Washington, D.C. 20549

TABLE OF CONTENTS

CNI Charter Funds Annual Report

| 2 | Letter to Our Shareholders |

| 4 | Money Market Funds Investment Adviser's Report |

| 6 | Fixed Income Funds Investment Adviser's Report |

| 8 | Fixed Income Funds Overview |

| 12 | Equity and Blended Funds Investment Adviser's Report |

| 14 | Equity and Blended Funds Overview |

| 18 | CCMA Funds Investment Adviser's Report |

| 22 | CCMA Funds Overview |

| 26 | Schedule of Investments |

| 78 | Statements of Assets and Liabilities |

| 82 | Statements of Operations |

| 86 | Statements of Changes in Net Assets |

| 92 | Financial Highlights |

| 96 | Notes to Financial Statements |

| 106 | Report of Independent Registered Public Accounting Firm |

| 108 | Trustees and Officers |

| 111 | Notice to Shareholders |

| 112 | Disclosure of Fund Expenses |

| 114 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q is also available on the Funds’ website at www.cnicharterfunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.cnicharterfunds.com, and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

CNI CHARTER FUNDS | PAGE 1

| letter to our shareholders |

|

This annual report covers CNI Charter Funds (the “Trust”) for the fiscal year ending September 30, 2010. On the following pages, you will find the specific details of each Fund’s portfolio and investment performance.

The U.S. economy continues to grind slowly ahead. Private payrolls have increased for nine consecutive months and household consumption has grown. Residential real estate, which appears finally to have hit bottom after a five-year bear market, is progressing at a rate much slower than has been found in past recoveries. This recession and recovery, like many caused by financial crises, is more severe and longer lasting, ultimately leading to a protracted economic recovery process. Simply put, it takes a long time to repair financial damage. Restoring the balance sheets of households and businesses does not happen quickly.

The stage is now set for an expansion. Interest rates are at, or near, record lows. Corporations are chock full of cash and ready to move ahead. Households and small businesses seem to be waiting to get a higher degree of confidence before they move ahead. Economic recoveries are never a linear move upward and there are generally fits and starts along the way. This recovery is no different — the reality is that although the U.S. economy is getting better, the pace of improvement is likely to remain slow for some time.

Within this economic framework, the underlying investment philosophy of the Trust’s two affiliated advisors - City National Asset Management, Inc. (“CNAM”) and CCM Advisors, LLC (“CCMA”) - is to pursue the long-term goals and objectives specified for each of the Funds. With an active yet disciplined style, each Fund is managed with the goal of achieving competitive rates of return consistent with its respective, prescribed risk parameters. The Trust follows a disciplined investment process that begins with a thorough assessment of the macroeconomic environment and the financial markets. Our broad based research process takes advantage of the most advanced investment technology, fundamental valuation, and quantitative tools to determine the most attractive sectors and securities within each Fund’s area o f concentration. The final step is to construct and continuously monitor precise portfolios that meet the objectives of the specific Funds, without being swayed by short term trends and fads. This approach, which extends to sub-advisors managing assets in selected portfolios, continued to serve shareholders well during the ongoing market uncertainty for the fiscal year ending September 30, 2010.

CNI CHARTER FUND HIGHLIGHTS

As of September 30, 2010, the Trust offers fifteen portfolios across the U.S. Equity, U.S. Fixed Income and Short Term Investment asset classes to provide solutions to a variety of shareholder investment needs. During the year, funds advised by CCMA, an affiliate of CNAM and City National Bank, were re-branded as part of the Trust to reflect our desire to expand the array of investment options offered to all shareholders. This annual report incorporates all portfolios within the Trust managed by CNAM and CCMA.

The Funds and the advisers to the Funds remain fully committed to placing the needs of shareholders first. One demonstration of our commitment to maintain competitively positioned funds is the continuing voluntary waiver of investment advisory and other fees on our Money Market Funds so that shareholder return could remain positive in a near zero short term interest rate environment of the past year.

By adhering to our basic investment discipline and maintaining the appropriate amount of risk control in the various portfolios, the Funds continued to provide returns that are competitive in their respective investment arenas. Those returns relative to respective benchmarks and peer groups are provided in each of the accompanying commentaries on the CNAM advised money market, fixed income and equity portfolios and on the CCMA advised portfolios.

CNI CHARTER FUNDS | PAGE 2

Please read the following pages carefully as they contain important information on the assets and financial condition of the Funds. If you have any questions about this report or CNI Charter Funds, please call your investment professional or (888) 889-0799.

Thank you for choosing CNI Charter Funds.

Sincerely,

Richard S. Gershen

President

CNI Charter Funds

Past performance is no guarantee of future results. Certain shareholders may be subject to the Alternative Minimum Tax (AMT). Federal income tax rules apply to any capital gain distributions.

Fund expenses have been waived during the period on which the performance is based. Without waivers, performance would be lower.

This information must be preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing.

CNI CHARTER FUNDS | PAGE 3

| investment adviser’s report |

|

| Money Market Funds |

The past 12 months have been a period of continued improvement and relative calm for the credit markets. Short term markets improved with each passing month as efforts by central banks took hold and eventually expired. In fact, many of the Federal Reserve (the “Fed”) programs designed to support liquidity in the money markets, such as the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), Commercial Paper Funding Facility (CPFF), Primary Dealer Credit Facility (PDCP) and Term Securities Lending Facility (TSLF), expired on February 1, 2010, with little fanfare or noticeable effect.

In response to the market turbulence of 2008-2009 the Securities and Exchange Commission (SEC) approved amendments to Rule 2a-7, the section of the Investment Company Act of 1940 that governs the operations of money market funds. The rule changes were designed with the purpose of better protecting investors and making money market funds more resilient and able to withstand market stresses similar to those of 2008. The changes that took effect in May and June of 2010 seek to shorten the maximum weighted-average maturity of money market funds, restrict the maximum exposure to “second tier” and illiquid securities, require funds to design and implement periodic stress tests of their funds, and require enhanced disclosure of portfolio holdings. We support these changes and feel they will allow greater protections for investors.

As of this writing, the effective Fed Funds target rate has remained at 0.00% to 0.25% since late 2008. With most money market instrument yields based on the Fed Funds rate, this has put downward pressure on yields for the underlying securities found in money market funds. In fact, much of 2010 has been marked by historically low yields with many funds yielding at or near 0.0%. As a result of this ultra-low yield environment, money market fund assets have declined close to 17% over the past 12 months according to iMoneyNet.

