UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 4th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(626) 914-7235

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

| | |

| Shenkman Capital Floating Rate High Income Fund | |

| Class F | SFHFX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Floating Rate High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F | $58 | 0.56% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Shenkman Floating Rate High Income Fund (the “Fund”) modestly underperformed the Morningstar LSTA US B- Ratings and Above Loan Index (the “Index”) for the twelve months ended September 30, 2024 (the “Period”). The Index returned 9.69% in the Period, buoyed by high coupons and robust CLO formations. The Telecommunication Services sector outperformed during the Period including several distressed issuers that rebounded sharply later in the Period. The Fund maintained an underweight in the sector which negatively impacted relative performance. Loans rated B-, which represent approximately 25% of the Index, outperformed for the Period.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period included the Fund’s out-of-Index allocation to high yield bonds, which outperformed leveraged loans for the period. |

| |

Top Detractors |

| ↓ | Conversely, our underweight in the B- rated loans and being underweight in the Telecommunication Services sector both detracted from the Fund’s performance. |

We believe the Fund is well-positioned, maintaining a bias toward higher quality loans with appropriate industry diversification and a conservative credit profile. The top sector weightings remained unchanged with Software & Services, Consumer Services, and Capital Goods remaining the three largest exposures. We increased exposures across several sectors, with Software & Services, Financial Services, and Telecommunication Services seeing the largest increases while Pharmaceuticals, Biotechnology & Life Sciences and Commercial & Professional Services seeing the largest exposure decreases. The Fund’s rating profile remained largely unchanged, with a modest increase in single B rated loans while reducing exposures in BBB & Above rated loans.

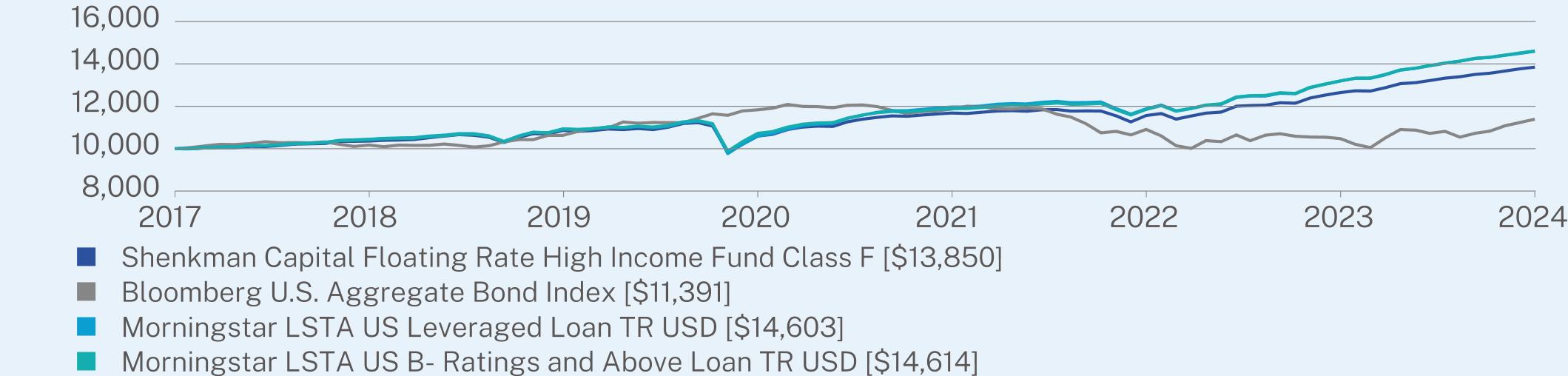

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Floating Rate High Income Fund | PAGE 1 | TSR-AR-00770X485 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(03/01/2017) |

Class F | 8.77 | 4.81 | 4.39 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.73 |

Morningstar LSTA US Leveraged Loan TR USD | 9.59 | 5.74 | 5.12 |

Morningstar LSTA US B- Ratings and Above Loan TR USD | 9.69 | 5.71 | 5.13 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $274,354,993 |

Number of Holdings | 492 |

Net Advisory Fee | $866,106 |

Portfolio Turnover | 70% |

Average Credit Quality | B+ / B1* |

Weighted Average Maturity | 4.53 years |

30-Day SEC Yield | 8.22% |

30-Day SEC Yield Unsubsidized | 8.04% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Floating Rate High Income Fund | PAGE 2 | TSR-AR-00770X485 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

First American Government Obligations Fund | 5.0% |

Gen Digital, Inc. | 0.8% |

Cloud Software Group, Inc. | 0.7% |

AssuredPartners, Inc. | 0.7% |

Acrisure LLC | 0.7% |

Flutter Financing BV | 0.7% |

Delivery Hero Finco LLC | 0.7% |

Alterra Mountain Co. | 0.7% |

UKG, Inc. | 0.6% |

Asurion LLC | 0.6% |

| |

Security Type | (% of net assets) |

Bank Loans | 84.8% |

Corporate Bonds | 12.7% |

Money Market Funds | 5.0% |

Cash & Other | -2.5% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Floating Rate High Income Fund | PAGE 3 | TSR-AR-00770X485 |

1014610665109531106611779113951273313850102831015811203119861187910144102101139110183107121104411161120991178613324146031018510682110691121512017117671332414614

| | |

| Shenkman Capital Floating Rate High Income Fund | |

| Institutional Class | SFHIX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Floating Rate High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $56 | 0.54% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Shenkman Floating Rate High Income Fund (the “Fund”) modestly underperformed the Morningstar LSTA US B- Ratings and Above Loan Index (the “Index”) for the twelve months ended September 30, 2024 (the “Period”). The Index returned 9.69% in the Period, buoyed by high coupons and robust CLO formations. The Telecommunication Services sector outperformed during the Period including several distressed issuers that rebounded sharply later in the Period. The Fund maintained an underweight in the sector which negatively impacted relative performance. Loans rated B-, which represent approximately 25% of the Index, outperformed for the Period.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period included the Fund’s out-of-Index allocation to high yield bonds, which outperformed leveraged loans for the period. |

| |

Top Detractors |

| ↓ | Conversely, our underweight in the B- rated loans and being underweight in the Telecommunication Services sector both detracted from the Fund’s performance. |

We believe the Fund is well-positioned, maintaining a bias toward higher quality loans with appropriate industry diversification and a conservative credit profile. The top sector weightings remained unchanged with Software & Services, Consumer Services, and Capital Goods remaining the three largest exposures. We increased exposures across several sectors, with Software & Services, Financial Services, and Telecommunication Services seeing the largest increases while Pharmaceuticals, Biotechnology & Life Sciences and Commercial & Professional Services seeing the largest exposure decreases. The Fund’s rating profile remained largely unchanged, with a modest increase in single B rated loans while reducing exposures in BBB & Above rated loans.

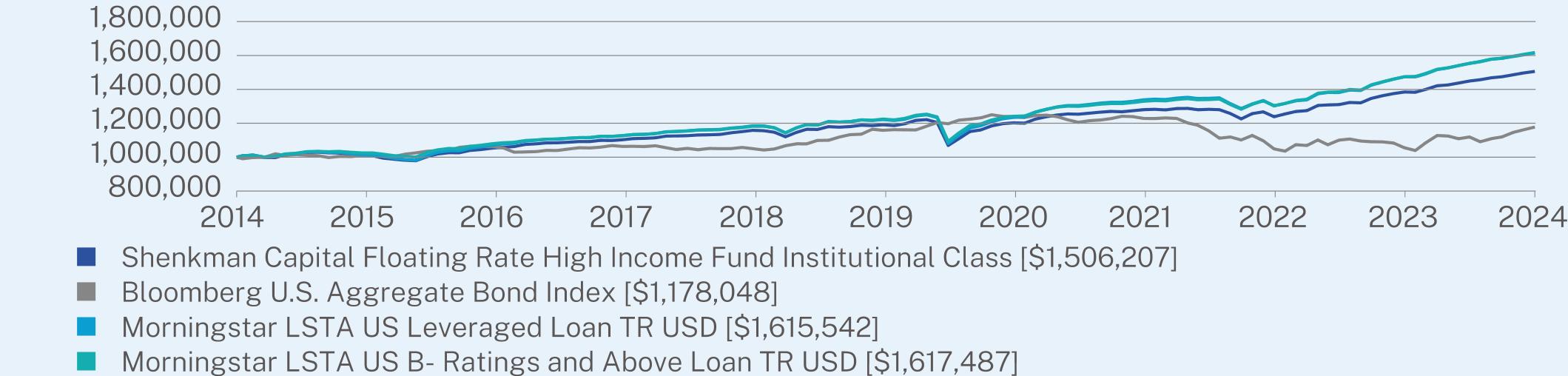

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Floating Rate High Income Fund | PAGE 1 | TSR-AR-00770X576 |

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(10/15/2014) |

Institutional Class | 8.79 | 4.80 | 4.20 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.66 |

Morningstar LSTA US Leveraged Loan TR USD | 9.59 | 5.74 | 4.93 |

Morningstar LSTA US B- Ratings and Above Loan TR USD | 9.69 | 5.71 | 4.95 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $274,354,993 |

