united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-08037

AdvisorOne Funds

(Exact name of registrant as specified in charter)

17605 Wright Street Suite 2, Omaha, NE 68130

(Address of principal executive offices) (Zip code)

Gemini Fund Services, LLC., 80 4221 North 203rd Street, Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 402-493-3313

Date of fiscal year end: 4/30

Date of reporting period: 10/31/20

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

Milestone Treasury Obligations Fund |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Semi-Annual Report |

| |

| |

| |

| |

| October 31, 2020 |

| |

| |

| |

| |

| |

| |

| |

| |

| ADVISOR |

| |

| Brinker Capital Investments, LLC |

| |

| |

| |

| |

| |

| |

| |

| Distributed by Northern Lights Distributors, LLC, Member FINRA |

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of Milestone Treasury Obligations Fund.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website advisoronefunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically or to continue receiving paper copies of shareholder reports, which are available free of charge, by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by following the instructions included with paper Fund documents that have been mailed to you.

| Milestone Treasury Obligations Fund |

| Letter to Our Shareholders |

| October 31, 2020 |

| |

Dear Investors:

During the six month period ended October 31, 2020, the Federal Reserve has kept short-term interest rates unchanged to combat the economic effects of the pandemic, leaving the current Fed Funds target to 0.00 percent -0.25 percent. During this time, the Milestone Treasury Obligations Fund remained focused on its conservative investment philosophy and management discipline.

The Milestone Treasury Obligations Fund Institutional class ended the six month period ended October 31, 2020 with a 30-day yield of 0.01 percent. We continue to expect the Federal Reserve to remain at this level of short-term interest rates until more information is available regarding economic and employment situations across the nation.

We are proud to provide this report, which highlights the results of our conservative, compliance-driven investment philosophy implemented in the Milestone Treasury Obligations Fund.

7467-NLD-12/1/2020

3234-CLS-12/1/2020

| Milestone Treasury Obligations Fund |

| PORTFOLIO SUMMARY (Unaudited) |

| October 31, 2020 |

| |

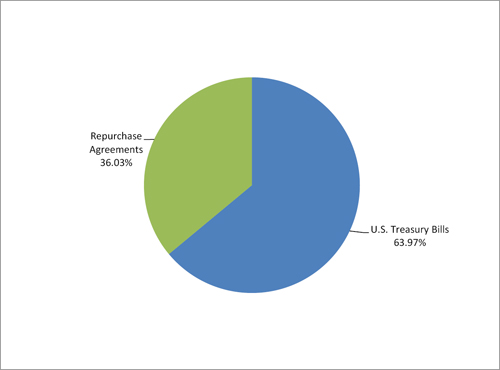

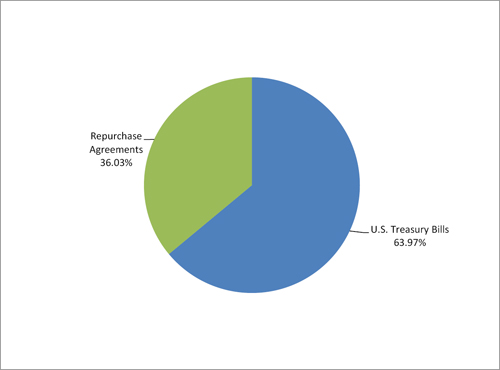

PORTFOLIO BREAKDOWN

All data is as of October 31, 2020. The Portfolio breakdown is expressed as a percentage of total investments and may vary over time.

Please refer to the Portfolio of Investments for a detailed listing of the Fund’s holdings.

| Milestone Treasury Obligations Fund |

| PORTFOLIO OF INVESTMENTS (Unaudited) |

| October 31, 2020 |

| | | Principal | | | Interest | | Maturity | | | | |

| | | Amount | | | Rate* | | Date | | | Fair Value | |

| U.S. Government Obligations - 63.95% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| U.S. Treasury Bills * - 63.95% | | | | | | | | | | | | | | |

| | | $ | 20,000,000 | | | 0.082% | | | 11/3/20 | | | $ | 19,999,908 | |

| | | | 10,000,000 | | | 0.077% | | | 11/10/20 | | | | 9,999,799 | |

| | | | 20,000,000 | | | 0.104-0.178% | | | 11/24/20 | | | | 19,998,147 | |

| | | | 10,000,000 | | | 0.097% | | | 11/27/20 | | | | 9,999,296 | |

| | | | 20,000,000 | | | 0.085% | | | 12/3/20 | | | | 19,998,445 | |

| | | | 10,000,000 | | | 0.120% | | | 1/7/21 | | | | 9,997,720 | |

| | | | 15,000,000 | | | 0.107% | | | 1/12/21 | | | | 14,996,775 | |

| | | | 20,000,000 | | | 0.091-0.109% | | | 2/2/21 | | | | 19,994,717 | |

| | | | 20,000,000 | | | 0.119-0.122% | | | 2/9/21 | | | | 19,993,264 | |

| | | | 10,000,000 | | | 0.115% | | | 2/16/21 | | | | 9,996,567 | |

| | | | | | | | | | | | | | | |

| Total U.S. Government Obligations (Cost $154,974,638) | | | | | | | 154,974,638 | |

| | | | | | | | | |

| Repurchase Agreements - 36.02% | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