FUND COMMENTARY

| | • | The Prime Money Market Fund continued to emphasize high quality liquid issuers as a way to garner yield while keeping an emphasis on risk management. With our strategy focusing primarily on the highest quality and liquid issuers, the Fund performed very well during this period. The fund continues to keep the average life around 40 days in order to maintain higher yielding holdings in this very low interest rate environment. Until we get evidence of sustained economic growth, we will maintain our 40-50 day average life. |

| | • | The Government Money Market Fund was positioned well for changes in Fed policy and the lower economic growth environment. We maintained our maturity profile of over 45 days average life in the Fund in order to benefit from higher yielding holdings in the face of continued low interest rates projected for early 2011. |

| | • | Our objective for the California Tax Exempt Money Market Fund continues to focus on the fundamental objective of principal preservation and liquidity. With the yield curve for allowable tax-free money market fund assets essentially flat we have kept the average life of the portfolio short at 20 days. Additionally, we continue to watch the state of California very closely as the economic crisis continues to put pressure on the state and local issuers. We continue to avoid direct issues of California General Obligations due to the uncertainty in its ratings and budgetary imbalances. |

STRATEGIC OUTLOOK

On November 3, 2010 the Fed announced measures that will continue to support low interest rates for an “extended period” of time. Given the slow pace of economic recovery and continuing high unemployment, it appears that the Federal Reserve Open Market Committee (“FOMC”) will not begin to increase interest rates until late 2011. We consider our Money Market Funds to be appropriately positioned for the low rate and

CNI CHARTER FUNDS | PAGE 4

slow economic growth environment that is expected. As always, City National Asset Management, Inc. continues to monitor the objectives of the Funds very closely and seek opportunities in the markets to best serve our shareholders.

Sincerely,

Gregory Kaplan | William Miller |

| | |

Paul Single | |

Directors of Fixed Income Investments

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 5

| investment adviser’s report |

|

| Fixed Income Funds |

The overall pace of the economic recovery remains sedated relative to past recoveries. This fact is most evident in the labor markets. Aggressive actions of fiscal stimulus by the federal government and assertive easing of monetary policy by the Federal Reserve Bank (the “Fed”) appear to have shortened the recession from what it could have been. Nevertheless, neither action has been enough to spur a robust expansion. It seems as if the economy is in an awkward stage between a full recession and a strong recovery.

Even more apparent is that the economy is in a liquidity trap; consumer interest rates are at record lows, yet demand for loans remains low. While fiscal stimulus is the most effective tool for boosting economic growth, current changes in Washington appear to negate this opportunity. Consequently, the Fed is the only game in town. As the leader of this recovery, the Fed brought overnight rates down to near zero back in December 2008. In the fall of 2010, they entered a second stage of quantitative easing, with the strategy of buying securities to lower intermediate and longer-term interest rates. This should, in effect, lower interest rates on consumer loans and mortgages, further discouraging personal savings.

Against this backdrop, the share price of bond funds has been moving up in response to the lower interest rate environment yet, at the same time, the dividend yield has been moving down in response to the lower market yields. In the taxable bond market, Treasury rates continued their march downward as demand for the perceived safety of treasury securities remained high and inflation expectations continued to drop. The yield on corporate bonds fell for those same fundamental reasons and perceived credit quality improved along with a recovering economy.

However, the story was a bit different in the municipal bond market where many issuers have grappled with declining revenues and associated budgetary challenges. There have been a few relatively small, yet well covered, actual or near defaults that have kept the broader municipal market on edge. Most notable among these have been Jefferson County Alabama, Vallejo California and Harrisburg Pennsylvania. A well-diversified portfolio, emphasis on the highest quality sectors and a stringent review of potential credit issues remains a strong focus for City National Asset Management, Inc.

All returns listed below relate to the 12-month period ending September 30, 2010 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

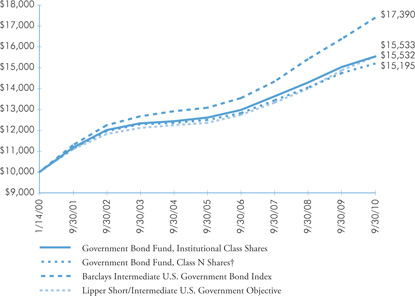

GOVERNMENT BOND FUND

The Government Bond Fund (the “Fund”) produced a total return of 3.37% while the Barclays Capital Intermediate U.S. Government Bond Index returned 6.19%. The Fund trailed the benchmark due to our underweight in U.S. Treasury securities. We maintain our slightly shorter maturity stance versus the benchmark in order to keep liquidity higher than normal to support shareholder activity. The Fund also trailed its peer group during this period as evidenced by the Lipper Short Intermediate U.S. Government Objective return of 4.44%.

CORPORATE BOND FUND

The Corporate Bond Fund (the “Fund”) produced a total return of 6.50% while the Barclays Capital Intermediate U.S. Corporate Index returned 11.55%. The Fund maintained a cautious stance in the face of elevated unemployment and uncertain economic conditions. Our underweight in lower quality (BBB) issues led to a lower than benchmark return. However, opportunistic trades in finance issuers and increased allocation to lower quality issues resulted in performance closer to peer funds as shown by the Lipper Short Intermediate Investment Grade Objective return of 7.64%.

CALIFORNIA TAX-EXEMPT BOND FUND

The California Tax Exempt Bond Fund (the “Fund”) produced a total return of 4.34% while the Barclays Capital CA Intermediate-Short Municipal Bond Index returned 5.20%. The past fiscal year returns were very close to historical averages as municipals continued

CNI CHARTER FUNDS | PAGE 6

migrating back to the norm after the credit crisis. Absolute performance was strong – but lagged behind the Barclays index primarily because the Fund had a far smaller concentration in California State General Obligation issues. The Fund fared significantly better against its peer group, the Lipper California Short/Intermediate Municipal Fund Objective, which returned 3.32%. This is due to the Fund having a longer duration by design to capture gains as weak economic performance and technical market factors related to the Build America Bond program led to falling tax-exempt yields.

HIGH YIELD BOND FUND

The High Yield Bond Fund’s (the “Fund”) total return was 20.17%. This compares favorably to the Citigroup High Yield Market Capped Index return of 16.98% (the “Market Cap” refers to the fact that no one security can comprise more than 2% of the index) and Lipper’s High Current Yield Bond Fund Objective return of 16.59%. An important strategy of the Fund is that it seeks to buy high yield bonds that are at the upper credit quality end of the below investment grade spectrum. This is a key risk control measure and is designed to avoid defaults in this higher risk sector of the corporate bond market. Fund investors were rewarded this year for this approach as none of the bonds held by the Fund went into default. Also aiding performance was the decision to allocate about 25% of the Fund to senior secured bon ds with a first call on the underlying company’s assets, as this type of security has outpaced the index. Exposure to Industrial bonds in sectors benefitting from economic recovery, including Finance, Technology and Telecommunications, contributed to the Fund’s outperformance. This was countered by underweighting three groups that did well in this fiscal period: Chemicals, Transportation and Manufacturing, reflective of the Fund sub-advisor’s macroeconomic forecast that the recovery will be gradual in 2011.

The following pages provide an overview of each of the Fixed Income Funds managed by City National Asset Management, Inc. Please visit cnicharterfunds.com for the most current returns.

Sincerely,

Gregory Kaplan | William Miller |

| | |

Paul Single | |

Directors of Fixed Income Investments

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 7

| fund overview |

|

| Corporate Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing in a diversified portfolio of investment grade fixed income securities, primarily corporate bonds issued by domestic and international companies denominated in U.S. dollars.