Number of Holdings | 492 |

Net Advisory Fee | $866,106 |

Portfolio Turnover | 70% |

Average Credit Quality | B+ / B1* |

Weighted Average Maturity | 4.53 years |

30-Day SEC Yield | 8.26% |

30-Day SEC Yield Unsubsidized | 8.08% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Floating Rate High Income Fund | PAGE 2 | TSR-AR-00770X576 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

First American Government Obligations Fund | 5.0% |

Gen Digital, Inc. | 0.8% |

Cloud Software Group, Inc. | 0.7% |

AssuredPartners, Inc. | 0.7% |

Acrisure LLC | 0.7% |

Flutter Financing BV | 0.7% |

Delivery Hero Finco LLC | 0.7% |

Alterra Mountain Co. | 0.7% |

UKG, Inc. | 0.6% |

Asurion LLC | 0.6% |

| |

Security Type | (% of net assets) |

Bank Loans | 84.8% |

Corporate Bonds | 12.7% |

Money Market Funds | 5.0% |

Cash & Other | -2.5% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Floating Rate High Income Fund | PAGE 3 | TSR-AR-00770X576 |

1006568105318911030251158632119133912025241280463123868813844521506207101020410626581063429105049711586551239586122849110491361055896117804810144391069869112657411850821221854123478913385581303942147412016155421025205107926511273071182292122509012412761330034130237114746561617487

| | |

| Shenkman Capital Short Duration High Income Fund | |

| Class A | SCFAX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Short Duration High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $100 | 0.96% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended September 30, 2024, the Shenkman Short Duration High Income Fund (the “Fund”) performed in-line with its benchmark, the ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C). The Fund posted strong above-coupon returns for the period despite the meaningful rate volatility throughout the period as shorter-term Treasury rates ultimately declined by period end given the Fed’s pivot from its historic rate hike cycle.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period were the Fund’s higher exposure and selection to bonds with final maturities greater than 3 years as those bonds saw greater benefits from the decline in rates. Additional contributors were our selection in the BB rate credits, allocation to CCC & Below rated credits, selection in Utilities, and zero weighting in Oil & Gas. |

| |

Top Detractors |

| ↓ | Some of the detractors over the period included our negative selection and underweight in the B rated credits, underweight in Consumer Staples Discretionary, and negative selection in Healthcare. |

We believe the Fund has maintained strategic positioning with its higher quality, shorter duration focus, complemented by ample diversification, and a relatively conservative credit and maturity profile. The top 5 sector weightings remained unchanged with Leisure, Gaming, Travel and Industrials remaining the two largest exposures while rankings shuffled within the remaining three, with Financials, Automotives and Healthcare rounding out the remaining top 5 in size order. We increased exposures across many sectors, with Financials and Automotives seeing the largest increases while Industrials and Leisure, Gaming, Travel saw the largest exposure decreases, largely as a result of corporate actions as bonds were called or tendered. We have intentionally avoided the Oil & Gas sector given our view of the unfavorable risk/reward and higher volatility in this segment of the short duration market. The Fund’s average rating profile improved to Ba3/BB- given an increase in BB rated bonds while CCC exposure decreased as several lower rated CCC bonds were upgraded or favorably redeemed. The Fund’s average final maturity profile remained largely unchanged as bond seasoning and corporate actions were largely offset by purchases of longer tenured short duration bonds.

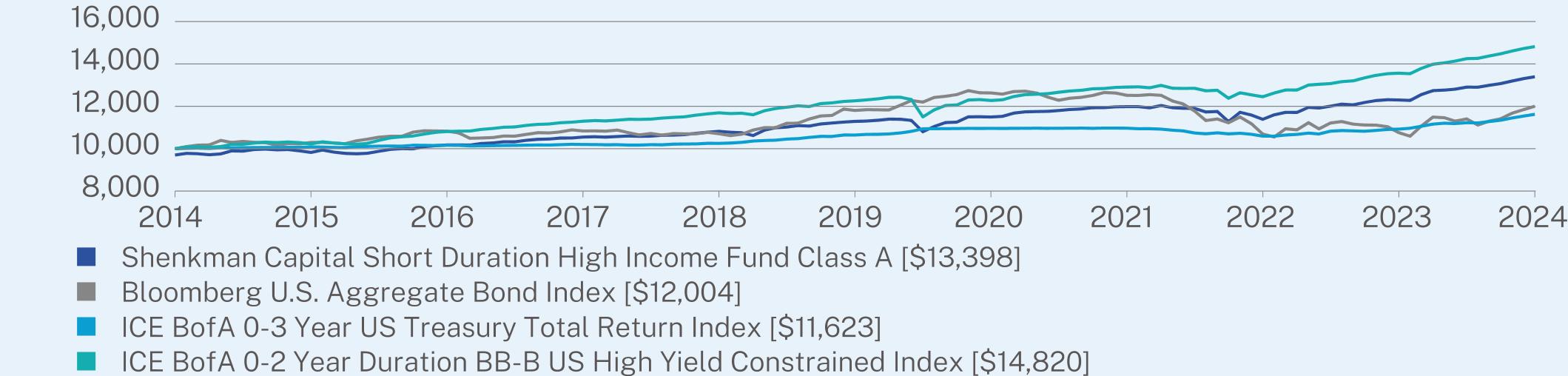

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Short Duration High Income Fund | PAGE 1 | TSR-AR-00770X501 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A (without sales charge) | 8.93 | 3.48 | 3.28 |

Class A (with sales charge)** | 5.63 | 2.86 | 2.97 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA 0-3 Year US Treasury Total Return Index | 6.39 | 1.78 | 1.52 |

ICE BofA 0-2 Year Duration BB-B US High Yield Constrained Index | 9.26 | 3.87 | 4.01 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| ** | Class A shares may be subject to a 3.00% front-end sales charge imposed on purchases (as a precentage of offering price). |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $1,866,939,775 |

Number of Holdings | 375 |

Net Advisory Fee | $9,755,069 |

Portfolio Turnover | 59% |

Average Credit Quality | BB- / Ba3* |

Weighted Average Maturity | 2.49 years |

Effective Duration | 1.13 years |

30-Day SEC Yield | 4.96% |

30-Day SEC Yield Unsubsidized | 4.94% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Short Duration High Income Fund | PAGE 2 | TSR-AR-00770X501 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

Tenet Healthcare Corp. | 1.3% |

Caesars Entertainment, Inc. | 1.2% |

Uber Technologies, Inc. | 1.2% |

IQVIA, Inc. | 1.2% |

Clarios Global LP / Clarios US Finance Co. | 1.0% |

CCO Holdings LLC / CCO Holdings Capital Corp. | 1.0% |

International Game Technology PLC | 1.0% |

Carnival Holdings Bermuda Ltd. | 0.9% |

First American Government Obligations Fund | 0.9% |

Teva Pharmaceutical Finance Netherlands III BV | 0.8% |

| |

Security Type | (% of net assets) |

Corporate Bonds | 86.3% |

Bank Loans | 9.0% |

Convertible Bonds | 1.2% |

Money Market Funds | 0.9% |

Cash & Other | 2.6% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Short Duration High Income Fund | PAGE 3 | TSR-AR-00770X501 |

97029823101781055010820112891149811987113891229913398100001029410829108361070511807126321251810691107601200410000100851016010199102511064410961109671059410925116231000010226108111129811694122601227612909124521356414820

| | |

| Shenkman Capital Short Duration High Income Fund | |

| Class C | SCFCX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Short Duration High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $177 | 1.70% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended September 30, 2024, the Shenkman Short Duration High Income Fund (the “Fund”) performed in-line with its benchmark, the ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C). The Fund posted strong above-coupon returns for the period despite the meaningful rate volatility throughout the period as shorter-term Treasury rates ultimately declined by period end given the Fed’s pivot from its historic rate hike cycle.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period were the Fund’s higher exposure and selection to bonds with final maturities greater than 3 years as those bonds saw greater benefits from the decline in rates. Additional contributors were our selection in the BB rate credits, allocation to CCC & Below rated credits, selection in Utilities, and zero weighting in Oil & Gas. |

| |

Top Detractors |

| ↓ | Some of the detractors over the period included our negative selection and underweight in the B rated credits, underweight in Consumer Staples Discretionary, and negative selection in Healthcare. |

We believe the Fund has maintained strategic positioning with its higher quality, shorter duration focus, complemented by ample diversification, and a relatively conservative credit and maturity profile. The top 5 sector weightings remained unchanged with Leisure, Gaming, Travel and Industrials remaining the two largest exposures while rankings shuffled within the remaining three, with Financials, Automotives and Healthcare rounding out the remaining top 5 in size order. We increased exposures across many sectors, with Financials and Automotives seeing the largest increases while Industrials and Leisure, Gaming, Travel saw the largest exposure decreases, largely as a result of corporate actions as bonds were called or tendered. We have intentionally avoided the Oil & Gas sector given our view of the unfavorable risk/reward and higher volatility in this segment of the short duration market. The Fund’s average rating profile improved to Ba3/BB- given an increase in BB rated bonds while CCC exposure decreased as several lower rated CCC bonds were upgraded or favorably redeemed. The Fund’s average final maturity profile remained largely unchanged as bond seasoning and corporate actions were largely offset by purchases of longer tenured short duration bonds.

