| INVESTMENT ADVISER | EULAV Asset Management 7 Times Square 21st Floor New York, NY 10036-6524 | | S E M I – A N N U A L R E P O R T |

| | J u n e 3 0 , 2 0 1 2 |

| | |

| DISTRIBUTOR | EULAV Securities LLC | | |

| | 7 Times Square 21st Floor | | |

| | New York, NY 10036-6524 | | |

| CUSTODIAN BANK | State Street Bank and Trust Co. | | |

| | 225 Franklin Street | | |

| | Boston, MA 02110 | | |

| SHAREHOLDER | State Street Bank and Trust Co. | | |

| SERVICING AGENT | c/o BFDS | | |

| | P.O. Box 219729 | | |

| | Kansas City, MO 64121-9729 | | The Value Line

Fund, Inc. |

| INDEPENDENT | PricewaterhouseCoopers LLP | |

| REGISTERED PUBLIC | 300 Madison Avenue | |

| ACCOUNTING FIRM | New York, NY 10017 | |

| LEGAL COUNSEL | Peter D. Lowenstein, Esq. | |

| | 496 Valley Road | |

| | Cos Cob, CT 06807-0272 | | |

| DIRECTORS | Mitchell E. Appel | | |

| | Joyce E. Heinzerling | | |

| | Francis C. Oakley | | |

| | David H. Porter | | |

| | Paul Craig Roberts | | |

| | Nancy-Beth Sheerr | | |

| | Daniel S. Vandivort | | |

| OFFICERS | Mitchell E. Appel | | |

| | President | | |

| | Michael J. Wagner | | |

| | Chief Compliance Officer | | |

| | Emily D. Washington | | |

| | Treasurer and Secretary | | |

| | | | |

| | | | |

| | | |  |

| | | | |

| This unaudited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Fund (obtainable from the Distributor). | | |

| #00086630 | | |

| The Value Line Fund, Inc. | |

| | |

| | To Our Value Line |

To Our Shareholders (unaudited): | |

Enclosed is your semi-annual report for the six-month period ended June 30, 2012. I encourage you to carefully review this report, which includes economic observations, your Fund’s performance data and highlights, schedule of investments, and financial statements.

The Value Line Fund, Inc. (the “Fund”) earned a total return of 8.52% for the six months ending June 30, 2012, after fees and expenses. That compared with a total return of 9.49% for the benchmark index, the Standard & Poor’s 500.(1) Pressuring the Fund’s performance relative to the benchmark was a partial rebound in the previously weak Financial Services sector, where the Fund remains underweighted.

It has now been three years since we repositioned the Fund for improved performance. We are gratified by the results. For the three years ended June 30, 2012*, the Fund earned an average annual total return of 18.14%. That compared with average annual total returns of 16.40% for the S&P 500 and 15.92% for the multi-cap growth fund peer group, as measured by Lipper Inc., the independent fund advisory service. The 2009 repositioning included a broadening of the Fund’s stock selection universe to encompass the 1,200 or so stocks in the top three Ranks of the Value Line Timeliness Ranking System. This has allowed greater diversification of the portfolio, which reduces exposure to any single economic sector. It has also resulted in decreased turnover of portfolio holdings, which lowers trading expenses. At the same time, we handed the reins to our senior portfolio manager who has demonstrated widely recognized success managing other equity portfolios in our fund family for over twenty years.

The Fund’s expanded stock selection criteria allow us to implement our disciplined investment strategy to full advantage. We invest in proven winners—those companies that have established five to ten year records of superior relative earnings growth and stock price growth. This is a portfolio of growth stocks. We also look for companies demonstrating strong short-term, quarter-to-quarter, relative earnings momentum and stock price momentum. If a holding later falters on these measures, we do not hesitate to replace it with a stock showing superior strength.

The Fund invests in companies of all sizes. Its approximately 170 holdings are well-diversified in that respect, comprised of about one-third large-capitalization companies, one-third mid-cap and one-third small-cap. In addition, the portfolio is widely diversified across many industries.

We will maintain our time-tested investment discipline. Thank you for investing with us.

| | Sincerely, | |

| | | |

| | /s/ Mitchell Appel | |

| | Mitchell Appel, President | |

| | | |

| | /s/ Stephen E. Grant | |

| | Stephen E. Grant, Portfolio Manager | |

| | |

| (1) | The Standard & Poor’s 500 Index consists of 500 stocks which are traded on the New York Stock Exchange, American Stock Exchange and the NASDAQ National Market System and is representative of the broad stock market. This is an unmanaged index and does not reflect charges, expenses or taxes, and it is not possible to directly invest in this index. |

| | |

| * | The Fund’s 1 year average total return 0.63%; 5 year average annual total return -2.81%; 10 year average annual total return 2.06%. |

Past performance does not guarantee future results. Investment return and principal value of an investment can fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and that current performance may be lower or higher than the performance data quoted. Investors should carefully consider the investment objectives, risks, charges and expense of a fund. This and other important information about a fund is contained in the fund’s prospectus. A copy of our funds’ prospectus can be obtained by going to our website at www.vlfunds.com or calling 800.243-2729.

| | The Value Line Fund, Inc. |

| | |

| Fund Shareholders | |

| | |

| Economic Highlights (unaudited) | |

The first half of 2012 saw a robust U.S. stock market, with the S&P 500 returning 9.49% for the period. The strength of the market was evident despite some strong headwinds, including a weakening outlook for global economic growth. Several members of the European Union continued to face a serious debt crisis including Greece, Portugal, Italy, and Spain. Tough austerity measures have been implemented but it is still unclear as to the timetable for the resolution of the debt crisis most severely affecting southern Europe.

At home, GDP grew 2.0% for the first quarter of the year, slowing to 1.5% for the second quarter. A sluggish labor market remains the primary stumbling block for the U.S. economy which seems to be in the summer doldrums. Employment growth averaged 75,000 per month in the second quarter, down from a monthly average of 226,000 in the first quarter. The higher jobs number of the first quarter did allow for a modest improvement in the overall unemployment rate, dropping from 8.5% at year-end 2011 to 8.2% on June 30, 2012.

