UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07831

FMI Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: March 31, 2008

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

March 31, 2008

FMI

Focus Fund

A NO-LOAD

MUTUAL FUND

FMI Focus Fund

Ted D. Kellner, CFA

President

April 14, 2008

Dear Fellow Shareholders:

The first quarter of 2008 was one of the most difficult we have seen in a long time. FMI Focus Fund declined 9.62%, and it is indeed small solace that the Fund slightly outperformed the Russell 2000, down 9.90% and the Russell 2000 Growth down 12.83%. Investors are paying the piper for the incredible financial excesses of recent years, but this too will end.

One year ago a managing director of one of the largest private equity firms in the world, was quoted as saying “[Liquidity] has enabled us to do transactions that were previously unimaginable. Frankly, there is so much liquidity in the world financial system that lenders (even our lenders) are making very risky credit decisions.” He continued, “…most investors in most asset classes are not being paid for the risk being taken.” That firm was Carlyle Group, a primary sponsor of the Carlyle Capital Fund, which, in an irony that is all too common on Wall Street, was virtually wiped out in the first quarter of 2008. Like the Bear Stearns hedge funds last summer, this fund was built on credulity and optimism, rather than prudence and risk sensitivity.

The Bear Stearns problems from 2007 spiraled out of control in March and resulted in a highly unusual takeover of the firm by J.P. Morgan, supported by guarantees by the Federal Reserve and the Treasury on $30 billion of dicey Bear Stearns’ investments. The list of casualties grows daily, along with questionable actions by the government as they seek to put out one fire after another. The Fed’s primary role is to maintain the value of the currency, a role abdicated in an effort to stem the fallout from a credit crisis they should have curbed several years ago.

As always, the problems we face today will create investment opportunities. And Rick and Glenn, in their letter, do an excellent job of describing the process they are going through to find tomorrow’s winners in the financial wreckage wrought by the market excesses. Their letter is a must read. And so, while we agree that we are already in a recession, as that reality is increasingly being acknowledged in broader circles, the markets have factored much of the downturn into share prices, and will begin to anticipate an economic recovery before we see an actual upturn.

We thank you very much for your continued support of, and investment in, the FMI Focus Fund.

Sincerely,

Ted D. Kellner, CFA

President

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

|  |

| Richard E. Lane | Glenn W. Primack |

| Portfolio Manager | Portfolio Manager |

| | |

April 11, 2008

Dear Fellow Shareholders,

Close to an Inflection Point!!

The past six to nine months have been down right ugly. The U.S. economy probably fell into a recession late last fall as the credit cycle unraveled. We have written extensively about the subprime mortgage debacle, the aggressive use of debt by private equity firms or leveraged buyouts, bizarre securitization of debt financings, home equity withdrawals gone wild, and Wall Street and hedge funds dangerous levels of borrowings. Well, it has all come home to roost to the point that the Federal Reserve, stepping in to save the day, has had to employ nearly half its balance sheet to prevent an implosion.

The severity of the situation has not exactly been lost on investors who have driven the Dow Jones Industrial Average up and down by as much as 500 points in a day. That is serious fear and panic! If that isn’t bad enough, we have been fed a daily meal of dooms day talk (gross hyperbole) by the Presidential candidates proclaiming only they have the solution to save us. The politicians can say what they want, but not one of them

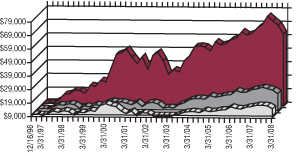

THE VALUE OF A $10,000 INVESTMENT IN THE FMI FOCUS FUND FROM ITS INCEPTION (12/16/96) TO 3/31/08 AS COMPARED TO THE RUSSELL 2000 AND THE RUSSELL 2000 GROWTH

| | FMI Focus Fund $62,620 Russell 2000(1) $22,619 Russell 2000 Growth(2) $15,304 |

Results From Fund Inception (12/16/96) Through 3/31/08

| | | | Annualized Total | Annualized Total | Annualized Total Return* |

| | Total Return* | Total Return* For the | Return* For the 5 | Return* For the 10 | Through 3/31/08 From |

| | Last 3 Months | Year Ended 3/31/08 | Years Ended 3/31/08 | Years Ended 3/31/08 | Fund Inception 12/16/96 |

| FMI Focus Fund | -9.62% | -10.03% | 13.04% | 12.16% | 17.64% |

| Russell 2000 | -9.90% | -13.00% | 14.90% | 4.96% | 7.50% |

| Russell 2000 Growth | -12.83% | -8.94% | 14.24% | 1.75% | 3.84% |

| (1) | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index which comprises the 3,000 largest U.S. companies based on total market capitalization. |

| (2) | The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. |

| * | Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fmifunds.com. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

could pass an Economics 101 exam. This credit cycle has been a long time coming, and just like a bad fever, will only heal with time and market forces, not foolish government interference.

Notwithstanding the pain we have all felt, with the FMI Focus Fund down 9.62% in the first quarter of 2008, there are two distinct rays of hope shining through the financial clouds. The first is that many opportunities, i.e. cheap stocks, are cropping up daily. The second is that we are probably more than halfway through a bear market both in terms of time and decline.

Many financial writers have chronicled the historical fact that the average recession lasts two to four quarters and the stock market nearly always turns up six months prior to the economic pickup. Indeed, the economically sensitive transportation stocks have already begun an upturn. Looking back, the transports accurately presaged the weak economy when they turned down in the early spring of last year, well in advance of the stock market generally. This sector of the stock market is often an excellent barometer because inventory destocking usually occurs as the economy slows and can be subtle enough that investors don’t perceive it happening. The opposite may be happening as we speak.

The economy is indeed weak, but inventories nearly across the board are at historically low levels. Perhaps the transportation stocks are portending a new inventory cycle is upon us, preceding the actual pickup in the economy. Another way to think about it is the store shelves are empty because the store owner got too bearish. Upon seeing a few shoppers he has to restock before his sales increase. We view the strength in the trucking and rail stocks as an encouraging early indicator.

As outlined in our previous shareholder letter, our strategy has been to gradually deploy the large year-end cash position as opportunities arose. As of this writing, we have deployed about half of the reserve, which has proven to be early. We anticipate feeding some more in as we gain confidence that the severe credit storm is passing. Generally, the deployment has been into existing holdings we know well and deem to have strong balance sheets (staying power), and growth prospects. Recent additions include Molex Inc. (MOLX), Kennametal Inc. (KMT), Exterran Holdings Inc. (EXH), Cytec Industries Inc. (CYT), Sapient Corp. (SAPE), Manpower Inc. (MAN), Packaging Corp. of America (PKG), AMN Healthcare Services, Inc. (AHS), and Charles River Laboratories International, Inc. (CRL). New to the portfolio are Nordstrom, Inc. (JWN) and Volcom, Inc. (VLCM), which our retail analyst, Faraz Farzam, reviews later in the letter.

The other strategy we hope to deploy opportunistically is a significant boost in our regional bank investments. Recall from the last shareholder letter our interest in this space. We dipped a couple of toes in the water with UCBH Holdings, Inc. (UCBH) and East West Bancorp, Inc. (EWBC) and promptly had them bitten off! The experience has not dampened our enthusiasm or commitment to the idea but has reinforced how difficult it is to find a bottom to this group. We have not put much money into the banks yet, but anticipate continuing to average in.

The Case for Regional Banks

There was a time when regional banks were great businesses. Many had strong geographical franchises, strong lending spreads, good credit quality, and if in the right part of the country, excellent growth. Often that combination resulted in robust return on assets and equity. Of course the constant consolidation in the industry has always been of no small interest to us as well. There are lots of takeover possibilities. Unfortunately, the past few years have been quite challenging to the industry.

