.48 | | |

| | | | | | | | | |

Martin J. McGahan

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 113,504 shares | | | | * | | |

| | | | | | | | | |

Victoria W. Beck

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 109,516 shares | | | | * | | |

| | | | | | | | | |

Ted S. Biderman

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 53,333 shares | | | | * | | |

| | | | | | | | | |

Bradley G. Devine

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 53,500 shares | | | | * | | |

| | | | | | | | | |

W. Price Dunaway

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 41,668 shares | | | | * | | |

| | | | | | | | | |

Ronald N. Gully

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 47,567 shares | | | | * | | |

| | | | | | | | | |

James R. Andrews, M.D.

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 101,000 shares | | | | * | | |

| | | | | | | | | |

Scott A. Cochran

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 162,500 shares | | | | 1.40 | | |

| | | | | | | | | |

Donny R. Jackson

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 21,167 shares | | | | * | | |

| | | | | | | | | |

Timothy J. Lindgren

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 30,167 shares | | | | * | | |

| | | | | | | | | |

Russell H. Maddox

1841 West Oak Parkway, Suite A

Marietta, GA 30062 | | | 192,667 shares | | | | 1.64 | | |

| | | | | | | | | | |

All officers and Directors as a group – 12 persons | | | 2,523,953 shares | | | | 21.42 | | |

Dr. Wheelock’s beneficial ownership includes presently exercisable options to purchase up to 168,000 shares of Company Stock at a purchase price of $6.50 per share, 50,000 shares at $6.66 per share, 20,000 shares $8.50 per share and 25,000 shares at $10.50 per share.

Mr. McGahan’s beneficial ownership includes presently exercisable options to purchase up to 30,000 shares of Company Stock at a purchase price of $6.66 per share, 5,000 shares at $7.70 per share and 63,000 shares at $9.00 per share.

Ms. Beck’s beneficial ownership includes presently exercisable options to purchase up to 5,000 shares of Company Stock at a purchase price of $6.00 per share, 24,000 shares at $6.50 per share, 10,000 shares at $6.66 per share, 20,000 shares at $6.969 per share, 2,500 shares at $7.70 per share, 5,000 shares at $8.50 per share, 6,000 shares at $10.50 per share and 15,000 shares at $12.0625 per share.

Mr. Biderman’s beneficial ownership includes presently exercisable options to purchase up to 10,000 shares of Company Stock at a purchase price of $6.66 per share and 43,333 shares at $9.50 per share.

Mr. Devine’s beneficial ownership includes presently exercisable options to purchase up to 6,000 shares of Company Stock at a purchase price of $6.00 per share, 24,000 shares at $6.50 per share, 15,000 shares at $6.66 per share, 2,500 shares at $7.70 per share, 5,000 shares at $10.50 per share and 1,000 shares at $12.0625 per share.

Mr. Dunaway’s beneficial ownership includes presently exercisable options to purchase up to 8,334 shares of Company Stock at a purchase price of $8.38 per share and 33,334 shares at $11.03 per share.

Mr. Gully’s beneficial ownership includes presently exercisable options to purchase up to 20,000 shares of Company Stock at a purchase price of $5.099 per share, 20,000 shares at $6.66 per share and 6,667 shares at $7.70 per share.

Dr. Andrews’ beneficial ownership includes presently exercisable options to purchase up to 16,000 shares of Company Stock at a purchase price of $6.50 per share, 15,000 shares at $6.66 per share, 20,000 shares at $8.25 and 50,000 shares at $12.0625 per share.

Mr. Cochran’s beneficial ownership includes presently exercisable options to purchase up to 20,000 shares of Company Stock at a purchase price of $6.50 per share, 17,500 shares at $6.66 per share and 20,000 shares at $8.25 per share.

Mr. Jackson’s beneficial ownership includes presently exercisable options to purchase up to 2,500 shares of Company Stock at a purchase price of $6.66 per share and 16,667 shares at $6.80 per share.

Mr. Lindgren’s beneficial ownership includes presently exercisable options to purchase up to 2,500 shares of Company Stock at a purchase price of $6.66 per share and 16,667 shares at $6.80 per share.

Mr. Maddox’s beneficial ownership includes presently exercisable options to purchase up to 66,667 shares of Company Stock at a purchase price of $6.00 per share, 20,000 shares at $6.50 per share, 32,500 shares at $6.66 per share, 20,000 shares at $8.25 per share, 5,000 shares at $8.50 per share and 2,500 shares at $8.99 per share.

9

Section 16(a) Beneficial Ownership Reporting Compliance

Executive officers, Directors and certain persons who own more than ten percent of the Company Stock are required by Section 16(a) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and related regulations:

| (a) | to file reports of their ownership of Company Stock with the SEC and the Nasdaq National Market (“Nasdaq”); and |

| | |

| (b) | to furnish us with copies of the reports. |

Based upon a review of filings with the Securities and Exchange Commission and written representations that no other reports were required, the Company believes that all of the Company’s Directors and executive officers complied with the reporting requirements of Section 16(a) of the 1934 Act during 2003 except:

W. Price Dunaway’s stock option grant on July 9, 2003, subsequently reported on Form 5.

Ronald N. Gully’s stock purchase on March 19, 2002, subsequently reported on Form 5.

INFORMATION ABOUT THE BOARD AND CORPORATE GOVERNANCE

The Board is elected by the Shareholders to oversee their interest in the long-term health and the overall success of the Company’s business and financial strength. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the Shareholders. The Board selects and oversees the members of senior management, who are charged by the Board with conducting the business of the Company.

The Board has made, developed, changed and documented corporate governance policies in the past year. The Nomination Committee has added corporate governance responsibilities to its charter. The Nomination Committee will review and assess the Company’s corporate governance policies. The Chairman of the Nomination Committee presides at all meetings of the non-management and independent Directors. These meetings include the evaluation of the Chief Executive Officer. The Nomination Committee examines the performance and qualifications of each incumbent or proposed Director before recommending him or her to the Board for nomination or renomination.

Independence Determination

No Director will be deemed to be independent unless the Board affirmatively determines that the Director has no material relationship with the Company, directly or as an officer, Shareholder or partner of an organization that has a relationship with the Company. The Board observes all criteria for independence established by Nasdaq and other applicable governing laws and regulations. No member of the Board serves on more than two other boards of directors of publicly-traded companies.

In its recent review of Director independence, the Board considered all commercial, banking, consulting, legal, accounting, charitable or other business relationships any Director may have with the Company. The Board will conduct such review annually. As a result of its recent review, the Board has determined that all of the current and proposed Directors, with the exception of Dr. Argil J. Wheelock, Martin J. McGahan and Dr. Andreas Baenziger, are independent. The independent Directors are James R. Andrews, M.D., Scott A. Cochran, Donny R. Jackson, Timothy J. Lindgren, Russell H. Maddox and J. Richard Steadman, M.D. Although they are not independent, Messrs. Wheelock, McGahan and Baenziger

10

bring a wealth of experience, expertise and judgment to the Company’s Board of Directors. Dr. Wheelock is a urologist and has been in the lithotripsy business for eighteen years. Dr. Baenziger is an orthopaedic surgeon and has been in the medical device industry for eleven years. Mr. McGahan is our current President and acting Chief Financial Officer with over ten years of experience in the healthcare industry.

The Board and Board Committees

In 2003, the Board of Directors held six meetings and Committees of the Board of Directors held a total of twelve meetings. Overall attendance at such meetings was 94%. Each Director attended more than 66% of the aggregate of all meetings of the Board of Directors and the Committee on which he served during 2003. The Company has no established policy regarding Board members’ attendance at the Annual Meeting. Five of the Company’s six Directors were present at the Company’s 2003 Annual Meeting.