Comparison of Change in the Value of a $10,000 Investment in the Corporate Bond Fund, Institutional Class or Class N Shares, versus the Barclays Intermediate U.S. Corporate Index, and the Lipper Short/Intermediate Investment Grade Debt Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Ally Financial, FDIC Insured | |

| 2.200%, 12/19/12 | 4.4 |

| Wachovia Bank | |

| 4.800%, 11/01/14 | 3.3 |

| Kingdom of Denmark | |

| 2.750%, 11/15/11 | 2.9 |

| Caisse Centrale Desjardins du Quebec | |

| 2.650%, 09/16/15 | 2.8 |

| General Electric Capital, FDIC Insured, MTN |

| 2.625%, 12/28/12 | 2.7 |

| Citigroup Funding, FDIC Insured | |

| 2.250%, 12/10/12 | 2.4 |

| JPMorgan Chase, FDIC Insured | |

| 2.125%, 12/26/12 | 2.4 |

| ConocoPhillips Canada Funding I | |

| 5.625%, 10/15/16 | 2.2 |

| General Electric Capital, Ser A, MTN | |

| 6.000%, 06/15/12 | 2.1 |

| Wells Fargo, FDIC Insured | |

| 3.000%, 12/09/11 | 2.1 |

CNI CHARTER FUNDS | PAGE 8

| fund overview |

|

| Government Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing primarily in U.S. government securities either issued or guaranteed by the U.S. government or its agencies or instrumentalities.

Comparison of Change in the Value of a $10,000 Investment in the Government Bond Fund, Institutional Class or Class N Shares, versus the Barclays Intermediate U.S. Government Bond Index, and the Lipper Short/Intermediate U.S. Government Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Israel Government AID Bond | |

| 3.815%, 05/15/20 | 7.2 |

| FHLB | |

| 4.805%, 08/20/15 | 7.2 |

| FNMA | |

| 2.500%, 06/10/11 | 6.3 |

| FNMA | |

| 3.000%, 07/28/14 | 5.9 |

| FNMA REMIC, Ser 2006-R009, Cl AJ | |

| 5.750%, 12/15/18 | 5.7 |

| FHLMC REMIC, Ser 2007-R011, Cl AB | |

| 5.500%, 12/15/20 | 5.3 |

| FNMA | |

| 4.625%, 05/01/13 | 4.8 |

| FHLB | |

| 3.250%, 09/12/14 | 4.8 |

| FHLMC, MTN | |

| 1.250%, 03/23/11 | 4.4 |

| FNMA | |

| 2.000%, 09/30/15 | 4.4 |

CNI CHARTER FUNDS | PAGE 9

| fund overview |

|

| California Tax Exempt Bond Fund |

The Fund seeks to provide current income exempt from Federal and California state income tax (as the primary component of a total return strategy) by investing primarily in California municipal bonds and notes.

Comparison of Change in the Value of a $10,000 Investment in the California Tax Exempt Bond Fund, Institutional Class or Class N Shares, versus the Barclays CA Intermediate-Short Municipal Index, and the Lipper CA Short/Intermediate Municipal Debt Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Orange County, Public Financing Authority, |

| RB, NATL-RE | |

| 5.000%, 07/01/17 | 2.7 |

| Los Angeles, Department of Water & Power, |

| Sub-Ser A-2, RB, AGM | |

| Callable 07/01/15 @ 100 | |

| 5.000%, 07/01/25 | 2.5 |

| Golden State, Tobacco Settlement, | |

| Ser A-1, RB | |

| Pre-Funded @ 100 | |

| 6.750%, 06/01/13 | 2.5 |

| Los Angeles County, Public Works Financing Authority, | |

| SAB, AGM | |

| 5.250%, 10/01/18 | 2.1 |

| California State, Economic Recovery Authority, |

| Ser A, GO, NATL-RE | |

| Callable 07/01/14 @ 100 | |

| 5.000%, 07/01/15 | 2.1 |

| Sacramento, Municipal Utility District, | |

| Ser T, RB, NATL-RE FGIC | |

| Callable 05/15/14 @ 100 | |

| 5.250%, 05/15/22 | 2.0 |

| Gilroy, Unified School District, | |

| GO, NATL-RE FGIC | |

| Callable 08/01/13 @ 100 | |

| 5.250%, 08/01/19 | 2.0 |

| California State, Department of Water Resources, |

| Power Supply Project, Ser H, RB, AGM |

| Callable 05/01/18 @ 100 | |

| 5.000%, 05/01/21 | 2.0 |

| Los Angeles, Wastewater Systems Authority, |

| Ser A, RB | |

| 5.000%, 06/01/14 | 2.0 |

| San Jose, Redevelopment Authority, | |

| Ser A, TA, NATL-RE | |

| Callable 08/01/15 @ 100 | |

| 5.000%, 08/01/17 | 2.0 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 10

| fund overview |

|

| High Yield Bond Fund |

The Fund seeks to maximize total return by investing primarily in fixed income securities rated below investment grade including corporate bonds and debentures, convertible and preferred securities, zero coupon obligations and debt securities that are issued by U.S. and foreign governments and their agencies.

Comparison of Change in the Value of a $10,000 Investment in the High Yield Bond Fund, Institutional Class or Class N Shares, versus the Citigroup High Yield Market Capped Index, and the Lipper High Current Yield Bond Funds Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Ironshore Holdings US | |

| 8.500%, 05/15/20 | 1.4 |

| Spectrum Brands Holdings | |

| 9.500%, 06/15/18 | 1.3 |

| Telcordia Technologies | |

| 11.000%, 05/01/18 | 1.3 |

| River Rock Entertainment Authority | |

| 9.750%, 11/01/11 | 1.3 |

| GXS Worldwide | |

| 9.750%, 06/15/15 | 1.2 |

| Nuveen Investments | |

| 10.500%, 11/15/15 | 1.2 |

| CPG International I | |

| 10.500%, 07/01/13 | 1.2 |

| Intcomex | |

| 13.250%, 12/15/14 | 1.1 |

| Aspect Software | |

| 10.625%, 05/15/17 | 1.1 |

| BioScrip | |

| 10.250%, 10/01/15 | 1.1 |

CNI CHARTER FUNDS | PAGE 11

| investment adviser’s report |

|

| Equity and Blended Funds |

In the fiscal year ending September 30, 2010, the U.S. equity market as measured by the S&P 500 Index was fairly volatile. The first six months of the fiscal year saw an 11.8% return as the economy continued to improve from the worst recession since World War II. Then for the next three months, the market was down 11.4%. The gains from the first six months were wiped out by this decline and the sustainability of the stock market’s rise upward was called into question.

The decline was brought on by the sovereign debt issues faced by several Southern European countries (Portugul, Spain, Greece, Italy) and Ireland who had borrowed much more than their economies could handle during a recessionary event. As these countries encountered the most recent worldwide recession, the bond markets questioned their ability to repay their obligations. This caused all riskier assets to start to decline in value as investors sought safety. The desire for “safe” investments also drove investors to reduce their exposure in equities worldwide, including the United States.

To stem the decline in the worldwide markets, many Northern European countries (primarily Germany) and the rest of the world put forth a program to help the leveraged countries roll over their debt for the next three years while working through their problems. While we are not convinced that this solves the problem, it does remove it from the current investment equation and the markets were able to focus on the rest of the world economies that are doing better (including the United States). Therefore, the last quarter of the fiscal year was quite positive with a return of 11.3% as measured by the S&P 500 Index.