A never ending inverted yield curve environment (short-term interest rates higher than long-term rates are bad for lenders), encroachment by Wall Street via securitization (an alternative to bank loans) and shrinking credit spreads/risk premiums all served to limit loan growth and profit margins - a double whammy. This marginalization of the banking business drove many less-disciplined bankers to stretch for what little business

was left, which helped set up part of the current disastrous credit cycle. Thanks to the visibility of deposit rates on the internet, banks also faced greater competition here as well. Paying higher interest rates on deposits put even more pressure on lending spreads. It seemed the banking business was becoming an anachronism.

Amazingly, the bursting of the credit bubble has given new life to the regional banks, at least the ones that survive this downturn. It turns out that securitization wasn’t such a good idea and credit spreads got insanely narrow. With the large money center banks and Wall Street titans now severely wounded, many regional banks are there to pick up the pieces. With the securitization competition largely gone, not only are the regional banks getting their lending volumes back, but the profit margins are coming back as well, reversing the double whammy. But before we celebrate too wildly, investors must understand that the credit cycle is hitting the regional banks as well, just not nearly as bad. Just how bad remains to be seen and is the principal governor to the speed with which we reengage.

In putting together our dream team of regional banks, we have spent much of the last three months traveling around the country “kicking the tires.” We have assembled a list of 15 or so banks with smart management, good demographics and solid credit quality history, any one of which we would buy at certain prices. Most of our candidates also represent attractive acquisition candidates as well. Before we get too aggressive though, we want to see some more cards turned up on the table, i.e. first quarter earnings and subsequent discussions on credit quality. This is a really bad cycle, and as such, we can’t emphasize enough how careful investors need to be walking through these credit minefields. Most of our candidates are in the western part of the U.S., including Texas, home to the most dynamic population growth. And because of the growth prospects, takeover potential is also ever present. As we are in the process of culling and purchasing our regional portfolio, specific company write-ups will have to wait for future shareholder letters.

We would conclude our discussion by noting that in addition to the improved business prospects for the regional banks, the stocks are really beaten up and nearly universally hated. On average, bank stocks yield more than ten-year treasury notes, which as market pundit Steve Leuthold notes, hasn’t happened in over 45 years. We also note the similarity to the Savings and Loan crisis of 1989-1990. The bottom of that crisis was truly a scary time yet proved to be an incredible time to invest in the space. Stay tuned!

The American Consumer at Waterloo

In the early 19th century, on the eve of Napoleon’s attack on Waterloo, Baron Nathan Von Rothschild, the founder of one of the great banking families of Europe proclaimed, “The time to buy is when blood is running in the streets.” Over the past two years the U.S. consumer has been under a three pronged attack, higher food and energy costs, higher mortgage payments, and the credit crunch brought upon by the much talked about sub-prime crisis. Not surprisingly, U.S. retailers have also felt the pinch from the consumer, as their sales, and their stock prices, have been under intense pressure since the summer of 2007, reaching prices not seen in many cases since 2005, and in some cases since 2001.

Clearly, when it comes to retail shares, blood is running in the streets! The complete evisceration of nearly the entire retail and apparel sectors has given us a tremendous opportunity to upgrade this segment of our portfolio with some very high quality companies, exhibiting attractive growth profiles, cemented by strong brands at bargain basement prices.

As such we have dipped our toe in the surfing waters of California based Volcom, Inc., a designer of premium young men’s and women’s apparel. The stores target the skate boarding, surfing and to a lesser extent snowboarding lifestyle consumer. Over the past few years, the “West Coast Lifestyle” brands, as they are known, have captured tremendous mindshare within American youth culture, reaching far beyond the California roots. We have done a tremendous amount of field work related to Volcom and almost all of our checks have

returned extremely positive. Not only are Volcom’s domestic growth prospects quite attractive, but management is set to launch their brand into the large and potentially highly lucrative European retail market where they enjoy a unique combination of high brand recognition with what amounts to a nearly open field for growth.

The second addition in our retail roundup is Nordstrom’s. A venerable old retailer known for their legendary merchandising skills and service, Nordstrom’s has spent the better part of the last decade with little or no growth in stores while investing in state of the art information systems and management. Over the same time frame, their competitors, the traditional department stores like Macy’s, have consolidated and have done everything they can to destroy what little goodwill they had with their customers. A great example was when Macy’s bought the iconic Marshall Field’s and tragically decided to rebrand and remerchandise the stores as Macy’s. To this day, loyal Marshall Field’s customers continue to picket the changes outside the Chicago store! While the competition continues to alienate their customers, Nordstrom’s continues to provide great merchandise coupled with world class service in a more rationally stored environment, we believe Nordstrom’s can continue to take meaningful market share. We were able to accumulate the shares of the Nordstrom’s family franchise at prices that even the Rothschild family would find very attractive.

Return of the Industrials

Our final strategy may be several quarters away from implementation, which is a return to industrials. We believe the falling dollar makes our manufacturing sector very competitive internationally. Given our unsustainably large balance of trade deficit, the export of goods seems destined to be robust. We also view the stretched consumer in need of balance sheet “reliquification.” As such, post-economic recovery, we anticipate that companies on the producer side of the economy will likely yield stronger earnings, but we would rather get further through the recession before committing more capital here. Further, the industrial stocks have also held up “too well” so far this cycle, so we will patiently wait for our opportunity.

As is our custom, we thank you, our fellow shareholders, for your loyalty and patience. The current environment is volatile and unnerving but historically, that has been the best time to invest, not cut and run. We feel good about our game plan and hope this letter provides you helpful and hopeful insights!

Sincerely,

|  |

| Richard E. Lane, CFA | Glenn W. Primack |

| Portfolio Manager | Portfolio Manager |

FMI Focus Fund

COST DISCUSSION

As a shareholder of the Fund you incur ongoing costs, including management fees and other Fund expenses. You do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees because the Fund does not charge these fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in FMI Focus Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2007 through March 31, 2008.

Industry Sectors as of March 31, 2008

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Fund. To determine your total costs of investing in the Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example at the end of this article.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account | Account | During Period* |

| | Value 10/01/07 | Value 3/31/08 | 10/01/07-3/31/08 |

| FMI Focus Fund Actual | $1,000.00 | $ 866.20 | $7.18 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.30 | $7.76 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.54%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period between October 1, 2007 and March 31, 2008). |

FMI Focus Fund

STATEMENT OF NET ASSETS

March 31, 2008 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 87.9% (a) | | | | | | |

COMMON STOCKS — 87.2% (a) | | | | | | |

COMMERCIAL SERVICES SECTOR — 6.8% | | | | | | |

| | | Advertising/Marketing Services — 1.9% | | | | | | |

| | 787,700 | | ValueClick, Inc.* | | $ | 13,572,177 | | | $ | 13,587,825 | |

| | | | Personnel Services — 4.9% | | | | | | | | |

| | 626,900 | | AMN Healthcare Services, Inc.* | | | 10,994,667 | | | | 9,666,798 | |