The Board of Directors has an Audit Committee, a Compensation Committee and a Nomination Committee. The Board of Directors has adopted a written charter for each of these Committees. The full text of each charter and the Company’s Corporate Governance Guidelines are available on the Company’s website located at www.healthtronics.com. Additionally, a copy of the revised Audit Committee Charter is attached as Appendix A hereto.

The following table lists each Board member and identifies each of the Committees of which he is a member and the number of meetings held during 2003.

| | Audit | | Compensation | | Nomination |

| |

| |

| |

|

James R. Andrews | | | | X | | |

Scott A. Cochran | | X | | | | |

Donny R. Jackson | | Chair | | | | X |

Argil J. Wheelock, M.D. | | | | | | |

Russell H. Maddox | | | | Chair | | Chair |

Timothy J. Lindgren | | X | | | | |

Number of Meetings | | 10 | | 2 | | 1 |

AUDIT

The Audit Committee

Under the terms of its charter, the Audit Committee represents and assists the Board in fulfilling its oversight responsibility relating to the integrity of the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, the internal audit function, the annual independent audit of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements and its ethics program, the independent auditors’ qualifications and independence and the performance of its independent auditors. In fulfilling its duties, the Audit Committee, among other things, shall:

| • | have the sole authority and responsibility to hire, evaluate and, where appropriate, replace the independent auditors; |

| | |

| • | review with management and the independent auditors, the interim financial statements and the Company’s disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations prior to filing of the Company’s Quarterly Reports on Form 10-Q; |

| | |

| • | review with management and the independent auditors the financials statements to be included in the Company’s Annual Report on Form 10-K (or the annual report) including |

11

| | (a) their judgment about the quality, not just acceptability, of the Company’s accounting principles, including significant financial reporting issues and judgments made in connection with the preparation of the financial statements; (b) the clarity of the disclosures in the financial statements; and (c) the Company’s disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations, including critical accounting policies; |

| | |

| • | review and discuss with management and the independent auditors the Company’s policies with respect to risk assessment and risk management; |

| | |

| • | review and discuss with management and the independent auditors the Company’s internal controls and the Company’s disclosure controls and procedures and quarterly assessment of such controls and procedures; |

| | |

| • | establish procedures for handling complaints regarding accounting, internal accounting controls, and auditing matters, including procedures for confidential, anonymous submission of concerns by employees regarding accounting and auditing matters; and |

| | |

| • | review and discuss with management and the independent auditors the adequacy and effectiveness of the Company’s legal, regulatory and ethical compliance programs. |

Each member of the Audit Committee (i) is “independent” as defined by Rule 4200(a)(15) of the Nasdaq listing standards, (ii) meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, (iii) has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years, and (iv) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. Additionally, the Company has and will continue to have, at least one member of the Audit Committee who has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. The Board of Directors has determined that Donny Jackson is an “audit committee financial expert” as defined in applicable Securities and Exchange Commission rules.

COMPENSATION

The Compensation Committee

Under the terms of its charter, the Compensation Committee has overall responsibility for evaluation and approving the officer compensation plans, policies and programs of the Company. In fulfilling its duties, the Compensation Committee, among other things, shall:

| • | review the competitiveness of the Company’s executive compensation programs to ensure (a) the attraction and retention of qualified corporate officers, (b) the motivation of corporate officers to achieve the Company’s business objectives, and (c) the alignment of the interests of key leadership with the long-term interests of the Company’s Shareholders; |

| | |

| • | review trends in management compensation, oversee the development of new compensation plans and, when necessary, approve the revision of existing plans; |

| | |

| • | review the performance of executive management other than the CEO, whose performance will be reviewed by the Nomination Committee; |

12

| • | review and approve Chairman and CEO goals and objectives, evaluate Chairman and CEO performance in light of those corporate objectives, and set Chairman and CEO compensation levels consistent with company philosophy. The Nomination Committee’s CEO evaluation will be considered in setting CEO salary and other compensation; |

| | |

| • | approve the salaries, bonus and other compensation for all corporate officers at the level of Chief Operating Officer and above, provided that, as to the Chairman and the Chief Executive Officer, the Committee will recommend appropriate salary, bonus and other compensation to the entire Board for approval; |

| | |

| • | review and approve compensation packages for new corporate officers and termination packages for corporate officers as requested by management; |

| | |

| • | review and approve the awards made under any executive officer bonus plan, and provide an appropriate report to the Board; |

| | |

| • | review and discuss with the Board and senior officers plans for officer development and corporate succession plans for the CEO and other senior officers; |

| | |

| • | review and make recommendations concerning long-term incentive compensation plans, including the use of stock options and other equity-based plans. Except as otherwise delegated by the Board, the Compensation Committee will act on behalf of the Board as the committee established to administer equity-based and employee benefit plans, and as such will discharge any responsibilities imposed on the Committee under those plans, including making and authorizing grants, in accordance with the terms of those plans; and |

| | |

| • | produce an annual Report of the Compensation Committee on Executive Compensation for the Company’s annual proxy statement in compliance with applicable SEC and Nasdaq rules and regulations. |

Each member of the Compensation Committee meets the independence requirements of Nasdaq and the Company’s Corporate Governance Guidelines.

NOMINATION

The Nomination Committee

Under the terms of its charter, the Nomination Committee has overall responsibility for identifying and recommending Board of Director nominees for the next annual meeting of the Shareholders and review and development of the Company’s Corporate Governance Guidelines. In fulfilling its duties, the Nomination Committee, among other things, shall:

| • | annually evaluate and report to the Board on the performance and effectiveness of the Board to facilitate the Directors fulfilling their responsibilities in a manner that serves the interests of the Company’s Shareholders; |

| | |

| • | annually present to the Board a list of individuals recommended for nomination for election to the Board at the annual meeting of Shareholders; |

| | |

| • | before recommending an incumbent, replacement or additional Director, review his or her qualifications, including capability, availability to serve, conflicts of interest, and other relevant factors; |

13

| • | assist in identifying, interviewing and recruiting candidates for the Board; |

| | |

| • | annually review the composition of each committee and present recommendations for committee memberships to the Board as needed; |

| | |

| • | periodically review the compensation paid to non-employee Directors for annual retainers (including Board and committee Chairs) and meeting fees, if any, and make recommendations to the Board for any adjustments. No member of the Committee will act to fix his or her own compensation except for uniform compensation to Directors for their services as such; |

| | |

| • | consider issues involving related party transactions with Directors and similar issues; and |

| | |

| • | regularly review and make recommendations about changes to the charters of other Board committees after consultation with the respective committee chairs. |

The Chairman of the Nomination Committee presides at all meetings of the non-management Directors, including the meeting in which the Chief Executive Officer’s performance is evaluated.

The Nomination Committee will consider recommendations for Directorships submitted by Shareholders. Shareholders who wish the Nomination Committee to consider their recommendations for nominees for the position of Director should submit their recommendations in writing to the Nomination Committee in care of the Office of the Secretary, HealthTronics Surgical Services, Inc., 1841 West Oak Parkway, Suite A, Marietta, Georgia 30062. Recommendations by Shareholders that are made in accordance with these procedures will receive the same consideration given to nominees of the Nomination Committee.

In its assessment of each potential candidate, the Nomination Committee will review the nominee’s judgment, experience, independence, understanding of the Company’s or other related industries and such other factors the Nomination Committee determines are pertinent in light of the current needs of the Board. Diversity of race, ethnicity, gender and age are factors in evaluating candidates for Board membership, among others. The Nomination Committee will also take into account the ability of a Director to devote the time and effort necessary to fulfill his or her responsibilities.

