UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-07811 |

Jennison Mid-Cap Growth Fund, Inc.

Exact name of registrant as specified in charter:

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Address of principal executive offices:

Deborah A. Docs

Gateway Center 3,

100 Mulberry Street,

Newark, New Jersey 07102

Name and address of agent for service:

| | | | |

Registrant’s telephone number, including area code: | | 800-225-1852 | | |

| | | | |

Date of fiscal year end: | | 8/31/2009 | | |

| | | | |

Date of reporting period: | | 8/31/2009 | | |

Item 1 – Reports to Stockholders

| | |

| AUGUST 31, 2009 | | ANNUAL REPORT |

Jennison Mid-Cap Growth Fund, Inc.

FUND TYPE

Mid-cap stock

OBJECTIVE

Long-term capital appreciation

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden, Jennison, Prudential Financial and the Rock Prudential logo are registered service marks of The Prudential Insurance Company of America, Newark, NJ, and its affiliates.

October 15, 2009

Dear Shareholder:

We hope you find the annual report for the Jennison Mid-Cap Growth Fund informative and useful. Because of ongoing market volatility, we understand that this is a difficult time to be an investor. While it is impossible to predict what the future holds, we continue to believe a prudent response to uncertainty is to maintain a diversified portfolio, including stock and bond mutual funds consistent with your tolerance for risk, time horizon, and financial goals.

A diversified asset allocation offers two potential advantages: it limits your exposure to any particular asset class, plus it provides a better opportunity to invest some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. Keep in mind that diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

JennisonDryden Mutual Funds give you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of four leading asset managers. JennisonDryden equity funds are advised by Jennison Associates LLC, Quantitative Management Associates LLC (QMA), or Prudential Real Estate Investors. Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds through its unit Prudential Fixed Income Management. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies. Prudential Real Estate Investors is a unit of PIM.

Thank you for choosing JennisonDryden Mutual Funds.

Sincerely,

Judy A. Rice, President

Jennison Mid-Cap Growth Fund, Inc.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 1 |

Your Fund’s Performance

Fund objective

The investment objective of the Jennison Mid-Cap Growth Fund, Inc. is long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective.

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. Class A and Class L shares have a maximum initial sales charge of 5.50% and 5.75%, respectively. Gross operating expenses: Class A, 1.21%; Class B, 1.91%; Class C, 1.91%; Class L, 1.41%; Class M, 1.91%; Class R, 1.66%; Class X, 1.91%; Class Z, 0.91%. Net operating expenses apply to: Class A, 1.21%; Class B, 1.91%; Class C, 1.91%; Class L, 1.41%; Class M, 1.91%; Class R, 1.41%; Class X, 1.91%; Class Z, 0.91%, after contractual reduction through 12/31/2010.

| | | | | | | | | | | |

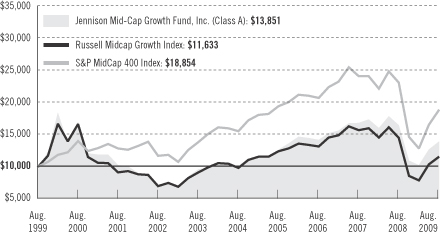

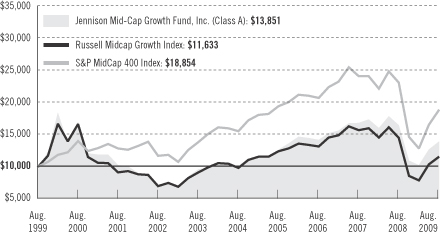

| Cumulative Total Returns as of 8/31/09 |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception1 |

Class A | | –15.63 | % | | 46.45 | % | | 46.57 | % | | — |

Class B | | –16.21 | | | 41.14 | | | 35.97 | | | — |

Class C | | –16.16 | | | 41.22 | | | 36.04 | | | — |

Class L | | –15.76 | | | N/A | | | N/A | | | –0.64% (6/12/06) |

Class M | | –16.21 | | | N/A | | | N/A | | | –2.30 (6/12/06) |

Class R | | –15.73 | | | N/A | | | N/A | | | 17.67 (6/3/05) |

Class X | | –16.12 | | | N/A | | | N/A | | | –1.93 (6/12/06) |

Class Z | | –15.33 | | | 48.41 | | | 50.45 | | | — |

Russell Midcap Growth Index2 | | –20.21 | | | 17.93 | | | 16.33 | | | ** |

Russell Midcap Index3 | | –19.92 | | | 18.22 | | | 64.28 | | | *** |

S&P MidCap 400 Index4 | | –18.17 | | | 21.54 | | | 88.54 | | | **** |

Lipper Mid-Cap Growth Funds Avg.5 | | –21.46 | | | 15.42 | | | 28.87 | | | ***** |

| | |

| 2 | | Visit our website at www.jennisondryden.com |

| | | | | | | | | | | |

| Average Annual Total Returns6 as of 9/30/09 | | | |

| | | One Year | | | Five Years | | | Ten Years | | | Since Inception1 |

Class A | | –3.76 | % | | 6.94 | % | | 3.78 | % | | — |

Class B | | –3.91 | | | 7.20 | | | 3.60 | | | — |

Class C | | 0.15 | | | 7.36 | | | 3.60 | | | — |

Class L | | –4.23 | | | N/A | | | N/A | | | –0.13% (6/12/06) |

Class M | | –4.91 | | | N/A | | | N/A | | | 0.26 (6/12/06) |

Class R | | 1.62 | | | N/A | | | N/A | | | 5.30 (6/3/05) |

Class X | | –4.80 | | | N/A | | | N/A | | | 0.07 (6/12/06) |

Class Z | | 2.11 | | | 8.41 | | | 4.63 | | | — |

Russell Midcap Growth Index2 | | –0.40 | | | 3.75 | | | 2.18 | | | ** |

Russell Midcap Index3 | | –3.55 | | | 3.89 | | | 6.05 | | | *** |

S&P MidCap 400 Index4 | | –3.11 | | | 4.53 | | | 7.48 | | | **** |

Lipper Mid-Cap Growth Funds Avg.5 | | –2.74 | | | 3.16 | | | 2.68 | | | ***** |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. The average annual total returns assume the payment of the maximum applicable sales charge. Class A and Class L shares are subject to a maximum front-end sales charge of 5.50% and 5.75%, respectively. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B, Class C, Class L, Class M, and Class X shares are subject to a maximum CDSC of 5%, 1%, 1%, 6%, and 6%, respectively. Class R and Class Z shares are not subject to a sales charge. Class L shares are closed to most new purchases (with the exception of exchanges from the same class of shares offered by certain other JennisonDryden Funds).

Source: Prudential Investments LLC and Lipper Inc. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of such fee waivers and/or expense reimbursements, total returns would be lower.

1Inception returns are provided for any share class with less than 10 years of returns. The Since Inception returns for the Russell Midcap Growth Index, Russell Midcap Index, S&P MidCap 400 Index, and the Lipper Mid-Cap Growth Funds Average (Lipper Average) are measured from the closest month-end to inception date, and not from the Fund’s actual inception date.

2The Russell Midcap Growth Index is a market value-weighted index that measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

3The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index.

4The S&P MidCap 400 Index is an unmanaged index of 400 domestic stocks chosen for market size, liquidity, and industry group representation. It gives a broad look at how U.S. mid-cap stock prices have performed.