| | 258,400 | | Manpower Inc. | | | 13,256,300 | | | | 14,537,584 | |

| | 1,002,800 | | MPS Group, Inc.* | | | 12,533,127 | | | | 11,853,096 | |

| | | | | | | 36,784,094 | | | | 36,057,478 | |

| CONSUMER NON-DURABLES SECTOR — 1.8% | | | | | | | | |

| | | | Apparel/Footwear — 1.8% | | | | | | | | |

| | 553,100 | | Liz Claiborne, Inc. | | | 17,786,656 | | | | 10,038,765 | |

| | 150,000 | | Volcom, Inc.* | | | 3,065,115 | | | | 3,031,500 | |

| | | | | | | 20,851,771 | | | | 13,070,265 | |

| DISTRIBUTION SERVICES SECTOR — 8.2% | | | | | | | | |

| | | | Electronics Distributors — 4.1% | | | | | | | | |

| | 604,600 | | Arrow Electronics, Inc.* | | | 17,271,552 | | | | 20,344,790 | |

| | 630,000 | | Ingram Micro Inc.* | | | 8,682,194 | | | | 9,972,900 | |

| | | | | | | 25,953,746 | | | | 30,317,690 | |

| | | | Food Distributors — 0.9% | | | | | | | | |

| | 348,500 | | United Natural Foods, Inc.* | | | 8,497,193 | | | | 6,520,435 | |

| | | | Medical Distributors — 0.4% | | | | | | | | |

| | 178,834 | | PSS World Medical, Inc.* | | | 2,974,552 | | | | 2,979,374 | |

| | | | Wholesale Distributors — 2.8% | | | | | | | | |

| | 262,800 | | Beacon Roofing Supply, Inc.* | | | 2,411,313 | | | | 2,628,000 | |

| | 102,000 | | Grainger (W.W.), Inc. | | | 5,210,799 | | | | 7,791,780 | |

| | 541,900 | | Interline Brands, Inc.* | | | 9,456,673 | | | | 10,052,245 | |

| | | | | | | 17,078,785 | | | | 20,472,025 | |

| ELECTRONIC TECHNOLOGY SECTOR — 10.4% | | | | | | | | |

| | | | Computer Communications — 0.6% | | | | | | | | |

| | 172,600 | | Juniper Networks, Inc.* | | | 2,472,166 | | | | 4,315,000 | |

| | | | Computer Peripherals — 1.4% | | | | | | | | |

| | 524,200 | | NetApp, Inc.* | | | 13,632,957 | | | | 10,510,210 | |

| | | | Electronic Equipment/Instruments — 1.0% | | | | | | | | |

| | 532,600 | | JDS Uniphase Corp.* | | | 8,390,350 | | | | 7,131,514 | |

| | | | Electronic Production Equipment — 2.2% | | | | | | | | |

| | 1,022,600 | | Asyst Technologies, Inc.* | | | 4,129,154 | | | | 3,579,100 | |

| | 453,100 | | Entegris Inc.* | | | 4,298,858 | | | | 3,257,789 | |

| | 432,200 | | MKS Instruments, Inc.* | | | 7,479,734 | | | | 9,249,080 | |

| | | | | | | 15,907,746 | | | | 16,085,969 | |

FMI Focus Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2008 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 87.9% (a) (Continued) | | | | | | |

COMMON STOCKS — 87.2% (a) (Continued) | | | | | | |

ELECTRONIC TECHNOLOGY SECTOR — 10.4% (Continued) | | | | | | |

| | | Semiconductors — 5.2% | | | | | | |

| | 1,531,000 | | Altera Corp. | | $ | 28,122,734 | | | $ | 28,216,330 | |

| | 1,658,000 | | PMC-Sierra, Inc.* | | | 8,560,642 | | | | 9,450,600 | |

| | | | | | | 36,683,376 | | | | 37,666,930 | |

| ENERGY MINERALS SECTOR — 0.5% | | | | | | | | |

| | | | Oil & Gas Production — 0.5% | | | | | | | | |

| | 49,200 | | Noble Energy, Inc. | | | 972,817 | | | | 3,581,760 | |

FINANCE SECTOR — 9.2% | | | | | | | | |

| | | | Finance/Rental/Leasing — 2.3% | | | | | | | | |

| | 906,000 | | Rent-A-Center, Inc.* | | | 16,404,395 | | | | 16,625,100 | |

| | | | Insurance Brokers/Services — 1.3% | | | | | | | | |

| | 400,000 | | Arthur J. Gallagher & Co. | | | 10,847,892 | | | | 9,448,000 | |

| | | | Property/Casualty Insurance — 1.5% | | | | | | | | |

| | 870,100 | | Old Republic International Corp. | | | 12,585,726 | | | | 11,232,991 | |

| | | | Regional Banks — 4.0% | | | | | | | | |

| | 531,325 | | Associated Banc-Corp | | | 13,090,703 | | | | 14,149,185 | |

| | 262,100 | | East West Bancorp, Inc. | | | 6,060,634 | | | | 4,652,275 | |

| | 98,100 | | First Midwest Bancorp, Inc. | | | 2,710,317 | | | | 2,724,237 | |

| | 71,400 | | Nexity Financial Corp.* | | | 1,142,400 | | | | 479,808 | |

| | 901,700 | | UCBH Holdings, Inc. | | | 12,859,235 | | | | 6,997,192 | |

| | | | | | | 35,863,289 | | | | 29,002,697 | |

| | | | Specialty Insurance — 0.1% | | | | | | | | |

| | 60,500 | | MGIC Investment Corp. | | | 3,505,943 | | | | 637,065 | |

HEALTH TECHNOLOGY SECTOR — 6.9% | | | | | | | | |

| | | | Biotechnology — 3.0% | | | | | | | | |

| | 370,000 | | Charles River Laboratories International, Inc.* | | | 18,428,984 | | | | 21,807,800 | |

| | | | Medical Specialties — 3.9% | | | | | | | | |

| | 247,300 | | Beckman Coulter, Inc. | | | 13,099,340 | | | | 15,963,215 | |

| | 111,500 | | PerkinElmer, Inc. | | | 1,841,612 | | | | 2,703,875 | |

| | 51,600 | | Waters Corp.* | | | 2,949,647 | | | | 2,874,120 | |

| | 291,500 | | Wright Medical Group, Inc.* | | | 6,274,047 | | | | 7,036,810 | |

| | | | | | | 24,164,646 | | | | 28,578,020 | |

| INDUSTRIAL SERVICES SECTOR — 7.0% | | | | | | | | |

| | | | Contract Drilling — 1.9% | | | | | | | | |

| | 200,000 | | Pride International, Inc.* | | | 3,424,031 | | | | 6,990,000 | |

| | 171,100 | | Rowan Companies, Inc. | | | 4,705,531 | | | | 7,045,898 | |

| | | | | | | 8,129,562 | | | | 14,035,898 | |

FMI Focus Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2008 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 87.9% (a) (Continued) | | | | | | |

COMMON STOCKS — 87.2% (a) (Continued) | | | | | | |

INDUSTRIAL SERVICES SECTOR — 7.0% (Continued) | | | | | | |

| | | Environmental Services — 1.1% | | | | | | |

| | 203,682 | | Casella Waste Systems, Inc.* | | $ | 1,654,240 | | | $ | 2,226,244 | |

| | 195,000 | | Republic Services, Inc. | | | 1,879,351 | | | | 5,701,800 | |

| | | | | | | 3,533,591 | | | | 7,928,044 | |

| | | | Oilfield Services/Equipment — 4.0% | | | | | | | | |

| | 541,700 | | Dresser-Rand Group, Inc.* | | | 12,742,153 | | | | 16,657,275 | |

| | 193,521 | | Exterran Holdings Inc.* | | | 12,228,455 | | | | 12,489,845 | |

| | | | | | | 24,970,608 | | | | 29,147,120 | |

| PROCESS INDUSTRIES SECTOR — 10.7% | | | | | | | | |

| | | | Chemicals: Major Diversified — 1.0% | | | | | | | | |

| | 187,300 | | Celanese Corp. | | | 2,864,529 | | | | 7,314,065 | |

| | | | Chemicals: Specialty — 4.7% | | | | | | | | |

| | 1,145,360 | | Cambrex Corp. | | | 12,172,318 | | | | 7,937,345 | |

| | 339,581 | | Cytec Industries Inc. | | | 18,664,770 | | | | 18,286,437 | |

| | 256,200 | | Rockwood Holdings Inc.* | | | 4,865,505 | | | | 8,395,674 | |

| | | | | | | 35,702,593 | | | | 34,619,456 | |

| | | | Containers/Packaging — 4.3% | | | | | | | | |

| | 301,200 | | Bemis Company, Inc. | | | 7,980,847 | | | | 7,659,516 | |

| | 510,200 | | Packaging Corp of America | | | 10,827,460 | | | | 11,392,766 | |