Nominees may be suggested by Directors, members of management or Shareholders. In identifying and considering candidates for nomination to the Board of Directors the Nomination Committee considers, in addition to the requirements set out in the Company’s Corporate Governance Guidelines and the Nomination Committee’s charter, quality of experience, the needs of the Company and the range of talent and experience represented on the Board.

Dr. Baenziger, Dr. Steadman and Mr. McGahan are the only nominees for Director proposed to be elected for the first time at the Annual Meeting. Dr. Baenziger was Chief Executive Officer of the Company’s primary equipment manufacturer prior to the Company’s purchase of a controlling interest in the manufacturer. Dr. Baenziger’s and Dr. Steadman’s names were proposed pursuant to the terms of the purchase agreement for the purchase of HMT Holding AG. Mr. McGahan’s name was first suggested by the Chief Executive Officer.

Each member of the Nomination Committee meets the independence requirements of Nasdaq, the 1934 Act and the Company’s Corporate Governance Guidelines.

14

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS OF

HEALTHTRONICS SURGICAL SERVICES, INC. ON EXECUTIVE COMPENSATION

The Compensation Committee, among its various functions, establishes and reviews the salaries and other compensation paid to our executive officers and the Chief Executive Officer. In accordance with Nasdaq rules, the compensation of the Chief Executive Officer is determined by the Compensation Committee. Beginning in fiscal 2004, the Chief Executive Officer will not be present during voting or deliberations with respect to his compensation. This report summarizes the policies followed in setting compensation for our executive officers and Chief Executive Officer in 2003.

The Compensation Committee has established a compensation program for executive officers that is intended to reward performance in a growth stage entity in a developing industry. For 2003, the executive officer compensation included a conservative annual base salary with the potential for an annual bonus in cash or equity based on Company performance. The 2002 annual base salaries for executive officers were increased from 2001 to be in line with peer firms. The annual bonus was based on the Company meeting revenue and earning growth targets. As a result of the annual bonus utilizing year-end results, bonuses for 2002 performance are paid in 2003. No annual bonus was paid during 2002 as the 2001 bonuses were paid prior to year-end as special bonuses following the consummation of the Litho Group, Inc. acquisition. During 2003, the compensation committee granted 492,000 stock options. Of these, 115,000 options were granted to executive officers.

We believe the executive compensation policies and programs of the Company serve the interests of the Shareholders and the Company. Pay delivered to the executives is based on Company and individual performance. We will continue to evaluate and, as necessary, update our compensation programs to assure that they remain performance-driven, reward competitively, serve to retain the best talent and reinforce equity ownership. Through these principles, we believe executives will be motivated to achieve long-term, sustainable growth for the Company. We invite Shareholders to review the following tables for details of specific awards.

Russell H. Maddox

James R. Andrews, M.D.

15

EXECUTIVE COMPENSATION

Summary of Cash And Certain Other Compensation

The following table and footnotes provides certain summary information concerning compensation paid or accrued by the Company in 2003, 2002 and 2001 to or on behalf of the Company’s Chief Executive Officer and each of the four other executive officers whose compensation exceeded $100,000 for the fiscal year ended December 31, 2003 (hereafter referred to as the named executive officers).

[table on following page]

16

Summary Compensation Table

| | | | Annual Compensation | | Long-Term

Compensation | | | |

| | | | |

| | | |

| | | | | Awards | | | |

| | | |

| |

| | | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Other Annual

Compensation ($) (1) | | Securities

Underlying

Options (#) | | All Other

Compensation ($) (2) | |

| |

| |

| |

| |

| |

| |

| |

Argil J. Wheelock, M.D.

Chief Executive Officer | | fiscal year

ended

12/31/03 | | | 262,441 | | | | 102,000 | | | | 10,705 | | | | 50,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/02 | | | 301,349 | | | | 0 | | | | 13,331 | | | | 0 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/01 | | | 110,315 | | | | 67,809 | | | | 12,823 | | | | 210,000 | | | | 350,003 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Martin J. McGahan

President and Chief Operating

Officer (Acting Chief Financial

Officer) | | fiscal year

ended

12/31/03 | | | 205,000 | | | | 109,000 | | | | 14,612 | | | | 30,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/02 | | | 202,878 | | | | 0 | | | | 13,869 | | | | 15,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/01 | | | 78,114 | | | | 100,000 | | | | 8,221 | | | | 120,000 | | | | 100,001 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Victoria W. Beck

Executive Vice President and

Chief Accounting Officer | | fiscal year

ended

12/31/03 | | | 118,530 | | | | 40,000 | | | | 6,015 | | | | 10,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/02 | | | 116,679 | | | | 0 | | | | 8,485 | | | | 7,500 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/01 | | | 112,069 | | | | 96,481 | | | | 11,981 | | | | 50,000 | | | | 50,000 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Ted S. Biderman

Senior Vice President, Secretary

and General Counsel (3) | | fiscal year

ended

12/31/03 | | | 170,000 | | | | 25,000 | | | | 7,900 | | | | 10,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/02 | | | 121,728 | | | | 16,000 | | | | 16,847 | | | | 65,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Bradley G. Devine

Senior Vice President and Chief

Operating Officer of Equipment

Sales and Service | | fiscal year

ended

12/31/03 | | | 123,000 | | | | 52,500 | | | | 6,385 | | | | 15,000 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/02 | | | 121,728 | | | | 16,000 | | | | 16,847 | | | | 7,500 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | fiscal year

ended

12/31/01 | | | 83,162 | | | | 87,000 | | | | 16,408 | | | | 0 | | | | 0 | | |

17

| (1) | In addition to their annual remuneration, executive officers who are also employees are entitled to receive the Company’s matching contribution under the 401(k) plan. The Company-sponsored match amounts are shown in the “Other Annual Compensation” column above. Also shown in the “Other Annual Compensation” column is an auto allowance for Mr. Devine of $5,847 in 2001, 2002 and 2003; insurance premiums paid by the Company for Dr. Wheelock of $2,148 in 2000, $2,323 in 2001 and $2,331 in 2002, for Mr. McGahan of $2,870 in 2002 and $4,919 in 2003 and for Ms. Beck of $614 in 2000, $1,481 in 2001 and $1,484 in 2002 and relocation expenses for Mr. McGahan of $8,221 in 2001. |

| | |

| (2) | In 2001, a total of 94,962 shares of Company Stock were issued under the Company’s deferred compensation plan in lieu of a cash bonus. |

| | |

| (3) | Mr. Biderman joined the Company in April 2002. |

2003 Stock Options Granted

The following table contains information concerning the grant of stock options during 2003 to the named executive officers.

Option/SAR grants in last fiscal year

[individual grants]

Name and Title | | Number of

Securities

Underlying

Options/SARs (#) | | Percent of Total

Options/SARs

Granted to

Employees in

Fiscal Year | | Exercise or

Base Price | | Expiration

Date | | Grant Date

Present Value

($) (1) | |

| |

| |

| |

| |

| |

| |

Argil J. Wheelock, M.D.