BNP Paribas Securities Corp., dated 10/30/2020, repurchase price $30,000,000, value at maturity including interest earned $30,000,150 (Collateralized by: Short Term Trading Index: $3,359,300, 1.125%, 1/15/2021; aggregate market value plus accrued interest $4,011,464; U.S. Treasury Note: $22,725,500, 2.125 - 2.250%, 2/15/2021 - 11/30/2024; aggregate market value plus accrued interest $24,570,811; U.S. Treasury Bond: $1,257,400, 4.500 - 8.125%, 5/15/2021 - 5/15/2037; aggregate market value plus accrued interest $2,017,337. U.S; Treasury Bill: $400, 0.000%, 3/25/2021; aggregate market value plus accrued interest $400)

| | | | 30,000,000 | | | 0.060% | | 11/2/20 | | | 30,000,000 | |

| | | | | | | | | | | | | |

Societe Generale, dated 10/30/2020, repurchase price $30,000,000, value at maturity including interest earned $30,000,175 (Collateralized by: U.S. Treasury Inflationary Notes: $8,753,995, 0.000%, 11/15/2020 - 2/15/2043; aggregate market value plus accrued interest $6,348,725; U.S. Treasury Notes: $200, 0.500%, 4/30/2027 - 8/31/2027; aggregate market value plus accrued interest $199; U.S. Treasury Floating Rate Note: $100, 0.155%, 7/31/2022; aggregate market value plus accrued interest $100; Short Term Trading Index: $1,520,000, 0.125%, 7/15/2030; aggregate market value plus accrued interest $1,697,020; U.S. Treasury Principal Note: $35,152,700, 0.000%, 2/15/2040 - 2/15/2048; aggregate market value plus accrued interest $22,553,756; U.S. Treasury Bills: $200, 0.000%, 9/9/2021 - 10/7/2021; aggregate market value plus accrued interest $200)

| | | | 30,000,000 | | | 0.070% | | 11/2/20 | | | 30,000,000 | |

| | | | | | | | | | | | | |

Fixed Income Clearing Corporation, dated 10/30/2020, repurchase price $27,300,000, value at maturity including interest earned $27,300,137 (Collateralized by: U.S. Treasury Note: $26,032,000, 0.125%, 10/15/2025; aggregate market value plus accrued interest $27,846,079.)

| | | | 27,300,000 | | | 0.060% | | 11/2/20 | | | 27,300,000 | |

| | | | | | | | | | | | | |

| Total Repurchase Agreements (Cost $87,300,000) | | | | | 87,300,000 | |

| | | | | | | |

| Total Investments (Cost $242,274,638) - 99.97% | | | | $ | 242,274,638 | |

| Other Assets in Excess of Liabilities - Net - 0.03% | | | | | 69,510 | |

| Net Assets - 100.00% | | | | $ | 242,344,148 | |

| * | Interest rate shown is the discounted rate at time of purchase for U.S. Treasury Bills. |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

| October 31, 2020 |

| ASSETS | | | | |

| Investments, at value and cost | | $ | 154,974,638 | |

| Repurchase agreements, at value and cost | | | 87,300,000 | |

| Cash | | | 82,550 | |

| Receivable due from Adviser | | | 27,822 | |

| Interest receivable | | | 308 | |

| Prepaid expenses and other assets | | | 36,171 | |

| TOTAL ASSETS | | | 242,421,489 | |

| | | | | |

| LIABILITIES | | | | |

| Dividends payable | | | 679 | |

| Payable to related parties | | | 22,720 | |

| Accrued expenses and other liabilities | | | 53,942 | |

| TOTAL LIABILITIES | | | 77,341 | |

| NET ASSETS | | $ | 242,344,148 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid in capital | | $ | 242,339,693 | |

| Accumulated earnings | | | 4,455 | |

| NET ASSETS | | $ | 242,344,148 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| Investor Class Shares: | | | | |

| Net Assets | | $ | 68,623,906 | |

| Shares of beneficial interest outstanding | | | 68,592,986 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 1.00 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net Assets | | $ | 173,720,242 | |

| Shares of beneficial interest outstanding | | | 173,648,589 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 1.00 | |

| | | | | |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| STATEMENT OF OPERATIONS (Unaudited) |

| For the Six Months Ended October 31, 2020 |

| INVESTMENT INCOME | | | | |

| Interest | | $ | 224,309 | |

| TOTAL INVESTMENT INCOME | | | 224,309 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 138,204 | |

| Shareholder service fees: | | | | |

| Investor Class Shares | | | 4,815 | |

| Administrative services fees | | | 61,080 | |

| Transfer agent fees | | | 46,555 | |

| Trustees’ fees and expenses | | | 26,980 | |

| Registration fees | | | 21,957 | |

| Professional fees | | | 17,951 | |

| Custodian fees | | | 13,792 | |

| Insurance expense | | | 11,546 | |

| Printing and postage expenses | | | 10,330 | |

| Compliance officer fees | | | 5,889 | |

| Other expenses | | | 8,790 | |

| TOTAL EXPENSES | | | 367,889 | |

| | | | | |

| Less: Fees Waived and/or expense reimbursed by the advisor | | | (155,589 | ) |

