TABLE OF CONTENTS

CNI Charter Funds Annual Report

| 2 | Letter to Our Shareholders |

| 4 | Money Market Funds Investment Adviser's Report |

| 6 | Fixed Income and Blended Funds Investment Adviser's Report |

| 10 | Fixed Income and Blended Funds Overview |

| 17 | Equity Funds Investment Adviser's Report |

| 20 | Equity Funds Overview |

| 24 | Schedule of Investments |

| 82 | Statements of Assets and Liabilities |

| 86 | Statements of Operations |

| 90 | Statements of Changes in Net Assets |

| 96 | Financial Highlights |

| 100 | Notes to Financial Statements |

| 111 | Report of Independent Registered Public Accounting Firm |

| 112 | Trustees and Officers |

| 114 | Notice to Shareholders |

| 115 | Disclosure of Fund Expenses |

| 117 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. The Funds’ Form N-Q filings are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q filing is also available on the Funds’ website at www.cnicharterfunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.cnicharterfunds.com, and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

CNI CHARTER FUNDS | PAGE 1

| letter to our shareholders |

|

| ECONOMIC AND MARKET OVERVIEW |

The beginning of the fiscal year nearly coincided with the October 3, 2011 low point of the U.S. stock market. The downturn had been triggered by concerns about slower economic growth in China and the U.S., European sovereign debt and the federal budget ceiling showdown in Washington. These three themes framed stock and bond market results and the economy figured predominantly in the election campaign over the past twelve months. After compromises were reached, albeit temporarily, within the European Union and Congress, domestic stocks rebounded in the first half of the fiscal year, with the S&P 500 gaining 29.6% at the mid-point of the year as investors concentrated on strong corporate balance sheets and an improving economic scenario.

The June quarter saw a pullback in the domestic and international equity markets as signs of a slowdown became apparent and optimistic economic growth estimates in the U.S. and China were revised downward. While the U.S. rate of growth was lowered from 2% to 1.5%, expectations for China’s declined from 10% to 7%, still an exuberant rate of growth. The European Central Bank (“ECB”) had a series of stop-start resolutions within the Union as Spain and Italy began to show mounting signs of financial strain. As global equity and foreign markets retreated, domestic bonds gained, as investors sought the safe haven of U.S. government bonds and the improving financial condition of many U.S. corporations.

Beginning in early June, equity markets began a steady climb that peaked with the Fed’s announcement of another round of quantitative easing in September. The question arises: what accounts for the strong performance over the summer of the riskier asset classes such as stocks? As stated above, U.S. economic activity weakened slightly from its already sluggish pace while the European recession deepened. Predictions of China’s soft economic landing were threatened by a number of data points that were below forecasters’ already-diminished expectations. No visible progress was achieved in solving the notorious “fiscal cliff” problem, which threatens to cause a recession next year in the U.S. if left unattended. What, then, caused investors to rediscover their appetite for risk?

One of the stock market’s tried-and-true maxims is “don’t fight the Fed,” meaning that when the Federal Open Market Committee (“FOMC”) is attempting to stimulate the economy through monetary easing, it is generally a bad time to be betting against stocks. In the environment we face today, one could easily extend that adage to “don’t fight the ECB, the People’s Bank of China, or the hundreds of other less influential central banks that have made easing moves around the world over the past year.” Not quite as crisp, but equally important as the Fed message.

Indeed, as the global economic conditions worsened throughout the summer, investors became convinced that more aggressive stimulus would be forthcoming. And they were not disappointed. Comments by ECB President Mario Draghi and Fed Chairman Ben Bernanke confirmed their intentions to “do whatever is necessary” to improve the economic conditions in their regions. Only China, confronting an important leadership change planned for November, has so far failed to follow through with the aggressive stimulus that many economists are advocating.

Are these easing moves a panacea for the world’s ailing economies and a ticket to higher stock prices? Certainly not. Many of these actions involve injecting additional liquidity into local economies by central banks’ increasing the money supply, i.e. “printing more money.” The risks of such a strategy include rising inflation, declining value of the local currency, and increasing governmental debt burdens. Gold’s 13.5% rise in the last fiscal quarter is testimony to investors’ concerns about these actions, in that gold is viewed as a safe haven during periods of monetary expansion.

So far, none of the negative side effects of these actions has been realized. Inflation remains well under control at around 2%, and the U.S. dollar has been relatively stable versus other major currencies (whose central banks are undertaking similar forms of stimulus). As a result, interest rates have remained benign, providing another quarter of solid returns from fixed income securities. High yield bonds, an area we highlighted late last year as particularly attractive, have delivered outstanding results, generating a total return of more than 12% in 2012.

CNI CHARTER FUNDS | PAGE 2

While our preference would be for higher asset prices to be driven by accelerating economic growth and stronger corporate earnings, for now the actions of global central banks appear to be winning the day. It remains to be seen how long this will appease investors before the bill comes due.

Post the Funds’ fiscal year end the U.S. saw the culmination of a long election campaign with the result that the federal government will continue to be divided between a Democratic White House and a split Congress, with Republicans holding the majority in the House. What kind of compromise will be reached to solve the $600 billion “fiscal cliff” is the overwhelming question for investors in the coming months. The triggering of sequestration of the federal budget would possibly cause a recession, while an increase in taxes may be a drag on growth. Countering that argument, continued borrowing by the federal government, predominantly from China, mounts further debt on a large deficit. Since these issues are at the top of investors’ agendas there will be significant pressure on our political leaders to find a workable solution. City National Asset Management (“CNAM”) continues to closely monitor these events and plans to make necessary portfolio adjustments as the outcome becomes clearer.

On July 2, 2012 City National Corporation announced the purchase of Rochdale Investment Management LLC of New York City. Rochdale will be merged with CNI Charter Funds adviser, City National Asset Management, Inc. The addition of the Rochdale investment professionals has opened up exciting opportunities, including the recently announced introduction of the new CNI Charter U.S. Core Equity Fund. We continue to work with the Rochdale investment team to combine their experience and talents with ours to enhance the management of CNI Charter Funds.

| FEE WAIVERS FOR MONEY MARKET FUNDS |

The Federal Reserve Bank Open Market Committee has announced its intention to maintain its low interest rate policy for short maturity funds into 2015. The purpose of this strategy is to keep borrowing costs low in order to stimulate credit demand and encourage investors to assume more risk. For money market investors it also means that yields on money market funds are likely to remain near zero for the foreseeable future. In order to protect the interests and preserve the capital of the CNI Charter Money Market Fund investors, CNAM has waived a substantial amount of its fees on these Funds since the financial crisis began in late 2008. The three Funds subject to this policy are the Prime, Government and California Tax Exempt Money Market Funds. This fee waiver has enabled all three Funds to produce positive, though modest, returns throughout the period.

As the adviser to CNI Charter Funds, CNAM proactively seeks to meet each of our mutual funds’ investment objectives through security research, continuous monitoring and re-evaluation of the portfolios holdings in a constantly changing market environment. CNAM maintains high standards of compliance review of our investment managers for each Fund.

Please read the following pages carefully as they contain important information on the assets and financial condition of the Funds. If you have any questions about this report you may call your investment professional or our toll-free number at (888) 889-0799.

Thank you for the confidence you place in CNI Charter Funds.