Chief Executive Officer | | | 50,000 | | | | 10.16 | % | | $ | 6.66 | | | | 1/24/2013 | | | $ | 217,500 | | |

| | | | | | | | | | | | | | | | | | | | | |

Martin J. McGahan

President and Chief Operating

Officer (Acting Chief Financial

Officer) | | | 30,000 | | | | 6.10 | % | | $ | 6.66 | | | | 1/24/2013 | | | $ | 130,500 | | |

| | | | | | | | | | | | | | | | | | | | | |

Victoria W. Beck

Executive Vice President and

Chief Accounting Officer | | | 10,000 | | | | 2.03 | % | | $ | 6.66 | | | | 1/24/2013 | | | $ | 43,500 | | |

| | | | | | | | | | | | | | | | | | | | | |

Ted S. Biderman

Senior Vice President, Secretary

and General Counsel | | | 10,000 | | | | 2.03 | % | | $ | 6.66 | | | | 1/24/2013 | | | $ | 43,500 | | |

| | | | | | | | | | | | | | | | | | | | | |

Bradley G. Devine

Senior Vice President and Chief

Operating Officer of Equipment

Sales and Service | | | 15,000 | | | | 3.05 | % | | $ | 6.66 | | | | 1/24/2013 | | | $ | 65,250 | | |

|

| (1) | The “grant date present value” is based upon the Black-Scholes option pricing model adapted for use in valuing executive stock options. The actual value, if any, the executive may realize upon exercise of the option will depend on the excess of the stock price over the exercise price on the date the option is exercised, so there is no assurance the value realized by the executive will be at or near the value estimated by the Black-Scholes model. The principal assumptions incorporated into the valuation model by the Company are as follows: (i) dividend yield of 0%; (ii) expected volatility of .797% (iii) risk-free interest rate of 2.93%; and (iv) expected life of 5 years. No assumptions were made regarding nontransferability or risk of forfeiture. The assumptions chosen materially impact the resulting valuations. |

18

The following chart details the exercise of any outstanding options and the number and value of unexercised stock options.

Aggregated option/SAR exercises in last fiscal year and FY-end option/SAR values

Name | | Shares

Acquired

on

Exercise | | Value

Realized | | Number of Securities

Underlying Unexercised

Options/SARs

at FY-End

Exercisable/

Unexercisable | | Value of Unexercised

In-the-Money

Options/SARs

at FY-End

Exercisable/

Unexercisable | |

| |

| |

| |

| |

| |

Argil J. Wheelock, M.D.

Chairman and Chief Executive Officer | | | 0 | | | $ | 0 | | | | 171,000/134,000 | | | | | $0/$0 | | |

| | | | | | | | | | | | | | | | | | |

Martin J. McGahan

President and Chief Operating Officer

(Acting Chief Financial Officer) | | | 0 | | | $ | 0 | | | | 68,000/70,000 | | | | | $0/$0 | | |

| | | | | | | | | | | | | | | | | | |

Victoria W. Beck

Executive Vice President and Chief

Accounting Officer | | | 5,000 | | | $ | 27,872 | | | | 71,500/37,000 | | | | | $1,500/$0 | | |

| | | | | | | | | | | | | | | | | | |

Ted S. Biderman

Senior Vice President, Secretary and

General Counsel | | | 0 | | | $ | 0 | | | | 21,666/53,334 | | | | | $0/$0 | | |

| | | | | | | | | | | | | | | | | | |

Bradley G. Devine

Senior Vice President and Chief

Operating Officer of Equipment Sales

and Service | | | 0 | | | $ | 0 | | | | 32,500/32,000 | | | | | $1,800/$0 | | |

EXECUTIVE OFFICERS OF THE COMPANY

The name and positions of the Company’s executive officers are set forth below.

Name | | Position Held | | Date First Employed |

| |

| |

|

Argil J. Wheelock, M.D. | | Chairman and Chief Executive Officer | | July 1, 1996 |

| | | | |

Martin J. McGahan | | President and Chief Operating Officer (Acting Chief

Financial Officer) | | June 19, 2001 |

| | | | |

Andreas Baenziger, M.D. | | Chief Operating Officer of Product Development,

Manufacturing, Sales and Service | | March 5, 2004 |

| | | | |

Victoria W. Beck | | Executive Vice President and Chief Accounting Officer | | August 1, 1997 |

| | | | |

Ted S. Biderman | | Senior Vice President, General Counsel and Secretary | | April 15, 2002 |

| | | | |

Bradley G. Devine | | Senior Vice President and Chief Operating Officer

of Equipment Sales and Service | | September 1, 1999 |

| | | | |

W. Price Dunaway | | Senior Vice President and Chief Operating Officer

of Lithotripsy Operations | | March 14, 2003 |

| | | | |

Ronald N. Gully | | Senior Vice President and Chief Operating Officer of

Orthopaedic Division | | October 1, 2001 |

19

Biographical Information

Please see the biographical information under the “Directors” section for the biographical information of Dr. Wheelock, Mr. McGahan and Dr. Baenziger.

VICTORIA W. BECK, age 48 - Ms. Beck served as the Company’s Chief Financial Officer from August 1997 until June 2001, when she was promoted to Executive Vice President and Vice President of Finance. Ms. Beck, a certified public accountant, graduated from Georgia State University with a degree in accounting. Before coming to the Company, from mid 1994 until July of 1997, Ms. Beck was the owner of a CPA and consultancy firm that specialized in growth-oriented, emerging companies in the high-tech sector as well as businesses with foreign parent companies. From mid 1987 until mid 1994 she was the controller of Miller/Zell, a privately held Georgia company. From 1982 until mid 1987 Ms. Beck worked for the international accounting firm of Price Waterhouse, where she was an auditor for emerging companies.

TED S. BIDERMAN, age 35 - Mr. Biderman has served as the Company’s Senior Vice President, General Counsel and Secretary since April 2002. Mr. Biderman came to the Company after practicing law at Miller & Martin LLP, from 1996 to 2002. He was a member of the firm’s corporate practice group with an emphasis on securities and mergers and acquisitions. Mr. Biderman is a member of the Business and Health Law Sections of the American Bar Association and is licensed to practice law in Georgia and Tennessee. Mr. Biderman received concurrent JD and MBA degrees from Drake University and a BS in Accounting from the University of Tennessee at Chattanooga.

BRADLEY G. DEVINE, age 44 - Since September 1999, Mr. Devine has served as the Company’s Vice President and, currently, Senior Vice President and Chief Operating Officer of Equipment Sales and Service. Mr. Devine started his career in Biomedical Technology Service in 1979 in the United States Air Force, where he spent 8 ½ years as a Department of Defense inspector for x-ray systems. In June 1987, Mr. Devine received the Meritorious Service Medal for his many contributions to the Air Force. Prior to joining the Company he served as: Technical Support Manager, for ServiceTrends, a medical device service company, from 1998 to 1999; a consultant to hospitals and independent biomedical/ imaging equipment service companies, from 1996 through 1997; a service engineer for Dornier Medical Systems, a manufacturer of medical equipment, from 1994 to 1996; a service engineer at Georgetown University Hospital, from 1991 through 1993; Service Manager and Director of Operations for Mid-Atlantic Clinical Engineering, from 1987 through 1990. Mr. Devine has a degree in Electronics Technology from Los Angeles Metropolitan College.

W. PRICE DUNAWAY, age 52 – Mr. Dunaway joined the Company as Senior Vice President and Chief Operating Officer of Lithotripsy Operations in March 2003. Prior to this, from 2001 to 2003, he was Chief Operating Officer of Lexicor Health Services, Inc., a telemedicine information and equipment business; cofounder and Chief Executive Officer of Accelerated Pharmaceuticals, a company that performs computer modeling of small molecules based on gene structures, from 1998 to 2001; Chief Financial Officer of Osbon Medical Systems, Inc., a medical device and diagnostic equipment supplier, from 1989 to 1997; and Chief Operating Officer of Lenox Optical, Inc., a chain of one hour superopticals from 1986 to 1989.

RONALD N. GULLY, age 46 - Mr. Gully joined the Company as Senior Vice President of Reimbursement and Insurance in October 2001. In April 2002, he was promoted to Senior Vice President and Chief Operating Officer of Orthopaedic Division. Mr. Gully has more than 15 years experience in the management and marketing of healthcare services. Prior to joining the Company, Mr. Gully had served as Chief Executive Officer and President of Ascension Corporation, a healthcare information technology company, from 2000 to 2001, and as Vice President of Managed Care for HealthSouth Corporation, from 1993 to 2000.