Weakness in overall job creation has led to a decline in consumer confidence in 5 of the last 6 months. However, despite this decline in consumer confidence, consumers have reported no plans to slash their spending, although spending dropped slightly in May, the first drop in 11 months. It is critical that consumers continue to spend as they account for 70% of economic activity. Falling prices at the pump may continue to provide spending support for this critical component of economic growth.

In addition to lower gas prices, the housing market has been a bit of a bright spot for the consumer, albeit in selective areas of the country. There have been recent signs of recovery including sales of new single family homes in May that were at its highest level in more than two years. May’s much bigger than expected increase also reduced the supply of newly built houses to its lowest point since before the housing crisis. While homebuilding is unlikely to take off until the unemployment rate recedes, the reduced supply of homes may pave the way for some firming of housing prices.

U.S. Treasury bond prices also defied those investors expecting a weakened performance from the U.S. government’s loss of it AAA rating last year from the Standard and Poor’s rating agency. The other major rating agencies, Moody’s and Fitch, maintained their AAA ratings for U.S. government debt. Many investors were drawn to the relative safety of U.S. Treasury bonds amidst the uncertainty of world economic events. While the 10-year U.S. Treasury bond hovered around a 2% yield in the first quarter, it had touched a 1.5% yield by June.

| The Value Line Fund, Inc. |

| |

| |

| FUND EXPENSES (unaudited): |

| |

| Example |

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2012 through June 30, 2012).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | | | | | | | Expenses | |

| | | Beginning | | | Ending | | | paid during | |

| | | account value | | | account value | | | period 1/1/12 | |

| | | 1/1/12 | | | 6/30/12 | | | thru 6/30/12* | |

| | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,085.20 | | | $ | 5.24 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.07 | |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.01% multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. This expense ratio may differ from the expense ratio shown in the Financial Highlights. |

| | The Value Line Fund, Inc. |

| | |

| Portfolio Highlights at June 30, 2012 (unaudited) | |

| | |

| Ten Largest Holdings | |

| | | | | | | | | Percentage of |

| Issue | | Shares | | | Value | | | Net Assets |

| Edwards Lifesciences Corp. | | | 23,000 | | | $ | 2,375,900 | | | | 2.0 | % |

| AutoZone, Inc. | | | 6,000 | | | $ | 2,203,020 | | | | 1.9 | % |

| Rollins, Inc. | | | 85,000 | | | $ | 1,901,450 | | | | 1.6 | % |

| TJX Companies, Inc. (The) | | | 44,000 | | | $ | 1,888,920 | | | | 1.6 | % |

| Express Scripts Holding Co. | | | 31,340 | | | $ | 1,749,712 | | | | 1.5 | % |

| Yum! Brands, Inc. | | | 26,800 | | | $ | 1,726,456 | | | | 1.5 | % |

| FMC Corp. | | | 31,400 | | | $ | 1,679,272 | | | | 1.4 | % |

| Panera Bread Co. Class A | | | 12,000 | | | $ | 1,673,280 | | | | 1.4 | % |

| Church & Dwight Co., Inc. | | | 30,000 | | | $ | 1,664,100 | | | | 1.4 | % |

| Norvo Nordisk A/S ADR | | | 10,100 | | | $ | 1,467,934 | | | | 1.2 | % |

| |

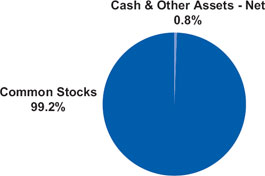

| Asset Allocation – Percentage of Net Assets |

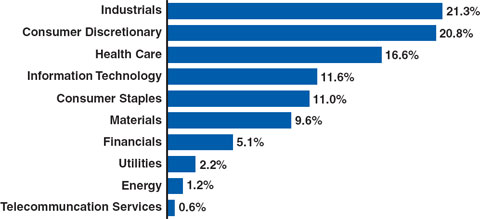

Sector Weightings – Percentage of Total Investment Securities |

| |

|

| The Value Line Fund, Inc. |

| |

| Schedule of Investments (unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS (99.2%) | | | | |

| | | | | | | | |

| | | | CONSUMER DISCRETIONARY (20.6%) | | | | |

| | 6,000 | | AutoZone, Inc. * | | $ | 2,203,020 | |

| | 7,000 | | Bed Bath & Beyond, Inc. * | | | 432,600 | |

| | 9,800 | | BorgWarner, Inc. * (1) | | | 642,782 | |

| | 22,400 | | Brinker International, Inc. | | | 713,888 | |

| | 11,000 | | Buckle, Inc. (The) (1) | | | 435,270 | |

| | 9,000 | | Buffalo Wild Wings, Inc. * | | | 779,760 | |

| | 3,400 | | Chipotle Mexican Grill, Inc. * | | | 1,291,830 | |

| | 11,700 | | Coach, Inc. | | | 684,216 | |

| | 17,500 | | Darden Restaurants, Inc. | | | 886,025 | |

| | 14,000 | | Deckers Outdoor Corp. * (1) | | | 616,140 | |

| | 9,000 | | Dick’s Sporting Goods, Inc. | | | 432,000 | |

| | 22,000 | | Dollar Tree, Inc. * | | | 1,183,600 | |

| | 11,000 | | Domino’s Pizza, Inc. | | | 340,010 | |

| | 3,800 | | Fossil, Inc. * | | | 290,852 | |

| | 9,300 | | Genuine Parts Co. | | | 560,325 | |

| | 13,000 | | Gildan Activewear, Inc. | | | 357,760 | |

| | 5,000 | | Johnson Controls, Inc. | | | 138,550 | |

| | 21,500 | | LKQ Corp. * | | | 718,100 | |

| | 3,000 | | Lululemon Athletica, Inc. * (1) | | | 178,890 | |

| | 15,300 | | McDonald’s Corp. | | | 1,354,509 | |

| | 7,000 | | NIKE, Inc. Class B | | | 614,460 | |

| | 2,000 | | O’Reilly Automotive, Inc. * | | | 167,540 | |

| | 12,000 | | Panera Bread Co. Class A * | | | 1,673,280 | |

| | 10,400 | | Penn National Gaming, Inc. * | | | 463,736 | |

| | 3,000 | | Ralph Lauren Corp. | | | 420,180 | |

| | 10,500 | | Starbucks Corp. | | | 559,860 | |

| | 3,000 | | Tim Hortons, Inc. | | | 157,920 | |

| | 44,000 | | TJX Companies, Inc. (The) | | | 1,888,920 | |

| | 6,000 | | Ulta Salon, Cosmetics & Fragrance, Inc. | | | 560,280 | |

| | 6,700 | | Under Armour, Inc. Class A * (1) | | | 633,016 | |

| | 800 | | VF Corp. | | | 106,760 | |

| | 10,000 | | Warnaco Group, Inc. (The) * | | | 425,800 | |

| | 4,000 | | Wolverine World Wide, Inc. | | | 155,120 | |

| | 4,600 | | Wynn Resorts Ltd. | | | 477,112 | |

| | 26,800 | | Yum! Brands, Inc. | | | 1,726,456 | |

| | | | | | | 24,270,567 | |

| | | | | | | | |

| Shares | | | | Value | |

| | | | CONSUMER STAPLES (10.9%) | | | | |

| | 2,400 | | Boston Beer Co., Inc. (The) Class A * | | $ | 290,400 | |

| | 4,900 | | British American Tobacco PLC ADR | | | 500,388 | |

| | 8,000 | | Bunge Ltd. | | | 501,920 | |

| | 15,400 | | Casey’s General Stores, Inc. | | | 908,446 | |

| | 30,000 | | Church & Dwight Co., Inc. | | | 1,664,100 | |

| | 9,000 | | Costco Wholesale Corp. | | | 855,000 | |

| | 22,800 | | Diamond Foods, Inc. (1) | | | 406,752 | |

| | 5,500 | | Energizer Holdings, Inc. * | | | 413,875 | |

| | 36,000 | | Flowers Foods, Inc. | | | 836,280 | |

| | 15,000 | | General Mills, Inc. | | | 578,100 | |

| | 20,000 | | Green Mountain Coffee Roasters, Inc. * (1) | | | 435,600 | |

| | 8,000 | | Harris Teeter Supermarkets, Inc. | | | 327,920 | |

| | 11,400 | | Herbalife Ltd. | | | 550,962 | |

| | 41,000 | | Hormel Foods Corp. | | | 1,247,220 | |

| | 12,700 | | Ingredion, Inc. | | | 628,904 | |

| | 21,100 | | J&J Snack Foods Corp. | | | 1,247,010 | |

| | 7,000 | | PepsiCo, Inc. | | | 494,620 | |

| | 2,000 | | Reynolds American, Inc. | | | 89,740 | |

| | 5,300 | | TreeHouse Foods, Inc. * | | | 330,137 | |

| | 6,000 | | Whole Foods Market, Inc. | | | 571,920 | |

| | | | | | | 12,879,294 | |

| | | | | | | | |

| | | | ENERGY (1.2%) | | | | |

| | 2,300 | | Core Laboratories N.V. | | | 266,570 | |

| | 4,000 | | Devon Energy Corp. | | | 231,960 | |

| | 14,000 | | Enbridge, Inc. | | | 558,880 | |

| | 3,700 | | Noble Energy, Inc. | | | 313,834 | |

| | | | | | | 1,371,244 | |

| | | | | | | | |

| | | | FINANCIALS (5.1%) | | | | |

| | 8,000 | | Affiliated Managers Group, Inc. * | | | 875,600 | |

| | 20,000 | | AFLAC, Inc. | | | 851,800 | |

| | 10,000 | | American Tower Corp. REIT | | | 699,100 | |

| | 2,000 | | Axis Capital Holdings Ltd. | | | 65,100 | |

| | 14,000 | | Bank of Montreal | | | 773,640 | |

| | 3,000 | | BlackRock, Inc. | | | 509,460 | |

| | 2,300 | | Camden Property Trust REIT | | | 155,641 | |

| | 4,600 | | M&T Bank Corp. | | | 379,822 | |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| June 30, 2012 |

| Shares | | | | Value | |

| | | | | | | | |

| | 8,000 | | Royal Bank of Canada | | $ | 409,760 | |

| | 13,500 | | Stifel Financial Corp. * | | | 417,150 | |

| | 13,000 | | T. Rowe Price Group, Inc. | | | 818,480 | |

| | | | | | | 5,955,553 | |

| | | | HEALTH CARE (16.4%) | | | | |

| | 13,600 | | Alexion Pharmaceuticals, Inc. * | | | 1,350,480 | |

| | 9,600 | | Allergan, Inc. | | | 888,672 | |

| | 1,000 | | Bio-Rad Laboratories, Inc. Class A * | | | 100,010 | |

| | 7,000 | | C.R. Bard, Inc. | | | 752,080 | |

| | 10,400 | | Catalyst Health Solutions, Inc. * | | | 971,776 | |

| | 12,200 | | Cerner Corp. * | | | 1,008,452 | |

| | 18,900 | | Computer Programs & Systems, Inc. | | | 1,081,458 | |

| | 7,000 | | DaVita, Inc. * | | | 687,470 | |

| | 3,000 | | DENTSPLY International, Inc. | | | 113,430 | |

| | 23,000 | | Edwards Lifesciences Corp. * | | | 2,375,900 | |

| | 11,700 | | Endo Health Solutions, Inc. * | | | 362,466 | |

| | 31,340 | | Express Scripts Holding Co. * | | | 1,749,712 | |

| | 12,700 | | Henry Schein, Inc. * | | | 996,823 | |

| | 6,600 | | IDEXX Laboratories, Inc. * | | | 634,458 | |

| | 1,000 | | Intuitive Surgical, Inc. * | | | 553,790 | |

| | 9,100 | | Mednax, Inc. * | | | 623,714 | |

| | 3,800 | | Mettler-Toledo International, Inc. * | | | 592,230 | |

| | 10,100 | | Novo Nordisk A/S ADR | | | 1,467,934 | |

| | 17,500 | | Owens & Minor, Inc. | | | 536,025 | |

| | 6,600 | | Techne Corp. | | | 489,720 | |

| | 16,000 | | Teva Pharmaceutical Industries Ltd. ADR | | | 631,040 | |

| | 8,200 | | Thermo Fisher Scientific, Inc. | | | 425,662 | |

| | 6,400 | | Universal Health Services, Inc. Class B | | | 276,224 | |

| | 7,000 | | Volcano Corp. * | | | 200,550 | |

| | 6,000 | | Waters Corp. * | | | 476,820 | |

| | | | | | | 19,346,896 | |

| | | | INDUSTRIALS (21.1%) | | | | |

| | 1,200 | | Acuity Brands, Inc. | | | 61,092 | |

| | 26,500 | | AMETEK, Inc. | | | 1,322,615 | |

| | 5,800 | | C.H. Robinson Worldwide, Inc. | | | 339,474 | |

| | 11,100 | | Canadian National Railway Co. | | | 936,618 | |

| | | | | | | | |

| Shares | | | | Value | |

| | | | | | | | |

| | 12,000 | | Chicago Bridge & Iron Co. N.V. | | $ | 455,520 | |

| | 15,000 | | CLARCOR, Inc. | | | 722,400 | |

| | 7,000 | | Clean Harbors, Inc. * | | | 394,940 | |

| | 23,700 | | Danaher Corp. | | | 1,234,296 | |

| | 37,000 | | Donaldson Co., Inc. | | | 1,234,690 | |

| | 2,400 | | Esterline Technologies Corp. * | | | 149,640 | |

| | 11,700 | | Exelis, Inc. | | | 115,362 | |

| | 12,000 | | Fastenal Co. | | | 483,720 | |

| | 7,000 | | FedEx Corp. | | | 641,270 | |

| | 9,300 | | Graco, Inc. | | | 428,544 | |

| | 11,187 | | HEICO Corp. | | | 442,110 | |

| | 15,000 | | IDEX Corp. | | | 584,700 | |

| | 11,200 | | IHS, Inc. Class A * | | | 1,206,576 | |

| | 5,850 | | ITT Corp. | | | 102,960 | |

| | 6,800 | | J.B. Hunt Transport Services, Inc. | | | 405,280 | |

| | 10,000 | | Kansas City Southern | | | 695,600 | |

| | 15,700 | | Kirby Corp. * | | | 739,156 | |

| | 7,400 | | L-3 Communications Holdings, Inc. | | | 547,674 | |

| | 2,300 | | Middleby Corp. (The) * | | | 229,103 | |

| | 9,200 | | Parker Hannifin Corp. | | | 707,296 | |

| | 6,200 | | Precision Castparts Corp. | | | 1,019,838 | |

| | 15,000 | | Republic Services, Inc. | | | 396,900 | |

| | 85,000 | | Rollins, Inc. | | | 1,901,450 | |

| | 13,400 | | Roper Industries, Inc. | | | 1,320,972 | |

| | 12,000 | | Stericycle, Inc. * | | | 1,100,040 | |

| | 6,800 | | Toro Co. (The) | | | 498,372 | |

| | 7,000 | | Union Pacific Corp. | | | 835,170 | |

| | 11,400 | | United Technologies Corp. | | | 861,042 | |

| | 6,600 | | Valmont Industries, Inc. | | | 798,402 | |

| | 4,300 | | Verisk Analytics, Inc. Class A * | | | 211,818 | |

| | 4,900 | | W.W. Grainger, Inc. | | | 937,076 | |

| | 25,300 | | Waste Connections, Inc. | | | 756,976 | |

| | | | | | | 24,818,692 | |

| | | | | | | | |

| | | | INFORMATION TECHNOLOGY (11.5%) | | | | |

| | 19,600 | | Accenture PLC Class A | | | 1,177,764 | |

| | 8,300 | | Alliance Data Systems Corp. * (1) | | | 1,120,500 | |

| | 7,000 | | Amphenol Corp. Class A | | | 384,440 | |

| | 4,500 | | Anixter International, Inc. | | | 238,725 | |

| | 13,500 | | ANSYS, Inc. * | | | 851,985 | |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| Schedule of Investments (unaudited) |

| Shares | | | | Value | |

| | | | | | | | |

| | 23,000 | | Check Point Software Technologies Ltd. * | | $ | 1,140,570 | |

| | 16,000 | | Cognizant Technology Solutions Corp. Class A * | | | 960,000 | |

| | 7,000 | | Equinix, Inc. * | | | 1,229,550 | |

| | 5,700 | | F5 Networks, Inc. * | | | 567,492 | |

| | 13,200 | | Informatica Corp. * | | | 559,152 | |

| | 2,600 | | MasterCard, Inc. Class A | | | 1,118,286 | |

| | 9,400 | | MICROS Systems, Inc. * | | | 481,280 | |

| | 12,000 | | Netgear, Inc. * | | | 414,120 | |

| | 10,800 | | Open Text Corp. * (1) | | | 538,920 | |

| | 4,000 | | Rackspace Hosting, Inc. * | | | 175,760 | |

| | 7,000 | | Salesforce.com, Inc. * | | | 967,820 | |

| | 4,300 | | Solera Holdings, Inc. | | | 179,697 | |

| | 12,000 | | TIBCO Software, Inc. * | | | 359,040 | |

| | 6,000 | | VMware, Inc. Class A * | | | 546,240 | |

| | 8,100 | | Wright Express Corp. * | | | 499,932 | |

| | | | | | | 13,511,273 | |

| | | | | | | | |

| | | | MATERIALS (9.6%) | | | | |

| | 20,000 | | Ball Corp. | | | 821,000 | |

| | 4,200 | | CF Industries Holdings, Inc. | | | 813,708 | |

| | 34,000 | | Crown Holdings, Inc. * | | | 1,172,660 | |

| | 10,000 | | Cytec Industries, Inc. | | | 586,400 | |

| | 3,000 | | Ecolab, Inc. | | | 205,590 | |

| | 31,400 | | FMC Corp. | | | 1,679,272 | |

| | 5,900 | | NewMarket Corp. | | | 1,277,940 | |

| | 10,000 | | Packaging Corp. of America | | | 282,400 | |

| | 11,300 | | Praxair, Inc. | | | 1,228,649 | |

| | 12,000 | | Scotts Miracle-Gro Co. (The) Class A (1) | | | 493,440 | |

| | 12,400 | | Sigma-Aldrich Corp. | | | 916,732 | |

| | 25,900 | | Silgan Holdings, Inc. | | | 1,105,671 | |

| | 12,400 | | Valspar Corp. (The) | | | 650,876 | |

| | | | | | | 11,234,338 | |

| | | | | | | | |

| | | | TELECOMMUNICATION SERVICES (0.6%) | | | | |

| | 13,000 | | Crown Castle International Corp. * | | | 762,580 | |

| | | | | | | | |

| | | | UTILITIES (2.2%) | | | | |

| | 10,000 | | ITC Holdings Corp. | | | 689,100 | |

| | 18,000 | | ONEOK, Inc. | | | 761,580 | |

| | 23,000 | | Questar Corp. | | | 479,780 | |

| | 15,300 | | Wisconsin Energy Corp. | | | 605,421 | |

| | | | | | | 2,535,881 | |

| | | | | | | | |

| Shares | | | | Value | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $81,640,084) | | | | |

| | | | (99.2%) | | $ | 116,686,318 | |

| COLLATERAL FOR SECURITIES ON LOAN (4.5%) | | | | |

| | 5,245,135 | | Value Line Funds | | | | |

| | | | Collateral Account | | | 5,245,135 | |

| | | | TOTAL COLLATERAL FOR SECURITIES ON LOAN | | | | |

| | | | (Cost $5,245,135) (4.5%) | | | 5,245,135 | |

| | | | | | | | |

| | | | TOTAL INVESTMENT SECURITIES (103.7%) | | | | |

| | | | (Cost $86,885,219) | | | 121,931,453 | |

| | | | | | | | |

EXCESS OF LIABILITIES OVER CASH AND OTHER ASSETS (-3.7%) | | | (4,307,977 | ) |

| | | | | | | | |

| NET ASSETS (100%) | | $ | 117,623,476 | |

| | | | | | | | |

NET ASSET VALUE OFFERING AND REDEMPTION PRICE, PER OUTSTANDING SHARE ($117,623,476 ÷ 11,994,129 shares outstanding) | | $ | 9.81 | |

| * | Non-income producing. |

| (1) | A portion or all of the security was held on loan. As of June 30, 2012, the market value of the securities on loan was $5,272,194. |

| ADR | American Depositary Receipt. |

| REIT | Real Estate Investment Trust. |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

Statement of Assets and Liabilities at June 30, 2012 (unaudited) |

| Assets: | | | |

| Investment securities, at value | | | |

| (Cost – $86,885,219) (securities on loan, at value, $5,272,194) | | $ | 121,931,453 | |

| Cash | | | 377,219 | |

| Receivable for securities sold | | | 523,864 | |

| Receivable for capital shares sold | | | 83,734 | |

| Interest and dividends receivable | | | 62,022 | |

| Receivable for securities lending income | | | 11,234 | |

| Prepaid expenses | | | 8,157 | |

| Other | | | 225 | |

| Total Assets | | | 122,997,908 | |

| | | | | |

| Liabilities: | | | | |

| Payable upon return of collateral for securities on loan | | | 5,245,135 | |

| Payable for capital shares redeemed | | | 3,536 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 63,445 | |

| Directors’ fees and expenses | | | 150 | |

| Other | | | 62,166 | |

| Total Liabilities | | | 5,374,432 | |

| Net Assets | | $ | 117,623,476 | |

| | | | | |

| Net assets consist of: | | | | |

| Capital stock, at $1.00 par value (authorized 50,000,000, outstanding 11,994,129 shares) | | $ | 11,994,129 | |

| Additional paid-in capital | | | 128,662,668 | |

| Undistributed net investment income | | | 113,340 | |

| Accumulated net realized loss on investments and foreign currency | | | (58,192,934 | ) |

| Net unrealized appreciation of investments and foreign currency translations | | | 35,046,273 | |

| Net Assets | | $ | 117,623,476 | |

| | | | | |

| Net Asset Value, Offering and Redemption Price per Outstanding Share ($117,623,476 ÷ 11,994,129 shares outstanding) | | $ | 9.81 | |

Statement of Operations for the Six Months Ended June 30, 2012 (unaudited) |

| Investment Income: | | | |

| Dividends (net of foreign withholding tax of $13,790) | | $ | 749,339 | |

| Securities lending income | | | 13,899 | |

| Interest | | | 1,071 | |

| Total Income | | | 764,309 | |

| | | | | |

| Expenses: | | | | |

| Advisory fee | | | 439,408 | |

| Service and distribution plan fees | | | 159,493 | |

| Auditing and legal fees | | | 49,418 | |

| Transfer agent fees | | | 48,526 | |

| Printing and postage | | | 36,954 | |

| Registration and filing fees | | | 25,309 | |

| Custodian fees | | | 17,008 | |

| Directors’ fees and expenses | | | 14,015 | |

| Insurance | | | 8,000 | |

| Other | | | 11,892 | |

| Total Expenses Before Fees Waived and Custody Credits | | | 810,023 | |

| Less: Service and Distribution Plan Fees Waived | | | (159,493 | ) |

| Less: Custody Credits | | | (84 | ) |

| Net Expenses | | | 650,446 | |

| Net Investment Income | | | 113,863 | |

| Net Realized and Unrealized Gain on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Gain | | | 7,467,676 | |

| Change in Net Unrealized Appreciation/(Depreciation) | | | 3,979,915 | |

| Net Realized Gain and Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Exchange Transactions | | | 11,447,591 | |

| Net Increase in Net Assets from Operations | | $ | 11,561,454 | |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| Statement of Changes in Net Assets |

| for the Six Months Ended June 30, 2012 (unaudited) and for the Year Ended December 31, 2011 |

| | | Six Months Ended | | | | |

| | | June 30, 2012 | | | Year Ended | |

| | | (unaudited) | | | December 31, 2011 | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 113,863 | | | $ | (25,717 | ) |

| Net realized gain on investments and foreign currency | | | 7,467,676 | | | | 7,607,515 | |

| Change in net unrealized appreciation/(depreciation) | | | 3,979,915 | | | | (3,327,050 | ) |

| Net increase in net assets from operations | | | 11,561,454 | | | | 4,254,748 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net investment income | | | — | | | | (18,709 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 2,420,647 | | | | 49,836,935 | |

| Proceeds from reinvestment of dividends to shareholders | | | — | | | | 17,762 | |

| Cost of shares redeemed | | | (29,694,693 | ) | | | (24,954,879 | ) |

| Net increase/(decrease) in net assets from capital share transactions | | | (27,274,046 | ) | | | 24,899,818 | |

| Total Increase/(Decrease) in Net Assets | | | (15,712,592 | ) | | | 29,135,857 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 133,336,068 | | | | 104,200,211 | |

| End of period | | $ | 117,623,476 | | | $ | 133,336,068 | |

| Undistributed net investment income/(loss), at end of period | | $ | 113,340 | | | $ | (523 | ) |

See Notes to Financial Statements.

| | The Value Line Fund, Inc. |

| | |

| Notes to Financial Statements (unaudited) | |

1. Significant Accounting Policies

The Value Line Fund, Inc., (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company whose primary investment objective is long term-growth of capital.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

(A) Security Valuation: Securities listed on a securities exchange are valued at the closing sales prices on the date as of which the net asset value is being determined. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price. In the absence of closing sales prices for such securities and for securities traded in the over-the-counter market, the security is valued at the midpoint between the latest available and representative asked and bid prices. Short-term instruments with maturities of 60 days or less at the date of purchase are valued at amortized cost, which approximates market value. Short-term instruments with maturities greater than 60 days at the date of purchase are valued at the midpoint between the latest available and representative asked and bid prices, and commencing 60 days prior to maturity such securities are valued at amortized cost. Securities for which market quotations are not readily available or that are not readily marketable and all other assets of the Fund are valued at fair value as the Board of Directors may determine in good faith. In addition, the Fund may use the fair value of a security when the closing market price on the primary exchange where the security is traded no longer accurately reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer.

(B) Fair Value Measurements: The Fund follows fair valuation accounting standards (FASB ASC 820-10) which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| • | Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| • | Level 3 — Inputs that are unobservable. |

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments in securities as of June 30, 2012:

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 116,686,318 | | | $ | 0 | | | $ | 0 | | | $ | 116,686,318 | |

| Collateral for Securities on Loan | | | 0 | | | | 5,245,135 | | | | 0 | | | | 5,245,135 | |

| Total Investments in Securities | | $ | 116,686,318 | | | $ | 5,245,135 | | | $ | 0 | | | $ | 121,931,453 | |

| The Value Line Fund, Inc. | |

| | |

| | June 30, 2012 |

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2011-04, “Fair Value Measurements and Disclosures (Topic 820) — Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (“ASU 2011-04”). ASU 2011-04 clarifies the application of existing fair value measurement requirements, changes certain principles related to measuring fair value, and requires additional disclosures about fair value measurements.

Specifically, the guidance specifies that the concepts of highest and best use and valuation of premise in a fair value measurement are only relevant when measuring the fair value of nonfinancial assets whereas they are not relevant when measuring the fair value of financial assets and liabilities.

Required disclosures are expanded under the new guidance, especially for fair value measurements that are categorized within Level 3 of the fair value hierarchy, for which quantitative information about the unobservable inputs used, and a narrative description of the valuation processes in place and sensitivity of recurring Level 3 measurements to changes in unobservable inputs will be required. Entities will also be required to disclose the categorization by level of the fair value hierarchy for items that are not measured at fair value in the statement of financial position but for which the fair value is required to be disclosed.

ASU 2011-04 is effective for annual periods beginning after December 15, 2011 and is to be applied prospectively. The Fund is currently assessing the impact of this guidance on its financial statements.

The Fund follows the updated provisions surrounding fair value measurements and disclosures on transfers in and out of all levels of the fair value hierarchy on a gross basis and the reasons for the transfers as well as to disclosures about the valuation techniques and inputs used to measure fair value for investments that fall in either Level 2 or Level 3 of the fair value hierarchy.

For the six months ended June 30, 2012, there was no significant transfer activity between Level 1 and Level 2.

For the six months ended June 30, 2012, there were no Level 3 investments. The Schedule of Investments includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements: In connection with transactions in repurchase agreements, the Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings. There were no open repurchase agreements at June 30, 2012.

(D) Federal Income Taxes: It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions available to regulated investment companies, as defined in applicable sections of the Internal Revenue Code, and to distribute all of its investment income and capital gains to its shareholders. Therefore, no provision for federal income tax is required.

| | The Value Line Fund, Inc. |

| | |

| Notes to Financial Statements (unaudited) | |

Management has analyzed the Fund’s tax positions taken on federal and state income tax returns for all open tax years (fiscal years ended December 31, 2008 through December 31, 2011), and has concluded that no provision for federal or state income tax is required in the Fund’s financial statements. The Fund’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(E) Security Transactions and Distributions: Security transactions are accounted for on the date the securities are purchased or sold. Interest income is accrued as earned. Realized gains and losses on sales of securities are calculated for financial accounting and federal income tax purposes on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

(F) Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Fund does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Fund, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/depreciation on investments.