Looking forward, the Federal Reserve has started its latest phase of monetary policy (dubbed quantitative easing 2 or QE2) that is designed to help increase inflation to an acceptable level and also increase the monetary turnover in the economy which will hopefully continue to push growth upward. Although the long term effects of this policy are murky, we believe that this policy will be positive over the near term for growth assets and we continue to invest accordingly.

All returns listed below relate to the 12-month period ending September 30, 2010 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

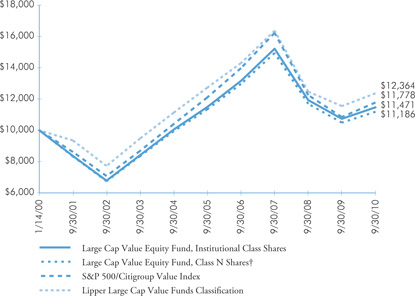

LARGE CAP VALUE EQUITY FUND

The Large Cap Value Equity Fund (the “Fund”) gained 6.85%, which lagged the S&P500/Citigroup Value Index return of 8.54% and the Lipper Large Cap Value Funds Classification return of 7.57%. The Fund did well by owning stocks that were out of favor and trading at attractive valuations. This was particularly true for the Industrial and Consumer sectors, where our stocks did better than those in the index. However, there were stocks in the Staples, Utilities and Financial sectors that did better than those we owned. Several of these were marginal players that after stumbling very near the precipice unexpectedly sprang back to their feet. The Fund did not own many of these lower quality players, and as such the benefit to our more conservative holdings was muted.

The Fund had some notable successes and a few disappointments during the year. Verizon Wireless, the largest U.S. mobile phone company, is expected to start selling Apple’s iPhone in January 2011 and this news propelled the stock to a 22.9% gain. The rails also did well during the year with both CSX Corp. and Union Pacific showing better than expected earnings strength and a vote of confidence from Warren Buffett (who acquired Burlington Northern), returning 34.7% and 42.7% respectively. These gains were partially offset by losses in the Financial sector. Earnings disappointments from Bank of America (down 22.4%) early in the year had a greater impact than the earnings recovery later in the year. Goldman Sachs (down 20.8%) succumbed to pressure on news of SEC action for their actions in the Collateralized Debt Obligation (“CDO ”) market.

These are interesting and volatile times that require a disciplined investment process. We continue to believe that buying good companies at reasonable prices will enable the Fund to extend its long-term track record of outperformance.

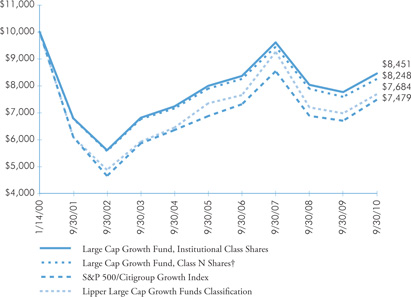

LARGE CAP GROWTH EQUITY FUND

The Large Cap Growth Equity Fund (the “Fund) gained 8.89% compared to 11.67% for the S&P 500 Growth Index and 10.14% for the Lipper Large-Cap Growth Fund Classification.

CNI CHARTER FUNDS | PAGE 12

A majority of the underperformance in the Fund was due to our conservative stance over the last 12 months as many of the best performing stocks over this period were the lower quality, riskier types of companies. These companies were closer to bankruptcy in the bad times but as the economy started to recover, investors were looking to take on more risk and these companies benefitted the most. We believe the higher quality companies with good earnings growth that we continue to invest in will perform better going forward as the world’s growth appears to be slowing to a more modest pace.

We had some winners and losers that are worth mentioning. On the positive side, the Fund had significant exposure to Apple (returning 53.1% for the year), Oracle (30.0%), Caterpillar (57.6%) and Cognizant Technology (66.8%). All four of these companies were technology or industrial related companies, which were two of the best performing sectors of the last 12 months.

Conversely, some of the Fund’s larger underperforming stock positions were Goldman Sachs (-20.8%), Gilead Sciences (-23.4%), Microsoft (-2.9%) and Hewlett Packard (-10.3%). Each of these companies was down for company specific reasons and we continue to have an optimistic outlook for Gilead and Microsoft. We have sold Goldman Sachs and have reduced our exposure to HP. Looking forward, we are very optimistic in our outlook, especially in select technology names including Apple, which is now the largest holding in the Fund. We have spent a great deal of time focusing on getting “more growth for less” by buying stock in companies with great earnings growth for lower prices, which should provide for positive incremental performance in the future.

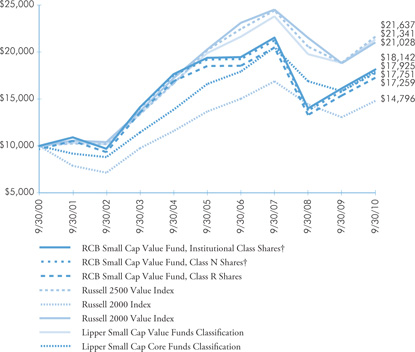

RCB SMALL CAP VALUE FUND

The RCB Small Cap Value Fund (the “Fund”) returned 12.51% compared to the Russell 2000 Value Index return of 11.84% and the core Russell 2000 Index of 13.35%. While the Fund’s sub-advisor, Reed Conner & Birdwell LLC, follows a value style of investing, they are careful not to overweight the Fund’s holdings in the Financial sector (which comprises approximately 40% of the Russell 2000 Value Index). Therefore, the Fund is weighted along the core guidelines of the Russell 2000 Index for better diversification. This proved to be prudent as the holdings in the Financial sector were the weakest in the Fund, as they were in the market generally. The largest contributor to the Fund’s performance came from the Consumer Discretionary sector, especially in the latter half of the fiscal year when holdings in media an d retail components of this sector led the group. In line with the Fund’s sector weightings, Lipper Analytics compares this Fund to its Small Cap Core Funds Classification, which returned 13.2% for the fiscal year.

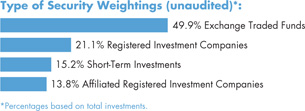

MULTI-ASSET FUND

The Multi-Asset Fund (the “Fund”) returned 7.15% compared to the Lipper Flexible Portfolio Funds Objective return of 9.55%. The Fund returns were positively affected by an increasing exposure to international fixed income, particularly emerging markets. The Fund’s fixed income allocation increased substantially, as positions in high yield and international bonds were initiated. Over the course of the year, the Fund transitioned its equity exposure from a value to a growth tilt. The allocations to small and mid cap equities were also increased at the expense of large cap equities. Domestic real estate investment trusts (REITs) were added to the Fund but subsequently sold for a significant gain. As a result of investments made during the year, the Fund ended the fiscal year with a reduced cash position.

The following pages provide an overview of each of the Equity and Blended Funds managed by City National Asset Management, Inc. Please visit cnicharterfunds.com for the most current returns.

Sincerely,

Oliver Campbell | Otis “Tres” Heald |

Directors of Equity Investments

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 13

| fund overview |

|

| Large Cap Value Equity Fund |

The Fund seeks to provide capital appreciation and moderate income consistent with current returns available in the marketplace by investing in large U.S. corporations and U.S. dollar denominated American Depositary Receipts of large foreign corporations which are undervalued.