Sincerely,

Bruce Simon

Chief Investment Officer

CNI Charter Funds

Past performance is no guarantee of future results. Certain shareholders may be subject to the Alternative Minimum Tax (AMT). Federal income tax rules apply to any capital gain distributions.

Fund expenses have been waived during the period on which the performance is based. Without waivers, performance would be lower.

This information must be preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing.

CNI CHARTER FUNDS | PAGE 3

| investment adviser’s report |

|

Money Market Funds |

Many of the same difficulties that confronted the short term markets in the last few years have continued. The perpetual uncertainty regarding the European debt crisis, downgrades of domestic and global financial institutions and continued low interest rates lead the list of issues that made it such a challenging period.

The European sovereign debt crisis reached perilous levels late last year forcing the European Central Bank to implement long-term financing operations that eventually calmed markets and provided needed liquidity. As the year progressed, political discussions among member countries presented financial markets with variable moments of salvation and stress. While European Union policymakers have addressed liquidity challenges and contagion issues, the longer-term solvency and economic stability remain a concern. Most money market participants continue to hold reduced exposure to European financials.

In June, Moody’s announced the downgrades of 15 banks and securities firms with global capital markets operations. The downgrades had little impact on the money markets, as all ratings remained Tier 1 (as defined by the Securities and Exchanges Commission’s Rule 2a-7 under the Investment Company Act of 1940), and the long interval between the announcement and actual downgrades gave us and the markets ample time to reposition portfolios.

Historically low interest rates continue to beleaguer short term markets and money market fund managers. The effective Federal Reserve (“Fed”) Funds target rate has remained at 0.00% to 0.25% since late 2008. In September the Federal Reserve pledged to keep the benchmark rate at a record low level until early 2015. The average money market fund continues to offer yields at or near 0.00%. As a result of this ultra low yield environment, nearly all money market fund advisers are waiving fees and absorbing a portion of expenses.

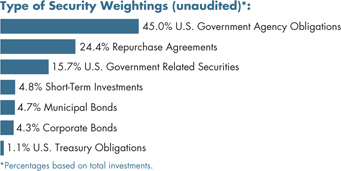

| | • | The Government Money Market Fund was positioned properly for Fed policy and market conditions that changed frequently throughout the year. The Fund has maintained a maturity profile of approximately 50 days average life in order to benefit from higher yielding securities in the face of continued low interest rates. City National Asset Management, Inc. (“CNAM”) waived the majority of its fees to produce a positive return of 0.01% for the year in the Institutional Class, Class N and Class S of this Fund. |

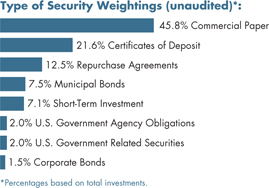

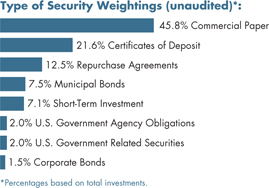

| | • | The Prime Money Market Fund continues to focus on a well diversified strategy of high quality, liquid issuers. Due to continued uncertainty regarding European financial institutions with exposure to the sovereign debt crisis, the adviser decided that the Fund will not own their securities out of an abundance of caution. CNAM waived the majority of its fees to produce a positive return of 0.02% for the year in Institutional Class and 0.01% for the year in Class N and Class S. |

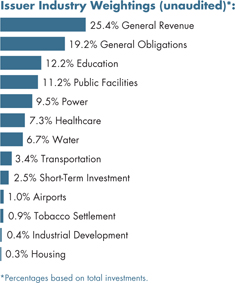

| | • | The objective for the California Tax Exempt Money Market Fund continues to focus on the fundamental objective of principal preservation and liquidity. The yield curve for allowable money market securities remains relatively flat, the benefit gained generally outweighed by the risk of extending. Therefore, the average maturity of the portfolio remains short at 32 days. While the California economy has shown improvement, the adviser continues to carefully watch credit developments and remains very selective of the municipalities in which the Fund invests. Additionally, the adviser eliminated exposure to European bank liquidity providers for the Fund’s variable rate demand notes as the European credit crisis deepened. CNAM waived the majority of its fees to produce a return of 0.01% in the Institutional Class, Class N and Class S of the Fund. |

CNI CHARTER FUNDS | PAGE 4

Due to the continued slow pace of the economic recovery and high levels of unemployment the Fed has pledged to keep rates at historically low levels for an extended period of time. The adviser considers the CNI Charter Money Market Funds to be appropriately positioned for the slow economic growth that is forecasted for the coming year. As always, City National Asset Management continues to monitor the objectives of the Funds very closely and seek opportunities in the markets to best serve the Funds’ shareholders.

Sincerely,

|  |

| | |

| Gregory Kaplan | William Miller |

| | |

| |

| Paul Single | |

Directors of Fixed Income Investments

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 5

| investment adviser’s report |

|

Fixed Income and Blended Funds |

The first fiscal quarter of the year came at a peak in U.S. Treasury prices after the flight out of European sovereign debt drove investors to a safe haven. Early October 2011 showed the bond market at a high when both U.S. and foreign stock markets reached a bottom. As investors came out of the “risk-off” scenario and ventured back into non-safe haven securities, U.S. government securities began to sell-off and corporate and high yield bonds began to recover.

During the middle two fiscal quarters of 2012, equity and bond performance seemed eerily similar to that of 2011. Risk assets performed very well in the second fiscal quarter only to pull back in the third. Risk assets initially improved on the back of high levels of bullish optimism stemming from the announcement of European Central Bank’s (ECB) Long Term Refinancing Operation which quelled market fears of a near term European Union collapse. However, in late March the trend in U.S. economic data began to weaken with cautionary notes persisting into the summer. At the same time Europe dipped into recessionary conditions and China and major emerging market economies experienced a material slowdown in GDP growth rates. With the rose colored glasses removed, the global economic headwinds proved too much for the markets bullish sentiment resulting, once again, in a flight to quality into fixed income product with a bias towards U.S. Treasuries and Agencies.

Despite these woes, the last fiscal quarter proved positive for risk assets. Markets once again embraced a new ECB supportive/easing program, the Outright Monetary Transactions Programme, which is intended to keep European Sovereign debt yields relatively low via open market purchases. The market simply shrugged off relatively anemic domestic and global GDP growth rates, continued high levels of unemployment, “fiscal cliff” rumblings, a divisive Presidential election and continued unease in Europe. Oddly enough, improved U.S. housing data was a notable bright spot.

In late September the Fed announced a third round of quantitative easing which targets mortgage-backed securities in an effort to keep mortgage rates low to encourage GDP growth through home sales. The impact of the program is difficult to quantify at this time as it has only been in use for a short time period and its absolute size remains unknown given its open ended nature.

In spite of the ups and down from quarter to quarter, fixed income markets ended the fiscal year with positive, and in some cases above average, returns.

| LIMITED MATURITY FIXED INCOME FUND |

The objectives of the Limited Maturity Fixed Income Fund are to provide a high level of current income, consistent with the preservation of capital and liquidity. These objectives were achieved in the fiscal year under review. This Fund’s dual benchmarks are the BofA Merrill Lynch 3-Month U.S. Treasury Index, so risk averse yield oriented investors can compare the Fund’s returns to what economists call the “risk-free” return; and the BofA Merrill Lynch 1-3 Year U.S. Treasury Index as a total return short-maturity index. For the fiscal year the Institutional Class of the Fund returned 1.88% versus 0.56% for the BofA Merrill Lynch 1-3 Year U.S. Treasury Index and 0.07% for the BofA Merrill Lynch 3-Month U.S. Treasury Index.