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Short Duration High Income Fund | PAGE 1 | TSR-AR-00770X600 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C (without sales charge) | 8.16 | 2.73 | 2.52 |

Class C (with sales charge)** | 7.16 | 2.73 | 2.52 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA 0-3 Year US Treasury Total Return Index | 6.39 | 1.78 | 1.52 |

ICE BofA 0-2 Year Duration BB-B US High Yield Constrained Index | 9.26 | 3.87 | 4.01 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| ** | Class C shares may be subject to a 1.00% deferred sales charge if shares are redeemed within 18 months of purchase (as a percentage of original purchase price or redemption price, whichever is less). |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $1,866,939,775 |

Number of Holdings | 375 |

Net Advisory Fee | $9,755,069 |

Portfolio Turnover | 59% |

Average Credit Quality | BB- / Ba3* |

Weighted Average Maturity | 2.49 years |

Effective Duration | 1.13 years |

30-Day SEC Yield | 4.32% |

30-Day SEC Yield Unsubsidized | 4.31% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Short Duration High Income Fund | PAGE 2 | TSR-AR-00770X600 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

Tenet Healthcare Corp. | 1.3% |

Caesars Entertainment, Inc. | 1.2% |

Uber Technologies, Inc. | 1.2% |

IQVIA, Inc. | 1.2% |

Clarios Global LP / Clarios US Finance Co. | 1.0% |

CCO Holdings LLC / CCO Holdings Capital Corp. | 1.0% |

International Game Technology PLC | 1.0% |

Carnival Holdings Bermuda Ltd. | 0.9% |

First American Government Obligations Fund | 0.9% |

Teva Pharmaceutical Finance Netherlands III BV | 0.8% |

| |

Security Type | (% of net assets) |

Corporate Bonds | 86.3% |

Bank Loans | 9.0% |

Convertible Bonds | 1.2% |

Money Market Funds | 0.9% |

Cash & Other | 2.6% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Short Duration High Income Fund | PAGE 3 | TSR-AR-00770X600 |

1000010045103241063410825112121133611731110611186112829100001029410829108361070511807126321251810691107601200410000100851016010199102511064410961109671059410925116231000010226108111129811694122601227612909124521356414820

| | |

| Shenkman Capital Short Duration High Income Fund | |

| Class F | SCFFX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Short Duration High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F | $74 | 0.71% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended September 30, 2024, the Shenkman Short Duration High Income Fund (the “Fund”) performed in-line with its benchmark, the ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C). The Fund posted strong above-coupon returns for the period despite the meaningful rate volatility throughout the period as shorter-term Treasury rates ultimately declined by period end given the Fed’s pivot from its historic rate hike cycle.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period were the Fund’s higher exposure and selection to bonds with final maturities greater than 3 years as those bonds saw greater benefits from the decline in rates. Additional contributors were our selection in the BB rate credits, allocation to CCC & Below rated credits, selection in Utilities, and zero weighting in Oil & Gas. |

| |

Top Detractors |

| ↓ | Some of the detractors over the period included our negative selection and underweight in the B rated credits, underweight in Consumer Staples Discretionary, and negative selection in Healthcare. |

We believe the Fund has maintained strategic positioning with its higher quality, shorter duration focus, complemented by ample diversification, and a relatively conservative credit and maturity profile. The top 5 sector weightings remained unchanged with Leisure, Gaming, Travel and Industrials remaining the two largest exposures while rankings shuffled within the remaining three, with Financials, Automotives and Healthcare rounding out the remaining top 5 in size order. We increased exposures across many sectors, with Financials and Automotives seeing the largest increases while Industrials and Leisure, Gaming, Travel saw the largest exposure decreases, largely as a result of corporate actions as bonds were called or tendered. We have intentionally avoided the Oil & Gas sector given our view of the unfavorable risk/reward and higher volatility in this segment of the short duration market. The Fund’s average rating profile improved to Ba3/BB- given an increase in BB rated bonds while CCC exposure decreased as several lower rated CCC bonds were upgraded or favorably redeemed. The Fund’s average final maturity profile remained largely unchanged as bond seasoning and corporate actions were largely offset by purchases of longer tenured short duration bonds.

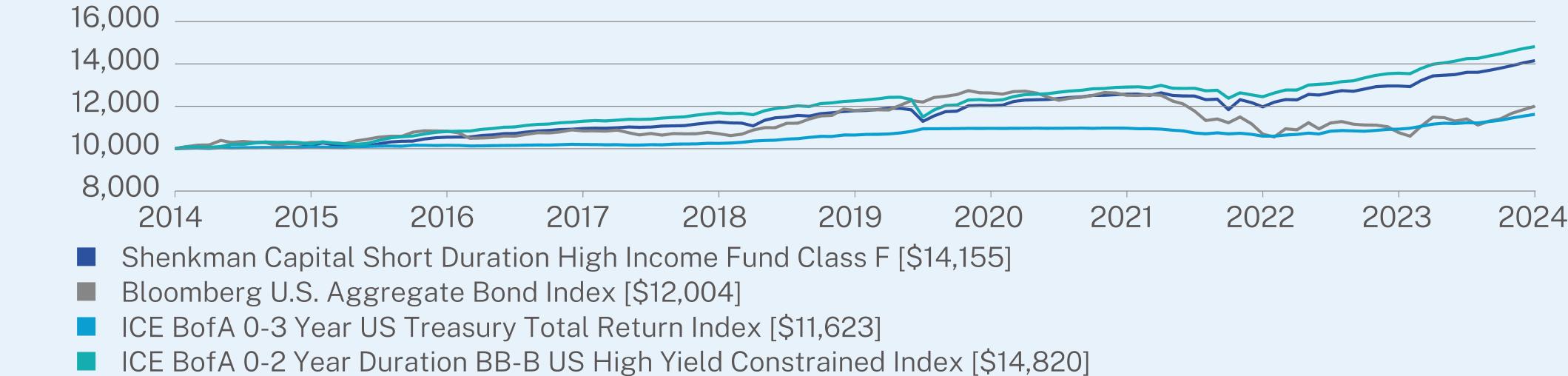

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Short Duration High Income Fund | PAGE 1 | TSR-AR-00770X766 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class F | 9.21 | 3.73 | 3.54 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA 0-3 Year US Treasury Total Return Index | 6.39 | 1.78 | 1.52 |

ICE BofA 0-2 Year Duration BB-B US High Yield Constrained Index | 9.26 | 3.87 | 4.01 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $1,866,939,775 |

Number of Holdings | 375 |

Net Advisory Fee | $9,755,069 |

Portfolio Turnover | 59% |

Average Credit Quality | BB- / Ba3* |

Weighted Average Maturity | 2.49 years |

Effective Duration | 1.13 years |

30-Day SEC Yield | 5.36% |

30-Day SEC Yield Unsubsidized | 5.34% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Short Duration High Income Fund | PAGE 2 | TSR-AR-00770X766 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

Tenet Healthcare Corp. | 1.3% |

Caesars Entertainment, Inc. | 1.2% |

Uber Technologies, Inc. | 1.2% |

IQVIA, Inc. | 1.2% |

Clarios Global LP / Clarios US Finance Co. | 1.0% |

CCO Holdings LLC / CCO Holdings Capital Corp. | 1.0% |

International Game Technology PLC | 1.0% |

Carnival Holdings Bermuda Ltd. | 0.9% |

First American Government Obligations Fund | 0.9% |

Teva Pharmaceutical Finance Netherlands III BV | 0.8% |

| |

Security Type | (% of net assets) |

Corporate Bonds | 86.3% |

Bank Loans | 9.0% |

Convertible Bonds | 1.2% |

Money Market Funds | 0.9% |

Cash & Other | 2.6% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Short Duration High Income Fund | PAGE 3 | TSR-AR-00770X766 |

1000010151105441095411261117891203512575119731296114155100001029410829108361070511807126321251810691107601200410000100851016010199102511064410961109671059410925116231000010226108111129811694122601227612909124521356414820

| | |

| Shenkman Capital Short Duration High Income Fund | |

| Institutional Class | SCFIX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Shenkman Capital Short Duration High Income Fund for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://www.shenkmancapital.com/strategies#mutual_funds. You can also request this information by contacting us at 1-855-743-6562.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $68 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the 12-month period ended September 30, 2024, the Shenkman Short Duration High Income Fund (the “Fund”) performed in-line with its benchmark, the ICE BofA 0-2 Year Duration BB-B U.S. HY Constrained Index (H42C). The Fund posted strong above-coupon returns for the period despite the meaningful rate volatility throughout the period as shorter-term Treasury rates ultimately declined by period end given the Fed’s pivot from its historic rate hike cycle.

