UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number _811-02265_

Value Line Fund, Inc.

(Exact name of registrant as specified in charter)

220 East 42nd Street, New York, N.Y. 10017

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1500

Date of fiscal year end: December 31, 2008

Date of reporting period: December 31, 2008

Item I. | Reports to Stockholders. |

A copy of the Annual Report to Stockholders for the period ended 12/31/08 is included with this Form.

| | | |

| INVESTMENT ADVISER | EULAV Asset Management, LLC | A N N U A L R E P O R T |

| | D e c e m b e r 3 1, 2 0 0 8 |

| | | |

| DISTRIBUTOR | Value Line Securities, Inc. | |

| | 220 East 42nd Street | |

| | New York, NY 10017-5891 | |

| | | |

| CUSTODIAN BANK | State Street Bank and Trust Co. | |

| | 225 Franklin Street | |

| | Boston, MA 02110 | The Value Line Fund, Inc. |

| | |

| SHAREHOLDER | State Street Bank and Trust Co. |

| SERVICING AGENT | c/o BFDS |

| | P.O. Box 219729 |

| | Kansas City, MO 64121-9729 |

| | |

| INDEPENDENT | PricewaterhouseCoopers LLP |

| REGISTERED PUBLIC | 300 Madison Avenue |

| ACCOUNTING FIRM | New York, NY 10017 |

| | | |

| LEGAL COUNSEL | Peter D. Lowenstein, Esq. | |

| | 496 Valley Road | |

| | Cos Cob, CT 06807-0272 | |

| | | |

| DIRECTORS | Joyce E. Heinzerling | |

| | Francis C. Oakley | |

| | David H. Porter | |

| | Paul Craig Roberts | |

| | Thomas T. Sarkany | |

| | Nancy-Beth Sheerr | |

| | Daniel S. Vandivort | |

| | | |

| OFFICERS | Mitchell E. Appel | |

| | President | |

| | Howard A. Brecher | |

| | Vice President and Secretary | |

| | Emily D. Washington | |

| | Treasurer | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| This audited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Fund (obtainable from the Distributor). |

| #00062643 | |

The Value Line Fund, Inc.

To Our Shareholders (unaudited):

For the twelve months ended December 31, 2008, the total return for The Value Line Fund (the “Fund”) was -49.28%. This was below the S&P 500 Index(1) return of -37.00% for the same time period.

In 2008, the S&P 500 Index had its worst year since 1937. The most significant factor affecting the stock market was the weakened state of the financial sector combined with the reluctance of banks and other credit market participants to lend money. The Federal Reserve has pumped billions of dollars into the credit markets in order to encourage lending and also to build demand for high-grade corporate debt. In addition, the federal government was instrumental in rescuing American International Group and Fannie Mae, and it indicates it will continue to support struggling corporations. The Federal Reserve Board has responded to credit problems by lowering interest rates. During the past twelve months, the Federal Funds(2) rate was cut by 400 basis points from 4.25% to 0.25%.

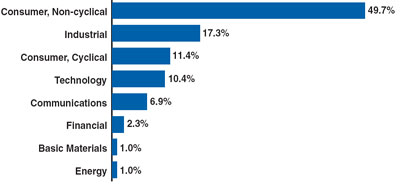

The Value Line Fund generally invests in U.S. stocks that are ranked in the highest category for relative price performance over the next six to twelve months by the Value Line Timeliness Ranking System. The System favors stocks with strong price and earnings momentum relative to those of the approximately 1,700 companies in The Value Line Investment Survey. The Fund is underweighted in the financial services sector relative to the S&P 500 Index and has an above-average weighting of approximately 23% of its market value in health-care related companies, including pharmaceutical firms.

We appreciate your confidence in The Value Line Fund and look forward to serving your investment needs in the future.

| | | |

| | Sincerely, | |

| | | |

| | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel President | |

| | | |

| February 20, 2009 | | |

| | |

| (1) | The Standard& Poor’s 500 Index consists of 500 stocks which are traded on the New York Stock Exchange, American Stock Exchange and the NASDAQ National Market System and is representative of the broad stock market. This is an unmanaged index and does not reflect charges, expenses or taxes. It is not possible to directly invest in this index. |

| | |

| (2) | The interest rate charged by banks with excess reserves at a Federal Reserve District Bank, to banks needing overnight loans to meet reserve requirements. |

The Value Line Fund, Inc.

Economic Observations (unaudited)

The recession is in full bloom, having hit this country with its worst business setback in several generations. Meanwhile, the downturn is spreading overseas with ferocity, creating a global crisis.

The current situation is traceable to several events, beginning with the sharp declines in housing construction, home sales, and real estate prices. We also have seen a reduction in credit availability, a high level of bank failures, rising foreclosure rates, increasing unemployment, a contraction in retailing and auto activity, and sharp declines in manufacturing and nonmanufacturing. These developments are consistent with a deep and prolonged recession. As 2009 unfolds, we are facing a serious worldwide contraction that optimistically will last only through the middle of this year. Government reaction to this global upheaval is likely to involve attempts to pass additional stimulus measures, with an emphasis on infrastructure rebuilding and employment improvement. It is hoped that such efforts will shorten the downturn’s duration and reduce its severity.

Meanwhile, inflation, which had earlier moved sharply higher in this country due to dramatic increases in oil, food, and commodity prices, has moderated quickly, thanks to even more dramatic declines in energy prices since last summer. Our expectation is that, absent a more potent long-term business expansion than we now project, inflation should remain in check for the most part through the early years of the next decade. In fact, there is the possibility that we could see selective bouts of deflation along the way, especially if consumer demand falters for any extended period of time.

The Value Line Fund, Inc.

| |

| FUND EXPENSES (unaudited): |

Example

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2008 through December 31, 2008).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | Beginning account value 7/1/08 | | | Ending account value 12/31/08 | | | Expenses paid during period 7/1/08 thru 12/31/08* | |

| | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 565.90 | | | $ | 3.90 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.03 | |

| | | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.99% multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. This expense ratio may differ from the expense ratio shown in the Financial Highlights. |

The Value Line Fund, Inc.