The objective of providing a high level of income was demonstrated by outpacing both of the yield benchmarks; the Fund’s 30-day SEC yield at September 30, 2012 was 0.67%, compared to 0.25% for the BofA Merrill Lynch 1-3 Year U.S. Treasury Index, and 0.02% for BofA Merrill Lynch 3-Month U.S. Treasury Index. This kind of spread was maintained throughout the fiscal year. The Fund’s two largest sector weightings are high grade corporate and agency securities. At year end all the holdings in the Fund were rated single “A” or higher.

CNI CHARTER FUNDS | PAGE 6

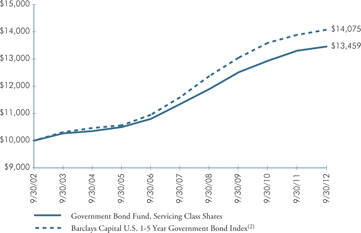

The Servicing Class of the Government Bond Fund produced a return of 1.15%. By comparison the Barclays Capital U.S. 1-5 Year Government Bond Index returned 1.33%. The Fund performed closely with the benchmark due to its overweight in agency-backed debt and collateralized mortgage obligations. By comparison, the Fund maintains a somewhat shorter duration versus the Barclays Capital U.S. 1-5 Year Government Bond Index in order to keep liquidity higher than normal to support shareholder activity.

The Servicing Class of the Corporate Bond Fund produced a total annual net return of 5.89%, while the Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index returned 5.27%. The Fund maintains its positive stance on corporate credit quality while its overweight in lower quality (BBB) issues contributed to lower performance over the very volatile third quarter.

Continued positive domestic GDP growth (albeit slow) and tentatively positive news out of Europe are both supportive of credit quality. In addition, credit is expected to perform well in the near term given the relative values created with the sell-off in August and September.

| CALIFORNIA TAX EXEMPT BOND FUND |

The California Tax Exempt Bond Fund produced a total return of 4.59% for the Servicing Class, while the Barclays Capital CA Intermediate-Short Municipal Index returned 4.97%. By comparison the Lipper CA Short/Intermediate Municipal Objective median return was 3.68%. The first quarter of the fiscal year experienced a significant increase in market volatility due to the expiration of the Build America Bond Program combined with heightened credit fears. This set the market up for good returns late in the second fiscal quarter. Very limited bond supply and improving economic outlook helped to more than offset earlier weakness. This was followed by further strength in high quality bond markets due to the debt ceiling debate and ultimate downgrade of U.S. Treasury debt by Standard & Poor’s in August. The fiscal year wrapped up on a very strong note for the Fund as its high quality intermediate structure benefited from the acute concern of an imminent Greek default.

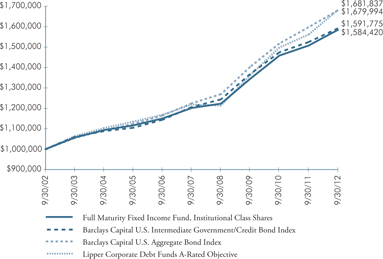

| FULL MATURITY FIXED INCOME FUND |

The Full Maturity Fixed Income Fund combines two portfolios designed to complement each other in the core + alpha strategy and to provide a “full” maturity spectrum.

| | • | Boyd Watterson Asset Management, the alpha sub-adviser, manages its portfolio compared to the Barclays Capital U.S. Intermediate Government/Credit Bond Index, and will more aggressively move duration above or below its index by 20%; |

| | • | Baird Advisors, the core sub-adviser, structures its portfolio compared to the Barclays Capital U.S. Aggregate Bond Index, and seeks to add value through sector selection while maintaining a neutral duration to the index. |

Following its investment objectives of providing a high level of current income, consistent with the preservation of capital, the Fund is broadly diversified in government and investment grade securities. The Fund began the fiscal year with a 60% tilt towards the intermediate portfolio, which was a defensive allocation in case of an interest rate increase in the first two quarters of the fiscal year.

By February the Federal Reserve had announced that interest rates were to remain at low levels for at least another 18 months (it has since been extended to mid-2015). It was determined that the higher yielding instruments, including corporate bonds and mortgage-backed securities, held in the aggregate portfolio would provide a better opportunity for investment income. The weighting of the Fund was changed to allocate 60% to the aggregate portfolio at that time. The Fund ended the fiscal year with 40.8% of the net assets in corporate bonds and 21.7% in U.S. government-backed mortgage obligations. Further, the Fund maintained a safe haven position of 18.8% in Treasuries and 7.7% in Agencies. The diversification among sectors for the Fund is designed to protect investors from any one sector’s risk, while maintaining a steady cashflow stream from the fixed income payments. The Fund invests in investment grade bonds only and has maintained an overall portfolio AA investment quality rating.

CNI CHARTER FUNDS | PAGE 7

| investment adviser’s report |

|

Fixed Income and Blended Funds (continued) |

The net return of the Fund’s Institutional Class was 5.11% for the fiscal year. This was higher than the Barclays Capital U.S. Intermediate Government/Credit Bond Index return of 4.40% for the period and tracked closely to the Barclays Capital U.S. Aggregate Bond Index return of 5.16%. The Lipper Corporate Debt Funds A-Rated Objective, which includes bond funds that are 100% weighted in corporate bonds, compared to the Fund’s 40.9% weighting, returned 7.71% for the fiscal year.

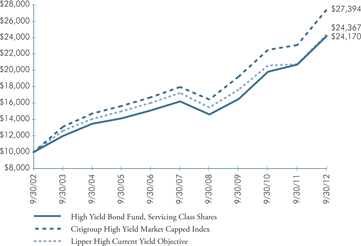

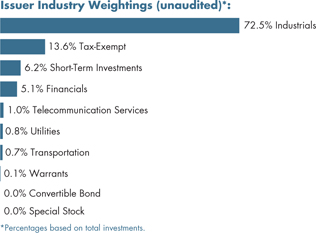

The High Yield Bond Fund is sub-advised by Guggenheim Partners Investment Management, LLC. The first fiscal quarter was a time of recovery from the downswing investors experienced at the end of the previous fiscal year. High yield bonds are closely related to equity market returns and both began an upswing in tandem. Industrial sector bonds began the fiscal year with a 71.6% weight in the portfolio, and even as slower economic growth became apparent over the course of the fiscal year, the Fund experienced growth in returns as the sub-adviser increased investment in corporate Industrial bonds to 82.9% by fiscal year end. The Fund underweighted investments in the riskier Financials sector by minimizing bank sector bonds which ranged from an 8.2% allocation at the start of the fiscal year and decreased slightly to 7.7% at fiscal year end.