| | 213,500 | | Pactiv Corp.* | | | 5,319,478 | | | | 5,595,835 | |

| | 876,500 | | Smurfit-Stone Container Corp.* | | | 9,493,559 | | | | 6,749,050 | |

| | | | | | | 33,621,344 | | | | 31,397,167 | |

| | | | Industrial Specialties — 0.7% | | | | | | | | |

| | 343,700 | | Ferro Corp. | | | 5,084,721 | | | | 5,107,382 | |

PRODUCER MANUFACTURING SECTOR — 9.0% | | | | | | | | |

| | | | Electrical Products — 3.2% | | | | | | | | |

| | 287,000 | | Greatbatch, Inc.* | | | 5,681,847 | | | | 5,283,670 | |

| | 840,500 | | Molex Inc. Cl A | | | 21,733,116 | | | | 18,373,330 | |

| | | | | | | 27,414,963 | | | | 23,657,000 | |

| | | | Industrial Machinery — 3.3% | | | | | | | | |

| | 165,000 | | Kadant Inc.* | | | 2,852,293 | | | | 4,847,700 | |

| | 647,900 | | Kennametal Inc. | | | 13,315,515 | | | | 19,067,697 | |

| | | | | | | 16,167,808 | | | | 23,915,397 | |

| | | | Miscellaneous Manufacturing — 1.1% | | | | | | | | |

| | 238,900 | | Brady Corp. | | | 7,678,141 | | | | 7,986,427 | |

| | | | Trucks/Construction/Farm Machinery — 1.4% | | | | | | | | |

| | 19,800 | | Federal Signal Corp. | | | 310,969 | | | | 276,408 | |

| | 150,000 | | Joy Global Inc. | | | 7,157,887 | | | | 9,774,000 | |

| | | | | | | 7,468,856 | | | | 10,050,408 | |

FMI Focus Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2008 (Unaudited)

| Shares | | | | Cost | | | Value | |

| LONG-TERM INVESTMENTS — 87.9% (a) (Continued) | | | | | | |

COMMON STOCKS — 87.2% (a) (Continued) | | | | | | |

RETAIL TRADE SECTOR — 9.3% | | | | | | |

| | | Apparel/Footwear Retail — 4.1% | | | | | | |

| | 581,690 | | Jos. A. Bank Clothiers, Inc.* | | $ | 14,562,657 | | | $ | 11,924,645 | |

| | 225,216 | | Nordstrom, Inc. | | | 8,119,654 | | | | 7,342,042 | |

| | 368,400 | | Ross Stores, Inc. | | | 9,950,233 | | | | 11,037,264 | |

| | | | | | | 32,632,544 | | | | 30,303,951 | |

| | | | Department Stores — 1.5% | | | | | | | | |

| | 249,500 | | Kohl’s Corp.* | | | 11,293,076 | | | | 10,701,055 | |

| | | | Discount Stores — 2.3% | | | | | | | | |

| | 856,400 | | Family Dollar Stores, Inc. | | | 18,157,573 | | | | 16,699,800 | |

| | | | Specialty Stores — 1.4% | | | | | | | | |

| | 520,000 | | PetSmart, Inc. | | | 12,826,105 | | | | 10,628,800 | |

TECHNOLOGY SERVICES SECTOR — 5.5% | | | | | | | | |

| | | | Information Technology Services — 1.9% | | | | | | | | |

| | 569,200 | | CIBER, Inc.* | | | 4,240,033 | | | | 2,789,080 | |

| | 90,828 | | JDA Software Group, Inc.* | | | 669,364 | | | | 1,657,611 | |

| | 1,355,200 | | Sapient Corp.* | | | 9,977,779 | | | | 9,432,192 | |

| | | | | | | 14,887,176 | | | | 13,878,883 | |

| | | | Internet Software/Services — 2.0% | | | | | | | | |

| | 318,300 | | Akamai Technologies, Inc.* | | | 10,806,867 | | | | 8,963,328 | |

| | 227,400 | | Omniture, Inc.* | | | 5,001,179 | | | | 5,277,954 | |

| | | | | | | 15,808,046 | | | | 14,241,282 | |

| | | | Packaged Software — 1.6% | | | | | | | | |

| | 741,500 | | Parametric Technology Corp.* | | | 6,776,739 | | | | 11,849,170 | |

TRANSPORTATION SECTOR — 1.9% | | | | | | | | |

| | | | Air Freight/Couriers — 0.7% | | | | | | | | |

| | 254,500 | | UTI Worldwide, Inc. | | | 4,422,430 | | | | 5,110,360 | |

| | | | Trucking — 1.2% | | | | | | | | |

| | 475,100 | | Werner Enterprises, Inc. | | | 8,963,337 | | | | 8,817,856 | |

| | | | Total common stocks | | | 623,976,347 | | | | 637,017,669 | |

| | | | | | | | | | | | |

| MUTUAL FUNDS — 0.7% (a) | | | | | | | | |

| | 150,000 | | KBW Regional Banking ETF | | | 5,261,475 | | | | 5,271,000 | |

| | | | Total long-term investments | | | 629,237,822 | | | | 642,288,669 | |

FMI Focus Fund

STATEMENT OF NET ASSETS (Continued)

March 31, 2008 (Unaudited)

| Principal Amount | | Cost | | | Value | |

| SHORT-TERM INVESTMENTS — 12.1% (a) | | | | | | |

| | | U.S. Treasury Securities — 9.7 % | | | | | | |

| $ | 20,000,000 | | U.S. Treasury Bills, 0.31%, due 4/10/08 | | $ | 19,998,450 | | | $ | 19,998,450 | |

| | 20,000,000 | | U.S. Treasury Bills, 1.01%, due 4/17/08 | | | 19,991,022 | | | | 19,991,022 | |

| | 11,000,000 | | U.S. Treasury Bills, 1.05%, due 4/24/08 | | | 10,992,621 | | | | 10,992,621 | |

| | 20,000,000 | | U.S. Treasury Bills, 1.03%, due 5/01/08 | | | 19,982,833 | | | | 19,982,833 | |

| | | | Total U.S. treasury securities | | | 70,964,926 | | | | 70,964,926 | |

| | | | Variable Rate Demand Note — 2.4% | | | | | | | | |

| | 17,057,296 | | U.S. Bank, N.A., 2.40% | | | 17,057,296 | | | | 17,057,296 | |

| | | | Total short-term investments | | | 88,022,222 | | | | 88,022,222 | |

| | | | Total investments | | $ | 717,260,044 | | | | 730,310,891 | |

| | | | Cash and receivables, less liabilities — 0.0% (a) | | | | | | | 158,263 | |

| | | | Net Assets | | | | | | $ | 730,469,154 | |

| | | | Net Asset Value Per Share ($0.0001 par value, 100,000,000 | | | | | | | | |

| | | | shares authorized), offering and redemption price | | | | | | | | |

| | | | ($730,469,154 ÷ 26,014,255 shares outstanding) | | | | | | $ | 28.08 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this statement.

