| | Semi-Annual Report | | SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND |

| | |

| | | SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND |

| | March 31, 2024 | |

| | | |

| | | |

| | | Each a series of Advisors Series Trust (the “Trust”) |

| | | | | | | |

| | | SHENKMAN CAPITAL | | Institutional | | |

| | | FLOATING RATE | Class F | Class | | |

| | | HIGH INCOME FUND | (SFHFX) | (SFHIX) | | |

| | | | | | | |

| | | SHENKMAN CAPITAL | | | | Institutional |

| | | SHORT DURATION | Class A | Class C | Class F | Class |

| | | HIGH INCOME FUND | (SCFAX) | (SCFCX) | (SCFFX) | (SCFIX) |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, Wisconsin 53201-0701 1-855-SHENKMAN (1-855-743-6562) | | | | | | | |

| | | | | | | | |

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SHAREHOLDER LETTER

March 31, 2024 (Unaudited)

Dear Shareholder,

Fund Overview and Performance

The Shenkman Capital Floating Rate High Income Fund (the “Fund”) seeks to generate high current income through active selection and management of investments, primarily in the leveraged loan universe, and looks to build a portfolio with the best chance of providing superior risk-adjusted returns. For the semi-annual period ended March 31, 2024 (the “Period”), the Morningstar LSTA US Leveraged Loan Index (the “Index”) and Morningstar LSTA US B- Ratings and Above Loan Index (the “B- & Above Index”) returned 5.40% and 5.33%, respectively. The Period was market by a shift in tone from the Fed early in the fourth quarter, which alluded to probable rate cuts in 2024, spurring a rally in U.S. Treasuries and investment grade bonds, along with significant outperformance in equities. However, the inflation deceleration trend stalled in the first quarter of 2024 and several Fed governors indicated rate cuts were unlikely without further deceleration in inflation. The reversion to a more hawkish stance pressured fixed income assets and prompted renewed interest in floating rate instruments, providing a tailwind for the leveraged loan market in the first quarter. The Fund’s institutional class shares (SFHIX) had a net return of 4.70% for the Period. The Fund’s F class shares (SFHFX) had a net return of 4.69% for the Period.

For context, over the Period, high yield and investment grade bonds, as measured by the ICE BofA U.S. High Yield Index (H0A0) and the ICE BofA U.S. Corporate Index (C0A0), posted returns of 8.68% and 7.83%, respectively, while the Index returned 5.40%. Periodic Index returns by rating exhibited modest differentiation and a bias toward lower-rated cohorts, with BB-rated, B-rated, and CCC & Below-rated loans returning 4.76%, 5.69%, and 6.11%, respectively. The Fund had a lower weight than the Index in riskier credit profiles, including CCC & below -rated and second lien loans, which detracted from relative performance, while out-of-index positions in high yield bonds contributed to relative performance for the Period. From a sector attribution standpoint, the Fund benefitted from positive selection in Utilities and an underweight in Food, Beverage & Tobacco. Main detractors included negative selection in Telecommunication Services and Media & Entertainment.

The Fund remained well-diversified, with investments in over 350 issuers across more than 50 industries. For liquidity purposes, the Fund targets an allocation of approximately 15% of assets to cash and bonds.

Market Commentary

Primary leveraged loan market activity surged in the first quarter to $317.7 billion amid a wave of repricing/refinancing activity, marking the second most active quarter on record, following full year 2023 issuance of

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

$370.1 billion, though net new issuance remains muted as repricing/refinancing dominate activity. From a demand perspective, net CLO formations totaled $48.1 billion in the first quarter compared to net issuance of $33.6 billion and $115.6 billion in the first quarter and full year 2023, respectively. Following outflows in both 2022 and 2023, retail demand for leveraged loans rebounded as benchmark rates rose during the quarter. Inflows into retail leveraged loan mutual funds totaled $2.8 billion during the first quarter. Eleven loan issuers defaulted in the first quarter totaling $7.2 billion in loans following 30 defaults totaling $30.7 billion in full year 2023. The trailing 12-month par-weighted default rate ended the quarter at 1.77%, a 33bp decrease from the previous quarter and 4bp higher than one year ago, according to J.P. Morgan Research. For context, the historical leveraged loan default rate is approximately 3%.

Outlook

The fourth quarter marked a turning point in many investors’ sentiments as the Fed seemed to soften its rhetoric, with the first talk of potential rate cuts being forecast for 2024. However, inflation deceleration seemed to stall in the first quarter while a relatively robust labor market and strong GDP spurred more hawkish comments from Fed governors, which appeared to have dashed hopes for imminent rate cuts. While we believe lower rates remain a possibility this year, the size and frequency of reductions remain open to debate. We believe this scenario could also unclog the global financial system, resulting in an acceleration in M&A activity, a surge in new issuance, and improved liquidity. The balance of the year is likely to remain Fed-focused as an unexpected rise in inflation could spur rates to remain at recent highs, though a contentious general election and simmering geopolitical risks are surely to garner investor attention as well. The coming months could be a crucial test of market resilience as consumers and corporations continue to adapt to the “new normal” of high borrowing costs, while geopolitical risks continue to loom large. We continue to monitor developments across industries and the broader economy, seeking to assess the potential impact on the leveraged loan market. In our opinion, given the current attractive all-in credit spreads, we believe the leveraged loan market presents compelling relative value opportunities, particularly given high current base rates are likely to remain elevated for the foreseeable future as any potential Fed rate decreases are likely to be small barring a major catalyst for significant cuts. As we seek to proactively manage the portfolio and trade exposures across our global platform, our goal remains to safeguard against potential downside risks while concurrently optimizing returns.

We maintain a constructive outlook on the loan market overall; however, we believe that credit selection will remain a primary driver of performance differentiation this year. In the event of episodic market turbulence, we believe there is potential for increased dispersion between better quality and

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

riskier credits after a period of significant compression. Consequently, we remain cautious as we continuously assess the relative value of the Fund’s positions. A foundational pillar of our investment philosophy remains the preservation of capital as we strive to deliver, or beat, market returns throughout the cycle with a lower risk profile. As a conservative asset manager, we intend to remain defensively positioned in our portfolios and will seek to take advantage of market dislocations only in what we believe to be creditworthy, Shenkman-approved issuers in both the primary and secondary markets.

Thank you again for your continued support and trust in the Fund. We look forward to growing with you.

Sources: LCD, JPM Research

IMPORTANT INFORMATION

The Shenkman Group of Companies (the “Shenkman Group”) consists of Shenkman Capital Management, Inc., and its affiliates and subsidiaries, including, without limitation, Shenkman Capital Management Ltd, Romark Credit Advisors LP, and Romark CLO Advisors LLC. The Shenkman Group focuses on the leveraged finance market and is dedicated to providing in-depth, bottom-up, fundamental credit analysis.

