OUR MISSION The Atlantic Stewardship Bank was established to serve the northern New Jersey community’s financial needs and to give back, or tithe, one tenth of our earnings to the community. We are a confident and progressive institution that meets business and individual banking deposit and borrowing needs. We understand the value of each and every customer and make it a priority to treat each customer fairly and with respect. By investing prudently, we safeguard assets, provide ample capital for growth and recognize our shareholders. As a responsible and accountable employer, we cultivate a caring, professional environment where our associates can be productive and are encouraged to grow. We are an independent commercial bank that stands on solid Christian principles and the American banking regulations established by the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the State of New Jersey. We hold these fundamentals paramount in every decision we make; for the good of our customers, our shareholders, and our associates.

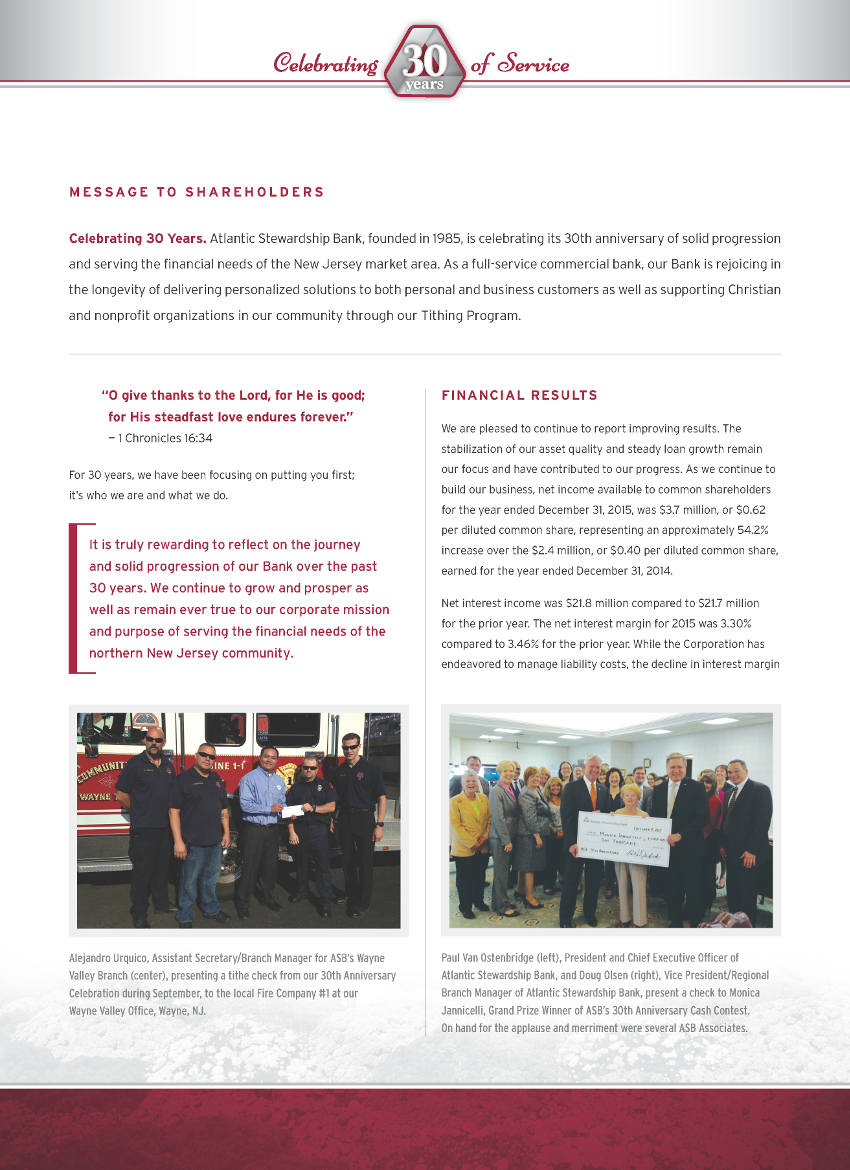

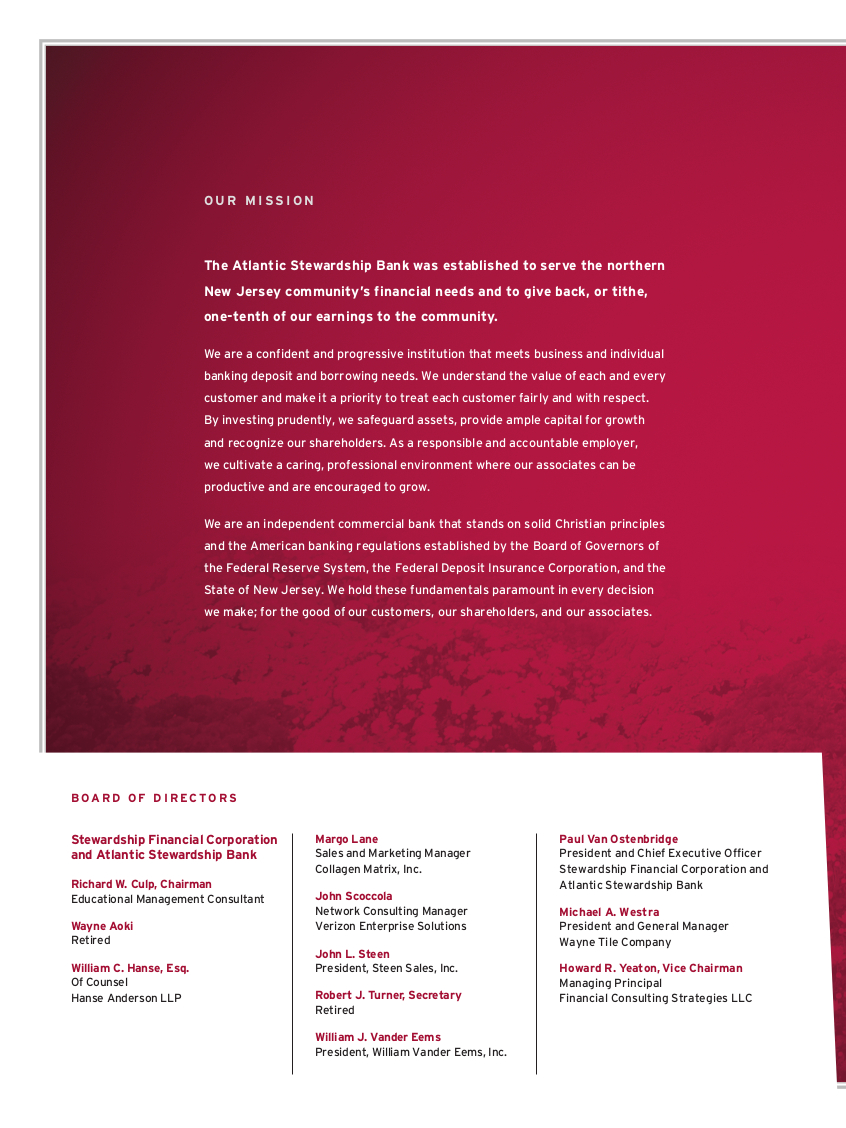

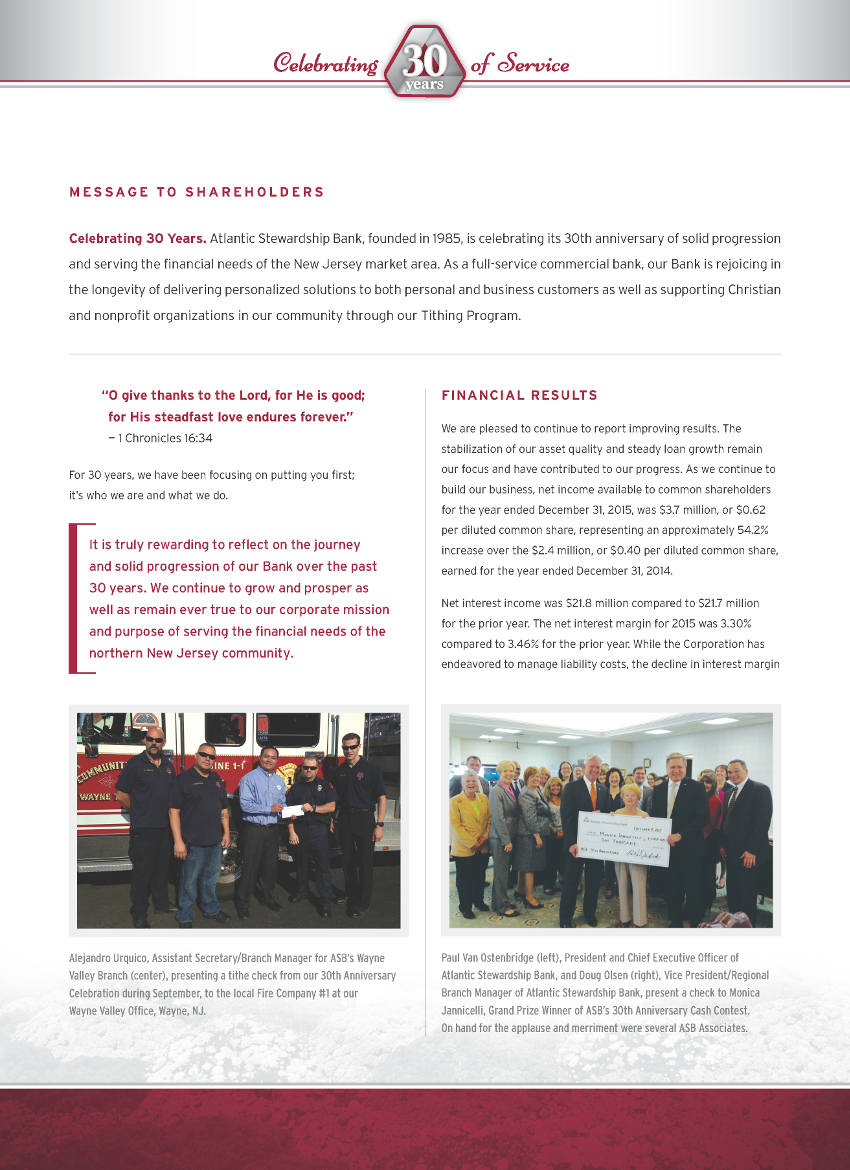

MESSAGE TO SHAREHOLDERS Celebrating 30 Years. Atlantic Stewardship Bank, founded in 1985, is celebrating its 30th anniversary of solid progression and serving the financial needs of the New Jersey market area. As a fullservice commercial bank, our Bank is rejoicing in the longevity of delivering personalized solutions to both personal and business customers as well as supporting Christian and nonprofit organizations in our community through our Tithing Program. “O give thanks to the Lord, for He is good; for His steadfast love endures forever.” — 1 Chronicles 16:34 For 30 years, we have been focusing on putting you first; it’s who we are and what we do. It is truly rewarding to reflect on the journey and solid progression of our Bank over the past 30 years. We continue to grow and prosper as well as remain ever true to our corporate mission and purpose of serving the financial needs of the northern New Jersey community.