5The Lipper Average represents returns based on an average return of all funds in the Lipper Mid-Cap Growth Funds category for the periods noted. Funds in the Lipper Average invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 3 |

Your Fund’s Performance (continued)

median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value compared with the S&P MidCap 400 Index.

6The average annual total returns take into account applicable sales charges. Class A, Class B, Class C, Class L, Class M, Class R, and Class X shares are subject to an annual distribution and service (12b-1) fee of up to 0.30%, 1.00%, 1.00%, 0.50%, 1.00%, 0.75%, and 1.00%, respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

**Russell Midcap Growth Index Closest Month-End to Inception cumulative total returns as of 8/31/09 are –13.56% for Class L, Class M, and Class X; and –0.07% for Class R. Russell Midcap Growth Index Closest Month-End to Inception average annual total returns as of 9/30/09 are –2.66% for Class L, Class M, and Class X; and 1.28% for Class R.

***Russell Midcap Index Closest Month-End to Inception cumulative total returns as of 8/31/09 are –14.60% for Class L, Class M, and Class X; and –0.45% for Class R. Russell Midcap Index Closest Month-End to Inception average annual total returns as of 9/30/09 are –3.03% for Class L, Class M, and Class X; and 1.18% for Class R.

****S&P MidCap 400 Index Closest Month-End to Inception cumulative total returns as of 8/31/09 are –10.28% for Class L, Class M, and Class X; and 3.70% for Class R. S&P MidCap 400 Index Closest Month-End to Inception average annual total returns as of 9/30/09 are –1.57% for Class L, Class M, and Class X; and 2.14% for Class R.

*****Lipper Average Closest Month-End to Inception cumulative total returns as of 8/31/09 are –14.29% for Class L, Class M, and Class X; and 0.84% for Class R. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/09 are –2.89% for Class L, Class M, and Class X; and 1.09% for Class R.

Investors cannot invest directly in an index. The Russell Midcap Growth Index, Russell Midcap Index, and S&P MidCap 400 Index do not bear sales charges, operating expenses of a mutual fund, or deductions for taxes. Returns for these indexes would be lower if they were subject to these deductions. Returns for the Lipper Average reflect the deduction of mutual fund operating expenses, but not sales charges or taxes.

| | | |

| Five Largest Holdings expressed as a percentage of net assets as of 8/31/09 | |

Annaly Capital Management, Inc., Real Estate Investment Trust | | 3.9 | % |

NII Holdings, Inc., Wireless Telecommunication Services | | 3.7 | |

Southwestern Energy Co., Oil, Gas & Consumable Fuels | | 2.4 | |

Crown Castle International Corp., Wireless Telecommunications Services | | 2.3 | |

Thermo Fisher Scientific, Inc., Life Sciences Tools & Services | | 2.2 | |

Holdings reflect only long-term investments and are subject to change.

| | | |

| Five Largest Industries expressed as a percentage of net assets as of 8/31/09 | |

Health Care Providers & Services | | 10.4 | % |

Wireless Telecommunication Services | | 8.0 | |

Oil, Gas & Consumable Fuels | | 6.0 | |

Software | | 4.5 | |

Specialty Retail | | 4.5 | |

Industry weightings reflect only long-term investments and are subject to change.

| | |

| 4 | | Visit our website at www.jennisondryden.com |

Strategy and Performance Overview

How did the Fund perform?

The Jennison Mid Cap Growth Fund Class A shares declined 15.63% for the 12 months ended August 31, 2009, but outperformed the 20.21% decline of its benchmark the Russell Midcap® Growth Index (the Index). The Fund also outperformed the 21.46% decline of the Lipper Mid Cap Growth Funds Average.

Strong stock selection in the energy, financials, and industrials sectors helped the Fund’s performance relative to the Index. Weak stock selection in the telecommunications services sector, in addition to an underweight position in the consumer discretionary sector, hurt performance. All sectors in the Fund and in the Index experienced negative returns for the 12-month reporting period.

What was the investment environment like during the reporting period?

The reporting period was marked by economic and market turmoil. The severe credit crisis that began in 2007 escalated in September 2008, with an extraordinary and alarming series of events: the U.S. government’s takeover of Fannie Mae, Freddie Mac, and AIG; the failure of Lehman Brothers; the distressed sales of the commercial banking franchises of Washington Mutual and Wachovia; Bank of America’s acquisition of Merrill Lynch; and the conversion of investment banks Goldman Sachs and Morgan Stanley to commercial banks.

The credit crisis prompted unprecedented coordination between the U.S. Department of the Treasury and the U.S. Federal Reserve Bank in efforts to resuscitate credit markets and stabilize the financial system. Inflation concerns abated, as slumping demand in the U.S. and the weakening global economy hit commodities prices. The ongoing housing correction, debt deflation, rising unemployment, and stalled production and consumption all contributed to the most severe recession in recent history. Corporations across the globe announced workforce reductions and capital expenditure cuts.

Efforts to revive the economy which were initiated by the Bush administration were subsequently expanded and modified by the Obama administration. The Treasury Department introduced broad new credit stimulus programs concurrent with initiatives to peel away layers of distressed bank loans while laying the groundwork for regulatory overhaul of the financial system. Further capital was injected into major banks as part of a move to stabilize institutions considered too big to fail, and a large fiscal stimulus package was enacted. U.S. equity markets rebounded sharply on signs of economic stabilization in the final months of the period. A combination of falling housing prices, caused primarily by rising foreclosures, low interest rates, and increased availability of mortgage credit stimulated housing activity. Conditions in

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 5 |

Strategy and Performance Overview (continued)

financial markets have improved and household spending has continued to show signs of stabilizing, although it remains constrained by ongoing job losses, sluggish income growth, lower household wealth, and tight credit. The decline in sales of stores that have been open for a year or more moderated, reflecting the less competitive environment created by several closures and bankruptcies and a reduction in markdown activity. Businesses continued to rein in labor costs, contributing to higher monthly job losses and a U.S. unemployment rate that reached 9.4% at the end of July 2009. Corporations bolstered profits by cutting costs and reducing inventories. As some indicators suggested a stabilizing economy, investors began to readjust their risk exposure. Nevertheless, the severity of the recession continued to cast uncertainty for the coming quarters.

Which holdings made the largest positive contribution to the Fund’s return?

The top individual contributor to positive performance was Annaly Capital Management, a real estate investment trust (REIT) which owns, manages, and finances a portfolio of mortgage-backed securities (MBS) guaranteed by the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation. Despite the volatile environment, the company announced solid financial results and kept its debt at low levels. Jennison believes that the Fund will continue to benefit from Annaly’s management expertise.

Positions in the information technology sector contributed most significantly to the Fund’s performance. The most notable companies were McAfee, Check Point Software Technologies, and Broadcom. McAfee produces security software that protects computer systems and networks. Jennison believes the company is well positioned, due to its prominence in the software market and a robust pipeline of new products. Its strong revenue stream will most likely continue because of its subscription-based business model.

Check Point Software Technologies benefited from extending its service contracts and turning toward a subscription-based model. In Jennison’s opinion, Check Point has a healthy balance sheet and should continue to deliver strong financial results despite the challenging business environment. The company’s acquisition of Nokia Security Appliance may also benefit earnings growth in the near future.

