SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials | | ¨ | | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

KEYNOTE SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

February 27, 2003

To Our Stockholders:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of Keynote Systems, Inc. to be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Tuesday, March 25, 2003 at 10:00 a.m., Pacific Time.

The matters expected to be acted upon at the meeting are described in detail in the following notice of the 2003 Annual Meeting of Stockholders and proxy statement.

It is important that you use this opportunity to take part in the affairs of Keynote Systems, Inc. by voting on the business to come before this meeting.Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

Sincerely,

Umang Gupta

Chairman of the Board and Chief Executive Officer

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

NOTICE OF THE 2003 ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2003 Annual Meeting of Stockholders of Keynote Systems, Inc. will be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Tuesday, March 25, 2003 at 10:00 a.m., Pacific Time, for the following purposes:

1. To elect directors, each to serve until his or her successor has been elected and qualified or until his or her earlier resignation or removal;

2. To approve amendments to the 1999 Equity Incentive Plan to eliminate the automatic annual increase in the number of shares reserved for issuance under the plan and to reduce the per employee share grant limitation;

3. To approve an amendment to the 1999 Employee Stock Purchase Plan to eliminate the automatic annual increase in the number of shares reserved for issuance under the plan;

4. To ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending September 30, 2003; and

5. To transact such other business as may properly come before the meeting or any adjournment.

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on February 27, 2003 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors,

John Flavio

Secretary

San Mateo, California

February 27, 2003

Whether or not you expect to attend the Annual Meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

TABLE OF CONTENTS

The Report of the Audit Committee, the Report of the Compensation Committee and the Stock Price Performance Graph contained in this proxy statement are required by the Securities and Exchange Commission. The information in these sections shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference into such filings. In addition, this information shall not otherwise be deemed to be “soliciting material” or to be filed under those Acts.

i

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

PROXY STATEMENT

FOR THE 2003 ANNUAL MEETING OF STOCKHOLDERS

February 27, 2003

The accompanying proxy is solicited on behalf of the board of directors of Keynote Systems, Inc., a Delaware corporation, for use at the 2003 Annual Meeting of Stockholders to be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Tuesday, March 25, 2003, at 10:00 a.m., Pacific Time. Only holders of record of our common stock at the close of business on February 27, 2003, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on the February 15, 2003, we had 22,805,071 shares of common stock outstanding and entitled to vote. All proxies will be voted in accordance with the instructions contained therein and, if no choice is specified, the proxies will be voted in favor of the nominees and the proposals presented in the accompanying notice of the Annual Meeting and this proxy statement. This proxy statement and the accompanying form of proxy were first mailed to stockholders on or about February 28, 2003. Our annual report and Form 10-K for the fiscal year ended September 30, 2002 are enclosed with this proxy statement.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the record date.

Vote Needed for a Quorum

A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority of the shares of our common stock entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business.

Vote Required to Approve the Proposals

With respect to Proposal No. 1, directors will be elected by a plurality of the votes of the shares of our common stock, present in person or represented by proxy at the Annual Meeting, and entitled to vote on the election of directors. Approval and adoption of each of Proposal No. 2 and Proposal No. 3 requires the affirmative vote of a majority of the shares of our common stock entitled to vote on the proposal that are present in person or represented by proxy at the Annual Meeting and are voted for or against the proposal. The effectiveness of any of the proposals is not conditioned upon the approval by our stockholders of any of the other proposals by the stockholders.

Effect of Abstentions

If stockholders abstain from voting, including brokers holding their customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the Annual Meeting. These shares will count toward determining whether or not a quorum is present. However, these shares will not be taken into account in determining the outcome of any of the proposals.

Effect of “Broker Non-Votes”

If a stockholder does not give a proxy to its broker with instructions as to how to vote the shares, the broker has authority under New York Stock Exchange rules to vote those shares for or against certain “routine” matters,

1

such as all of the proposals to be voted on at the Annual Meeting. If a broker votes shares that are unvoted by its customers for or against a proposal, these shares are considered present and entitled to vote at the Annual Meeting. These shares will count toward determining whether or not a quorum is present. These shares will also be taken into account in determining the outcome of all of the proposals.

Although all of the proposals to be voted on at the Annual Meeting are considered “routine,” where a matter is not “routine,” a broker generally would not be entitled to vote its customers’ unvoted shares. These shares would be considered present but are not considered entitled to vote on the matter. These shares would count toward determining whether or not a quorum is present. However, these shares would not be taken into account in determining the outcome of any of the proposals.

Adjournment of Meeting

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of the majority of the shares of common stock present in person or represented by proxy at the Annual Meeting.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies to be voted at the Annual Meeting. Following the original mailing of the proxies and other soliciting materials, we and/or our agents may also solicit proxies by mail, telephone, telegraph or in person. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders of our common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In these cases, we will reimburse the record holders for their reasonable expenses if they ask us to do so.

Revocability of Proxies

Any person signing a proxy in the form accompanying this proxy statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote. A proxy may be revoked by any of the following methods:

| | • | | a written instrument delivered to us stating that the proxy is revoked; |

| | • | | a subsequent proxy that is signed by the person who signed the earlier proxy and is presented at the Annual Meeting; or |

| | • | | attendance at the Annual Meeting and voting in person. |

Please note, however, that if a stockholder’s shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming the stockholder’s beneficial ownership of the shares.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, stockholders will elect each director to hold office until the next Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until such director’s earlier resignation or removal. The size of our board of directors is currently set at six members. Accordingly, six nominees will be elected at the Annual Meeting to be our directors. If any nominee for any reason is unable to serve, or for good cause will not serve, as a director, the proxies may be voted for a substitute nominee as the proxy holder may determine. We are not aware of any nominee who will be unable to or, for good cause, will not serve as a director.

Nominees for Board of Directors

The names of the nominees for election to our board of directors at the Annual Meeting, and information about each of them, are included below.

Name

| | Age

| | Principal Occupation

| | Director Since

|

Umang Gupta | | 53 | | Chairman of the Board and Chief Executive Officer, Keynote | | 1997 |

|

David Cowan | | 36 | | General Partner, Bessemer Venture Partners | | 1998 |

|

Stratton Sclavos | | 41 | | President, Chief Executive Officer and Director, VeriSign, Inc. | | 1999 |

|

Deborah Rieman | | 53 | | Retired President and Chief Executive Officer, Check Point Software Technologies Ltd. | | 2002 |

|

Mohan Gyani | | 50 | | Senior Advisor, Office of the Chairman and Chief Executive Officer, AT&T Wireless Mobility Services | | 2002 |

|

Geoffrey Penney | | 57 | | Executive Vice President and Chief Information Officer, Charles Schwab Corporation | | 2002 |

Umang Gupta has served as one of our directors since September 1997 and as our Chief Executive Officer and Chairman of the board since December 1997. Previously, he was a private investor and an advisor to high-technology companies. He was the founder and Chairman of the board and Chief Executive Officer of Centura Software Corporation, formerly known as Gupta Corporation, from 1984 to 1995. Prior to that he held various positions with Oracle Corporation and IBM. Mr. Gupta holds a B.S. degree in chemical engineering from the Indian Institute of Technology, Kanpur, India, and an M.B.A. degree from Kent State University.