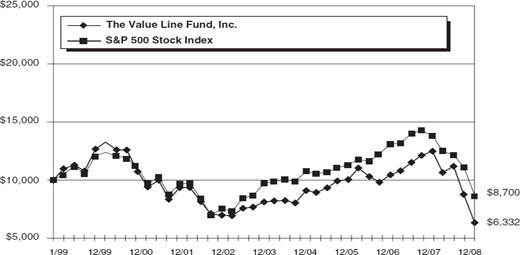

The following graph compares the performance of The Value Line Fund, Inc. to that of the S&P 500 Index. The Value Line Fund, Inc. is a professionally managed mutual fund, while the Index is not available for investment and is unmanaged. The returns for the Index do not reflect charges, expenses or taxes but do include the reinvestment of dividends. The comparison is shown for illustrative purposes only.

Comparison of a Change in Value of a $10,000 Investment

in the Value Line Fund, Inc. and the S&P 500 Index*

| * | The Standard and Poor’s 500 Stock Index is an unmanaged index that is representative of the larger-capitalization stocks traded in the United States. |

| Performance Data:** | | | | | | |

| | | | | | | |

| | | Average Annual Total Return | | | Growth of an Assumed Investment of $10,000 | |

| 1 year ended 12/31/08 | | | (49.28 | )% | | $ | 5,072 | |

| 5 years ended 12/31/08 | | | (4.85 | )% | | $ | 7,800 | |

| 10 years ended 12/31/08 | | | (4.47 | )% | | $ | 6,332 | |

| | |

| ** | The performance data quoted represent past performance and are no guarantee of future performance. The average annual total returns and growth of an assumed investment of $10,000 include dividends reinvested and capital gains distributions accepted in shares. The investment return and principal value of an investment will fluctuate so that an investment, when redeemed, may be worth more or less than its original cost. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

The Value Line Fund, Inc.

| |

| Portfolio Highlights at December 31, 2008 (unaudited) |

Ten Largest Holdings

| Issue | | Shares | | | Value | | | Percentage of Net Assets | |

| Crawford & Co. Class B | | | 77,000 | | | $ | 1,119,580 | | | | 1.20 | % |

| OSI Pharmaceuticals, Inc. | | | 28,000 | | | $ | 1,093,400 | | | | 1.17 | % |

| FLIR Systems, Inc. | | | 35,000 | | | $ | 1,073,800 | | | | 1.15 | % |

| Nash Finch Co. | | | 23,000 | | | $ | 1,032,470 | | | | 1.11 | % |

| Alliance Data Systems Corp. | | | 22,000 | | | $ | 1,023,660 | | | | 1.10 | % |

| Interwoven, Inc. | | | 81,000 | | | $ | 1,020,600 | | | | 1.10 | % |

| MTS Systems Corp. | | | 38,000 | | | $ | 1,012,320 | | | | 1.09 | % |

| ViaSat, Inc. | | | 42,000 | | | $ | 1,011,360 | | | | 1.09 | % |

| Endo Pharmaceuticals Holdings, Inc. | | | 39,000 | | | $ | 1,009,320 | | | | 1.08 | % |

| TreeHouse Foods, Inc. | | | 37,000 | | | $ | 1,007,880 | | | | 1.08 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

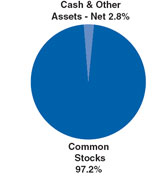

| Asset Allocation — Percentage of Net Assets | | | | | | | | | | | | |

| |

| Sector Weightings — Percentage of Total Investment Securities |

The Value Line Fund, Inc.