Jennison favors Broadcom, a manufacturer of semiconductors for wired and wireless communications, especially for the sales potential of bundled, or “triple-play,” technology providers, along with its integrated Bluetooth/Wifi/FM applications. Broadcom should experience an improved earnings outlook.

| | |

| 6 | | Visit our website at www.jennisondryden.com |

In the healthcare sector, Beckman Coulter also performed well. The company manufactures biomedical testing instruments that are used to automate and simplify laboratory processes. A combination of new products, a strong product pipeline, and a high percentage of recurring revenue derived from an operating lease model have created a favorable outlook for the company. Jennison considers Beckman Coulter to be a market leader in clinical diagnostics.

Which holdings detracted most from the Fund’s return?

The top detractor from performance for the fiscal year was digital wireless communications provider NII Holdings. This was partially due to its weighting, as it was the second-largest holding in the Fund. Despite strong revenue growth and a record number of new subscribers, shares fell significantly in late 2008 and early 2009 due to the impact of a rapid deterioration in the exchange rate for the Brazilian real and Mexican peso on its financial results. During the first half of 2009, the company gained from subscriber growth, which helped to offset currency weakness and the economic slowdown in Latin America. Jennison favors NII for its solid fundamentals and believes it should benefit from expanding wireless demand in emerging Latin American markets. In Jennison’s opinion, NII has a strong balance sheet and should continue to grow at a faster rate than other wireless companies.

Construction and engineering services provider Chicago Bridge & Iron also hurt performance due to project delays and a decrease in the company’s scheduled projects, which caused the company’s management to reduce its earnings outlook for 2009. Jennison grew cautious of the near-term effect that these delays could have on generating free cash flow, which is operating cash flow minus capital expenditures, and decided to eliminate this company from the portfolio.

Another holding that detracted from the Fund’s performance was White Mountains Insurance Group, a provider of property and casualty insurance and reinsurance. While Jennison likes the company’s business model, the Fund sold shares due to liquidity concerns resulting from losses in White Mountains’ investment portfolios.

Industrials sector holding Ametek, which also hurt performance, manufactures electronic instruments and electromechanical devices. Ametek’s management lowered its earnings outlook for the second half of 2009, citing expected weakness in the analytical instruments business. The company’s primary customers are oil and gas and chemical companies, which have significantly reduced capital spending due to lower commodity prices and economic weakness. Jennison believes management has taken appropriate steps to address economic hurdles through its continued focus on efficiency and that the company’s long-term fundamentals remain strong.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 7 |

Strategy and Performance Overview (continued)

Were there significant changes to the portfolio?

During the reporting period there were no significant changes to the portfolio. Rather, Jennison added or exited individual positions based on company fundamentals and a stock’s potential regarding its risk versus reward.

The Fund is heavily weighted in relatively high quality, sustainable growth companies which are generating solid returns on capital and strong free cash flow. Many of these companies benefit from recurring revenue business models, which are not particularly sensitive to the overall level of economic activity. Jennison is increasingly focused on the overall free-cash flow yield, and the willingness of companies to return cash to shareholders in the form of dividends.

| | |

| 8 | | Visit our website at www.jennisondryden.com |

Comments on Five Largest Holdings

| 3.9% | Annaly Capital Management, Inc., Real Estate Investment Trust (REIT) |

Please see section containing comments on the Fund’s largest contributors for the reporting period.

| 3.7% | NII Holdings, Inc., Wireless Telecommunication Services |

Please see section containing comments on the Fund’s largest detractor for the reporting period.

| 2.4% | Southwestern Energy Co., Oil, Gas & Consumable Fuels |

Southwestern Energy is primarily a producer of natural gas in the Midwest, South, and Southwest regions of the U.S. The company’s strong, low-cost growth, in Jennison’s opinion, will continue over the next several years as it more efficiently drills the Fayetteville Shale field in Arkansas. Jennison believes the ultimate potential of this mining operation is yet to be fully appreciated, and should become more apparent as Southwestern moves out of exploration and into development over the next several years.

| 2.3% | Crown Castle International Corp., Wireless Telecommunication Services |

Crown Castle operates and leases wireless towers and other communications structures. Jennison likes the company for its strong cash flow and earnings. Jennison believes that the wireless tower industry represents a strong business model with both solid growth and stable characteristics. Crown Castle should benefit from increasing mobile phone users and continued growth in data usage on wireless networks.

| 2.2% | Thermo Fisher Scientific, Inc., Life Sciences Tools & Services |

Thermo Fisher Scientific is an integrated life science tools company that provides analytical instruments, equipment, testing chemicals, and software. The company also provides services for research, manufacturing, analysis, discovery and diagnostics. Jennison likes the company for its strong market position, high-quality management team, and longer-term growth potential. Given the company’s growth potential, Jennison believes the stock is attractively valued relative to its peers.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 9 |

Fees and Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on March 1, 2009, at the beginning of the period, and held through the six-month period ended August 31, 2009. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of JennisonDryden funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses,

| | |

| 10 | | Visit our website at www.jennisondryden.com |

which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

Jennison Mid-Cap

Growth Fund | | Beginning Account

Value

March 1, 2009 | | Ending Account

Value

August 31, 2009 | | Annualized

Expense Ratio | | | Expenses Paid

During the

Six-Month Period* |

| | | | | | | | | | | | | | |

| Class A | | Actual | | $ | 1,000.00 | | $ | 1,363.90 | | 1.18 | % | | $ | 7.03 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,019.26 | | 1.18 | % | | $ | 6.01 |

| | | | | | | | | | | | | | |

| Class B | | Actual | | $ | 1,000.00 | | $ | 1,358.90 | | 1.88 | % | | $ | 11.18 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.73 | | 1.88 | % | | $ | 9.55 |

| | | | | | | | | | | | | | |

| Class C | | Actual | | $ | 1,000.00 | | $ | 1,358.60 | | 1.88 | % | | $ | 11.18 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.73 | | 1.88 | % | | $ | 9.55 |

| | | | | | | | | | | | | | |

| Class L | | Actual | | $ | 1,000.00 | | $ | 1,361.80 | | 1.38 | % | | $ | 8.22 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.25 | | 1.38 | % | | $ | 7.02 |

| | | | | | | | | | | | | | |

| Class M | | Actual | | $ | 1,000.00 | | $ | 1,359.20 | | 1.88 | % | | $ | 11.18 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.73 | | 1.88 | % | | $ | 9.55 |

| | | | | | | | | | | | | | |

| Class R | | Actual | | $ | 1,000.00 | | $ | 1,362.30 | | 1.38 | % | | $ | 8.22 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,018.25 | | 1.38 | % | | $ | 7.02 |

| | | | | | | | | | | | | | |

| Class X | | Actual | | $ | 1,000.00 | | $ | 1,359.30 | | 1.88 | % | | $ | 11.18 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,015.73 | | 1.88 | % | | $ | 9.55 |

| | | | | | | | | | | | | | |

| Class Z | | Actual | | $ | 1,000.00 | | $ | 1,365.90 | | 0.88 | % | | $ | 5.25 |

| | | Hypothetical | | $ | 1,000.00 | | $ | 1,020.77 | | 0.88 | % | | $ | 4.48 |

* Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2009, and divided by 365 days. Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 11 |