FMI Focus Fund

STATEMENT OF OPERATIONS

For the Six Month Period Ending March 31, 2008 (Unaudited)

| INCOME: | | | |

| Dividends | | $ | 3,511,196 | |

| Interest | | | 1,536,397 | |

| Total income | | | 5,047,593 | |

| EXPENSES: | | | | |

| Management fees | | | 5,153,276 | |

| Transfer agent fees | | | 586,669 | |

| Administrative and accounting services | | | 250,301 | |

| Printing and postage expense | | | 143,047 | |

| Custodian fees | | | 88,524 | |

| Registration fees | | | 34,050 | |

| Professional fees | | | 27,508 | |

| Board of Directors fees | | | 22,800 | |

| Insurance expense | | | 18,439 | |

| Other expenses | | | 24,009 | |

| Total expenses | | | 6,348,623 | |

| NET INVESTMENT LOSS | | | (1,301,030 | ) |

| NET REALIZED GAIN ON INVESTMENTS | | | 60,032,229 | |

| NET DECREASE IN UNREALIZED APPRECIATION ON INVESTMENTS | | | (177,273,546 | ) |

| NET LOSS ON INVESTMENTS | | | (117,241,317 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (118,542,347 | ) |

The accompanying notes to financial statements are an integral part of this statement.

FMI Focus Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the Six Month Period Ending March 31, 2008 (Unaudited) and For the Year Ended September 30, 2007

| | | 2008 | | | 2007 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (1,301,030 | ) | | $ | (1,618,449 | ) |

| Net realized gain on investments | | | 60,032,229 | | | | 76,871,435 | |

| Net (decrease) increase in unrealized appreciation on investments | | | (177,273,546 | ) | | | 53,775,675 | |

| Net (decrease) increase in net assets from operations | | | (118,542,347 | ) | | | 129,028,661 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions from net realized gains ($2.4030 and $4.2996 per share, respectively) | | | (63,183,602 | ) | | | (113,038,704 | )* |

| FUND SHARE ACTIVITIES: | | | | | | | | |

| Proceeds from shares issued (849,800 and 1,552,719 shares, respectively) | | | 25,860,784 | | | | 52,759,060 | |

| Net asset value of shares issued in distributions reinvested | | | | | | | | |

| (1,885,744 and 3,385,251 shares, respectively) | | | 61,475,293 | | | | 109,645,434 | |

| Cost of shares redeemed (3,105,664 and 4,781,083 shares, respectively) | | | (93,996,941 | ) | | | (162,184,744 | ) |

| Net (decrease) increase in net assets derived from Fund share activities | | | (6,660,864 | ) | | | 219,750 | |

| TOTAL (DECREASE) INCREASE | | | (188,386,813 | ) | | | 16,209,707 | |

| NET ASSETS AT THE BEGINNING OF THE PERIOD | | | 918,855,967 | | | | 902,646,260 | |

| NET ASSETS AT THE END OF THE PERIOD (Includes undistributed | | | | | | | | |

| net investment income of $0 and $0, respectively) | | $ | 730,469,154 | | | $ | 918,855,967 | |

* See Note 8.

The accompanying notes to financial statements are an integral part of these statements.

FMI Focus Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each period)

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | For the Six Month | | | | | | | | | | | | | | | | |

| | | Period Ending | | | | | | | | | | | | | | | | |

| | | March 31, | | | Years Ended September 30, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 34.83 | | | $ | 34.42 | | | $ | 35.83 | | | $ | 32.14 | | | $ | 29.35 | | | $ | 20.81 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.05 | ) | | | (0.06 | ) | | | (0.13 | ) | | | (0.21 | ) | | | (0.29 | ) | | | (0.18 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| (losses) gains on investments | | | (4.30 | ) | | | 4.77 | | | | 2.44 | | | | 5.44 | | | | 3.08 | | | | 8.72 | |

| Total from investment operations | | | (4.35 | ) | | | 4.71 | | | | 2.31 | | | | 5.23 | | | | 2.79 | | | | 8.54 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (2.40 | ) | | | (4.30 | ) | | | (3.72 | ) | | | (1.54 | ) | | | — | | | | — | |

| Total from distributions | | | (2.40 | ) | | | (4.30 | ) | | | (3.72 | ) | | | (1.54 | ) | | | — | | | | — | |

| Net asset value, end of period | | $ | 28.08 | | | $ | 34.83 | | | $ | 34.42 | | | $ | 35.83 | | | $ | 32.14 | | | $ | 29.35 | |

| TOTAL RETURN | | | (13.38% | )* | | | 14.87% | | | | 7.75% | | | | 16.83% | | | | 9.51% | | | | 41.04% | |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s $) | | | 730,469 | | | | 918,856 | | | | 902,646 | | | | 1,053,437 | | | | 1,063,995 | | | | 948,471 | |

| Ratio of expenses to average net assets | | | 1.54% | ** | | | 1.52% | | | | 1.50% | | | | 1.48% | | | | 1.43% | | | | 1.47% | |

Ratio of net investment loss to average net assets | | | (0.32% | )** | | | (0.17% | ) | | | (0.38% | ) | | | (0.61% | ) | | | (0.87% | ) | | | (0.71% | ) |

| Portfolio turnover rate | | | 41.2% | | | | 40.9% | | | | 49.0% | | | | 63.1% | | | | 63.8% | | | | 52.6% | |

The accompanying notes to financial statements are an integral part of this statement.

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS

March 31, 2008 (Unaudited)

| (1) | Summary of Significant Accounting Policies — |

The following is a summary of significant accounting policies of the FMI Focus Fund (the "Fund"), a portfolio of FMI Funds, Inc. (the "Company") which is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Company was incorporated under the laws of Maryland on September 5, 1996 and the Fund commenced operations on December 16, 1996. The assets and liabilities of each Fund in the Company are segregated as a shareholder’s interest is limited to the Fund in which the shareholder owns shares. The investment objective of the Fund is to seek capital appreciation principally through investing in common stocks and warrants, engaging in short sales, investing in foreign securities and effecting transactions in stock index futures contracts, options on stock index futures contracts, and options on securities and stock indexes.

| | (a) | Each security, excluding short-term investments, is valued at the last sale price reported by the principal security exchange on which the issue is traded. Securities that are traded on the Nasdaq Markets are valued at the Nasdaq Official Closing Price or if no sale is reported, at the latest bid price. Securities which are traded over-the-counter are valued at the latest bid price. Securities sold short which are listed on a national securities exchange or the Nasdaq Stock Market but which were not traded on the valuation date are valued at the most recent ask price. Unlisted equity securities for which market quotations are readily available are valued at the most recent bid price. Options purchased or written by the Fund are valued at the average of the most recent bid and ask prices. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. The fair value of a security is the amount which the Fund might reasonably expect to receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. Short-term investments with maturities of 60 days or less are valued at amortized cost which approximates value. For financial reporting purposes, investment transactions are recorded on the trade date. |

| | In September 2006, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS") No. 157, "Fair Value Measurements." This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this standard relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. The Fund does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements included within the Statement of Operations for the period. |

| | (b) | Net realized gains and losses on sales of securities are computed on the identified cost basis. |

| | (c) | Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. |

| | (d) | The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. The Fund may be susceptible to credit risk with respect to these notes to the extent the issuer defaults on its payment obligation. The Fund’s policy is to monitor the creditworthiness of the issuer and nonperformance by these issuers is not anticipated. |

| | (e) | Accounting principles generally accepted in the United States of America ("GAAP") require that permanent differences between income for financial reporting and tax purposes be reclassified in the capital accounts. |

| | (f) | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| | (g) | The Fund may sell securities short. For financial statement purposes, an amount equal to the settlement amount would be included in the statement of net assets as a liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities sold, but not yet purchased, may require purchasing the securities at prices which may differ from the market value reflected on the statement of net assets. The Fund is liable for any dividends payable on securities while those securities are in a short position. Under the 1940 Act, the Fund is required to maintain collateral for its short positions consisting of liquid securities. The collateral is required to be adjusted daily to reflect changes in the value of the securities sold short. |