| | |

| Schedule of Investments | December 31, 2008 |

| Shares | | | | Value | |

| COMMON STOCKS (97.2%) | | | | |

| | | | | |

| | | | AEROSPACE/DEFENSE (2.9%) | | | | |

| | 11,000 | | Alliant Techsystems, Inc. * | | $ | 943,360 | |

| | 22,500 | | HEICO Corp. | | | 873,675 | |

| | 18,000 | | Raytheon Co. | | | 918,720 | |

| | | | | | | 2,735,755 | |

| | | | | | | | |

| | | | APPAREL (0.9%) | | | | |

| | 31,000 | | Jos. A. Bank Clothiers, Inc. * | | | 810,650 | |

| | | | | | | | |

| | | | BIOTECHNOLOGY (3.7%) | | | | |

| | 14,000 | | Amgen, Inc. * | | | 808,500 | |

| | 30,000 | | Martek Biosciences Corp. * | | | 909,300 | |

| | 14,000 | | Myriad Genetics, Inc. * | | | 927,640 | |

| | 13,000 | | Techne Corp. | | | 838,760 | |

| | | | | | | 3,484,200 | |

| | | | | | | | |

| | | | CABLE TV (2.9%) | | | | |

| | 54,000 | | Comcast Corp. Class A | | | 872,100 | |

| | 37,000 | | DIRECTV Group, Inc. (The) * | | | 847,670 | |

| | 53,000 | | Shaw Communications, Inc. Class B | | | 937,040 | |

| | | | | | | 2,656,810 | |

| | | | | | | | |

| | | | CHEMICAL — BASIC (1.0%) | | | | |

| | 16,000 | | Compass Minerals International, Inc. | | | 938,560 | |

| | | | | | | | |

| | | | COMPUTER & PERIPHERALS (1.0%) | | | | |

| | 54,000 | | Synaptics, Inc.* | | | 894,240 | |

| | | | | | | | |

| | | | COMPUTER SOFTWARE & SERVICES (5.0%) | | | | |

| | 28,000 | | Accenture Ltd. Class A | | | 918,120 | |

| | 22,000 | | CACI International, Inc. Class A * | | | 991,980 | |

| | 35,000 | | Intuit, Inc. * | | | 832,650 | |

| | 17,000 | | ManTech International Corp. Class A * | | | 921,230 | |

| | 55,000 | | Oracle Corp. * | | | 975,150 | |

| | | | | | | 4,639,130 | |

| | | | | | | | |

| | | | DIVERSIFIED COMPANIES (0.9%) | | | | |

| | 21,000 | | Chemed Corp. | | | 835,170 | |

| Shares | | | | Value | |

| | | | DRUG (9.0%) | | | | |

| | 38,000 | | Bristol-Myers Squibb Co. | | $ | 883,500 | |

| | 17,000 | | Celgene Corp. * | | | 939,760 | |

| | 39,000 | | Endo Pharmaceuticals Holdings, Inc. * | | | 1,009,320 | |

| | 19,000 | | Gilead Sciences, Inc. * | | | 971,660 | |

| | 16,000 | | Novo Nordisk A/S ADR | | | 822,240 | |

| | 28,000 | | OSI Pharmaceuticals, Inc. * | | | 1,093,400 | |

| | 26,000 | | Perrigo Co. | | | 840,060 | |

| | 28,000 | | Sanofi-Aventis ADR | | | 900,480 | |

| | 21,000 | | Teva Pharmaceutical Industries Ltd. ADR | | | 893,970 | |

| | | | | | | 8,354,390 | |

| | | | | | | | |

| | | | E-COMMERCE (1.1%) | | | | |

| | 81,000 | | Interwoven, Inc. * | | | 1,020,600 | |

| | | | | | | | |

| | | | EDUCATIONAL SERVICES (4.9%) | | | | |

| | 12,000 | | Apollo Group, Inc. Class A * | | | 919,440 | |

| | 56,000 | | Corinthian Colleges, Inc. * | | | 916,720 | |

| | 16,000 | | DeVry, Inc. | | | 918,560 | |

| | 10,000 | | ITT Educational Services, Inc. * | | | 949,800 | |

| | 4,000 | | Strayer Education, Inc. | | | 857,640 | |

| | | | | | | 4,562,160 | |

| | | | | | | | |

| | | | ELECTRICAL EQUIPMENT (2.1%) | | | | |

| | 35,000 | | FLIR Systems, Inc. * | | | 1,073,800 | |

| | 11,000 | | W.W. Grainger, Inc. | | | 867,240 | |

| | | | | | | 1,941,040 | |

| | | | | | | | |

| | | | ELECTRONICS (1.0%) | | | | |

| | 36,000 | | Greatbatch, Inc. * | | | 952,560 | |

| | | | | | | | |

| | | | ENTERTAINMENT TECHNOLOGY (0.8%) | | | | |

| | 26,000 | | Netflix, Inc. * | | | 777,140 | |

| | | | | | | | |

| | | | ENVIRONMENTAL (1.9%) | | | | |

| | 14,000 | | Clean Harbors, Inc. * | | | 888,160 | |

| | 17,000 | | Stericycle, Inc. * | | | 885,360 | |

| | | | | | | 1,773,520 | |

See Notes to Financial Statements.

The Value Line Fund, Inc.