Shenkman Capital Management, Inc. (“Shenkman” or “Shenkman Capital”) is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”). Romark Credit Advisors LP is also registered as an investment adviser with the SEC and Romark CLO Advisors LLC is registered as a relying adviser of Romark Credit Advisors LP (together, “Romark”). Shenkman Capital Management Ltd is a wholly-owned subsidiary of Shenkman Capital Management, Inc. and is authorized and regulated by the U.K. Financial Conduct Authority. Such registrations do not imply any specific skill or training. EEA Investors: This material is provided to you because you have been classified as a professional client in accordance with the Markets in Financial Instruments Directive (Directive 2014/65/EU) (known as “MiFID II”) or as otherwise defined under applicable local regulations. If you are unsure about your classification or believe that you may be a retail client under these rules, please contact the Shenkman Group and disregard this information.

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. There can be no assurance that the Fund will achieve its stated objective. In addition to the normal risks associated with investing, bonds and bank loans, and the funds that invest in them are subject to interest rate risk and can be expected to decline in value as interest rates rise. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

The Fund invests in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Leverage may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the fund to be more volatile than if leverage was not used.

Investments in CLOs carry additional risks, including the possibility that distributions from collateral securities will not be adequate to make interest payments and that the quality of the collateral may decline in value or default.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Credit quality weights by rating are derived from the highest bond rating as determined by S&P Global Ratings (“S&P”), Moody’s or Fitch. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as S&P or Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when none of the three rating agencies have issued a formal rating, the Advisor will classify the security as nonrated.

The ICE BofA U.S. High Yield Index (H0A0) has an inception date of August 31, 1986 and tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

The ICE BofA U.S. Corporate Index (C0A0) has an inception date of December 31, 1972, and tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market.

The Morningstar® LSTA U.S. Leveraged Loan Index is a market-value weighted index designed to measure the performance of the US leveraged loan market.

The Morningstar® LSTA US B- Ratings and Above Loan TR USD Index tracks the current outstanding balance and spread over LIBOR for fully funded institutional term loans that are rated B- or above and syndicated to U.S. loan investors. The Morningstar® LSTA US B- Ratings and Above Loan TR USD Index is unmanaged, not available for direct investment and does not reflect deductions for fees or expenses.

You cannot invest directly in an index.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of fund holdings.

An original issue discount (OID) is the discount in price from a bond’s face value at the time a bond or other debt instrument is first issued.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Must be preceded or accompanied by a prospectus.

The credit rating is a financial indicator to potential investors of debt securities such as bonds. These are assigned by credit rating agencies such as Moody’s and S&P to have letter designations (such as AAA, B, CC) which represent the quality of a bond. Moody’s assigns bond credit ratings of Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, with WR and NR as withdrawn and not rated. S&P assigns bond credit ratings of AAA, AA, A, BBB, BB, B, CCC, CC, C, D.

These materials may contain information obtained from third parties, and may include ratings from credit ratings agencies such as S&P. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third-party information contained in this presentation was obtained from sources that the Shenkman Group considers to be reliable; however, no representation is made as to, and no responsibility, warranty or liability is accepted for, the accuracy, completeness, timeliness or availability of such information, including ratings. Neither the Shenkman Group nor any third party content provider is responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. NEITHER THE SHENKMAN GROUP NOR ANY THIRD PARTY CONTENT PROVIDERS GIVE ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. NEITHER THE SHENKMAN GROUP NOR ANY THIRD PARTY CONTENT PROVIDERS SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF SUCH THIRD PARTY CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

References to indices are for information purposes only. The Shenkman Group believes that any indices discussed herein are broad market indices and are indicative of the type of investments that the Shenkman Group may purchase, but may contain different securities than those held in the Shenkman Group portfolios managed pursuant to the strategies described herein. The indices have not been selected to represent an appropriate benchmark. The strategies referred to herein are not design to mimic the investments on which any index is based. The indices are unmanaged and not available for direct investment and do not reflect deductions for fees or expenses.

The Shenkman Capital Floating Rate High Income Fund is distributed by Quasar Distributors, LLC, which is not affiliated with Shenkman Capital Management, Inc.

SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND

SHAREHOLDER LETTER

March 31, 2024 (Unaudited)

Dear Shareholder,

During the fiscal six months ended March 31, 2024 (the “Period”), the Shenkman Capital Short Duration High Income Fund (the “Fund”) continued to seek a high level of current income by focusing on investments within the non-investment grade universe believed to be high-quality yet short duration. The Fund’s Institutional Class shares (“SCFIX”) returned 5.00% net for the Period and ended the Period with a duration-to-worst of 1.49 years and average final maturity of 2.5 years. The Fund’s Class A shares returned 4.94% (without sales load) and 1.76% (with maximum sales load imposed on purchases of 3.00%) for the Period, and the Class F shares returned 4.97% net. Additionally, the Class C shares returned 4.47% (without sales load) and 3.47% (with maximum deferred sales load of 1.00%). The Fund’s benchmark, the ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C), returned 5.08% net for the Period while the ICE BofA 0-3 Year U.S. Treasury Index (G1QA) returned 2.75%.

In what was a relatively strong period for the broader high yield market, the Fund participated materially in the rally despite its more defensive shorter tenor positioning. The broader high yield market as measured by the ICE BofA U.S. High Yield Index (H0A0) posted a return 8.68% for the Period. SCFIX performance modestly trailed the H42C while outperforming shorter-dated Treasuries as measured by G1QA for the period. On a sector basis, all sectors posted positive returns with positive selection in Utilities and Automotives Industrials serving as the largest contributors to relative performance while underweight in Consumer Staples Discretionary and negative selection in Healthcare were the largest detractors over the period. On a ratings basis, the Fund’s BB rated and CCC rated credits were contributors to relative performance while negative selection and underweight in B rated credits were a detractor. The Fund’s sector positioning is largely a function of its focus on bottom-up, individual security selection and fundamental analysis and less driven by top-down, sector-driven allocations. The Fund’s top three broader sector exposures are concentrated in Leisure, Gaming & Travel, Industrials and Healthcare. We believe our Leisure, Gaming & Travel exposure is well diversified, including subsegments that have been more stable such as fast-food franchisors and regional theme parks as well as those subsegments we believe are better positioned for an ultimate recovery in travel and entertainment such as Hotels & Gaming. The Industrials sector exposure captures a wide range of sub-industries and holdings that are broadly diversified and include service companies that in our view have attractive business models and competitive positions. The Healthcare sector is historically among the most stable and defensive sector given its consistent/recurring revenues, solid free cash flow generation and strong asset coverage. Additionally, we have intentionally avoided the Oil & Gas sector given the unfavorable risk/reward for shorter maturities in the space and the asymmetric downside volatility associated

SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

with the volatile swings in commodity prices. The Fund’s exposure to bank loans was also a modest detractor to performance as bank loan returns trailed short duration for the Period. As of March 31, 2024, the Fund’s average price was $98.96 (up from $97.16 at the beginning of the period), with a current yield of 6.31%, yield-to-maturity of 6.68% and a yield-to-worst of 6.38%. As we believe diversification remains a key factor in helping to mitigate risk, the portfolio was well-diversified, ending the period with investments in 223 issuers across 15 sectors as of March 31, 2024.