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2008 (Unaudited)

| (1) | Summary of Significant Accounting Policies — (Continued) |

| | (h) | The Fund may own certain securities that are restricted. Restricted securities include Section 4(2) commercial paper, securities issued in a private placement, or securities eligible for resale pursuant to Rule 144A under the Securities Act of 1933. A restricted security cannot be resold to the general public without prior registration under the Securities Act of 1933 (the "Act") or pursuant to the resale limitations provided by Rule 144A under the Act, or an exemption from the registration requirements of the Act. |

| | (i) | No provision has been made for Federal income taxes since the Fund has elected to be taxed as a "regulated investment company" and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| | Accounting Pronouncements – Effective March 31, 2008, the Fund became subject to FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes" ("FIN 48"). FIN 48 requires the evaluation, recognition, measurement, and disclosure in financial statements of tax positions taken on previously filed tax returns or expected to be taken on future returns. Each tax position must meet a recognition threshold that is "more-likely-than-not" (i.e., has a likelihood of more than 50%), based on the technical merits, that the position will be sustained upon examination by the applicable taxing authority. In evaluating whether a tax position has met the threshold, the Fund must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. A tax position not deemed to meet the "more-likely-than-not" threshold is recorded as a tax expense in the current year. |

| | The Fund has reviewed all taxable years that are open for examination (i.e., not barred by the applicable statute of limitations) by taxing authorities of the major taxing jurisdictions, including the Internal Revenue Service. As of March 31, 2008, open taxable years consisted of the taxable years ended September 30, 2004 through 2007. No examination of the Fund is currently in progress. |

| | The Fund has reviewed all its open taxable years for the major taxing jurisdictions and concluded that application of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the Fund’s tax return for the taxable year ended September 30, 2007. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. |

| (2) | Investment Adviser and Management Agreement and Transactions With Related Parties — |

The Fund has a management agreement with Fiduciary Management, Inc. ("FMI"), with whom certain officers and directors of the Fund are affiliated, to serve as investment adviser and manager. Under the terms of the agreement, the Fund will pay FMI a monthly management fee at an annual rate of 1.25% of the daily net assets. The Fund has an administrative agreement with FMI to supervise all aspects of the Fund’s operations except those performed by FMI pursuant to the management agreement. Under the terms of the agreement, the Fund will pay FMI a monthly administrative fee at the annual rate of 0.20% of the daily net assets up to and including $30,000,000, 0.10% on the next $70,000,000 and 0.05% of the daily net assets of the Fund in excess of $100,000,000.

FMI entered into a sub-advisory agreement with Broadview Advisors, LLC, to assist it in the day-to-day management of the Fund. Broadview Advisors, LLC, determines which securities will be purchased, retained or sold for the Fund. FMI pays Broadview Advisors, LLC 76% of the Fund’s management fee of 1.25% of the daily net assets.

Under the management agreement, FMI will reimburse the Fund for expenses over 2.75% of the daily net assets of the Fund. No such reimbursements were required for the six month period ending March 31, 2008.

The Fund has entered into a Distribution Plan (the "Plan"), pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan provides that the Fund may incur certain costs which may not exceed the lesser of a monthly amount equal to 0.25% of the Fund’s daily net assets or the actual distribution costs incurred during the year. Amounts payable under the Plan are paid monthly for any activities or expenses primarily intended to result in the sale of shares of the Fund. For the six month period ending March 31, 2008, no such expenses were incurred.

In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2008 (Unaudited)

U.S. Bank, N.A. has made available to the Fund a $60,000,000 credit facility pursuant to a Credit Agreement ("Agreement") dated November 18, 2002 for the purpose of having cash available to satisfy redemption requests and to purchase portfolio securities. Principal and interest of such loan under the Agreement are due not more than 31 days after the date of the loan. Amounts under the credit facility bear interest at a rate per annum equal to the current prime rate minus one on the amount borrowed. Advances will be collateralized by securities owned by the Fund. During the six month period ending March 31, 2008, the Fund had an outstanding average daily balance of $519 under the Agreement. The maximum amount outstanding during that period was $95,000. Interest expense amounted to $16 for the six month period ending March 31, 2008. The Fund did not have a loan outstanding on March 31, 2008. The Credit Agreement expires on June 5, 2008.

| (4) | Distribution to Shareholders — |

Net investment income and net realized gains, if any, are distributed to shareholders at least annually.

| (5) | Investment Transactions — |

For the six month period ending March 31, 2008, purchases and proceeds of sales of investment securities (excluding short-term investments) were $301,342,582 and $342,365,959, respectively.

| (6) | Accounts Payable and Accrued Liabilities — |

As of March 31, 2008, liabilities of the Fund included the following:

| Payable to brokers for securities purchased | | $ | 10,219,093 | |

| Payable to FMI for management and administrative fees | | | 813,274 | |

| Due to custodian | | | 330,668 | |

| Other liabilities | | | 445,923 | |

| (7) | Sources of Net Assets — |

As of March 31, 2008, the sources of net assets were as follows:

| Fund shares issued and outstanding | | $ | 671,486,235 | |

| Net unrealized appreciation on investments | | | 13,050,847 | |

| Accumulated net realized gains on investments | | | 45,932,072 | |

| | | $ | 730,469,154 | |

| (8) | Income Tax Information — |

The following information for the Fund is presented on an income tax basis as of March 31, 2008:

| | | Gross | | Gross | | Net Unrealized |

| Cost of | | Unrealized | | Unrealized | | Appreciation |

| Investments | | Appreciation | | Depreciation | | on Investments |

| $726,124,970 | | $70,912,509 | | $66,726,588 | | $4,185,921 |

The following information for the Fund is presented on an income tax basis as of September 30, 2007:

| | | Gross | | Gross | | Net Unrealized | | Distributable | | Distributable |

| Cost of | | Unrealized | | Unrealized | | Appreciation | | Ordinary | | Long-Term |

| Investments | | Appreciation | | Depreciation | | on Investments | | Income | | Capital Gains |

| $726,193,605 | | $210,560,109 | | $25,287,463 | | $185,272,646 | | $3,507,465 | | $50,627,727 |

The difference between the cost amount for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

March 31, 2008 (Unaudited)

| (8) | Income Tax Information — (Continued) |

The tax components of dividends paid during the years ended September 30, 2007 and 2006, capital loss carryovers, which may be used to offset future capital gains, subject to Internal Revenue Code limitations, as of September 30, 2007, and tax basis post-October losses as of September 30, 2007, which are not recognized for tax purposes until the first day of the following fiscal year are:

| September 30, 2007 | | September 30, 2006 |

| Ordinary | | Long-Term | | Net Capital | | | | Ordinary | | Long-Term |

| Income | | Capital Gains | | Loss | | Post-October | | Income | | Capital Gains |

| Distributions | | Distributions | | Carryovers | | Losses | | Distributions | | Distributions |

| $22,364,961 | | $90,673,743 | | $ — | | $ — | | $44,245,543 | | $64,871,770 |

For corporate shareholders of the Fund, the percentage of dividend income distributed for the year ended September 30, 2007 which is designated as qualifying for the dividends received deduction is 45% (unaudited).

For all shareholders of the Fund, the percentage of dividend income under the Jobs and Growth Tax Relief Act of 2003, is 45% (unaudited).