| Shares | | | | Value | |

| | | | FINANCIAL SERVICES — DIVERSIFIED (3.2%) | | | | |

| | 77,000 | | Crawford & Co. Class B * | | $ | 1,119,580 | |

| | 29,000 | | Global Payments, Inc. | | | 950,910 | |

| | 38,000 | | H&R Block, Inc. | | | 863,360 | |

| | | | | | | 2,933,850 | |

| | | | | | | | |

| | | | FOOD PROCESSING (3.9%) | | | | |

| | 37,000 | | Diamond Foods, Inc. | | | 745,550 | |

| | 40,000 | | Flowers Foods, Inc. | | | 974,400 | |

| | 37,000 | | Peet’s Coffee & Tea, Inc. * | | | 860,250 | |

| | 37,000 | | TreeHouse Foods, Inc. * | | | 1,007,880 | |

| | | | | | | 3,588,080 | |

| | | | | | | | |

| | | | FOOD WHOLESALERS (3.1%) | | | | |

| | 26,000 | | Green Mountain Coffee Roasters, Inc. * | | | 1,006,200 | |

| | 23,000 | | Nash Finch Co. | | | 1,032,470 | |

| | 35,000 | | Spartan Stores, Inc. | | | 813,750 | |

| | | | | | | 2,852,420 | |

| | | | | | | | |

| | | | HEALTH CARE INFORMATION SYSTEMS (2.0%) | | | | |

| | 23,000 | | Cerner Corp. * | | | 884,350 | |

| | 36,000 | | Computer Programs & Systems, Inc. | | | 964,800 | |

| | | | | | | 1,849,150 | |

| | | | | | | | |

| | | | HEAVY CONSTRUCTION (0.6%) | | | | |

| | 24,100 | | Stantec, Inc. * | | | 595,270 | |

| | | | | | | | |

| | | | HOUSEHOLD PRODUCTS (1.0%) | | | | |

| | 17,000 | | Church & Dwight Co., Inc. | | | 954,040 | |

| | | | | | | | |

| | | | INDUSTRIAL SERVICES (3.0%) | | | | |

| | 17,000 | | C.H. Robinson Worldwide, Inc. | | | 935,510 | |

| | 29,000 | | Expeditors International of Washington, Inc. | | | 964,830 | |

| | 44,000 | | SAIC, Inc. * | | | 857,120 | |

| | | | | | | 2,757,460 | |

| Shares | | | | Value | |

| | | | INFORMATION SERVICES (2.2%) | | | | |

| | 22,000 | | Alliance Data Systems Corp. * | | $ | 1,023,660 | |

| | 13,000 | | Dun & Bradstreet Corp. (The) | | | 1,003,600 | |

| | | | | | | 2,027,260 | |

| | | | | | | | |

| | | | MACHINERY (0.9%) | | | | |

| | 20,000 | | Wabtec Corp. | | | 795,000 | |

| | | | | | | | |

| | | | MEDICAL SERVICES (2.8%) | | | | |

| | 23,000 | | Amedisys, Inc. * | | | 950,820 | |

| | 17,000 | | DaVita, Inc. * | | | 842,690 | |

| | 30,000 | | Psychiatric Solutions, Inc. * | | | 835,500 | |

| | | | | | | 2,629,010 | |

| | | | | | | | |

| | | | MEDICAL SUPPLIES (13.5%) | | | | |

| | 11,000 | | Bard (C.R.), Inc. | | | 926,860 | |

| | 18,000 | | Baxter International, Inc. | | | 964,620 | |

| | 13,000 | | Becton, Dickinson & Co. | | | 889,070 | |

| | 96,000 | | CryoLife, Inc. * | | | 932,160 | |

| | 60,000 | | Cyberonics, Inc. * | | | 994,200 | |

| | 16,000 | | Edwards Lifesciences Corp. * | | | 879,200 | |

| | 15,000 | | Haemonetics Corp. * | | | 847,500 | |

| | 14,000 | | Johnson & Johnson | | | 837,620 | |

| | 33,000 | | Meridian Bioscience, Inc. | | | 840,510 | |

| | 24,000 | | Owens & Minor, Inc. | | | 903,600 | |

| | 25,000 | | ResMed, Inc. * | | | 937,000 | |

| | 26,000 | | St. Jude Medical, Inc. * | | | 856,960 | |

| | 36,000 | | STERIS Corp. | | | 860,040 | |

| | 28,000 | | Thoratec Corp. * | | | 909,720 | |

| | | | | | | 12,579,060 | |

| | | | | | | | |

| | | | NATURAL GAS — DIVERSIFIED (1.0%) | | | | |

| | 32,000 | | Southwestern Energy Co. * | | | 927,040 | |

| | | | | | | | |

| | | | PACKAGING & CONTAINER (0.9%) | | | | |

| | 24,000 | | Rock-Tenn Co. Class A | | | 820,320 | |

| | | | | | | | |

| | | | PHARMACY SERVICES (1.8%) | | | | |

| | 14,000 | | Express Scripts, Inc. * | | | 769,720 | |

| | 22,000 | | Medco Health Solutions, Inc. * | | | 922,020 | |

| | | | | | | 1,691,740 | |

See Notes to Financial Statements.

| |

| The Value Line Fund, Inc. |

| |

| December 31, 2008 |

| Shares | | | | Value | |

| | | | PRECISION INSTRUMENT (3.0%) | | | | |

| | 17,000 | | Axsys Technologies, Inc. * | | $ | 932,620 | |

| | 13,000 | | Mettler-Toledo International, Inc. * | | | 876,200 | |

| | 38,000 | | MTS Systems Corp. | | | 1,012,320 | |

| | | | | | | 2,821,140 | |

| | | | | | | | |

| | | | RAILROAD (4.1%) | | | | |

| | 13,000 | | Burlington Northern Santa Fe Corp. | | | 984,230 | |

| | 31,000 | | Genesee & Wyoming, Inc. Class A * | | | 945,500 | |

| | 21,000 | | Norfolk Southern Corp. | | | 988,050 | |

| | 19,000 | | Union Pacific Corp. | | | 908,200 | |

| | | | | | | 3,825,980 | |

| | | | | | | | |

| | | | RESTAURANT (2.0%) | | | | |

| | 16,000 | | McDonald’s Corp. | | | 995,040 | |

| | 16,000 | | Panera Bread Co. Class A * | | | 835,840 | |

| | | | | | | 1,830,880 | |

| | | | | | | | |

| | | | RETAIL — AUTOMOTIVE (0.9%) | | | | |

| | 6,000 | | AutoZone, Inc. * | | | 836,820 | |

| | | | | | | | |

| | | | RETAIL BUILDING SUPPLY (0.8%) | | | | |

| | 21,000 | | Tractor Supply Co. * | | | 758,940 | |

| | | | | | | | |

| | | | RETAIL STORE (3.6%) | | | | |

| | 24,000 | | BJ’s Wholesale Club, Inc. * | | | 822,240 | |

| | 20,000 | | Dollar Tree, Inc. * | | | 836,000 | |

| | 34,000 | | Family Dollar Stores, Inc. | | | 886,380 | |

| | 15,000 | | Wal-Mart Stores, Inc. | | | 840,900 | |

| | | | | | | 3,385,520 | |

| | | | | | | | |

| | | | SHOE (0.9%) | | | | |

| | 17,000 | | NIKE, Inc. Class B | | | 867,000 | |

| | | | | | | | |

| | | | TELECOMMUNICATION SERVICES (0.8%) | | | | |

| | 32,000 | | NTELOS Holdings Corp. | | | 789,120 | |

| Shares | | | | Value | |

| | | | THRIFT (1.0%) | | | | |

| | 60,000 | | Hudson City Bancorp, Inc. | | $ | 957,600 | |

| | | | | | | | |

| | | | WIRELESS NETWORKING (1.1%) | | | | |

| | 42,000 | | ViaSat, Inc. * | | | 1,011,360 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS AND TOTAL INVESTMENT SECURITIES (97.2%) (Cost $93,574,577) | | $ | 90,459,985 | |

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES (2.8%) | | | 2,638,836 | |

NET ASSETS (100%) | | $ | 93,098,821 | |

| | | | | | | | |

| NET ASSET VALUE OFFERING AND REDEMPTION PRICE, PER OUTSTANDING SHARE ($93,098,821 ÷ 14,979,001 shares outstanding) | | $ | 6.22 | |

| * | Non-income producing. |

| | |

| ADR | American Depositary Receipt. |

See Notes to Financial Statements.