Over the Last-Twelve-Months period, the Fund underperformed the Bloomberg U.S. Aggregate Bond Index which returned 11.57% for the period.

| |

Top Contributors |

| ↑ | The top contributors for the period were the Fund’s higher exposure and selection to bonds with final maturities greater than 3 years as those bonds saw greater benefits from the decline in rates. Additional contributors were our selection in the BB rate credits, allocation to CCC & Below rated credits, selection in Utilities, and zero weighting in Oil & Gas. |

| |

Top Detractors |

| ↓ | Some of the detractors over the period included our negative selection and underweight in the B rated credits, underweight in Consumer Staples Discretionary, and negative selection in Healthcare. |

We believe the Fund has maintained strategic positioning with its higher quality, shorter duration focus, complemented by ample diversification, and a relatively conservative credit and maturity profile. The top 5 sector weightings remained unchanged with Leisure, Gaming, Travel and Industrials remaining the two largest exposures while rankings shuffled within the remaining three, with Financials, Automotives and Healthcare rounding out the remaining top 5 in size order. We increased exposures across many sectors, with Financials and Automotives seeing the largest increases while Industrials and Leisure, Gaming, Travel saw the largest exposure decreases, largely as a result of corporate actions as bonds were called or tendered. We have intentionally avoided the Oil & Gas sector given our view of the unfavorable risk/reward and higher volatility in this segment of the short duration market. The Fund’s average rating profile improved to Ba3/BB- given an increase in BB rated bonds while CCC exposure decreased as several lower rated CCC bonds were upgraded or favorably redeemed. The Fund’s average final maturity profile remained largely unchanged as bond seasoning and corporate actions were largely offset by purchases of longer tenured short duration bonds.

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

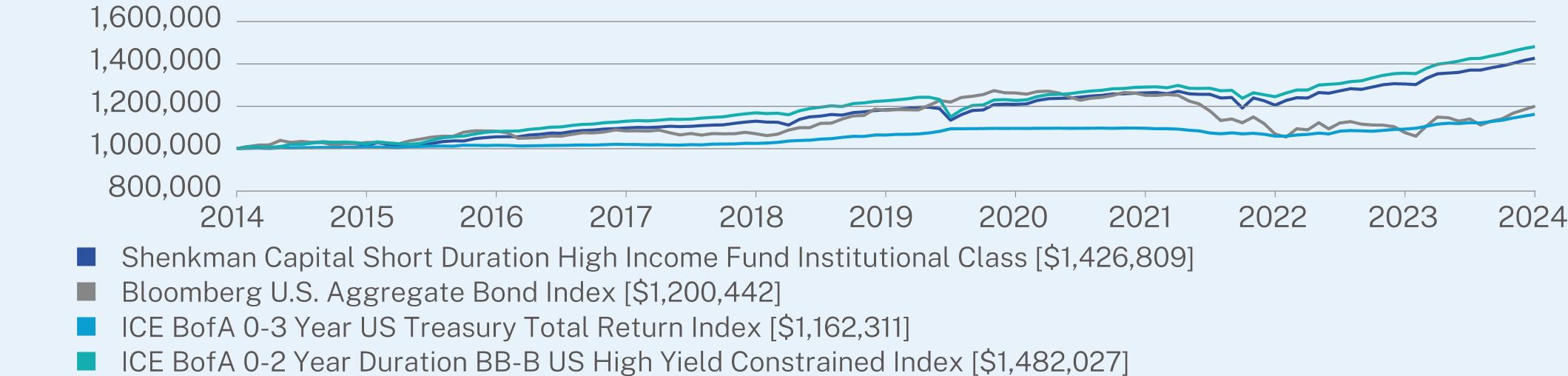

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Shenkman Capital Short Duration High Income Fund | PAGE 1 | TSR-AR-00770X709 |

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Class | 9.28 | 3.80 | 3.62 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA 0-3 Year US Treasury Total Return Index | 6.39 | 1.78 | 1.52 |

ICE BofA 0-2 Year Duration BB-B US High Yield Constrained Index | 9.26 | 3.87 | 4.01 |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $1,866,939,775 |

Number of Holdings | 375 |

Net Advisory Fee | $9,755,069 |

Portfolio Turnover | 59% |

Average Credit Quality | BB- / Ba3* |

Weighted Average Maturity | 2.49 years |

Effective Duration | 1.13 years |

30-Day SEC Yield | 5.45% |

30-Day SEC Yield Unsubsidized | 5.43% |

Visit https://www.shenkmancapital.com/strategies#mutual_funds for more recent performance information.

| * | Credit quality ratings reflect the highest rating assigned by S&P Global Ratings, Fitch or Moody’s if ratings differ. These ratings agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are BBB/Baa or higher. Below investment grade ratings are BB/Ba or lower. |

| Shenkman Capital Short Duration High Income Fund | PAGE 2 | TSR-AR-00770X709 |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (% of net assets) |

Tenet Healthcare Corp. | 1.3% |

Caesars Entertainment, Inc. | 1.2% |

Uber Technologies, Inc. | 1.2% |

IQVIA, Inc. | 1.2% |

Clarios Global LP / Clarios US Finance Co. | 1.0% |

CCO Holdings LLC / CCO Holdings Capital Corp. | 1.0% |

International Game Technology PLC | 1.0% |

Carnival Holdings Bermuda Ltd. | 0.9% |

First American Government Obligations Fund | 0.9% |

Teva Pharmaceutical Finance Netherlands III BV | 0.8% |

| |

Security Type | (% of net assets) |

Corporate Bonds | 86.3% |

Bank Loans | 9.0% |

Convertible Bonds | 1.2% |

Money Market Funds | 0.9% |

Cash & Other | 2.6% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.shenkmancapital.com/strategies#mutual_funds.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Shenkman Capital Management documents not be householded, please contact Shenkman Capital Management at 1-855-743-6562, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Shenkman Capital Management or your financial intermediary.

| Shenkman Capital Short Duration High Income Fund | PAGE 3 | TSR-AR-00770X709 |

10000001016003105635110983071129954118380012095611263674120535513056881426809100000010294081082859108364510704671180681126315012518441069080107596912004421000000100850610159541019908102511810643981096054109668010594221092546116231110000001022553108106911297701169433122603112276031290933124519613564371482027

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Mr. Joe D. Redwine, Ms. Michele Rackey, Ms. Anne Kritzmire and Mr. Craig Wainscott are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant including the review of federal income tax returns, review of federal excise tax returns, review of state tax returns, if any, and assistance with calculation of required income, capital gain and excise distributions. There were no “other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 9/30/2024 | FYE 9/30/2023 |

| (a) Audit Fees | $52,000 | $50,700 |

| (b) Audit-Related Fees | N/A | N/A |

| (c) Tax Fees | $7,200 | $7,200 |

| (d) All Other Fees | N/A | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Tait, Weller & Baker LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 9/30/2024 | FYE 9/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) During the audit of the registrant’s financial statements, 100 percent of the hours were attributed to work performed by persons other than full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 9/30/2024 | FYE 9/30/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedules of Investments is included within the financial statements filed under Item 7 of this Form. |

| | |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

SHENKMAN CAPITAL FUNDS

Shenkman Capital Floating Rate High Income Fund

Shenkman Capital Short Duration High Income Fund

Core Financial Statements

September 30, 2024

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024

| | | | | | | |

BANK LOANS - 84.8%(e)

|

AEROSPACE & DEFENSE - 1.4%

| | | | | | |

Apple Bidco LLC, Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 09/25/2028 | | | $627,469 | | | $629,605 |

Barnes Group, Inc., Senior Secured First Lien, 7.35% (1 mo. SOFR US + 2.50%), 08/30/2030 | | | 589,710 | | | 590,816 |

Brown Group Holding LLC, Senior Secured First Lien

| | | | | | |

7.60% (1 mo. SOFR US + 2.75%), 07/01/2031 | | | 267,874 | | | 267,613 |

7.81% (3 mo. SOFR US + 2.75%), 07/01/2031 | | | 203,194 | | | 202,996 |

8.00% (3 mo. SOFR US + 2.75%), 07/01/2031 | | | 428,206 | | | 427,789 |

Dynasty Acquisition Co., Inc., Senior Secured First Lien, 8.35%

(1 mo. SOFR US + 3.50%), 08/24/2028 | | | 565,902 | | | 566,980 |

LSF11 Trinity Bidco, Inc., Senior Secured First Lien, 8.42% (1 mo. SOFR US + 3.50%), 06/17/2030 | | | 389,353 | | | 390,326 |

Standard Aero Ltd., Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 08/24/2028 | | | 218,197 | | | 218,613 |

TransDigm, Inc., Senior Secured First Lien, 7.32% (3 mo. SOFR US + 2.50%), 01/20/2032 | | | 511,000 | | | 509,562 |

| | | | | | 3,804,300 |

AUTO RETAIL - 0.3%

| | | | | | |

CWGS Group LLC, Senior Secured

First Lien

| | | | | | |

7.57% (1 mo. SOFR US + 2.50%), 06/05/2028 | | | 20,474 | | | 19,643 |

7.58% (1 mo. SOFR US + 2.50%), 06/05/2028 | | | 332,912 | | | 319,387 |

LS Group OpCo Acquistion LLC, Senior Secured First Lien, 7.85% (1 mo. SOFR US + 3.00%), 04/23/2031 | | | 407,828 | | | 408,466 |

| | | | | | 747,496 |

AUTOMOTIVE - 1.2%

| | | | | | |

Adient US LLC, Senior Secured First Lien, 7.60% (1 mo. SOFR US + 2.75%), 01/29/2031 | | | 404,259 | | | 405,187 |