Portfolio of Investments

as of August 31, 2009

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

LONG-TERM INVESTMENTS 96.6% |

COMMON STOCKS | | | |

| |

Aerospace & Defense 1.8% | | | |

| 469,500 | | ITT Corp. | | $ | 23,512,560 |

| |

Air Freight & Logistics 1.3% | | | |

| 135,300 | | C.H. Robinson Worldwide, Inc.(b) | | | 7,611,978 |

| 281,600 | | Expeditors International of Washington, Inc. | | | 9,197,056 |

| | | | | |

| | | | | 16,809,034 |

| |

Biotechnology 1.1% | | | |

| 106,900 | | Cephalon, Inc.(a)(b) | | | 6,085,817 |

| 225,900 | | Vertex Pharmaceuticals, Inc.(a)(b) | | | 8,450,919 |

| | | | | |

| | | | | 14,536,736 |

| |

Capital Markets 3.1% | | | |

| 779,450 | | Eaton Vance Corp.(b) | | | 22,268,887 |

| 979,400 | | TD Ameritrade Holding Corp.(a) | | | 18,843,656 |

| | | | | |

| | | | | 41,112,543 |

| |

Chemicals 2.6% | | | |

| 644,200 | | Ecolab, Inc. | | | 27,243,218 |

| 128,500 | | FMC Corp.(b) | | | 6,129,450 |

| | | | | |

| | | | | 33,372,668 |

| |

Commercial Services & Supplies 1.5% | | | |

| 691,305 | | Iron Mountain, Inc.(a)(b) | | | 20,248,323 |

| |

Communications Equipment 0.2% | | | |

| 195,753 | | Ciena Corp.(a)(b) | | | 2,623,090 |

| |

Computers & Peripherals 0.9% | | | |

| 517,700 | | NetApp, Inc.(a)(b) | | | 11,777,675 |

| |

Construction & Engineering 0.8% | | | |

| 188,000 | | Fluor Corp.(b) | | | 9,945,200 |

| |

Electrical Equipment 2.5% | | | |

| 495,350 | | Ametek, Inc.(b) | | | 15,593,618 |

| 348,200 | | Roper Industries, Inc. | | | 16,497,716 |

| | | | | |

| | | | | 32,091,334 |

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 13 |

Portfolio of Investments

as of August 31, 2009 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Electronic Equipment & Instruments 3.9% | | | |

| 559,200 | | Amphenol Corp. (Class A)(b) | | $ | 19,549,632 |

| 555,000 | | Anixter International, Inc.(a)(b) | | | 19,469,400 |

| 470,800 | | Avnet, Inc.(a) | | | 12,546,820 |

| | | | | |

| | | | | 51,565,852 |

| |

Energy Equipment & Services 1.9% | | | |

| 528,800 | | Cameron International Corp.(a)(b) | | | 18,883,448 |

| 135,400 | | FMC Technologies, Inc.(a) | | | 6,458,580 |

| | | | | |

| | | | | 25,342,028 |

| |

Food Products 3.2% | | | |

| 741,300 | | ConAgra Foods, Inc. | | | 15,218,889 |

| 658,100 | | Dean Foods Co.(a) | | | 11,937,934 |

| 243,700 | | Ralcorp Holdings, Inc.(a) | | | 15,287,301 |

| | | | | |

| | | | | 42,444,124 |

| |

Health Care Equipment & Supplies 3.2% | | | |

| 319,500 | | Beckman Coulter, Inc. | | | 21,636,540 |

| 62,700 | | C.R. Bard, Inc. | | | 5,052,366 |

| 317,500 | | ResMed, Inc.(a) | | | 14,576,425 |

| | | | | |

| | | | | 41,265,331 |

| |

Health Care Providers & Services 10.4% | | | |

| 652,200 | | Community Health Systems, Inc.(a)(b) | | | 20,068,194 |

| 507,000 | | DaVita, Inc.(a) | | | 26,216,970 |

| 307,100 | | Express Scripts, Inc.(a) | | | 22,178,762 |

| 273,300 | | Henry Schein, Inc.(a)(b) | | | 14,479,434 |

| 186,200 | | Laboratory Corp. of America Holdings(a)(b) | | | 12,994,898 |

| 654,400 | | Patterson Cos., Inc.(a)(b) | | | 17,819,312 |

| 402,800 | | Quest Diagnostics, Inc.(b) | | | 21,735,088 |

| | | | | |

| | | | | 135,492,658 |

| |

Hotels, Restaurants & Leisure 3.7% | | | |

| 275,600 | | Darden Restaurants, Inc. | | | 9,075,508 |

| 607,300 | | Tim Hortons, Inc. | | | 17,156,225 |

| 636,200 | | Yum! Brands, Inc.(b) | | | 21,789,850 |

| | | | | |

| | | | | 48,021,583 |

| |

Household Products 1.4% | | | |

| 328,400 | | Church & Dwight Co., Inc. | | | 18,761,492 |

See Notes to Financial Statements.

| | |

| 14 | | Visit our website at www.jennisondryden.com |

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Independent Power Producers & Energy Traders 1.4% | | | |

| 1,344,300 | | AES Corp. (The)(a) | | $ | 18,376,581 |

| |

Insurance 1.1% | | | |

| 539,900 | | W.R. Berkley Corp. | | | 13,794,445 |

| |

Internet Software & Services 2.0% | | | |

| 1,228,200 | | VeriSign, Inc.(a)(b) | | | 26,025,558 |

| |

IT Services 3.5% | | | |

| 204,775 | | Alliance Data Systems Corp.(a)(b) | | | 11,377,299 |

| 747,900 | | Amdocs Ltd.(a) | | | 18,188,928 |

| 467,100 | | Cognizant Technology Solutions Corp.(a) | | | 16,292,448 |

| | | | | |

| | | | | 45,858,675 |

| |

Life Sciences Tools & Services 3.2% | | | |

| 387,000 | | Charles River Laboratories International, Inc.(a)(b) | | | 13,347,630 |