| | | | | |

| NET EXPENSES | | | 212,300 | |

| NET INVESTMENT INCOME | | | 12,009 | |

| | | | | |

| REALIZED GAIN ON INVESTMENTS | | | | |

| Net realized gain from security transactions | | | 3,616 | |

| NET REALIZED GAIN ON INVESTMENTS | | | 3,616 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 15,625 | |

| | | | | |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | October 31, 2020 | | | April 30, 2020 | |

| | | (Unaudited) | | | | |

| INCREASE IN NET ASSETS FROM: | | | | | | | | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 12,009 | | | $ | 4,478,640 | |

| Net realized gain from security transactions | | | 3,616 | | | | 8,479 | |

| Net increase in net assets resulting from operations | | | 15,625 | | | | 4,487,119 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributions Paid | | | | | | | | |

| Investor Shares | | | (2,463 | ) | | | (1,135,161 | ) |

| Institutional Shares | | | (9,546 | ) | | | (3,346,132 | ) |

| Net decrease in net assets from distributions to shareholders | | | (12,009 | ) | | | (4,481,293 | ) |

| | | | | | | | | |

| TRANSACTIONS IN SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Investor Shares | | | 81,552,324 | | | | 174,940,397 | |

| Institutional Shares | | | 890,461,214 | | | | 2,174,203,752 | |

| Net asset value of shares issued in reinvestment of distributions: | | | | | | | | |

| Investor Shares | | | 2,464 | | | | 1,135,151 | |

| Institutional Shares | | | 853 | | | | 292,267 | |

| Payments for shares redeemed: | | | | | | | | |

| Investor Shares | | | (85,731,780 | ) | | | (174,626,140 | ) |

| Institutional Shares | | | (1,050,170,490 | ) | | | (2,070,861,067 | ) |

| Net increase (decrease) in net assets from shares of beneficial interest | | | (163,885,415 | ) | | | 105,084,360 | |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (163,881,799 | ) | | | 105,090,186 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 406,225,947 | | | | 301,135,761 | |

| End of period | | $ | 242,344,148 | | | $ | 406,225,947 | |

| | | | | | | | | |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| | | For the | | | For the | |

| | | Six Months Ended | | | Year Ended | |

| | | October 31, 2020 | | | April 30, 2020 | |

| | | (Unaudited) | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Investor Shares: | | | | | | | | |

| Shares Sold | | | 81,552,324 | | | | 174,940,397 | |

| Shares Reinvested | | | 2,464 | | | | 1,135,151 | |

| Shares Redeemed | | | (85,731,780 | ) | | | (174,626,140 | ) |

| Net increase (decrease) in shares of beneficial interest outstanding | | | (4,176,992 | ) | | | 1,449,408 | |

| | | | | | | | | |

| Institutional Shares: | | | | | | | | |

| Shares Sold | | | 890,461,214 | | | | 2,174,203,752 | |

| Shares Reinvested | | | 853 | | | | 292,267 | |

| Shares Redeemed | | | (1,050,170,490 | ) | | | (2,070,861,067 | ) |

| Net increase (decrease) in shares of beneficial interest outstanding | | | (159,708,423 | ) | | | 103,634,952 | |

| | | | | | | | | |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| FINANCIAL HIGHLIGHTS |

| | | Investor Class Shares | |

| | | Six Months | | | | | | | | | | | | | | | Five Months | | | | |

| | | Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Ended | | | Year Ended | |

| | | October 31, 2020 | | | April 30, 2020 | | | April 30, 2019 | | | April 30, 2018 | | | April 30, 2017 | | | April 30, 2016 | | | November 30, 2015 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.000 | (b) | | | 0.013 | | | | 0.017 | | | | 0.008 | | | | 0.003 | | | | 0.000 | (b) | | | 0.000 | (b) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.000 | ) (b) | | | (0.013 | ) | | | (0.017 | ) | | | (0.008 | ) | | | (0.003 | ) | | | (0.000 | ) (b) | | | (0.000 | ) (b) |

| Net realized gains | | | — | | | | (0.000 | ) (b) | | | — | | | | 0.000 | | | | (0.000 | ) (b) | | | (0.000 | ) (b) | | | — | |

| Total distributions | | | (0.000 | ) (b) | | | (0.013 | ) | | | (0.017 | ) | | | (0.008 | ) | | | (0.003 | ) | | | (0.000 | ) | | | (0.000 | ) |

| Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| Total return | | | 0.00 | % (g) | | | 1.34 | % | | | 1.74 | % | | | 0.84 | % | | | 0.24 | % | | | 0.04 | % (g) | | | 0.00 | % |

| Net assets, at end of period (000s) | | $ | 68,624 | | | $ | 72,800 | | | $ | 71,349 | | | $ | 23,458 | | | $ | 29,575 | | | $ | 19,973 | | | $ | 23,537 | |

| Ratio of gross expenses to average net assets (c) | | | 0.28 | % (f) | | | 0.44 | % | | | 0.47 | % | | | 0.32 | % | | | 0.19 | % | | | 0.43 | % (f) | | | 0.41 | % |

| Ratio of net expenses to average net assets | | | 0.15 | % (d)(f) | | | 0.42 | % (d) | | | 0.45 | % | | | 0.32 | % | | | 0.20 | % | | | 0.19 | % (f) | | | 0.09 | % (d) |

| Ratio of net investment income to average net assets | | | 0.01 | % (d)(f) | | | 1.33 | % | | | 1.78 | % | | | 0.82 | % | | | 0.26 | % | | | 0.12 | % (f) | | | 0.00 | % (e) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Amount represents less than $0.001 per share. |