FINANCIAL RESULTS We are pleased to continue to report improving results. The stabilization of our asset quality and steady loan growth remain our focus and have contributed to our progress. As we continue to build our business, net income available to common shareholders for the year ended December 31, 2015, was $3.7 million, or $0.62 per diluted common share, representing an approximately 54.2% increase over the $2.4 million, or $0.40 per diluted common share, earned for the year ended December 31, 2014. Net interest income was $21.8 million compared to $21.7 million for the prior year. The net interest margin for 2015 was 3.30% compared to 3.46% for the prior year. While the Corporation has endeavored to manage liability costs, the decline in interest margin is reflective of the lower yields on assets due to a prolonged period of low interest rates. Management has accepted the continued low interest rate environment and determined how best to create earnings for the Corporation. Noninterest income was $3.5 million for the year ended December 31, 2015, compared to $3.0 million for the prior year. The improvement includes the Corporation returning to selling the majority of residential loan production. As a result, gains on sales of mortgage loans nearly doubled from $72,000 in 2014 to $141,000 in 2015. Finally, the 2014 income included a loss of $241,000 from the sale of nonperforming loans. For the year ended December 31, 2015, the Corporation recorded a negative provision for loan losses of $1.4 million as compared to a $50,000 negative provision for loan losses in the prior year, reflective of the stabilization and improvement in our credit metrics. Nonperforming loans were $1.9 million, or 0.36% of total loans at December 31, 2015, down substantially compared to $3.6 million, or 0.76% of total loans, at December 31, 2014. The allowance for loan losses represented 1.68% of total gross loans compared to 2.01% prior year. The Corporation’s capital levels continue to remain strong with a Tier 1 leverage ratio of 7.67% and total riskbased capital ratio of 14.34%, far exceeding the regulatory requirements of 4% and 8%, respectively, to be considered a “well capitalized” institution. Total assets of $717.9 million at December 31, 2015, reflected an increase of $24.3 million, or 3.5%, compared to $693.6 million of assets at December 31, 2014. As a result of the concerted efforts of the management team, the Corporation has solidified its focus on loan growth. During 2015, our loan portfolio increased $49.9 million, representing a 10.7% rate of growth. Earlier in 2015, in order to manage the growth in assets while still assisting in the funding of the loan growth, the Corporation identified and sold approximately $26.8 million of availableforsale securities with high price volatility. Further in 2015, we announced the completion of our $16.6 million private placement of subordinated notes to certain qualified institutional buyers and institutional accredited investors. The Company used the proceeds from the placement of the subordinated notes to redeem the $15.0 million of Series B preferred stock issued to the United States Treasury in connection with its participation in the Small Business Lending Fund (SBLF) and for general corporate purposes. The repayment of the SBLF preferred stock prior to the increase in the dividend rate to 9% and the replacement of such with new qualifying capital that is a lower rate, taxdeductible instrument, made the overall transaction very attractive. Since the beginning, we knew we had something special and unique. It’s remarkable to think about where we came from, how we are positioned for future success, and all the customers and associates who have been with us since we first opened our doors for business on September 28, 1985. OPERATING HIGHLIGHTS The Bank continues to cultivate our commercial loan portfolio and position ourselves for future progress with the addition of three new Commercial Lending Officers who specialize in business development, risk and portfolio management along with financial analysis competencies. Additionally, the Bank hired William S. Clement, Senior Vice President, Chief Lending Officer, and James H. Shields, Senior Vice President, Chief Credit Officer, to bring their expertise and experience to our Bank with regard to market knowledge, loan portfolio management and credit quality assessment. With our enhanced lending team, personalized handson approach and localized decision making, our business solutions provide peace of mind.

Moreover, in 2015, we introduced our new Small Business Lending Program as a solution for shortterm credit needs for business loans with balances of $250,000 or less, with competitive pricing. Whether it is a line of credit or a term loan, we streamlined the process to allow for expedited turnaround. We want our customers to focus on what’s important to them, and that’s running their business. We remain an active residential mortgage lender offering highly competitive rates and terms on a variety of mortgage solutions. The Bank’s ongoing goal is to enhance our lending and credit processes while continually improving our efficiencies and swiftness in servicing