David Cowanhas served as one of our directors since March 1998. Since August 1996, Mr. Cowan has served as a General Partner of Bessemer Venture Partners, a venture capital investment firm. Mr. Cowan is also a director of VeriSign, Inc. as well as of several private companies. Mr. Cowan holds an A.B. degree in mathematics and computer science and a M.B.A. degree from Harvard University.

Stratton Sclavoshas served as one of our directors since April 1999. Since July 1995, Mr. Sclavos has served as the President, Chief Executive Officer and a director of VeriSign, Inc. Mr. Sclavos is also a director of Juniper Networks, Inc., Intuit, Inc. and Marimba, Inc. Mr. Sclavos holds a B.S. degree in electrical and computer engineering from the University of California, Davis.

Deborah Riemanhas served as one of our directors since January 2002. Since June 1999, Dr. Rieman has managed a private investment fund. Since August 1999, Dr. Rieman has also served as an Entrepreneur-in-Residence with U.S. Venture Partners, a venture capital firm. From July 1995 to June 1999, Dr. Rieman was the President and Chief Executive Officer of Check Point Software Technologies Inc., an Internet security software

3

company. Dr. Rieman also serves as a director of Altera Corp., Corning Inc., Tumbleweed Communications Inc., and two private companies. Dr. Rieman holds a Ph.D. degree in mathematics from Columbia University and a B.A. degree in mathematics from Sarah Lawrence College.

Mohan Gyanihas served as one of our directors since January 2002. Since January 2003, Mr. Gyani has served as Senior Advisor, Office of the Chairman and Chief Executive Officer, of AT&T Wireless Mobility Services, a telecommunications company. He served from March 2000 to January 2003 as President and Chief Executive Officer and from January 2000 to March 2000 as Chief Financial Officer of AT&T Wireless Mobility Services. From October 1999 to December 1999, Mr. Gyani served as President and Chief Financial Officer of PeoplePC, Inc., a computer company. From June 1999 to September 1999, he served as the Head of Strategy and Corporate Development and a member of the board of directors of Vodafone AirTouch Plc, a mobile telecommunications network company. He served as Executive Vice President and Chief Financial Officer of AirTouch, a telecommunications company, from September 1995 to June 1999, prior to its merger with Vodafone. Mr. Gyani holds an M.B.A. degree and a B.A. degree in business administration from San Francisco State University.

Geoffrey Penneyhas served as one of our directors since July 2002. Since December 1998, Mr. Penney has served as Executive Vice President, and since November 2001, as Chief Information Officer, of the Charles Schwab Corporation, a financial services company. He served from February 1997 to December 1998 as Senior Vice President of Financial Products and International Technology of the Charles Schwab Corporation. From February 1994 to February 1997, Mr. Penney served as Senior Vice President of Fidelity Investments, a financial services company. Mr. Penney holds a Ph.D. degree and B.A. degree in inorganic chemistry from St. John’s College, Cambridge.

The Board Recommends a Vote FOR the Election of

Each of the Nominated Directors.

Board Meetings and Board Committees

Board Meetings

The board met four times, including telephone conference meetings, and acted two times by written consent, during the fiscal year ended September 30, 2002. No director, other than Mr. Sclavos, attended fewer than 75% of the total number of meetings held by the board and by all committees of the board on which such director served, during the period that such director served.

Board Committees

Our board of directors has a compensation committee and an audit committee. Our board does not have a nominating committee or a committee performing similar functions.

Compensation Committee. The current members of our compensation committee are Mr. Cowan and Dr. Rieman. The compensation committee reviews and makes recommendations to our board concerning salaries and incentive compensation for our officers and employees. The compensation committee also administers our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan. The compensation committee met two times during the fiscal year ended September 30, 2002.

Audit Committee. The current members of our audit committee are Mr. Gyani, Mr. Penney and Mr. Sclavos. Our audit committee reviews our financial statements, monitors our accounting policies and practices, makes recommendations to our board regarding the selection of independent auditors and reviews the results and scope of audits and other services provided by our independent auditors. The audit committee met four times during the fiscal year ended September 30, 2002.

4

Director Compensation

Cash Compensation. Our directors do not receive cash compensation for their services as directors, but are reimbursed for their reasonable expenses in attending board and board committee meetings.

Option Grants. Each non-employee director who was a member of our board on or before the date of our initial public offering was granted an option to purchase 50,000 shares at an exercise price equal to the fair market value of our common stock on the date of grant. Each new non-employee who becomes a director is automatically granted an option to purchase 50,000 shares of common stock under our 1999 Equity Incentive Plan on the date he or she becomes a director, at an exercise price to be equal to the fair market value of our common stock on the date of grant. The options have ten-year terms and terminate three months following the date the director ceases to be one of our directors or consultants or 12 months if the termination is due to death or disability. All options automatically granted to non-employee directors under the plan vest over three years. One-third of the shares subject to these options vest on the earlier of one-year following the director’s appointment to our board of directors or the first annual meeting of our stockholders following the grant of the option. The remaining shares subject to these options vest ratably monthly over the two years from the date on which shares first vest.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee has at any time since our formation been one of our officers or employees. None of our executive officers currently serves or in the past has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board or compensation committee.

5

PROPOSAL NO. 2

APPROVAL OF AMENDMENTS TO THE 1999 EQUITY INCENTIVE PLAN

Our stockholders are being asked to approve amendments to the 1999 Equity Incentive Plan:

| | • | | to eliminate the automatic annual increase in the number of shares reserved for issuance under the plan, from the current automatic increase, which is equal to 5% of our outstanding shares; and |

| | • | | to reduce the number of shares a person is eligible to receive in any calendar year to 2.0 million shares for new employees and 1.0 million for all other persons, from the current limitations of 4.5 million shares for new employees and 4.0 million shares for all other persons. |

The board believes that equity is an important component of employee compensation because it has the potential to increase in value over time, which we hope will create better performance incentives for our employees and will maximize the value of our common stock for our stockholders. The board is recommending these amendments to the plan because it believes that the elimination of the automatic annual increase and the reduced limitation on share grants will allow us to continue to attract and retain key personnel and to compensate them appropriately, while enabling us to reduce the potential amount of dilution experienced by our stockholders as a result of share grants.

Section 162(m) of the Internal Revenue Code limits our tax deduction in any taxable year to $1.0 million for compensation paid to our Chief Executive Officer and each of our four other most highly compensated executive officers. Compensation includes salary as well as any gains realized upon exercise of stock options granted under the plan. However, we may take a deduction for all such compensation that qualifies as “performance-based” compensation, even if it exceeds $1.0 million. For options to qualify as “performance-based” under Section 162(m), among other things, our stockholders must approve the material terms of the plan, such as the limitation on the number of shares a person is eligible to receive in any calendar year, as described above. Our board of directors adopted the plan in June 1999 and our stockholders approved the material terms of the plan, as amended, most recently in September 1999. Historically, we have taken a tax deduction for compensation attributable to options pursuant to this exception.

The board is not proposing any other amendments to the plan. If Proposal No. 2 is not approved, the current automatic annual increase of 5% of our outstanding shares will remain in effect and the current per employee share grant limitation of 4.5 million for new employees and 4.0 million shares for all other persons in any calendar year will continue to apply.