| (c) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (d) | The advisor, Brinker Capital Investments, LLC, has agreed to waive additional fees in order to maintain a positive return. The additional waiver, 0.12% for the six months ended October 31, 2020, 0.01% for the year ended April 30, 2020, and 0.09% for the year ended November 30, 2015, decreased the net expense ratio. |

| (f) | Annualized for periods less than one year. |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| FINANCIAL HIGHLIGHTS |

| | | Institutional Class Shares | |

| | | Six Months | | | | | | | | | | | | | | | Five Months | | | | |

| | | Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Ended | | | Year Ended | |

| | | October 31, 2020 | | | April 30, 2020 | | | April 30, 2019 | | | April 30, 2018 | | | April 30, 2017 | | | April 30, 2016 | | | November 30, 2015 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.000 | (b) | | | 0.015 | | | | 0.020 | | | | 0.010 | | | | 0.002 | | | | 0.000 | (b) | | | 0.000 | (b) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.000 | ) (b) | | | (0.015 | ) | | | (0.020 | ) | | | (0.010 | ) | | | (0.002 | ) | | | (0.000 | ) (b) | | | (0.000 | ) (b) |

| Net realized gains | | | — | | | | (0.000 | ) (b) | | | — | | | | 0.000 | | | | (0.000 | ) (b) | | | (0.000 | ) (b) | | | — | |

| Total distributions | | | (0.000 | ) (b) | | | (0.015 | ) | | | (0.020 | ) | | | (0.010 | ) | | | (0.002 | ) | | | (0.000 | ) | | | (0.000 | ) |

| Net asset value, end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| Total return | | | 0.00 | % (g) | | | 1.58 | % | | | 1.99 | % | | | 0.97 | % | | | 0.24 | % | | | 0.04 | % (g) | | | 0.00 | % |

| Net assets, at end of period (000s) | | $ | 173,720 | | | $ | 333,426 | | | $ | 229,787 | | | $ | 290,693 | | | $ | 361,627 | | | $ | 322,688 | | | $ | 302,841 | |

| Ratio of gross expenses to average net assets (c) | | | 0.26 | % (f) | | | 0.22 | % | | | 0.22 | % | | | 0.22 | % | | | 0.19 | % | | | 0.28 | % (f) | | | 0.26 | % |

| Ratio of net expenses to average net assets | | | 0.15 | % (d)(f) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.19 | % (f) | | | 0.09 | % (d) |

| Ratio of net investment income to average net assets | | | 0.01 | % (d)(f) | | | 1.51 | % | | | 1.96 | % | | | 0.96 | % | | | 0.24 | % | | | 0.12 | % (f) | | | 0.00 | % (e) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Amount represents less than $0.001 per share. |

| (c) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the advisor. |

| (d) | The advisor, Brinker Capital Investments, LLC, has agreed to waive additional fees in order to maintain a positive return. The additional waiver, 0.05% for the six months ended October 31, 2020 and 0.09% for the year ended November 30, 2015, decreased the net expense ratio. |

| (f) | Annualized for periods less than one year. |

Refer to the Notes to Financial Statements in this report for further information regarding the values set forth above.

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

| October 31, 2020 |

The Milestone Treasury Obligations Fund (the “Fund”), formerly known as the Treasury Obligations Portfolio (“Predecessor Fund”), was reorganized into AdvisorOne Funds (the “Trust”) on January 23, 2012. The Fund is a diversified series of the Trust. The Trust was formed as a Delaware business trust in December 1996 and is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Predecessor Fund was a series of the Milestone Funds, a Delaware business trust formed on July 14, 1994. The Fund is authorized to issue an unlimited number of shares of beneficial interest without par value and offers two classes of shares: Investor Class Shares and Institutional Class Shares. The Fund is a money market fund that seeks to provide its shareholders with the maximum current income that is consistent with the preservation of capital and the maintenance of liquidity. Each share of the Fund’s two classes represents an undivided, proportionate interest in the Fund. All income, expenses (other than class specific expenses), and realized gains or losses are allocated daily to each class of shares based on the relative value of the shares of each class. The Fund’s class specific expenses include shareholder service fees. In addition, there are differences among the classes of shares with respect to the minimum investment required and voting rights affecting each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment companies accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standards Update (“ASU”) 2013-08.

Valuation of Securities – Securities in which the Fund invests may be valued at amortized cost. Under the amortized cost method, a portfolio instrument is valued at cost and any premium or discount is amortized to maturity. Amortization of premium and accretion of market discount are charged to income. Debt securities (other than short-term obligations) are valued each day by an independent pricing service approved by the Trust’s Board of Trustees (the “Board”) based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type, indications as to values from dealers, and general market conditions or market quotations from a major market maker in the securities.

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

The Fund may hold securities for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – The fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the advisor, the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor to make such a judgment include, but are not limited to, the following: only a bid price or an ask price is available; the spread between bid and ask prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to the Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private placements or non-traded securities are valued via inputs from the advisor based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of October 31, 2020 for the Fund’s investments measured at fair value:

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Government Obligations | | $ | — | | | $ | 154,974,638 | | | $ | — | | | $ | 154,974,638 | |

| Repurchase Agreements | | | — | | | | 87,300,000 | | | | — | | | | 87,300,000 | |

| Total Investments | | $ | — | | | $ | 242,274,638 | | | $ | — | | | $ | 242,274,638 | |

The Fund did not hold any Level 3 securities during the period.