The net return of the Fund’s Servicing Class of 16.77% for the fiscal year tracked slightly below the Lipper High Current Yield Objective return for this category of 17.54% for the same period. By comparison, the Fund’s primary benchmark, the Citigroup High Yield Market Capped Index, was up 18.69% for the fiscal year (the “Market Capped” refers to the fact that no one security can comprise more than a 2% weighting of the index). The difference in return from the benchmark may be attributed in part to higher levels of cash and the sub-adviser taking a gradual approach to investing in late 2011 and early 2012, as new issuance of bonds in this category was low. The Fund’s portfolio managers have followed a strategy of buying the high yielding bonds of middle sized companies, rather than those of very large capitalized companies. Mid-sized company bonds tend to yield income at a higher rate than larger capitalization company bonds. There were 251 holdings at fiscal year end, which enables the portfolio to spread risk among more entities. The sub-adviser also invests in higher credit range, intermediate maturity bonds in an effort to avoid defaults in this category. It has been successful in meeting its objective of maximizing return in the high yield market.

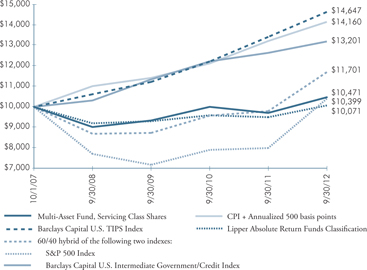

For the fiscal year, the Multi-Asset Fund’s Servicing Class returned 7.89%, beating the 4.73% median return for the Lipper Absolute Return Funds Classification peer group. Risk assets performed well, headlined by substantial gains in equity markets and Real Estate Investment Trusts (“REITs”). Fixed income markets also generated positive returns, with the higher yielding products leading the way.

Given the uncertainties in Europe, we liquidated the Fund’s position in developed international equities. The exposure to mid cap was also liquidated, leaving the Fund allocated exclusively to large cap focused funds. A greater emphasis has been placed on dividend paying stocks, as these provide enhanced yield and should offer some protection in the event of a market decline. During the year, the portfolio managers exited positions in individual short-term bonds, placing the proceeds into limited maturity fixed income funds. Also, a new position in a mutual fund that invests primarily in mortgage-backed securities was added and the Fund’s position in international bonds was reduced. We increased the allocation to real assets over the course of the year, initiating a position in domestic REITs and adding to gold.

CNI CHARTER FUNDS | PAGE 8

Sincerely,

|  |

| | |

| Gregory Kaplan | William Miller |

| | |

| |

| Paul Single | |

Directors of Fixed Income Investments

City National Asset Management, Inc.

Timothy G. Solberg, CFA

Director of Sub-advised Funds

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 9

| fund overview |

|

Limited Maturity Fixed Income Fund |

The Fund seeks to provide a high level of current income, consistent with the preservation of capital and liquidity by investing primarily in fixed income securities either issued or guaranteed by the U.S. government or its agencies or instrumentalities, money market instruments and non-convertible fixed income securities of U.S. companies.

Comparison of Change in the Value of a $1,000,000 Investment in the Limited Maturity Fixed Income Fund, Institutional Class Shares, versus the BofA Merrill Lynch 1-3 Year U.S. Treasury Index and the BofA Merrill Lynch 3-Month U.S. Treasury Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

BofA Merrill Lynch 1-3 Year U.S. Treasury Index | | | | | | |

BofA Merrill Lynch 3-Month U.S. Treasury Index | | | | | | |

| * | The graph is based on only Institutional Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Class I Shares of the predecessor to the Limited Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 22, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 22, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on October 22, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of October 22, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 22, 1988 to October 21, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| FNMA | |

| 0.500%, 07/02/15 | 7.2% |

| FHLMC REMIC, Ser 2004-2825, Cl VP | |

| 5.500%, 06/15/15 | 6.2% |

| U.S. Treasury Note | |

| 0.250%, 06/30/14 | 4.5% |

| FNMA | |

| 5.000%, 03/15/16 | 3.7% |

| FHLMC | |

| 1.000%, 07/30/14 | 3.7% |

| FHLMC | |

| 4.375%, 07/17/15 | 3.6% |

| FHLMC | |

| 1.250%, 05/12/17 | 3.3% |

| Southern California, Public Power Authority, Ser B, RB, AGM, ETM | |

| 6.930%, 05/15/17 | 2.7% |

| U.S. Treasury Note | |

| 2.375%, 09/30/14 | 2.6% |

| Wachovia | |

| 5.750%, 06/15/17 | 2.4% |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 10

| fund overview |

|

Government Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing primarily in securities either issued or guaranteed by the U.S. government or its agencies or instrumentalities.

Comparison of Change in the Value of a $10,000 Investment in the Government Bond Fund, Servicing Class Shares, versus the Barclays Capital U.S. 1-5 Year Government Bond Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

Institutional Class(2)^^† | | | | | | |

| | | | | | |

Barclays Capital U.S. 1-5 Year Government Bond Index | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Institutional Class and Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on February 1, 2012. |

| (3) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| ^^ | The Fund’s Institutional Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the Fund’s minimum initial investment requirement. |

| † | Institutional Class Shares’ performance for the period of January 14, 2000 to February 1, 2012 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Institutional Class Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Institutional Class Shares for that period would have been lower because the expenses of the Institutional Class Shares are lower than those of the Servicing Class Shares. |

| †† | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Israel Government AID Bond | |

| 4.115%, 05/15/20 | 7.2% |

| Tennessee Valley Authority, Ser E | |

| 6.250%, 12/15/17 | 5.4% |

| Egypt Government AID Bond | |

| 4.450%, 09/15/15 | 4.7% |

| GNMA, Ser 2012-43, Cl HA | |

| 3.500%, 06/20/40 | 4.4% |

| FNMA REMIC, Ser 2011-99, Cl AV | |

| 4.000%, 08/25/24 | 4.3% |

| FHLB | |

| 0.683%, 04/08/14 | 4.3% |

| FHLMC, Ser 2012-4077, Cl BA | |

| 2.000%, 05/15/42 | 4.3% |

| FFCB | |

| 1.875%, 12/07/12 | 4.2% |

| FNMA REMIC, Ser 2012-32, Cl DE | |

| 3.000%, 12/25/26 | 4.2% |

| FHLMC REMIC, Ser 2011-3806, Cl UP | |

| 4.500%, 02/15/41 | 4.1% |

CNI CHARTER FUNDS | PAGE 11

| fund overview |

|

Corporate Bond Fund |

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing in a diversified portfolio of fixed income securities, primarily investment grade corporate bonds issued by domestic and international companies denominated in U.S. dollars.

Comparison of Change in the Value of a $10,000 Investment in the Corporate Bond Fund, Servicing Class Shares, versus the Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Lowe's | |

| 6.100%, 09/15/17 | 2.7% |

| Caisse Centrale Desjardins du Quebec | |

| 2.650%, 09/16/15 | 2.3% |

| General Electric Capital | |

| 2.150%, 01/09/15 | 2.3% |

| Teva Pharmaceutical Finance IV | |

| 1.700%, 11/10/14 | 2.3% |

| VW Credit, MTN | |

| 1.875%, 10/13/16 | 2.3% |

| Total Capital International | |

| 1.500%, 02/17/17 | 2.3% |

| GNMA REMIC, Ser 2012-3, Cl AK | |

| 3.000%, 01/16/27 | 2.2% |

| JPMorgan Chase | |

| 6.000%, 10/01/17 | 2.1% |

| General Electric Capital, FDIC Insured, MTN | |

| 2.625%, 12/28/12 | 2.1% |

| American Express Credit, MTN | |

| 2.800%, 09/19/16 | 2.1% |

CNI CHARTER FUNDS | PAGE 12

| fund overview |

|

California Tax Exempt Bond Fund |

The Fund seeks to provide current income exempt from federal and California state income tax (as the primary component of a total return strategy) by investing primarily in California municipal bonds and notes.