| 637,000 | | Thermo Fisher Scientific, Inc.(a)(b) | | | 28,798,770 |

| | | | | |

| | | | | 42,146,400 |

| |

Machinery 2.2% | | | |

| 255,400 | | Danaher Corp.(b) | | | 15,505,334 |

| 488,560 | | IDEX Corp.(b) | | | 12,917,526 |

| | | | | |

| | | | | 28,422,860 |

| |

Media 1.2% | | | |

| 1,280,899 | | Regal Entertainment Group (Class A) | | | 16,203,372 |

| |

Metals & Mining 1.9% | | | |

| 337,000 | | Cliffs Natural Resources, Inc. | | | 8,529,470 |

| 456,900 | | Goldcorp, Inc. | | | 16,658,574 |

| | | | | |

| | | | | 25,188,044 |

| |

Oil, Gas & Consumable Fuels 6.0% | | | |

| 480,200 | | Denbury Resources, Inc.(a)(b) | | | 7,308,644 |

| 345,900 | | Newfield Exploration Co.(a) | | | 13,382,871 |

| 214,300 | | Range Resources Corp.(b) | | | 10,365,691 |

| 848,500 | | Southwestern Energy Co.(a) | | | 31,275,710 |

| 418,600 | | XTO Energy, Inc. | | | 16,157,960 |

| | | | | |

| | | | | 78,490,876 |

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 15 |

Portfolio of Investments

as of August 31, 2009 continued

| | | | | |

| Shares | | Description | | Value (Note 1) |

| | | | | |

COMMON STOCKS (Continued) | | | |

| |

Personal Products 1.4% | | | |

| 573,300 | | Avon Products, Inc.(b) | | $ | 18,271,071 |

| |

Pharmaceuticals 1.0% | | | |

| 894,500 | | Mylan, Inc.(a)(b) | | | 13,122,315 |

| |

Professional Services 1.7% | | | |

| 139,500 | | FTI Consulting, Inc.(a) | | | 6,073,830 |

| 600,300 | | Robert Half International, Inc. | | | 15,781,887 |

| | | | | |

| | | | | 21,855,717 |

| |

Real Estate Investment Trust 3.9% | | | |

| 2,968,200 | | Annaly Capital Management, Inc.(b) | | | 51,468,589 |

| |

Semiconductors & Semiconductor Equipment 4.2% | | | |

| 679,395 | | Broadcom Corp. (Class A)(a)(b) | | | 19,328,788 |

| 671,800 | | Marvell Technology Group Ltd.(a) | | | 10,244,950 |

| 865,800 | | Maxim Integrated Products, Inc.(b) | | | 16,259,724 |

| 422,800 | | Xilinx, Inc.(b) | | | 9,403,072 |

| | | | | |

| | | | | 55,236,534 |

| |

Software 4.5% | | | |

| 936,100 | | Check Point Software Technologies(a) | | | 26,089,107 |

| 367,300 | | McAfee, Inc.(a) | | | 14,611,194 |

| 751,400 | | Nuance Communications, Inc.(a)(b) | | | 9,264,762 |

| 125,300 | | Salesforce.com, Inc.(a)(b) | | | 6,499,311 |

| 49,618 | | Sybase, Inc.(a) | | | 1,729,187 |

| | | | | |

| | | | | 58,193,561 |

| |

Specialty Retail 4.5% | | | |

| 298,700 | | Guess?, Inc. | | | 10,466,448 |

| 181,100 | | O’Reilly Automotive, Inc.(a)(b) | | | 6,932,508 |

| 470,135 | | Ross Stores, Inc.(b) | | | 21,927,096 |

| 555,200 | | TJX Cos., Inc. | | | 19,959,440 |

| | | | | |

| | | | | 59,285,492 |

| |

Textiles, Apparel & Luxury Goods 1.4% | | | |

| 469,700 | | Phillips-Van Heusen Corp. | | | 17,745,266 |

| |

Wireless Telecommunication Services 8.0% | | | |

| 792,200 | | American Tower Corp. (Class A)(a) | | | 25,073,130 |

See Notes to Financial Statements.

| | |

| 16 | | Visit our website at www.jennisondryden.com |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| | | | | | |

COMMON STOCKS (Continued) | | | | |

| |

Wireless Telecommunication Services (cont’d.) | | | | |

| 1,133,650 | | Crown Castle International Corp.(a)(b) | | $ | 30,449,839 | |

| 2,046,990 | | NII Holdings, Inc.(a) | | | 48,534,133 | |

| | | | | | |

| | | | | 104,057,102 | |

| | | | | | |

| | TOTAL LONG-TERM INVESTMENTS

(cost $1,084,383,734) | | | 1,262,664,689 | |

| | | | | | |

SHORT-TERM INVESTMENT 28.7% | |

| |

Affiliated Money Market Mutual Fund | | | | |

| 375,360,190 | | Dryden Core Investment Fund - Taxable Money Market Series

(cost $375,360,190; includes $334,883,887 of cash collateral received for securities on loan)(c)(d) | | | 375,360,190 | |

| | | | | | |

| | TOTAL INVESTMENTS 125.3%

(cost $1,459,743,924; Note 5) | | | 1,638,024,879 | |

| | Liabilities in excess of other assets (25.3)% | | | (330,956,494 | ) |

| | | | | | |

| | NET ASSETS 100.0% | | $ | 1,307,068,385 | |

| | | | | | |

| (a) | Non-income producing security. |

| (b) | All or a portion of security is on loan. The aggregate market value of such securities is $320,755,565; cash collateral of $334,883,887 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. |

| (c) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan. |

| (d) | Prudential Investments LLC, the manager of the Fund, also serves as manager of the Dryden Core Investment Fund—Taxable Money Market Series. |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices in active markets for identical securities

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 17 |

Portfolio of Investments

as of August 31, 2009 continued

The following is a summary of the inputs used as of August 31, 2009 in valuing the Fund’s assets carried at fair value:

| | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 |

Investments in Securities | | | | | | | | | |

Common Stocks | | $ | 1,262,664,689 | | $ | — | | $ | — |

Affiliated Money Market Mutual Fund | | | 375,360,190 | | | — | | | — |

| | | | | | | | | |

| | | 1,638,024,879 | | | — | | | — |

Other Financial Instruments* | | | — | | | — | | | — |

| | | | | | | | | |

Total | | $ | 1,638,024,879 | | $ | — | | $ | — |

| | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

As of August 31, 2008 and August 31, 2009, the Fund did not use any significant unobservable inputs (Level 3) in determining the value of investments.

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of August 31, 2009 were as follows:

| | | |

Affiliated Money Market Mutual Fund (including 25.6% of collateral received for securities on loan) | | 28.7 | % |

Health Care Providers & Services | | 10.4 | |

Wireless Telecommunication Services | | 8.0 | |

Oil, Gas & Consumable Fuels | | 6.0 | |

Software | | 4.5 | |

Specialty Retail | | 4.5 | |

Semiconductors & Semiconductor Equipment | | 4.2 | |

Electronic Equipment & Instruments | | 3.9 | |

Real Estate Investment Trust | | 3.9 | |

Hotels, Restaurants & Leisure | | 3.7 | |

IT Services | | 3.5 | |

Food Products | | 3.2 | |

Health Care Equipment & Supplies | | 3.2 | |

Life Sciences Tools & Services | | 3.2 | |

Capital Markets | | 3.1 | |

Chemicals | | 2.6 | |

Electrical Equipment | | 2.5 | |

Machinery | | 2.2 | |

Internet Software & Services | | 2.0 | |

Energy Equipment & Services | | 1.9 | |

Metals & Mining | | 1.9 | |

Aerospace & Defense | | 1.8 | |

Professional Services | | 1.7 | |

See Notes to Financial Statements.

| | |

| 18 | | Visit our website at www.jennisondryden.com |

| | | |

Industry (cont’d.) | | | |

Commercial Services & Supplies | | 1.5 | % |

Household Products | | 1.4 | |

Independent Power Producers & Energy Traders | | 1.4 | |

Personal Products | | 1.4 | |

Textiles, Apparel & Luxury Goods | | 1.4 | |

Air Freight & Logistics | | 1.3 | |

Media | | 1.2 | |

Biotechnology | | 1.1 | |

Insurance | | 1.1 | |

Pharmaceuticals | | 1.0 | |

Computer & Peripherals | | 0.9 | |

Construction & Engineering | | 0.8 | |

Communications Equipment | | 0.2 | |

| | | |

| | 125.3 | |

Liabilities in excess of other assets | | (25.3 | ) |

| | | |

| | 100.0 | % |

| | | |

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 19 |

Statement of Assets and Liabilities

as of August 31, 2009

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $320,755,565: | | | | |

Unaffiliated Investments (cost $1,084,383,734) | | $ | 1,262,664,689 | |

Affiliated Investments (cost $375,360,190) | | | 375,360,190 | |

Cash | | | 190,184 | |

Receivable for investments sold | | | 7,136,555 | |

Receivable for Fund shares sold | | | 4,288,958 | |

Dividends receivable | | | 851,645 | |

Prepaid expenses | | | 41,172 | |

| | | | |

Total assets | | | 1,650,533,393 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 334,883,887 | |