20

Employment Contracts

Dr. Wheelock entered into an amended and restated employment contract with the Company effective January 1, 2004. The terms of the contract include an annual base salary of at least $300,000 and either a corporate automobile or an auto allowance of $600 per month. Dr. Wheelock may also receive annual bonuses and stock options at the discretion of the Compensation Committee. The length of the contract is 3 years and shall automatically renew for 3 years upon each anniversary date of the contract unless written notice of intention to terminate the contract is given at least 60 days prior to the anniversary date. The contract may be terminated by either party for cause or the incapacity of Dr. Wheelock. All unvested options shall vest and become exercisable immediately upon a change of control of the Company (as defined in the employment agreement) or termination of the contract, other than for cause or incapacity. The contract also provides for a severance payment of 299% of Dr. Wheelock’s annual salary and bonus in the event he is terminated without cause.

Mr. McGahan entered into an amended and restated employment contract with the Company effective January 1, 2004. The terms of the contract include an annual base salary of at least $250,000. Mr. McGahan also receives a “whole” life insurance policy. If his employment is terminated for cause or due to Mr. McGahan’s incapacity, any equity in the insurance policy will remain property of the Company. Mr. McGahan may also receive annual bonuses and stock options at the discretion of the Compensation Committee or Chief Executive Officer. The length of the contract is 3 years and shall automatically renew for 3 years upon each anniversary date of the contract unless written notice of intention to terminate the contract is given at least 60 days prior to the anniversary date. The contract may be terminated by either party for cause or the incapacity of Mr. McGahan. All unvested options shall vest and become exercisable immediately upon a change of control of the Company (as defined in the employment agreement) or termination of the contract, other than for cause or incapacity. The contract also provides for a severance payment of 299% of Mr. McGahan’s annual salary and bonus in the event he is terminated without cause.

Mr. Biderman entered into an amended and restated employment contract with the Company effective January 1, 2004. The terms of the contract include an annual base salary of at least $170,000. Mr. Biderman may also receive annual bonuses and stock options at the discretion of the Compensation Committee or Chief Executive Officer. The length of the contract is 3 years and shall automatically renew for 3 years upon each anniversary date of the contract unless written notice of intention to terminate the contract is given at least 60 days prior to the anniversary date. The contract may be terminated by either party for cause or the incapacity of Mr. Biderman. All unvested options shall vest and become exercisable immediately upon a change of control of the Company (as defined in the employment agreement) or termination of the contract, other than for cause or incapacity. The contract also provides for a severance payment of 299% of Mr. Biderman’s annual salary and bonus in the event he is terminated without cause.

21

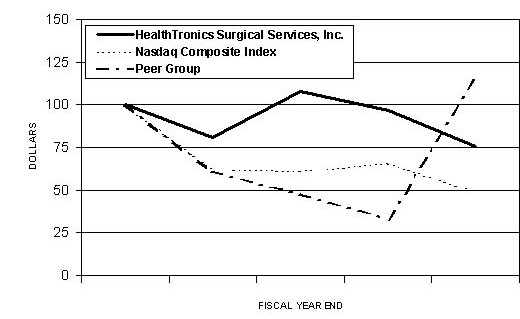

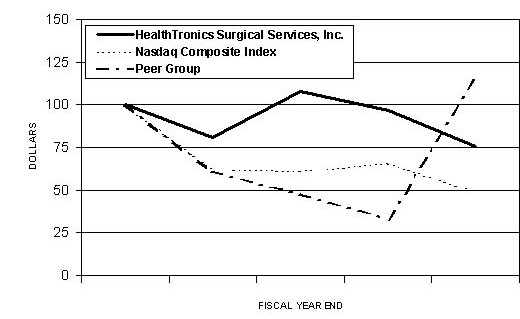

PERFORMANCE GRAPH

Comparison of Five-Year Cumulative Total Return Among

HealthTronics Surgical Services, Inc., a Health Services Peer Group and the Nasdaq Composite Index

Fiscal Year End | | Nasdaq

Composite Index | | Health Services

Peer Group | | HealthTronics

Surgical Services, Inc. | |

| |

| |

| |

| |

| 12/31/99 | | | 100.00 | | | | 100.00 | | | | 100.00 | | |

| 12/31/00 | | | 60.71 | | | | 61.69 | | | | 80.83 | | |

| 12/31/01 | | | 47.93 | | | | 60.64 | | | | 108.26 | | |

| 12/31/02 | | | 32.82 | | | | 65.34 | | | | 96.37 | | |

| 12/31/03 | | | 49.23 | | | | 115.14 | | | | 75.78 | | |

The graph compares our cumulative total stockholder return with the cumulative total stockholder returns of the Nasdaq Composite Index and to an index of peer group companies we selected, for the period from December 31, 1999 through December 31, 2003. The Health Services Peer Group is a peer group constructed by the Company that consists of Prime Medical Services, Inc., Medstone International, Inc., Urologix, Inc. and Candela Corporation. The graph assumes $100 invested on December 31, 1999, in our Company Stock and in each index with the subsequent reinvestment of dividends on a quarterly basis.

22

Equity Compensation Plan Information

Plan Category | | Number of

Securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a) | | Weighted average

exercise price

of outstanding

options, warrants

and rights

(b) | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(c) | |

| | | | | | | |

Equity compensation plans approved by

security holders | | | 2,000,000 | | | $ | 7.61 | | | | 342,295 | | |

Equity compensation plans not approved

by security holders | | | 900,000 | | | | 8.90 | | | | – | | |

| | |

| | | | | | | |

| | |

Total | | | 2,900,000 | | | | | | | | 342,295 | | |

| | |

| | | | | | | |

| | |

Narrative Description of Equity Compensation Plans Not Approved by Security Holders

The stock option plans not approved by Shareholders provided for the grant of compensation based stock options to employees or Directors at the discretion of the Board of Directors. The options were issued at market value at the time of the grant. The options vest over a period of service, as specified at the time of the grant with terms of 3 to 10 years. If an employee, Director or consultant left the Company, any unvested options terminated and vested options must have been exercised within a specified time period.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Relationships and Transactions with Management and Others

Randy Wheelock is a principal of US Orthotripsy, LLC, a limited partner in Orthotripsy Services of Eastern Tennessee, L.P. (“East Tennessee”) and OssaTron Services of the Carolinas, L.P. (“Carolinas”). East Tennessee provides Orthotripsy services in East Tennessee and Carolinas provides Orthotripsy services in North Carolina and South Carolina. US Orthotripsy, LLC also manages East Tennessee and Carolinas and Randy Wheelock was paid a monthly management fee of $4,333 plus reimbursement for reasonable expenses during 2003. Randy Wheelock is the brother of Dr. Argil Wheelock, Company CEO and Chairman.

Dr. Wheelock directly owns a 2.78% interest and indirectly owns an additional 3.3% interest (through 9% ownership in a corporate partner, NGST, Inc.) in Tenn-Ga Stone Group Two, a Tennessee general partnership. Tenn-Ga Stone Group Two provides lithotripsy services in Tennessee and North Georgia. Dr. Wheelock purchased his interests in Tenn-Ga Stone Group Two in or about 1990. The Company manages Tenn-Ga Stone Group Two and is a 28% owner and managing partner of Tenn-Ga Stone Group Three, a Tennessee general partnership that has a 38.25% ownership interest in Tenn-Ga Stone Group Two. Tenn-Ga Stone Group Two pays the Company a management fee of $40,000 per year. The Company also supplies service, parts and consumables to Tenn-Ga Stone Group Two at standard rates. During 2003, Tenn-Ga Stone Group Two paid $285,915 to the Company for such services, parts and consumables.