American Axle & Manufacturing, Inc., Senior Secured First Lien, 8.20% (1 mo. SOFR US + 3.00%), 12/13/2029 | | | 732,266 | | | 735,473 |

Autokiniton US Holdings, Inc., Senior Secured First Lien, 9.07% (1 mo. SOFR US + 4.00%), 04/06/2028 | | | 296,681 | | | 296,982 |

Clarios Global LP, Senior Secured First Lien, 7.35% (1 mo. SOFR US + 2.50%), 05/06/2030 | | | 260,000 | | | 260,434 |

| | | | | | | |

| | | | | | | |

First Brands Group LLC, Senior Secured First Lien

| | | | | | |

10.78% (3 mo. SOFR US + 5.00%), 03/30/2027 | | | $465,345 | | | $461,274 |

10.78% (3 mo. SOFR US + 5.00%), 03/30/2027 | | | 272,135 | | | 269,712 |

Tenneco, Inc., Senior Secured First Lien

| | | | | | |

9.80% (3 mo. SOFR US + 5.00%), 11/17/2028 | | | 1,354 | | | 1,290 |

10.29% (3 mo. SOFR US + 4.75%), 11/17/2028 | | | 232,409 | | | 220,243 |

10.33% (3 mo. SOFR US + 5.00%), 11/17/2028 | | | 479,646 | | | 456,711 |

Thor Industries, Inc., Senior Secured First Lien, 7.10% (1 mo. SOFR US + 2.25%), 11/15/2030 | | | 165,367 | | | 165,780 |

| | | | | | 3,273,086 |

BUILDING PRODUCTS - 1.6%

| | | | | | |

Cornerstone Building Brands, Inc., Senior Secured First Lien, 8.55% (1 mo. SOFR US + 3.25%), 04/12/2028 | | | 405,642 | | | 397,981 |

Janus International Group LLC, Senior Secured First Lien, 7.35% (1 mo. SOFR US + 2.50%), 08/05/2030 | | | 769,910 | | | 771,235 |

MIWD Holdco II LLC, Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 03/28/2031 | | | 477,803 | | | 479,229 |

Quikrete Holdings, Inc., Senior Secured First Lien, 7.35% (1 mo. SOFR US + 2.50%), 04/14/2031 | | | 497,500 | | | 498,234 |

Star Holding LLC, Senior Secured First Lien, 9.35% (1 mo. SOFR US + 4.50%), 07/31/2031 | | | 557,000 | | | 545,373 |

STS Operating, Inc., Senior Secured First Lien, 8.95% (1 mo. SOFR US + 4.00%), 03/25/2031 | | | 628,840 | | | 625,501 |

Summit Materials LLC, Senior Secured First Lien, 7.05% (3 mo. SOFR US + 1.75%), 01/12/2029 | | | 271,009 | | | 272,448 |

Tamko Building Products LLC, Senior Secured First Lien, 8.17% (1 mo. SOFR US + 3.25%), 09/20/2030 | | | 452,483 | | | 454,179 |

Verde Purchaser LLC, Senior Secured First Lien, 9.10% (3 mo. SOFR US + 4.50%), 12/02/2030 | | | 359,100 | | | 356,593 |

| | | | | | 4,400,773 |

CHEMICALS - 2.6%

| | | | | | |

Axalta Coating Systems US Holdings, Inc., Senior Secured First Lien, 6.60% (3 mo. SOFR US + 2.00%), 12/20/2029 | | | 777,180 | | | 780,379 |

Consolidated Energy Finance SA, Senior Secured First Lien, 9.56% (3 mo. SOFR US + 4.50%), 11/18/2030 | | | 336,310 | | | 317,091 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

CHEMICALS - (Continued)

|

Discovery Purchaser Corp., Senior Secured First Lien, 9.69%

(3 mo. SOFR US + 4.38%), 10/04/2029 | | | $412,533 | | | $411,329 |

EcovystCatalyst Technologies LLC, Senior Secured First Lien

| | | | | | |

7.50% (3 mo. SOFR US + 2.25%), 06/12/2031 | | | 173,057 | | | 172,232 |

7.50% (3 mo. SOFR US + 2.25%), 06/12/2031 | | | 66,750 | | | 66,432 |

INEOS US Finance LLC, Senior Secured First Lien, 8.10%

(1 mo. SOFR US + 3.25%), 02/19/2030 | | | 310,000 | | | 310,222 |

INEOS US Petrochem LLC, Senior Secured First Lien

| | | | | | |

7.82% (1 mo. SOFR US + 2.75%), 01/29/2026 | | | 176,807 | | | 176,880 |

8.80% (1 mo. SOFR US + 3.75%), 03/01/2030 | | | 236,013 | | | 236,456 |

Koppers, Inc., Senior Secured First Lien, 8.10% (1 mo. SOFR US + 3.00%), 04/10/2030 | | | 231,348 | | | 232,505 |

LSF11 A5 HoldCo LLC, Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.50%), 10/16/2028 | | | 769,421 | | | 768,940 |

Lummus Technology Holdings V LLC, Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.50%), 12/31/2029 | | | 585,060 | | | 587,465 |

Nouryon USA LLC, Senior Secured First Lien, 8.82% (3 mo. SOFR US + 3.50%), 04/03/2028 | | | 305,916 | | | 306,999 |

Olympus Water US Holding Corp., Senior Secured First Lien, 8.10% (3 mo. SOFR US + 3.50%), 06/23/2031 | | | 261,653 | | | 261,980 |

Polar US Borrower LLC, Senior Secured First Lien

| | | | | | |

10.24% (3 mo. SOFR US + 4.75%), 10/15/2025 | | | 259,516 | | | 205,450 |

10.24% (3 mo. SOFR US + 4.75%), 10/15/2025 | | | 221,794 | | | 175,586 |

SCIH Salt Holdings, Inc., Senior Secured First Lien, 8.87% (3 mo. SOFR US + 3.50%), 03/16/2027 | | | 787,742 | | | 788,593 |

Sparta US HoldCo LLC, Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.25%), 08/02/2028 | | | 514,453 | | | 514,987 |

Tronox Finance LLC, Senior Secured First Lien, 7.60% (1 mo. SOFR US + 2.50%), 09/30/2031 | | | 411,000 | | | 410,400 |

Vibrantz Technologies, Inc., Senior Secured First Lien, 9.85% (3 mo. SOFR US + 4.25%), 04/23/2029 | | | 224,316 | | | 219,290 |

| | | | | | | |

| | | | | | | |

Windsor Holdings III LLC, Senior Secured First Lien, 8.46% (1 mo. SOFR US + 3.50%), 08/01/2030 | | | $315,619 | | | $317,508 |

| | | | | | 7,260,724 |

COMMERCIAL SERVICES - 5.3%

| | | | | | |

AlixPartners LLP, Senior Secured First Lien, 7.57% (1 mo. SOFR US + 2.50%), 02/04/2028 | | | 1,186,049 | | | 1,188,718 |

Allied Universal Holdco LLC, Senior Secured First Lien, 8.80% (1 mo. SOFR US + 3.75%), 05/15/2028 | | | 394,964 | | | 391,558 |

American Auto Auction Group LLC, Senior Secured First Lien, 9.90% (3 mo. SOFR US + 5.00%), 12/30/2027 | | | 539,485 | | | 542,522 |

Apex Group Treasury LLC, Senior Secured First Lien, 9.39% (6 mo. SOFR US + 3.75%), 07/27/2028 | | | 401,083 | | | 402,085 |

Aramark Services, Inc., Senior Secured First Lien

| | | | | | |

6.94% (1 mo. SOFR US + 1.75%), 01/15/2027 | | | 398,000 | | | 398,571 |

6.85% (1 mo. SOFR US + 2.00%), 06/24/2030 | | | 270,872 | | | 271,922 |

Camelot US Acquisition LLC, Senior Secured First Lien

| | | | | | |

7.60% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | 315,531 | | | 315,452 |

7.60% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | 73,550 | | | 73,532 |

7.60% (1 mo. SOFR US + 2.75%), 01/31/2031 | | | 6,252 | | | 6,250 |

CoreLogic, Inc., Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.50%), 06/02/2028 | | | 554,514 | | | 550,406 |

Deerfield Dakota Holding LLC, Senior Secured First Lien, 8.35% (3 mo. SOFR US + 3.75%), 04/09/2027 | | | 685,607 | | | 672,622 |

Dun & Bradstreet Corp., Senior Secured First Lien, 7.61% (1 mo. SOFR US + 2.75%), 01/18/2029 | | | 394,507 | | | 394,617 |

EAB Global, Inc., Senior Secured First Lien, 8.21% (1 mo. SOFR US + 3.25%), 08/16/2028 | | | 555,347 | | | 554,028 |