Repurchase Agreements – The Fund may purchase securities from financial institutions subject to the seller’s agreement to repurchase and the Fund’s agreement to resell the securities at par. The advisor only enters into repurchase agreements with financial institutions that are primary dealers and deemed to be creditworthy by the advisor in accordance with procedures adopted by the Board. Securities purchased subject to repurchase agreements are maintained with a custodian of the Fund and must have, at all times, an aggregate market value plus accrued interest greater than or equal to the repurchase price. If the market value of the underlying securities falls below 102% of the value of the repurchase price, the Fund will require the seller to deposit additional collateral by the next business day. In the event that the seller under the agreement defaults on its repurchase obligation or fails to deposit sufficient collateral, the Fund has the contractual right, subject to the requirements of applicable bankruptcy and

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

insolvency laws, to sell the underlying securities and may claim any resulting loss from the seller.

Offsetting of Financial Assets and Derivative Liabilities – The following table presents the Fund’s liability derivatives available for offset, net of collateral pledged as of October 31, 2020:

| | | | | | | | | | | | Gross Amounts Not Offset in the Statement | | | | |

| Assets: | | | | | | | | | | | of Assets & Liabilities | | | | |

| | | | | | Gross Amounts | | | Net Amounts of | | | | | | | | | | |

| | | | | | Offset in the | | | Assets Presented in | | | | | | | | | | |

| | | Gross Amounts of | | | Statement of Assets | | | the Statement of | | | Financial | | | Cash Collateral | | | | |

| Description | | Recognized Assets | | | & Liabilities | | | Assets & Liabilities | | | Instruments | | | Received | | | Net Amount | |

| BNP Paribas Securities Corp. | | $ | 30,000,000 | (1) | | $ | — | | | $ | 30,000,000 | | | $ | (30,000,000 | ) | | $ | — | (2) | | $ | — | |

| Societe Generale | | | 30,000,000 | (1) | | | — | | | | 30,000,000 | | | | (30,000,000 | ) | | | — | (2) | | | — | |

| Fixed Income Clearing Corporation | | | 27,300,000 | (1) | | | — | | | | 27,300,000 | | | | (27,300,000 | ) | | | — | (2) | | | — | |

| Total | | $ | 87,300,000 | | | $ | — | | | $ | 87,300,000 | | | $ | (87,300,000 | ) | | $ | — | | | $ | — | |

| (1) | Repurchase Agreements at value as presented in the Portfolio of Investments. |

| (2) | The amount is limited to the derivative liability balance and, accordingly, does not include excess collateral pledged. |

Security Transactions – Security transactions are recorded on the trade date. Realized gains and losses are recorded on an identified cost basis. The cost of investments for federal income tax purposes at October 31, 2020 is the same as shown in the accompanying Portfolio of Investments.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds.

Federal Income Taxes – It is the Fund’s policy to comply with all sections of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income gains to its shareholders and therefore, no provision for federal income tax has been made.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years 2018-2020, or expected to be taken in the Fund’s 2021 tax returns. The Fund identified its major tax jurisdictions as U.S., Nebraska and foreign jurisdictions where the Fund made significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Interest Income and Dividends to Shareholders – Interest income is accrued as earned. Discounts and premiums on securities purchased are accreted and amortized over the lives of the respective securities. Dividends to shareholders from each class of the Fund’s net investment income are declared daily and distributed monthly. Net realized capital gains, unless offset by any available capital loss carry-forwards, are distributed at least annually. Net realized capital gains earned by the Fund are considered short-term gains for tax purposes. Distributions to shareholders for tax purposes were ordinary income.

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

| 3. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

The Trust, on behalf of the Fund, has entered into an investment advisory agreement with Brinker Capital Investments, LLC (the “Advisor”, formerly CLS Investments, LLC), a subsidiary of Orion Advisor Solutions Inc. As compensation for the services rendered, facilities furnished, and expenses borne by the Advisor, the Fund will pay the Advisor a fee accrued daily and paid monthly, at the annualized rate of 0.10% of the average daily net assets of the Fund. For the six months ended October 31, 2020, the Fund incurred $138,204 in advisory fees.

On September 24, 2020, CLS Investments, LLC (and its affiliates) and Brinker Capital, Inc. (“BCI”) were acquired by Orion Advisor Solutions, Inc. (“Orion”), a newly formed company controlled by funds affiliated with Genstar Capital Partners LLC and TA Associates (the “Change of Control Transaction”). Prior to the Change of Control Transaction, BCI was an unaffiliated registered investment adviser, wholly-owned by Brinker Capital Holdings, Inc., whose principal owner was Irwin Charles Widger. Immediately following the Change of Control Transaction, BCI merged into CLS, and the combined entity changed its name to Brinker Capital Investments, LLC, a Nebraska limited liability company. The Change of Control Transaction did not result in any changes to the Fund’s investment objectives, principal strategies or risks.