FMI Focus Fund

ADVISORY AGREEMENT

On December 21, 2007, the Board of Directors of FMI Funds, Inc. ("Directors") approved the continuation of the FMI Focus Fund’s investment advisory agreement with Fiduciary Management, Inc. and its sub-advisory agreement with Broadview Advisors, LLC. Prior to approving the continuation of the agreements, the Directors considered:

| • | the nature, extent and quality of the services provided by Fiduciary Management, Inc. and Broadview Advisors, LLC |

| • | the investment performance of the Fund |

| • | the cost of the services to be provided and profits to be realized by Fiduciary Management, Inc. and Broadview Advisors, LLC from their relationship with the Fund |

| • | the extent to which economies of scale would be realized as the Fund grew and whether fee levels reflect any economies of scale |

| • | the expense ratio of the Fund |

| • | the manner in which portfolio transactions for the Fund were conducted, including the use of soft dollars |

In considering the nature, extent and quality of the services provided by Fiduciary Management, Inc. and Broadview Advisors, LLC, the Directors reviewed a report describing the portfolio management, shareholder communication and servicing, prospective shareholder assistance and regulatory compliance services provided by Fiduciary Management, Inc. and Broadview Advisors, LLC to the Fund. The Directors concluded that Fiduciary Management, Inc. and Broadview Advisors, LLC were providing essential services to the Fund. In particular, the Directors concluded that Fiduciary Management, Inc. and Broadview Advisors, LLC were preparing reports to shareholders in addition to those required by law, and were providing services to the Fund that were in addition to the services investment advisers typically provided non-mutual fund clients.

The Directors compared the performance of the Fund to benchmark indices over various periods of time and concluded that the performance of the Fund warranted the continuation of the agreements.

In concluding that the advisory fees payable by the Fund were reasonable, the Directors reviewed a report that concluded that the profits Fiduciary Management, Inc. realized with respect to the Fund, expressed as a percentage of pre-tax revenues, was generally less than that of publicly traded investment advisers. The Directors also reviewed reports comparing the Fund’s expense ratio and advisory fees paid by the Fund to those of other comparable mutual funds and concluded that the advisory fee paid by the Fund and the Fund’s expense ratio were within the range of comparable mutual funds. The Directors noted that the investment advisory fee was not adjusted if economies of scale were realized as the Fund grew, but did not consider that factor to be significant in light of the other factors considered, and because of the Fund’s investment style, was unlikely to realize economies of scale.

Finally, the Directors reviewed reports discussing the manner in which portfolio transactions for the Fund were conducted, including the use of soft dollars. Based on these reports, the Directors concluded that the research obtained by Broadview Advisors, LLC was beneficial to the Fund and that Broadview Advisors, LLC was executing the Fund’s portfolio transactions in a manner designated to obtain best execution for the Fund.

ADDITIONAL INFORMATION

For additional information about the Directors and Officers or for a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call (800) 811-5311 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission (the "Commission") at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities is available on the Fund’s website at http://www.fmifunds.com or the website of the Commission no later than August 31 for the prior 12 months ending June 30. The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Commission’s website. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and that information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

FMI Focus Fund

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

www.fmifunds.com

414-226-4555

BOARD OF DIRECTORS

BARRY K. ALLEN

ROBERT C. ARZBAECHER

GEORGE D. DALTON

PATRICK J. ENGLISH

GORDON H. GUNNLAUGSSON

TED D. KELLNER

RICHARD E. LANE

PAUL S. SHAIN

INVESTMENT ADVISER

AND ADMINISTRATOR

FIDUCIARY MANAGEMENT, INC.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

PORTFOLIO MANAGER

BROADVIEW ADVISORS, LLC

100 East Wisconsin Avenue, Suite 2250

Milwaukee, Wisconsin 53202

TRANSFER AGENT AND

DIVIDEND DISBURSING AGENT

U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

800-811-5311 or 414-765-4124

CUSTODIAN

U.S. BANK, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PRICEWATERHOUSECOOPERS LLP

100 East Wisconsin Avenue, Suite 1800

Milwaukee, Wisconsin 53202

LEGAL COUNSEL

FOLEY & LARDNER LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of FMI Focus Fund unless accompanied or preceded by the Fund’s current prospectus.

SEMIANNUAL REPORT

March 31, 2008

FMI

Large Cap

Fund

A NO-LOAD

MUTUAL FUND

FMI

Large Cap

Fund

April 1, 2008

Dear Fellow Shareholders:

The FMI Large Cap Fund declined 5.50%(1) in the March quarter. The benchmark Standard & Poor’s 500 Index(2) fell 9.45% in the period. Stocks that aided the good relative performance included Tyco International Ltd., Wal-Mart Stores, Inc., and United Parcel Service, Inc. On the flipside, recession worries hurt Best Buy Co., Inc. and Cintas Corp. We are optimistic about the investment prospects for these companies. Time Warner Inc.’s stock also continued to struggle in the quarter as investors’ view of cable and AOL remained negative. We still like the risk/reward at Time Warner. We also sold Sprint Nextel Corp. in the quarter… a real black eye for us. We stayed with the company through several bad quarters because we knew the spectrum and franchise value of the firm was much greater than the stock price. When the fourth quarter was announced, showing a substantial shortfall in the fundamentals along with a $2.5 billion drawdown of their credit lines, we felt there was a nontrivial chance that it could get a lot worse before getting better. With no way to know how long credit might prove tight for Sprint, and it’s looking like it would be several more quarters to turn the business, we made the difficult decision to sell.

As you know, our custom is to discuss individual investments in the letters following the March and September quarters, with longer, macro comments at mid-year and year-end. We will stick to that format, but given the very significant events in recent months, we want to make some general observations first.

One year ago we quoted a managing director of one of the largest private equity firms in the world, who said, “[Liquidity] has enabled us to do transactions that were previously unimaginable. Frankly, there is so much liquidity in the world financial system that lenders (even our lenders) are making very risky credit decisions.” He continued, “…most investors in most asset classes are not being paid for the risk being taken.” That firm was Carlyle Group, a primary sponsor of the Carlyle Capital Fund, which, in an irony that is all too common on Wall Street, was virtually wiped out in the first quarter of 2008. This $22.7 billion fund stood on just $940 million of equity. Like the Bear Stearns hedge funds last summer, this fund was built on credulity and optimism, rather than prudence and risk sensitivity. The same can be said for many of the investments held by Wall Street brokers, banks and insurance companies. The losses on mortgages and derivatives are now approaching $400 billion and some estimate the eventual total will exceed $600 billion.

The Bear Stearns problems from 2007 spiraled out of control in March and resulted in a highly unusual takeover of the firm by J.P. Morgan. The Federal Reserve and the Treasury assisted the deal, providing $30 billion of guarantees on dicey Bear Stearns’ investments along with the opportunity for large brokers to borrow from the Fed, the first time since the Great Depression that the government lent money to securities firms. At the same time, federal regulators loosened the capital requirements of Fannie Mae and Freddie Mac, allowing them to purchase an additional $200 billion of mortgage securities. Although it is April 1 today, this is not an April Fool’s joke. Wall Street brokerage firms made billions of dollars of profit speculating on mortgages and mortgage derivatives, while their executives took home hundreds of millions of dollars in compensation, yet the government is there to bail them out when the going gets rough? Fannie and Freddie are in trouble precisely because their capital was weak and they encouraged profligate and undisciplined lending. Now the government wants to solve that problem by allowing them to buy even more mortgages? This will likely result in yet another taxpayer bailout.

| (1) | The Fund’s one year, annualized five year, and since inception (December 31, 2001) returns through March 31, 2008 were –3.40%, 14.67% and 8.30%, respectively. |

| (2) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e. its market price per share times the number of shares outstanding.) Stocks may be added or deleted from the Index from time to time. |

The Fed’s complicity in this heist is shocking. On March 18, they lowered the Fed Funds rate 75 basis points to 2.25%, following an unscheduled cut of 50 basis points earlier in the quarter. It is no surprise the dollar continues to reach new lows, while commodities and inflation reach new highs. It will be difficult for the Fed to restore trust in the financial system while turning a blind eye to the dollar. As Reuven Brenner, a professor at McGill University, stated recently in a Wall Street Journal editorial, “The liquidity crisis and the stable dollar are related. The vast extension of credit since 2002 could have never happened if the Fed had sustained a stable value for the dollar.”