First Advantage Holdings LLC, Senior Secured First Lien, 8.35% (1 mo. Term SOFR + 3.25%), 10/31/2031 | | | 746,000 | | | 743,669 |

Foundever Worldwide Corp., Senior Secured First Lien, 8.82% (1 mo. SOFR US + 3.75%), 08/28/2028 | | | 862,476 | | | 572,740 |

Garda World Security Corp., Senior Secured First Lien, 8.60% (1 mo. SOFR US + 3.50%), 02/01/2029 | | | 1,373,223 | | | 1,374,768 |

Grant Thornton LLP, Senior Secured First Lien, 8.10% (1 mo. SOFR US + 3.25%), 05/30/2031 | | | 271,000 | | | 271,698 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

COMMERCIAL SERVICES - (Continued)

|

HomeServe USA Corp., Senior Secured First Lien, 7.21% (1 mo. SOFR US + 2.50%), 10/21/2030 | | | $356,210 | | | $355,987 |

Indy US Bidco LLC, Senior Secured First Lien

| | | | | | |

8.82% (1 mo. SOFR US + 3.75%), 03/06/2028 | | | 308,896 | | | 305,973 |

8.82% (1 mo. SOFR US + 3.75%), 03/06/2028 | | | 178,723 | | | 177,032 |

Indy US Holdco LLC, Senior Secured First Lien

| | | | | | |

9.60% (1 mo. SOFR US + 4.75%), 03/06/2028 | | | 516,588 | | | 515,728 |

9.60% (1 mo. SOFR US + 4.75%), 03/06/2028 | | | 375,032 | | | 374,408 |

9.60% (1 mo. SOFR US + 4.75%), 03/06/2028 | | | 12,380 | | | 12,359 |

Iron Mountain Information Management LLC, Senior Secured First Lien, 6.85% (1 mo. SOFR US + 2.00%), 01/31/2031 | | | 271,189 | | | 270,002 |

Isolved, Inc., Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 10/15/2030 | | | 427,853 | | | 430,065 |

OMNIA Partners LLC, Senior Secured First Lien

| | | | | | |

8.53% (3 mo. SOFR US + 3.25%), 07/25/2030 | | | 511,569 | | | 513,669 |

8.53% (3 mo. SOFR US + 3.25%), 07/25/2030 | | | 90,921 | | | 91,294 |

Planet US Buyer LLC, Senior Secured First Lien, 8.60% (3 mo. SOFR US + 3.50%), 02/10/2031 | | | 794,010 | | | 796,392 |

Pre-Paid Legal Services, Inc., Senior Secured First Lien, 8.82% (1 mo. SOFR US + 3.75%), 12/15/2028 | | | 657,435 | | | 657,764 |

Saphilux Sarl, Senior Secured First Lien, 8.56% (3 mo. SOFR US + 3.50%), 07/27/2028 | | | 412,787 | | | 414,077 |

Tempo Acquisition LLC, Senior Secured First Lien, 7.10% (1 mo. SOFR US + 2.25%), 08/31/2028 | | | 406,847 | | | 407,512 |

VT Topco, Inc., Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 08/12/2030 | | | 406,803 | | | 408,540 |

| | | | | | 14,455,960 |

CONSTRUCTION & ENGINEERING - 1.7%

|

Amentum Holdings, Inc., Senior Secured First Lien, 8.10% (3 mo. SOFR US + 2.25%), 09/29/2031 | | | 947,000 | | | 945,224 |

American Residential Services LLC, Senior Secured First Lien, 8.63% (3 mo. SOFR US + 3.50%), 10/15/2027 | | | 653,538 | | | 655,583 |

| | | | | | | |

| | | | | | | |

APi Group DE, Inc., Senior Secured First Lien, 6.85% (1 mo. SOFR US + 2.00%), 01/03/2029 | | | $542,000 | | | $542,276 |

Brand Industrial Services, Inc., Senior Secured First Lien, 9.75% (3 mo. SOFR US + 4.50%), 08/01/2030 | | | 540,111 | | | 526,357 |

Centuri Group, Inc., Senior Secured First Lien, 7.57% (1 mo. SOFR US + 2.50%), 08/28/2028 | | | 486,732 | | | 486,315 |

Tecta America Corp., Senior Secured First Lien

| | | | | | |

9.07% (1 mo. SOFR US + 4.00%), 04/10/2028 | | | 678,152 | | | 682,177 |

9.32% (1 mo. SOFR US + 4.25%), 04/10/2028 | | | 210,870 | | | 212,122 |

Tiger Acquisition LLC, Senior Secured First Lien, 8.30% (1 mo. SOFR US + 3.25%), 06/01/2028 | | | 562,480 | | | 560,511 |

| | | | | | 4,610,565 |

CONSUMER DISCRETIONARY - 2.3%

|

American Greetings Corp., Senior Secured First Lien, 10.60%

(1 mo. SOFR US + 5.75%), 10/30/2029 | | | 388,556 | | | 392,139 |

Fugue Finance LLC, Senior Secured First Lien, 9.06% (3 mo. SOFR US + 4.00%), 01/26/2028 | | | 440,681 | | | 444,064 |

Hanesbrands, Inc., Senior Secured First Lien, 8.60% (1 mo. SOFR US + 3.75%), 03/08/2030 | | | 498,410 | | | 498,410 |

KUEHG Corp., Senior Secured First Lien, 9.10% (3 mo. SOFR US + 4.50%), 06/12/2030 | | | 350,722 | | | 352,158 |

Learning Care Group USNo 2, Inc., Senior Secured First Lien

| | | | | | |

8.60% (3 mo. SOFR US + 4.00%), 08/11/2028 | | | 7,065 | | | 7,111 |

9.11% (3 mo. SOFR US + 4.00%), 08/11/2028 | | | 25,833 | | | 26,003 |

9.26% (3 mo. SOFR US + 4.00%), 08/11/2028 | | | 77,500 | | | 78,009 |

9.29% (3 mo. SOFR US + 4.00%), 08/11/2028 | | | 43,056 | | | 43,338 |

Peloton Interactive, Inc., Senior Secured First Lien, 10.85% (1 mo. SOFR US + 6.00%), 05/30/2029 | | | 407,978 | | | 410,323 |

Prometric Holdings, Inc., Senior Secured First Lien, 9.82% (1 mo. SOFR US + 4.75%), 01/31/2028 | | | 807,134 | | | 813,188 |

Renaissance Holdings Corp., Senior Secured First Lien, 9.10% (1 mo. SOFR US + 4.25%), 04/30/2030 | | | 722,714 | | | 723,248 |

Samsonite IP Holdings Sarl, Senior Secured First Lien, 6.85% (1 mo. SOFR US + 2.00%), 06/10/2030 | | | 377,197 | | | 379,006 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

CONSUMER DISCRETIONARY - (Continued)

|

Spring Education Group, Inc., Senior Secured First Lien, 8.60% (3 mo. SOFR US + 4.00%), 10/04/2030 | | | $358,293 | | | $361,338 |

Tory Burch LLC, Senior Secured First Lien, 8.32% (1 mo. SOFR US + 3.25%), 04/14/2028 | | | 362,813 | | | 363,818 |

Wand NewCo3, Inc., Senior Secured First Lien

| | | | | | |

7.85% (3 mo. SOFR US + 3.25%), 01/30/2031 | | | 398,165 | | | 398,165 |

8.10% (1 mo. SOFR US + 3.25%), 01/30/2031 | | | 684,122 | | | 684,122 |

Weber-Stephen Products LLC, Senior Secured First Lien, 8.32%

(1 mo. SOFR US + 3.25%), 10/29/2027 | | | 294,065 | | | 278,178 |

WW International, Inc., Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.50%), 04/13/2028 | | | 240,686 | | | 66,378 |

| | | | | | 6,318,996 |

CONSUMER NON-DISCRETIONARY - 0.1%

|

Kronos Acquisition Holdings, Inc., Senior Secured First Lien, 9.31% (3 mo. SOFR US + 4.00%), 07/08/2031 | | | 279,000 | | | 262,260 |

ENVIRONMENTAL & FACILITIES SERVICES - 1.8%

|

Action Environmental Group, Inc., Senior Secured First Lien

| | | | | | |

8.60% (3 mo. SOFR US + 4.00%), 10/24/2030 | | | 656,217 | | | 658,677 |

9.33% (1 mo. SOFR US + 4.00%), 10/24/2030(g) | | | 94,857 | | | 95,213 |

Belfor Holdings, Inc., Senior Secured First Lien, 8.60% (1 mo. SOFR US + 3.75%), 11/04/2030 | | | 937,074 | | | 942,350 |

GFL Environmental, Inc., Senior Secured First Lien, 7.32% (3 mo. SOFR US + 2.00%), 06/27/2031 | | | 769,000 | | | 769,138 |

Gopher Resource LLC, Senior Secured First Lien, 8.21% (1 mo. Synthetic LIBOR + 3.25%), 03/06/2025(a) | | | 308,711 | | | 301,331 |