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Value Equity Fund, Institutional Class or Class N Shares, versus the S&P 500/Citigroup Value Index, and the Lipper Large Cap Value Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| JPMorgan Chase | 3.0 |

| Chevron | 3.0 |

| Exxon Mobil | 2.7 |

| Wells Fargo | 2.3 |

| Wal-Mart Stores | 2.2 |

| Verizon Communications | 2.1 |

| AT&T | 2.1 |

| Bank of America | 2.0 |

| Procter & Gamble | 2.0 |

| ConocoPhillips | 1.7 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 14

| fund overview |

|

| Large Cap Growth Equity Fund |

The Fund seeks to provide capital appreciation by investing in large U.S. corporations and U.S. dollar denominated American Depositary Receipts of large foreign corporations with the potential for growth.

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Growth Equity Fund, Institutional Class or Class N Shares, versus the S&P 500/Citigroup Growth Index, and the Lipper Large Cap Growth Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on March 28, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to March 28, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Apple | 4.7 |

| Microsoft | 3.6 |

| IBM | 3.4 |

| Exxon Mobil | 3.0 |

| Oracle | 2.8 |

| Qualcomm | 2.0 |

| CVS | 2.0 |

| AT&T | 1.9 |

| Illinois Tool Works | 1.8 |

| Schlumberger | 1.7 |

CNI CHARTER FUNDS | PAGE 15

| fund overview |

|

| RCB Small Cap Value Fund |

The Fund seeks to provide capital appreciation by investing primarily in smaller U.S. corporations which are considered undervalued.

Comparison of Change in the Value of a $10,000 Investment in the RCB Small Cap Value Fund, Institutional Class, Class N Shares, or Class R Shares, versus the Russell 2500 Value Index, the Russell 2000 Index, the Russell 2000 Value Index, the Lipper Small Cap Value Funds Classification, and the Lipper Small Cap Core Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

Institutional Class (1)^† | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on October 3, 2001. |

| (2) | The Fund’s predecessor commenced operations on September 30, 1998, and reorganized into Class R shares of the Fund on October 1, 2001. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | The performance of the Institutional Class and Class N Shares for October 1, 2001, and October 2, 2001, reflects the performance of the Fund’s Class R shares. The performance of all share classes for the period prior to October 1, 2001, reflects the performance of the Class R Shares of a predecessor mutual fund, which commenced operations on September 30, 1998, and reorganized into the Fund’s Class R Shares on October 1, 2001. The performance of the predecessor fund’s Class R Shares has not been adjusted to reflect the expenses applicable to Institutional and Class N Shares. If performance of the predecessor fund’s Class R Shares had been adjusted, the performance of the Institutional Class and Class N Shares would have been higher because the expenses of the predecessor fund’s Class R Shares are higher than those of the Fund's Institutional Class and Class N Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| White Mountains Insurance Group | 6.3 |

| Chimera Investment | 5.3 |

| Central Garden & Pet, Cl A | 5.1 |

| Wendy's/Arby's Group, Cl A | 4.7 |

| Global Cash Access Holdings | 4.4 |

| Teleflex | 4.1 |

| PerkinElmer | 4.1 |

| Ralcorp Holdings | 4.1 |

| Alleghany | 4.1 |

| Symetra Financial | 3.8 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 16

| fund overview |

|

| Multi-Asset Fund |

The Fund seeks to generate a positive total return in excess of inflation in a manner consistent with capital preservation in all market environments by investing all or a substantial portion of its assets in other mutual funds or other types of funds like exchange-traded funds.

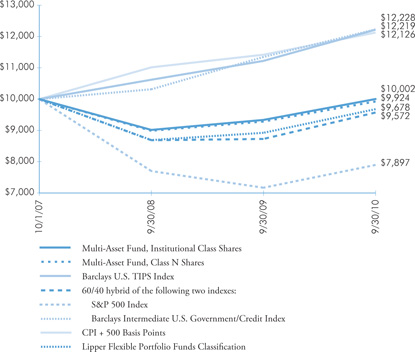

Comparison of Change in the Value of a $10,000 Investment in the Multi-Asset Fund, Institutional Class or Class N Shares, versus the Barclays U.S. TIPS Index; a 60/40 hybrid of the following two indexes: the S&P 500 Index and the Barclays Intermediate U.S. Government/Credit Index; the CPI + 500 Basis Points; and the Lipper Flexible Portfolio Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Commenced operations on October 1, 2007. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| SPDR S&P 500 Fund | 19.6 |

| iShares S&P MidCap 400 Index Fund | 9.2 |

| Oppenheimer International Bond Fund, Class A | 6.8 |

| CNI Corporate Bond Fund, Institutional Class | 6.6 |

| SPDR Barclays Capital High Yield Bond Fund | 6.4 |

| Vanguard Small Cap Value | 6.2 |

| Vanguard Emerging Markets | 6.2 |

| Cohen & Steers International Realty Fund, Inc. | 4.0 |

| PIMCO Emerging Markets Bond Fund, Institutional Class | 3.8 |

| CNI High Yield Bond Fund, Institutional Class | 3.8 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 17

| investment adviser’s report |

|

| CCMA Advised Funds |

This section of the Annual Report will summarize results for the CNI Charter Funds that are advised by CCM Advisors, LLC (“CCMA”). It will cover results for the twelve months ending September 30, 2010.

During the fiscal year CCMA adopted the CNI Charter Funds name as the sole name for its advised funds and discontinued its use of AHA in the funds’ names. CCMA continues to have a close working relationship with the American Hospital Association which helped start these funds. However, since the Funds are available to the general public as part of a larger fund family, we have decided to adopt the CNI Charter name to avoid confusion.

All returns listed below relate to the 12-month period ending September 30, 2010 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

LIMITED MATURITY FIXED INCOME FUND

The Limited Maturity Fixed Income Fund (the “Fund”) follows the multiple portfolio style of combining complementary core + alpha portfolios to blend returns over interest rate and sector cycles. In January of this year the two sub-portfolios were combined under one sub-adviser, City National Asset Management, Inc. (“CNAM”), to take advantage of their expertise to more quickly move along the short term maturity spectrum as economic and interest rate conditions warranted. The sub-advisor actively shifts the duration based on Federal Reserve Bank’s Federal Open Market Committee (“FOMC”) interest rate setting and quantitative monetary easing/tightening policies. The sub-adviser then weights among sectors to allocate among corporate, mortgage and asset-backed securities.

The objectives of this Fund combine preservation of capital, liquidity and maximization of returns only after consideration of low risk qualifications.

The combined portfolios which create this investment grade fund are benchmarked to the BofA/Merrill Lynch (“ML”) 1-3 Year Treasury Index and the ML 3 Month U.S. Treasury Index. During the fiscal year ended September 30, 2010, the FOMC actions kept short term yields near zero, causing the 30-day SEC yield on the ML 3 Month U.S. Treasury Index (“T-Bill”) to move only slightly from the very low 0.12% in September 2009 to 0.16% in September 2010 (see Yield Curve chart below at the 3M (month) maturity plot point). The Fund’s 30-day SEC yield has been substantially higher, at 1.65%, in September 2009 and 1.00%, in September 2010. For income oriented investors, the Fund is currently yielding more than T-Bills and many other short term instruments.