Terms of the 1999 Equity Incentive Plan

Term of the Plan. The plan became effective on September 24, 1999. The plan will terminate 10 years from the date the plan was adopted by our board, unless it is terminated earlier under the terms of the plan.

Administration of the Plan. The plan is administered by our compensation committee, all of the members of which are “non-employee directors” under applicable federal securities laws and “outside directors” as defined under applicable federal tax laws. Except for the automatic option grants to non-employee directors described above under Proposal No. 1 in the section “Director Compensation,” the compensation committee has the authority to construe and interpret the plan, grant awards and make all other determinations necessary or advisable for the administration of the plan, and its decisions are final and binding. Grants of options to non-officer employees to purchase 40,000 or fewer shares of our common stock can be authorized by our Chief Executive Officer and ratified by our compensation committee.

Shares Reserved Under the Plan. The board initially reserved 5,000,000 shares of common stock available for issuance under this plan. In addition, upon the date of our initial public offering on September 24, 1999, a

6

total of 38,037 additional shares previously reserved for grant under our 1996 Stock Option Plan and 1999 Stock Option Plan became available for grant under the plan. Shares will again be available for grant and issuance under the plan that:

| | • | | are subject to issuance upon exercise of an option granted under the plan that cease to be subject to the option for any reason other than exercise of the option; |

| | • | | have been issued upon the exercise of an option granted under the plan that are subsequently forfeited or repurchased by us at the original exercise price; or |

| | • | | are subject to an award granted pursuant to a restricted stock purchase agreement under the plan that are subsequently forfeited or repurchased by us at the original purchase price. |

In addition, on January 1 of each year, the total number of shares reserved for issuance under the plan increases automatically by a number of shares equal to 5% of our outstanding shares on December 31 of the preceding year. As of February 15, 2003, there were 5,170,001 shares available for issuance under the plan. If Proposal No. 2 is approved by our stockholders, there will be no additional automatic annual increases in the future.

Eligibility to Participate. The plan authorizes the award of stock options, restricted stock awards and stock bonuses. These may be granted to our employees, officers, directors, consultants, independent contractors and advisors. As of February 15, 2003, approximately 208 persons were eligible to participate in the plan. If we are dissolved, liquidated or have a “change in control” transaction, outstanding awards may be assumed or substituted by the successor corporation, if any. In the discretion of the compensation committee, the vesting of these awards may accelerate upon one of these transactions.

Stock Options. The plan provides for the grant of incentive stock options that qualify under Section 422 of the Internal Revenue Code and nonstatutory stock options. Incentive stock options may be granted only to our employees or employees of a parent or subsidiary of us. The exercise price of incentive stock options must be at least equal to the fair market value of our common stock on the date of grant. The exercise price of incentive stock options granted to 10% stockholders must be at least equal to 110% of the fair market value of our common stock on the date of grant. The exercise price of nonstatutory stock options must be at least equal to 85% of the fair market value of our common stock on the date of grant. The maximum term of options granted under the plan is 10 years.

Options may be exercised during the lifetime of the optionee only by the optionee. The compensation committee could provide for differing provisions in individual award agreements, but only with respect to awards that are not incentive stock options. Options granted under the plan generally may be exercised for a period of time after the termination of the optionee’s service to us. Options will generally terminate three months after the termination of employment or 12 months if the termination is due to death or disability.

Restricted Stock and Stock Bonuses. The plan authorizes the grant of restricted stock and stock bonus awards either in addition to or in lieu of other awards under the plan, under the terms, conditions and restrictions as the compensation committee may provide. They may be issued for past services or may be awarded upon the completion of certain services or performance goals.

Amendments to the Plan. The board may at any time terminate or amend the plan in any respect. The Board will not, without stockholder approval, amend the plan in any manner that requires the approval of our stockholders.

Federal Income Tax Information. The following is a general summary as of the date of this proxy statement of the United States federal income tax consequences to us and employees participating in the plan. Federal tax laws may change and the federal, state and local tax consequences for any participating employee will depend upon his or her individual circumstances. Each participating employee has been and

7

is encouraged to seek the advice of a qualified tax advisor regarding the tax consequences of participation in the plan. The following discussion does not purport to describe state or local income tax consequences or tax consequences for employees in countries other than the United States.

Options granted under the plan may be either incentive stock options that satisfy the requirements of Section 422 of the Internal Revenue Code or nonstatutory stock options that are not intended to meet these requirements.

Tax Treatment for Employees—Incentive Stock Options. An employee will not recognize income for federal income tax purposes upon grant of an incentive stock option and will incur no tax upon exercise of an incentive stock option unless the employee is subject to the alternative minimum tax.

If the employee holds the shares purchased upon exercise of the incentive stock option for more than one year after the date the option was exercised and for more than two years after the option grant date, the employee generally will realize long-term capital gain or loss (rather than ordinary income or loss) upon disposition of such shares. This gain or loss will be equal to the difference between the amount realized upon such disposition and the amount paid for such shares. If the employee disposes of the shares prior to the expiration of either the one-year or the two-year required holding periods described above (which is referred to as a “disqualifying disposition”), then the gain realized upon such disposition, up to the difference between the option exercise price and the fair market value of such shares on the date of exercise (or, if less, the amount realized on a sale of such shares), will be treated as ordinary income. Any additional gain will be capital gain, depending upon the amount of time the shares were held by the employee.

The difference between the exercise price and fair market value of the shares on the date of exercise is an adjustment to income for purposes of the alternative minimum tax, or AMT. The AMT (which is imposed to the extent it exceeds the taxpayer’s regular tax) is currently 26% of an individual taxpayer’s alternative minimum taxable income (28% percent in the case of alternative minimum taxable income in excess of $175,000). Alternative minimum taxable income is determined by adjusting regular taxable income for certain items, increasing that income by certain tax preference items and reducing this amount by the applicable exemption amount ($45,000 in the case of a joint return, subject to reduction under certain circumstances). If a disqualifying disposition of the shares occurs in the same taxable year of the employee as exercise of the incentive stock option, there is no AMT adjustment with respect to those shares. Also, upon a sale of the shares that is either (i) not a disqualifying disposition or (ii) a disqualifying disposition in a calendar year other than the year of exercise, alternative minimum taxable income is reduced in the year of sale by the excess of the fair market value of the shares at exercise over the amount paid for the shares.

Tax Treatment for Employees—Nonstatutory Stock Options. An employee will not recognize income for federal income tax purposes at the time a nonstatutory stock option is granted. However, upon exercise of a nonstatutory stock option, the employee must include in income as compensation an amount equal to the difference between the fair market value of the shares on the date of exercise and the employee’s purchase price. The included amount must be treated as ordinary income by the employee and may be subject to income tax withholding by us (either by payment in cash or withholding out of the employee’s salary). Upon resale of the shares by the employee, any subsequent appreciation or depreciation in the value of the shares will be treated as long-term or short-term capital gain or loss.

Tax Treatment for Keynote. We will be entitled to a deduction in connection with the disposition of shares acquired under an incentive stock option only to the extent that the employee recognizes ordinary income on a disqualifying disposition of the shares. We will be entitled to a deduction in connection with the exercise of a nonstatutory stock option by an employee to the extent that the employee recognizes ordinary income.