JFL-Tiger Acquisition Co., Inc., Senior Secured First Lien, 9.46% (3 mo. SOFR US + 4.50%), 10/17/2030 | | | 423,798 | | | 425,916 |

ReworldHolding Corp., Senior Secured First Lien

| | | | | | |

7.35% (1 mo. SOFR US + 2.50%), 11/30/2028 | | | 335,518 | | | 336,174 |

7.59% (6 mo. SOFR US + 2.50%), 11/30/2028 | | | 26,282 | | | 26,333 |

7.59% (6 mo. SOFR US + 2.50%), 11/30/2028 | | | 6,570 | | | 6,583 |

| | | | | | | |

| | | | | | | |

7.85% (1 mo. SOFR US + 2.75%), 11/30/2028 | | | $419,856 | | | $420,862 |

7.85% (1 mo. SOFR US + 2.75%), 11/30/2028 | | | 23,000 | | | 23,056 |

Win Waste Innovations Holdings, Inc., Senior Secured First Lien, 7.82% (1 mo. SOFR US + 2.75%), 03/27/2028 | | | 987,060 | | | 942,643 |

| | | | | | 4,948,276 |

FINANCIALS: BANKS - 0.1%

| | | | | | |

EnergySolutions LLC, Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.75%), 09/23/2030 | | | 341,420 | | | 344,196 |

FINANCIALS: DIVERSIFIED - 5.2%

| | | | | | |

Armor Holdco, Inc., Senior Secured First Lien, 10.26% (6 mo. SOFR US + 4.50%), 12/11/2028 | | | 544,562 | | | 548,646 |

Ascensus Holdings, Inc., Senior Secured First Lien, 8.57% (1 mo. SOFR US + 3.50%), 08/02/2028 | | | 784,791 | | | 785,776 |

Avolon TLB Borrower 1 US LLC, Senior Secured First Lien, 6.96% (1 mo. SOFR US + 2.00%), 06/22/2028 | | | 901,002 | | | 903,922 |

BCPE Pequod Buyer, Inc., Senior Secured First Lien, 8.42%

(1 mo. Term SOFR + 3.50%),

09/19/2031 | | | 751,000 | | | 748,574 |

Blackhawk Network Holdings, Inc., Senior Secured First Lien, 9.85% (1 mo. SOFR US + 5.00%), 03/12/2029 | | | 469,823 | | | 472,465 |

Boost Newco Borrower LLC, Senior Secured First Lien, 7.10% (3 mo. SOFR US + 2.50%), 01/31/2031 | | | 952,000 | | | 953,585 |

CastlelakeAviation One DAC, Senior Secured First Lien

| | | | | | |

7.45% (3 mo. SOFR US + 2.50%), 10/22/2026 | | | 525,216 | | | 526,991 |

7.70% (3 mo. SOFR US + 2.75%), 10/22/2027 | | | 516,795 | | | 519,273 |

Citco Funding LLC, Senior Secured First Lien, 7.31% (6 mo. SOFR US + 2.75%), 04/27/2028 | | | 672,859 | | | 677,276 |

Corp. Service Co., Senior Secured

First Lien

| | | | | | |

7.95% (1 mo. SOFR US + 2.50%), 11/03/2027 | | | 381,210 | | | 381,210 |

7.45% (1 mo. SOFR US + 2.50%), 11/05/2029 | | | 542,581 | | | 544,162 |

Edelman Financial Engines Center LLC, Senior Secured First Lien, 8.10%

(1 mo. SOFR US + 3.25%), 04/07/2028 | | | 444,450 | | | 444,130 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

FINANCIALS: DIVERSIFIED - (Continued)

|

Edelman Financial Engines Center LLC, Senior Secured Second Lien, 10.10% (1 mo. SOFR US + 5.25%), 10/06/2028 | | | $1,021,000 | | | $1,020,576 |

EIG Management Co. LLC, Senior Secured First Lien, 9.96% (1 mo. SOFR US + 5.00%), 05/17/2029 | | | 632,988 | | | 634,570 |

Focus Financial Partners LLC, Senior Secured First Lien

| | | | | | |

8.33% (1 mo. SOFR US + 3.25%), 09/17/2031 | | | 559,869 | | | 558,839 |

8.41% (1 mo. SOFR US + 3.25%), 09/17/2031 | | | 60,131 | | | 60,021 |

June Purchaser LLC, Senior Secured First Lien

| | | | | | |

8.67% (1 mo. Term SOFR + 3.25%), 09/11/2031 | | | 486,000 | | | 484,481 |

8.67% (1 mo. Term SOFR + 3.25%), 09/11/2031 | | | 81,000 | | | 80,747 |

Lakeland Holdings LLC, Senior Unsecured First Lien

| | | | | | |

8.00%, 09/27/2027 | | | 225,670 | | | 42,877 |

8.00%, 09/27/2027 | | | 107,661 | | | 20,456 |

MoneyGram International, Inc., Senior Secured First Lien, 9.68%

(3 mo. SOFR US + 4.75%), 06/03/2030 | | | 265,200 | | | 253,350 |

NAB Holdings LLC, Senior Secured First Lien, 7.35% (3 mo. SOFR US + 2.75%), 11/24/2028 | | | 491,847 | | | 490,991 |

Neon Maple US Debt Mergersub, Inc., Senior Secured First Lien, 8.35% (1 mo. Term SOFR + 3.00%), 07/21/2031 | | | 503,000 | | | 498,076 |

NuveiTechnologies Corp., Senior Secured First Lien

| | | | | | |

8.06% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | 141,849 | | | 142,229 |

8.06% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | 95,281 | | | 95,537 |

8.06% (1 mo. SOFR US + 3.00%), 12/19/2030 | | | 24,637 | | | 24,703 |

VFH Parent LLC, Senior Secured First Lien, 7.60% (1 mo. SOFR US + 2.75%), 06/23/2031 | | | 910,000 | | | 912,275 |

WEX, Inc., Senior Secured First Lien, 7.25% (1 mo. SOFR US + 2.00%), 04/03/2028 | | | 692,053 | | | 694,153 |

Zelis Payments Buyer, Inc., Senior Secured First Lien, 7.60% (1 mo. SOFR US + 2.75%), 09/28/2029 | | | 659,685 | | | 660,064 |

| | | | | | 14,179,955 |

| | | | | | | |

| | | | | | | |

FINANCIALS: INSURANCE - 4.2%

| | | | | | |

AcrisureLLC, Senior Secured First Lien

| | | | | | |

7.96% (1 mo. SOFR US + 3.00%), 02/16/2027 | | | $1,902,891 | | | $1,900,912 |

8.21% (1 mo. SOFR US + 3.25%), 11/06/2030 | | | 408,015 | | | 404,828 |

Alliant Holdings Intermediate LLC, Senior Secured First Lien, 8.10% (1 mo. SOFR US + 3.00%), 09/19/2031 | | | 295,000 | | | 293,682 |

AssuredPartners, Inc., Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 02/14/2031 | | | 1,921,345 | | | 1,921,681 |

Asurion LLC, Senior Secured First Lien, 8.32% (1 mo. SOFR US + 3.25%), 12/23/2026 | | | 1,667,958 | | | 1,668,508 |

Asurion LLC, Senior Secured Second Lien, 10.32% (1 mo. SOFR US + 5.25%), 02/03/2028 | | | 718,000 | | | 676,073 |

BroadStreet Partners, Inc., Senior Secured First Lien

| | | | | | |

8.10% (1 mo. SOFR US + 3.25%), 06/16/2031 | | | 289,982 | | | 289,160 |

8.10% (1 mo. SOFR US + 3.25%), 06/16/2031 | | | 29,683 | | | 29,599 |

HUB International Ltd., Senior Secured First Lien, 8.26% (3 mo. SOFR US + 3.00%), 06/20/2030 | | | 1,294,503 | | | 1,294,076 |

Jones Deslauriers Insurance Management, Inc., Senior Secured First Lien, 8.40% (3 mo. SOFR US + 3.25%), 03/15/2030 | | | 274,165 | | | 274,439 |

TIH Insurance Holdings LLC, Senior Secured First Lien, 7.85% (3 mo. SOFR US + 3.25%), 05/06/2031 | | | 1,447,000 | | | 1,447,152 |

TIH Insurance Holdings LLC, Senior Secured Second Lien, 9.35% (3 mo. SOFR US + 4.75%), 05/06/2032 | | | 505,000 | | | 514,469 |

USI, Inc., Senior Secured First Lien, 7.35% (3 mo. SOFR US + 2.75%), 11/23/2029 | | | 938,794 | | | 937,099 |

| | | | | | 11,651,678 |

FOOD & BEVERAGE - 1.8%

| | | | | | |

BCPE Empire Holdings, Inc., Senior Secured First Lien, 8.85% (1 mo. SOFR US + 4.00%), 12/26/2028 | | | 663,396 | | | 664,434 |

Delivery Hero Finco LLC, Senior Secured First Lien, 10.10% (3 mo. SOFR US + 5.00%), 12/12/2029 | | | 1,778,476 | | | 1,788,792 |