The Value Line Fund, Inc.

| | |

| Statement of Assets and Liabilities | |

| at December 31, 2008 | |

| Assets: | | | | |

Investment securities, at value (Cost — $93,574,577) | | $ | 90,459,985 | |

| Cash | | | 2,507,212 | |

| Receivable for securities sold | | | 2,547,293 | |

| Dividends receivable | | | 67,463 | |

| Prepaid expenses | | | 19,237 | |

| Receivable for capital shares sold | | | 14,249 | |

| Total Assets | | | 95,615,439 | |

| | | | | |

| Liabilities: | | | | |

| Payable for securities purchased | | | 2,370,071 | |

| Payable for capital shares repurchased | | | 45,097 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 53,559 | |

| Directors’ fees and expenses | | | 4,251 | |

| Other | | | 43,640 | |

| Total Liabilities | | | 2,516,618 | |

| Net Assets | | $ | 93,098,821 | |

| Net assets consist of: | | | | |

| Capital stock, at $1.00 par value (authorized 50,000,000, outstanding 14,979,001 shares) | | $ | 14,979,001 | |

| Additional paid-in capital | | | 147,065,288 | |

| Accumulated net investment loss | | | (118 | ) |

| Accumulated net realized loss on investments and foreign currency | | | (65,831,529 | ) |

| Net unrealized depreciation of investments and foreign currency translations | | | (3,113,821 | ) |

| Net Assets | | $ | 93,098,821 | |

| Net Asset Value, Offering and Redemption Price per Outstanding Share ($93,098,821 ÷ 14,979,001 shares outstanding) | | $ | 6.22 | |

Statement of Operations

for the Year Ended December 31, 2008

| Investment Income: | | | | |

| Dividends (net of foreign withholding tax of $7,716) | | $ | 922,891 | |

| Interest | | | 80,724 | |

| Total Income | | | 1,003,615 | |

| Expenses: | | | | |

| Advisory fee | | | 1,038,300 | |

| Service and distribution plan fees | | | 380,273 | |

| Transfer agent fees | | | 107,718 | |

| Auditing and legal fees | | | 75,788 | |

| Printing and postage | | | 69,080 | |

| Custodian fees | | | 38,998 | |

| Registration and filing fees | | | 34,216 | |

| Directors’ fees and expenses | | | 15,229 | |

| Insurance | | | 12,860 | |

| Other | | | 8,948 | |

| Total Expenses Before Custody Credits and Fees Waived | | | 1,781,410 | |

| Less: Service and Distribution Plan Fees Waived | | | (380,273 | ) |

Less: Custody Credits | | | (6,067 | ) |

| Net Expenses | | | 1,395,070 | |

| Net Investment Loss | | | (391,455 | ) |

Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Loss | | | (65,713,102 | ) |

| Change in Net Unrealized Appreciation/(Depreciation) | | | (29,419,261 | ) |

| Net Realized Loss and Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Exchange Transactions | | | (95,132,363 | ) |

Net Decrease in Net Assets from Operations | | $ | (95,523,818 | ) |

See Notes to Financial Statements.

The Value Line Fund, Inc.

| |

Statement of Changes in Net Assets for the Years Ended December 31, 2008 and 2007 |

| | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (391,455 | ) | | $ | (227,361 | ) |

| Net realized gain/(loss) on investments and foreign currency | | | (65,713,102 | ) | | | 30,404,146 | |

| Change in net unrealized appreciation/(depreciation) | | | (29,419,261 | ) | | | 5,312,314 | |

| Net increase/(decrease) in net assets from operations | | | (95,523,818 | ) | | | 35,489,099 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net realized gain from investment transactions | | | (3,966,886 | ) | | | (27,740,813 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 2,949,282 | | | | 3,289,737 | |

| Proceeds from reinvestment of distributions | | | 3,752,515 | | | | 26,184,717 | |

| Cost of shares repurchased | | | (17,385,892 | ) | | | (31,298,206 | ) |

| Net decrease in net assets from capital share transactions | | | (10,684,095 | ) | | | (1,823,752 | ) |

| Total Increase/(Decrease) in Net Assets | | | (110,174,799 | ) | | | 5,924,534 | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 203,273,620 | | | | 197,349,086 | |

| End of year | | $ | 93,098,821 | | | $ | 203,273,620 | |

| | | | | | | | | |

| Accumulated net investment loss, at end of year | | $ | (118 | ) | | $ | — | |

See Notes to Financial Statements.

The Value Line Fund, Inc.

| |

| Notes to Financial Statements |

1. Significant Accounting Policies

The Value Line Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company whose primary investment objective is long-term growth of capital.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

(A) Security Valuation. Securities listed on a securities exchange are valued at the closing sales prices on the date as of which the net asset value is being determined. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price. In the absence of closing sales prices for such securities and for securities traded in the over-the-counter market, the security is valued at the midpoint between the latest available and representative asked and bid prices. Short-term instruments with maturities of 60 days or less at the date of purchase are valued at amortized cost, which approximates market value. Short-term instruments with maturities greater than 60 days at the date of purchase are valued at the midpoint between the latest available and representative asked and bid prices, and commencing 60 days prior to maturity such securities are valued at amortized cost. Securities for which market quotations are not readily available or that are not readily marketable and all other assets of the Fund are valued at fair value as the Board of Directors may determine in good faith. In addition, the Fund may use the fair value of a security when the closing market price on the primary exchange where the security is traded no longer accurately reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer.

(B) Fair Value Measurements. The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. FAS 157 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

| | |

| ● | Level 1 — quoted prices in active markets for identical investments |

| | |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | |

| ● | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The Value Line Fund, Inc.

The following is a summary of the inputs used as of December 31, 2008 in valuing the Fund’s investments carried at value:

| | | | | | | |

| Valuation Inputs | | Investments in Securities | | | Other Financial Instruments* | |

| | | | | | | |

| Level 1 — Quoted Prices | | $ | 90,459,985 | | | | — | |

| Level 2 — Other Significant Observable Inputs | | | — | | | | — | |

| Level 3 — Significant Unobservable Inputs | | | — | | | | — | |

| Total | | $ | 90,459,985 | | | | — | |

| * | Other financial instruments include futures, forwards and swap contracts. |

For the year ended December 31, 2008, there were no Level 3 investments.

(C) Repurchase Agreements. In connection with transactions in repurchase agreements, the Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings. There were no open repurchase agreements at December 31, 2008.