8

Maximum Tax Rates. The maximum rate applicable to ordinary income is 39.1%. Long-term capital gain on stock held for more than twelve months will be taxed at a maximum rate of 20%. Capital gains will continue to be offset by capital losses and up to $3,000 of capital losses may be offset annually against ordinary income.

ERISA Information. The plan is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974.

History of Grants. Please see the section “History of Grants Under the Plans” under Proposal No. 3 for a description of the options granted under our 1999 Equity Incentive Plan and our 1999 Employee Stock Purchase Plan over the life of these plans, through February 15, 2003, to our Chief Executive Officer, our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2002, our current executive officers as a group, our current non-employee directors as a group and our current employees (excluding executive officers and directors) as a group.

The Board Recommends a Vote FOR the Approval of Amendments to

the 1999 Equity Incentive Plan.

9

PROPOSAL NO. 3

APPROVAL OF AN AMENDMENT TO THE 1999 EMPLOYEE STOCK PURCHASE PLAN

Our stockholders are being asked to approve an amendment to the 1999 Employee Stock Purchase Plan to eliminate the automatic annual increase in the number of shares reserved for issuance under the plan, from the current automatic increase, which is equal to 1% of our outstanding shares.

As discussed above under Proposal No. 2, the board believes that equity is an important component of employee compensation. The board is recommending this amendment to the plan because it believes that the elimination of the automatic annual increase will allow us to continue to attract and retain key personnel and to compensate them appropriately, while enabling us to reduce the potential amount of dilution experienced by our stockholders as a result of share grants.

The board is not proposing any other amendments to the plan. If Proposal No. 3 is not approved, the current automatic annual increase of 1% of our outstanding shares will remain in effect.

Terms of the 1999 Employee Stock Purchase Plan

The plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code.

Term of the Plan. The plan became effective on September 24, 1999. The plan will terminate 10 years from the date the plan was adopted by our board, unless it is terminated earlier under the terms of the plan.

Administration of the Plan. The plan is administered by our compensation committee. Our compensation committee has the authority to construe and interpret the plan, and its decisions are final and binding.

Shares Reserved Under the Plan. The board of directors initially reserved 400,000 shares of common stock under this plan. In addition, on January 1 of each year, the total number of shares reserved for issuance under the plan increases automatically by a number of shares equal to 1% of our outstanding shares on December 31 of the preceding year. As of February 15, 2003, there were 1,028,624 shares available for issuance under the plan. If Proposal No. 3 is approved by our stockholders, there will be no additional automatic annual increases in the future. The aggregate number of shares reserved for issuance under the plan may not exceed 4,000,000.

Eligibility to Participate. Employees generally are eligible to participate in the plan if they are employed 10 days before the beginning of the applicable offering period and they are customarily employed by us for more than 20 hours per week and more than five months in a calendar year and are not, and would not become as a result of being granted an option under the plan, 5% stockholders of us. Participation in the plan ends automatically upon termination of employment for any reason. As of February 15, 2003, approximately 202 persons were eligible to participate in the plan.

How Purchases are Made. Under the plan, eligible employees are permitted to acquire shares of our common stock through payroll deductions. Eligible employees may select a rate of payroll deduction between 2% and 10% of their compensation and are subject to maximum purchase limitations. Each offering period under the plan is for two years and consists of four six-month purchase periods. Offering periods and purchase periods begin on February 1 and August 1 of each year.

The plan provides that, in the event of our proposed dissolution or liquidation, each offering period that commenced prior to the closing of the proposed event shall continue for the duration of the offering period, provided that the compensation committee may fix a different date for termination of the plan. The purchase price for our common stock purchased under the plan is 85% of the lesser of the fair market value of our

10

common stock on the first or last day of the applicable offering period. The compensation committee has the power to change the duration of offering periods without stockholder approval, if the change is announced at least 15 days prior to the beginning of the affected offering period.

Amendments to the Plan. The board may at any time amend, terminate or extend the plan. However, a termination cannot affect options previously granted under the plan and an amendment cannot result in a change to an option previously granted under the plan that adversely affects the right of a participant in the plan. Stockholder approval is required for an amendment to increase the number of shares that may be issued or to change the terms of eligibility under the plan. The board may make amendments to the plan as it determines to be advisable if the financial accounting treatment for the plan is different from the financial accounting treatment in effect on the date the plan was adopted by the board.

Federal Income Tax Information. The following is a general summary as of the date of this proxy statement of the United States federal income tax consequences to us and employees participating in the plan. Federal tax laws may change and the federal, state and local tax consequences for any participating employee will depend upon his or her individual circumstances. Each participating employee has been and is encouraged to seek the advice of a qualified tax advisor regarding the tax consequences of participation in the plan. The following discussion does not purport to describe state or local income tax consequences or tax consequences for employees in countries other than the United States.

Tax Treatment for Employees. An employee will not recognize income for federal income tax purposes either upon enrollment in the plan or upon the purchase of shares. All tax consequences are deferred until an employee sells the shares, disposes of the shares by gift, ceases to be employed by us more than three months before the exercise of a purchase right or dies. Payroll deductions, however, remain fully taxable as ordinary income at the time the deduction is taken, and there is no deferral of the ordinary income assessed on these amounts.

If the shares are held for more than one year after the date of purchase and more than two years from the beginning of the applicable offering period, or if the employee dies while owning the shares, the employee realizes ordinary income on a sale, or a disposition by way of gift or upon death, to the extent of the lesser of: (a) 15% of the fair market value of our common stock at the beginning of the offering period; or (b) the actual gain, the amount by which the fair market value of the shares on the date of sale, gift or death exceeds the purchase price. All additional gain upon the sale of shares is treated as capital gain. If the shares are sold and the sale price is less than the purchase price, there is no ordinary income and the employee has a capital loss for the difference between the sale price and the purchase price.

If the shares are sold or are otherwise disposed of including by way of gift, but not death, bequest or inheritance prior to the expiration of either of the one-year or the two-year required holding periods described above (which is referred to as a “disqualifying disposition”), the employee realizes ordinary income at the time of sale or other disposition, taxable to the extent that the fair market value of our common stock at the date of purchase is greater than the purchase price. This excess will constitute ordinary income, not currently subject to withholding, in the year of the sale or other disposition even if no gain is realized on the sale or if a gratuitous transfer is made. The difference, if any, between the proceeds of sale and the aggregate fair market value of our common stock at the date of purchase is a capital gain or loss.

Tax Treatment for Keynote. We will be entitled to a deduction in connection with the disposition of shares acquired under the plan only to the extent that the employee recognizes ordinary income on a disqualifying disposition of the shares.

Maximum Tax Rates. The maximum rate applicable to ordinary income is 39.1%. Long-term capital gain on stock held for more than twelve months will be taxed at a maximum rate of 20%. Capital gains will continue to be offset by capital losses and up to $3,000 of capital losses may be offset annually against ordinary income.

11

ERISA Information. The plan is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974.

History of Grants Under the Plans

Our Chief Executive Officer and four other most highly compensated executive officers who were serving as executive officers as of September 30, 2002 have been granted options to purchase shares under the 1999 Equity Incentive Plan and the 1999 Employee Stock Purchase Plan, over the life of these plans through February 15, 2003, as follows:

| | | Number of Shares

|

Name and Position

| | 1999 Equity Incentive Plan

| | 1999 Employee Stock Purchase Plan

|

Umang Gupta Chief Executive Officer | | 1,600,000 | | — |

|

John Flavio Senior Vice President of Finance and Chief Financial Officer | | 175,000 | | 4,490 |

|

Lloyd Taylor Vice President of Operations | | 178,500 | | 3,117 |

|

Donald Aoki Vice President of Engineering | | 200,000 | | 8,316 |

|

Richard Rudolph Vice President of Worldwide Sales | | 150,000 | | 4,883 |

Our current executive officers as a group, our current non-employee directors as a group and our current employees (excluding executive officers and directors) as a group have been granted options to purchase shares under the 1999 Equity Incentive Plan and the 1999 Employee Stock Purchase Plan, over the life of these plans through February 15, 2003, as follows:

| | | Number of Shares

|

| | | 1999 Equity Incentive Plan

| | 1999 Employee Stock Purchase Plan

|

Current executive officers (6 persons) | | 2,453,500 | | 19,608 |

Current non-employee directors (5 persons) | | 250,000 | | — |

Current employees (excluding executive officers and non-employee directors) | | 3,485,134 | | 374,880 |

The Board Recommends a Vote FOR the Approval of an Amendment to

the 1999 Employee Stock Purchase Plan.

12

EQUITY COMPENSATION PLANS

As of September 30, 2002, we maintained our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan, both of which were approved by our stockholders. Our 1996 Stock Option Plan and our 1999 Stock Option Plan, both of which were terminated in connection with our initial public offering in September 1999, were also approved by our stockholders. The following table gives information about equity awards under those plans as of September 30, 2002:

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of Shares to be Issued Upon Exercise of Outstanding Options

| | Weighted-Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for Equity Compensation Plans (Excluding Shares Reflected in Column (a))

| |

Equity compensation plans approved by stockholders | | 6,380,996 | | $ | 12.58 | | 4,591,567 | (1) |

Equity compensation plans not approved by stockholders(2) | | — | | | — | | — | |

| | |

| |

|

| |

|

|

Total | | 6,380,996 | | $ | 12.58 | | 4,591,567 | |

| | |

| |

|

| |

|

|

| (1) | | Of these, 3,723,214 shares remained available for grant under the 1999 Equity Incentive Plan and 868,353 shares remained available for grant under the 1999 Employee Stock Purchase Plan. All of the shares available for grant under the 1999 Equity Incentive Plan may be issued as restricted stock, although we currently have no intention to do so. |

| (2) | | In connection with our acquisition of Velogic, Inc. in June 2002, we assumed the options to purchase stock initially granted under Velogic’s 1998 Stock Option/Stock Issuance Plan. The options have been converted into options to purchase our common stock on the terms specified in the agreement and plan of reorganization with Velogic but are otherwise administered in accordance with the terms of Velogic’s 1998 Stock Option/Stock Issuance Plan. No additional awards have been or will be made under Velogic’s 1998 Stock Option/Stock Issuance Plan. The options generally vest over four years and expire ten years from the date of grant. As of September 30, 2002, there were outstanding options to purchase a total of 3,945 shares with a weighted average exercise price of $2.053 per share. Information regarding these assumed options is not included in the table above. |

13

PROPOSAL NO. 4

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The audit committee of our board of directors has selected KPMG LLP as the independent auditors to perform the audit of our financial statements for the fiscal year ending September 30, 2003, and our stockholders are being asked to ratify such selection. Representatives of KPMG are expected to be present at the Annual Meeting, will have the opportunity to make a statement at the Annual Meeting if they desire to do so and are expected to be available to respond to appropriate questions.

The Board Recommends a Vote FOR the Ratification of the Selection of KPMG LLP.

REPORT OF THE AUDIT COMMITTEE

The audit committee of the board of directors monitors the adequacy of Keynote’s accounting and financial reporting processes. The committee also evaluates the performance and independence of Keynote’s independent auditors. The audit committee operates under a written charter, which was adopted by each of Keynote’s board of directors and audit committee on June 9, 2000. A copy of this charter was filed as an Appendix to Keynote’s proxy statement filed with the Securities and Exchange Commission on January 29, 2001. Under the written charter the committee consists of at least three directors and each member of the committee is “independent” as defined by the rules of The NASDAQ Stock Market. The current members of the committee are Mr. Gyani, Mr. Penney and Mr. Sclavos.

Keynote’s financial and senior management supervise the systems of internal controls and the financial reporting process. Keynote’s independent auditors perform an independent audit of Keynote’s consolidated financial statements in accordance with generally accepted auditing standards and issue a report on these consolidated financial statements. The audit committee monitors these processes.

The audit committee has reviewed Keynote’s audited consolidated financial statements for the fiscal year ended September 30, 2002 and has met with both the management of Keynote and its independent accountants to discuss the consolidated financial statements. Keynote’s management represented to the audit committee that Keynote’s audited consolidated financial statements were prepared in accordance with generally accepted accounting principles.

The audit committee discussed with Keynote’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees. The audit committee has also received from Keynote’s independent auditors the written disclosures and letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with Keynote’s independent auditors the independence of that firm. The audit committee has also considered whether the provision of non-audit services by Keynote’s independent auditors is compatible with maintaining the independence of the independent auditors.

Based on the audit committee’s discussions with the management of Keynote and Keynote’s independent auditors and based on the audit committee’s review of Keynote’s audited consolidated financial statements together with the report of Keynote’s independent auditors on the consolidated financial statements and the representations of Keynote’s management with regard to these consolidated financial statements, the audit committee recommended to Keynote’s board of directors that the audited consolidated financial statements be included in Keynote’s annual report on Form 10-K for the fiscal year ended September 30, 2002, filed with the Securities and Exchange Commission.

14

During the fiscal year ended September 30, 2002, the aggregate fees billed by Keynote’s independent auditors, KPMG LLP, for professional services were as follows:

| | • | | Audit Fees. The aggregate fees billed by KPMG LLP for professional services rendered for the audit of Keynote’s annual consolidated financial statements for the fiscal year ended September 30, 2002 including all statutory audits required for Keynote’s subsidiaries and for the review of the consolidated financial statements included in Keynote’s Forms 10-Q for the fiscal year ended September 30, 2002 were approximately $311,109; |

| | • | | Financial Information Systems Design and Implementation Fees. KPMG LLP did not render any professional services for financial information systems design and implementation professional services for the fiscal year ended September 30, 2002; and |

| | • | | All Other Fees. The aggregate fees billed by KPMG LLP for services other than those described above for the fiscal year ended September 30, 2002 totaled approximately $108,995. These fees were for services rendered primarily for tax consultation and the preparation of tax returns. The Audit Committee has determined that the provision of these services is compatible with maintaining KPMG LLP’s independence. |

Audit Committee

Mohan Gyani

Geoffrey Penney

Stratton Sclavos

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information as to the beneficial ownership of our common stock as of January 31, 2003 by:

| | • | | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | | our Chief Executive Officer and four other most highly compensated executive officers whose salary and bonus for the fiscal year ending September 30, 2002 was more than $100,000; and |

| | • | | directors and executive officers as a group. |

The percentage ownership is based on 22,971,677 shares of common stock outstanding as of January 31, 2003. Shares of common stock that are subject to options currently exercisable or exercisable within 60 days of January 31, 2003, are deemed outstanding for the purposes of computing the percentage ownership of the person holding these options but are not deemed outstanding for computing the percentage ownership of any other person. Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Unless indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise noted, the address for each of the 5% or greater stockholders listed below is c/o Keynote Systems, Inc., 777 Mariners Island Boulevard, San Mateo, CA 94404.

| | | Shares Beneficially Owned

| |

Name of Beneficial Owner

| | Number of Shares

| | Percent

| |

Umang Gupta(1) | | 2,863,409 | | 12.1 | % |

FMR Corp.(2) 82 Devonshire Street Boston, MA 02109 | | 2,724,067 | | 11.9 | |

Cannell Capital LLC(3) 150 California Street, 5th Floor San Francisco, CA 94111 | | 1,608,500 | | 7.0 | |

Donald Aoki(4) | | 206,229 | | * | |

David Cowan(5) | | 198,251 | | * | |

John Flavio(6) | | 187,328 | | * | |

Lloyd Taylor(7) | | 183,803 | | * | |

Rich Rudolph(8) | | 51,758 | | * | |

Stratton Sclavos(9) | | 50,000 | | * | |

Mohan Gyani(10) | | 31,944 | | * | |

Deborah Rieman(10) | | 31,944 | | * | |

Geoffrey Penney(11) | | 16,666 | | * | |

All 11 directors and executive officers as a group(12) | | 3,852,285 | | 15.9 | % |

| * | | Indicates beneficial ownership of less than 1%. |

| (1) | | Includes 70,000 shares held by the Gupta Family 1999 Irrevocable Trust. Mr. Gupta disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 712,499 shares subject to options exercisable within 60 days of January 31, 2003. |

| (2) | | Based solely on information provided by FMR Corp. as of December 31, 2002 in an amended Schedule 13G filed with the Securities and Exchange Commission on February 13, 2003. According to this Schedule 13G, FMR Corp. may be deemed to share voting and/or investment power with respect to these shares with certain affiliated companies and persons listed in the Schedule 13G. |

16

| (3) | | Based solely on information provided by Cannell Capital LLC as of December 31, 2002 in an amended Schedule 13G filed with the Securities and Exchange Commission on February 14, 2003. According to this Schedule 13G, Cannell Capital LLC may be deemed to share voting and/or investment power with respect to these shares with certain affiliated companies and persons listed in the Schedule 13G. |

| (4) | | Includes 2,042 shares held by Mr. Aoki as trustee for his minor children and 950 shares held by the Frank and Jeanne Aoki Revocable Trust, over which Mr. Aoki exercises investment power. Mr. Aoki disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 91,249 shares subject to options exercisable within 60 days of January 31, 2003. |

| (5) | | Includes 50,000 shares subject to options exercisable within 60 days of January 31, 2003. |

| (6) | | Includes 168,331 shares subject to options exercisable within 60 days of January 31, 2003. |

| (7) | | Includes 123,949 shares held by the Taylor Family Trust. Includes 59,854 shares subject to options exercisable within 60 days of January 31, 2003. |

| (8) | | Includes 46,875 shares subject to options exercisable within 60 days of January 31, 2003. |

| (9) | | Represents 50,000 shares subject to options exercisable within 60 days of January 31, 2003. |

| (10) | | Includes 39,419 shares subject to options exercisable within 60 days of January 31, 2003. |

| (11) | | Represents 16,666 shares subject to options exercisable within 60 days of January 31, 2003. |

| (12) | | Includes 1,296,862 shares subject to options exercisable within 60 days of January 31, 2003. |

17

EXECUTIVE COMPENSATION

The following table presents compensation information for the fiscal years ending September 30, 2000, 2001 and 2002 paid or accrued to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2002.

Summary Compensation Table

Name and Principal Position

| | Fiscal Year

| | Annual Compensation

| | | Long Term Compensation

|

| | | | Awards

|

| | | Salary

| | Bonus

| | Other Annual Compensation

| | | Securities Underlying Options

|

Umang Gupta Chief Executive Officer | | 2002 2001 2000 | | $ | 244,072 200,645 200,860 | | $ | 100,000 — 150,000 | | $ | — — — | | | 1,300,000 — 300,000 |

|

John Flavio Senior Vice President of Finance and Chief Financial Officer | | 2002 2001 2000 | | | 198,426 185,148 173,713 | | | 19,262 13,933 36,500 | | | — — — | | | 70,000 75,000 30,000 |

|

Lloyd Taylor Vice President of Operations | | 2002 2001 2000 | | | 186,251 179,588 164,984 | | | 25,608 — 14,630 | | | — — — | | | 60,000 76,000 30,000 |

|

Donald Aoki Vice President of Engineering | | 2002 2001 2000 | | | 185,794 179,154 168,842 | | | 22,302 14,875 8,500 | | | — — — | | | 50,000 120,000 30,000 |

|

Richard Rudolph Vice President of Worldwide Sales | | 2002 2001 2000 | | | 153,125 — — | | | — — — | | | 25,216 — — | (1) | | 150,000 — — |

| (1) | | Represents an allowance for certain travel expenses. |

Option Grants in Fiscal 2002

The following table presents the grants of stock options under our 1999 Equity Incentive Plan during the fiscal year ended September 30, 2002 to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2002.

Name

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

| | Number of Securities Underlying Options Granted

| | Percent of Total Options Granted to Employees in Fiscal 2002

| | | Exercise Price Per Share

| | Expiration Date

| |

| | | | | | 5%

| | 10%

|

Umang Gupta | | 1,300,000 | | 28.9 | % | | $ | 7.52 | | 11-11-11 | | $ | 6,148,074 | | $ | 15,580,426 |

|

John Flavio | | 30,000 40,000 | | 0.7 0.9 | | | | 7.52 7.27 | | 11-11-11 06-30-12 | | | 141,879 182,883 | | | 359,548 463,460 |

|

Lloyd Taylor | | 60,000 | | 1.3 | | | | 7.27 | | 06-30-12 | | | 274,324 | | | 695,190 |

|

Donald Aoki | | 50,000 | | 1.1 | | | | 7.27 | | 06-30-12 | | | 228,603 | | | 579,325 |

|

Richard Rudolph | | 150,000 | | 3.3 | | | | 8.65 | | 12-16-11 | | | 815,991 | | | 2,067,881 |

18

All options granted under our 1999 Equity Incentive Plan are either incentive stock options or nonstatutory stock options. Options granted under our 1999 Equity Incentive Plan generally vest and become exercisable over a four-year period as to 25% of the shares subject to the option one year from the date of grant and as to 2.083% of the shares each succeeding month. Options expire 10 years from the date of grant. Options were granted at an exercise price equal to the fair market value of our common stock. In the year ending September 30, 2002, we granted to our employees options to purchase a total of 4,498,853 shares of our common stock.

Potential realizable values are computed by:

| | • | | multiplying the number of shares of common stock subject to a given option by the market price per share of our common stock on the date of grant; |

| | • | | assuming that the aggregate option exercise price derived from that calculation compounds at the annual 5% or 10% rates shown in the table for the entire 10 year term of the option; and |

| | • | | subtracting from that result the aggregate option exercise price. |

The 5% and 10% assumed annual rates of stock price appreciation are required by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future common stock prices. The closing price per share of our common stock as reported on the NASDAQ National Market on September 30, 2002, was $6.57.

Aggregated Option Exercises in Fiscal 2002 and Option Values at September 30, 2002

The following table presents the number of shares of common stock subject to vested and unvested stock options held as of September 30, 2002 by our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2002. None of these individuals exercised stock options during the fiscal year ended September 30, 2002 or held in-the-money options as of September 30, 2002, based on $6.57, the closing price per share of our common stock on September 30, 2002, as reported on the NASDAQ National Market.

| | | Number of Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at September 30, 2002

| | Value of Unexercised In-the-Money Options at September 30, 2002

|

Name

| | | | Vested

| | Unvested

| | Vested

| | Unvested

|

Umang Gupta | | — | | $ | — | | 487,500 | | 1,112,500 | | $ | — | | $ | — |

|

John Flavio | | — | | | — | | 125,831 | | 191,669 | | | — | | | — |

|

Lloyd Taylor | | — | | | — | | 47,353 | | 147,815 | | | — | | | — |

|

Donald Aoki | | — | | | — | | 71,249 | | 172,501 | | | — | | | — |

|

Richard Rudolph | | — | | | — | | — | | 150,000 | | | — | | | — |

Each of the options granted to the optionees listed in the table above generally vests and becomes exercisable over a four-year period as to 25% of the shares subject to the option one year from the date of grant and as to 2.083% of the shares each succeeding month. In the case of options as to which we have a right to repurchase any unvested shares, this right generally lapses over a four-year period as to 25% of the shares subject to the option one year from the date of grant and as to 2.083% of the shares each succeeding month. As of September 30, 2002, Mr. Taylor held 12,500 shares subject to our right of repurchase.

Employment Agreement with Chief Executive Officer

We entered into an employment agreement with Umang Gupta, our Chief Executive Officer, in December 1997 and amended this agreement in November 2001. This agreement, as amended, establishes Mr. Gupta’s

19

annual base salary and eligibility for benefits and bonuses. This agreement continues until it is terminated upon written notice by Mr. Gupta or us. We must pay Mr. Gupta his salary and other benefits through the date of any termination of his employment. If his employment is terminated by us without cause or through his constructive termination due to a material reduction in his salary or benefits, a material change in his responsibilities or a sale of us if he is not the Chief Executive Officer of the resulting combined company, we must also pay his salary for six additional months after that date.

In connection with the November 2001 amendment of this agreement, Mr. Gupta was granted an option to purchase 1,300,000 shares of common stock at an exercise price of $7.52 per share. This option is immediately exercisable, subject to our right to repurchase the shares of common stock upon termination of his employment. This option vested as to 20,833 shares on January 7, 2002, vests as to 33,333 shares each month thereafter for 24 months and then vests as to 20,833 shares each month thereafter.

Under the agreement, as amended, all shares subject to Mr. Gupta’s options will vest in full 90 days following a sale of us if Mr. Gupta is not the Chief Executive Officer of the resulting combined company. If his employment is terminated by us without cause or through his voluntary termination, and if he assists in the transition to a successor Chief Executive Officer, vesting of the shares subject to his options will continue for an additional 12 months. If his employment is terminated by us without cause or due to his death or through his constructive termination due to a material reduction in his salary or benefits or a material change in his responsibilities, the shares subject to his options will vest in an amount equal to the number that would vest during the six months following this termination. If his employment is terminated by us for cause or due to his disability or through his voluntarily termination, the vesting of any shares subject to his options will cease on the date of termination.

Other Change-of-Control Arrangements

The options that we grant to our executive officers, other than our Chief Executive Officer, as described above, under our 1999 Equity Incentive Plan generally provide for acceleration of the vesting of such options upon the occurrence of specified events. If the executive officer is terminated without cause following a sale of our company that occurs 12 or more months after the date of grant of the option, that option vests immediately with respect to all of the shares subject to that option. For the purposes of this provision, a sale of our company includes any sale of all or substantially all of our assets, or any merger or consolidation of us with or into any other corporation, corporations, or other entity in which more than 50% of our voting power is transferred. For purposes of this provision, cause means (i) willfully engaging in gross misconduct that is materially and demonstrably injurious to us; (ii) willful and continued failure to substantially perform the executive officer’s duties (other than incapacity due to physical or mental illness), provided that this failure continues after our Board of Directors has provided the executive officer with a written demand for substantial performance, setting forth in detail the specific respects in which it believes the executive officer has willfully and not substantially performed his or her duties and a reasonable opportunity (to be not less than 30 days) to cure the failure. A termination without cause includes a termination of employment by an executive officer within 30 days following any one of the following events: (x) a 10% or more reduction in the executive officer’s salary that is not part of a general salary reduction plan applicable to all officers of the successor company; (y) a change in the executive officer’s position or status to a position that is not at the level of Vice President or above with the successor; or (z) relocating the executive officer’s principal place of business, in excess of fifty (50) miles from the current location of such principal place of business.

The options that we grant to our non-employee directors under the automatic option grant provision of our 1999 Equity Incentive Plan provide that any unvested shares subject to these options will become immediately exercisable upon a transaction that results in a change of control.

20

REPORT OF THE COMPENSATION COMMITTEE

The compensation committee of the board of directors administers Keynote’s executive compensation program. The current members of the compensation committee are Mr. Cowan and Dr. Rieman. Each is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code. Neither of Mr. Cowan nor Dr. Rieman has any interlocking relationships as defined by the Securities and Exchange Commission.

General Compensation Philosophy

The role of the compensation committee is to set the salaries and other compensation of Keynote’s executive officers and other key employees, and to make grants of stock options and to administer the stock option and other employee equity and bonus plans. Keynote’s compensation philosophy for executive officers is to relate compensation to corporate performance and increases in stockholder value, while providing a total compensation package that is competitive and enables Keynote to attract, motivate, reward and retain key executive officers and employees. Accordingly, each executive officer’s compensation package may, in one or more years, be comprised of the following three elements:

| | • | | base salary that is designed primarily to be competitive with base salary levels in effect at high technology companies in the San Francisco Bay Area that are of comparable size to Keynote and with which Keynote competes for executive personnel; |

| | • | | annual variable performance awards, such as bonuses, payable in cash and/or stock-based incentive awards, tied to the achievement of performance goals, financial or otherwise, established by the compensation committee; and |

| | • | | long-term stock-based incentive awards which strengthen the mutuality of interests between Keynote’s executive officers and Keynote’s stockholders. |

In preparing the Stock Price Performance Graph for this proxy statement, Keynote used The Street.com Internet Sector Index as its published line of business index. The compensation practices of most of the companies in that index were not reviewed by Keynote when the compensation committee reviewed the compensation information described above because such companies were determined not to be competitive with Keynote for executive talent.

Executive Compensation

Base Salary. Salaries for executive officers for the fiscal year ended September 30, 2002 were generally determined on an individual basis by evaluating each executive officer’s scope of responsibility, performance, prior experience and salary history, as well as the salaries for similar positions at comparable companies.

Annual Incentive Awards. In the past, Keynote has included performance-based bonuses, payable in cash and/or stock-based incentive awards, as part of each executive officer’s annual compensation plan. Annual performance-based bonuses are based on mutually agreed upon goals and objectives. This practice is expected to continue and each executive officer’s annual performance will be measured by the achievement of established goals and objectives.

Long-Term Incentive Awards. The compensation committee believes that equity-based compensation in the form of stock options links the interests of executive officers with the long-term interests of Keynote’s stockholders and encourages executive officers to remain employed with Keynote. Stock options generally have value for executive officers only if the price of our stock increases above the fair market value on the grant date and the officer remains employed with Keynote for the period required for the shares to vest.

21

Keynote grants stock options in accordance with its 1999 Equity Incentive Plan. In the fiscal year ended September 30, 2002, stock options were granted to certain executive officers as incentives for them to become employees or to aid in the retention of executive officers and to align their interests with those of Keynote’s stockholders. Stock options typically have been granted to executive officers when the executive officer first joins us. The compensation committee may, however, grant additional stock options to executive officers for other reasons. The number of shares subject to each stock option granted is within the discretion of the compensation committee and is based on anticipated future contribution and ability to impact Keynote’s results, past performance or consistency within the officer’s peer group and the number of unvested options. In the fiscal year ended September 30, 2002, the compensation committee considered these factors. At the discretion of the compensation committee, executive officers may also be granted stock options to provide greater incentives to continue their employment with Keynote and to strive to increase the value of Keynote’s common stock. The stock options generally vest and become exercisable over a four-year period and are granted at a price that is equal to the fair market value of Keynote’s common stock on the date of grant.

Chief Executive Officer Compensation

Mr. Gupta’s base salary, target bonus, bonus paid and long-term incentive awards for the fiscal year ended September 30, 2002 were determined by the compensation committee in a manner consistent with the factors described above for all executive officers. In November 2001, in connection with the amendment of Mr. Gupta’s employment agreement, which establishes his annual base salary, the compensation committee increased his base salary from $200,000, which was established in December 1997 in connection with his original employment agreement, to $250,000. In addition, at that time, the compensation committee granted him an option to purchase 1,300,000 shares, based on its evaluation of his expected future contributions to Keynote. For the fiscal year ended September 30, 2002, Mr. Gupta was eligible to receive a bonus of up to $150,000, and in February 2003, the compensation committee awarded him a bonus of $100,000.

Internal Revenue Code Section 162(m) Limitation

Section 162(m) of the Internal Revenue Code limits our tax deduction in any taxable year to $1.0 million for compensation paid to our Chief Executive Officer and each of our four other most highly compensated executive officers. Having considered the requirements of Section 162(m), the compensation committee believes that prior grants made pursuant to Keynote’s 1999 Equity Incentive Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations on deductibility. However, if Proposal No. 2 is not approved by Keynote’s stockholders, future stock option grants to our Chief Executive Officer and each of our four other most highly compensated executive officers pursuant to Keynote’s 1999 Equity Incentive Plan will no longer be exempt from the limitations on deductibility. The compensation committee’s present intention is to comply with Section 162(m) unless the compensation committee believes that these requirements are not be in the best interest of Keynote or its stockholders.

Compensation Committee

David Cowan

Deborah Rieman

22

STOCK PRICE PERFORMANCE GRAPH

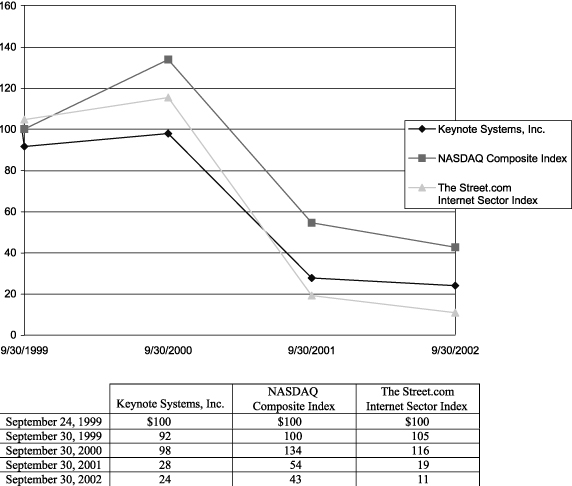

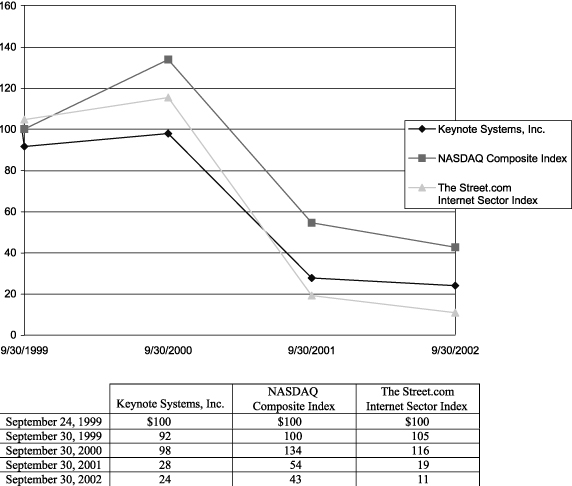

The following graph and table compare the cumulative total stockholder return on our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index. The graph and table assume that $100 was invested in our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index on September 24, 1999, the date of our initial public offering, and calculate the annual return through September 30, 2002. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

23

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than the arrangements described above in “Executive Compensation” and “Director Compensation” and the transaction described below, since October 1, 2001, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a party:

| | • | | in which the amount involved exceeds $60,000; and |

| | • | | in which any director, executive officer, holder of more than 5% of our common stock or any member of their immediate family had or will have a direct or indirect material interest. |

Customer Relationship with AT&T Wireless

Since the quarter ended September 30, 2000, we have been providing our web performance benchmarking services and consulting services to AT&T Wireless. Through December 31, 2002, we had received approximately $466,000 from AT&T Wireless for these services. We are providing these services on standard terms that are substantially similar to the terms on which we provide our services to unaffiliated third parties. Mohan Gyani, one of our directors, has served in various positions with AT&T Wireless Mobility Services, a division of AT&T Wireless. We do not believe that the services we provide to AT&T Wireless are on terms any more or less favorable to us than those with other third parties.

STOCKHOLDER PROPOSALS FOR THE 2004 ANNUAL MEETING OF STOCKHOLDERS

Proposals of stockholders intended to be presented at our 2004 Annual Meeting of Stockholders and included in our proxy statement and form of proxy relating to the meeting, pursuant to Rule 14a-8 under the Exchange Act, must be received by us at our principal executive offices no later than 120 calendar days before the one year anniversary of the date of this proxy statement, or October 30, 2003. In accordance with our bylaws, written notice of any proposals of stockholders intended to be presented at the meeting but not included in our proxy materials must be received by us at our principal executive offices not less than 60 days nor more than 90 days before the one year anniversary of the date of the annual meeting to which this proxy statement relates. For the 2004 Annual Meeting, such notice must been received between December 26, 2003 and January 25, 2004. Such notice must include information on the nominees for election and the business to be brought before the meeting. Such notice must also contain information concerning the stockholder submitting the proposal, including its name and address, the number and class of shares of our capital stock beneficially owned by such stockholder and any material interest that such stockholder has in the business proposed to be brought before the meeting. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions established by the Securities and Exchange Commission.

COMPLIANCE UNDER SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934