our clients’ needs. Deposit balances totaled $604.8 million at December 31, 2015, compared to $556.5 million for the prior year. The Corporation continues to evaluate operational efficiencies seeking the best use of branch personnel to meet the changing needs of our customer base and to deliver the utmost in customer service. TECHNOLOGY The Bank recently announced our official expansion further into the Apple experience with the launch of our new Atlantic Stewardship Bank Apple Watch App. We released our ASB Apple Watch App during the month of November, which is paired through the customers’ iPhone and configured through their ASB Online Banking Service. Our new app will allow customers to quickly check the balances of their various accounts and find the locations of our ATMs and branches. We are committed to meeting the needs of our customers, and as such, we will continue to provide the latest in hightech services for their ease and accessibility. BRAND MANAGEMENT In 2015, we initiated a branding study to identify our existing brand equity. Our goal was to determine the unique personality that “connects” our Bank with our customers. This marketing strategy will help us strengthen our brand positioning as well as allow us to deliver more consistent and powerful marketing messages at all of our touchpoints. We plan to integrate our study results and incorporate our evolving brand essence in all our future communications. Furthermore, during 2016, we intend to launch our new Bank positioning theme line, which will encompass our company DNA and reinforce our brand value. In October, we officially announced our participation in social media to increase our brand awareness, strengthen our emotional connection and trust with customers, and to drive increased activity to our website. Whether it is Facebook, YouTube or LinkedIn, our Bank is embracing social channels. We want to connect with customers in real time, gain customer feedback and appeal to all generations. Our corporate Facebook page is serving as an added link with customers and the communities we serve. We are posting pictures and having conversations regarding topics such as our tithe donations, involvement in the community and local schools, branch celebrations, and educating customers on what differentiates us from the competition. The Bank is continuing to find new ways to evolve and redefine the way we communicate with our customers and prospects.