Payable for investments purchased | | | 4,479,148 | |

Payable for Fund shares reacquired | | | 2,482,783 | |

Management fee payable | | | 658,362 | |

Accrued expenses | | | 312,356 | |

Distribution fee payable | | | 326,546 | |

Affiliated transfer agent fee payable | | | 292,799 | |

Deferred directors’ fees | | | 29,127 | |

| | | | |

Total liabilities | | | 343,465,008 | |

| | | | |

| |

Net Assets | | $ | 1,307,068,385 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 64,734 | |

Paid-in capital in excess of par | | | 1,369,784,903 | |

| | | | |

| | | 1,369,849,637 | |

Undistributed net investment income | | | 2,291,159 | |

Accumulated net realized loss on investments | | | (243,353,366 | ) |

Net unrealized appreciation on investments | | | 178,280,955 | |

| | | | |

Net assets, August 31, 2009 | | $ | 1,307,068,385 | |

| | | | |

See Notes to Financial Statements.

| | |

| 20 | | Visit our website at www.jennisondryden.com |

| | | |

Class A | | | |

Net asset value and redemption price per share | | | |

($764,081,502 ÷ 37,748,377 shares of common stock issued and outstanding) | | $ | 20.24 |

Maximum sales charge (5.50% of offering price) | | | 1.18 |

| | | |

Maximum offering price to public | | $ | 21.42 |

| | | |

Class B | | | |

Net asset value, offering price and redemption price per share | | | |

($44,341,025 ÷ 2,428,962 shares of common stock issued and outstanding) | | $ | 18.26 |

| | | |

Class C | | | |

Net asset value, offering price and redemption price per share | | | |

($81,161,500 ÷ 4,444,834 shares of common stock issued and outstanding) | | $ | 18.26 |

| | | |

Class L | | | |

Net asset value, offering price and redemption price per share | | | |

($10,099,226 ÷ 502,354 shares of common stock issued and outstanding) | | $ | 20.10 |

| | | |

Class M | | | |

Net asset value, offering price and redemption price per share | | | |

($8,912,154 ÷ 488,563 shares of common stock issued and outstanding) | | $ | 18.24 |

| | | |

Class R | | | |

Net asset value, offering price and redemption price per share | | | |

($28,761,061 ÷ 1,435,473 shares of common stock issued and outstanding) | | $ | 20.04 |

| | | |

Class X | | | |

Net asset value, offering price and redemption price per share | | | |

($4,388,334 ÷ 239,708 shares of common stock issued and outstanding) | | $ | 18.31 |

| | | |

Class Z | | | |

Net asset value, offering price and redemption price per share | | | |

($365,323,583 ÷17,445,742 shares of common stock issued and outstanding) | | $ | 20.94 |

| | | |

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 21 |

Statement of Operations

Year Ended August 31, 2009

| | | | |

Net Investment Income | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $12,690) | | $ | 11,701,827 | |

Affiliated income from securities loaned, net | | | 1,340,593 | |

Affiliated dividend income | | | 353,678 | |

Unaffiliated interest income | | | 147 | |

| | | | |

Total income | | | 13,396,245 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 5,375,466 | |

Distribution fee—Class A | | | 1,601,390 | |

Distribution fee—Class B | | | 411,281 | |

Distribution fee—Class C | | | 629,083 | |

Distribution fee—Class L | | | 49,369 | |

Distribution fee—Class M | | | 119,293 | |

Distribution fee—Class R | | | 60,634 | |

Distribution fee—Class X | | | 45,672 | |

Transfer agent’s fees and expenses (including affiliated expenses of $1,076,500) (Note 3) | | | 2,232,000 | |

Reports to shareholders | | | 193,000 | |

Registration fees | | | 125,000 | |

Custodian’s fees and expenses | | | 120,000 | |

Directors’ fees | | | 54,000 | |

Legal fees and expenses | | | 29,000 | |

Audit fee | | | 21,000 | |

Insurance expenses | | | 16,000 | |

Miscellaneous | | | 9,489 | |

| | | | |

Total expenses | | | 11,091,677 | |

Less: Expense subsidy (Note 2) | | | (1,596 | ) |

| | | | |

Net expenses | | | 11,090,081 | |

| | | | |

Net investment income | | | 2,306,164 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net realized loss on investment transactions | | | (183,828,758 | ) |

Net change in unrealized appreciation on investments | | | 97,121,354 | |

| | | | |

Net loss on investments | | | (86,707,404 | ) |

| | | | |

Net Decrease In Net Assets Resulting From Operations | | $ | (84,401,240 | ) |

| | | | |

See Notes to Financial Statements.

| | |

| 22 | | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended August 31, | |

| | | 2009 | | | 2008 | |

Increase (Decrease) In Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 2,306,164 | | | $ | (3,277,860 | ) |

Net realized gain (loss) on investments and foreign currency transactions | | | (183,828,758 | ) | | | 92,809,870 | |

Net change in unrealized appreciation (depreciation) on investments | | | 97,121,354 | | | | (115,841,600 | ) |

| | | | | | | | |

Net decrease in net assets resulting from operations | | | (84,401,240 | ) | | | (26,309,590 | ) |

| | | | | | | | |

| | |

Fund share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 638,099,424 | | | | 268,611,623 | |

Net asset value of shares issued in connection with merger (Note 7) | | | 59,187,693 | | | | 122,757,479 | |

Cost of shares reacquired | | | (285,586,252 | ) | | | (249,041,935 | ) |

| | | | | | | | |

Net increase in net assets from Fund share transactions | | | 411,700,865 | | | | 142,327,167 | |

| | | | | | | | |

Total increase | | | 327,299,625 | | | | 116,017,577 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 979,768,760 | | | | 863,751,183 | |

| | | | | | | | |

End of year | | $ | 1,307,068,385 | | | $ | 979,768,760 | |

| | | | | | | | |

(a) Includes undistributed net investment income of | | $ | 2,291,159 | | | | — | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 23 |

Notes to Financial Statements

Jennison Mid-Cap Growth Fund, Inc. (the “Fund”) (formerly known as Jennison U.S. Emerging Growth Fund, Inc.) is registered under the Investment Company Act of 1940 as a diversified, open-end, management investment company. The Fund was incorporated in Maryland on August 23, 1996. The Fund issued 2,500 shares each of Class A, Class B, Class C and Class Z common stock for $100,000 on October 21, 1996 to Prudential Investments, LLC, (“PI” or “Manager”). Investment operations commenced on December 31, 1996. The Fund issued 250 shares each of Class L, Class M and Class X common stock for $7,500 on June 12, 2006 to PI.