For the fiscal year, the total return of the Fund was 3.28%. The ML 1-3 year Treasury Index had a one year return of 2.53% and the T-Bills’ one year return was 0.13%. Corporate fixed income securities rallied in the first half of this fiscal year as a response to the economic stimulus programs and the ending of the recession. Since the Fund is a diversified blend of corporate, Treasury, agency and mortgage securities, it was able to participate in the rally in corporate and other credit rated fixed income securities with a corporate securities weighting that ranged from 41.2% to 36.2% from beginning to end of the fiscal year. As the Fund is designed to protect shareholder principal the sub-adviser follows conservative investment grade quality guidelines. The Lipper Short-Intermediate Investment Grade Debt Funds Objective universe wa s skewed in favor of corporate bond sector returns during the year, and had an average return of 7.64%. However, since the Lipper universe includes funds that are wholly invested or have a heavy weighting in corporate bonds, many of the funds in the universe are invested outside of the Limited Fund’s diversified, conservative approach.

CNI CHARTER FUNDS | PAGE 18

Yield Curve

Source: Bloomberg, Pertrac

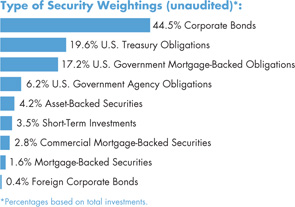

FULL MATURITY FIXED INCOME FUND

The Full Maturity Fixed Income Fund (the “Fund”) combines portfolios of two sub-advisers designed to complement each other in the core + alpha strategy and to provide a “full” maturity spectrum. They are:

| | • | Boyd Watterson Asset Management, the alpha sub-adviser, which manages to the Barclays Capital U.S. Intermediate Government/Credit Index and will aggressively move duration above or below its index by 20%; |

| | • | Baird Advisors, the core sub-adviser, which manages to the Barclays Capital U.S. Aggregate Index, is always duration neutral to its index and seeks to add value by sector selection. |

The Fund began the fiscal year with a longer average maturity of 5.3 years than its primary benchmark, the Barclays Capital Intermediate U.S. Government/Credit Index, 4.5 years, a measure which aided performance in the falling interest rate environment and remains in place at the end of the fiscal year. As the Yield Curve chart (above) shows, rates have continued to shift downwards for intermediate to longer maturities over the course of the year, and remained very low at the shorter maturity end of the time horizon. Bond prices and interest rates have an inverse relationship, so that when interest rates fall, prices rise.

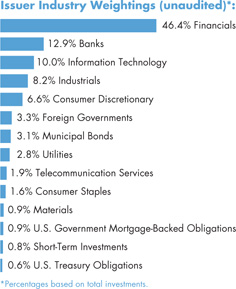

The Fund sub-advisers began the fiscal year with a 39.8% tilt towards corporate bonds and ended the year with a 45.4% position which aided the Fund’s performance. Treasury prices rose in the second half of the fiscal year as a response to the flight from the debt problems of the Economic Monetary Union of the European Union, which originated with Greece, Portugal and several other member states. Purchases of Treasuries and mortgages by the Federal Reserve Bank provided economic support to those sectors, boosting prices of the former and stabilizing the mortgage-backed securities market. The corporate and commercial mortgage-backed security weightings added substantially to the Fund’s returns. The Fund invests in investment grade bonds only and, in an effort to control risk, has sold out of a small weighting of bonds that had b een downgraded during the mortgage crisis. The pie chart below shows the weighting of the two sub-advisers as of September 30, 2010:

Full Maturity Fixed Income Fund

Weightings By Sub-adviser

September 2010

The Fund’s total return was 8.48% for the fiscal year. This was ahead of the Barclays Capital Intermediate US Government/Credit Index return of 7.77% for the same period. The Lipper Corporate A-Rated Debt Funds Objective universe, which includes bond funds that are 100% invested in corporate bonds, returned 9.93%. However, by means of comparison, the Fund follows a diversified investment strategy among sectors and is not allowed to heavily allocate to corporate bonds (or any other sector); the Fund’s current 45.4% weighting in corporate bonds is the highest it has ever been.

CNI CHARTER FUNDS | PAGE 19

| investment adviser’s report |

|

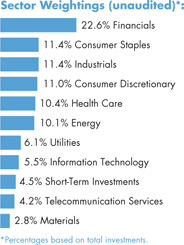

DIVERSIFIED EQUITY FUND

The Diversified Equity Fund (the “Fund”) produced a total return of 6.69%. Lipper Analytics compares this Fund to its Large-Cap Core Funds Classification, which had a total return of 7.93% for the same period. The S&P 500 was up 10.16% for the same period. At the beginning of the fiscal year, this Fund combined four portfolio sub-advisers. In September 2010 we eliminated an equity portfolio manager and divided the Fund among the three remaining sub-advisers. The current sub-advisers and their target weights at the end of the fiscal year are:

| | • | Large cap core value, AMBS Investment Counsel, (37.5% weighting); |

| | • | Alpha large-mid value, SKBA Capital Management (25.0%); and |

| | • | Alpha growth, Turner Investment Partners (37.5%). |

These weightings reflect a gradual increase in growth oriented stocks over the course of the year.

Diversified Equity Fund

Target Weightings By Sub-adviser

September 2010

The best performing sector for the Fund and in the stock market generally this fiscal year was Telecomm Services, which was overweighted in the Fund throughout the year. Materials were up in the market and overweighted in the Fund also, reflecting rising commodity prices as the global recession ended in June 2009. However, below market weights in Consumer Discretionary stocks hurt relative performance. The largest weighting in the Fund throughout the year was Information Technology, which aided performance. Unfortunately, the second largest weighting, Financials, after a strong start a year ago, was the weakest performing sector this year and contributed to the lag in performance versus the index. CCMA realigned the target weightings of the sub-advisers at the beginning of September 2010 as we seek to provide a mix of equity styles best s uited to blend returns with risk control in a volatile market.

SOCIALLY RESPONSIBLE EQUITY FUND

The Socially Responsible Equity Fund (the “Fund”) completed its fifth full fiscal year of performance. The Fund follows pro-green, environmental sustainability, good corporate governance and product and worker safety guidelines for securities researched and selected. It is further designed to meet the social guidelines of faith-based organizations. As a value style fund, investing in large-to mid-capitalization equities, it generally invests in securities which are part of the Russell 1000 Value Index, but there are approximately 200 stocks in the index which are not eligible for inclusion in the Fund due to the socially responsible guidelines. The Fund returned 8.51% for the fiscal year. The Lipper Multi-Cap Value Funds Classification peer group is a value style fit in terms of fundamental economic analysis and large/mid capi talization, but the underlying funds have no social restrictions: it returned 9.34% for the fiscal year. The growth-oriented MSCI KLD 400 Social Index is a stock index constructed using environmental, social and governance factors, and was up 9.33% as growth stocks were up in 2010. Overweights to Healthcare and Financial sector stocks lagged the market. A higher than index allocation to Materials and a near market weight in Industrials aided overall returns.

The Fund’s sub-adviser, SKBA Capital Management, uses its Socially Responsible Value investment style, and incorporates the social guidelines of the U.S. Conference of Catholic Bishops. Proactively, SKBA researches companies that have good environmental sustainability, human rights and governance track records.