Market Commentary

Equity performance has been impressive over the last six months as the S&P 500 posted consecutive double-digit quarterly gains. Investors likely recognized that the U.S. economy has weathered the most aggressive interest rate hiking cycle since the 1980’s without the anticipated repercussions of high unemployment or a recession. The riskiest market tiers have generated remarkable returns since late October. While markets were driven largely by widespread optimism over the timing of Fed rate cuts, subsequent economic data releases have signaled inflation may be stickier than previously anticipated. The convergence of strong GDP, moderating inflation, and a more dovish tone and pivot from the Fed spurred a widespread rally in the final two months of 2023. The broader high yield market, as measured by the H0A0, finished the year with a blockbuster November-December return of 8.40%, the highest two month gain since April-May 2020, while returns were more tempered in the first quarter of 2024 with the 10-year U.S Treasury yield rising from its recent December low as investors scaled back their expectations for reductions in 2024. Despite the varying degree of optimism within the Period, the broader high yield market, as measured by the H0A0, rallied 8.68% over the six months ended March 31, 2024 as the longer duration tiers of the high yield market outperformed shorter duration tiers given the movement in the rates market, while the CCC rated credits posted the strongest period returns, followed by BB rated credits, with B rated credits trailing slightly behind.

The J.P. Morgan U.S. high yield bond par-weighted trailing 12-month default rate ended the Period at 1.7%, while including distressed exchanges it would have been 2.59%, up 68 bps from a year ago. New issuance during the first quarter of 2024 totaled an estimated $81bn, almost doubling the fourth quarter of 2023’s new issuance of approximately $41bn.

Outlook

Going forward, the refinancing cycle is expected to remain in force. We believe M&A, which is already up meaningfully versus a year ago, is likely to be more prevalent in leveraged finance. We anticipate these trends will keep defaults modest, thereby partially rationalizing spreads being tighter than historical averages. The yields offered by leveraged finance appear to be

SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

attracting capital inflows, which comes after years of a low-rate environment. The level of new issuance and distressed exchange offers may lead to significant changes in the constituents in the marketplace, creating both opportunities and risks. We believe these potential changes underscore the need for thoughtful portfolio construction and extensive credit analysis to address the challenges of the fixed income market today. We continue to believe the higher-quality short duration segment of the high yield market remains well positioned as a lower volatility solution with the ability to seek to capture attractive risk-adjusted returns in the current environment.

Thank you again for your continued support and trust in our strategy. We look forward to growing with you.

IMPORTANT INFORMATION

The Shenkman Group of Companies (the “Shenkman Group”) consists of Shenkman Capital Management, Inc., and its affiliates and subsidiaries, including, without limitation, Shenkman Capital Management Ltd, Romark Credit Advisors LP, and Romark CLO Advisors LLC. The Shenkman Group focuses on the leveraged finance market and is dedicated to providing in-depth, bottom-up, fundamental credit analysis.

Shenkman Capital Management, Inc. (“Shenkman” or “Shenkman Capital”) is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”). Romark Credit Advisors LP is also registered as an investment adviser with the SEC and Romark CLO Advisors LLC is registered as a relying adviser of Romark Credit Advisors LP (together, “Romark”). Shenkman Capital Management Ltd is a wholly-owned subsidiary of Shenkman Capital Management, Inc. and is authorized and regulated by the U.K. Financial Conduct Authority. Such registrations do not imply any specific skill or training. EEA Investors: This material is provided to you because you have been classified as a professional client in accordance with the Markets in Financial Instruments Directive (Directive 2014/65/EU) (known as “MiFID II”) or as otherwise defined under applicable local regulations. If you are unsure about your classification or believe that you may be a retail client under these rules, please contact the Shenkman Group and disregard this information.

Any third-party information contained herein was obtained from sources that Shenkman considers to be reliable; however, no representation is made as to, and Shenkman accepts no responsibility, warranty or liability for the accuracy or completeness of such information. Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. There can be no assurance that the Fund will achieve its stated objective. In addition to the normal risks associated with investing, bonds and bank loans, and the funds that invest in them are subject to interest rate risk and can be expected to decline in value as interest rates rise. Investment by the Fund in lower-rated and non-rated

SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund invests in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Leverage may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the fund to be more volatile than if leverage was not used.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

The ICE BofA U.S. High Yield Index (H0A0) has an inception date of August 31, 1986 and tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

The ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C) consists of all securities in the ICE BofA BB-B U.S. High Yield Index (HUC4) that have a duration-to-worst of 2 years or less. The ICE BofA U.S. High Yield, BB-B Rated, Constrained Index (HUC4) has an inception date of December 31, 1996, and is a subset of the ICE BofA U.S. High Yield Index (H0A0) that consists of all securities rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. The ICE BofA U.S. Treasuries 0-3 year Index (G1QA) is an unmanaged index that tracks the performance of the direct sovereign debt of the U.S. Government having a maturity of less than three years.

You cannot invest directly in an index.

Basis points (bps) are equivalent to one-one hundredths of a percentage point.

Yield to Maturity is the total return anticipated on a bond if the bond is held until it matures.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

Duration-to-worst is the duration of a bond computed using either the final maturity date, or a call date within the bond’s call schedule, whichever would result in the lowest yield to the investor.

Yield is defined as the income return on an investment. This refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value.

Yield-to-worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting.

Spread-to-worst is the difference between the yield-to-worst of a bond and yield-to-worst of a U.S. Treasury with a similar duration.

Current Yield is the annual income (interest or dividends) divided by the current price of the security. This measure looks at the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased the bond and held it for a year. This measure is not an accurate reflection of the actual

SHENKMAN CAPITAL SHORT DURATION HIGH INCOME FUND

SHAREHOLDER LETTER – Continued

March 31, 2024 (Unaudited)

return that an investor will receive in all cases because bond and stock prices are constantly changing due to market factors.

Yield-to-Maturity is the rate of return anticipated on a bond if held until the end of its lifetime. YTM is considered a long-term bond yield expressed as an annual rate. The YTM calculation takes into account the bond’s current market price, par value, coupon interest rate and time to maturity. It is also assumed that all coupon payments are reinvested at the same rate as the bond’s current yield. YTM is a complex but accurate calculation of a bond’s return that helps investors compare bonds with different maturities and coupons.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of fund holdings.

Must be preceded or accompanied by a prospectus.

The credit rating is a financial indicator to potential investors of debt securities such as bonds. These are assigned by credit rating agencies such as Moody’s and S&P Global Ratings (“S&P”) to have letter designations (such as AAA, B, CC) which represent the quality of a bond. Moody’s assigns bond credit ratings of Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, with WR and NR as withdrawn and not rated. S&P assigns bond credit ratings of AAA, AA, A, BBB, BB, B, CCC, CC, C, D.

Any information in these materials from ICE Data Indices, LLC (“ICE BofA”) was used with permission. ICE BofA PERMITS USE OF THE ICE BofA INDICES AND RELATED DATA ON AN “AS IS” BASIS, MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BofA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THE USE OF THE FOREGOING, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND THE SHENKMAN GROUP, OR ANY OF ITS PRODUCTS OR SERVICES.

References to indices are for information purposes only. The Shenkman Group believes that any indices discussed herein are broad market indices and are indicative of the type of investments that the Shenkman Group may purchase, but may contain different securities than those held in the Shenkman Group portfolios managed pursuant to the strategies described herein. The indices have not been selected to represent an appropriate benchmark. The strategies referred to herein are not designed to mimic the investments on which any index is based. The indices are unmanaged and not available for direct investment and do not reflect deductions for fees or expenses.

The Shenkman Capital Short Duration High Income Fund is distributed by Quasar Distributors, LLC, which is not affiliated with Shenkman Capital Management, Inc.

SHENKMAN CAPITAL FUNDS

EXPENSE EXAMPLE

March 31, 2024 (Unaudited)

As a shareholder of a fund, you incur two types of costs: (1) transaction costs including sales charges (loads), if applicable; redemption fees, if applicable; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1 fees); and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from October 1, 2023 to March 31, 2024.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is charged to the account annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is

SHENKMAN CAPITAL FUNDS

EXPENSE EXAMPLE – Continued

March 31, 2024 (Unaudited)

useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| Shenkman Capital Floating Rate High Income Fund | | | |

| Actual | | | |

| Class F | $1,000.00 | $1,046.90 | $2.92 |

| Institutional Class | $1,000.00 | $1,047.00 | $2.76 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | | | |

| Class F | $1,000.00 | $1,022.15 | $2.88 |

| Institutional Class | $1,000.00 | $1,022.30 | $2.73 |

(1) | Shenkman Capital Floating Rate High Income Fund – Class F and Institutional Class expenses are equal to the Fund shares’ annualized expense ratio of 0.57% and 0.54%, respectively, multiplied by the average account value over the period, multiplied by 183 days/366 days (to reflect the six-month period of operation). The Fund’s ending account values in the table are based on its six-month total return of 4.69% for Class F and 4.70% for the Institutional Class as of March 31, 2024. |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(2) |

| Shenkman Capital Short Duration High Income Fund | | | |

| Actual | | | |

| Class A | $1,000.00 | $1,049.40 | $4.92 |

| Class C | $1,000.00 | $1,044.70 | $8.74 |

| Class F | $1,000.00 | $1,049.70 | $3.69 |

| Institutional Class | $1,000.00 | $1,050.00 | $3.33 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | | | |

| Class A | $1,000.00 | $1,020.20 | $4.85 |

| Class C | $1,000.00 | $1,016.45 | $8.62 |

| Class F | $1,000.00 | $1,021.40 | $3.64 |

| Institutional Class | $1,000.00 | $1,021.75 | $3.29 |

(2) | Shenkman Capital Short Duration High Income Fund – Class A, Class C, Class F, and Institutional Class expenses are equal to the Fund shares’ annualized expense ratio of 0.96%, 1.71%, 0.72% and 0.65%, respectively, multiplied by the average account value over the period, multiplied by 183 days/366 days (to reflect the six-month period of operation). The Fund’s ending account values in the table are based on its six-month total return of 4.94% for Class A, 4.47% for Class C, 4.97% for Class F, and 5.00% for the Institutional Class as of March 31, 2024. |

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

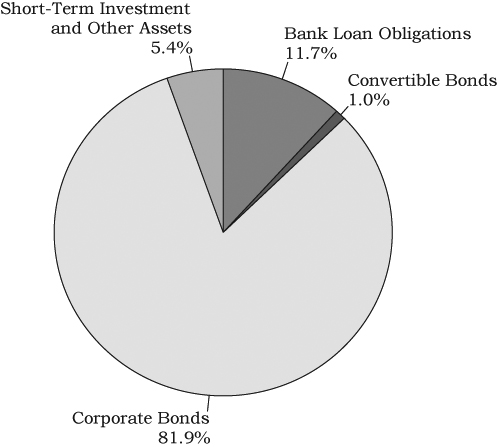

PORTFOLIO ALLOCATION

March 31, 2024 (Unaudited)

| | % Net |

| TOP TEN HOLDINGS | Assets |

| Verscend Holding Corp., Senior Secured First Lien, | |

| 9.44% (1 mo. SOFR US + 4.00%), 08/27/2025 | 0.84% |

| Gen Digital, Inc., 5.00%, 04/15/2025 | 0.82% |

| Flutter Financing BV, Senior Secured First Lien, | |

| 7.56% (3 mo. SOFR US + 2.25%), 11/29/2030 | 0.79% |

| Asurion LLC, Senior Secured First Lien, | |

| 8.69% (1 mo. SOFR US + 3.25%), 12/23/2026 | 0.74% |

| Alterra Mountain Co., Senior Secured First Lien, | |

| 8.94% (1 mo. SOFR US + 3.50%), 08/17/2028 | 0.67% |

| Garda World Security Corp., Senior Secured First Lien, | |

| 9.58% (3 mo. SOFR US + 4.25%), 02/01/2029 | 0.64% |

| Cotiviti, Inc., Senior Secured First Lien, 8.32%, 02/24/2031 | 0.62% |

| NRG Energy, Inc., Senior Secured First Lien, | |

| 7.33%, 03/27/2031 | 0.62% |

| Proofpoint, Inc., Senior Secured First Lien, | |

| 8.69% (1 mo. SOFR US + 3.25%), 08/31/2028 | 0.60% |

| UKG, Inc., Senior Secured First Lien, | |

| 8.81% (3 mo. SOFR US + 3.50%), 02/10/2031 | 0.60% |

The portfolio’s holdings and allocations are subject to change. The top ten holdings presented exclude the money market fund. The percentages are of total net assets as of March 31, 2024.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) | | | | | | |

| | | | | | | |

| AEROSPACE & DEFENSE – 1.4% | | | | | | |

| Apple Bidco LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 8.83% (1 mo. SOFR US + 3.50%), | | | | | | |

| 09/25/2028 | | $ | 630,638 | | | $ | 633,047 | |

| Barnes Group, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.83% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 08/30/2030 | | | 593,020 | | | | 594,576 | |

| Bleriot US Bidco, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.57% (3 mo. SOFR US + 4.00%), | | | | | | | | |

| 10/31/2028 | | | 295,765 | | | | 297,244 | |

| Brown Group Holding LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.31% (3 mo. SOFR US + 3.00%), | | | | | | | | |

| 07/02/2029 | | | 428,206 | | | | 428,716 | |

| 8.33% (1 mo. SOFR US + 3.00%), | | | | | | | | |

| 07/02/2029 | | | 270,128 | | | | 270,449 | |

| 8.34% (3 mo. SOFR US + 3.00%), | | | | | | | | |

| 07/02/2029 | | | 203,194 | | | | 203,436 | |

| Dynasty Acquisition Co., Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.33% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 08/24/2028 | | | 551,230 | | | | 552,660 | |

| LSF11 Trinity Bidco, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.33% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 06/17/2030 | | | 391,319 | | | | 393,276 | |

| Standard Aero Ltd., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.33% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 08/24/2028 | | | | | | | | |

| | | | 236,810 | | | | 237,425 | |

| | | | | | | | 3,610,829 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| AUTO RETAIL – 0.8% | | | | | | |

| CWGS Group LLC, | | | | | | |

| Senior Secured First Lien | | | | | | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | |

| 06/05/2028 | | $ | 505,243 | | | $ | 493,499 | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 06/05/2028 | | | 33,851 | | | | 33,064 | |

| LS Group OpCo Acquisition LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.68% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 11/02/2027 | | | 986,850 | | | | 989,165 | |

| Mavis Tire Express Services Topco Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.08% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 05/04/2028 | | | 535,181 | | | | 536,701 | |

| | | | | | | | 2,052,429 | |

| AUTOMOTIVE – 1.5% | | | | | | | | |

| Adient US LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/29/2031 | | | 690,000 | | | | 692,587 | |

| American Axle & Manufacturing, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.92% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 12/13/2029 | | | 732,266 | | | | 735,011 | |

| Autokiniton US Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.44% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 04/06/2028 | | | 298,176 | | | | 299,527 | |

| Clarios Global LP, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.33% (1 mo. SOFR US + 3.00%), | | | | | | | | |

| 05/06/2030 | | | 260,000 | | | | 260,975 | |

| First Brands Group LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 10.57% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 03/30/2027 | | | 467,537 | | | | 468,414 | |

| 10.57% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 03/30/2027 | | | 317,545 | | | | 318,418 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| AUTOMOTIVE – 1.5% – Continued | | | | | | |

| Garrett LX I Sarl, | | | | | | |

| Senior Secured First Lien | | | | | | |

| 9.81% (3 mo. SOFR US + 4.50%), | | | | | | |

| 04/28/2028 | | $ | 160,714 | | | $ | 161,920 | |

| 9.81% (3 mo. SOFR US + 4.50%), | | | | | | | | |

| 04/28/2028 | | | 107,143 | | | | 107,946 | |

| Phinia, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.43% (Prime Rate + 3.00%), 07/03/2028 | | | 267,862 | | | | 268,114 | |

| Tenneco, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 10.42% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 11/17/2028 | | | 479,646 | | | | 452,596 | |

| 10.45% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 11/17/2028 | | | 1,354 | | | | 1,278 | |

| Thor Industries, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 11/15/2030 | | | 363,000 | | | | 364,588 | |

| | | | | | | | 4,131,374 | |

| BUILDING PRODUCTS – 2.8% | | | | | | | | |

| Cornerstone Building Brands, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.68% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 04/12/2028 | | | 742,744 | | | | 740,215 | |

| CPG International LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.93% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 04/30/2029 | | | 262,925 | | | | 263,706 | |

| Fastlane Parent Co., Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.83% (1 mo. SOFR US + 4.50%), | | | | | | | | |

| 09/29/2028 | | | 349,245 | | | | 349,402 | |

| Griffon Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.75% (3 mo. SOFR US + 2.25%), | | | | | | | | |

| 01/24/2029 | | | 379,671 | | | | 380,324 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| BUILDING PRODUCTS – 2.8% – Continued | | | | | | |

| Janus International Group LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 8.62% (3 mo. SOFR US + 3.25%), | | | | | | |

| 08/03/2030 | | $ | 799,980 | | | $ | 803,680 | |

| MIWD Holdco II LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.83%, 03/28/2031 (e) | | | 479,000 | | | | 481,845 | |

| Quikrete Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.07% (1 mo. SOFR US + 2.63%), | | | | | | | | |

| 01/29/2027 | | | 895,391 | | | | 897,330 | |

| 7.94%, 03/25/2031 (e) | | | 500,000 | | | | 500,835 | |

| SRS Distribution, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 06/05/2028 | | | 826,132 | | | | 832,778 | |

| 8.68%, 06/05/2028 (e) | | | 149,000 | | | | 149,709 | |

| STS Operating, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.32% (3 mo. SOFR US + 4.00%), | | | | | | | | |

| 03/25/2031 | | | 632,000 | | | | 634,175 | |

| Summit Materials LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.83% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 01/12/2029 | | | 524,000 | | | | 527,210 | |

| Tamko Building Products LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.83% (3 mo. SOFR US + 3.50%), | | | | | | | | |

| 09/20/2030 | | | 454,768 | | | | 455,336 | |

| Verde Purchaser LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.31% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 12/02/2030 | | | 360,000 | | | | 358,427 | |

| | | | | | | | 7,374,972 | |

| CHEMICALS – 3.0% | | | | | | | | |

| Axalta Coating Systems US Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.33% (3 mo. SOFR US + 2.00%), | | | | | | | | |

| 12/20/2029 | | | 781,143 | | | | 783,233 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CHEMICALS – 3.0% – Continued | | | | | | |

| Consolidated Energy Finance SA, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 9.83% (1 mo. SOFR US + 4.50%), | | | | | | |

| 11/18/2030 | | $ | 338,000 | | | $ | 327,544 | |

| Discovery Purchaser Corp., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 9.71% (3 mo. SOFR US + 4.38%), | | | | | | | | |

| 10/04/2029 | | | 622,567 | | | | 622,788 | |

| 9.71% (3 mo. SOFR US + 4.38%), | | | | | | | | |

| 10/04/2029 | | | 1,560 | | | | 1,561 | |

| Ecovyst Catalyst Technologies LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.91% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 06/09/2028 | | | 252,148 | | | | 252,344 | |

| 7.91% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 06/09/2028 | | | 96,980 | | | | 97,055 | |

| INEOS US Petrochem LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.19% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/29/2026 | | | 282,849 | | | | 283,273 | |

| 9.18% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 03/01/2030 | | | 237,208 | | | | 237,209 | |

| Koppers, Inc., Senior Secured First Lien | | | | | | | | |

| 8.93% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 04/10/2030 | | | 145,831 | | | | 146,378 | |

| 8.93% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 04/10/2030 | | | 86,680 | | | | 87,005 | |

| LSF11 A5 HoldCo LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 10/16/2028 | | | 450,804 | | | | 451,536 | |

| 9.68% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 10/16/2028 | | | 322,563 | | | | 323,490 | |

| Lummus Technology Holdings V LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 12/31/2029 | | | 588,000 | | | | 589,411 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CHEMICALS – 3.0% – Continued | | | | | | |

| Nouryon USA LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 9.42% (1 mo. SOFR US + 4.00%), | | | | | | |

| 04/03/2028 | | $ | 306,683 | | | $ | 308,089 | |

| Olympus Water US Holding Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.57% (3 mo. SOFR US + 4.25%), | | | | | | | | |

| 11/09/2028 | | | 283,577 | | | | 284,819 | |

| Polar US Borrower LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 10.16% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 10/15/2025 | | | 259,516 | | | | 197,720 | |

| 10.16% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 10/15/2025 | | | 221,794 | | | | 168,980 | |

| SCIH Salt Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.44% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 03/16/2027 | | | 792,716 | | | | 795,060 | |

| Sparta US HoldCo LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.69% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 08/02/2028 | | | 517,098 | | | | 518,344 | |

| Tronox Finance LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.11% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 03/13/2028 | | | 346,154 | | | | 346,332 | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 03/13/2028 | | | 70,154 | | | | 70,190 | |

| Vantage Specialty Chemicals, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.07% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 10/26/2026 | | | 315,326 | | | | 312,370 | |

| Vibrantz Technologies, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.72% (3 mo. SOFR US + 4.25%), | | | | | | | | |

| 04/23/2029 | | | 407,999 | | | | 404,468 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CHEMICALS – 3.0% – Continued | | | | | | |

| Windsor Holdings III LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 9.33% (1 mo. SOFR US + 4.00%), | | | | | | |

| 08/01/2030 | | $ | 317,205 | | | $ | 318,842 | |

| | | | | | | | 7,928,041 | |

| COMMERCIAL SERVICES – 5.4% | | | | | | | | |

| AlixPartners LLP, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 02/04/2028 | | | 1,192,196 | | | | 1,195,027 | |

| Allied Universal Holdco LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.08% (1 mo. SOFR US + 4.75%), | | | | | | | | |

| 05/15/2028 | | | 442,775 | | | | 444,593 | |

| American Auto Auction Group LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.46% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 12/30/2027 | | | 542,259 | | | | 540,057 | |

| Apex Group Treasury LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.33% (3 mo. SOFR US + 3.75%), | | | | | | | | |

| 07/27/2028 | | | 403,150 | | | | 403,402 | |

| Aramark Services, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.19% (1 mo. SOFR US + 1.75%), | | | | | | | | |

| 01/15/2027 | | | 398,000 | | | | 398,348 | |

| 7.95% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 06/24/2030 | | | 455,706 | | | | 456,419 | |

| Camelot US Acquisition LLC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/31/2031 | | | 317,116 | | | | 317,354 | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/31/2031 | | | 73,920 | | | | 73,975 | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/31/2031 | | | 6,283 | | | | 6,288 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES – 5.4% – Continued | | | | | | |

| Deerfield Dakota Holding LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 9.06% (3 mo. SOFR US + 3.75%), | | | | | | |

| 04/09/2027 | | $ | 1,216,290 | | | $ | 1,211,814 | |

| Dun & Bradstreet Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 01/18/2029 | | | 396,489 | | | | 396,860 | |

| EAB Global, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 08/16/2028 | | | 490,138 | | | | 490,996 | |

| Foundever Worldwide Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.19%, 08/28/2028 (e) | | | 309,000 | | | | 266,513 | |

| Galaxy US Opco, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 10.06% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 04/30/2029 | | | 237,352 | | | | 215,397 | |

| 10.06% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 04/30/2029 | | | 115,186 | | | | 104,531 | |

| Garda World Security Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.58% (3 mo. SOFR US + 4.25%), | | | | | | | | |

| 02/01/2029 | | | 1,729,000 | | | | 1,734,412 | |

| HomeServe USA Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.33% (1 mo. SOFR US + 3.00%), | | | | | | | | |

| 10/21/2030 | | | 358,000 | | | | 359,298 | |

| Iron Mountain, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.19% (1 mo. SOFR US + 1.75%), | | | | | | | | |

| 01/02/2026 | | | 526,201 | | | | 526,419 | |

| 7.58% (1 mo. SOFR US + 2.25%), | | | | | | | | |

| 01/31/2031 | | | 556,568 | | | | 553,321 | |

| Isolved, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.48% (6 mo. SOFR US + 4.00%), | | | | | | | | |

| 10/05/2030 | | | 428,925 | | | | 432,009 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| COMMERCIAL SERVICES – 5.4% – Continued | | | | | | |

| OMNIA Partners LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 9.07% (3 mo. SOFR US + 3.75%), | | | | | | |

| 07/25/2030 | | $ | 602,490 | | | $ | 605,972 | |

| Planet US Buyer LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.81% (3 mo. SOFR US + 3.50%), | | | | | | | | |

| 02/10/2031 | | | 796,000 | | | | 799,534 | |

| Pre-Paid Legal Services, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.19% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 12/15/2028 | | | 661,401 | | | | 659,096 | |

| Saphilux Sarl, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.39% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 07/27/2028 | | | 365,085 | | | | 366,797 | |

| SS&C Technologies, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.68% (1 mo. SOFR US + 2.25%), | | | | | | | | |

| 03/22/2029 | | | 373,194 | | | | 374,041 | |

| 7.68% (1 mo. SOFR US + 2.25%), | | | | | | | | |

| 03/22/2029 | | | 193,650 | | | | 194,090 | |

| Tempo Acquisition LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 08/31/2028 | | | 74,438 | | | | 74,757 | |

| Vestis Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.58% (3 mo. SOFR US + 2.25%), | | | | | | | | |

| 02/24/2031 | | | 657,000 | | | | 657,821 | |

| VT Topco, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.58% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 08/12/2030 | | | 578,271 | | | | 580,543 | |

| | | | | | | | 14,439,684 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CONSTRUCTION & ENGINEERING – 2.2% | | | | | | |

| Amentum Government Services Holdings LLC, | | | | | | |

| Senior Secured First Lien | | | | | | |

| 9.44% (1 mo. SOFR US + 4.00%), | | | | | | |

| 01/31/2027 | | $ | 612,667 | | | $ | 614,964 | |

| 9.44% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 01/31/2027 | | | 308,446 | | | | 309,603 | |

| 9.33% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 02/15/2029 | | | 296,884 | | | | 297,935 | |

| American Residential Services LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.07% (3 mo. SOFR US + 3.50%), | | | | | | | | |

| 10/15/2027 | | | 656,933 | | | | 657,346 | |

| APi Group, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.69% (1 mo. SOFR US + 2.25%), | | | | | | | | |