(D) Federal Income Taxes. It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, including the distribution requirements of the Tax Reform Act of 1986, and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

(E) Security Transactions and Distributions. Security transactions are accounted for on the date the securities are purchased or sold. Interest income is accrued as earned. Realized gains and losses on sales of securities are calculated for financial accounting and federal income tax purposes on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles.

(F) Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Fund does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Fund, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/depreciation on investments.

| The Value Line Fund, Inc. |

| |

| Notes to Financial Statements |

(G) Representations and Indemnifications. In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(H) Foreign Taxes. The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

| 2. | Capital Share Transactions, Dividends and Distributions to Shareholders |

Transactions in capital stock were as follows:

| | | | | | | |

| | | Year Ended December 31, 2008 | | | Year Ended December 31, 2007 | |

| Shares sold | | | 327,686 | | | | 237,070 | |

| Shares issued to shareholders in reinvestment of dividends and distributions | | | 628,471 | | | | 2,111,782 | |

| | | | 956,157 | | | | 2,348,852 | |

| Shares repurchased | | | (1,823,282 | ) | | | (2,315,940 | ) |

| Net increase/(decrease) | | | (867,125 | ) | | | 32,912 | |

| Distributions per share from net realized gains | | $ | 0.2759 | | | $ | 2.0136 | |

| 3. | Purchases and Sales of Securities |

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | | |

| | | Year Ended December 31, 2008 | |

| Purchases: | | | | |

| Investment Securities | | $ | 407,558,590 | |

| Sales: | | | | |

| Investment Securities | | $ | 417,630,987 | |

| | | | | |

At December 31, 2008, information on the tax components of capital is as follows:

| Cost of investments for tax purposes | | $ | 94,081,740 | |

| Gross tax unrealized appreciation | | $ | 4,468,691 | |

| Gross tax unrealized depreciation | | | (8,090,446 | ) |

| Net tax unrealized depreciation on investments | | $ | (3,621,755 | ) |

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term gain | | $ | — | |

| Capital loss carryforward, expires December 31, 2016 | | $ | (37,251,300 | ) |

During the year ended December 31, 2008, as permitted under federal income tax regulations, the Fund elected to defer $28,073,185 of post-October net capital and currency losses to the next taxable year.

To the extent that current or future capital gains are offset by capital losses, the Fund does not anticipate distributing any such gains to shareholders.

It is uncertain whether the Fund will be able to realize the benefits of the losses before they expire.

The differences between book and tax basis unrealized appreciation/(depreciation) on investments were primarily attributed to wash sales.

| The Value Line Fund, Inc. |

| |

| December 31, 2008 |

Permanent book-tax differences relating to the current year were reclassified within the composition of the net asset accounts. The Fund decreased additional paid-in capital by approximately $391,493, decreased accumulated net investment loss by $391,337 and decreased accumulated net realized loss by $156. Net assets were not affected by these reclassifications. These reclassifications were primarily due to differing treatments of net operating losses and foreign currency translation for tax purposes.

The tax composition of distributions to shareholders for the years ended December 31, 2008 and December 31, 2007 were as follows:

| | | | | | | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Ordinary income | | $ | 2,418,777 | | | $ | 23,180,166 | |

| Long-term capital gain | | | 1,548,109 | | | | 4,560,647 | |

| | | $ | 3,966,886 | | | $ | 27,740,813 | |

| 5. | Investment Advisory Fee, Service and Distribution Fees and Transactions with Affiliates |

On June 30, 2008, Value Line, Inc. (“Value Line”) reorganized its investment management division into EULAV Asset Management, LLC (“EULAV”), a newly formed, wholly-owned subsidiary. As part of the reorganization, each advisory agreement was transferred from Value Line to EULAV and EULAV replaced Value Line as the Fund’s investment adviser. The portfolio managers, who are now employees of EULAV, have not changed as a result of the reorganization.

An advisory fee of $1,038,300 was paid or payable to Value Line or EULAV (the “Adviser”), for the year ended December 31, 2008. This was computed at the rate of 0.70% of the first $100 million of the Fund’s average daily net assets plus 0.65% on the excess thereof, and paid monthly. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping and clerical personnel necessary for managing the affairs of the Fund. The Adviser also provides persons, satisfactory to the Fund’s Board of Directors, to act as officers and employees of the Fund and pays their salaries and wages. Direct expenses of the Fund are charged to the Fund while common expenses of the Value Line Funds are allocated proportionately based upon the funds’ respective net assets. The Fund bears all other costs and expenses.

The Fund has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, for the payment of certain expenses incurred by Value Line Securities, Inc. (the “Distributor”), a wholly-owned subsidiary of Value Line, in advertising, marketing and distributing the Fund’s shares and for servicing the Fund’s shareholders at an annual rate of 0.25% of the Fund’s average daily net assets. For the year ended December 31, 2008, fees amounting to $380,273 before fee waivers, were accrued under the Plan. Effective May 1, 2007 and 2008, the Distributor contractually agreed to waive the Fund’s 12b-1 fee for one year periods. For the year ended December 31, 2008, the fees waived amounted to $380,273. The Distributor has no right to recoup prior waivers.

For the year ended December 31, 2008, the Fund’s expenses were reduced by $6,067 under a custody credit arrangement with the custodian.

Certain officers, employees and a director of Value Line and/or affiliated companies are also officers and a director of the Fund.