The Fund’s investment objective is to achieve long-term capital appreciation. It invests primarily in equity securities of small and medium-sized U.S. companies, which will generally have a market capitalization less than the largest capitalization of the Standard & Poor’s Mid-Cap 400 Stock Index, with the potential for above average growth.

The Fund’s fiscal year has changed from an annual reporting period that ends October 31 to one that ends August 31, effective August 31, 2007. This change should have no impact on the way the Fund is managed. Shareholders will receive future annual and semiannual reports on the new fiscal year-end schedule.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation: Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and ask prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the Nasdaq official closing price (“NOCP”) on the day of valuation, or if there was no NOCP, at the last sale price. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”), in consultation with the subadvisers; to be over-the-counter, are valued at market value using prices provided by an independent pricing agent or principal market maker. Options on securities and indices traded on an exchange are valued at the last sale price as of the close of trading on the applicable exchange or, if

| | |

| 24 | | Visit our website at www.jennisondryden.com |

there was no sale, at the mean between the most recently quoted bid and asked prices on such exchange. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted bid and asked prices on such exchange or board of trade or at the last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available, or whose values have been affected by events occurring after the close of the security’s foreign market and before the Funds’ normal pricing time, are valued at fair value in accordance with the Board of Directors’ approved fair valuation procedures. When determining the fair valuation of securities some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Investments in mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Short-term debt securities which mature in 60 days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term debt securities which mature in more than 60 days are valued at current market quotations.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities-at the current daily rate of exchange.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 25 |

Notes to Financial Statements

continued

(ii) purchases and sales of investment securities, income and expenses-at the rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the period. Accordingly, realized foreign currency gains or losses are included in the reported net realized gains or losses on investment transactions.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from the holdings of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on investments and foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability or the level of governmental supervision and regulation of foreign securities markets.

Securities Lending: The Fund may lend its portfolio securities to broker-dealers. The loans are secured by collateral at least equal, at all times, to the market value of the securities loaned. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the lender securities identical to the loaned securities. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities using the collateral in the open market. The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The Fund also continues to receive interest and dividends or amounts equivalent thereto, on the securities loaned and recognizes any unrealized gain or loss in the market price of the securities loaned that may occur during the term of the loan.

| | |

| 26 | | Visit our website at www.jennisondryden.com |

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains and losses on sales of portfolio securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, including amortization of premium and accretion of discounts on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on the accrual basis.

Net investment income or loss, (other than distribution fees which are charged directly to the respective class) and unrealized and realized gains or losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Dividends and Distributions: The Fund expects to pay dividends of net investment income and distributions of net realized capital and currency gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

Taxes: It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required.

Withholding taxes on foreign dividends are recorded, net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadvisor’s performance of such services. PI has entered into a subadvisory agreement with Jennison Associates LLC (“Jennison”). The subadvisory agreement provides that Jennison furnishes investment advisory services in connection with the management

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 27 |

Notes to Financial Statements

continued

of the Fund. In connection therewith, Jennison is obligated to keep certain books and records of the Fund. PI pays for the services of Jennison, the cost of compensation of officers and employees of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

The management fee paid to PI is computed daily and payable monthly, at an annual rate of .60 of 1% of the Fund’s average daily net assets up to $1 billion and ..55 of 1% of the average daily net assets in excess of $1 billion. The effective management fee rate was .60 of 1% for the year ended August 31, 2009. For the period June 16, 2006 to June 17, 2007, the Manager has contractually agreed to waive up to .08% of the Fund’s management fee so that the Fund’s operating expenses during such period, exclusive of taxes, interest, brokerage, distribution fees and non-routine expenses do not exceed .83% of the Fund’s average daily net assets. Effective March 2, 2007 through September 30, 2008, such waiver has been amended to up to .06% for such adjusted operating expenses in excess of .89%.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C, Class L, Class M, Class R, Class X and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A, Class B, Class C, Class L, Class M, Class R, Class X and Class Z shares, pursuant to plans of distribution (the “Class A, B, C, L, M, R, X and Z Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Z shares of the Fund.

Pursuant to the Class A, B, C, L, M, R, X and Z Plans, the Fund compensates PIMS for distribution related activities at an annual rate of up to .30 of 1%, 1%, 1%, .50 of 1%, 1%, .75 of 1% and 1% of the average daily net assets of the Class A, B, C, L, M, R and X shares, respectively. PIMS contractually agreed to limit such fees to .50 of 1% of the average daily net assets of Class R shares through December 31, 2010.

PIMS has advised the Fund that it received approximately $404,300 in front-end sales charges resulting from sales of Class A shares during the year ended August 31, 2009. From these fees, PIMS paid such sales charges to affiliated broker-dealers, which in turn paid commissions to salespersons and incurred other distribution costs. PIMS has advised the Fund that for the year ended August 31, 2009, it received approximately $800, $95,000, $12,500, $17,000 and $4,600 in contingent deferred sales charges

| | |

| 28 | | Visit our website at www.jennisondryden.com |

imposed upon redemptions by certain Class A, Class B, Class C, Class M and Class X shareholders, respectively.

PI, PIMS and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Fund, along with other affiliated registered investment companies (the “Funds”), is a party to a Syndicated Credit Agreement (“SCA”) with two banks. The SCA provides for a commitment of $500 million. Interest on any borrowings under the SCA is incurred at contracted market rates and a commitment fee for the unused amount is accrued daily and paid quarterly. Effective October 22, 2009, the Funds renewed the SCA with the banks. The commitment under the renewed SCA continues to be $500 million. The Funds pay a commitment fee of .15 of 1% of the unused portion of the renewed SCA. The expiration date of the renewed SCA will be October 20, 2010. For the period from October 24, 2008 through October 21, 2009, the Funds paid a commitment fee of .13 of 1% of the unused portion of the agreement. The purpose of the SCA is to provide an alternative source of temporary funding for capital share redemptions.

The Fund did not utilize the line of credit during the year ended August 31, 2009.

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

The Fund pays networking fees to affiliated and unaffiliated broker/dealers including fees relating to the services of Wells Fargo Advisors, LLC (“Wells Fargo”) and First Clearing, LLC (“First Clearing”), affiliates of PI. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. For the year ended August 31, 2009, the Fund incurred approximately $850,000 in total networking fees, of which $228,100 and $18,000, respectively was paid to First Clearing and Wells Fargo. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

Prudential Investment Management, Inc., (“PIM”), an indirect, wholly-owned subsidiary of Prudential, is the Fund’s security lending agent. For the year ended August 31, 2009, PIM has been compensated approximately $566,500 for these services.

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 29 |

Notes to Financial Statements

continued

The Fund invests in the Taxable Money Market Series (the “Series”), a portfolio of Dryden Core Investment Fund. The Series is a money market mutual fund registered under the Investment Company Act of 1940, as amended, and managed by PI. Earnings from the Series are disclosed on the Statement of Operations as affiliated dividends.

Note 4. Portfolio Securities

Purchases and sales of investment securities, other than short-term investments, for the year ended August 31, 2009 were $902,488,859 and $529,400,053, respectively.

Note 5. Distributions and Tax Information

Distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. In order to present undistributed net investment income, accumulated net realized loss on investments and paid-in capital in excess of par on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par and accumulated net realized loss on investments. For the fiscal year ended August 31, 2009, the adjustments were to increase accumulated net realized loss on investments and to increase paid-in-capital in excess of par by $15,898,275 due to reclassification of capital loss carryforward from reorganization, reclassification of disallowed losses from wash sales due to reorganization and write-off of capital loss carryforward due to expiration and loss limitations. Net investment income, net realized losses and net assets were not affected by this change.