CNI CHARTER FUNDS | PAGE 20

Please visit our websites, cnicharterfunds.com and cnicharter-ccma.com, for updates and further background information. We want to thank our shareholders for their confidence in the Funds and express our best wishes for the New Fiscal Year.

Sincerely,

Timothy G. Solberg, CFA

Timothy G. Solberg, CFAChief Investment Officer

CCM Advisors, LLC

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 21

| fund overview |

|

| Limited Maturity Fixed Income Fund |

The Fund seeks to provide a high level of current income, consistent with the preservation of capital and liquidity by investing primarily in fixed income securities either issued or guaranteed by the U.S. Government or its agencies or instrumentalities, money market instruments and non-convertible fixed income securities of U.S. companies.

Comparison of Change in the Value of a $10,000 Investment in the Limited Maturity Fixed Income Fund, Institutional Class Shares and Class N Shares, versus the BofA Merrill Lynch 3-Month U.S. Treasury Index and the BofA Merrill Lynch 1-3 Year U.S. Treasury Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Class I Shares of the predecessor to the Limited Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 22, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 22, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Limited Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 22, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on October 22, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of October 22, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 22, 1988 to October 21, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If i t had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

U.S. Treasury Note

4.250%, 08/15/15 | 8.5 |

FHLMC

4.375%, 07/17/15 | 3.7 |

FHLB

5.750%, 05/15/12 | 2.7 |

FNMA

5.250%, 08/01/12 | 2.7 |

FHLMC

4.750%, 03/05/12 | 2.6 |

FNMA

5.375%, 11/15/11 | 2.6 |

U.S. Treasury Note

2.375%, 09/30/14 | 2.6 |

FHLB

5.375%, 08/19/11 | 2.6 |

FNMA

6.000%, 05/15/11 | 2.6 |

Citigroup Funding

2.250%, 12/10/12 | 2.6 |

CNI CHARTER FUNDS | PAGE 22

| fund overview |

|

| Full Maturity Fixed Income Fund |

The Fund seeks to provide a high level of current income, consistent with the preservation of capital by investing primarily in fixed income securities either issued or guaranteed by the U.S. Government or its agencies or instrumentalities, money market instruments, non-convertible fixed income securities of U.S. companies and U.S. dollar-denominated debt obligations issued by foreign governments and corporations.

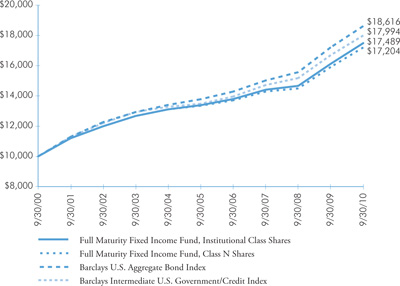

Comparison of Change in the Value of a $10,000 Investment in the Full Maturity Fixed Income Fund, Institutional Class Shares and Class N Shares, versus the Barclays U.S. Aggregate Bond Index and the Barclays Intermediate U.S. Government/Credit Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Class I Shares of the predecessor to the Full Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Full Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on May 11, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of May 11, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to May 11, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

U.S. Treasury Note

2.375%, 03/31/16 | 4.7 |

U.S. Treasury Bond

6.250%, 08/15/23 | 4.4 |

U.S. Treasury Note

1.750%, 07/31/15 | 2.2 |

FNMA

4.625%, 10/15/13 | 2.2 |

U.S. Treasury Bond

5.250%, 11/15/28 | 2.2 |

U.S. Treasury Note

2.375%, 07/31/17 | 1.9 |

FHLB

4.500%, 11/15/12 | 1.8 |

U.S. Treasury Note

4.750%, 05/15/14 | 1.8 |

FNMA, Pool 745418

5.500%, 04/01/36 | 1.7 |

FNMA, Pool 745275

5.000%, 02/01/36 | 1.4 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 23

| fund overview |

|

| Diversified Equity Fund |

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of large-capitalization U.S. companies that are diversified among various industries and market sectors.

Comparison of Change in the Value of a $10,000 Investment in the Diversified Equity Fund, Institutional Class Shares and Class N Shares, versus the S&P 500 Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Class I Shares of the predecessor to the Diversified Equity Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Diversified Equity Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on December 30, 2002. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of December 30, 2002, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to December 30, 2002, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performa nce of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Apple | 2.3 |

| PepsiCo | 2.2 |

| Oracle | 1.6 |

| Abbott Laboratories | 1.5 |

| US Bancorp | 1.5 |

| Royal Dutch Shell, Cl B ADR | 1.4 |

| EMC | 1.4 |

| Cisco Systems | 1.4 |

| IBM | 1.4 |

| Wal-Mart Stores | 1.3 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 24

| fund overview |

|

| Socially Responsible Equity Fund |

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of U.S. issuers that meet certain socially responsible criteria.

Comparison of Change in the Value of a $10,000 Investment in the Socially Responsible Equity Fund, Institutional Class Shares and Class N Shares, versus the MSCI KLD 400 Social Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| (1) | Class I Shares of the predecessor to the Socially Responsible Equity Fund (the “Predecessor Fund”) commenced operations on January 3, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of January 3, 2005 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Socially Responsible Equity Fund (the “Predecessor Fund”) commenced operations on January 3, 2005. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on August 12, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of August 12, 2005, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of January 3, 2005 to August 12, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the perform ance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Brookfield Asset Management, Cl A | 3.7 |

| Berkshire Hathaway, Cl B | 3.3 |

| Emerson Electric | 3.1 |

| Patterson-UTI Energy | 3.1 |

| Abbott Laboratories | 3.0 |

| Waste Management | 3.0 |

| Chubb | 3.0 |

| ConocoPhillips | 3.0 |

| Spectra Energy | 2.9 |

| Encana | 2.8 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 25

| schedule of investments |

|

| Prime Money Market Fund |

| Description | | | | | | |

| Commercial Paper [38.8%] | | | | | | |

| Airport Develop/Maint [1.6%] | |

| Los Angeles Department of Airports | | | | |

| | $ | 20,000 | | | $ | 19,993 | |

| Banks [15.7%] | | | | | | | | |

| Banco Bilbao Vizcaya Argentaria (A) | | | | | | | | |

| 0.290%, 10/22/10 | | | 25,000 | | | | 24,996 | |

| Barclays US Funding | | | | | | | | |

| 0.150%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| KBC Financial Products International (A) | | | | | | | | |

| 0.500%, 10/18/10 | | | 25,000 | | | | 24,994 | |

| Korea Development Bank | | | | | | | | |

| 0.650%, 11/08/10 | | | 25,000 | | | | 24,983 | |

| 0.450%, 12/23/10 | | | 25,000 | | | | 24,974 | |

| Standard Chartered Bank (A) | | | | | | | | |

| 0.390%, 11/08/10 | | | 25,000 | | | | 24,990 | |

| 0.250%, 10/04/10 | | | 25,000 | | | | 24,999 | |

| UniCredit Bank Ireland (A) | | | | | | | | |

| 0.610%, 12/20/10 | | | 25,000 | | | | 24,966 | |

| | | | | | | 199,902 | |

| Financial Services [13.7%] | | | | | | | | |

| Danske (A) | | | | | | | | |

| 0.360%, 11/15/10 | | | 25,000 | | | | 24,989 | |

| 0.260%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| Gotham Funding (A) | | | | | | | | |