Pursuant to a written contract (the “Waiver Agreement”), the Advisor has agreed, at least until August 31, 2021, to waive a portion of its advisory fee and has agreed to reimburse the Fund for other expenses to the extent necessary so that the total expenses incurred by the Fund (excluding expenses relating to dividends on short sales, interest expense, indirect fees and expenses of underlying funds, and extraordinary or non-recurring expenses) do not exceed 0.45% per annum of Investor Class average daily net assets and 0.20% per annum for Institutional Class average daily net assets (the “Expense Limitation”).

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

If the Advisor waives any fee or reimburses any expense pursuant to the Waiver Agreement, and the Fund’s operating expenses attributable to Investor Class and Institutional Class shares are subsequently less than the Expense Limitation, the Advisor shall be entitled to reimbursement by the Fund for such waived fees or reimbursed expenses provided that such reimbursement does not cause the Fund’s expenses to exceed the lesser of the Expense Limitation in place at the time of the waiver or at the time of the reimbursement. If the operating expenses attributable to the Investor Class and Institutional Class shares subsequently exceed the Expense Limitation then in place or in place at time of waiver, the reimbursements shall be suspended. The Advisor may seek recoupment only for expenses waived or paid by it during the three years prior to such reimbursement. For the six months ended October 31, 2020, the Advisor waived fees/reimbursed expenses in the amount of $63,476 pursuant to the Waiver Agreement.

The following amounts are subject to recapture by the Fund until the following dates:

| April 30, 2021 | April 30, 2022 | April 30, 2023 |

| $71,035 | $50,283 | $52,160 |

The Advisor has agreed to waive additional fees in order to maintain a positive yield. This agreement may be terminated at any time. For the six month period ended October 31, 2020, the Advisor waived an additional:

| Investor | Institutional |

| $44,785 | $47,328 |

The Trust, on behalf of the Fund, has adopted a Shareholder Services Plan providing that the Trust may obtain the services of the Advisor and other qualified financial institutions to act as shareholder servicing agents for their customers. Under this plan, the Trust has authorized the Advisor to enter into agreements pursuant to which the shareholder servicing agents perform certain shareholder services.

For these services, the Fund pays servicing fees up to an annual rate of the average daily net assets as follows:

| | Shareholder |

| | Servicing |

| Share Class | Fees |

| Investor Class Shares | 0.25% |

| Institutional Class Shares | 0.10% |

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

The Fund pays the shareholder servicing agents these amounts with respect to shares owned by investors for which the shareholder servicing agents maintain a servicing relationship pursuant to the Shareholder Servicing Agreement.

For the six months ended October 31, 2020, the Fund’s Investor Class shares incurred shareholder servicing fees in the amount of $4,815.

Distributor

Northern Lights Distributors, LLC (the “Distributor”) serves as principal underwriter for each fund of the Trust and maintains all records required to be maintained pursuant to the Fund’s Shareholder Services Plan. For the six months ended October 31, 2020, there were no underwriting commissions paid for sales of shares.

Administration, Fund Accounting, Transfer Agent

Gemini Fund Services, LLC (“GFS”), an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to a separate servicing agreement with GFS, the Fund pays GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of GFS, and are not paid any fees directly by the Fund for serving in such capacities.

Blu Giant, LLC (“Blu Giant”)

Blu Giant, an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

Chief Compliance Officer

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of GFS and the Distributor, provides a chief compliance officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Trustee Fees

The Trust pays each Trustee of the Trust who is not an interested person a flat fee of $80,000 per year paid in quarterly installments. The Trust also reimburses the Trustees for travel and other expenses incurred in attending meetings of the Board. Officers of the Trust and Trustees who are interested persons of the Trust do not receive any direct compensation from the Trust.

| Milestone Treasury Obligations Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) (Unaudited) |

| October 31, 2020 |

| 4. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of distributions paid during the years ended April 30, 2020 and April 30, 2019 was as follows:

| | | Fiscal Year Ended | | | Fiscal Year Ended | |

| | | April 30, 2020 | | | April 30, 2019 | |

| Ordinary Income | | $ | 4,878,706 | | | $ | 6,308,235 | |

| Long-Term Capital Gain | | | — | | | | — | |

| Return of Capital | | | — | | | | — | |

| | | $ | 4,878,706 | | | $ | 6,308,235 | |

As of April 30, 2020, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation/ | | | Accumulated | |

| Income | | | Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | Earnings/(Deficits) | |

| $ | 10,196 | | | $ | — | | | $ | — | | | $ | — | | | $ | (9,357 | ) | | $ | — | | | $ | 839 | |

The difference between book basis and tax basis undistributed net investment income and other book tax differences due to accrued dividend payable.

At April 30, 2020, the Fund had utilized capital loss carryforwards as follows:

| Non-Expiring | | | Non-Expiring | | | | | | CLCF | |

| Short-Term | | | Long-Term | | | Total | | | Utilized | |

| $ | — | | | $ | — | | | $ | — | | | $ | 769 | |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. On November 17, 2020 notice was mailed to inform shareholders that the Board concluded that it is in the best interests of the Fund and its shareholders that the Fund cease operations. The Board determined to close the Fund and redeem all outstanding shares on December 15, 2020.

Management has determined that no other events or transactions occurred requiring adjustment or disclosure in the financial statements.

| Milestone Treasury Obligations Fund |

| EXPENSE EXAMPLE (Unaudited) |

| October 31, 2020 |

As a shareholder of the Fund, you incur ongoing costs, including advisory fees; administration fees; shareholder service fees (Investor Class); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2020 through October 31, 2020.