As of August 31, 2009, the Fund had a capital loss carryforward for tax purposes of approximately $89,209,000 of which $29,927,000 expires in 2010, $1,789,000 expires in 2011, $567,000 expires in 2012, $1,057,000 expires in 2013, $5,016,000 expires in 2015, $17,993,000 expires in 2016 and $32,860,000 expires in 2017. Certain portions of the capital loss carryforwards were assumed by the Fund as a result of acquisitions. Utilization of these capital loss carryforwards may be limited in accordance with income tax regulations. As of August 31, 2009, approximately $84,485,000 of its capital loss carryovers were written-off due to expiration and loss limitations. No capital gains distributions are expected to be paid to shareholders

| | |

| 30 | | Visit our website at www.jennisondryden.com |

until net gains have been realized in excess of such carryforward. It is uncertain whether the Fund will be able to realize the full benefit prior to the expiration dates.

The Fund elected to treat post-October capital losses of approximately $115,433,000 incurred in the ten months ended August 31, 2009 as having incurred in the next fiscal year (August 31, 2010).

As of August 31, 2009, the accumulated undistributed earnings on a tax basis was $2,320,235 of ordinary income. This amount differs from undistributed investment income on the Statement of Assets and Liabilities primarily due to timing differences.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of August 31, 2009 were as follows:

| | | | | | |

Tax Basis of

Investments | | Appreciation | | Depreciation | | Net

Unrealized

Appreciation |

| $1,498,454,996 | | $165,728,068 | | $(26,158,185) | | $139,569,883 |

The difference between book basis and tax basis was primarily attributable to deferred losses on wash sales.

Management has analyzed the Funds’ tax positions taken on federal income tax returns for all open tax years and has concluded that as of August 31, 2009, no provision for income tax would be required in the Funds’ financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Note 6. Capital

The Fund offers Class A, Class B, Class C, Class L, Class M , Class R, Class X and Class Z shares. Class A and Class L shares are sold with a front-end sales charge of up to 5.5% and 5.75%, respectively. All investors who purchase Class A or Class L shares in an amount of $1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (CDSC) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential Financial, Inc. Class B shares are sold with a CDSC which declines from 5% to zero depending on the period of time the shares are held. Class M and Class X shares are sold with a CDSC which declines from 6% to zero depending on the period of time

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 31 |

Notes to Financial Statements

continued

the shares are held. Class C shares are sold with a CDSC of 1% during the first 12 months. Class B shares will automatically convert to Class A shares on a quarterly basis approximately seven years after purchase. A special exchange privilege is also available for shareholders who qualified to purchase Class A shares at net asset value. Class M shares will automatically convert to Class A shares approximately eight years after purchase. Class L shares are closed to most new purchases (with the exception of reinvested dividends). Class L and Class M shares are only exchangeable with Class L and Class M shares, respectively, offered by certain other Strategic Partners Funds. Class X shares are closed to new purchases. Class R and Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to a limited group of investors.

There are 2 billion shares of $.001 par value common stock authorized divided into eight classes, designated Class A, Class B, Class C, Class L, Class M, Class R, Class X and Class Z, which consists of 800 million, 400 million, 300 million, 100 million, 100 million, 100 million, 100 million and 100 million authorized shares, respectively.

Transactions in shares of common stock were as follows:

| | | | | | | |

Class A | | Shares | | | Amount | |

Year ended August 31, 2009: | | | | | | | |

Shares sold | | 19,722,612 | | | $ | 342,262,795 | |

Shares issued in connection with the merger | | 2,961,111 | | | | 51,641,778 | |

Shares reacquired | | (10,176,648 | ) | | | (180,013,801 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 12,507,075 | | | | 213,890,772 | |

Shares issued upon conversion from Class B, Class M and Class X | | 1,192,470 | | | | 21,130,779 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 13,699,545 | | | $ | 235,021,551 | |

| | | | | | | |

Year ended August 31, 2008: | | | | | | | |

Shares sold | | 6,834,281 | | | $ | 167,329,475 | |

Shares issued in connection with the merger | | 2,829,916 | | | | 72,188,891 | |

Shares reacquired | | (5,318,412 | ) | | | (130,601,226 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 4,345,785 | | | | 108,917,140 | |

Shares issued upon conversion from Class B, Class M and Class X | | 2,147,383 | | | | 52,634,414 | |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 6,493,168 | | | $ | 161,551,554 | |

| | | | | | | |

| | |

| 32 | | Visit our website at www.jennisondryden.com |

| | | | | | | |

Class B | | Shares | | | Amount | |

Year ended August 31, 2009: | | | | | | | |

Shares sold | | 414,803 | | | $ | 6,617,021 | |

Shares issued in connection with the merger | | 291,890 | | | | 4,603,107 | |

Shares reacquired | | (519,973 | ) | | | (8,136,624 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 186,720 | | | | 3,083,504 | |

Shares reacquired upon conversion into Class A | | (840,948 | ) | | | (13,621,279 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (654,228 | ) | | $ | (10,537,775 | ) |

| | | | | | | |

Year ended August 31, 2008: | | | | | | | |

Shares sold | | 286,850 | | | $ | 6,438,230 | |

Shares issued in connection with the merger | | 1,139,766 | | | | 26,579,354 | |

Shares reacquired | | (775,680 | ) | | | (17,389,588 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding before conversion | | 650,936 | | | | 15,627,996 | |

Shares reacquired upon conversion into Class A | | (1,802,650 | ) | | | (40,489,216 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (1,151,714 | ) | | $ | (24,861,220 | ) |

| | | | | | | |

Class C | | | | | | |

Year ended August 31, 2009: | | | | | | | |

Shares sold | | 1,532,247 | | | $ | 24,232,375 | |

Shares issued in connection with the merger | | 84,090 | | | | 1,326,104 | |

Shares reacquired | | (877,505 | ) | | | (13,704,445 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 738,832 | | | $ | 11,854,034 | |

| | | | | | | |

Year ended August 31, 2008: | | | | | | | |

Shares sold | | 461,651 | | | $ | 10,377,828 | |

Shares issued in connection with the merger | | 792,008 | | | | 18,469,609 | |

Shares reacquired | | (849,200 | ) | | | (18,989,478 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | 404,459 | | | $ | 9,857,959 | |

| | | | | | | |

Class L | | | | | | |

Year ended August 31, 2009: | | | | | | | |

Shares sold | | 3,780 | | | $ | 66,175 | |

Shares reacquired | | (147,361 | ) | | | (2,547,122 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (143,581 | ) | | $ | (2,480,947 | ) |

| | | | | | | |

Year ended August 31, 2008: | | | | | | | |

Shares sold | | 10,932 | | | $ | 275,045 | |

Shares reacquired | | (165,861 | ) | | | (4,063,185 | ) |

| | | | | | | |

Net increase (decrease) in shares outstanding | | (154,929 | ) | | $ | (3,788,140 | ) |

| | | | | | | |

| | |

| Jennison Mid-Cap Growth Fund, Inc. | | 33 |

Notes to Financial Statements

continued

| | | | | | | |