FroneriUS, Inc., Senior Secured

First Lien

| | | | | | |

7.30% (1 mo. SOFR US + 2.25%), 02/01/2027 | | | 270,024 | | | 269,822 |

7.70% (1 mo. SOFR US + 2.25%), 02/01/2027 | | | 122,872 | | | 122,780 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

FOOD & BEVERAGE - (Continued)

|

HLF Financing Sarl LLC, Senior Secured First Lien, 11.60%

(1 mo. SOFR US + 6.75%), 04/12/2029 | | | $319,950 | | | $303,473 |

Pegasus Bidco BV, Senior Secured First Lien, 8.87% (3 mo. SOFR US + 3.75%), 07/12/2029 | | | 527,242 | | | 528,726 |

Saratoga Food Specialties LLC, Senior Secured First Lien, 8.70%

(3 mo. SOFR US + 3.75%), 03/07/2029 | | | 379,050 | | | 381,182 |

Triton Water Holdings, Inc., Senior Secured First Lien, 9.11%

(3 mo. SOFR US + 3.25%), 03/31/2028 | | | 815,066 | | | 814,577 |

| | | | | | 4,873,786 |

HEALTHCARE: EQUIPMENT & SUPPLIES - 2.4%

|

AthenaHealth Group, Inc., Senior Secured First Lien, 8.50%

(1 mo. SOFR US + 3.25%), 02/15/2029 | | | 743,168 | | | 739,765 |

Azalea Topco, Inc., Senior Secured First Lien, 8.35% (1 mo. SOFR US + 3.50%), 04/24/2031 | | | 1,134,000 | | | 1,132,889 |

Bausch + Lomb Corp., Senior Secured First Lien, 8.37% (1 mo. SOFR US + 3.25%), 05/10/2027 | | | 581 | | | 579 |

Covetrus, Inc., Senior Secured First Lien, 10.33% (3 mo. SOFR US + 5.00%), 10/15/2029 | | | 231,475 | | | 220,047 |

Gainwell Acquisition Corp., Senior Secured First Lien, 8.80% (3 mo. SOFR US + 4.00%), 10/01/2027 | | | 942,229 | | | 899,239 |

Insulet Corp., Senior Secured First Lien, 7.75% (1 mo. SOFR US + 2.50%), 08/01/2031 | | | 1,263,735 | | | 1,271,045 |

Medline Borrower LP, Senior Secured First Lien, 7.60% (1 mo. SOFR US + 2.75%), 10/23/2028 | | | 1,590,499 | | | 1,592,941 |

Waystar Technologies, Inc., Senior Secured First Lien, 7.60%

(1 mo. SOFR US + 2.75%), 10/22/2029 | | | 718,626 | | | 719,977 |

| | | | | | 6,576,482 |

HEALTHCARE: FACILITIES - 4.0%

| | | | | | |

ADMI Corp., Senior Secured First Lien, 8.82% (1 mo. SOFR US + 3.75%), 12/23/2027 | | | 414,173 | | | 406,258 |

CHG Healthcare Services, Inc., Senior Secured First Lien

| | | | | | |

8.46% (1 mo. SOFR US + 3.50%), 09/29/2028 | | | 387,377 | | | 388,424 |

| | | | | | | |

| | | | | | | |

8.57% (1 mo. SOFR US + 3.50%), 09/29/2028 | | | $160,917 | | | $161,127 |

Concentra Health Services, Inc., Senior Secured First Lien, 7.10% (1 mo. SOFR US + 2.25%), 07/28/2031 | | | 407,000 | | | 406,746 |

Examworks Bidco, Inc., Senior Secured First Lien, 8.07% (1 mo. SOFR US + 3.00%), 11/01/2028 | | | 947,537 | | | 949,906 |

Global Medical Response, Inc., Senior Secured First Lien

| | | | | | |

10.46% (includes 0.75% PIK)

(1 mo. SOFR US + 4.75%), 10/02/2028 | | | 838,974 | | | 835,501 |

10.46% (includes 0.75% PIK)

(1 mo. SOFR US + 4.75%), 10/02/2028 | | | 19,737 | | | 19,655 |

HAH Group Holding Co. LLC, Senior Secured First Lien, 9.96%

(1 mo. Term SOFR), 09/17/2031 | | | 554,000 | | | 547,856 |

Heartland Dental LLC, Senior Secured First Lien, 9.35% (1 mo. SOFR US + 4.50%), 04/28/2028 | | | 806,165 | | | 793,653 |

Hunter US Bidco, Inc., Senior Secured First Lien, 9.68% (3 mo. SOFR US + 4.25%), 08/21/2028 | | | 276,000 | | | 274,965 |

Inception Finco Sarl, Senior Secured First Lien, 9.10% (3 mo. SOFR US + 4.50%), 04/09/2031 | | | 570,000 | | | 574,631 |

LifePoint Health, Inc., Senior Secured First Lien, 8.96% (1 mo. SOFR US + 4.00%), 05/14/2031 | | | 839,238 | | | 840,363 |

ModivCare, Inc., Senior Secured First Lien, 10.08% (3 mo. SOFR US + 4.75%), 07/01/2031 | | | 336,158 | | | 318,405 |

Option Care Health, Inc., Senior Secured First Lien, 7.21% (1 mo. SOFR US + 2.25%), 10/27/2028 | | | 407,605 | | | 409,559 |

Pacific Dental Services, Inc., Senior Secured First Lien, 7.85%

(1 mo. SOFR US + 2.75%), 03/17/2031 | | | 477,600 | | | 477,899 |

Pluto Acquisition I, Inc., Senior Secured First Lien

| | | | | | |

10.25% (3 mo. SOFR US + 5.50%), 06/20/2028 | | | 90,065 | | | 91,416 |

10.25% (3 mo. SOFR US + 5.50%), 06/20/2028 | | | 1,801 | | | 1,828 |

9.13% (3 mo. SOFR US + 4.00%), 09/20/2028 | | | 192,261 | | | 176,560 |

Radnet Management, Inc., Senior Secured First Lien, 7.78%

(3 mo. SOFR US + 2.50%), 04/18/2031 | | | 406,980 | | | 407,829 |

Select Medical Corp., Senior Secured First Lien, 8.25% (1 mo. SOFR US + 3.00%), 03/05/2027 | | | 130,469 | | | 131,148 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Shenkman Capital Floating Rate High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

HEALTHCARE: FACILITIES - (Continued)

|

SonravaHealth Co.-Borrower LLC, Senior Secured First Lien

| | | | | | |

7.68% (3 mo. SOFR US + 6.50%), 05/18/2028 | | | $115,398 | | | $116,552 |

11.50% (1 mo. SOFR US + 7.25%), 08/18/2028 | | | 335,319 | | | 225,641 |

Sotera Health Holdings LLC, Senior Secured First Lien, 8.10%

(1 mo. SOFR US + 3.25%), 05/30/2031 | | | 648,000 | | | 646,785 |

Surgery Center Holdings, Inc., Senior Secured First Lien, 7.67%

(1 mo. SOFR US + 2.75%), 12/19/2030 | | | 1,299,470 | | | 1,301,809 |

US Radiology Specialists, Inc., Senior Secured First Lien, 9.35%

(3 mo. SOFR US + 4.75%), 12/15/2027 | | | 525,744 | | | 527,058 |

| | | | | | 11,031,574 |

HEALTHCARE: LIFE SCIENCES - 1.2%

|

Avantor Funding, Inc., Senior Secured First Lien, 7.05% (1 mo. SOFR US + 2.00%), 11/08/2027 | | | 542,937 | | | 546,594 |

Cambrex Corp., Senior Secured First Lien, 8.55% (1 mo. SOFR US + 3.50%), 12/07/2026 | | | 274,149 | | | 272,949 |

Catalent Pharma Solutions, Inc., Senior Secured First Lien, 7.92% (1 mo. SOFR US + 3.00%), 02/22/2028 | | | 519,390 | | | 520,364 |

Curia Global, Inc., Senior Secured First Lien, 9.20% (3 mo. SOFR US + 3.75%), 08/28/2026 | | | 703,962 | | | 672,118 |

Phoenix Newco, Inc., Senior Secured First Lien, 7.85% (1 mo. SOFR US + 3.00%), 11/15/2028 | | | 589,622 | | | 590,403 |

Star Parent, Inc., Senior Secured First Lien, 9.08% (3 mo. SOFR US + 3.75%), 09/30/2030 | | | 816,149 | | | 795,288 |

| | | | | | 3,397,716 |

HEALTHCARE: MANAGED HEALTH CARE - 0.9%

|

Bella Holding Co. LLC, Senior Secured First Lien, 8.80% (1 mo. SOFR US + 3.75%), 05/10/2028 | | | 434,879 | | | 435,423 |

Charlotte Buyer, Inc., Senior Secured First Lien, 9.85% (1 mo. SOFR US + 4.75%), 02/11/2028 | | | 284,831 | | | 287,368 |

Cotiviti, Inc., Senior Secured First Lien, 8.45% (1 mo. SOFR US + 3.25%), 04/30/2031 | | | 1,651,700 | | | 1,652,732 |

| | | | | | 2,375,523 |

| | | | | | | |

| | | | | | | |