(G) Representations and Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(H) Foreign Taxes: The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(I) Securities Lending: Under an agreement with State Street Bank & Trust (“State Street”), the Fund can lend its securities to brokers, dealers and other financial institutions approved by the Board of Directors. By lending its investment securities, the Fund attempts to increase its net investment income through receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Generally, in the event of a counter-party default, the Fund has the right to use the collateral to offset the losses incurred.

| The Value Line Fund, Inc. | |

| | |

| | June 30, 2012 |

Upon entering into a securities lending transaction, the Fund receives cash or other securities as collateral in an amount equal to or exceeding 102% of the current market value of the loaned securities. Any cash received as collateral is generally invested by State Street Global Advisors, acting in its capacity as securities lending agent (the “Agent”), in The Value Line Funds collateral account. A portion of the dividends received on the collateral is rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

As of June 30, 2012, the Fund loaned securities which were collateralized by cash. The value of the securities on loan and the value of the related collateral were as follows:

| | | |

| | | |

| | |

| Loaned | Collateral | Mark) |

| $5,272,194 | $5,245,135 | $5,386,605 |

(J) Subsequent Events: Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued, and except as already included in the notes to these financial statements, has determined that no additional items require disclosure.

| 2. Capital Share Transactions, Dividends and Distributions to Shareholders |

Transactions in capital stock were as follows:

| | Six Months Ended | | | | |

| | June 30, 2012 | | | Year Ended |

| | (unaudited) | | | December 31, 2011 |

| Shares sold | | | 249,009 | | | 5,328,951 | |

| Shares issued on reinvestment | | | — | | | 1,976 | |

| Shares redeemed | | | (3,006,327 | ) | | | (2,772,173 | ) |

| Net increase/(decrease) | | | (2,757,318 | ) | | | 2,558,754 | |

| Dividends per share from net investment income | | $ | — | | | $ | 0.0013 | |

3. Purchases and Sales of Securities

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | Six Months Ended June 30, 2012 (unaudited) | |

| Purchases: | | | |

| Investment Securities | | $ | 2,541,211 | |

| Sales: | | | | |

| Investment Securities | | $ | 29,640,982 | |

4. Income Taxes

At June 30, 2012, information on the tax components of capital is as follows:

| Cost of investments for tax purposes | | $ | 86,885,219 | |

| Gross tax unrealized appreciation | | $ | 36,716,531 | |

| Gross tax unrealized depreciation | | | (1,670,297 | ) |

| Net tax unrealized appreciation on investments | | $ | 35,046,234 | |

| | The Value Line Fund, Inc. |

| | |

| Notes to Financial Statements (unaudited) | |

5. Investment Advisory Fee, Service and Distribution Fees and Transactions With Affiliates

An advisory fee of $439,408 was paid or payable to EULAV Asset Management (the “Adviser”) for the six months ended June 30, 2012. This was computed at an annual rate of 0.70% of the first $100 million of the Fund’s average daily net assets plus 0.65% of the excess thereof, and paid monthly. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping, and clerical personnel necessary for managing the affairs of the Fund. The Adviser also provides persons, satisfactory to the Fund’s Board of Directors, to act as officers and employees of the Fund and pays their salaries. Effective December 16, 2011 the Fund no longer waives Advisory fees.

The Fund has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities LLC (the “Distributor”) for advertising, marketing and distributing the Fund’s shares and for servicing the Fund’s shareholders at an annual rate of 0.25% of the Fund’s average daily net assets. For the six months ended June 30, 2012, fees amounting to $159,493 before fee waivers were accrued under the Plan. Effective May 1, 2007 through June 30, 2013, the Distributor contractually agreed to waive the Fund’s 12b-1 fee for one year periods. For the six months ended June 30, 2012 all 12b-1 fees were waived. The Distributor has no right to recoup prior waivers.

For the six months ended June 30, 2012, the Fund’s expenses were reduced by $84 under a custody credit arrangement with the custodian.

Direct expenses of the Fund are charged to the Fund while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Fund bears all other costs and expenses.

Certain officers and a Trustee of the Adviser are also officers and a director of the Fund. At June 30, 2012, the officers and directors of the Fund as a group owned 1,072 shares, representing less than 1% of the outstanding shares.

| The Value Line Fund, Inc. |

| |

| Financial Highlights |

Selected data for a share of capital stock outstanding throughout each period:

| | | Six Months Ended | | | | | | | | | | | | | | | | |

| | | June 30, 2012 | | | Years Ended December 31, | |

| | | (unaudited) | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Net asset value, beginning of period | | $ | 9.04 | | | $ | 8.55 | | | $ | 6.81 | | | $ | 6.22 | | | $ | 12.83 | | | $ | 12.48 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss) | | | 0.01 | | | | (0.00 | )(1) | | | 0.00 | (1) | | | (0.01 | ) | | | (0.03 | ) | | | (0.01 | ) |

Net gains or (losses) on securities

(both realized and unrealized) | | | 0.76 | | | | 0.49 | | | | 1.74 | | | | 0.60 | | | | (6.30 | ) | | | 2.37 | |

| Total from investment operations | | | 0.77 | | | | 0.49 | | | | 1.74 | | | | 0.59 | | | | (6.33 | ) | | | 2.36 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | | (0.00 | )(1) | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.28 | ) | | | (2.01 | ) |

| Total distributions | | | — | | | | (0.00 | )(1) | | | — | | | | — | | | | (0.28 | ) | | | (2.01 | ) |

| Net asset value, end of period | | $ | 9.81 | | | $ | 9.04 | | | $ | 8.55 | | | $ | 6.81 | | | $ | 6.22 | | | $ | 12.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 8.52 | %(2) | | | 5.75 | % | | | 25.55 | % | | | 9.49 | % | | | (49.28 | )% | | | 19.50 | % |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 117,623 | | | $ | 133,336 | | | $ | 104,200 | | | $ | 92,680 | | | $ | 93,099 | | | $ | 203,274 | |

Ratio of expenses to average net assets(3) | | | 1.26 | %(4) | | | 1.29 | % | | | 1.31 | %(5) | | | 1.36 | % | | | 1.17 | % | | | 1.08 | % |

Ratio of expenses to average net assets(6) | | | 1.01 | %(4) | | | 0.94 | % | | | 0.91 | %(7) | | | 1.04 | % | | | 0.92 | % | | | 0.82 | % |

| Ratio of net investment income/(loss) to average net assets | | | 0.18 | %(4) | | | (0.02 | )% | | | 0.02 | % | | | (0.22 | )% | | | (0.26 | )% | | | (0.11 | )% |

| Portfolio turnover rate | | | 2 | %(2) | | | 18 | % | | | 27 | % | | | 122 | % | | | 273 | % | | | 216 | % |

| (1) | Amount is less than $.01 per share. |

| (2) | Not annualized. |

| (3) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of the advisory fees by the Adviser and the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets net of custody credits, but exclusive of the fee waivers would have been 1.07% for the year ended December 31, 2007 and would have been unchanged for the other periods shown. |

| (4) | Annualized. |

| (5) | Ratio reflects expenses grossed up for the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

| (6) | Ratio reflects expenses net of the custody credit arrangement and net of the waiver of the advisory fee by the Adviser and the service and distribution plan fees by the Distributor. |

| (7) | Ratio reflects expenses net of the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

See Notes to Financial Statements.

The Value Line Fund, Inc.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted these proxies for the 12-month period ended June 30 is available through the Fund’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

| The Value Line Fund, Inc. |

| |

| Management of the Fund |

MANAGEMENT INFORMATION

The business and affairs of the Fund are managed by the Fund’s officers under the direction of the Board of Directors. The following table sets forth information on each Director and Officer of the Fund. Each Director serves as a director or trustee of each of the 12 Value Line Funds. Each Director serves until his or her successor is elected and qualified.

| | | | | | | | | Other |

| | | | | Length of | | Principal Occupation | | Directorships |

| Name, Address, and YOB | | Position | | Time Served | | During the Past 5 Years | | Held by Director |

| Interested Director* | | | | | | | | |

Mitchell E. Appel YOB: 1970 | | Director | | Since 2010 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line, Inc. (“Value Line”) from April 2008 to December 2010 and from September 2005 to November 2007; Director from February 2010 to December 2010; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009, Trustee since December 2010 and Treasurer since January 2011. | | None |

| Non-Interested Directors | | | | | | | | |

Joyce E. Heinzerling 500 East 77th Street New York, NY 10162 YOB: 1956 | | Director | | Since 2008 | | President, Meridian Fund Advisers LLC. (consultants) since April 2009; General Counsel, Archery Capital LLC (private investment fund) until April 2009. | | Burnham Investors Trust, since 2004 (4 funds). |

Francis C. Oakley 54 Scott Hill Road Williamstown, MA 01267 YOB: 1931 | | Director | | Since 2000 | | Professor of History, Williams College, (1961-2002). Professor Emeritus since 2002; President Emeritus since 1994 and President, (1985-1994); Chairman (1993-1997) and Interim President (2002-2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center. | | None |

David H. Porter 5 Birch Run Drive Saratoga Springs, NY 12866 YOB: 1935 | | Director | | Since 1997 | | Professor, Skidmore College since 2008; Visiting Professor of Classics, Williams College, (1999-2008); President Emeritus, Skidmore College since 1999 and President, (1987-1998). | | None |

| | |

| | The Value Line Fund, Inc. |

| | |

| Management of the Fund | |

| | | | | | | | | Other |

| | | | | Length of | | Principal Occupation | | Directorships |

| Name, Address, and YOB | | Position | | Time Served | | During the Past 5 Years | | Held by Director |

Paul Craig Roberts 169 Pompano St. Panama City Beach, FL 32413 YOB: 1939 | | Director | | Since 1983 | | Chairman, Institute for Political Economy. | | None |

Nancy-Beth Sheerr 1409 Beaumont Drive Gladwyne, PA 19035 YOB: 1949 | | Director | | Since 1996 | | Senior Financial Adviser, Veritable L.P. (Investment Adviser). | | None |

Daniel S. Vandivort

59 Indian Head Road Riverside, CT 06878 YOB: 1954 | | Director (Chairman of Board since 2010) | | Since 2008 | | President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management (2005-2007); Managing Director, Weiss, Peck and Greer, (1995-2005). | | None |

| Officers | | | | | | | | |

Mitchell E. Appel YOB: 1970 | | President | | Since 2008 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line from April 2008 to December 2010 and from September 2005 to November 2007; Director from February 2010 to December 2010; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009, Trustee since December 2010 and Treasurer since January 2011. |

Michael J. Wagner YOB: 1950 | | Chief Compliance Officer | | Since 2009 | | Chief Compliance Officer of the Value Line Funds since June 2009; President of Northern Lights Compliance Service, LLC (formerly Fund Compliance Services, LLC (2006 - present)) and Senior Vice President (2004 - 2006) and President and Chief Operations Officer (2003 - 2006) of Gemini Fund Services, LLC; Director of Constellation Trust Company until 2008. |

Emily D. Washington YOB: 1979 | | Treasurer and Secretary | | Since 2008 | | Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008 and secretary since 2010; Associate Director of Mutual Fund Accounting at Value Line until August 2008. |

| * | Mr. Appel is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Adviser and Distributor. |

| | |

| Unless otherwise indicated, the address for each of the above officers is c/o Value Line Funds, 7 Times Square, New York, NY 10036. |

| |

| The Fund’s Statement of Additional Information (SAI) includes additional information about the Fund’s Directors and is available, without charge, upon request by calling 1-800-243-2729 or on the Fund’s website, www.vlfunds.com. |

| The Value Line Fund, Inc. | |

| The Value Line Family of Funds |

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — Value Line U.S. Government Money Market Fund, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line Strategic Asset Management Trust* seeks to achieve a high total investment return consistent with reasonable risk.

1993 — Value Line Emerging Opportunities Fund invests in US common stocks of small capitalization companies, with its primary objective being long-term growth of capital.

1993 — Value Line Asset Allocation Fund seeks high total investment return, consistent with reasonable risk. The Fund invests in stocks, bonds and money market instruments utilizing quantitative modeling to determine the asset mix.

| * | Only available through the purchase of Guardian Investor, a tax deferred variable annuity, or ValuePlus, a variable life insurance policy. |

For more complete information about any of the Value Line Funds, including charges and expenses, send for a prospectus from EULAV Securities LLC, 7 Times Square, New York, New York 10036-6524 or call 1-800-243-2729, 9am-5pm CST, Monday-Friday, or visit us at www.vlfunds.com. Read the prospectus carefully before you invest or send money.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c) ) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively. |

| (b) | The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses. |

Item 12. Exhibits.

| (a) | (1) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

(2) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto as Exhibit 99.906.CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President |

| | | |

| Date: | September 7, 2012 | |

| | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | | |

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President, Principal Executive Officer |

| | | |

| By: | /s/ Emily D. Washington | |

| | Emily D. Washington, Treasurer, Principal Financial Officer |

| | | |

| Date: | September 7, 2012 | |