| 0.250%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| Grampian Funding (A) | | | | | | | | |

| 0.290%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| HSBC Finance | | | | | | | | |

| 0.440%, 12/07/10 | | | 25,000 | | | | 24,980 | |

| Natixis US Finance | | | | | | | | |

| 0.320%, 12/01/10 | | | 25,000 | | | | 24,986 | |

| Societe Generale North America | | | | | | | | |

| 0.240%, 10/05/10 | | | 25,000 | | | | 24,999 | |

| | | | | | | 174,954 | |

| Foreign Governments [3.9%] | |

| Republic of Ireland International Bond | | | | | |

| 0.890%, 11/24/10 | | $ | 25,000 | | | $ | 24,966 | |

| 0.560%, 10/22/10 | | | 25,000 | | | | 24,992 | |

Total Foreign Governments | | | | | | | 49,958 | |

| Special Purpose Banks [3.9%] | |

| Dexia Delaware | | | | | | | | |

| 0.550%, 12/01/10 | | | 25,000 | | | | 24,977 | |

| 0.470%, 10/22/10 | | | 25,000 | | | | 24,993 | |

Total Special Purpose Banks | | | | | | | 49,970 | |

Total Commercial Paper (Cost $494,777) | | | | | | | 494,777 | |

| U.S. Government Agency Obligations [3.9%] | |

| FHLB | | | | | | | | |

| 0.420%, 10/15/10 | | | 25,000 | | | | 25,000 | |

| 0.480%, 10/25/10 | | | 25,000 | | | | 25,002 | |

Total U.S. Government Agency Obligations (Cost $50,002) | | | | | | | 50,002 | |

| Corporate Bonds [2.7%] | | | | | | | | |

| Banks [1.6%] | | | | | | | | |

| Westpac Banking, MTN | | | | | | | | |

| | | 20,500 | | | | 20,508 | |

| Financial Services [1.1%] | | | | | | | | |

| General Electric Capital | | | | | | | | |

| | | 13,845 | | | | 13,839 | |

Total Corporate Bonds (Cost $34,347) | | | | | | | 34,347 | |

| Certificates of Deposit [35.3%] | | | | | | | | |

| Banco Bilbao Vizcaya Argentaria NY | | | | | | | | |

| 0.770%, 01/03/11 | | | 25,000 | | | | 25,001 | |

| Banco Del Estado De Chile | | | | | | | | |

| 0.240%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| 0.550%, 01/31/11 | | | 25,000 | | | | 25,000 | |

| Banco Santander | | | | | | | | |

| 0.920%, 10/12/10 | | | 25,000 | | | | 25,000 | |

| Barclays Bank | | | | | | | | |

| 0.690%, 05/10/11 | | | 25,000 | | | | 25,000 | |

| Bayerische Landesbank | | | | | | | | |

| 0.470%, 12/09/10 | | | 25,000 | | | | 25,001 | |

| 0.600%, 02/07/11 | | | 25,000 | | | | 25,000 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 26

| schedule of investments |

|

Prime Money Market Fund (concluded) |

| Description | | | | | | |

| BNP Paribas NY | | | | | | |

| 0.240%, 10/07/10 | | $ | 25,000 | | | $ | 25,000 | |

| Commerzbank NY | | | | | | | | |

| 0.505%, 10/13/10 | | | 25,000 | | | | 25,000 | |

| Erste Group Bank | | | | | | | | |

| 0.300%, 10/01/10 | | | 25,000 | | | | 25,000 | |

| 0.300%, 10/13/10 | | | 25,000 | | | | 25,000 | |

| KBC Bank NY | | | | | | | | |

| 0.750%, 10/14/10 | | | 25,000 | | | | 25,000 | |

| Landesbank Hessen-Thueringen GZ | | | | | | | | |

| 0.900%, 10/19/10 | | | 25,000 | | | | 25,000 | |

| 0.750%, 02/01/11 | | | 25,000 | | | | 25,000 | |

| Natixis NY | | | | | | | | |

| 0.460%, 11/04/10 | | | 25,000 | | | | 25,000 | |

| Norinchukin Bank | | | | | | | | |

| 0.480%, 11/08/10 | | | 25,000 | | | | 25,001 | |

| Skandinaviska Enskilda Banken NY | | | | | | | | |

| 0.560%, 10/14/10 | | | 25,000 | | | | 25,000 | |

| UniCredit NY | | | | | | | | |

| 0.715%, 11/03/10 | | | 25,000 | | | | 25,000 | |

Total Certificates of Deposit (Cost $450,003) | | | | | | | 450,003 | |

| Cash Equivalent [0.3%] | | | | | | | | |

| Goldman Sachs Financial Square Funds - Government Fund, 0.090%* | | | 4,235,021 | | | | 4,235 | |

Total Cash Equivalent (Cost $4,235) | | | | | | | 4,235 | |

| Repurchase Agreements(C) [19.0%] | |

| Nomura | | | | | | | | |

| 0.250%, dated 09/30/10, repurchased on 10/01/10, repurchase price $125,000,868 (collateralized by various U.S. Government obligations, ranging in par value $492,678-$49,507,669, 0.000%-4.250%, 04/01/11-02/26/29; with total market value $127,502,877) | | | 125,000 | | | | 125,000 | |

| Deutsche Bank | | | | | | | | |

| 0.240%, dated 09/30/10, repurchased on 10/01/10, repurchase price $50,000,333 (collateralized by a FNMA obligation, par value $51,000,695, 5.125%, 04/15/11; with total market value $50,000,695) | | | 50,000 | | | | 50,000 | |

| Description | | | | | | |

| Bank of America | | | | | | |

| 0.220%, dated 09/30/10, repurchased on 10/01/10, repurchase price $50,000,306 (collateralized by a FHLB and FNMA obligation, ranging in par value $7,663,000-$41,915,000, 0.000%-3.625%, 12/29/10-07/01/11; with total market value $51,002,996) | | $ | 50,000 | | | $ | 50,000 | |

| Barclays | | | | | | | | |

| 0.200%, dated 09/30/10, repurchased on 10/01/10, repurchase price $16,400,091 (collateralized by a U.S. Treasury Note, par value $15,074,000, 3.500%, 02/15/18; with total market value $16,728,057) | | | 16,400 | | | | 16,400 | |

Total Repurchase Agreements (Cost $241,400) | | | | 241,400 | |

Total Investments [100.0%] (Cost $1,274,764) | | | $ | 1,274,764 | |

| Percentages are based on Net Assets of $1,274,880 ($ Thousands). |

| * | The rate reported is the 7-day current yield as of September 30, 2010. |

| (A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On September 30, 2010, the value of these securities amounted to $245,442 (000), representing 19.3% of the net assets of the Fund. |

| (B) | Floating Rate Security — The rate reported is the rate in effect on September 30, 2010. |

| (C) | Tri-Party Repurchase Agreement. |

| FHLB — Federal Home Loan Bank |

| FNMA — Federal National Mortgage Association |

The following is a summary of the inputs used as of September 30, 2010 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | | | | | | | | | | | | |