Focused on Our Future November 2021 Published: November 8, 2021

Moving FirstEnergy Forward EEI Financial Conference – Published November 8, 20212 We are a forward-thinking electric utility centered on integrity, powered by a diverse team of employees committed to making customers’ live brighter, the environment better and our communities stronger. Transformative Equity Raise of $3.4B at Blended Premium Valuation of 33x LTM P/E - $2.4B from FET LLC Minority Interest Sale (19.9%) and $1B Common Equity Issuance - Strengthens balance sheet and supports long-term growth - Eliminates all non-SIP/DRIP equity plans Increasing 2021-2025 Investment Plan to $17B - Represents ~15% increase, or ~$2.2B - Transmission increase of ~25%, or ~$1.4B - ~75% formula rate spend vs. ~65% previously Introducing 6-8% long-term annual EPS growth rate Projecting 13% FFO-to-Debt no later than 2024; targeting mid-teens thereafter 2022 Earnings guidance of $2.30-2.50/sh - Reflects Ohio settlement; baseline for EPS growth 2022 Investment Plan of $3.3B - ~15% increase vs. 2021 2022 Dividend of $1.56/sh; maintained at 2021 level - Subject to board approval

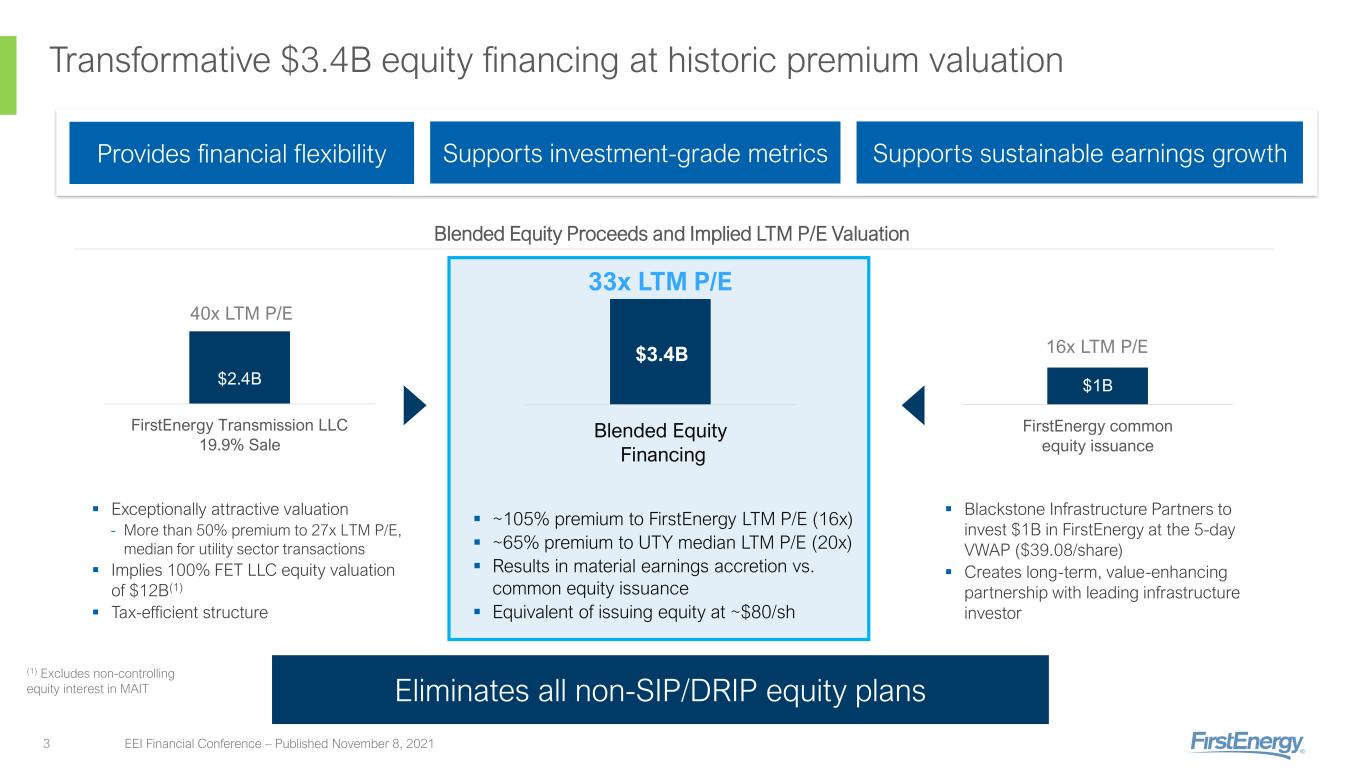

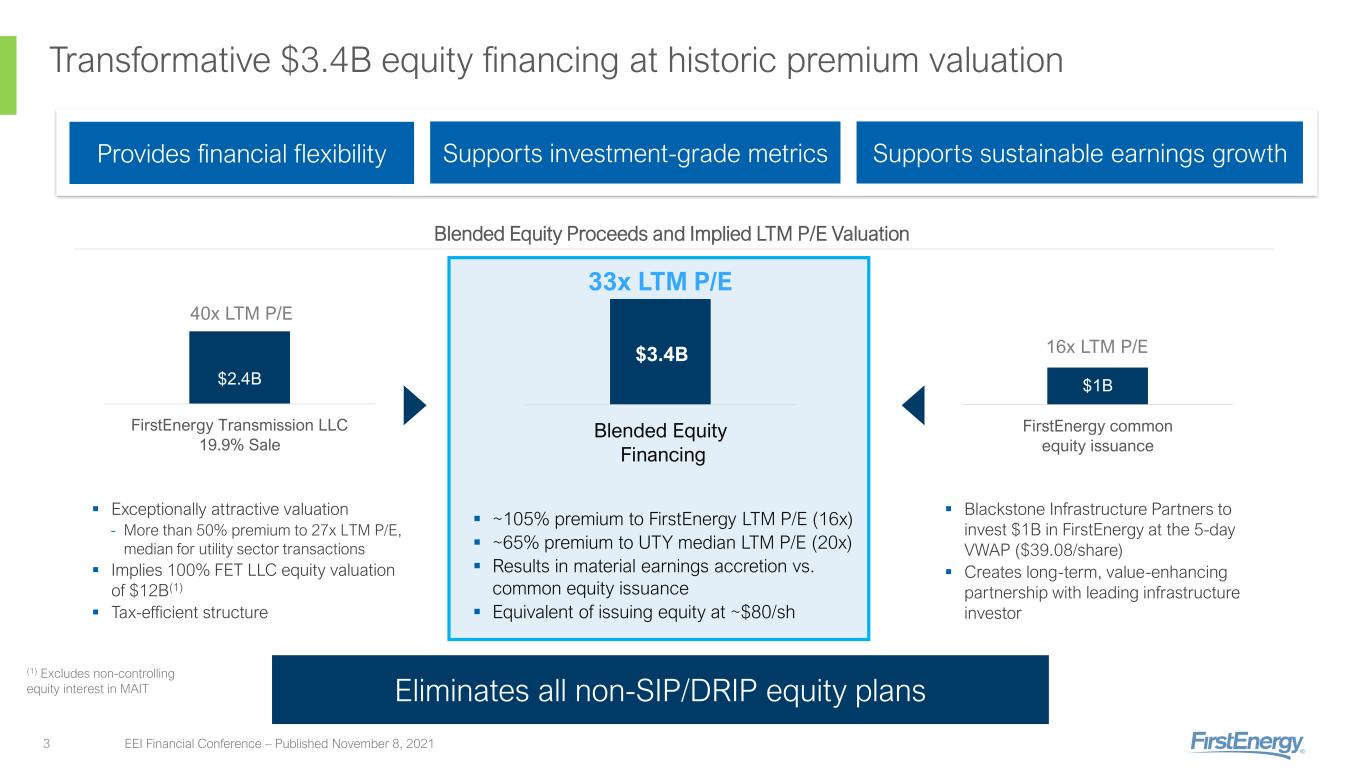

Transformative $3.4B equity financing at historic premium valuation EEI Financial Conference – Published November 8, 20213 Blended Equity Proceeds and Implied LTM P/E Valuation $2.4B FirstEnergy Transmission LLC 19.9% Sale FirstEnergy common equity issuance 40x LTM P/E 16x LTM P/E$3.4B Blended Equity Financing 33x LTM P/E ▪ Exceptionally attractive valuation - More than 50% premium to 27x LTM P/E, median for utility sector transactions ▪ Implies 100% FET LLC equity valuation of $12B(1) ▪ Tax-efficient structure ▪ Blackstone Infrastructure Partners to invest $1B in FirstEnergy at the 5-day VWAP ($39.08/share) ▪ Creates long-term, value-enhancing partnership with leading infrastructure investor ▪ ~105% premium to FirstEnergy LTM P/E (16x) ▪ ~65% premium to UTY median LTM P/E (20x) ▪ Results in material earnings accretion vs. common equity issuance ▪ Equivalent of issuing equity at ~$80/sh Eliminates all non-SIP/DRIP equity plans (1) Excludes non-controlling equity interest in MAIT $1B Supports investment-grade metricsProvides financial flexibility Supports sustainable earnings growth

FET Minority Interest Sale: Transaction Summary EEI Financial Conference – Published November 8, 20214 Topic Description Minority Investor ■ Brookfield Super-Core Infrastructure Partners – Part of one of the largest infrastructure portfolios in the world Purchase Price & Implied Valuation ■ All-cash investment of $2.4B for a 19.9% minority ownership interest in FET LLC – Implied 40x LTM P/E and 3x Firm Value / Rate Base – Values FET at $12B equity value and $19B firm value on a 100% basis Governance ■ Brookfield Super-Core Infrastructure Partners will receive certain minority governance rights commensurate with its 19.9% minority interest Required Approvals ■ Transaction is subject to FERC approval and CFIUS clearance Timeline ■ Expected transaction close in the first half of 2022; subject to regulatory approvals Use of Proceeds ■ Proceeds will be used to strengthen the balance sheet and to fund incremental growth opportunities that will drive the transition to a clean energy future

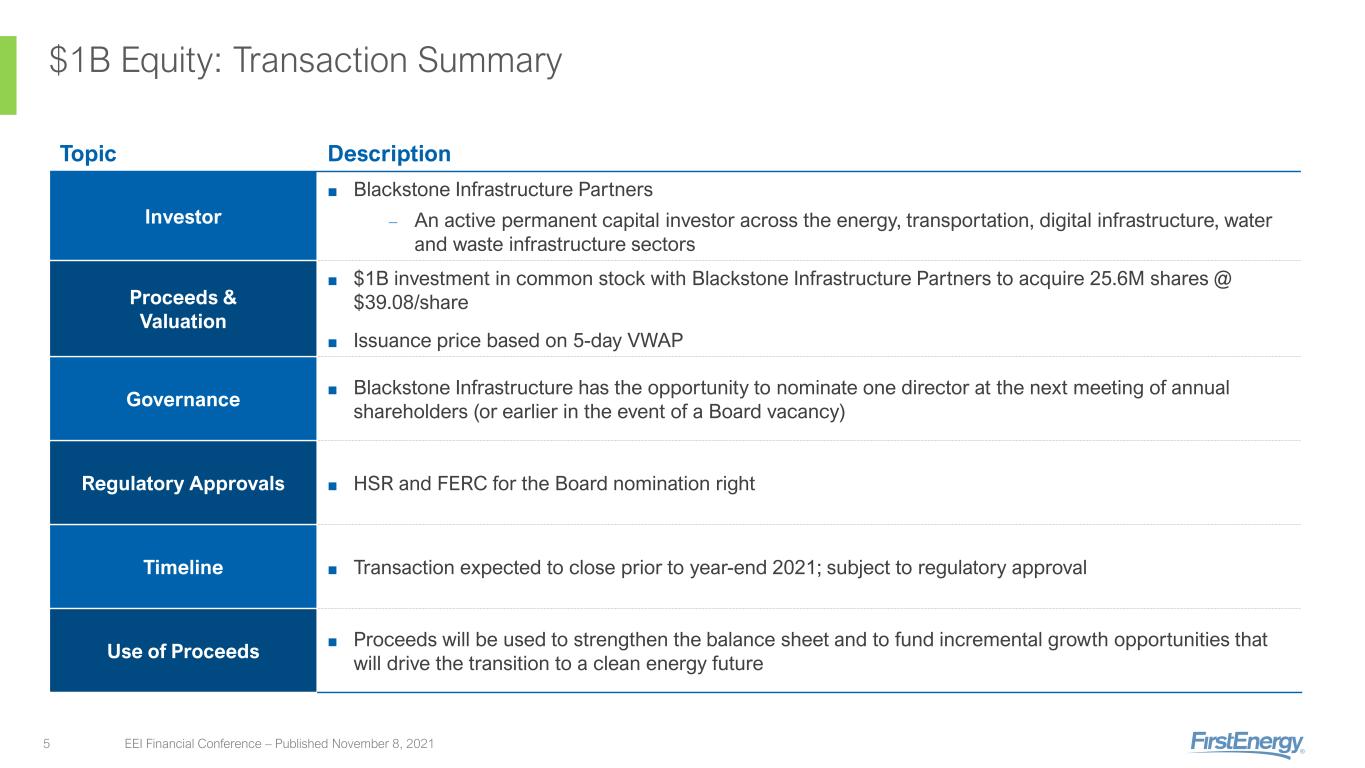

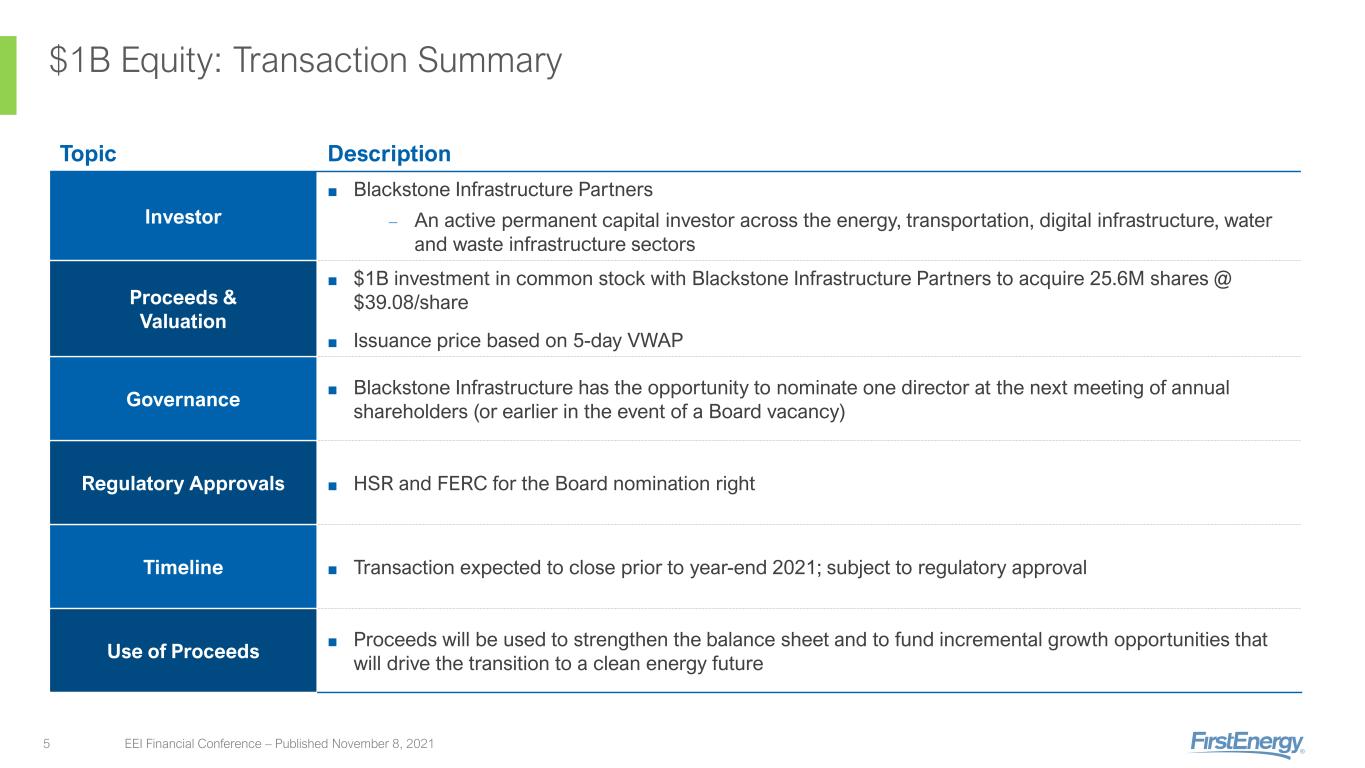

$1B Equity: Transaction Summary EEI Financial Conference – Published November 8, 20215 Topic Description Investor ■ Blackstone Infrastructure Partners – An active permanent capital investor across the energy, transportation, digital infrastructure, water and waste infrastructure sectors Proceeds & Valuation ■ $1B investment in common stock with Blackstone Infrastructure Partners to acquire 25.6M shares @ $39.08/share ■ Issuance price based on 5-day VWAP Governance ■ Blackstone Infrastructure has the opportunity to nominate one director at the next meeting of annual shareholders (or earlier in the event of a Board vacancy) Regulatory Approvals ■ HSR and FERC for the Board nomination right Timeline ■ Transaction expected to close prior to year-end 2021; subject to regulatory approval Use of Proceeds ■ Proceeds will be used to strengthen the balance sheet and to fund incremental growth opportunities that will drive the transition to a clean energy future

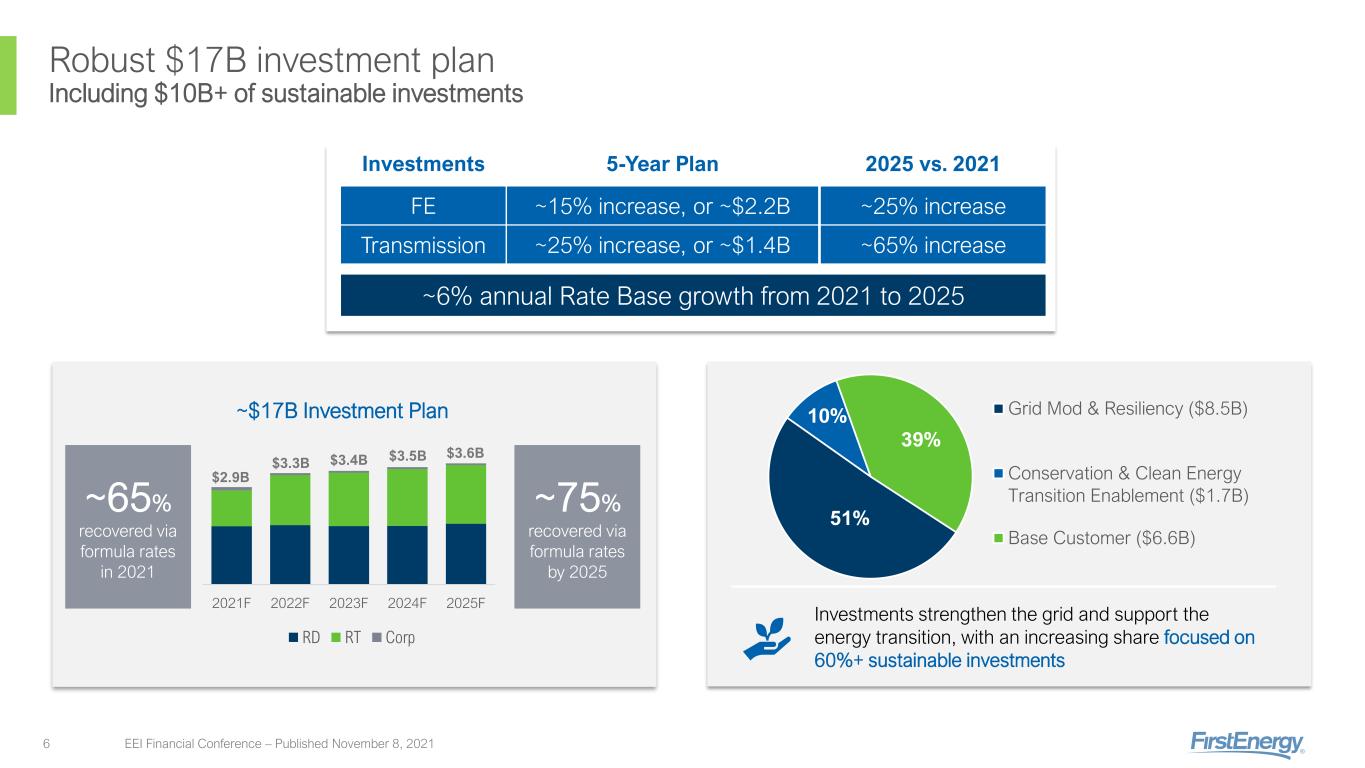

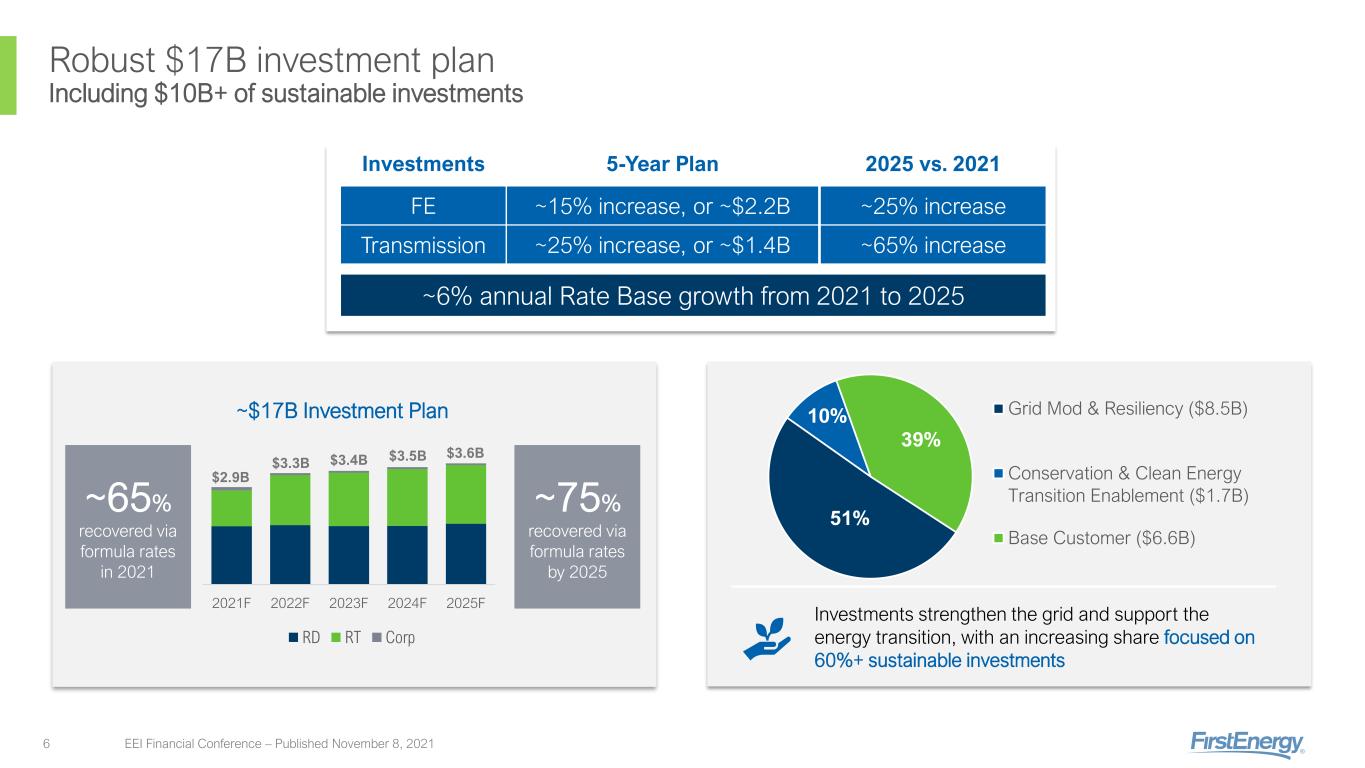

Robust $17B investment plan Including $10B+ of sustainable investments EEI Financial Conference – Published November 8, 20216 2021F 2022F 2023F 2024F 2025F RD RT Corp ~$17B Investment Plan ~75% recovered via formula rates by 2025 ~65% recovered via formula rates in 2021 51% 10% 39% Grid Mod & Resiliency ($8.5B) Conservation & Clean Energy Transition Enablement ($1.7B) Base Customer ($6.6B) Investments strengthen the grid and support the energy transition, with an increasing share focused on 60%+ sustainable investments ~6% annual Rate Base growth from 2021 to 2025 FE Transmission ~25% increase ~65% increase ~15% increase, or ~$2.2B ~25% increase, or ~$1.4B 5-Year Plan 2025 vs. 2021Investments $2.9B $3.3B $3.4B $3.5B $3.6B

Focused on achieving Investment-Grade ratings EEI Financial Conference – Published November 8, 20217 ▪ 6(1) new board members (5 independent) ▪ 6 external, experienced senior leaders GOVERNANCE, COMPLIANCE and DISCLOSURES FINANCIAL STRATEGY ▪ Robust internal investigation ▪ Continued cooperation with DOJ, SEC and FERC ▪ Remediated material weakness ▪ Constructive, unanimous Ohio settlement - Resolves 10 cases; subject to PUCO approval ▪ Limited political activity ▪ Committed to transparency & accountability ▪ Enhanced disclosures; targeting meaningful CPA-Zicklin score improvements ▪ Transformative equity raise which accelerates improvement in consolidated credit metrics through debt reduction ▪ Credit facilities restructuring strengthens subsidiary credit profiles ▪ Executing FE Forward; focused on optimizing O&M and capital efficiency ▪ Increasing cash flow and strengthening credit metrics ▪ Projecting 13% FFO-to-Debt no later than 2024; targeting mid-teens thereafter (1) One additional independent Board member anticipated to be elected in May 2022 (or earlier in the event of a Board vacancy) Committed to improving Governance & Compliance and strengthening our credit profile

Moving FirstEnergy Forward: Our Value Proposition EEI Financial Conference – Published November 8, 20218 Customer-focused, all electric regulated utility with geographic and regulatory diversity 6-8% annual EPS, 6% annual Rate Base growth and a sustainable dividend $17B investment program through 2025; targeting ~75% formula rate recoverable Significant long-term infrastructure growth opportunities: electrification, renewables integration, and grid reliability and resiliency Focused on customer satisfaction, reliability and affordability We remain uniquely positioned to offer a premium valuation proposition Building a diverse workforce with a world-class compliance function and a culture centered on integrity Proven track record of safety and operational excellence Our transformative and strategic financing plan along with FE Forward… Enables the strengthening of our credit profile Provides increased financial flexibility to fund investments Eliminates all non-SIP/DRIP equity plans

Investor Relations Contact Information EEI Financial Conference – Published November 8, 20219 Focused on our Future For our e-mail distribution list, please contact: Linda M. Foster, Executive Assistant to Vice President fosterl@firstenergycorp.com 330.384.2509 Shareholder Inquires: Shareholder Services (American Stock Transfer & Trust Company, LLC) firstenergy@amstock.com 1.800.736.3402 Irene M. Prezelj, Vice President prezelji@firstenergycorp.com 330.384.3859 Gina E. Caskey, Senior Advisor caskeyg@firstenergycorp.com 330.761.4185 Jake M. Mackin, Consultant mackinj@firstenergycorp.com 330.384.4829

Forward-Looking Statements EEI Financial Conference – Published November 8, 202110 This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan,” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from governmental investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into on July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations regarding House Bill 6, as passed by Ohio’s 133rd General Assembly, and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the potential of non compliance with debt covenants in our credit facilities; the risks and uncertainties associated with litigation, arbitration, mediation and similar proceedings; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, including the final approval by the Public Utilities Commission of Ohio (“PUCO”) of the Unanimous Stipulation and Recommendation filed by the Company and eleven other parties with the PUCO on November 1, 2021; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, maintaining financial flexibility, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, greenhouse gas reduction goals, controlling costs, improving our credit metrics, growing earnings, and strengthening our balance sheet, including the ability to complete the transactions contemplated by the recently announced agreements governing the sale of a minority interest in FirstEnergy Transmission, LLC and the common stock issuance on the anticipated terms and timing or at all, including the receipt of regulatory approvals; economic and weather conditions affecting future operating results, such as a recession, significant weather events and other natural disasters, and associated regulatory events or actions in response to such conditions; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; the extent and duration of the COVID-19 pandemic and the impacts to our business, operations and financial condition resulting from the outbreak of COVID-19, including, but not limited to, disruption of businesses in our territories and governmental and regulatory responses to the pandemic; the effectiveness of our pandemic and business continuity plans, the precautionary measures we are taking on behalf of our customers, contractors and employees, our customers’ ability to make their utility payment and the potential for supply-chain disruptions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, the impact of climate change or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions, including inflationary pressure, affecting us and/or our customers and those vendors with which we do business; the risks associated with cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy’s board of directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy’s filings with the SEC, including, but not limited to, the most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

Non-GAAP Financial Matters EEI Financial Conference – Published November 8, 202111 This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (loss), Operating earnings (loss) per share (EPS), Operating earnings (loss) per share (EPS) by segment, Free Cash Flow (FCF), Funds from Operations (FFO) and Adjusted Cash from Operations. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). Operating earnings (loss), Operating earnings (loss) per share, Operating earnings (loss) per share by segment, FCF and Adjusted Cash from Operations are not calculated in accordance with GAAP to the extent they exclude the impact of “special items.” Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. FE Management cannot estimate on a forward-looking basis the impact of these items in the context of Operating earnings per share guidance for 2022 and future annual projected earnings growth because these items, which could be significant are difficult to predict and may be highly variable. Consequently, the Company is unable to reconcile Operating earnings per share guidance for 2022 and future annual projected earnings growth to a GAAP measure without unreasonable effort. Basic (GAAP) EPS and Operating EPS and Basic (GAAP) EPS and Operating EPS for each segment are calculated by dividing Operating earnings (loss), which excludes special items as discussed above, by 545 million shares for 2021 and 573 million shares for 2022. Management uses non-GAAP financial measures such as Operating earnings (loss), Operating earnings (loss) per share, FCF, and Adjusted Cash from Operations to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating earnings (loss) per share by segment to further evaluate the Company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment, Free Cash Flow, and Adjusted Cash from Operations provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FE has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures.