TABLE OF CONTENTS

CNI Charter Funds Annual Report

| 2 | Letter to Our Shareholders |

| 4 | Money Market Funds Investment Adviser's Report |

| 6 | Fixed Income and Blended Funds Investment Adviser's Report |

| 9 | Fixed Income and Blended Funds Overview |

| 16 | Equity Funds Investment Adviser's Report |

| 19 | Equity Funds Overview |

| 24 | Schedule of Investments |

| 78 | Statements of Assets and Liabilities |

| 82 | Statements of Operations |

| 86 | Statements of Changes in Net Assets |

| 92 | Financial Highlights |

| 96 | Notes to Financial Statements |

| 106 | Report of Independent Registered Public Accounting Firm |

| 107 | Trustees and Officers |

| 109 | Notice to Shareholders |

| 110 | Disclosure of Fund Expenses |

| 112 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. The Funds’ Form N-Q filings are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q filing is also available on the Funds’ website at www.cnicharterfunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.cnicharterfunds.com, and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

CNI CHARTER FUNDS | PAGE 1

letter to our shareholders

ECONOMIC AND MARKET OVERVIEW

When this fiscal year started in October 2010, the Federal Open Market Committee (FOMC) had just announced plans for stimulating sluggish U.S. economic growth by acquiring Treasury debt on the open market in order to drive interest rates lower. The stimulus seemed to have had the desired effect, and by January, economic forecasts for the 2011 U.S. Gross Domestic Product’s growth were in the 3.5% range. Unfortunately, higher inflation (due mainly to food and energy prices), which cut into real consumer spending, along with supply chain disruptions caused by the Japanese tsunami in March caused the economy to weaken in the second quarter. By mid-summer, the gridlock in Washington over the debt ceiling debate, the credit downgrade of U.S. government bonds, and the steadily deteriorating situation in Europe caused a sharp pullback in equity prices. Since then, economic conditions in the United States have improved, but with the situation in Europe still highly volatile, we have actively repositioned the CNI Charter Fund portfolios for a slow growth economy and a more defensive stance.

The U.S. economy faces three important challenges ahead: 1) dealing with the overhang of excessive debt, at both the household and government levels; 2) a sticky unemployment rate of about 9%, which will decrease only when the rate of economic expansion picks up; and 3) the potential spillover from a possible recession in Europe.

Equity markets started the fiscal year with an encouraging upward slope of increasing returns in the December and March quarters. Most of those gains were wiped out by the sharp selloff towards the end of our fiscal year. For the fiscal year ended September 30, 2011, the S&P 500 Index remained in positive territory with returns of 1.14%.

Despite the downgrade, investors continued to flock to the perceived safety of U.S. government debt, and by late September the yield on the bellweather 10-year maturity U.S. Treasury note had fallen to a six decade low. Overall, the bond market outperformed stocks, with the Barclays Capital U.S. Intermediate Government/Credit Index up 3.40% for the fiscal year.

Related to the worldwide flight to the safety of the U.S. Treasury bond, the dollar rose versus many foreign currencies during the fourth quarter. This foreign exchange movement dampened the returns of foreign securities to U.S. investors. Outside the United States, many emerging market countries were tightening monetary policy in order to restrain inflationary pressures. As a result, this was a fiscal year that favored domestic investment over international: the international developed equity markets, measured by EAFE (the Europe, Australasia and Far East Index) declined by 9.36%, while the MSCI Emerging Markets Index fell by 16.15% for the fiscal year.

The Federal Reserve Bank continued to keep short term interest rates near zero in an effort to stimulate investment in the domestic economy. This has caused money market fund yields to fall to historically low rates. Late in the quarter, the Fed also began “Operation Twist” designed to lower mortgage rates in order to boost the moribund housing market. That, along with the heavy buying of Treasuries during the recent turmoil, succeeded in lowering rates further at the longer maturity end of the yield curve.

ORGANIZATIONAL CHANGES

Previously the CNI Charter Funds were advised by two advisory groups, City National Asset Management, Inc. (“CNAM”) and CCM Advisors, LLC (“CCMA”), both fully owned subsidiaries of the same parent, City National Corporation. On January 1, 2011, the business activities of CCMA were combined into CNAM, as a means of streamlining administration, research and software, and bringing the entire CNI Charter Fund family under one roof. The former CCMA team continues its advisory practice as CNAM’s Chicago office and is responsible for the oversight of all the sub-advised CNI Charter Funds.

CNI CHARTER FUNDS | PAGE 2

FEE WAIVERS FOR MONEY MARKET FUNDS

CNAM is very focused on the needs of the Funds’ shareholders. As stated above, the Federal Reserve Bank’s strategy is to maintain short-term interest rates at very low levels to stimulate the economy and the housing market. The Fed has announced that it intends to maintain short-term rates near zero until mid-2013. In order to protect the interests and preserve the capital of the CNI Charter Money Market Fund investors, CNAM has waived a substantial amount of its fees on these Funds since the financial crisis began in late 2008. The three Funds subject to this policy are the Prime, Government and California Tax Exempt Money Market Funds. This has enabled all three Funds to produce positive, albeit modest, returns throughout this period.

This marks my first fiscal year end as the Chief Investment Officer of CNAM and the CNI Charter Funds. As the investment adviser to the Funds, CNAM continues to follow its investment discipline throughout periods of market turmoil. CNAM seeks to meet each of our mutual funds’ distinct investment objectives through intensive security research, continuous monitoring of financial data, re-evaluation of portfolio holdings and weightings during changing circumstances, and maintenance of high compliance standards.

Please read the following pages carefully as they contain important information on the assets and financial condition of the Funds. If you have any questions about this report or CNI Charter Funds, please call your investment professional or (888) 889-0799.

Thank you for the confidence you place in the CNI Charter Funds.

Sincerely,

Bruce Simon

Chief Investment Officer

CNI Charter Funds

Past performance is no guarantee of future results. Certain shareholders may be subject to the Alternative Minimum Tax (AMT). Federal income tax rules apply to any capital gain distributions.

Fund expenses have been waived during the period on which the performance is based. Without waivers, performance would be lower.

This information must be preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing.

CNI CHARTER FUNDS | PAGE 3

investment adviser’s report

Money Market Funds

The last twelve months have been very challenging for the short-term markets. The continued disruptions in the European crisis saga, a U.S. Government downgrade by Standard & Poor’s and continued low interest rates top the list of issues that made it such a challenging period.

The European sovereign debt crisis became more pronounced as the year progressed. The European Central Bank, European Union officials and participant countries attempted to offer solutions to prevent the default of Greek debt and avoid any contagion to other countries and financial institutions. The most recent discussions appear to have provided solutions that could solve the problem, but most market participants continue to hold reduced exposure to European debt.

In early August, the credit rating agency Standard & Poor’s downgraded its credit rating of the U.S. Federal government from AAA to AA+. This was the first time that the U.S. Government has been given a rating below AAA. The market reacted with very little fanfare at the announcement and has actually traded higher due to continued global economic weakness and flight to quality trades caused by the Euro crisis. Both Fitch and Moody’s maintained their credit ratings of the U.S. Federal government at AAA.

Historically low interest rates continue to beleaguer short-term markets and money market fund managers. The effective Fed Funds target rate has remained at 0.00% to 0.25% since late 2008. In August, the Federal Reserve Bank (the “Fed”) pledged to keep the benchmark rate at a record low level at least through mid-2013. The average money market fund continues to offer yields at or near 0.00%. As a result of this ultra low yield environment, 98.4% of all funds are waiving fees and absorbing a portion of expenses, according to iMoneyNet.

FUND COMMENTARY

All returns listed below relate to the 12-month period ended September 30, 2011 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

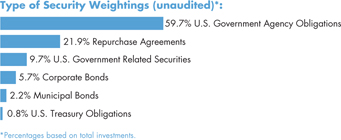

| | • | The Government Money Market Fund was positioned properly for changes, or lack thereof, in Fed policy and the lower economic growth environment. The Fund has maintained a maturity profile of approximately 50 days average life in order to benefit from higher yielding securities in the face of continued low interest rates. CNAM waived the majority of its fees to produce a positive return of 0.02%. |

| | • | The Prime Money Market Fund continues to focus on a well diversified strategy of high quality, liquid issuers. Due to continued pressure on European financial institutions with exposure to the sovereign debt crisis, out of an abundance of caution, the Fund will not acquire any additional debt securities issued by European financial institutions until we believe the market has stabilized. CNAM waived the majority of its fees to produce a positive return of 0.06%. |

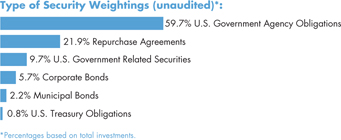

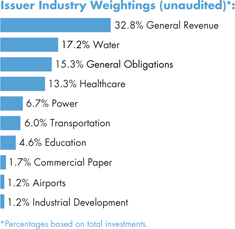

| | • | Our objective for the California Tax Exempt Money Market Fund continues to focus on the fundamental objective of principal preservation and liquidity. The yield curve for allowable money market securities remains relatively flat, with the risk of extending generally outweighing the benefit gained, and thus the average maturity of the portfolio remains short at 27 days. We continue to carefully watch credit developments in California and while the state has strengthened its liquidity position, we have been very selective of other municipalities. Over the course of the year, we have also eliminated or nearly eliminated exposure to European bank liquidity providers for our variable rate demand notes as the European credit crisis deepened. CNAM waived the majority of its fees to produce a return of 0.02%. |

CNI CHARTER FUNDS | PAGE 4

STRATEGIC OUTLOOK

As mentioned, due to the continued slow pace of the economic recovery and high levels of unemployment the Fed has pledged to keep rates at historically low levels for an extended period of time. We consider our Money Market Funds to be appropriately positioned for the low and slow economic growth that is expected. As always, CNAM continues to monitor the objectives of the Funds very closely and seek opportunities in the markets to best serve the Funds’ shareholders.

Sincerely,

|  |

| Gregory Kaplan | William Miller |

Paul Single

Directors of Fixed Income Investments

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 5

investment adviser’s report

Fixed Income and Blended Funds

For the first half of 2011, risk assets performed well with equities and bonds showing positive year over year gains. However, the European sovereign debt crisis, which has dominated international headlines throughout the year, and the accompanying worry peaked in late third-quarter 2011, as the inability of the European leaders to quell the market’s desire for action contributed to downtrodden consumer sentiment and a buildup of fear as seen with the VIX Index (a measure of stock market volatility) more than tripling, from 14.6 to 48.0 (versus an average of 18.6 over the last year). This dramatic uptick in fear created a flight to quality with investors fleeing into Treasuries and out of risk assets, resulting in a total return of 5.97% for the Barclays Capital U.S. Treasury Index over the fiscal year ending September 30, 2011.

In late September, the Federal Reserve Bank (the “Fed”) engaged in another easing program dubbed “Operation Twist.” Operation Twist’s intent is to spur economic growth and investment by flattening the yield curve. This will be done by selling short-term securities and buying long-term securities to bring down longer term interest rates. Furthermore, the Fed stated plainly that its goal is to keep rates low through mid-2013. With rates remaining near historic lows, the Fed is hoping to encourage investors to move out of low risk assets (Treasuries) and into higher risk assets (mainly corporate bonds and equities). A massive flow of capital out of Treasuries and into higher risk assets would positively impact asset prices and in turn, consumer sentiment.

The flight to quality during August and September in particular, benefitted Treasuries and agency-backed debt, while the yield on corporate bonds increased from 1.54% to 2.41% per Barclays Capital U.S. Corporate Investment Grade Index. The back-up in yields has made for very attractive entry points across the corporate credit space.

Similarly municipal bonds have benefitted from the Fed's commitment to low interest rates and the flight to quality during August and September, during which muni 10-year yields fell by 42 basis points. The municipal yield curve remained quite steep over the period encouraging investors to extend at the margin and avoid negligible rates in cash and short-term securities. The commonly watched value barometer of municipal yields relative to Treasury yields has remained well above historical averages. This has encouraged cross-over buyers to shift assets from government markets into high grade municipal debt supporting additional issuance late in the year.

All returns listed below relate to the 12-month period ended September 30, 2011 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

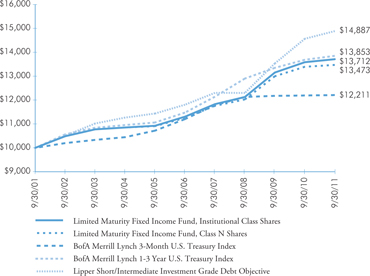

LIMITED MATURITY FIXED INCOME FUND

The Limited Maturity Fixed Income Fund follows the multi-portfolio style of combining complementary core + alpha portfolios to blend returns over interest rate and sector cycles. The portfolio managers met the objectives of the Fund, which are to preserve capital, maintain liquidity and maximize income in a high credit quality fund. The barbelled portfolios which create this Fund are benchmarked to the BofA/Merrill Lynch 3-Month U.S. Treasury Bill Index and the BofA/Merrill Lynch 1-3 Year Treasury Index. For the fiscal year the Fund returned 0.92% versus 1.20% for the BofA/Merrill Lynch 1-3 Year Treasury Index and 0.14% for the BofA/Merrill Lynch 3-Month U.S. Treasury Bill Index.

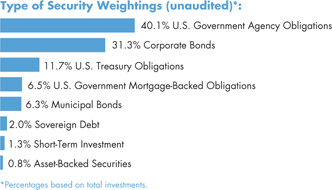

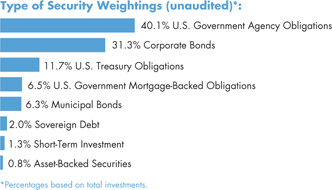

For income oriented investors, the Fund’s 30-day SEC yield at September 30, 2011 was 1.16%, compared to 0.30% for the BofA/Merrill Lynch 1-3 Year Treasury Index and 0.02% for BofA/Merrill Lynch U.S. Treasury Bills Index. The Fund maintained an income advantage over both indices over the year, because it was diversified in both high grade corporate and agency securities. The largest sector allocation, Agencies, comprised 40.1% of the Fund at year end, while Treasuries were 11.7% and Corporate Bonds were 31.3%. The Fund’s performance year-to-date primarily stems from the allocation to corporate bonds which had performed well in the first half of the year, but experienced negative price performance over the third quarter, while the diversification to government bonds aided performance at the end of the year during the bond market turmoil.

CNI CHARTER FUNDS | PAGE 6

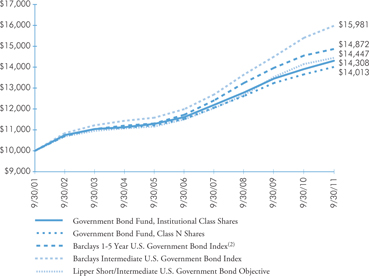

GOVERNMENT BOND FUND

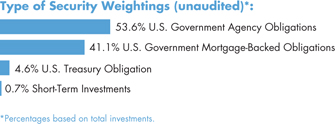

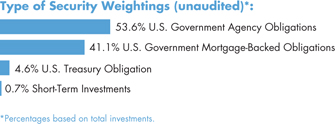

The Government Bond Fund produced a return of 2.86%. By comparison, the Barclays Capital U.S. 1-5 Year Government Bond Index returned 2.16%. The Fund outperformed the benchmark due to the Funds’ overweight in agency-backed debt and collateralized mortgage obligations. In addition, the Fund maintained a somewhat shorter duration versus the benchmark in order to keep liquidity higher than normal to support shareholder activity.

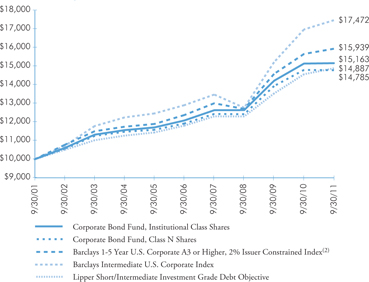

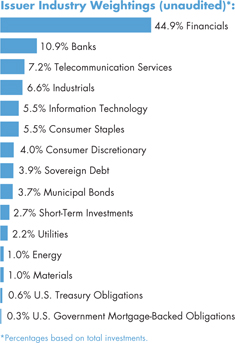

CORPORATE BOND FUND

The Corporate Bond Fund produced a total annual net return of 0.15%, while the Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index returned 1.79%. The Fund maintained its positive stance on corporate credit quality while its overweight in lower quality (BBB) issues contributed to poor relative performance over the very volatile third quarter.

Continued positive (albeit slow) domestic GDP growth, and tentatively positive news from Europe are both supportive of credit quality. In addition, credit is expected to perform well in the near term given the relative values created with the sell-off in August and September.

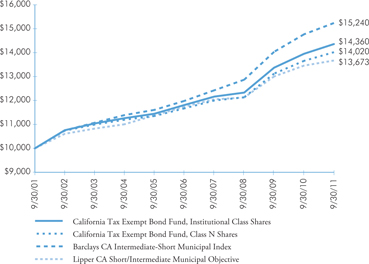

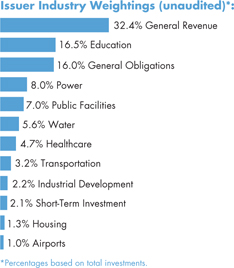

CALIFORNIA TAX EXEMPT BOND FUND

The California Tax Exempt Bond Fund produced a total return of 2.92%, while the Barclays Capital CA Intermediate-Short Municipal Index returned 3.19%. By comparison the Lipper CA Short/Intermediate Muni Debt Objective median return was 1.59%. The first quarter of the fiscal year experienced a significant increase in market volatility due to the expiration of the Build America Bond Program combined with heightened credit fears. This set the market up for good returns late in the second fiscal quarter. Very limited bond supply and improving economic outlook helped to more than offset earlier weakness. This was followed by further strength in high quality bond markets due to the debt ceiling debate and ultimate downgrade of U.S. Treasury debt by Standand & Poor’s (“S&P”) in August. The fiscal year wrapped up on a very strong note for the Fund as its high quality intermediate structure benefited from the acute concern of an imminent Greek default.

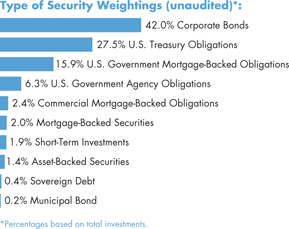

FULL MATURITY FIXED INCOME

The Full Maturity Fixed Income Fund combines two portfolios designed to complement each other in the core + alpha strategy and to provide a “full” maturity spectrum. The sub-advisers are:

| | • | Boyd Watterson Asset Management, the alpha sub-adviser, manages to the Barclays Capital U.S. Intermediate Government/Credit Bond Index, and will more aggressively move duration above or below the index by up to 20%; |

| | • | Baird Advisors, the core sub-adviser, manages to the Barclays Capital U.S. Aggregate Bond Index, and is always duration neutral to the index and seeks to add value by sector selection. |

Following its investment objectives of preserving capital and seeking investment income, the Fund is broadly diversified in government and investment grade securities. The Fund’s sub-advisers began the fiscal year with a 45.4% tilt towards corporate bonds, which was the favored sector in the first three quarters of the fiscal year and benefitted performance. Despite S&P’s downgrade, U.S. Treasury prices rose sharply in the final fiscal quarter (ended September 30) as a response to the flight from European Union debt problems with Greece. The Fund ended the fiscal year with a 27.5% weighting in Treasuries and 6.3% in Agencies; these Government bond weightings benefitted investors in the Treasury rally. The diversification among sectors for this Fund serves to protect investors from any one sector’s risk, while maintaining a steady cashflow stream from the fixed income payments. The Fund invests in investment grade bonds only and has maintained an overall portfolio AA investment quality rating.

The Fund’s total return was 3.36% for the fiscal year. This was in line with the Barclays Capital U.S. Intermediate Government/Credit Bond Index return of 3.40% for the period. The Lipper Corporate Debt Funds A-Rated Objective, which includes bond funds that are 100% weighted towards corporate bonds, returned 4.11% for the fiscal year.

CNI CHARTER FUNDS | PAGE 7

investment adviser’s report

Fixed Income and Blended Funds (continued)

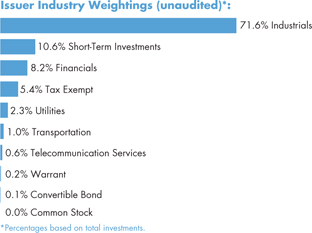

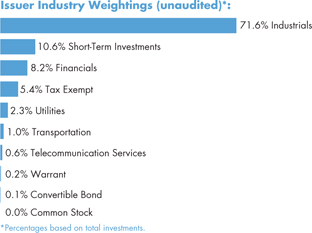

HIGH YIELD BOND FUND

The High Yield Bond Fund, sub-advised by Guggenheim Partners LLC, was in the select few of below investment grade bond managers able to produce positive returns for the fiscal year. In the first three fiscal quarters, when Industrial sector returns were still generally on the upswing, the Fund participated in this sector, ending the fiscal year with 71.6% weight, even as the Fund’s sub-adviser forecast slower economic growth in the period. The Fund underweighted the riskier Financials sector, minimizing bank sector bonds, having an 8.2% allocation at fiscal year end. During the flight to high quality bonds in the final fiscal quarter, when below investment grade bonds were down sharply, the Fund’s portfolio was down less, providing investors with a twelve-month return of 4.45%. By comparison, the Fund’s primary benchmark, the Citigroup High Yield Market Capped Index, was up 2.59% for the year (the “Market Capped” refers to the fact that no one security can be more than 2% weighting of the index). The Lipper High Current Yield Objective return for this category was 0.71% for the same period.

The Fund’s sub-adviser has followed a strategy of buying the high yielding bonds of mid-sized companies, rather than those of the very large capitalized companies because they generally yield at a higher rate and there are more potential holdings (263 at fiscal year end), which enables the Fund to spread risk. The sub-adviser also buys intermediate maturity bonds in the higher credit range, in an effort to avoid defaults in this category. The sub-adviser has been successful in meeting the Fund’s objective of maximizing return in the high yield market.

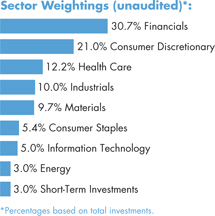

MULTI-ASSET FUND

For the fiscal year, the Multi Asset Fund returned -2.97%, compared to -0.98% median return for the Lipper Absolute Return Objective peer group. Fund returns were negatively impacted during the flight from risky assets that occurred as a result of the flare up of the European sovereign debt crisis in August and September. The Fund’s cash and fixed income allocations increased significantly as allocations to riskier assets were aggressively reduced due to heightened market volatility.

Additionally, the Fund’s remaining equity allocations were shifted to be more defensive, with biases to domestic, large cap and dividend-paying stocks. Heightened volatility and potentially weaker economic growth also led us to reduce the Fund’s real estate and commodity allocations. We increased the Fund’s allocation to high yield debt towards the end of the fiscal year, as valuations became very attractive due to the risk averse environment.

The following pages provide an overview of each of the Fixed Income and Blended Funds managed by CNAM. Please visit cnicharterfunds.com for the most current returns.

Sincerely,

|  |

| Gregory Kaplan | William Miller |

Paul Single

Paul Single

Directors of Fixed Income Investments

City National Asset Management, Inc.

Timothy G. Solberg, CFA

Director of Sub-advised Funds

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 8

fund overview

Limited Maturity Fixed Income Fund

The Fund seeks to provide a high level of current income, consistent with the preservation of capital and liquidity by investing primarily in fixed income securities either issued or guaranteed by the U.S. Government or its agencies or instrumentalities, money market instruments and non-convertible fixed income securities of U.S. companies.

Comparison of Change in the Value of a $10,000 Investment in the Limited Maturity Fixed Income Fund, Institutional Class Shares and Class N Shares, versus the BofA Merrill Lynch 3-Month U.S. Treasury Index and the BofA Merrill Lynch 1-3 Year U.S. Treasury Index, and the Lipper Short/Intermediate Investment Grade Debt Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Bofa Merrill Lynch 3-Month U.S. Treasury Index | | | | | | |

Bofa Merrill Lynch 1-3 Year U.S. Treasury Index | | | | | | |

Lipper Short/Intermediate Investment Grade Debt Objective | | | | | | |

| (1) | Class I Shares of the predecessor to the Limited Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 22, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 22, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Limited Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 22, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on October 22, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of October 22, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 22, 1988 to October 21, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| U.S. Treasury Notes | |

| 4.250%, 08/15/15 | 9.0 |

| FHLB | |

| 0.875%, 08/22/12 | 5.3 |

| FNMA | |

| 0.500%, 08/09/13 | 5.3 |

| FHLB | |

| 5.750%, 05/15/12 | 4.8 |

| FHLMC | |

| 2.125%, 09/21/12 | 4.7 |

| FHLMC | |

| 4.375%, 07/17/15 | 3.9 |

| Southern California Public Power Authority, Sub-Ser B, AGM | |

| 6.930%, 05/15/17 | 3.4 |

| FNMA | |

| 5.000%, 02/13/17 | 3.1 |

| FNMA | |

| 5.250%, 08/01/12 | 2.7 |

| U.S. Treasury Notes | |

| 4.125%, 08/31/12 | 2.7 |

CNI CHARTER FUNDS | PAGE 9

fund overview

Government Bond Fund

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing primarily in U.S. Government securities either issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

Comparison of Change in the Value of a $10,000 Investment in the Government Bond Fund, Institutional Class or Class N Shares, versus the Barclays Capital U.S. 1-5 Year Government Bond Index, Barclays Capital U.S. Intermediate U.S. Government Bond Index, and the Lipper Short/Intermediate U.S. Government Bond Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| (2) | The Fund’s adviser has elected to compare the Fund's performance to the Barclays Capital U.S. 1-5 Year Government Bond Index as it believes this is the most appropriate index for comparison to the Fund's performance. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. 1-5 Year Government Bond Index | | | | | | |

Barclays Capital U.S. Intermediate Government Bond Index | | | | | | |

Lipper Short/Intermediate U.S. Government Bond Objective | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Israel Government AID Bond | |

| 3.962%, 05/15/20 | 7.2 |

| Tennessee Valley Authority, Ser E | |

| 6.250%, 12/15/17 | 5.6 |

| Egypt Government AID Bond | |

| 4.450%, 09/15/15 | 5.1 |

| FHLMC REMIC, Ser 2011-3806, Cl UP | |

| 4.500%, 02/15/41 | 4.8 |

| U.S. Treasury Note | |

| 1.375%, 11/30/15 | 4.6 |

| FFCB | |

| 1.875%, 12/07/12 | 4.6 |

| FHLB | |

| 0.393%, 04/08/14 | 4.5 |

| FHLMC | |

| 1.050%, 06/27/14 | 4.5 |

| FFCB | |

| 0.600%, 08/01/13 | 4.5 |

| FHLMC REMIC, Ser 2010-3680, Cl VA | |

| 4.500%, 07/15/21 | 4.4 |

CNI CHARTER FUNDS | PAGE 10

fund overview

Corporate Bond Fund

The Fund seeks to provide current income (as the primary component of a total return intermediate duration strategy) by investing in a diversified portfolio of investment grade fixed income securities, primarily corporate bonds issued by domestic and international companies denominated in U.S. dollars.

Comparison of Change in the Value of a $10,000 Investment in the Corporate Bond Fund, Institutional Class or Class N Shares, versus the Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index, the Barclays Capital U.S. Intermediate Corporate Bond Index, and the Lipper Short/Intermediate Investment Grade Debt Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| (2) | The Fund’s adviser has elected to compare the Fund's performance to the Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index as it believes this is the most appropriate index for comparison to the Fund's performance. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. Corporate 1-5 A3 or Higher, 2% Issuer Constrained Index | | | | | | |

Barclays Capital U.S. Intermediate Corporate Bond Index | | | | | | |

Lipper Short/Intermediate Investment Grade Debt Objective | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Wachovia Bank | |

| 4.800%, 11/01/14 | 3.1 |

| General Electric Capital | |

| 5.900%, 05/13/14 | 2.9 |

| Caisse Centrale Desjardins du Quebec | |

| 2.650%, 09/16/15 | 2.7 |

| Kingdom of Denmark | |

| 2.750%, 11/15/11 | 2.7 |

| General Electric Capital, FDIC Insured |

| 2.625%, 12/28/12 | 2.5 |

| Ally Financial, FDIC Insured | |

| 2.200%, 12/19/12 | 2.3 |

| JPMorgan Chase, FDIC Insured | |

| 2.125%, 12/26/12 | 2.3 |

| Citigroup Funding, FDIC Insured | |

| 2.250%, 12/10/12 | 2.3 |

| Verizon Communications | |

| 5.550%, 02/15/16 | 2.2 |

| ConocoPhillips Canada Funding I | |

| 5.625%, 10/15/16 | 2.1 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 11

fund overview

California Tax Exempt Bond Fund

The Fund seeks to provide current income exempt from Federal and California state income tax (as the primary component of a total return strategy) by investing primarily in California municipal bonds and notes.

Comparison of Change in the Value of a $10,000 Investment in the California Tax Exempt Bond Fund, Institutional Class or Class N Shares, versus the Barclays Capital CA Intermediate-Short Municipal Index, and the Lipper CA Short/Intermediate Municipal Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital CA Intermediate-Short Municipal Index | | | | | | |

Lipper CA Short/Intermediate Municipal Objective | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| California Statewide Communities Development Authority, Proposition 1A Receivables, Ser PG, RB | |

| 5.000%, 06/15/13 | 4.6 |

| County of Riverside California, Ser A, COP, AMBAC | |

| 5.000%, 11/01/17 | 3.0 |

| California State, GO | |

| Callable 3/1/2015 @ 100 | |

| 5.000%, 03/01/16 | 2.9 |

| Southern California, Public Power Authority, Subordinated Southern Transmission Project, Ser A, RB | |

| 5.000%, 07/01/17 | 2.5 |

| Orange County, Public Financing Authority, RB, NATL-RE | |

| 5.000%, 07/01/17 | 2.1 |

| Imperial Irrigation District, RB | |

| Callable 7/1/2021 @ 100 | |

| 5.250%, 07/01/23 | 2.1 |

| California State, GO | |

| Callable 11/1/2020 @ 100 | |

| 5.000%, 11/01/22 | 2.1 |

| Modesto Irrigation District, Ser A, RB | |

| 5.000%, 07/01/17 | 2.0 |

| California State, GO | |

| 5.000%, 09/01/20 | 2.0 |

| California State, Public Works Board, University of California Research Project, Ser L, RB, NATL-RE | |

| Callable 11/1/2015 @ 100 | |

| 5.250%, 11/01/16 | 2.0 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 12

fund overview

Full Maturity Fixed Income Fund

The Fund seeks to provide a high level of current income, consistent with the preservation of capital by investing primarily in fixed income securities either issued or guaranteed by the U.S. Government or its agencies or instrumentalities, money market instruments, non-convertible fixed income securities of U.S. companies and U.S. dollar-denominated debt obligations issued by foreign governments and corporations.

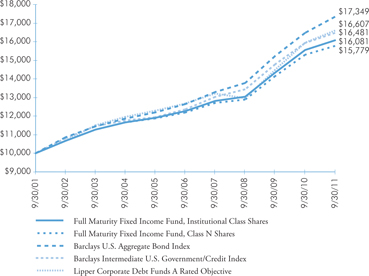

Comparison of Change in the Value of a $10,000 Investment in the Full Maturity Fixed Income Fund, Institutional Class Shares and Class N Shares, versus the Barclays Capital U.S. Aggregate Bond Index, the Barclays Capital U.S. Intermediate Government/Credit Bond Index, and the Lipper Corporate Debt Funds A-Rated Objective (1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. Aggregate Bond Index | | | | | | |

Barclays Capital U.S. Intermediate Government/Credit Bond Index | | | | | | |

Lipper Corporate Debt Funds A-Rated Objective | | | | | | |

| (1) | Class I Shares of the predecessor to the Full Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Full Maturity Fixed Income Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on May 11, 2004. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of May 11, 2004, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to May 11, 2004, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| U.S. Treasury Note | |

| 2.375%, 07/31/17 | 6.3 |

| U.S. Treasury Bond | |

| 6.250%, 08/15/23 | 4.1 |

| U.S. Treasury Note | |

| 2.625%, 11/15/20 | 3.0 |

| U.S. Treasury Note | |

| 1.750%, 07/31/15 | 2.3 |

| FNMA | |

| 4.625%, 10/15/13 | 2.3 |

| U.S. Treasury Note | |

| 2.375%, 09/30/14 | 2.0 |

| U.S. Treasury Note | |

| 4.750%, 05/15/14 | 1.8 |

| FNMA | |

| 5.500%, 04/01/36 | 1.5 |

| U.S. Treasury Note | |

| 2.375%, 03/31/16 | 1.4 |

| U.S. Treasury Bond | |

| 4.375%, 02/15/38 | 1.4 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 13

fund overview

High Yield Bond Fund

The Fund seeks to maximize total return by investing primarily in fixed income securities rated below investment grade including corporate bonds and debentures, convertible and preferred securities, zero coupon obligations and debt securities that are issued by U.S. and foreign governments and their agencies.

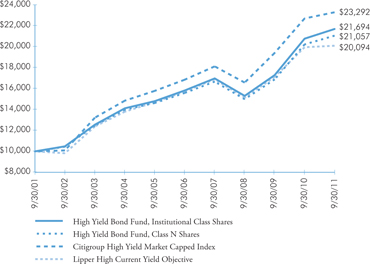

Comparison of Change in the Value of a $10,000 Investment in the High Yield Bond Fund, Institutional Class or Class N Shares, versus the Citigroup High Yield Market Capped Index, and the Lipper High Current Yield Objective(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Citigroup High Yield Market Capped Index | | | | | | |

Lipper High Current Yield Objective | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| CIT Group | |

| 7.000%, 05/02/17 | 1.0 |

| Ironshore Holdings US | |

| 8.500%, 05/15/20 | 0.9 |

| Marquette Transportation | |

| 10.875%, 01/15/17 | 0.9 |

| Coleman Cable | |

| 9.000%, 02/15/18 | 0.9 |

| United Maritime Group | |

| 11.750%, 06/15/15 | 0.8 |

| CKE Restaurants | |

| 11.375%, 07/15/18 | 0.8 |

| AES | |

| 7.375%, 07/01/21 | 0.8 |

| Kratos Defense & Security Solutions | |

| 10.000%, 06/01/17 | 0.8 |

| iGate | |

| 9.000%, 05/01/16 | 0.8 |

| Quadra FNX Mining | |

| 7.750%, 06/15/19 | 0.8 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 14

fund overview

Multi-Asset Fund

The Fund seeks to generate a positive total return in excess of inflation in a manner consistent with capital preservation in all market environments by investing all or a substantial portion of its assets in other mutual funds or other types of funds like exchange-traded funds.

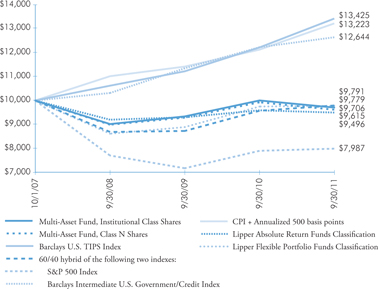

Comparison of Change in the Value of a $10,000 Investment in the Multi-Asset Fund, Institutional Class or Class N Shares, versus the Barclays Capital U.S. TIPS Index; a 60/40 hybrid of the following two indexes: the S&P 500 Index and the Barclays Capital U.S. Intermediate Government/Credit Index; the CPI + Annualized 500 basis points; the Lipper Absolute Return Funds Classification; and the Lipper Flexible Portfolio Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

Barclays Capital U.S. TIPS Index | | | | |

60/40 hybrid of the following two indexes: S&P 500 Index Barclays Capital U.S. Intermediate Government/Credit Index | | | | |

CPI + Annualized 500 basis points | | | | |

Lipper Absolute Return Funds Classification | | | | |

Lipper Flexible Portfolio Funds Classification | | | | |

| (1) | Commenced operations on October 1, 2007. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| SPDR S&P 500 Fund | 8.4 |

| Oppenheimer International Bond Fund, Class A | 6.4 |

| CNI High Yield Bond Fund, Institutional Class | 5.8 |

| Vanguard Short-Term Bond Index Fund | 5.1 |

| Principal Preferred Securities Fund | 5.0 |

| Fidelity Floating Rate High Income Fund | 4.5 |

| CNI Corporate Bond Fund, Institutional Class | 4.3 |

| CNI Government Bond Fund, Institutional Class | 3.5 |

| Cohen & Steers International Realty Fund, Inc. | 3.1 |

| PIMCO Emerging Markets Bond Fund | 3.1 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 15

investment adviser’s report

Equity Funds

The fiscal year ended September 30, 2011 was really a tale of two markets. First, we experienced the continuation of a bull market that had begun in March of 2009. This market showed robust price appreciation and was accompanied by improving economic fundamentals. From September 30, 2010 through April 29, 2011, the S&P 500 Index returned 20.79% and the Nasdaq Composite Index returned 21.99%. This period was brought to an end by two major events. First, the Japanese earthquake and corresponding tsunami on March 11 brought the world’s fourth largest exporter (the United States is third) to its knees overnight. It took a while for this disaster’s economic effects to be felt but, within 30 to 60 days, the world’s industrial companies were feeling the full force of this disaster. The second market event was the sovereign debt issues being experienced by Greece, Ireland, Portugal, Italy and Spain. As the debate on how to resolve these issues became more public, it would not take long to adversely affect asset prices across the world.

The second half of the fiscal year was much more difficult and most of the gains achieved through the first half of the year were lost. From April 29, 2011 through September 30, 2011, the S&P 500 Index was down 16.26% while the Nasdaq Composite Index declined 15.57%. In addition to the lingering effects of the Japanese disaster and the raging debate on how to resolve the sovereign debt issues in Europe, there was a contentious debate on the home grown budget deficits here in the United States. While Japan’s economy is improving as the country continues to repair the damage brought by the earthquake, European and U.S. debt issues promise to be in the headlines for the foreseeable future.

So, at the end of the day, the Fund’s returns essentially were flat for the fiscal year ended September 30, 2011 with the S&P 500 Index returning 1.14% and the Nasdaq Composite Index returning 2.99% for the same period. Looking forward, we believe the equity market is inexpensive based on most valuation measures. However, we do not see tremendous upside in the equity market until there is some political resolution on how to address the U.S. and European fiscal problems.

All returns listed below relate to the 12-month period ended September 30, 2011 and are net of expenses. CNI Charter Funds’ returns refer to Institutional Class Shares. Other classes would have different returns.

DIVERSIFIED EQUITY FUND

As with other equity funds, this was a volatile year for the Diversified Equity Fund. The Fund began the fiscal year with a lead on the S&P 500 Index at quarters ended December 31 and March 31, due in part to weightings in Energy, which saw oil prices spike during the Arab spring revolts, and Industrials and Materials as the economy was expanding. The markets slowed dramatically as the economic recovery looked like it may be stalled, and then went into a slide during the summer months when oil prices and industrial production dropped. The Information Technology sector split between those that were gaining by the new “cloud” technology and those being outpaced by recent developments. During the last fiscal quarter’s steep market drop, the Fund’s underweight in defensive sectors such as Consumer Staples, and no holdings in Utilities were a disadvantage relative to the Index.

The Fund produced a return of -4.27% for this fiscal year. Lipper Analytics compares this Fund to its Multi-Cap Core Funds Classification, which had a return of -2.36% for the same period. The S&P 500 Index was up 1.14% for the same period. At the beginning of September 2011, we terminated an equity portfolio manager which had contributed to the Fund’s underperformance versus the S&P 500 Index benchmark. We decided to allocate 60% of the Fund to the higher dividend paying stocks of the value oriented sub-adviser, SKBA Capital Management, LLC, with 40% allocated to the growth style sub-adviser, Turner Investment Partners, Inc.

At fiscal year end, the Fund is selectively allocated to Information Technology companies that seek to take advantage of the most recent advances in cloud computing, while poised for a slower economy, with the largest weightings in non-money center bank Financial sector equities (insurance companies and regional

CNI CHARTER FUNDS | PAGE 16

banks), and Healthcare sector corporations set to benefit from the current market. Consumer Discretionary holdings round out the fourth largest weighting, as the Fed continues to hold interest rates low to stimulate consumer spending on larger items that need to be financed by the average consumer.

LARGE CAP VALUE EQUITY FUND

While all stocks experienced the downswing in markets during the final fiscal quarter, value oriented stocks in this Fund did relatively better than their peers. The strategy of seeking out of favor companies at attractive prices while keeping a focus on quality of financials has served the Fund well. Gains in Telecommunications and Information Technology aided returns, as did judicious selling of certain Energy related stocks before a dramatic downturn in oil prices caused the sector to decline significantly. While the overall Finance sector, which at year-end held the largest allocation at 22.4% of the portfolio, aided the Fund’s return for the year, a money center bank and insurance company were laggards in the portfolio. Other sectors contributing to returns were Industrials and Information Technology.

The Large Cap Value Equity Fund produced a return of -2.20%. The return was 46 basis points ahead of its primary benchmark, the S&P 500 Value Index, for the fiscal year. The Fund’s returns compared favorably to the Lipper Large-Cap Value Funds Classification median return of -3.54%.

LARGE CAP GROWTH EQUITY FUND

While growth oriented stocks generally were in favor this year, they experienced a drawback in returns and the consensus was that the period of more aggressive expansion was over. During the final fiscal quarter, all growth style sectors experienced a slide in returns as investors reassessed the economic recovery. This Fund was no exception, and saw a retraction in results. The Large Cap Growth Equity Fund returns for the fiscal year were -2.86%, compared to 4.85% for the S&P 500 Growth Index. By comparison, the Lipper Large-Cap Growth Funds Classification median return was 0.27%.

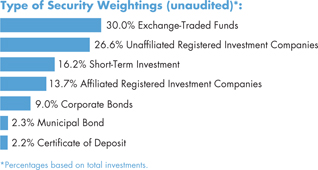

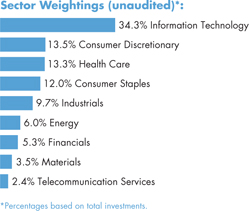

The Fund did well during the first half of the year and underperformed during the second half of the year, mainly due to taking a more aggressive stance regarding the prospects for economic growth. As the likelihood of recession increased owing to concerns surrounding deteriorating U.S. economic growth and European sovereign debt issues, positions within economically sensitive sectors underperformed. This was particularly true for Consumer Discretionary, the second largest weighting in the portfolio at 13.3%, and smaller weightings in Materials and Energy sectors, where stocks in the Index performed better than those owned in the Fund. Holdings in Information Technology, which comprised the largest allocation of the Fund at 34.3%, produced mixed results. As part of the re-evaluation of overall growth prospects in the economy, the portfolio managers continue to employ a disciplined investment process focusing on higher quality companies with good earnings growth prospects and reasonable valuations.

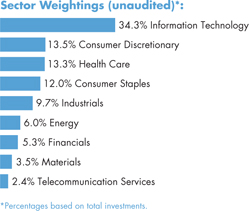

SOCIALLY RESPONSIBLE EQUITY FUND

The Socially Responsible Equity Fund seeks to invest in companies that follow “ESG” or environmental, social and governance guidelines. It is sub-advised by SKBA Capital Management, LLC, a value style equity manager with long-term experience in ESG responsible investing. Besides seeking companies with sound financial ratios and social worth, the Fund restricts investment in certain companies which are deemed not socially responsible, including tobacco and nuclear power companies. The avoidance of nuclear power worked to this Fund’s advantage earlier in 2011 after the Japanese tsunami and power plant crisis, as stocks of U.S. nuclear power generators dropped in a spillover effect.

For the fiscal year, this Fund was down 3.67%. Lipper classifies this Fund in the Multi-Cap Value category, as it follows a large cap bias but holds up to 20% in mid-sized capitalization companies.

At September 30, the 45 holdings in this portfolio were diversified towards dividend paying companies that will produce yields even in a slower economy. The heaviest sector weights were tilted towards non-money center

CNI CHARTER FUNDS | PAGE 17

investment adviser’s report

Equity Funds (continued)

bank Financials, including insurance companies, at 25.7%; Healthcare companies set to benefit from current health testing and pharmaceutical market, 18.7%; and about 10% each in Industrials, Information Technology and Energy.

CSC SMALL CAP VALUE FUND (FORMERLY, “RCB SMALL CAP VALUE FUND”)

On July 1, 2011, the portfolio management team that has sub-advised the Fund since inception established Cove Street Capital, LLC, and the CNI Charter Funds elected to hire Cove Street Capital to serve as the Fund’s sub-adviser with the same portfolio team and renamed this Fund from “RCB” to “CSC” to reflect the sub-adviser change. During this fiscal year, the Fund experienced wider volatility which is common for smaller capitalized stocks in a market downturn compared with large capitalized stocks. Although the Fund lagged its Lipper category during the first three fiscal quarters, the sub-adviser had increased the Fund’s cash position to 16% in mid-July, which proved beneficial at the beginning of the market downturn in the final fiscal quarter and helped mitigate overall returns for the year. Despite a strong showing in the final fiscal quarter, returns for the fiscal year for the Fund were -7.38% compared to the median Lipper Small-Cap Core Funds Classification return of -2.88%.

The Fund held a concentrated portfolio, consisting of 29 stocks at year end. Therefore, selection of stocks is more important than in a broadly diversified portfolio. Several detractors from performance for the year were in the Materials and Energy sectors, somewhat countered by gains in the Financial (insurance) and both Consumer sectors: Staples and Discretionary.

The following pages provide an overview of each of the Equity Funds managed by CNAM. Please visit cnicharterfunds.com for the most current returns.

Sincerely,

| |

| Oliver Campbell | Otis “Tres” Heald |

Directors of Equity Investments

City National Asset Management, Inc.

Timothy G. Solberg, CFA

Director of Sub-advised Funds

City National Asset Management, Inc.

This material represents the managers’ assessment of the portfolios and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice.

CNI CHARTER FUNDS | PAGE 18

fund overview

Diversified Equity Fund

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of large-capitalization U.S. companies that are diversified among various industries and market sectors.

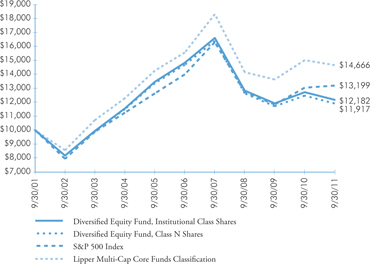

Comparison of Change in the Value of a $10,000 Investment in the Diversified Equity Fund, Institutional Class Shares and Class N Shares, versus the S&P 500 Index, and the Lipper Multi-Cap Core Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Multi-Cap Core Funds Classification | | | | | | |

| (1) | Class I Shares of the predecessor to the Diversified Equity Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of October 20, 1988 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Diversified Equity Fund (the “Predecessor Fund”) commenced operations on October 20, 1988. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on December 30, 2002. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of December 30, 2002, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of October 20, 1988 to December 30, 2002, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Apple | 2.8 |

| Brookfield Asset Management, Cl A | 2.3 |

| Tyco International | 2.1 |

| PepsiCo | 1.9 |

| IBM | 1.9 |

| Berkshire Hathaway, Cl B | 1.8 |

| BB&T | 1.8 |

| CareFusion | 1.7 |

| HCC Insurance Holdings | 1.7 |

| Covidien | 1.7 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 19

fund overview

Large Cap Value Equity Fund

The Fund seeks to provide capital appreciation and moderate income consistent with current returns available in the marketplace by investing in large U.S. corporations and U.S. dollar denominated American Depositary Receipts of large foreign corporations which are undervalued.

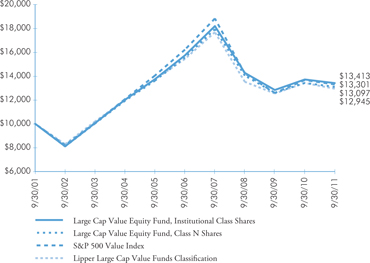

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Value Equity Fund, Institutional Class or Class N Shares, versus the S&P 500 Value Index, and the Lipper Large Cap Value Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Large Cap Value Funds Classification | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on April 13, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to April 13, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Exxon Mobil | 3.7 |

| Chevron | 3.6 |

| ConocoPhillips | 3.2 |

| Berkshire Hathaway, Cl B | 2.5 |

| JPMorgan Chase | 2.5 |

| Wal-Mart Stores | 2.5 |

| General Electric | 2.5 |

| Wells Fargo | 2.4 |

| Procter & Gamble | 2.2 |

| Comcast, Cl A | 2.0 |

CNI CHARTER FUNDS | PAGE 20

fund overview

Large Cap Growth Equity Fund

The Fund seeks to provide capital appreciation by investing in large U.S. corporations and U.S. dollar denominated American Depositary Receipts of large foreign corporations with the potential for growth.

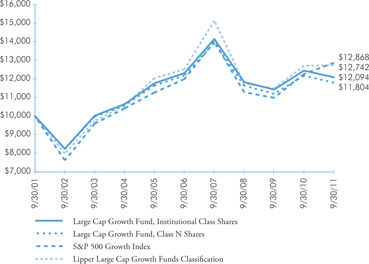

Comparison of Change in the Value of a $10,000 Investment in the Large Cap Growth Equity Fund, Institutional Class or Class N Shares, versus the S&P 500 Growth Index, and the Lipper Large Cap Growth Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Large Cap Growth Funds Classification | | | | | | |

| (1) | Commenced operations on January 14, 2000. |

| (2) | Commenced operations on March 28, 2000. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | Class N Shares’ performance for the period of January 14, 2000 to March 28, 2000 was calculated using the performance of the Institutional Class Shares adjusted to reflect the expenses of the Class N Shares. If performance of the Institutional Class Shares had not been adjusted, the performance of the Class N Shares for that period would have been higher because the expenses of the Class N Shares are higher than those of the Institutional Class Shares. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| Apple | 9.5 |

| Google, Cl A | 4.5 |

| IBM | 4.3 |

| Celgene | 3.3 |

| Qualcomm | 3.3 |

| Mastercard, Cl A | 2.7 |

| EMC | 2.6 |

| Oracle | 2.5 |

| Gilead Sciences | 2.4 |

| Cummins | 2.3 |

CNI CHARTER FUNDS | PAGE 21

fund overview

September 30, 2011

Socially Responsible Equity Fund

The Fund seeks to provide long-term capital growth by investing primarily in common stocks of U.S. issuers that meet certain socially responsible criteria.

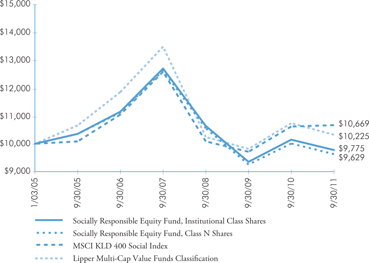

Comparison of Change in the Value of a $10,000 Investment in the Socially Responsible Equity Fund, Institutional Class Shares and Class N Shares, versus the MSCI KLD 400 Social Index and the Lipper Multi-Cap Value Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

| | | | | | |

| | | | | | |

MSCI KLD 400 Social Index | | | | | |

Lipper Multi-Cap Value Funds Classification | | | | | |

| (1) | Class I Shares of the predecessor to the Socially Responsible Equity Fund (the “Predecessor Fund”) commenced operations on January 3, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Institutional Class Shares of the Fund for the period of January 3, 2005 to September 29, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. |

| (2) | Class I Shares of the predecessor to the Socially Responsible Equity Fund (the “Predecessor Fund”) commenced operations on January 3, 2005. Class A Shares of the Predecessor Fund, the predecessor to the Class N Shares of the Fund, commenced operations on August 12, 2005. On September 30, 2005, the Predecessor Fund reorganized into the Fund. The performance results for Class N Shares of the Fund for the period of August 12, 2005, to September 29, 2005, reflects the performance of the Predecessor Fund’s Class A Shares. The performance results for Class N Shares of the Fund for the period of January 3, 2005 to August 12, 2005, reflects the performance of the Predecessor Fund’s Class I Shares. The performance of the Predecessor Fund’s Class I Shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Fund’s Class N Shares. If it had, the performance of the Fund’s Class N Shares would have been lower than that shown. |

| TOP TEN HOLDINGS* |

| % OF PORTFOLIO |

| Chubb | 3.5 |

| Spectra Energy | 3.4 |

| Brookfield Asset Management, Cl A | 3.4 |

| Bristol-Myers Squibb | 3.2 |

| Berkshire Hathaway, Cl B | 3.0 |

| ConocoPhillips | 3.0 |

| Abbott Laboratories | 2.9 |

| Automatic Data Processing | 2.8 |

| Patterson | 2.8 |

| Analog Devices | 2.8 |

| * | Excludes Cash Equivalents |

CNI CHARTER FUNDS | PAGE 22

fund overview

CSC Small Cap Value Fund††

The Fund seeks to provide capital appreciation by investing primarily in smaller U.S. corporations which are considered undervalued.

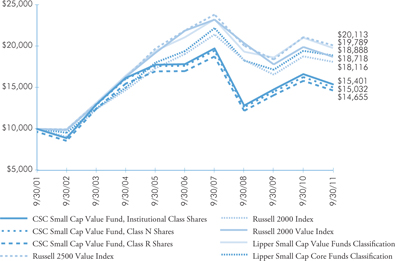

Comparison of Change in the Value of a $10,000 Investment in the CSC Small Cap Value Fund, Institutional Class, Class N Shares, or Class R Shares, versus the Russell 2500 Value Index, the Russell 2000 Index, the Russell 2000 Value Index, the Lipper Small Cap Value Funds Classification, and the Lipper Small Cap Core Funds Classification(1)

| (1) | The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

Past performance is no indication of future performance.

The Fund’s comparative benchmarks do not include the annual operating expenses incurred by the Fund. Please note that one cannot invest directly in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | |

Institutional Class (1)^† | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Lipper Small Cap Value Funds Classification | | | | | | |

Lipper Small Cap Core Funds Classification | | | | | | |

| (1) | Commenced operations on October 3, 2001. |

| (2) | The Fund’s predecessor commenced operations on September 30, 1998, and reorganized into Class R shares of the Fund on October 1, 2001. |

| ^ | The Fund’s Institutional Class Shares are currently offered only to accounts for which City National Bank serves as trustee or in a fiduciary capacity. |

| † | The performance of the Institutional Class and Class N Shares for October 1, 2001, and October 2, 2001, reflects the performance of the Fund’s Class R shares. The performance of all share classes for the period prior to October 1, 2001, reflects the performance of the Class R Shares of the Fund’s predecessor, which commenced operations on September 30, 1998, and reorganized into the Fund’s Class R Shares on October 1, 2001. The performance of the predecessor fund’s Class R Shares has not been adjusted to reflect the expenses applicable to Institutional and Class N Shares. If performance of the predecessor fund’s Class R Shares had been adjusted, the performance of the Institutional Class and Class N Shares would have been higher because the expenses of the predecessor fund’s Class R Shares are higher than those of the Fund's Institutional Class and Class N Shares. |

| †† | See Note 1 in Notes to Financial Statements. |

| TOP TEN HOLDINGS |

| % OF PORTFOLIO |

| White Mountains Insurance Group | 7.3 |

| HSN | 5.7 |

| Alleghany | 5.5 |

| Central Garden & Pet, Cl A | 5.4 |

| Teleflex | 5.4 |

| Wendy's | 5.1 |

| Coinstar | 4.9 |

| PerkinElmer | 4.3 |

| Symetra Financial | 4.1 |

| Hallmark Financial Services | 3.6 |

CNI CHARTER FUNDS | PAGE 23

schedule of investments

Government Money Market Fund

| | | | | |

| U.S. Government Agency Obligations [59.7%] | | | | |

| FAMC DN (A) | | | | | | |

| 0.020%, 10/06/11 | | $ | 15,000 | | | $ | 15,000 | |

| 0.060%, 10/07/11 | | | 23,000 | | | | 23,000 | |

| 0.060%, 10/24/11 | | | 31,750 | | | | 31,749 | |

| 0.050%, 12/01/11 | | | 19,000 | | | | 18,998 | |

| 0.120%, 02/03/12 | | | 30,000 | | | | 29,988 | |

| 0.140%, 04/25/12 | | | 27,000 | | | | 26,978 | |

| FFCB | | | | | | | | |

| 0.154%, 12/14/11(B) | | | 50,000 | | | | 50,000 | |

| 0.250%, 07/02/12 | | | 24,400 | | | | 24,397 | |

| FFCB DN | | | | | | | | |

| 0.010%, 10/24/11(A) | | | 10,000 | | | | 10,000 | |

| FHLB | | | | | | | | |

| 0.216%, 10/13/11(B) | | | 50,000 | | | | 50,003 | |

| 0.230%, 10/21/11 | | | 47,000 | | | | 47,001 | |

| 0.132%, 10/27/11(B) | | | 40,000 | | | | 40,000 | |

| 0.300%, 11/08/11 | | | 50,000 | | | | 50,000 | |

| 0.260%, 11/23/11 | | | 50,000 | | | | 49,998 | |

| 0.750%, 12/21/11 | | | 55,000 | | | | 55,058 | |

| 0.370%, 01/04/12 | | | 10,440 | | | | 10,447 | |

| 0.100%, 01/18/12 | | | 20,000 | | | | 19,999 | |

| 0.180%, 01/24/12(B) | | | 30,000 | | | | 30,003 | |

| 0.250%, 04/04/12 | | | 17,100 | | | | 17,099 | |

| 0.130%, 05/15/12 | | | 15,000 | | | | 14,998 | |

| 0.260%, 07/06/12 | | | 25,000 | | | | 24,999 | |

| 0.330%, 07/16/12 | | | 25,000 | | | | 25,000 | |

| 0.130%, 07/18/12(B) | | | 20,000 | | | | 20,000 | |

| 0.330%, 08/08/12 | | | 20,000 | | | | 20,000 | |

| 0.450%, 09/24/12 | | | 10,000 | | | | 10,001 | |

| FHLB DN (A) | | | | | | | | |

| 0.009%, 10/07/11 | | | 36,827 | | | | 36,827 | |

| 0.030%, 10/17/11 | | | 25,000 | | | | 25,000 | |

| 0.025%, 10/19/11 | | | 25,000 | | | | 25,000 | |

| 0.080%, 10/21/11 | | | 50,000 | | | | 49,998 | |

| 0.012%, 10/28/11 | | | 21,350 | | | | 21,350 | |

| 0.020%, 11/02/11 | | | 20,000 | | | | 20,000 | |

| 0.050%, 11/04/11 | | | 35,246 | | | | 35,244 | |

| 0.030%, 11/25/11 | | | 45,000 | | | | 44,998 | |

| 0.100%, 01/18/12 | | | 33,000 | | | | 32,990 | |

| FHLMC | | | | | | | | |

| 0.185%, 08/10/12(B) | | | 20,000 | | | | 20,002 | |

| FHLMC DN (A) | | | | | | | | |

| 0.134%, 10/03/11 | | $ | 60,626 | | | $ | 60,625 | |

| 0.001%, 10/06/11 | | | 25,000 | | | | 25,000 | |

| 0.001%, 10/13/11 | | | 15,960 | | | | 15,960 | |

| 0.001%, 10/18/11 | | | 10,068 | | | | 10,068 | |

| 0.001%, 10/24/11 | | | 50,000 | | | | 50,000 | |

| 0.001%, 10/31/11 | | | 23,811 | | | | 23,811 | |

| 0.180%, 12/13/11 | | | 50,000 | | | | 49,982 | |

| 0.120%, 01/03/12 | | | 30,000 | | | | 29,991 | |

| 0.060%, 01/09/12 | | | 44,000 | | | | 43,993 | |

| 0.090%, 02/07/12 | | | 28,712 | | | | 28,703 | |

| 0.100%, 02/13/12 | | | 15,887 | | | | 15,881 | |

| 0.110%, 03/13/12 | | | 25,000 | | | | 24,987 | |

| 0.140%, 08/06/12 | | | 25,000 | | | | 24,970 | |

| FICO STRIP PO (A) | | | | | | | | |

| 0.080%, 10/05/11 | | | 10,000 | | | | 10,000 | |

| 0.190%, 04/05/12 | | | 14,445 | | | | 14,431 | |

| FNMA | | | | | | | | |

| 2.000%, 01/09/12 | | | 45,000 | | | | 45,229 | |

| 0.875%, 01/12/12 | | | 25,000 | | | | 25,042 | |

| FNMA DN (A) | | | | | | | | |

| 0.100%, 10/03/11 | | | 100,000 | | | | 99,999 | |

| 0.060%, 10/19/11 | | | 30,000 | | | | 29,999 | |

| 0.080%, 11/02/11 | | | 50,000 | | | | 49,996 | |

| 0.110%, 11/14/11 | | | 50,000 | | | | 49,993 | |

| 0.190%, 12/01/11 | | | 50,000 | | | | 49,984 | |

| 0.140%, 12/19/11 | | | 30,000 | | | | 29,991 | |

| 0.020%, 12/28/11 | | | 50,000 | | | | 49,998 | |

| 0.090%, 01/03/12 | | | 50,000 | | | | 49,988 | |

| 0.180%, 05/01/12 | | | 17,000 | | | | 16,982 | |

Total U.S. Government Agency Obligations (Cost $1,951,728) | | | | 1,951,728 | |

| U.S. Government Related Securities [9.7%] | | | | | |

| Straight-A Funding (A) | | | | | | | | |

| 0.190%, 11/01/11 | | | 40,000 | | | | 39,994 | |

| 0.190%, 11/14/11 | | | 40,000 | | | | 39,991 | |

| 0.190%, 12/19/11 | | | 59,191 | | | | 59,166 | |

| 0.190%, 12/20/11 | | | 25,000 | | | | 24,989 | |

| 0.180%, 11/02/11 | | | 24,000 | | | | 23,996 | |

| 0.170%, 12/12/11 | | | 50,000 | | | | 49,983 | |

| 0.160%, 10/26/11 | | | 27,300 | | | | 27,297 | |

| 0.120%, 10/04/11 | | | 46,044 | | | | 46,044 | |

| 0.090%, 10/05/11 | | | 5,400 | | | | 5,400 | |

Total U.S. Government Related Securities (Cost $316,860) | | | | 316,860 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 24

schedule of investments

Government Money Market Fund (continued)

| Corporate Bonds [5.6%] | | | | | | | | |

| Banks [2.6%] | | | | | | | | |

| American Express Bank, FDIC Insured, MTN | | | | | | | | |

| 3.150%, 12/09/11 | | $ | 22,250 | | | $ | 22,379 | |

| Bank of America, FDIC Insured, MTN | | | | | | | | |

| 2.100%, 04/30/12 | | | 20,000 | | | | 20,224 | |

| 0.555%, 06/22/12(B) | | | 9,100 | | | | 9,123 | |

| Regions Bank, FDIC Insured, MTN | | | | | | | | |

| 3.250%, 12/09/11 | | | 28,063 | | | | 28,229 | |

| US Central Federal Credit Union | | | | | | | | |

| 1.250%, 10/19/11 | | | 6,249 | | | | 6,252 | |

| | | | 86,207 | |

| Financial Services [1.7%] | | | | | |

| Citigroup, FDIC Insured | | | | | | | | |

| 2.875%, 12/09/11 | | | 42,000 | | | | 42,221 | |

| General Electric Capital, FDIC Insured, MTN | | | | | | | | |

| 2.250%, 03/12/12 | | | 12,940 | | | | 13,061 | |

| | | | 55,282 | |

| Investment Banker/Broker Dealer [1.3%] | | | | | |

| Goldman Sachs Group | | | | | | | | |

| 0.522%, 11/09/11(B) | | | 13,420 | | | | 13,427 | |

| Morgan Stanley, FDIC Insured | | | | | | | | |

| 3.250%, 12/01/11 | | | 25,000 | | | | 25,130 | |

| 1.176%, 12/01/11(B) | | | 5,400 | | | | 5,410 | |

Total Investment Banker/Broker Dealer | | | | 43,967 | |

Total Corporate Bonds (Cost $185,456) | | | | 185,456 | |

| | | | | | | | | |

| Municipal Bonds [2.2%] | | | | | | | | |

| California [0.5%] | | | | | | | | |

| California Statewide, Communities Development Authority, Fairway Family Apartments Project, Ser PP, RB, FNMA (B) (C) | | | | | | | | |

| 0.170%, 10/06/11 | | | 8,000 | | | | 8,000 | |

| Sacramento County, Housing Authority, Ashford Heights Apartments Project, Ser H, RB, FNMA (B) (C) | | | | | | | | |

| 0.180%, 10/06/11 | | | 9,000 | | | | 9,000 | |

| | | | 17,000 | |

| Nevada [0.6%] | | | | | | | | |

| Nevada, Housing Division, Vista Creek Project, RB, FNMA (B) (C) | | | | | | | | |

| | $ | 21,000 | | | $ | 21,000 | |

| Texas [0.9%] | | | | | | | | |

| Houston, Housing Finance, Regency Park Apartments Project, RB, FNMA (B) (C) | | | | | | | | |