| 10/01/2026 | | | 519,910 | | | | 521,332 | |

| Artera Services LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.81% (3 mo. SOFR US + 4.50%), | | | | | | | | |

| 02/10/2031 | | | 408,000 | | | | 410,040 | |

| Brand Industrial Services, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.81% (3 mo. SOFR US + 5.50%), | | | | | | | | |

| 08/01/2030 | | | 830,825 | | | | 835,424 | |

| Centuri Group, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 08/28/2028 | | | 657,863 | | | | 659,096 | |

| 10.00% (Prime Rate + 1.50%), | | | | | | | | |

| 08/28/2028 | | | 1,900 | | | | 1,903 | |

| Tecta America Corp., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 9.44% (1 mo. SOFR US + 4.00%), | | | | | | | | |

| 04/10/2028 | | | 681,656 | | | | 684,267 | |

| 9.69% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 04/10/2028 | | | 211,935 | | | | 212,747 | |

| Tiger Acquisition LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.68% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 06/01/2028 | | | 580,125 | | | | 575,980 | |

| | | | | | | | 5,780,637 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CONSUMER DISCRETIONARY – 2.0% | | | | | | |

| Champ Acquisition Corp., | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 11.11% (3 mo. SOFR US + 5.50%), | | | | | | |

| 12/22/2025 | | $ | 155,578 | | | $ | 156,210 | |

| Fugue Finance LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.34% (3 mo. SOFR US + 4.00%), | | | | | | | | |

| 01/26/2028 | | | 442,907 | | | | 444,499 | |

| Hanesbrands, Inc., Senior Secured First Lien, | | | | | | | | |

| 9.08% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 03/08/2030 | | | 500,940 | | | | 501,489 | |

| KUEHG Corp., Senior Secured First Lien, | | | | | | | | |

| 10.35% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 06/12/2030 | | | 352,740 | | | | 354,153 | |

| Learning Care Group US No 2, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 10.09% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 08/11/2028 | | | 38,750 | | | | 38,879 | |

| 10.06% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 08/11/2028 | | | 38,750 | | | | 38,879 | |

| 10.07% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 08/11/2028 | | | 68,889 | | | | 69,119 | |

| 10.06% (3 mo. SOFR US + 4.75%), | | | | | | | | |

| 08/11/2028 | | | 7,836 | | | | 7,862 | |

| Prometric Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.69% (1 mo. SOFR US + 5.25%), | | | | | | | | |

| 01/29/2025 | | | 722,190 | | | | 722,945 | |

| Renaissance Holdings Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.58% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 04/08/2030 | | | 726,355 | | | | 728,624 | |

| Samsonite IP Holdings Sarl, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 06/09/2030 | | | 378,143 | | | | 379,799 | |

| Spring Education Group, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.81% (3 mo. SOFR US + 4.50%), | | | | | | | | |

| 10/04/2030 | | | 360,098 | | | | 362,033 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| CONSUMER DISCRETIONARY – 2.0% – Continued | | | | | | |

| Tory Burch LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 8.69% (1 mo. SOFR US + 3.25%), | | | | | | |

| 04/17/2028 | | $ | 364,688 | | | $ | 364,622 | |

| Wand NewCo 3, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.08% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 01/30/2031 | | | 1,085,000 | | | | 1,089,324 | |

| WW International, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 04/13/2028 | | | 273,415 | | | | 122,011 | |

| | | | | | | | 5,380,448 | |

| CONSUMER NON-DISCRETIONARY – 0.3% | | | | | | | | |

| Kronos Acquisition Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 9.36% (3 mo. SOFR US + 3.75%), | | | | | | | | |

| 12/22/2026 | | | 532,485 | | | | 533,785 | |

| 9.36% (3 mo. SOFR US + 3.75%), | | | | | | | | |

| 12/22/2026 | | | 227,002 | | | | 227,556 | |

| | | | | | | | 761,341 | |

| ENVIRONMENTAL SERVICES – 1.8% | | | | | | | | |

| Action Environmental Group, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 9.82% (3 mo. SOFR US + 4.50%), | | | | | | | | |

| 10/24/2030 | | | 511,000 | | | | 512,278 | |

| 9.82%, 10/24/2030 (e)(h) | | | 77,000 | | | | 77,193 | |

| Belfor Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.08% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 11/04/2030 | | | 942,089 | | | | 947,977 | |

| Brightview Landscapes LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.31% (3 mo. SOFR US + 3.00%), | | | | | | | | |

| 04/20/2029 | | | 466,785 | | | | 467,952 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| ENVIRONMENTAL SERVICES – 1.8% – Continued | | | | | | |

| Covanta Holding Corp., | | | | | | |

| Senior Secured First Lien | | | | | | |

| 8.07% (1 mo. SOFR US + 2.75%), | | | | | | |

| 11/30/2028 | | $ | 420,908 | | | $ | 421,321 | |

| 7.83% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 11/30/2028 | | | 343,843 | | | | 343,521 | |

| 7.83% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 11/30/2028 | | | 26,282 | | | | 26,257 | |

| 8.07% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 11/30/2028 | | | 23,000 | | | | 23,023 | |

| GFL Environmental, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.82% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 05/28/2027 | | | 657,780 | | | | 661,072 | |

| JFL-Tiger Acquisition Co., Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.32% (3 mo. SOFR US + 5.00%), | | | | | | | | |

| 10/17/2030 | | | 425,933 | | | | 427,596 | |

| Win Waste Innovations Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.19% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 03/27/2028 | | | 992,161 | | | | 927,388 | |

| | | | | | | | 4,835,578 | |

| FINANCIALS: BANKS – 0.1% | | | | | | | | |

| EnergySolutions LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.31% (3 mo. SOFR US + 4.00%), | | | | | | | | |

| 09/23/2030 | | | 360,190 | | | | 361,924 | |

| | | | | | | | | |

| FINANCIALS: DIVERSIFIED – 4.2% | | | | | | | | |

| Amynta Agency Borrower, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 9.58% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 02/28/2028 | | | 241,765 | | | | 242,949 | |

| 9.58% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 02/28/2028 | | | 84,772 | | | | 85,187 | |

| Ascensus Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 08/02/2028 | | | 788,930 | | | | 787,057 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| FINANCIALS: DIVERSIFIED – 4.2% – Continued | | | | | | |

| Avolon TLB Borrower 1 US LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 7.33% (1 mo. SOFR US + 2.00%), | | | | | | |

| 06/22/2028 | | $ | 905,541 | | | $ | 906,819 | |

| Blackhawk Network Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.32% (1 mo. SOFR US + 5.00%), | | | | | | | | |

| 03/12/2029 | | | 328,000 | | | | 328,941 | |

| Boost Newco Borrower LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.31% (3 mo. SOFR US + 3.00%), | | | | | | | | |

| 01/31/2031 | | | 952,000 | | | | 956,566 | |

| Castlelake Aviation One DAC, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.83% (3 mo. SOFR US + 2.50%), | | | | | | | | |

| 10/22/2026 | | | 527,923 | | | | 528,615 | |

| 8.42% (3 mo. LIBOR US + 2.75%), | | | | | | | | |

| 10/22/2026 (a) | | | 675 | | | | 676 | |

| 8.08% (3 mo. SOFR US + 2.75%), | | | | | | | | |

| 10/22/2027 | | | 519,425 | | | | 520,292 | |

| Citco Funding LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.67% (6 mo. SOFR US + 3.50%), | | | | | | | | |

| 04/27/2028 | | | 427,490 | | | | 429,093 | |

| Citco Group Ltd., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.42% (6 mo. SOFR US + 3.25%), | | | | | | | | |

| 04/27/2028 | | | 248,750 | | | | 249,644 | |

| Edelman Financial Engines Center LLC, | | | | | | | | |

| Senior Secured Second Lien, | | | | | | | | |

| 12.19% (1 mo. SOFR US + 6.75%), | | | | | | | | |

| 07/20/2026 | | | 815,000 | | | | 820,351 | |

| Edelman Financial Engines Center LLC/The, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 04/07/2028 | | | 445,564 | | | | 446,163 | |

| Focus Financial Partners LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 06/30/2028 | | | 750,950 | | | | 749,426 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| FINANCIALS: DIVERSIFIED – 4.2% – Continued | | | | | | |

| Jane Street Group LLC, | | | | | | |

| Senior Secured First Lien, | | | | | | |

| 7.94% (1 mo. SOFR US + 2.50%), | | | | | | |

| 01/26/2028 | | $ | 71,814 | | | $ | 71,931 | |

| Lakeland Holdings LLC, | | | | | | | | |

| Senior Unsecured First Lien | | | | | | | | |

| 8.00%, 09/27/2027 | | | 225,670 | | | | 124,118 | |

| 8.00%, 09/27/2027 | | | 107,661 | | | | 59,213 | |

| MoneyGram International, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 10.84% (3 mo. SOFR US + 5.50%), | | | | | | | | |

| 06/03/2030 | | | 266,405 | | | | 264,573 | |

| NAB Holdings LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.21% (3 mo. SOFR US + 2.75%), | | | | | | | | |

| 11/23/2028 | | | 494,319 | | | | 494,358 | |

| Nuvei Technologies Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.43% (1 mo. SOFR US + 3.00%), | | | | | | | | |

| 12/19/2030 | | | 596,000 | | | | 598,110 | |

| VFH Parent LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.43% (1 mo. SOFR US + 3.00%), | | | | | | | | |

| 01/16/2029 | | | 513,884 | | | | 513,884 | |

| WEX, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 7.33% (1 mo. SOFR US + 2.00%), | | | | | | | | |

| 04/03/2028 | | | 695,490 | | | | 695,987 | |

| WMB Holdings, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 7.93% (1 mo. SOFR US + 2.50%), | | | | | | | | |

| 11/03/2027 | | | 396,459 | | | | 395,467 | |

| 8.08% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 11/05/2029 | | | 476,830 | | | | 478,420 | |

| Zelis Payments Buyer, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.07% (1 mo. SOFR US + 2.75%), | | | | | | | | |

| 09/28/2029 | | | 663,000 | | | | 663,736 | |

| | | | | | | | 11,411,576 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| FINANCIALS: INSURANCE – 4.2% | | | | | | |

| Acrisure LLC, | | | | | | |

| Senior Secured First Lien | | | | | | |

| 8.94% (1 mo. Synthetic LIBOR US + | | | | | | |

| 3.50%), 02/15/2027 (a) | | $ | 888,373 | | | $ | 888,928 | |

| 9.69% (1 mo. Synthetic LIBOR US + | | | | | | | | |

| 4.25%), 02/15/2027 (a) | | | 259,038 | | | | 260,171 | |

| AssuredPartners, Inc., | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 02/12/2027 | | | 628,709 | | | | 630,067 | |

| 8.94% (1 mo. SOFR US + 3.50%), | | | | | | | | |

| 02/12/2027 | | | 354,963 | | | | 355,672 | |

| Asurion LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.69% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 12/23/2026 | | | 2,019,310 | | | | 1,983,244 | |

| BroadStreet Partners, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.08% (1 mo. SOFR US + 3.75%), | | | | | | | | |

| 01/26/2029 | | | 320,467 | | | | 321,789 | |

| HUB International Ltd., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.57% (3 mo. SOFR US + 3.25%), | | | | | | | | |

| 06/20/2030 | | | 1,301,000 | | | | 1,302,945 | |

| Jones Deslauriers Insurance Management, Inc., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.80% (3 mo. SOFR US + 3.50%), | | | | | | | | |

| 03/15/2030 | | | 367,000 | | | | 367,459 | |

| NFP Corp., | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.69% (1 mo. SOFR US + 3.25%), | | | | | | | | |

| 02/13/2027 | | | 1,184,200 | | | | 1,187,012 | |

| OneDigital Borrower LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 9.68% (1 mo. SOFR US + 4.25%), | | | | | | | | |

| 11/16/2027 | | | 293,646 | | | | 294,014 | |

| Truist Insurance Holdings LLC, | | | | | | | | |

| Senior Secured First Lien, | | | | | | | | |

| 8.58%, 03/24/2031 (e) | | | 1,447,000 | | | | 1,446,393 | |

The accompanying notes are an integral part of these financial statements.

SHENKMAN CAPITAL FLOATING RATE HIGH INCOME FUND

SCHEDULE OF INVESTMENTS – Continued

March 31, 2024 (Unaudited)

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| BANK LOANS – 84.5% (f) – Continued | | | | | | |

| | | | | | | |

| FINANCIALS: INSURANCE – 4.2% – Continued | | | | | | |

| Truist Insurance Holdings LLC, | | | | | | |

| Senior Secured Second Lien, | | | | | | |

| 10.07%, 03/08/2032 (e) | | $ | 505,000 | | | $ | 508,841 | |

| USI, Inc./NY, | | | | | | | | |

| Senior Secured First Lien | | | | | | | | |

| 8.35% (3 mo. SOFR US + 3.00%), | | | | | | | | |

| 11/22/2029 | | | 943,511 | | | | 945,082 | |

| 8.60% (3 mo. SOFR US + 3.25%), | | | | | | | | |

| 09/27/2030 | | | 428,105 | | | | 428,940 | |

| 8.60% (3 mo. SOFR US + 3.25%), | | | | | | | | |

| 09/27/2030 | | | 312,175 | | | | 312,784 | |

| | | | | | | | 11,233,341 | |

| FOOD & BEVERAGE – 1.2% | | | | | | | | |