The coup de grace is the Paulson Plan, the Bush administration’s blueprint to remodel the U.S. financial system. While there are a few laudable aspects to the plan, namely the consolidation of some government agencies and increased disclosure, it dramatically increases the Fed’s charter and the role of the Federal government. Five new federal agencies would be created, with comforting names like The Prudential Financial Regulatory Agency and the Conduct of Business Regulatory Agency. This plan, along with the bailouts articulated above, is just another slap to the free market system. Capitalism works precisely because it sometimes delivers fatal blows to participants. These blows force capitalists to pay attention to risk and adjust their behavior.

As much as we despise what the Fed has done over the past many years, and particularly the response to the financial turmoil in 2008, our job as investors is to survey the landscape and deal with the world as it is, not as we would want it to be. The Paulson Plan faces an uphill battle in Congress over the next several years. More worrisome are the actions the Fed and Treasury can take without any congressional oversight. It is particularly ironic, given all the political rhetoric in favor of the little guy, that Congress cheers the Fed’s moves. Any student of economics knows that inflation is one of the most regressive “taxes” there is. We will have to weigh the macro more carefully over the next few years than we ever have in the past.

Perhaps not so surprising, the tumultuous environment is providing interesting valuations on a number of companies. Below we have highlighted two new ideas.

AUTOMATIC DATA PROCESSING, INC. (ADP)

Description

Automatic Data Processing, with over $8 billion in revenues and approximately 585,000 clients, is one of the world’s largest providers of business outsourcing solutions. Leveraging more than 55 years of experience, ADP offers a wide range of human resources, payroll, tax and benefits administration solutions from a single source. ADP is also a leading provider of integrated computing solutions to auto, truck, motorcycle, marine and recreational vehicle dealers throughout the world.

Good Business

| • | The core payroll outsourcing business of ADP has become a necessary business service. ADP pays 33 million workers in over 30 countries, including one out of six in the United States. |

| • | The revenue model is highly recurring. |

| • | After spinning-off the slower growth Brokerage Services business, the company is now focused on its primary business, Employer Services. |

| • | Overall organic growth should be above average over an economic cycle, augmented by smaller acquisitions in the core business. |

| • | The financial model is impressive as the company generates 13-14% margins and a 10% return on invested capital (ROIC). The ROIC is actually much higher when client funds and corporate cash are excluded (over 15%). Operating margins including fees generated by payroll float approximate 20%. |

| • | ADP generates over $1 billion in free cash flow every year. |

| • | The company has over $1.3 billion of cash ($2.50 per share) and very little debt. |

| • | Currently, ADP yields 2.9%. |

Valuation

| • | ADP trades at 18x forward earnings per share (EPS), less than 10x earnings before interest, taxes, depreciation and amortization (EBITDA) and 2.2x sales. |

| • | Over the past ten years, ADP has traded, on average, at over 30x EPS, 15x EBITDA and 4.0x sales. |

| • | Over the past five years, the company has traded, on average, at over 22x EPS. |

Management

| • | Gary Butler has served as ADP’s President and Chief Executive Officer since August 31, 2006. He was President and COO from April 1998 to August 31, 2006. Gary replaced Arthur Weinbach, who was the previous CEO and Chairman of the Board. |

| • | Chris Reidy is ADP’s CFO, and has been in this position since October 2006. |

| • | Michael Martone became Chief Operating Officer less than a year ago. |

Investment Thesis

The shares of ADP have depreciated approximately 20% in the past six months as recession worries have gathered momentum. ADP’s top-management is relatively new and has focused ADP more than ever on its core business, emphasizing profitable growth and returning excess cash to shareholders. ADP repurchased $2 billion worth of stock in 2007 and increased the dividend 24%. This is a great business with moderate to good growth prospects and an attractive valuation for long-term investors.

ROBERT HALF INTERNATIONAL INC. (RHI)

Description

Robert Half provides specialized staffing and internal audit and risk consulting services. The company derives more than 70% of its revenue from the accounting and finance market. In 2006, temporary placement accounted for 78% of revenue and 70% of operating profit, permanent placement accounted for 8% of revenue and 17% of operating profit, and risk consulting and internal audit services accounted for 14% of revenue and 13% of operating profit.

Good Business

| • | Robert Half has established significant brand equity following years of excellent service. They are succeeding in extending their brand to other professional services. |

| • | Customers and employment candidates seek to do business with the company on a repeat basis, given its strong reputation. |

| • | Its focus on providing specialty-staffing services to small and medium sized customers has resulted in an operating margin that is approximately double that of other staffing firms. When combined with low capital expenditure requirements and a preference to grow the business organically, this has resulted in an ROIC of nearly 20% over a cycle. |

| • | This is an easy business to understand. |

| • | There is $324.5 million in net cash on the balance sheet. |

Valuation

| • | The stock has declined 43% from its 52-week high, and has underperformed the Standard & Poor’s 500 Index by 38% over the last twelve months on recession concerns. |

| • | Robert Half currently trades for 0.8x sales. The five-year average multiple is 1.6, and the ten-year average multiple is 1.7. One standard deviation below the five-year average multiple is 1.3, and one standard deviation below the ten-year average multiple is 1.2. |

| • | We see downside risk of 20% to $19 per share, and upside potential to $48 per share over the next four years, for an attractive reward-to-risk of 5-to-1. |

Management

| • | Robert Half is one of the premier managers in the industry. It is a high quality company that consistently generates profit margins that are well above industry averages. |

| • | Management has been adept at recognizing and capitalizing on industry trends, and believes that internal expansion generally involves less risk compared to acquisitions. |

| • | The company has been generous in returning excess cash to shareholders in the form of stock buybacks and dividends. |

| • | Management has skin in the game, as all directors and executive officers as a group own 11.6% of the stock. |

| • | Harold Messmer has been Chairman since 1988 and CEO since 1987. |

| • | Keith Waddell has been Vice Chairman since 1999, President since 2004, and CFO since 1988. |

Investment Thesis

The stock appears to be discounting a lot of bad news ahead of an actual downturn in the fundamentals of business. This has created an opportunity to purchase a high quality company that should be a beneficiary of several secular trends, including greater attention to internal controls, transparency in financial reporting, and corporate governance due to increased regulation and compliance rules.

Thank you for your confidence in FMI Large Cap Fund.

Sincerely,

|  |  |

| Ted D. Kellner, CFA | Donald S. Wilson, CFA | Patrick J. English, CFA |

| President and | Vice President | Vice President and |

| Portfolio Manager | | Portfolio Manager |

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

FMI Large Cap Fund

COST DISCUSSION

As a shareholder of the Fund you incur ongoing costs, including management fees and other Fund expenses. You do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees because the Fund does not charge these fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in FMI Large Cap Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2007 through March 31, 2008.

Industry Sectors as of March 31, 2008

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Fund. To determine your total costs of investing in the Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example at the end of this article.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account | Account | During Period* |

| | Value 10/01/07 | Value 3/31/08 | 10/01/07-3/31/08 |

| FMI Large Cap Fund Actual | $1,000.00 | $ 923.60 | $4.81 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.00 | $5.05 |