Comparison of Change in the Value of a $10,000 Investment in the California Tax Exempt Bond Fund, Servicing Class Shares, versus the Barclays Capital CA Intermediate-Short Municipal Index and the Lipper CA Short/Intermediate Municipal Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital CA Intermediate-Short Municipal Index | | | | | | |

Lipper CA Short/Intermediate Municipal Objective | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Riverside County, Ser A, COP, AMBAC | |

| 5.000%, 11/01/17 | 3.1% |

| California State, GO | |

| Callable 03/01/15 @ 100 | |

| 5.000%, 03/01/16 | 2.8% |

| California State, GO | |

| 5.000%, 09/01/21 | 2.5% |

| Southern California, Public Power Authority, Subordinated Southern Transmission Project, Ser A, RB | |

| 5.000%, 07/01/17 | 2.4% |

| Orange County, Public Financing Authority, RB, NATL-RE | |

| 5.000%, 07/01/17 | 2.1% |

| California State, GO | |

| 5.000%, 09/01/20 | 2.1% |

| California State, GO | |

| Callable 11/01/20 @ 100 | |

| 5.000%, 11/01/22 | 2.1% |

| Los Angeles, Unified School District, Ser I, GO | |

| Callable 07/01/19 @ 100 | |

| 5.250%, 07/01/23 | 2.0% |

| San Francisco California Public Utilities Commission Water Revenue, Ser D, RB | |

| 4.000%, 11/01/19 | 2.0% |

| Modesto Irrigation District, Ser A, RB | |

| 5.000%, 07/01/17 | 2.0% |

| * | Excludes Cash Equivalent |

CNI CHARTER FUNDS | PAGE 13

| fund overview |

|

Full Maturity Fixed Income Fund |

The Fund seeks to provide a high level of current income, consistent with the preservation of capital by investing primarily in fixed income securities either issued or guaranteed by the U.S. government or its agencies or instrumentalities, money market instruments, non-convertible fixed income securities of U.S. companies and U.S. dollar-denominated debt obligations issued by foreign governments and corporations.

Comparison of Change in the Value of a $1,000,000 Investment in the Full Maturity Fixed Income Fund, Institutional Class Shares, versus the Barclays Capital U.S. Intermediate Government/Credit Bond Index, the Barclays Capital U.S. Aggregate Bond Index and the Lipper Corporate Debt Funds A-Rated Objective (1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. Intermediate Government/Credit Bond Index | | | | | | |

Barclays Capital U.S. Aggregate Bond Index | | | | | | |

Lipper Corporate Debt Funds A-Rated Objective | | | | | | |

| * | The graph is based on only Institutional Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Class I Shares of the predecessor to the Full Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on May 11, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of May 11, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to May 11, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| U.S. Treasury Bond | |

| 6.250%, 08/15/23 | 3.4% |

| U.S. Treasury Bond | |

| 4.375%, 02/15/38 | 2.7% |

| U.S. Treasury Note | |

| 2.375%, 07/31/17 | 2.4% |

| U.S. Treasury Bond | |

| 5.250%, 11/15/28 | 2.2% |

| U.S. Treasury Note | |

| 2.750%, 02/15/19 | 1.9% |

| FNMA | |

| 2.375%, 07/28/15 | 1.9% |

| FNMA | |

| 0.625%, 10/30/14 | 1.8% |

| U.S. Treasury Note | |

| 1.750%, 05/15/22 | 1.7% |

| FHLMC, Pool C03490 | |

| 4.500%, 08/01/40 | 1.7% |

| U.S. Treasury Note | |

| 0.875%, 07/31/19 | 1.6% |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 14

| fund overview |

|

High Yield Bond Fund |

The Fund seeks to maximize total return by investing primarily in fixed income securities rated below investment grade including corporate bonds and debentures, convertible and preferred securities, zero coupon obligations and debt securities that are issued by U.S. and foreign governments and their agencies.

Comparison of Change in the Value of a $10,000 Investment in the High Yield Bond Fund, Servicing Class Shares, versus the Citigroup High Yield Market Capped Index and the Lipper High Current Yield Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

Institutional Class(2)^^† | | | | | | |

| | | | | | |

Citigroup High Yield Market Capped Index | | | | | | |

Lipper High Current Yield Objective | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Institutional and Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on February 2, 2012. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| ^^ | The Fund’s Institutional Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the Fund’s minimum initial investment requirement. |

| † | Institutional Class Shares’ performance for the period of January 14, 2000 to February 2, 2012 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Institutional Class Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Institutional Class Shares for that period would have been lower because the expenses of the Institutional Class Shares are lower than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Thermadyne Holdings | |

| 9.000%, 12/15/17 | 1.2% |

| Nuveen Investments | |

| 9.125%, 10/15/17 | 1.2% |

| First Data | |

| 8.750%, 01/15/22 | 1.1% |

| BreitBurn Energy Partners | |

| 7.875%, 04/15/22 | 1.1% |

| Exterran Holdings | |

| 7.250%, 12/01/18 | 1.1% |

| Burlington Coat Factory Warehouse | |

| 10.000%, 02/15/19 | 1.1% |

| Reynolds Group Issuer | |

| 6.875%, 02/15/21 | 1.1% |

| Central Garden and Pet | |

| 8.250%, 03/01/18 | 1.1% |

| Crestwood Midstream Partners | |

| 7.750%, 04/01/19 | 1.0% |

| Univision Communications | |

| 6.875%, 05/15/19 | 1.0% |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 15

| fund overview |

|

Multi-Asset Fund |

The Fund seeks to generate a positive total return in excess of inflation in a manner consistent with capital preservation in all market environments by investing all or a substantial portion of its assets in other mutual funds or other types of funds like exchange-traded funds.

Comparison of Change in the Value of a $10,000 Investment in the Multi-Asset Fund, Servicing Class Shares, versus the Barclays Capital U.S. TIPS Index; a 60/40 hybrid of the following two indexes: the S&P 500 Index and the Barclays Capital U.S. Intermediate Government/Credit Index; the CPI + Annualized 500 basis points; and the Lipper Absolute Return Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | |

| | | | |

Institutional Class(2)^^† | | | | |

| | | | |

Barclays Capital U.S. TIPS Index | | | | |

| 60/40 hybrid of the following two indexes: | | | | |

| S&P 500 Index | | | | |

Barclays Capital U.S. Intermediate Government/Credit Index | | | | |

CPI + Annualized 500 basis points | | | | |

Lipper Absolute Return Funds Classification | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Institutional and Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on October 1, 2007. |

| (2) | Commenced operations on March 22, 2012. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| ^^ | The Fund’s Institutional Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the Fund’s minimum initial investment requirement. |

| † | Institutional Class Shares’ performance for the period of October 1, 2007 to March 22, 2012 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Institutional Class Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Institutional Class Shares for that period would have been lower because the expenses of the Institutional Class Shares are lower than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Vanguard Short-Term Bond Index Fund | 21.3% |

| SPDR S&P 500 | 9.5% |

| CNI Corporate Bond Fund, Cl I | 7.1% |

| Principal Preferred Securities Fund | 6.8% |

| DoubleLine Total Return Bond Fund | 6.1% |

| Powershares DB Gold | 5.3% |

| CNI Limited Maturity Fixed Income Fund, Cl I | 5.3% |

| CNI Government Bond Fund, Cl I | 5.1% |

| Vanguard Dividend Appreciation | 4.7% |

| SPDR S&P Dividend | 4.7% |

CNI CHARTER FUNDS | PAGE 16

| investment adviser’s report |

|

Equity Funds |

| INVESTORS RETURN TO “RISK-ON” MODE |

The fiscal year began last October with the beginning of the recovery from the sharp downswing in share prices due to the twin crises of the U.S. debt ceiling stand-off in Washington and the possible default of European sovereign debt and its effects on banks with exposure to it. After compromises were reached in both arenas, even though the solutions were not long term, the U.S. stock markets began to climb and forecasts were for a moderate economic recovery in the United States even with a recession occurring in the European Monetary Union.