Actual Expenses

The “Actual” columns in the table below provide information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Hypothetical |

| | | | | | | Actual | | (5% return before expenses) |

| | | | | Beginning | | Ending | | Expenses | | Ending | | Expenses |

| | | Portfolio’s | | Account | | Account | | Paid | | Account | | Paid |

| | | Annualized | | Value | | Value | | During | | Value | | During |

| | | Expense Ratio | | 5/1/2020 | | 10/31/2020* | | Period** | | 10/31/2020* | | Period** |

| Milestone Treasury Obligations Fund: | | | | | | | | | | | | |

| Investor Class | | 0.15% | | $1,000.00 | | $1,000.00 | | $0.76 | | $1,024.45 | | $0.77 |

| Institutional Class | | 0.15% | | $1,000.00 | | $1,000.00 | | $0.76 | | $1,024.45 | | $0.77 |

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

| Milestone Treasury Obligations Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| October 31, 2020 |

At a video conference (the “Meeting”) of the Board of Trustees (the “Board” or the “Trustees”) of the AdvisorOne Funds (the “Trust”) held on July 16, 2020, the Board, including those Trustees who are not “interested persons” as that term is defined in the Investment Company Act of 1940, as revised (the “Independent Trustees”), considered the renewal of the Investment Advisory Agreement between the Trust and CLS Investments, LLC (“CLS”) on behalf of the CLS Global Diversified Equity Fund (“Global Diversified Equity”), CLS Growth and Income Fund (“Growth and Income”), CLS Global Aggressive Equity Fund (“Global Aggressive Equity”), CLS Flexible Income Fund (“Flexible Income”), and CLS Shelter Fund (“Shelter”), (collectively the “Core Funds”), and Milestone Treasury Obligations Fund (“Milestone”) (Core Funds and Milestone are collectively referred to herein as the “Funds”) (“Advisory Agreement”).

In considering an interim advisory agreement between the Trust, on behalf of the Funds, and CLS (the “Interim Advisory Agreement”) as permitted by Rule 15a-4 under the 1940 Act, and (ii) new advisory agreement (“New Advisory Agreement”), to take effect upon the later of shareholder approval or the completion of the Change of Control Transaction, and reaching their conclusions, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below. They also interviewed representatives of CLS and Brinker to confirm their understanding of the Change of Control Transaction. In their deliberations considering the New Advisory Agreement, the Trustees did not identify any one factor as all important, but rather considered these factors collectively, and each Trustee may have attributed different weights to the various factors. The Board, in their deliberations referred to the investment adviser as “CLS” acknowledging that upon completion of the Change of Control Transaction, the entity will be named Brinker Capital Investments, LLC.

Nature, Extent and Quality of Services. The Trustees discussed the credentials and experience of CLS personnel, noting that several members of the portfolio management team had advanced credentials including Chartered Financial Analyst, Chartered Market Technician, Certified Investment Management Analyst and Chartered Alternative Investment Analyst. The Trustees reviewed materials provided by Brinker that described the personnel, history, and capabilities of Brinker, and discussed how those resource could complement those of CLS. The Trustees expressed confidence in the current portfolio management team, citing the collaborative and open portfolio management process resulting in quality portfolio selection, analysis, and compliance monitoring. They observed that the resources of Brinker would be additive to those of CLS. The Trustees considered CLS’s investment management strategies including the Risk Budgeting methodology and the technical and fundamental factors used to manage the non-risk budgeted funds. The Trustees considered the financial stability and organizational resources that were available to CLS through its ownership structure and the additional talent and experience that would be gained by the merger of CLS and Brinker. The Trustees agreed that the nature and quality of services provided by CLS had been satisfactory, and that after the Change of Control Transaction, CLS would continue to have adequate investment, compliance and financial resources to successfully manage the Funds.

Performance. The Board reviewed information on the investment performance of each Fund versus its respective benchmark and peer group year to date through June 30, 2020. In connection with its most recent approval of the continuation of the Current Advisory Agreement in April 2020, the Board was provided with reports regarding each Fund’s performance over various time periods. The Trustees determined it was appropriate to rely on their review and deliberations of CLS’s performance at prior meetings, as supplemented in the current materials. In doing so, and in conjunction with CLS’s representation that the Funds’ strategies were not expected to change following the Change of Control Transaction, the Trustees determined that the performance of each Fund was reasonable.

| Milestone Treasury Obligations Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) (Continued) |

| October 31, 2020 |

Costs of Advisory Services, Profitability and Economies of Scale. With respect to the cost of advisory services, the Board considered that the investment advisory fee payable to CLS under the New Agreement was the same as the investment advisory fee payable to CLS under the Current Advisory Agreement and the expense caps under the expense limitation agreements would not change after the Change of Control Transaction. With respect to profitability of CLS and economies of scale, the Board considered CLS’s profitability and economies of scale from its management of the Funds when it most recently approved the continuation of the Current Advisory Agreement. The Board recognized that CLS’s overall profitability and economies of scale may change as a result of the Change of Control Transaction, but that CLS had represented to the Board that its profitability with respect to the Funds was unlikely to change, and CLS did not expect to realize any additional economies of scale as a result of the Change of Control Transaction. After discussion, it was the consensus of the Board that the fees paid by each Fund, and the profits realized by CLS, were not unreasonable and that it would not request any changes to the management fee structure at this time.

Conclusion. Having requested and received such information from CLS as the Board believed to be reasonably necessary to evaluate the terms of the New Advisory Agreement, and as assisted by the advice of independent counsel, the Board, including a majority of the Independent Trustees, determined that, with respect to the New Advisory Agreement, (a) the terms of the New Advisory Agreement are reasonable; (b) the Change of Control Transaction would not result in the imposition of an unfair burden on any of the Funds or their respective shareholders; and (c) the New Advisory Agreement was in the best interests of each Fund and its shareholders. They concluded that the Change of Control Transaction was not expected to have any negative impact on shareholders and could benefit shareholders if CLS is strengthened as a result of the Change of Control Transaction. Accordingly, the Board concluded to approve the New Advisory Agreement and recommend the New Advisory Agreement to shareholders for approval.

| Milestone Treasury Obligations Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) (Continued) |

| October 31, 2020 |

At a special meeting of shareholders of Milestone Treasury Obligations Fund held on November 13, 2020, shareholders of record as of the close of business on July 27, 2020, voted to approve the following proposal:

Proposal 1: To approve a new advisory agreement between the AdvisorOne Funds, on behalf of the Fund and CLS Investments, LLC.

| | | Shares | | | | | | | | | | | | | | | |

| | | Outstanding | | | Shares | | | Percentage | | | | | | | | | |

| | | As of Record | | | Present In | | | of Shares | | | | | | | | | |

| | | Date (July 27, | | | Person or | | | Present for | | | | | | | | | |

| Fund | | 2020) | | | By Proxy | | | Quorum | | Votes For | | | Votes Against | | | Abstain | |

| Milestone Treasury Obligations Fund | | | 260,161,843 | | | | 165,802,801 | | | 63.73% | | | 165,123,913 | | | | 231,862 | | | | 447,026 | |

| Advisor |

| Brinker Capital Investments, LLC |

| 17605 Wright Street |

| Omaha, NE 68130 |

| |

| Administrator |

| Gemini Fund Services, LLC |

| 80 Arkay Drive, Suite 110 |

| Hauppauge, NY 11788 |

| |

| Distributor |

| Northern Lights Distributors, LLC |

| 4221 North 203rd Street, Suite 100 |

| Elkhorn, NE 68022-3474 |

| 1-866-811-0225 |

| |

| Transfer Agent |

| Gemini Fund Services, LLC |

| 4221 North 203rd Street, Suite 100 |

| Elkhorn, NE 68022-3474 |

| 1-866-811-0225 |

| |

| Custodian |

| The Bank of New York Mellon |

| 225 Liberty Street |

| New York, NY 10286 |

| |

| Legal Counsel |

| Thompson Hine LLP |

| 41 South High Street, Suite 1700 |

| Columbus, OH 43215 |

| |

| Independent Registered Public Accounting Firm |

| Tait, Weller & Baker LLP |

| 50 South 16th Street, Suite 2900 |

| Philadelphia, PA 19102 |

This report is authorized for distribution only to current shareholders and to others who have received a copy of the Milestone Fund’s prospectus.

A description of the Fund’s proxy voting policies and procedures is available without charge and upon request by calling 1-866-811-0225 or by accessing the Securities and Exchange Commission’s (“Commission”) website at http://www.sec.gov.

Information regarding how the Fund voted proxies for portfolio securities, if applicable, during the most recent 12-month period ended June 30, is also available, without charge and upon request, by calling 1-866-811-0225 or accessing the Fund’s Form N-PX on the Commission’s website at http://www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the commission monthly on Form N-MFP. The Fund’s Form N-MFP is available on the Commission’s website at http://www.sec.gov.

Milestone Treasury Obligations Fund

4221 North 203rd Street, Suite 100

Elkhorn, NE 68022-3474

1-866-811-0225

Item 2. Code of Ethics. Not required for semi-annual reports.

Item 3. Audit Committee Financial Expert. Not required for semi-annual reports.

Item 4. Principal Accountant Fees and Services. Not required for semi-annual reports.

Item 5. Audit Committee of Listed Companies. Not applicable to open-end investment companies.

Item 6. Schedule of Investments. Schedule of investments in securities of unaffiliated issuers is included under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Funds. Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Funds. Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders. None

Item 11. Controls and Procedures.

(a) Based on an evaluation of the registrant’s disclosure controls and procedures as of a date within 90 days of filing date of this Form N-CSR, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s last fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. Not applicable to open-end investment companies.

Item 13. Exhibits.

(a)(1) Not required for semi-annual reports.

(a)(2) Certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 (and Item 11(a)(2) of Form N-CSR) are filed herewith..

(a)(3) Not applicable.

(b) Certifications required by Section 906 of the Sarbanes-Oxley Act of 2002 (and Item 11(b) of Form N-CSR) are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) AdvisorOne Funds.

By (Signature and Title)

/s/ Ryan Beach

Ryan Beach, Principal Executive Officer/President

Date 1/8/21

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)

/s/ Ryan Beach

Ryan Beach, Principal Executive Officer/ President

Date 1/8/21

By (Signature and Title)

/s/ Reid Peters

Reid Peters, Principal Financial Officer/Treasurer

Date 1/8/21