In 1998, Dr. Wheelock purchased a 3% ownership interest in Lincolnland Lithotripsy, Inc., a corporation that provides mobile lithotripsy services in Illinois. The Company also supplies service, parts and consumables to Lincolnland Lithotripsy, Inc. at standard rates. During 2003, Lincolnland Lithotripsy, Inc. paid $254,122 to the Company for such services, parts and consumables.

23

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(PROPOSAL NO. 2)

The Audit Committee has appointed Ernst & Young LLP to serve as independent auditors for the fiscal year ending December 31, 2004, subject to ratification of the appointment by the Shareholders. Ernst & Young LLP has served as the Company’s independent auditors for many years and is considered by management to be well qualified.

REPORT OF THE AUDIT COMMITTEE

The Company has an Audit Committee composed entirely of non-management Directors. The members of the Audit Committee meet the independence and experience requirements of Nasdaq. In 2003, the Committee held five regularly scheduled, in person meetings, and five meetings by telephone conference call. The Committee has adopted, and annually reviews, a charter outlining the practices it follows. In April 2004 the Board of Directors amended the charter; a copy of the charter is attached as Appendix A to this proxy statement. The charter complies with all current regulatory requirements.

During the year 2003, at each of its regularly scheduled meetings, the Committee met with the senior members of the Company’s financial management team, the Company’s general counsel and the Company’s independent auditors. The Committee’s agenda is established by the Committee’s Chairman. The Committee had private sessions, at two of its regularly scheduled meetings, with the Company’s independent auditors at which candid discussions of financial management, accounting and internal control issues took place.

The Committee appointed Ernst & Young LLP as our independent auditors for the year ended December 31, 2003 and reviewed with the Company’s financial managers, and the independent auditors, overall audit scopes and plans, the results of internal and external audit examinations, evaluations by the auditors of the Company’s internal controls and the quality of the Company’s financial reporting. Although the Committee has the sole authority to appoint the independent auditor, the Committee will continue its long-standing practice of recommending that the Board ask the Shareholders, at their annual meeting, to approve the Committee’s selection of the independent auditor. Representatives of Ernst & Young LLP will be present at the Annual Meeting. They will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Management has reviewed the audited financial statements in the Annual Report with the Audit Committee including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant accounting judgments and estimates, and the clarity of disclosures in the financial statements. In addressing the quality of management’s accounting judgments, members of the Audit Committee asked for management’s representations and reviewed certifications prepared by the Chief Executive Officer and Chief Financial Officer that the unaudited quarterly and audited consolidated financial statements of the Company fairly present, in all material respects, the financial condition and results of operations of the Company, and have expressed to both management and auditors their general preference for conservative policies when a range of accounting options is available.

The Committee discussed with the independent auditors other matters required to be discussed by the auditors with the Committee under Statement on Auditing Standards No. 61, as amended by Statement on Auditing Standards No. 90 (communications with audit committees), and other regulations. The Committee received and discussed with the auditors their annual written report on their independence from the Company and its management, which is made under Rule 3600T of the Public Company Accounting Oversight Board, which adopts on an interim basis Independence Standards Board Standard No. 1 (independence discussions with audit committees), and considered with the auditors whether the provision of

24

non-audit services provided by them to the Company during 2003 was compatible with the auditors’ independence.

In performing all of these functions, the Audit Committee acts in an oversight capacity. The Committee reviews the Company’s earnings releases before issuance and quarterly and annual reporting on Form 10-Q and Form 10-K prior to filing with the SEC. In its oversight role the Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors, who, in their report, express an opinion on the conformity of the Company’s annual financial statements to generally accepted accounting principles.

In reliance on these reviews and discussions, and the report of the independent auditors, the Audit Committee has recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the SEC.

Donny R. Jackson, Chairman

Scott A. Cochran

Timothy J. Lindgren

The foregoing report of the Audit Committee shall not be deemed to be incorporated by reference into any of the Company’s previous or future filings with the SEC, except as otherwise explicitly specified by the language in any such filing.

AUDIT FEES AND ALL OTHER FEES

Audit Fees

The aggregate fees billed for professional services rendered by Ernst & Young LLP for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2002 and 2003 and the reviews of the financial statements included in the Company’s Forms 10-Q for fiscal years 2002 and 2003 were $284,500 for fiscal year 2002 and $341,500 for fiscal year 2003.

Audit-Related Fees

The aggregate fees billed by Ernst & Young LLP for audit-related services for fiscal years 2002 and 2003 were $23,500 and $332,575, respectively. Audit-related services principally include due diligence in connection with an acquisition and accounting consultations.

Tax Fees

No fees related to tax services were paid to Ernst & Young LLP for fiscal years 2002 and 2003.

All Other Fees

There were no fees paid to Ernst & Young LLP for services not included above.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by the independent auditors.

25

Under the policy, the audit committee has pre-approved work associated with accounting consultation relating to the application of accounting pronouncements, new accounting pronouncements, and other accounting consultation related to restructurings, divestitures, acquisitions, mergers and equity transactions in an amount not to exceed $25,000 per quarter.

The Board of Directors recommends a vote

FOR

the ratification of the appointment of Ernst & Young LLP as independent auditors.

APPROVAL OF THE COMPANY’S 2004 EQUITY INCENTIVE PLAN

(PROPOSAL NO. 3)

The following summary of the 2004 Equity Incentive Plan (the “Equity Incentive Plan” or the “Plan”) is qualified in its entirety by the text of the plan, which is available on our website at www.healthtronics.com or by contacting us as set forth on page 30. Shareholders can view the Equity Incentive Plan by accessing the website, then clicking on “Investor Relations” then on “Corporate Governance.”

The material terms of the Plan are as follows:

Purpose

To attract and retain individuals eligible to participate in the Plan and to further the growth, development and financial success of the Company by aligning the personal interests of participants in the Equity Incentive Plan, through the ownership of shares of the Company’s common stock and other incentives, with those of the Company and the Company’s shareholders.

Administration

The Board of Directors or a committee designated by the Board of Directors, such as the Compensation Committee (in either case, the “Administrator”).

Eligibility

Officers, employees, directors, consultants and other persons selected by the Board of Directors or the committee designated to administer the Equity Incentive Plan.

Stock Subject to the Plan

Five hundred thousand shares of the Company’s common stock will be reserved for delivery to individuals under the Plan. There will be no pre-established limits on what number of the 500,000 shares of the Company’s common stock reserved for the Plan will be allocated as stock options, stock appreciation rights (“SARs”), restricted stock grants, stock purchase rights, and other stock based awards.

Awards under the Plan

| • | Options. The Company will have the ability to award “Incentive Stock Options” and “Non-Statutory Stock Options” under the Plan (in either case, “Option(s)”). |

| | |

| • | Incentive Stock Options.Only key managerial employees of the Company (or certain of its affiliates) may be eligible to receive an award of Incentive Stock Options. Incentive Stock Options awarded under |

26

| | the plan must have an exercise price of at least 100% of the fair market value of our common stock on the date of grant. In the case of an employee who owns stock representing more than 10% of the voting power of the Company, the exercise price will be at least 110% of the fair market value of our common stock on the date of grant. |

| | |

| • | Non-Statutory Stock Options. The Company can award Non-Statutory Stock Options to any person eligible under the Plan. The Plan does not establish a minimum exercise price for Non-Statutory Stock Options granted under the Plan. |

| | |

| • | Other Terms Applicable to Options. Options may contain other provisions the Administrator decides are appropriate relating to when the Options will become exercisable, the times and circumstances the option may be exercised, and the methods the exercise price may be paid. Options that become exercisable will expire no later than 10 years from the date the Options were granted; however, in certain cases the Options will expire 5 years from the date they were granted (i.e., in the case of options granted to an employee who owns stock representing more than 10% of the voting power of the Company). |

| | |

| • | Stock Appreciation Rights. SARs granted under the plan will entitle the participant to receive, in either cash or stock, the excess of the fair market value of one share of our common stock over the exercise price of the SAR. The Committee will determine the terms under which SARs are awarded, including the times and circumstances under which a SAR may be exercised. SARs may be granted at a price determined by the Administrator, and may be granted in tandem with an Option, such that the exercise of the SAR or related Option will result in a forfeiture of the right to exercise the related Option for an equivalent number of shares, or independently of any Option. Any SAR may be exercised at the times specified in the document awarding the SAR, and the SAR will expire at the time designated at the time the SAR is awarded. |

| | |

| • | Restricted Stock. Restricted Stock may be granted alone or in conjunction with other awards under the Equity Incentive Plan and may be conditioned upon continued employment for a specified period, the attainment of specific performance goals or such factors as the Administrator may determine. In making an award of Restricted Stock, the Administrator will determine the restrictions that will apply, the period during which the award will be subject to such restrictions, and the price, if any, payable by a recipient. The Administrator may amend any award of Restricted Stock to accelerate the dates after which such award may be executed in whole or in part. Shares of Restricted Stock shall not be transferable until after removal of the legend with respect to such shares. |

| | |

| • | Stock Purchase Rights. Stock Purchase Rights may be issued either alone, in addition to, or in tandem with other awards granted under the Plan and/or cash awards made outside of the Plan. The Administrator will determine the terms, conditions and restrictions related to the Stock Purchase Rights, including the number of shares that such person shall be entitled to purchase, the price to be paid, and the time within which such person must accept such offer. (all in accordance with a Restricted Stock purchase agreement). Unless the Administrator determines otherwise, the Restricted Stock purchase agreement shall grant the Company a repurchase option exercisable upon the voluntary or involuntary termination of the purchaser’s service with the Company for any reason (including death or disability). |

| | |

| • | Other Stock-Based Awards. The Administrator shall have complete discretion in determining the number of shares subject to “Other Stock Based Awards”, the consideration for such awards and the terms, conditions and limitations pertaining to same including, without limitation, restrictions based upon the achievement of specific business objectives, tenure, and other measurements of individual or business performance, and/or restrictions under applicable federal or state securities laws, and conditions under which such awards will lapse. Payment of Other Stock Based Awards may be in the form of cash, shares, other awards, or in such combinations thereof as the Administrator shall determine at the time of |

27

| | grant, and with such restrictions as it my impose. |

Performance Awards

The Administrator may condition the receipt of an award or the vesting of an award on certain business criteria. If the Administrator determines that such performance conditions should be considered “performance-based compensation” under Section 162(m) of the Internal Revenue Code, the performance goals must relate to one of the following business criteria: (1) fair market value of shares of our common stock; (2) operating profit; (3) sales volume of our products; (4) earnings per share; (5) revenues; (6) cash flow; (7) cash flow return on investment; (8) return on assets, return on investment, return on capital, return on equity; (9) economic value added; (10) operating margin; (11) net income; pretax earnings; pretax earnings before interest, depreciation and amortization; pretax operating earnings after interest expense and before incentives, service fees, and extraordinary or special items; (12) any of the above goals as compared to the performance of a published index, such as the Standard & Poor’s 500 Stock Index or a group of comparable companies.

Adjustments Upon Changes in Capitalization, Merger or Asset Sale.

| • | Changes in Capitalization. Subject to any required action by the shareholders of the Company, the number of shares of common stock subject to the Plan (whether awarded or reserved but not awarded) as well as the price per share of common stock subject to the Plan (whether awarded or reserved but not awarded) shall be proportionately adjusted for any increase or decrease in the number of issued shares of common stock resulting from a stock split, reverse stock split, stock dividend, combination or reclassification of the common stock, or any other increase or decrease in the number of issued shares of common stock effected without receipt of consideration by the Company. |

| | |

| • | Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company, the Administrator in its discretion may provide for a participant to have the right to exercise his or her award until 15 days prior to such transaction as to all of the shares covered thereby. To the extent it has not been previously exercised, an award will terminate immediately prior to the consummation of such proposed action. |

| | |

| • | Merger or Asset Sale. In the event of a merger of the Company with or into another corporation, or the sale of substantially all of the assets of the Company, each outstanding award shall be assumed or an equivalent option or right substituted by the successor corporation. In the event that the successor corporation refuses to assume or substitute for the award, the Participant shall fully vest in and have the right to exercise the award as to all of the shares, including shares as to which it would not otherwise be vested or exercisable. |

Transferability of Awards

Awards may not be pledged, assigned or transferred while the plan participant is still living, except that options may be transferred to a Plan Participant’s spouse as directed by a court, provided such transfer is “incident to divorce” within the meaning of Section 1041 of the Internal Revenue Code of 1986, as amended.

Termination, Amendment or Suspension

The Board of Directors or the Committee can terminate, suspend or amend the Plan at any time, unless that approval is required under federal or state law or by the stock exchange on which our common stock is listed.

28

Federal Income Tax Consequences

| • | Stock Options and Stock Appreciation Rights. Under current federal income tax regulations, there will be no income tax consequences upon the grant of an option or a stock appreciation right (SAR) to either optionees or us. However, the optionee will realize ordinary income upon the exercise of an option or a SAR in an amount equal to the excess of the fair market value of our common stock on the date of exercise over the exercise price of the option or SAR. At the same time, we will receive a deduction for the same amount. The gain, if any, realized upon the subsequent sale of the shares acquired upon exercise of an option will constitute short- or long-term capital gain, depending on how long the optionee holds the shares after exercise. |

| | |

| • | Restricted Stock. Under current federal income tax regulations, there will be no income tax consequences upon the award of restricted stock to either the grantee or us. A grantee will recognize ordinary income when the restrictions on the transferability of the shares expire, which is referred to as the vesting of the shares. The amount of income recognized will be equal to the fair market value of such shares on the date of vesting over the amount paid, if any, at the time of the grant. Dividends on shares of restricted stock that are paid (or are payable) to grantees prior to the time the shares are vested will be treated as additional compensation, and not dividend income, for federal income tax purposes. |

In addition to the general rules described above, the deductibility of the income realized by certain executive officers will be conditioned on the satisfaction of the requirements of Section 162(m) of the Internal Revenue Code. It is our intention that the plan will be administered in a manner that maximizes the deductibility of the payments under Section 162(m). The federal income tax consequences described in this section are based on U.S. laws in effect on March 1, 2004, and there is no assurance that they will not change in the future and affect the tax consequences of awards made under this plan. Tax consequences may be different in other countries.

Estimate of Benefits

The awards that will be made under the plan are not presently determinable. Each year, the Administrator decides what types of equity awards to make to our executive officers and other employees.

The Board of Directors recommends a vote

FOR

the proposal to adopt the 2004 Equity Incentive Plan.

COMMUNICATIONS, SHAREHOLDER PROPOSALS AND COMPANY DOCUMENTS

| Q. | How do you submit a Shareholder proposal? |

We must receive proposals of Shareholders intended to be presented at the 2005 Annual Meeting of Shareholders on or before December 23, 2004, in order for the proposals to be eligible for inclusion in our proxy statement and proxy relating to that meeting. These proposals should be sent to the Secretary by fax to (770) 419-9490, by mail to the Office of the Secretary, 1841 West Oak Parkway, Suite A, Marietta, Georgia 30062 or by e-mail to Ted.Biderman@healthtronics.com.

According to our Bylaws, a proposal for action to be presented by any Shareholders at an annual meeting of Shareholders shall be out of order and shall not be acted upon unless

29

| • | specifically described in our notice to all Shareholders of the meeting and the matters to be acted upon thereat; or |

| | |

| • | the proposal shall have been submitted in writing to the Secretary at the above fax number or mailing address or e-mail address and received at our principal executive offices prior to December 22, 2004, and such proposal is, under law, an appropriate subject for Shareholders’ action. |

| | |

| Q. | How can a Shareholder communicate with the Company’s outside Directors? |

Mail can be addressed to Directors in care of the Office of the Secretary, HealthTronics Surgical Services, Inc., 1841 West Oak Parkway, Suite A, Marietta, Georgia 30062. At the direction of the Board of Directors, all mail received will be opened and screened for security purposes. The mail will then be logged in. All mail, other than trivial or obscene items, will be forwarded. Trivial items will be delivered to the Directors at the next scheduled Board meeting. Mail addressed to a particular Director will be forwarded or delivered to that Director. Mail addressed to “Outside Directors” or “Non-Management Directors” will be forwarded or delivered to the Chairman of the Nomination Committee. Mail addressed to the “Board of Directors” will be forwarded or delivered to the Chairman of the Board.

| Q. | Where can you see the Company’s corporate documents and SEC filings? |

The Company’s website contains the Company’s Articles of Incorporation, Bylaws, Corporate Governance Guidelines and the Committee Charters and the Company’s SEC filings. To view the Articles of Incorporation, Bylaws, Corporate Governance Guidelines or Committee Charters, go to www.healthtronics.com, click on “Investor Relations”, then on “Corporate Governance”. To view the Company’s SEC filings and Forms 3, 4 and 5 filed by the Company’s Directors and Executive Officers, go to www.healthtronics.com, click on “Investor Relations” then click on “SEC filings”.

| Q. | How can I obtain copies of the Company’s Annual Report on Form 10-K? |

The Company will promptly deliver free of charge, upon request, a copy of the Company’s Annual Report on Form 10-K to any Shareholder requesting a copy. Requests should be directed to the Company’s Investor Relations Department, HealthTronics Surgical Services, Inc., 1841 West Oak Parkway, Suite A, Marietta, Georgia 30062.

30

OTHER MATTERS

Management does not know of any matters other than those referred to in the accompanying notice of the Annual Meeting of Shareholders that may properly come before the meeting or any adjournments thereof.

As to any other matters that may properly come before the meeting, it is intended that all properly executed proxies delivered pursuant to this solicitation will be voted on any such matters in accordance with the discretion of the persons named on the enclosed proxy.

The form of proxy and this proxy statement have been approved by the Board of Directors and are being mailed and delivered to Shareholders by its authority.

|

|

| ARGIL J. WHEELOCK

Chairman |

Marietta, Georgia

April 21, 2004 | |

The Company’s 2003 Annual Report, which includes audited financial statements, has been mailed to Shareholders of the Company. The Annual Report does not form any part of the material for the solicitation of proxies.

31

Appendix A

AUDIT COMMITTEE CHARTER

(Adopted 4/8/04)

Purpose

The purpose of the Audit Committee is to oversee the accounting and financial reporting processes of HealthTronics Surgical Services, Inc. (the “Company”) and the audits of the Company’s financial statements. In furtherance of this purpose, the Audit Committee shall assist the Board of Directors (the “Board”) of the Company in monitoring and overseeing (1) the integrity of the Company’s financial statements and related disclosures, (2) the qualifications, independence, and performance of the Company’s independent auditor, and (3) the Company’s compliance with applicable legal requirements and its business conduct policies.

Composition and Qualifications

The Audit Committee shall consist of at least three members. The members of the Audit Committee shall be appointed by the Board, upon the recommendation of the Nominating Committee, and may be replaced by the Board.

The members of the Audit Committee shall meet the independence, experience, and other requirements of the Securities Exchange Act of 1934 (the “Exchange Act”), the rules and regulations of the Securities and Exchange Commission (the “Commission”), and the rules of the Nasdaq Stock Market. At least one member of the Audit Committee shall be an “audit committee financial expert” as defined by the Commission.

Meetings

The Audit Committee shall meet as often as it determines, but not less frequently than quarterly. The Audit Committee shall meet periodically with management and the independent auditor in separate executive sessions. The Audit Committee may request any officer or employee of the Company or the Company’s independent auditor or outside counsel to attend any meeting of the Audit Committee or to meet with any of its members or advisors. The Audit Committee shall make regular reports of its meetings to the Board.

Authority and Responsibilities

The Audit Committee shall have the sole authority to appoint or replace the independent auditor. The independent auditor shall report directly to the Audit Committee. The Audit Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including the resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work.

The Audit Committee shall pre-approve all audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor, subject to the exception forde minimisnon-audit services described in Section 10A(i)(1)(B) of the Exchange Act and Rule 2-01(c)(7)(i)(C) of Regulation S-X which are approved by the Audit Committee prior to the completion of the audit. The Audit Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that the decisions of such subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next scheduled meeting.

A-1

The Audit Committee shall have the authority, to the extent that it deems necessary or appropriate to carry out its duties, to retain independent legal, accounting or other advisors. The Company shall provide for appropriate funding, as determined by the Audit Committee, for the payment of compensation to any accounting firm engaged for the purpose of rendering or issuing an audit report or related work or performing other audit, review or attest services for the Company, compensation to any advisors employed by the Audit Committee, and ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its responsibilities.

In addition, the Audit Committee, to the extent that it deems necessary or appropriate, shall:

Oversight of Financial Statements and Related Disclosures

| 1. | Prior to the filing of the Company’s quarterly report on Form 10-Q, review and discuss with management and the independent auditor the Company’s quarterly financial statements (including the results of the independent auditor’s review of the financial statements) and the Company’s disclosures in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the quarterly report. |

| | |

| 2. | Prior to the commencement of the audit of the Company’s annual financial statements, review and discuss with management and the independent auditor the scope, schedule, and staffing of the audit. |

| | |

| 3. | Prior to the filing of the Company’s annual report on Form 10-K, review and discuss with management and the independent auditor the Company’s audited annual financial statements (including the results of the independent auditor’s audit of the financial statements) and the Company’s disclosures in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the annual report, and recommend to the Board whether the audited annual financial statements should be included in the annual report. |

| | |

| 4. | Discuss with the independent auditor all matters required to be communicated to the Audit Committee under generally accepted auditing standards, including the judgments of the independent auditor with respect to the quality, not just the acceptability, of the Company’s accounting principles and underlying estimates in the financial statements. |

| | |

| 5. | Discuss with management and the independent auditor the significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including any significant changes in the Company’s selection or application of accounting principles, any major issues as to the adequacy of the Company’s internal controls, and any special steps adopted in light of material internal control deficiencies or weaknesses. |

| | |

| 6. | Review and discuss with management and the independent auditor the reports from the independent auditor covering: |

| (a) | all critical accounting policies and practices to be used; |

| | |

| (b) | all alternative treatments of financial information within generally accepted accounting principles (“GAAP”) for policies and practices related to material items that have been discussed with management, including the ramifications of the use of such alternative disclosures and treatments and the treatment preferred by the independent auditor; and |

| | |

| (c) | other material written communications between the independent auditor and management, |

A-2

| | including any engagement letter, independence letter, management representation letter, schedule of unadjusted audit differences, listing of adjustments and reclassifications not recorded, management letter, and report on observations and recommendations on internal controls. |

| 7. | Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit, including any difficulties with management encountered in performing the audit (such as restrictions on the scope of the independent auditor’s activities or on its access to requested information) and any significant disagreements with management over the application of accounting principles, the basis for management’s accounting estimates, and the disclosures in the financial statements. |

| | |

| 8. | Discuss with the independent auditor any material communications between the audit engagement team and the independent auditor’s national office regarding auditing or accounting issues presented by the engagement. |

| | |