After a difficult spring that saw equity markets surrender most of the gains posted earlier in the fiscal year, a rally resumed in June and continued with little interruption through the end of the third quarter. The S&P 500 Stock Index returned 6.4% in the final fiscal quarter, extending its calendar year-to-date gain to an impressive 16.4%, and 30.2% for the fiscal year ended September 30. Other equity markets around the world also rallied late in the year, generating similar returns as the U.S. stock market in the final fiscal quarter. On a fiscal year basis, the United States remained among the leaders in stock market performance versus other large investable markets, demonstrated by the MSCI EAFE Index (which measures equity market performance of developed markets in Europe, Australasia and the Far East) fiscal year return of 13.75%. In general we anticipate that the U.S. economy will continue to support slow but steady growth but cannot remove the possibility of a black swan geopolitical or economic event from the near term time horizon.

The following section provides a brief synopsis of the equity funds in the CNI Charter Fund family with related performance for the fiscal year. Further information may be found on our website, cnicharterfunds.com.

The Diversified Equity Fund is split among three portfolio management teams to create a large/mid multi-cap blend portfolio. The Fund’s allocations are:

| | • | 45% allocation to SKBA Capital Management LLC, a large/midcap value equity sub-adviser; |

| | • | 30% allocation to Turner Investments L.P., an alpha large/midcap growth equity sub-adviser; |

| | • | 25% allocation to City National Asset Management, the Fund’s investment adviser, which uses a customized, tobacco-free S&P 500 Index replication strategy to create the Fund’s core portfolio weighting. |

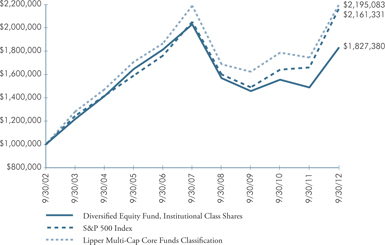

The index replication portion of the portfolio was added at the mid-point of the fiscal year; for the first half of the year the Fund was split between SKBA and Turner. The Fund’s Institutional Class shares produced returns of 22.75% this fiscal year. Lipper Analytics compares the Fund to its Multi-Cap Core Funds Classification, which had a median return of 25.79% for the year. The S&P 500 Index returned 30.20% for the period. At the beginning of the fiscal year the Fund’s combined sub-advisers matched the gains in the S&P 500 Index as it rose from its low point in October 2011. The Fund’s second fiscal quarter was also favorable as the Fund’s largest holding, Apple, comprising 4% of the Fund, led the Technology sector and the market upward. However, many of the Technology and Consumer Discretionary stocks reversed course in the next quarter, including the Facebook IPO, which was held in the Turner portfolio of the Fund.

At fiscal year-end the Fund’s portfolio was most heavily allocated to information technology companies, non-money center bank financial sector equities (insurance companies and regional banks) and Healthcare companies. Defensive sectors like Telecommunication Services, Consumer Staples and Utilities are underweighted. Overall the Fund’s portfolio reflects an expectation of continued U.S. economic growth in the near term.

| LARGE CAP VALUE EQUITY FUND |

Large cap value style stocks posted robust returns this fiscal year, as equities rallied off of the depressed lows reached at the beginning of October 2011. The Large Cap Value Equity Fund’s Servicing Class produced healthy gains of 26.57% over the fiscal year, compared to the 30.81% return of the

CNI CHARTER FUNDS | PAGE 17

| investment adviser’s report |

|

Equity Funds (continued) |

S&P 500 Value Index and 27.74% return of the Lipper Large Cap Value Funds Classification. The difference in returns is attributable in part to the adviser’s conservative strategy of structuring the portfolio with “deep” value characteristics which are more pronounced than those of the index. The strategy is designed with the intention to withstand the wide swings of market volatility and to provide growth in capital with less risk.

Solid results from the high dividend yielding Telecommunication Services, Consumer Staples and Utilities sectors were offset by lagging returns from companies owned in the Consumer Discretionary, Energy and Materials sectors as the U.S. economy slowed its rate of expansion. The latter half of the fiscal year proved more favorable to the style of the Fund as it generated a return of 3.34% over the volatile last six months of the fiscal period, topping both the Index’s 2.49% and the Lipper peer category’s 2.09%. At fiscal year end, with the three largest allocations a 25.4% weight in Financials (normally a heavy weighting in the value style), 11.0% in Energy and 10.4% in Industrials, the Fund remains largely sector neutral to the Index. There is slight underweight to Telecommunication Services, where securities were sold to realize profits.

| LARGE CAP GROWTH EQUITY FUND |

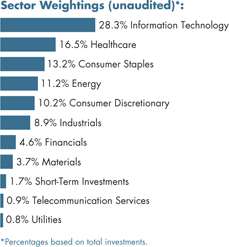

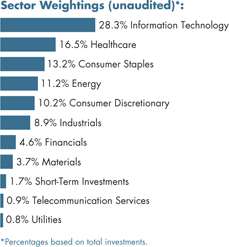

Large cap growth oriented stocks posted very strong returns during the fiscal year. For the fiscal year, the Large Cap Growth Equity Fund’s Servicing Class returned 30.43%, which exceeded the S&P 500 Growth Index and Lipper Large Cap Growth Funds Classification benchmarks of 29.65% and 27.19%, respectively, during the same period. During the fiscal period, the Healthcare, Information Technology, Consumer Staples and Consumer Discretionary sectors outperformed the benchmark, while Energy, Materials, Telecommunication Service, Financials and Industrials sectors trailed.