The Adviser and/or affiliated companies and the Value Line Profit Sharing and Savings Plan owned 299,281 shares of the Fund’s capital stock, representing less than 1% of the outstanding shares at December 31, 2008. In addition, officers and directors of the Fund as a group owned 1,829 shares of the Fund, representing less than 1% of the outstanding shares.

| The Value Line Fund, Inc. |

| |

| Notes to Financial Statements |

By letter dated June 15, 2005, the staff of the Northeast Regional Office of the Securities and Exchange Commission (“SEC”) informed Value Line that it was conducting an investigation in the matter of Value Line Securities, Inc. (“VLS”). Value Line has supplied numerous documents to the SEC in response to its requests and various individuals, including employees and former employees of Value Line, directors of the Fund and others, have provided testimony to the SEC. On May 8, 2008, the SEC issued a formal order of private investigation regarding whether VLS’ brokerage charges and related expense reimbursements from the Value Line Funds (“Funds”) during periods prior to 2005 were excessive and whether adequate disclosure was made to the SEC and the Boards of Directors and shareholders of the Funds. Thereafter, certain officers of Value Line, who are former officers of the Funds, asserted their constitutional privilege not to provide testimony. Value Line has informed the Funds that it believes that the SEC has completed the fact finding phase of its investigation and Value Line will seek to settle this matter with the SEC. Although management of Value Line cannot determine the effect that the investigation will have on Value Line’s financial statements, it believes that any settlement is likely to be material to it and has informed the Funds of its belief, in light of settlement discussions to date, that there are no loss contingencies that should be accrued or disclosed in the Fund’s financial statements and that the resolution of this matter is not likely to have a materially adverse effect on the ability of the Adviser or VLS to perform their respective contracts with the Fund.

| The Value Line Fund, Inc. |

| |

| Financial Highlights |

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Net asset value, beginning of year | | $ | 12.83 | | | $ | 12.48 | | | $ | 13.14 | | | $ | 13.90 | | | $ | 14.25 | |

| Income from investment oprations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.03 | ) | | | (0.01 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.08 | ) |

| Net gains or (losses) on securities | | | | | | | | | | | | | | | | | | | | |

| (both realized and unrealized) | | | (6.30 | ) | | | 2.37 | | | | 0.58 | | | | 1.53 | | | | 1.80 | |

| Total from investment operations | | | (6.33 | ) | | | 2.36 | | | | 0.53 | | | | 1.46 | | | | 1.72 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net realized gains | | | (0.28 | ) | | | (2.01 | ) | | | (1.19 | ) | | | (2.22 | ) | | | (2.07 | ) |

| Net asset value, end of year | | $ | 6.22 | | | $ | 12.83 | | | $ | 12.48 | | | $ | 13.14 | | | $ | 13.90 | |

| Total return | | | (49.28 | )% | | | 19.50 | % | | | 4.00 | % | | | 10.40 | % | | | 12.09 | % |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 93,099 | | | $ | 203,274 | | | $ | 197,349 | | | $ | 213,715 | | | $ | 215,025 | |

Ratio of expenses to average net assets(1) | | | 1.17 | % | | | 1.08 | % | | | 1.12 | % | | | 1.13 | % | | | 1.13 | % |

Ratio of expenses to average net assets(2) | | | 0.92 | % | | | 0.82 | % | | | 1.04 | % | | | 1.13 | % | | | 1.13 | % |

| Ratio of net investment loss to average net assets | | | (0.26 | )% | | | (0.11 | )% | | | (0.37 | )% | | | (0.52 | )% | | | (0.58 | )% |

| Portfolio turnover rate | | | 273 | % | | | 216 | % | | | 224 | % | | | 224 | % | | | 297 | % |

(1) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets, net of custody credits, but exclusive of the waiver of the service and distribution plan fees by the Distributor, would have been 1.07% for the year ended December 31, 2007 and would not have changed for the other years shown. |

| | |

(2) | Ratio reflects expenses net of the custody credit arrangement and net of the waiver of a portion of the service and distribution plan fees by the Distributor. |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of The Value Line Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Value Line Fund, Inc. (the “Fund”) at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 27, 2009

| The Value Line Fund, Inc. |

| |

| Federal Tax Notice (unaudited) |

For corporate taxpayers, 7.10% of the ordinary income distributions paid during the calendar year 2008 qualify for the corporate dividends received deductions. During the calendar year 2008, 36.26% of the ordinary income distributions are treated as qualified dividends. During the calendar year 2008, the Fund distributed $1,548,132 of long-term capital gain to its shareholders. |

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted these proxies during the most recent 12-month period ended June 30 is available through the Fund’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

| The Value Line Fund, Inc. |

| |

| Management of the Fund |

MANAGEMENT INFORMATION

The business and affairs of the Fund are managed by the Fund’s officers under the direction of the Board of Directors. The following table sets forth information on each Director and Officer of the Fund. Each Director serves as a director or trustee of each of the 14 Value Line Funds. Each Director serves until his or her successor is elected and qualified.

| | | | | | | | | |

| Name, Address, and Age | | Position | | Length of

Time

Served | | Principal

Occupation During the

Past 5 Years | | Other

Directorships

Held by Director |

| Interested Director* | | | | | | | | | |

Thomas T. Sarkany Age 62 | | Director | | Since 2008 | | Mutual Fund Marketing Director of Value Line Securities, Inc. (the “Distributor”). | | None |

| Non-Interested Directors | | | | | | | | | |

Joyce E. Heinzerling 500 East 77th Street New York, NY 10162 Age 53 | | Director | | Since 2008 | | General Counsel, Archery Capital LLC (private investment fund). | | Burnham Investors Trust, since 2004 (4 funds). |

Francis C. Oakley 54 Scott Hill Road Williamstown, MA 01267 Age 77 | | Director (Lead Independent Director since 2008) | | Since 2000 | | Professor of History, Williams College, (1961–2002); Professor Emeritus since 2002. President Emeritus since 1994 and President, (1985–1994); Chairman (1993–1997) and Interim President (2002–2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center. | | None |

David H. Porter 5 Birch Run Drive Saratoga Springs, NY 12866 Age 73 | | Director | | Since 1997 | | Visiting Professor of Classics, Williams College, since 1999; President Emeritus, Skidmore College since 1999 and President, (1987–1998). | | None |

Paul Craig Roberts 169 Pompano St. Panama City Beach, FL 32413 Age 69 | | Director | | Since 1983 | | Chairman, Institute for Political Economy. | | None |

Nancy-Beth Sheerr 1409 Beaumont Drive Gladwyne, PA 19035 Age 59 | | Director | | Since 1996 | | Senior Financial Advisor, Veritable L.P. (investment adviser) since 2004; Senior Financial Advisor, Hawthorn, (2001–2004). | | None |

| The Value Line Fund, Inc. |

| |

| Management of the Fund |

| Name, Address, and Age | | Position | | Length of

Time

Served | | Principal

Occupation During the Past 5 Years | | Other

Directorships

Held by Director |

Daniel S. Vandivort 59 Indian Head Road Riverside, CT 06878 Age 54 | | Director | | Since 2008 | | President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management 2005–2007; Managing Director, Weiss, Peck and Greer, 1995–2005. | | None |

| Officers | | | | | | | | | |

Mitchell E. Appel Age 38 | | President | | Since 2008 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line since April 2008 and from September 2005 to November 2007 Treasurer from June 2005 to September 2005; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of Circle Trust Company from January 2003 to May 2005; Chief Financial Officer of the Distributor since April 2008. | | |

Howard A. Brecher Age 55 | | Vice President and Secretary | | Since 2008 | | Vice President and Secretary of each of the Value Line Funds since June 2008; Vice President, Secretary nd a Director of aValue Line; Vice President of the Distributor and Secretary since June 2008; Vice President, Secretary, Treasurer, General Counsel and a Director of Arnold Bernhard & Co., Inc. | | |

Emily D. Washington Age 30 | | Treasurer | | Since 2008 | | Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008; Associate Director of Mutual Fund Accounting at Value Line until August 2008. | | |

| * | Mr. Sarkany is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Distributor. |

Unless otherwise indicated, the address for each of the above officers is c/o Value Line funds, 220 East 42nd Street, New York, NY 10017.

| The Fund’s Statement of Additional Information (SAI) includes additional information about the Fund’s directors and is available, without charge, upon request by calling 1-800-243-2729 or on the fund’s website, www.vlfunds.com. |

| The Value Line Fund, Inc. |

| |

| |

[This page is intentionally left blank.]

| The Value Line Fund, Inc. |

| |

| |

[This page is intentionally left blank.]

| The Value Line Fund, Inc. |

| |

| The Value Line Family of Funds |

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — The Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — The Value Line Cash Fund, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1985 — Value Line Convertible Fund seeks high current income together with capital appreciation primarily from convertible securities ranked 1 or 2 for year-ahead performance by the Value Line Convertible Ranking System.

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line New York Tax Exempt Trust seeks to provide New York taxpayers with the maximum income exempt from New York State, New York City and federal income taxes while avoiding undue risk to principal. The Trust may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1987 — Value Line Strategic Asset Management Trust* seeks to achieve a high total investment return consistent with reasonable risk.

1993 — Value Line Emerging Opportunities Fund invests primarily in common stocks or securities convertible into common stock, with its primary objective being long-term growth of capital.

1993 — Value Line Asset Allocation Fund seeks high total investment return, consistent with reasonable risk. The Fund invests in stocks, bonds and money market instruments utilizing quantitative modeling to determine the asset mix.

| | |

| * | Only available through the purchase of Guardian Investor, a tax deferred variable annuity, or ValuePlus, a variable life insurance policy. |

For more complete information about any of the Value Line Funds, including charges and expenses, send for a prospectus from Value Line Securities, Inc., 220 East 42nd Street, New York, New York 10017-5891 or call 1-800-243-2729, 9am – 5pm CST, Monday — Friday, or visit us at www.vlfunds.com. Read the prospectus carefully before you invest or send money.

(a) The Registrant has adopted a Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

(f) Pursuant to item 12(a), the Registrant is attaching as an exhibit a copy of its Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

| Item 3. | Audit Committee Financial Expert. |

(a)(1)The Registrant has an Audit Committee Financial Expert serving on its Audit Committee.

(2) The Registrant’s Board has designated Francis C. Oakley, a member of the Registrant’s Audit Committee, as the Registrant’s Audit Committee Financial Expert. Mr. Oakley is an independent director who is a Professor of History with Williams College. He spent most of his professional career at Williams College, where he served as a faculty member, President Emeritus and President (1961-2003). He also served as Chairman (1993-1997) and President (2002-2003) of The American Council of Learned Societies. He has also previously served as Trustee and Chairman of the Board of Trustees of National Humanities Center.

A person who is designated as an “audit committee financial expert” shall not make such person an "expert" for any purpose, including without limitation under Section 11 of the Securities Act of 1933 or under applicable fiduciary laws, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.

| Item 4. | Principal Accountant Fees and Services |

| | | | |

| | (a) | Audit Fees 2008 - $18,200 |

| | | | |

| | (b) | Audit-Related fees – None. |

| | | | |

| | (c) | Tax Preparation Fees 2008 -$9,250 |

| | | | |

| | (d) | All Other Fees – None |

| | | | |

| | (e) | (1) | Audit Committee Pre-Approval Policy. All services to be performed for the Registrant by PricewaterhouseCoopers LLP must be pre-approved by the audit committee. All services performed were pre-approved by the committee. |

| | | | |

| | (e) | (2) | Not applicable. |

| | | | |

| | (f) | Not applicable. |

| | | | |

| | (g) | Aggregate Non-Audit Fees 2008 -$9,250 |

| | | | |

| | (h) | Not applicable. |

| Item 11. | Controls and Procedures. |

| | | |

| | (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c) ) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively. |

| | | |

| | (b) | The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses. |

| Item 12. | Exhibits. |

| | | | |

| | (a) | Code of Business Conduct and Ethics for Principal Executive and Senior Financial Officers attached hereto as Exhibit 99.2R CODE ETH. |

| | | | |

| | (b) | (1) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

| | | | |

| | | (2) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto as Exhibit 99.906.CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President | |

| | | |

| | | |

| Date: | March 10, 2009 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President, Principal Executive Officer |

| | | |

| | | |

| By: | /s/ Emily D. Washington | |

| | Emily D. Washington, Treasurer, Principal Financial Officer |

| | | |

| | | |

| Date: | March 10, 2009 | |