COMMUNITY COMMITMENT Our Tithing Program remains a constant source of assistance for Christian and local nonprofit organizations and civic groups in the areas we serve. These organizations, such as local food pantries, Christian missions, schools and healthcare facilities, value our tithe donations that help support their operations. Since the program’s inception in 1987, over $8.6 million has been shared with hundreds of worthy groups. Each day, we see or hear about the positive impact that these fine organizations have had in far corners of the world and in our communities. We feel honored and truly blessed to be able to contribute to their good works with our financial assistance and to be able to continue the tradition of the founders of the Bank. CLOSING SENTIMENTS The banking industry has gone through some dramatic transformations over the years, and this has changed the scope of how we conduct our business today. There are a lot of good things happening, and we are blessed to have a supportive Board, knowledgeable staff and the expertise to strategically shift to remain ahead of the curve. We want to personally thank everyone for their dedication and commitment, and we are excited for the next 30 years and beyond. We are grateful to our shareholders, associates and, most of all, our loyal customers for their continued support and confidence in Stewardship Financial Corporation and Atlantic Stewardship Bank. “And now, our God, we give thanks to you and praise your glorious name.” — 1 Chronicles 29:13 With this in mind, we thank our Lord for allowing the Corporation and the Bank to continue to thrive. We rejoice in our 30year anniversary celebration and will continue to serve the needs of our customers and community. President and Chief Financial Officer

BUSINESS DEVELOPMENT BOARDS BERGEN William F. Gilsenan, Jr. Chairman Steven Barlotta, CPA J.T. Bolger Linda A. Brock William Cook Frederic Farcy William Haggerty, CPA Christopher Heck Eric Koch, CPA Bartel Leegwater Celine November, Esq. Donald W. Reeder, Esq. Kevin Sincavage John C. Stanley Jeffrey R. Van Inwegen, M.D. MORRIS Joseph Pellegrino Chairman Benjamin Burton Anthony Corbo, Jr. Joseph Daughtry Christopher Kelly Kenneth Vander May Abe Van Wingerden Anita Van Wingerden Michael Wolansky, CPA PASSAIC Mary Forshay Chairwoman Patrick Anderson, CPA, Esq. Ben Della Cerra Robert Fylstra, CPA Paul D. Heerema Douglas Hoogerhyde, CPA Donald G. Matthews, Esq. Thomas Mizzone, Jr., CPA William A. Mohaghan III, Esq. Mary Postma George Schaaf Darryl Siss, Esq. Charles Verhoog Ralph Wiegers BRANCH LOCATIONS AND ASSOCIATES Headquarters — Midland Park 630 Godwin Avenue Raymond J. Santhouse Branch Manager, Vice President & Regional Manager Hawthorne 386 Lafayette Avenue & 1111Goffle Road Douglas Olsen Branch Manager, Vice President & Regional Manager Montville 2 Changebridge Road Richard Densel Branch Manager & Assistant Vice President North Haledon 33 Sicomac Road Grace Lobbregt Branch Manager & Assistant Vice President Pequannock 249 Newark Pompton Turnpike Louise Rohner Branch Manager & Assistant Vice President Ridgewood 190 Franklin Avenue Paul J. Pellegrine Branch Manager & Assistant Vice President Waldwick 64 Franklin Turnpike Franca Iacovo Branch Manager & Assistant Vice President Wayne Hills 87 Berdan Avenue John Lindemulder Branch Manager & Vice President Wayne Valley 311 Valley Road Alejandro Urquico Branch Manager & Assistant Secretary Westwood 200 Kinderkamack Road Laurie Mahoney Branch Manager & Assistant Vice President Wyckoff 378 Franklin Avenue Karen Mullane Branch Manager & Assistant Vice President 630 Godwin Avenue, Midland Park, NJ 07432 2014447100 | 877844BANK www.asbnow.com