The Fund remains well diversified with exposure across all economic sectors and within major industry classifications. Holdings in the Information Technology sector comprised the largest allocation of the Fund at 28.3%, followed by Healthcare, Consumer Staples and Energy at 16.5%, 13.2% and 11.2%, respectively. Due to the current uncertain economic environment and diminished prospects for reaccelerating growth at fiscal year end, CNAM maintained a sector neutral strategy, preferring not to overweight or underweight sectors relative to the benchmark, but rather to add value through stock selection. The managers continue to employ a disciplined investment process focusing on higher quality companies with good earnings growth prospects and reasonable valuations.

| SOCIALLY RESPONSIBLE EQUITY FUND |

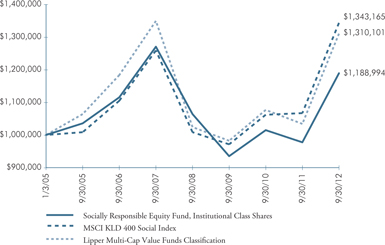

The Socially Responsible Equity Fund seeks to invest in companies that follow “ESG” (i.e., Environmental, Social and Governance) guidelines. It is sub-advised by SKBA Capital Management, a value style equity manager with long-term experience in ESG responsible investing. Besides seeking companies with favorable financial results and social worth, the Fund seeks to restrict investment companies which profit from activities that are not socially responsible, (including manufacturing tobacco-related products), showing poor product or employee safety records, or following unsound environmental practices. For the fiscal year, the Fund’s Institutional Class shares gained 21.63%. Lipper classifies the Fund in the Multi-Cap Value category, as it follows a large cap bias but holds up to 20% in middle sized capitalization companies. This Lipper classification had a 26.71% return for the fiscal year, but does not restrict investment in any stocks for socially responsible purposes. The MSCI KLD Social 400 Index, a socially responsible equity index, produced a return of 25.90% over the same period.

At September 30, 2012, the 50 holdings in this portfolio were biased towards value oriented stocks that will produce yields even in a slower economy. Heaviest sector weights were tilted towards non-money center bank Financials, including insurance companies, at 28.0%; Healthcare companies at 15.8%; 11.1% in Information Technology; and 10.4% each in Energy and Industrials. The sub-adviser chose to underweight Consumer Staples, Telecommunication Services and Utilities sectors.

CNI CHARTER FUNDS | PAGE 18

Sincerely,

Otis “Tres” Heald III

Director of Equity Investments

City National Asset Management, Inc.

Timothy G. Solberg, CFA

Director of Sub-advised Funds

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 19

| fund overview |

|

Diversified Equity Fund |

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of large-capitalization U.S. companies that are diversified among various industries and market sectors.

Comparison of Change in the Value of a $1,000,000 Investment in the Diversified Equity Fund, Institutional Class Shares, versus the S&P 500 Index and the Lipper Multi-Cap Core Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Multi-Cap Core Funds Classification | | | | | | |

| * | The graph is based on only Institutional Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Class I Shares of the predecessor to the Diversified Equity Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on December 30, 2002. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of December 30, 2002, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to December 30, 2002, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Apple | 4.0% |

| Tyco International | 1.5% |

| Berkshire Hathaway, Cl B | 1.5% |

| BB&T | 1.5% |

| PepsiCo | 1.4% |

| Cisco Systems | 1.4% |

| Brookfield Asset Management, Cl A | 1.4% |

| Google, Cl A | 1.3% |

| CareFusion | 1.3% |

| Microsoft | 1.3% |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 20

| fund overview |

|

Large Cap Value Equity Fund |

The Fund seeks to provide capital appreciation and moderate income consistent with current returns available in the marketplace by investing in large U.S. corporations and U.S. dollar-denominated American Depositary Receipts of large foreign corporations which are undervalued.

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Value Equity Fund, Servicing Class Shares, versus the S&P 500 Value Index and the Lipper Large Cap Value Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

Institutional Class(2)^^† | | | | | | |

| | | | | | |

| | | | | | |

Lipper Large Cap Value Funds Classification | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Institutional and Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on February 1, 2012. |

| (3) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| ^^ | The Fund’s Institutional Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank which meet the Fund’s minimum initial investment requirement. |

| † | Institutional Class Shares’ performance for the period of January 14, 2000 to February 1, 2012 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Institutional Class Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Institutional Class Shares for that period would have been lower because the expenses of the Institutional Class Shares are lower than those of the Servicing Class Shares. |

| †† | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Wells Fargo | 2.7% |

| Microsoft | 2.7% |

| JPMorgan Chase | 2.7% |

| Wal-Mart Stores | 2.7% |

| General Electric | 2.6% |

| Berkshire Hathaway, Cl B | 2.5% |

| Exxon Mobil | 2.5% |

| AT&T | 2.4% |

| Chevron | 2.4% |

| Citigroup | 2.3% |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 21

| fund overview |

|

Large Cap Growth Equity Fund |

The Fund seeks to provide capital appreciation by investing in large U.S. corporations and U.S. dollar-denominated American Depositary Receipts of large foreign corporations with the potential for growth.

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Growth Equity Fund, Servicing Class Shares, versus the S&P 500 Growth Index and the Lipper Large Cap Growth Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Large Cap Growth Funds Classification | | | | | | |

| * | The graph is based on only Servicing Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on March 28, 2000. |

| ^ | The Fund’s Servicing Class Shares are available only to fiduciary, advisory, agency, custodial and other similar accounts maintained at City National Bank. |

| † | Class N Shares’ performance for the period of January 14, 2000 to March 28, 2000 was calculated using the performance of the Servicing Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Servicing Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Servicing Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Apple | 11.3% |

| Exxon Mobil | 3.9% |

| Google, Cl A | 3.4% |

| Gilead Sciences | 3.4% |

| Qualcomm | 3.4% |

| CVS | 2.8% |

| DIRECTV | 2.6% |

| EMC | 2.6% |

| Mylan | 2.5% |

| Celgene | 2.4% |

CNI CHARTER FUNDS | PAGE 22

| fund overview |

|

Socially Responsible Equity Fund |

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of U.S. issuers that meet certain socially responsible criteria.

Comparison of Change in the Value of a $1,000,000 Investment in the Socially Responsible Equity Fund, Institutional Class Shares, versus the MSCI KLD 400 Social Index and the Lipper Multi-Cap Value Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | |

| | | | | |

| | | | | |

MSCI KLD 400 Social Index | | | | | |

Lipper Multi-Cap Value Funds Classification | | | | | |

| * | The graph is based on only Institutional Class Shares; performance for Class N Shares would be different due to differences in fee structures. |

| (1) | Class I Shares of the predecessor to the Socially Responsible Equity Fund (the “Predecessor Fund”) commenced operations on January 3, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of January 3, 2005 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on August 12, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of August 12, 2005, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of January 3, 2005 to August 12, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Brookfield Asset Management, Cl A | 3.3% |

| Abbott Laboratories | 3.0% |

| PepsiCo | 2.9% |

| Chubb | 2.9% |

| Laboratory Corp of America Holdings | 2.9% |

| Spectra Energy | 2.9% |

| ConocoPhillips | 2.9% |

| EI du Pont de Nemours | 2.7% |

| Arrow Electronics | 2.5% |

| Patterson | 2.5% |

| * | Excludes Cash Equivalent |

CNI CHARTER FUNDS | PAGE 23

| schedule of investments |

|

Government Money Market Fund |

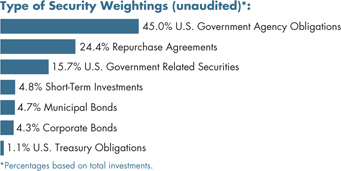

| U.S. Government Agency Obligations [45.4%] | | | | |

| FAMC DN (A) | | | | | | |

| 0.100%, 10/02/12 | | $ | 5,000 | | | $ | 5,000 | |

| 0.160%, 11/06/12 | | | 22,000 | | | | 21,996 | |

| 0.160%, 11/08/12 | | | 30,000 | | | | 29,995 | |

| 0.170%, 11/27/12 | | | 20,000 | | | | 19,995 | |

| 0.155%, 11/29/12 | | | 25,000 | | | | 24,994 | |

| 0.135%, 12/21/12 | | | 20,000 | | | | 19,994 | |

| 2.060%, 01/02/13 | | | 38,689 | | | | 38,672 | |

| 0.196%, 02/01/13 | | | 50,000 | | | | 49,966 | |

| 0.170%, 03/01/13 | | | 25,000 | | | | 24,982 | |

| 0.170%, 03/08/13 | | | 25,000 | | | | 24,981 | |

| 0.190%, 03/25/13 | | | 30,000 | | | | 29,972 | |

| 0.220%, 04/01/13 | | | 12,927 | | | | 12,913 | |

| 0.180%, 04/23/13 | | | 10,000 | | | | 9,990 | |

| 0.203%, 05/10/13 | | | 70,000 | | | | 69,913 | |

| 0.190%, 06/10/13 | | | 25,000 | | | | 24,967 | |

| 0.185%, 06/21/13 | | | 40,000 | | | | 39,946 | |

| FFCB (B) | | | | | | | | |

| 0.240%, 10/01/12 | | | 5,000 | | | | 5,001 | |

| 0.230%, 10/01/12 | | | 25,000 | | | | 24,997 | |

| 0.256%, 10/02/12 | | | 31,690 | | | | 31,693 | |

| 0.206%, 10/02/12 | | | 43,750 | | | | 43,751 | |

| 0.196%, 10/02/12 | | | 25,000 | | | | 24,997 | |

| 0.166%, 10/02/12 | | | 25,000 | | | | 24,997 | |

| 0.236%, 10/03/12 | | | 14,000 | | | | 14,003 | |

| 0.246%, 10/04/12 | | | 20,000 | | | | 20,000 | |

| 0.193%, 10/11/12 | | | 20,000 | | | | 20,000 | |

| 0.210%, 12/06/12 | | | 50,000 | | | | 49,994 | |

| 0.351%, 02/10/13 | | | 22,075 | | | | 22,094 | |

| FHLB | | | | | | | | |

| 0.300%, 10/01/12(B) | | | 10,000 | | | | 10,004 | |

| 0.250%, 10/01/12(B) | | | 20,000 | | | | 19,999 | |

| 0.240%, 10/01/12(B) | | | 25,000 | | | | 24,994 | |

| 0.230%, 10/01/12(B) | | | 15,000 | | | | 14,996 | |

| 0.200%, 10/01/12(B) | | | 70,000 | | | | 69,998 | |

| 0.190%, 10/01/12(B) | | | 20,000 | | | | 19,999 | |

| 0.180%, 10/01/12(B) | | | 20,000 | | | | 19,999 | |

| 0.210%, 10/09/12(B) | | | 15,000 | | | | 15,000 | |

| 0.224%, 12/12/12(B) | | $ | 20,000 | | | $ | 20,000 | |

| 0.289%, 12/20/12(B) | | | 9,400 | | | | 9,404 | |

| 0.170%, 01/24/13 | | | 23,000 | | | | 23,000 | |

| 0.160%, 02/08/13 | | | 10,000 | | | | 9,997 | |

| 0.240%, 04/16/13 | | | 10,000 | | | | 10,001 | |

| 3.625%, 05/29/13 | | | 21,565 | | | | 22,051 | |

| 0.250%, 06/07/13 | | | 20,000 | | | | 20,000 | |

| 1.625%, 06/14/13 | | | 26,125 | | | | 26,388 | |

| 4.000%, 09/06/13 | | | 6,515 | | | | 6,743 | |

| FHLB DN | | | | | | | | |

| 0.180%, 10/03/12(A) | | | 20,000 | | | | 20,000 | |

| FHLMC | | | | | | | | |

| 0.375%, 11/30/12 | | | 25,000 | | | | 25,008 | |

| 0.750%, 03/28/13 | | | 15,000 | | | | 15,038 | |

| 4.125%, 09/27/13 | | | 11,808 | | | | 12,262 | |

| FHLMC DN (A) | | | | | | | | |

| 0.159%, 10/01/12 | | | 80,873 | | | | 80,873 | |

| 0.140%, 10/22/12 | | | 20,000 | | | | 19,998 | |

| FNMA | | | | | | | | |

| 0.350%, 10/01/12(B) | | | 15,000 | | | | 15,004 | |

| 4.750%, 11/19/12 | | | 11,432 | | | | 11,502 | |

| 3.875%, 07/12/13 | | | 31,414 | | | | 32,297 | |

| 0.500%, 08/09/13 | | | 6,500 | | | | 6,517 | |

| FNMA DN (A) | | | | | | | | |

| 0.060%, 10/01/12 | | | 12,796 | | | | 12,796 | |

| 0.140%, 10/03/12 | | | 99,000 | | | | 99,000 | |

| 2.012%, 01/23/13 | | | 25,000 | | | | 24,987 | |

Total U.S. Government Agency Obligations (Cost $1,447,658) | | | | | | | 1,447,658 | |

| U.S. Government Related Securities [15.7%] | | | | | |

| Straight-A Funding | | | | | | | | |

| 0.190%, 10/17/12 | | | 25,000 | | | | 24,998 | |

| 0.180%, 10/02/12 | | | 65,000 | | | | 65,000 | |

| 0.180%, 10/09/12 | | | 64,253 | | | | 64,250 | |

| 0.180%, 10/10/12 | | | 54,358 | | | | 54,356 | |

| 0.180%, 10/25/12 | | | 23,075 | | | | 23,072 | |

| 0.180%, 10/26/12 | | | 50,000 | | | | 49,994 | |

| 0.180%, 10/30/12 | | | 17,148 | | | | 17,145 | |

| 0.180%, 11/05/12 | | | 54,026 | | | | 54,017 | |

| 0.180%, 11/06/12 | | | 30,076 | | | | 30,071 | |

| 0.180%, 11/07/12 | | | 3,250 | | | | 3,249 | |

| 0.180%, 11/26/12 | | | 25,000 | | | | 24,993 | |

| 0.180%, 12/03/12 | | | 40,453 | | | | 40,440 | |

| 0.180%, 12/04/12 | | | 50,000 | | | | 49,984 | |

Total U.S. Government Related Securities (Cost $501,569) | | | | | | | 501,569 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 24

| schedule of investments |

|

Government Money Market Fund (continued) |

| Municipal Bonds [4.7%] | | | | | | | | |

| California [1.6%] | | | | | | | | |

| Abag Finance Authority for Nonprofit, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.170%, 10/04/12(B) (C) | | $ | 15,000 | | | $ | 15,000 | |

| California Statewide, Communities Development Authority, Fairway Family Apartments Project, Ser PP, RB, FNMA, AMT | | | | | | | | |

| 0.190%, 10/04/12(B) (C) | | | 8,000 | | | | 8,000 | |

| Los Angeles, Community Redevelopment Agency, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.170%, 10/04/12(B) (C) | | | 15,450 | | | | 15,450 | |

| Sacramento County Housing Authority, Ser H, RB, FNMA, AMT | | | | | | | | |

| 0.180%, 10/04/12(B) (C) | | | 9,000 | | | | 9,000 | |

| | | | | | | 47,450 | |

| New York [1.8%] | | | | | | | | |

| New York State, Housing Finance Agency, West 38th Street, RB, FNMA, AMT | | | | | | | | |